Opportunity Cost of Environmental Regulation in China’s Industrial Sector

Abstract

:1. Introduction

2. Methodology

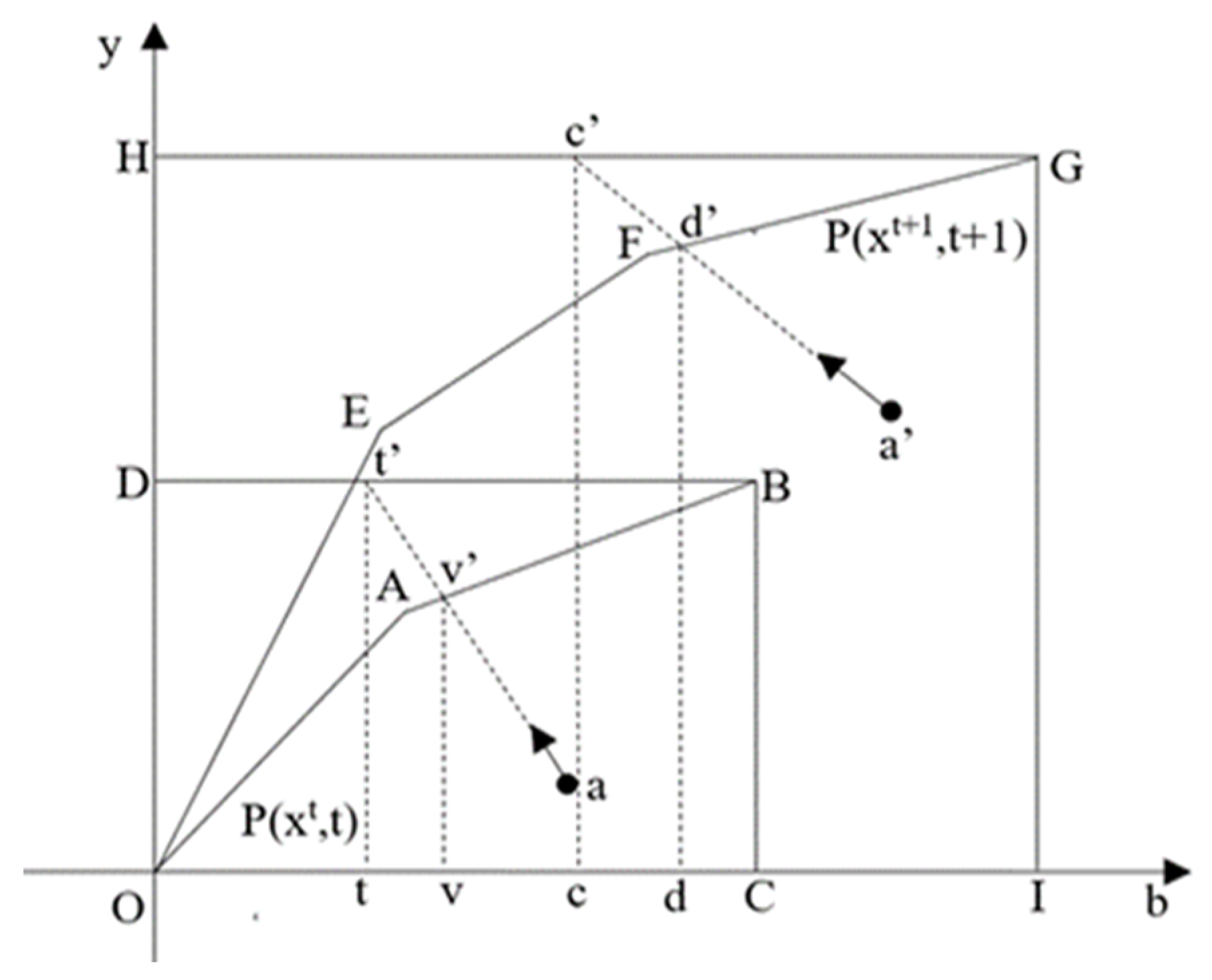

2.1. Defining Opportunity Cost of Environmental Regulation

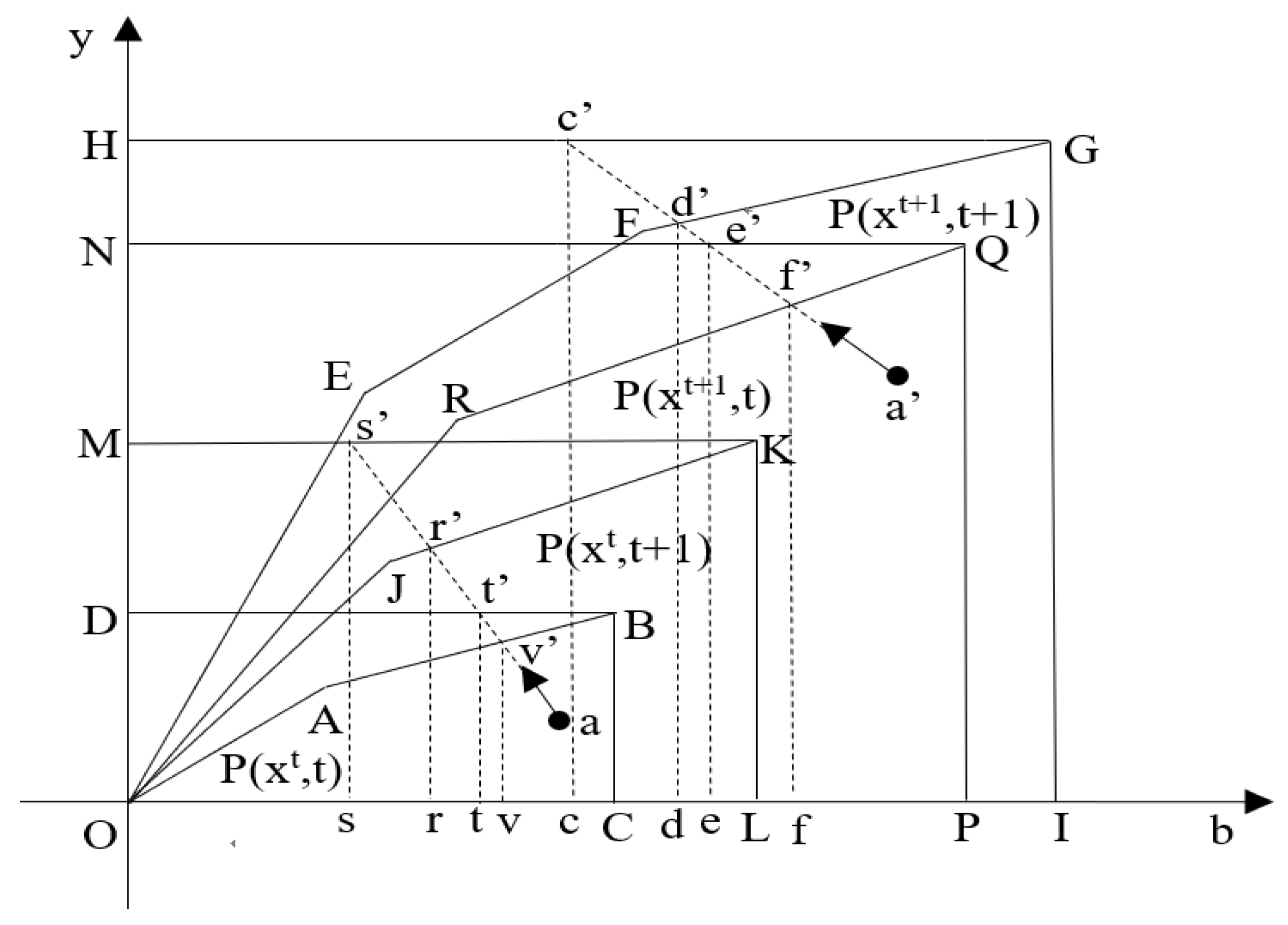

2.2. Decomposing the Change of Opportunity Cost

2.3. Mediation Model

3. Data and Variables

4. Results and Discussion

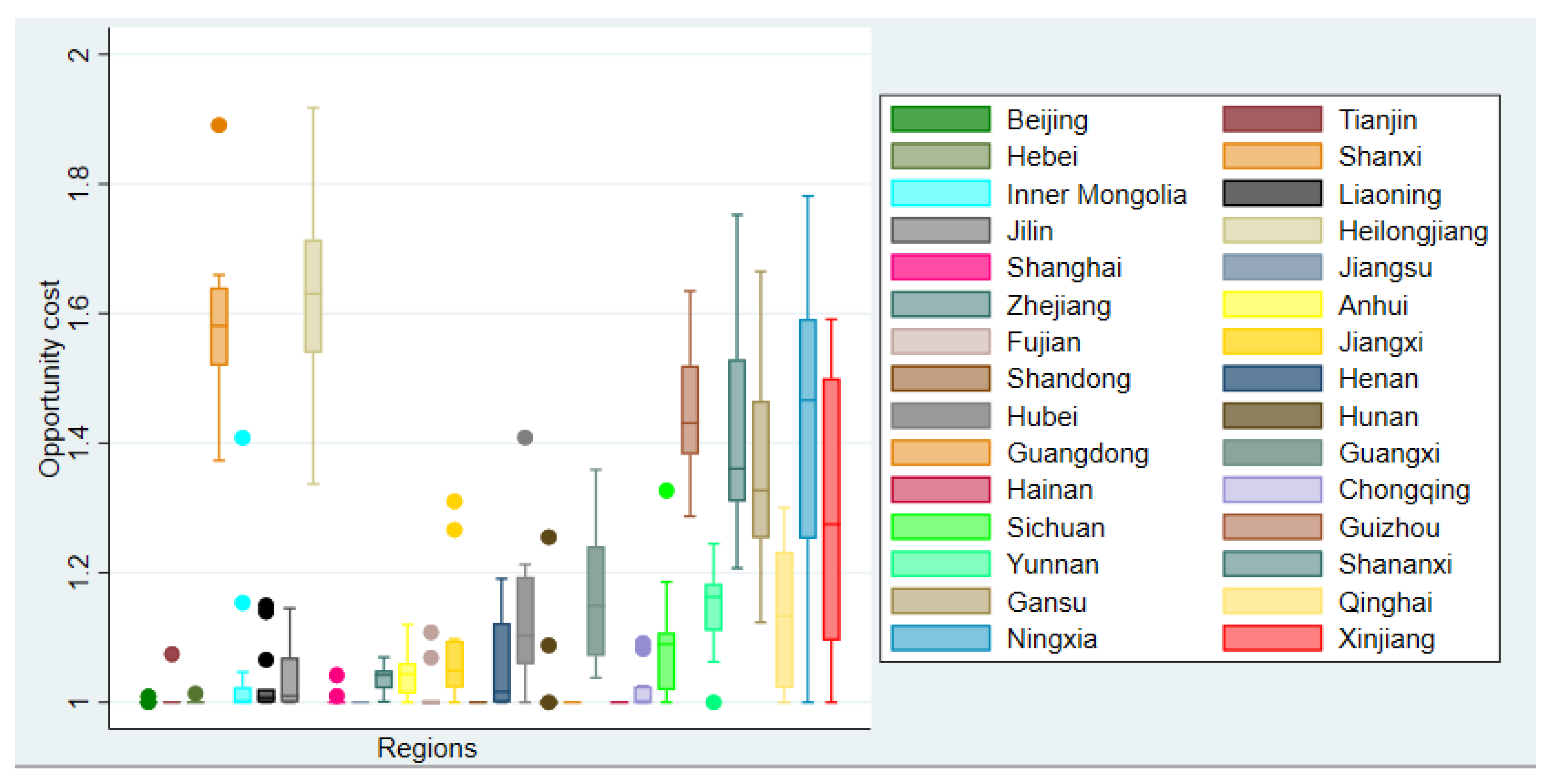

4.1. Estimated Opportunity Cost and Its Changes

4.2. Empirical Results from Mediation Analysis

4.2.1. Baseline Results from Mediation Analysis

4.2.2. Heterogeneous Effects by Region

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Calculation

Appendix B. Additional Empirical Results

| Region | Mean | St. Dev. | Min | Max | Region | Mean | St. Dev. | Min | Max |

|---|---|---|---|---|---|---|---|---|---|

| Beijing | 1.001 | 0.003 | 1 | 1.009 | Henan | 1.058 | 0.069 | 1 | 1.191 |

| Tianjin | 1.006 | 0.021 | 1 | 1.074 | Hubei | 1.128 | 0.113 | 1 | 1.409 |

| Hebei | 1.001 | 0.004 | 1 | 1.014 | Hunan | 1.026 | 0.073 | 1 | 1.255 |

| Shanxi | 1.575 | 0.130 | 1.373 | 1.891 | Guangdong | 1 | 0 | 1 | 1 |

| Inner Mongolia | 1.050 | 0.116 | 1 | 1.408 | Guangxi | 1.158 | 0.098 | 1.038 | 1.359 |

| Liaoning | 1.031 | 0.053 | 1 | 1.149 | Hainan | 1 | 0 | 1 | 1 |

| Jilin | 1.044 | 0.055 | 1 | 1.145 | Chongqing | 1.017 | 0.032 | 1 | 1.092 |

| Heilongjiang | 1.610 | 0.157 | 1.337 | 1.918 | Sichuan | 1.092 | 0.089 | 1 | 1.327 |

| Shanghai | 1.004 | 0.011 | 1 | 1.042 | Guizhou | 1.447 | 0.106 | 1.287 | 1.635 |

| Jiangsu | 1 | 0 | 1 | 1 | Yunnan | 1.148 | 0.071 | 1 | 1.245 |

| Zhejiang | 1.037 | 0.021 | 1.001 | 1.069 | Shaanxi | 1.426 | 0.172 | 1.207 | 1.752 |

| Anhui | 1.047 | 0.038 | 1 | 1.120 | Gansu | 1.345 | 0.155 | 1.124 | 1.665 |

| Fujian | 1.014 | 0.034 | 1 | 1.108 | Qinghai | 1.136 | 0.111 | 1 | 1.300 |

| Jiangxi | 1.080 | 0.098 | 1 | 1.310 | Ningxia | 1.414 | 0.263 | 1 | 1.782 |

| Shandong | 1 | 0 | 1 | Xinjiang | 1.300 | 0.212 | 1 | 1.591 |

| Two-Year Pairs | ΔOC | ΔOCTC | ΔOCIC | Two-Year Pairs | ΔOC | ΔOCTC | ΔOCIC |

|---|---|---|---|---|---|---|---|

| 2003–2004 | 0.949 | 1.075 | 0.882 | 2009–2010 | 1.012 | 1.056 | 0.958 |

| 2004–2005 | 0.968 | 1.033 | 0.937 | 2010–2011 | 0.993 | 1.088 | 0.912 |

| 2005–2006 | 1.026 | 1.061 | 0.967 | 2011–2012 | 0.992 | 1.023 | 0.970 |

| 2006–2007 | 1.016 | 1.082 | 0.939 | 2012–2013 | 0.985 | 1.015 | 0.971 |

| 2007–2008 | 1.021 | 1.046 | 0.976 | 2013–2014 | 1.018 | 1.036 | 0.983 |

| 2008–2009 | 0.978 | 1.006 | 0.973 | 2014–2015 | 1.040 | 1.061 | 0.980 |

| Geometric mean | 1.000 | 1.048 | 0.954 |

References

- Hartman, R.S.; Wheeler, D.; Singh, M. The cost of air pollution abatement. Appl. Econ. 1997, 29, 759–774. [Google Scholar] [CrossRef]

- De Cara, S.; Jayet, P.-A. Marginal abatement costs of greenhouse gas emissions from European agriculture, cost effectiveness, and the EU non-ETS burden sharing agreement. Ecol. Econ. 2011, 70, 1680–1690. [Google Scholar] [CrossRef] [Green Version]

- Wei, D.; Rose, A. Interregional sharing of energy conservation targets in China: Efficiency and equity. Energy J. 2009, 30. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Lovell, C.A.K.; Yaisawarng, S. Derivation of shadow prices for undesirable outputs: A distance function approach. Rev. Econ. Stat. 1993, 75, 374–380. [Google Scholar] [CrossRef]

- Coggins, J.S.; Swinton, J.R. The price of pollution: A dual approach to valuing SO2 allowances. J. Environ. Econ. Manag. 1996, 30, 58–72. [Google Scholar] [CrossRef] [Green Version]

- Swinton, J.R. At what cost do we reduce pollution? Shadow prices of SO2 emissions. Energy J. 1998, 19. [Google Scholar] [CrossRef]

- Lee, M. The shadow price of substitutable sulfur in the US electric power plant: A distance function approach. J. Environ. Manag. 2005, 77, 104–110. [Google Scholar] [CrossRef]

- Chung, Y.H.; Färe, R.; Grosskopf, S. Productivity and undesirable outputs: A directional distance function approach. J. Environ. Manag. 1997, 51, 229–240. [Google Scholar] [CrossRef] [Green Version]

- Färe, R.; Grosskopf, S.; Noh, D.-W.; Weber, W. Characteristics of a polluting technology: Theory and practice. J. Econ. 2005, 126, 469–492. [Google Scholar] [CrossRef]

- Lee, C.-Y.; Zhou, P. Directional shadow price estimation of CO2, SO2 and NOx in the United States coal power industry 1990–2010. Energy Econ. 2015, 51, 493–502. [Google Scholar] [CrossRef]

- Murty, M.N.; Kumar, S.; Dhavala, K.K. Measuring environmental efficiency of industry: A case study of thermal power generation in India. Environ. Resour. Econ. 2007, 38, 31–50. [Google Scholar] [CrossRef]

- Park, H.; Lim, J. Valuation of marginal CO2 abatement options for electric power plants in Korea. Energy Policy 2009, 37, 1834–1841. [Google Scholar] [CrossRef]

- Matsushita, K.; Yamane, F. Pollution from the electric power sector in Japan and efficient pollution reduction. Energy Econ. 2012, 34, 1124–1130. [Google Scholar] [CrossRef]

- Wei, C.; Löschel, A.; Liu, B. An empirical analysis of the CO2 shadow price in Chinese thermal power enterprises. Energy Econ. 2013, 40, 22–31. [Google Scholar] [CrossRef]

- Ma, C.; Hailu, A. The marginal abatement cost of carbon emissions in China. Energy J. 2016, 37. [Google Scholar] [CrossRef]

- Ma, C.; Hailu, A.; You, C. A critical review of distance function based economic research on China’s marginal abatement cost of carbon dioxide emissions. Energy Econ. 2019, 84, 104533. [Google Scholar] [CrossRef]

- Boyd, G.A.; McClelland, J.D. The impact of environmental constraints on productivity improvement in integrated paper plants. J. Environ. Econ. Manag. 1999, 38, 121–142. [Google Scholar] [CrossRef]

- Pasurka, C.A. Technical change and measuring pollution abatement costs: An activity analysis framework. Environ. Resour. Econ. 2001, 18, 61–85. [Google Scholar] [CrossRef]

- Picazo-Tadeo, A.J.; Reig-Martinez, E.; Hernandez-Sancho, F. Directional distance functions and environmental regulation. Resour. Energy Econ. 2005, 27, 131–142. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Pasurka, C.A., Jr. Environmental production functions and environmental directional distance functions. Energy 2007, 32, 1055–1066. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Pasurka, C. Technical change and pollution abatement costs. Eur. J. Oper. Res. 2016, 248, 715–724. [Google Scholar] [CrossRef]

- Goulder, L.H.; Mathai, K. Optimal CO2 Abatement in the Presence of Induced Technological Change. J. Environ. Econ. Manag. 2000, 39, 1–38. [Google Scholar] [CrossRef] [Green Version]

- Buonanno, P.; Carraro, C.; Galeotti, M. Endogenous induced technical change and the costs of Kyoto. Resour. Energy Econ. 2003, 25, 11–34. [Google Scholar] [CrossRef] [Green Version]

- Fischer, C.; Newell, R.G. Environmental and technology policies for climate mitigation. J. Environ. Econ. Manag. 2008, 55, 142–162. [Google Scholar] [CrossRef] [Green Version]

- Grimaud, A.; Rouge, L. Environment, directed technical change and economic policy. Environ. Resour. Econ. 2008, 41, 439–463. [Google Scholar] [CrossRef]

- Carraro, C.; De Cian, E.; Nicita, L.; Massetti, E.; Verdolini, E. Others Environmental policy and technical change: A survey. Int. Rev. Environ. Resour. Econ. 2010, 4, 163–219. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The environment and directed technical change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef] [Green Version]

- Liu, C.; Ma, C.; Xie, R. Structural, innovation and efficiency effects of environmental regulation: Evidence from China’s carbon emissions trading pilot. Environ. Resour. Econ. 2020, 75, 741–768. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Two-stage DEA: Caveat emptor. J. Prod. Anal. 2011, 36, 205–218. [Google Scholar] [CrossRef]

- Daraio, C.; Simar, L.; Wilson, P.W. Central limit theorems for conditional efficiency measures and tests of the separability condition in non-parametric, two-stage models of production. Econ. J. 2018, 21, 170–191. [Google Scholar] [CrossRef] [Green Version]

- Bădin, L.; Daraio, C.; Simar, L. Optimal bandwidth selection for conditional efficiency measures: A data-driven approach. Eur. J. Oper. Res. 2010, 201, 633–640. [Google Scholar] [CrossRef] [Green Version]

- Bădin, L.; Daraio, C.; Simar, L. How to measure the impact of environmental factors in a nonparametric production model. Eur. J. Oper. Res. 2012, 223, 818–833. [Google Scholar] [CrossRef]

- Bădin, L.; Daraio, C.; Simar, L. Explaining inefficiency in nonparametric production models: The state of the art. Ann. Oper. Res. 2014, 214, 5–30. [Google Scholar] [CrossRef]

- Bădin, L.; Daraio, C.; Simar, L. A bootstrap approach for bandwidth selection in estimating conditional efficiency measures. Eur. J. Oper. Res. 2019, 277, 784–797. [Google Scholar] [CrossRef]

- Perelman, S. R&D, technological progress and efficiency change in industrial activities. Rev. Income Wealth 1995, 41, 349–366. [Google Scholar]

- Intergovernmental Panel on Climate Change (IPCC). 2006 IPCC Guidelines for National Greenhouse Gas Inventories. 2006. Available online: www.ipcc.ch (accessed on 23 April 2021).

- National Coordination Committee Office on Climate Change and Energy Research Institute under the National Development and Reform Commission. National Greenhouse Gas Inventory of the People’s Republic of China; Chinese Environmental Science Press: Beijing, China, 2007. (In Chinese) [Google Scholar]

- Du, L.; Wei, C.; Cai, S. Economic development and carbon dioxide emissions in China: Provincial panel data analysis. China Econ. Rev. 2012, 23, 371–384. [Google Scholar] [CrossRef]

- Fosfuri, A.; Motta, M.; Rønde, T. Foreign direct investment and spillovers through workers’ mobility. J. Int. Econ. 2001, 53, 205–222. [Google Scholar] [CrossRef] [Green Version]

- McConnell, V.D.; Schwab, R.M. The impact of environmental regulation on industry location decisions: The motor vehicle industry. Land Econ. 1990, 66, 67–81. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R.; Okubo, T. Trade, environmental regulations and industrial mobility: An industry-level study of Japan. Ecol. Econ. 2010, 69, 1995–2002. [Google Scholar] [CrossRef] [Green Version]

- Millimet, D.L.; Roy, J. Empirical tests of the pollution haven hypothesis when environmental regulation is endogenous. J. Appl. Econ. 2016, 31, 652–677. [Google Scholar] [CrossRef]

- Cai, X.; Lu, Y.; Wu, M.; Yu, L. Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J. Dev. Econ. 2016, 123, 73–85. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Palmer, K. Environmental regulation and innovation: A panel data study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

| Variable | N. Obs. | Unit | Mean | St. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| y | 390 | 108 Yuan | 16,835.735 | 22,188.596 | 247.9 | 130,177.787 |

| CO2 | 390 | 104 ton | 15,188.005 | 10,957.742 | 985.885 | 54,612.751 |

| Labor | 390 | 104 person | 281.740 | 309.384 | 11.6 | 1568 |

| Capital | 390 | 108 Yuan | 4987.320 | 4433.920 | 197.3 | 26,791.931 |

| Energy | 390 | 104 ton | 5718.096 | 4152.231 | 365.143 | 20,765.304 |

| ER | 390 | / | 0.0022 | 0.0018 | 0.0004 | 0.0146 |

| FDI | 390 | / | 0.1729 | 0.1608 | 0.0126 | 0.6559 |

| R&D | 390 | / | 0.0089 | 0.0038 | 0.0018 | 0.0232 |

| Province | ΔOC | ΔOCTC | ΔOCIC | Province | ΔOC | ΔOCTC | ΔOCIC |

|---|---|---|---|---|---|---|---|

| Beijing | 1.000 | 1.050 | 0.953 | Henan | 1.004 | 1.013 | 0.991 |

| Tianjin | 0.994 | 1.046 | 0.950 | Hubei | 0.977 | 1.053 | 0.928 |

| Hebei | 0.999 | 1.015 | 0.984 | Hunan | 0.981 | 1.012 | 0.970 |

| Shanxi | 1.023 | 1.078 | 0.949 | Guangdong | 1 | 1.0372 | 0.964 |

| Inner Mongolia | 0.974 | 1.038 | 0.938 | Guangxi | 0.985 | 1.033 | 0.954 |

| Liaoning | 1.001 | 1.025 | 0.976 | Hainan | 1 | 1.072 | 0.933 |

| Jilin | 1.001 | 1.043 | 0.960 | Chongqing | 0.999 | 1.007 | 0.992 |

| Heilongjiang | 1.023 | 1.076 | 0.951 | Sichuan | 0.985 | 1.036 | 0.951 |

| Shanghai | 1.003 | 1.037 | 0.967 | Guizhou | 1.003 | 1.061 | 0.946 |

| Jiangsu | 1 | 1.038 | 0.964 | Yunnan | 1.002 | 1.081 | 0.927 |

| Zhejiang | 1.005 | 1.028 | 0.978 | Shaanxi | 0.979 | 1.080 | 0.907 |

| Anhui | 0.997 | 1.022 | 0.976 | Gansu | 0.982 | 1.081 | 0.909 |

| Fujian | 0.994 | 1.021 | 0.974 | Qinghai | 1.022 | 1.120 | 0.912 |

| Jiangxi | 0.985 | 1.020 | 0.966 | Ningxia | 1.031 | 1.093 | 0.943 |

| Shandong | 1 | 1.030 | 0.971 | Xinjiang | 1.039 | 1.114 | 0.933 |

| Panel A | |||

| (1) FDI | (2) R&D | (3) Opportunity cost | |

| Environmental Regulation | −0.0622 ** (0.0320) | 0.1059 *** (0.0396) | 0.7632 ** (0.3453) |

| Energy | −0.2030 * (0.1062) | −0.1440 (0.0995) | −1.9899 *** (0.7492) |

| Capital | 0.2417 ** (0.0993) | −0.2960 ** (0.1221) | 3.6021 *** (1.1074) |

| Labor | −0.0283 (0.1062) | −0.4146 *** (0.1352) | −1.0377 (1.1534) |

| FDI | 1.7252 *** (0.6583) | ||

| R&D | −0.2336 (0.5184) | ||

| Constant | −2.2018 *** (0.6598) | 1.4084 * (0.7632) | −1.2786 (6.9350) |

| Panel B | |||

| Coefficient | Boot S.E. | 95% Conf. Interval | |

| IndirectFDI | −0.107 | 0.074 | [−0.310,−0.010] |

| IndirectRD | −0.025 | 0.060 | [−0.168, 0.077] |

| Indirecttotal | −0.132 | 0.087 | [−0.338, 0.07] |

| Total effects | 0.631 | 0.339 | [0.015, 1.348] |

| Panel A: FDI | West | East | North | Middle | South |

|---|---|---|---|---|---|

| Environmental regulation | −0.2279 *** (0.0666) | −0.0131 (0.1001) | 0.0476 (0.0407) | 0.0541 (0.1337) | −0.0239 (0.1003) |

| Energy | −0.1489 (0.2938) | −0.3091 (0.3555) | 0.1538 (0.2241) | 0.2412 (0.1910) | −0.1426 (0.1721) |

| Capital | 0.4145 (0.3972) | 0.0479 (0.3265) | 0.0557 (0.1935) | 0.5508 (0.4524) | 0.1461 (0.2568) |

| Labor | 0.4686 ** (0.2057) | 0.1841 (0.3326) | −0.6889 ** (0.2769) | −2.6322 *** (0.6937) | −0.0575 (0.3739) |

| Constant | −7.8463 *** (2.0565) | 0.1203 (2.2371) | −1.2851 (1.4503) | 4.9908 * (2.7181) | −2.1861 (2.0888) |

| Panel B: R&D | |||||

| Environmental regulation | −0.0069 (0.0532) | 0.2272 * (0.1305) | 0.0786 (0.111) | −0.0517 (0.1987) | 0.2301 (0.1968) |

| Energy | 0.0410 (0.1536) | 0.8381 *** (0.2934) | 0.1006 (0.5451) | −0.2485 (0.2822) | −0.7124 (0.5740) |

| Capital | 0.4812 ** (0.2441) | 0.1921 (0.3257) | 0.5460 (0.4211) | −1.0098 (0.6720) | 0.3270 (0.6079) |

| Labor | −0.7135 *** (0.1910) | −1.8359 *** (0.3809) | −1.5403 ** (0.6413) | 2.7142 *** (0.8988) | −0.6454 (0.6150) |

| Constant | −4.3580 (1.6303) | −1.4969 (2.0950) | −2.6035 (3.3341) | −7.9813 * (4.3548) | 3.4627 (7.2453) |

| Panel C: Opportunity Cost | |||||

| Environmental regulation | 0.5271 (0.6554) | 1.3644 (1.0533) | 0.1345 * (1.2936) | −0.8431 (1.2479) | 0.0968 (1.1021) |

| Energy | −2.0442 (1.2771) | −7.4827 * (3.9471) | −3.7304 (6.2817) | −2.6985 (2.1587) | −6.3665 * (3.6657) |

| Capital | 6.2315 *** (2.3997) | 9.3207 *** (3.5381) | −5.7871 (4.6460) | 4.3239 (3.5943) | 3.7926 (2.7248) |

| Labor | −0.1565 (2.7068) | −4.3722 (5.1323) | 4.5894 (10.8649) | 9.2114 (8.7463) | −4.0951 (3.2376) |

| FDI | 0.3966 (0.8501) | 4.1294 * (2.4453) | 3.6003 (7.0003) | 4.8435 (3.1722) | −8.1509 ** (3.8888) |

| Constant | −19.4309 (21.4833) | 22.1423 (22.4864) | 91.2396 ** (39.6340) | −57.5722 * (33.3223) | 25.3202 (35.2361) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Lu, Y.; Zhang, L. Opportunity Cost of Environmental Regulation in China’s Industrial Sector. Int. J. Environ. Res. Public Health 2021, 18, 8579. https://doi.org/10.3390/ijerph18168579

Wang Y, Lu Y, Zhang L. Opportunity Cost of Environmental Regulation in China’s Industrial Sector. International Journal of Environmental Research and Public Health. 2021; 18(16):8579. https://doi.org/10.3390/ijerph18168579

Chicago/Turabian StyleWang, Ye, Yunguo Lu, and Lin Zhang. 2021. "Opportunity Cost of Environmental Regulation in China’s Industrial Sector" International Journal of Environmental Research and Public Health 18, no. 16: 8579. https://doi.org/10.3390/ijerph18168579

APA StyleWang, Y., Lu, Y., & Zhang, L. (2021). Opportunity Cost of Environmental Regulation in China’s Industrial Sector. International Journal of Environmental Research and Public Health, 18(16), 8579. https://doi.org/10.3390/ijerph18168579