The Business Digitalization Process in SMEs from the Implementation of e-Commerce: An Empirical Analysis

Abstract

:1. Introduction

2. Literature Review and Hypotheses Development

2.1. Implementation of E-Commerce

2.2. Business Digitalization

2.3. Operational Efficiency

2.4. Corporate Performance

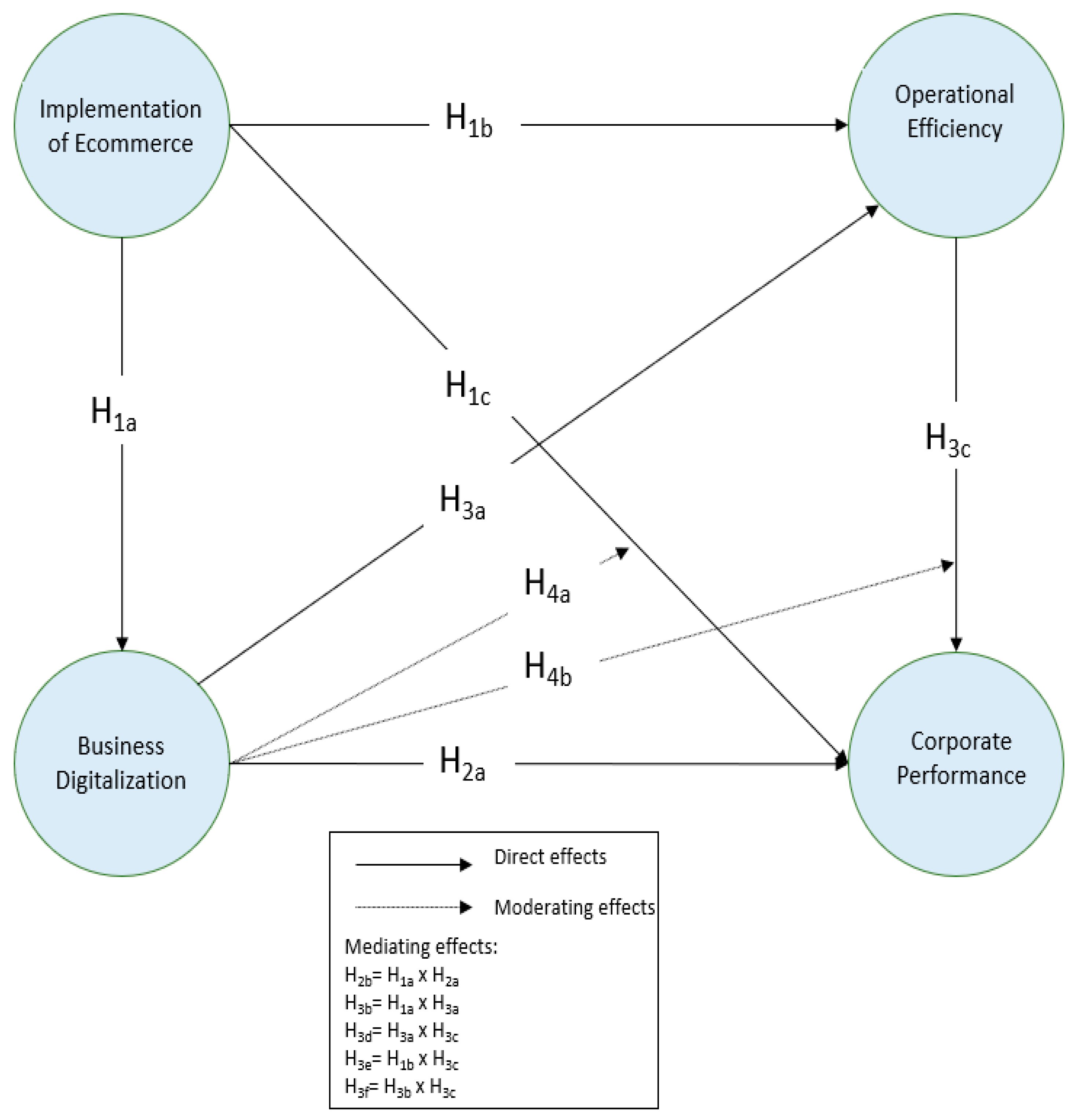

2.5. Hypothesis Development

3. Methods

3.1. Sample and Data Collection

3.2. Measurement Variables

3.3. Statistical and Econometric Procedures

- Structural Model: This represents the theoretical model, illustrating the dependency relationships between independent and dependent variables. It helps in understanding how different variables are interconnected and influence one another.

- Measurement Model: This part demonstrates the relationships between constructs and their respective indicators. It helps ensure that the selected indicators effectively measure the constructs they are intended to represent.

- Loadings Analysis: We examined the loadings of the indicators, which represent the simple correlations between each indicator and its respective construct. These loadings help us understand how well each item measures the intended construct.

- Reliability Analysis: To assess the reliability of our constructs, we utilized various measures, including:

- Cronbach’s Alpha: This statistic assesses the internal consistency of a test or scale. It indicates how closely related the items in a construct are. A higher Cronbach’s alpha suggests greater reliability.

- Composite Reliability: This measure evaluates the reliability of a construct by considering the correlations between its indicators. It provides an insight into the consistency and stability of the construct.

- Dijkstra–Henseler Rho Ratio: This ratio is another indicator of composite reliability, offering an alternative perspective on the internal consistency of a construct.

4. Results

4.1. Measurement Model

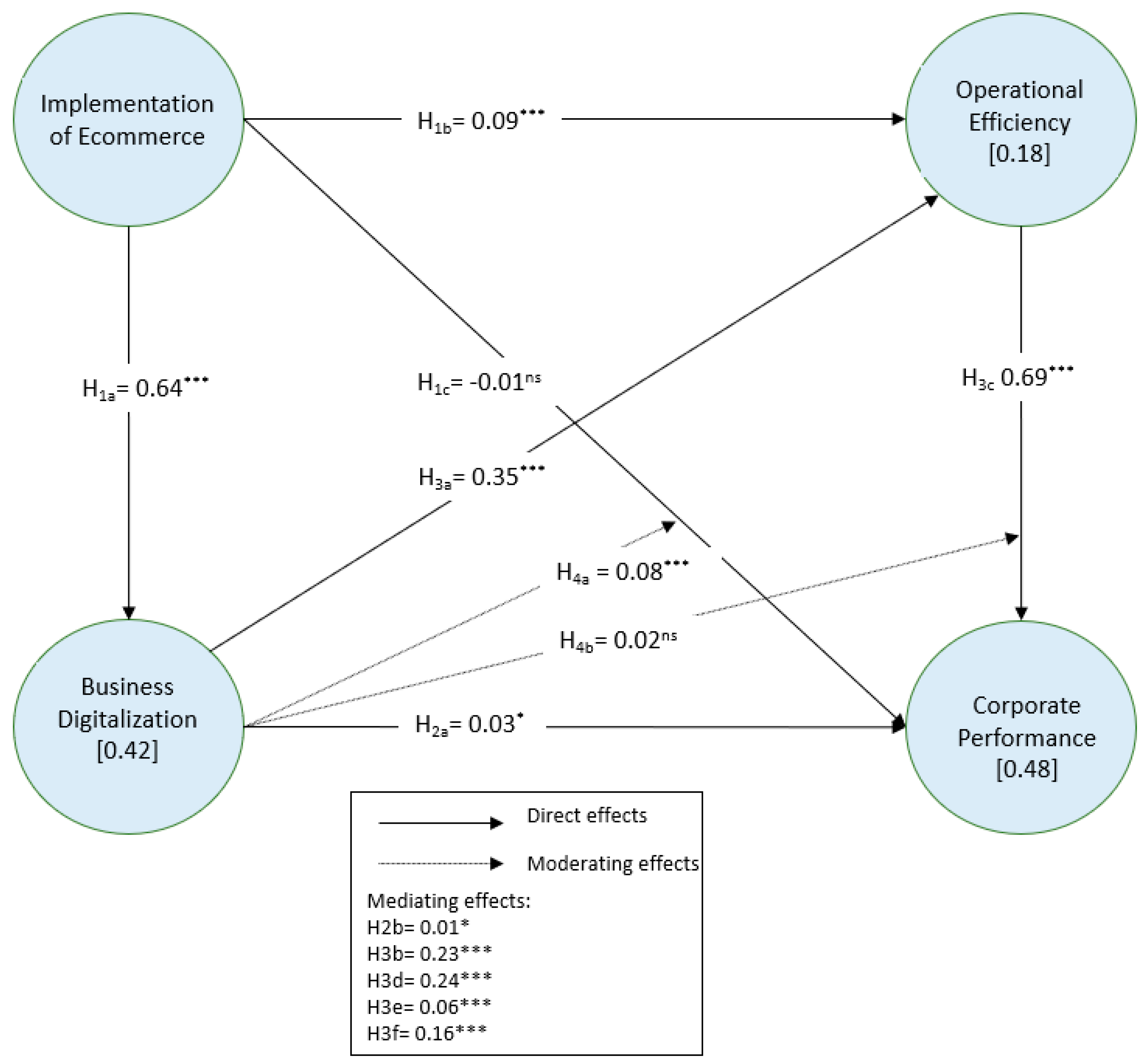

4.2. Structural Model: Direct Effects

4.3. Structural Model: Mediating Effects

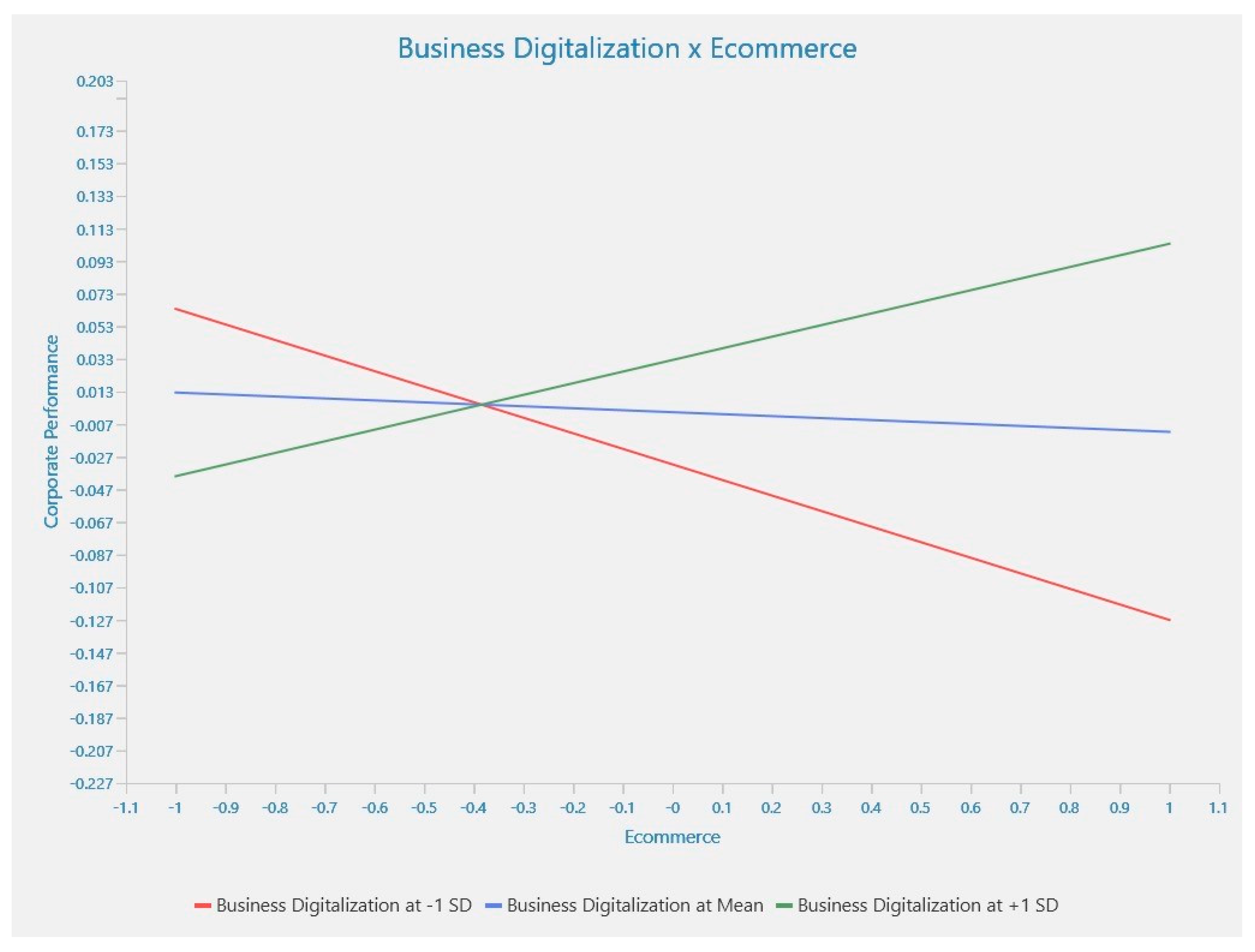

4.4. Structural Model: Moderating Effects

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hantoko, D.; Li, X.; Pariatamby, A.; Yoshikawa, K.; Horttanainen, M.; Yan, M. Challenges and Practices on Waste Management and Disposal during COVID-19 Pandemic. J. Environ. Manag. 2021, 286, 112140. [Google Scholar] [CrossRef] [PubMed]

- Li, L.; Tong, Y.; Wei, L.; Yang, S. Digital Technology-Enabled Dynamic Capabilities and Their Impacts on Firm Performance: Evidence from the COVID-19 Pandemic. Inf. Manag. 2022, 59, 103689. [Google Scholar] [CrossRef]

- Juliet Orji, I.; Ojadi, F.; Kalu Okwara, U. The Nexus between E-Commerce Adoption in a Health Pandemic and Firm Performance: The Role of Pandemic Response Strategies. J. Bus. Res. 2022, 145, 616–635. [Google Scholar] [CrossRef]

- Velasco, B.Z.; Espinoza, E.B.C.; Guatumillo, M.A.M. El E-Commerce En Las Empresas Ecuatorianas. Rev. Publicando 2021, 8, 13–20. [Google Scholar] [CrossRef]

- Šaković Jovanović, J.; Vujadinović, R.; Mitreva, E.; Fragassa, C.; Vujović, A. The Relationship between E-Commerce and Firm Performance: The Mediating Role of Internet Sales Channels. Sustainability 2020, 12, 6993. [Google Scholar] [CrossRef]

- Jarach, D. The Digitalisation of Market Relationships in the Airline Business: The Impact and Prospects of e-Business. J. Air Transp. Manag. 2002, 8, 115–120. [Google Scholar] [CrossRef]

- Abed, S.S. Social Commerce Adoption Using TOE Framework: An Empirical Investigation of Saudi Arabian SMEs. Int. J. Inf. Manag. 2020, 53, 102118. [Google Scholar] [CrossRef]

- Barnes, S.J. Information Management Research and Practice in the Post-COVID-19 World. Int. J. Inf. Manag. 2020, 55, 102175. [Google Scholar] [CrossRef]

- Mainardes, E.W.; de Souza, I.M.; Correia, R.D. Antecedents and Consequents of Consumers Not Adopting E-Commerce. J. Retail. Consum. Serv. 2020, 55, 102138. [Google Scholar] [CrossRef]

- Bharadwaj, S.; Bharadwaj, A.; Bendoly, E. The Performance Effects of Complementarities between Information Systems, Marketing, Manufacturing, and Supply Chain Processes. Inf. Syst. Res. 2007, 18, 437–453. [Google Scholar] [CrossRef]

- Papadopoulos, T.; Baltas, K.N.; Balta, M.E. The Use of Digital Technologies by Small and Medium Enterprises during COVID-19: Implications for Theory and Practice. Int. J. Inf. Manag. 2020, 55, 102192. [Google Scholar] [CrossRef] [PubMed]

- Sharma, S.; Singh, G.; Sharma, R.; Jones, P.; Kraus, S.; Dwivedi, Y.K. Digital Health Innovation: Exploring Adoption of COVID-19 Digital Contact Tracing Apps. IEEE Trans. Eng. Manag. 2022, 2021, 1–17. [Google Scholar] [CrossRef]

- Yu, R.; Wu, C.; Yan, B.; Yu, B.; Zhou, X.; Yu, Y.; Chen, N. Analysis of the Impact of Big Data on E-Commerce in Cloud Computing Environment. Complexity 2021, 2021, 5613599. [Google Scholar] [CrossRef]

- Chang, K.; Jackson, J.; Grover, V. E-Commerce and Corporate Strategy: An Executive Perspective. Inf. Manag. 2003, 40, 663–675. [Google Scholar] [CrossRef]

- Liu, W.; Zhang, J.; Wei, S.; Wang, D. Factors Influencing Organisational Efficiency in a Smart-Logistics Ecological Chain under e-Commerce Platform Leadership. Int. J. Logist. Res. Appl. 2021, 24, 364–391. [Google Scholar] [CrossRef]

- Achabal, D.; Heineke, J.M.; McIntyre, S.H. Issues and Perspectives on Retail Productivity. J. Retail. 1984, 60, 107–129. [Google Scholar]

- Yang, Z.; Shi, Y.; Yan, H. Scale, Congestion, Efficiency and Effectiveness in e-Commerce Firms. Electron. Commer. Res. Appl. 2016, 20, 171–182. [Google Scholar] [CrossRef]

- Hung, S.-W.; Lu, W.-M.; Wang, T.-P. Benchmarking the Operating Efficiency of Asia Container Ports. Eur. J. Oper. Res. 2010, 203, 706–713. [Google Scholar] [CrossRef]

- Ju, S.; Tang, H. Competition and Operating Efficiency of Manufacturing Companies in E-Commerce Environment: Empirical Evidence from Chinese Garment Companies. Appl. Econ. 2023, 55, 2113–2128. [Google Scholar] [CrossRef]

- Park, G.; Lee, S.-K.; Choi, K. Evaluating the Service Operating Efficiency and Its Determinants in Global Consulting Firms: A Metafrontier Analysis. Sustainability 2021, 13, 10352. [Google Scholar] [CrossRef]

- Andonov, A.; Dimitrov, G.P.; Totev, V. Impact of E-Commerce on Business Performance. TEM J. 2021, 10, 1558–1564. [Google Scholar] [CrossRef]

- Ausat, A.M.A.; Peirisal, T. Determinants of E-Commerce Adoption on Business Performance: A Study of MSMEs in Malang City, Indonesia. J. Optimasi Sist. Ind. 2021, 20, 104–114. [Google Scholar] [CrossRef]

- Purba, M.I.; Simanjutak, D.C.Y.; Malau, Y.N.; Sholihat, W.; Ahmadi, E.A. The Effect of Digital Marketing and E-Commerce on Financial Performance and Business Sustaina-Bility of MSMEs during COVID-19 Pandemic in Indonesia. Int. J. Data Netw. Sci. 2021, 5, 275–282. [Google Scholar] [CrossRef]

- Alzahrani, J. The Impact of E-Commerce Adoption on Business Strategy in Saudi Arabian Small and Medium Enterprises (SMEs). Rev. Econ. Political Sci. 2019, 4, 73–88. [Google Scholar] [CrossRef]

- Özbek, N.; Melén Hånell, S.; Tolstoy, D.; Rovira Nordman, E. Exploring Different Responses to Mimetic Pressures: An Institutional Theory Perspective on e-Commerce Adoption of an Internationalizing Retail SME. Int. Rev. Retail. Distrib. Consum. Res. 2022, 1–19. [Google Scholar] [CrossRef]

- Fonseka, K.; Jaharadak, A.A.; Raman, M. Impact of E-Commerce Adoption on Business Performance of SMEs in Sri Lanka; Moderating Role of Artificial Intelligence. Int. J. Soc. Econ. 2022, 49, 1518–1531. [Google Scholar] [CrossRef]

- Hussain, A.; Akbar, M.; Shahzad, A.; Poulova, P.; Akbar, A.; Hassan, R. E-Commerce and SME Performance: The Moderating Influence of Entrepreneurial Competencies. Adm. Sci. 2022, 12, 13. [Google Scholar] [CrossRef]

- Caputo, A.; Pizzi, S.; Pellegrini, M.M.; Dabić, M. Digitalization and Business Models: Where Are We Going? A Science Map of the Field. J. Bus. Res. 2021, 123, 489–501. [Google Scholar] [CrossRef]

- Eller, R.; Alford, P.; Kallmünzer, A.; Peters, M. Antecedents, Consequences, and Challenges of Small and Medium-Sized Enterprise Digitalization. J. Bus. Res. 2020, 112, 119–127. [Google Scholar] [CrossRef]

- Gregory, G.D.; Ngo, L.V.; Karavdic, M. Developing E-Commerce Marketing Capabilities and Efficiencies for Enhanced Performance in Business-to-Business Export Ventures. Ind. Mark. Manag. 2019, 78, 146–157. [Google Scholar] [CrossRef]

- John, V.; Vikitset, N. Impact of B2C E-Commerce on Small Retailers in Thailand: An Investigation Into Profitability, Operating Efficiency, and Employment Generation. SSRN Electron. J. 2019, 1–18. [Google Scholar] [CrossRef]

- Wang, L.; Sun, H. Influencing Factors of Second-Hand Platform Trading in C2C E-Commerce. J. Intell. Manag. Decis. 2023, 2, 21–29. [Google Scholar] [CrossRef]

- Alwan, S.Y.; Hu, Y.; Al Asbahi, A.A.M.H.; Al Harazi, Y.K.; Al Harazi, A.K. Sustainable and Resilient E-Commerce under COVID-19 Pandemic: A Hybrid Grey Decision-Making Approach. Environ. Sci. Pollut. Res. 2023, 30, 47328–47348. [Google Scholar] [CrossRef] [PubMed]

- Guven, H. Industry 4.0 and Marketing 4.0: In Perspective of Digitalization and E-Commerce. In Agile Business Leadership Methods for Industry 4.0; Emerald Publishing Limited: Bingley, UK, 2020; pp. 25–46. ISBN 9781800433809. [Google Scholar]

- Kilay, A.L.; Simamora, B.H.; Putra, D.P. The Influence of E-Payment and E-Commerce Services on Supply Chain Performance: Implications of Open Innovation and Solutions for the Digitalization of Micro, Small, and Medium Enterprises (MSMEs) in Indonesia. J. Open Innov. Technol. Mark. Complex. 2022, 8, 119. [Google Scholar] [CrossRef]

- Nanda, A.; Xu, Y.; Zhang, F. How Would the COVID-19 Pandemic Reshape Retail Real Estate and High Streets through Acceleration of E-Commerce and Digitalization? J. Urban Manag. 2021, 10, 110–124. [Google Scholar] [CrossRef]

- Yuan, J.; Zou, H.; Xie, K.; Dulebenets, M.A. An Assessment of Social Distancing Obedience Behavior during the COVID-19 Post-Epidemic Period in China: A Cross-Sectional Survey. Sustainability 2021, 13, 8091. [Google Scholar] [CrossRef]

- Hayakawa, K.; Mukunoki, H.; Urata, S. Can E-Commerce Mitigate the Negative Impact of COVID-19 on International Trade? Jpn. Econ. Rev. 2021, 74, 215–232. [Google Scholar] [CrossRef]

- Radosavljević, K. Digital Transformation and Risk Mitigation in Emerging Insurance Markets: A Comparative Analysis between China and Serbia. Oppor. Chall. Sustain. 2023, 2, 104–115. [Google Scholar] [CrossRef]

- Ritter, T.; Pedersen, C.L. Digitization Capability and the Digitalization of Business Models in Business-to-Business Firms: Past, Present, and Future. Ind. Mark. Manag. 2020, 86, 180–190. [Google Scholar] [CrossRef]

- Hagberg, J.; Sundstrom, M.; Egels-Zandén, N. The Digitalization of Retailing: An Exploratory Framework. Int. J. Retail Distrib. Manag. 2016, 44, 694–712. [Google Scholar] [CrossRef]

- Gartner. Gartner Digital-Transformation. Available online: https://www.gartner.com/en/information-technology/glossary/digital-transformation (accessed on 1 February 2023).

- Su, J.; Wang, D.; Zhang, F.; Xu, B.; Ouyang, Z. A Multi-Criteria Group Decision-Making Method for Risk Assessment of Live-Streaming E-Commerce Platform. J. Theor. Appl. Electron. Commer. Res. 2023, 18, 1126–1141. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. In International Business Strategy: Theory and Practice; Sage Publications: Thousand Oaks, CA, USA, 2015; Volume 17, pp. 283–301. ISBN 9781315848365. [Google Scholar]

- Porter, M.E. Competitive Advantage: Creating and Sustaining Superior Performance; Free Press: Florence, MA, USA, 1985; ISBN 0-684-84146-0. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. The Balanced Scorecard: Measures That Drive Performance; Harvard Business Review; Harvard Business Publishing: Brighton, MA, USA, 2005; Volume 70. [Google Scholar]

- Gunasekaran, A.; Marri, H.B.; McGaughey, R.E.; Nebhwani, M.D. E-Commerce and Its Impact on Operations Management. Int. J. Prod. Econ. 2002, 75, 185–197. [Google Scholar] [CrossRef]

- Johnson, D.S. Digitization of Selling Activity and Sales Force Performance: An Empirical Investigation. J. Acad. Mark. Sci. 2005, 33, 3–18. [Google Scholar] [CrossRef]

- Madeja, N.; Schoder, D. Impact of Electronic Commerce Customer Relationship Management on Corporate Success-Results from an Empirical Investigation. In Proceedings of the 36th Annual Hawaii International Conference on System Sciences, Big Island (Hawaii), HI, USA, 6–9 January 2003; p. 10. [Google Scholar]

- Davis, E.; Kay, J. Assessing Corporate Performance. Bus. Strategy Rev. 1990, 1, 1–16. [Google Scholar] [CrossRef]

- Demsetz, H.; Villalonga, B. Ownership Structure and Corporate Performance. J. Corp. Financ. 2001, 7, 209–233. [Google Scholar] [CrossRef]

- Kaplan, S.N.; Reishus, D. Outside Directorships and Corporate Performance. J. Financ. Econ. 1990, 27, 389–410. [Google Scholar] [CrossRef]

- Opler, T.C.; Titman, S. Financial Distress and Corporate Performance. J. Financ. 1994, 49, 1015–1040. [Google Scholar] [CrossRef]

- Rappaport, A. Corporate Performance Standards and Shareholder Value. J. Bus. Strategy 1983, 3, 28–38. [Google Scholar] [CrossRef]

- Xiaoming, C.; Junchen, H. A Literature Review on Organization Culture and Corporate Performance. Int. J. Bus. Adm. 2012, 3, 28. [Google Scholar] [CrossRef]

- Kumar, S.; Petersen, P. Impact of E-commerce in Lowering Operational Costs and Raising Customer Satisfaction. J. Manuf. Technol. Manag. 2006, 17, 283–302. [Google Scholar] [CrossRef]

- Mangiaracina, R.; Perego, A.; Seghezzi, A.; Tumino, A. Innovative Solutions to Increase Last-Mile Delivery Efficiency in B2C e-Commerce: A Literature Review. Int. J. Phys. Distrib. Logist. Manag. 2019, 49, 901–920. [Google Scholar] [CrossRef]

- Liu, K.P.; Chiu, W. Supply Chain 4.0: The Impact of Supply Chain Digitalization and Integration on Firm Performance. Asian J. Bus. Ethics 2021, 10, 371–389. [Google Scholar] [CrossRef]

- Saini, A. Organizational Capabilities in E-Commerce: An Empirical Investigation of E-Brokerage Service Providers. J. Acad. Mark. Sci. 2005, 33, 360–375. [Google Scholar] [CrossRef]

- Abou-foul, M.; Ruiz-Alba, J.L.; Soares, A. The Impact of Digitalization and Servitization on the Financial Performance of a Firm: An Empirical Analysis. Prod. Plan. Control 2021, 32, 975–989. [Google Scholar] [CrossRef]

- Guo, L.; Xu, L. The Effects of Digital Transformation on Firm Performance: Evidence from China’s Manufacturing Sector. Sustainability 2021, 13, 12844. [Google Scholar] [CrossRef]

- Nwankpa, J.K.; Roumani, Y. IT Capability and Digital Transformation: A Firm Performance Perspective. In ICIS Proceedings; Association for Information Systems: Dublin, Ireland, 2016. [Google Scholar]

- Wang, X.; Gu, Y.; Ahmad, M.; Xue, C. The Impact of Digital Capability on Manufacturing Company Performance. Sustainability 2022, 14, 6214. [Google Scholar] [CrossRef]

- Zhang, Y.; Ma, X.; Pang, J.; Xing, H.; Wang, J. The Impact of Digital Transformation of Manufacturing on Corporate Performance—The Mediating Effect of Business Model Innovation and the Moderating Effect of Innovation Capability. Res. Int. Bus. Financ. 2023, 64, 101890. [Google Scholar] [CrossRef]

- Martín-Peña, M.-L.; Sánchez-López, J.-M.; Díaz-Garrido, E. Servitization and Digitalization in Manufacturing: The Influence on Firm Performance. J. Bus. Ind. Mark. 2019, 35, 564–574. [Google Scholar] [CrossRef]

- Porter, M.E.; Heppelmann, J.E. How Smart, Connected Products Are Transforming Competition. Harv. Bus. Rev. 2014, 92, 64–88. [Google Scholar]

- Heredia, J.; Castillo-Vergara, M.; Geldes, C.; Carbajal Gamarra, F.M.; Flores, A.; Heredia, W. How Do Digital Capabilities Affect Firm Performance? The Mediating Role of Technological Capabilities in the “New Normal”. J. Innov. Knowl. 2022, 7, 100171. [Google Scholar] [CrossRef]

- Martínez-Caro, E.; Cegarra-Navarro, J.G.; Alfonso-Ruiz, F.J. Digital Technologies and Firm Performance: The Role of Digital Organisational Culture. Technol. Forecast. Soc. Chang. 2020, 154, 119962. [Google Scholar] [CrossRef]

- Wielgos, D.M.; Homburg, C.; Kuehnl, C. Digital Business Capability: Its Impact on Firm and Customer Performance. J. Acad. Mark. Sci. 2021, 49, 762–789. [Google Scholar] [CrossRef]

- Gill, A.; Singh, M.; Mathur, N.; Mand, H.S. The Impact of Operational Efficiency on the Future Performance of Indian Manufacturing Firms. Int. J. Econ. Financ. 2014, 6, 259. [Google Scholar] [CrossRef]

- Mahsud, R.; Yukl, G.; Prussia, G.E. Human Capital, Efficiency, and Innovative Adaptation as Strategic Determinants of Firm Performance. J. Leadersh. Organ. Stud. 2011, 18, 229–246. [Google Scholar] [CrossRef]

- Min, S.; Wolfinbarger, M. Market Share, Profit Margin, and Marketing Efficiency of Early Movers, Bricks and Clicks, and Specialists in e-Commerce. J. Bus. Res. 2005, 58, 1030–1039. [Google Scholar] [CrossRef]

- Lee, K.; Azmi, N.; Hanaysha, J.; Alzoubi, H.; Alshurideh, M. The Effect of Digital Supply Chain on Organizational Performance: An Empirical Study in Malaysia Manufacturing Industry. Uncertain Supply Chain Manag. 2022, 10, 495–510. [Google Scholar] [CrossRef]

- Tohanean, D.; Toma, S.-G.; Dumitru, I. Organizational Performance and Digitalization in Industry 4.0. J. Emerg. Trends Mark. Manag. 2018, 1, 282–293. [Google Scholar]

- Antonucci, Y.L.; Fortune, A.; Kirchmer, M. An Examination of Associations between Business Process Management Capabilities and the Benefits of Digitalization: All Capabilities Are Not Equal. Bus. Process Manag. J. 2021, 27, 124–144. [Google Scholar] [CrossRef]

- Lee, Y.-Y.; Falahat, M.; Sia, B.-K. Impact of Digitalization on the Speed of Internationalization. Int. Bus. Res. 2019, 12, 1. [Google Scholar] [CrossRef]

- Suasana, I.G.A.K.G.; Warmika, I.G.K.; Ekawati, N.W.; Rastini, N.M. Is Marketing Digitization Important? Int. J. Data Netw. Sci. 2022, 6, 813–822. [Google Scholar] [CrossRef]

- Saldanha, T.J.V.; Kathuria, A.; Khuntia, J.; Konsynski, B.; Andrade Rojas, M. Leveraging Digitalization of Services for Performance: Evidence from the Credit Union Industry. In Proceedings of the 17th International Conference on Ion Sources (ICIS 2017), Geneva, Switzerland, 15–20 October 2017. [Google Scholar]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common Method Biases in Behavioral Research: A Critical Review of the Literature and Recommended Remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef] [PubMed]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to Use and How to Report the Results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Mayr, S.; Erdfelder, E.; Buchner, A.; Faul, F. A Short Tutorial of GPower. Tutor. Quant. Methods Psychol. 2007, 3, 51–59. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Erbaum Press: Hillsdale, NJ, USA, 2013; ISBN 1483276481. [Google Scholar]

- Etumnu, C.E. A Competitive Marketplace or an Unfair Competitor? An Analysis of Amazon and Its Best Sellers Ranks. J. Agric. Econ. 2022, 73, 924–937. [Google Scholar] [CrossRef]

- Ha, S.; Stoel, L. Consumer E-Shopping Acceptance: Antecedents in a Technology Acceptance Model. J. Bus. Res. 2009, 62, 565–571. [Google Scholar] [CrossRef]

- Horng, S.-M.; Wu, C.-L. How Behaviors on Social Network Sites and Online Social Capital Influence Social Commerce Intentions. Inf. Manag. 2020, 57, 103176. [Google Scholar] [CrossRef]

- Zhao, Q.; Zhang, Y.; Friedman, D.; Tan, F. E-Commerce Recommendation with Personalized Promotion. In RecSys ‘15: Proceedings of the 9th ACM Conference on Recommender Systems, Vienna, Austria, 16 September 2015; ACM: New York, NY, USA, 2015; pp. 219–226. [Google Scholar]

- Nasiri, M.; Ukko, J.; Saunila, M.; Rantala, T.; Rantanen, H. Digital-Related Capabilities and Financial Performance: The Mediating Effect of Performance Measurement Systems. Technol. Anal. Strateg. Manag. 2020, 32, 1393–1406. [Google Scholar] [CrossRef]

- Niemand, T.; Rigtering, J.P.C.; Kallmünzer, A.; Kraus, S.; Maalaoui, A. Digitalization in the Financial Industry: A Contingency Approach of Entrepreneurial Orientation and Strategic Vision on Digitalization. Eur. Manag. J. 2021, 39, 317–326. [Google Scholar] [CrossRef]

- Jiang, Y.; Colakoglu, S.; Lepak, D.P.; Blasi, J.R.; Kruse, D.L. Involvement Work Systems and Operational Effectiveness: Exploring the Moderating Effect of National Power Distance. J. Int. Bus. Stud. 2015, 46, 332–354. [Google Scholar] [CrossRef]

- Lin, W.T.; Shao, B.B.M. Assessing the Input Effect on Productive Efficiency in Production Systems: The Value of Information Technology Capital. Int. J. Prod. Res. 2006, 44, 1799–1819. [Google Scholar] [CrossRef]

- Pérez-Rave, J.I.; Guerrero, R.F.; Vallina, A.S.; Echavarría, F.G. A Measurement Model of Dynamic Capabilities of the Continuous Improvement Project and Its Role in the Renewal of the Company’s Products/Services. Oper. Manag. Res. 2023, 16, 126–140. [Google Scholar] [CrossRef]

- Rho, S.; An, J. Evaluating the Efficiency of a Two-Stage Production Process Using Data Envelopment Analysis. Int. Trans. Oper. Res. 2007, 14, 395–410. [Google Scholar] [CrossRef]

- Roriz, C.; Nunes, E.; Sousa, S. Application of Lean Production Principles and Tools for Quality Improvement of Production Processes in a Carton Company. Procedia Manuf. 2017, 11, 1069–1076. [Google Scholar] [CrossRef]

- Santa, R.; Hyland, P.; Ferrer, M. Technological Innovation and Operational Effectiveness: Their Role in Achieving Performance Improvements. Prod. Plan. Control 2014, 25, 969–979. [Google Scholar] [CrossRef]

- Fernández-Gámez, M.; Gutiérrez-Ruiz, A.; Becerra-Vicario, R.; Ruiz-Palomo, D. The Effects of Creating Shared Value on the Hotel Performance. Sustainability 2019, 11, 1784. [Google Scholar] [CrossRef]

- García-Lopera, F.; Santos-Jaén, J.M.; Palacios-Manzano, M.; Ruiz-Palomo, D. Exploring the Effect of Professionalization, Risk-Taking and Technological Innovation on Business Performance. PLoS ONE 2022, 17, e0263694. [Google Scholar] [CrossRef]

- León-Gómez, A.; Santos-Jaén, J.M.; Ruiz-Palomo, D.; Palacios-Manzano, M. Disentangling the Impact of ICT Adoption on SMEs Performance: The Mediating Roles of Corpo-Rate Social Responsibility and Innovation. Oeconomia Copernic. 2022, 13, 831–866. [Google Scholar] [CrossRef]

- Palacios-Manzano, M.; Leon-Gomez, A.; Santos-Jaen, J.M. Corporate Social Responsibility as a Vehicle for Ensuring the Survival of Construction SMEs. The Mediating Role of Job Satisfaction and Innovation. IEEE Trans. Eng. Manag. 2022, 1–14. [Google Scholar] [CrossRef]

- Cepeda-Carrion, G.; Cegarra-Navarro, J.G.; Cillo, V. Tips to Use Partial Least Squares Structural Equation Modelling (PLS-SEM) in Knowledge Management. J. Knowl. Manag. 2019, 23, 67–89. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Becker, J.-M. SmartPLS 4. Boenningstedt; SmartPLS GmbH: Oststeinbek, Germany, 2022. [Google Scholar]

- Streukens, S.; Leroi-Werelds, S. Bootstrapping and PLS-SEM: A Step-by-Step Guide to Get More out of Your Bootstrap Results. Eur. Manag. J. 2016, 34, 618–632. [Google Scholar] [CrossRef]

- Yusif, S.; Hafeez-Baig, A.; Soar, J.; Teik, D.O.L. PLS-SEM Path Analysis to Determine the Predictive Relevance of e-Health Readiness Assessment Model. Health Technol. 2020, 10, 1497–1513. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial Least Squares Structural Equation Modeling (PLS-SEM): An Emerging Tool in Business Research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Danks, N.P.; Ray, S. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R; Classroom Companion: Business; Springer International Publishing: Cham, Switzerland, 2021; ISBN 978-3-030-80518-0. [Google Scholar]

- Ávila, M.M.; Moreno, E.F. Aplicación de La Técnica PLS-SEM En La Gestión Del Conocimiento: Un Enfoque Técnico Práctico/Application of the PLS-SEM Technique in Knowledge Management: A Practical Technical Approach. RIDE Rev. Iberoam. Investig. Desarro. Educ. 2018, 8, 130–164. [Google Scholar] [CrossRef]

- Kline, R.B. Principles and Practice of Structural Equation Modeling, 2nd ed.; Guilford Press: New York, NY, USA, 2005. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39. [Google Scholar] [CrossRef]

- Hair, J.F.; Astrachan, C.B.; Moisescu, O.I.; Radomir, L.; Sarstedt, M.; Vaithilingam, S.; Ringle, C.M. Executing and Interpreting Applications of PLS-SEM: Updates for Family Business Researchers. J. Fam. Bus. Strategy 2021, 12, 100392. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Ringle, C.M. Rethinking Some of the Rethinking of Partial Least Squares. Eur. J. Mark. 2019, 53, 566–584. [Google Scholar] [CrossRef]

- Chin, W.W. The Partial Least Squares Approach to Structural Modeling. Mod. Methods Bus. Res. 1998, 295, 295–336. [Google Scholar]

- Dijkstra, T.K.; Henseler, J. Consistent Partial Least Squares Path Modeling. MIS Q. Manag. Inf. Syst. 2015, 39, 297–316. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a Silver Bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Koolman, J.; Karlson, P. Ecdysone Oxidase, an Enzyme from the Blowfly Calliphora erythrocephala (Meigen). Biol. Chem. 1975, 356, 1131–1138. [Google Scholar] [CrossRef]

- Falk, R.F.; Miller, N.B. A Primer for Soft Modeling; University of Akron Press: Akron, OH, USA, 1992; Volume 2, p. 103. [Google Scholar]

- Palos-Sanchez, P.; Saura, J.R.; Velicia-Martin, F.; Cepeda-Carrion, G. A Business Model Adoption Based on Tourism Innovation: Applying a Gratification Theory to Mobile Applications. Eur. Res. Manag. Bus. Econ. 2021, 27, 100149. [Google Scholar] [CrossRef]

- Ali, I.; Ali, M.; Leal-Rodríguez, A.L.; Albort-Morant, G. The Role of Knowledge Spillovers and Cultural Intelligence in Enhancing Expatriate Employees’ Individual and Team Creativity. J. Bus. Res. 2019, 101, 561–573. [Google Scholar] [CrossRef]

| Industry | Total | Micro Size | Small Size | Medium Size | ||||

|---|---|---|---|---|---|---|---|---|

| N | % | N | % | N | % | N | % | |

| Primary Sector | 132 | 3.20% | 52 | 2.28% | 31 | 2.96% | 49 | 6.23% |

| Extractive Industries | 67 | 1.63% | 7 | 0.31% | 12 | 1.14% | 48 | 6.10% |

| Manufacturing Industries | 855 | 20.75% | 395 | 17.29% | 209 | 19.92% | 251 | 31.89% |

| Energy, Water, Recycling | 44 | 1.07% | 22 | 0.96% | 11 | 1.05% | 11 | 1.40% |

| Construction | 126 | 3.06% | 41 | 1.79% | 43 | 4.10% | 42 | 5.34% |

| Trade | 668 | 16.21% | 460 | 20.13% | 132 | 12.58% | 76 | 9.66% |

| Services | 1630 | 39.55% | 915 | 40.04% | 468 | 44.61% | 247 | 31.39% |

| Other Activities | 599 | 14.54% | 393 | 17.20% | 143 | 13.63% | 63 | 8.01% |

| TOTAL | 4121 | 100% | 2285 | 100% | 1049 | 100% | 787 | 100% |

| Implementation of e-Commerce | |

| What technologies do you use in your company and how important are they? Please indicate the degree of importance for your company on a scale from 1 to 5, where 1 is not very important to 5 very important [13,83,84,85,86,87]: | |

| EC_001 | Own website |

| EC_002 | We make sales on our own e-commerce portal |

| EC_003 | E-commerce in Marketplace (Amazon or equivalent) |

| EC_004 | Social networks for commercial purposes |

| EC_005 | Big data and data analysis software |

| Business Digitalization | |

| Indicate the degree of agreement or disagreement on a scale of 1 to 5 on the following aspects related to the digitalization strategy [29,87,88]: | |

| BD_001 | We are well aware of the possibilities and advantages of digitalization |

| BD_002 | We allocate significant resources to digitize the business |

| BD_003 | The business model is evaluated and updated in terms of digitalization |

| BD_004 | Our employees are prepared for the digital development of the company |

| BD_005 | Our managers are well trained in digitalization |

| BD_006 | The degree of process automation is high in my company |

| BD_007 | We use digitalization in the organizational management of the company |

| BD_008 | Our company regularly organizes training for digital transformation |

| Operational Efficiency | |

| In comparison with your direct competitors, indicate where your company stands on the following performance indicators [89,90,91,92,93,94,95]: | |

| OE_001 | Quality of your products |

| OE_002 | The efficiency of production processes |

| OE_003 | Changes or improvements in existing products/services |

| OE_004 | Changes or improvements in production processes |

| Corporate Performance | |

| In comparison with your direct competitors, indicate where your company stands on the following performance indicators [96,97,98,99]: | |

| CP_001 | Customer satisfaction |

| CP_002 | Speed of sales growth |

| CP_003 | Profitability |

| CP_004 | Employee satisfaction |

| CP_005 | Level of absenteeism |

| Composite Indicators | Mean | SD | Loading | t-Student | α | ρA | ρC | AVE |

|---|---|---|---|---|---|---|---|---|

| Implementation of E-commerce | 0.808 | 0.813 | 0.867 | 0.569 | ||||

| EC_001 | 2.616 | 2.062 | 0.810 | 130.086 | ||||

| EC_002 | 2.049 | 1.962 | 0.842 | 153.669 | ||||

| EC_003 | 1.787 | 1.927 | 0.724 | 69.308 | ||||

| EC_004 | 3.278 | 1.828 | 0.667 | 64.945 | ||||

| EC_005 | 1.779 | 1.907 | 0.713 | 75.144 | ||||

| Business Digitalization | 0.939 | 0.940 | 0.949 | 0.702 | ||||

| BD_001 | 3.654 | 1.249 | 0.695 | 71.181 | ||||

| BD_002 | 3.109 | 1.358 | 0.851 | 150.978 | ||||

| BD_003 | 3.008 | 1.369 | 0.857 | 174.739 | ||||

| BD_004 | 3.145 | 1.304 | 0.847 | 145.059 | ||||

| BD_005 | 3.305 | 1.317 | 0.852 | 159.828 | ||||

| BD_006 | 2.922 | 1.314 | 0.847 | 147.708 | ||||

| BD_007 | 3.024 | 1.334 | 0.877 | 202.844 | ||||

| BD_008 | 2.961 | 1.363 | 0.864 | 173.057 | ||||

| Operational Efficiency | 0.774 | 0.778 | 0.854 | 0.595 | ||||

| OE_001 | 4.211 | 0.927 | 0.791 | 104.048 | ||||

| OE_002 | 4.061 | 0.924 | 0.772 | 98.517 | ||||

| OE_003 | 3.638 | 1.554 | 0.775 | 83.675 | ||||

| OE_004 | 3.454 | 1.585 | 0.746 | 72.133 | ||||

| Corporate Performance | 0.813 | 0.830 | 0.870 | 0.574 | ||||

| CP_001 | 4.324 | 0.863 | 0.784 | 104.917 | ||||

| CP_002 | 3.967 | 0.971 | 0.811 | 113.763 | ||||

| CP_003 | 3.980 | 0.931 | 0.795 | 93.947 | ||||

| CP_004 | 4.173 | 0.897 | 0.777 | 83.718 | ||||

| CP_005 | 3.719 | 1.146 | 0.601 | 41.823 | ||||

| I | II | III | IV | ||

|---|---|---|---|---|---|

| I | Business Digitalization | 0.838 | 0.358 | 0.729 | 0.499 |

| II | Corporate Performance | 0.302 | 0.758 | 0.301 | 0.830 |

| III | Implementation of E-commerce | 0.644 | 0.236 | 0.754 | 0.409 |

| IV | Operational Efficiency | 0.415 | 0.684 | 0.322 | 0.771 |

| I | II | III | ||

|---|---|---|---|---|

| I | Business Digitalization | 1.934 | 1.709 | |

| II | Implementation of E-commerce | 1.000 | 1.771 | 1.709 |

| III | Operational Efficiency | 1.412 |

| CI | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Path | SD | T-Value | f2 | 5% | 95% | H | Supported | ||

| Direct effects | |||||||||

| Impl. Of E-commerce > Business Digitalization | 0.644 | 0.010 | 65.752 *** | 0.709 | 0.628 | 0.660 | H1a | YES | |

| Impl. Of E-commerce > Operational Efficiency | 0.094 | 0.019 | 4.988 *** | 0.006 | 0.064 | 0.125 | H1b | YES | |

| Impl. Of E-commerce > Corporate Performance | −0.012 | 0.015 | 0.797 | 0.000 | −0.037 | 0.013 | H1c | NO | |

| Business Digitalization > Corporate Performance | 0.032 | 0.018 | 1.808 * | 0.001 | 0.003 | 0.061 | H2a | YES | |

| Business Digitalization > Operational Efficiency | 0.354 | 0.020 | 17.927 *** | 0.089 | 0.322 | 0.386 | H3a | YES | |

| Operational Efficiency > Corporate Performance | 0.687 | 0.013 | 6.302 *** | 0.634 | 0.664 | 0.705 | H3c | YES | |

| Indirect effects | VAF | ||||||||

| Individual indirect effects | |||||||||

| Impl. Of E-commerce > Business Digitalization > Corporate Performance | 0.021 | 0.011 | 1.806 * | 0.002 | 0.039 | 9.17% | H2b | YES | |

| Impl. Of E-commerce > Business Digitalization > Operational Efficiency | 0.228 | 0.014 | 16.786 *** | 0.206 | 0.250 | 70.81% | H3b | YES | |

| Business Digitalization > Operational Efficiency > Corporate Performance | 0.242 | 0.015 | 16.654 *** | 0.219 | 0.267 | 88.32% | H3d | YES | |

| Impl. Of E-commerce > Operational Efficiency > Corporate Performance | 0.064 | 0.013 | 4.961 *** | 0.043 | 0.086 | 27.95% | H3e | YES | |

| Impl. Of E-commerce > Business Digitalization > Operational Efficiency > Corporate Performance | 0.156 | 0.010 | 15.730 *** | 0.140 | 0.173 | 68.12% | H3f | YES | |

| Moderating effects | |||||||||

| Business Digitalization × Impl. Of E-commerce > Corporate Performance | 0.083 | 0.013 | 6.302 *** | 0.061 | 0.105 | ||||

| Business Digitalization × Operational Efficiency > Corporate Performance | 0.023 | 0.016 | 1.444 | −0.003 | 0.051 | ||||

| Global indirect effects | VAF | ||||||||

| Business Digitalization > Corporate Performance | 0.242 | 0.015 | 16.654 *** | 0.219 | 0.267 | 88.32% | |||

| Impl. Of E-commerce > Corporate Performance | 0.241 | 0.014 | 17.265 *** | 0.218 | 0.264 | 100.00% | |||

| Impl. Of E-commerce > Operational Efficiency | 0.228 | 0.014 | 16.786 *** | 0.206 | 0.250 | 70.81% | |||

| Total effect | |||||||||

| Business Digitalization > Corporate Performance | 0.274 | 0.022 | 12.734 *** | 0.239 | 0.309 | ||||

| Impl. Of E-commerce > Corporate Performance | 0.229 | 0.016 | 14.443 *** | 0.203 | 0.255 | ||||

| Impl. Of E-commerce > Operational Efficiency | 0.322 | 0.014 | 22.520 *** | 0.299 | 0.346 | ||||

| Operational Efficiency > Corporate Performance | 0.684 | 0.013 | 5me05 *** | 0.664 | 0.705 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Santos-Jaén, J.M.; Gimeno-Arias, F.; León-Gómez, A.; Palacios-Manzano, M. The Business Digitalization Process in SMEs from the Implementation of e-Commerce: An Empirical Analysis. J. Theor. Appl. Electron. Commer. Res. 2023, 18, 1700-1720. https://doi.org/10.3390/jtaer18040086

Santos-Jaén JM, Gimeno-Arias F, León-Gómez A, Palacios-Manzano M. The Business Digitalization Process in SMEs from the Implementation of e-Commerce: An Empirical Analysis. Journal of Theoretical and Applied Electronic Commerce Research. 2023; 18(4):1700-1720. https://doi.org/10.3390/jtaer18040086

Chicago/Turabian StyleSantos-Jaén, José Manuel, Fernando Gimeno-Arias, Ana León-Gómez, and Mercedes Palacios-Manzano. 2023. "The Business Digitalization Process in SMEs from the Implementation of e-Commerce: An Empirical Analysis" Journal of Theoretical and Applied Electronic Commerce Research 18, no. 4: 1700-1720. https://doi.org/10.3390/jtaer18040086

APA StyleSantos-Jaén, J. M., Gimeno-Arias, F., León-Gómez, A., & Palacios-Manzano, M. (2023). The Business Digitalization Process in SMEs from the Implementation of e-Commerce: An Empirical Analysis. Journal of Theoretical and Applied Electronic Commerce Research, 18(4), 1700-1720. https://doi.org/10.3390/jtaer18040086