1. Introduction

An extensive economic growth pattern has caused excessive resource consumption and deterioration of the environment in developing countries, especially in China [

1]. Consequently, China has implemented a series of environmental policies and emission reduction targets to achieve sustainable development [

2,

3]. The manufacturing sector, the largest energy consumption industry in China’s economic development, has played a primary role in driving severe air and water pollution, causing widespread health problems [

4]. According to the data in the China Environmental Statistics Yearbook from 2013 to 2015, 66.14% of the total emissions of waste gas came from manufacturing, and industrial sulfur dioxide emissions from manufacturing account for 51.79% of the total volume. Meanwhile, more than 38.68% of nitrogen oxides emissions come from manufacturing. The pure pursuit of GDP (gross domestic product) at the expense of resource waste and environmental damage is bound to be unsustainable [

5]. How to achieve green transformation and development has become an important direction for the future development of China’s manufacturing.

A large number of manufacturing firms in China have implemented environmental technologies as a strategic activity to reduce environmental impact [

6,

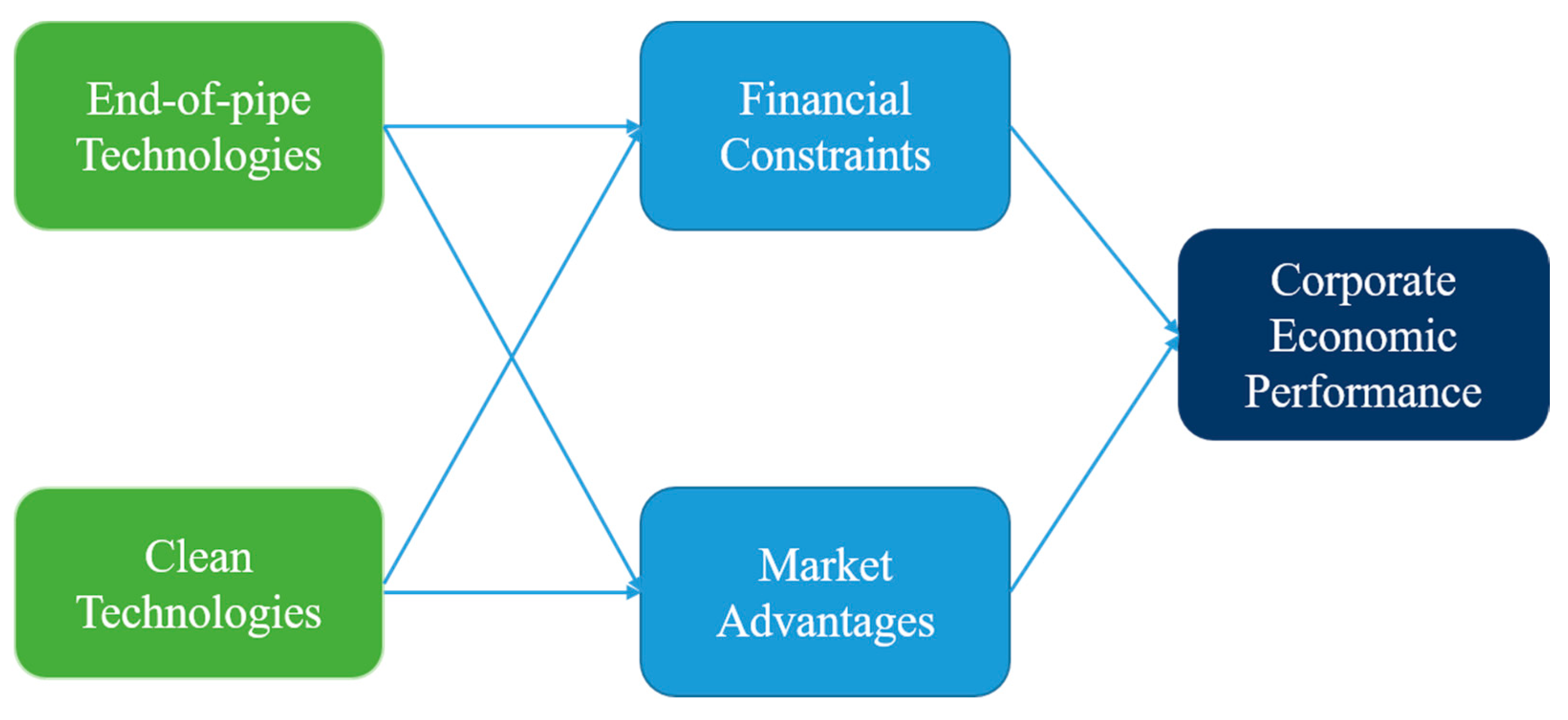

7]. Environmental technologies refer to the improvement of existing production processes or the addition of new processes, and are commonly divided into end-of-pipe technologies and clean technologies [

8,

9]. End-of-pipe technologies focus on pollution control technologies, using equipment that is added as a final process step to capture pollutants and wastes prior to their discharge. Clean technologies are defined as pollution prevention technologies, referring to fundamental changes to the manufacturing process that reduce any negative impact on the environment during material acquisition, production, or delivery.

The balance or trade-off between reducing pollution emissions and improving economic performance is key to the sustainable development of manufacturing companies. In the literature, two opposing views circulate regarding the impact of environmental technologies on firms’ economic performance. On the one hand, the traditional or cost-based view argues that under the constraints of environmental regulations, companies tend to redistribute their existing labor and capital resources to environmental technologies, which often adversely affect their economic performance [

10]. On the other hand, supporters of environmental technologies hold that environmental technologies can improve the productivity and competitiveness of firms, thus increasing the profits of firms [

11]. In addition, most manufacturing firms are dependent more on end-of-pipe technologies, which are conveniently added to the existing production process, ignoring the role of clean technologies [

9]. Therefore, the first focus of this study is to analyze how different types of environmental technologies affect economic performance.

Previous studies have shown that corporations can obtain many benefits and resources from external stakeholders through adopting environmental technologies [

12,

13]. The stakeholder theory identifies the generation of value as a central driver of the enterprise, this value is to be shared by a group of stakeholders who can affect or be affected by an organization [

14]. Along with green finance and green consumption spring up, investors and consumers are playing an increasing role in the profits of manufacturing enterprises. Consequently, this research further develops the second focus, that is, whether the adoption of environmental technologies responds to the requirements of stakeholders and thus improves the economic performance of the company.

There are obvious gaps in the current answers to the above questions; this statement can be explained as follows. For the first question, existing literature mainly examines the impact of environmental technologies on economic performance, while different types of environmental technologies are rarely discussed. Although Xie et al., (2016) examined the effects of green process innovation on the financial performance of manufacturing [

15], they neither exploit empirical research using firm-level data nor focus on stakeholder impact. For the second question, existing literature mainly explains the motivation of firms to adopt environmental technologies from the stakeholder’s perspective. Current research on the relationship between environmental technologies and stakeholders comes up with mixed or inconclusive results [

16]. It remains unclear how different types of environmental technologies affect financial constraints and market advantages.

In order to address the above gaps, this study empirically identifies the direct influence of different types of environmental technologies on economic performance at the firm level, as well as the indirect influence mechanism on financial constraints and market advantages. We use a large firm-level dynamic panel data set from 2011 to 2018 to investigate the effect of environmental technologies on manufacturing firms’ economic performance. Our findings show that end-of-pipe technologies and clean technologies have a positive effect on a firm’s economic performance. Furthermore, financial constraints and market advantages have a mediating effect on the relationship between a firm’s environmental technologies and economic performance, and its mediating effect differs depending on the types of environmental technologies. Finally, we test the endogeneity and robustness via several methods.

This paper mainly contributes to three aspects. First, prior studies concerning environmental technologies lack attention to environmental technologies. Therefore, we employ the investment in environment protection alteration and green patent as the measurement indicators in order to truly reflect technological characteristics of end-of-pipe technologies and clean technologies. Second, this paper enriches the literature related to the relationship between environmental sustainability behavior and the economic performance of manufacturing firms. It explains that environmental technologies may improve firms’ economic performance through alleviating financing constraints and market advantages, which provides new insights for manufacturing enterprises to promote green transformation. Finally, this research further supplements the stakeholder theory literature, especially regarding the investors and customers. In the context of booming green finance and green consumption, corporations can obtain more benefits and resources through clean technologies. Based on these findings, this paper provides practical guidance to manufacturing enterprises and government, enabling decisions to be made more efficiently.

4. Empirical Results

4.1. Descriptive Statistical Analysis

The summary statistics of the variables are shown in

Table 2. The average value of ROA is 0.044, and the standard deviation is 0.076, indicating a difference in the economic performance between different companies. The median of PATENT is 0, while the median of PIPE is 0, indicating that over half of the manufacturing enterprises have not invested in environmental technologies. We also conducted an analysis to examine environmental technologies adoption by firms under different subgroups. For the group with ROA above the mean, 24 percent of the companies used clean technology, and 14 percent used end-of-pipe technology. There was no difference in the use of cleaning technologies compared to the group below the mean, but the use of end-of-pipe technologies was lower. Further analysis shows that the number of green patents is higher in the above-average group than in the low-average group. This analysis verifies that manufacturing companies that tend to adopt green technologies are more likely to achieve higher economic performance. The correlation coefficients of all variables are less than 0.5, indicating that there is no serious multi-collinearity among variables (

Appendix A Table A2 provides the full correlation matrix).

4.2. Regression Analysis

This paper uses the fixed effects model to verify the impact of environmental technologies on the economic performance of manufacturing firms, as well as the mediating role of financial constraints and market share.

Table 3 provides the results for hypotheses (H1) to (H4). Model 1 examines the direct effects of end-of-pipe technologies and clean technologies on economic performance. The coefficient of PIPE is positive and significant (Model 1, β1 = 0.1592,

p = 0.028), supporting H1a. Model 1 also shows that the coefficient for PATENT is significant and positive (Model 1, β2 = 0.0028,

p = 0.032). This provides support for H1b. Ceteris paribus, the results indicate that if a manufacturing firm’s end-of-pipe technologies investment increases by 1% or the number of green patent applications increase by 1, the company will see a 0.159 and 0.0028% increase in ROA respectively. Therefore, it can be concluded that no matter whether manufacturing firms use more clean technologies or end-of-pipe technologies, they can obtain better economic performance.

Model 3 tests the direct effects of end-of-pipe technologies and clean technologies on financial constraints. The results indicate that firms with clean technologies which attracting green investment tend to have lower financial constraints (Model 2, β2 = −0.0074, p = 0.000). That is, ceteris paribus, if companies apply for an additional green patent, enterprises with average financial constraints level will see a 0.0074% decrease in financial constraints. This provides support for H2b. However, the effect of end-of-pipe technologies on financial constraints is not significant (Model 2, β1 = 0.0321, p = 0.482). H2a is not supported. In addition, Model 4 examines the direct effects of end-of-pipe technologies and clean technologies on market advantages. The result shows that manufacturing companies using end-of-pipe technology have a negative and significant association with market advantages (Model 3, β1 = −0.0369, p = 0.021). Ceteris paribus, a 1% increase in end-of-pipe technologies investment reduces ROA by 0.0369, supporting H3a. Meanwhile, there is no significant positive correlation between clean technologies and market advantage. H3b is not supported.

Models 4, 5, and 6 test the mediation effects. In Models 4 and 5, the coefficient of SA is negative and significant (Model 4, β3 = −0.0308, p = 0.041); the coefficient of SHARE is positive and significant (Model 5, β4 = −0.1920, p = 0.000), indicating that lower financial constraints and more market advantages enhance firms’ economic performance. When controlling for financial constraints and market advantages, the effect of end-of-pipe technologies on innovation performance is still significant and the coefficient of end-of-pipe technologies increases from 0.1592 to 0.1669 (Model 6, β1 = 0.1669, p = 0.022). Associated with the significant negative impact of end-of-pipe technologies on market advantages, these results indicate that market advantages mediate the relationship between end-of-pipe technologies and economic performance. Significantly, the mediation of market share is a masking effect, that is, the negative effect of end-of-pipe technologies on the market share will weaken the positive effect of end-of-pipe technologies on economic performance. H4b is supported, while H4a is not.

After controlling for mediators, the coefficient of PATENT is also significant and decreases from 0.0028 to 0.0026 (Model 6, β2 = 0.0026, p = 0.053), which indicated that financial constraints have a mediation effect on the relationship between clean technologies and a firm’s economic performance. In other words, clean technologies not only directly influence economic performance but also indirectly affects economic performance through mitigating financial constraints. H4c is supported, while H4d is not.

4.3. Robustness Testing

4.3.1. Heckman Two-Stage Procedure

In the study above, this research preliminarily demonstrates the positive relationship between environmental technologies and economic performance. However, the relationship may be affected by unobservable variables, resulting in wrong results. To ensure the robustness of empirical results, this paper uses a two-stage processing effect model to analyze the impact of environmental technologies on a firm’s economic performance. The first-step regression was conducted to obtain the inverse Mill ratio (IMR). In the second-step regression, the IMR was introduced into all models.

Table 4 shows the regression estimates of the above two steps. As shown in Panel A of

Table 4, we conducted the probit model for the first-step regression, with the dependent variable was the environmental technologies adoption dummy (ETA), which equals 1 if the firm adopts environmental technologies, and 0 otherwise. Carbon markets are a globally accepted tool to encourage the adoption of environmental technologies [

62]. China’s pilot carbon emissions trading programs began operating in the second half of 2013 in seven provinces and cities [

63]. The new variable introduced in the first-step regression is the dummy variable of carbon emission trading pilots (CEP).

Through the above two-stage regression test, it can be found that in the first-stage regression results, there is a significant positive correlation between CEP and environmental technologies adoption. The result from Panel A indicates that manufacturing companies participating in Carbon Emission Trading are 26.71% more likely to adopt environmental technologies compared to non-pilot manufacturing companies. In the second stage regression, the inverse Mills ratio is significant in each model, which suggests that our models have a problem with sample selection bias. The two-stage regression results after controlling for endogenous selection bias show that there is a significant positive correlation between different types of environmental technologies and economic performance. These results are consistent with the above analysis conclusions.

4.3.2. Accuracy of Independent Variable Measurement

The difference between clean technologies and end-of-pipe technologies is that the former affects the production process itself. Therefore, we can analyze the impact of different types of environmental technologies measurement indicators on enterprise productivity to demonstrate the accuracy of independent variable measurement. In this paper, we use a semi-parametric estimation approach (LP for short) to calculate the total factor productivity (TFP). We provide the results of the effect of end-of-pipe technologies and clean technologies on TFP in

Table 4. The result shows that the effect of clean technologies on TFP is significant and positive (Model 1, β = 0.0166,

p = 0.02). Ceteris paribus, if companies apply for an additional green patent, enterprises will see a 0.0167% increase in TFP. However, the coefficient of end-of-pipe technologies is not significant, indicating the end-of-pipe technologies has a limited impact on the firms’ productivity. Taken together, our use of environmental alteration investments and green patents to measure different types of environmental technologies is accurate, and only clean technologies play an important role in a firm’s productivity.

4.3.3. One-Year Lagged Effect

As environmental technologies take a longer period of time to influence firm economic performance, we ran a robustness analysis by lagging environmental technologies by tone-year periods in

Table 5. The result for clean technologies indicates that financial constraints and market advantages mediate the positive influence of PTENT

t−1 on a firm’s economic performance, and the effects last for at least 1 year. On the other hand, the results for PIPE

t−1 differ in that it is not significantly associated with economic performance. These results show that clean technologies have a more permanent impact on economic performance than end-of-pipe technologies.

5. Conclusions

This study explored the relationship between environmental technologies and economic performance using a sample of listed manufacturing companies. As environmental technologies are divided into clean technologies and clean technologies, both types of environmental technologies can improve firms’ economic performance. Concurrently, this study proved that the more focus a manufacturing firm on environmental technologies inputs, the more it is equipped to meet the green finance and green consumption demands; consequently, its economic performance is improved through mitigating financial constraints and improving market advantage. Therefore, we draw the following conclusions.

First, the adoption of environmental technologies, whether clean technologies or end-of-pipe technologies, could improve the economic performance of manufacturing firms. On one hand, environmental technologies could directly reduce pollution control costs and increase revenue. On the other hand, environmental technologies could indirectly affect economic performance through external benefits and resources from stakeholders. Second, clean technologies not only directly affect economic performance but also indirectly affects economic performance through mitigating financial constraints; end-of-pipe technologies do not significantly affect financial constraints. The possible explanation for this outcome is that end-of-pipe technologies need to pay high transformation costs in the short term, which cannot be covered by the support of green finance. Finally, the end-of-pipe technologies not only directly influence economic performance but also indirectly affect economic performance through weakened market advantages; clean technologies do not significantly affect market advantages. The reason may be the complexity in the process of environmental technologies compared to traditional innovation, which leads to the difficulty to forming market advantages quickly. In addition, the awareness of green consumption is still inadequate.

The aforementioned findings also significantly contribute to industrial implications and social practice. First, this study provided new ideas for green transformation of manufacturing industries. Most Chinese firms have a low environmental innovation capacity [

7]. This phenomenon hinders the development of companies, especially for manufacturing enterprises. This paper found that the adoption of environmental technologies, whether end-of-pipe technologies or clean technologies, could improve a manufacturing firm’s economic performance. In addition, compared with end-of-pipe technologies, clean technologies will be more effective in the long run. Therefore, the implementation of green innovation and environmental disclosure should be enhanced to help firms obtain more financing resources and maximize benefits and ensure the rapid development of enterprises and healthy economic practices.

Second, this research provides important help for the government to more effectively formulate and implement green financial system. Green finance is an important pushing way of green transformation and development, it encourages enterprises to conduct environmental technologies and promotes the clean production of industries. Our study shows that the Chinese green financial system provides effective financial support for manufacturing enterprises adopting clean technologies, while it does not for those adopting end-of-pipe technologies. This requires the government to formulate more detailed financial policies and improve differentiated financial policies for enterprises adopting different types of environmental technologies. By promoting these practices, the governments could also alleviate the financing difficulties of manufacturing enterprises and then proceeding to promote regional green development economic growth.

Finally, our result stresses the importance of popularizing the concept of green consumption. On one hand, enterprises require an in-depth analysis of the market green demands and turn green R&D investment into a measurable business return. Meanwhile, the enterprises need to establish the overall green image of the enterprise through building green product promotion and sales channels. On the other hand, the government is the most important promoter of green consumption; it shoulders the responsibility of promoting and disseminating knowledge related to green environmental protection. By strengthening market supervision and fostering the market participants’ attention for green development, we could create a situation where the enterprise’s green product innovation ability and market shares are closely related and mutually reinforcing.

As with any empirical study, our study is not exempt from limitations. A primary limitation relates to the use of green patents to measure clean technologies. It should be recognized that we focused exclusively on green patents, which led to an underestimation of the impact of clean technologies. Future studies might focus on introducing clean technologies, which then can encompass overall R&D funding of clean technologies. Furthermore, future environmental technologies studies might compare the impact of different environmental technologies types on enterprise performance through the expenditure of capitalization. A second limitation is our use of a carbon trading pilot policy as an antecedent variable influencing the adoption of environmental technologies. We encourage future studies to collect different antecedent variables for specific types of environmental technologies to more effectively control model endogeneity. Another limitation is our focus on green financing and green consumption. An interesting direction for future studies would be to investigate the link between environmental technologies and benefits from other stakeholders. Finally, a potential limitation is the lack of examination of industry heterogeneity. We certainly encourage scholars to conduct comparative studies on different industries, which may provide more targeted guidance for enterprises to strengthen their environmental technologies and economic performance.