1. Introduction

On 31st December 2019, the World Health Organization (WHO) identified the first case of COVID-19 in Wuhan China (

https://www.who.int/emergencies/diseases/novel-coronavirus-2019). In early and mid-January 2020, the virus started to spread to other Chinese provinces, supported by a huge movement of people towards their hometowns to celebrate Chinese New Year which turned the outbreak into a national crisis. Although Wuhan officials announced a complete travel ban in terms of its residents on January 23, the virus still spread quickly. The WHO declared a global emergency due to the rapidly spreading of COVID-19 on January 30, 2020. It’s only the sixth time that such type of global emergency has been announced, with past examples including that of the Democratic Republic of Congo Ebola outbreak and the Zika virus. Chinese scientists linked this disease to a virus family known as coronaviruses, which includes both the severe acute respiratory syndrome (SARS) virus and the Middle East respiratory syndrome (MERS). According to the Centre of Disease Control and Prevention (CDC), the COVID-19 symptoms may occur within as few as 2 days or as long as 14 days after exposure or contact with an already affected person, which makes it even harder to confirm and control during early stages. By assessing the risk of spread and severity of COVID-19 outside China WHO declared this virus as a pandemic on March 11, 2020. The fatality rate of COVID-19 as compare to other known viruses is quite low, but its infection rate is relatively high (

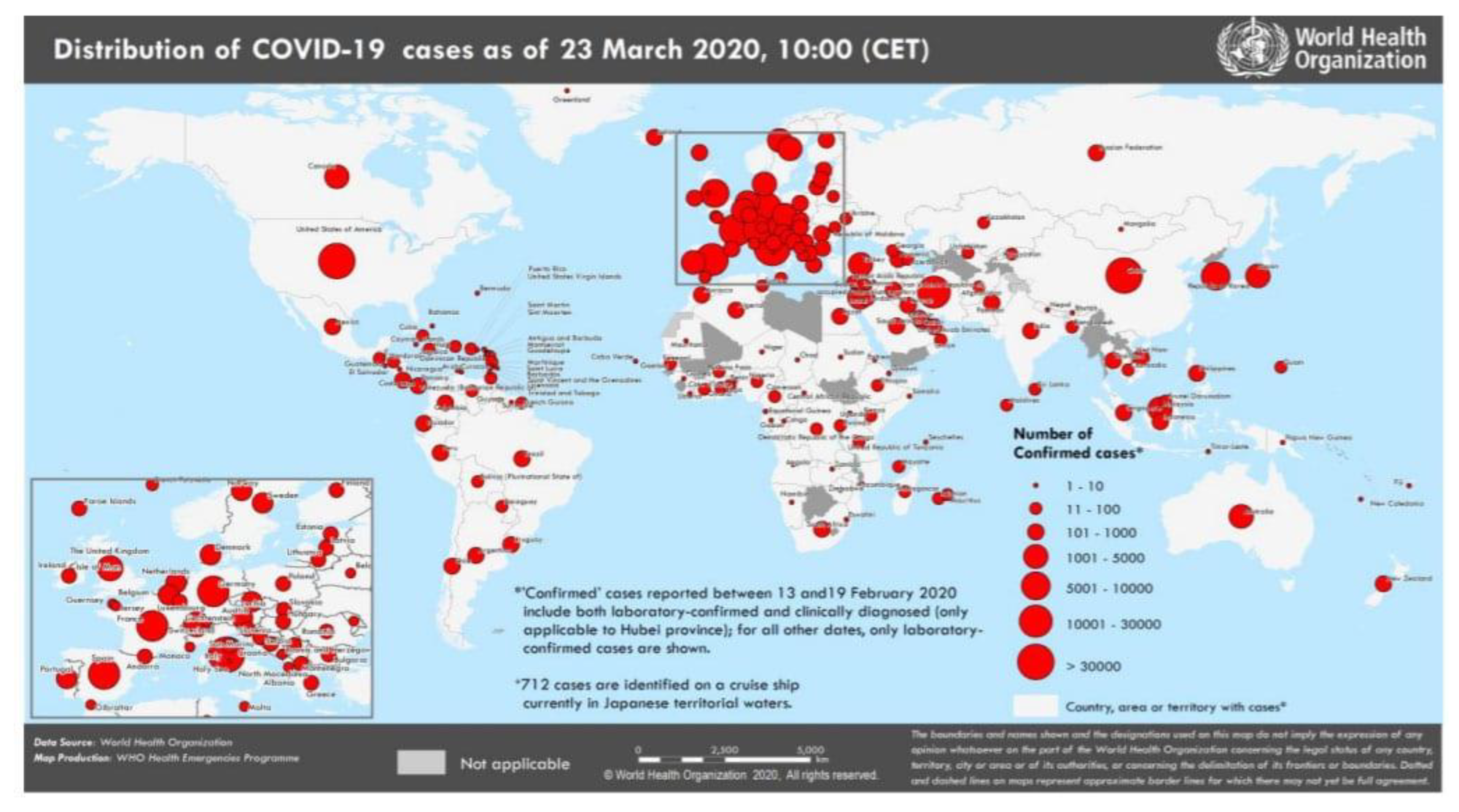

Table 1). As of March 23, China, Italy, and the United States have most of the number of confirmed cases of COVID 19,81601, 59,138, and 31,573 respectively (WHO situation report–63,

Figure 1). According to CDC and many other researchers at the moment, the source of COVID-19 is unknown and there is no specific vaccine and treatment [

1,

2,

3].

The WHO and public health officials performed the role of mediator to communicate the risk of an outbreak to the investors and it shapes the investors’ sentiments towards the disease [

4]. Investor’s sentiments influence the stock markets significantly. When the market is trending upwards and there is less perceived risk then investor behaves more optimistically. When the market is trending downwards then investors’ sentiments become relatively pessimistic and investors will tend to wait to enter the market until a revival begins [

5,

6]. Such situations lead to short term investor overreaction. Shu [

7] studied how mood affects financial market behavior. The study shows how the fluctuations in investor mood directly affect prices for equilibrium assets and projected returns. Researchers suggest that media coverage also affects the actions of investors, the higher the number of articles relating to unexpected events, the greater the number of withdrawals [

8,

9,

10]. Globalization has linked economies worldwide and increased the interdependence of global financial markets in recent years. This increased interdependence among the global stock markets may have an impact on global investors’ decisions on asset allocation and on economies as well as economic policies to ensure economic stability [

11]. By using a vector auto regression model, In, Kim, and Yoon [

12] examined the dynamic linkages and interactions between the Asian stock markets and their results showed that the markets became more closely linked during the financial crisis, except Malaysia. For any global financial market analyst, it is obvious that stock markets continue to move in the same direction in different countries. There are some variations, however, in the sense that some stock markets appear more correlated with each other than others [

13]. Although globalization brings many significant economic advantages, it also plays an important role during infectious global crises [

14]. The planet has recently been hit by increasing numbers of infectious diseases such as Crimean Congo hemorrhagic fever, Ebola virus, MERS CoV, SARS, Lassa fever, Nipah Virus, avian flu, Rift Valley fever, Zika virus. The spread of contagious disease not only affects people’s health and lives but also induces a decline in economic growth.

Explaining why market participants make decisions contrary to rational market participants’ assumptions is one of the central issues in the behavioral finance studies. There are major challenges of COVID-19 to personal lives, including lockdowns (or lockdown-like situations) for a large number of people. Besides the extreme occurrences of death and disease, many people across the globe are panicking because of this fast-spreading infectious disease. Such external and unexpected shocks can bring down economic trends and suddenly change investor’s sentiments. Kaplanski and Levy [

15] suggest that investment decisions can be affected by bad mood and anxiety and that anxious individuals may be more pessimistic about future returns and therefore tend to take fewer risks. Anxiety creates a negative feeling which can impact investment decisions and the subsequent returns on assets.

The unusual situation developed by COVID-19 offers us an opportunity to assess the pandemic’s impact on the stock markets of affected nations due to an unforeseen and feared disease. In this paper, we discuss the effect of COVID-19 on major affected countries’ stock markets as measured by their leading stock indices in Japan, Singapore, Korea, Thailand, Indonesia, Russia, Malaysia, the USA and Germany, etc. Due to the short time of the virus outbreak, an event study is conducted to examine the impact of the unexpected outbreak of COVID-19 on stock market indices performances.

The remainder of the paper is organized in the following sections:

Section 2 includes the related theoretical and empirical literature, the data and methodology are discussed in

Section 3, followed by the empirical evidence in

Section 4, and

Section 5 includes a conclusion.

4. Empirical Results of Event Study on AR and CAR

The mean and standard deviation of the composite index return before and after the event are given in

Table 3. As the basic statistic description, where Panel A shows the data from 21 February, 2019 to 19 January, 2020 and Panel B shows the data from 20 January, 2020 to 18 March, 2020,

Table 3 indicates that after 20 January, 2020, all the mean returns decreased and most standard deviations increased compared with the previous ones. The indices for France, Germany, Russia, Italy, Thailand, the UK, Canada, Japan, the USA, India, Abu Dhabi and Australia decreased the most in mean return, by 0.01 approximately, while those for Singapore, Thailand, Korea, Indonesia, and Hong Kong fell the most (by 325.245%, 274.619%,115.163%, 64.345%, and 49.086%, respectively) by percentage. Whereas, the mean returns of SSEC and SZCS, which represent the market of the mainland of China, fell the least in percentage. It appears that COVID-19 reduces the stock market returns in all affected countries and increases their volatility, showing not only a greater impact on the stock markets in Asia but also an inescapable influence on those in countries out of Asia.

Table 4 illustrates the ARs of the sample indices on and after 20 January, 2020. On the day of the event, the representative composite indices for France, London, Malaysia, Indonesia, Hong Kong, Singapore, Thailand, Italy and India react most rapidly with negative ARs. On the following day, ARs of ADX, DJIA, FTSE100, KOSPI, IMOEX.ME, N225, AXJO, STI, TPE TAIEX, AAXJ, SET50, HSI, SSEC, SZCS, FTMIB and NSEI are negative. It can be seen that the actual returns of Asian countries were further away from the expectation than that of other regions, with indices representing markets in Taiwan, Hong Kong, Shanghai and Shenzhen indexes decreasing most significantly on day 1. It indicates that the Chinese stock market suffered a serious negative impact when the news of the coronavirus was firstly widely reported by the international media.

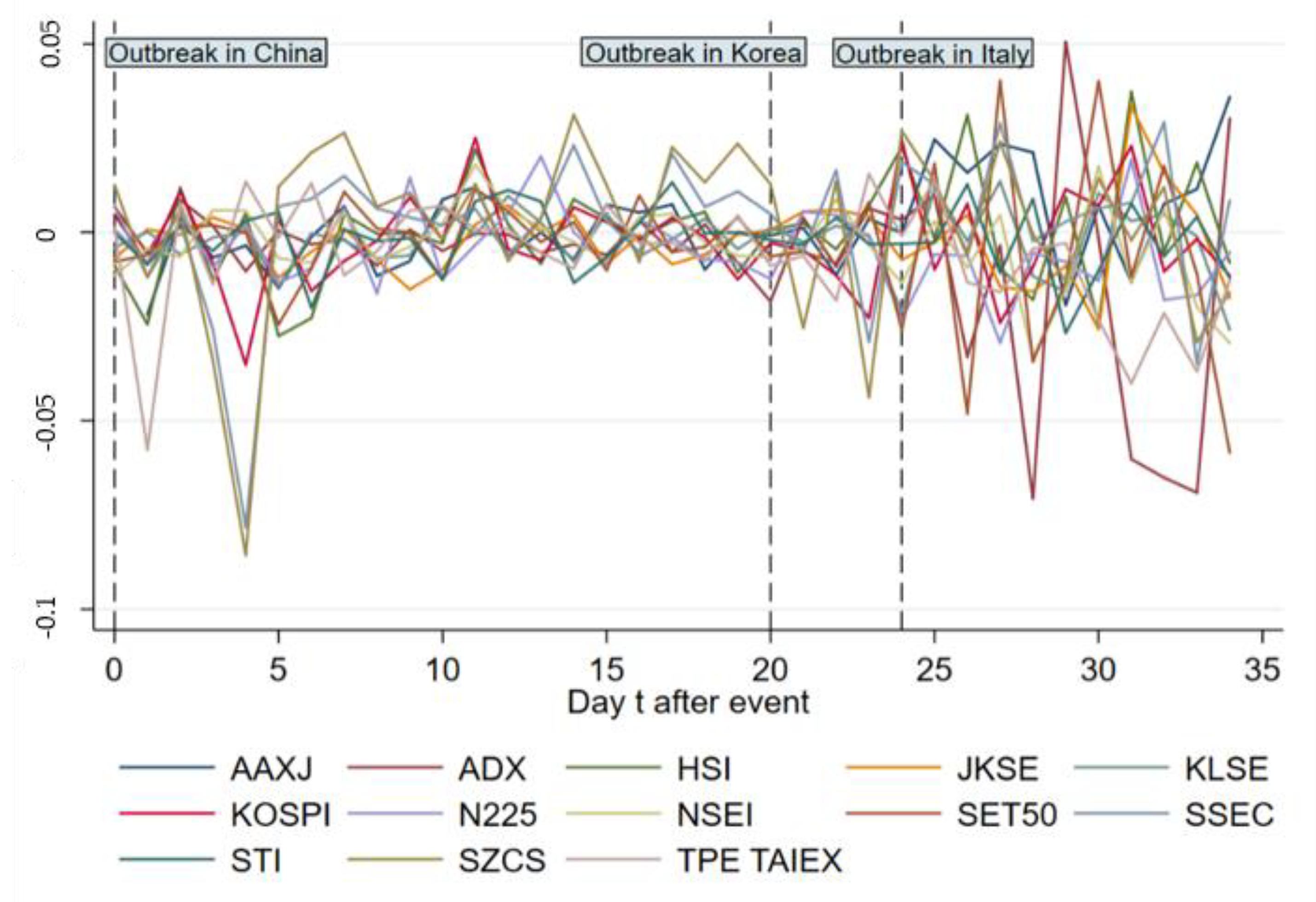

Figure 2 and

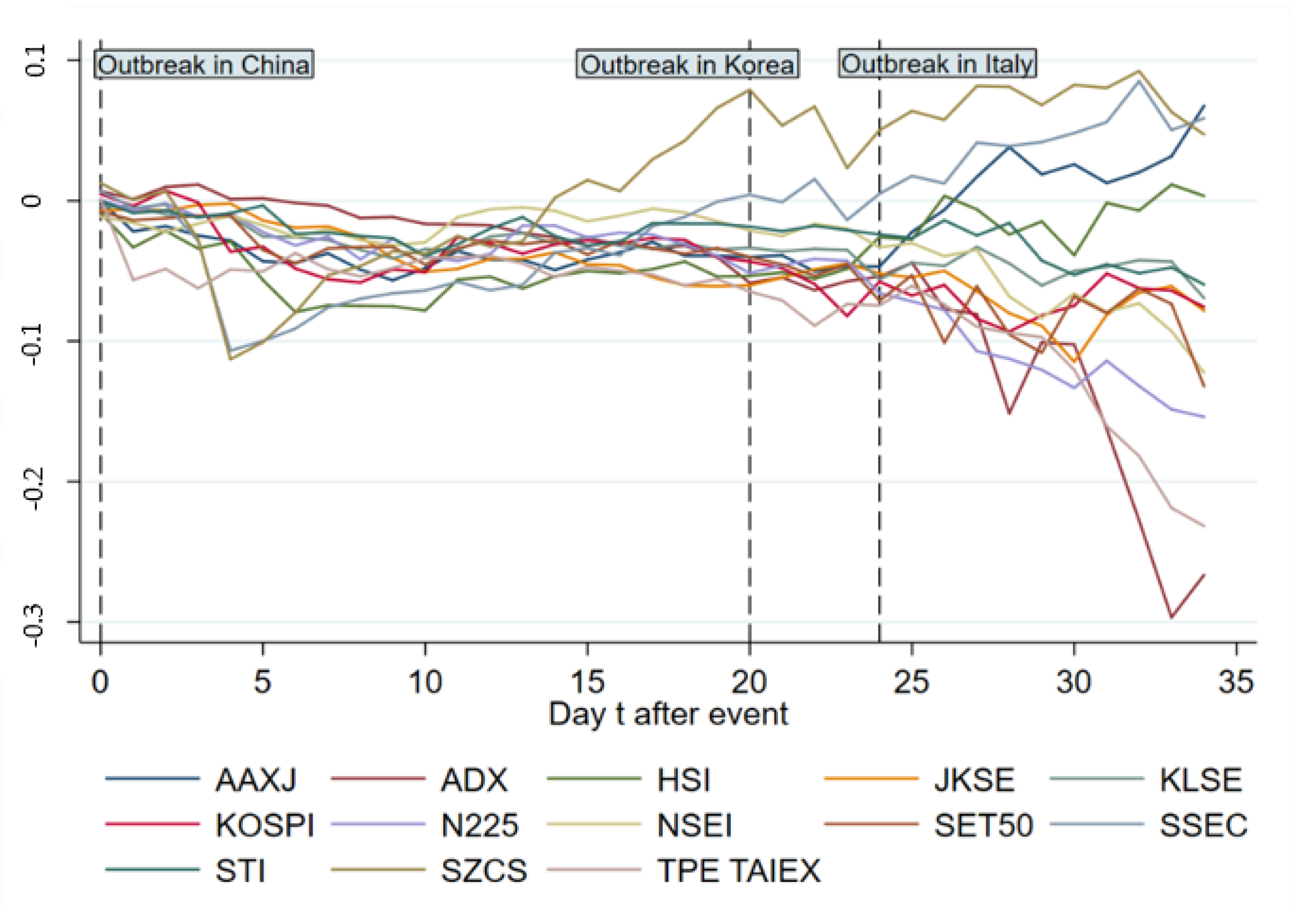

Figure 3 give ARs and CARs of the main indices in Asia from day 0 to 34, showing that most ARs become negative during 1 day after the event. The pandemic broke out in Korea and Italy on 19 February, 2020 and 21 February, 2020, respectively, indicating another two big events of COVID-19; we marked the two outbreaks in the figures to show the specific reaction of stock markets on the timeline. In

Figure 2, some indices for instance, TPE TAIEX, HSI and SZCS, saw a sharp decline in AR right after the event day. On day 4, ARs of Asian main indices experience a dramatic fall with the biggest drop in SZCS for Shenzhen, SSEC for Shanghai and KOSPI for Korea, rendering the following fluctuation, which becomes more violent after day 24 (outbreak in Italy).

Figure 3 shows that the CARs of included indices keep going down overall from day 0 to 4, after which SZCS and SSEC keep going up from day 5 to 20. The following violent fluctuation of ARs has different cumulative effects on indices as CARs of SZCS, SSEC, HSI and AAXJ increase in general while others decrease or stay stuck.

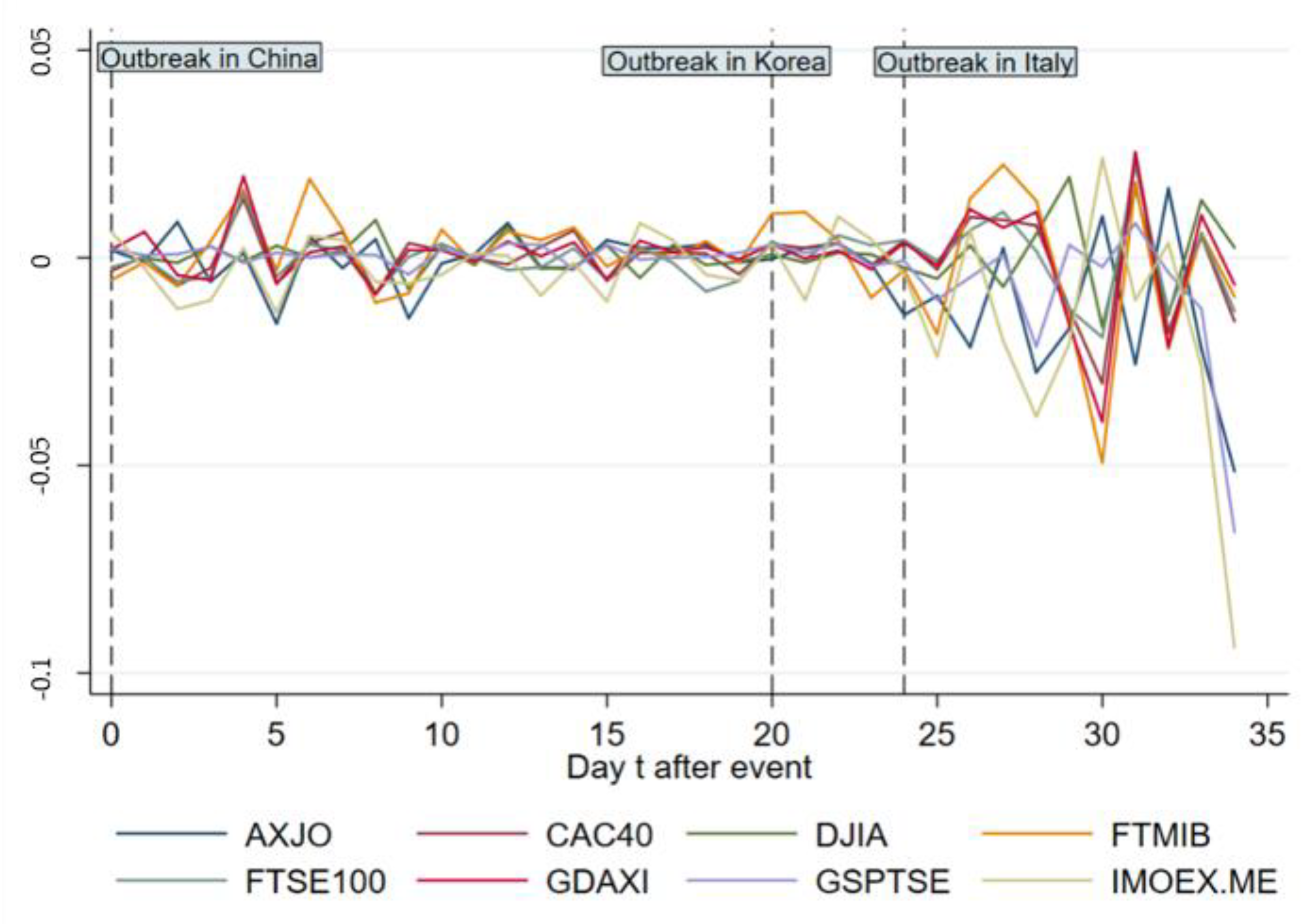

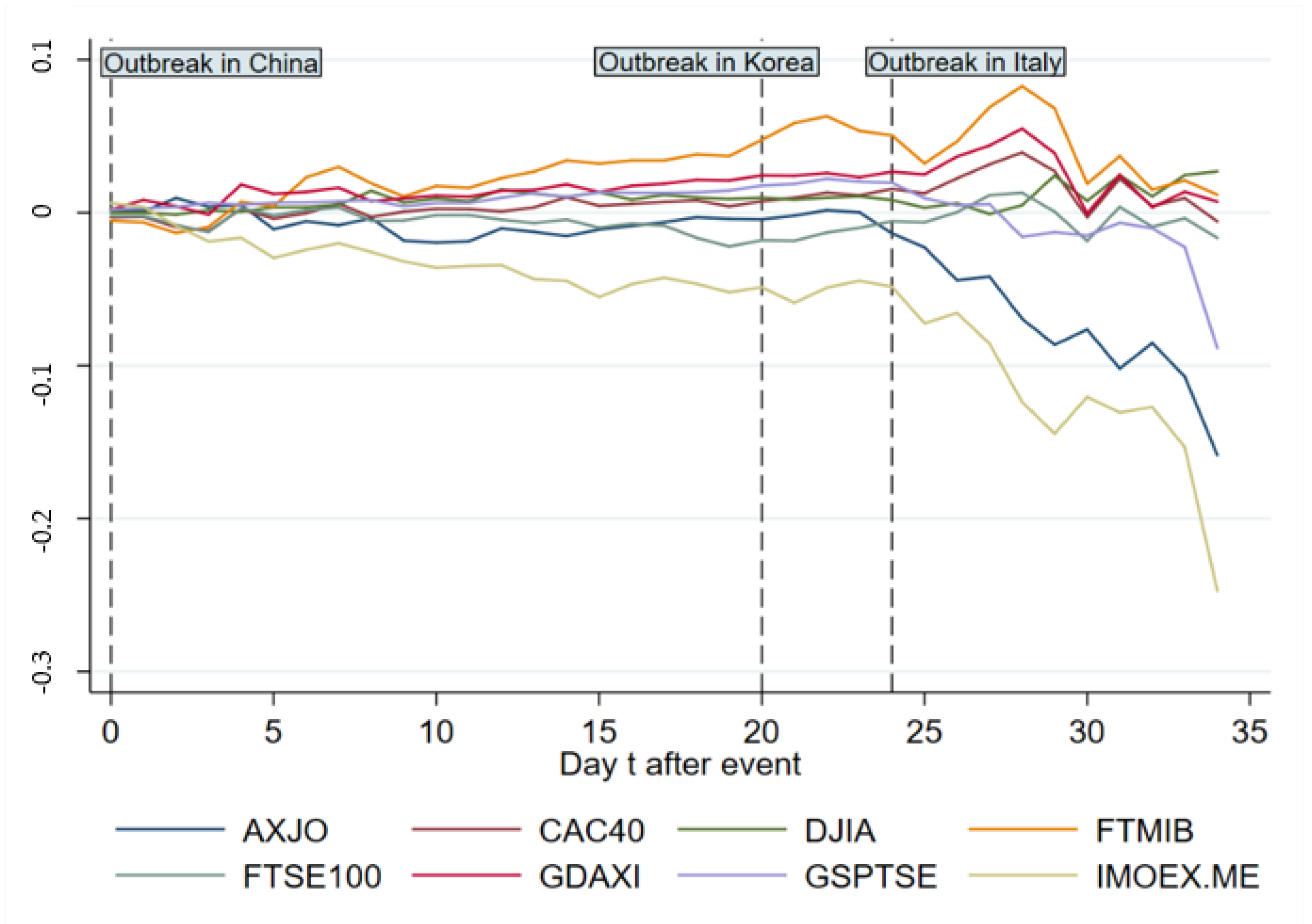

Figure 4 and

Figure 5 exhibit ARs and CARs of main indices out of Asia from day 0 to 34. As is shown in

Figure 4, the ARs witness violent fluctuations relatively except those of GSPTSE for Canada and DJIA for America, with a drastic “up and down” between day 3 and day 5. After day 24, a violent fluctuation occurs across all indices showing an obvious negative influence on ARs.

Figure 5 indicates that before day 24 there is no significant effect on CARs except a gentle decline and increase for IMOEX.ME and FTMIB respectively. After day 24, CARs of most indices decrease in general.

Table 5,

Table 6,

Table 7,

Table 8 and

Table 9 compare the significant CARs of affected countries in different event windows.

Table 5 illustrates that in the event window (0, 6), indices for Hong Kong, Malaysia, Japan, Thailand and Asia ex-Japan show significant negative CARs while Canada shows a significantly positive CAR. It appears that Asian countries experience an obvious downturn after the breakout of COVID-19 immediately. According to the data shown in

Table 6, the CAR of Abu Dhabi representative index in the event window (7, 13) is –0.021254 (5% level), while those of Shanghai and Shenzhen representative index turn significantly positive at 0.0311078 (10% level) and 0.0506241 (10% level), respectively, which demonstrates the recovery of the Chinese stock market as in China the spread of COVID-19 is being controlled.

Table 7 shows that in the event window (14, 20), N225 for Japan and ADX for Abu Dhabi show significant negative CARs at –0.0337579 (5% level) and –0.0356547 (10% level), respectively. SZCS for Shenzhen and SSEC for Shanghai are still significantly positive in CARs. The effects of COVID-19 on stock markets during this period are not as significant as a whole.

Table 8 indicates the indices for the UK and France show positive CARs at 0.029436 (1% level) and 0.0241526 (10% level), respectively. During this time window, Europe has not become the center of the pandemic outbreak.

Table 9 shows that in the window (28, 34), CARs of indices representing Taiwan, India and Australia are –0.1419123 (1% level), –0.0873618 (10% level) and –0.1167886 (10% level). Most indices of countries out of Asia for instance, France, the UK, Russia and Italy, have negative CARs.

The results show that the stock markets in Asia, especially in Hong Kong, Malaysia, Japan, and Thailand, responded rapidly to the news of the coronavirus outbreak. For the mainland Chinese market, the negative influence does not last for long as SZCS and SSEC show significantly positive CARs in the event window (7, 13) and (14, 20). This demonstrates the quick recovery of the mainland Chinese market from the pandemic after the confirmed cases decrease. For stock markets in countries out of Asia, there is no noticeable decline of cumulative abnormal return until day 24 in this group causing negative CARs for most countries, especially significant for Australia.

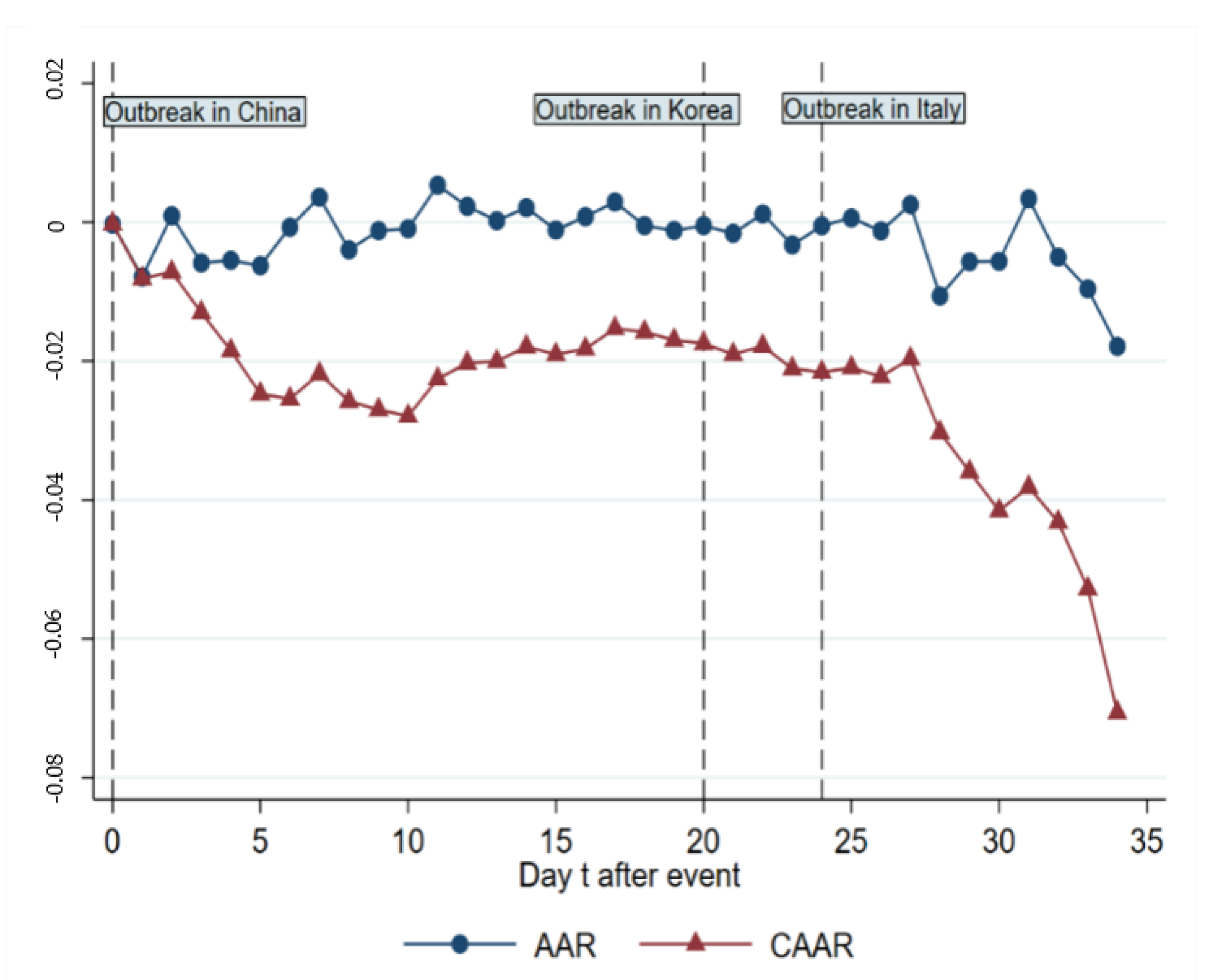

The results of the daily cumulative average abnormal return (CAAR) across all indices, which is using an average of 21 indices we chose, are shown in

Table 10, indicating that most of the CAARs are significant and decrease over time, from –0.0002348 on day 0 to –0.0706297 (5% level) on day 34.

Figure 6 illustrates the change of AAR (average abnormal returns of all indices) and CAAR from day 0 to 34, which is a downward sloping trend as a whole with stagnation in between day 10 and day 27. It seems that there are two plunges in stock markets on day 1 and day 24, which roughly match the outbreaks in and out of Asia. Similar results using (–1, –120), (–1, –150) and (–1, –180) as the estimated windows also support the findings which shows the robustness of event negative effect on AR and CAR using (–1,–90) as estimation window (available under inquiry).

To test for possible COVID-19 outbreak effects and transmission channel on major stock market indices we used panel data for 21 market indices in a 35-day window after the outbreak. We conducted ordinary least square (OLS) regressions to analyze the outbreak effect. The variables we chose to include in the empirical model are discussed in the earlier sections as daily abnormal returns (

AR) as a dependent variable (the calculation of AR is using Equation (3) in the earlier section: event study set-up). The independent variable is the logged global COVID-19 confirmed cases (

Log_case) which we extracted from the WIND database. Furthermore, we controlled global market systematic risks using Dow Jones Global Index daily returns (

ReturnM) and country specific systematic risks using daily returns of each index (

Return). In further regressions to test the mediating effect, we used S&P 500 volatility index (VIX) provided by the Chicago Board Options Exchange which was widely used as a proxy to gauge investors’ fear. The summary statistics are shown in

Table 11.

It can be seen that the mean of AR, ReturnM, and Return are all negative after the virus outbreak.

7. Conclusions

This research has aimed to analyze the immediate effect of COVID-19 on the stock markets of the major affected countries. This research adds to the literature as it explores the unexpected outbreak effects on financial markets of a feared disease. From the viewpoint of an investor, the findings of this analysis illustrate the importance of not only the company’s business factors but also the investment risks brought on by such a sudden event. Our results suggest: (1) COVID-19 outbreak has a significant negative effect on stock market returns across all affected countries and areas. Two plunges in stock markets AAR and CAAR on day 1 and day 24 match the outbreaks in and out of Asia. (2) Stock markets of Asian countries react more quickly to the outbreak with some of them recovering slightly in the later stage of the pandemic. (3) Confirmed cases of COVID-19 have significant adverse effects on major stock indices performances with those in Asia suffering a greater decrease in terms of abnormal returns. (4) Investor’s fear sentiment is proved to be a complete mediator and transmission channel for the COVID-19 outbreak’s effect on stock markets.

As the COVID-19 epidemic now becomes a pandemic, we need to think of not only ways to avoid future public health problems but also financial issues as well. The virus spreads exponentially, doubling new infections every two to three days, or even quicker. Fears of pandemic and policy measures to control disease transmission have contributed to a global supply shock, especially in the labor-intensive and manufacturing sector. To safeguard the staff, factories and offices are shutting or reducing activities which decreases labor force, productivity, and ultimately affects the profitability of companies. It would leave several businesses illiquid and, if not handled correctly by officials, would cause companies to resort to staff cutbacks or to shut down entirely. This is the main explanation of why financial markets have been in panic mode worldwide. Stock prices represent the potential of future earnings, and investors see the pandemic as a dampening economic activity and are concerned about future revenue. Before the severity of the deterioration is evident, the normal investors’ response would be to sell the stocks.

Our findings have significant implications for policymakers. A coalition of government officials, investment banks regulators, and the central bank would be required to tackle this challenge. Through rolling over current loans, bank authorities would allow banks to be lenient towards businesses in badly impaired economic sectors such as manufacturing, travel and tourism. Managing the COVID-19 crisis needs a rational approach such that officials should immediately inform citizens of what they and the health care system will do without triggering uncertainty.

This paper presents an initial analysis of the pandemic issue; there is significant room for further research into investor confidence inside and between foreign markets. In future studies, the research could be taken on investor sentiment and uncertainty as a framework. Considering the practicality of our conclusions, we conclude that our results would be valuable for institutional and individual investors, fund managers, financial, industrial analysts, and public health officials to effectively communicate the risk of an infectious disease. Health officials must consider the psychological and sentimental impact of their announcements as well.

As with all studies our work has several limitations, one of them is that we only studied the immediate and short-term effects of COVID-19 on majors affected countries’ stock markets due to the short event window period and the evolving nature of the virus spread. Another limitation is that we didn’t study the demographic variables such as age, gender, education level, experience in the stock market and type of investor, etc. due to lack of data.