The Healthiness of Food and Beverages on Price Promotion at Promotional Displays: A Cross-Sectional Audit of Australian Supermarkets

Abstract

1. Introduction

2. Materials and Methods

2.1. Study Design and Sampling

2.2. Audit Tool

2.3. Data Collection

2.4. Data Management

2.5. Data Analysis

2.6. Ethical Approval

3. Results

3.1. Proportion of Food Display Space with Products on Price Promotion in Prominent Locations

3.1.1. End of Aisles

3.1.2. Island Bins

3.1.3. Checkouts

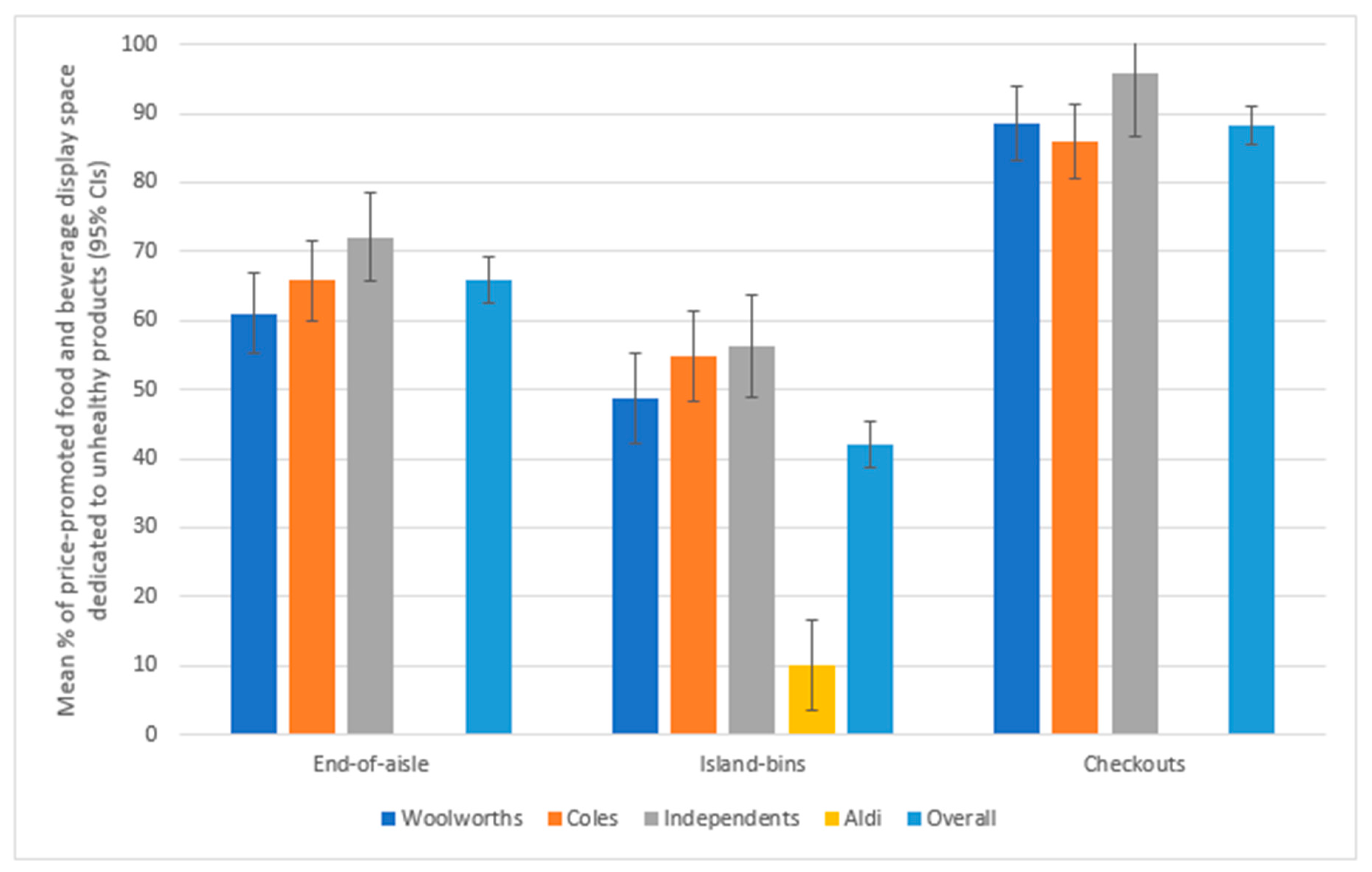

3.2. Proportion of Price-Promoted Food and Beverage Display Space Dedicated to Unhealthy Products in Prominent Locations

3.2.1. End of Aisles

3.2.2. Island Bins

3.2.3. Checkouts

3.3. Magnitude of Discount

3.3.1. End of Aisles

3.3.2. Island Bins

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

References

- Stanaway, J.D.; Afshin, A.; Gakidou, E.; Lim, S.S.; Abate, D.; Abate, K.H.; Abbafati, C.; Abbasi, N.; Abbastabar, H.; Abd-Allah, F.; et al. Global, regional, and national comparative risk assessment of 84 behavioural, environmental and occupational, and metabolic risks or clusters of risks for 195 countries and territories, 1990–2017: A systematic analysis for the Global Burden of Disease Study 2017. Lancet 2018, 392, 1923–1994. [Google Scholar] [CrossRef]

- Backholer, K.; Spencer, E.; Gearon, E.; Magliano, D.J.; McNaughton, S.A.; Shaw, J.E.; Peeters, A. The association between socio-economic position and diet quality in Australian adults. Public Health Nutr. 2016, 19, 477–485. [Google Scholar] [CrossRef] [PubMed]

- Stringhini, S.; Carmeli, C.; Jokela, M.; Avendaño, M.; Muennig, P.; Guida, F.; Ricceri, F.; d’Errico, A.; Barros, H.; Bochud, M.; et al. Socioeconomic status and the 25 × 25 risk factors as determinants of premature mortality: A multicohort study and meta-analysis of 1·7 million men and women. Lancet 2017, 389, 1229–1237. [Google Scholar] [CrossRef]

- Devaux, M.; Sassi, F. Social inequalities in obesity and overweight in 11 OECD countries. Eur. J. Public Health 2013, 23, 464–469. [Google Scholar] [CrossRef]

- Marmot, M.; Atkinson, T.; Bell, J.; Black, C.; Broadfoot, P.; Cumberlege, J.; Diamond, I.; Gilmore, I.; Ham, C.; Meacher, M.; et al. The Marmot review: Fair society, healthy lives. In Strategic Review of Health Inequalities in England Post-2010; IHE: London, UK, 2010. [Google Scholar]

- Swinburn, B.A.; Sacks, G.; Hall, K.D.; McPherson, K.; Finegood, D.T.; Moodie, M.L.; Gortmaker, S.L. The global obesity pandemic: Shaped by global drivers and local environments. Lancet 2011, 378, 804–814. [Google Scholar] [CrossRef]

- IBISWorld. Industry Insider. Available online: https://www.ibisworld.com/industry-insider/press-releases/checkout-update-q1-2018-ibisworld-reveals-the-state-of-play-in-the-supermarkets-and-grocery-stores-industry/ (accessed on 23 May 2019).

- Dawson, J. Retailer activity in shaping food choice. Food Qual. Prefer. 2013, 28, 339–347. [Google Scholar] [CrossRef]

- Nakamura, R.; Pechey, R.; Suhrcke, M.; Jebb, S.A.; Marteau, T.M. Sales impact of displaying alcoholic and non-alcoholic beverages in end-of-aisle locations: An observational study. Soc. Sci. Med. 2014, 108, 68–73. [Google Scholar] [CrossRef]

- Muruganantham, G.; Bhakat, R.S. A review of impulse buying behavior. Int. J. Mark. Stud. 2013, 5, 149. [Google Scholar]

- Chandon, P.; Wansink, B. Is food marketing making us fat? A multi-disciplinary review. Found. Trends Mark. 2011, 5, 113–196. [Google Scholar] [CrossRef]

- Blattberg, R.C.; Briesch, R.A. Sales promotion. In Oxford Handbook of Pricing Management; Oxford University Press: Oxford, UK, 2010. [Google Scholar]

- Neslin, S.A.; Van Heerde, H. Promotion dynamics. Found. Trends Mark. 2009, 3, 177–268. [Google Scholar] [CrossRef]

- Mackenbach, J.D.; Nelissen, K.G.; Dijkstra, S.C.; Poelman, M.P.; Daams, J.G.; Leijssen, J.B.; Nicolaou, M. A systematic review on socioeconomic differences in the association between the food environment and dietary behaviors. Nutrients 2019, 11, 2215. [Google Scholar] [CrossRef] [PubMed]

- Chandon, P.; Wansink, B. When are stockpiled products consumed faster? A convenience-salience framework of postpurchase consumption incidence and quantity. J. Mark. Res. 2002, 39, 321–335. [Google Scholar] [CrossRef]

- Spencer, S. Price Determination in the Australian Food Industry, A Report; Australian Government Department of Agriculture, Fisheries and Forestry: Canberra, Australia, 2004. [Google Scholar]

- Caristo, F. Experience, Not Price, Influences Store Choice. Available online: https://www.nielsen.com/au/en/insights/article/2019/experience-not-price-influences-store-choice/ (accessed on 3 September 2019).

- Crothers, L. Australia: Retail Food Sector Report 2017; USDA Foreign Agricultural Service: Washington, DC, USA, 2017. [Google Scholar]

- Ailawadi, K.L.; Beauchamp, J.P.; Donthu, N.; Gauri, D.K.; Shankar, V. Communication and promotion decisions in retailing: A review and directions for future research. J. Retail. 2009, 85, 42–55. [Google Scholar] [CrossRef]

- Pollock, S.; Signal, L.; Watts, C. Supermarket discounts: Are they promoting healthy non-alcoholic beverages? Nutr. Diet. 2009, 66, 101–107. [Google Scholar] [CrossRef]

- Powell, L.M.; Kumanyika, S.K.; Isgor, Z.; Rimkus, L.; Zenk, S.N.; Chaloupka, F.J. Price promotions for food and beverage products in a nationwide sample of food stores. Prev. Med. 2016, 86, 106–113. [Google Scholar] [CrossRef] [PubMed]

- Zorbas, C.; Gilham, B.; Boelsen-Robinson, T.; Blake, M.R.; Peeters, A.; Cameron, A.J.; Wu, J.H.; Backholer, K. The frequency and magnitude of price-promoted beverages available for sale in Australian supermarkets. Aust. N. Z. J. Public Health 2019, 43, 346–351. [Google Scholar] [CrossRef]

- Riesenberg, D.; Backholer, K.; Zorbas, C.; Sacks, G.; Paix, A.; Marshall, J.; Blake, M.R.; Bennett, R.; Peeters, A.; Cameron, A.J. Price Promotions by Food Category and Product Healthiness in an Australian Supermarket Chain, 2017–2018. Am. J. Public Health 2019, 109, 1434–1439. [Google Scholar] [CrossRef] [PubMed]

- Ravensbergen, E.A.; Waterlander, W.E.; Kroeze, W.; Steenhuis, I.H. Healthy or unhealthy on sale? A cross-sectional study on the proportion of healthy and unhealthy foods promoted through flyer advertising by supermarkets in The Netherlands. BMC Public Health 2015, 15, 470. [Google Scholar] [CrossRef]

- Exum, B.; Thompson, S.H.; Thompson, L. A pilot study of grocery store sales: Do low prices = high nutritional quality? Nutr. Food Sci. 2014, 44, 64. [Google Scholar] [CrossRef]

- SafeFood. What’s on Offer? The Types of Food and Drink on Price Promotion in Retail Outlets in the Republic of Ireland; Ulster University: Northern Ireland, UK, 2019. [Google Scholar]

- Kent, M.P.; Rudnicki, E.; Usher, C. Less healthy breakfast cereals are promoted more frequently in large supermarket chains in Canada. BMC Public Health 2017, 17, 877. [Google Scholar]

- Australian Bureau of Statistics. Australian Statistical Geography Standard (ASGS): Volume 1—Main Structure and Greater Capital City Statistical Areas. Available online: https://www.abs.gov.au/ausstats/abs@.nsf/Lookup/by%20Subject/1270.0.55.001~July%202016~Main%20Features~Statistical%20Area%20Level%202%20(SA2)~10014 (accessed on 23 May 2019).

- Australian Bureau of Statistics. Technical Paper: Socio-Economic Indexes for Areas (SEIFA); Australian Bureau of Statistics: Canberra, Australia, 2016.

- Schultz, S.; Cameron, A.; Grigsby-Duffy, L.; Robinson, E.; Marshall, J.; Orellana, L.; Sacks, G. Availability and placement of healthy and discretionary food in Australian supermarkets by chain and level of socioeconomic disadvantage. Public Health Nutr. 2020, 14, 1–12. [Google Scholar] [CrossRef] [PubMed]

- Vandevijvere, S.; Mackenzie, T.; Mhurchu, C.N. Indicators of the relative availability of healthy versus unhealthy foods in supermarkets: A validation study. Int. J. Behav. Nutr. Phys. Act. 2017, 14, 53. [Google Scholar] [CrossRef] [PubMed]

- National Health and Medical Research Council. Australian Dietary Guidelines; National Health and Medical Research Council: Canberra, Australia, 2013.

- Australian Bureau of Statistics. Australian Health Survey: Users’ Guide, 2011–2013. Available online: http://www.abs.gov.au/ausstats/abs@.nsf/Lookup/4363.0.55.001Chapter65062011-13 (accessed on 1 November 2019).

- Wesfarmers. 2019 First Quarter Retail Sales Results; Wesfarmers Limited: Perth, Australia, 2019. [Google Scholar]

- Power Retail. Woolworths Growth Hits Two-Year Low. 2018. Available online: https://powerretail.com.au/news/woolworths-growth-slows/ (accessed on 1 January 2020).

- Lee, A.J.; Kane, S.; Ramsey, R.; Good, E.; Dick, M. Testing the price and affordability of healthy and current (unhealthy) diets and the potential impacts of policy change in Australia. BMC Public Health 2016, 16, 315. [Google Scholar] [CrossRef] [PubMed]

- Love, P.; Whelan, J.; Bell, C.; Grainger, F.; Russell, C.; Lewis, M.; Lee, A. Healthy Diets in Rural Victoria—Cheaper than Unhealthy Alternatives, yet Unaffordable. Int. J. Environ. Res. Public Health 2018, 15, 2469. [Google Scholar] [CrossRef] [PubMed]

- Zorbas, C.; Lee, A.; Peeters, A.; Lewis, M.; Landrigan, T.; Backholer, K. Streamlined data-gathering techniques to estimate the price and affordability of healthy and unhealthy diets under different pricing scenarios. Public Health Nutr. 2020, 14, 1–11. [Google Scholar] [CrossRef]

- Zorbas, C.; Palermo, C.; Chung, A.; Iguacel, I.; Peeters, A.; Bennett, R.; Backholer, K. Factors perceived to influence healthy eating: A systematic review and meta-ethnographic synthesis of the literature. Nutr. Rev. 2018, 76, 861–874. [Google Scholar] [CrossRef]

- Darmon, N.; Drewnowski, A. Contribution of food prices and diet cost to socioeconomic disparities in diet quality and health: A systematic review and analysis. Nutr. Rev. 2015, 73, 643–660. [Google Scholar] [CrossRef]

- Australian Institute of Health and Welfare. Rural & Remote Health. Available online: https://www.aihw.gov.au/reports/rural-remote-australians/rural-remote-health (accessed on 1 May 2020).

- Peeters, A. Obesity and the future of food policies that promote healthy diets. Nat. Rev. Endocrinol. 2018, 14, 430–437. [Google Scholar] [CrossRef]

- Bennett, R.; Zorbas, C.; Huse, O.; Peeters, A.; Cameron, A.J.; Sacks, G.; Backholer, K. Prevalence of healthy and unhealthy food and beverage price promotions and their potential influence on shopper purchasing behaviour: A systematic review of the literature. Obes. Rev. 2020, 21, e12948. [Google Scholar] [CrossRef]

- Shaw, S.C.; Ntani, G.; Baird, J.; Vogel, C.A. A systematic review of the influences of food store product placement on dietary-related outcomes. Nutr. Rev. 2020. [Google Scholar] [CrossRef]

- Cadario, R.; Chandon, P. Which Healthy Eating Nudges Work Best? A Meta-Analysis of Field Experiments. Mark. Sci. 2020, 39, 465–486. [Google Scholar] [CrossRef]

- Brimblecombe, J.; McMahon, E.; Ferguson, M.; De Silva, K.; Peeters, A.; Miles, E.; Wycherley, T.; Minaker, L.; Greenacre, L.; Gunther, A. Effect of restricted retail merchandising of discretionary food and beverages on population diet: A pragmatic randomised controlled trial. Lancet Planet. Health 2020, 4, e463–e473. [Google Scholar] [CrossRef]

- Ananthapavan, J.; Sacks, G.; Brown, V.; Moodie, M.; Nguyen, P.; Barendregt, J.; Veerman, L.; Mantilla Herrera, A.M.; Lal, A.; Peeters, A.; et al. Restrictions on price promotions of sugar-sweetened beverages. In ACE-Obesity Policy 2018: Assessing Cost-Effectiveness of Obesity Prevention Policies in Australia; Deakin University: Melbourne, Australia, 2018. [Google Scholar]

- Zeviani, R. Pricing for Profit: How to Improve Margins in a Highly Price-Sensitive Market. Available online: https://www.nielsen.com/au/en/insights/article/2018/pricing-for-profit-how-to-improve-margins-in-a-highly-price-sensitive-market/ (accessed on 1 September 2019).

- World Cancer Research Fund International. Nourishing Framework. Available online: https://www.wcrf.org/int/policy/nourishing/our-policy-framework-promote-healthy-diets-reduce-obesity (accessed on 8 August 2019).

- Informas. Benchmarking Food Environments. Available online: https://www.informas.org/about-informas/ (accessed on 8 August 2019).

- World Health Organization. Taking Action on Childhood Obesity Report; World Obesity Federation & World Health Organization: Geneva, Switzerland, 2018. [Google Scholar]

- World Health Organization. Global Action Plan for the Prevention and Control of Noncommunicable Diseases 2013–2020; World Health Organization: Geneva, Switzerland, 2013. [Google Scholar]

- World Health Organization. Using Price Policies to Promote Healthier Diets; World Health Organization: Copenhagen, Denmark, 2015. [Google Scholar]

- UK Department of Health & Social Care. Tackling Obesity: Empowering Adults and Children to Live Healthier Lives; Policy paper; Gov.uk: London, UK, 2020.

| End of Aisle | Island Bins 3 | Checkouts | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Supermarket Group | Mean % of Display Space Devoted to Food and Beverages (SD) | Mean % of Food and Beverage Display Space Price Promoted (SD) | Mean % of Price Promotions That Were Temporary 1 (SD) | Mean % of Price Promotions That Were Permanent 2 (SD) | Mean % of Food and Beverage Display Space Price Promoted (SD) | Mean % of Price Promotions That Were Temporary (SD) | Mean % of Price Promotions That Were Permanent (SD) | Mean % of Display Space Devoted to Food and Beverages (SD) | Mean % of Food and Beverage Display Space Price Promoted (SD) | Mean % of Price Promotions That Were Temporary (SD) | Mean % of Price Promotions That Were Permanent (SD) | ||||||

| All | DISCOUNTS | Multi-Buys | Fresh Specials | All | Discounts | Multi-Buys | Fresh Special | ||||||||||

| Woolworths | 58.2 (1.2) | 91.1 (1.3) | 82.6 (1.5) | 78.7 (1.5) | 0.5 (2.4) | 3.4 (0.5) | 17.4 (1.5) | 71.6 (1.6) | 83.4 (1.5) | 60.6 (1.9) | 3.3 (0.4) | 19.5 (1.5) | 16.6 (1.5) | 46.2 (2.3) | 61.7 (3.5) | 73.8 (3.9) | 26.2 (3.9) |

| Coles | 63.9 (1.3) | 83.7 (1.3) | 87.0 (2.0) | 77.4 (2.4) | 9.2 (1.2) | 0.3 (0.3) | 13.0 (2.0) | 63.2 (2.7) | 76.0 (2.1) | 39.5 (2.6) | 20.0 (1.3) | 16.4 (1.9) | 24.0 (2.1) | 52.4 (3.4) | 68.6 (4.0) | 79.3 (3.8) | 20.7 (3.8) |

| ALDI | 64.8 (2.3) | 3.4 (1.8) | 100 (0) | 90.7 (9.3) | 0 | 9.3 (9.3) | 0 | 26.7 (2.2) | 100 (0) | 23.3 (6.3) | 0 | 76.7 (6.3) | 0 | 54.9 (2.8) | 0.3 (0.3) | 100 (0) | 0 |

| Independents | 58.1 (4.7) | 46.1 (6.4) | 81.2 (7.3) | 69.4 (8.7) | 11.9 (5.6) | 0 | 18.8 (7.3) | 34.4 (5.8) | 88.3 (5.7) | 66.5 (7.7) | 13.4 (4.9) | 8.5 (3.0) | 11.7 (5.7) | 65.0 (4.8) | 16.0 (4.8) | 90.0 (10.0) | 10.0 (10.0) |

| Overall | 61.3 (1.4) | 56.1 (3.8) | 85.7 (2.1) | 77.4 (2.7) | 6.0 (1.6) | 2.3 (1.1) | 14.3 (2.1) | 49.0 (2.5) | 86.7 (1.6) | 46.6 (2.9) | 9.0 (1.3) | 31.1 (3.3) | 13.3 (1.6) | 54.6 (1.8) | 36.6 (3.4) | 79.1 (2.8) | 20.9 (2.8) |

| End of Aisle 1 | Island Bins | Checkouts 1 | |||||

|---|---|---|---|---|---|---|---|

| Supermarket Group, SEP | No. of Stores | Mean % of Food and Beverage Display Space Price Promoted (95% CIs) | Mean % of Price-Promoted Food and Beverage Display Space Dedicated to Unhealthy Products (95% CIs) | Mean % of Food and Beverage Display Space Price Promoted (95% CIs) | Mean % of Price-Promoted Food and Beverage Display Space Dedicated to Unhealthy Products (95% CIs) | Mean % of Food and Beverage Display Space Price Promoted (95% CIs) | Mean % of Price-Promoted Food and Beverage Display Space Dedicated to Unhealthy Products (95% CIs) |

| Woolworths | 26 | 91.1 (82.7, 99.5) | 61.0 (55.2, 66.8) | 71.6 (64.8, 78.3) | 48.8 (42.3, 55.3) | 61.7 (53.3, 70.0) | 88.5 (83.1, 94.0) |

| Q1 | 10 | 93.1 (82.1, 100) | 62.3 (52.9, 71.6) | 70.2 (59.3, 81.0) | 50.9 (40.5, 61.4) | 56.7 (43.2, 70.2) | 88.2 (81.0, 95.3) |

| Q2–Q5 | 16 | 89.8 (81.1, 98.6) | 60.2 (52.8, 67.6) | 72.4 (63.8, 81.0) | 47.5 (39.2, 55.8) | 64.8 (54.2, 75.4) | 88.8 (83.1, 94.4) |

| Coles | 26 | 83.7 (75.3, 92.2) | 65.8 (60.0, 71.6) | 63.2 (56.4, 69.9) | 54.9 (48.5, 61.4) | 68.6 (60.2, 76.9) | 85.9 (80.5, 91.3) |

| Q1 | 10 | 84.7 (73.6, 95.8) | 62.0 (52.7, 71.3) | 68.4 (57.5, 79.2) | 57.3 (46.8, 67.7) | 68.3 (54.9, 81.8) | 92.5 (85.4, 99.7) |

| Q2–Q5 | 16 | 83.1 (74.4, 91.9) | 68.2 (60.9, 75.6) | 59.9 (51.4, 68.5) | 53.5 (45.2, 61.7) | 68.7 (58.1, 79.4) | 81.4 (75.8, 87.1) |

| Aldi | 26 | n/a | n/a | 26.7 (19.9, 33.4) | 10.1 (3.5, 16.8) | n/a | n/a |

| Q1 | 10 | n/a | n/a | 21.2 (10.3, 32.0) | 14.2 (3.2, 25.3) | n/a | n/a |

| Q2–Q5 | 16 | n/a | n/a | 30.1 (21.5, 38.7) | 7.8 (0, 16.1) | n/a | n/a |

| Independents | 26 | 46.1 (37.7, 54.5) | 72.1 (65.7, 78.6) | 34.4 (27.7, 41.2) | 56.2 (48.8, 63.6) | 16.0 (7.6, 24.3) | 95.7 (86.7, 100) |

| Q1 | 10 | 66.2 (55.1, 77.3) | 73.9 (64.5, 83.2) | 45.4 (34.6, 56.3) | 55.3 (44.3, 66.3) | 19.1 (5.6, 32.5) | 89.3 (79.2, 99.4) |

| Q2–Q5 | 16 | 33.5 (24.7, 42.3) | 70.5 (61.6, 79.4) | 27.5 (19.0, 36.1) | 57.0 (47.0, 67.0) | 14.1 (3.4, 24.7) | 100 (89.9, 100) |

| Overall | 104 | 73.6 (69.7, 77.6) * | 65.9 (62.5, 69.4) | 49.0 (45.6, 52.3) * | 42.0 (38.7, 45.4) | 48.7 (43.9, 53.6) | 88.3 (85.5, 91.2) * |

| Q1 | 40 | 81.4 (74.0, 88.7) | 66.0 (60.6, 71.4) | 51.3 (45.9, 56.7) | 44.9 (39.6, 50.3) | 48.0 (40.3, 55.8) | 90. 2 (85.0, 95.4) |

| Q2–Q5 | 64 | 68.8 (63.0, 74.6) | 65.8 (61.3, 70.3) | 47.5 (43.2, 51.8) | 40.1 (35.8, 44.4) | 49.2 (43.1, 55.3) | 87.5 (83.2, 91.8) |

| Mean Proportion (%) of Price-Promoted Food and Beverage Display Space Dedicated to Unhealthy Products (95% CIs) | ||||

|---|---|---|---|---|

| Supermarket Group, SEP | Island Bins near Checkouts | Island Bins near End of Aisles 1 | Island Bins near Entrance 1 | Island Bins Elsewhere in Store |

| Woolworths | 80.9 (71.8, 89.9) | 65.9 (54.2, 77.5) | 19.4 (8.3, 30.5) | 50.2 (40.6, 59.9) |

| Q1 | 85.9 (71.3, 100) | 67.4 (49.6, 85.3) | 15.2 (0, 33.1) | 54.7 (39.1, 70.2) |

| Q2–Q5 | 77.7 (66.2, 89.3) | 64.7 (49.2, 80.1) | 22.0 (7.9, 36.1) | 47.5 (35.2, 59.7) |

| Coles | 82.4 (73.1, 91.6) | 81.3 (70.4, 92.2) | 19.3 (8.0, 30.6) | 44.3 (34.7, 53.9) |

| Q1 | 86.2 (71.6, 100) | 77.2 (60.2, 94.1) | 14.6 (0, 32.5) | 59.3 (43.8, 74.9) |

| Q2–Q5 | 79.8 (67.9, 91.7) | 84.3 (70.0, 98.6) | 22.4 (7.8, 37.0) | 34.9 (22.6, 47.2) |

| Aldi | 66.1 (53.7, 78.4) | n/a | n/a | 13.7 (1.8, 25.7) |

| Q1 | 91.7 (68.6, 100) | n/a | n/a | 31.7 (9.8, 53.7) |

| Q2–Q5 | 65.6 (48.2, 83.1) | n/a | n/a | 6.3 (0, 20.4) |

| Independents | 75.1 (61.2, 89.0) | 65.0 (49.6, 80.5) | 38.5 (23.3, 53.6) | 50.1 (38.5, 61.7) |

| Q1 | 75.1 (56.2, 93.9) | 57.0 (35.1, 78.8) | 19.6 (0, 44.9) | 52.8 (36.5, 69.2) |

| Q2–Q5 | 59.3 (43.0, 75.6) | 73.0 (51.2, 94.9) | 48.9 (30.1, 67.8) | 47.4 (31.0, 63.8) |

| Overall | 77.8 (72.5, 83.1) | 72.2 (65.1, 79.3) | 23.5 (16.4, 30.5) | 41.3 (36.0, 46.6) |

| Q1 | 84.6 (76.2, 93.0) * | 68.8 (58.1, 79.5) | 15.9 (4.5, 27.2) | 52.2 (43.8, 60.6) * |

| Q2–Q5 | 73.4 (66.5, 80.2) | 74.8 (65.4, 84.3) | 28.2 (19.3, 37.2) | 34.3 (27.6, 41.1) |

| End-of-Aisle 1 | Island Bins | |||||||

|---|---|---|---|---|---|---|---|---|

| Supermarket Group, SEP | Mean Magnitude of Discount (95% CIs), % | Mean Magnitude of Discount on Unhealthy Products (95% CIs), % | Mean Magnitude of Discount on Healthy Products (95% CIs), % | Mean Difference in Magnitude of Discount between Healthy and Unhealthy Products (95% CIs), % | Mean Magnitude of Discount (95% CIs), % | Mean Magnitude of Discount on Unhealthy Products (95% CIs), % | Mean Magnitude of Discount on Healthy Products (95% CIs), % | Mean Difference in Magnitude of Discount between Healthy and Unhealthy Products (95% CIs), % |

| Woolworths | 39.4 (37.0, 41.9) | 40.3 (37.6, 42.9) | 38.4 (35.4, 41.4) | −1.9 (−4.6, 0.8) | 34.7 (32.2, 37.3) | 34.0 (31.2, 36.9) | 35.8 (33.0, 38.7) | 1.8 (−0.6, 4.2) |

| Q1 | 40.7 (36.8, 44.2) | 40.4 (36.1, 44.7) | 41.3 (36.6, 46.1) | 1.0 (−3.4, 5.3) | 34.1 (30.0, 38.3) | 32.8 (28.2, 37.4) | 36.9 (32.3, 41.5) | 4.1 (0.2, 8.0) |

| Q2−Q5 | 38.6 (35.6, 41.7) | 40.2 (36.8, 43.6) | 36.5 (32.7, 40.3) | −3.7 (−7.1, −0.3) | 35.1 (31.8, 38.4) | 34.8 (31.2, 38.4) | 35.2 (31.5, 38.8) | 0.4 (−2.7, 3.5) |

| Coles | 38.9 (36.5, 41.3) | 38.3 (35.7, 41.0) | 40.6 (37.6, 43.5) | 2.2 (−0.5, 4.9) | 30.1 (27.6, 32.7) | 28.5 (25.7, 31.4) | 33.8 (30.9, 36.7) | 5.2 (2.8, 7.7) |

| Q1 | 38.9 (35.0, 42.8) | 38.1 (33.8, 42.4) | 40.7 (35.9, 45.5) | 2.6 (−1.7, 7.0) | 29.8 (25.6, 33.9) | 27.7 (23.1, 32.3) | 34.8 (29.9, 39.6) | 6.8 (2.9, 10.8) |

| Q2−Q5 | 38.9 (35.8, 42.0) | 38.5 (35.1, 41.9) | 40.5 (36.7, 44.2) | 2.0 (−1.5, 5.4) | 30.3 (27.1, 33.6) | 29.1 (25.4, 32.7) | 33.3 (29.6, 36.9) | 4.2 (1.1, 7.3) |

| Aldi | n/a | n/a | n/a | n/a | 31.6 (28.6, 34.7) | 32.9 (29.3, 36.5) | 31.2 (27.3, 35.1) | −0.6 (−3.5, 2.3) |

| Q1 | n/a | n/a | n/a | n/a | 28.5 (23.6, 33.5) | 27.8 (22.4, 33.3) | 29.1 (22.6, 35.7) | 1.3 (−3.3, 6.0) |

| Q2−Q5 | n/a | n/a | n/a | n/a | 33.6 (29.7, 37.6) | 36.8 (32.0, 41.7) | 32.3 (27.5, 37.2) | −1.8 (−5.5, 1.9) |

| Independents | 30.4 (27.7, 33.2) | 31.2 (28.2, 34.2) | 33.2 (29.4, 36.9) | 0.3 (−2.8, 3.3) | 29.0 (26.1, 31.9) | 30.8 (27.6, 34.1) | 27.6 (23.8, 31.4) | −2.9 (−5.7, −0.1) |

| Q1 | 33.1 (29.0, 37.3) | 32.9 (28.4, 37.4) | 33.4 (27.7, 39.2) | 0 (−4.6, 4.5) | 30.9 (26.6, 35.3) | 32.8 (27.9, 37.6) | 27.0 (21.8, 32.2) | −3.2 (−7.3, 0.9) |

| Q2−Q5 | 28.2 (24.5, 31.9) | 29.8 (25.7, 33.9) | 32.9 (28.0, 38.0) | 0.5 (−3.6, 4.6) | 27.4 (23.5, 31.4) | 29.3 (23.0, 35.5) | 28.3 (22.8, 33.8) | −2.6 (−6.4, 1.1) |

| Overall | 36.7 (35.3, 38.2) | 37.1 (35.5, 38.7) | 38.0 (36.1, 39.8) | 0.2 (−1.4, 1.8) | 31.5 (30.1, 32.9) | 31.5 (24.9, 33.6) | 32.8 (31.2, 34.5) | 1.3 (0, 2.6) |

| Q1 | 37.7 (35.4, 40.0) | 37.3 (34.7, 39.8) | 39.1 (36.2, 42.0) | 1.2 (−1.3, 3.8) | 31.0 (28.9, 33.2) | 30.4 (28.0, 32.8) | 32.6 (30.0, 35.2) | 2.5 (0.4, 4.6) |

| Q2−Q5 | 36.1 (34.2, 38.0) | 36.9 (34.8, 39.0) | 37.3 (34.9, 39.6) | −0.5 (−2.6, 1.7) | 31.8 (30.0, 33.6) | 32.2 (30.2, 34.2) | 33.0 (30.9, 35.1) | 0.5 (−1.2, 2.1) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Grigsby-Duffy, L.; Schultz, S.; Orellana, L.; Robinson, E.; Cameron, A.J.; Marshall, J.; Backholer, K.; Sacks, G. The Healthiness of Food and Beverages on Price Promotion at Promotional Displays: A Cross-Sectional Audit of Australian Supermarkets. Int. J. Environ. Res. Public Health 2020, 17, 9026. https://doi.org/10.3390/ijerph17239026

Grigsby-Duffy L, Schultz S, Orellana L, Robinson E, Cameron AJ, Marshall J, Backholer K, Sacks G. The Healthiness of Food and Beverages on Price Promotion at Promotional Displays: A Cross-Sectional Audit of Australian Supermarkets. International Journal of Environmental Research and Public Health. 2020; 17(23):9026. https://doi.org/10.3390/ijerph17239026

Chicago/Turabian StyleGrigsby-Duffy, Lily, Sally Schultz, Liliana Orellana, Ella Robinson, Adrian J. Cameron, Josephine Marshall, Kathryn Backholer, and Gary Sacks. 2020. "The Healthiness of Food and Beverages on Price Promotion at Promotional Displays: A Cross-Sectional Audit of Australian Supermarkets" International Journal of Environmental Research and Public Health 17, no. 23: 9026. https://doi.org/10.3390/ijerph17239026

APA StyleGrigsby-Duffy, L., Schultz, S., Orellana, L., Robinson, E., Cameron, A. J., Marshall, J., Backholer, K., & Sacks, G. (2020). The Healthiness of Food and Beverages on Price Promotion at Promotional Displays: A Cross-Sectional Audit of Australian Supermarkets. International Journal of Environmental Research and Public Health, 17(23), 9026. https://doi.org/10.3390/ijerph17239026