Consumers’ Adoption and Use of E-Currencies in Virtual Markets in the Context of an Online Game

Abstract

1. Introduction

2. Literature Review

2.1. Virtual Markets

2.2. E-Currencies in Virtual Markets

2.3. Challenges in E-Currencies

3. Materials and Methods

3.1. Data Collection

3.2. Hypotheses Development

3.2.1. Perceived Usefulness

3.2.2. Perceived Ease of Use

3.2.3. Perceived Risks

3.2.4. Perceived Trust

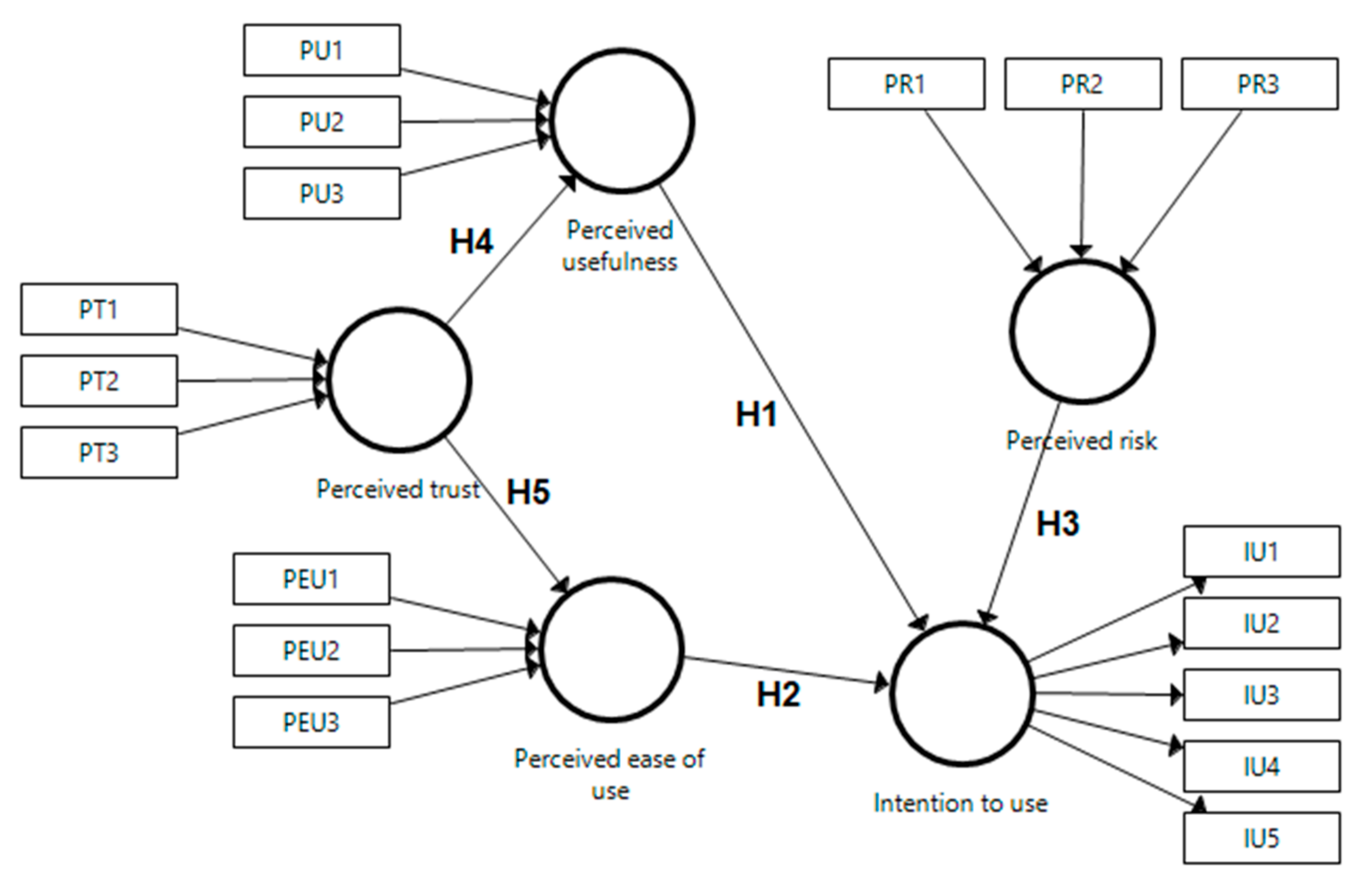

3.3. Model

4. Results

4.1. Measurement Model Assessment

4.2. Structural Model Assessment

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Nazir, M.; Man Lui, C.S. A survey of research in real-money trading (RMT) in virtual world. Int. J. Virtual Communities Soc. Netw. 2017, 9, 34–53. [Google Scholar] [CrossRef]

- Davis, F.D. A Technology Acceptance Model for Empirically Testing New End-User Information Systems: Theory and Results, Massachusetts Institute of Technology. Ph.D. Thesis, MIT Sloan School of Management, Cambridge, MA, USA, 1986. [Google Scholar]

- Kim, T. The predecessors of bitcoin and their implications for the prospect of virtual currencies. PLoS ONE 2015, 10, e0123071. [Google Scholar] [CrossRef]

- Holin, L.; Sun, C.-T. Cash trade in free-to-play online games. Games Cult. 2011, 6, 270–287. [Google Scholar] [CrossRef]

- Xu, X.; Yang, X.; Lu, J.; Lan, J.; Peng, T.-Q.; Wu, Y.; Chen, W. Examining the effects of network externalities, density, and closure on in-game currency price in online games. Internet Res. 2017, 27, 924–941. [Google Scholar] [CrossRef]

- Fernandes, L.V.; Castanho, C.D.; Jacobi, R.P. A survey on game analytics in massive multiplayer online games. In Proceedings of the 2018 17th Brazilian Symposium on Computer Games and Digital Entertainment (SBGames), Foz do Iguacu, Brazil, 29 October–1 November 2018; pp. 372–381. [Google Scholar]

- Guo, H.; Hao, L.; Mukhopadhyay, T.; Sun, D. Selling virtual currency in digital games: Implications for gameplay and social welfare. Inf. Syst. Res. 2019, 30, 430–446. [Google Scholar] [CrossRef]

- Zagała, K.; Strzelecki, A. eSports evolution in football game series. Phys. Cult. Sport. Stud. Res. 2019, 83, 50–62. [Google Scholar] [CrossRef]

- Hamari, J.; Keronen, L. Why do people buy virtual goods: A meta-analysis. Comput. Hum. Behav. 2017, 71, 59–69. [Google Scholar] [CrossRef]

- Zhang, Y.; Huang, W. The research on consumer behavior of online games and its influencing factors. MATEC Web Conf. 2019, 267, 04010. [Google Scholar] [CrossRef][Green Version]

- Mijal, M. Gry komputerowe w organizacji–Uwarunkowania psychologiczne. Probl. Zarz. 2012, 10, 262–270. [Google Scholar] [CrossRef]

- Yee, N. The labor of fun. Games Cult. 2006, 1, 68–71. [Google Scholar] [CrossRef]

- Houliez, C.; Gamble, E. Dwelling in Second Life? A phenomenological evaluation of online virtual worlds. Virtual Real. 2013, 17, 263–278. [Google Scholar] [CrossRef]

- Kaplan, A.M.; Haenlein, M. The fairyland of Second Life: Virtual social worlds and how to use them. Bus. Horiz. 2009, 52, 563–572. [Google Scholar] [CrossRef]

- Lukowicz, K.; Strzelecki, A. User satisfaction on social media profile of e-sports organization. Mark. Manag. Innov. 2020, 61–75. [Google Scholar] [CrossRef]

- Rigby, C.S.; Przybylski, A.K. Virtual worlds and the learner hero. Theory Res. Educ. 2009, 7, 214–223. [Google Scholar] [CrossRef]

- Woo, K.; Kwon, H.; Kim, H.; Kim, C.; Kim, H.K. What can free money tell us on the virtual black market? In ACM SIGCOMM Computer Communication Review, Proceedings of the ACM SIGCOMM 2011 Conference, Toronto, ON, Canada, 15–19 August 2011; ACM: New York, NY, USA, 2011; pp. 392–393. [Google Scholar]

- Constantiou, I.; Legarth, M.F.; Olsen, K.B. What are users’ intentions towards real money trading in massively multiplayer online games? Electron. Mark. 2012, 22, 105–115. [Google Scholar] [CrossRef]

- Fetscherin, M.; Lattemann, C. User acceptance of virtual worlds. J. Electron. Commer. Res. 2008, 9, 231–242. [Google Scholar]

- Cheng, M.-T.; Lin, Y.-W.; She, H.-C. Learning through playing Virtual Age: Exploring the interactions among student concept learning, gaming performance, in-game behaviors, and the use of in-game characters. Comput. Educ. 2015, 86, 18–29. [Google Scholar] [CrossRef]

- Atlas, S.A. Inductive metanomics: Economic experiments in virtual worlds. J. Virtual Worlds Res. 2008, 1. [Google Scholar] [CrossRef]

- Qin, H.; Patrick Rau, P.-L.; Salvendy, G. Measuring player immersion in the computer game narrative. Int. J. Hum. Comput. Interact. 2009, 25, 107–133. [Google Scholar] [CrossRef]

- Gałka, P.; Strzelecki, A. How randomness affects player ability to predict the chance to win at PlayerUnknown’s Battlegrounds (PUBG). Comput. Games J. 2021. [Google Scholar] [CrossRef]

- Guo, Y.; Barnes, S. Virtual item purchase behavior in virtual worlds: An exploratory investigation. Electron. Commer. Res. 2009, 9, 77–96. [Google Scholar] [CrossRef]

- Hofman-Kohlmeyer, M. Why people join virtual worlds of computer games? Qualitative research amongst polish users. In CBU International Conference Proceedings 2019, Proceedings of the International Conference on Innovations in Science and Education, Prague, Czech Republic, 20–22 March 2019; Open Journal Systems: Prague, Czech Republic, 2019; Volume 7, pp. 130–136. [Google Scholar]

- Mackiewicz, P.; Musiał, M. Rozwój wirtualnych systemów monetarnych. Financ. Sci. 2014, 1, 132–141. [Google Scholar] [CrossRef]

- Živić, N.; Andjelković, I.; Özden, T.; Dekić, M.; Castronova, E. Results of a massive experiment on virtual currency endowments and money demand. PLoS ONE 2017, 12, e0186407. [Google Scholar] [CrossRef]

- Guo, Y.; Barnes, S. Purchase behavior in virtual worlds: An empirical investigation in Second Life. Inf. Manag. 2011, 48, 303–312. [Google Scholar] [CrossRef]

- Wohn, D.Y. Spending real money. In Proceedings of the 32nd Annual ACM Conference on Human Factors in Computing Systems—CHI’14, Toronto, ON, Canada, 26 April–1 May 2014; ACM Press: New York, NY, USA, 2014; pp. 3359–3368. [Google Scholar]

- Rossi, L. MMORPG guilds as online communities–Power, space and time: From fun to engagement in virtual worlds. SSRN Electron. J. 2012. [Google Scholar] [CrossRef]

- Gałuszka, D. Gold farming: Preliminary dissertation on the basis of Polish gold farmer case study. Perspekt. Kult. 2015, 12, 92–109. [Google Scholar]

- Nardi, B.; Kow, Y.M. Digital imaginaries: How we know what we (think we) know about Chinese gold farming. First Monday 2010. [Google Scholar] [CrossRef]

- Guo, J.; Chow, A.; Wigand, R.T. Virtual wealth protection through virtual money exchange. Electron. Commer. Res. Appl. 2011, 10, 313–330. [Google Scholar] [CrossRef]

- Kim, Y.B.; Kang, K.; Choo, J.; Kang, S.J.; Kim, T.; Im, J.; Kim, J.-H.; Kim, C.H. Predicting the currency market in online gaming via lexicon-based analysis on its online forum. Complexity 2017, 2017, 4152705. [Google Scholar] [CrossRef]

- Messinger, P.R.; Stroulia, E.; Lyons, K.; Bone, M.; Niu, R.H.; Smirnov, K.; Perelgut, S. Virtual worlds–Past, present, and future: New directions in social computing. Decis. Support Syst. 2009, 47, 204–228. [Google Scholar] [CrossRef]

- Mennecke, B.E.; Terando, W.D.; Janvrin, D.J.; Dilla, W.N. It’s just a game, or is it? Real money, real income, and real taxes in virtual worlds. Commun. Assoc. Inf. Syst. 2007, 20, 134–141. [Google Scholar] [CrossRef]

- Jedlińska, R.J. Wpływ gospodarki wirtualnej na gospodarkę realną–Wybrane zagadnienia. Pr. Nauk. Uniw. Ekon. Wrocławiu 2015, 104–116. [Google Scholar] [CrossRef]

- Lee, E.; Woo, J.; Kim, H.; Kim, H.K. No silk road for online gamers! In Proceedings of the 2018 World Wide Web Conference on World Wide Web—WWW ’18, Lyon, France, 23–27 April 2018; ACM Press: New York, NY, USA, 2018; pp. 1825–1834. [Google Scholar]

- Kawale, J.; Pal, A.; Srivastava, J. Churn Prediction in MMORPGs: A social influence based approach. In Proceedings of the 2009 International Conference on Computational Science and Engineering, Vancouver, BC, Canada, 29–31 August 2009; pp. 423–428. [Google Scholar]

- Jin, W.; Sun, Y.; Wang, N.; Zhang, X. Why users purchase virtual products in MMORPG? An integrative perspective of social presence and user engagement. Internet Res. 2017, 27, 408–427. [Google Scholar] [CrossRef]

- Shim, K.J.; Srivastava, J. Behavioral profiles of character types in EverQuest II. In Proceedings of the 2010 IEEE Conference on Computational Intelligence and Games, Copenhagen, Denmark, 18–21 August 2010; pp. 186–194. [Google Scholar]

- Greengard, S. Social games, virtual goods. Commun. ACM 2011, 54, 19–22. [Google Scholar] [CrossRef]

- Heeks, R. Understanding “Gold Farming” and real-money trading as the intersection of real and virtual economies. J. Virtual Worlds Res. 1970, 2. [Google Scholar] [CrossRef]

- Kang, A.R.; Jeong, S.H.; Mohaisen, A.; Kim, H.K. Multimodal game bot detection using user behavioral characteristics. Springerplus 2016, 5, 523. [Google Scholar] [CrossRef] [PubMed]

- Kwon, H.; Mohaisen, A.; Woo, J.; Kim, H.K.; Kim, Y.; Lee, E.J. Crime scene reconstruction: Online gold farming network analysis. IEEE Trans. Inf. Forensics Secur. 2016, 1. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, G.V. Partial least squares structural equation modeling (PLS-SEM). Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Kock, N. Minimum sample size estimation in PLS-SEM: An application in tourism and hospitality research. In Applying Partial Least Squares in Tourism and Hospitality Research; Ali, F., Rasoolimanesh, S.M., Cobanoglu, C., Eds.; Emerald Publishing Limited: Bingley, UK, 2018; pp. 1–16. ISBN 9781787566996. [Google Scholar]

- Muthén, L.K.; Muthén, B.O. How to use a Monte Carlo study to decide on sample size and determine power. Struct. Equ. Model. A Multidiscip. J. 2002, 9, 599–620. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares StructuralEquation Modeling (PLS-SEM), 2nd ed.; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2017; ISBN 9781483377445. [Google Scholar]

- Moore, G.C.; Benbasat, I. Development of an instrument to measure the perceptions of adopting an information technology innovation. Inf. Syst. Res. 1991, 2, 192–222. [Google Scholar] [CrossRef]

- Pańkowska, M.; Pyszny, K.; Strzelecki, A. Users’ adoption of sustainable cloud computing solutions. Sustainability 2020, 12, 9930. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 319. [Google Scholar] [CrossRef]

- Hamid, A.A.; Razak, F.Z.A.; Bakar, A.A.; Abdullah, W.S.W. The effects of perceived usefulness and perceived ease of use on continuance intention to use e-government. Procedia Econ. Financ. 2016, 35, 644–649. [Google Scholar] [CrossRef]

- Miyazaki, A.D.; Fernandez, A. Consumer perceptions of privacy and security risks for online shopping. J. Consum. Aff. 2001, 35, 27–44. [Google Scholar] [CrossRef]

- Jo Black, N.; Lockett, A.; Winklhofer, H.; Ennew, C. The adoption of internet financial services: A qualitative study. Int. J. Retail Distrib. Manag. 2001, 29, 390–398. [Google Scholar] [CrossRef]

- Olczyk, A. “Your character has been robbed. Do you want to sue the other player?” Polskie prawo karne a “kradzież” przedmiotu w grze komputerowej. Replay Pol. J. Game Stud. 2014, 1, 107–117. [Google Scholar]

- Jarvenpaa, S.; Tractinsky, N.; Vitale, M. Consumer trust in an Internet store. Inf. Technol. Manag. 2000, 1, 45–71. [Google Scholar] [CrossRef]

- Hoffman, D.L.; Novak, T.P.; Peralta, M. Building consumer trust online. Commun. ACM 1999, 42, 80–85. [Google Scholar] [CrossRef]

- Liu, C.; Marchewka, J.T.; Lu, J.; Yu, C.-S. Beyond concern—A privacy-trust-behavioral intention model of electronic commerce. Inf. Manag. 2005, 42, 289–304. [Google Scholar] [CrossRef]

- Schumacker, R.; Lomax, R.G. A Beginner’s Guide to Structural Equation Modeling, 4th ed.; Routledge: New York, NY, USA, 2016. [Google Scholar]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial least squares structural equation modeling. In Handbook of Market Research; Homburg, C., Klarmann, M., Vomberg, A.E., Eds.; Springer International Publishing: Cham, Switzerland, 2017; pp. 1–40. ISBN 978-1-4522-1744-4. [Google Scholar]

- Hamari, J.; Alha, K.; Järvelä, S.; Kivikangas, J.M.; Koivisto, J.; Paavilainen, J. Why do players buy in-game content? An empirical study on concrete purchase motivations. Comput. Human Behav. 2017, 68, 538–546. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Becker, J.-M. SmartPLS 3. Bönningstedt: SmartPLS GmbH. Available online: http://www.smartpls.com (accessed on 15 January 2021).

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Petter, S.; Straub, D.; Rai, A. Specifying formative constructs in information systems research. MIS Q. 2007, 31, 623. [Google Scholar] [CrossRef]

- Freckleton, R.P. Dealing with collinearity in behavioural and ecological data: Model averaging and the problems of measurement error. Behav. Ecol. Sociobiol. 2011, 65, 91–101. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Routledge: London, UK, 2013; ISBN 9780203771587. [Google Scholar]

| Gender | Number of Respondents | Percentage |

|---|---|---|

| Female | 85 | 41.46% |

| Male | 118 | 57.56% |

| Other | 2 | 0.98% |

| Education | Number of respondents | Percentage |

| Primary education | 5 | 2.44% |

| Secondary education | 30 | 14.63% |

| Bachelor’s degree | 109 | 53.17% |

| Master’s degree | 47 | 22.93% |

| PhD | 14 | 6.83% |

| Age | Number of respondents | Percentage |

| 13–17 | 5 | 2.44% |

| 18–24 | 113 | 55.12% |

| 25–34 | 69 | 33.66% |

| 35–44 | 13 | 6.34% |

| 45–54 | 3 | 1.46% |

| 55–64 | 2 | 0.98% |

| >65 | 0 | 0.00% |

| Total | 205 | 100% |

| Variable | Items |

|---|---|

| Perceived usefulness (PU) | PU1: I think that virtual currency is very useful to my life in general. PU2: I think that virtual currency is helpful to improve my performance in the virtual world. PU3: I think that virtual currency is helpful to enhance the effectiveness of my life. |

| Perceived ease of use (PEU) | PEU1: I think using e-currencies are clear and understandable. PEU2: I think using e-currencies does not require a lot of mental effort. PEU3: I think buying e-currencies is easy. |

| Perceived risk (PR) | PR1: I feel uncertainty when buying e-currencies. PR2: I think that e-currency trading is bad for the role-playing. PR3: I think that virtual currencies are too attached to the virtual world account. |

| Perceived trust (PT) | PT1: I think buying e-currencies is safe. PT2: I believe that the e-currency retailer is trustworthy. PT3: I trust this e-currency retailer because they keep my best interests in mind |

| Intention to use (IU) | IU1: I need virtual currency to improve my equipment. IU2: Virtual currency improves my avatar. IU3: Virtual currency will allow me to enjoy the virtual world more quickly. IU4: Using e-currency gives me a higher place in the ranking. IU5: E-currencies allow gambling (e.g., buying loot boxes). |

| Variable | Item | Loadings | Reliability Coefficient | AVE |

|---|---|---|---|---|

| >0.7 | >0.5 | >0.5 | ||

| IU | IU1 | 0.815 | 0.664 | 0.713 |

| IU2 | 0.884 | 0.781 | ||

| IU3 | 0.857 | 0.734 | ||

| IU4 | 0.820 | 0.672 |

| Variable | Composite Reliability ρc | Reliability Indicator ρA | Cronbach’s Alpha |

|---|---|---|---|

| >0.7 | >0.7 | 0.7–0.9 | |

| IU | 0.908 | 0.867 | 0.865 |

| Variable | Item | Weight | Loading | p < 0.05 |

|---|---|---|---|---|

| PU | PU2 | 0.697 | 0.968 | Yes |

| PU3 | 0.369 | 0.882 | Yes | |

| PT | PT1 | 0.291 | 0.874 | Yes |

| PT2 | 0.458 | 0.923 | Yes | |

| PT3 | 0.366 | 0.881 | Yes | |

| PEU | PEU1 | 0.448 | 0.924 | Yes |

| PEU2 | 0.380 | 0.906 | Yes | |

| PEU3 | 0.280 | 0.864 | Yes | |

| PR | PR2 | 0.463 | 0.689 | Yes |

| PR3 | 0.759 | 0.897 | Yes |

| Item | VIF | Item | VIF |

|---|---|---|---|

| PEU1 | 2.559 | PT1 | 2.439 |

| PEU2 | 2.550 | PT2 | 2.518 |

| PEU3 | 2.344 | PT3 | 2.197 |

| PR2 | 1.097 | PU2 | 2.184 |

| PR3 | 1.097 | PU3 | 2.184 |

| Path | Path Coefficient | BCa [2.5;97.5] % | T-Statistics | ƒ2 | Confirmed p < 0.05 |

|---|---|---|---|---|---|

| PEU → IU | 0.278 | [0.135;0.397] | 4.123 | 0.089 | Yes |

| PR → IU | 0.177 | [0.025;0.310] | 2.409 | 0.051 | Yes |

| PT → PEU | 0.593 | [0.475;0.675] | 12.107 | 0.541 | Yes |

| PT → PU | 0.522 | [0.401;0.621] | 9.486 | 0.375 | Yes |

| PU → IU | 0.389 | [0.264;0.511] | 6.053 | 0.173 | Yes |

| Variable | R2 | Q2 |

|---|---|---|

| IU | 0.379 | 0.262 |

| PEU | 0.351 | 0.275 |

| PU | 0.273 | 0.234 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gawron, M.; Strzelecki, A. Consumers’ Adoption and Use of E-Currencies in Virtual Markets in the Context of an Online Game. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1266-1279. https://doi.org/10.3390/jtaer16050071

Gawron M, Strzelecki A. Consumers’ Adoption and Use of E-Currencies in Virtual Markets in the Context of an Online Game. Journal of Theoretical and Applied Electronic Commerce Research. 2021; 16(5):1266-1279. https://doi.org/10.3390/jtaer16050071

Chicago/Turabian StyleGawron, Magdalena, and Artur Strzelecki. 2021. "Consumers’ Adoption and Use of E-Currencies in Virtual Markets in the Context of an Online Game" Journal of Theoretical and Applied Electronic Commerce Research 16, no. 5: 1266-1279. https://doi.org/10.3390/jtaer16050071

APA StyleGawron, M., & Strzelecki, A. (2021). Consumers’ Adoption and Use of E-Currencies in Virtual Markets in the Context of an Online Game. Journal of Theoretical and Applied Electronic Commerce Research, 16(5), 1266-1279. https://doi.org/10.3390/jtaer16050071