Evolutionary Game Analysis of Carbon Emission Reduction between Government and Enterprises under Carbon Quota Trading Policy

Abstract

:1. Introduction

2. Multi-Agent Driving Mechanism of Carbon Trading

2.1. Government Participation Drives the Evolution Mechanism of Carbon Trading

2.2. Evolution Mechanism of Enterprise Entities Driving Carbon Trading

3. Construction and Analysis of Evolutionary Game Model

3.1. Parameter Description

3.2. Basic Assumptions of the Model

3.3. Evolutionary Game Model between Government and Enterprises

3.4. The Tripartite Evolutionary Game Model between the Government and Both Enterprises

4. Simulation Analysis

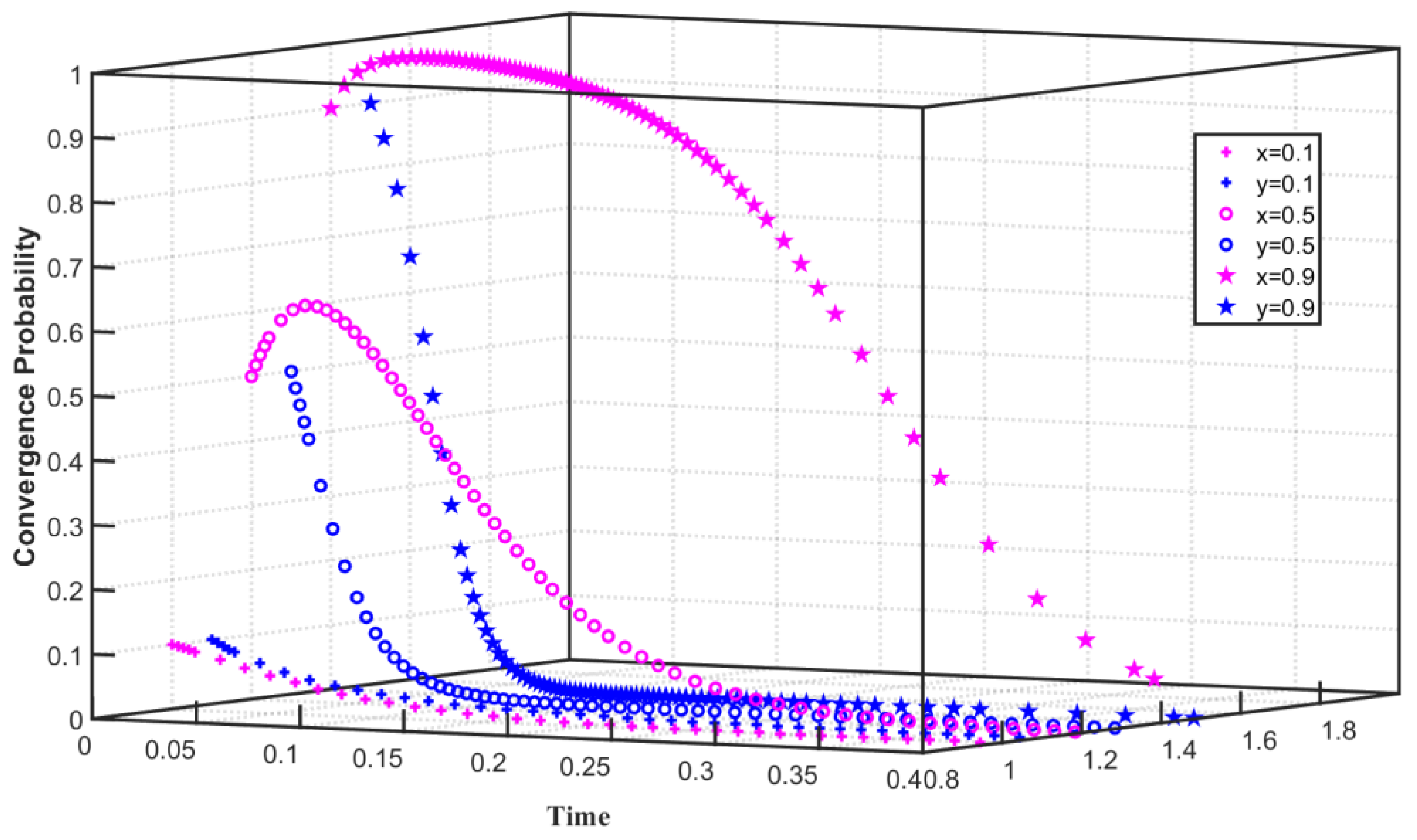

4.1. High Emissions Reduction Costs

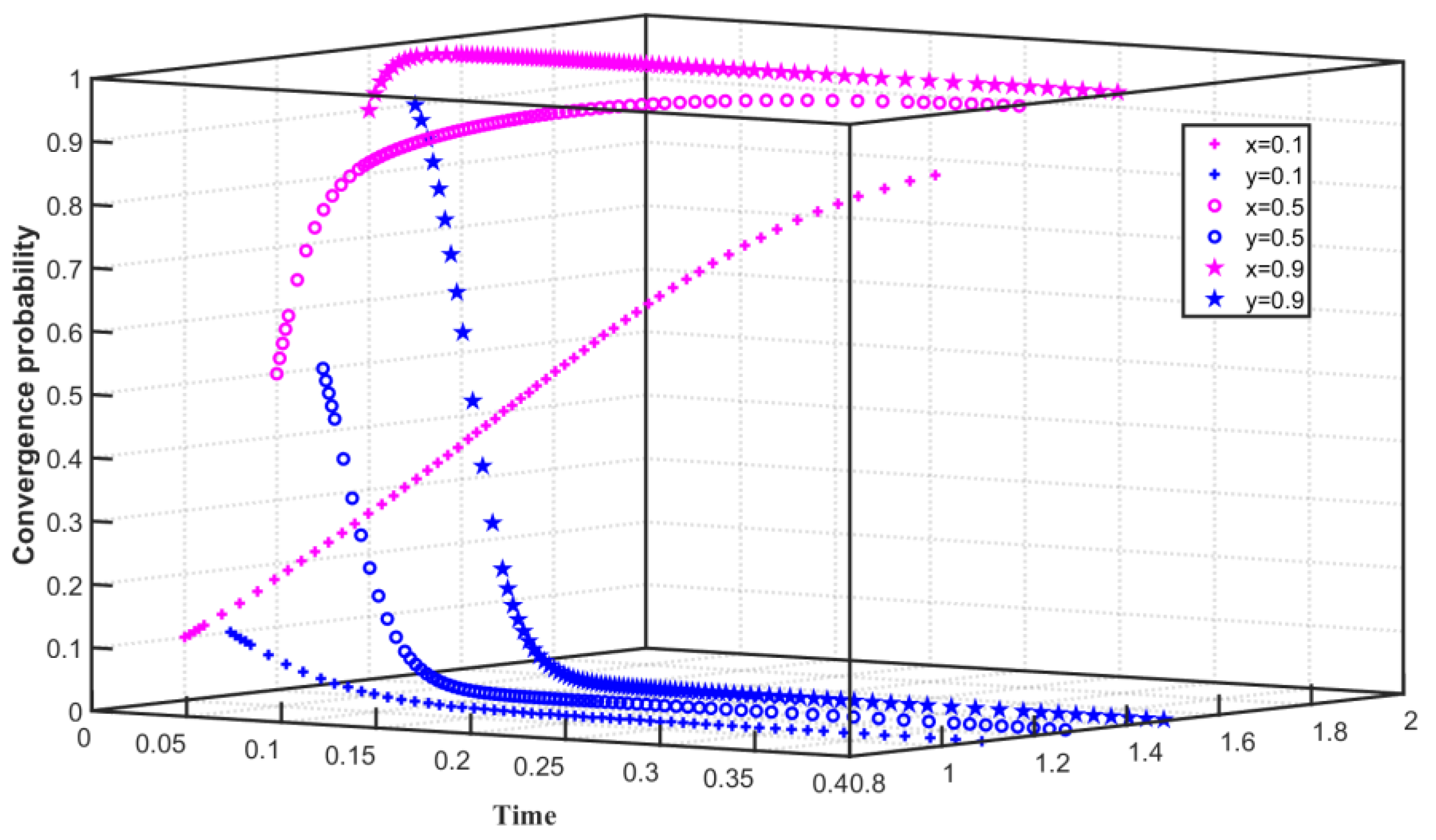

4.2. Low Carbon Emission Reduction Costs

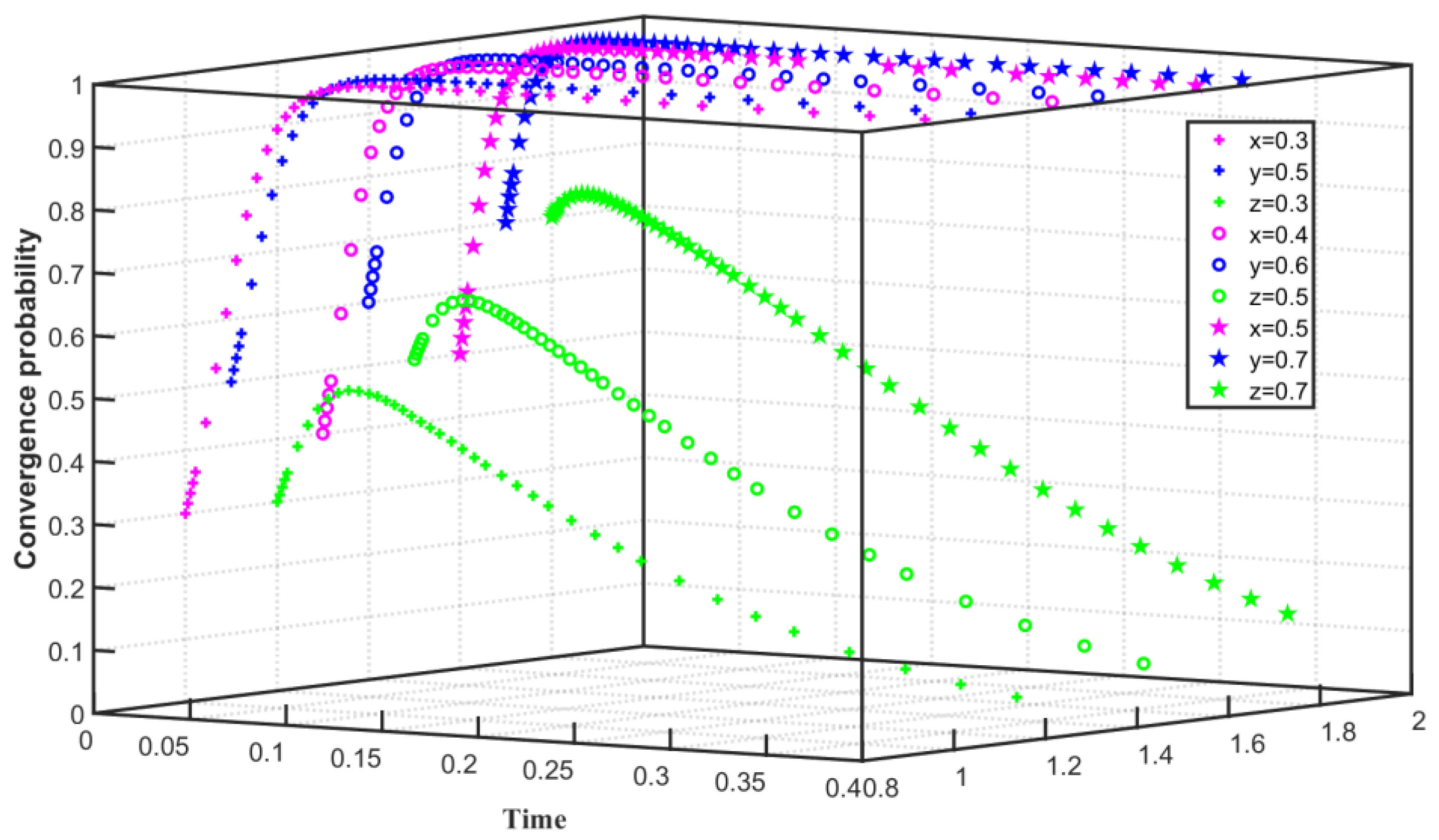

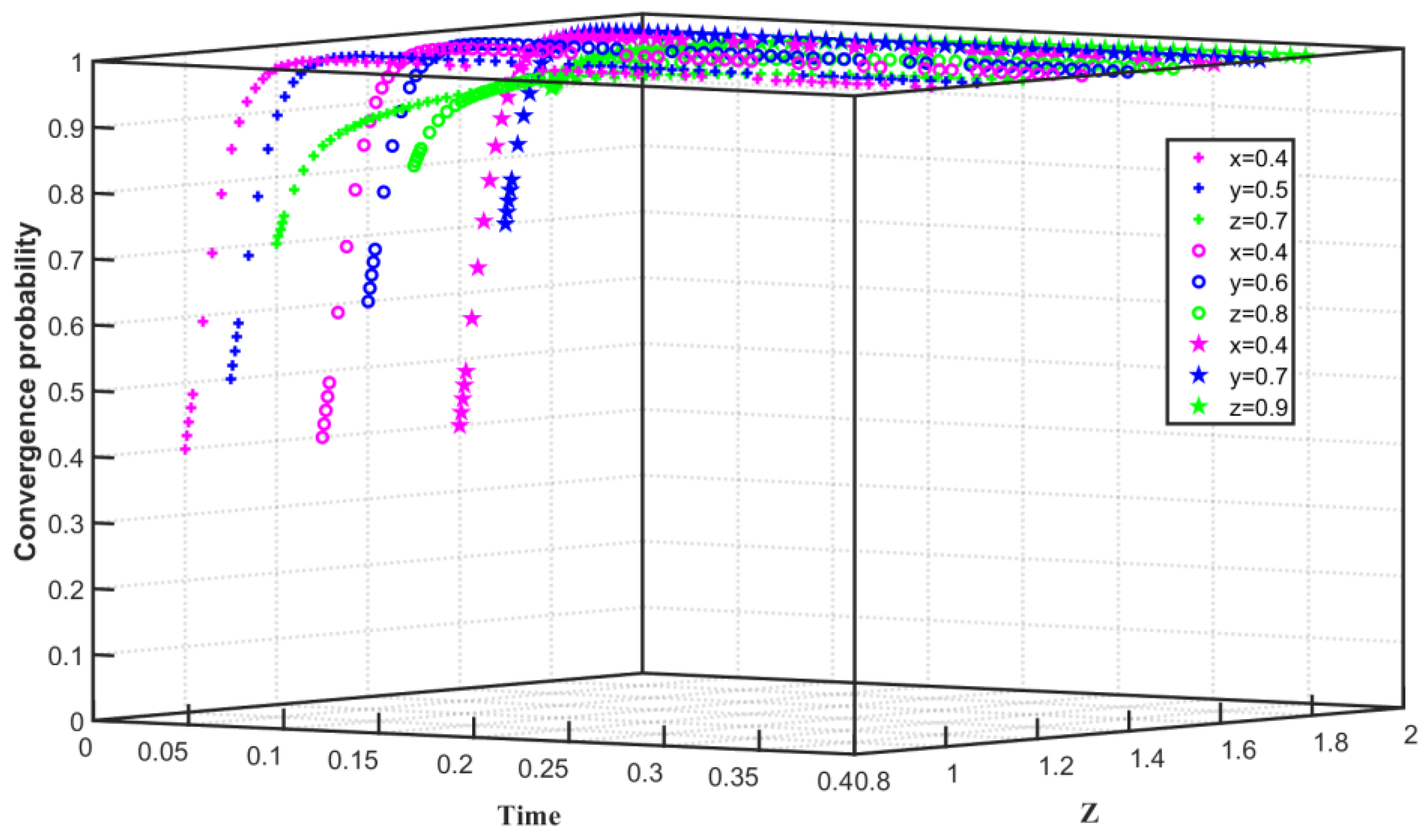

4.3. High Free Quota

5. Conclusions

- (1)

- In the two-party evolutionary game model, the carbon trading behavior is affected by the joint action of the enterprise and the government. Enterprise behavior is closely related to its cost and benefit. The enterprise chooses not to reduce carbon emission when the enterprise’s carbon emission reduction cost is high. The enterprise chooses to reduce carbon emission as the enterprise’s emission reduction cost is low. Government behavior is also constrained by the cost of regulating enterprise emission reductions. When the cost of government regulation is high, the government tends to choose not to regulate enterprises. The revenue of enterprises in carbon trading is relatively large, and the government obtains higher revenue from carbon trading on the condition that the free carbon allowances given by the government to enterprises are high and the carbon emission reduction of enterprises is low. Therefore, the enterprises converge on the choice of carbon emission reduction, and the government converges on the choice to regulate emission reduction enterprises.

- (2)

- In the three-party evolutionary game model, the convergence of the two enterprises and the government to the game equilibrium state ultimately depends on their own costs and benefits, and the carbon trading behavior is still subject to the joint action of the two enterprises and the government. Enterprise behavior is closely related to its cost and benefit. When the emission reduction costs of the two enterprises are high, both enterprises choose not to reduce carbon emissions. When the emission reduction costs of the two enterprises are low, both enterprises choose to reduce carbon emissions. Government behavior is not only related to subsidies to emission reduction enterprises but also affected by the cost of emission reduction regulations for enterprises. When government subsidies to enterprises are high, the government chooses not to regulate enterprises. When the cost of regulation is low, the government tends to choose to regulate enterprises.

- (3)

- The difference in initial willingness mainly affects the speed at which the subject converges to the steady state. When enterprises converge on the choice of carbon emission reduction, with the continuous improvement of the initial willingness, the enterprises will increase the speed of convergence on the stabilization strategy. Correspondingly, when the government converges on choosing to regulate enterprises, with the continuous improvement of the initial willingness, the government will also accelerate the speed of convergence to a steady state. However, when enterprises converge on choosing not to reduce carbon emissions, with the increase in initial willingness, enterprises initially tend to choose carbon emissions reduction and then converge to no carbon emissions reduction, which slows down the speed of convergence to no carbon emissions reduction. When the government chooses not to regulate, the time for the government to converge on not to regulate is prolonged as the government’s willingness to regulate increases.

- (1)

- The carbon emission cost of enterprises should be reduced. As a new carbon market model, the healthy operation of carbon trading can drive market entities to actively participate in carbon trading [75], increase the activity of carbon market trading, realize the rationality of carbon allowance pricing, and give full play to the guidance mechanism of carbon price on emission reduction strategies [76]. It forces enterprises to increase R&D expenditures [77], develop emission reduction technologies, reduce the cost of carbon emission reduction, urge enterprises to actively reduce carbon emission, and form a benign interaction in the carbon trading market.

- (2)

- The vitality of enterprises to reduce carbon emissions should be enhanced. At this stage, the industry structure included in the national carbon market is relatively simple, with the power generation industry as the main industry. In the future, more energy-intensive industries will be introduced to enrich the market transaction entities [78], enhance the liquidity of the carbon market, reshape the supply and demand relationship of carbon trading, and increase the trading volume of the carbon market. At the same time, most of the current carbon quota allocation methods are based on free allocation [67], and later consideration will be given to introducing paid allocation mechanism to optimize the rationality of quota allocation and enhance the initiative of enterprises to reduce carbon emissions.

- (3)

- The abilities of regulation and fulfillment for the government should be stimulated. At present, the government has successively issued the “Opinions of the Central Committee of the Communist Party of China and the State Council on Completely, Accurately and Comprehensively Implementing the New Development Concept and Doing a Good Job in Peaking and Carbon Neutralization”, “Interim Measures for the Administration of Carbon Emissions Trading”, and “Administrative Measures for Carbon Emissions Trading (for Trial Implementation)” and other documents [79], in order to ensure the efficient operation of the carbon market, it is still necessary to further improve the regulations at the carbon trading level [80], build a service-oriented government, strengthen the government’s power to supervise carbon trading behavior [81], and optimize public services.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Huo, W.; Qi, J.; Yang, T.; Liu, J.; Liu, M.; Zhou, Z. Effects of China’s pilot low-carbon city policy on carbon emission reduction: A quasi-natural experiment based on satellite data. Technol. Forecast. Soc. Chang. 2022, 175, 121422. [Google Scholar] [CrossRef]

- Wang, R.; Wen, X.; Wang, X.; Fu, Y.; Zhang, Y. Low carbon optimal operation of integrated energy system based on carbon capture technology, LCA carbon emissions and ladder-type carbon trading. Appl. Energy 2022, 311, 118664. [Google Scholar] [CrossRef]

- Karthick, B.; Uthayakumar, R. Impact of carbon emission reduction on supply chain model with manufacturing decisions and dynamic lead time under uncertain demand. Clean. Logist. Supply Chain 2022, 4, 100037. [Google Scholar] [CrossRef]

- Wang, L. Research on the dynamic relationship between China’s renewable energy consumption and carbon emissions based on ARDL model. Resour. Policy 2022, 77, 102764. [Google Scholar] [CrossRef]

- Li, W.; Yu, X.; Hu, N.; Huang, F.; Wang, J.; Peng, Q. Study on the relationship between fossil energy consumption and carbon emission in Sichuan Province. Energy Rep. 2022, 8, 53–62. [Google Scholar] [CrossRef]

- Li, R.; Li, L.; Wang, Q. The impact of energy efficiency on carbon emissions: Evidence from the transportation sector in Chinese 30 provinces. Sustain. Cities Soc. 2022, 82, 103880. [Google Scholar] [CrossRef]

- Cheng, Y.; Gu, B.; Tan, X.; Yan, H.; Sheng, Y. Allocation of provincial carbon emission allowances under China’s 2030 carbon peak target: A dynamic multi-criteria decision analysis method. Sci. Total Environ. 2022, 837, 155798. [Google Scholar] [CrossRef]

- Sun, L.; Li, W. Has the opening of high-speed rail reduced urban carbon emissions? Empirical analysis based on panel data of cities in China. J. Clean. Prod. 2021, 321, 128958. [Google Scholar] [CrossRef]

- Cui, X.; Zhao, K.; Zhou, Z.; Huang, P. Examining the uncertainty of carbon emission changes: A systematic approach based on peak simulation and resilience assessment. Environ. Impact Assess. Rev. 2021, 91, 106667. [Google Scholar] [CrossRef]

- Chen, C.; Bi, L. Study on spatio-temporal changes and driving factors of carbon emissions at the building operation stage—A case study of China. Build. Environ. 2022, 91, 109147. [Google Scholar] [CrossRef]

- Feng, T.-T.; Li, R.; Zhang, H.-M.; Gong, X.-L.; Yang, Y.-S. Induction mechanism and optimization of tradable green certificates and carbon emission trading acting on electricity market in China. Resour. Conserv. Recycl. 2021, 169, 105487. [Google Scholar] [CrossRef]

- Liu, Z.; Sun, T.; Yu, Y.; Ke, P.; Deng, Z.; Lu, C.; Huo, D.; Ding, X. Real-Time Carbon Emission Accounting Technology toward Carbon Neutrality. Engineering 2022. [Google Scholar] [CrossRef]

- Dong, Z.; Xia, C.; Fang, K.; Zhang, W. Effect of the carbon emissions trading policy on the co-benefits of carbon emissions reduction and air pollution control. Energy Policy 2022, 165, 112998. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, S.; Shao, X.; He, Y. Policy spillover effect and action mechanism for environmental rights trading on green innovation: Evidence from China’s carbon emissions trading policy. Renew. Sustain. Energy Rev. 2022, 153, 111779. [Google Scholar] [CrossRef]

- Chen, H.; Qi, S.; Tan, X. Decomposition and prediction of China’s carbon emission intensity towards carbon neutrality: From perspectives of national, regional and sectoral level. Sci. Total Environ. 2022, 825, 153839. [Google Scholar] [CrossRef]

- Barragán-Beaud, C.; Pizarro-Alonso, A.; Xylia, M.; Syri, S.; Silveira, S. Carbon tax or emissions trading? An analysis of economic and political feasibility of policy mechanisms for greenhouse gas emissions reduction in the Mexican power sector. Energy Policy 2018, 122, 287–299. [Google Scholar] [CrossRef]

- Shahbaz, M.; Li, J.; Dong, X.; Dong, K. How financial inclusion affects the collaborative reduction of pollutant and carbon emissions: The case of China. Energy Econ. 2022, 107, 105847. [Google Scholar] [CrossRef]

- Li, X. Local government decision-making competition and regional carbon emissions: Experience evidence and emission reduction measures. Sustain. Energy Technol. Assess. 2022, 50, 101800. [Google Scholar] [CrossRef]

- Gu, G.; Zheng, H.; Tong, L.; Dai, Y. Does carbon financial market as an environmental regulation policy tool promote regional energy conservation and emission reduction? Empirical evidence from China. Energy Policy 2022, 163, 112826. [Google Scholar] [CrossRef]

- Wang, L.; Hui, M. Research on joint emission reduction in supply chain based on carbon footprint of the product. J. Clean. Prod. 2020, 263, 121086. [Google Scholar] [CrossRef]

- Zhu, E.; Qi, Q.; Chen, L.; Wu, X. The spatial-temporal patterns and multiple driving mechanisms of carbon emissions in the process of urbanization: A case study in Zhejiang, China. J. Clean. Prod. 2022, 358, 131954. [Google Scholar] [CrossRef]

- Li, Z.; Wang, J. Spatial emission reduction effects of China’s carbon emissions trading: Quasi-natural experiments and policy spillovers. Chin. J. Popul. Resour. Environ. 2021, 19, 246–255. [Google Scholar] [CrossRef]

- Zhang, W.; Liu, X.; Wang, D.; Zhou, J. Digital economy and carbon emission performance: Evidence at China’s city level. Energy Policy 2022, 165, 112927. [Google Scholar] [CrossRef]

- Liu, X.; Ji, Q.; Yu, J. Sustainable development goals and firm carbon emissions: Evidence from a quasi-natural experiment in China. Energy Econ. 2021, 103, 105627. [Google Scholar] [CrossRef]

- Liu, H.; Kou, X.; Xu, G.; Qiu, X.; Liu, H. Which emission reduction mode is the best under the carbon cap-and-trade mechanism? J. Clean. Prod. 2021, 314, 128053. [Google Scholar] [CrossRef]

- Linghu, D.; Wu, X.; Lai, K.-H.; Ye, F.; Kumar, A.; Tan, K.H. Implementation strategy and emission reduction effectiveness of carbon cap-and-trade in heterogeneous enterprises. Int. J. Prod. Econ. 2022, 248, 108501. [Google Scholar] [CrossRef]

- Li, Z.; Wang, J. The Dynamic Impact of Digital Economy on Carbon Emission Reduction: Evidence City-level Empirical Data in China. J. Clean. Prod. 2022, 351, 131570. [Google Scholar] [CrossRef]

- Yang, H.; Wang, X.; Bin, P. Agriculture carbon-emission reduction and changing factors behind agricultural eco-efficiency growth in China. J. Clean. Prod. 2022, 334, 130193. [Google Scholar] [CrossRef]

- Wang, B.; Ji, F.; Zheng, J.; Xie, K.; Feng, Z. Carbon emission reduction of coal-fired power supply chain enterprises under the revenue sharing contract: Perspective of coordination game. Energy Econ. 2021, 102, 105467. [Google Scholar] [CrossRef]

- Jin, J.; Wen, Q.; Cheng, S.; Qiu, Y.; Zhang, X.; Guo, X. Optimization of carbon emission reduction paths in the low-carbon power dispatching process. Renew. Energy 2022, 188, 425–436. [Google Scholar] [CrossRef]

- Wang, W.; Hao, S.; He, W.; Mohamed, M.A. Carbon emission reduction decisions in construction supply chain based on differential game with government subsidies. Build. Environ. 2022, 109149. [Google Scholar] [CrossRef]

- Wang, Y.; Xu, X.; Zhu, Q. Carbon emission reduction decisions of supply chain members under cap-and-trade regulations: A differential game analysis. Comput. Ind. Eng. 2021, 162, 107711. [Google Scholar] [CrossRef]

- Song, X.; Shen, M.; Lu, Y.; Shen, L.; Zhang, H. How to effectively guide carbon reduction behavior of building owners under emission trading scheme? An evolutionary game-based study. Environ. Impact Assess. Rev. 2021, 90, 106624. [Google Scholar] [CrossRef]

- Liu, Z.; Jiang, P.; Wang, J.; Zhang, L. Ensemble system for short term carbon dioxide emissions forecasting based on multi-objective tangent search algorithm. J. Environ. Manag. 2022, 302, 113951. [Google Scholar] [CrossRef] [PubMed]

- Wang, W.; Zhang, Y.-J. Does China’s carbon emissions trading scheme affect the market power of high-carbon enterprises? Energy Econ. 2022, 108, 105906. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, S.; Luo, T.; Gao, J. The effect of emission trading policy on carbon emission reduction: Evidence from an integrated study of pilot regions in China. J. Clean. Prod. 2020, 265, 121843. [Google Scholar] [CrossRef]

- Chen, W.; Zhang, L.; Shi, L.; Shao, Y.; Zhou, K. Carbon emissions trading system and investment efficiency: Evidence from China. J. Clean. Prod. 2022, 358, 131782. [Google Scholar] [CrossRef]

- Huang, W.; Wang, Q.; Li, H.; Fan, H.; Qian, Y.; Klemeš, J.J. Review of recent progress of emission trading policy in China. J. Clean. Prod. 2022, 349, 131480. [Google Scholar] [CrossRef]

- Wang, H.; Shi, W.; He, Y.; Dong, J. Spill-over effect and efficiency of seven pilot carbon emissions trading exchanges in China. Sci. Total Environ. 2022, 838, 156020. [Google Scholar] [CrossRef]

- Li, J.-L.; Chi, Y.-Y.; Li, Y.; Pang, Y.; Jin, F. Does the coexistence of carbon emission trading and energy efficiency trading make sense? The case of China. Energy Rep. 2022, 8, 710–721. [Google Scholar] [CrossRef]

- Zhang, W.; Li, J.; Li, G.; Guo, S. Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy 2020, 196, 117117. [Google Scholar] [CrossRef]

- Wang, P.; Tang, J.; Zhang, Z.; Li, Y.; Wu, H.; Ji, C.; Lin, Z.; Ma, J.; Qi, H.; Zhang, W.; et al. Bidding strategy optimization for power generation company in carbon emission rights and electricity market. Energy Rep. 2022, 8, 325–331. [Google Scholar] [CrossRef]

- Zhou, F.; Wang, X. The carbon emissions trading scheme and green technology innovation in China: A new structural economics perspective. Econ. Anal. Policy 2022, 74, 365–381. [Google Scholar] [CrossRef]

- Chen, S.; Shi, A.; Wang, X. Carbon emission curbing effects and influencing mechanisms of China’s Emission Trading Scheme: The mediating roles of technique effect, composition effect and allocation effect. J. Clean. Prod. 2020, 264, 121700. [Google Scholar] [CrossRef]

- Fageda, X.; Teixidó, J.J. Pricing carbon in the aviation sector: Evidence from the European emissions trading system. J. Environ. Econ. Manag. 2022, 111, 102591. [Google Scholar] [CrossRef]

- Luo, Y.; Wang, W.; Zhao, D. The impacts of carbon emission trading mechanism on the power transition pathway-taking Guangdong-Hong Kong-Macao Greater Bay Area as an example. J. Clean. Prod. 2022, 330, 129894. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Liang, T.; Jin, Y.-L.; Shen, B. The impact of carbon trading on economic output and carbon emissions reduction in China’s industrial sectors. Appl. Energy 2020, 260, 114290. [Google Scholar] [CrossRef]

- Hong, Q.; Cui, L.; Hong, P. The impact of carbon emissions trading on energy efficiency: Evidence from quasi-experiment in China’s carbon emissions trading pilot. Energy Econ. 2022, 110, 106025. [Google Scholar] [CrossRef]

- Zhang, M.; Ge, Y.; Liu, L.; Zhou, D. Impacts of carbon emission trading schemes on the development of renewable energy in China: Spatial spillover and mediation paths. Sustain. Prod. Consum. 2022, 32, 306–317. [Google Scholar] [CrossRef]

- Ying, Z.; Xin-gang, Z. The impact of Renewable Portfolio Standards on carbon emission trading under the background of China’s electricity marketization reform. Energy 2021, 226, 120322. [Google Scholar] [CrossRef]

- Li, L.; Zhang, S.; Cao, X.; Zhang, Y. Assessing economic and environmental performance of multi-energy sharing communities considering different carbon emission responsibilities under carbon tax policy. J. Clean. Prod. 2021, 328, 129466. [Google Scholar] [CrossRef]

- Zou, H.; Zhong, M.-R. Factor reallocation and cost pass-through under the carbon emission trading policy: Evidence from Chinese metal industrial chain. J. Environ. Manag. 2022, 313, 114924. [Google Scholar] [CrossRef] [PubMed]

- Chu, Z.; Bian, C.; Yang, J. Joint prevention and control mechanism for air pollution regulations in China: A policy simulation approach with evolutionary game. Environ. Impact Assess. Rev. 2021, 91, 106668. [Google Scholar] [CrossRef]

- Li, M.; Gao, X. Implementation of enterprises’ green technology innovation under market-based environmental regulation: An evolutionary game approach. J. Environ. Manag. 2022, 308, 114570. [Google Scholar] [CrossRef]

- Sun, Y.; Liu, B.; Fan, J.; Qiao, Q. The multi-player evolutionary game analysis for the protective development of ecotourism. Environ. Sci. Policy 2021, 126, 111–121. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, D.; Shi, X. Exploring the dilemma of overcapacity governance in China’s coal industry: A tripartite evolutionary game model. Resour. Policy 2021, 71, 102000. [Google Scholar] [CrossRef]

- Yang, K.; Wang, W.; Xiong, W. Promoting the sustainable development of infrastructure projects through responsible innovation: An evolutionary game analysis. Util. Policy 2021, 70, 101196. [Google Scholar] [CrossRef]

- Dong, J.; Jiang, Y.; Liu, D.; Dou, X.; Liu, Y.; Peng, S. Promoting dynamic pricing implementation considering policy incentives and electricity retailers’ behaviors: An evolutionary game model based on prospect theory. Energy Policy 2022, 167, 113059. [Google Scholar] [CrossRef]

- Chu, Z.; Bian, C.; Yang, J. How can public participation improve environmental governance in China? A policy simulation approach with multi-player evolutionary game. Environ. Impact Assess. Rev. 2022, 95, 106782. [Google Scholar] [CrossRef]

- Lu, W.; Du, L.; Tam, V.W.Y.; Yang, Z.; Lin, C.; Peng, C. Evolutionary game strategy of stakeholders under the sustainable and innovative business model: A case study of green building. J. Clean. Prod. 2022, 333, 130136. [Google Scholar] [CrossRef]

- Yu, N.; Zhao, C. Chain Innovation Mechanism of the Manufacturing Industry in the Yangtze River Delta of China Based on Evolutionary Game. Sustainability 2021, 13, 9729. [Google Scholar] [CrossRef]

- Wei, J.; Wang, C. Improving interaction mechanism of carbon reduction technology innovation between supply chain enterprises and government by means of differential game. J. Clean Prod. 2021, 296, 126578. [Google Scholar] [CrossRef]

- Pan, X.; Pu, C.; Yuan, S.; Xu, H. Effect of Chinese pilots carbon emission trading scheme on enterprises’ total factor productivity: The moderating role of government participation and carbon trading market efficiency. J. Environ. Manag. 2022, 316, 115228. [Google Scholar] [CrossRef]

- Cheng, F.; Chen, T.; Chen, Q. Cost-reducing strategy or emission-reducing strategy? The choice of low-carbon decisions under price threshold subsidy. Transp. Res. Part E Logist. Transp. Rev. 2022, 157, 102560. [Google Scholar] [CrossRef]

- Li, X.; Li, Z.; Su, C.-W.; Umar, M.; Shao, X. Exploring the asymmetric impact of economic policy uncertainty on China’s carbon emissions trading market price: Do different types of uncertainty matter? Technol. Forecast. Soc. Change 2022, 178, 121601. [Google Scholar] [CrossRef]

- Wang, W.; Zhou, C.; Li, X. Carbon reduction in a supply chain via dynamic carbon emission quotas. J. Clean. Prod. 2019, 240, 118244. [Google Scholar] [CrossRef]

- Wu, Q.; Wang, Y. How does carbon emission price stimulate enterprises’ total factor productivity? Insights from China’s emission trading scheme pilots. Energy Econ. 2022, 109, 105990. [Google Scholar] [CrossRef]

- Zhang, X.; Gan, D.; Wang, Y.; Liu, Y.; Ge, J.; Xie, R. The impact of price and revenue floors on carbon emission reduction investment by coal-fired power plants. Technol. Forecast. Soc. Chang. 2020, 154, 119961. [Google Scholar] [CrossRef]

- Zhang, C.; Zhang, X. Evolutionary game analysis of air pollution co-investment in emission reductions by steel enterprises under carbon quota trading mechanism. J. Environ. Manag. 2022, 317, 115376. [Google Scholar] [CrossRef]

- Zhao, X.; Liu, L.; Di, Z.; Xu, L. Subsidy or punishment: An analysis of evolutionary game on implementing shore-side electricity. Reg. Stud. Mar. Sci. 2021, 48, 102010. [Google Scholar] [CrossRef]

- Zhang, M.; Kong, Z. A tripartite evolutionary game model of emergency supplies joint reserve among the government, enterprise and society. Comput. Ind. Eng. 2022, 169, 108132. [Google Scholar] [CrossRef]

- Yuan, M.; Li, Z.; Li, X.; Li, L.; Zhang, S.; Luo, X. How to promote the sustainable development of prefabricated residential buildings in China: A tripartite evolutionary game analysis. J. Clean Prod. 2022, 349, 131423. [Google Scholar] [CrossRef]

- Liu, Y.; Zuo, J.; Pan, M.; Ge, Q.; Chang, R.; Feng, X.; Fu, Y.; Dong, N. The incentive mechanism and decision-making behavior in the green building supply market: A tripartite evolutionary game analysis. Build. Environ. 2022, 214, 108903. [Google Scholar] [CrossRef]

- Hao, X.; Liu, G.; Zhang, X.; Dong, L. The coevolution mechanism of stakeholder strategies in the recycled resources industry innovation ecosystem: The view of evolutionary game theory. Technol. Forecast. Soc. Change 2022, 179, 121627. [Google Scholar] [CrossRef]

- Sun, W.; Huang, C. Predictions of carbon emission intensity based on factor analysis and an improved extreme learning machine from the perspective of carbon emission efficiency. J. Clean. Prod. 2022, 338, 130414. [Google Scholar] [CrossRef]

- Ma, Q.; Tariq, M.; Mahmood, H.; Khan, Z. The nexus between digital economy and carbon dioxide emissions in China: The moderating role of investments in research and development. Technol. Soc. 2022, 68, 101910. [Google Scholar] [CrossRef]

- He, Y.; Fu, F.; Liao, N. Exploring the path of carbon emissions reduction in China’s industrial sector through energy efficiency enhancement induced by R&D investment. Energy 2021, 225, 120208. [Google Scholar] [CrossRef]

- Wu, F.; Huang, N.; Zhang, F.; Niu, L.; Zhang, Y. Analysis of the carbon emission reduction potential of China’s key industries under the IPCC 2 °C and 1.5 °C limits. Technol. Forecast. Soc. Change 2020, 159, 120198. [Google Scholar] [CrossRef]

- Zhang, H.; Sun, X.; Bi, C.; Ahmad, M.; Wang, J. Can sustainable development policy reduce carbon emissions? Empirical evidence from resource-based cities in China. Sci. Total Environ. 2022, 838, 156341. [Google Scholar] [CrossRef]

- Xuan, D.; Ma, X.; Shang, Y. Can China’s policy of carbon emission trading promote carbon emission reduction? J. Clean. Prod. 2020, 270, 122383. [Google Scholar] [CrossRef]

- Zhang, W.; Li, G.; Guo, F. Does carbon emissions trading promote green technology innovation in China? Appl. Energy 2022, 315, 119012. [Google Scholar] [CrossRef]

| Parameter | Definition |

|---|---|

| Comprehensive income when the enterprise does not reduce emissions (purchase carbon quotas) | |

| Increased comprehensive income when all enterprises choose to reduce emissions at the same time | |

| Government benefits when enterprises do not reduce emissions (purchase carbon credits) | |

| ) | |

| Government benefits when some enterprises do not reduce emissions (purchase carbon quotas) and when some enterprises choose to reduce emissions | |

| Government subsidies for emission reduction enterprises | |

| The government’s penalties for enterprises that do not reduce emissions | |

| Regulatory costs for government supervision of enterprise emission reductions | |

| The cost of the government’s failure to implement regulations on whether enterprises reduce emissions | |

| Costs for enterprises to implement emission reduction | |

| The cost of enterprises not reducing emissions (purchasing carbon credits) | |

| Carbon allowances allocated by the government to enterprises for free | |

| Carbon emissions when enterprises actively reduce emissions | |

| Carbon emissions when enterprises do not reduce emissions | |

| Carbon trading price |

| Strategy | Government | ||

|---|---|---|---|

| Enterprise | Reduction | ||

| Purchase ) | |||

| Equilibrium | ||

|---|---|---|

| E1(0,0) | E2(0,1) | E3(1,0) | E4(1,1) | ||

|---|---|---|---|---|---|

| Type 1 | − | + | + | − | |

| − | + | + | − | ||

| Stability | ESS | Saddle point | Saddle point | ESS | |

| Type 2 | − | − | + | + | |

| + | − | +/− | +/− | ||

| Stability | Unstable point | ESS | Unstable point | Unstable point | |

| Type 3 | + | + | − | − | |

| +/− | +/− | − | + | ||

| Stability | Unstable point | Unstable point | ESS | Unstable point | |

| Strategy | Enterprise 2 | ||

|---|---|---|---|

| Enterprise 1 | |||

| Purchase ) | |||

| Strategy | Enterprise 2 | ||

|---|---|---|---|

| Enterprise 1 | ) | ||

| Purchase ) | |||

| Equilibrium | |||

|---|---|---|---|

| Eigenvalues | ||||||||

|---|---|---|---|---|---|---|---|---|

| + | − | + | + | + | − | − | − | |

| + | + | − | + | − | + | − | − | |

| + | + | + | − | − | − | + | − | |

| Stability | Saddle point | Unstable point | Unstable point | Unstable point | Unstable point | Unstable point | Unstable point | ESS |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, N.; Chen, J.; Cheng, L. Evolutionary Game Analysis of Carbon Emission Reduction between Government and Enterprises under Carbon Quota Trading Policy. Int. J. Environ. Res. Public Health 2022, 19, 8565. https://doi.org/10.3390/ijerph19148565

Yu N, Chen J, Cheng L. Evolutionary Game Analysis of Carbon Emission Reduction between Government and Enterprises under Carbon Quota Trading Policy. International Journal of Environmental Research and Public Health. 2022; 19(14):8565. https://doi.org/10.3390/ijerph19148565

Chicago/Turabian StyleYu, Na, Jianghua Chen, and Lei Cheng. 2022. "Evolutionary Game Analysis of Carbon Emission Reduction between Government and Enterprises under Carbon Quota Trading Policy" International Journal of Environmental Research and Public Health 19, no. 14: 8565. https://doi.org/10.3390/ijerph19148565

APA StyleYu, N., Chen, J., & Cheng, L. (2022). Evolutionary Game Analysis of Carbon Emission Reduction between Government and Enterprises under Carbon Quota Trading Policy. International Journal of Environmental Research and Public Health, 19(14), 8565. https://doi.org/10.3390/ijerph19148565