Application of Social Network Analysis to Visualization and Description of Industrial Clusters: A Case of the Textile Industry

Abstract

:1. Introduction

2. Literature Review

2.1. Industrial Cluster as an Inter-Organizational Network

2.2. Approaches to Identifying Industrial Clusters

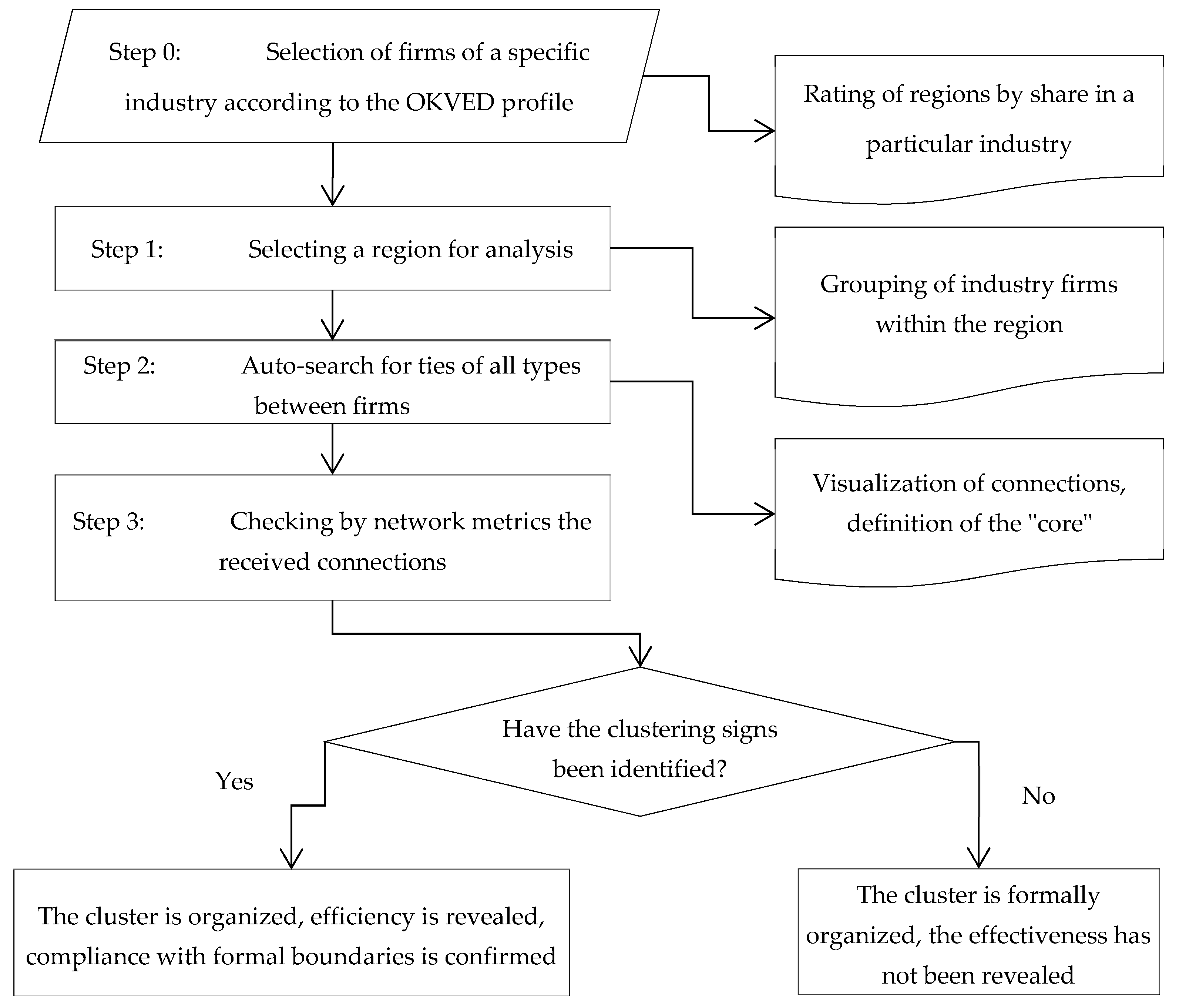

3. Materials and Methods

- Ownership of equity management (including arbitration management);

- Connections between possible relatives;

- Registration address, phone, and e-mail;

- Historical connections;

- Franchise;

- Common counterparts (for government contracts, arbitration courts, etc.).

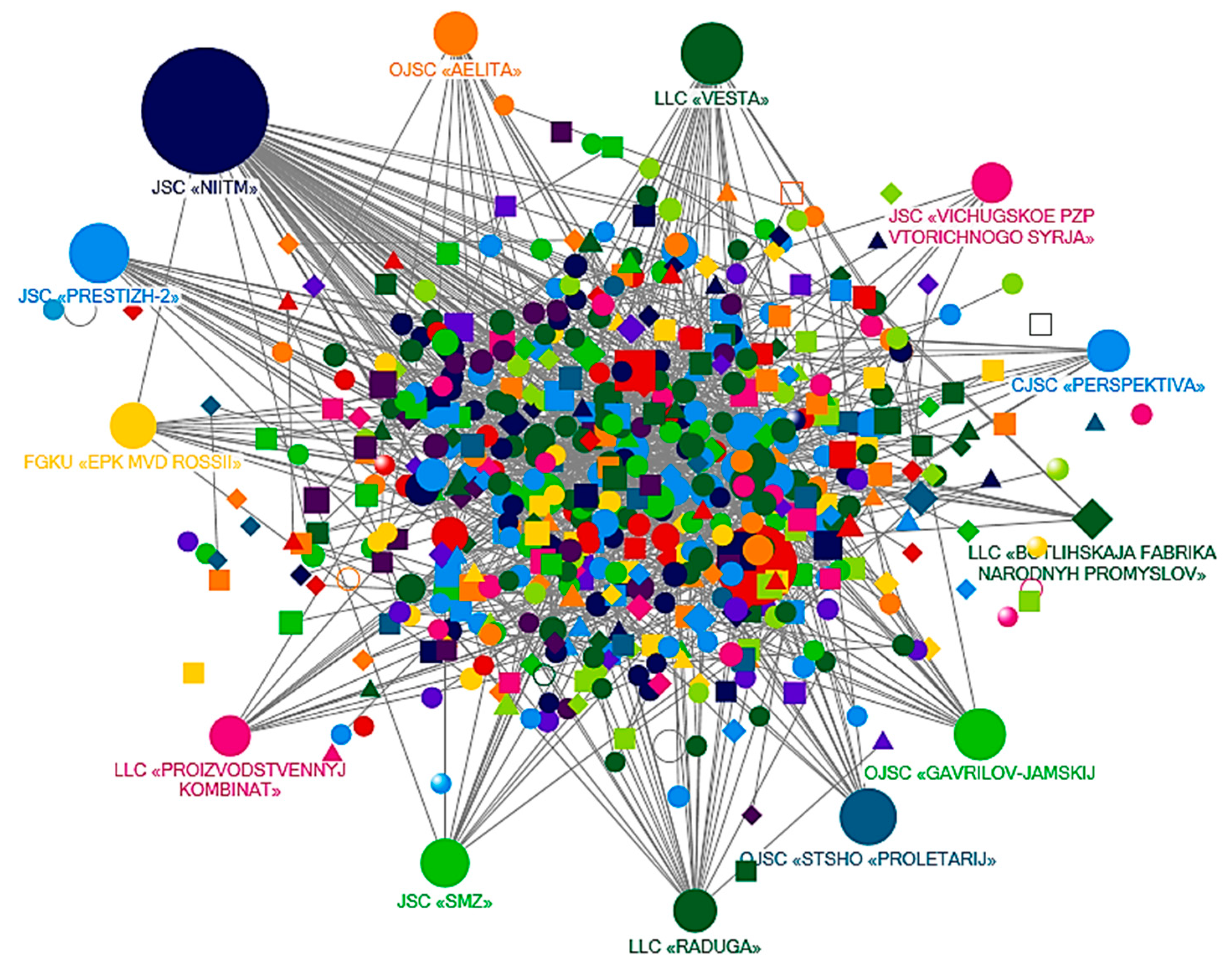

4. Results and Discussion

- Only firms with more than four connections are present;

- The size of the node reflects the number of connections;

- Firms from different regions are indicated in different colors.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Enterprise | Betweenness Centrality | Region |

|---|---|---|

| JSC «NIITM» | 7,810,948 | Ivanovo region |

| LLC «VESTA» | 1,485,712 | Moscow |

| JSC «PRESTIZH-2» | 1,225,938 | Sverdlovsk region |

| LLC «RADUGA» | 1,156,502 | Chelyabinsk region |

| OJSC «STSHO «PROLETARIJ» | 901,402 | Moscow region |

| LLC «STIL» | 832,502 | Republic of Mari El |

| OJSC «GAVRILOV-JAMSKIJ LNOKOMBINAT» | 722,649 | Yaroslavl region |

| JSC «SMZ» | 709,992 | Moscow region |

| LLC «SILUET» | 670,088 | Kabardino-Balkarian Republic |

| FGKU «EPK MVD ROSSII» | 657,070 | Moscow |

| OJSC «AELITA» | 527,000 | Republic of Tatarstan |

| LLC «NADEZHDA» | 499,376 | Belgorod region |

| Enterprise | Number of Connections | Region | Industry | |

|---|---|---|---|---|

| 1 | JSC «NIITM» | 538 | Ivanovo region | Scientific research institute, manufacturing of other textiles |

| 2 | LLC «VESTA» | 123 | Moscow | Cotton fabrics production |

| 3 | JSC «PRESTIZH-2» | 112 | Sverdlovsk region | Production of other clothing and accessories |

| 4 | OJSC «STSHO «PROLETARIJ» | 101 | Moscow region | Carded wool fiber spinning |

| 5 | OJSC « GAVRILOV-JAMSKIJ LNOKOMBINAT» | 82 | Yaroslavl region | Manufacturing of textile fabrics |

| 6 | JSC «SMZ» | 71 | Moscow region | Manufacturing of finished textiles other than clothing |

| 7 | SFSI «JEPK MVD ROSSII» | 63 | Moscow | Production of workwear |

| 8 | OJSC «TREHGORNAJA MANUFAKTURA» | 62 | Moscow | Cotton fabrics production |

| 9 | OJSC «AJELITA» | 58 | Republic of Tatarstan | Manufacture of outerwear from textile materials, except knitted |

| 10 | LLC «RADUGA» | 56 | Chelyabinsk region | Production of workwear |

| 11 | «LECHEBNO-PROIZVODSTVENNYE MASTERSKIE PRI KOVASHEVSKOJ PSIHIATRICHESKOJ BOLNICE» | 55 | Leningrad region | Production of other clothing and accessories |

| 12 | CJSC «PERSPEKTIVA» | 52 | Moscow region | Production of workwear |

| 13 | LLC «BOTLIHSKAJA FABRIKA NARODNYH PROMYSLOV» | 50 | Dagestan Republic | Felt production |

| 14 | LLC «PROIZVODSTVENNYJ KOMBINAT» | 48 | Orenburg region | Manufacture of outerwear from textile materials, except knitted |

| 15 | JSC «VICHUGSKOE PZP VTORICHNOGO SYRJA» | 47 | Ivanovo region | Production of non-woven textile materials and products other than clothing |

| 16 | MUC «AURGAZINSKOE RPU BON» | 46 | Republic of Bashkortostan | Production of other clothing and accessories |

| 17 | LLC «KOMPRESSIONNYJ LAJNER» | 41 | Tomsk region | Production of knitted and knitted hosiery products |

| 18 | LLC «NADEZHDA» | 39 | Belgorod region | Production of workwear |

| 19 | LLC «SOZVEZDIE» | 36 | Nizhny Novgorod region | Production of ropes, twine, and networks |

| 20 | LLC «GENERALNYJ PROGON» | 35 | Moscow | Manufacture of outerwear from textile materials, except knitted or knitted |

| 21 | LLC «BMP «ROSTOK» | 35 | Altai Territory | Production of other clothing and accessories |

| 22 | JSC «DETSKAJA SHVEJNAJA KOMPANIJA» | 34 | Moscow | Production of other clothing and accessories |

| 23 | LLC «JELEGANT» | 33 | Krasnoyarsk Territory | Production of other clothing and accessories |

| 24 | LLC «SSHF» | 31 | Vladimir region | Manufacture of outerwear from textile materials, except knitted |

| 25 | LLC «AVS PLJUS» | 31 | Sverdlovsk region | Production of other outerwear |

| 26 | JSC PO «DINAMO» | 31 | Moscow | Manufacturing of finished textiles other than clothing |

| 27 | LLC «SILUJET» | 30 | Kabardino-Balkarian Republic | Production of other outerwear |

| 28 | JSC «TEKSKOR» | 30 | Volgograd region | Production of cord fabrics |

| 29 | LLC «STIL» | 29 | Republic of Mari El | Production of other outerwear |

| 30 | JSC «POLET» | 29 | Ivanovo region | Manufacturing of finished textiles other than clothing |

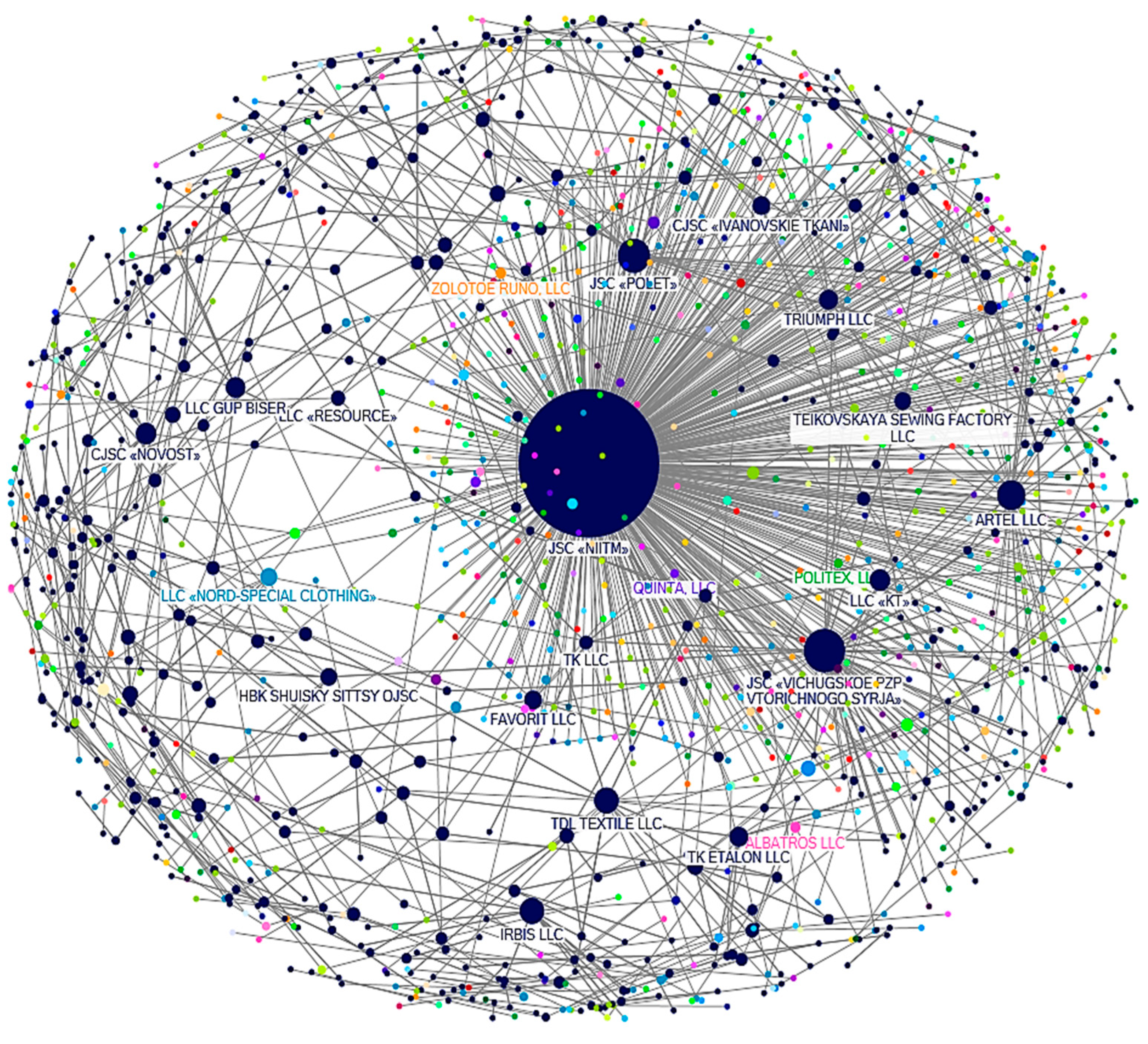

| Enterprise | Number of Connections | Region | Industry | |

|---|---|---|---|---|

| 1 | JSC «NIITM» | 538 | Ivanovo region | Scientific research institute, manufacturing of other textiles |

| 2 | JSC «VICHUGSKOE PZP VTORICHNOGO SYRJA» | 47 | Ivanovo region | Salvage |

| 3 | JSC «POLET» | 29 | Ivanovo region | Garment production |

| 4 | ARTEL LLC | 22 | Ivanovo region | Production of nonwoven materials |

| 5 | TDL TEXTILE LLC | 17 | Ivanovo region | Garment production |

| 6 | IRBIS LLC | 17 | Ivanovo region | Production of workwear |

| 7 | CJSC «NOVOST» | 12 | Ivanovo region | Production of workwear |

| 8 | LLC «KT» | 12 | Ivanovo region | Production of workwear |

| 9 | LLC GUP BISER | 11 | Ivanovo region | Production of workwear |

| 10 | TK ETALON LLC | 10 | Ivanovo region | Fabrics production |

| 11 | TRIUMPH LLC | 10 | Ivanovo region | Clothing production |

| 12 | CJSC «IVANOVO TISSUES» | 9 | Ivanovo region | Fabrics production |

| 13 | FAVORIT LLC | 9 | Ivanovo region | Production of workwear |

| 14 | HBK SHUISKY SITTSY OJSC | 8 | Ivanovo region | Fabrics production |

| 15 | TEIKOVSKAYA SEWING FACTORY LLC | 8 | Ivanovo region | Clothing production |

| 16 | LLC «NORD-SPECIAL CLOTHING» | 8 | Moscow region | Production of workwear |

| 17 | TD TEXTILE LLC | 7 | Ivanovo region | Production of workwear |

| 18 | LLC CAS «RED BRANCH» | 7 | Ivanovo region | Production of non-woven textiles |

| 19 | TEXTILE TRADITIONS LLC | 7 | Ivanovo region | Manufacturing of finished textiles other than clothing |

| 20 | OSWTEX LLC | 7 | Ivanovo region | Production of workwear |

| 21 | SHUYSKOYE SEWING ENTERPRISE NO. 1 LLC | 6 | Ivanovo region | Production of workwear |

| 22 | LLC «PSHC» | 6 | Ivanovo region | Production of workwear |

| 23 | GALTEX LLC | 6 | Ivanovo region | Fabrics production |

| 24 | LLC «RESOURCE» | 6 | Ivanovo region | Preparation and spinning of textile fibers |

| 25 | ALS LLC | 6 | Ivanovo region | Production of knitted fabric |

| 26 | LLC «TEXTILE COMPANY» RUSSIAN HOUSE « | 6 | Ivanovo region | Fabrics production |

| 27 | SPETSODEZHDA LLC | 6 | Perm Territory | Production of workwear |

| 28 | JSC «IVANOVOISKOZH» | 6 | Ivanovo region | Manufacturing of textiles |

| 29 | SHUISKY TEXTILE LLC | 5 | Ivanovo region | Production of knitted fabric |

| 30 | TK LLC | 5 | Ivanovo region | Manufacturing of finished textiles other than clothing |

| Subject | Questions |

|---|---|

| The history of the textile industry in the region | The state of the industry in the region before the cluster. Are there any Soviet or pre-revolutionary capacities? What state are they in now? How can you describe the dynamics of the industry before and after the advent of the cluster? |

| The history of the cluster | How did the cluster appear? Who was the initiator: business or state? How actively does the region’s business participate in the cluster? Are there barriers to joining the cluster? Is it possible to work without participating in the cluster? |

| Integration of firms within the cluster | How are firms integrated into a cluster? Is there a common infrastructure? Are there common purchasing and sales? If not, why? Is there a specialization between firms? Is there competition between companies? What is the relationship between the cluster members? |

| Cluster management | How is the cluster managed? Who makes strategic decisions? Are there governing bodies? If yes, how are they formed, and if not, how is cooperation between cluster members regulated? |

| Cluster’s competitive advantage | Do the firms see the benefits of networking? What competitive advantages do firms have? |

| Network members | How easy can a firm from outside enter the cluster, such as big market players from other regions, fashion designers, textile schools, or special workshops? |

| The strategy and the vision for the future | What is the strategy and the vision of the textile industry in your region? What challenges does it face? What is the cluster’s development strategy? What can be improved in the cluster’s structure, coordination, or monitoring? |

References

- Agafonov, Vladimir A. 2010. Cluster strategy: A systemic approach. Economic Science of Contemporary Russia 3: 77–91. Available online: https://cyberleninka.ru/article/n/klasternaya-strategiya-sistemnyy-podhod (accessed on 30 November 2021).

- Agafonov, Vladimir A. 2015. Regional Innovation Clusters. Regional Economics and Management: Electronic Scientific Journal, 4301. Available online: https://eee-region.ru/article/4301 (accessed on 30 November 2021).

- Albino, Vito, Nunzio Carbonara, and Ilaria Giannoccaro. 2007. Supply chain cooperation in industrial districts: A simulation analysis. European Journal of Operational Research 177: 261–80. [Google Scholar] [CrossRef]

- Baggio, Rodolfo, and Marina Sheresheva. 2014. Network approach in economics and management: The interdisciplinary nature. Vestnik Moskovskogo Universiteta. Ekonomika/Moscow University Economics Bulletin 2: 3–21. Available online: https://www.researchgate.net/publication/281116682_Setevoj_podhod_v_ekonomike_i_upravlenii_mezdisciplinarnyj_harakter (accessed on 30 November 2021).

- Bek, Mikhail A., Nadezhda N. Bek, Marina Y. Sheresheva, and Wesley J. Johnston. 2013. Perspectives of SME innovation clusters development in Russia. Journal of Business & Industrial Marketing 28: 240–59. [Google Scholar] [CrossRef]

- Belso-Martínez, José Antonio, Francisco Mas-Verdu, and Lorenzo ChinchillaMira. 2020. How do interorganizational networks and firm group structures matter for innovation in clusters: Different networks, different results. Journal of Small Business Management 58: 73–105. [Google Scholar] [CrossRef]

- Bergenholtz, Carsten, and Christian Waldstrøm. 2011. Inter-organizational network studies—A literature review. Industry and Innovation 18: 539–62. [Google Scholar] [CrossRef]

- Bittencourt, Bruno Anicet, Aurora Carneiro Zen, Vitor Schmidt, and Douglas Wegner. 2018. The orchestration process for emergence of clusters of innovation. Journal of Science and Technology Policy Management 11: 277–90. [Google Scholar] [CrossRef] [Green Version]

- Bode, Alexander, Tobias B. Talmon l’Armee, and Simon Alig. 2010. Research note: Clusters vs. networks—A literature-based approach towards an integrated concept. International Journal of Globalisation and Small Business 4: 92–110. [Google Scholar] [CrossRef]

- Borgatti, Stephen P., Martin G. Everett, and Jeffrey C. Johnson. 2018. Analyzing Social Networks, 2nd ed. London: Sage. [Google Scholar]

- Brachert, Matthias, Mirko Titze, and Alexander Kubis. 2011. Identifying industrial clusters from a multidimensional perspective: Methodical aspects with an application to Germany. Papers in Regional Science 90: 419–39. [Google Scholar] [CrossRef]

- Brenner, Thomas. 2004. Local Industrial Clusters: Existence, Emergence and Evolution. London: Routledge. [Google Scholar]

- Brenner, Thomas, and André Mühlig. 2013. Factors and Mechanisms Causing the Emergence of Local Industrial Clusters: A Summary of 159 Cases. Regional Studies 47: 480–507. [Google Scholar] [CrossRef]

- Breznitz, Shiri M. 2013. Cluster Sustainability: The Israeli Life Sciences Industry. Economic Development Quarterly 27: 29–39. Available online: https://journals.sagepub.com/doi/10.1177/0891242412471846 (accessed on 30 November 2021). [CrossRef]

- EOCIC. 2020. European Panorama of Clusters and Industrial Change; Luxembourg: Publications Office of the European Union. Available online: https://clustercollaboration.eu/sites/default/files/news_attachment/european_panorama_2020.pdf (accessed on 30 November 2021).

- Expósito-Langa, Manuel, José-Vicente Tomás-Miquel, and F. Xavier Molina-Morales. 2015. Innovation in clusters: Exploration capacity, networking intensity and external resources. Journal of Organizational Change Management 28: 26–42. [Google Scholar] [CrossRef] [Green Version]

- Fedorov, Sergey. 2021. Cluster policy and innovative activity of industrial enterprises. Vestnik Moskovskogo Universiteta. Ekonomika/Moscow University Economics Bulletin 4: 161–85. [Google Scholar] [CrossRef]

- Felzensztein, Christian, Eli Gimmon, and Kenneth R. Deans. 2018. Coopetition in regional clusters: Keep calm and expect unexpected changes. Industrial Marketing Management 69: 116–24. Available online: https://isiarticles.com/bundles/Article/pre/pdf/85841.pdf (accessed on 30 November 2021). [CrossRef]

- Giuliani, Elisa, Pierre-Alexandre Balland, and Andrés Matta. 2019. Straining but not thriving: Understanding network dynamics in underperforming industrial clusters. Journal of Economic Geography 19: 147–72. [Google Scholar] [CrossRef]

- He, Shuangnan. 2019. Research on the Cooperation Networks of Xiuyan Jade Carving Industry Based on SNA. In International Conference on Management, Finance and Social Sciences Research (MFSSR 2019). London: Francis Academic Press. [Google Scholar] [CrossRef]

- Intarakumnerd, Patarapong. 2005. The roles of intermediaries in clusters: The Thai experiences in high-tech and community-based clusters. Asian Journal of Technology Innovation 13: 23–43. [Google Scholar] [CrossRef]

- Islankina, Ekaterina, and Thomas Wolfgang Thurner. 2018. Internationalization of cluster initiatives in Russia: Empirical evidence. Entrepreneurship & Regional Development 30: 776–99. [Google Scholar] [CrossRef]

- Khakimov, Ziyodulla A. 2019. Synergy effect textile clusters of Uzbekistan. Asian Journal of Technology & Management Research 9: 65–71. Available online: http://ajtmr.com/papers/Vol9Issue1/Vol9Iss1_P8.pdf (accessed on 30 November 2021).

- Khalid, Haris. 2019. Systematic literature review on social network analysis. Paper presented at the 2019 International Conference on Innovative Computing (ICIC), Lahore, Pakistan, November 1–2; pp. 1–7. [Google Scholar] [CrossRef]

- Kowalski, Arkadiusz M. 2020. Towards an Asian model of clusters and cluster policy: The super cluster strategy. Journal of Competitiveness 12: 74–90. [Google Scholar] [CrossRef]

- Kozonogova, Elena, Daniil Kurushin, and Julia Dubrovskaya. 2019. Computer visualization of the identify industrial clusters task using GVMap. Scientific Visualization 11: 126–41. [Google Scholar] [CrossRef]

- Kudrjavtseva, Tatiana, and Nikolay Zhabin. 2014. Formation of an algorithm to define clusters in regional economy. Nauchno-tehnicheskie vedomosti Sankt-Peterburgskogo gosudarstvennogo politehnicheskogo universiteta. Economics 3: 124–31. Available online: https://cyberleninka.ru/article/n/formirovanie-algoritma-identifikatsii-klasterov-v-ekonomike-regiona (accessed on 30 November 2021).

- Marshall, Alfred. 1922. Principles of Economics. New York: McMillan Publishing Company. [Google Scholar]

- Martin, Ron, and Peter Sunley. 2003. Deconstructing clusters: Chaotic concept or policy panacea? Journal of Economic Geography 3: 5–35. [Google Scholar] [CrossRef]

- Martínez, Adriana, José A. Belso-Martínez, and Francisco Más-Verdú. 2012. Industrial clusters in Mexico and Spain: Comparing inter-organizational structures within context of change. Journal of Organizational Change Management 25: 657–81. [Google Scholar] [CrossRef]

- Maskell, Peter. 2001. Towards a knowledge-based theory of the geographical cluster. Industrial and Corporate Change 10: 921–43. [Google Scholar] [CrossRef]

- McCann, Brian T., and Timothy B. Folta. 2011. Performance differentials within geographic clusters. Journal of Business Venturing 26: 104–23. [Google Scholar] [CrossRef]

- Melnik, Mikhail Ion. 2015. Confronting the Challenges of Asymmetry of Information and Competition: The Rise of eBay. In Trends and Innovations in Marketing Information Systems. Hershey: IGI Global, pp. 293–307. [Google Scholar]

- Ménard, Claude. 1996. On clusters, hybrids, and other strange forms: The case of the French poultry industry. Journal of Institutional and Theoretical Economics (JITE)/Zeitschrift für die Gesamte Staatswissenschaft 152: 154–83. [Google Scholar]

- Moore, James F. 1993. Predators and prey: A new ecology of competition. Harvard Business Review 71: 75–86. Available online: https://www.researchgate.net/publication/13172133_Predators_and_Prey_A_New_Ecology_of_Competition (accessed on 30 November 2021). [PubMed]

- Moore, James F. 1996. The Death of Competition: Leadership and Strategy in the Age of Business Ecosystems. New York: Harper Business. [Google Scholar]

- Newlands, David. 2003. Competition and Cooperation in Industrial Clusters: The Implications for Public Policy. European Planning Studies 11: 521–32. [Google Scholar] [CrossRef]

- NodeXL. 2021. NodeXL Official Site. Available online: https://nodexl.com/ (accessed on 15 October 2021).

- Orekhova, Svetlana V., Andrei V. Misyura, and Julia S. Bausova. 2020. Strategy vs. business model: Evolution and differentiation. Vestnik Moskovskogo Universiteta. Ekonomika/Moscow University Economics Bulletin 3: 160–81. [Google Scholar] [CrossRef]

- Papagiannidis, Savvas, Eric W. K. See-To, Dimitris G. Assimakopoulos, and Yang Yang. 2018. Identifying industrial clusters with a novel big-data methodology: Are SIC codes (not) fit for purpose in the Internet age? Computers & Operations Research 98: 355–66. [Google Scholar]

- Pavelkova, Drahomira, Miroslav Zizka, Lubor Homolka, Adriana Knapkova, and Natalie Pelloneova. 2021. Do clustered firms outperform the non-clustered? Evidence of financial performance in traditional industries. Economic Research-Ekonomska Istraživanja 34: 1–23. [Google Scholar] [CrossRef]

- Peeters, Ludo, Marc Tiri, and Adrian Berwert. 2001. Identification of Techno-Economic Clusters Using Input-Output Data: Application to Flanders and Switzerland. In Innovative Clusters: Drivers of National Innovation Systems. Paris: OECD, pp. 251–72. Available online: https://www.researchgate.net/publication/282236332_Identification_of_techno-economic_clusters_using_input-output_data_application_to_Flanders_and_Switzerland (accessed on 30 November 2021).

- Porter, Michael E. 1998. Clusters and the New Economics of Competition. Harvard Business Review 76: 77–90. Available online: https://hbr.org/1998/11/clusters-and-the-new-economics-of-competition (accessed on 25 November 2021). [PubMed]

- Porter, Michael E. 2000. Location, competition, and economic development: Local clusters in a global economy. Economic Development Quarterly 14: 15–34. [Google Scholar] [CrossRef]

- Porter, Michael E. 2003. The Economic Performance of Regions. Regional Studies 37: 549–78. Available online: https://www.hse.ru/mirror/pubs/share/212158628 (accessed on 30 November 2021). [CrossRef]

- Porter, Michael E. 2004. Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York: Free Press. [Google Scholar]

- Razminienė, Kristina, Irina Vinogradova-Zinkevič, and Manuela Tvaronavičienė. 2021. Tracing Relationship between Cluster’s Performance and Transition to the Circular Economy. Sustainability 13: 13933. [Google Scholar] [CrossRef]

- Sheresheva, Marina Y. 2010. Forms of Inter-Firm Networking. Moscow: SU-HSE Publishing. [Google Scholar]

- Sheresheva, Marina Y. 2016. Creation of tourist clusters in Russian regions. Logistika 6: 52–56. [Google Scholar]

- Sozinova, Anastasia A., Olga I. Okhrimenko, Ludmila V. Goloshchapova, Eugeny P. Kolpak, Natalia B. Golovanova, and Evgeny A. Tikhomirov. 2017. Industrial and innovation clusters: Development in Russia. International Journal of Applied Business and Economic Research 15: 111–18. Available online: https://www.researchgate.net/profile/Anastasia-Sozinova/publication/318490388_Industrial_and_innovation_clusters_Development_in_Russia/links/5ffc22eb45851553a03650fc/Industrial-and-innovation-clusters-Development-in-Russia.pdf (accessed on 16 February 2022).

- SPARK-Interfax. 2021. Interfax Official Site. Available online: https://www.spark-interfax.ru (accessed on 16 November 2021).

- Stejskal, Jan. 2011. Analysis of the applicability of selected methods for industrial clusters identifying. International Journal of Systems Applications, Engineering & Development 5: 255–62. [Google Scholar]

- Valitova, Lilia A., Elena R. Sharko, and Marina Y. Sheresheva. 2021. Identification of industrial clusters based on the analysis of business relationships: An example of the textile industry. Upravlenets–The Manager 12: 59–74. [Google Scholar] [CrossRef]

- Vom Hofe, Rainer, and Saurav Dev Bhatta. 2007. Method for Identifying Local and Domestic Industrial Clusters Using Interregional Commodity Trade Data. Industrial Geographer 4: 1–27. [Google Scholar]

- Yim, Deok Soon, Wangdong Kim, and Young-ho Nam. 2020. The Strategic Transformation from Innovation Cluster to Digital Innovation Cluster during and after COVID-19. Asian Journal of Innovation and Policy 9: 164–86. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sheresheva, M.Y.; Valitova, L.A.; Sharko, E.R.; Buzulukova, E.V. Application of Social Network Analysis to Visualization and Description of Industrial Clusters: A Case of the Textile Industry. J. Risk Financial Manag. 2022, 15, 129. https://doi.org/10.3390/jrfm15030129

Sheresheva MY, Valitova LA, Sharko ER, Buzulukova EV. Application of Social Network Analysis to Visualization and Description of Industrial Clusters: A Case of the Textile Industry. Journal of Risk and Financial Management. 2022; 15(3):129. https://doi.org/10.3390/jrfm15030129

Chicago/Turabian StyleSheresheva, Marina Y., Lilia A. Valitova, Elena R. Sharko, and Ekaterina V. Buzulukova. 2022. "Application of Social Network Analysis to Visualization and Description of Industrial Clusters: A Case of the Textile Industry" Journal of Risk and Financial Management 15, no. 3: 129. https://doi.org/10.3390/jrfm15030129

APA StyleSheresheva, M. Y., Valitova, L. A., Sharko, E. R., & Buzulukova, E. V. (2022). Application of Social Network Analysis to Visualization and Description of Industrial Clusters: A Case of the Textile Industry. Journal of Risk and Financial Management, 15(3), 129. https://doi.org/10.3390/jrfm15030129