Transparency of Financial Reporting on Greenhouse Gas Emission Allowances: The Influence of Regulation

Abstract

1. Introduction

2. Materials and Methods

2.1. Development of the Hypothesis

2.1.1. Financial Reporting on EA and GHG Emissions—An Overview

2.1.2. Transparency of Financial Reporting on EA and GHG Emissions and the Role of Accounting Regulation

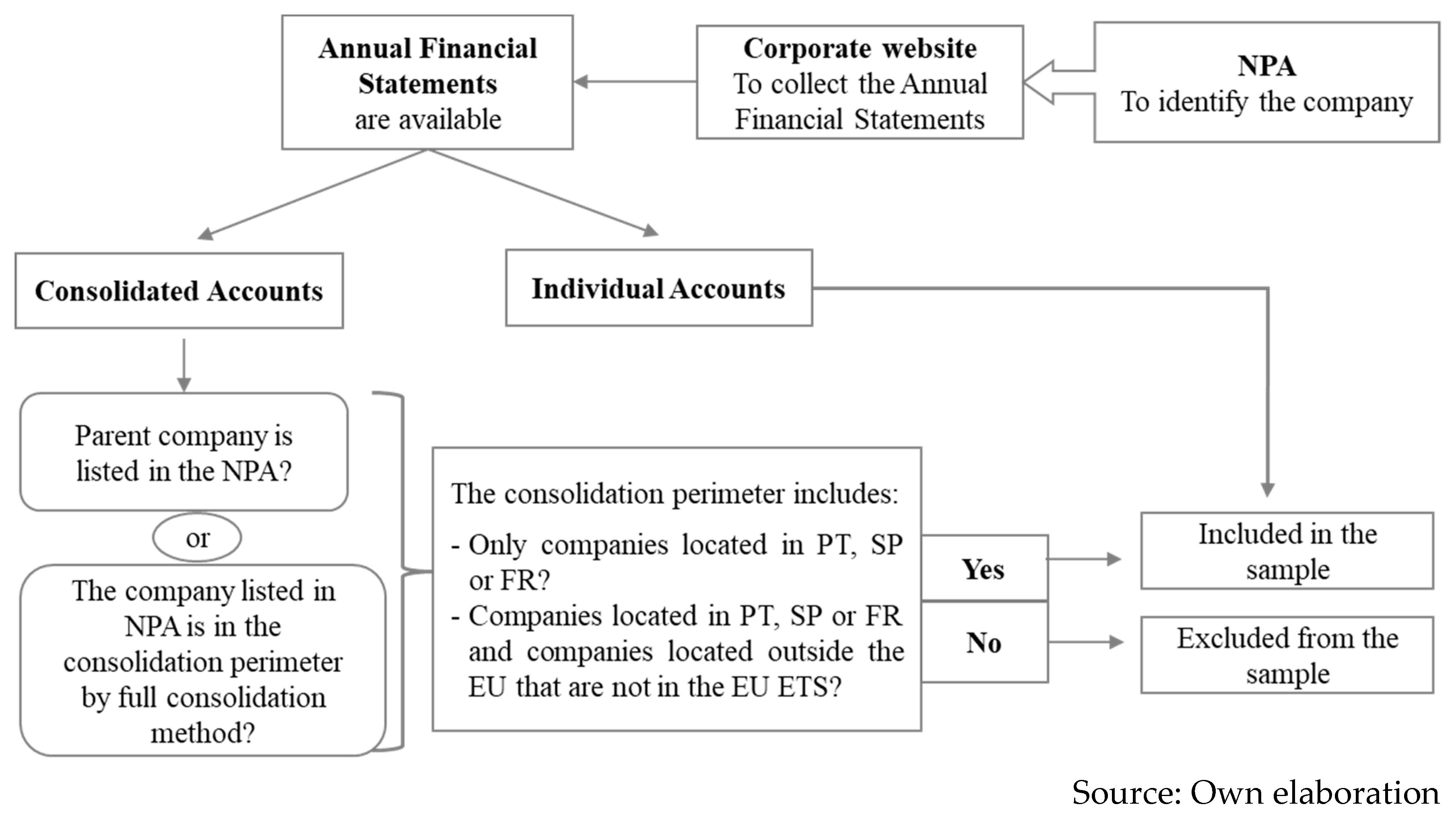

2.2. Sample and Data

2.3. Variables

2.3.1. Dependent Variables

2.3.2. Independent Variables: Treatment and Control

2.3.3. Model and Econometric Analysis

3. Results and Discussion

3.1. Univariate Analysis

3.2. Multivariate Analysis

4. Conclusions

4.1. Conclusions and Contribution

4.2. Limitations

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A—Frequencies of the Accounting Policies Regarding EA and GHG Emissions

| IFRS | Spanish GAAP | French GAAP | Portuguese GAAP | |||||

| Freq | Perc | Freq | Perc | Freq | Perc | Freq | Perc | |

| Are EAs’ recognized? | ||||||||

| Yes | 245 | 68.82 | 79 | 98.75 | 85 | 87.63 | ||

| No | 35 | 9.83 | 2 | 2.06 | ||||

| Only when GHG emissions exceed EA held | 9 | 2.53 | ||||||

| Do not have EA | 2 | 0.56 | 1 | 1.03 | ||||

| Not disclosed | 65 | 18.26 | 1 | 1.25 | 15 | 100.00 | 9 | 9.28 |

| I1. Rec EA | ||||||||

| 1—Intangible Asset | 222 | 62.36 | 79 | 98.75 | 82 | 84.54 | ||

| 2—Inventory | 22 | 6.18 | ||||||

| 3—Financial Asset | 3 | 3.09 | ||||||

| 4—Other current asset | 5 | 1.40 | ||||||

| 0—Not disclosed | 70 | 19.66 | 1 | 1.25 | 15 | 100.00 | 9 | 9.28 |

| 99- Not applied | 37 | 10.39 | 3 | 3.09 | ||||

| I2. Count EA | ||||||||

| 1—Owners’ Equity | 65 | 81.25 | 64 | 65.98 | ||||

| 2—Other non-current liability | 7 | 1.97 | ||||||

| 3—Liability | 4 | 4.12 | ||||||

| 4—Financial liability | 3 | 3.09 | ||||||

| 5—Liability—EA allocated | 4 | 1.12 | ||||||

| 6—Deferred income | 145 | 40.73 | 9 | 9.28 | ||||

| 7—Government grant | 45 | 12.64 | 7 | 8.75 | ||||

| 8—Grant reduced to asset carrying amount | 11 | 3.09 | ||||||

| 9—Income—Government grant | 5 | 1.40 | ||||||

| 10—Operational income | 7 | 1.97 | ||||||

| 0—Not disclosed | 95 | 26.69 | 8 | 10.00 | 15 | 100.00 | 14 | 14.43 |

| 99—Not applied | 37 | 10.39 | 3 | 3.09 | ||||

| I3. Initial Meas EA | ||||||||

| 1—Acquisition cost | 6 | 1.69 | 2 | 2.50 | ||||

| 2—Fair value | 15 | 15.46 | ||||||

| 3—Market value | 175 | 49.16 | 64 | 80.00 | 64 | 65.98 | ||

| 4—Price | 7 | 1.97 | ||||||

| 5—Quoted average price | 7 | 1.97 | ||||||

| 6—Zero | 41 | 11.52 | ||||||

| 7—Symbolic value | 6 | 1.69 | 7 | 8.75 | ||||

| 0—Not disclosed | 77 | 21.63 | 7 | 8.75 | 15 | 100.00 | 15 | 15.46 |

| 99—Not applied | 37 | 10.39 | 3 | 3.09 | ||||

| I4. Subseq Meas EA | ||||||||

| 1—Historical cost | 58 | 16.29 | 4 | 5.00 | 6 | 6.19 | ||

| 2—Cost less accumulated amortisations | 15 | 15.46 | ||||||

| 3—Cost less accumulated impairment losses | 120 | 33.71 | 43 | 53.75 | 5 | 5.15 | ||

| 4—Cost model | 25 | 25.77 | ||||||

| 5—First in First Out | 2 | 0.56 | ||||||

| 6—Cost or net realisable value, the lower | 6 | 1.69 | ||||||

| 7—Fair value | 12 | 3.37 | 20 | 20.62 | ||||

| 8—Revaluation model | 5 | 5.15 | ||||||

| 9—Net liability approach | 7 | 8.75 | 1 | 1.03 | ||||

| 10—Net asset approach | 7 | 1.97 | ||||||

| 0—Not disclosed | 114 | 32.02 | 26 | 32.50 | 15 | 100,00 | 17 | 17.53 |

| 99—Not applied | 37 | 10.39 | 3 | 3.09 | ||||

| I5. Rec GHG emissions | ||||||||

| 1—Amortization expenses | 39 | 40.21 | ||||||

| 2—Cost of consumed materials | 2 | 0.56 | ||||||

| 3—Other operational losses | 14 | 3.93 | 6 | 6.19 | ||||

| 4—Liability | 11 | 3.09 | 4 | 4.12 | ||||

| 5—Financial Liability | 3 | 3.09 | ||||||

| 6—Provision | 182 | 51.12 | 79 | 98.75 | 14 | 14.43 | ||

| 7—No recognition | 70 | 19.66 | 18 | 18.56 | ||||

| 0—Not disclosed | 77 | 21.63 | 1 | 1.25 | 15 | 100,00 | 13 | 13.40 |

| I6. Mens GHG emissions | ||||||||

| 1—Cost | 26 | 32.50 | ||||||

| 2—First in First Out | 2 | 0.56 | 32 | 32.99 | ||||

| 3—Initial price | 7 | 1.97 | ||||||

| 4—Average price of EA | 7 | 1.97 | 3 | 3.09 | ||||

| 5—Average cost of EA + Acq. Cost EA | 6 | 1.69 | ||||||

| 6—Average cost of EA + Best estimate to acquire | 7 | 1.97 | 7 | 8.75 | ||||

| 7—Fuel consumption + average price of EA | 3 | 3.75 | ||||||

| 8—Cancelation of the obligation order | 7 | 8.75 | ||||||

| 9—Carrying amount (CA) EA | 68 | 19.10 | 11 | 13.75 | 1 | 1.03 | ||

| 10—CA EA + average price of EA + best estimate | 14 | 3.93 | 12 | 15.00 | ||||

| 11—CA EA + Best estimate to acquire | 40 | 11.24 | ||||||

| 12—CA EA + price at closing | 17 | 4.78 | ||||||

| 13—CA EA + market value | 4 | 1.12 | ||||||

| 0—Not disclosed | 117 | 32.87 | 14 | 17.50 | 15 | 100.00 | 43 | 44.33 |

| 99—Not applied | 67 | 18.82 | 18 | 18.56 | ||||

| I7. Rec GHGe over EA | ||||||||

| 1—Expense accrual | 2 | 2.06 | ||||||

| 2—Liability | 19 | 5.34 | ||||||

| 3—Financial Liability | 14 | 3.93 | 14 | 14.43 | ||||

| 4—Provision | 109 | 30.62 | 28 | 35.00 | 44 | 45.36 | ||

| 5—No recognition | 28 | 7.87 | 11 | 11.34 | ||||

| 0—Not disclosed | 186 | 52.25 | 52 | 65.00 | 15 | 100.00 | 26 | 26.80 |

| I8. Rec EA acq | ||||||||

| 1—Intangible Asset | 185 | 51.97 | 67 | 83.75 | 45 | 46.39 | ||

| 2—Inventory | 27 | 7.58 | ||||||

| 3—Never acquired EA | 14 | 14.43 | ||||||

| 0—Not disclosed | 144 | 40.45 | 13 | 16.25 | 15 | 100.00 | 38 | 39.18 |

Appendix B—Levels of Transparency of EA and GHG Emissions Financial Reporting

| Accounting Approach | Full sample (Obs: 548) | IFRS (obs = 356) | Spanish (obs = 80) | French (obs = 15) | Portuguese (obs = 97) | |||||

| Mean | Std. Dev. | Mean | Std. Dev. | Mean | Std. Dev. | Mean | Std. Dev. | Mean | Std. Dev. | |

| IFRIC3_cost | 0,0128 | 0,1124 | 0,0197 | 0,1390 | 0,0000 | 0,0000 | 0,0000 | 0,0000 | 0,0000 | 0,0000 |

| GovGrant | 0,1569 | 0,3641 | 0,2809 | 0,4501 | 0,0625 | 0,2436 | 0,0000 | 0,0000 | 0,0000 | 0,0000 |

| Inventory | 0,0511 | 0,2204 | 0,0787 | 0,2696 | 0,0000 | 0,0000 | 0,0000 | 0,0000 | 0,0000 | 0,0000 |

| NetLiab | 0,0109 | 0,1042 | 0,0169 | 0,1289 | 0,0000 | 0,0000 | 0,0000 | 0,0000 | 0,0000 | 0,0000 |

| ICAC | 0,0438 | 0,2048 | 0,0393 | 0,1946 | 0,0875 | 0,2843 | 0,0000 | 0,0000 | 0,0309 | 0,1740 |

| AFRS26 | 0,0511 | 0,2204 | 0,0000 | 0,0000 | 0,0000 | 0,0000 | 0,0000 | 0,0000 | 0,2887 | 0,4555 |

| NoRec | 0,0420 | 0,2007 | 0,0590 | 0,2359 | 0,0000 | 0,0000 | 0,0000 | 0,0000 | 0,0206 | 0,1428 |

| NoDisc | 0,1369 | 0,3440 | 0,1433 | 0,3508 | 0,0125 | 0,1118 | 1,0000 | 0,0000 | 0,0825 | 0,2765 |

| Variable | Full sample (Obs: 548) | IFRS GAAP (Obs: 356) | Spanish GAAP (Obs: 80) | Portuguese GAAP (obs = 97) | Min | Max | ||||

| Mean | Std. Dev. | Mean | Std. Dev. | Mean | Std. Dev. | Mean | Std. Dev. | |||

| I1.dummy | 0.7442 | 0.4367 | 0.6994 | 0.4591 | 0.9875 | 0.1118 | 0.8763 | 0.3310 | 0 | 1 |

| I2.dummy | 0.6762 | 0.4683 | 0.6292 | 0.4837 | 0.9000 | 0.3019 | 0.8247 | 0.3822 | 0 | 1 |

| I3.dummy | 0.7102 | 0.4541 | 0.6798 | 0.4672 | 0.9125 | 0.2843 | 0.8144 | 0.3908 | 0 | 1 |

| I4.dummy | 0.6064 | 0.4890 | 0.5758 | 0.4949 | 0.6750 | 0.4713 | 0.7938 | 0.4067 | 0 | 1 |

| I5.dummy | 0.6386 | 0.4808 | 0.5871 | 0.4931 | 0.9875 | 0.1118 | 0.6804 | 0.4687 | 0 | 1 |

| I6.dummy | 0.4955 | 0.5004 | 0.4831 | 0.5004 | 0.8250 | 0.3824 | 0.3711 | 0.4856 | 0 | 1 |

| I7.dummy | 0.4132 | 0.4929 | 0.3989 | 0.4904 | 0.3500 | 0.4800 | 0.6186 | 0.4883 | 0 | 1 |

| I8.dummy | 0.6100 | 0.4882 | 0.5955 | 0.4915 | 0.8375 | 0.3712 | 0.6082 | 0.4907 | 0 | 1 |

| ID | 4.9543 | 2.9162 | 4.6489 | 3.0743 | 6.4750 | 1.3685 | 5.5876 | 2.3352 | 0 | 8 |

| ID.EA | 2.7719 | 1.6418 | 2.5843 | 1.7235 | 3.4750 | 0.8711 | 3.3093 | 1.3099 | 0 | 4 |

| ID.eGHG | 2.1823 | 1.4773 | 2.0646 | 1.5305 | 3.0000 | 0.9808 | 2.2784 | 1.2726 | 0 | 4 |

Appendix C—Correlation Matrix

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) | (19) | |

| (1) ID | 1.0000 | ||||||||||||||||||

| (2) ID.EA | 0.8487 * | 1.0000 | |||||||||||||||||

| (3) ID.eGHG | 0.9542 * | 0.6954 * | 1.0000 | ||||||||||||||||

| (4) BoPFS.IFRS | −0.0898 ** | −0.1404 * | −0.0970 ** | 1.0000 | |||||||||||||||

| (5) Size | −0.0179 | −0.0335 | −0.0048 | 0.2434 * | 1.0000 | ||||||||||||||

| (6) ROA | 0.1340 * | 0.0957 ** | 0.1385 * | −0.1406 * | −0.0693 | 1.0000 | |||||||||||||

| (7) ROE | 0.0888 ** | 0.0226 | 0.1103 * | −0.0541 | −0.0328 | 0.6971 * | 1.0000 | ||||||||||||

| (8) ROS | 0.1167 * | 0.1427 * | 0.1083 | −0.2164 * | −0.2445 * | 0.1241 * | 0.0073 | 1.0000 | |||||||||||

| (9) DebtE | −0.0190 | −0.1252 * | 0.0277 | 0.0433 | 0.0876 | −0.1314 * | 0.0109 | −0.1277 * | 1.0000 | ||||||||||

| (10) DebtTA | −0.0791 *** | −0.1915 * | −0.0270 | 0.0865 | 0.1095 | −0.2044 * | 0.0365 | −0.1131 * | 0.8905 * | 1.0000 | |||||||||

| (11) Audit | 0.1128 * | 0.0548 | 0.1524 * | 0.1774 * | 0.0851 | −0.0851 | −0.0568 | −0.1774 * | −0.1064 | −0.0568 | 1.0000 | ||||||||

| (12) Aviation | −0.0967 ** | −0.1461 * | −0.0625 | −0.0255 | 0.0203 | −0.0203 | −0.0203 | 0.1827 * | −0.0406 | 0.1218 *** | 0.0558 | 1.0000 | |||||||

| (13) Cement | −0.0203 | 0.0085 | −0.0439 | −0.0174 | 0.0426 | −0.0426 | −0.1193 * | −0.1874 * | −0.1193 * | −0.1193 * | 0.1456 * | −0.0436 | 1.0000 | ||||||

| (14) Combustion | −0.1062 ** | −0.0894 ** | −0.0816 *** | −0.1477 * | 0.1045 ** | 0.0523 | 0.0470 | 0.2143 * | −0.0366 | −0.0366 | −0.2413 * | −0.1103 * | −0.2880 * | 1.0000 | |||||

| (15) PulpPaper | −0.0249 | 0.0588 | −0.0673 | 0.0269 | −0.2984 * | 0.0265 | −0.0530 | 0.0199 | −0.0663 | −0.0928 *** | −0.0644 | −0.0618 | −0.1613 * | −0.4082 * | 1.0000 | ||||

| (16) P.Electricity | 0.0967 ** | −0.0482 | 0.1230 * | −0.1229 * | 0.0079 | 0.0788 *** | 0.1891 * | −0.2521 * | 0.2757 * | 0.2757 * | 0.0845 * | −0.0482 | −0.1259 * | −0.3186 * | −0.1785 * | 1.0000 | |||

| (17) OilRef. | 0.0640 | 0.0448 | 0.0804 *** | 0.0773 *** | 0.0000 | −0.0496 | −0.0992 ** | 0.0000 | −0.0496 | −0.0496 | 0.0454 | −0.0136 | −0.0355 | −0.0898 * | −0.0503 | −0.0393 | 1.0000 | ||

| (18) Steel | 0.0749 *** | 0.0694 | 0.0566 | 0.2116 * | 0.2037 * | −0.1067 ** | −0.0097 | 0.0291 | 0.0679 | 0.0388 | 0.1243 * | −0.0372 | −0.0972 * | −0.2459 * | −0.1378 * | −0.1075 * | −0.0303 | 1.0000 | |

| (19) Glass | 0.0912 ** | 0.1225 * | 0.0982 ** | 0.1918 * | −0.0317 | −0.0528 | −0.0528 | −0.0211 | −0.0739 *** | −0.0844 ** | 0.1127 * | −0.0338 | −0.0881 * | −0.2230 * | −0.1249 * | −0.0975 * | −0.0275 | −0.0753 ** | 1.0000 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) | (18) | (19) | (20) | (21) | (22) | (23) | (24) | |

| (1) IFRIC3_cost | 1.0000 | |||||||||||||||||||||||

| (2) GovGrant | −0.0491 | 1.0000 | ||||||||||||||||||||||

| (3) NetLiab | −0.0264 | −0.1001 ** | 1.0000 | |||||||||||||||||||||

| (4) Invent | −0.0120 | −0.0454 | −0.0244 | 1.0000 | ||||||||||||||||||||

| (5) ICAC | −0.0243 | −0.0923 ** | −0.0497 | −0.0225 | 1.0000 | |||||||||||||||||||

| (6) AFRS26 | −0.0264 | −0.1001 ** | −0.0538 | −0.0244 | −0.0497 | 1.0000 | ||||||||||||||||||

| (7) NRec | −0.0238 | −0.0903 ** | −0.0486 | −0.0220 | −0.0448 | −0.0486 | 1.0000 | |||||||||||||||||

| (8) NDisc | −0.0453 | −0.1718 * | −0.0924 ** | −0.0419 | −0.0852 ** | −0.0924 ** | −0.0833 *** | 1.0000 | ||||||||||||||||

| (9) BoPFS.IFRS | 0.0835 *** | 0.3169 * | 0.1704 * | 0.0773 *** | −0.0297 | −0.3160 * | 0.1156 * | 0.0253 | 1.0000 | |||||||||||||||

| (10) Size | 0.0000 | 0.1703 * | 0.0703 | −0.1488 * | 0.0000 | −0.1641 * | −0.1158 * | 0.0225 | 0.2434 * | 1.0000 | ||||||||||||||

| (11) ROA | −0.0689 | 0.1064 ** | −0.0586 | 0.0496 | 0.1009 ** | −0.1406 * | 0.0901 ** | −0.0676 | −0.1406 * | −0.0693 | 1.0000 | |||||||||||||

| (12) ROE | −0.0689 | 0.1419 * | 0.0586 | 0.0000 | 0.0504 | −0.1524 * | 0.0386 | −0.0601 | −0.0541 | −0.0328 | 0.6971 * | 1.0000 | ||||||||||||

| (13) ROS | 0.1609 * | −0.0922 ** | −0.1406 * | 0.0992 ** | 0.1135 * | −0.0352 | −0.1158 * | 0.0000 | −0.2164 * | −0.2445 * | 0.1241 * | 0.0073 | 1.0000 | |||||||||||

| (14) DebtE | 0.0689 | 0.0922 ** | 0.1641 * | −0.1488 * | −0.0883 ** | 0.0469 | 0.0772 *** | −0.1352 * | 0.0433 | 0.0876 ** | −0.1314 * | 0.0109 | −0.1277 * | 1.0000 | ||||||||||

| (15) DebtTA | 0.0460 | 0.0709 *** | 0.1524 * | −0.1488 * | −0.1135 * | 0.0469 | 0.0515 | −0.0375 | 0.0865 ** | 0.1095 | −0.2044 * | 0.0365 | −0.1131 * | 0.8905 * | 1.0000 | |||||||||

| (16) Audit | 0.0491 | −0.0621 | 0.1001 ** | 0.0454 | −0.0793 *** | −0.0594 | 0.0903 ** | −0.3099 * | 0.1774 * | 0.0851 | −0.0851 | −0.0568 | −0.1774 * | −0.1064 | −0.0568 | 1.0000 | ||||||||

| (17) Aviation | −0.0147 | −0.0558 | −0.0300 | −0.0136 | −0.0277 | −0.0300 | −0.0270 | 0.1992 * | −0.0255 | 0.0203 | −0.0203 | −0.0203 | 0.1827 * | −0.0406 | 0.1218 *** | 0.0558 | 1.0000 | |||||||

| (18) Cement | −0.0384 | −0.1456 * | −0.0783 *** | −0.0355 | −0.0722 *** | 0.3321 * | −0.0706 *** | −0.1343 * | −0.0174 | 0.0426 | −0.0426 | −0.1193 * | −0.1874 * | −0.1193 * | −0.1193 * | 0.1456 * | −0.0436 | 1.0000 | ||||||

| (19) Combustion | −0.0971 ** | −0.2565 * | 0.1376 * | 0.1233 * | 0.2507 * | −0.1981 * | −0.1787 * | 0.2084 * | −0.1477 * | 0.1045 ** | 0.0523 | 0.0470 | 0.2143 * | −0.0366 | −0.0366 | −0.2413 * | −0.1103 * | −0.2880 * | 1.0000 | |||||

| (20) PulpPaper | −0.0544 | 0.1288 * | −0.1110 * | −0.0503 | −0.1023 * | 0.0381 | 0.2974 * | −0.0267 | 0.0269 | −0.2984 * | 0.0265 | −0.0530 | 0.0199 | −0.0663 | −0.0928 *** | −0.0644 | −0.0618 | −0.1613 * | −0.4082 * | 1.0000 | ||||

| (21) P.Electricity | −0.0425 | 0.1606 * | −0.0866 ** | −0.0393 | −0.0799 *** | 0.0652 | 0.0886 ** | −0.0514 | −0.1229 * | 0.0079 | 0.0788 *** | 0.1891 * | −0.2521 * | 0.2757 * | 0.2757 * | 0.0845 * | −0.0482 | −0.1259 * | −0.3186 * | −0.1785 * | 1.0000 | |||

| (22) Oil Refiner | −0.0120 | −0.0454 | −0.0244 | −0.0111 | −0.0225 | −0.0244 | −0.0220 | −0.0419 | 0.0773 *** | 0.0000 | −0.0496 | −0.0992 ** | 0.0000 | −0.0496 | −0.0496 | 0.0454 | −0.0136 | −0.0355 | −0.0898 * | −0.0503 | −0.0393 | 1.0000 | ||

| (23) Steel | 0.3948 * | −0.1243 * | 0.1201 * | −0.0303 | −0.0617 | −0.0669 | −0.0603 | −0.1147 * | 0.2116 * | 0.2037 * | −0.1067 ** | −0.0097 | 0.0291 | 0.0679 | 0.0388 | 0.1243 * | −0.0372 | −0.0972 * | −0.2459 * | −0.1378 * | −0.1075 * | −0.0303 | 1.0000 | |

| (24) Glass | −0.0297 | 0.4618 * | 0.0072 | −0.0275 | −0.0559 | −0.0606 | −0.0547 | −0.1040 ** | 0.1918 * | −0.0317 | −0.0528 | −0.0528 | −0.0211 | −0.0739 *** | −0.0844 ** | 0.1127 * | −0.0338 | −0.0881 * | −0.2230 * | −0.1249 * | −0.0975 * | −0.0275 | −0.0753 ** | 1.0000 |

Appendix D—Statistic Models: the Influence of Accounting Regulations on the Indexes of the Disclosure

| (1) ID | (2) ID.EA | (3) ID.eGHG | ||||

| Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | |

| BoPFS.IFRS | −0.8402 * | 0.2541 | −0.5416 ** | 0.2424 | −0.3228 ** | 0.1329 |

| Size | 0.1711 | 0.1855 | −0.0345 | 0.1211 | 0.0975 | 0.0949 |

| ROA | 0.0314 | 0.2605 | 0.0282 | 0.0600 | 0.1219 | 0.1337 |

| ROE | 0.3676 | 0.2508 | 0.0253 | 0.0705 | 0.1755 | 0.1272 |

| ROS | 0.5978 * | 0.1811 | 0.1357 *** | 0.0751 | 0.3069 * | 0.0872 |

| DebtE | 1.4218 * | 0.4364 | 0.3590 ** | 0.1450 | 0.7047 * | 0.2148 |

| DebtA | −1.5074 * | 0.4473 | −0.1524 | 0.1470 | −0.6186 * | 0.2204 |

| Audit | 1.7479 * | 0.4013 | 0.6490 * | 0.2499 | 0.9450 * | 0.1938 |

| _cons | 1.8618 ** | 0.9113 | 1.7397 * | 0.4320 | 0.2075 | 0.4506 |

| i.Year | No(1) | Yes | Yes | |||

| N obs/N groups | 548/85 | 548/85 | 548/85 | |||

| chi2 (8) = 60.36 * | chi2 (14) = 35.24 * | chi2 (14) = 64.04 * | ||||

| Hausman chi2 | 26.94 ** | 33.06 * | 31.37 * | |||

| AR(1) | 0.330 | rho=0.835 | 0.371 | |||

| Wald chi2 | 1.4 × 108 * | 3.8 × 105 * | 3.9× 105 * | |||

| LM chi2 | 953.52 * | 947.92 * | 925.01 * | |||

Appendix E—Logistic Regressions: the Influence of Accounting Regulations on the Disclosure of Accounting Approaches Statistic Models: the Influence of Accounting Regulations on the Indexes of the Disclosure

| (1) IFRIC3_cost | (2) GovGrant | (3) NetLiab | (4) Inventory | (5) ICAC | (6) AFRS26 | (7) NRec | (8) NDiv | |||||||||

| Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | Coef. | Std. Err. | |

| BoPFS.IFRS | −0.8978 | 2.8800 | 5.3734 * | 1.5752 | 3.0022 ** | 1.4854 | 4.9124 ** | 2.2842 | 0.4792 | 0.4764 | −8.4853 * | 2.8815 | 2.5282 * | 0.8312 | 0.7992 ** | 0.3409 |

| Size | −2.8876 | 1.9260 | 2.6690 * | 0.4795 | −0.5220 | 0.3442 | −4.8690 ** | 2.1321 | 0.0126 | 0.3311 | 1.6844 | 1.2739 | −1.0232 ** | 0.4004 | −0.0830 | 0.2254 |

| ROA | −1.8704 | 1.5785 | 0.3796 | 0.4705 | −0.5879 | 0.5307 | 1.1698 | 1.9157 | 0.5006 | 0.5279 | −0.9742 | 0.9509 | 1.3884 ** | 0.6107 | −0.1607 | 0.3495 |

| ROE | 0.9363 | 1.6338 | 1.2157 ** | 0.5012 | 0.5529 | 0.4257 | −1.1375 | 1.9803 | −0.1213 | 0.4985 | −1.2298 | 0.8326 | −0.7003 | 0.6201 | −0.5054 | 0.3426 |

| ROS | 3.6618 ** | 1.6906 | 0.6545 *** | 0.3958 | −0.9763 ** | 0.4223 | 0.4112 | 1.0079 | 0.3548 | 0.3427 | 1.0470 | 1.0798 | −1.0024 ** | 0.4429 | −0.5643 ** | 0.2240 |

| DebtE | 1.0276 | 1.8870 | 0.2645 | 0.6306 | 1.3149 ** | 0.6443 | −1.1202 | 2.8090 | 0.4784 | 0.8797 | −2.2846 | 1.6745 | 2.5496 *** | 1.3017 | −1.5548 * | 0.4578 |

| DebtA | 0.0293 | 2.5682 | 0.1770 | 0.6407 | −0.3339 | 0.6669 | −1.7385 | 3.9064 | −0.9422 | 0.8947 | 4.0748 ** | 2.0740 | −1.8880 | 1.2806 | 0.6681 | 0.4773 |

| Audit | 0.1271 | 2.4471 | −2.2061 * | 0.5353 | 2.5268 *** | 1.4688 | −1.3267 | 2.0880 | −0.0725 | 0.4990 | −0.0733 | 1.1126 | 3.2177 ** | 1.6331 | −2.2944 * | 0.3548 |

| Aviation | −4.7746 | 3.4028 | −6.4056 * | 2.0933 | 1.3466 | 1.9044 | 5.0777 | 5.1772 | 2.0857 | 2.1055 | −7.1057 *** | 4.2955 | 3.3988 | 2.3195 | 5.8969 * | 1.7164 |

| Cement | −4.4409 | 4.4055 | −7.8923 * | 1.6211 | −1.7274 | 1.6184 | 3.0690 | 2.9951 | −0.1952 | 2.0264 | −1.4140 | 2.4352 | −0.2303 | 2.0437 | −0.6079 | 2.0258 |

| Combustion | −4.2134 | 3.2466 | −6.8711 * | 0.9024 | 1.0934 | 0.7474 | 2.1054 | 2.1110 | 2.2567 | 1.4638 | −12.8288 ** | 5.4975 | −1.2894 | 2.0162 | 2.9376 ** | 1.4486 |

| PulpPaper | −5.4676 *** | 3.3006 | −2.9223 * | 0.6310 | −2.4641 | 1.6056 | −0.8796 | 2.3527 | −0.9251 | 2.0180 | −3.3876 | 2.4631 | 3.0432 ** | 1.4676 | 2.1672 | 1.4697 |

| P.Electricity | −5.0719 *** | 2.8624 | −2.1843 * | 0.8293 | −2.3606 | 1.6142 | 1.7172 | 2.9785 | 0.0393 | 2.0513 | −4.8502 | 3.2045 | 2.0424 | 1.5550 | 2.7249 *** | 1.5182 |

| Oil Ref. | 2.3537 | 2.2461 | −3.7216 ** | 1.5504 | 0.8134 | 1.6637 | 4.2271 | 3.1434 | 1.6912 | 2.0525 | 0.9334 | 2.0857 | 1.9094 | 2.1255 | 1.4649 | 2.0486 |

| Steel | 2.1221 | 2.3374 | −9.0969 * | 1.7550 | 1.0417 | 0.8914 | 3.5759 | 3.2872 | 0.0125 | 2.0271 | −1.8213 | 2.4410 | 0.3770 | 2.0392 | 0.2953 | 2.0248 |

| Glass | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- |

| cons | −5.9999 | 5.5174 | −11.7422 * | 2.6302 | −7.3692 * | 2.6402 | 2.2574 | 5.0230 | −5.3300 ** | 2.2466 | −1.0186 | 3.9577 | −8.8620 * | 2.9971 | 1.1811 | 1.7927 |

| i.Ano | Não | Não | Não | Não | Não | Não | Não | Não | ||||||||

| N | 548 | 548 | 548 | 548 | 548 | 548 | 548 | 548 | ||||||||

| chi2 (15) | 17.53 | 17.44 * | 37.55 * | 12.46 | 24.14 *** | 31.40 * | 40.44 * | 77.50 * | ||||||||

| Penalized Log likelihood | −9.9687 | −69.9257 | −60.2749 | −9.8626 | −69.0688 | −28.437 | −42.937 | −136.3877 | ||||||||

References

- Wambsganss, J.R.; Sanford, B. The Problem with Reporting Pollution Allowances. Crit. Perspect. Account. 1996, 7, 643–652. [Google Scholar] [CrossRef]

- Gibson, K. The Problem with Reporting Pollution Allowances: Reporting Is Not the Problem. Crit. Perspect. Account. 1996, 7, 655–665. [Google Scholar] [CrossRef]

- PWC & IETA. Trouble-Entry Accounting-Revisited, 2007, 1–48. Available online: https://www.ieta.org/resources/Resources/Reports/trouble_entry_accounting.pdf (accessed on 28 January 2020).

- Ragan, J.M.; Stagliano, A.J. Cap and Trade Allowance Accounting: A Divergence Between Theory and Practice. Int. J. Econ. Bus. Res. 2007, 5, 47–58. [Google Scholar] [CrossRef]

- Bebbington, J.; Larrinaga-González, C. Carbon trading: Accounting and reporting issues. Eur. Account. Rev. 2008, 17, 697–717. [Google Scholar] [CrossRef]

- KPMG. Accounting for Carbon: The Impact of Carbon Trading on Financial Statements. 2008, p. 22. Available online: http://content.ccrasa.com/library_1/3201%20-%20Accounting%20for%20carbon%20The%20impact%20of%20carbon%20trading%20on%20financial%20statements.pdf (accessed on 28 January 2020).

- Cook, A. Emission rights: From costless activity to market operations. Account. Organ. Soc. 2009, 34, 456–468. [Google Scholar] [CrossRef]

- Giner, B. Accounting for Emission Trading Schemes: A Still Open Debate. Account. Organ. Soc. 2014, 34, 45–51. [Google Scholar] [CrossRef]

- Allini, A.; Giner, B.; Caldarelli, A. Opening the black box of accounting for greenhouse gas emissions: The different views of institutional bodies and firms. J. Clean. Prod. 2018, 172, 2195–2205. [Google Scholar] [CrossRef]

- Inchausti, B.G. La contabilidad de los derechos de emisión: Una perspectiva internacional. Revista Espanola de Financiacion y Contabilidad 2007, 36, 175–193. [Google Scholar] [CrossRef]

- Lovell, H.; Aguiar, T.S.; de Bebbington, J.; Larrinaga-González, C. Monitoring, Accounting for Carbon: Reporting and Verifying Emissions in the Climate Economy. In ACCA Research Report; The Association of Certified Chartered Accountants (ACCA): London, UK, 2010. [Google Scholar] [CrossRef]

- Steenkamp, N.; Rahman, A.; Kashyap, V. Recognition, measurement and disclosure of carbon emission allowances under the EU ETS—An exploratory study. In Proceedings of the 10th CSEAR Australasian Conference, Launceston Campus, University of Tasmania, Hobart, Australia, 5–7 December 2011. [Google Scholar]

- Warwick, P.; Ng, C. The “Cost” of Climate Change: How Carbon Emissions Allowances are Accounted for Amongst European Union Companies. Aust. Account. Rev. 2012, 22, 54–67. [Google Scholar] [CrossRef]

- Black, C. Accounting for Carbon Emission Allowances in the European Union: In Search of Consistency. Account. Eur. 2013, 10, 223–239. [Google Scholar] [CrossRef]

- Ayaz, H. Analysis of Carbon Emission Accounting Practices of Leading Carbon Emitting European Union Companies. Athens J. Bus. Econ. 2017, 3, 463–486. [Google Scholar] [CrossRef]

- Ernst & Young. Carbon Market Readiness. 2010. Available online: http://globalsustain.org/files/Carbon_market_readiness.pdf. (accessed on 28 January 2020).

- Barth, M.E.; Schipper, K. Financial Reporting Transparency. J. Account. Audit. Finance 2008, 23, 173–190. [Google Scholar] [CrossRef]

- IFRS–Home. Available online: ifrs.org. (accessed on 11 January 2020).

- European Commission, Union Registry. Available online: ec.europa.eu/clima/policies/ets/registry_en#tab-0-1. (accessed on 26 June 2019).

- European Commission, Market Stability Reserve. Available online: ec.europa.eu/clima/policies/ets/reform_en. (accessed on 26 June 2019).

- Larrinaga, C. Carbon accounting and carbon governance. Soc. Environ. Account. J. 2014, 34, 1–5. [Google Scholar] [CrossRef]

- Lovell, H.; Bebbington, J.; Larrinaga, C.; Sales de Aguiar, T.R. Putting carbon markets into practice: A case study of financial accounting in Europe. Environ. Planning C: Govern. Policy 2013, 31, 741–757. [Google Scholar] [CrossRef]

- Ernst & Young. Accounting for Emission Reductions and Other Incentive Schemes. 2009, p. 12. Available online: https://www.ey.com/Publication/vwLUAssets/Accounting_for_emission_reductions_and_other_incentive_schemes/%24FILE/Accounting_emission_reductions_July09.pdf. (accessed on 28 January 2020).

- Busch, T.; Hoffmann, V.H. How Hot Is Your Bottom Line? Linking Carbon and Financial Performance. Bus. Soc. 2011, 50, 233–265. [Google Scholar] [CrossRef]

- Lovell, H.; Mackenzie, D. Accounting for Carbon: The Role of Accounting Professional Organisations in Governing Climate Change. Antipode 2011, 43, 704–730. [Google Scholar] [CrossRef]

- IFRS–Research Programme. Available online: ifrs.org/projects/work-plan/research-programme/#pipeline. (accessed on 28 January 2020).

- Criado-Jiménez, I.; Fernández-Chulián, M.; Husillos-Carqués, F.J.; Larrinaga-González, C. Compliance with mandatory environmental reporting in financial statements: The case of Spain (2001–2003). J. Bus. Ethics 2008, 79, 245–262. [Google Scholar] [CrossRef]

- Holthausen, R.W. Accounting Standards, Financial Reporting Outcomes and Enforcement. J. Account. Res. 2009, 47, 447–458. [Google Scholar] [CrossRef]

- Barbu, E.M.; Dumontier, P.; Feleagǎ, N.; Feleagǎ, L. Mandatory environmental disclosures by companies complying with IASs/IFRSs: The cases of France, Germany, and the UK. Inter. J. Account. 2014, 49, 231–247. [Google Scholar] [CrossRef]

- Cowan, S.; Gadenne, D. Australian corporate environmental reporting: A comparative analysis of disclosure practices across voluntary and mandatory disclosure systems. J. Account. Organ. Change 2005, 1, 165–179. [Google Scholar] [CrossRef]

- Llena, F.; Moneva, J.M.; Hernandez, B. Environmental disclosures and compulsory accounting standards: The case of Spanish annual reports. Bus. Strategy Environ. 2007, 16, 50–63. [Google Scholar] [CrossRef]

- Deegan, C.; Gordon, B. A Study of the Environmental Disclosure Practices of Australian Corporations. Account. Bus. Res. 1996, 26, 187–199. [Google Scholar] [CrossRef]

- Larrinaga, C.; Carrasco, F.; Correa, C.; Llena, F.; Moneva, J. Accountability and accounting regulation: The case of the Spanish environmental disclosure standard. Eur. Account. Rev. 2002, 11, 723–740. [Google Scholar] [CrossRef]

- Adams, C.A.; Coutts, A.; Harte, G. Corporate Equal Opportunities (Non-) Disclosure. Br. Account. Rev. 1995, 27, 87–108. [Google Scholar] [CrossRef]

- Gallego-Álvarez, I.; Martínez-Ferrero, J.; Cuadrado-Ballesteros, B. Accounting Treatment for Carbon Emission Rights. Systems 2016, 4, 12. [Google Scholar] [CrossRef]

- European Commission, Free Allocation. Available online: ec.europa.eu/clima/policies/ets/allowances_en. (accessed on 9 July 2019).

- Matsumura, E.M.; Prakash, R.; Vera-Muñoz, S.C. Firm-value effects of carbon emissions and carbon disclosures. Account. Rev. 2014, 89, 695–724. [Google Scholar] [CrossRef]

- Elfrink, J.; Ellison, M. Accounting for Emission Allowances: An Issue in Need of Standards. CPA J. 2009, 79, 30. Available online: https://www.journalofaccountancy.com/issues/2009/jul/20081312.html. (accessed on 28 January 2020).

- Monteiro, S.; Vilas Boas, S. O Relato sobre Licenças de Emissão de CO2: O Caso das Empresas Portuguesas do PNALE I. In XV Encuentro AECA, 2012. Available online: http://www.aeca1.org/xvencuentroaeca/cd/72h.pdf. (accessed on 28 January 2020).

- Giner, B. The influence of company characteristics and accounting regulation on information disclosed by Spanish firms. Eur. Account. Rev. 1997, 6, 45–68. [Google Scholar] [CrossRef]

- Mateos-Ansótegui, A.I.; Bilbao-Estrada, I. Accounting Planning and Greenhouse Gas Emission Rights. Revista Universo Contábil 2007, 3, 101–122. [Google Scholar]

- Fornaro, J.M.; Winkelman, K.A.; Glodstein, D. Accounting for Emissions—Emerging issues and the need for global accounting standards. J. Account. July 2009, 1–7. Available online: https://search.proquest.com/openview/bad6d41e993f45c93972168f8f822c37/1?pq-origsite=gscholar&cbl=41065 (accessed on 28 January 2020).

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Prado-Lorenzo, J.-M.; Rodríguez-Domínguez, L.; Gallego-Álvarez, I.; García-Sánchez, I.-M. Factors influencing the disclosure of greenhouse gas emissions in companies world-wide. Manag. Decis. 2009, 47, 1133–1157. [Google Scholar] [CrossRef]

- Luo, L.; Lan, Y.C.; Tang, Q. Corporate Incentives to Disclose Carbon Information: Evidence from the CDP Global 500 Report. J. Int. Financial Manag. Account. 2012, 23, 93–120. [Google Scholar] [CrossRef]

- Qiu, Y.; Shaukat, A.; Tharyan, R. Environmental and social disclosures: Link with corporate financial performance. Br. Account. Rev. 2016, 48, 102–116. [Google Scholar] [CrossRef]

- Liu, Y.S.; Zhou, X.; Yang, J.H.; Hoepner, A.G.F. Corporate Carbon Emission and Financial Performance: Does Carbon Disclosure Mediate the Relationship in the UK? Disccusion paper ICM-2016-03, junio 2016. Available online: https://pdfs.semanticscholar.org/217e/7771283088f61d895e6225663e175c371b2f.pdf (accessed on 28 January 2020).

- Dechow, P.; Ge, W.; Schrand, C. Understanding earnings quality: A review of the proxies, their determinants and their consequences. J. Account. Econ. 2010, 50, 344–401. [Google Scholar] [CrossRef]

- Labra, R.; Torrecillas, C. Guía Cero para datos de panel. Un enfoque práctico. UAM-Accenture Working Papers. 2014; 16, 57. [Google Scholar]

- Pindado, J.; Requejo, I. 10th Course: Data Management and Panel Data Models, Salamanca. 11th to 15th of July 2016. Universidad de Salamanca, 2016. Available online: https://fundacion.usal.es/es/images/stories/pdf/Syllabus_Data_Management_and_Panel_Data_Models_2016.pdf (accessed on 22 January 2020).

- Lee, Y. Diagnostic Testing for Dynamic Panel Data Models, 2006. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.466.8012&rep=rep1&type=pdf. (accessed on 28 January 2020).

- Moundigbaye, M.; Rea, W.S.; Reed, W.R. Which Panel Data Estimator Should I Use? A Corrigendum and Extension. Economics 2018, 12, 1–31. [Google Scholar] [CrossRef]

- Verbeek, M. A Guide to Modern Econometrics, 5th ed.; Wiley: Hoboken, NJ, USA, 2017. [Google Scholar]

- Firth, D. Bias Reduction of Maximum Likelihood Estimates Author. Biometrika 1993, 80, 27–38. Available online: http://www.jstor.org/stable/2336755 (accessed on 28 January 2020). [CrossRef]

- Moneva, J.M.; Llena, F. Environmental disclosures in the annual reports of large companies in Spain. Eur. Account. Rev. 2000, 9, 7–29. [Google Scholar] [CrossRef]

| IFRIC 3 | CNC—Portugal 1 | ICAC—Spain 2 | ANC—France 3 | ||||

|---|---|---|---|---|---|---|---|

| Before 1 January 2010 | After 1 January 2010 | Before 1 January 2016 | After 1 January 2016 | Before 1 January 2013 | After 1 January 2013 | ||

| Recognition of EA | Intangible assets/Government Grant (Deferred income) | Intangible assets/Government Grant (Deferred income) | Intangible assets/Government Grant (Owners’ Equity) | Intangible assets/Government Grant (Owners’ Equity) | Inventory 4/Government Grant (Owners’ Equity) | Intangible assets/Liability—Quotas d’émission alloués par l’État | Inventory |

| Initial measurement of EA | Market value | Fair value | Fair value | Market value | Market value (fair value) | Market value | Nil value |

| Subsequent measurement of EA | Cost model or Revaluation model (without amortizations) | Cost less accumulated impairments (extraordinary amortization) | Cost less accumulated amortizations | Cost less accumulated impairments | Cost less accumulated impairments | Cost or Acquisition cost of equivalents (best estimate) | -- |

| Recognition and measurement of GHG emissions | Operational Loss/Provisions 1 using best estimate (usually the market price) | Operational Loss/Provisions using First in First out (FIFO) | Amortization loss/Accumulated Amortizations using First in First out (FIFO) | Operational Loss/Provisions using: 1) the carrying amount of the EA held (proportion of GHG emissions of the period to the total GHG emissions) 2) weighted average cost (WAC) of the remaining EA. | Loss/Liability using the initial value of EA | Operational loss/Inventory using FIFO or WAC | |

| Recognize the government grant (as income) over the periods in which the related expenses are intended to offset | |||||||

| GHG emissions above detained EA | Loss/Provision using best estimate (when the estimate of GHG emissions exceeds the carrying amount of the EA held for purposes of compliance) (In the case of Portugal, before 1 January 2010, was prescribed the fair value for this measurement) | Loss/Liability using the close value of EA | Liability at acquisition cost for EA necessary to cover the GHG emissions | ||||

| 1 The Portuguese legislation (Comissão de Normalização Contabilística-CNC) is presented with two accounting treatments, due to the legislative amendment introduced for periods beginning on or after 1 January, 2010. The accounting treatment in force until 1 January, 2010, was introduced by Technical Interpretation (TI) 4. For periods after 1 January, 2010, Notice 15654/2009 of 7 September (modified by Notice 8256/2015 of July 29) changes the accounting treatment provided for in that TI. 2 The Spanish legislation (Instituto de Contabilidad y Auditoría de Cuentas-ICAC) is presented with two accounting treatments, due to the legislative amendment introduced for periods beginning on or after 1 January, 2016. The accounting treatment in force until January 1, 2016, was introduced by the Resolution of 8 February, 2006, and by the Resolution of 23 May, 2013. Royal Decree 602/2016 changes the accounting treatment of the aforementioned Resolutions, for periods starting from 1 January 2016, but only as regards the nature of the EA held to comply with the obligation to settle the GHG emissions incurred. 3 The French legislation (Autorité des Normes Comptables-ANC)is presented with two accounting treatments, due to the legislative amendment introduced for periods beginning on or after 1 January, 2013. The Avis nº 2004-C du 23 mars du Comité de urgence established the accounting treatment recommended until 1 January, 2013. Réglement no. 2012-03 of 4 Octobre 2012 changes the accounting treatment of GHG emission allowances and assimilated units, but the comparison refers only to the production model and excludes the trading model. 4 EA to be consumed after a period of one year shall be presented in a separated line. | |||||||

| Panel A—Accounting policies for recognition and measurement of EA and GHG emissions | |||||||

| Categorical variables | Abbreviation | ||||||

| I1. Initial recognition of EA | Rec EA | ||||||

| I2. Counterpart on the initial recognition of EA | Count EA | ||||||

| I3. Initial measurement of EA | Initial Meas EA | ||||||

| I4. Subsequent measurement of EA | Subseq Meas EA | ||||||

| I5. Recognition of GHG emissions | Rec GHG emissions | ||||||

| I6. Measurement of GHG emissions | Meas GHG emissions | ||||||

| I7. Recognition of GHG emissions over-allocated EA | Rec GHGe over EA | ||||||

| I8. Recognition of EA acquired to cover GHG emissions over cap | Rec EA acq | ||||||

| Panel B—Identification of Accounting Approaches | |||||||

| Approach | I1 | I2 | I3 | I4 | I5 | I6 | I7 |

| IFRIC3_cost | 1 | 3-5-6-7 | 3-4-5 | 3 | 3-6 | 4-7 | |

| GovGrant | 1 | 3-5-6-7 | 3-4-5 | 3 | 3-6 | 9-11-12-13 | |

| NetLiab | 1-6-7-99 | 7-0 | 1-2-3-4 | ||||

| Inventory | 2 | 1-6-7 | 1-6 | 2-3 | a 1-2-5-6-9-10-11-12-13 | ||

| ICAC | 1 | 1-7 | 3-4-5 | 3 | 3-6 | 4-5-6-10 | |

| AFRS26 b | 1 | 1-7 | 2-3-4-5 | 2-4 | 2 | ||

| NoRec | 99 | 99 | 7 | 5 | |||

| NoDisc | 0 | 0 | 0 | 0 | |||

| The accounting approach is a dichotomous variable, that takes the value 1 if it is identified by the joint answers of each categorical variable (I1 to I7)—representing accounting policies, and 0 otherwise. Each categorical variable may present one or more possibilities to be considered that a certain accounting approach is being adopted. The numbers showed below each categorical variable correspond to the category expressed on Appendix A. The abbreviations for the identified accounting approaches are as follows: IFRIC 3—cost model (IFRIC3_cost), government grant approach (GovGrant) as exposed by Ernst and Young [37], net liability approach (NetLiab), the French inventory approach (Inventory) as exposed by ANC in 2012, the Spanish approach exposed in Resolution 8 of February of 2006 (ICAC), the Portuguese approach exposed in the appendix to Accounting and Financial Reporting Standard (AFRS) 26 (hereafter AFRS26), the approach of disclosing off-balance sheet policies (NoRec), and the approach of non-disclosure of EA or GHG emissions (NoDisc). A I6 for inventory approach presents a variety of options in content analysis (1-2-5-6-9-10-11-12-13 in Appendix A), but there are only six observations that fulfil the previous criteria. It discloses I6 as the carrying amount of EA held. B I7 was not considered to identify the approach because the disclosure may not have happened if GHG emissions are below EA allocated for free and held for compliance. | |||||||

| Panel C—Indexes of the Disclosure | |||||||

| Variable | Type | Description | Measurement | ||||

| ID | Levels of transparency | Index of disclosure | Takes values from 0 to 8 (is the sum of I1.dummy to I8.dummy) | ||||

| ID.IFRS | Index of disclosure in an IFRS basis | ||||||

| ID.NatGAAP | Index of disclosure in a national GAAP basis | ||||||

| ID.EA | Levels of transparency—Good vs Bad news | Index of disclosure of good news | Takes values from 0 to 4 (is the sum of I1.dummy to I4.dummy for EA; is the sum of I5.dummy to I8.dummy for GHG emissions) | ||||

| ID.IFRS.EA | Index of disclosure of good news in IFRS | ||||||

| ID.NatGAAP.EA | Index of disclosure of good news in national GAAP | ||||||

| ID.eGHG | Index of disclosure of bad news | ||||||

| ID.IFRS.eGHG | Index of disclosure of bad news in IFRS | ||||||

| ID.NatGAAP.eGHG | Index of disclosure of bad news in national GAAP | ||||||

| BoPFS | Spain | France | Portugal | Total | ||||

|---|---|---|---|---|---|---|---|---|

| Freq | Perc | Freq | Perc | Freq | Perc | Freq | Perc | |

| IFRS | 215 | 72,88 | 73 | 82,95 | 68 | 41,21 | 356 | 64.96 |

| Spanish GAAP | 80 | 27,12 | 80 | 14.60 | ||||

| French GAAP | 15 | 17,05 | 15 | 2,74 | ||||

| Portuguese GAAP | 97 | 58,79 | 97 | 17.70 | ||||

| Total | 295 | 100,00 | 88 | 100,00 | 165 | 100,00 | 548 | 100.00 |

| Industry | Freq. | Percent |

|---|---|---|

| Aviation | 9 | 1.64 |

| Cement | 56 | 10.22 |

| Combustion | 231 | 42.15 |

| Pulp and paper | 102 | 18.61 |

| Production of electricity | 67 | 12.23 |

| Oil refineries | 6 | 1.09 |

| Steel | 42 | 7.66 |

| Glass | 35 | 6.39 |

| 548 | 100.00 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Milanés Montero, P.; Pérez Calderón, E.; Lourenço Dias, A.I. Transparency of Financial Reporting on Greenhouse Gas Emission Allowances: The Influence of Regulation. Int. J. Environ. Res. Public Health 2020, 17, 893. https://doi.org/10.3390/ijerph17030893

Milanés Montero P, Pérez Calderón E, Lourenço Dias AI. Transparency of Financial Reporting on Greenhouse Gas Emission Allowances: The Influence of Regulation. International Journal of Environmental Research and Public Health. 2020; 17(3):893. https://doi.org/10.3390/ijerph17030893

Chicago/Turabian StyleMilanés Montero, Patricia, Esteban Pérez Calderón, and Ana Isabel Lourenço Dias. 2020. "Transparency of Financial Reporting on Greenhouse Gas Emission Allowances: The Influence of Regulation" International Journal of Environmental Research and Public Health 17, no. 3: 893. https://doi.org/10.3390/ijerph17030893

APA StyleMilanés Montero, P., Pérez Calderón, E., & Lourenço Dias, A. I. (2020). Transparency of Financial Reporting on Greenhouse Gas Emission Allowances: The Influence of Regulation. International Journal of Environmental Research and Public Health, 17(3), 893. https://doi.org/10.3390/ijerph17030893