Economic Growth and Environmental Quality: Analysis of Government Expenditure and the Causal Effect

Abstract

1. Introduction

2. Literature Review

2.1. Environmental Quality and Government Finance Expenditure

2.2. Economic Growth and Environmental Quality

2.3. Economic Growth and Government Finance Expenditure

3. Data and Variables

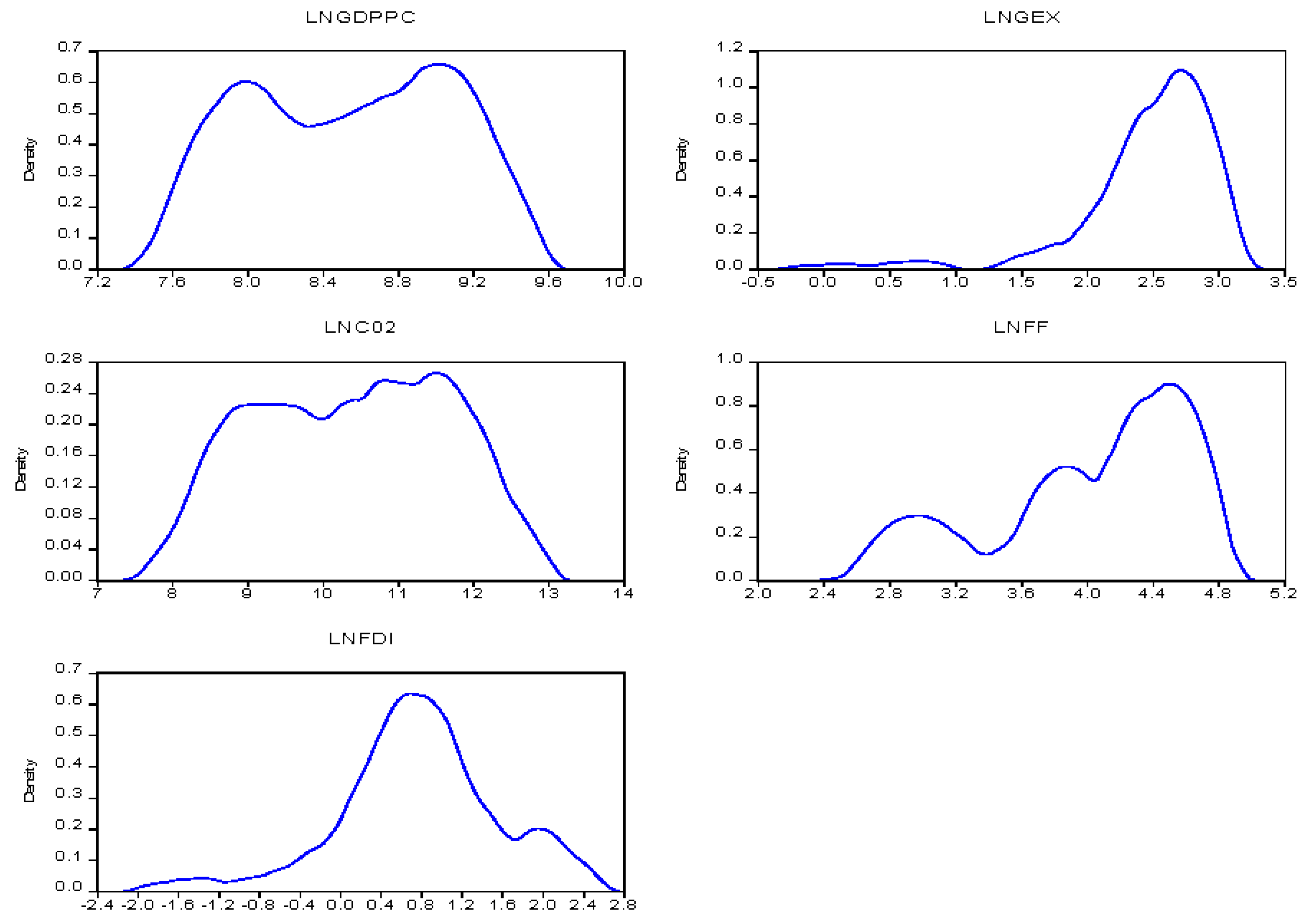

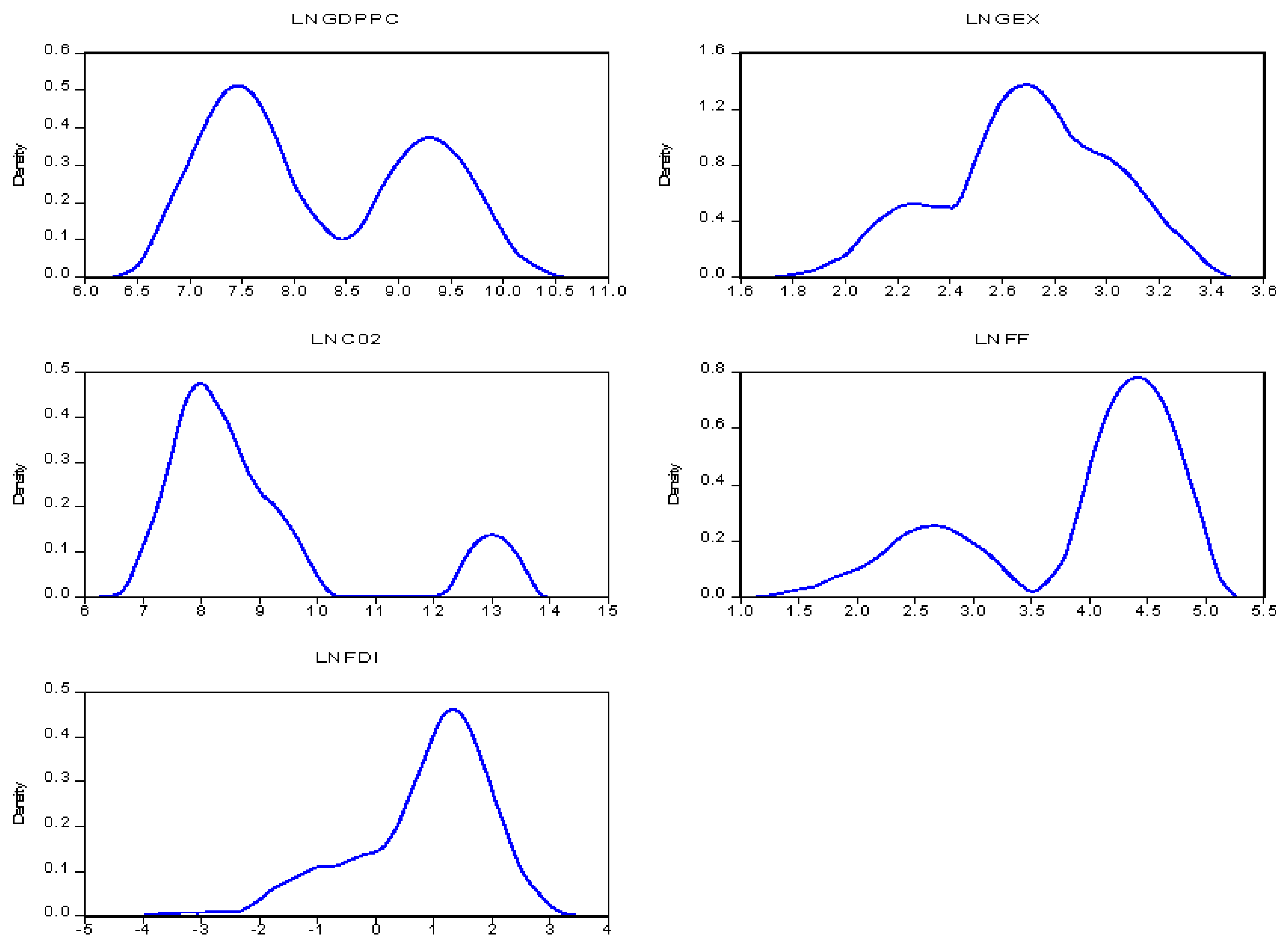

3.1. Preliminary Analysis

3.1.1. Trend of Variables

3.1.2. Cross-Sectional Dependency and Correlation Analysis

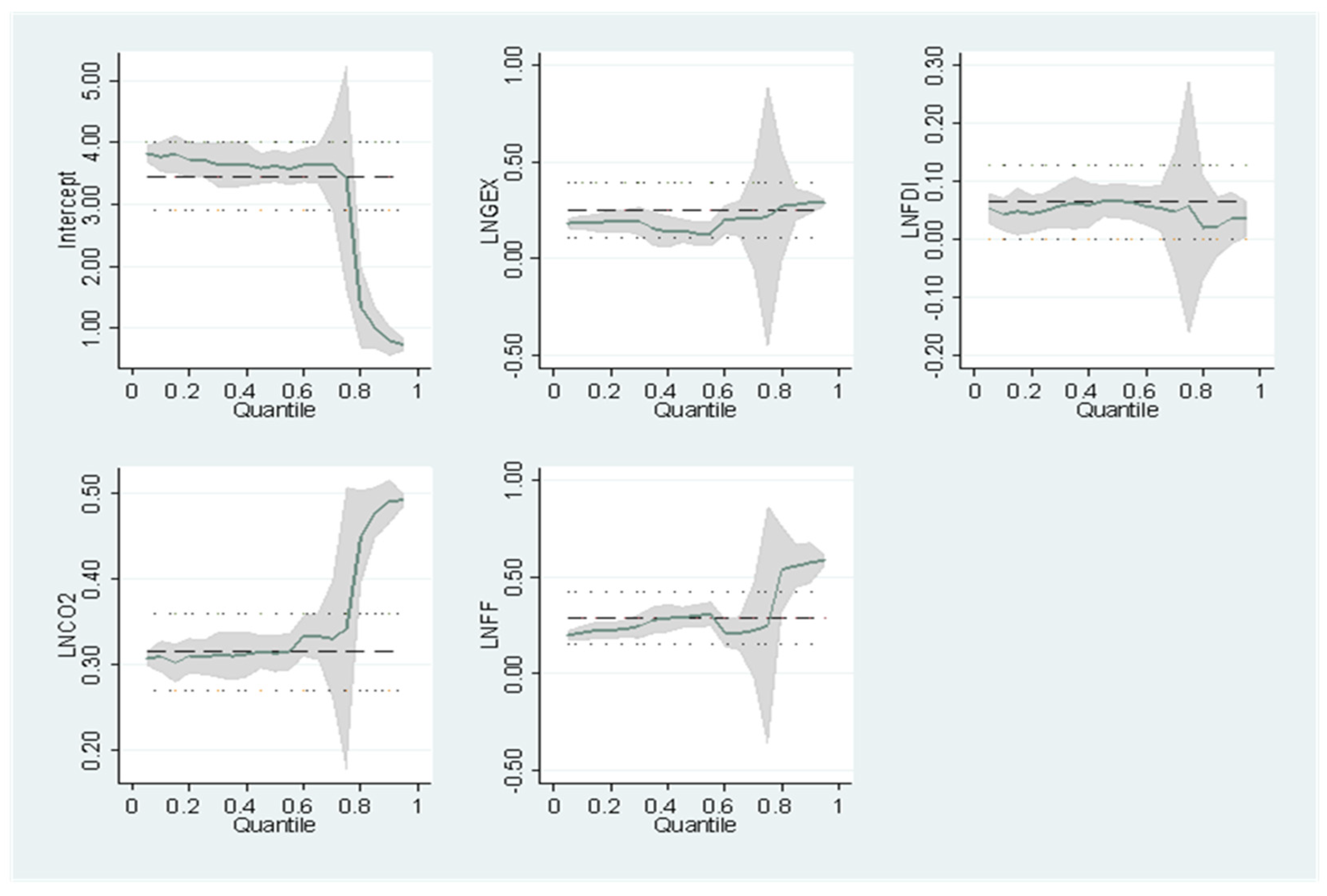

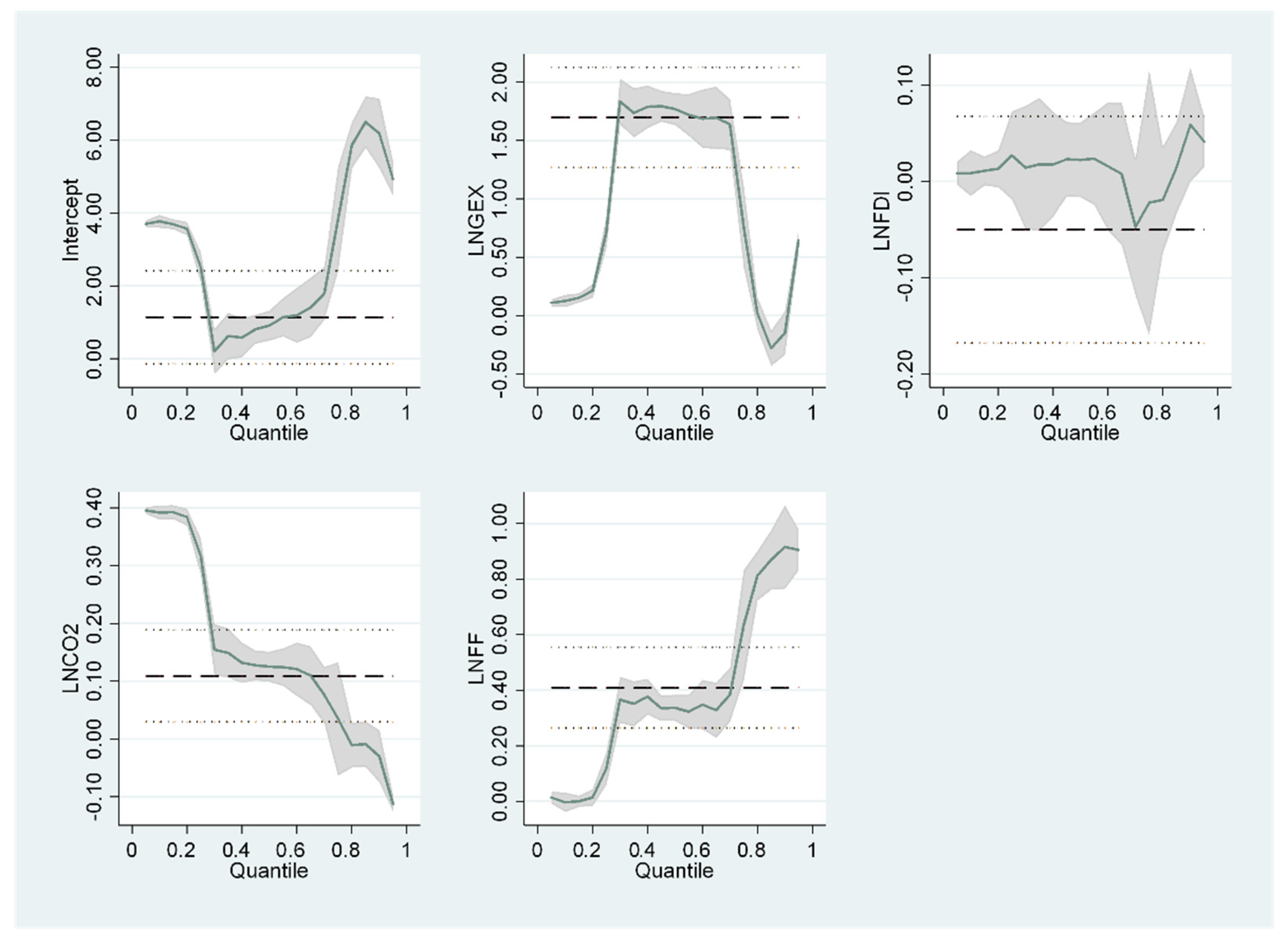

3.2. Model Estimation

4. Results and Discussion

4.1. PVAR Results

4.2. Variance Decomposition

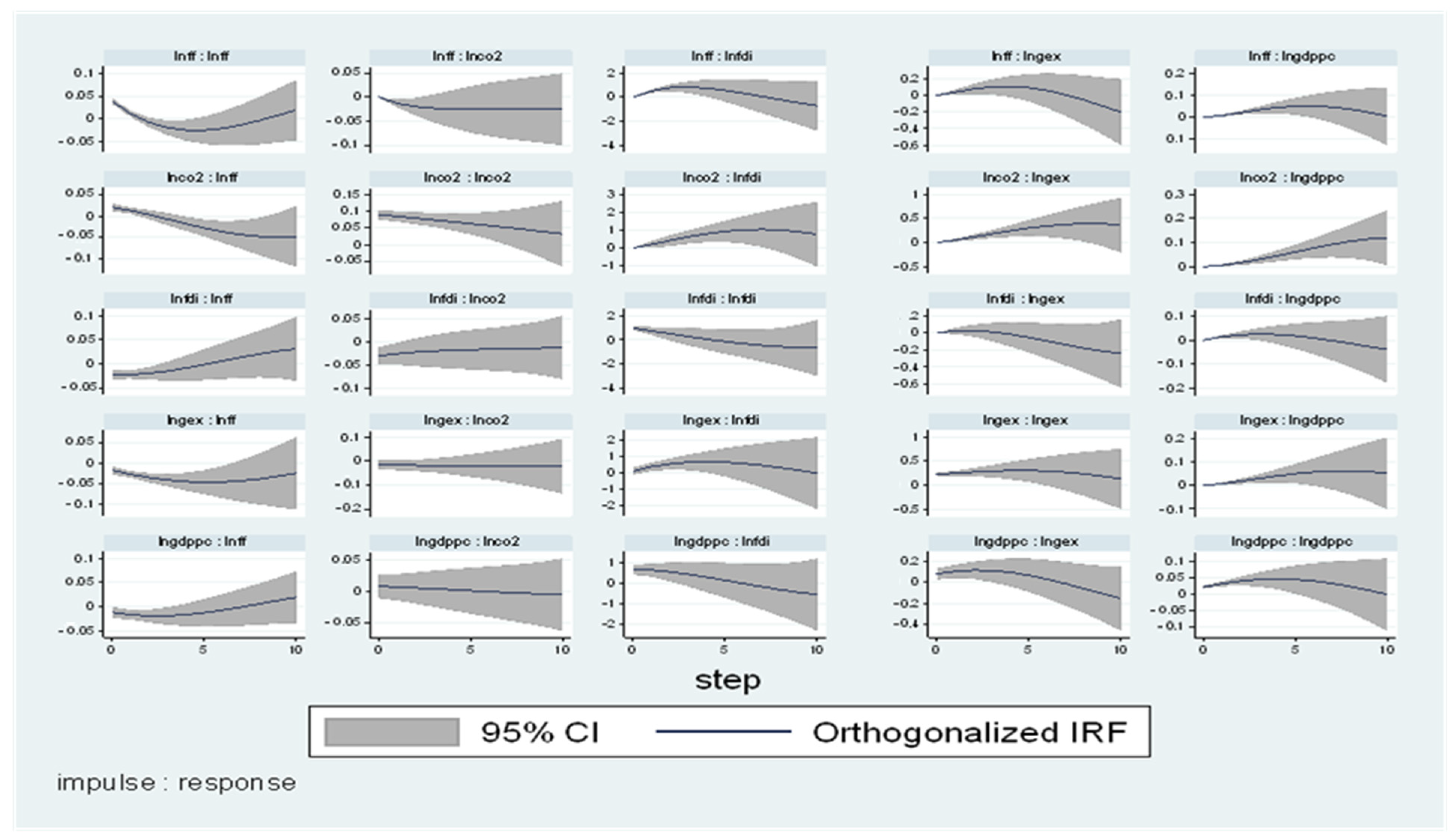

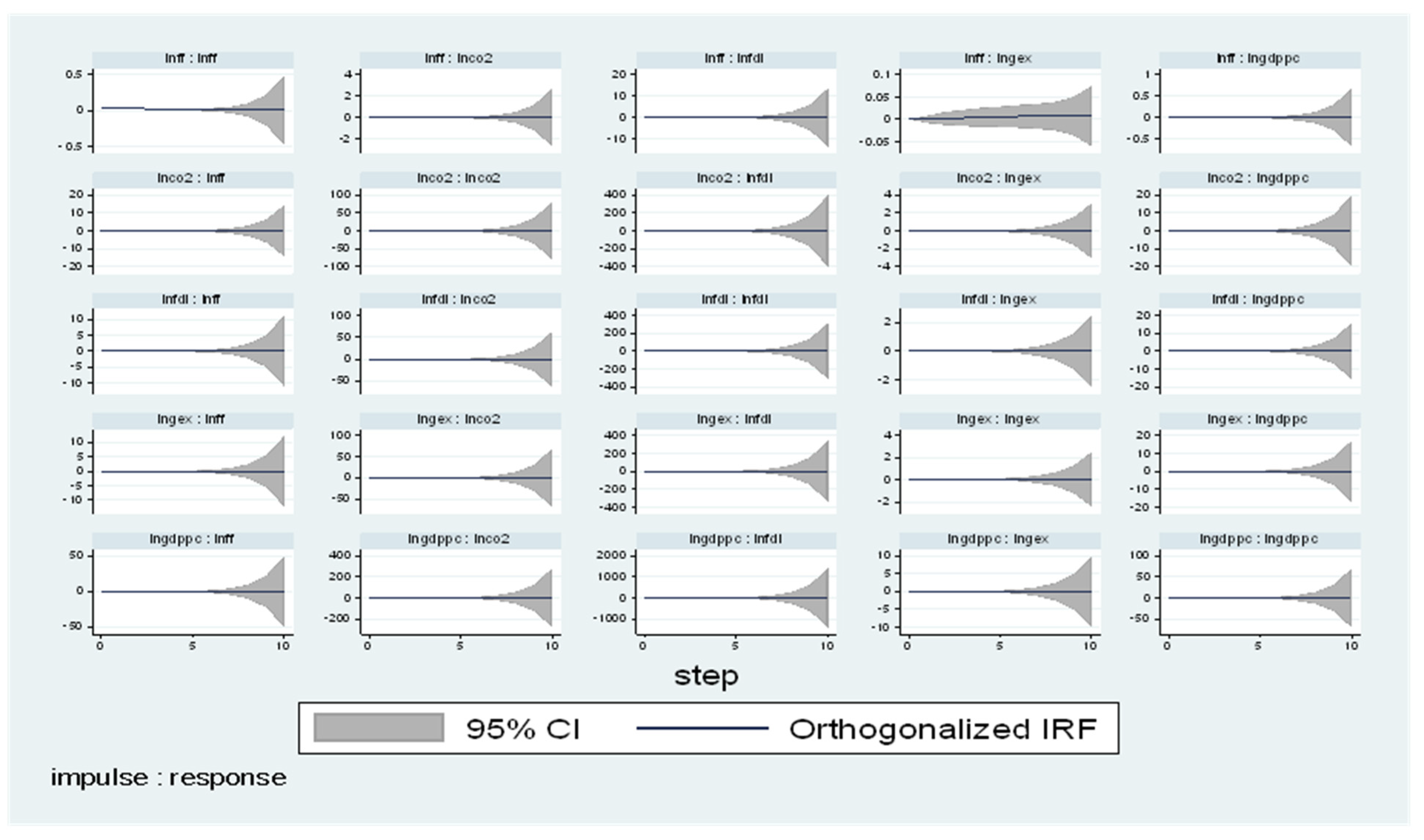

4.3. Impulse Response Analysis (IRA)

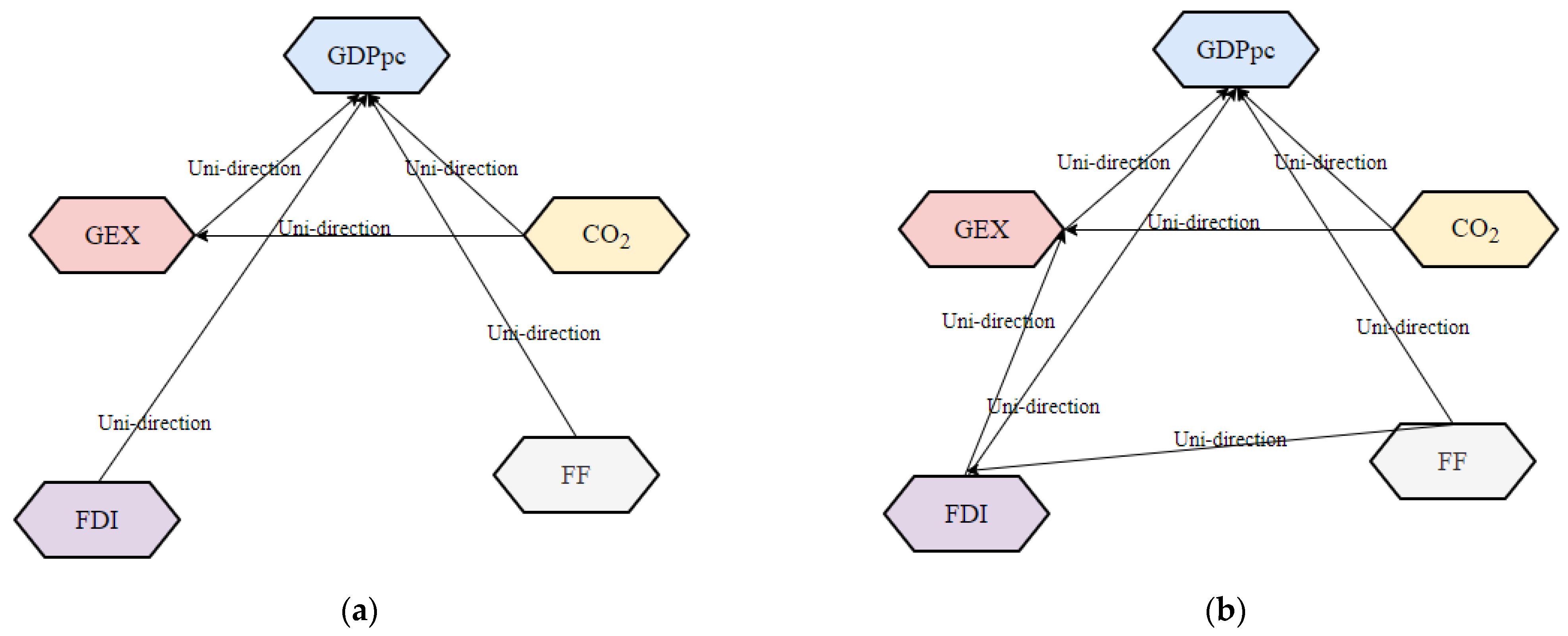

4.4. Granger Causality Test

5. Conclusions

5.1. Policy Implication

5.2. Limitation of the Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviation

| EX | Environmental expenditures |

| EG | Economic growth |

| EQ | Environmental quality |

| GEX | Government finance expenditure |

| GDPpc | GDP per capita |

| NASA | Northern Africa and Southern Africa republics |

| PQR | Panel quantile regression |

| PVAR | Panel vector autoregressive |

| GMM | Generalized method of moment |

| CO2 | Carbon dioxide emission |

| FDI | Foreign direct investment |

| FF | Fossil fuel |

| WWII | World War II |

| GHG | Greenhouse gases |

| UNFCC | United Nations Framework Convention on Climate Change |

| MENA | Middle East/North Africa |

References

- Mesjasz-Lech, A. Environmental Protection Expenditures and Effects of Environmental Governance of Sustainable Development in Manufacture Enterprise. Available online: https://ideas.repec.org/h/pkk/meb017/244-257.html (accessed on 12 November 2021).

- Ssali, M.W.; Du, J.; Mensah, I.A.; Hongo, D.O. Investigating the nexus among environmental pollution, economic growth, energy use, and foreign direct investment in 6 selected sub-Saharan African countries. Environ. Sci. Pollut. Res. 2019, 26, 11245–11260. [Google Scholar] [CrossRef] [PubMed]

- Asongu, S.A.; Agboola, M.O.; Alola, A.A.; Bekun, F.V. The criticality of growth, urbanization, electricity and fossil fuel consumption to environment sustainability in Africa. Sci. Total Environ. 2020, 712, 136376. [Google Scholar] [CrossRef] [PubMed]

- Işik, C.; Kasımatı, E.; Ongan, S. Analyzing the causalities between economic growth, financial development, international trade, tourism expenditure and/on the CO2 emissions in Greece. Energy Sources Part B Econ. Plan. Policy 2017, 12, 665–673. [Google Scholar] [CrossRef]

- Zuo, S.; Zhu, M.; Xu, Z.; Oláh, J.; Lakner, Z. The Dynamic Impact of Natural Resource Rents, Financial Development, and Technological Innovations on Environmental Quality: Empirical Evidence from BRI Economies. Int. J. Environ. Res. Public Health 2021, 19, 130. [Google Scholar] [CrossRef] [PubMed]

- Krajewski, P. The Impact of Public Environmental Protection Expenditure on Economic Growth. Probl. Ekorozw. Probl. Sustain. Dev. 2016, 11, 99–104. Available online: https://ssrn.com/abstract=2884612 (accessed on 12 November 2021).

- Zafar, M.W.; Shahbaz, M.; Hou, F.; Sinha, A. From nonrenewable to renewable energy and its impact on economic growth: The role of research & development expenditures in Asia-Pacific Economic Cooperation countries. J. Clean. Prod. 2019, 212, 1166–1178. [Google Scholar] [CrossRef]

- European Environmental Agency. “No Title,” Environmental Protection Expenditure. 2016. Available online: http://ec.europa.eu/environment/action-programme/ (accessed on 11 November 2021).

- Ibrahim, M.D.; Alola, A.A.; Cunha Ferreira, D. A two-stage data envelopment analysis of efficiency of social-ecological systems: Inference from the sub-Saharan African countries. Ecol. Indic. 2021, 123, 107381. [Google Scholar] [CrossRef]

- He, L.; Wu, M.; Wang, D.; Zhong, Z. A study of the influence of regional environmental expenditure on air quality in China: The effectiveness of environmental policy. Environ. Sci. Pollut. Res. 2018, 25, 7454–7468. [Google Scholar] [CrossRef]

- Gholipour, H.F.; Farzanegan, M.R. Institutions and the effectiveness of expenditures on environmental protection: Evidence from Middle Eastern countries. Const. Political Econ. 2018, 29, 20–39. [Google Scholar] [CrossRef]

- UN. The Declaration of the UNs Conference on the Human Environment. 1972. Available online: https://legal.un.org/avl/ha/dunche/dunche.html (accessed on 23 November 2021).

- UNFCC. Uniting the World to Tackle Climate Change: COP26 and the Commitments of European Standards. 2021. Available online: https://www.cencenelec.eu/media/Policy%20Opinions/cen-cenelec_position_paper_cop26.pdf (accessed on 23 November 2021).

- Furuoka, F. Renewable electricity consumption and economic development: New findings from the Baltic countries. Renew. Sustain. Energy Rev. 2017, 71, 450–463. [Google Scholar] [CrossRef]

- Kim, M.H.; Adilov, N. The lesser of two evils: An empirical investigation of foreign direct investment-pollution tradeoff. Appl. Econ. 2012, 44, 2597–2606. [Google Scholar] [CrossRef]

- Zhao, W.; Xu, Y. Public Expenditure and Green Total Factor Productivity: Evidence from Chinese Prefecture-Level Cities. Int. J. Environ. Res. Public Health 2022, 19, 5755. [Google Scholar] [CrossRef] [PubMed]

- Fan, W.; Li, L.; Wang, F.; Li, D. Driving factors of CO2 emission inequality in China: The role of government expenditure. China Econ. Rev. 2020, 64, 101545. [Google Scholar] [CrossRef]

- Halkos, G.E.; Paizanos, E.A. The channels of the effect of government expenditure on the environment: Evidence using dynamic panel data. J. Environ. Plan. Manag. 2017, 60, 135–157. [Google Scholar] [CrossRef]

- Fincke, B.; Greiner, A. Public Debt and Economic Growth in Emerging Market Economies. S. Afr. J. Econ. 2015, 83, 357–370. [Google Scholar] [CrossRef]

- Pyerina-Carmen, G.; Cezar, B.; Eftalea, C.; Ana, E.; Angela, D.; Emilia, V. Insulation materials for buildings—A successful research and development collaboration for the Romanian wool fibres manufacturing. Ind. Text. 2018, 69, 419–421. [Google Scholar] [CrossRef]

- Barra, C.; Zotti, R. Investigating the non-linearity between national income and environmental pollution: International evidence of Kuznets curve. Environ. Econ. Policy Stud. 2018, 20, 179–210. [Google Scholar] [CrossRef]

- Zhu, H.; Xia, H.; Guo, Y.; Peng, C. The heterogeneous effects of urbanization and income inequality on CO2 emissions in BRICS economies: Evidence from panel quantile regression. Environ. Sci. Pollut. Res. 2018, 25, 17176–17193. [Google Scholar] [CrossRef]

- Xie, J.Y.; Suh, D.H.; Joo, S.-K. A Dynamic Analysis of Air Pollution: Implications of Economic Growth and Renewable Energy Consumption. Int. J. Environ. Res. Public Health 2021, 18, 9906. [Google Scholar] [CrossRef]

- Odhiambo, N.M. CO2 emissions and economic growth in sub-Saharan African countries: A panel data analysis. Int. Area Stud. Rev. 2017, 20, 264–272. [Google Scholar] [CrossRef]

- Espoir, D.K.; Sunge, R.; Bannor, F. CO2 emissions and economic development in Africa: Evidence from a dynamic spatial panel model. J. Environ. Manag. 2021, 300, 113617. [Google Scholar] [CrossRef]

- Musah, M.; Kong, Y.; Mensah, I.A.; Antwi, S.K.; Donkor, M. The link between carbon emissions, renewable energy consumption, and economic growth: A heterogeneous panel evidence from West Africa. Environ. Sci. Pollut. Res. 2020, 27, 28867–28889. [Google Scholar] [CrossRef]

- Mensah, I.A.; Sun, M.; Gao, C.; Omari-Sasu, A.Y.; Zhu, D.; Ampimah, B.C.; Quarcoo, A. Analysis on the nexus of economic growth, fossil fuel energy consumption, CO2 emissions and oil price in Africa based on a PMG panel ARDL approach. J. Clean. Prod. 2019, 228, 161–174. [Google Scholar] [CrossRef]

- Orubu, O.C.; Omotor, G.D. Environmental quality and economic growth: Searching for environmental Kuznets curves for air and water pollutants in Africa. Energy Policy 2011, 39, 4178–4188. [Google Scholar] [CrossRef]

- Barreto, H. Omitted Variable Bias. In Introductory Econometrics: Using Monte Carlo Simulation with Microsoft Excel; Cambridge University Press: Cambridge, UK, 2006. [Google Scholar]

- Clarke, K.A. The Phantom Menace: Omitted Variable Bias in Econometric Research. Confl. Manag. Peace Sci. 2005, 22, 341–352. [Google Scholar] [CrossRef]

- Baz, K.; Cheng, J.; Xu, D.; Abbas, K.; Ali, I.; Ali, H.; Fang, C. Asymmetric impact of fossil fuel and renewable energy consumption on economic growth: A nonlinear technique. Energy 2021, 226, 120357. [Google Scholar] [CrossRef]

- Hadj, T.B. Nonlinear impact of biomass energy consumption on ecological footprint in a fossil fuel–dependent economy. Environ. Sci. Pollut. Res. 2021, 28, 69329–69342. [Google Scholar] [CrossRef]

- Ekwueme, D.C.; Zoaka, J.D.; Alola, A.A. Carbon emission effect of renewable energy utilization, fiscal development, and foreign direct investment in South Africa. Environ. Sci. Pollut. Res. 2021, 28, 41821–41833. [Google Scholar] [CrossRef]

- Vo, X.V.; Zaman, K. Relationship between energy demand, financial development, and carbon emissions in a panel of 101 countries: “go the extra mile” for sustainable development. Environ. Sci. Pollut. Res. 2020, 27, 23356–23363. [Google Scholar] [CrossRef]

- Naz, S.; Sultan, R.; Zaman, K.; Aldakhil, A.M.; Nassani, A.A.; Abro, M.M.Q. Moderating and mediating role of renewable energy consumption, FDI inflows, and economic growth on carbon dioxide emissions: Evidence from robust least square estimator. Environ. Sci. Pollut. Res. 2019, 26, 2806–2819. [Google Scholar] [CrossRef]

- Chenran, X.; Limao, W.; Chengjia, Y.; Qiushi, Q.; Ning, X. Measuring the Effect of Foreign Direct Investment on CO2 Emissions in Laos. J. Resour. Ecol. 2019, 10, 685. [Google Scholar] [CrossRef]

- Aluko, O.A.; Ibrahim, M. Institutions and the financial development–economic growth nexus in sub-Saharan Africa. Econ. Notes 2020, 49, e12163. [Google Scholar] [CrossRef]

- Musah, M.; Kong, Y.; Mensah, I.A.; Antwi, S.K.; Osei, A.A.; Donkor, M. Modelling the connection between energy consumption and carbon emissions in North Africa: Evidence from panel models robust to cross-sectional dependence and slope heterogeneity. Environ. Dev. Sustain. 2021, 23, 15225–15239. [Google Scholar] [CrossRef]

- Al-Moulani, A.; Alexiou, C. Banking sector depth and economic growth nexus: A comparative study between the natural resource-based and the rest of the world’s economies. Int. Rev. Appl. Econ. 2017, 31, 625–650. [Google Scholar] [CrossRef]

- Bernauer, T.; Koubi, V. States as Providers of Public Goods: How Does Government Size Affect Environmental Quality? SSRN Electron. J. 2006. [Google Scholar] [CrossRef]

- López, R.; Galinato, G.I.; Islam, A. Fiscal spending and the environment: Theory and empirics. J. Environ. Econ. Manag. 2011, 62, 180–198. [Google Scholar] [CrossRef]

- Lin, Q.; Chen, G.; Du, W.; Niu, H. Spillover effect of environmental investment: Evidence from panel data at provincial level in China. Front. Environ. Sci. Eng. 2012, 6, 412–420. [Google Scholar] [CrossRef]

- Halkos, G.E.; Paizanos, E.A. The effect of government expenditure on the environment:An empirical investigation. Ecol. Econ. 2013, 91, 48–56. [Google Scholar] [CrossRef]

- López, R.; Palacios, A. Why has Europe Become Environmentally Cleaner? Decomposing the Roles of Fiscal, Trade and Environmental Policies. Environ. Resour. Econ. 2014, 58, 91–108. [Google Scholar] [CrossRef]

- Islam, A.M.; López, R.E. Government Spending and Air Pollution in the US. Int. Rev. Environ. Resour. Econ. 2015, 8, 139–189. [Google Scholar] [CrossRef]

- Galinato, G.I.; Galinato, S.P. The effects of government spending on deforestation due to agricultural land expansion and CO2 related emissions. Ecol. Econ. 2016, 122, 43–53. [Google Scholar] [CrossRef]

- Raworth, K. Doughnut Economics: Seven Ways to Think Like a 21st-Century Economist; Random House Business: New York, NY, USA, 2017; Available online: https://www.amazon.com/Doughnut-Economics-Seven-21st-Century-Economist/dp/1603586741 (accessed on 26 December 2021).

- Anwar, A.; Sinha, A.; Sharif, A.; Siddique, M.; Irshad, S.; Anwar, W.; Malik, S. The nexus between urbanization, renewable energy consumption, financial development, and CO2 emissions: Evidence from selected Asian countries. Environ. Dev. Sustain. 2022, 24, 6556–6576. [Google Scholar] [CrossRef]

- Sunkanmi, O.; Nurudeen, A.; Usman, A. Government Expenditure and Economic Growth in Nigeria, 1970–2008: A Disaggregated Analysis. Bus. Econ. J. 2010, 2010, BEJ-4. Available online: http://astonjournals.com/bej (accessed on 13 December 2021).

- Haug, A.A.; Ucal, M. The role of trade and FDI for CO2 emissions in Turkey: Nonlinear relationships. Energy Econ. 2019, 81, 297–307. [Google Scholar] [CrossRef]

- Rehman, A.; Ma, H.; Ahmad, M.; Ozturk, I.; Işık, C. An asymmetrical analysis to explore the dynamic impacts of CO2 emission to renewable energy, expenditures, foreign direct investment, and trade in Pakistan. Environ. Sci. Pollut. Res. 2021, 28, 53520–53532. [Google Scholar] [CrossRef] [PubMed]

- Işık, C.; Ongan, S.; Özdemir, D. Testing the EKC hypothesis for ten US states: An application of heterogeneous panel estimation method. Environ. Sci. Pollut. Res. 2019, 26, 10846–10853. [Google Scholar] [CrossRef]

- Isik, C.; Ongan, S.; Özdemir, D. The economic growth/development and environmental degradation: Evidence from the US state-level EKC hypothesis. Environ. Sci. Pollut. Res. 2019, 26, 30772–30781. [Google Scholar] [CrossRef]

- Kivyiro, P.; Arminen, H. Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: Causality analysis for Sub-Saharan Africa. Energy 2014, 74, 595–606. [Google Scholar] [CrossRef]

- Hamilton, T.G.A.; Kelly, S. Low carbon energy scenarios for sub-Saharan Africa: An input-output analysis on the effects of universal energy access and economic growth. Energy Policy 2017, 105, 303–319. [Google Scholar] [CrossRef]

- Keynes, J.M. Las Posibilidades Económicas de Nuestros Nietos: Una Lectura de Keynes por Joaquín Estefanía; Taurus: Madrid, Spain, 2015; pp. 20–255. [Google Scholar]

- Bergh, A.; Karlsson, M. Government size and growth: Accounting for economic freedom and globalization. Public Choice 2010, 142, 195–213. [Google Scholar] [CrossRef]

- Zimčík, P. Economic Growth and Budget Constraints: EU Countries Panel Data Analysis. Rev. Econ. Perspect. 2016, 16, 87–101. [Google Scholar] [CrossRef]

- Jiranyakul, K. The Relation between Government Expenditures and Economic Growth in Thailand. SSRN Electron. J. 2013. [Google Scholar] [CrossRef]

- Tatahi, M.; Cetin, E.I.; Cetin, M.K. The Cause of Higher Economic Growth: Assessing the Long-Term and Short-Term Relationships between Economic Growth and Government Expenditure. Macroecon. Dyn. 2016, 20, 229–250. [Google Scholar] [CrossRef]

- Chandio, A.A.; Jiang, Y.; Rehman, A.; Jingdong, L. Impact of Government Expenditure on Agricultural Sector and Economic Growth in Pakistan. Int. J. Adv. Biotechnol. Res. 2016, 7, 1046–1053. [Google Scholar]

- Khac Lich, H.; Cam Tu, D. The Optimal Public Expenditure in Developing Countries. VNU J. Sci. Econ. Bus. 2019, 35. [Google Scholar] [CrossRef]

- Işık, C.; Ongan, S.; Bulut, U.; Karakaya, S.; Irfan, M.; Alvarado, R.; Ahmad, M.; Rehman, A. Reinvestigating the Environmental Kuznets Curve (EKC) hypothesis by a composite model constructed on the Armey curve hypothesis with government spending for the US States. Environ. Sci. Pollut. Res. 2020, 29, 16472–16483. [Google Scholar] [CrossRef]

- Manu, E.K.; Xuezhou, W.; Paintsil, I.O.; Gyedu, S.; Ntarmah, A.H. Financial development and economic growth nexus in Africa. Bus. Strateg. Dev. 2020, 3, 506–521. [Google Scholar] [CrossRef]

- World Bank. Environment in Mena, Sector Brief. World Bank Group. 2008. Available online: http://web.worldbank.org/archive/website01418/WEB/IMAGES/ENVIR-12.PDF (accessed on 17 December 2021).

- Croitoru, L.; Sarraf, M. The Cost of Environmental Degradation: Case Studies from the Middle East and North Africa. 2010. Available online: https://openknowledge.worldbank.org/handle/10986/2499 (accessed on 29 November 2021).

- Yaduma, N.; Kortelainen, M.; Wossink, A. The environmental Kuznets curve at different levels of economic development: A counterfactual quantile regression analysis for CO2 emissions. J. Environ. Econ. Policy 2015, 4, 278–303. [Google Scholar] [CrossRef]

- World Bank Group. World Development Indicators; World Bank Group: Washington, DC, USA, 2020; Available online: https://datatopics.worldbank.org/world-development-indicators/ (accessed on 29 November 2021).

- Ahmad, M.; Zhao, Z.-Y.; Irfan, M.; Mukeshimana, M.C. Empirics on influencing mechanisms among energy, finance, trade, environment, and economic growth: A heterogeneous dynamic panel data analysis of China. Environ. Sci. Pollut. Res. 2019, 26, 14148–14170. [Google Scholar] [CrossRef]

- Bekhet, H.A.; Matar, A.; Yasmin, T. CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: Dynamic simultaneous equation models. Renew. Sustain. Energy Rev. 2017, 70, 117–132. [Google Scholar] [CrossRef]

- Rice, W.R. A Consensus Combined P-Value Test and the Family-Wide Significance of Component Tests. Biometrics 1990, 46, 303. [Google Scholar] [CrossRef]

- Qian, X.; Chen, G.; Kattel, B.; Lee, S.; Yang, Y. Factorial analysis of vertical ground reaction force and required coefficient of friction for safety of stair ascent and descent. Int. J. Ind. Oper. Res. 2018, 1, 002. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Shahbaz, M.; Roubaud, D.; Farhani, S. How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 2015, 113, 356–367. [Google Scholar] [CrossRef]

- Komen, M.H.; Gerking, S.; Folmer, H. Income and environmental R&D: Empirical evidence from OECD countries. Environ. Dev. Econ. 1997, 2, 505–515. [Google Scholar] [CrossRef]

- Mohammed Saud, M.A.; Guo, P.; Haq, I.U.; Pan, G.; Khan, A. Do government expenditure and financial development impede environmental degradation in Venezuela? PLoS ONE 2019, 14, e0210255. [Google Scholar] [CrossRef]

- Machado, J.A.F.; Santos Silva, J.M.C. Quantiles via moments. J. Econom. 2019, 213, 145–173. [Google Scholar] [CrossRef]

- Sherwood, B. Variable selection for additive partial linear quantile regression with missing covariates. J. Multivar. Anal. 2016, 152, 206–223. [Google Scholar] [CrossRef][Green Version]

- Zhu, H.; Duan, L.; Guo, Y.; Yu, K. The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: Evidence from panel quantile regression. Econ. Model. 2016, 58, 237–248. [Google Scholar] [CrossRef]

- Xuezhou, W.; Manu, E.K.; Akowuah, I.N. Financial development and environmental quality: The role of economic growth among the regional economies of Sub-Saharan Africa. Environ. Sci. Pollut. Res. 2021, 29, 23069–23093. [Google Scholar] [CrossRef]

- Arcand, J.-L.; Berkes, E.; Panizza, U. Too Much Finance; IMF: Washington, DC, USA, 2012. [Google Scholar]

- Andrews, D.W.K.; Lu, B. Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. J. Econom. 2001, 101, 123–164. [Google Scholar] [CrossRef]

- Love, I.; Zicchino, L. Financial development and dynamic investment behavior: Evidence from panel VAR. Econ. Financ. 2006, 46, 190–210. [Google Scholar] [CrossRef]

- Shoaib, H.M.; Rafique, M.Z.; Nadeem, A.M.; Huang, S. Impact of financial development on CO2 emissions: A comparative analysis of developing countries (D8) and developed countries (G8). Environ. Sci. Pollut. Res. 2020, 27, 12461–12475. [Google Scholar] [CrossRef] [PubMed]

- Muhammad, B.; Khan, S. Effect of bilateral FDI, energy consumption, CO2 emission and capital on economic growth of Asia countries. Energy Rep. 2019, 5, 1305–1315. [Google Scholar] [CrossRef]

- Asumadu-Sarkodie, S.; Owusu, P.A. Carbon dioxide emissions, GDP, energy use, and population growth: A multivariate and causality analysis for Ghana, 1971–2013. Environ. Sci. Pollut. Res. 2016, 23, 13508–13520. [Google Scholar] [CrossRef]

- Granger, C.W.J. Causality, cointegration, and control. J. Econ. Dyn. Control 1988, 12, 551–559. [Google Scholar] [CrossRef]

- Gani, A. Fossil fuel energy and environmental performance in an extended STIRPAT model. J. Clean. Prod. 2021, 297, 126526. [Google Scholar] [CrossRef]

- Manu, E.K.G.S.C.; Asante, D. Regional heterogeneities in the absorptive capacity of renewable energy deployment in Africa. Renew. Energy 2022, 193, 554–564. [Google Scholar] [CrossRef]

- Panayotou, T. Green Markets: The Economics of Sustainable Development. 1993. Available online: https://www.cabdirect.org/cabdirect/abstract/19946797014 (accessed on 30 December 2021).

| Var. | Indicators | Index (Code) | Source |

|---|---|---|---|

| Economic growth | GDPPC | The aggregate gross value added to the economy by all domestic manufacturers, plus any product tariffs, minus any subsidies not included in the product value. It is estimated without considering the depreciation of manufactured assets or natural resource depletion and deterioration. | WDI (2020) |

| Government finance expenditure | GEX | Transfer payments, which include wage transfers (pension, social benefits) and capital transfers, along with expenditure, such as government expenditure and investment | WDI (2020) |

| Environmental quality (EQ) | CO2 Fossil fuel | Pollutants are produced by the combustion of fossil fuels, the manufacture of cement, the use of solid, liquid, and gaseous fuels, and also gas flaring. | World Bank (2020) |

| Foreign direct investment | FDI | Investing in commercial interests in a different country by people or companies in another country. In other terms, FDI is an investment by a foreign entity in the form of controlling ownership in a firm in another nation. Foreign direct investment (% of GDP) | World Bank (2020) |

| North | South | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| GDPpc | GEX | CO2 | FF | FDI | GDPpc | GEX | CO2 | FF | FDI | |

| Mean | 8.535 | 2.461 | 10.388 | 4.026 | 0.763 | 8.250 | 2.697 | 8.955 | 3.889 | 0.831 |

| Median | 8.569 | 2.556 | 10.350 | 4.205 | 0.765 | 7.814 | 2.683 | 8.273 | 4.386 | 1.160 |

| Maximum | 9.284 | 3.019 | 12.288 | 4.589 | 2.253 | 9.882 | 3.267 | 13.128 | 4.597 | 2.716 |

| Minimum | 7.723 | −0.051 | 8.278 | 2.763 | −1.660 | 6.956 | 1.937 | 7.119 | 1.801 | −3.218 |

| Std. Dev. | 0.517 | 0.539 | 1.222 | 0.575 | 0.784 | 0.954 | 0.308 | 1.770 | 0.862 | 1.127 |

| Skewness | −0.074 | −2.359 | −0.078 | −0.880 | −0.472 | 0.273 | −0.264 | 1.578 | −1.042 | −1.038 |

| Kurtosis | 1.569 | 9.950 | 1.731 | 2.452 | 3.942 | 1.394 | 2.506 | 4.146 | 2.432 | 3.765 |

| Jarque–Bera | 8.794 | 299.962 | 6.952 | 14.451 | 7.569 | 14.25 | 2.595 | 55.927 | 23.151 | 24.286 |

| Probability | 0.012 | 0.000 | 0.031 | 0.000 | 0.022 | 0.000 | 0.273 | 0.000 | 0.000 | 0.000 |

| Sum Sq. Dev. | 26.969 | 29.403 | 150.982 | 33.404 | 62.167 | 107.470 | 11.248 | 369.7544 | 87.831 | 150.064 |

| Observations | 102 | 102 | 102 | 102 | 102 | 119 | 119 | 119 | 119 | 119 |

| Cross-Sectional Dependence Test | ||||||||||

| North | South | |||||||||

| Var. | CDP Test | p-Value | CDLMadj Test | p-Value | CDP-Test | p-Value | CDLMadj Test | p-Value | ||

| GDPpc | 15.124 *** | 0.000 | 38.880 *** | 0.000 | 12.879 *** | 0.000 | 33.100 *** | 0.000 | ||

| GEX | 3.035 *** | 0.002 | 5.775 *** | 0.000 | −1.760 ** | 0.078 | 8.780 *** | 0.000 | ||

| CO2 | 10.710 *** | 0.000 | 21.917 *** | 0.000 | 15.927 *** | 0.000 | 36.129 *** | 0.000 | ||

| FF | 2.603 *** | 0.001 | 4.361 *** | 0.000 | 5.637 *** | 0.000 | 7.823 *** | 0.000 | ||

| FDI | 4.395 *** | 0.000 | 308.997 *** | 0.000 | 4.239 *** | 0.000 | 3.329 *** | 0.000 | ||

| Correlation-North | Correlation-South | |||||||||

| LNGDPpc | 1 | 1 | ||||||||

| LNGEX | 0.305 | 1 | 0.586 | 1 | ||||||

| LNCO2 | 0.693 | −0.244 | 1 | 0.435 | 0.366 | 1 | ||||

| LNFF | 0.5724 | 0.708 | 0.084 | 1 | 0.307 | −0.107 | 0.033 | 1 | ||

| LNFDI | 0.0146 | 0.021 | −0.147 | 0.067 | 1 | −0.095 | −0.056 | −0.345 | 0.175 | 1 |

| North | South | |||||||

| Pedroni | ||||||||

| Statistic | Prob. | Statistic | Prob. | Statistic | Prob. | Statistic | Prob. | |

| Panel v-statistic | −0.663 | 0.746 | 0.191 | 0.424 | −0.308 | 0.621 | −0.104 | 0.541 |

| Panel rho-statistic | 0.677 | 0.751 | 0.732 | 0.768 | 0.502 | 0.692 | 1.164 | 0.877 |

| Panel PP-statistic | −1.737 ** | 0.041 | −2.115 | 0.017 | −3.715 *** | 0.000 | −2.442 ** | 0.007 |

| Panel ADF-statistic | −0.288 ** | 0.086 | −0.645 | 0.259 | −2.256 ** | 0.012 | −3.568 *** | 0.000 |

| Alternative hypothesis: individual AR coefs. (between-dimension) | ||||||||

| Statistic | Prob. | Statistic | Prob. | |||||

| Group rho-statistic | 1.694 | 0.954 | 2.397 | 0.991 | ||||

| Group PP-statistic | −5.363 ** | 0.000 | −2.010 | 0.022 | ||||

| Group ADF-statistic | −0.683 ** | 0.047 | −4.104 *** | 0.000 | ||||

| Kao | Kao | |||||||

| ADF | t-Statistic | Prob. | ADF | t-Statistic | Prob. | |||

| −1.561 * | 0.059 | −0.928 ** | 0.076 | |||||

| Johansen | Johansen | |||||||

| Hypothesized | Fisher Stat. * | Fisher Stat. * | Hypothesized | Fisher Stat. * | ||||

| No. of CE (s) | (from trace test) | Prob. | from the max-eigen test) | Prob. | ||||

| None | 110.5 | 0.000 | 110.5 | 0.000 | 77.84 | 0.000 | 77.84 | 0.000 |

| At most 1 | 190.7 | 0.000 | 140.0 | 0.000 | 186.5 | 0.000 | 111.1 | 0.000 |

| At most 2 | 95.67 | 0.000 | 57.01 | 0.000 | 105.7 | 0.000 | 70.05 | 0.000 |

| At most 3 | 57.26 | 0.000 | 50.56 | 0.000 | 55.69 | 0.000 | 39.44 | 0.000 |

| At most 4 | 23.94 | 0.020 | 23.94 | 0.020 | 44.27 | 0.000 | 44.27 | 0.000 |

| North | South | ||||||

|---|---|---|---|---|---|---|---|

| ALL | 25% | 50% | 75% | 25% | 50% | 75% | |

| LNGEX | 0.535 *** (0.092) | 0.114 *** (0.037) | 0.097 *** (0.026) | 0.081 * (0.033) | −0.215 * (0.403) | −0.118 (5.927) | −0.046 (10.069) |

| LNCO2 | 0.247 *** (0.025) | −0.096 (0.071) | −0.068 (0.050) | −0.042 (0.063) | −0.0228 (0.357) | 0.044 (5.243) | 0.093 (8.906) |

| LNFF | 0.276 *** (0.056) | 0.345 *** (0.098) | 0.347 *** (0.069) | 0.349 *** (0.088) | 0.202 (0.417) | 0.131 (6.115) | 0.077 (10.387) |

| LNFDI | 0.030 (0.043) | 0.018 * (0.009) | 0.014 * (0.007) | 0.010 (0.008) | 0.003 (0.052) | 0.000 (0.767) | −0.001 (1.303) |

| Year | 3.507 *** (0.370) | 0.026 *** (0.003) | 0.026 *** (0.002) | 0.026 *** (0.002) | 0.022 (0.016) | 0.020 (0.234) | 0.018 (0.397) |

| LNGDPpc | North | South | |||||

|---|---|---|---|---|---|---|---|

| lngdppc L1. | 0.853 *** | 0.020 | 0.000 | 2.111 *** | 0.233 | 0.000 | |

| lngex L1. | 0.038 *** | 0.007 | 0.000 | −0.592 *** | 0.114 | 0.000 | |

| lnco2 L1. | −0.007 | 0.020 | 0.724 | −0.533 *** | 0.133 | 0.000 | |

| lnff L1. | 0.278 *** | 0.041 | 0.000 | −0.058 | 0.075 | 0.442 | |

| lnfdi L1. | 0.021 *** | 0.003 | 0.000 | −0.049 *** | 0.009 | 0.000 | |

| lngex | |||||||

| lngdppc L1. | −0.978 *** | 0.151 | 0.000 | 0.285 | 0.195 | 0.144 | |

| lngex L1. | 1.219 *** | 0.055 | 0.000 | 0.704 | 0.128 | 0.000 | |

| lnco2 L1. | 0.283 | 0.166 | 0.089 | −0.198 | 0.112 | 0.076 | |

| lnff L1. | 1.776 *** | 0.405 | 0.000 | 0.003 | 0.095 | 0.972 | |

| lnfdi L1. | 0.065 ** | 0.020 | 0.001 | 0.017 | 0.009 | 0.070 | |

| lnco2 | |||||||

| lngdppc L1. | −0.122 * | 0.060 | 0.044 | 4.418 | 0.947 | 0.000 | |

| lngex L1. | 0.042 * | 0.019 | 0.026 | −2.472 | 0.442 | 0.000 | |

| lnco2 L1. | 0.945 *** | 0.050 | 0.000 | −1.136 | 0.528 | 0.032 | |

| lnff L1. | 0.241 * | 0.099 | 0.015 | −0.379 | 0.298 | 0.204 | |

| lnfdi L1. | 0.018 ** | 0.006 | 0.001 | −0.164 | 0.042 | 0.000 | |

| lnff | |||||||

| lngdppc L1. | 0.048 | 0.040 | 0.233 | 0.709 | 0.168 | 0.000 | |

| lngex | −0.070 *** | 0.009 | 0.000 | −0.365 | 0.082 | 0.000 | |

| lnco2 L1. | 0.101 ** | 0.035 | 0.003 | −0.317 | 0.094 | 0.001 | |

| lnff L1. | 0.289 *** | 0.067 | 0.000 | 0.759 | 0.062 | 0.000 | |

| lnfdi L1. | −0.013 *** | 0.003 | 0.000 | −0.028 | 0.009 | 0.002 | |

| lnfdi | |||||||

| lngdppc L1. | −2.102 ** | 0.823 | 0.011 | 17.475 | 3.713 | 0.000 | |

| lngex L1. | 1.870 *** | 0.293 | 0.000 | −9.639 | 1.885 | 0.000 | |

| Lnco2 L1. | −1.681 ** | 0.765 | 0.028 | −8.022 | 2.099 | 0.000 | |

| lnff L1. | 15.946 *** | 1.676 | 0.000 | −0.884 | 1.381 | 0.522 | |

| lnfdi L1. | 0.903 *** | 0.155 | 0.000 | −0.181 | 0.193 | 0.348 | |

| LNGDPpc | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1.000 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 | 0.000 | 0.000 | 0.000 | 0.000 | |

| 2 | 0.842 | 0.024 | 0.007 | 0.006 | 0.121 | 0.723 | 0.074 | 0.157 | 0.000 | 0.046 | |

| 3 | 0.678 | 0.055 | 0.025 | 0.051 | 0.192 | 0.795 | 0.057 | 0.112 | 0.000 | 0.036 | |

| 4 | 0.539 | 0.082 | 0.055 | 0.114 | 0.209 | 0.718 | 0.064 | 0.163 | 0.000 | 0.055 | |

| 5 | 0.430 | 0.105 | 0.097 | 0.170 | 0.197 | 0.751 | 0.059 | 0.140 | 0.001 | 0.050 | |

| 6 | 0.348 | 0.123 | 0.149 | 0.207 | 0.173 | 0.704 | 0.058 | 0.176 | 0.001 | 0.061 | |

| 7 | 0.285 | 0.136 | 0.208 | 0.223 | 0.147 | 0.721 | 0.058 | 0.163 | 0.001 | 0.058 | |

| 8 | 0.237 | 0.147 | 0.270 | 0.224 | 0.122 | 0.687 | 0.055 | 0.193 | 0.001 | 0.064 | |

| 9 | 0.200 | 0.154 | 0.331 | 0.213 | 0.101 | 0.693 | 0.058 | 0.185 | 0.002 | 0.062 | |

| 10 | 0.170 | 0.160 | 0.390 | 0.197 | 0.083 | 0.665 | 0.054 | 0.212 | 0.002 | 0.067 | |

| lngex | |||||||||||

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.013 | 0.987 | 0.000 | 0.000 | 0.000 | ||

| 1 | 0.173 | 0.827 | 0.000 | 0.000 | 0.000 | 0.034 | 0.927 | 0.028 | 0.000 | 0.012 | |

| 2 | 0.190 | 0.758 | 0.019 | 0.015 | 0.017 | 0.028 | 0.902 | 0.037 | 0.000 | 0.033 | |

| 3 | 0.177 | 0.686 | 0.059 | 0.048 | 0.031 | 0.048 | 0.853 | 0.053 | 0.001 | 0.045 | |

| 4 | 0.152 | 0.621 | 0.113 | 0.080 | 0.035 | 0.045 | 0.838 | 0.056 | 0.001 | 0.060 | |

| 5 | 0.126 | 0.566 | 0.174 | 0.102 | 0.032 | 0.058 | 0.811 | 0.061 | 0.002 | 0.068 | |

| 6 | 0.104 | 0.519 | 0.239 | 0.112 | 0.026 | 0.057 | 0.802 | 0.060 | 0.003 | 0.078 | |

| 7 | 0.086 | 0.479 | 0.302 | 0.112 | 0.021 | 0.065 | 0.786 | 0.061 | 0.004 | 0.084 | |

| 8 | 0.072 | 0.445 | 0.362 | 0.106 | 0.016 | 0.065 | 0.780 | 0.059 | 0.005 | 0.091 | |

| 9 | 0.060 | 0.415 | 0.416 | 0.096 | 0.013 | 0.071 | 0.769 | 0.058 | 0.006 | 0.096 | |

| 10 | 0.051 | 0.389 | 0.463 | 0.086 | 0.010 | 0.013 | 0.987 | 0.000 | 0.000 | 0.000 | |

| lnco2 | |||||||||||

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.942 | 0.000 | 0.057 | 0.000 | 0.000 | ||

| 1 | 0.115 | 0.002 | 0.884 | 0.000 | 0.000 | 0.763 | 0.105 | 0.094 | 0.001 | 0.038 | |

| 2 | 0.153 | 0.002 | 0.833 | 0.001 | 0.012 | 0.816 | 0.075 | 0.081 | 0.000 | 0.028 | |

| 3 | 0.171 | 0.008 | 0.785 | 0.007 | 0.028 | 0.762 | 0.099 | 0.096 | 0.001 | 0.043 | |

| 4 | 0.171 | 0.019 | 0.749 | 0.022 | 0.039 | 0.790 | 0.085 | 0.087 | 0.000 | 0.038 | |

| 5 | 0.160 | 0.031 | 0.725 | 0.040 | 0.044 | 0.759 | 0.096 | 0.099 | 0.000 | 0.047 | |

| 6 | 0.145 | 0.042 | 0.713 | 0.056 | 0.044 | 0.777 | 0.088 | 0.091 | 0.000 | 0.044 | |

| 7 | 0.129 | 0.053 | 0.712 | 0.066 | 0.040 | 0.755 | 0.092 | 0.102 | 0.000 | 0.050 | |

| 8 | 0.115 | 0.063 | 0.717 | 0.071 | 0.035 | 0.767 | 0.088 | 0.097 | 0.000 | 0.048 | |

| 9 | 0.102 | 0.072 | 0.725 | 0.071 | 0.030 | 0.751 | 0.089 | 0.107 | 0.000 | 0.053 | |

| 10 | 0.090 | 0.079 | 0.735 | 0.069 | 0.026 | 0.942 | 0.000 | 0.057 | 0.000 | 0.000 | |

| lnff | |||||||||||

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.699 | 0.001 | 0.069 | 0.230 | 0.000 | ||

| 1 | 0.111 | 0.123 | 0.109 | 0.656 | 0.000 | 0.623 | 0.074 | 0.075 | 0.194 | 0.034 | |

| 2 | 0.155 | 0.216 | 0.117 | 0.486 | 0.026 | 0.664 | 0.056 | 0.073 | 0.181 | 0.025 | |

| 3 | 0.167 | 0.309 | 0.100 | 0.370 | 0.054 | 0.648 | 0.065 | 0.081 | 0.169 | 0.037 | |

| 4 | 0.154 | 0.379 | 0.079 | 0.322 | 0.065 | 0.671 | 0.061 | 0.076 | 0.160 | 0.032 | |

| 5 | 0.134 | 0.425 | 0.072 | 0.306 | 0.063 | 0.663 | 0.062 | 0.086 | 0.152 | 0.038 | |

| 6 | 0.114 | 0.453 | 0.084 | 0.295 | 0.054 | 0.677 | 0.061 | 0.081 | 0.146 | 0.035 | |

| 7 | 0.097 | 0.466 | 0.114 | 0.277 | 0.046 | 0.671 | 0.060 | 0.090 | 0.140 | 0.038 | |

| 8 | 0.084 | 0.468 | 0.156 | 0.253 | 0.040 | 0.680 | 0.062 | 0.086 | 0.136 | 0.036 | |

| 9 | 0.072 | 0.463 | 0.204 | 0.226 | 0.035 | 0.699 | 0.001 | 0.069 | 0.230 | 0.000 | |

| 10 | 0.063 | 0.452 | 0.254 | 0.200 | 0.031 | 0.623 | 0.074 | 0.075 | 0.194 | 0.034 | |

| lnfdi | |||||||||||

| 1 | 0.461 | 0.019 | 0.000 | 0.093 | 0.427 | 0.834 | 0.001 | 0.006 | 0.000 | 0.158 | |

| 2 | 0.399 | 0.047 | 0.005 | 0.095 | 0.455 | 0.768 | 0.070 | 0.098 | 0.000 | 0.064 | |

| 3 | 0.318 | 0.069 | 0.024 | 0.182 | 0.406 | 0.796 | 0.063 | 0.089 | 0.000 | 0.053 | |

| 4 | 0.260 | 0.083 | 0.059 | 0.251 | 0.347 | 0.790 | 0.065 | 0.098 | 0.000 | 0.046 | |

| 5 | 0.223 | 0.092 | 0.106 | 0.279 | 0.300 | 0.799 | 0.064 | 0.095 | 0.000 | 0.041 | |

| 6 | 0.199 | 0.098 | 0.159 | 0.277 | 0.268 | 0.796 | 0.064 | 0.099 | 0.000 | 0.040 | |

| 7 | 0.181 | 0.100 | 0.212 | 0.262 | 0.245 | 0.801 | 0.065 | 0.097 | 0.000 | 0.037 | |

| 8 | 0.167 | 0.102 | 0.261 | 0.243 | 0.227 | 0.799 | 0.064 | 0.100 | 0.000 | 0.036 | |

| 9 | 0.155 | 0.103 | 0.304 | 0.225 | 0.213 | 0.802 | 0.065 | 0.098 | 0.001 | 0.035 | |

| 10 | 0.144 | 0.104 | 0.342 | 0.210 | 0.200 | 0.800 | 0.064 | 0.101 | 0.000 | 0.035 | |

| North | South | |||||||

|---|---|---|---|---|---|---|---|---|

| Null Hypothesis | W-Stat. | Zbar-Stat. | Prob. | Direction of Causality | W-Stat. | Zbar-Stat. | Prob. | Direction of Causality |

| LNGEX ↔ LNGDPpc LNGDPpc ↔ LNGEX | 3.499 5.23 * | 0.758 2.075 | 0.448 0.038 | Uni-directional | 4.766 * 7.789 | 1.858 4.336 | 0.063 1.000 | Uni-directional |

| LNCO2 ↔ LNGDPpc LNGDPpc ↔ LNCO2 | 9.745 5.869 * | 5.498 2.557 | 4.000 0.010 | Uni-directional | 8.342 9.375 | 4.789 5.636 | 2 × 10−6 2 × 10−8 | |

| LNFF ↔ LNGDPpc LNGDPpc ↔ LNFF | 9.425 3.802 | 5.255 0.987 | 1.000 0.323 | 5.246 * 4.325 | 2.251 1.496 | 0.024 0.134 | Uni-directional | |

| LNFDI ↔ LNGDPpc LNGDPpc ↔ LNFDI | 4.780 * 2.625 | 1.730 0.095 | 0.085 0.924 | Uni-directional | 8.760 5.050 * | 5.131 2.090 | 3 × 10−7 0.036 | Uni-directional |

| LNCO2 ↔ LNGEX LNGEX ↔ LNCO2 | 5.831 * 1.804 | 2.528 −0.528 | 0.014 0.597 | Uni-directional | 5.827 ** 2.567 | 2.727 0.055 | 0.006 0.955 | Uni-directional |

| LNFF ↔ LNGEX LNGEX ↔ LNFF | 6.162 ** 2.648 | 2.779 0.109 | 0.005 0.912 | Uni-directional | 3.027 2.812 | 0.432 0.256 | 0.665 0.797 | |

| LNFDI ↔ LNGEX LNGEX ↔ LNFDI | 1.522 * 2.596 | −0.741 0.073 | 0.458 0.943 | Uni-directional | 3.891 6.655 *** | 1.140 3.406 | 0.254 0.000 | Uni-directional |

| LNFF ↔ LNCO2 LNCO2 ↔ LNFF | 4.939 3.472 | 1.851 0.737 | 0.061 0.466 | 3.047 4.182 | 0.448 1.378 | 0.653 0.167 | ||

| LNFDI ↔ LNCO2 LNCO2 ↔ LNFDI | 2.535 1.533 | 0.027 −0.733 | 0.974 0.463 | 3.970 3.252 | 1.205 0.616 | 0.228 0.537 | ||

| LNFDI ↔ LNFF LNFF ↔ LNFDI | 12.899 3.2932 | 7.892 0.602 | 3.000 0.547 | 5.246 ** 4.325 | 2.251 1.496 | 0.024 0.134 | Uni-directional | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Donkor, M.; Kong, Y.; Manu, E.K.; Ntarmah, A.H.; Appiah-Twum, F. Economic Growth and Environmental Quality: Analysis of Government Expenditure and the Causal Effect. Int. J. Environ. Res. Public Health 2022, 19, 10629. https://doi.org/10.3390/ijerph191710629

Donkor M, Kong Y, Manu EK, Ntarmah AH, Appiah-Twum F. Economic Growth and Environmental Quality: Analysis of Government Expenditure and the Causal Effect. International Journal of Environmental Research and Public Health. 2022; 19(17):10629. https://doi.org/10.3390/ijerph191710629

Chicago/Turabian StyleDonkor, Mary, Yusheng Kong, Emmanuel Kwaku Manu, Albert Henry Ntarmah, and Florence Appiah-Twum. 2022. "Economic Growth and Environmental Quality: Analysis of Government Expenditure and the Causal Effect" International Journal of Environmental Research and Public Health 19, no. 17: 10629. https://doi.org/10.3390/ijerph191710629

APA StyleDonkor, M., Kong, Y., Manu, E. K., Ntarmah, A. H., & Appiah-Twum, F. (2022). Economic Growth and Environmental Quality: Analysis of Government Expenditure and the Causal Effect. International Journal of Environmental Research and Public Health, 19(17), 10629. https://doi.org/10.3390/ijerph191710629