Competition among Supply Chains and Governmental Policy: Considering Consumers’ Low-Carbon Preference

Abstract

:1. Introduction

2. Literature Review

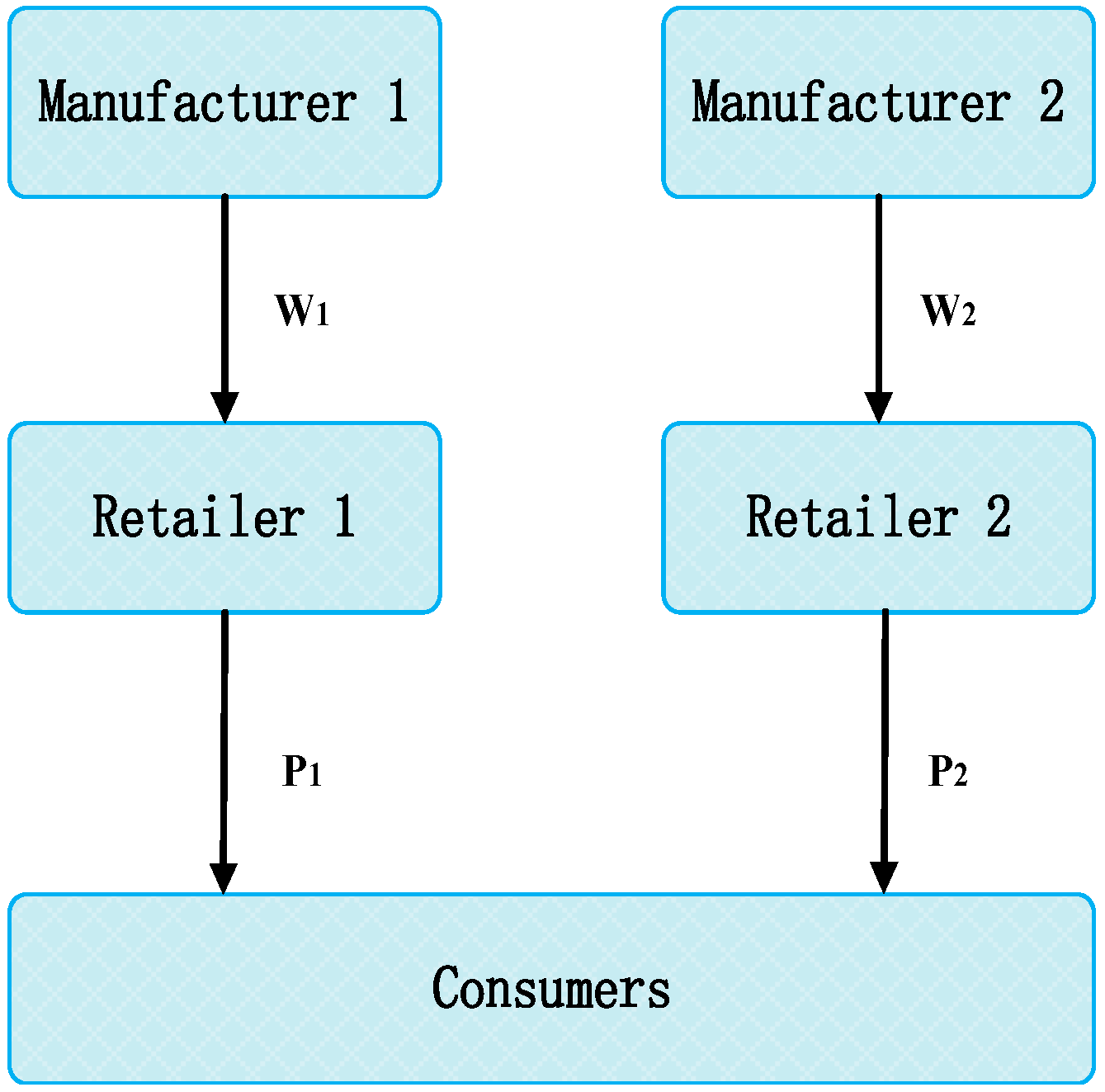

3. Model Description

4. Equilibrium Solutions and Discussions

5. Governmental Subsidy Policy

- (1)

- The low-carbon supply chain’s wholesale price and sale price will decrease and the decrement is more than the wholesale price and sale price of regular supply chain.

- (2)

- The profit of the manufacturer who chooses low-carbon production and its retailer will both increase, whereas the profit of the manufacturer that chooses regular production and its retailer will both decrease.

- (3)

- The profit of a manufacturer will increase or decrease more than that of its retailer.

6. Conclusions and Future Directions

- (1)

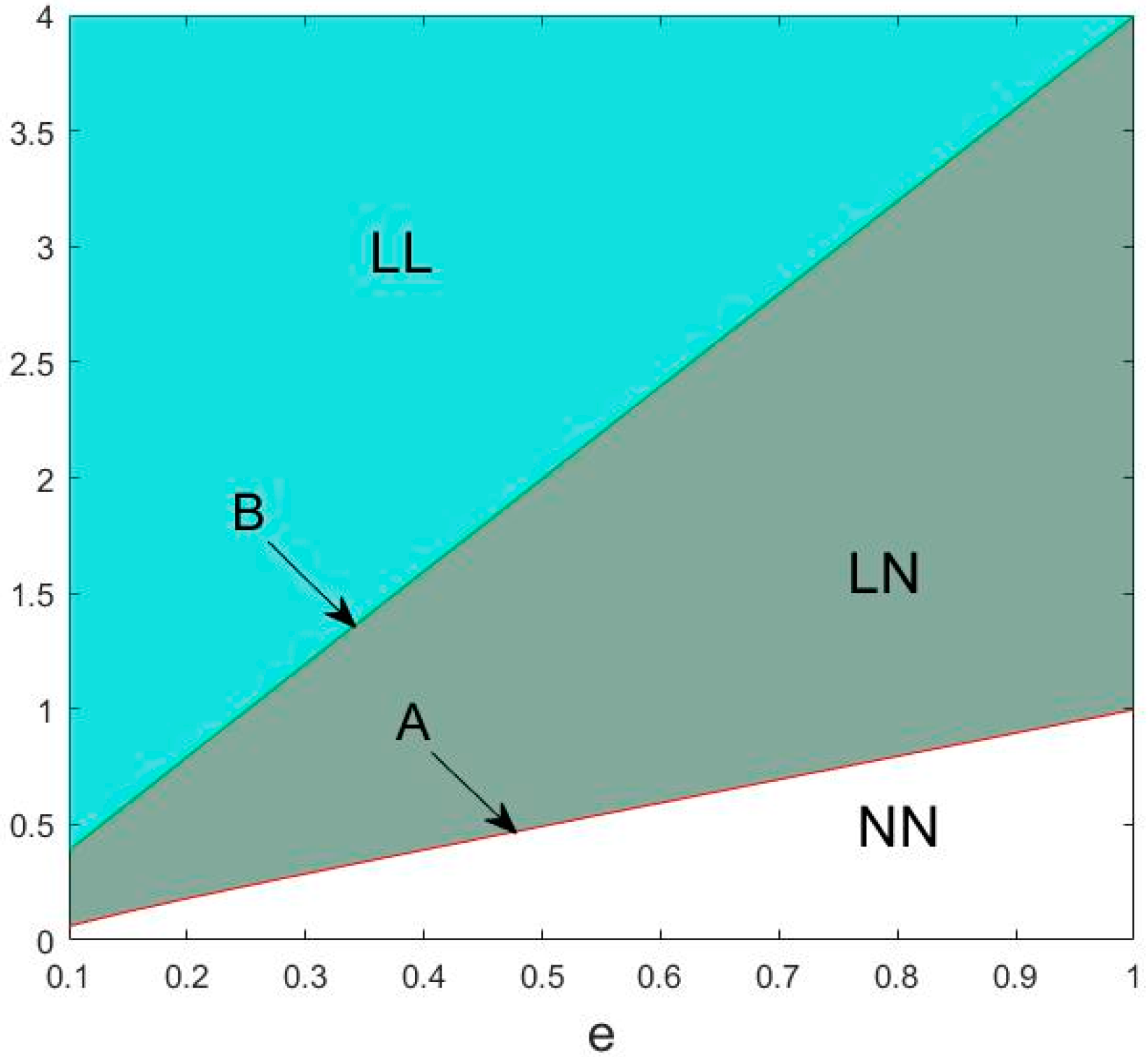

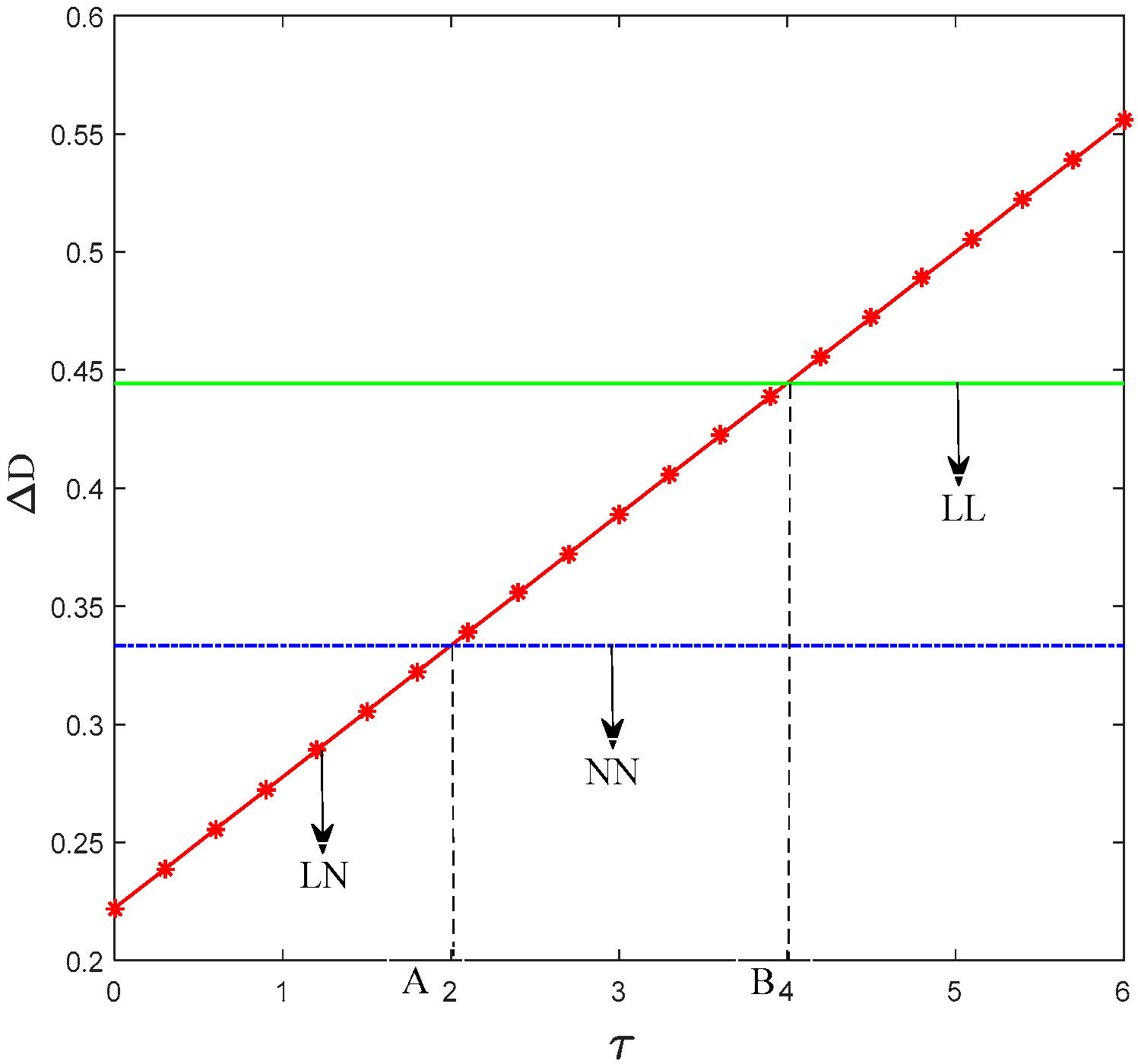

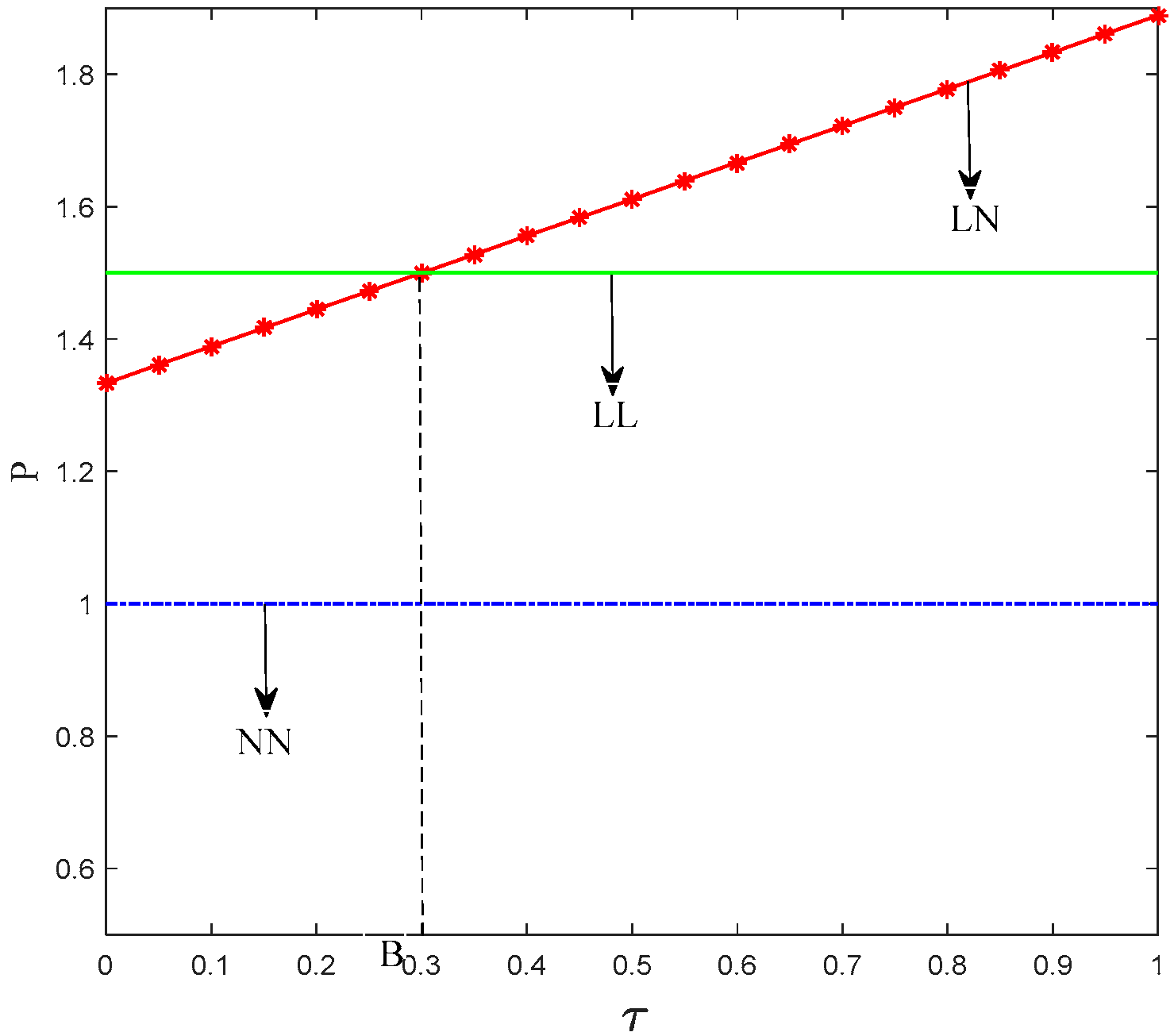

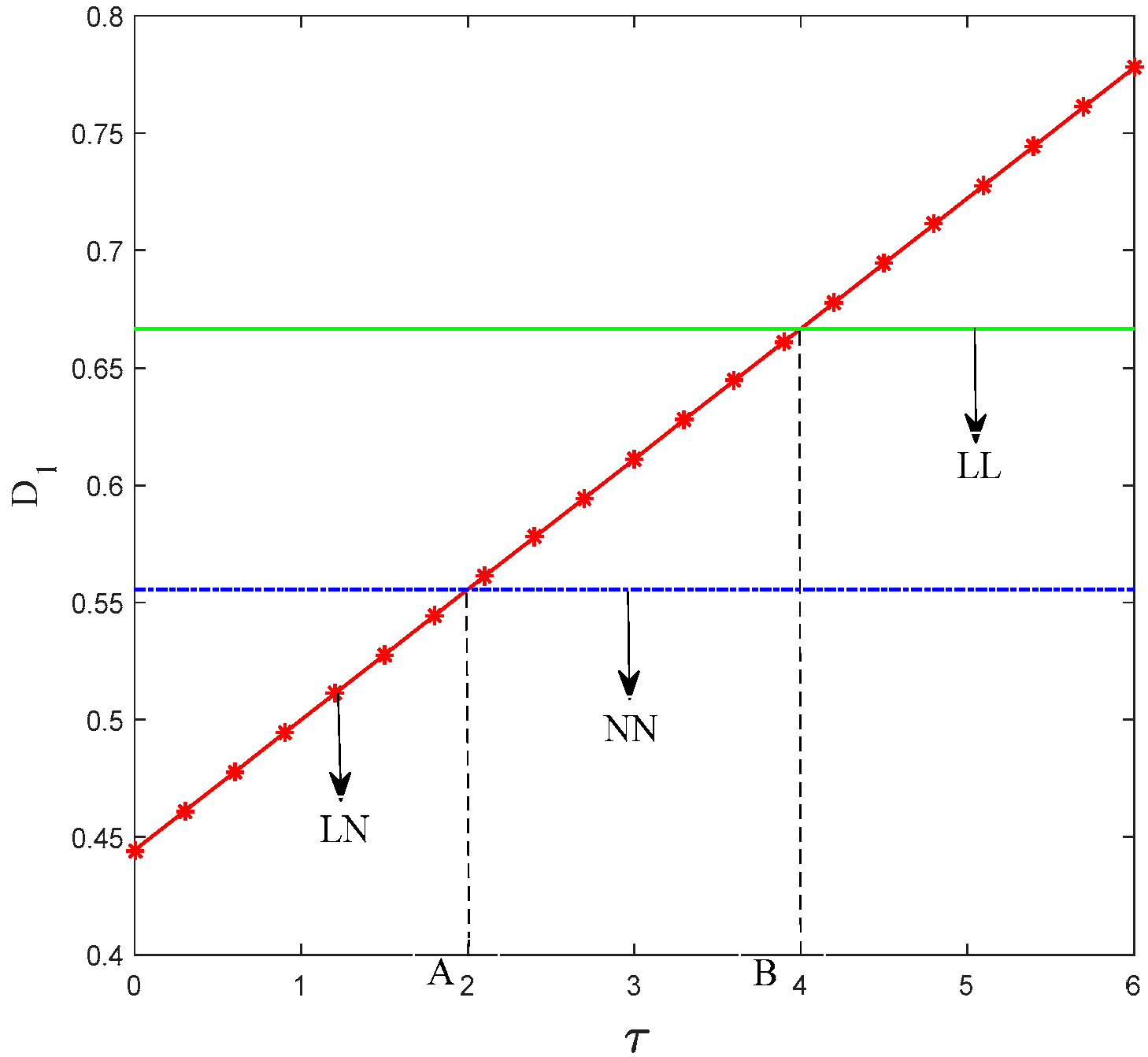

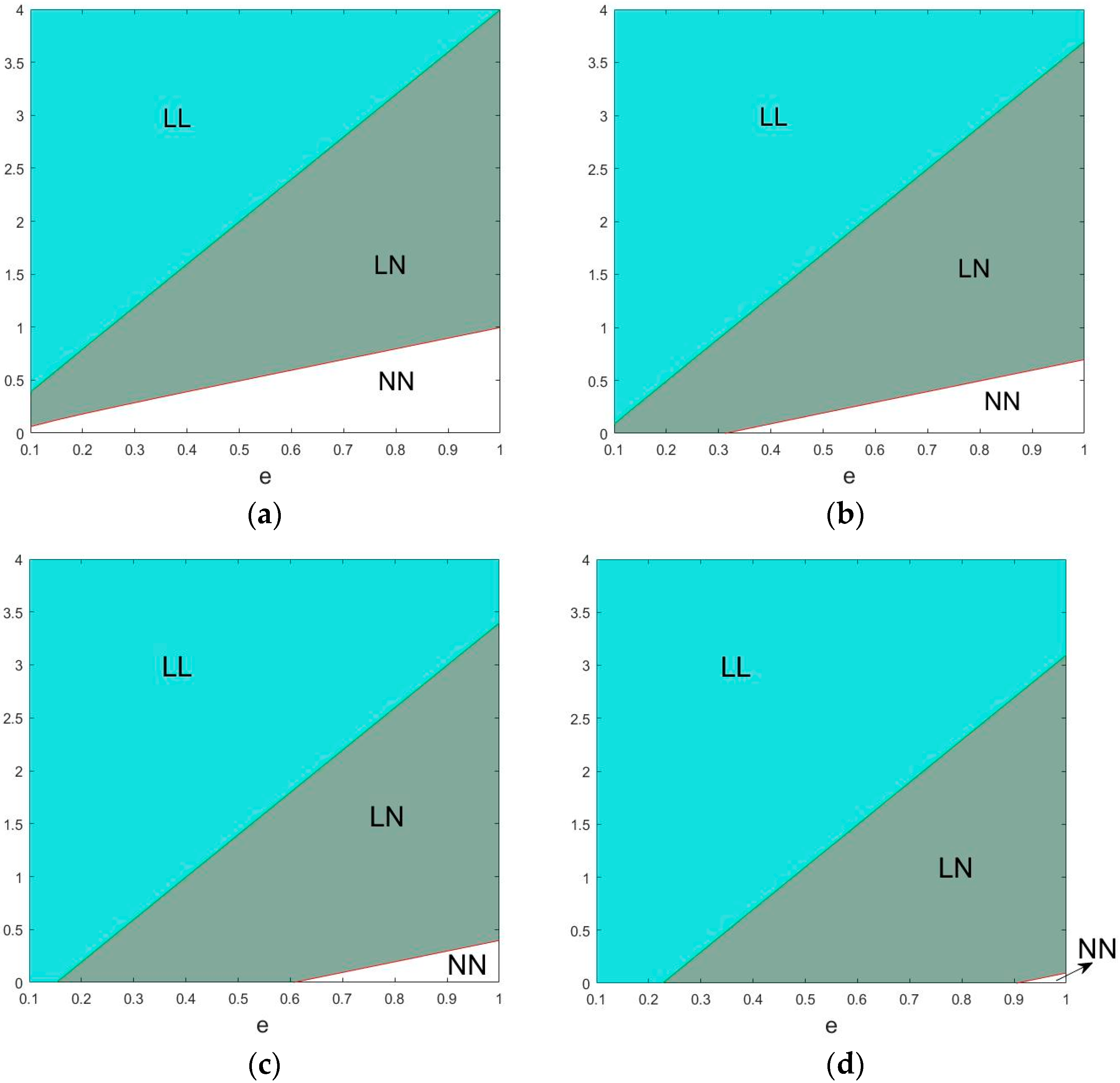

- When consumers’ low-carbon preference is low, two manufacturers will choose regular production. When consumers’ low-carbon preference increases, the manufacturer with low cost of low-carbon production will choose low-carbon production, whereas the other manufacturer will still choose regular production. When consumers have a high preference for low-carbon products, both manufacturers will choose low-carbon production.

- (2)

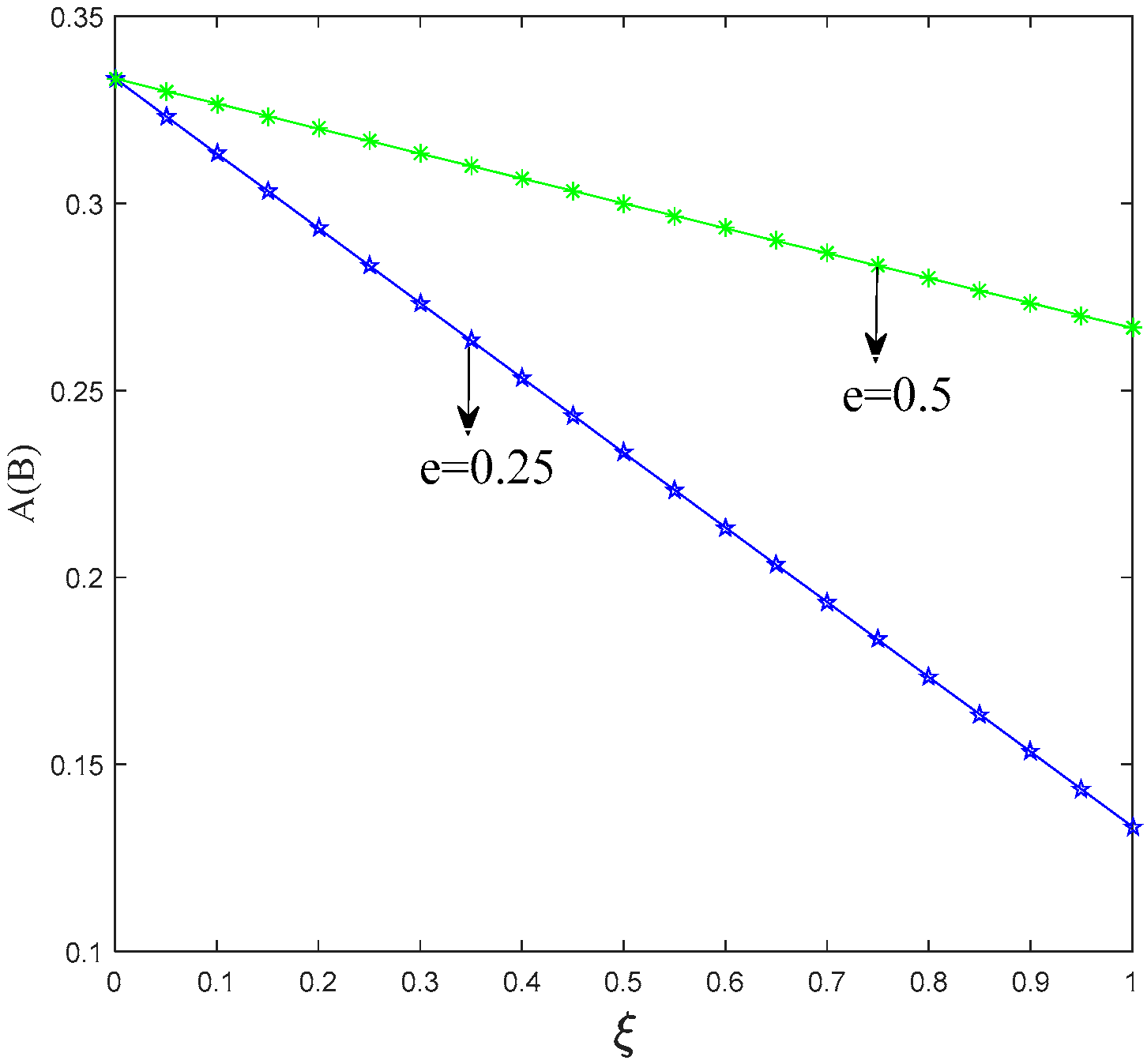

- When products’ carbon emission reduction has a low impact on the consumer purchase decision, the price of low-carbon product from manufacturer 1 is the largest in scenario LL, only manufacturer 1 choose low-carbon production, and the market share between the two manufacturers is the smallest. When the impact of products’ carbon emission reduction on consumers exceeds a certain level, low-carbon products from manufacturer 1 have the largest price in scenario LN and manufacturer 1 gradually achieves a large market share with the expansion of its competitive advantage.

- (3)

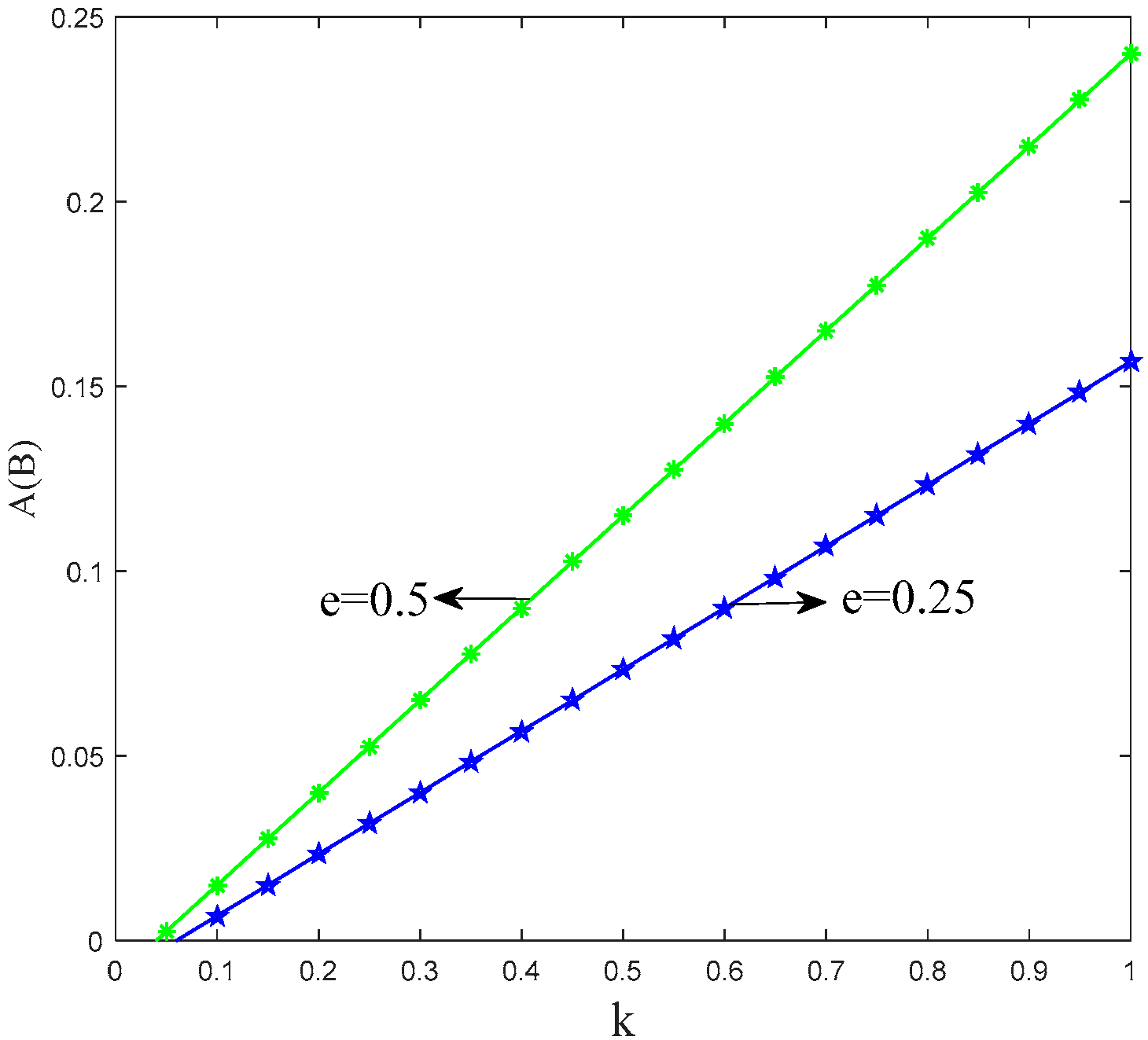

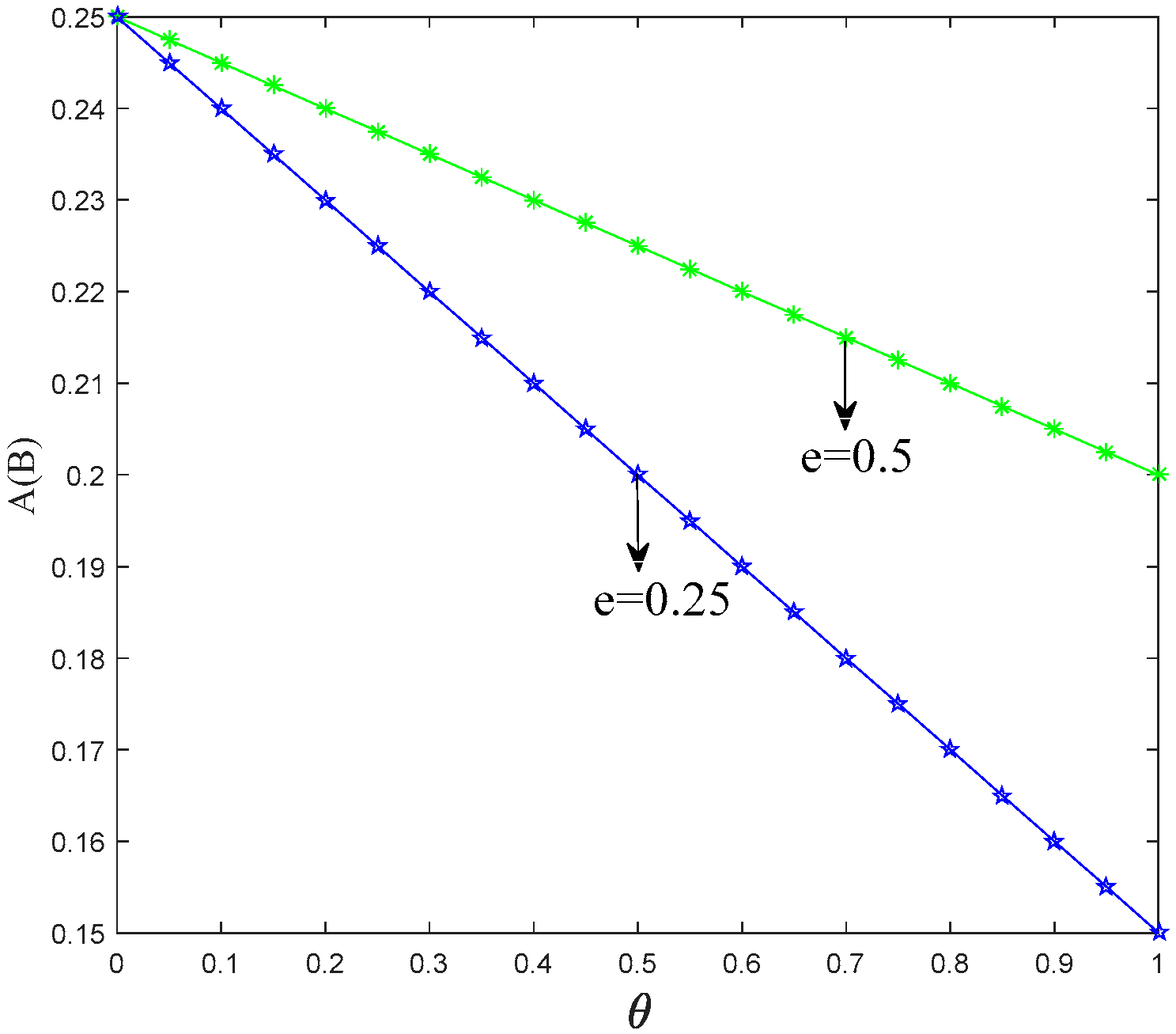

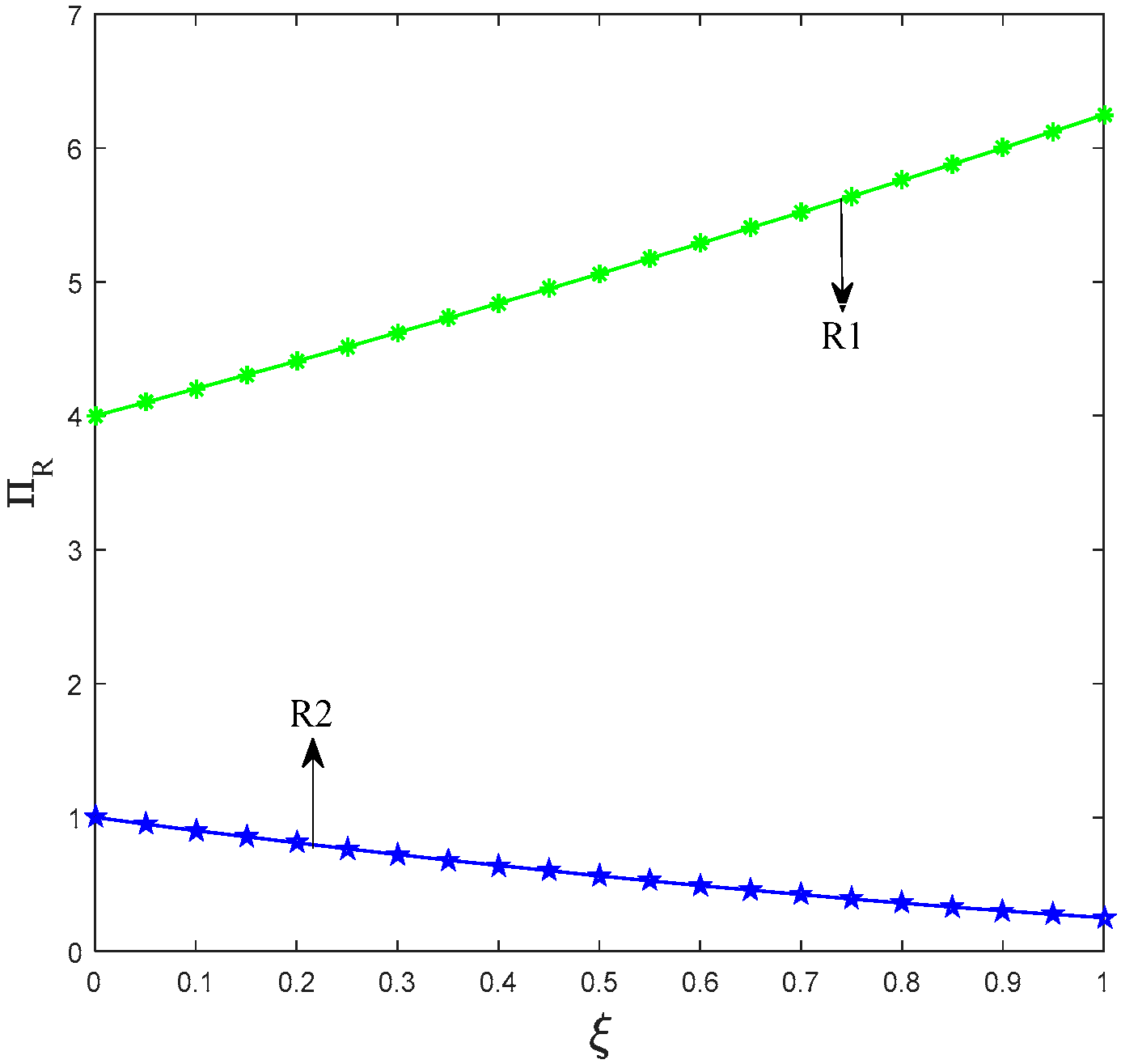

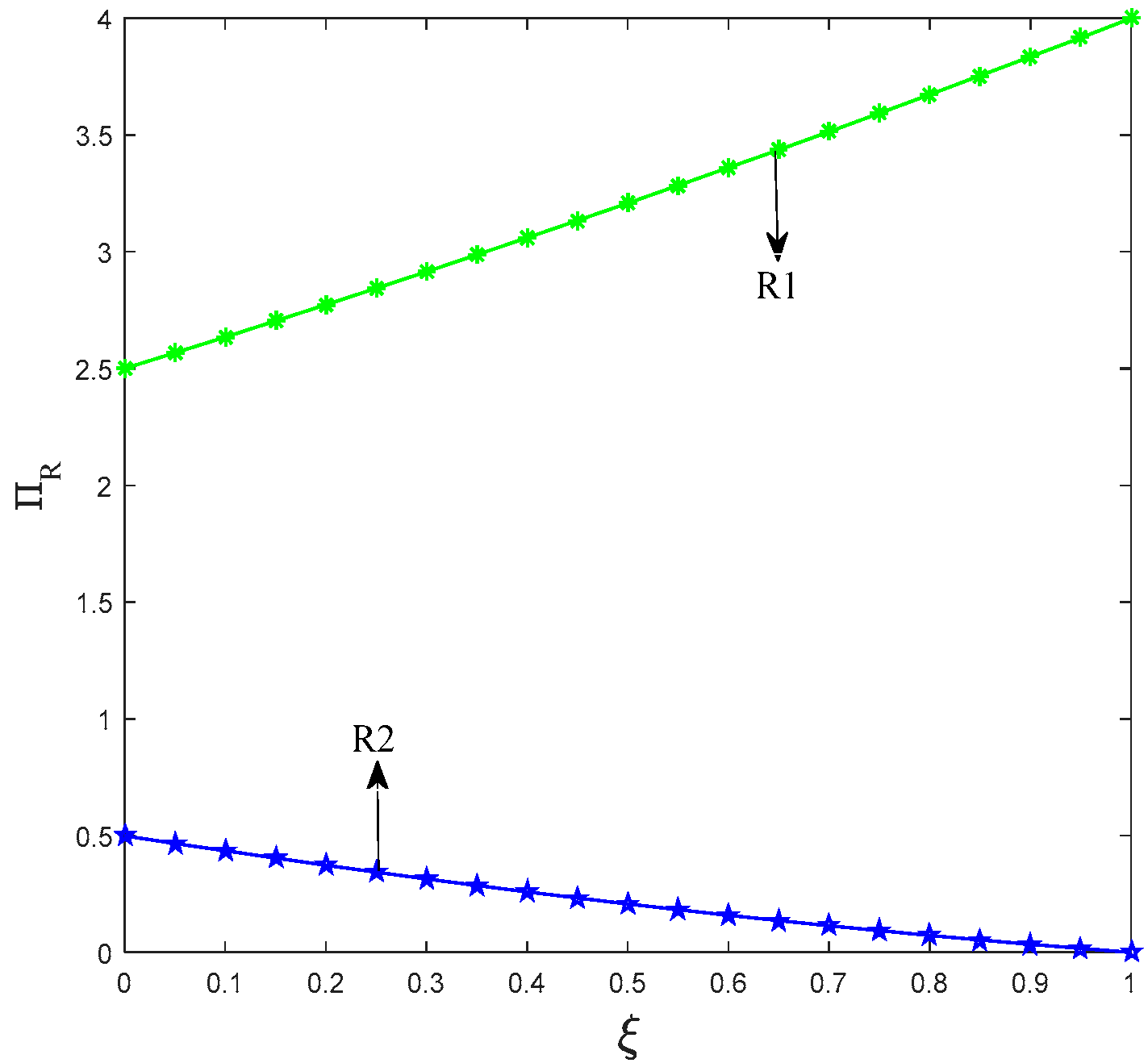

- If the manufacturer with low fare to reduce carbon emissions chooses to take low-carbon production, regardless of what the other manufacturer chooses, then the profit of its retailer is positively linked to the influence coefficient of promotional efforts on consumer utility, whereas the other retailer’s profit is negatively linked to it.

- (4)

- Given the increase of government’s low-carbon production subsidy, two manufacturers will more likely choose scenarios LL and LN and less likely choose scenario NN. This proves that government subsidy have an important role to play in reducing carbon emissions.

Author Contributions

Funding

Conflicts of Interest

Appendix A

Appendix A.1. Solutions under Scenario NN

| Scenario NN | Supply Chain 1 | Supply Chain 2 |

|---|---|---|

Appendix A.2. Solutions under Scenario NL

| Scenario NL | Supply Chain 1 | Supply Chain 2 |

|---|---|---|

Appendix A.3. Solutions under Scenario LN

| Scenario LN | Supply Chain 1 | Supply Chain 2 |

|---|---|---|

Appendix A.4. Solutions under Scenario LL

| Scenario LL | Supply Chain 1 | Supply Chain 2 |

|---|---|---|

| NN | NL | LN | LL | |

|---|---|---|---|---|

| M1 | ||||

| M2 |

Appendix B

References

- FAO-IPCC Expert Meeting on Climate Change, Land Use and Food Security. Available online: http://www.ipcc.ch/pdf/supporting-material/EM_FAO_IPCC_report.pdf (accessed on 11 July 2018).

- Barbier, E. The concept sustainable economic development. Environ. Conserv. 1987, 14, 101–110. [Google Scholar] [CrossRef]

- Nesticò, A.; Sica, F. The sustainability of urban renewal projects: A model for economic multi-criteria analysis. J. Prop. Invest. Financ. 2017, 35, 397–409. [Google Scholar] [CrossRef]

- Climate Savers. Available online: http://www.worldwildlife.org/partnerships/climate-savers (accessed on 11 July 2018).

- Christopher, M. Logistics and supply chain management: Strategies for reducing cost and improving service (second edition). Int. J. Logist. Res. Appl. 1999, 2, 103–104. [Google Scholar] [CrossRef]

- Ai, X.; Chen, J.; Zhao, H.; Tang, X. Competition among supply chains: Implications of full returns policy. Int. J. Prod. Econ. 2012, 139, 257–265. [Google Scholar] [CrossRef]

- Zhao, J.; Hobbs, B.F.; Pang, J.S. Long-run equilibrium modeling of emissions allowance allocation systems in electric power markets. Oper. Res. 2010, 58, 529–548. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon footprint and the management of supply chains: Insights from simple models. IEEE Trans. Autom. Sci. Eng. 2013, 10, 99–116. [Google Scholar] [CrossRef]

- Du, S.; Zhu, J.; Jiao, H.; Ye, W. Game-theoretical analysis for supply chain with consumer preference to low carbon. Int. J. Prod. Res. 2015, 53, 3753–3768. [Google Scholar] [CrossRef]

- Tang, S.; Wang, W.; Cho, S.; Yan, H. Reducing emissions in transportation and inventory management: (R, Q) policy with considerations of carbon reduction. Eur. J. Oper. Res. 2018, 269. [Google Scholar] [CrossRef]

- Drake, D.F.; Kleindorfer, P.R.; Van Wassenhove, L.N. Technology choice and capacity portfolios under emissions regulation. Prod. Oper. Manag. 2016, 25, 1006–1025. [Google Scholar] [CrossRef]

- Fan, R.; Dong, L. The dynamic analysis and simulation of government subsidy strategies in low-carbon diffusion considering the behavior of heterogeneous agents. Energy Policy 2018, 117, 252–262. [Google Scholar] [CrossRef]

- Du, S.; Hu, L.; Wang, L. Low-carbon supply policies and supply chain performance with carbon concerned demand. Ann. Oper. Res. 2017, 255, 569–590. [Google Scholar] [CrossRef]

- Meng, X.; Yao, Z.; Nie, J.; Zhao, Y.; Li, Z. Low-carbon product selection with carbon tax and competition: Effects of the power structure. Int. J. Prod. Econ. 2018, 200, 224–230. [Google Scholar] [CrossRef]

- Mcguire, T.W.; Staelin, R. An industry equilibrium analysis of downstream vertical integration. Mark. Sci. 1983, 2, 161–191. [Google Scholar] [CrossRef]

- Xiao, T.; Choi, T.M. Purchasing choices and channel structure strategies for a two-echelon system with risk-averse players. Int. J. Prod. Econ. 2009, 120, 54–65. [Google Scholar] [CrossRef]

- Xiao, T.; Yang, D. Price and service competition of supply chains with risk-averse retailers under demand uncertainty. Int. J. Prod. Econ. 2017, 114, 187–200. [Google Scholar] [CrossRef]

- Zhao, X.; Shi, C. Structuring and contracting in competing supply chains. Int. J. Prod. Econ. 2011, 134, 434–446. [Google Scholar] [CrossRef]

- Mahmoodi, A.; Eshghi, K. Price competition in duopoly supply chains with stochastic demand. J. Manuf. Syst. 2014, 33, 604–612. [Google Scholar] [CrossRef]

- Amin-Naseri, M.R.; Khojasteh, M.A. Price competition between two leader–follower supply chains with risk-averse retailers under demand uncertainty. Int. J. Adv. Manuf. Technol. 2015, 79, 377–393. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Nooridaryan, M.; Govindan, K. Pricing and ordering decisions of two competing supply chains with different composite policies: A stackelberg game-theoretic approach. Int. J. Prod. Res. 2016, 54, 2807–2836. [Google Scholar] [CrossRef]

- Wang, Y.Y.; Hua, Z.; Wang, J.C.; Lai, F. Equilibrium analysis of markup pricing strategies under power imbalance and supply chain competition. IEEE Trans. Eng. Manag. 2017, 64, 464–475. [Google Scholar] [CrossRef]

- Yao, D.Q.; Liu, J.J. Competitive pricing of mixed retail and e-tail distribution channels. Omega 2009, 33, 235–247. [Google Scholar] [CrossRef]

- Atasu, A.; Souza, G.C. How does product recovery affect quality choice? Prod. Oper. Manag. 2013, 22, 991–1010. [Google Scholar] [CrossRef]

| Model Parameters | Underling Meaning of the Model Parameters |

| V | Consumers’ valuation for the regular product |

| t | Consumers’ travelling cost |

| τ | Consumers’ preference for low-carbon products |

| ci | Cost of regular production |

| e | Carbon emission reduction rate |

| ki | Per unit fare to take low-carbon production |

| ξ | Promotional sensitivity coefficient |

| θi | Retailers’ low-carbon promotional efforts |

| Ui | Consumer utility |

| Πi | Profit of manufacturer/retailer |

| Di | Demand of products |

| Decision Parameters | Underling Meaning of the Decision Parameters |

| pi | Unit price |

| wi | Unit wholesale price |

| Scenarios | Supply Chain 1 (Regular Products) | Supply Chain 1 (Low-Carbon Products) |

|---|---|---|

| Supply chain 2 (Regular products) | Scenario NN | Scenario LN |

| Supply chain 2 (Low-carbon products) | Scenario NL | Scenario LL |

| Scenario NL | Supply Chain 1 | Supply Chain 2 |

|---|---|---|

| w | ||

| p | ||

| D | ||

| ΠM | ||

| ΠR |

| Scenario LN | Supply Chain 1 | Supply Chain 2 |

|---|---|---|

| w | ||

| p | ||

| D | ||

| ΠM | ||

| ΠR |

| Scenario LL | Supply Chain 1 | Supply Chain 2 |

|---|---|---|

| w | ||

| p | ||

| D | ||

| ΠM | ||

| ΠR |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pu, X.; Song, Z.; Han, G. Competition among Supply Chains and Governmental Policy: Considering Consumers’ Low-Carbon Preference. Int. J. Environ. Res. Public Health 2018, 15, 1985. https://doi.org/10.3390/ijerph15091985

Pu X, Song Z, Han G. Competition among Supply Chains and Governmental Policy: Considering Consumers’ Low-Carbon Preference. International Journal of Environmental Research and Public Health. 2018; 15(9):1985. https://doi.org/10.3390/ijerph15091985

Chicago/Turabian StylePu, Xujin, Zhiping Song, and Guanghua Han. 2018. "Competition among Supply Chains and Governmental Policy: Considering Consumers’ Low-Carbon Preference" International Journal of Environmental Research and Public Health 15, no. 9: 1985. https://doi.org/10.3390/ijerph15091985

APA StylePu, X., Song, Z., & Han, G. (2018). Competition among Supply Chains and Governmental Policy: Considering Consumers’ Low-Carbon Preference. International Journal of Environmental Research and Public Health, 15(9), 1985. https://doi.org/10.3390/ijerph15091985