4.3. Dynamic Ordinary Least Squares (DOLS) and Co-integration Test

We employed DOLS to find a long-run association between CO

2, GDPP, and FDI along with other economic determinants for the group and individual countries.

Table 4 presents the results for the group of countries. The results of Model (3) reveal that GDPP significantly positively affects CO

2 at 10% level. This result implies that an increase in GDPP by 1 unit increases CO

2 by 0.3188 units. Theoretically, the increase in production level may increase the economic growth (EG), and when the production level increases at an intense level, it pollutes the environment. This result corresponds to the prior studies conducted by Pandey and Mishra [

51], and Jaunky [

67]. From the controlling factors, the results show that urban population (UP) and energy consumption (EC) significantly negatively affect CO

2 in the SAARC countries (see

Table 4). The results of model (4) demonstrate that the coefficients of both key variables including CO

2 and FDI are statistically insignificant. The other determining factors of GDPP including domestic capital (DS) and inflation rate (INF) have significantly positive effects on GDPP. In SAARC countries, labor market is quite attractive and cheap, which progressively contributes to the economy of these countries. In SAARC countries, the flow of domestic capital along with foreign capital is higher, which helps to grow the overall economy of this region. The results of model (5) show that the coefficients of both CO

2 and GDPP are statistically insignificant. Among the controlling factors, domestic capital (DS) significantly positively affects FDI in the SAARC countries. Hence, the results of these three models endorse the unidirectional causal association of economic growth (EG) with carbon emission (CE) for SAARC countries. This finding validates the findings of prior studies conducted by Abdouli and Hammami [

28], Jaunky [

67] and Lotfalipour et al. [

44] (see

Table 4).

Table 5 and

Table 6 demonstrate the results for individual countries. The results of Model (3) for Bangladesh reveal that GDPP significantly positively affects CO

2 at 1% level. It proposes that an increase in GDPP by 1 unit can augment the CO

2 by 0.7196 units. Moreover, FDI significantly negatively affects CO

2 at 5% level. It advocates that an increase in FDI by 1 unit decreases the CO

2 by 0.024 units. Attaining the environmentally sound development like developed countries was an emerging issue for Bangladesh in recent years, therefore, Bangladesh adopted the policies to deal with environmental challenges, and accomplished numerous milestones in the environment sector despite the difficulties of poverty, overpopulation, corruption, and lack of resources [

68]. Among the controlling factors, financial development (FD) and urban population (UP) have significant positive effects on CO

2 at 1% level, while EC significantly negatively affects CO

2 at 1% level. The results of Model (4) for Bangladesh show that the coefficients of both main key factors including CO

2 and FDI are statistically insignificant. From the controlling factors, the results reveal that inflation significantly positively influences CO

2 at 10% level. The results of Model 5 imply that CO

2 significantly negatively affects FDI at 5% level. It implies that the addition to CO

2 by 1 unit decreases the FDI by 4.3554 units. Moreover, the results reveal that GDPP significantly positively affects the FDI at 1% level, it advocates that an augmentation in the GDPP by 1 unit increases the FDI by 5.0376 units. Among the controlling factors, domestic capital (DS) significantly positively influences FDI at 1% level, while labor force (LF) and exchange rate (EX) have negative effects on FDI at 5% level. Finally, the results of these models confirm the unidirectional causal association of economic growth (EG) with carbon emissions (CE), the bidirectional causal association between FDI and CE, and unidirectional causality from EG to FDI. These findings are in line with previous studies by Jaunky [

67], and Omri, Nguyen and Rault [

35] (See

Table 5).

The results of Model (3) for India show that GDPP has a significant positive effect on CO

2 at 5% level. It suggests that an increase in GDPP by 1 unit increases the CO

2 by 0.7386 units. Moreover, the results highlight that FDI significantly negatively affects CO2 at 10% level. It postulates that addition to FDI by 1 unit can reduce the CO

2 by 0.057 units. India endorsed the Paris agreement and took measures for environmental protection during the growth process. In recent years, India has adopted policies to expand its renewable power, especially solar with the help of foreign investors [

69]. Among the controlling factors, EC significantly negatively influences CO

2 at 10% level. The results of Model (4) for India reveal that CO

2 significantly positively affects GDPP at 1% level. It postulates that an augmentation in CO

2 by 1 unit increases the GDPP by 2.6166 units. Among the controlling factors, domestic capital (DS) and labor force (LF) significantly positively affect GDPP at 1% level, while inflation (INF) has a significant negative effect on GDPP at 10% level. The results of Model (5) for India indicate that CO

2 significantly positively affects the FDI at 5% level. Among the controlling factors, labor force (LF) significantly positively influences FDI at 1% level. Finally, the results of these models confirm bidirectional causal association between EG and CE, bidirectional causal association between FDI and CE, and unidirectional causality from EG to FDI. These findings are similar to prior researches conducted by Pao and Tsai [

70], and Olusanya [

71] (See

Table 5).

The results of Model (3) for Nepal show that the coefficients of both GDPP and FDI are statistically insignificant, which suggests that there is no significant effect of these variables on CO

2. Nepal is one of the richest countries ecologically, but poor economically [

72]. Nepal has also signed the Paris agreement and made international commitments for attaining economic, social, and environmental growth in the future. In light of the Paris agreement, Nepal has attained almost six-fold progress in terms of green growth by following the sustainable development goals (SDGs) to achieve the status of a least developed country (LDC) in recent years [

73]. Among the controlling factors, financial development (FD) has a significant positive effect on CO

2 at 5% level, while EC has a significant negative effect on CO

2 at 1% level. The results of Model (4) for Nepal demonstrate that the coefficients of both CO

2 and FDI are statistically insignificant, which infer that there is no significant effect of these variables on GDPP. Among the controlling factors, inflation has a significant positive effect on GDPP at 10% level. The results of Model (5) for Nepal reveal that the coefficients of key variables including CO

2, GDPP, and other variables are statistically insignificant. Finally, the results of these models confirm that there is no causal association between key variables including economic growth (EG), FDI and carbon emission (CE). This result correlates with the findings of a previous study conducted by Shaari, et al. [

74] (See

Table 6).

The results of Model (3) for Pakistan reveal that the coefficients of both FDI and GDPP are statistically insignificant, which implies that there is no significant effect of these variables on CO

2. During the recent few decades, the economy of Pakistan has demonstrated enormous growth and great potential for growth in the future. Pakistan has persistently got benefits from globalization in terms of trade, as a result, the energy demand was increased in Pakistan in recent years. However, the economic development created environmental challenges for Pakistan [

75]. To deal with these environmental challenges, Pakistan initially formulated an environmental policy in 2005 [

76]. Pakistan as a developing and emerging economy is the major destination for foreign investment, while foreign investment is the major source for technology transfer [

77]. At present, Pakistan is trying its best for technology transfer under the umbrella of foreign investment, particularly through China Pakistan Economic Corridor (CPEC) project to deal with environmental challenges [

78]. Among the controlling factors, urban population (UP) and energy consumption (EC) have significant negative effects on CO

2 at 1% and 10% levels respectively. The results of Model (4) for Pakistan indicate that the coefficients of both CO

2 and FDI are statistically insignificant, which reveals that there is no significant effect of these variables on GDPP. Among the controlling factors, domestic capital (DS) and inflation (INF) have significant positive effects on GDPP at 10% and 1% levels respectively. The results of Model (5) for Pakistan reveal that CO

2 has a significant positive association with FDI at 1% level. It infers that an increase in CO

2 by 1 unit increases the FDI by 10.266 units. Furthermore, the results indicate that GDPP significantly negatively affects FDI at 10% level. It infers that the addition to GDPP by 1 unit decreases the FDI by 1.3627 units in Pakistan. Among the controlling factors, domestic capital (DS), labor force (LF), the exchange rate (EX), and trade openness (TD) have significant positive effects on FDI at different significance levels. Finally, the results of these models confirm the unidirectional causality from carbon emissions (CE) and economic growth (EG) to FDI. These results are in line with a study conducted by Olusanya [

71] (See

Table 6).

The results of Model (3) for Sri Lanka demonstrate that GDPP significantly positively affects CO

2 at 1% level. It infers that addition to GDPP by 1 unit can augment the CO

2 by 0.8364 units. Furthermore, FDI significantly negatively associates with CO

2 at 5% level. It postulates that addition to FDI by 1 unit decreases CO

2 by 0.5519 units. In the early years, Sir Lanka like other developing countries was failed to attain substantial progress to controlling the risk of climate changes [

8]. However, Sri Lanka adopted the comprehensive national action plan to deal with climate change challenges in 2015. These policy-level initiatives have yet to implement in true letter and spirit because of lack of stakeholders support, insufficient policy level directions, and public awareness [

79]. Among the other economic factors, FD significantly positively influences CO

2 at 5% level. The results of Model (4) for Sri Lanka indicate that the coefficients of both CO

2 and FDI are statistically insignificant, which infer that both CO

2 and FDI have no significant effect on GDPP. Among the controlling factors, domestic capital (DS) and inflation (INF) are significantly positively associated with GDPP at 10% and 1% levels respectively. The results of Model (5) indicate that GDPP significantly positively affects FDI at 10% level. It postulates that the addition to GDPP by 1 unit increases the FDI by 1.4789 units. Among the controlling factors, trade (TD) significantly positively influences FDI at 5% level. Finally, the results of these models confirm the unidirectional causality from economic growth (EG) and FDI to carbon emissions (CE), and the unidirectional causal association of EG with FDI. These results correlate with the study conducted by Lee [

34] (See

Table 6).

In addition to DOLS, we employed the panel co-integration tests together with the Pedroni and Kao methods to observe the co-integration among the variables considered in the models of CO

2, GDPP, and FDI, the results are shown in

Table 7. The number of lags is chosen in line with the Akaike information criterion (AIC). The results for panel co-integration tests in Model (3) reveal that panel PP-statistics validate the presence of co-integration among variables considered in the model of CO

2 at 1% level, while panel ADF-statistics also confirm the co-integration at 1% level. Moreover, group PP-statistics, group ADF-statistics, and ADF t-statistics combined with the Kao method also confirm the co-integration among variables at 1% level.

In model (4), panel ADF-statistics, group ADF-statistics, and ADF t-statistics validate the presence of long-run connections among variables at 5% and 1% levels respectively. In model (5), panel PP-statistics, panel ADF statistics, group PP-statistics, group ADF-statistics, and ADF t-statistics endorse the co-integration among variables at 1% level. Hence, it can be concluded that there is a long-run co-integration among variables considered in models of carbon emissions (CE), economic growth (EG), and FDI.

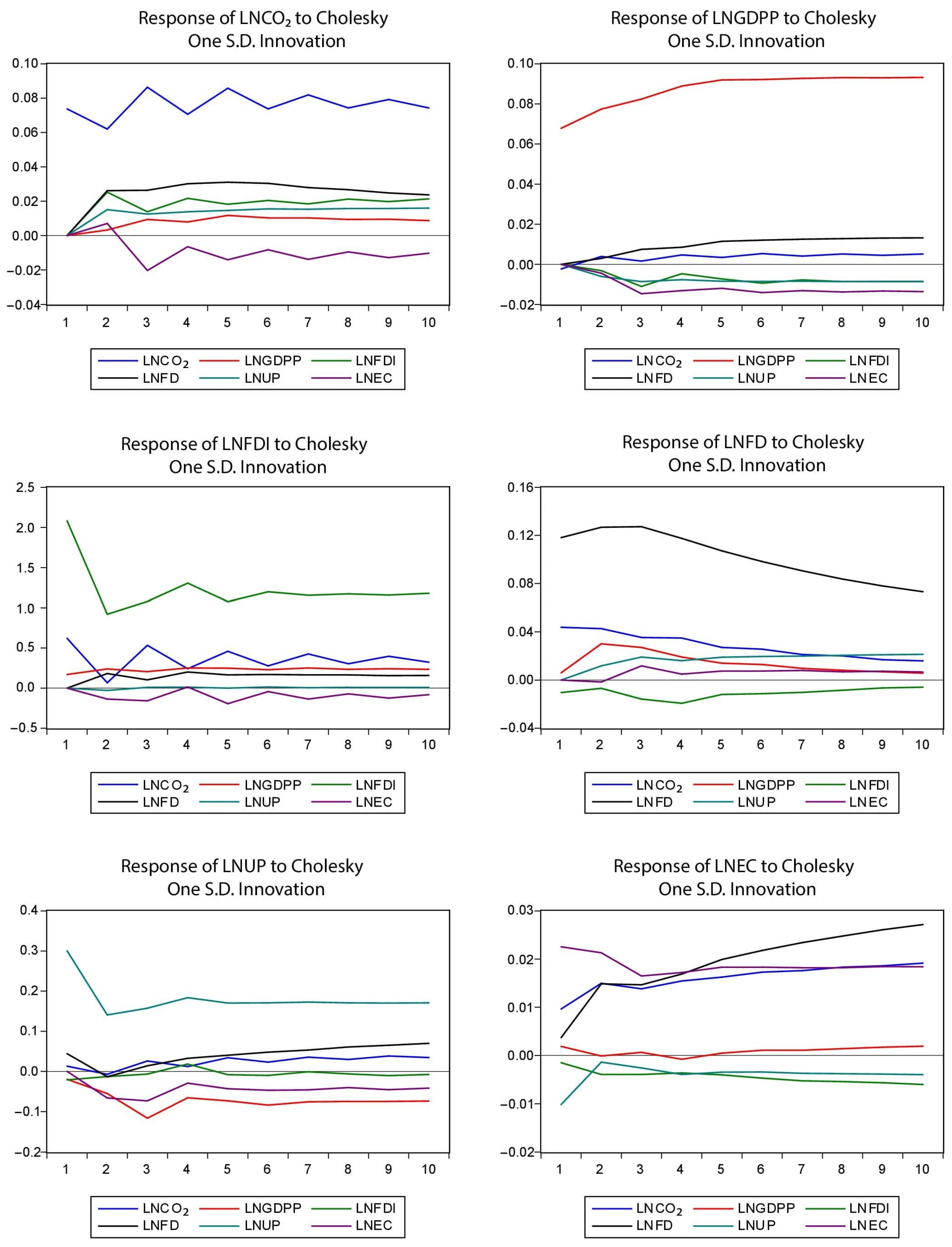

4.5. Impulse Response Analysis (IRA)

We drafted the IRA in the order of variables with a time horizon of 10 years period. The dependent variable is prioritized as the first variable in the order of variables, and others are the explanatory variables.

Figure 1 shows that shocks in all explanatory variables including EG, financial development (FD), FDI, and urban population (UP) have a positive association with carbon emission (CO

2) over the period. Contrarily, EC has a positive association with CO

2 in the initial two years, while it has a negative connection with CO

2 in all other years for the SAARC countries.

Figure 1 also reveals that shocks in the CO

2 and financial development (FD) have positive shocks to GDPP, while other variables have negative shocks to GDPP over the period for the SAARC countries.

Figure 1 also depicts that the shocks in CO

2, financial development (FD), and GDPP have positive shocks to FDI over the ten years, while the shocks in energy consumption (EC) have a negative effect over the period for the SAARC countries.

Figure 1 also demonstrates that the shocks in CO

2, GDPP, urban population (UP) have positive shocks to financial development (FD), while shocks in energy consumption (EC) have negative effects on FD in the initial two years, afterwards, these shocks have positive effects on FD in the rest of period. Moreover, shocks in FDI have negative effects on FD over the period for the SAARC countries.

Figure 1 also reveals that shocks in CO

2 and FD have a positive association with the urban population (UP) in the whole period except in the second year. Furthermore, shocks in FDI have a mixed trend of effects on UP for the whole period. Contrarily, shocks in GDPP and EC positively influenced UP over the period for the SAARC countries.

Figure 1 also depicts that shocks in CO

2 and FD have a positive association with energy consumption (EC) in the whole period. Moreover, shocks in GDPP have negative effects on EC from second to fifth years, afterwards, these have positive effects on EC in the rest of the period. Furthermore, shocks in FDI and urban population (UP) have negative effects on EC over the period for the SAARC countries.