1. Introduction

The environmental problems caused by the greenhouse effect have become more and more serious [

1]. Global warming brings a huge pressure to human survival and health and has aroused widespread concern around the world [

2]. To this end, many governments have implemented environmental policies such as carbon taxes and cap and trade [

3]. In practice, Canada and Australia introduced carbon taxes in 2008 and 2012 respectively [

4]. Compared with carbon tax, cap and trade is also conducive to saving energy and reducing emissions. For instance, both the European Union’s emissions trading scheme [

5] and the China’s cap-and-trade scheme [

6] are successful solutions. In a cap-and-trade scheme, companies receive a carbon quota from the government and trade the quota by taking into account their emissions. Since 2012, China has piloted carbon trading in seven cities, which includes Beijing, Shanghai and Shenzhen, etc. Meanwhile, the Chinese government formally implemented a carbon trading policy in 2017 [

7]. Therefore, carbon emission reduction has become an important goal to achieve high-quality economic development in China.

In reality, governments guide consumers to buy green products by using carbon labels. For example, China’s energy labeling program was significant in guiding consumers to buy low-carbon and environmentally friendly products, which was launched in 2005 and involved household appliances, automobiles and other industries [

8]. Through the government subsidies, China’s energy labelling program has not only encouraged companies to produce low-carbon products, but also changed consumers’ purchase preferences. Adaman et al. [

9] showed that consumers were willing to pay more for environment-friendly products. Meanwhile, with the implementation of more and more environmental regulations and the development of low-carbon technologies, many manufacturing enterprises are committed to the production of green products to improve their competitiveness, which help directly reduce carbon emissions [

10,

11]. For instance, a California clothing company has produced green products for many years [

12], and Gree Electric of China has focused on energy efficient product design and innovation and invested more than

$1 billion in carbon reduction technologies in 2008 [

8].

In order to meet the growing low-carbon demand of consumers, the upstream enterprises of the supply chain have to accelerate the development of emission reduction technologies, and the downstream enterprises have to increase the promotion of low-carbon products. This will increase the operating costs of the supply chain. Thus, low-carbon supply chain (LCSC) management has become an important research topic in recent years.

Empirical research shows that the members in a supply chain have fairness preferences, which are often referred to fairness concerns. Specifically, they focus not only on maximizing their own profits, but also on the fair results of profit distribution in the supply chain [

13]. For example, Xuzhou Wanji Trading Co., Ltd. from Xuzhou of China terminated its distribution business with P&G from Cincinnati of America in 2010 because it believed that P&G’s products were unreasonably priced. In 2010, Haier Electric was committed to the development and production of low-carbon products, while retailers such as Gome and Suning carried out product sales. However, as the manufacturer was in a strong position, Haier was more concerned with its own interests, which caused the unfair feelings for Gome and Suning [

14]. In the face of unfair treatment of peers, the fairness of enterprises plays an important role in their decision-making [

15]. Therefore, fairness is an important factor that should be considered when manufacturing enterprises invest in emission reduction and supply chain operation management [

4]. Studies have shown that fairness concern not only affect the price strategies and efficiency of supply chains [

15,

16], but also can encourage manufacturers to make more use of green technologies [

17]. Manufacturing enterprises adopt low-carbon technology to reduce carbon emissions, which will increase costs. As rational decision-makers, manufacturers may deliberately raise wholesale prices in order to share emission reduction costs, which will lead to the unfair treatment of downstream retailers and ultimately reduce their incentives [

14]. Therefore, the decision-makers in the supply chain not only consider their own profits, but also consider the fairness among members. Therefore, it is very important to study the pricing decisions in LCSCs with the members’ fairness concerns.

To our best of knowledge, only a few papers have simultaneously studied the impact of carbon emission limit and fairness concern on the optimal prices and carbon emission strategies of members in low-carbon supply chains [

15,

18,

19]. However, most studies rarely incorporate both carbon quota policy and fairness concern into the decision-making process of LCSCs. Different from these studies, our research attempts to solve the following questions: (1) What is the difference between fairness neutrality and fairness concern in pricing decisions? (2) Under the carbon quota policy, how do the fairness concerns of different members in the supply chain affect the pricing of low-carbon products and the profits of all members? (3) How does the consumers’ low-carbon preference for products affect the pricing of low-carbon products and the profits of all members in the supply chain? Therefore, this paper considers a LCSC with a cap-and-trade system and establishes a master-slave decision-making model by using game theory, where a pricing decision-making problem under the fairness concerns of both manufacturers and retailers is studied. The purpose of this study is to provide a theoretical basis and decision support for the low-carbon supply chain pricing processes considering the fairness concerns of its members. The novelty of this paper can be concluded as follows. Firstly, the carbon quota policy and the fairness concern of members are considered in the pricing decision-making process of the low-carbon supply chain. Secondly, the consumers’ preferences for low-carbon products are discussed in the above decision-making process. Thirdly, by using dynamic game theory, four pricing decision-making models for low-carbon supply chains (LCSCs) are proposed and analyzed. The rest of the paper is organized as follows.

Section 2 introduces a comprehensive review of carbon quota and fairness concern based on LCSCs.

Section 3 describes the notation and assumptions of the model.

Section 4 analyzes different models.

Section 5 presents numerical analysis and sensitivity analysis.

Section 6 introduces the conclusion and research prospects.

3. Problem Description

We design a two-echelon low-carbon supply chain (LCSC) which includes a retailer and a manufacturer. The manufacturing process produces carbon emissions. At the beginning of each year, the government gives a free carbon quota to the manufacturer. If the manufacturer’s carbon emissions exceed the quota, it will have to buy carbon credits from a carbon trading market, and when the manufacturer’s carbon emissions are lower than the government’s quota, it can sell the excess carbon credits.

Firstly, the centralized pricing decision-making and decentralized pricing decision-making processes of the LCSC are studied. Then, the decentralized pricing decision-making process of the LCSC is studied respectively, where dynamic game theory is applied. A flow chart of the decision-making processes in the LCSC is shown in

Figure 1. The government first gives the manufacturer a certain carbon quota (

). If the amount of carbon produced by the manufacturer exceeds

A, the manufacturer will buy the carbon emission right in the trading market with a price

, otherwise manufacturers would sell carbon credits with a price

. To investigate the optimal pricing decisions by considering fairness concern under carbon quota policy, four cases of pricing decisions will be discussed, which are shown in

Figure 1. In case 1, a centralized pricing decision for the LCSC is made in which the manufacturer and retailer act as a whole to face the sales market and sell the product to the customer with a price

. In case 2, a decentralized pricing decision for the LCSC is made where the manufacturer first sell the product to the retailer with a wholesale price

and then the retailer sells the product to the customer with a price

. In case 3 and 4, a decentralized pricing decision is made for the LCSC by considering the fairness concern of the manufacturer and the fairness concern of the retailer, respectively.

4. Models and Analysis

In the studied low-carbon supply chain (LCSC), the manufacturer produces green products and invests in carbon reduction, and the retailer sells green products and has a low-carbon preference. The relationship between the two submits to the master–slave game in which the manufacturer takes the lead.

4.1. Notations and Assumptions

For lucidity and simplicity, the parameters and core variables are expressed in

Table 1.

This paper assumes the following:

(1) The demand for green products faced by the retailer is not only concerned with the retail price, but also influenced by the low-carbon preference of the consumer. The market demand function can be described by

[

14].

(2) The manufacturer has to improve its technology with a reduction cost of the carbon emission for reducing the carbon emission. This cost can be described by

[

41].

4.2. Centralized Pricing Decision-Making Model for LCSC

The LCSC is an idealized organization which aims to maximize the profits in the LCSC. Therefore, the manufacturer and the retailer face the sales market together. The wholesale price determined by the manufacturer is treated as an internal transfer price, which affects the profit of each member but does not affect the total profit. Thus, an appropriate retail price

and a carbon emission reduction rate

β* are set to maximize the profit function of the entire supply chain. The profit function can be expressed as

The hessian matrix

with respect to

and

can be expressed as

As the first order principal subformula

, if the second order principal subformula

,

is a negative definite matrix. Let

and

, then

and

in centralized pricing decision-making can be obtained:

Next, we substitute

and

into the demand function

and the profit function of supply chain

. Thus,

and

in centralized pricing decision-making can be calculated:

If , the retail price and the carbon emission reduction rate are concave functions of the profit of the supply chain. Meanwhile, in order to ensure that they are non-negative, the condition of and must be satisfied.

4.3. Decentralized Pricing Decision-Making Model for LCSC

In a decentralized pricing decision-making model, the manufacturer can be regarded as a Stackelberg leader who determines the optimal unit wholesale price of the product

w and the carbon emission reduction rate

β, and the retailer can be regarded as a follower who determines the retail price of the product

p. Thus, the profit functions can be expressed as

By adopting the reverse derivation method, the retailer first determines

, and then the manufacturer determines

w and

. Due to

, let

, then

determined by the retailer can be obtained as follows:

The hessian matrix

with respect to the wholesale price

and the carbon emission reduction rate

can be expressed as follows:

As the first order principal subformula

, if the second order principal subformula

,

is a negative definite matrix. Let

and

, then

and

in decentralized pricing decision-making can be obtained as follows:

Next, we substitute

and

into the demand function

. Thus,

and

in decentralized pricing decision-making can be obtained as follows:

The optimal retailer profit

, the manufacturer profit

, and

in decentralized pricing decision-making can be calculated as follows:

Obviously, if , the second order principal subformula of the hessian matrix is greater than zero. At the same time, if and , , and are nonnegative.

4.4. Decentralized Pricing Decision-Making Model for LCSC

The manufacturer has the characteristic of fairness concern, while the retailer has the characteristic of fairness neutrality. As the decision-makers often only focus on the negative unfair utility to themselves, the manufacturer’s fairness concern coefficient

is introduced by Du et al. [

39]. Then, the utility functions can be expressed as

The retailer and the manufacturer also follow the Stackelberg game when the manufacturer is concerned about the fairness. Similarly to

Section 4.3, the retailer acts as a follower who maximizes their utility function based on the wholesale price and the carbon emission reduction rate set by the manufacturer.

Since

, let

; the optimal retail price

determined at the time of manufacturer’s fairness concern can be obtained as follows:

Through substituting

into the manufacturer’s utility function

, the hessian matrix

and the carbon emission reduction rate

can be expressed as follows:

As the first order principal subformula

, if the second order principal subformula

,

is a negative definite matrix

. Let

and

, the optimal wholesale price

and the carbon emission reduction rate

under manufacturer’s fairness concern can be obtained as follows:

Next, we substitute

and

into the demand function

and the utility function of manufacturer

. Thus,

under manufacturer’s fairness concern can be obtained as follows:

The optimal manufacturer profit

and the profit

can be obtained as follows:

Similarly to

Section 4.3, if

, the second order principal subformula of the hessian matrix

is greater than zero. At the same time, if

and

,

wm,

and

are nonnegative.

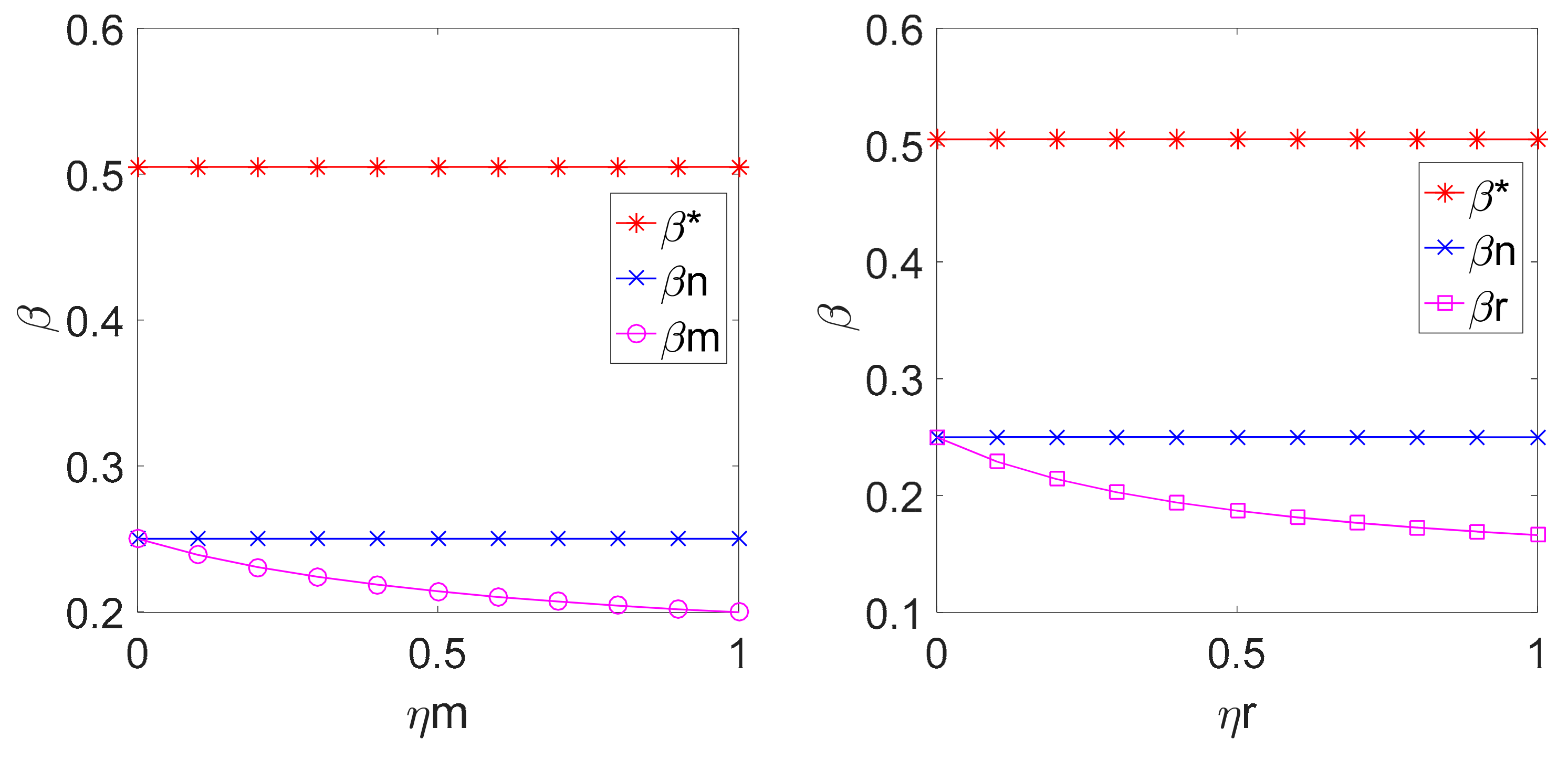

Proposition 1. In the decentralized pricing decision, the wholesale price with the manufacturer’s fairness concern is higher than the wholesale price with the manufacturer’s fairness neutrality, while the carbon emission reduction rate with the manufacturer’s fairness concern is lower. The carbon emission reduction rate in the decentralized pricing decision is lower than the rate in the centralized pricing decision.

The proof of Proposition 1 is given in

Appendix A.

Proposition 1 shows that if the manufacturer pays attention to fairness and wants to satisfy its own requirement to fairness, it will not only raise the wholesale price of the product, but also reduce the carbon emission reduction rate.

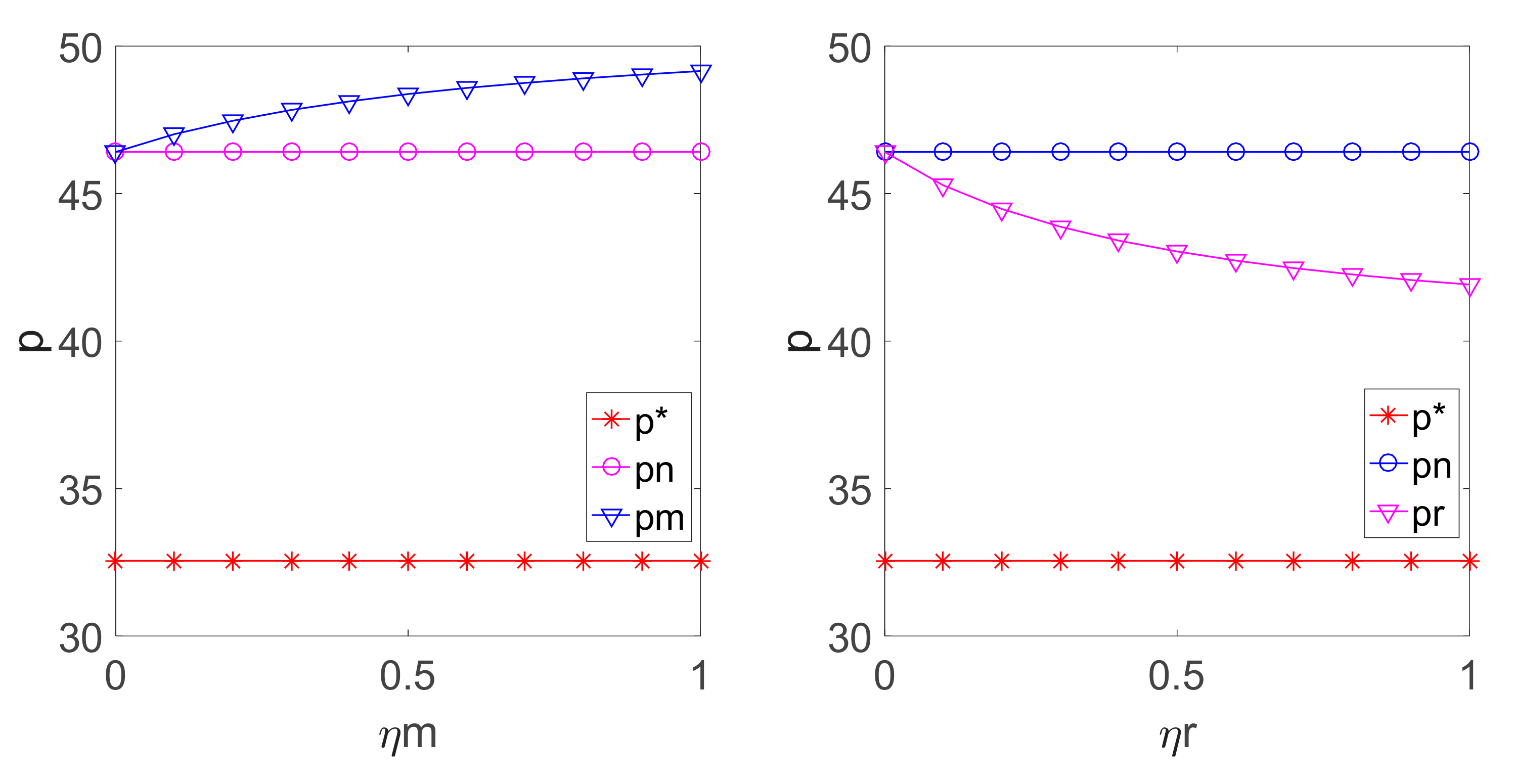

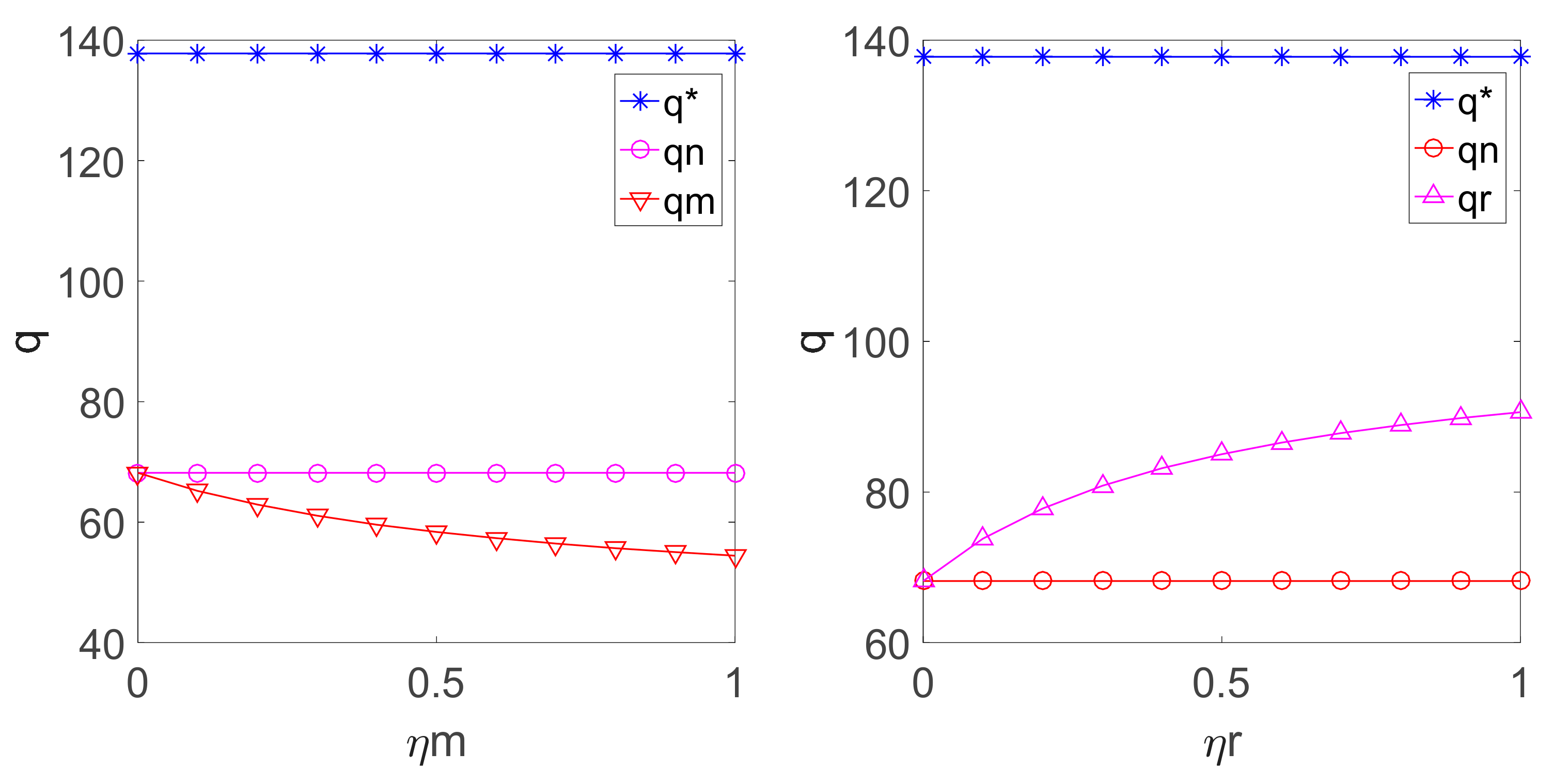

Corollary 1. In the decentralized pricing decision, the retail price with the manufacturer’s fairness concern is higher than the retail price with the manufacturer’s fairness neutrality, and the latter price is greater than the retail price in the centralized pricing decision. Similarly, in the decentralized pricing decision, the order quantity with the manufacturer’s fairness concern is lower than the order quantity with the manufacturer’s fairness neutrality, and the latter quantity is also lower than the order quantity in the centralized pricing decision.

Corollary 1 indicates that the manufacturer’s fairness concern forces the retailer to raise the retail price of the product and reduce the demand of the product.

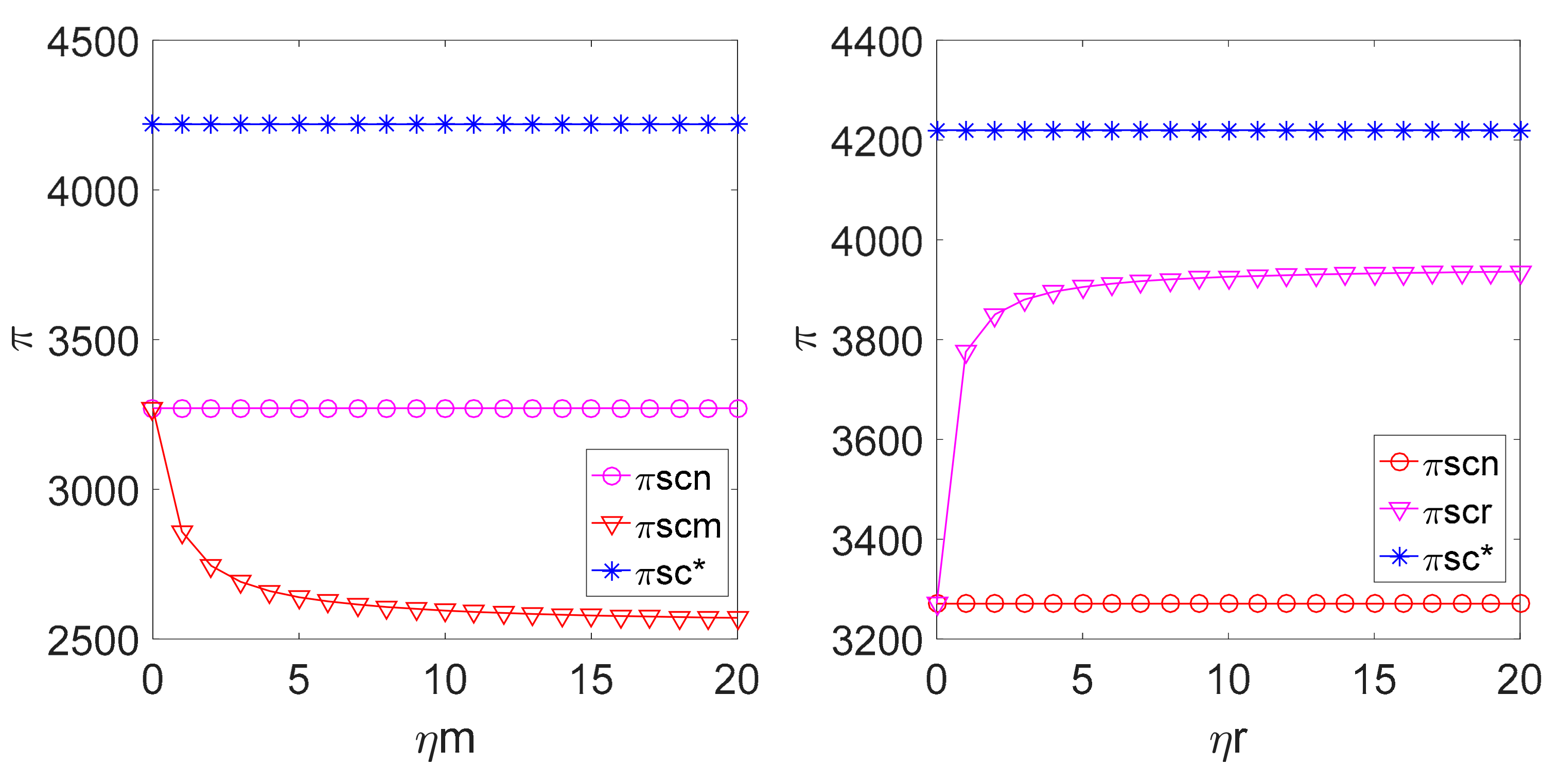

Corollary 2. In the decentralized pricing decision, the profit of the supply chain in the case of the manufacturer’s fairness concern is smaller than the profit of the supply chain in the case of the manufacturer’s fairness neutrality, and the latter profit is smaller than the profit of the supply chain in the centralized pricing decision.

Corollary 2 shows that the manufacturer’s fair concern behavior not only reduces its own profit and that of the retailer, but also reduces the profit of the supply chain. This can be explained by the fact that the manufacturer pursues a fair profit distribution by sacrificing part of the profit to punish its rivals.

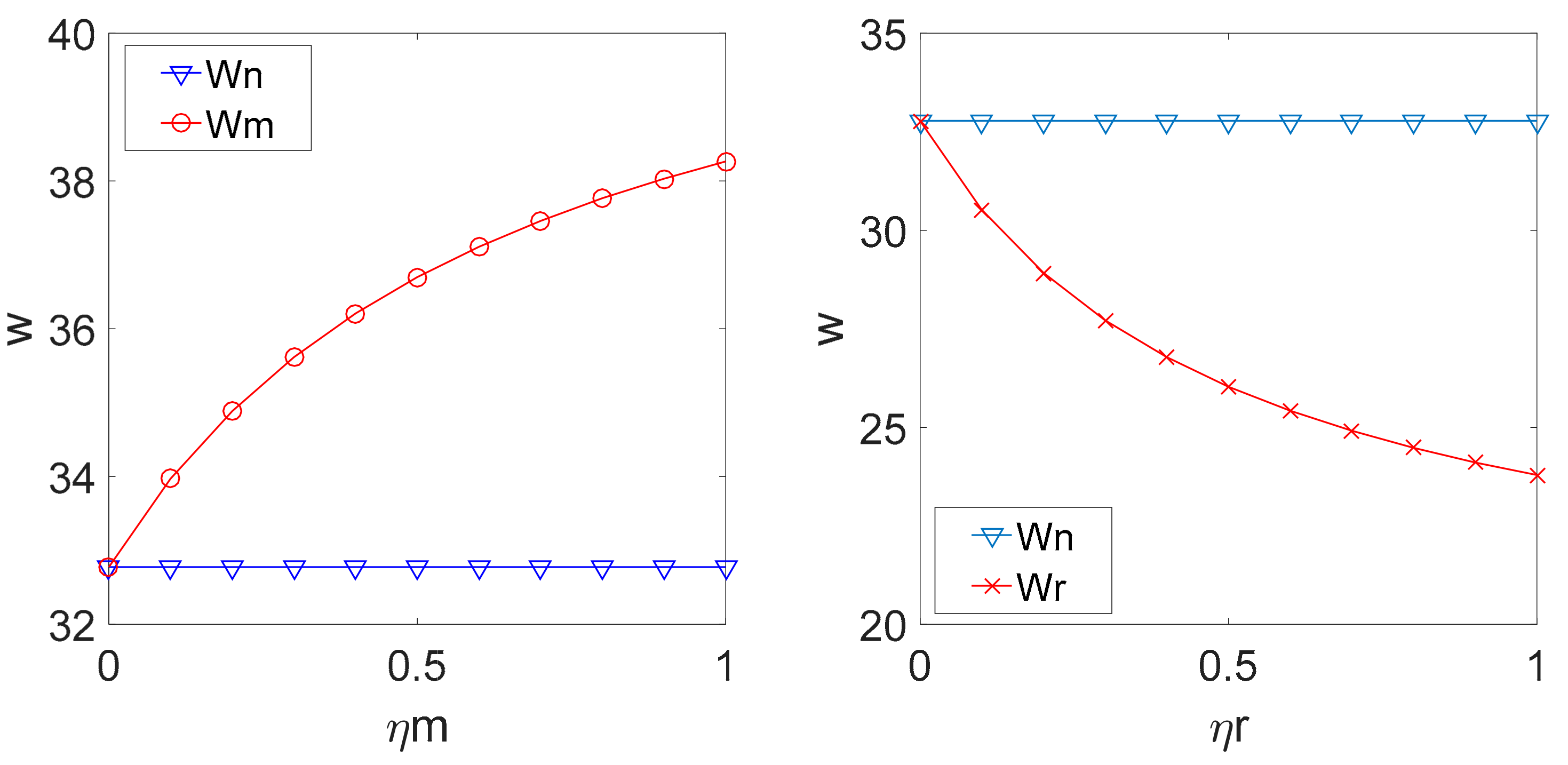

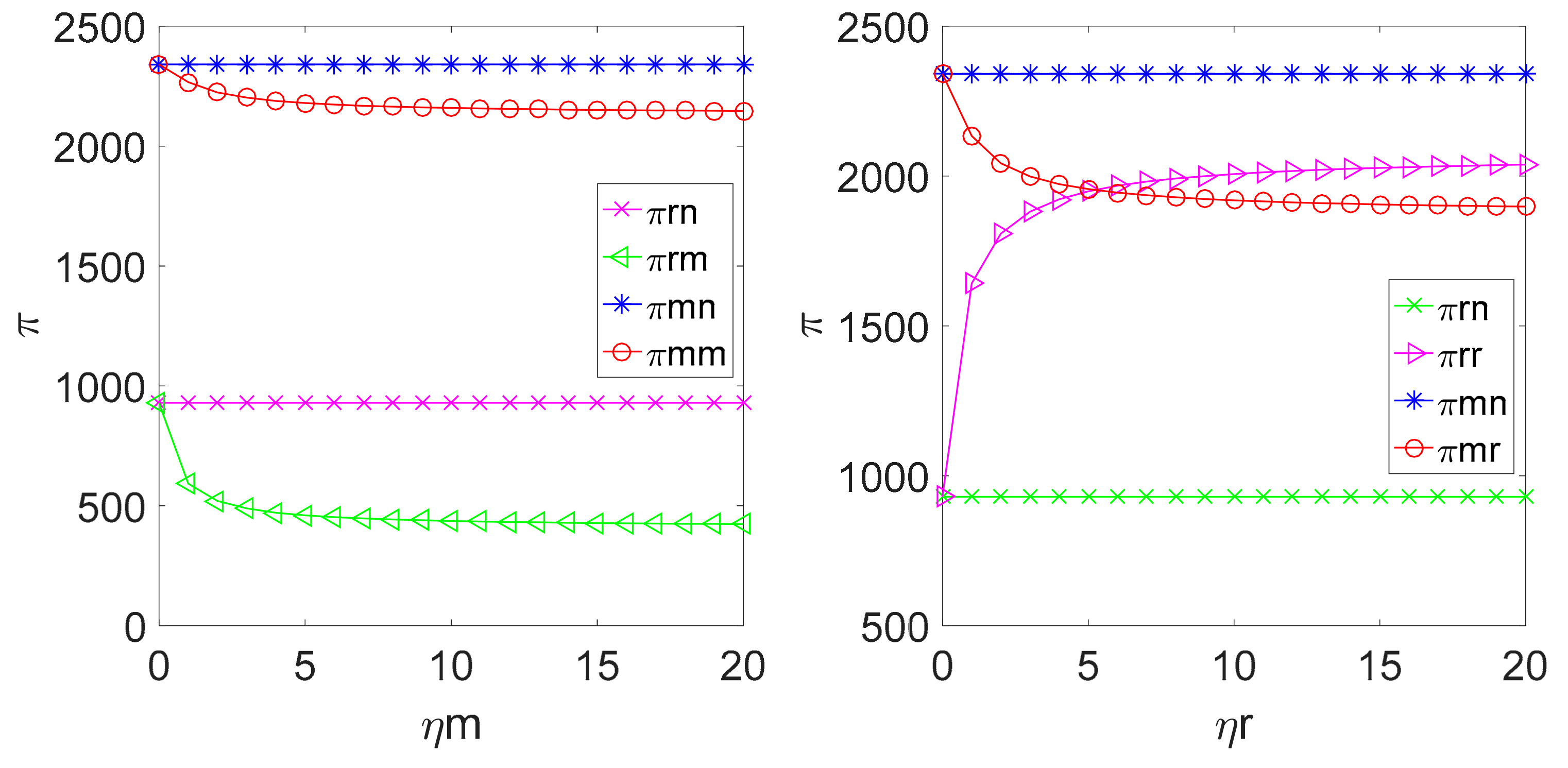

Proposition 2. In the decentralized pricing decision, the carbon emission reduction rate βm and the order quantity are negatively correlated with the manufacturer’s fairness concern coefficient.

The proof of Proposition 2 is given in

Appendix D.

Proposition 2 shows that if manufacturer pays attention to fairness, the fairness concern coefficient has an influence on the decision variables.

Proposition 3. In the decentralized pricing decision, and are negatively correlated with .

The proof of Proposition 3 is given in

Appendix E.

Proposition 3 shows that if manufacturer pays attention to fairness, the fairness concern coefficient has an influence on the profit of all members. This indicates that the manufacturer’s fairness concern coefficient not only hurts its own profit, but also hurts the profit of the downstream retailer.

4.5. Decentralized Pricing Decision-Making Model for LCSC Considering Retailer’s Fairness Concern

As the retailer has the characteristic of fairness concern and the manufacturer has the characteristic of fairness neutrality, the retailer is concerned with both its own profit and the fairness. By introducing the retailer’s fairness concern coefficient

[

39], the utility functions are expressed as follows:

The retailer and the manufacturer follow the Stackelberg game where the retailer is concerned with the fairness. Similar to

Section 4.4, the retailer first maximizes its utility function by using a reverse derivation. Since

, let

, then

determined by the retailer at the time of retailer’s fairness concern is obtained as follows:

Through substituting

into the manufacturer’s utility function

, the hessian matrix

with respect to wholesale price

and

can be expressed:

As the first order principal subformula

, if the second order principal subformula

,

is a negative definite matrix and

is a concave function of

and

. Let

and

, then

and the carbon emission reduction rate

under retailer’s fairness concern can be obtained as follows:

Next, we substitute

and

into the demand function

and the utility function of manufacturer

. Thus,

and

under retailer’s fairness concern can be obtained as follows:

Through substituting

,

and

into the manufacturer’s utility function and the retailer’s utility function, the profit can be obtained as follows, respectively:

Similarly to

Section 4.3, if

, the second order principal subformula of the hessian matrix

is greater than zero. At the same time, if

and

,

,

and

are nonnegative.

Proposition 4. The wholesale price is lower than those under the fairness neutrality in the pricing decision.

The proof of Proposition 4 is given in

Appendix F.

Proposition 4 indicates that if the retailer pays attention to fairness, the manufacturer decreases the wholesale price and its carbon emission reduction rates.

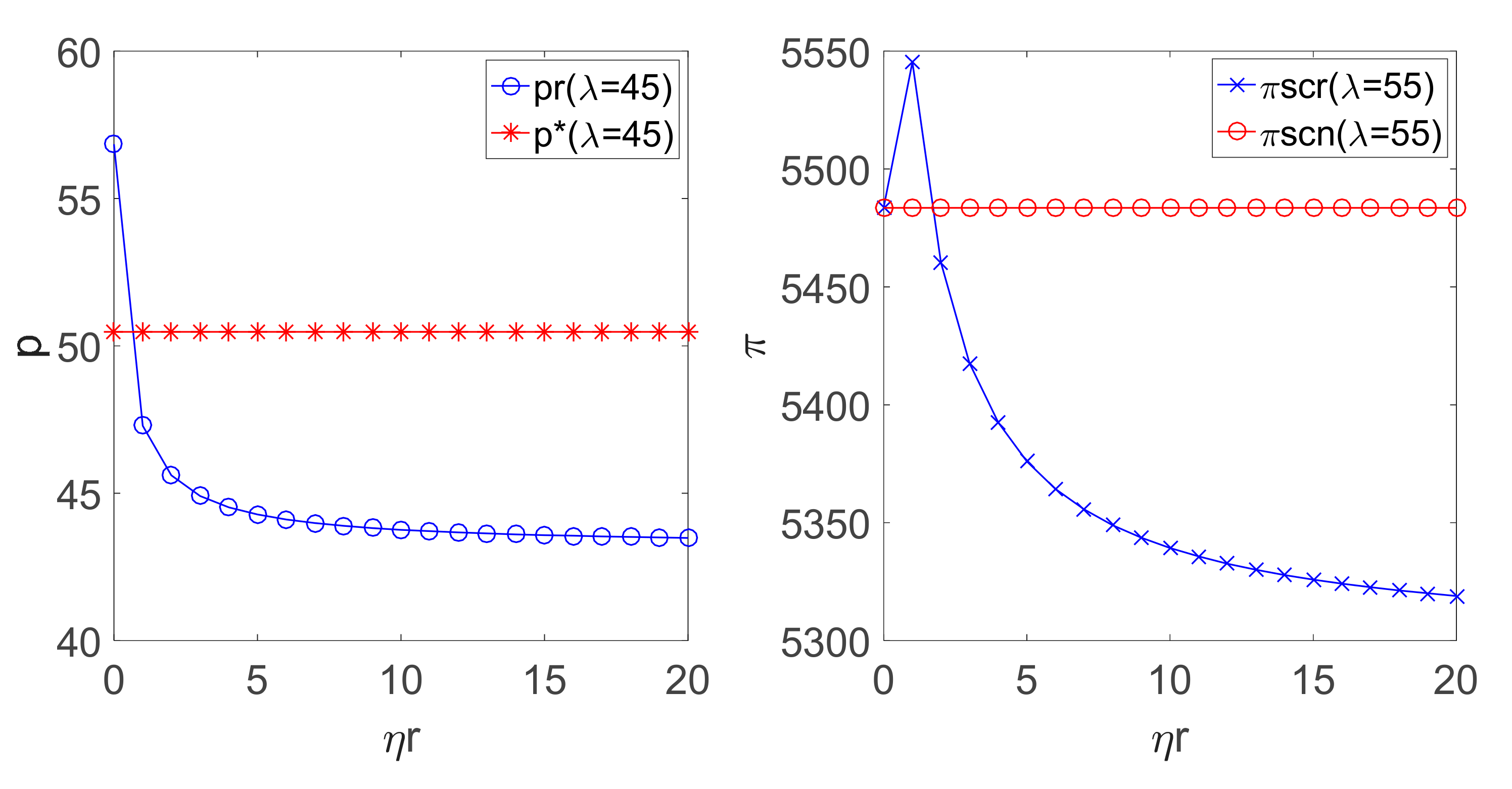

Corollary 3. (i) The retail price in the decentralized pricing decision with the manufacturer’s fairness concern is lower than the retail price in the decentralized pricing decision with fairness neutrality. (ii) If , the retail price in the decentralized pricing decision with the manufacturer’s fairness concern is higher than the retail price in the centralized pricing decision. (iii) When , let . If , the retail price in the decentralized pricing decision is higher than the retail price in the centralized pricing decision, and if , the latter retail price is higher than the former retail price.

Corollary 3 shows that if retailer cares about fairness, they will reduce the retail price to increase the sales volume.

Corollary 4. (i) The profit of the retailer in the decentralized pricing decision with fairness concern is larger than the profit of the retailer in the decentralized pricing decision with fairness neutrality, while the profit of the manufacturer in the decentralized pricing decision with fairness concern is smaller than the profit of the manufacturer in the decentralized pricing decision with fairness neutrality. (ii) Let . If , the profit in the decentralized pricing decision is larger than the profit obtained in the decentralized pricing decision with fairness neutrality. If , the former profit is smaller than the latter profit. (iii) The profit of the supply chain in the decentralized pricing decision with the manufacturer’s fairness is smaller than the profit in the the centralized pricing decision.

Corollary 4 shows that the retailer’s fairness concern coefficient increases the profit of the retailer and decreases the profit of the manufacturer, and the profit of the supply chain in the decentralized pricing decision is smaller than the profit of the supply chain in the centralized pricing decision. This can be explained by the fact that the retailer pursues the fair profit allocation, which sacrifices the profit of its rival to increase its own profit.

Proposition 5. In the decentralized pricing decision, , and are negatively correlated with the retailer’s fairness concern coefficient , and the order quantity is positively correlated with .

The proof of Proposition 5 is given in

Appendix I.

Proposition 5 indicates that if the retailer pays attention to fairness, the fairness concern coefficient has an influence on the decision variables.

Proposition 6. In the decentralized pricing decision with the retailer’s fairness concern, is positively correlated with .

The proof of Proposition 6 is given in

Appendix J.

Proposition 6 indicates that if the retailer pays attention to fairness, the fairness concern coefficient has an effect on the profits of the members. Specifically, the retailer’s profit increases with the increase of the retailer’s fairness concern coefficient.

6. Conclusions

This research studies a LCSC decision-making problem with fairness concern by considering the carbon quota policy. The LCSC includes a manufacturer and a retailer, in which the government gives a free quota of carbon to the manufacturer who applies low-carbon technologies to reduce its emission. The effects of the fairness concern coefficient on the players’ decisions are discussed in the paper.

For the studied LCSC, our results show that the total profit of the LCSC under the centralized decision are higher than that under the decentralized decision when fairness is considered. If the manufacturer is concerned with fairness, the fairness concern coefficient further reduces the carbon emission reduction rate and the LCSC’s total profit. If the retailer is concerned with fairness and the consumers have low demand for low-carbon products, the fairness concern coefficient will further boost the LCSC’s total profit. Meanwhile, if the consumers have high preferences for low-carbon products, the fairness concern coefficient of the retailer would result in a lower retail price compared with the retail price of centralized pricing decision-making, and the LCSC’s total profit will be further reduced.

Note that our study still has some limitations. First of all, this paper does not consider the double-fairness concern characteristic, in which the manufacturer and the retailer may have fairness concern at the same time. Secondly, the coordination of a low-carbon supply chain achieved by contract can be explored. Finally, cooperative emission reduction may be conducive to improve the sustainable development level of the supply chain. These provide the directions for our future study.