The Role of China in the UK Relative Imports from Three Selected Trading Regions: The Case of Textile Raw Material Industry

Abstract

:1. Introduction

2. UK Textile Raw Materials Imports

2.1. Comparisons between China and Three Free Trade Regions in Competitiveness and Revealed Comparative Advantages

2.2. UK Textile Materials Imports from EEA

2.3. UK Textile Materials Imports from ASEAN

2.4. UK Textile Materials Imports from North America

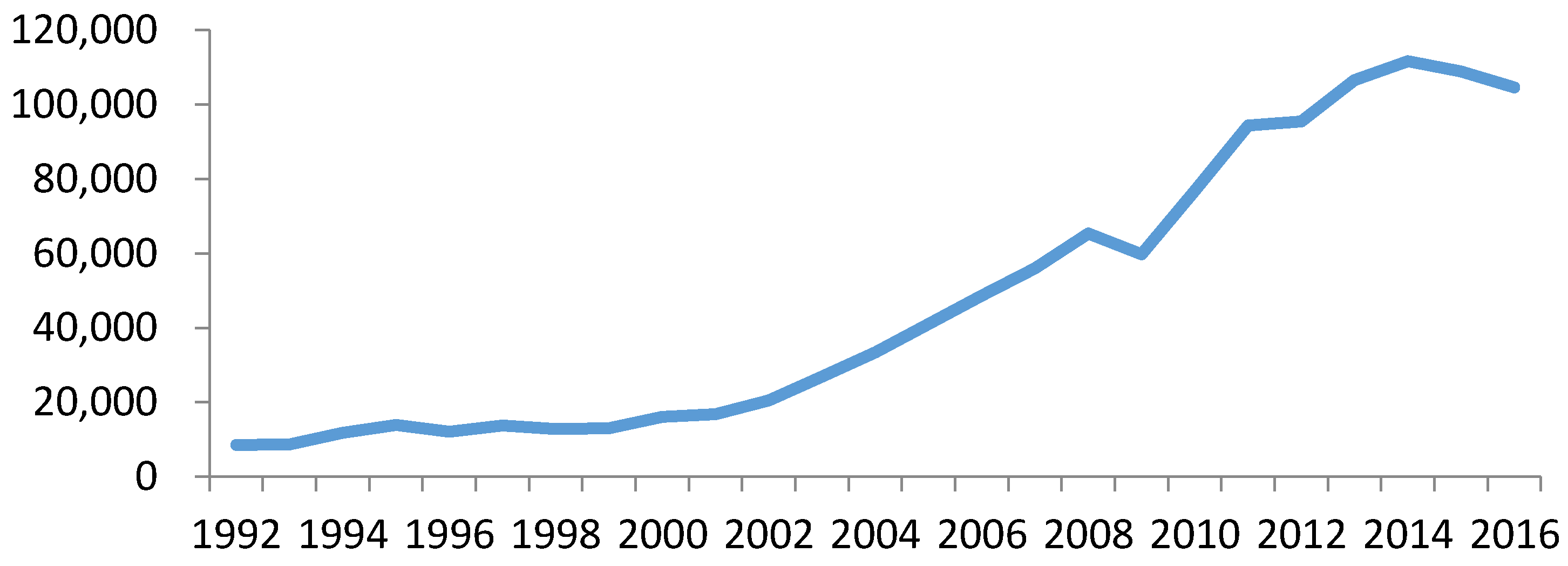

2.5. Status of China in the UK’s Textile Materials Imports

3. Model

4. The Seemingly Unrelated Regression Model (SUR Model) and Data Description

5. Discussion

5.1. The Effects of Relative Imports Prices

5.2. The Effects of International Trade Barriers

5.3. The Influence of China Joining WTO

5.4. The Effects of China’s Domestic Export Tax Policy

5.5. The Environmental and Ecological Labelling in the UK Relative Raw Textile Imports

6. Conclusions

Acknowledgments

Conflicts of Interest

References

- Spear, B. Textile patents and the GB industrial revolution. World Pat. Inf. 2016, 44, 53–56. [Google Scholar] [CrossRef]

- Aristotelous, K. Exchange-rate volatility, exchange-rate regime, and trade volume: Evidence from the UK-U.S. export function (1889–1999). Econ. Lett. 2001, 72, 87–94. [Google Scholar] [CrossRef]

- Broll, U.; Eckwert, B. Exchange rate volatility and international trade. South. Econ. J. 1999, 66, 178–185. [Google Scholar] [CrossRef]

- Kenworthy, J.L. U.S.-China textile relations. China Bus. Rev. 1991, 18, 40–44. [Google Scholar]

- Taylor, G. China textile trade. J. Fash. Mark. Manag. 2004, 8, 136–140. [Google Scholar] [CrossRef]

- Sun, S.; Anwar, S. Foreign direct investment and the performance of indigenous firms in China’s textile industry. Q. Rev. Econ. Finance 2017, 65, 107–113. [Google Scholar] [CrossRef]

- Dickson, K.; Coles, A.M. Textile design protection: Copyright, CAD and competition. Technovation 2000, 20, 47–53. [Google Scholar] [CrossRef]

- Dereli, T.; Durmuşoğlu, A. Patenting activities in Turkey: The case of the textile industry. World Pat. Inf. 2009, 31, 123–130. [Google Scholar] [CrossRef]

- McAdam, R.; McClelland, J. Sources of new product ideas and creativity practices in the UK textile industry. Technovation 2002, 22, 113–121. [Google Scholar] [CrossRef]

- Roper, S.; Love, J.H. Innovation and export performance: Evidence from the UK and German manufacturing plants. Res. Policy 2002, 31, 1087–1102. [Google Scholar] [CrossRef]

- Serra, F.; Pointon, J.; Abdou, H. Factors influencing the propensity to export: A study of UK and Portuguese textile firms. Int. Bus. Rev. 2012, 21, 210–224. [Google Scholar] [CrossRef]

- Ortiz, T.; Castillo, V.; Alfaro, G.T.; Rajagopal, E.T. Does textile sector trade of Mexico drive international competitive advantage. Int. J. Bus. Compet. Growth 2010, 1, 162–176. [Google Scholar] [CrossRef]

- Roche, J. The international textile industry. In The International Cotton Trade; Woodhead Publishing: Sawston, UK, 1994; pp. 133–186. [Google Scholar]

- Feenstra, R.C. Quality change under trade restraints in Japanese autos. Quart. J. Econ. 1998, 103, 131–146. [Google Scholar] [CrossRef]

- Harrigan, J.; Barrows, G. Testing the theory of trade policy: Evidence from the abrupt end of the multifiber arrangement. Rev. Econ. Stat. 2009, 91, 282–294. [Google Scholar] [CrossRef]

- Khandelwal, A.K.; Schott, P.K.; Wei, S.-J. Trade liberalization and embedded institutional reform: Evidence from Chinese exporters. Am. Econ. Rev. 2013, 103, 2169–2195. [Google Scholar] [CrossRef]

- Feng, L.; Li, Z.; Swenson, D.L. Trade policy uncertainty and exports: Evidence from China’s WTO accession. J. Int. Econ. 2017, 106, 20–36. [Google Scholar] [CrossRef]

- Yang, Y. China’s Textile and Clothing Exports: Changing International Comparative Advantage and Its Policy Implications; Australian National University: Melbourne, Australia, 1999. [Google Scholar]

- Chen, K.; Jackson, K.C. The statistical coverage of China’s textile industry. J. Text. Inst. 1996, 87, 82–88. [Google Scholar] [CrossRef]

- Bini-Smaghi, L. Exchange rate variability and trade: Why is it so difficult to find any empirical relationship? Appl. Econ. 1991, 23, 927–936. [Google Scholar] [CrossRef]

- Broda, C.; Romalis, J. Identifying the relationship between trade and exchange rate volatility. In Commodity Prices and Markets, East Asia Seminar on Economics, Volume 20; University of Chicago Press: Chicago, IL, USA, 2011. [Google Scholar]

- Rauch, J.R. Networks versus markets in international trade. J. Int. Econ. 1999, 48, 7–37. [Google Scholar] [CrossRef]

- Belanger, D.; Gutiérrez, S.; Racette, D.; Raynauld, J. The impact of exchange rate variability on trade flows: Further results on sectoral U.S. imports from Canada. N. Am. J. Econ. Finance 1992, 3, 888–892. [Google Scholar] [CrossRef]

- De Vita, G.; Abbott, A. The impact of exchange rate volatility on UK exports to EU countries. Scott. J. Political Econ. 2004, 51, 62–81. [Google Scholar] [CrossRef]

- Peridy, N. Exchange rate volatility, sectoral trade and aggregation. Weltwirtschaftliches Archiv. 2003, 139, 389–418. [Google Scholar] [CrossRef]

- Feenstra, R.C. Advanced International Trade: Theory and Evidence; Princeton University Press: Princeton, NJ, USA, 2003. [Google Scholar]

- Byrne, J.P.; Darby, J.; MacDonald, R. U.S. Trade and Exchange Rate Volatility: A Real Sectoral Bilateral Analysis; Department of Economics, University of Glasgow: Glasgow, UK, 2006. [Google Scholar]

- Armington, P. A theory of demand for products distinguished by place of production. IMF Staff Papers 1969, 16, 170–201. [Google Scholar]

- Klein, M.W. Sectoral effects of exchange rate volatility on United States exports. J. Int. Money Finance 1990, 9, 299–308. [Google Scholar] [CrossRef]

- Curran, L. Forecasting the trade outcomes of liberalisation in a quota context—What do we learn from changes in textiles trade after the ATC? J. World Trade 2008, 42, 129–150. [Google Scholar]

- Zellner, A. An efficient method of estimating seemingly unrelated regressions and tests for aggregation bias. J. Am. Stat. Assoc. 1962, 57, 348–368. [Google Scholar] [CrossRef]

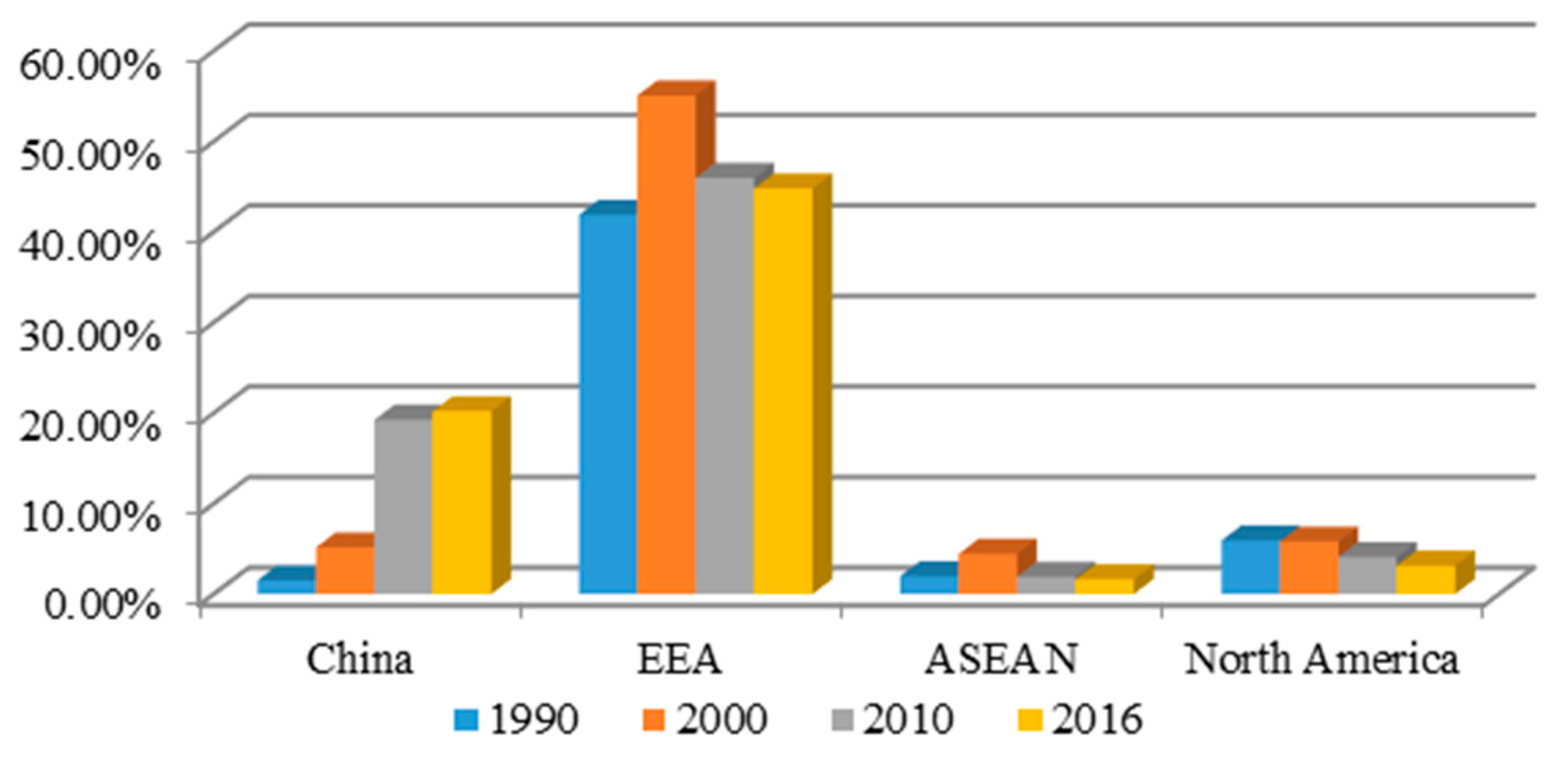

| Country/Region | 1990 | 2000 | 2010 | 2016 | ||||

|---|---|---|---|---|---|---|---|---|

| Imports % | Imports % | Imports % | Imports % | |||||

| World | 7017.65 | 100% | 7265.29 | 100% | 7163.52 | 100% | 7217.23 | 100% |

| China | 107.16 | 2% | 373.79 | 5% | 1379.87 | 19% | 1456.72 | 20% |

| EEA | 2954.15 | 42% | 4010.39 | 55% | 3298.82 | 46% | 3237.83 | 45% |

| ASEAN | 139.30 | 2% | 323.30 | 4% | 136.50 | 2% | 118.40 | 2% |

| North America | 417.64 | 6% | 421.52 | 6% | 293.05 | 4% | 225.48 | 3% |

| Country/Region | 1990 | 1995 | 2000 | 2005 | 2010 | 2016 |

|---|---|---|---|---|---|---|

| China | - | 0.691 | 0.693 | 0.796 | 0.829 | 0.850 |

| EEA | 0.203 | 0.255 | 0.256 | 0.266 | 0.277 | 0.240 |

| ASEAN | 0.419 | 0.496 | 0.455 | 0.192 | 0.112 | −0.202 |

| North America | −0.029 | −0.009 | −0.126 | −0.177 | 0.029 | −0.068 |

| Country/Region | 1990 | 1995 | 2000 | 2005 | 2010 | 2016 |

|---|---|---|---|---|---|---|

| China | - | 0.602 | 0.424 | 0.626 | 0.656 | 0.624 |

| EEA | 1.059 | 0.903 | 0.801 | 0.711 | 0.654 | 0.593 |

| ASEAN | 1.224 | 1.483 | 0.899 | 0.535 | 0.523 | 0.450 |

| North America | 1.132 | 1.003 | 0.552 | 0.502 | 0.483 | 0.438 |

| Year | Austria | Belgium | Bulgaria | Croatia | Cyprus | Czech | Denmark | Estonia | Finland | France |

| 1990 | 152.54 | - | 0.32 | - | 2.33 | 20.76 | 112.26 | - | 17.07 | 559.05 |

| 2000 | 82.38 | 853.54 | 1.91 | 3.07 | 0.61 | - | 62.55 | 29.14 | 8.37 | 485.63 |

| 2010 | 46.07 | 805.78 | 16.21 | 0.60 | 0.22 | - | 90.91 | 1.13 | 9.33 | 237.37 |

| 2016 | 48.72 | 730.26 | 19.70 | 0.17 | 0.07 | - | 95.85 | 0.24 | 16.70 | 224.99 |

| Year | Germany | Greece | Hungary | Iceland | Ireland | Italy | Latvia | Liechtentein | Lithuania | Luxembourg |

| 1990 | - | 57.54 | 6.76 | 1.80 | 305.98 | 755.63 | - | - | - | - |

| 2000 | 619.96 | 32.36 | 12.05 | 2.00 | 232.64 | 695.06 | 2.65 | - | 3.19 | 14.39 |

| 2010 | 578.79 | 22.21 | 32.55 | 0.06 | 85.43 | 527.41 | 3.31 | - | 4.82 | 29.41 |

| 2016 | 537.30 | 11.12 | 25.79 | 0.04 | 48.86 | 465.71 | 9.71 | - | 24.66 | 11.41 |

| Year | Malta | Norway | Holland | Poland | Portugal | Romania | Spain | Sweden | Slovenia | Slovakia |

| 1990 | 1.96 | 12.39 | 447.03 | 20.07 | 306.49 | 3.14 | 130.89 | 40.13 | - | - |

| 2000 | 0.29 | 8.43 | 365.68 | 34.69 | 219.53 | 4.35 | 185.13 | 33.45 | 11.18 | 6.16 |

| 2010 | 0.09 | 5.98 | 438.00 | 39.02 | 117.42 | 22.87 | 107.20 | 47.58 | 11.01 | 18.04 |

| 2016 | 0.03 | 4.39 | 499.25 | 84.71 | 127.14 | 19.14 | 151.54 | 40.91 | 5.77 | 33.65 |

| Year | Malaysia | Indonesia | Thailand | Philippines | Singapore | Brunei | Vietnam | Laos | Myanmar | Cambodia |

|---|---|---|---|---|---|---|---|---|---|---|

| 1990 | 13.05 | 80.25 | 30.14 | 4.23 | 11.36 | 0.27 | --- | --- | --- | --- |

| 2000 | 37.67 | 169.22 | 99.15 | 7.51 | 1.26 | 0.94 | 7.28 | 0.06 | --- | 0.18 |

| 2010 | 10.43 | 46.11 | 54.60 | 6.77 | 0.98 | --- | 16.65 | 0.002 | --- | 0.91 |

| 2016 | 6.27 | 26.55 | 33.77 | 5.94 | 0.73 | 0.008 | 38.21 | 0.03 | --- | 6.93 |

| Year | The U.S. | Canada | Mexico |

|---|---|---|---|

| 1990 | 353.01 | 46.14 | 18.49 |

| 2000 | 397.34 | 16.70 | 7.48 |

| 2010 | 256.96 | 17.13 | 18.96 |

| 2016 | 201.85 | 10.81 | 12.83 |

| Region | Countries |

|---|---|

| EEA | Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxemburg, Malta, Holland, Norway, Poland, Portugal, Romania, Spain, Sweden, Slovenia, Slovakia |

| ASEAN | Malaysia, Indonesia, Thailand, Philippines, Singapore, Brunei, Vietnam, Laos, Burma, Cambodia |

| North America | The United States, Canada, Mexico |

| Industry | Sectors |

|---|---|

| Textile yarn, fabrics, made-up articles and related products |

|

| Sectors | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| EEA | ||||||||||

| Mean | −0.015 | −1.631 | −1.788 | −0.930 | −1.399 | −1.38 | 0.738 | −3.35 | −1.778 | |

| S.D. | 2.549 | 2.366 | 3.375 | 2.011 | 2.969 | 3.286 | 2.070 | 2.155 | 2.740 | |

| Mean | 0.139 | 0.990 | 1.023 | −0.377 | 1.048 | 0.753 | 0.146 | 0.401 | 0.373 | |

| S.D. | 0.751 | 0.721 | 0.543 | 1.036 | 0.797 | 1.125 | 0.813 | 0.608 | 1.030 | |

| ASEAN | ||||||||||

| Mean | −2.511 | −3.85 | −3.00 | −4.844 | −4.815 | −3.628 | −3.403 | −4.502 | −5.95 | |

| S.D. | 2.626 | 2.868 | 3.153 | 2.479 | 2.263 | 2.582 | 1.670 | 1.783 | 1.828 | |

| Mean | −0.140 | 0.505 | 0.263 | 0.602 | 0.595 | 0.619 | −0.083 | −0.138 | 1.121 | |

| S.D. | 0.769 | 0.799 | 0.805 | 1.13 | 0.881 | 1.133 | 0.744 | 0.540 | 1.480 | |

| North America | ||||||||||

| Mean | −0.341 | −1.489 | −1.141 | −0.980 | −1.345 | −1.432 | −0.202 | −1.931 | −0.796 | |

| S.D. | 0.835 | 1.162 | 1.188 | 1.019 | 1.265 | 1.301 | 1.242 | 0.864 | 0.606 | |

| Mean | 0.037 | 0.433 | 0.377 | −0.082 | 0.469 | 0.381 | 0.082 | 0.236 | −0.064 | |

| S.D. | 0.295 | 0.291 | 0.289 | 0.466 | 0.251 | 0.334 | 0.181 | 0.236 | 0.299 | |

| Variables | Three Trade Regions | Constant | R2 | Obs | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SITC | ||||||||||

| Sector 1. Textile yarn | EEA | 2.102 *** (6.32) | −0.769 ** (2.50) | −0.928 * (1.96) | −1.343 ** (2.38) | −1.472 ** (2.39) | 0.386 (0.56) | 0.390 | 152 | |

| ASEAN | −2.448 *** (5.77) | −1.656 *** (6.47) | 0.923 (1.75) | −1.320 *** (2.49) | 0.750 (1.53) | −0.050 ** (2.12) | 0.354 | 166 | ||

| North American | 0.419 ** (2.00) | −0.886 *** (4.35) | 0.225 (0.99) | −1.092 *** (4.34) | −0.646 *** (2.62) | −0.337 ** (2.19) | 0.437 | 87 | ||

| Sector 2. Cotton fabrics woven | EEA | 0.578 *** (1.62) | −0.438 *** (6.78) | −0.526 (1.14) | −1.107 ** (2.14) | 0.657 (1.31) | 0.066 (0.09) | 0.328 | 153 | |

| ASEAN | −2.296 *** (4.76) | −1.604 *** (6.46) | 0.201 (0.32) | −0.621 (1.00) | −1.045 ** (2.01) | 1.105 (1.29) | 0.322 | 149 | ||

| North American | −1.414 *** (4.09) | −0.624 ** (2.41) | 0.118 (0.30) | −0.073 (0.17) | −0.439 (1.11) | 0.274 (0.52) | 0.412 | 81 | ||

| Sector 3. Fabrics woven of man-made textile materials | EEA | 2.547 *** (5.89) | −1.157 *** (3.09) | −2.227 (1.80) | −1.931 ** (2.95) | −1.348 ** (2.25) | −1.199 * (1.96) | 0.478 | 153 | |

| ASEAN | −1.208 (3.23) | −1.760 *** (8.79) | 2.309 *** (4.48) | −2.190 *** (4.37) | −1.021 ** (2.43) | −0.668 ** (1.94) | 0.592 | 164 | ||

| North American | −0.655 *** (2.66) | −1.288 * (1.79) | 0.786 *** (2.51) | −1.021 *** (3.05) | 0.064 (0.24) | −1.02 * (1.77) | 0.433 | 86 | ||

| Sector 4. Other textile fabrics woven | EEA | 0.024 (0.09) | −0.351 ** (2.91) | 0.244 (0.59) | −1.147 ** (2.31) | −0.423 (0.95) | −0.175 (0.760) | 0.247 | 153 | |

| ASEAN | −3.435 (7.62) | −0.183 ** (2.00) | −0.304 (0.47) | −1.332 ** (2.15) | −1.139 ** (2.34) | −1.435 ** (2.04) | 0.149 | 150 | ||

| North American | −0.795 ** (2.88) | −0.474 ** (2.30) | 0.146 (0.47) | −0.039 (0.11) | −0.612 ** (2.23) | 0.405 (1.70) | 0.268 | 86 | ||

| Sector 5. Knitted or crocheted fabrics | EEA | 1.329 ** (2.76) | −1.096 *** (3.88) | 0.431 (1.15) | −1.925 *** (3.17) | −2.506 *** (4.54) | −1.299 * (1.94) | 0.442 | 153 | |

| ASEAN | −2.430 *** (7.85) | −1.256 *** (8.13) | −0.377 (0.87) | −1.142 ** (2.85) | −1.884 *** (5.61) | −1.48 ** (2.39) | 0.524 | 150 | ||

| North American | −0.266 (0.84) | −1.384 ** (2.20) | −0.394 (1.15) | −0.980 *** (2.86) | −1.101 *** (3.79) | −0.308 ** (2.07) | 0.439 | 84 | ||

| Sector 6. Tulle, lace, embroidery, ribbons, etc. | EEA | 1.181 *** (2.84) | −0.371 *** (3.06) | −0.954 (1.26) | −2.581 *** (3.99) | −1.201 (1.41) | −0.240 (0.55) | 0.364 | 153 | |

| ASEAN | −1.906 *** (5.85) | −0.717 *** (5.64) | 1.491 *** (3.29) | −1.862 *** (4.27) | −1.092 (2.93) | −0.464 (1.45) | 0.541 | 164 | ||

| North American | −0.564 (1.88) | −0.284 *** (2.79) | 0.389 (1.06) | −1.16 (3.12) | −0.341 (1.08) | −0.763 (1.75) | 0.379 | 85 | ||

| Sector 7. Special yarn and related products | EEA | 2.728 *** (13.09) | −0.407 ** (2.10) | −0.963 (1.34) | −2.468 *** (6.21) | −1.310 ** (0.33) | 0.603 (1.25) | 0.701 | 102 | |

| ASEAN | −2.217 (8.67) | −0.599 *** (3.05) | −0.262 (0.76) | −0.995 *** (2.77) | −0.238 1.64 | −0.69 (1.71) | 0.198 | 89 | ||

| North American | 0.567 *** (4.05) | −0.570 *** (4.05) | 0.190 (1.03) | −1.838 *** (7.27) | −0.434 1.33 | −0.667 (1.36) | 0.664 | 44 | ||

| Sector 8. Made up articles | EEA | −2.406 *** (5.15) | −0.279 ** (2.52) | −0.371 (1.19) | −1.908 *** (3.89) | −1.470 (0.24) | −0.393 (1.26) | 0.311 | 153 | |

| ASEAN | −4.036 *** (18.61) | −1.410 *** (8.35) | 0.922 *** (3.34) | −1.168 *** (4.20) | −0.406 (1.74) | −0.513 (1.37) | 0.609 | 169 | ||

| North American | −1.471 *** (7.42) | −0.688 *** (2.72) | −0.368 (1.32) | −0.816 *** (2.91) | −0.394 (1.71) | −0.473 (1.49) | 0.246 | 87 | ||

| Sector 9. Flooring coverings, etc. | EEA | −1.265 *** (2.99) | −1.231 ** (9.28) | −0.417 (0.81) | 1.874 (0.86) | 0.360 (0.51) | 0.274 (3.05) | 0.402 | 146 | |

| ASEAN | −5.575 (17.05) | −0.021 ** (2.20) | −0.489 (1.08) | −0.106 (0.23) | −0.558 (1.38) | −1.580 ** (2.48) | 0.023 | 149 | ||

| North American | −0.222 (1.38) | −0.038 *** (3.41) | 0.118 (0.62) | −0.737 *** (3.23) | −0.468 *** (2.37) | −0.655 ** (2.74) | 0.275 | 77 | ||

© 2017 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, J. The Role of China in the UK Relative Imports from Three Selected Trading Regions: The Case of Textile Raw Material Industry. Int. J. Environ. Res. Public Health 2017, 14, 1481. https://doi.org/10.3390/ijerph14121481

Xu J. The Role of China in the UK Relative Imports from Three Selected Trading Regions: The Case of Textile Raw Material Industry. International Journal of Environmental Research and Public Health. 2017; 14(12):1481. https://doi.org/10.3390/ijerph14121481

Chicago/Turabian StyleXu, Junqian. 2017. "The Role of China in the UK Relative Imports from Three Selected Trading Regions: The Case of Textile Raw Material Industry" International Journal of Environmental Research and Public Health 14, no. 12: 1481. https://doi.org/10.3390/ijerph14121481

APA StyleXu, J. (2017). The Role of China in the UK Relative Imports from Three Selected Trading Regions: The Case of Textile Raw Material Industry. International Journal of Environmental Research and Public Health, 14(12), 1481. https://doi.org/10.3390/ijerph14121481