Financial Attributes, Environmental Performance, and Environmental Disclosure in China

Abstract

1. Introduction

2. Theoretical Literature Review

2.1. Environmental Disclosure Theory

2.2. Empirical Literature Review and Hypothesis Development

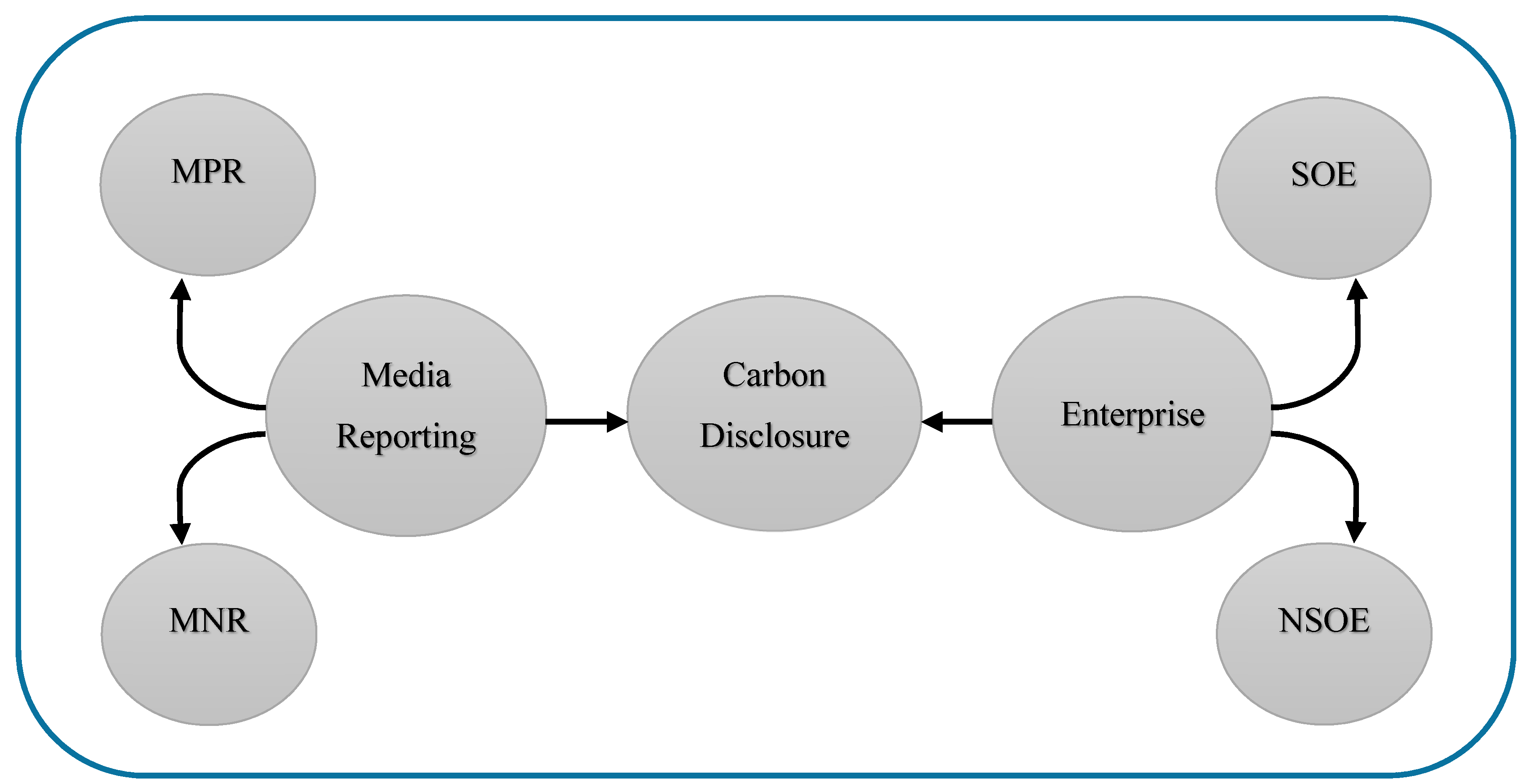

2.3. Carbon Information Disclosure and External Pressure

3. Research Design

3.1. Variable Explanations and Methodology

3.2. Models

4. Empirical Results and Discussion

4.1. Descriptive Statistics

4.2. Pearson Coefficient Correlation

4.3. Regression Analysis

4.4. Interaction between SOE Pressure and NSOE Pressure on Carbon Information Disclosure

4.5. Control of Heteroscedasticity

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Kohl, W.L. Consumer country energy cooperation: The International Energy Agency and the global energy order. In Global Energy Governance: The New Rules of the Game; Brookings Institution Press: Washington, DC, USA, 2010; pp. 195–220. [Google Scholar]

- Shealy, M.; Dorian, J.P. Growing Chinese coal use: Dramatic resource and environmental implications. Energy Policy 2010, 38, 2116–2122. [Google Scholar] [CrossRef]

- Mancheri, N.A.; Sprecher, B.; Bailey, G.; Ge, J.; Tukker, A. Effect of Chinese policies on rare earth supply chain resilience. Resour. Conserv. Recycl. 2019, 142, 101–112. [Google Scholar] [CrossRef]

- Wen, F.; Ye, Z.; Yang, H.; Li, K. Exploring the rebound effect from the perspective of household: An analysis of China’s provincial level. Energy Econ. 2018, 75, 345–356. [Google Scholar] [CrossRef]

- Xiao, J.; Zhou, M.; Wen, F.; Wen, F. Asymmetric impacts of oil price uncertainty on Chinese stock returns under different market conditions: Evidence from oil volatility index. Energy Econ. 2018, 74, 777–786. [Google Scholar] [CrossRef]

- Luo, L.; Tang, Q. Does voluntary carbon disclosure reflect underlying carbon performance? J. Contemp. Account. Econ. 2014, 10, 191–205. [Google Scholar] [CrossRef]

- Luo, L.; Lan, Y.C.; Tang, Q. Corporate incentives to disclose carbon information: Evidence from the CDP Global 500 report. J. Int. Financ. Manag. Account. 2012, 23, 93–120. [Google Scholar] [CrossRef]

- Li, D.; Huang, M.; Ren, S.; Chen, X.; Ning, L. Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. J. Bus. Ethics 2018, 150, 1089–1104. [Google Scholar] [CrossRef]

- Huixiang, Z.; Tao, Z.; Zhifang, Z.; Yang, Z.; Xiaohong, C. Water disclosure and firm risk: Empirical evidence from highly water-sensitive industries in China. Bus. Strategy Environ. 2020, 29, 17–38. [Google Scholar]

- Hui-Cheng, Y.; Lopin, K.; Beiling, M. The drivers of carbon disclosure: Evidence from China’s sustainability plans. Carbon Manag. 2020, 11, 399–414. [Google Scholar]

- He, P.; Shen, H.; Zhang, Y.; Ren, J. External pressure, corporate governance, and voluntary carbon disclosure: Evidence from China. Sustainability 2019, 11, 2901. [Google Scholar] [CrossRef]

- Xiang, X.; Liu, C.; Yang, M.; Zhao, X. Confession or justification: The effects of environmental disclosure on corporate green innovation in China. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2735–2750. [Google Scholar] [CrossRef]

- Kleinschmit, D.; Krott, M. The media in forestry: Government, governance and social visibility. In Public and Private in Natural Resource Governance: A False Dichotomy; Earthscan: London, UK, 2008; pp. 127–141. [Google Scholar]

- Meng, X.; Zeng, S.; Shi, J.J.; Qi, G.; Zhang, Z. The relationship between corporate environmental performance and environmental disclosure: An empirical study in China. J. Environ. Manag. 2014, 145, 357–367. [Google Scholar] [CrossRef]

- Tang, Q.; Luo, L. Carbon management systems and carbon mitigation. Aust. Account. Rev. 2014, 24, 84–98. [Google Scholar] [CrossRef]

- Patten, D.M. The relation between environmental performance and environmental disclosure: A research note. Account. Organ. Soc. 2002, 27, 763–773. [Google Scholar] [CrossRef]

- Al-Tuwaijri, S.A.; Christensen, T.E.; Hughes Ii, K. The relations among environmental disclosure, environmental performance, and economic performance: A simultaneous equations approach. Account. Organ. Soc. 2004, 29, 447–471. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Wiseman, J. An evaluation of environmental disclosures made in corporate annual reports. Account. Organ. Soc. 1982, 7, 53–63. [Google Scholar] [CrossRef]

- Bewley, K.; Li, Y. Disclosure of environmental information by Canadian manufacturing companies: A voluntary disclosure perspective. Adv. Environ. Account. Manag. 2000, 1, 201–226. [Google Scholar]

- Cotter, J.; Najah, M.M. Institutional investor influence on global climate change disclosure practices. Aust. J. Manag. 2012, 37, 169–187. [Google Scholar] [CrossRef]

- Rankin, M.; Windsor, C.; Wahyuni, D. An investigation of voluntary corporate greenhouse gas emissions reporting in a market governance system. Account. Audit. Account. 2011, 24, 1037–1070. [Google Scholar] [CrossRef]

- Tauringana, V.; Chithambo, L. The effect of DEFRA guidance on greenhouse gas disclosure. Br. Account. Rev. 2015, 47, 425–444. [Google Scholar] [CrossRef]

- Dragomir, V.D. The disclosure of industrial greenhouse gas emissions: A critical assessment of corporate sustainability reports. J. Clean. Prod. 2012, 29, 222–237. [Google Scholar] [CrossRef]

- Griffin, P.A.; Lont, D.H.; Sun, E.Y. The relevance to investors of greenhouse gas emission disclosures. Contemp. Account. Res. 2017, 34, 1265–1297. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Pinnuck, M.; Richardson, G.D. The valuation relevance of greenhouse gas emissions under the European Union carbon emissions trading scheme. Eur. Account. Rev. 2015, 24, 551–580. [Google Scholar] [CrossRef]

- Blanco, C.; Caro, F.; Corbett, C.J. The state of supply chain carbon footprinting: Analysis of CDP disclosures by US firms. J. Clean. Prod. 2016, 135, 1189–1197. [Google Scholar] [CrossRef]

- Depoers, F.; Jeanjean, T.; Jérôme, T. Voluntary disclosure of greenhouse gas emissions: Contrasting the carbon disclosure project and corporate reports. J. Bus. Ethics 2016, 134, 445–461. [Google Scholar] [CrossRef]

- Guo, X.; Ren, D.; Shi, J. Carbon emissions, logistics volume and GDP in China: Empirical analysis based on panel data model. Environ. Sci. Pollut. Res. 2016, 23, 24758–24767. [Google Scholar] [CrossRef]

- Gonzalez-Gonzalez, J.M.; Ramírez, C.Z. Voluntary carbon disclosure by Spanish companies: An empirical analysis. Int. J. Clim. Chang. Strateg. Manag. 2016, 8, 57–79. [Google Scholar] [CrossRef]

- Kalu, J.U.; Buang, A.; Aliagha, G.U. Determinants of voluntary carbon disclosure in the corporate real estate sector of Malaysia. J. Environ. Manag. 2016, 182, 519–524. [Google Scholar] [CrossRef]

- Liu, X.; Anbumozhi, V. Determinant factors of corporate environmental information disclosure: An empirical study of Chinese listed companies. J. Clean. Prod. 2009, 17, 593–600. [Google Scholar] [CrossRef]

- Dyck, I.; Zingales, L. The Corporate Governance Role of the Media; CEPR Discussion Papers; CEPR: London, UK, 2002. [Google Scholar]

- Vida, G.-B.; Grant, S. BP’s use of posture to respond to the Deepwater Horizon crisis. J. Econ. Financ. Sci. 2013, 6, 359–382. [Google Scholar]

- Aerts, W.; Cormier, D. Media legitimacy and corporate environmental communication. Account. Organ. Soc. 2009, 34, 1–27. [Google Scholar] [CrossRef]

- Beatty, T.; Shimshack, J.P. The impact of climate change information: New evidence from the stock market. BE J. Econ. Anal. Policy 2010, 10. [Google Scholar] [CrossRef]

- Dong, F.; Long, R.; Yu, B.; Wang, Y.; Li, J.; Wang, Y.; Dai, Y.; Yang, Q.; Chen, H. How can China allocate CO2 reduction targets at the provincial level considering both equity and efficiency? Evidence from its Copenhagen Accord pledge. Resour. Conserv. Recycl. 2018, 130, 31–43. [Google Scholar] [CrossRef]

- Chen, J.C.; Cho, C.H.; Patten, D.M. Initiating disclosure of environmental liability information: An empirical analysis of firm choice. J. Bus. Ethics 2014, 125, 681–692. [Google Scholar] [CrossRef]

- Busch, T.; Hoffmann, V.H. How hot is your bottom line? Linking carbon and financial performance. J. Bus. Soc. 2011, 50, 233–265. [Google Scholar] [CrossRef]

- Bhattacharya, U.; Daouk, H.; Welker, M. The world price of earnings opacity. Account. Rev. 2003, 78, 641–678. [Google Scholar] [CrossRef]

- Lang, M.; Lundholm, R. Cross-sectional determinants of analyst ratings of corporate disclosures. J. Account. Res. 1993, 31, 246–271. [Google Scholar] [CrossRef]

- Lang, M.H.; Lundholm, R.J. Corporate disclosure policy and analyst behavior. Account. Rev. 1996, 71, 467–492. [Google Scholar]

- Barry, C.B.; Brown, S.J. Differential information and the small firm effect. J. Financ. Econ. 1984, 13, 283–294. [Google Scholar] [CrossRef]

- Handa, P.; Linn, S.C. Arbitrage pricing with estimation risk. J. Financ. Quant. Anal. 1993, 28, 81–100. [Google Scholar] [CrossRef]

- Doan, M.H.; Sassen, R. The relationship between environmental performance and environmental disclosure: A meta-analysis. J. Ind. Ecol. 2020, 24, 1140–1157. [Google Scholar] [CrossRef]

- Pollach, I. Corporate environmental reporting and news coverage of environmental issues: An agenda-setting perspective. Bus. Strategy Environ. 2014, 23, 349–360. [Google Scholar] [CrossRef]

- Brambilla, I.; Hale, G.; Long, C. Foreign direct investment and the incentives to innovate and imitate. Scand. J. Econ. 2009, 111, 835–861. [Google Scholar] [CrossRef]

- Deephouse, D.L. Media reputation as a strategic resource: An integration of mass communication and resource-based theories. J. Manag. 2000, 26, 1091–1112. [Google Scholar] [CrossRef]

- Islam, M.A.; Deegan, C. Media pressures and corporate disclosure of social responsibility performance information: A study of two global clothing and sports retail companies. Account. Bus. Res. 2010, 40, 131–148. [Google Scholar] [CrossRef]

- Patten, D.M. Media exposure, public policy pressure, and environmental disclosure: An examination of the impact of tri data availability. Account. Forum 2002, 26, 152–171. [Google Scholar] [CrossRef]

- Zeng, S.; Xu, X.; Yin, H.; Tam, C.M. Factors that drive Chinese listed companies in voluntary disclosure of environmental information. J. Bus. Ethics 2012, 109, 309–321. [Google Scholar] [CrossRef]

- Liu, X.; Yu, Q.; Fujitsuka, T.; Liu, B.; Bi, J.; Shishime, T. Functional mechanisms of mandatory corporate environmental disclosure: An empirical study in China. J. Clean. Prod. 2010, 18, 823–832. [Google Scholar] [CrossRef]

- Li, F.; Morris, T.; Young, B. The Effect of Corporate Visibility on Corporate Social Responsibility. Sustainability 2019, 11, 3698. [Google Scholar] [CrossRef]

| Variables | Names | Symbol | Definitions |

|---|---|---|---|

| CDI | Carbon Disclosure Information | + | CDI Carbon Disclosure Information = 1; Carbon Information Not Disclosed = 0 |

| MNR | Media Negative Reporting | + | Denotes the number of times negatively reported by media |

| MPR | Media Positive Reporting | + | Denotes the number of times positively reported by media |

| SOE | State-Owned Enterprise | + | Governmental Pressure used as a Dummy variable; State-owned enterprise = 1; non-state-owned = 0 |

| NSOE | Non-State-owned Enterprise | + | Governmental Pressure used as a Dummy variable; non-state-owned = 1; state-owned = 0 |

| LF | Leverage Finance | + | Asset-Liability Ratio = Total Liabilities/Total Assets |

| LN Size | Natural LN Size | + | Denotes the logarithm of the total book value of the assets of the company at the end of the year |

| ML | Market Low | +/− | Provincial lowest average of marketization index per year |

| MH | Market High | +/− | Provincial highest average of marketization index per year |

| TOR | Turnover Rate | + | Sum of the turnover rate of tradable shares the current year |

| ROA | Rate of Assets | +/− | Return on Assets = Net profit/Average Total Assets |

| FAR | Fixed Assets Ratio | +/− | Fixed Asset Ratio = Fixed assets/Total Assets |

| Age | Age | +/− | Number of years passed since the company’s Initial Public Offering (IPO—Initial Public Offering) time |

| MBR | Market-book ratio | +/− | the market value/the book value |

| IGR | Income Growth Rate | +/− | Income growth rate |

| FSH | Foreign Shareholders | +/− | Percentage of foreign shares within the company |

| Variables | Minimum | Maximum | Sum | Mean | Std. Deviation | Variance | Skewness | |

|---|---|---|---|---|---|---|---|---|

| Statistic | Statistic | Statistic | Statistic | Statistic | Statistic | Statistic | Std. Error | |

| Carbon disclosure information (CDI) | 0 | 1 | 10,503 | 0.74 | 0.438 | 0.192 | −1.105 | 0.021 |

| Media Negative Reporting (MNR) | 0 | 21 | 9242 | 0.65 | 1.169 | 1.367 | 7.101 | 0.021 |

| Media Positive Reporting (MPR) | 0 | 19 | 5658 | 0.40 | 0.839 | 0.704 | 5.389 | 0.021 |

| State-Owned Enterprise (SOE) | 0 | 1 | 8663 | 0.61 | 0.487 | 0.238 | −0.459 | 0.021 |

| Non-State-Owned Enterprise (NSOE) | 0 | 1 | 5179 | 0.37 | 0.482 | 0.232 | 0.557 | 0.021 |

| Leverage finance (LF) | 0 | 1 | 9161 | 0.65 | 0.478 | 0.228 | −0.615 | 0.021 |

| Natural Log Size (LN Size) | 8 | 30 | 321,585 | 22.71 | 3.687 | 13.590 | −0.091 | 0.021 |

| Market low (ML) | 0 | 1 | 5912 | 0.42 | 0.493 | 0.243 | 0.334 | 0.021 |

| Market high (MH) | 0 | 1 | 8211 | 0.58 | 0.494 | 0.244 | −0.324 | 0.021 |

| Turnover rate (TOR) | 0.0100 | 24.46 | 91,346.35 | 6.451470 | 5.4317 | 29.504 | 0.589 | 0.021 |

| Rate of assets (ROA) | −0.4927 | 0.983 | 292.13 | 0.020633 | 0.270 | 0.073 | 0.120 | 0.021 |

| Fixed assets ratio (FAR) | 0.0023 | 1.0255 | 3919.86 | 0.276846 | 0.1852546 | 0.034 | 0.202 | 0.021 |

| Age | 0.0000 | 27.480 | 115,532.47 | 8.159649 | 4.32274 | 18.686 | 0.363 | 0.021 |

| Market-Book Ratio (MBR) | 0.0000 | 18.049 | 89,536.95 | 6.323678 | 5.52741 | 30.552 | 0.652 | 0.021 |

| Income growth rate (IGR) | −0.97 | 1.92 | 5884.74 | 0.4156 | 1.256 | 1.580 | 0.070 | 0.021 |

| Foreign shareholders (FSH) | 0.0594 | 0.996 | 7608.19 | 0.537340 | 0.26382 | 0.070 | −0.051 | 0.021 |

| Valid N (list-wise) | 14,159 | |||||||

| Variables | CDI | MNR | MPP | SOE | N/SOE | LF | LN Size | ML | MH | TOR | ROA | FAR | Age | MBR | IGR | FSH |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CDI | 1 | 0.960 ** | 0.162 ** | 0.076 ** | −0.012 | −0.007 | −0.080 ** | −0.096 ** | 0.100 ** | −0.006 | 0.208 ** | −0.179 ** | −0.013 | −0.091 ** | −0.001 | 0.056 ** |

| MNR | 0.960 ** | 1 | 0.198 ** | −0.065 ** | 0.086 ** | −0.064 ** | −0.162 ** | −0.108 ** | 0.109 ** | −0.036 ** | −0.097 ** | −0.206 ** | −0.138 ** | −0.082 ** | −0.028 ** | 0.015 |

| MPR | 0.162 ** | 0.198 ** | 1 | −0.060 ** | 0.066 ** | −0.055 ** | −0.125 ** | −0.108 ** | 0.109 ** | −0.025 ** | −0.041 ** | −0.139 ** | −0.140 ** | −0.051 ** | −0.014 | 0.036 ** |

| SOE | 0.076 ** | −0.065 ** | −0.060 ** | 1 | −0.953 ** | 0.884 ** | 0.216 ** | −0.158 ** | 0.161 ** | 0.128 ** | −0.042 ** | 0.064 ** | 0.340 ** | −0.377 ** | 0.050 ** | −0.104 ** |

| NSOE | −0.012 | 0.086 ** | 0.066 ** | −0.953 ** | 1 | −0.927 ** | −0.265 ** | 0.161 ** | −0.164 ** | −0.154 ** | 0.014 | −0.118 ** | −0.367 ** | 0.414 ** | −0.077 ** | 0.129 ** |

| LF | −0.007 | −0.064 ** | −0.055 ** | 0.884 ** | −0.927 ** | 1 | 0.263 ** | −0.175 ** | 0.180 ** | 0.161 ** | −0.021 * | 0.111 ** | 0.368 ** | −0.437 ** | 0.090 ** | −0.125 ** |

| LN Size | −0.080 ** | −0.162 ** | −0.125 ** | 0.216 ** | −0.265 ** | 0.263 ** | 1 | −0.140 ** | 0.139 ** | −0.183 ** | 0.172 ** | 0.458 ** | 0.402 ** | −0.079 ** | −0.063 ** | −0.036 ** |

| ML | −0.096 ** | −0.108 ** | −0.108 ** | −0.158 ** | 0.161 ** | −0.175 ** | −0.140 ** | 1 | −0.992 ** | 0.034 ** | 0.199 ** | 0.322 ** | 0.130 ** | 0.674 ** | 0.059 ** | −0.029 ** |

| MH | 0.100 ** | 0.109 ** | 0.109 ** | 0.161 ** | −0.164 ** | 0.180 ** | 0.139 ** | −0.992 ** | 1 | −0.033 ** | −0.204 ** | −0.321 ** | −0.132 ** | −0.678 ** | −0.061 ** | 0.026 ** |

| TOR | −0.006 | −0.036 ** | −0.025 ** | 0.128 ** | −0.154 ** | 0.161 ** | −0.183 ** | 0.034 ** | −0.033 ** | 1 | 0.063 ** | 0.038 ** | 0.009 | −0.099 ** | 0.433 ** | −0.175 ** |

| ROA | 0.208 ** | −0.097 ** | −0.041 ** | −0.042 ** | 0.014 | −0.021 * | 0.172 ** | 0.199 ** | −0.204 ** | 0.063 ** | 1 | 0.220 ** | 0.139 ** | 0.162 ** | 0.047 ** | −0.014 |

| FAR | −0.179 ** | −0.206 ** | −0.139 ** | 0.064 ** | −0.118 ** | 0.111 ** | 0.458 ** | 0.322 ** | −0.321 ** | 0.038 ** | 0.220 ** | 1 | 0.379 ** | 0.180 ** | −0.044 ** | −0.063 ** |

| Age | −0.013 | −0.138 ** | −0.140 ** | 0.340 ** | −0.367 ** | 0.368 ** | 0.402 ** | 0.130 ** | −0.132 ** | 0.009 | 0.139 ** | 0.379 ** | 1 | −0.160 ** | −0.050 ** | −0.146 ** |

| MBR | −0.091 ** | −0.082 ** | −0.051 ** | −0.377 ** | 0.414 ** | −0.437 ** | −0.079 ** | 0.674 ** | −0.678 ** | −0.099 ** | 0.162 ** | 0.180 ** | −0.160 ** | 1 | −0.025 ** | 0.096 ** |

| IGR | −0.001 | −0.028 ** | −0.014 | 0.050 ** | −0.077 ** | 0.090 ** | −0.063 ** | 0.059 ** | −0.061 ** | 0.433 ** | 0.047 ** | −0.044 ** | −0.050 ** | −0.025 ** | 1 | −0.186 ** |

| FSH | 0.056 ** | 0.015 | 0.036 ** | −0.104 ** | 0.129 ** | −0.125 ** | −0.036 ** | −0.029 ** | 0.026 ** | −0.175 ** | −0.014 | −0.063 ** | −0.146 ** | 0.096 ** | −0.186 ** | 1 |

| Variables | Model | Sum of Squares | Df | Mean Square | F | Sig. |

|---|---|---|---|---|---|---|

| SOE | Regression | 192.478 | 13 | 14.806 | 93.741 | 0.000 |

| Residual | 1366.075 | 8649 | 0.158 | |||

| Total | 1558.554 | 8662 | ||||

| NSOE | Regression | 174.609 | 13 | 13.431 | 82.956 | 0.000 |

| Residual | 836.272 | 5165 | 0.162 | |||

| Total | 1010.881 | 5178 |

| Variables | SOE | NSOE |

|---|---|---|

| Coefficients (Std. Error) | Coefficients (Std. Error) | |

| Intercept | −0.808 (0.096) *** | −0.741 (0.102) *** |

| MPR | 0.018 (0.006) *** | 0.011 (0.005) ** |

| MNR | −0.019 (0.005) *** | −0.015 (0.005) *** |

| LF | −0.065 (0.034) | −0.189 (0.028) *** |

| LN Size | −0.010 (0.001) *** | −0.015 (0.004) *** |

| ML | 0.355 (0.084) *** | 0.271 (0.071) *** |

| MH | 0.394 (0.083) *** | 0.410 (0.073) *** |

| TOR | −0.008 (0.001) *** | 0.006 (0.001) *** |

| ROA | 0.441 (0.016) *** | 0.671 (0.023) *** |

| FAR | −0.360 (0.025) *** | −0.295 (0.090) *** |

| Age | 0.004 (0.001) ** | 0.006 (0.002) *** |

| MBR | −0.009 (0.001) *** | −0.006 (0.003) * |

| IGR | 0.009 (0.004) *** | 0.010 (0.005) ** |

| FSH | 0.056 (0.018) *** | 0.063 (0.021) *** |

| Number of Obs. | 14,159 | 14,159 |

| R2 | 0.123 | 0.173 |

| Variables | Coefficients (Std. Error) | Coefficients (Std. Error) | Coefficients (Std. Error) |

|---|---|---|---|

| Intercept | 0.173 (0.068) *** | 0.178 (0.068) *** | 0.175 (0.068) *** |

| MPR | 0.018 (0.004) *** | 0.038 (0.007) *** | 0.016 (0.004) *** |

| MNR | −0.010 (0.003) *** | −0.009 (0.003) *** | 0.022 (0.008) |

| SOE | 0.627 (0.024) *** | 0.628 (0.024) *** | 0.650 (0.024) *** |

| NSOE | 0.472 (0.030) *** | 0.469 (0.030) *** | 0.490 (0.030) *** |

| NSOE * MPR | −0.015 (0.006) | ||

| SOE * MPR | −0.021 (0.005) | ||

| NSOE * MNR | −0.036 (0.010) *** | ||

| SOE * MNR | −0.045 (0.010) *** | ||

| LF | −0.151 (0.019) *** | −0.153 (0.019) *** | −0.151 (0.019) *** |

| LN Size | −0.007 (0.001) *** | −0.007 (0.001) *** | −0.008 (0.001) *** |

| ML | 0.314 (0.054) *** | 0.314 (0.054) *** | 0.314 (0.054) *** |

| MH | 0.365 (0.054) *** | 0.365 (0.054) *** | 0.367 (0.054) *** |

| TOR | −0.002 (0.001) * | −0.002 (0.001) * | −0.002 (0.001) * |

| ROA | 0.483 (0.013) *** | 0.484 (0.013) *** | 0.484 (0.013) *** |

| FAR | −0.366 (0.024) *** | −0.366 (0.024) *** | −0.367 (0.024) *** |

| Age | 0.005 (0.001) *** | 0.005 (0.001) *** | 0.004 (0.001) *** |

| MBR | −0.008 (0.001) *** | −0.008 (0.001) *** | −0.008 (0.001) *** |

| IGR | 0.006 (0.003) | 0.006 (0.003) | 0.006 (0.003) |

| FSH | 0.081 (0.013) *** | 0.082 (0.013) *** | 0.079 (0.013) *** |

| Number of Obs. | 14,159 | 14,159 | 14,159 |

| Adjusted R2 | 0.162 | 0.163 | 0.163 |

| Variables | Fixed Effects (b) | Random Effects (B) | Hausman Test |

|---|---|---|---|

| Coef. (Std. Error) | Coef. (Std. Error) | ||

| Intercept | −0.2771 (0.308) *** | −0.3028 (0.282) ** | |

| MPR | −0.0817 (0.013) *** | −0.0758 (0.012) *** | −0.0058 (0.005) |

| MNR | 0.137 (0.022) *** | 0.1437 (0.020) *** | −0.0058 (0.007) |

| SOE | 0.4014 (0.091) *** | 0.4420 (0.079) *** | −0.0405 (0.045) |

| NSOE | 0.1725 (0.021) *** | 0.1730 (0.019) *** | −0.0005 (0.008) |

| LF | −0.4262 (0.092) *** | −0.4425 (0.080) *** | 0.0162 (0.044) |

| LN Size | 0.0223 (0.005) *** | 0.0195 (0.004) *** | 0.0027 (0.002) |

| ML | 0.7447 (0.275) *** | 0.8163 (0.250) *** | −0.0716 (0.114) |

| MH | 0.7599 (0.276) *** | 0.8267 (0.252) *** | −0.0668 (0.113) |

| TOR | −0.0072 (0.003) * | −0.0109 (0.003) *** | 0.0037 (0.001) |

| ROA | 0.4446 (0.069) *** | 0.3933 (0.062) *** | 0.0512 (0.030) |

| FAR | −0.5837 (0.114) *** | −0.5295 (0.101) *** | −0.0542 (0.052) |

| Age | 0.0035 (0.004) | 0.0011 (0.003) | 0.0023 (0.002) |

| MBR | 0.0008 (0.004) * | 0.0006 (0.003) * | 0.0001 (0.001) |

| IGR | 0.0261 (0.012) ** | 0.04110 (0.011) *** | −0.0149 (0.004) |

| FSH | −0.0741 (0.054) *** | −0.0342 (0.047) *** | −0.0398 (0.025) |

| F (15,490) | 17.45 *** | ||

| Wald chi2 (15) | 293.71 *** | ||

| R-sq. | |||

| Within | 0.3482 | 0.3411 | |

| Between | 0.2223 | 0.2906 | |

| Overall | 0.3252 | 0.3324 | |

| Number of obs. | 606 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, D.; Zhu, S.; Memon, A.A.; Memon, H. Financial Attributes, Environmental Performance, and Environmental Disclosure in China. Int. J. Environ. Res. Public Health 2020, 17, 8796. https://doi.org/10.3390/ijerph17238796

Wu D, Zhu S, Memon AA, Memon H. Financial Attributes, Environmental Performance, and Environmental Disclosure in China. International Journal of Environmental Research and Public Health. 2020; 17(23):8796. https://doi.org/10.3390/ijerph17238796

Chicago/Turabian StyleWu, Die, Shuzhen Zhu, Aftab Ahmed Memon, and Hafeezullah Memon. 2020. "Financial Attributes, Environmental Performance, and Environmental Disclosure in China" International Journal of Environmental Research and Public Health 17, no. 23: 8796. https://doi.org/10.3390/ijerph17238796

APA StyleWu, D., Zhu, S., Memon, A. A., & Memon, H. (2020). Financial Attributes, Environmental Performance, and Environmental Disclosure in China. International Journal of Environmental Research and Public Health, 17(23), 8796. https://doi.org/10.3390/ijerph17238796