Induced Effect of Environmental Regulation on Green Innovation: Evidence from the Increasing-Block Pricing Scheme

Abstract

1. Introduction

2. Literature Review and Background

2.1. Induced Effect

2.2. Biased Induced Effect

2.3. Quality of Green Innovation

2.3.1. IBP Scheme in China

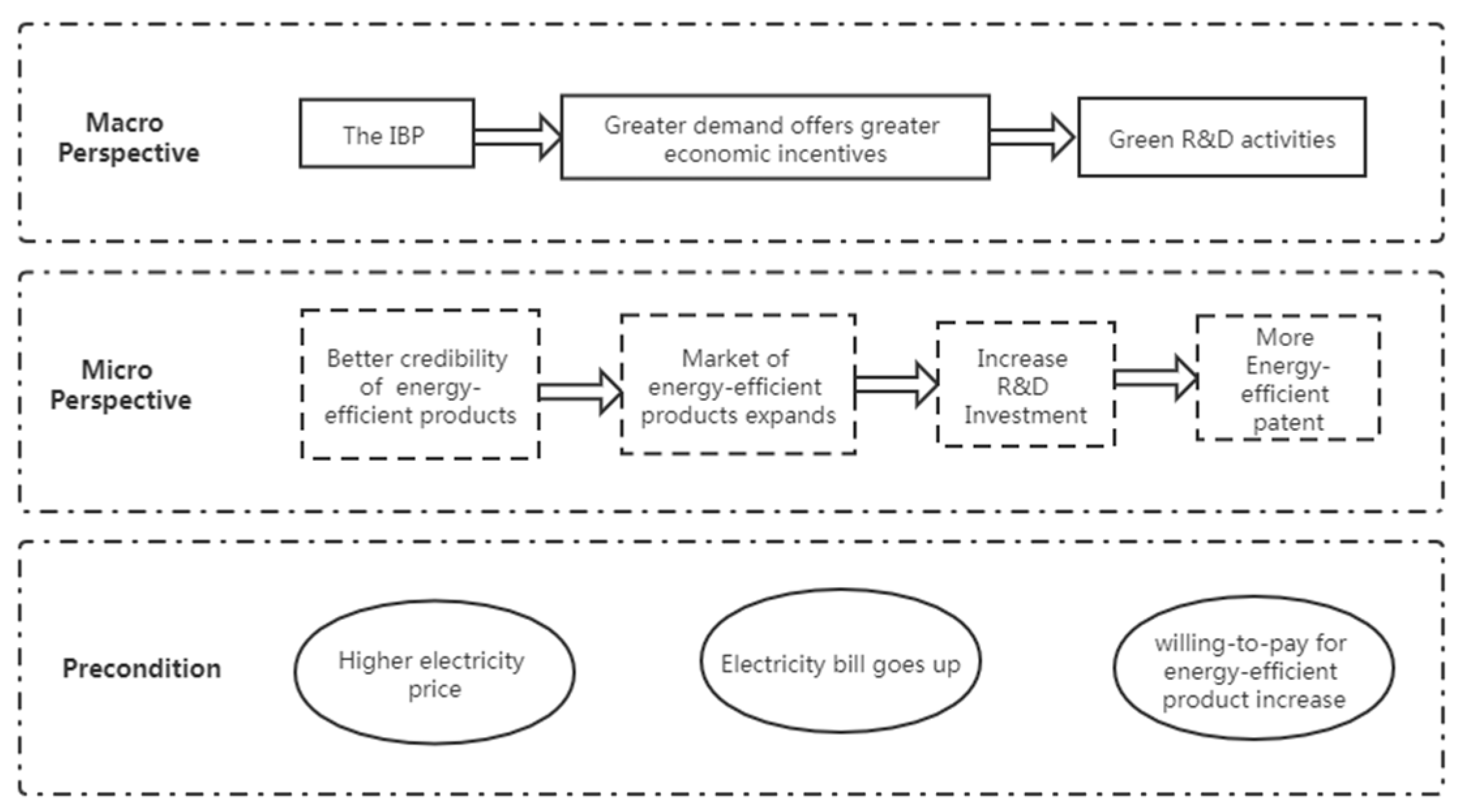

2.3.2. Mechanism of Induced Effect

3. Data and Method

3.1. Data

3.1.1. Patent Data

3.1.2. Control Variables

3.2. Identification Strategy

3.2.1. Identifying Assumptions and Checks

3.2.2. Estimation of the Induced Effect on Green Innovation

3.2.3. Estimation of The Biased Effect towards Green Innovation

3.2.4. Estimation of the Effect on Quality of Green Innovation

4. Results

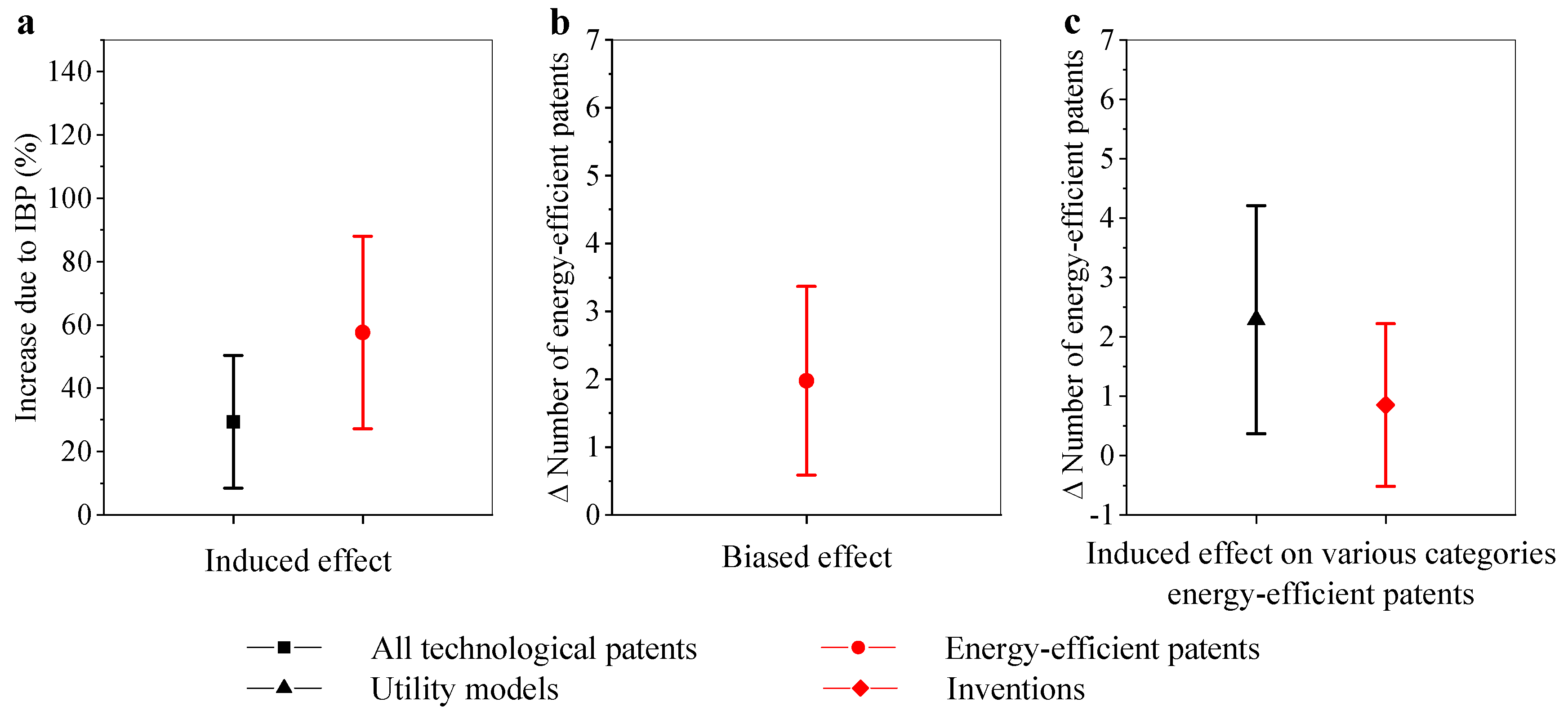

4.1. The Induced Effect of IBP on Green Innovation

4.2. The Biased Effect towards Green Innovation

4.3. Quality of Induced Innovation

5. Discussion

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

References

- Porter, M.E.; Van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Braun, E.; Wield, D. Regulation as a means for the social control of technology. Technol. Anal. Strateg. Manag. 1994, 6, 259–272. [Google Scholar] [CrossRef]

- Lanoie, P.; Laurent-anoie, P.; Laurentnstone, N.; Ambec, S. Environmental policy, innovation and performance: New insights on the Porter hypothesis. J. Econ. Manag. Strategy 2011, 20, 803–842. [Google Scholar] [CrossRef]

- Yang, C.H.; Tseng, Y.H.; Chen, C.P. Environmental regulations, induced R&D, and productivity: Evidence from Taiwan’s manufacturing industries. Resour. Energy Econ. 2012, 34, 514–532. [Google Scholar]

- Foray, D.; Grübler, A. Technology and the environment: An overview. Technol. Forecast. Soc. Chang. 1996, 53, 3–13. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. Environmental policy and technological change. Environ. Resour. Econ. 2002, 22, 41–70. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The environment and directed technical change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef]

- Aghion, P.; Dechezleprêtre, A.; Hemous, D.; Martin, R.; Van Reenen, J. Carbon taxes, path dependency, and directed technical change: Evidence from the auto industry. J. Polit Econ. 2016, 124, 1–51. [Google Scholar] [CrossRef]

- Hu, J.; Pan, X.; Huang, Q. Quantity or quality? The impacts of environmental regulation on firms’ innovation–Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol. Forecast. Soc. Chang. 2020, 158, 120122. [Google Scholar] [CrossRef]

- Brouillat, E.; Oltra, V. Extended producer responsibility instruments and innovation in eco-design: An exploration through a simulation model. Ecol. Econ. 2012, 83, 236–245. [Google Scholar] [CrossRef]

- Zhaohua, W.; Hao, L.; Nana, D.; Kaiwei, C.; Bin, L.; Bin, Z. How to effectively implement an incentive-based residential electricity demand response policy? Experience from large-scale trials and matching questionnaires. Energy Policy 2020, 141, 111450. [Google Scholar]

- Apergis, N.; Gangopadhyay, P. The asymmetric relationships between pollution, energy use and oil prices in Vietnam: Some behavioural implications for energy policy-making. Energy Policy 2020, 140, 111430. [Google Scholar] [CrossRef]

- Xinzhu, Z.; Lulu, T.; Yuan, M. Are residents more sensitive to incremental ladder pricing?-Analysis based on the additive DCC model. J. Econ. Perspect 2015, 2, 17–30. [Google Scholar]

- Popp, D. Induced innovation and energy prices. Am. Econ. Rev. 2002, 92, 160–180. [Google Scholar] [CrossRef]

- Popp, D.C. The effect of new technology on energy consumption. Resour. Energy Econ. 2001, 23, 215–239. [Google Scholar] [CrossRef]

- Rubashkina, Y.; Galeotti, M.; Verdolini, E. Environmental regulation and competitiveness: Empirical evidence on the Porter Hypothesis from European manufacturing sectors. Energy Policy 2015, 83, 288–300. [Google Scholar] [CrossRef]

- Hu, D.; Wang, Y.; Huang, J.; Huang, H. How do different innovation forms mediate the relationship between environmental regulation and performance? J. Clean. Prod. 2017, 161, 466–476. [Google Scholar] [CrossRef]

- Zhao, R.; Wu, X.; Philipp, B. The effect of institutional ownership on firm innovation: Evidence from Chinese listed firms. Res. Policy 2017, 46, 1533–1551. [Google Scholar]

- Chen, Z.; Zhang, J. Types of patents and driving forces behind the patent growth in China. Econ. Model. 2019, 80, 294–302. [Google Scholar] [CrossRef]

- Song, M.; Wang, S.; Sun, J. Environmental regulations, staff quality, green technology, R&D efficiency, and profit in manufacturing. Technol. Forecast. Soc. Chang. 2018, 133, 1–14. [Google Scholar]

- Jin, W.; Zhang, H.Q.; Liu, S.S.; Zhang, H.B. Technological innovation, environmental regulation, and green total factor efficiency of industrial water resources. J. Clean. Prod. 2019, 211, 61–69. [Google Scholar] [CrossRef]

- Kudamatsu, M. Has democratization reduced infant mortality in sub-Saharan Africa? Evidence from micro data. J. Eur. Econ. Assoc. 2012, 10, 1294–1317. [Google Scholar] [CrossRef]

- Zhang, Q.; Yang, L.; Song, D. Environmental effect of decentralization on water quality near the border of cities: Evidence from China’s Province-managing-county reform. Sci. Total Environ. 2020, 708, 135154. [Google Scholar] [CrossRef]

- Hoynes, H.; Page, M.; Stevens, A.H. Can targeted transfers improve birth outcomes? Evidence from the introduction of the WIC program. J. Public Econ. 2011, 95, 813–827. [Google Scholar] [CrossRef]

- Hoang, T.H.V.; Przychodzen, W.; Przychodzen, J.; Segbotangni, E.A. Does it pay to be green? A disaggregated analysis of US firms with green patents. Bus. Strategy Environ. 2020, 29, 1331–1361. [Google Scholar] [CrossRef]

- Christainsen, G.B.; Haveman, R.H. Public regulations and the slowdown in productivity growth. Am. Econ. Rev. 1981, 71, 320–325. [Google Scholar]

- Ambec, S.; Cohen, M.A.; Elgie, S.; Lanoie, P. The Porter hypothesis at 20: Can environmental regulation enhance innovation and competitiveness? Rev. Environ. Econ. Policy 2013, 7, 2–22. [Google Scholar] [CrossRef]

- Popp, D.; Newell, R. Where does energy R&D come from? Examining crowding out from energy R&D. Energy Econ. 2012, 34, 980–999. [Google Scholar]

- Porter, M.E. America’s Green Strategy. Sci. Am. 1991, 264, 168–170. [Google Scholar] [CrossRef]

- Doran, J.; Ryan, G. Regulation and firm perception, eco-innovation and firm performance. Eur. J. Innov. Manag. 2012, 15, 421–441. [Google Scholar] [CrossRef]

- Johnstone, N.; Haščič, I.; Popp, D. Renewable energy policies and technological innovation: Evidence based on patent counts. Environ. Resour. Econ. 2010, 45, 133–155. [Google Scholar] [CrossRef]

- Acemoglu, D. Directed technical change. Rev. Econ. Stud. 2002, 69, 781–809. [Google Scholar] [CrossRef]

- Autor, D.; Dorn, D. The Growth of Low-Skilled Service Jobs and the Polarization of the U. S. Labor Market. Am. Econ. Rev. 2013, 103, 1553–1597. [Google Scholar] [CrossRef]

- Acemoglu, D.; Akcigit, U.; Hanley, D.; Kerr, W. Transition to clean technology. J. Polit Econ. 2016, 124, 52–104. [Google Scholar] [CrossRef]

- Tang, J.; Zhong, S.; Xiang, G. Environmental Regulation, Directed Technical Change, and Economic Growth: Theoretic Model and Evidence from China. Int. Reg. Sci. Rev. 2019, 42, 519–549. [Google Scholar] [CrossRef]

- Greaker, M.; Heggedal, T.-R. A Comment on the Environment and Directed Technical Change; Discussion Papers; Statistics Norway, Research Department: Oslo, Norway, 2012; No. 713. [Google Scholar]

- Nesta, L.; Vona, F.; Nicolli, F. Environmental policies, competition and innovation in renewable energy. J. Environ. Econ. Manag. 2014, 67, 396–411. [Google Scholar] [CrossRef]

- Guo, Y.; Xia, X.; Zhang, S.; Zhang, D. Environmental regulation, government R&D funding and green technology innovation: Evidence from China provincial data. Sustainability 2018, 10, 940. [Google Scholar]

- Hu, A.G.; Zhang, P.; Zhao, L. China as number one? Evidence from China’s most recent patenting surge. J. Dev. Econ. 2017, 124, 107–119. [Google Scholar] [CrossRef]

- Chuanwang, S. Does the RBT Reform Achieve the Twin Objectives of Efficiency and Equity? Econ. Manag. J. 2014, 36, 156–167. [Google Scholar]

- Dan, L.; Jianjun, Y. A literature research on characteristics and trend for domestic green technology innovation. Sci. Res. Mgt. 2015, 36, 109–118. [Google Scholar]

- Weimin, J.; Lu, Z. Environmental regulation, economic opening and China’s industrial green technology progress. Econ. Res. J. 2014, 9, 34–47. [Google Scholar]

- Wanhong, L. Spatial econometrics test of pollutant discharge system’s driving on green technological innovation by taking 29 provinces and regions’ manufacturing industries as examples. Science Res. Mgt. 2015, 36, 1–9. [Google Scholar]

- Beck, T.; Levine, R.; Levkov, A. Big bad banks? The winners and losers from bank deregulation in the United States. J. Financ. 2010, 65, 1637e1667. [Google Scholar] [CrossRef]

- Song, D.; Zhang, Q.; Yang, L. Environmental effect of flattening administrative structure on local water quality: A county-level analysis of China’s County-Power-Expansion reform. J. Clean. Prod. 2020, 276, 123256. [Google Scholar] [CrossRef]

- Agarwal, S.; Qian, W. Consumption and debt response to unanticipated income shocks: Evidence from a natural experiment in Singapore. Am. Econ. Rev. 2014, 104, 4205–4230. [Google Scholar] [CrossRef]

- Calel, R.; Dechezlepretre, A. Environmental policy and directed technological change: Evidence from the European carbon market. Rev. Econ. Stat. 2016, 98, 173–191. [Google Scholar] [CrossRef]

- Newell, R.G. The role of markets and policies in delivering innovation for climate change mitigation. Oxf. Rev. Econ. Policy 2010, 26, 253–269. [Google Scholar] [CrossRef]

- Hung, M.F.; Chie, B.T. The long-run performance of increasing-block pricing in Taiwan’s residential electricity sector. Energy Policy 2017, 109, 782–793. [Google Scholar] [CrossRef]

- Cai, J. The impact of insurance provision on household production and financial decisions. Am. Econ. J. Econ. Policy 2016, 8, 44–88. [Google Scholar] [CrossRef]

- Lim, S.; Prakash, A. Voluntary regulations and innovation: The case of ISO 14001. Public Adm. Rev. 2014, 74, 233–244. [Google Scholar] [CrossRef]

- Newell, R.G.; Jaffe, A.B.; Stavins, R.N. The induced innovation hypothesis and energy-saving technological change. Q. J. Econ. 1999, 114, 941–975. [Google Scholar] [CrossRef]

- Chen, F.; Shi, B.; Kang, R. Does Environmental Policy Reduce Enterprise Innovation?-Evidence from China. Sustainability 2017, 9, 872. [Google Scholar]

- Hahn, R.W.; Stavins, R.N. Incentive-based environmental regulation: A new era from an old idea? Ecol. Law Q. 1991, 18, 1–42. [Google Scholar]

- Hu, A.G.; Jefferson, G.H. A great wall of patents: What is behind China’s recent patent explosion? J. Dev. Econ. 2009, 90, 57–68. [Google Scholar] [CrossRef]

| Level | Price (yuan/kW·h) | Consumption (per Month/Family) | Coverage (%family)/Average Consumption | |

|---|---|---|---|---|

| Zhejiang Province in 2004 | Floor level | Baseline price | Under 50 kW·h | 39.49% |

| Middle level | Baseline price + 0.03 | 51–200 kW·h | 26.93% | |

| Top level | Baseline price + 0.1 | Over 200 kW·h | 33.58% | |

| Note: The electricity price under the IBP in Zhejiang Province was predicted to increase by 0.032 yuan/kW·h. IBP is not applicable to schools. | ||||

| Fujian Province in 2004 | Floor level | Baseline price (0.4463) | Under 150 kW·h | 86.09 kW·h |

| Middle level | Baseline price + 0.02 | 151–400 kW·h | ||

| Top level | Baseline price + 0.12 | Over 400 kW·h | ||

| Sichuan Province in 2006 | First level | Baseline price | Under 60 kW·h | 63.9 kW·h |

| Second level | Baseline price + 0.08 | 61–100 kW·h | ||

| Third level | Baseline price + 0.11 | 101–150 kW·h | ||

| Fourth level | Baseline price + 0.16 | Over 150 kW·h | ||

| Note: Due to the lack of data, average consumption is calculated using data on the whole country. | ||||

| The remaining provinces in China in 2012 | Free level | Free | Under 15 kW·h | Families on social assistance |

| Floor level | Baseline price | Under 240 kW·h | 80% | |

| Middle level | Baseline price + 0.05 | 241–400 kW·h | 90% | |

| Top level | Baseline price + 0.3 | Over 400 kW·h | - | |

| Note: Consumption varies among the provinces and the data used in the table are for Beijing. The first breakpoints of most provinces fall between 150 and 200 kW·h per month/family, while the second fall between 350 and 400 kW·h per month/family. | ||||

| Variables | All Technological Patents | Energy-Efficient Patents | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| IBP | 0.456 ** | 0.294 *** | 0.799 *** | 0.576 *** |

| (2.17) | (2.75) | (2.97) | (3.72) | |

| Level of economy | 0.843 *** | 0.856 *** | ||

| (8.68) | (7.26) | |||

| Economic structure | 0.339 *** | 0.409 *** | ||

| (5.13) | (4.64) | |||

| Economic environment | −0.278 | −1.079 *** | ||

| (–1.03) | (−2.85) | |||

| International trade | −2.108 ** | −4.777 *** | ||

| (–2.19) | (–3.64) | |||

| Human resources | −0.00501 | 0.0182 | ||

| (−0.35) | (0.89) | |||

| Investment in R&D | 0.428 *** | 0.449 *** | ||

| (7.30) | (6.75) | |||

| Constant | 7.300 *** | −2.588 *** | 4.363 *** | −5.728 *** |

| (30.10) | (−5.37) | (18.45) | (−8.72) | |

| Observations | 377 | 377 | 377 | 377 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | Proportion of Green Innovation | Utility Models | Inventions | |

| IBP | 2.127 *** | 1.978 *** | 2.289 ** | 0.852 |

| (3.01) | (2.79) | (2.33) | (1.22) | |

| Level of economy | 0.530 | 0.265 | 1.209 ** | |

| (1.20) | (0.53) | (2.51) | ||

| Economic structure | 0.367 | 1.130 ** | −0.0866 | |

| (0.93) | (2.32) | (−0.23) | ||

| Economic environment | −5.908 *** | −5.253 ** | −7.437 *** | |

| (−3.44) | (−2.33) | (−4.32) | ||

| International trade | −15.24 ** | −18.75 ** | −17.20 *** | |

| (−2.50) | (−2.45) | (−2.92) | ||

| Human resources | 0.161 * | 0.0122 | 0.351 *** | |

| (1.73) | (0.10) | (3.86) | ||

| Investment in R&D | 0.337 | –0.189 | −0.394 | |

| (1.18) | (−0.58) | (−1.44) | ||

| Constant | 5.587 *** | 4.394 | 10.73 *** | −2.549 |

| (24.00) | (1.62) | (3.54) | (−0.79) | |

| Observations | 377 | 377 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Z.; Yang, L.; Fan, L. Induced Effect of Environmental Regulation on Green Innovation: Evidence from the Increasing-Block Pricing Scheme. Int. J. Environ. Res. Public Health 2021, 18, 2620. https://doi.org/10.3390/ijerph18052620

Liu Z, Yang L, Fan L. Induced Effect of Environmental Regulation on Green Innovation: Evidence from the Increasing-Block Pricing Scheme. International Journal of Environmental Research and Public Health. 2021; 18(5):2620. https://doi.org/10.3390/ijerph18052620

Chicago/Turabian StyleLiu, Zhangsheng, Liuqingqing Yang, and Liqin Fan. 2021. "Induced Effect of Environmental Regulation on Green Innovation: Evidence from the Increasing-Block Pricing Scheme" International Journal of Environmental Research and Public Health 18, no. 5: 2620. https://doi.org/10.3390/ijerph18052620

APA StyleLiu, Z., Yang, L., & Fan, L. (2021). Induced Effect of Environmental Regulation on Green Innovation: Evidence from the Increasing-Block Pricing Scheme. International Journal of Environmental Research and Public Health, 18(5), 2620. https://doi.org/10.3390/ijerph18052620