Abstract

This paper examines how businesses in Taiwan’s servicescapes are adapting to the growing trend of mobile payments and innovation ecosystems. Through the analysis of four case studies, we uncover the strategies these firms employ to address the challenges posed by changing consumer payment habits. Our research reveals that these companies are establishing efficient mechanisms within their ecosystems, supported by well-structured organizational frameworks. By leveraging innovation ecosystems, they are reshaping financial services and promoting collaborative growth among participants through technology, platforms, resource sharing, and knowledge exchange. This collaborative approach is driving significant changes in the sector, helping these businesses navigate through various challenges while fostering innovation and growth. Additionally, the scarcity of comprehensive observations of the digital payment ecosystem highlights the necessity for further exploration of actor interactions, regulatory mechanisms, and ecosystem management strategies. Such research efforts are crucial for enhancing our understanding of the evolving landscape of digital payments and innovation ecosystems, facilitating informed decision-making and promoting sustainable development in this dynamic industry.

1. Introduction

According to the 2023 Contactless Payment Trends Market Research Report, in Taiwan, the top six electronic payment tools are mobile payment apps. The Information Taiwan Council of Commerce reports a 62.2% mobile payment penetration rate in 2019, with 57 night markets adopting it. Taiwan’s Executive Yuan aims for a 90% penetration rate by 2025, creating a connected, co-creative payment ecosystem. The COVID-19 pandemic has led to changes in payment habits among Taiwanese people [1], and scholars suggest that pandemic isolation has led to new consumer needs and models [2].

The emergence of smart environments will redefine how customers conduct their experiences and this will require stakeholders to think about how they should utilize technology, engage and redesign services to remain competitive [3]. Another concept that requires academic attention is the ability of existing firms to compete with digital actors and to adapt to external shocks brought about by disruptive digital technologies [4].

Previous literature has focused primarily on applying theory to explain consumer behavior related to intentions to use and adopt mobile payments [5]. Future studies could incorporate market dynamics to study the impact of ecosystems [6]. Business strategies now emphasize multi-participant, cross-sectoral value co-creation and capture [7,8]. Many companies are building their own ecosystems as focal firms. Increasingly, empirical studies use dynamic capabilities to analyze digital transformation, a key topic in strategic management [9]. Successful innovation ecosystems facilitate information flow and resource access, fostering collaboration and strategic innovation across boundaries [10,11].

Overall, there is a need for more empirical research on upgrading dilemmas and their role in the ecosystem. Future research should examine the impacts of these dilemmas from different perspectives such as stakeholder collaboration, networking, and capacity building [12]. Most of the studies related to digital payment are single case studies; there is a lack of research on the overall observation of the digital payment ecosystem [13]. However, less is known about how actors interact and regulate each other, and research on ecosystem management and development mechanisms needs to be supplemented [14].

While small and medium-sized enterprises (SMEs) in Taiwan face challenges in obtaining point-of-sale (POS) machines, the case study in focus relates to mobile payment applications, addressing the transition from cash to mobile payments. In the post-Pandemic era, this article will provide clear insights and recommendations reflecting the current situation through multiple case studies, thereby enhancing the relevance and applicability of the research.

The case study in focus relates to mobile payment applications, addressing the transition from cash to mobile payment. This study provides insights from multiple cases into four servicescapes, which are utilized to illustrate the physical and social environments in which individuals live [15]. Servicescape is a model developed by Booms and Bitner to emphasize the impact of the physical environment in which a service process takes place [16]. We illustrate how value is co-created in many-to-many networks connected through mobile payments. Specifically, we delve into the role of coordination and management mechanisms in fostering the creation of innovation ecosystems. This addition aims to provide a deeper understanding of the intricate dynamics involved in the study’s context. Consequently, based on the above discussion of extant research and its gaps, our research questions are as follows:

- (1)

- What are the dynamic capabilities required for a focal firm to drive innovation ecosystems?

- (2)

- Why did the focal firm establish an overall operation mechanism in the innovation ecosystem?

- (3)

- How can participants in mobile payments participate and collaborate in an innovation ecosystem for mobile payments?

The remainder of this paper is structured as follows. In the next section, we review relevant literature on innovation systems, value co-creation, and innovation ecosystems. Subsequently, we discuss our interpretive case methodology. We then present the results of the case analysis and discuss the findings. We end the paper with conclusions and recommendations.

2. Literature Review

Mobile payment platforms serve as catalysts for value co-creation by facilitating seamless interactions between users and service providers, allowing for the exchange of resources and the creation of value outcomes. Additionally, the widespread adoption of mobile payment technologies enables businesses to connect with customers more effectively, and lead to enhanced customer experiences and increased opportunities for value creation. Thus, mobile payments play a crucial role in shaping and contributing to the dynamics of value co-creation within the innovation ecosystem.

In this review, we discuss different approaches to the definition of an innovation system and then describe the relevance of the concept to value co-creation and introduce the concepts of dynamic capabilities. Finally, we link these concepts with mobile payment.

2.1. Innovation Ecosystem

The innovation ecosystem is integrated to value creation and the establishment of value sets for co-creation. It comprises a network of interconnected actors, including focal firms, customers, vendors, complementary innovators, regulators, and other stakeholders [5]. These actors develop capabilities around innovation, share knowledge, technology, skills, and resources, while engaging in cooperation and competition [17]. In the context of mobile payments, this ecosystem plays a crucial role in shaping the landscape of financial services. Mobile payments leverage information and communication technology to broaden the range of financial services, especially for customers unable to access services through traditional physical locations. As a result, more businesses are transitioning their payment strategies towards online and mobile commerce, thereby contributing to the establishment of innovative ecosystems within the financial sector [18].

By linking to an underlying and evolving innovation system, ecosystem leaders facilitate the creation of value for groups (ecosystems) and components (individuals, companies, or communities) [18]. They play a crucial role in “connecting” supply and demand to facilitate cross-platform interaction within cross-platform ecosystems. Value creation involves the co-integration and exchange of support to generate shared value through service exchange [19].

Mobile payment platforms provide an excellent example of how ecosystem participants collaborate to create value. These platforms enable seamless transactions between users, businesses, and financial institutions, and foster a dynamic network of synthesized resources and exchanged services [20]. Mobile payment service providers focus on making their products and services easy to use [21]. They engage with real people over the phone or in person, complementing each other to enhance the overall customer experience [22].

In contrast to the traditional industry organization framework approach, the business environment is viewed as an interdependent system that is not limited to any single industry or organization [23]. In our understanding, an ecosystem of innovation encompasses innovative processes run by relevant actors if these processes are deployed with the external support of the ecosystem of innovation. Therefore, we extend this concept beyond the egocentric perspective, i.e., we define an innovation ecosystem from the perspective of a focal firm. A focal firm holds a central and prominent position within an ecosystem, serving as a key orchestrator that leads and coordinates various activities among ecosystem participants. This leading role often involves setting standards, establishing partnerships, and driving innovation, thus exerting significant influence on the direction and dynamics of the entire ecosystem [10,24].

2.2. Value Co-Creation

The realization of value co-creation encompasses co-production, co-design, and co-development of products or services [25,26]. Value networks can be defined as spontaneous combinations of participants. A value network can be defined as a spontaneous combination of participants who interact with each other to co-produce services, exchange services, and co-create value [27]. Thus, value is co-created when resources are used [28].

Values emerge from an interactive process influenced by institutions such as social norms, structures, and institutional arrangements, which both enable and constrain their co-creation [29]. In the service ecosystem, value co-creation allows participants to integrate resources into various dynamic interactions to jointly create value outcomes. The network can support and achieve two-way interaction between customers and service providers, as well as support and achieve value co-creation interaction between network participants [30].

Platform-based business networks are able to connect users who desire to interact and co-exist, enabling many businesses that would not otherwise be able to do so to interact with each other. The Internet enables them to maintain the necessary logistics in their daily lives. People tend to connect with different participants to jointly create value, and online connections enable tourists to obtain efficient, convenient, and real-time value [31].

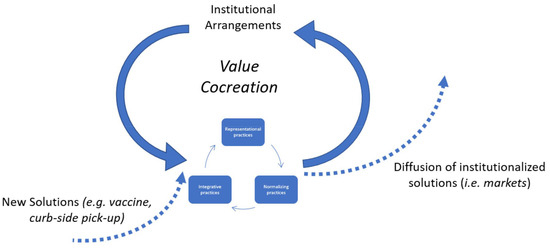

Akaka, Vargo, and Lusch [29] propose a framework that emphasizes the importance of studying value-creation practices as micro-foundations of macrostructures and highlights the need to study institutions and institutional arrangements at different levels of granularity (Figure 1). The framework suggests that the role of actors is dynamic and fluid, but also critical to the development of lasting mechanisms and solutions. The value-creation component consists of representative practices, integrative practices, and normalizing practices.

Figure 1.

Value co-creation structure by Akaka, Vargo, Nariswari, and O’Brien (2021) [32].

Mobile payment platforms serve as catalysts for value co-creation by facilitating seamless interactions between users and service providers, allowing for the exchange of resources and the creation of value outcomes. Thus, mobile payments play a crucial role in shaping and contributing to the dynamics of value co-creation within the innovation ecosystem.

2.3. Dynamic Capabilities

Dynamic capabilities include the sensing, trapping, and transforming needed to design and implement a business model. They enable organizations to upgrade their common capabilities and direct those capabilities [32]. Companies that have access to advanced dynamic capabilities will be able to detect new trends better [33]. The utility and dynamic possibilities of use have a stronger impact on contexts affected by digital technologies [34].

Through digital technologies, information systems enable decentralized economic and social actors not only to exchange resources, but also to synthesize them in a process of co-creation of materialized value [35]. Firms should develop strong relationship capabilities by selecting well-matched partners and linking them to their core research and development (R&D) teams to develop an integrated platform [36]. By creating a balanced ecosystem, all participants involved are able to create and capture business value for the entire ecosystem [37]. All participants are resource integrators in a network of other participants, and all participants are potential innovators or co-creators of value [38]. Mobile payment ecosystem managers need to develop different behaviors based on users’ usage of each proposed payment tool [39]. Therefore, research on value co-creation in networks needs to incorporate a dynamic approach in line with its characteristics of learning, adaptation, and evolution [40]. While existing research recognizes the link between platform leadership and coordination in network-centric innovation, more study is needed to determine whether and how platform leaders succeed in establishing themselves as trustworthy operators [41].

In summary, the discussion on mobile payments highlights their role in shaping and contributing to the dynamics of the innovation ecosystem by enabling new forms of value creation and exchange among ecosystem participants.

3. Methodology

3.1. Case Studies

Case study research is invaluable for examining and understanding current situations and practical phenomena in real-life settings. By employing multiple data collection methods to gather information from multiple cases, researchers can effectively investigate under-researched phenomena and uncover valuable insights [42,43,44]. Given that mobile payment is a new payment mode, particularly in Taiwanese daily life, the limited adoption among small and medium-sized merchants is notable. The selection of the night market, cultural and creative park, food market, and pharmacy as case study sites, all featuring merchants with 1–2 employees, are particularly impactful to SMEs. These four case studies serve as ideal subjects for exploratory research, leveraging the case study approach to study complex phenomena and develop new theories [45,46,47]. We believe that these additions provide a clearer understanding of the methodological approach adopted in our research and the significance of our choice of case studies in exploring the impact of mobile payment on Taiwanese daily life.

3.2. Case Selection

The aim of this research is to better understand how the mobile payments innovation ecosystem works internally and how its various actors interact to generate value. The necessity for mobile payments to involve multiple actors in the deployment of new processes is examined in this study, which also looks at the many actors involved in mobile payments, including mobile payment businesses, vendors, local organizations, and users.

According to Lian and Li [48], the main challenge will not only be maintaining current usage patterns, but also service switching or choice for individual or business clients as Taiwan’s penetration increases and various mobile payment services enter the market. The use of a single payment barcode to link multiple payment platforms in all the cases in this study will provide more in-depth insight. The study by Shang and Chiu [49] of a Taiwanese financial institution found that the ecosystem of mobile payments in Taiwan consists of multiple participants that may share customers and overlap across multiple customer journeys through their daily mobile usage, such as social networking, shopping, membership, and payment activities. Therefore, the investigation of multiple cases of servicescapes in this study can yield more generalized findings.

The four cases of cultural and creative parks, night markets, food markets, and pharmacies are all representative of this industry. From 2017 through 2022, servicescape A was named the top tourist destination in Taipei City for six years in a row. This demonstrates that this is a typical Taiwanese landmark. Servicescape B is one of Taiwan’s most famous food specialties, and features a number of Michelin-recommended snacks. Servicescape C is the preferred choice for many Taipei residents when it comes to purchasing New Year’s goods and sells a number of Chinese northern and southern flavors that are not readily available on the market. The pharmacies under servicescape D consist of pharmacies and cosmetics, with 16 cosmetics and 136 pharmacies, a total of 148 pharmacies in Taiwan are in the lower case and located in the community. Therefore, in this study, the above four cases were selected as case studies for the servicescapes studies.

3.3. Data Collection and Analysis

Our primary data sources in this study were in-depth interviews, in which interviewees were selected using purposeful sampling to fit the research aims. Data collection followed the case study protocol. We used multiple sources of evidence to create a case-study database and maintained a chain of evidence [47,50]. The development of the interview guide (Appendix A) was inspired by literature, but was open enough to allow for unexpected topics to emerge [51].

We conducted participant observation on individual cases, for the operations and interactions of the 40–144 merchants within a 7-month period. Additionally, we engaged in in-depth interviews with 1–2 managers from focal firms (Table 1). These interviews provided valuable insights into the strategic decisions, challenges, and innovations driving the development and evolution of the mobile payment landscape within each organization. Through this comprehensive approach, we were able to capture a holistic understanding of the complexities and dynamics of the innovation ecosystems under study. Between 2020 and 2021, in-depth interviews were carried out in four servicescapes, and direct observation and involvement complemented the interview data to assure structural validity and internal and external validity by triangulating the approach [52]. Direct observation of the visitor’s interactions with the servicescapes, as well as observation of group interactions, focuses on detailed description and analysis of the observed events. Deep interviews make use of an open-ended, discovery-focused style that enables a thorough investigation of the respondent’s thoughts and viewpoints on a subject. In order to investigate deeper meanings and understandings, deep interviewing entails not only asking questions, but also methodically documenting and transcribing responses. The interviewers were allowed to participate both officially and informally so that the change process could be documented right away through the internal follow-up procedure, field notes, and contacts with the organization’s members. Rich data are validated by the case studies using a multi-source validation procedure [53].

Table 1.

Summary of data collection.

4. Case Briefing

4.1. Servicescape A

Servicescape A (Table 2) is a cultural and creative park, characterized by confined space, dense crowds, and close contact, and has become a place where people avoid going due to the potential risk of infection (Figure 2). Since there is only one automated teller machine (ATM) for cash withdrawals, the current scenario has made it more difficult to access indoor activity, causing customers to be hesitant to queue up again after using the ATM. There are at present many mobile payment, e-payment, and third-party payment services on the market, and the space occupied by vendors when displaying the signs is inconvenient. And, it is easy to cause difficulties for consumers to understand how to use them, display them, and explain them to customers, all of which will result in additional costs and a low willingness to introduce them to small stores and vendors. QR Pay offers mobile and inductive payment services. A barcode allows consumers to connect to regularly used payment services without the need for cash or the installation of an app, and micro-vendors can apply for numerous payment platforms at the same time. QR Pay uses only one barcode and quick access to display and quickly transport it to the next location.

Table 2.

Summary of case characteristics.

Figure 2.

Mobile Payment Applications in the Cultural and Creative Industries Park. Source: Compiled by this study.

4.2. Servicescape B

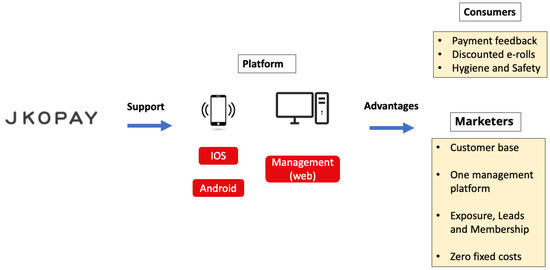

Servicescape B is a night market that has been significantly more impacted since the COVID-19 pandemic began in late 2020 (Figure 3). Even though the mobile payment provider arranged several events to encourage spending at the night market, many of the shops finally went down for lack of customers and revenue. Jko Pay is an application type mobile payment and supports the Taiwan bank account and card, the total number of users is 6 million or about 40% of Taiwan’s total population. Jko Pay could support linked bank accounts suitable for young people who do not have the means to apply for a credit card. Customers who use Jko Pay can obtain JK Dollars for their subsequent payments, and occasionally, customers can receive discount vouchers for events the firm organizes. Vendors joining Jko Pay can get more exposure and attract traffic. It is the only platform that will not increase additional fixed income, and the simple interface reduces the learning cost of merchants.

Figure 3.

Mobile Payment Applications in the Night Markets. Source: Compiled by this study.

4.3. Servicescape C

Servicescape C is the market, which has become a high-risk location due to the large number of vendors and people, high concentration of individuals, and frequent cash contact (Figure 4). It has the most confirmed cases and the greatest level of difficulty in preventing COVID-19 pandemic. The government has also implemented anti-disease policies such as single and double ID card segregation, crowd control at entrances and exits, and business hours control, as well as requiring markets with signs of confirmed cases to close and clean up the environment, which has had a significant impact on market business. According to the annual survey of market intelligence & consulting institute (MIC) in the institute for information industry, the mobile payment penetration rate of markets is only 1.2%, making the market a very low mobile payment penetration area in Taiwan. QR Pay provides QR code (quick-response code) scanning payment service with no equipment installation and no app download, 1.99% handling fee, and value-added service with management fee to attract vendors to participate in the market.

Figure 4.

Mobile Payment Applications in the Markets. Source: Compiled by this study.

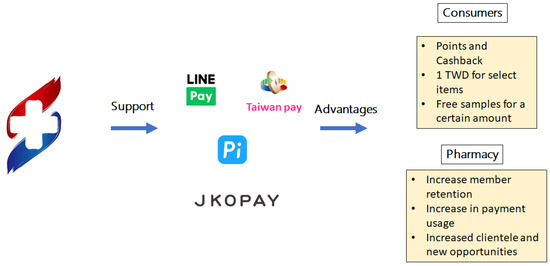

4.4. Servicescape D

Servicescape D is a neighborhood pharmacy. The COVID-19 pandemic has raised a demand for pharmacies. Community pharmacies have become an integral component of consumers’ everyday life, from COVID-19 pandemic prevention to treatment and follow-up care, in addition to the daily collection of medicine (Figure 5). Patients with chronic conditions require health education in an ageing society, but doctors’ time is limited, and hospital pharmacies are very busy. Therefore, pharmacists in community pharmacies can provide assistance. They will also work with commercial organizations or community conservation efforts to provide customer counselling and solutions. Most large pharmacies already accept mobile payments, and the demand for mobile payments is growing as a result of the COVID-19 pandemic impact. The introduction of mobile payment and sensor-based payment can meet the expectations of consumers. Consumers can receive points and cash rebates from payment providers, receive USD 1 off their next purchase when using mobile payment, and receive free health care product trial packs when using mobile payment.

Figure 5.

Mobile Payment Applications in the Pharmacy. Source: Compiled by this study.

We have compiled the applications, devices, and payment steps for the three mobile payment methods into a table for explanation (Table 3). Additionally, we have provided handling methods and analyzed the advantages and disadvantages of various options considering different customer types and accessibility considerations. For example, QR Pay caters to three types of customers: regular customers, customers with smartphones, and customers without smartphones. Regular customers can make payments by scanning QR codes. Customers with smartphones can download the corresponding payment application and make payments through the application. Additionally, customers without smartphones can use the platform website provided by the merchant for payments.

Table 3.

Summary of mobile payment.

5. Findings

5.1. Dynamic Capabilities of Focal Firms

The COVID-19 pandemic has increased consumer need for no-touch payments, with vendor answers outlining how the quickly changing social environment requires them to learn how to create and exploit new payments. The case at B market was originally the servicescape with the lowest use of mobile payment at less than 1% even though it is in Taipei City, the center of Taiwan. The focal firm finds that the younger generation is increasingly using mobile payments in markets near the office, and if you do not have what he wants, he will go somewhere else to buy it. This is the current trend. Mobile payment customer orders will be larger, with many customers using mobile payment scanning codes once it reaches NTD 800–900, with the sense of convenience of mobile payment making it simple to make a large profit.

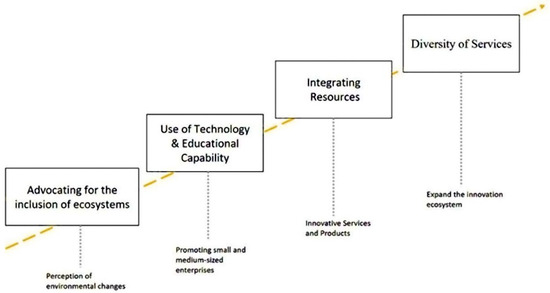

Therefore, focal firms need to be aware of the market trends and transform their existing operational capabilities into key dynamic capabilities for the new environment by advocating the inclusion of innovative new ecosystems [54], connecting with customers and suppliers to quickly respond to changing conditions, and enabling digitization to achieve flexibility over efficiency [55].

When most vendors first started learning how to set up mobile payments, it was a case of figuring out how to set it up and use it. This is a deterrent for many vendors. Particularly for the market vendors who are middle-aged and older, they believed that these 3C technologies were the domain of younger people, and will be very difficult to learn. These static resources are not enough to get them onto the digital platform. SMEs may consider finding new and effective ways of collaborating to gain external knowledge, which is essential for their digital transformation [56]. The current problem can be solved by creating new ecosystems that allow for the exchange of resources and the acquisition of knowledge; therefore, focal firms must be able to provide education in addition to learning the application of technology.

The results have shown the importance of data management; therefore, the ability to manage resources will affect the relationship between the consumers. In the case of the pharmacy, the value-added analysis of customer data by the focal firm enabled the partner to gain access to additional relationship marketing opportunities with prospective consumers. The pharmacy, through the members or potential customers, applying samples online will also bring customers to the shops and manufacturers. By engaging with them through new channels, strengthening connections with the community, and interacting with them online, they are able to develop a durable competitive edge. They will also be able to add new services to their core physical offerings by offering new digital products [56].

Four dynamic capabilities of focal firms to integrate micro, small, and medium-sized enterprises (MSMEs) participation are shown in Figure 6, including advocating for the inclusion of ecosystems, use of technology and educational capability, integrating resources, and diversity of services. The main motivation for the introduction of mobile payments is the provision of value-added services that help them face the barriers imposed by society and market competition, a change that helps organizations become efficient, useful, and reliable [57]. Developing products and services in digital technology is a core objective of organizational innovation [58]. To encourage the admission of more actors in innovation ecosystems, focal firms must aggressively create new products and services beyond the essential payment functions they supply.

Figure 6.

Four Dynamic Capabilities of Focal Firms to Integrate MSME Participation. Source: Compiled by this study.

5.2. Holistic Mechanisms for Innovation Ecosystems

The platform established by mobile payment provides data such as the ranking of shop orders, the ranking of shop members, and consumer buying habits, etc. Vendors can manage the data for the purpose of combining and adjusting their sales strategies, and they can investigate repurchase business potential from data analysis by integrating the large data of members. Data such as the ranking of shop orders and the ranking of shop members can be used by the management as a reference for future investment promotion. Mobile payment companies can also use data management to develop marketing events. Focal firms need to cultivate broader competitiveness in the ecosystem. It is important to review the tactics that have been deployed since poorly executed methods can have a systemic effect on other participants [59].

It is important for focal firms to establish a communication channel between the vendors. For example, the focal firm in the cultural and creative park provides advice on how to apply for mobile payment functions on Saturdays and Sundays and when discussing, signing contracts, and counselling vendors, the focal firm in night market helps vendors join the “Shop Counseling LINE@ account” so that vendors are aware of where to go and how to handle the aforementioned issues.

The case of cultural and creative park showed the value of creating a loyal following. They gave the vendor advice on how to run members, develop loyal customers, and increase the value of production by utilizing the digital instruments of mobile payment that consumers are accustomed to using today. It will successfully increase mobile payment usage and follow-up rates through the gradual mechanism of accompanying and counselling, integrate the traditional functions from the past, analyze customer needs, develop new products to meet those needs, and strengthen its own competitive advantage with innovative services. Through multilateral alliances on ecosystem platforms, organizations can create lasting advantages by earning trust throughout the customer journey, anticipating future customer needs, and taking care of them through an increasingly complex pipeline [60].

If it is not possible to conduct physical transactions during the COVID-19 pandemic, cultural and creative park management will assist the vendors in completing the Smart Payment and Smart Market setups. The vendors’ smart markets are bound to the cultural and creative park LINE accounts and can be promoted through the marketing campaigns of the focal firm as well as through on-site exhibitions. Consumers can purchase food from the vendor’s LINE shop before going to the show in the park. Customers do not have to wait in line to buy food since ordering and paying for products online enables sellers to prepare enough ingredients for the day in advance. Data management and continuous engagement will be carried out in the future through the development of the platform online and the gathering of membership data offline, further realizing the innovation of digital transformation. New functionality added to existing online channels may generate new sales opportunities by adding unmet needs for customer communication [61].

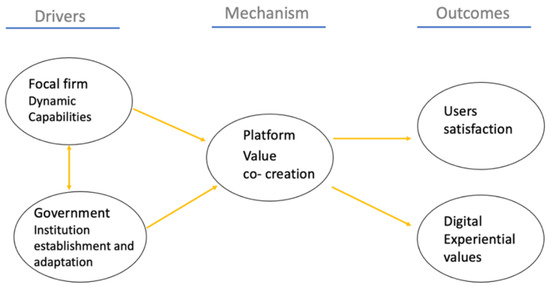

We enhance the Akaka (2021) [32] framework, emphasizing the vital function of the dynamic capacities of focal firms (Figure 7). In our four cases, the focal companies establish innovative ecosystems and collaborate with other participants. The role of these companies changes with shifts in government rules. SMEs participate in value creation through technology and education, while governments and NGOs manage, develop local economies, and pool resources. The firms’ new solutions, made using their skills, are put into action through setups and partnerships, then spread back to the market. Lastly, the focal companies will gather data on the effectiveness of user and mobile payments for subsequent management in order to formulate a long-term strategic plan.

Figure 7.

Four Dynamic Capabilities of Focal Firms to Integrate MSMEs Participation. Source: Compiled by this study.

Extending the value-creation component of representative practices to local economic development payments for action at demonstration sites will encourage more people to participate in the local economic promotion effect. Integrative practices are carried out online and offline by integrating vendors, collaborators, and other resources. This helps avoid threats and challenges to their ecosystems by working together and depending on their innovative instruments to develop local economic and institutionalized solutions for subsequent management and resource consolidation [31]. To preserve their leadership, these companies must constantly innovate and upgrade their platform contributions as well as ecosystem governance rules and guidelines in order to maintain a balance between cooperation and competition [62].

5.3. Government Involvement Helps to Achieve Urban Development Goals

The cultural park management described their involvement in accompanying, consulting, and advising in the setting up of mobile payments, and in each case, there was cooperation and coordination with the local government. Following the establishment of mobile payments in the vendors, the various market companies and ground promotion co-operatives provided on-site training services at the stalls or neighboring shops during the real implementation of mobile payments.

The market is experiencing an issue with some vendors hiding their mobile payment codes due to a lack of understanding of how to utilize them. QR Pay records that it spent quite a bit of time speaking with the vendors it advised to apply for the mobile payment and the smart marketplace so that the vendors would be confident in using them rather than applying for them but not using them.

The results of this study show that the running of ecosystems requires the mutual assistance of the local community, financial institutions, and the government, with a particular emphasis on the role of counselling, which allows for a process that requires a significant investment in staffing costs to provide one-on-one teaching and explanations to both the vendors and the consumers. Financial institutions, governments, and local organizations have to collaborate to provide both digital and physical pre-, mid-, and post-coaching to help vendors gain confidence in accepting mobile payments. Governments can acquire the aid and collaboration of civil society by building policy networks with civil society organizations to facilitate the smooth implementation of policies and decrease the cost of policy monitoring and control [63].

After the Taiwan COVID-19 Pandemic Control Center released the rules on masks for the public, Jko Pay thought it would be a good time to once again prepare and organize a large-scale night market marketing event to help night market vendors and revitalize the local economy. In this case, with the help of the neighborhood organization, the vendors had more trust in the focal firm. They informed the vendors about the events and gave focal firms that were interested in participating the opportunity to apply for the events immediately. The neighborhood organizations work to increase trust and advance the creation of innovation ecosystems.

In coordination with the local government, the consumption space, coupled with fast and convenient smart payment, will help promote a cashless market and smart city. Financial institutions work with government officials to implement the policy, allowing natural persons to become credit card acquirers. For example, Bank SinoPac can apply for QR Pay, a natural person’s designated shop, to accept credit card orders through the Internet.

After the end of the project, Jko Pay will continue to communicate with vendors after the project is completed to provide counselling and to organize diverse events to revitalize local business markets in collaboration with public sector projects. These actions will enhance the use of mobile payments by vendors and the general public, hence promoting the popularity of e-payments.

The government plays the role of a “rule-setting” and “coordinating” participant in the ecosystem. The yellow arrows represent the role of the government in the ecosystem (Figure 8). The grey circles represent digital platforms, in both virtual and physical environments, facilitating actor interaction and serving as a catalyst for local economic development among citizens and businesses. They also assist focal firms and vendors in consolidating their resources and providing aftercare customer relationship management. The government is the developer of the ecosystem and has a role in promoting the system and the mechanism as well as making flexible adjustments to keep up with the ever-changing environment over time. Still, it is more necessary for the various industries to simultaneously implement this system, publicize, and make use of consumer habits, in order to create a win-win situation, as well as making flexible adjustments to keep up with the ever-changing environment over time. Perceived usefulness and attitude have a significant impact on citizens’ use of mobile payment [64].

Figure 8.

Operating Model of Mobile Payment Innovative Ecosystems Participation. Source: Compiled by this study.

6. Discussion

This article describes how Taiwan used cooperation to establish a mechanism for creating a new ecosystem in the low mobile payment servicescape and promote social participation in the joint development of a smart environment, by analyzing the functions and roles of the focal firms and the government in the innovative ecosystems of the four servicescapes.

6.1. Focal Vendors Should Integrate Resources Effectively

In Taiwan, vendors or market stores may not always establish a company; therefore, Bank SinoPac invested in the scanner payment service, which enables applying for the service without having to build up a company. Normally, you need to set up a company number to apply for a credit card machine.

Through pre-, mid-, and post-counselling, payment service use is encouraged. Without experts to guide their education and offer counselling, they may quickly revert to their primitive ways. Making the proper service design choices can improve participant satisfaction and post-consumer behavior [65].

The example of Jko Pay and the night market demonstrates that utilizing a single tool to access a range of services does not require substantial hardware and software knowledge, according to feedback from the park management. Vendors are learning the tool, on average, over the course of two months, and that implementing a basic learning model would lower labor costs and improve learning efficiency. Additionally, improving the customer experience such that the pleasant feelings produced by the pathway encounter encourage them to continue using it [66]. As suggested by Akaka et al. (2021) [32], there is a need for institutional arrangements in value co-creation. Ecosystem leaders benefit the growth of other platforms by exploiting the complementarities of different platforms in the ecosystem [67]. Hence, we put forward the following proposition:

Proposition 1.

Lowering the entry threshold and offering extensive counselling will encourage more people to enter the mobile payment market.

6.2. Follow-Up on Management Needs to Be Supported by Technology and Digital Platform Services

Focal firms collect members using digital tools such as social media, apps, chatbots, and big data, which helps to modify the process of consumer value creation by generating new distribution channels integrated with an omni-channel perspective, resulting in a deeper and new relationship with consumers [34]. Direct digital transformation is more difficult for merchants, with the focus of vendors shifting from the introduction of mobile payments to gradually carrying out the setup for the online shop, and the value-added application service tools to achieve greater diffusion and sustained use of the benefits of e-commerce through the launch of a larger ecosystem [68]. According to Matarazzo et al. (2021) [35], the use and utility of dynamic capabilities are becoming more important in the digital environment. Managers’ investment in diversification can support business sustainability capabilities [69]. Hence, we put forward the following proposition:

Proposition 2.

If focal firms can help partners enable e-commerce, it will help to expand the ecosystem.

6.3. Collaboration between Focal Firms and the Government Promotes Local Economic Development Effectively

Although the vendors in this study saw the potential benefits of mobile payment, they were put off by the servicescape’s unfamiliarity and believed that face-to-face direct cash transactions, not being subject to levies by financial institutions and receiving their turnover on the same day it was earned, were more secure for the vendors. In practice, the integration of government and local organizations can reduce banking institutions’ manpower, and vendors are more willing to connect with and trust well-known government agencies. As a result, if the staff is friendly, helpful, and responsive, it adds to the entirety of the participant experience [70]. The park’s focal firms indicate that the best extra service is relationships. Patient companion counselling gives vendors, particularly micro vendors, the confidence to confront challenges, especially during a COVID-19 pandemic. Collaboration with external partners has been shown to help SMEs overcome knowledge or resource constraints [67].

Companies should develop strong relationship capabilities, selecting well-matched partners and linking them to the core R&D team to develop an integrated platform [36]. Innovation ecosystems must bring together different types of partners, including start-ups, multinational companies, governments, organizations or NGOs, communities, etc. [11]. According to Klimas and Czakon [10], vendors should focus on the deployment of innovation ecosystems with external help to co-run the innovation processes. Hence, we put forward the following proposition:

Proposition 3.

Active government facilitation and promotion can help build confidence in the emerging mobile payments market.

Finally, the study also summarizes a series of activities undertaken by the focal firms to establish and drive the development of the innovation ecosystem (Figure 9). From a value-creation perspective, mobile payment companies or leading enterprises integrate physical products with digital cross-domain collaborations. Through the dynamic capabilities of four key enterprises, they identify market demands, establish new products and services, and further develop innovative ecosystems. By integrating across three major domains, they obtain comprehensive strategies and solutions.

Figure 9.

The Driving Factor Operating Mechanism and Output of the Mobile Payment Innovation Ecosystem. Source: Compiled by this study.

7. Conclusions

7.1. Conclusions

This study examines how four servicescapes—cultural and creative markets, night markets, markets, and pharmacies—deal with the challenges caused by the COVID-19 pandemic through the use of mobile payments and the formation of innovation ecosystems. Focal firms’ leadership and government cooperation, in particular, enabled active involvement and trust development among SMEs. We reviewed the data collected from the focal firms’ perspectives and recognized four different dynamic competencies required for a successful move to innovation in the different environments of individual vendors, micro-merchants, and other small and medium-sized enterprises. In this study, the successful implementation of mobile payments was found to be attributed to the following three key factors: (1) no device installation required; (2) fast payment and receipt; (3) provide educational use and follow-up management services.

Through collaborative efforts and promotional activities, both consumers and local vendors can enhance their professional knowledge and experience, leading to increased mobile payment usage and the creation of value and business opportunities associated with mobile payment. With the rise of online transactions, the emergence of diverse payment tools, and supportive policies, micro, small, and medium-sized enterprises, including individual merchants, can now offer mobile payment services to consumers, thereby significantly boosting the growth of the mobile payment market.

The focus is on the role of the focal firm in introducing and sustaining continued usage, and bringing practical references to the study of mobile payments. Before the introduction of mobile payments, these environments were heavily reliant on cash transactions. As changing consumer habits prompted vendors to change their payment environments, the new shift in consumer habits from the consumer onward was a critical success factor in the promotion of mobile payments. The primary determinant influencing the effectiveness of participant cooperation is the similarity between the characteristics of the servicescape and the user profile of the mobile payment company. The closer the resemblance between the characteristics of the servicescape and the user profile, the higher the usage rate and transaction performance.

In our case, the focal firms have established effective mechanisms and institutionalized organizational structures of innovation ecosystems. The findings of our study are an important supplement to the development of mechanisms in the innovation ecosystem. The focal firms can change the financial services environment by creating ecosystems that enable interdependent growth and development of participants through the provision of technology, platforms, resources, and knowledge. We found that innovation ecosystems play a crucial role in enhancing participant marketing capabilities. They can assist in directing consumers to the vendors’ own self-operated media channels, such as Facebook fan pages and official websites. Additionally, innovation ecosystems enable the sending of free push notifications to consumers.

7.2. Theoretical Contribution

This study investigates four cases and provides a comprehensive view of the mobile payment ecosystem, which fills a gap in present studies in this area [13]. We analyzed the applicability and pros and cons of different types of mobile payments for various types of customers. Through an analysis of participants and operational mechanisms across different cases in the ecosystem, the comparative insights we gain from cross-case analysis can underscore the value of this article in comprehending various approaches within an ecosystem framework. Extending the theory of innovation and ecosystems to groups in everyday life, the study of individuals and groups reveals intrinsic connections, functions, and principles of operation.

Previous research has found that younger, well-educated, higher-income families with more smartphones are more likely to adopt and use mobile payments [71]. Our study provides additional insights for older users with lower levels of education. Consistent with Yi, Kim, and Oh [72], we found that payment convenience, customer service, and application design are key influencing factors, as revealed by our merchant-focused research. According to Pundziene, Adams, Grichnik, and Volkmann [12], a more in-depth discussion of stakeholder collaboration and networks, as well as the impact of capacity building on dealing with challenges, was added to the study of how actors influence and regulate each other, as well as the mechanisms of ecosystem management and development. We find that the overall performance of an innovative ecosystem can be used as a force for institutional innovation, driving institutional change from technological innovation. Specifically, as the overall performance of the innovation ecosystem improves, participants can develop new services, such as online services for vendors at physical markets and bazaars.

Soluk and Kammerlander [58] explained how barriers can impede the development of necessary dynamic capabilities and how respective enablers can help to mitigate these barriers. But we extend the current study by identifying the role of focal vendor dynamic capabilities in the creation of ecosystems, focusing primarily on technological barriers. This study extends the examination of dynamic capacities by including network value co-creation, especially the process of participant learning, adaptation, and evolution [38]. We researched the dynamic capabilities that platform partners need to successfully transition to innovation, including the importance of advocating for the inclusion of innovation ecosystems, the ability to apply and educate on science and technology, the ability to manage resources, the diversification of services, and the prerequisite implementation mechanisms for realizing these dynamic capabilities [56].

This study proposes a general model of the practical aspects of innovative ecosystems for academic researchers, practitioners, and governments as a general reference [11]. As presented by Gawer and Cusumano [42], focal firms are able to succeed as trusted managers through collaboration with local institutions and governments by understanding the link between platform leadership and coordination in network-centric innovation. Innovating through collaboration and creating an open environment that shapes innovative behavior are key elements of successful practices [73].

According to Verhoef, Broekhuizen, Bart, Bhattacharya, Qi Dong, Fabian, and Haenlein [4], this study’s findings contribute to technological resilience studies. Firms can compete with (new) digital players and respond to external shocks caused by disruptive digital technologies through diverse collaboration.

7.3. Practical Implications

Our research findings indicate that collaboration between financial institutions, local governments, and vendors can facilitate the development of local characteristics, yield benefits for the digital economy, and promote the adoption of local mobile payments. Partnerships among government departments, local organizations, and financial institutions can receive support and cooperation to facilitate the seamless implementation of policies, thus reducing monitoring and labor costs for financial institutions. This study provides valuable insights for governments and policymakers to formulate suitable strategic frameworks and policies aimed at achieving a cashless society [64].

Actors with heterogeneous and potentially complementary resources can create sustainable and dynamic cooperation [74]. Acting as the government official to provide easy-to-apply public funding for SMEs and supporting these companies in their attempts to digitize their processes, products, and business models will be critical enablers of their business transformation [58].

Mobile payment service providers and their partners must prioritize enhancing the consumer experience to drive adoption. Factors such as perceived usefulness, convenience, promotional incentives, and social recognition play crucial roles in consumer adoption [74]. In this study, it was found that the affiliation of different venues with various management units and departments affects the establishment of the innovation ecosystem, making cross-unit cooperation difficult to achieve.

Currently, key strategies include emphasizing brand differentiation, encouraging brand switching among competitors’ users, and maintaining market share. Following the COVID-19 pandemic, the inclusion of SMEs in mobile payment initiatives not only attracts a younger customer base and tourists, but also contributes to the revitalization of Taiwan’s smart cities and local economy.

The findings of this study are poised to promote mobile payment adoption, particularly among local SMEs. The availability of digital products will enhance customer satisfaction and staff efficiency, while innovative technological network utilization will lead to improved service quality [75]. This provides an important understanding of innovation ecosystem leaders and how solutions arise as built solutions and combine with different social networks in order to build more sustainable and generally effective solutions.

7.4. Research Limitations

The main limitation of this study is that it was conducted in the Taiwanese servicescape context, which has specific characteristics that may not be applicable to other cases. In addition, this study is based on multiple case studies in a single country and does not compare the results with other countries. Therefore, some modifications may be required when applying the framework and extending the results, since this study used exploratory research and in-depth interviews. While these methods allowed us to gain rich insights into the perspectives and experiences of participants, they inherently involve a smaller sample size and may not fully capture the diversity of opinions and contexts within the broader population. As a result, the findings of our study may not be generalizable to all situations or populations.

Author Contributions

Conceptualization, W.-K.N. and C.-L.C.; data curation, W.-H.C., S.C., and C.-L.C.; methodology, W.-K.N. and C.-L.C.; project administration, S.C., J.-L.J., and C.-L.C.; writing review and editing, W.-H.C. and C.-L.C.; writing—original draft, W.-K.N.; funding acquisition, S.C., investigation and supervision, S.C., W.-H.C., J.-L.J., and W.-K.N.; formal analysis, W.-K.N. and J.-L.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data is unavailable due to privacy.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

Interviews outline with pharmacy.

Table A1.

Interviews outline with pharmacy.

| 1. What are the specifics of the mobile payment import implementation? |

| 2. What are the business performances of corporations, the numbers of customers, and the use of multi-payment after and before the adoption of mobile payment? |

| 3. What are the products of the partner companies? |

| 4. How are consumer test scores collected? What plan was carried out? |

| 5. How are the Member Information data used after they have been collected? |

| 6. What are your thoughts on the importance of user experience in the mobile payment process? What steps have you taken to improve the user experience? |

Table A2.

Interviews outline with QR Pay.

Table A2.

Interviews outline with QR Pay.

| 1. How to extend the effect of value-added services in the future? |

| 2. How to enlist the participation of vendors around the market? |

| 3. How will the results of the marketing event be sustained in the future? |

| 4. What are the plans for co-operation with local governments? |

| 5. What are the plans for the arrival of overseas tourists after the outbreak is lifted? |

| 6. Does your mobile payment mechanism support multiple payment methods? If so, how do you achieve this diversity? |

Table A3.

Interviews outline with cultural park.

Table A3.

Interviews outline with cultural park.

| 1. How to connect customers’ needs beyond the payment function? |

| 2. What strategies have been adopted in the face of the onslaught of the COVID-19 pandemic? |

| 3. What promotions and services are used online? |

| 4. What are the online services and plans after the outbreak is lifted? |

| 5. What are the actors and works for management in payment adoption? |

| 6. What training plan and solution for mobile payment have been carried out? |

| 7. What strategies are used to maintain existing customers and develop new customers? |

| 8. What is the autonomy of vendor’s data? How are the backend data collected, analyzed, and applied? |

| 9. What is the plan for online and shops traffic diversion? |

| 10. When designing the mobile payment mechanism, have you considered scalability and the possibility of future expansion? What are your plans to address future changes and developments in the mobile payments market? |

Table A4.

Interviews outline with Jko Pay.

Table A4.

Interviews outline with Jko Pay.

| 1. How to extend the effect of value-added services in the future? |

| 2. How can more in-depth planning be carried out for night markets with different types and characteristics? |

| 3. There are different types of customers, such as local, tourist, commuter, etc. How to focus on different types as a follow-up reference? |

| 4. What are the plans for co-operation with local governments? |

| 5. What are the characteristics of night markets that are conducive to the promotion of mobile payments? |

| 6. How well are the vendors learning about mobile payments? |

| 7. What customized services are provided to vendors? |

| 8. How do we measure ongoing consumer use and satisfaction? |

| 9. What are the gains and growth of introducing mobile payments? |

| 10. What are the specific benefits for merchants using your mobile payment mechanism? How did you design the mechanism to ensure merchant satisfaction and benefits? |

References

- Yu, S.-Y.; Chen, D.C. Consumers’ Switching from Cash to Mobile Payment under the Fear of COVID-19 in Taiwan. Sustainability 2022, 14, 8489. [Google Scholar] [CrossRef]

- Cohen, M.J. Does the COVID-19 outbreak mark the onset of a sustainable consumption transition? Sustain. Sci. Pract. Policy 2020, 16, 1–3. [Google Scholar] [CrossRef]

- Buhalis, D.; Harwood, T.; Bogicevic, V.; Viglia, G.; Beldona, S.; Hofacker, C. Technological disruptions in services: Lessons from tourism and hospitality. J. Serv. Manag. 2019, 30, 484–506. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Dong, J.Q.; Fabian, N.; Haenlein, M. Digital transformation: A multidisciplinary reflection and research agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Gomes, L.A.D.V.; Facin, A.L.F.; Salerno, M.S.; Ikenami, R.K. Unpacking the innovation ecosystem construct: Evolution, gaps and trends. Technol. Forecast. Soc. Chang. 2018, 136, 30–48. [Google Scholar] [CrossRef]

- Paasi, J.; Wiman, H.; Apilo, T.; Valkokari, K. Modeling the dynamics of innovation ecosystems. Int. J. Innov. Stud. 2023, 7, 142–158. [Google Scholar] [CrossRef]

- Cannas, R. Exploring digital transformation and dynamic capabilities in agrifood SMEs. J. Small Bus. Manag. 2021, 61, 1611–1637. [Google Scholar] [CrossRef]

- Ellström, D.; Holtström, J.; Berg, E.; Josefsson, C. Dynamic capabilities for digital transformation. J. Strategy Manag. 2022, 15, 272–286. [Google Scholar] [CrossRef]

- Cordeiro, L.F.D.S.; Cordeiro, C.F.D.S.; Ferrari, S. Cotton yield and boron dynamics affected by cover crops and boron fertilization in a tropical sandy soil. Field Crops Res. 2022, 284, 108575. [Google Scholar] [CrossRef]

- Klimas, P.; Czakon, W. Species in the wild: A typology of innovation ecosystems. Rev. Manag. Sci. 2022, 16, 249–282. [Google Scholar] [CrossRef]

- Yaghmaie, P.; Vanhaverbeke, W. Identifying and describing constituents of innovation ecosystems. EuroMed J. Bus. 2020, 15, 283–314. [Google Scholar] [CrossRef]

- Pundziene, A.; Adams, R.; Grichnik, D.; Volkmann, C. Artificiality and Sustainability in Entrepreneurship. Exploring the Unforeseen and Paving the Way to a Sustainable Future; Springer: Cham, Switzerland, 2022; pp. 3–16. [Google Scholar]

- Kubiszewski, I.; Concollato, L.; Costanza, R.; Stern, D.I. Changes in authorship, networks, and research topics in ecosystem services. Ecosyst. Serv. 2023, 59, 101501. [Google Scholar] [CrossRef]

- Jacobides, M.G.; Cennamo, C.; Gawer, A. Towards a theory of ecosystems. Strateg. Manag. J. 2018, 39, 2255–2276. [Google Scholar] [CrossRef]

- Wang, Y.; Ma, L.; Pei, J.; Li, W.; Zhou, Y.; Dou, X.; Wang, X. The level of life space mobility among community-dwelling elderly: A systematic review and meta-analysis. Arch. Gerontol. Geriatr. 2023, 117, 105278. [Google Scholar] [CrossRef]

- Ananda, A.S.; Hanny, H.; Hernández-García, Á.; Prasetya, P. Stimuli Are All Around’—The Influence of Offline and Online Servicescapes in Customer Satisfaction and Repurchase Intention. J. Theor. Appl. Electron. Commer. Res. 2023, 18, 524–547. [Google Scholar] [CrossRef]

- Moore, J. Predators and prey: A new ecology of competition. Harv. Bus. Rev. 1999, 71, 75–86. [Google Scholar]

- Darko, P.; Liang, D.; Xu, Z.; Kobina, A.; Obiora, S. A novel multi-attribute decision-making for ranking mobile payment services using online consumer reviews. Expert Syst. Appl. 2023, 213, 119262. [Google Scholar] [CrossRef] [PubMed]

- Ng, C.L.; Vargo, S.L. Service-dominant logic, service ecosystems and institutions: An editorial. J. Serv. Manag. 2018, 29, 518–520. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Service-dominant logic 2025. Int. J. Res. Mark. 2017, 34, 46–67. [Google Scholar] [CrossRef]

- Kaur, P.; Dhir, A.; Singh, N.; Sahu, G.; Almotairi, M. An innovation resistance theory perspective on mobile payment solutions. J. Retail. Consum. Serv. 2020, 55, 102059. [Google Scholar] [CrossRef]

- Bolton, R.N.; McColl-Kennedy, J.R.; Cheung, L.; Gallan, A.; Orsingher, C.; Witell, L.; Zaki, M. Customer experience challenges: Bringing together digital, physical and social realms. J. Serv. Manag. 2018, 29, 776–808. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and micro-foundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Busch, G.; Spiller, A.; Kühl, S. Review: Ethical responsibilities and transformation strategies of focal companies in the meat supply chain: The implementation dilemma. Animal 2023, 17, 100915. [Google Scholar] [CrossRef] [PubMed]

- Kohtamäki, M.; Rajala, R. Theory and practice of value co-creation in b2b systems. Ind. Mark. Manag. 2016, 56, 4–13. [Google Scholar] [CrossRef]

- Marcos, J.; Nätti, S.; Palo, T.; Baumann, J. Value co-creation practices and capabilities: Sustained purposeful engagement across b2b systems. Ind. Mark. Manag. 2016, 56, 97–107. [Google Scholar] [CrossRef]

- Lusch, R.; Vargo, S.; Tanniru, M. Service, value networks and learning. J. Acad. Mark. Sci. 2009, 38, 19–31. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Service-dominant logic: Continuing the evolution. J. Acad. Mark. Sci. 2007, 36, 1–10. [Google Scholar] [CrossRef]

- Akaka, M.A.; Vargo, S.L.; Lusch, R.F. The complexity of context: A service ecosystems approach for international marketing. J. Int. Mark. 2013, 21, 1–20. [Google Scholar] [CrossRef]

- Beirão, G.; Patrício, L.; Fisk, R.P. Value cocreation in service ecosystems. J. Serv. Manag. 2017, 28, 227–249. [Google Scholar] [CrossRef]

- Wassler, P.; Fan, D.X.F. A tale of four futures: Tourism academia and COVID-19. Tour. Manag. Perspect. 2021, 38, 100818. [Google Scholar] [CrossRef]

- Akaka, M.A.; Vargo, S.L.; Nariswari, A.; O’Brien, M. Micro-foundations for macro-marketing: A metatheoretical lens for bridging the micro-macro divide. J. Macro-Mark. 2021, 43, 61–75. [Google Scholar] [CrossRef]

- Petricevic, O.; Teece, D.J. The structural reshaping of globalization: Implications for strategic sectors, profiting from innovation, and the multinational enterprise. J. Int. Bus. Stud. 2019, 50, 1487–1512. [Google Scholar] [CrossRef]

- Teece, D.; Peteraf, M.; Leih, S. Dynamic capabilities and organizational agility: Risk, uncertainty, and strategy in the innovation economy. Calif. Manag. Rev. 2016, 58, 13–35. [Google Scholar] [CrossRef]

- Matarazzo, M.; Penco, L.; Profumo, G.; Quaglia, R. Digital transformation and customer value creation in made in Italy SMEs: A dynamic capabilities perspective. J. Bus. Res. 2021, 123, 642–656. [Google Scholar] [CrossRef]

- Blaschke, M.; Riss, U.; Haki, K.; Aier, S. Design principles for digital value co-creation networks: A service-dominant logic perspective. Electron. Mark. 2019, 29, 443–472. [Google Scholar] [CrossRef]

- Chen, J.-S.; Kerr, D.; Chou, C.; Ang, C. Business co-creation for service innovation in the hospitality and tourism industry. Int. J. Contemp. Hosp. Manag. 2018, 29, 1522–1540. [Google Scholar] [CrossRef]

- Plugge, A.; Bouwman, H. Tensions in global IT multi-sourcing arrangements: Examining the barriers to attaining common value creation. J. Glob. Inf. Technol. Manag. 2018, 21, 262–281. [Google Scholar]

- Chen, C.-L. Value-constellation innovation by firms participating in government-funded technology development. J. Glob. Inf. Technol. Manag. 2020, 23, 248–272. [Google Scholar] [CrossRef]

- de Luna, I.R.; Liébana-Cabanillas, F.; Sánchez-Fernández, J.; Muñoz-Leiva, F. Mobile payment is not all the same: The adoption of mobile payment systems depending on the technology applied. Technol. Forecast. Soc. Chang. 2018, 146, 931–994. [Google Scholar] [CrossRef]

- Pinho, J. Dynamic capabilities and international performance of SMEs: The interaction effect of relational social capital. In Research Handbook on Export Marketing; Edward Elgar Publishing: Cheltenham, UK, 2014; pp. 45–59. [Google Scholar]

- Gawer, A.; Cusumano, M. Industry platforms and ecosystem innovation. J. Prod. Innov. Manag. 2014, 31, 417–433. [Google Scholar] [CrossRef]

- Perry, C. Processes of a case study methodology for postgraduate research in marketing. Eur. J. Mark. 1998, 32, 785–802. [Google Scholar] [CrossRef]

- Mills, A.J.; Durepos, G.; Wiebe, E. Encyclopedia of Case Study Research; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2010. [Google Scholar]

- Eisenhardt, K.M. Better stories and better constructs: The case for rigor and comparative logic. Acad. Manag. Rev. 1991, 16, 620–627. [Google Scholar] [CrossRef]

- Benbasat, I.; Goldstein, D.K.; Mead, M. The case research strategy in studies of information systems. MIS Q. 1987, 11, 369–386. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods; Sage Publications: Thousand Oaks, CA, USA; London, UK, 2003. [Google Scholar]

- Lian, J.-W.; Li, J. The dimensions of trust: An investigation of mobile payment services in Taiwan. Technol. Soc. 2021, 67, 101753. [Google Scholar] [CrossRef]

- Shang, S.S.C.; Chiu, L.S.L. A race pathway for inventing and sustaining mobile payment innovation—A case study of a leading bank in Taiwan. Asia Pac. Manag. Rev. 2023, 28, 401–409. [Google Scholar] [CrossRef]

- Alvesson, M. Beyond neopositivists, romantics, and localists: A reflexive approach to interviews in organizational research. Acad. Manag. Rev. 2003, 28, 13–33. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research and Applications: Design and Methods; SAGE: Los Angeles, CA, USA, 2018. [Google Scholar]

- Kasabov, E. Marketing mix. In Wiley Encyclopedia of Management; Wiley: Hoboken, NJ, USA, 2015. [Google Scholar]

- Eisenhardt, K.M. Building theories from case study research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Karimi, J.; Walter, Z. The role of dynamic capabilities in responding to digital disruption: A factor-based study of the newspaper industry. J. Manag. Inf. Syst. 2015, 32, 39–81. [Google Scholar] [CrossRef]

- Prentice, C.; Altinay, L.; Woodside, A.G. Transformative service research and COVID-19. Serv. Ind. J. 2021, 41, 1–8. [Google Scholar] [CrossRef]

- Haki, K.; Blaschke, M.; Aier, S.; Winter, R.; Tilson, D. Dynamic capabilities for transitioning from product platform ecosystem to innovation platform ecosystem. Eur. J. Inf. Syst. 2022, 33, 181–199. [Google Scholar] [CrossRef]

- Soluk, J.; Kammerlander, N. Digital transformation in family-owned Mittelstand firms: A dynamic capabilities perspective. Eur. J. Inf. Syst. 2021, 30, 676–711. [Google Scholar] [CrossRef]

- Baiyere, A.; Salmela, H.; Tapanainen, T. Digital transformation and the new logics of business process management. Eur. J. Inf. Syst. 2020, 29, 238–259. [Google Scholar] [CrossRef]

- Nambisan, S.; Lyytinen, K.; Majchrzak, A.; Song, M. Digital innovation management. MIS Q. 2017, 41, 223–238. [Google Scholar] [CrossRef]

- Han, J.; Zhou, H.; Lowik, S.; de Weerd-Nederhof, P. Enhancing the understanding of ecosystems under innovation management context: Aggregating conceptual boundaries of ecosystems. Ind. Mark. Manag. 2022, 106, 112–138. [Google Scholar] [CrossRef]

- Kapoor, R. Ecosystems: Broadening the locus of value creation. J. Organ. Des. 2018, 7, 12. [Google Scholar] [CrossRef]

- Arli, D.; Dietrich, T. Can social media campaigns backfire? Exploring consumers’ attitudes and word-of-mouth toward four social media campaigns and its implications on consumer-campaign identification. J. Promot. Manag. 2017, 23, 1–17. [Google Scholar] [CrossRef]

- Teece, D.J. Profiting from innovation in the digital economy: Enabling technologies, standards, and licensing models in the wireless world. Res. Policy 2018, 47, 1367–1387. [Google Scholar] [CrossRef]

- Fadhil-Ondoy, M.; Vafaei-Zadeh, A.; Hanifah, H.; Ramayah, T.; Ping, T. Achieving a sustainable cashless society through mobile e-wallet: An extended technology acceptance model. Int. J. Mob. Commun. 2024, 23, 257–297. [Google Scholar]

- Dolan, P. The sustainability of sustainable consumption. J. Macromark. 2002, 22, 170–181. [Google Scholar] [CrossRef]

- Tubillejas-Andrés, B.; Cervera-Taulet, A.; García, H.C. How emotional response mediates servicescape impact on post consumption outcomes: An application to opera events. Tour. Manag. Perspect. 2020, 34, 100660. [Google Scholar] [CrossRef]

- Wong, D.T.W.; Ngai, E.W.T. Economic, organizational, and environmental capabilities for business sustainability competence: Findings from case studies in the fashion business. J. Bus. Res. 2021, 126, 440–471. [Google Scholar] [CrossRef]

- Nguyen, A.T.V.; McClelland, R.; Thuan, N.H. Exploring customer experience during channel switching in omnichannel retailing context: A qualitative assessment. J. Retail. Consum. Serv. 2022, 64, 102803. [Google Scholar] [CrossRef]

- Zhang, T.; Gerlowski, D.; Acs, Z. Working from home: Small business performance and the COVID-19 pandemic. Small Bus. Econ. 2021, 58, 611–636. [Google Scholar] [CrossRef]

- Song, Z.; Sun, Y.; Wan, J.; Huang, L.; Zhu, J. Smart e-commerce systems: Current status and research challenges. Electron. Mark. 2019, 29, 221–238. [Google Scholar] [CrossRef]

- Song, K.; Wu, P.; Zou, S. The adoption and use of mobile payment: Determinants and relationship with bank access. China Econ. Rev. 2023, 77, 101907. [Google Scholar] [CrossRef]

- Yi, J.; Kim, J.; Oh, Y.K. Uncovering the quality factors driving the success of mobile payment apps. J. Retail. Consum. Serv. 2024, 77, 103641. [Google Scholar] [CrossRef]

- Chen, C.-L. Cross-disciplinary innovations by Taiwanese manufacturing SMEs in the context of industry 4.0. J. Manuf. Technol. Manag. 2020, 31, 1145–1168. [Google Scholar] [CrossRef]

- Zhang, M.Y.; Williamson, P. The emergence of multiplatform ecosystems: Insights from China’s mobile payments system in overcoming bottlenecks to reach the mass market. Technol. Forecast. Soc. Chang. 2021, 173, 121128. [Google Scholar] [CrossRef]

- Marshall, A.; Lipp, A.; Ikeda, K.; Singh, R.R. Ecosystems boost revenues from innovation initiatives. Strategy Leadersh. 2020, 48, 17–27. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).