Remanufacturing Marketing Decisions in the Presence of Retailing Platforms in the Carbon Neutrality Era

Abstract

:1. Introduction

- (1)

- Under the case where the IR and the platform firm compete with each other in a Nash game, what effects do the reselling and marketplace models have on the remanufacturing operations of the IR and the marketing channel preference of each partner?

- (2)

- Under the case where the IR and the platform firm compete with each other in a Stackelberg game, how does the leader status of a platform firm affect the remanufacturing operations and marketing channel preference of each partner?

2. Literature Review

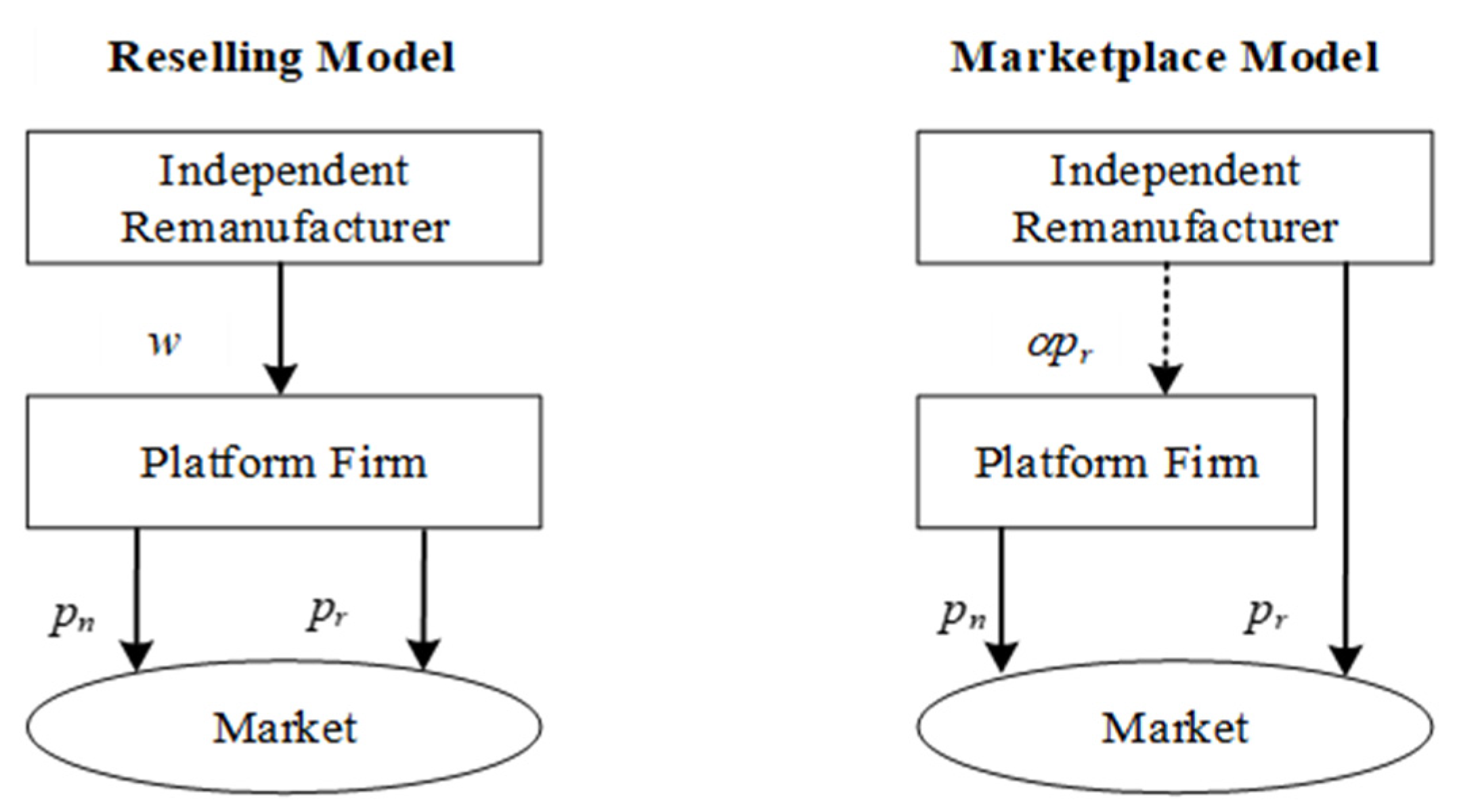

3. Model

4. Equilibrium Analysis

4.1. Reselling Model

- (1)

- If ,then , and ;

- (2)

- If ,then , and ;

- (3)

- If ,then and ,where .

4.2. Marketplace Model

- (1)

- If ,then and ;

- (2)

- If ,then and ;

- (3)

- If ,then ,where and .Furthermore, is increasing in ,while is decreasing in when .

- (1)

- If ,then ;

- (2)

- If ,then if and ;

- (3)

- If,then .

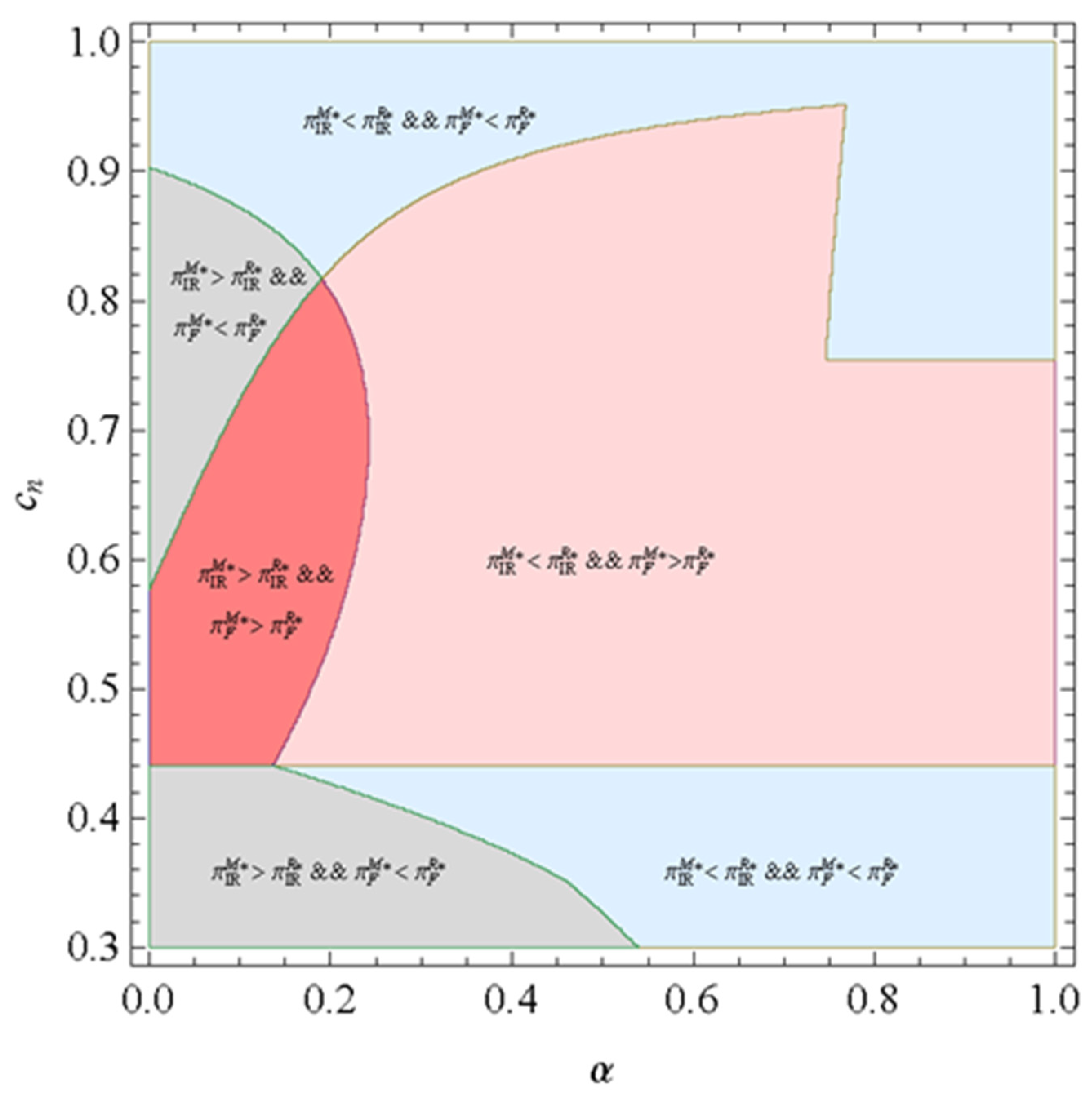

5. Comparative Analysis

- (1)

- when and ;

- (2)

- when;

- (3)

- when and ;

- (4)

- when.

6. Model Extensions

- (i)

- If , then ,, and ;

- (ii)

- If, then , , and ;

- (iii)

- If,then,,and.

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

- (1)

- If , then and ;

- (2)

- If , then and ;

- (3)

- If , then .

- (1)

- If , we have (i) If , ; (ii) If , ; (iii) if, ; (iv) If , , where satisfies .

- (2)

- If , we have (i) If , ; (ii) If , ; (iii) if , ; (iv) If , ; (v) If , .

- (3)

- If , we have (i) If , ; (ii) If , ; (iii) if , ; (iv) If , , where satisfies .

References

- Atasu, A.; Sarvary, M.; Van Wassenhove, L.N. Remanufacturing as a marketing strategy. Manag. Sci. 2008, 54, 1731–1746. [Google Scholar] [CrossRef] [Green Version]

- Li, Y.; Feng, L.; Govindan, K.; Xu, F. Effects of a secondary market on original equipment manufactures’ pricing, trade-in remanufacturing, and entry decisions. Eur. J. Oper. Res. 2019, 279, 751–766. [Google Scholar] [CrossRef]

- Liu, Z.; Zheng, X.; Li, D.; Liao, C.; Sheu, J. A novel cooperative game-based method to coordinate a sustainable supply chain under psychological uncertainty in fairness concerns. Transp. Res. Part E Logist. Transp. Rev. 2021, 147, 102237. [Google Scholar] [CrossRef]

- Li, X.; Li, Y.; Govindan, K. An incentive model for closed-loop supply chain under the EPR law. J. Oper. Res. Soc. 2014, 65, 88–96. [Google Scholar] [CrossRef]

- Zhao, X.; Li, Y.; Xu, F.; Dong, K. Sustainable collaborative marketing governance mechanism for remanufactured products with extended producer responsibility. J. Clean. Prod. 2017, 166, 1020–1030. [Google Scholar] [CrossRef]

- Lifset, R.; Atasu, A.; Tojo, N. Extended producer responsibility. J. Ind. Ecol. 2013, 1, 162–166. [Google Scholar] [CrossRef]

- Kharaji, M.; Yaghoubi, S.; Manouchehrabadi, M.K. A game theoretic incentive model for closed-loop solar cell supply chain by considering government role. Energy Sources Part A 2020, 1764150. [Google Scholar] [CrossRef]

- Mitra, S. Models to explore remanufacturing as a competitive strategy under duopoly. Omega 2016, 59, 215–227. [Google Scholar] [CrossRef]

- Yan, W.; Xiong, Y.; Xiong, Z.K.; Guo, N. Bricks vs. clicks: Which is better for marketing remanufactured products? Eur. J. Oper. Res. 2015, 242, 434–444. [Google Scholar] [CrossRef]

- Xiong, Y.; Zhao, Q.; Zhou, Y. Manufacturer-remanufacturing vs supplier-remanufacturing in a closed-loop supply chain. Int. J. Prod. Econ. 2016, 176, 21–28. [Google Scholar] [CrossRef] [Green Version]

- Caterpillar. Caterpillar’s Code of Conduct. Caterpillar, USA. 2019. Available online: https://www.caterpillar.com/en/company (accessed on 12 November 2021).

- Govindan, K.; Soleimani, H.; Kannan, D. Reverse logistics and closed-loop supply chain: A comprehensive review to explore the future. Eur. J. Oper. Res. 2015, 240, 603–626. [Google Scholar] [CrossRef] [Green Version]

- Govindan, K.; Jiménez-Parra, B.; Rubio, S.; Vicente-Molina, M.A.; Gupta, S.M. Remanufacturing: Opportunities and challenges for a sustainable consumption. Resour. Conserv. Recycl. 2019, 151, 104420. [Google Scholar] [CrossRef]

- Dissanayake, G.; Sinha, P. An examination of the product development process for fashion remanufacturing. Resour. Conserv. Recycl. 2015, 104, 94–102. [Google Scholar] [CrossRef]

- Bhatia, M.S.; Srivastava, R.K. Analysis of external barriers to remanufacturing using grey-DEMATEL approach: An Indian perspective. Resour. Conserv. Recycl. 2008, 136, 79–87. [Google Scholar] [CrossRef]

- Liu, Z.; Li, K.W.; Tang, J.; Gong, B.G.; Huang, J. Optimal operations of a closed-loop supply chain under a dual regulation. Int. J. Prod. Econ. 2021, 233, 107991. [Google Scholar] [CrossRef]

- Cao, J.; Zhang, X.; Hu, L.; Xu, J.; Zhao, Y.W.; Zhou, G.G.; Schnoor, J.L. EPR regulation and reverse supply chain strategy on remanufacturing. Comput. Ind. Eng. 2018, 125, 279–297. [Google Scholar] [CrossRef]

- Zhang, Y.; Hong, Z.; Chen, Z.; Glock, C. Tax or subsidy? design and selection of regulatory policies for remanufacturing. Eur. J. Oper. Res. 2020, 287, 885–900. [Google Scholar] [CrossRef]

- Liu, Y.; Li, R.; Song, Y.; Zhang, Z. The Role of Environmental Tax in Alleviating the Impact of Environmental Pollution on Residents’ Happiness in China. Int. J. Environ. Res. Public Health 2019, 16, 4574. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Üster, H.; Hwang, S.O. Closed-loop supply chain network design under demand and return uncertainty. Transp. Sci. 2016, 51, 1063–1085. [Google Scholar] [CrossRef]

- Park, K.; Kim, J.; Ko, Y.D.; Song, B.D. Redesign of reverse logistics network with managerial decisions on the minimum quality level and remanufacturing policy. J. Oper. Res. Soc. 2020, 1564–1577. [Google Scholar] [CrossRef]

- Reimann, M.; Xiong, Y.; Zhou, Y. Managing a closed-loop supply chain with process innovation for remanufacturing. Eur. J. Oper. Res. 2019, 276, 510–518. [Google Scholar] [CrossRef]

- Alfaro-Algaba, M.; Ramirez, F.J. Techno-economic and environmental disassembly planning of lithium-ion electric vehicle battery packs for remanufacturing. Resour. Conserv. Recycl. 2019, 154, 104461. [Google Scholar] [CrossRef]

- Li, G.; Reimann, M.; Zhang, W. When remanufacturing meets product quality improvement: The impact of production cost. Eur. J. Oper. Res. 2018, 271, 913–925. [Google Scholar] [CrossRef]

- Hagiu, A.; Wright, J. Marketplace or reseller? Manag. Sci. 2015, 61, 184–203. [Google Scholar] [CrossRef] [Green Version]

- Ha, A.Y.; Tong, S.; Wang, Y. Channel structures of online retailing platform. Manuf. Serv. Oper. Manag. 2021, 1011. [Google Scholar] [CrossRef]

- Wang, Y.; Huscroft, J.R.; Hazen, B.T.; Zhang, M. Green information, green certification and consumer perceptions of remanufactured automobile parts. Resour. Conserv. Recycl. 2018, 128, 187–196. [Google Scholar] [CrossRef]

- Zhang, F.; Zhang, R. Trade-in Remanufacturing, customer purchasing behavior, and government policy. Manuf. Serv. Oper. Manag. 2018, 20, 601–616. [Google Scholar] [CrossRef]

- Ke, C.; Yan, B. Trade-in value effects of used products in remanufacturing with considering consumer purchase behavior. J. Oper. Res. Soc. 2020, 20202, 1–26. [Google Scholar] [CrossRef]

- Abbey, J.D.; Meloy, M.G.; Guide, V.D.; Atalay, S. Remanufactured products in closed-loop supply chains for consumer goods. Prod. Oper. Manag. 2015, 24, 488–503. [Google Scholar] [CrossRef]

- Subramanian, R.; Subramanyam, R. Key Factors in the market for remanufactured products. Manuf. Serv. Oper. Manag. 2012, 14, 315–326. [Google Scholar] [CrossRef] [Green Version]

- Long, X.; Ge, J.; Shu, T.; Liu, Y. Analysis for recycling and remanufacturing strategies in a supply chain considering consumers’ heterogeneous WTP. Resour. Conserv. Recycl. 2019, 148, 80–90. [Google Scholar] [CrossRef]

- Choi, T. Pricing and branding for remanufactured fashion products. J. Clean. Prod. 2017, 165, 1385–1394. [Google Scholar] [CrossRef]

- Agrawal, V.V.; Atasu, A.; Ittersum, K. Remanufacturing, third-party competition, and consumers’ perceived value of new products. Manag. Sci. 2015, 61, 60–72. [Google Scholar] [CrossRef] [Green Version]

- Alizadeh-Basban, N.; Taleizadeh, A.A. A hybrid circular economy-game theoretical approach in a dual-channel green supply chain considering sale’s effort, delivery time, and hybrid remanufacturing. J. Clean. Prod. 2020, 250, 119521. [Google Scholar] [CrossRef]

- Kleber, R.; Reimann, M.; Souza, G.C.; Zhang, W.H. Two-sided competition with vertical differentiation in both acquisition and sales in remanufacturing. Eur. J. Oper. Res. 2020, 284, 572–587. [Google Scholar] [CrossRef]

- Sun, X.; Zhou, Y.; Li, Y.; Govindan, K.; Han, X. Differentiation competition between new and remanufactured products considering third-party remanufacturing. J. Oper. Res. Soc. 2020, 71, 161–180. [Google Scholar] [CrossRef]

- Wu, L.; Liu, L.; Wang, Z. Competitive remanufacturing and pricing strategy with contrast effect and assimilation effect. J. Clean. Prod. 2020, 257, 120333. [Google Scholar] [CrossRef]

- Li, Q.; Chen, X.; Huang, Y.; Gui, H.; Liu, S. The Impacts of Green Innovation Input and Channel Service in a Dual-Channel Value Chain. Int. J. Environ. Res. Public Health 2019, 16, 4566. [Google Scholar] [CrossRef] [Green Version]

| Conditions | |||

|---|---|---|---|

| Case 1: | 0 | ||

| Case 2: | 0 | ||

| 0 | |||

| Case 3: | 0 | ||

| 0 | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qiao, X.; Zhao, X.; Zou, J. Remanufacturing Marketing Decisions in the Presence of Retailing Platforms in the Carbon Neutrality Era. Int. J. Environ. Res. Public Health 2022, 19, 384. https://doi.org/10.3390/ijerph19010384

Qiao X, Zhao X, Zou J. Remanufacturing Marketing Decisions in the Presence of Retailing Platforms in the Carbon Neutrality Era. International Journal of Environmental Research and Public Health. 2022; 19(1):384. https://doi.org/10.3390/ijerph19010384

Chicago/Turabian StyleQiao, Xiaojiao, Xiukun Zhao, and Jinhui Zou. 2022. "Remanufacturing Marketing Decisions in the Presence of Retailing Platforms in the Carbon Neutrality Era" International Journal of Environmental Research and Public Health 19, no. 1: 384. https://doi.org/10.3390/ijerph19010384

APA StyleQiao, X., Zhao, X., & Zou, J. (2022). Remanufacturing Marketing Decisions in the Presence of Retailing Platforms in the Carbon Neutrality Era. International Journal of Environmental Research and Public Health, 19(1), 384. https://doi.org/10.3390/ijerph19010384