Abstract

This paper analyses the impact of financial development on the environmental quality and sustainability for the group of G7 countries over the period 1990–2019 based on static panel data-fixed effect models. The objective is to explore if there exists a non-linear relationship between the whole financial system development and a wide array of measures of environmental sustainability and degradation, namely adjusted net savings, greenhouse gas, CO2, methane, nitrous oxide emissions and ecological footprint. We define a new Financial Environmental Kuznets Curve (FEKC) by introducing the square term of financial development on the environment-finance relationship. Empirical results prove the existence of non-linear relationships between the composite index of financial development and environmental degradation for the group of advanced economies. In the case of methane, we validate the presence of an inverted-U shape association in line with the FEKC hypothesis, while for greenhouse gas and CO2 the link follows a U-shaped pattern. The impact of financial development on environmental sustainability is monotonically positive and statistically significant while the ecological footprint is not statistically linked with the level of financial development within G7 countries. Economic growth, human capital, population density and primary energy consumption appear as significant drivers of environmental quality and sustainability.

1. Introduction

Over the last decade increasing concerns have been arising in the fight against climate change, global warming and biosystems’ degradation. Since the approval of the Kyoto Protocol different commitments have been assumed by countries worldwide and nowadays environmental protection is at the core of policymakers’ agenda.

A decisive step from an international point of view is the commitment of well-developed countries to the achievement of Sustainable Development Goals (SDG). This initiative requires important financial support from public authorities and private financial systems because the transition process would not be possible if enough financing is not available for changing the prevailing economic model and promoting the more pollutant sectors to evolve towards a neutral carbon economy by 2050.

The specialized literature apprehends much attention to the negative externalities associated with environmental damage and climate change, and it has involved diverse disciplines like ecology, economy, and law, just to cite few [1].

In particular, the role of the financial system has been widely analyzed in the literature from different perspectives, like its impact on the level of economic growth, technological progress, and income inequality [2]. The primary objective of a well-developed financial system is to fulfil the basic needs of funds channeling, support of the payment system and the provision of financial services. Once these minimum standards have been achieved, it is expected that financial systems evolve in line with economic growth and foster economic development and prosperity.

However, until recent days prosperity has only been measured in socioeconomic terms, but with no reference to the natural environment. Quite recently for the sake of measuring prosperity new metrics aligned with ESG criteria (environmental, social and governance) are being used. However, our current economic model focused on a linear approach and based on increasing industrialization and commercialization demands high energy that results in high emissions and a serious threat to human beings [3]. The effects of the environmental degradation are not restricted to the economic sphere. According to [4] “the prevailing global warming and the subsequent climate change pose potential diverse physical, ecological and health threats reciprocated by extreme weather conditions”. Indeed, the environment is closely related to human health issues because there is a direct effect of pollutant emissions on a varied range of cardiopulmonary diseases and child mortality, not to mention problems associated with water quality and scarcity [5,6]. Recently, some authors have explored the link between air quality and the coronavirus disease rapid spread [7]. We should not ignore that all these harmful effects are accompanied by important economic costs of higher medical expenditures, lower labor productivity and losses of human lives. The OECD publishes specific data on mortality, morbidity and welfare costs from exposure to environmental-related risks.

Having emphasized the importance of the financial system as facilitating the transition towards a carbon neutral economy and a sustainable development model, this study sheds new light on the linear and non-linear impact of financial development in terms of environmental degradation and sustainability. In this paper we define a new Financial Environmental Kuznets Curve hypothesis (FEKC) as the existence of an inverted U-shaped relationship between levels of financial system development and levels of environmental degradation.

We will analyze the group of G7 countries that are financially developed and well positioned to guide developing countries within the path towards sustainability because if developed countries do not take decisive steps in these years, global goals of planet sustainability would not be achieved. [8] argued that developed countries have better ability to climate change adaptation than developing countries.

In particular, the article will explore if there is a threshold after which the level of financial development exerts a positive impact on the environment, either by reducing polluting emissions or increasing levels of environmental sustainability. When countries financially evolve and adopt greener technologies, switch to a more intensive use of renewable energies or invest more heavily in research and development activities, this could result in diminishing polluting emissions. This seems an interesting topic that deserves to be further empirically examined if we are aimed at simultaneously achieving an effective environmental protection and ambitious sustainability standards in the medium term.

Specifically, this paper set the following research objectives:

- (1)

- To assess which are the drivers of environmental burden and sustainability for the specific group of developed countries.

- (2)

- To analyze to what extent developed financial systems are well positioned to protect the environment and help reducing polluting emissions.

- (3)

- To assess the existing nexus between financial development and different proxies of environmental degradation at different stages of development, and explore if there is a U-shaped relationship (the so-called Financial Environmental Kuznets Curve, FEKC).

- (4)

- To give some recommendations for polluting emissions’ abatement strategies based on the empirical findings of this study.

In this paper we adopt a panel data-fixed effect analysis that explains time-invariant country-specific features that may create omitted-variable bias. We also include a wide range of environmental damage variables because there is evidence that they are driven by different forces, to a different extent and in different directions [9]. We will analyze global emissions of greenhouse gases (GHG, hereafter), its three main components, namely carbon dioxide (CO2), methane and nitrous oxide emissions, ecological footprint and a proxy of environmental sustainability.

The uniqueness of the paper lies on analyzing the non-linear relationship between financial system development and the natural environment within the EKC framework, assuming that this link is non-permanent, and it depends on the country’s phase of financial development. To the best of our knowledge no previous articles have particularly tested the non-linear impact of financial system development for the specific group of advanced economies and include into the analysis so diverse measures of environmental quality and sustainability as this study. Secondly, to assess the importance of the financial system we use a composite index of financial development that captures both the intermediation activity of banking institutions and the capitalization process carried out through capital markets, which gives a wider perspective of the financialization process than previous studies that are only focused on the credit provision channel [10]. Third, instead of considering levels of CO2 emissions, this study also includes varied environmental variables like the ecological footprint, the three main GHG (CO2, methane and nitrous oxide emissions) and also the environmental sustainability measured by the adjusted net savings. Fourth, new variables like the expenditure on research and development activities and a human capital index will be also appraised in this setting. Finally, this article extends previous studies by using more recent data so our findings contribute to the open debate and results can be contrasted with past studies. The data base and the open-source code required to replicate all analyses in this article (including multicollinearity diagnoses, descriptive and bivariate correlations procedures) are available in [11].

The remainder of this paper article is organized as follows. The next section reviews the literature on the topic and summarizes the main results achieved by previous studies so far. The section of data and empirical model describes the sample and the econometric technique applied. The fourth section presents the main empirical results, and the implications of the findings are discussed in the fifth section. The article ends with some concluding remarks that outline some recommendations for policymakers and regulators.

2. Literature Review

The existing nexus between the process of financialization and economic growth has been extensively analyzed in the literature. The origin of this line of research dates back to the study of [12] that defines a model for economic growth and its short-term and long-term equilibriums.

The link between the environment and economic growth has been hypothesized in the Environmental Kuznets Curve (EKC) framework. The EKC phenomenon was first established in the pioneering work of [13], which proves the existence of an inverted U-shaped relationship between growth and environmental quality. According to the EKC hypothesis, at the initial stage of growth a rise in income per capita causes high emissions and has a negative effect on the environment, but after reaching a certain threshold level, further increases in income reduces CO2 emissions and has a positive effect on environmental quality.

Other line of research focuses on the link between growth, financial development and CO2 emissions. From a theoretical point of view [14] have identified different channels through which the financial system may have an impact on the natural environment, which are capitalization effect, technology effect, income effect and regulation effect. The sign of the relationship will ultimately depend on which of the previous effect is dominant.

Empirical studies carried out reveal that results are sensible to the choice of methodology, the sample of countries, the set of explanatory variables and the period of analysis considered [15,16]. Thus, no consensus has been yet reached on this topic. Indeed, most of studies have been mainly focused on the effects of economic growth and financial development, among other drivers, on the level of CO2 emissions.

From the literature reviewed in this study we distinguish four groups of studies. Within the first group, some authors like [17] encounter a positive relationship between financial development and environmental quality because financial development helps in providing higher information about the importance of the environment, especially in developing countries. They find that foreign direct investment contributes to diminishing levels of CO2 emissions per capita, while the financial liberalization effect will ultimately depend on the strength of the institutional framework in force. In addition, these studies support that financial sector appears to be providing financial services for eco-friendly programs at a lower cost and are specialized intermediaries in financing these types of programs. Ref. [18] explore the relationship between financial development and environmental damage and argue that it is not significant in low-income countries because of their early stage of economic growth. However, for the group of upper-medium income countries, the outcome is the opposite and financial development enhances environmental quality. One explanation is that these developed countries have well-established financial systems that positively correlate with economic progress and financial systems are less intensive in capital than industrial production, thus generates lower CO2 emissions. Ref. [19] reveal that financial development, urban population and technology ensure an improved environmental quality in the long run in emerging economies, but in the short term they encounter a bidirectional causal relationship. Ref. [20] analyzes the linkage between financial development and the reduction of CO2 emissions related to a level of income inequality that should not be exceeded in order to maintain this effect. Ref. [21] explore the impact of domestic credit to the private sector subject to the level of trade by using fixed effect panel threshold model in the BRICS economies and find that environmental quality increases consistently across all intervals.

Within the second group of studies, ref. [22] analyses the positive relationship between polluting emissions and economic growth. Ref. [23] argues that financial development facilitates the access to credit for setting up businesses that are intensive in energy consumption, therefore increasing environmental burden. Ref. [24] supports that financial development reduces transaction costs and makes credits to the private sector relatively cheaper. This leads to the undertaking of new projects and buying new facilities that in the end will upsurge polluting emissions. Ref. [25] points out that industrial activities generally accompany financial development, which in turn have negative externalities of increasing pollution levels. A great deal of studies has focused on the group of developing countries due to their specific characteristics. Refs. [16,26,27,28,29] find a direct effect of economic growth in terms of increasing environmental degradation. However, scarce attention has been paid to the group of developed economies as the more pollutant cases. Among them, ref. [30] discover a positive relationship between credit provided by banks and GDP, and indirectly with CO2 emissions, while [28] find a direct and positive effect of financial development on CO2 levels for the group of G8 countries, although this effect is even more pronounced for the group of D8 countries.

A third group of papers is characterized by mixed results when analyzing an extensive panel of countries [31,32,33] from which no conclusive results can be obtained.

Finally, a fourth group of studies do not encounter a significant relationship between financial development and environmental quality like [34,35,36,37].

Table 1 below summarizes some important contributions to this field of study.

Table 1.

Literature review of the role of financial system on environmental degradation.

However, the empirical debate goes beyond the linear association of income, financial development and the environment, and some authors have explored this link within the Environmental Kuznets Curve (EKC) framework based on the work of [41] that analyses the non-linear empirical connection between economic growth and environmental quality. Empirical findings reveal the presence of an inverted U-shaped curve suggesting that income increases initially leads to higher levels of polluting emissions, but after a level the negative impact turns into positive by reducing environmental damage. Therefore, countries growing beyond this threshold can be considered as positive for the natural environment [27]. The turning point can be interpreted as the consequence of advances towards a more efficient use of energy and the implementation of environmental protection initiatives. According to [9] the theoretical explanations of this finding are three-fold. First, the variation of marginal utilities of economic growth and environmental quality, implying that when a country’s income grows then the rate of return of reducing pollution tends to increase. Secondly, the “pollution haven” effect that explains the relocation of most pollutant industries from developed to developing countries as a sort of environmental dumping, therefore reducing environmental damage. Last, a sectorial recomposition in favor of environmental- friendly activities that alleviates pollution. In addition, [33] point out that as people disposes of extra income this makes them be more natural environmentally oriented.

Within the EKC framework a great body of specialized literature has analyzed the level of carbon emissions [35,42,43,44,45], but ignore other emissions that can significantly harm the environment [46]. Other lines of research tend to focus on alternative measures of environmental damage like [47,48] who analyze GHG emissions, [49,50] study the ecological footprint and [33] includes into the analysis a varied mix of environmental quality variables and environmental sustainability. In the same vein, [51] focus on Islamic countries and [9] on the group of EU countries and explore the three main GHG gases. The reasoning is that environmental quality cannot be captured by levels of CO2 while ignoring degradation in soil stock, forestry stock, mining stock or oil stock, among others.

If we specifically analyze the evidence of EKC on developed countries [52,53] find an inverted U-shaped relationship in the case of France, and [48] in the US. Ref. [37] analyze the case of the 10 top-ten emitter countries applying quantile regressions and the findings of the study validates the EKC hypothesis only in top quantiles. Ref. [54] performs panel data analysis and find support of the EKC in American and European countries at all quantiles. Ref. [15] apply dynamic seemingly unrelated regression long-run panel and their results support the validity of the EKC hypothesis for 5 of the 18 Central and Eastern European countries, so partial support is empirically demonstrated. Likewise, ref. [18] conclude that among a mixed panel of countries the EKC only holds for the group of developed countries, in line with previous findings of [55]. On the contrary, ref. [49] do not support the EKC hypothesis for the group of EU countries applying a second generation of panel data analysis. Ref. [9] validate the existence of a U-shaped relationship for all environmental variables considered in their study for EU-27 and EU-15 countries in the short-run.

Another line of research tries to identify a potential N-shape relationship between the environment and economic growth by including a square and cubic term into the equation. For instance, ref. [1] separately analyze three regions in China and they estimate two inflection points of the inverted N-shaped model for CO2 emissions. Ref. [56] confirm the inverted N-shaped relationship between the pollution factor and economic growth per capita in China at a province level. Ref. [57] reveal that GDP per capita has an inverted N-shaped impact on environmental deterioration, having the financial development a direct and moderating effect. Within the same line [58] support the presence of an inverted N type after adding spatial effects. Ref. [59] find a cubic relationship of economic growth and reveal that different renewable and non-renewable energy proxies in Egypt follow a N-shape pattern.

However, up to this point, there is a gap in the existing literature because the non-linear impact of financial development has not been considered within the EKC framework for the group of advances economies. Indeed, we find just few studies that deal with this issue, like [60] at a province level in China and they conclude that initially financial development exerts a positive effect on the environment due to the technological effect (energy efficiency improvements). However, after a certain level additional increases of financial development lead to augmenting environmental damage (U-shaped form). Ref. [61] find the opposite outcome of an inverted U-association, indicating that at a second stage of economic growth financial development becomes environmentally friendly in the presence of strong economic institutions.

In the light of this mixed and inconclusive evidence we argue that there remains room for exploring the non-linear impact of financial development on environmental quality and sustainability in advanced economies. In this paper we define the Financial Environmental Kuznets Curve hypothesis (FEKC) as the existence of an inverted U-shaped connection between levels of financial development and environmental degradation, so as long as the financial system develops after a threshold the natural environment will benefit from technological progress, greener technologies, move to renewable sources of energy and the implementation of initiatives that help reducing existing levels of polluting emissions. This hypothesis should follow a U pattern in the case of environmental sustainability.

3. Data and Empirical Model

This section analyses the data and the econometric strategy applied in this research.

3.1. Data

This study covers annual time series data from 1990 to 2019 for the group of G7 countries (Canada, France, Germany, Italy, Japan, the UK, and the USA).

These countries have been selected because their levels of economic growth are the highest worldwide, so it can be expected that their financial systems are also well-developed. The aim of this study is to capture the effect of financialization at a second stage of development to see if non-linear patterns appear in this relationship.

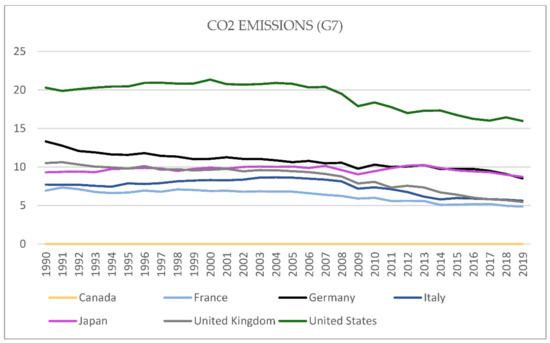

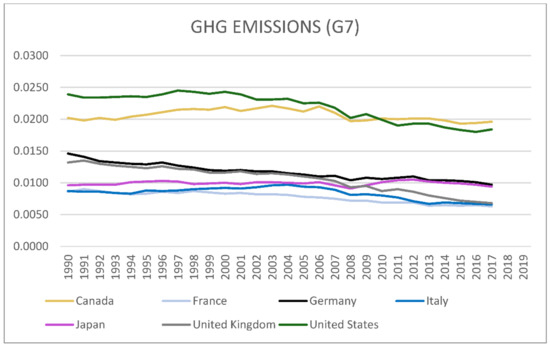

The selection of variables is based on existing literature and focused on the specific group of advanced economies. In this vein, a wide array of environmental proxies have been included to extend previous studies and simultaneously analyze global GHG emissions and its components, namely CO2, Methane (MET) and Nitrous oxide (NIT) (Time series of polluting emissions are included in Appendix A). In addition, the Ecological Footprint (EF) has been included in order to take into account the biosystems’ degradation. Finally, a proxy of environmental sustainability has been considered as the variable Adjusted Net Savings (ANS).

In this background we assume that environmental quality and sustainability are a function of important variables such as the GDP and the level of Financial Development (FD). Other important drivers of this relationship that should be controlled in advanced economies are Population Density (POP), Expenditure on Research and Development (RD), Primary Energy Consumption (PE) and Human Capital (HC). Each of these variables play an important role in advanced economies and exert a direct impact in environmental damage and environmental sustainability as argued in the literature review section.

The definition and data sources from official statistics of selected variables are shown in Table 2, while the descriptive statistics (i.e., mean value, standard deviation, maximum value, and minimum value) of all the selected variables are shown in Table 3. Research data was gathered from the World Bank database, International Monetary Fund database, CAIT Climate Data Explorer, Our World in data, Penn tables and the Global Carbon Project.

Table 2.

Variable synthesis.

Table 3.

Descriptive statistics.

3.2. Estimation Model

This section outlines the econometric instrument deployed in the study. In order to empirically explore the impact of financial development on the environmental degradation and sustainability econometric model panel data regression with fixed effects is used for the baseline model. The term “fixed effects” is due to the fact that, although the intercept may differ across individuals (the 7 countries), each individual’s intercept is time invariant [62,63].

Ref. [64] suggest that panel data estimation models have several advantages over time series data, such as it provides robust results and counters the issue of multicollinearity, heterogeneity and endogeneity. However, fixed effect regression accounts for unobserved time-invariant among individual characteristics, and that may lead to biased results.

To overcome this issue [65] employed the system generalized method of moments (SYS-GMM) to estimate a dynamic panel model that eliminates the countries’ specific heterogeneity by using the first difference of the dependent variable. However, while using cross-country data, we have a number of reasons to use a fixed effect model. First, we assume that those time-invariant features are unique to the country and may not be correlated with other country’s characteristics. Each country is different and therefore individual country’s error term and the constant (which captures individual country characteristics) may not be correlated with the others. Secondly, we assume that something within each country may impact or bias the predictor such as GDP or carbon emission, the outcome variables. This potential effect is unobservable; however, we can control it by using a fixed effect model. In this regard [4] propose to use fixed effect model instead of the model with random effects. The latter is more efficient (the variance of the estimation is lower) but less consistent than the fixed effects model, i.e., it is more accurate in the calculation of the parameter value but it may be more biased than the fixed effects model.

This study considers five important proxies of environmental quality (ENV): GHG, CO2, MET, NIT and EF. Additionally, we include the variable ANS as a proxy of environmental sustainability [33].

In this paper we use as the proxy of financial development the composite index of financial institutions and financial markets development in terms of depth, access and efficiency. For alleviating omitted variable bias, we sequentially added several control variables that are possibly connected with variation in environmental quality and sustainability. In the selection of control variables, after referring to the existing literature, we decided to control four variables, including Population Density (POP), Expenditure on Research and Development (RD), Primary Energy Consumption (PE) and Human Capital (HC).

Therefore, we can express the association of ENV with economic growth, financial development, population density, expenditure on research and development, primary energy consumption and human capital as follows:

ENV = f (GDP; FD; POP, RD, PE, HC),

All variables in Equation (1) are transformed into their natural logarithms to eliminate the effect of variable dimension as well as to reduce dispersion in the data and to minimize issues related to potential multicollinearity and heteroscedasticity in the data. The loglinear transformation data also produce more efficient and consistent results than the simple linear form [66]. The log-linear multivariable model is shown as follows:

where, i denotes the country (i = 1,…,7), and t indicates the time period (1990–2019). Log ENV appraises environmental variables. The coefficients correspond to GDP, FD, POP, RD, PE, HC, respectively, and the parameters can be interpreted as elasticities of ENV with respect to these variables. denotes the error term.

Based on previous studies that found a non-linear relationship between GDP and environmental quality (the so-called Environmental Kuznets Curve), this study goes further by analyzing the non-linear nexus between ENV (quality and sustainability) and FD to investigate the long-run relationship. We test if there is an inverted U-shaped association indicating that at the early stage of financial development the natural environment deteriorates as the financial system evolve, but when achieving a particular threshold of financialization the level of environmental degradation begins to fall. To test this hypothesis, we add the FD- squared value to test the validity of the so-called Financial Environmental Kuznets Curve (FEKC) hypothesis. In regressions we also account for the fact that financial development is correlated with economic growth, and so the former may simply pick up the effect of a general increase in wealth on the level of energy demand. We therefore add both FD and the square thereof to the regression. We rewrite the general model as follows:

According to the model, if the FEKC hypothesis defined in this article holds, then β2 should be statistically significant and positive while β3 would appear as statistically significant and with a negative sign. In this vein, an inverted U-shaped relationship between financial development and environmental degradation would be validated.

In the case of environmental sustainability, the same outcome will be obtained when the relationship follows a U pattern, then the effect of initial financial development will be negative by reducing environmental sustainability up to a point, and thereafter sustainability will start to increase along with financial development.

Table 4 shows the outcome of the pairwise correlation matrix. It reveals a positive correlation between FD and GHG, CO2, MET, NIT and EF. Also, HC, POP, RD and PE show a positive correlation with emissions. The correlation between FD or GDP and ANS is negative.

Table 4.

Pairwise correlations.

4. Empirical Results

Next tables present the outcomes of panel fixed-effect regression for each of the 6 dependent variables defined in this study. Regarding the assumptions of the regression, the Durbin-Watson statistics suggests that there is no autocorrelation in the data. The test of normality indicates that we can accept the normality assumption. The findings depict that the overall panel data regression models with fixed effects are good (except for the variable ANS adjusted R2 > 0.8).

The per capita CO2 emissions were hypothesized to be related to the level of economic development (proxied by per capita GDP) and financial development (FD) following [26]. In fact, the carbon emissions in a country do not necessarily depend on its income level alone; financial development may be another source. In order to evaluate this, goodness of fit tests [67] have been carried out to compare the adequacy of the models with or without the variable GDP. Those models with both variables are preferred according to the adjusted R-squared, AIC-Akaike information criterion, BIC-Bayesian information criterion- and Log-likelihood (see Table 5, Table 6, Table 7, Table 8, Table 9 and Table 10). The objective of model selection is to estimate the information loss when the probability distribution associated with the true (generating) model is approximated by probability distribution associated with the model that is to be evaluated.

Table 5.

Panel data-fixed effect regression results. Dependent variable: GHG.

Table 6.

Panel data-fixed effect regression results. Dependent variable: CO2.

Table 7.

Panel data-fixed effect regression results. Dependent variable: NIT.

Table 8.

Panel data-fixed effect regression results. Dependent variable: MET.

Table 9.

Panel data-fixed effect regression results. Dependent variable: EF.

Table 10.

Panel data-fixed effect regression results. Dependent variable: ANS.

Table 5 shows the fixed effect panel regression results of the association between FD and overall GHG. First, the linear model reveals that FD and PE exerts a monotonic and positive impact on the overall level of GHG emissions, while POP and HC counteract this effect by diminishing pollution levels. In this model GDP and RD appear as no significant with p-values higher than 0,1. The previous study of [68] found a bidirectional Granger causality link between economic growth, energy consumption and GHG for a group of 16 Asian countries.

Secondly, the non-linear (quadratic) model seems to better capture the behavior of GHG and almost all variables appear significant. In this vein, we find that GDP, POP and HC are contributing to reduce GHG harmful emissions, while PE creates a significantly positive link with GHG. Conversely, [48] analyses GHG emissions at a sector level in the US and confirms the validity of the EKC hypothesis (inverted U shape) for the specific relationship of economic growth and GHG, so only after the turning point the effect of GDP would turn into negative. Of particular interest in this quadratic model is the composite index of financial development, which is statistically significant and negatively linked to GHG indicating that a 1% increase in FD will reduce GHG emissions by 9.1%, signifying a mitigating effect of FD on environmental degradation. Meanwhile, the coefficient of FD square is positive and significant at 1%. These results demonstrate the presence of a U-shaped association between environmental damage and FD for these sampled countries. We can argue that FD is not accompanied by reduced levels of GHG as should be expected. Indeed, the beneficial effect on the environment reaches a minimum point after which environmental degradation starts to increase.

The next step of our research procedure consists of individually analyzing the three main components of GHG, namely CO2, NIT and MET. Results of the panel data-fixed effect model of CO2 emissions are presented in Table 6. Without taking the magnitude of coefficients into account, the linear model of CO2 reveal that PE outlines a statistically significant positive connection with carbon emissions, while HC develops a negative and significant impact on CO2. This study also demonstrates that there is a monotonically heightening (positive) association between FD and CO2. This result is in line with previous results of [69] for 21 North American economies and [61] who analyze an extensive panel of more than 100 countries. These authors show the positive impact of financial development on CO2 emissions, and that this effect is reduced when including institutional factors into the analysis. The study of [15] specifically considered the case of Eastern and Central European countries, and they find that financial development helps to reduce CO2, while energy consumption is the key determinant of CO2 emissions in line with the empirical results presented. The recent study of [70] also demonstrates that energy consumption leads to higher carbon emissions. In this study, the rest of variables like GDP and RD appear not significant in the linear model of CO2.

The empirical findings of the non-linear model support that FD is statistically significant and negatively associated with CO2. Howbeit, the squared variable of (FD) is significantly positive so these findings suggest a U-shaped connection between the composite index of financial development and carbon emissions in these countries. These results are aligned with those obtained for GHG, hence FD is not contributing to the de-carbonization of countries after a threshold level (the FEKC does not find empirical support). To the contrary, ref. [21] applied panel threshold models and find that domestic credit to the private sector develops a significantly negative association with carbon emissions but with different intensity depending on the interval of trade considered, so the impact is not equal, but it is negative in all the three intervals of trade defined. Moreover, results of the quadratic model prove that HC is currently empowered to mitigate emissions while PE is one of the major causes of carbon level increases. Likewise, ref. [35] demonstrate that energy had led to high CO2 emissions in the US over the last fifty years. Ref. [28] using the ARDL technique for the group of G8 and D8 separately reveal the positive effect of energy use on the augmentation of environmental degradation in both groups of countries.

Results on NIT as the proxy of environmental degradation are presented in Table 7. The linear model outlines that GDP, POP and RD are all significant drivers and exhibit a monotonically negative connection with this local pollutant. The variable FD appears as not statistically significant. Other studies like [9] find a U-shaped connection between nitrous oxide levels and GDP in the short run for the group of EU countries applying panel grey incidence analysis, even though results are sensitive to the model adopted. [56] analyze ammonia nitrogen emissions in Chinese provinces and results reveal a N-shape relationship with economic growth per capita.

In the quadratic model the results remain the same and GDP, POP and RD contribute to reducing levels of NIT. We can conclude that FD does not have a significant impact on NIT, mainly caused by agricultural and soil management activities. Moreover, HC and PE are also non-significant in this setting.

The third pollutant analyzed in this study is MET (Table 8). Empirical results of the linear model show that GDP, POP and RD are significantly helping reduce existing levels of MET, while HC is statistically significant and positively linked. In their study [71] use a proxy of human capital based on the number of patents instead of the level of education and find the opposite outcome.

In the quadratic model the picture appears more complete because a squared term of FD is introduced for appraising the non-linear effect. In this case, a 1% increase in FD is spurring MET (positive sign). The squared estimate of FD is significantly negative, hence for these sampled economies there is an inverted U-shaped association between FD and MET. In the light of these results, the FEKC hypothesis is validated. The rest of variables of the squared model present the same signs as the linear model, so GDP, POP and RD develop a significantly negative relationship with MET. In this case HC is the driving force behind increases in MET. A recent study of [72] applied panel Granger non-causality test and discovered a bidirectional causality link between methane emissions and economic growth. What is more, the EKC hypothesis of an inverted U-pattern relationship of growth and methane emissions holds for the group of CEMAC countries (Central African Economic and Monetary Community). [51] present evidence in Islamic countries in favor of non-linear patterns in environmental quality indicators related to economic growth. Methane, ecological footprint and CO2 follow an inverted U-shaped pattern.

The next variable to be analyzed is EF (Table 9). Under the linear specification, the findings show that GDP generates a statistically significant positive effect on EF, whereas HC is monotonically negative in this relationship. The same result was achieved by [73] for the case of developing countries in which human capital presents a negative association in the long term.

The quadratic model confirms these results and that FD is non-statistically significant for explaining EF in advanced economies. On the contrary, ref. [18] reveal in their study that FD helps reducing EF in high income countries.

Finally, for appraising environmental sustainability in this study we consider the variable ANS, and the results are show in Table 10. Empirical findings support that GDP and FD are significant drivers exerting a positive impact on environmental sustainability in line with previous findings of [33] for a group of OECD countries that validates the presence of an inverted-U relationship between environmental sustainability and GDP. The results of this study also show that POP, HC and RD produce a significantly negative effect on existing levels of environmental sustainability.

In the quadratic model the same results are confirmed except for RD that appears as no significant in this setting.

5. Discussion

Within the EKC framework the results of this study make significant contributions to this area of research by adding new evidence of the linear and non-linear impact of the whole financial system on the natural environment. There is a gap in the existing literature because the role of the financial system has been basically analyzed within the domain of linear models and focusing on the channel of credit provision. In this study it has been demonstrated that when including a quadratic term of financial development new results arise, so the real nature of this relationship can be better appraised. Until recently the impact of financial development has been classified as positive, negative or non-significant. This study provides empirical evidence demonstrating that this relationship is non-permanent, and it evolves with the country’s phase of financial development.

In addition, financial development has been appraised by simultaneously including the development of financial intermediaries, like banks providing credits to the private system, and the development of financial markets as liquidity providers. Only by jointly analyzing these two pillars of financial systems it would be possible to deeply comprehend the overall impact of the financial system and extract some useful conclusions.

Empirical findings show that the sign of the relationship between financial system development and GHG and CO2 emissions change from the linear to the non-linear models. Under linear specifications results prove that financial systems are contributing to increasing levels of GHG and CO2, but when introducing a non-linear term, this relationship becomes non-linear and follow a U-shaped form.

What is more, it seems vital to perform a disaggregated analysis of the three main GHG, whose behaviors are markedly different as it has been showed in this study and aligned with previous studies. Findings reveal that the overall impact of financial system development on GHG emissions is the net result of positive and negative impacts on its components, and these should be separately analyzed. This study identifies the presence of a U-shaped relationship between financial development and carbon emissions, while the opposite outcome of an inverted U-shaped pattern is identified in the case of methane emissions (the FEKC hypothesis).

These days increasing attention is being paid to the relevance of methane emissions due to its properties and potential for reducing CO2 levels in the long run. This is a consequence of the shorter period of oxidation of methane gas than that of carbon emissions. It is estimated in 10 years the period of oxidation after which methane molecules will be transformed into CO2, so having a warming potential 28 times higher than CO2 [71]. Thus, any effort made by current generations in reducing methane emissions will render positive and visible results in the medium term.

Across all models analyzed in this study some interesting conclusions can be drawn. First, primary energy consumption is one of the major forces behind increasing pollution levels in advanced economies. It seems imperative to advance towards a new economic model more reliable on clean sources of energy and that simultaneously help reduce countries’ energy dependence on fossil fuel energies. Additionally, any improvement in energy efficiency and the promotion of high-tech innovations can help reduce energy intensity levels.

Secondly, economic growth measured by GDP per capita exerts a positive effect in terms of environmental protection by reducing GHG, methane and nitrous oxide emissions as well as increasing environmental sustainability. Howbeit, the study does not find a statistically significant association with CO2 levels within the sampled economies.

The effect of human capital in all models is positive and contributes to reducing GHG, CO2 and the EF. This is the expected sign considering that human capital index is based on average years of schooling and the return to education, so it could be expected that the better educated the people the higher their concerns for environmental protection.

Regarding the effect of POP on environmental degradation the findings reveal that it is negative, except for CO2 and EF models. This is a consequence of the increasing process of urbanization in big cities in detriment of rural areas, and this process has not been accompanied by significant increases in pollution levels because cities are becoming greener and numerous initiatives have been put into practice in the attempt to achieve sustainable and smart cities aligned with the SDG. It seems that efforts are rendering positive results.

Finally, despite of the efforts that have been made by advanced economies on research and development expenditures, according to the empirical results RD have only generated the expected outcomes in terms of methane and nitrous oxide reduced emissions. However, there are not significant relationships between these expenses and GHG and CO2 emissions. Some reflections should be made about whether or not these public and private resources are being correctly managed and maybe some adjustments should be made by policymakers on this area.

6. Conclusions

This study relied on panel data estimation techniques to empirically analyze the impact of economic growth, financial development, population density, expenditure on research and development, primary energy consumption and human capital on environmental degradation and sustainability for the group of G7 countries over the period 1990–2019.

This work is unique and differ from previous studies since instead of testing the non-linear effect of GDP on the environment (the EKC hypothesis), it appraises the non-linear impact of financial development on the natural environment. The so-called FEKC supports that as countries financially develop they can alleviate existing levels of financial degradation and promote a higher environmental sustainability. In this study the specific impact of the financial system development on the natural environment has been analyzed under a linear and non-linear specification. Results reveal the existence of an inverted U-shaped relationship between methane emissions and financial development for the group of G7 countries and validate the FEKC hypothesis. Conversely, this relationship follows a U-shaped pattern for CO2 and GHG emissions.

These outcomes are of particular interest because the role of the financial system should be reinforced in order to alleviate existing levels of environmental burden. What is more, banking systems and financial markets have the capacity and the obligation to redirect financial flows to fight against climate change and enhance environmental sustainability in the medium term.

In the light of these results policymakers should pay attention to the potential of reducing GHG and CO2 emissions because if countries expand too rapidly their financial systems this can generate negative externalities. On this regard, one suggestion is that financialization should come along with a process of raising environmental awareness among financial intermediaries, investors, shareholders and corporations.

In this study it has been emphasized the need to disaggregate the analysis of GHG emissions into its components to have a whole perspective of the environment reality, because each local pollutant behaves differently as empirical results reveal.

The question that immediately follows is how can developed countries fight against increasing levels of pollutant emissions. It should be assumed that the reduction of pollution levels within advanced economies cannot be realized at the expense of economic growth. Instead, urgent changes need be made at different levels. In particular, developed countries should change the prevailing economic paradigm and evolve towards a model that integrates sustainability principles into the equation of shareholder value maximization. Only by doing so the SDG would be achieved.

Some recommendations for regulators and policymakers that are gaining momentum these days will be outline.

One initiative is the circular economy model. The conception of a circular economy is based on the idea that waste must be minimized and a reduction in the consumption of natural resources can be achieved by reintroducing recycled materials into the circular flow therefore reducing pollution levels.

It is also recommended that governments should promote a more efficient use of energy and the use sources of energy like wind, bio-diesel, solar and geothermal energy, which can reduce environmental degradation. This goal seems unattainable without a decisive public support for research and development activities. A key element that policymakers should bear in mind is the importance of technological progress because only by investing in innovative and environmental oriented activities a real advance towards environmental protection could be achieved. Two parallel energy transitions are currently taking place in developed countries: the electrification of the energy demand and the decarbonization of the energy supply. In this vein, renewables energies are making significant contributions to this double end and governments can subsidize interest rates for energy-efficient projects in parallel to tax on projects that rely heavily on non-renewable energies. Equally important for improving environmental quality is the proper use of land and some proposals have been suggested by the Common Centre for Research (European Commission) like afforestation, reforestation, better agricultural practices and bioengineering, among others

Thus, the transition process in which advanced economies are immersed should come hand in hand with adequate economic policies and incentives, technological availability, and changes in consumers preferences as the main drivers for the change of paradigm. Educating societies is playing a vital role in protecting the environment and controlling polluting emissions.

All the aforementioned changes pose potential threats to financial systems. On the one hand, financial intermediaries are highly exposed to climate risks (physical and transition risks), while at the same time these institutions are an important lever for social and economic changes through their credit channel. On the other hand, financial markets are relevant players in project assessment in terms of ESG criteria and play a fundamental role in the process of greening the economy. Over the last five years the financial regulatory framework has made a significant progress for protecting the environment, and authorities of developed countries have introduced more controls and transparency requirements for financial intermediaries aligned with the SDG.

Even though significant improvements have been achieved in the protection of the natural environment and people seem to be increasingly more concerned about its importance, there is a long road ahead for advanced economies in the attempt of guaranteeing the long-lasting wellbeing of our planet.

This study has some limitations because cross-country datasets are always limited to specific variables, therefore, availability of data on all such potential variables is always a limitation.

We suggest as lines for future research to continue analyzing the impact of the financialization process on the environment and try different methodological approaches to test the existence of a N-shape (cubic) relationship or apply some spatial data techniques that accounts for geographical attributes that can play a significant impact in terms of environmental quality. In addition, it is recommended to extend the research and include specific variables related to the role of education in promoting a peoples’ change towards more friendly-environmental attitudes. It is also advisable to further analyze the efficiency of private and public expenditures on research and development activities to devise whether or not these resources are being directed to their most efficient uses and are effectively protecting the natural environment.

Author Contributions

C.R. and R.C.-C.: Conceptualization of the paper; data curation, formal analysis, investigation, methodology; software, visualization, writing the original draft, writing the review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Data Availability Statement

The data base and open-source code required to replicate all analyses in this article is available online: https://github.com/raquelcaro1caro/The-non-linear-impact-of-FD-on-environmental-quality-and-sustainability (accessed on 12 May 2022).

Acknowledgments

We thank the reviewers for their helpful comments on an earlier draft of this paper.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Figure A1.

CO2 emissions for G7 countries. Source: Global Carbon Project.

Figure A2.

Greenhouse gas emissions for G7 countries. Source: World Bank (WDI).

References

- Fang, D.; Hao, P.; Wang, Z.; Hao, J. Analysis of the influence mechanism of CO2 emissions and verification of the Environmental Kuznets in China. Int. J. Environ. Res. Public Health 2021, 16, 994. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- De la Cuesta González, M.; Ruza y Paz-Curbera, C.; Rodríguez Fernández, J. Rethinking the income inequality and financial development nexus. A Study of nine OECD countries. Sustainability 2020, 12, 5449. [Google Scholar] [CrossRef]

- Ozatac, N.; Gokmenoglu, K.K.; Taspinar, N. Testing the EKC hypothesis by considering trade openness, urbanization, and financial development: The case of Turkey. Environ. Sci. Pollut. Res. 2017, 24, 16690–16701. [Google Scholar] [CrossRef] [PubMed]

- Anwar, A.; Younis, M.; Ullah, I. Impact of urbanization and economic growth on CO2 emission: A case of far East Asian Countries. Int. J. Environ. Res. Public Health 2020, 17, 2531. [Google Scholar] [CrossRef] [Green Version]

- Sun, J.; Zhou, Z.; Huang, J.; Li, G. A bibliometric analysis of the impacts of air pollution on children. Int. J. Environ. Res. Public Health 2020, 17, 1277. [Google Scholar] [CrossRef] [Green Version]

- Pope, C.A., III; Dockery, D.W. Health effects of fine particulate air pollution: Lines that connect. J. Air Waste Manag. Assoc. 2006, 56, 709–742. [Google Scholar] [CrossRef]

- Becchetti, L.; Beccari, G.; Conzo, G.; Conzo, P.; De Santis, D.; Salustri, F. Air quality and COVID-19 adverse outcomes: Divergent views and experimental findings. Environ. Res. 2021, 193, 110556. [Google Scholar] [CrossRef]

- Wijaya, S.A. Climate change, global warming and global inequality in developed and developing countries. Earth Environ. Sci. 2014, 19, 012008. Available online: https://iopscience.iop.org/article/10.1088/1755-1315/19/1/012008/pdf#:~:text=The%20developed%20countries%20consume%20more,reducing%20the%20global%20carbon%20emission (accessed on 20 January 2022).

- Madaleno, M.; Moutinho, V. Analysis of the new Kuznets relationship: Considering emissions of carbon, methanol and nitrous oxide greenhouse gases- Evidence from EU countries. Int. J. Environ. Res. Public Health 2021, 18, 2907. [Google Scholar] [CrossRef]

- Khan, S.; Khan, M.K.; Muhammad, B. Impact of financial development and energy consumption on environmental degradation in 184 countries using a dynamic panel model. Environ. Sci. Pollut. Res. 2021, 28, 9542–9557. [Google Scholar] [CrossRef]

- Caro-Carretero, R.; Ruza, C. The Non-Linear Impact of Financial Development on Environmental Quality and Sustainability. 2022. Available online: https://github.com/raquelcaro1caro/The-non-linear-impact-of-FD-on-environmental-quality-and-sustainability (accessed on 12 May 2022).

- Schumpeter, J.A. The Theory of Economic Development: An. Inquiry into Profits, Capital, Credit, Interest and the Business Cycle; Harvard University Press: Cambridge, MA, USA, 1934. [Google Scholar]

- Kuznets, S. Economic growth and income inequality. Am. Econ. Rev. 1955, 45, 1–28. Available online: https://assets.aeaweb.org/asset-server/files/9438.pdf (accessed on 10 January 2022).

- Yuxiand, K.; Chen, Z. Financial development and environmental performance. Environ. Dev. Econ. 2010, 16, 93–111. [Google Scholar] [CrossRef]

- Saud, S.; Chen, S.; Haseeb, A.; Khan, K.; Imran, M. The nexus between financial development, income level, and environment in Central and Eastern European Countries: A perspective on Belt and Road Initiative. Environ. Sci. Pollut. Res. 2019, 26, 16053–16075. [Google Scholar] [CrossRef] [PubMed]

- Acheampong, A.O. Modelling for insight: Does financial development improve environmental quality? Energy Econ. 2019, 83, 156–179. [Google Scholar] [CrossRef]

- Tamazian, A.; Rao, B. Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ. 2010, 32, 137–145. [Google Scholar] [CrossRef] [Green Version]

- Al-Mulali, U.; Weng-Wai, C.; Sheau-Ting, L.; Mohammed, A.H. Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol. Indic. 2015, 48, 315–323. [Google Scholar] [CrossRef]

- Raghutla, C.; Chittedi, K.R. Financial development, energy consumption, technology, urbanization, economic output and carbon emissions nexus in BRICS countries: An empirical analysis. Manag. Environ. Qual. Int. J. 2020, 32, 290–307. [Google Scholar] [CrossRef]

- Odhiambo, N.M. Financial development, income inequality and carbon emissions in sub-Saharan African countries: A panel data analysis. Energy Explor. Exploit. 2020, 38, 1914–1931. [Google Scholar] [CrossRef]

- Ganda, F. The non-linear influence of trade, foreign direct investment, financial development, energy supply and human capital on carbon emissions in the BRICS. Environ. Sci. Pollut. Res. 2021, 28, 57825–57841. [Google Scholar] [CrossRef]

- World Bank. World Development Report 1992: Development and the Environment; Oxford University Press: New York, NY, USA, 1992; Available online: https://openknowledge.worldbank.org/handle/10986/5975 (accessed on 10 January 2022).

- Sadrosky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Zhang, Y.J. The Impact of Financial Development on Carbon Emissions: An Empirical Analysis in China; Working Paper 8; Centre for Energy and Environmental Policy Research Beijing Institute of Technology: Beijing, China, 2011; Available online: http://ceep.bit.edu.cn/english/publications/wp/index.htm (accessed on 12 January 2022).

- Jensen, V.M. Trade and Environment: The pollution Haven Hypothesis and the Industrial Flight Hypothesis; some Perspectives on Theory and Empirics; University of Oslo, Centre for Development and the Environment: Oslo, Norway, 1996. [Google Scholar]

- Zhang, Y.J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Pao, H.T.; Tsai, C.M. Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): Evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 2011, 36, 685–693. [Google Scholar] [CrossRef]

- Shoaib, H.M.; Rafique, M.Z.; Nadeem, A.M.; Huang, S. Impact of financial development on CO2 emissions: A comparative analysis of developing countries (D8) and developed countries (G8). Environ. Sci. Pollut. Res. 2020, 27, 12461–12475. [Google Scholar] [CrossRef] [PubMed]

- Hunjra, A.I.; Tayachi, T.; Chani, M.I.; Verhoeven, P.; Mehmood, A. The moderating effect of institutional quality on the financial development and environmental quality nexus. Sustainability 2020, 12, 3805. [Google Scholar] [CrossRef]

- Jamel, L.; Maktouf, S. The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Econ. Financ. 2017, 5, 1341456. [Google Scholar] [CrossRef]

- Aşıcı, A.A. Economic growth and its impact on environment: A panel data analysis. Ecol. Indic. 2013, 24, 324–333. [Google Scholar] [CrossRef] [Green Version]

- Shahbaz, M.; Nasreen, S.; Abbas, F.; Anis, O. Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ. 2015, 51, 275–287. [Google Scholar] [CrossRef]

- Ganda, F. The environmental impacts of financial development in OECD countries: A panel GMM approach. Environ. Sci. Pollut. Res. 2019, 26, 6758–6772. [Google Scholar] [CrossRef]

- Omri, A.; Dalym, S.; Raultm, C.; Chaibi, A. Financial development, environmental quality, trade and economic growth: What causes what in MENA countries. Energy Econ. 2015, 48, 242–252. [Google Scholar] [CrossRef] [Green Version]

- Dogan, E.; Turkekul, B. CO2 emissions, real output, energy consumption, trade, urbanization and financial development: Testing the EKC hypothesis for the USA. Environ. Sci. Pollut. Res. 2016, 23, 1203–1213. [Google Scholar] [CrossRef]

- Maji, I.K.; Habibullah, M.S.; Saari, M.Y. Financial development and sectoral CO2 emissions in Malaysia. Environ. Sci. Pollut. Res. 2017, 24, 7160–7176. [Google Scholar] [CrossRef] [PubMed]

- Amin, A.; Dogan, E.; Khan, Z. The impacts of different proxies for financialization on carbon emissions in top-ten emitter countries. Sci. Total Environ. 2020, 740, 140127. [Google Scholar] [CrossRef] [PubMed]

- Shahbaz, M.; Solarin, S.A.; Mahmood, H.; Arouri, M. Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ. Modell. 2013, 35, 145–152. [Google Scholar] [CrossRef] [Green Version]

- Aye, G.C.; Edoja, P.E. Effect of economic growth on CO2 emission in developing countries: Evidence from a dynamic panel threshold model. Cogent Econ. Financ. 2017, 5, 1379239. [Google Scholar] [CrossRef]

- Tahir, T.; Luni, T.; Majeed, M.T.; Zafar, A. The impact of financial development and globalization on environmental quality: Evidence from South Asian economies. Environ. Sci. Pollut. Res. 2021, 28, 8088–8101. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Environmental Impact of a North. American Free Trade Agreement. National Bureau of Economic Research; Working Paper 3914; National Bureau of Economic Research: Cambridge, MA, USA, 1991. [Google Scholar] [CrossRef]

- Katircioğlu, S.T.; Taşpinar, N. Testing the moderating role of financial development in an environmental Kuznets curve: Empirical evidence from Turkey. Renew. Sustain. Energy Rev. 2017, 68, 572–586. [Google Scholar] [CrossRef]

- Javid, M.; Sharif, F. Environmental Kuznets curve and financial development in Pakistan. Renew. Sustain. Energy Rev. 2016, 54, 406–414. [Google Scholar] [CrossRef]

- Ali, W.; Abdullah, A.; Azam, M. Re-visiting the environmental Kuznets curve hypothesis for Malaysia: Fresh evidence from ARDL bounds testing approach. Renew. Sustain. Energy Rev. 2017, 77, 990–1000. [Google Scholar] [CrossRef]

- Khan, M.A.; Khan, M.Z.; Zaman, K.; Arif, M. Global estimates of energy-growth nexus: Application of seemingly unrelated regressions. Renew. Sustain. Energy Rev. 2014, 29, 63–71. [Google Scholar] [CrossRef]

- Destek, M.A.; Sarkodie, S.A. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total Environ. 2019, 650, 2483–2489. [Google Scholar] [CrossRef]

- Selden, T.; Song, D. Environmental quality and development: Is there a Kuznets curve for air pollution? J. Environ. Econ. Environ. Manag. 1994, 27, 147–162. [Google Scholar] [CrossRef]

- Cary, M. Have greenhouse gas emissions from US energy production peaked? State level evidence from six subsectors. Environ. Syst. Decis. 2020, 40, 125–134. [Google Scholar] [CrossRef]

- Destek, M.A.; Ulucak, R.; Dogan, E. Analyzing the environmental Kuznets curve for the EU countries: The role of ecological footprint. Environ. Sci. Pollut. Res. 2018, 25, 29387–29396. [Google Scholar] [CrossRef] [PubMed]

- Khan, I.; Hou, F.J.; Ahmad, M. Links among energy intensity, non-linear financial development, and environmental sustainability: New evidence from Asia Pacific Economic Cooperation countries. J. Clean. Prod. 2022, 330, 129747. [Google Scholar] [CrossRef]

- Ali, S.; Yusop, Z.; Kaliappan, S.R.; Chin, L. Trade-environment nexus in OIC countries: Fresh insights from environmental Kuznets curve using GHG emissions and ecological footprint. Environ. Sci. Pollut. Res. 2021, 28, 4531–4548. [Google Scholar] [CrossRef] [PubMed]

- Ang, J. CO2 Emissions, energy consumption and output in France. Energy Policy 2007, 35, 4772–4778. [Google Scholar] [CrossRef]

- Itkonen, J. Internal Validity of Estimating the Carbon Kuznets Curve by Controlling for Energy Use; IFO Working Paper 95; Institute for Economic Research, University of Munich: Munich, Germany, 2010; Available online: https://www.ifo.de/DocDL/IfoWorkingPaper-95.pdf (accessed on 12 January 2022).

- Keho, Y. Revisiting the income, energy consumption and carbon emissions nexus: New evidence from quantile regression for different country groups. Int. J. Energy Econ. Policy 2017, 7, 356–363. Available online: http://hdl.handle.net/11159/1251 (accessed on 12 January 2022).

- Stern, D.; Common, M. Is there an environmental Kuznets curve for sulfur? J. Environ. Econ. Manag. 2001, 41, 162–178. [Google Scholar] [CrossRef] [Green Version]

- Zeraibi, A.; Balsalobre-Lorente, D.; Shehzad, K. Testing the Environmental Kuznets Curve hypotheses in Chinese provinces: A nexus between regional government expenditures and environmental quality. Int. J. Environ. Res. Public Health 2021, 18, 9667. [Google Scholar] [CrossRef]

- Zhao, J.; Zhao, Z.; Zhang, H. The impact of growth, energy and financial development on environmental pollution in China: New evidence from a spatial econometric analysis. Energy Econ. 2021, 93, 104506. [Google Scholar] [CrossRef]

- Li, S.X.; Shi, J.R.; Wu, Q.S. Environmental Kuznets Curve: Empirical relationship between energy consumption and economic growth in upper-middle-income regions of China. Int. J. Environ. Res. Public Health 2020, 17, 6971. [Google Scholar] [CrossRef] [PubMed]

- Mahmood, H.; Alkhateeb, T.T.Y.; Tanveer, M.; Mahmoud, D.H.I. Testing the energy-environmental Kuznets curve hypothesis in the renewable and nonrenewable energy consumption models in Egypt. Int. J. Environ. Res. Public Health 2021, 18, 7334. [Google Scholar] [CrossRef] [PubMed]

- Hao, Y.; Zhang, Z.Y.; Liao, H.; Wei, Y.M.; Wang, S. Is CO2 emission a side effect of financial development? An empirical analysis for China. Environ. Sci. Pollut. Res. 2016, 23, 21041–21057. [Google Scholar] [CrossRef] [PubMed]

- Shah, W.U.H.; Yasmeen, R.; Padda, I.U.H. An analysis between financial development, institutions, and the environment: A global view. Environ. Sci. Pollut. Res. 2019, 26, 21437–21449. [Google Scholar] [CrossRef] [PubMed]

- Gujarati, D.N. Basic Econometrics, 4th ed.; McGraw-Hill: New York, NY, USA, 2003. [Google Scholar]

- Trpkova, M.; Tashevska, B. Determinants of economic growth in South—East Europe: A panel data approach. Perspect. Innov. Econ. Bus. 2011, 7, 12–15. [Google Scholar] [CrossRef]

- Ahmed, Z.; Nathaniel, S.P.; Shahbaz, M. The criticality of information and communication technology and human capital in environmental sustainability: Evidence from Latin American and Caribbean countries. J. Clean. Prod. 2021, 286, 125529. [Google Scholar] [CrossRef]

- Zhang, C.; Lin, Y. Panel Estimation for urbanization, energy consumption and CO2 emissions: A regional analysis in China. Energy Policy 2012, 49, 488–498. [Google Scholar] [CrossRef]

- Sinha, A.; Shahbaz, M. Estimation of environmental Kuznets curve for CO2 emission: Role of renewable energy generation in India. Renew. Energy 2018, 119, 703–711. [Google Scholar] [CrossRef] [Green Version]

- Box, G.E.P.; Jenkins, G.M.; Reinsel, G.C. Time Series Analysis: Forecasting and Control; J. Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Lu, W.C. Greenhouse gas emissions, energy consumption and economic growth: A panel cointegration analysis for 16 Asian countries. Int. J. Environ. Res. Public Health 2017, 14, 1436. [Google Scholar] [CrossRef] [Green Version]

- Mahmood, H. CO2 emissions, financial development, trade, and income in North America: A spatial panel data approach. SAGE Open 2020, 10, 1–15. [Google Scholar] [CrossRef]

- Xia, W.; Apergis, N.; Bashir, M.F.; Ghosh, S.; Doğan, B.; Shahzad, U. Investigating the role of globalization, and energy consumption for environmental externalities: Empirical evidence from developed and developing economies. Renew. Energy 2022, 183, 219–228. [Google Scholar] [CrossRef]

- Lin, X.; Zhao, Y.; Ahmad, M.; Ahmed, Z.; Rjoub, H.; Adebayo, T.S. Linking innovative human capital, economic growth, and CO2 emissions: An empirical study based on Chinese provincial panel data. Int. J. Environ. Res. Public Health 2021, 18, 8503. [Google Scholar] [CrossRef] [PubMed]

- Djoukouo, A.F.D. Relationship between methane emissions and economic growth in Central Africa countries: Evidence from panel data. Glob. Transit. 2021, 3, 126–134. [Google Scholar] [CrossRef]

- Ganda, F. The influence of growth determinants on environmental quality in Sub-Saharan Africa states. Environ. Dev. Sustain. 2021, 23, 7117–7139. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).