1. Introduction

Business to business (B2B) transactions account for an overwhelming share of e-commerce revenue. According to the report from Research and Markets 2020 [

1], this market will grow to

$20.9 trillion by 2027 due to the rapid migration of manufacturers and wholesalers from old-fashioned approaches to open, online platforms. This trend will make the B2B e-commerce market three times bigger than the business to consumer (B2C) market (

$6.2 trillion) within the same timeframe [

2]. The reason for this the is unique environment where buyers have a higher level of competence in the use of e-commerce infrastructure, trading partners, and often know each other, whereby purchases are more frequent (with higher value per transaction), and payment on delivery is not usually required [

3]. This rapid growth of B2B e-commerce increases the likelihood of disputes resulting from these transactions. There will be more disputes, both domestic and international [

4].

Disputes are a risk for all businesses and are a stressful, time-consuming, and costly element in e-commerce [

5,

6]. The business management may try to prevent and minimize the risk of a dispute, but the company will never be able to avoid it completely. However, it can at least mitigate the costs of resolving the dispute by favoring the out-of-court settlement strategy—alternative dispute resolution (ADR)—instead of lengthy court and arbitration [

7]. In the case of online transactions, it means online dispute resolution (ODR). The development of the ODR concept began in the 1990s, and its historical development is described, for example, in [

7,

8].

The research gap that this article fills can be presented in the context of the development of European approach to ODR. The European Union has taken a number of steps to enable customers to resolve their disputes in e-commerce using ADR and ODR, see

Section 2. Therefore, proposed approaches to ODR in the European Union so far focus only on B2C relationships in the e-commerce area [

9]. The vast majority of ODR solutions for B2C relationships do not use artificial intelligence (AI) approaches for better automation and faster dispute resolution [

10]. Existing ODR solutions, or artifacts such as approaches, methods, and models, using AI are often narrowly specialized according to the legal order in a certain state and their focus, for example, on civil law, labor law, consumer law, and family law.

Although B2B relationships were identified at the beginning of the 21st century as the most application-appropriate environment for ODR [

11], so far little attention has been paid to B2B relationships. It was only in 2018, an initiative was launched in Europe to promote ODR in the area of B2B relationships [

9]. Therefore, the authors expect the need to develop ODR solutions based on AI approaches in this area. Currently missing ODR solutions using AI approaches focused on the specifics of the B2B relationships in e-commerce. This identified gap in the research is filled in this article.

The ODR area is mainly application-oriented. In the last two decades, a number of artifacts have been designed (proposals on how to solve ODR in practice), which involve various approaches most often from AI. A detailed analysis of existing artifacts using AI approaches is presented in

Section 2.2. This article also presents novel artifact design, which is original among other artifacts focused on ODR and solves a specific problem context focused on the B2B relationship [

12] in e-commerce. This problem context is presented in

Section 1.1. The aim of the article and the formulation of the technical research problem according to the design science methodology are given in

Section 1.2.

From the practical point of view, the main output of the article is the design of the E-NeGotiAtion, which is usable in a defined problem context and evaluated by embedded single-case study research. From a scientific point of view, the presented design is also a contribution to the knowledge base focused on the design of an artifact in the ODR area according to the design science methodology. Therefore, this article is beneficial for practitioners (they can use the presented solution or its parts in their own implementation) and for scholars who deal with ADR or ODR areas (they can discuss the pros and cons of different solutions and be inspired to design new ones).

1.1. Specification of Problem Context Connected with Out-of-Court Dispute Resolution

The application possibilities of AI are developing rapidly thanks to extensive digitization on the part of companies and state administration in individual countries and the introduction of concepts such as Industry 4.0 and the associated sustainable development of the economy [

13,

14]. This also includes the widespread acceptance of digital technologies by humans and the sustainable development of the information society [

15,

16]. From the point of view of out-of-court dispute resolution, the area of artificial intelligence and law (AI & Law) is important for this article, which is closely connected with e-commerce, see

Section 2.1.

AI & Law is a wide area of research, development, and utilization of computers and AI approaches in legal practice [

17]. The main challenge in this area is the design of intuitive applications that could be used by a computer and legal non-experts [

10,

17]. The AI & Law area also includes negotiation between the parties of the dispute where ODR currently plays an important role. ODR solutions in AI & Law build on the experience of implementation, especially decision support systems, and expert systems in specific legal domain, see e.g., designed artifacts in [

18,

19,

20,

21,

22,

23,

24,

25,

26].

Section 2.2 deals with the use of AI approaches in the field of ODR in more detail. The following text defines the problem context on which this article and proposed solution focus. Expert systems in specific legal domain using both case-based and rule-based reasoning [

27]. Both approaches have their limitations and disadvantages [

10]. Rule-based systems are heavily dependent on formulated rules by human experts. Case-based systems face difficulties with the complexity that is associated with the description of individual cases and the building of a knowledge basis. In the AI & Law area, the negotiation decision support systems are mainly rule-based because their application to legal practice is easier [

10].

The problem with these solutions is that they may not be beneficial to interested parties because they are based either on expert rules or on cases that may be contextually distant from the circumstances of the solved case. Solutions are more tied to the law than to the context or the needs of the interested parties [

28]. Therefore, heuristic approaches started to be used to negotiate, focusing more on the needs of interested parties, e.g., using heuristics and game theory in the family law domain [

29].

These heuristics approaches include evolutionary computation that “has been successfully used to deal with problems that involve a significant amount of complex variables in which traditional approaches would not be suited” [

21]. However, soft computing or evolutionary computation are not mentioned in the latest review article [

10] on the use of AI in ODR. With all of that, these approaches have begun to be explored only in recent years. The ODR can be inspired by various applications that come from nearby areas, e.g., bargaining [

30], where evolutionary computation is used.

In the ODR, it was proposed that only one solution replace case-based reasoning by an evolutionary heuristic technique—genetic algorithm (GA)—focused on the resolution of labor disputes [

21,

31], that can also be used in B2C negotiation. A detailed description of the use of GA and the advantages and disadvantages of this solution are given in

Section 2.3. Despite those mentioned above, the main disadvantage of all approaches is that the designed artifact (e.g., framework, method, software) is always focused on a solution restricted to the specific domain. The same is also true in the ODR focused on e-commerce, where there are various types of relationships, which limit the application domain.

Types of disputes differ according to the type of relationship (e.g., B2C, B2B, C2C or consumer to consumer), as well as the nature of the dispute (e.g., commercial, consumer, family, employment, insurance, domain name disputes). B2C or C2C e-commerce is not so appropriate for the full range of ODR services due to their higher value and savvy participants, on the other hand, B2B transactions may be a better fit for the full range of ODR services [

11]. In addition, Katsh [

32] argues that the ODR process has a dual role—it resolves disputes and also builds confidence. By enabling effective law enforcement, ODR helps to build confidence among online businesses or supply chain participants, which also reflects the future cooperation of business partners. The solutions proposed so far focus on dispute resolution under a specific domain or B2C relationships—see

Section 2.2. These methods, however, do not address the specific business needs of businesses in B2B relationships, which may limit their applicability in practice.

In today’s world, where quickness plays a significant role in business decision-making, the absence of the ODR method that matches the specificities of B2B relationships means a serious handicap to the development of these relations. A trusted solution of the dispute contributes to building confidence between business partners, which can boost the growth of transactions between them. This situation also connected with the rise of B2B transactions worldwide is a major motivation of the article.

1.2. The Aim and Structure of the Article

This article focuses only on ODR in B2B relationships and disputes arising from contracts and concluded contracts (e.g., defective goods, technical characteristics, prices, delays in goods delivery) between two companies—the seller and the buyer. The buyer then offers the goods to other customers in the same form or with added value.

The aim of the article is to present a solution proposal that can be applied to ODR in B2B relationships. The proposed solution is an artifact in the form of the E-NeGotiAtion method, which can be part of a wider ADR framework (e.g., multimodal systems). Based on the literature research in

Section 2, it can be argued that not much attention has been paid to ODR in the area of B2B relationships since it is mainly consumer protection (B2C relations) that has been addressed so far. Introducing ODR solutions and practices in the defined area of B2B relationships can be considered an important issue for an increasing number of companies, as confirmed by the European Commission [

33]. Unless appropriate solutions are proposed, the development of (international) business could become inhibited by a lack of protection and trust in the speedy resolution of possible disputes and thus could lead to courts being overwhelmed.

It should be added that other solutions applied to different types of relationships may not be appropriate in this case, since they do not follow the specifics of B2B relationships—e.g., the number of products, different production and delivery times, the process of product testing and shipping, an emphasis on the speed of the dispute settlement. The ODR process can also be affected in the case of B2B by the sector in which the companies involved are doing business.

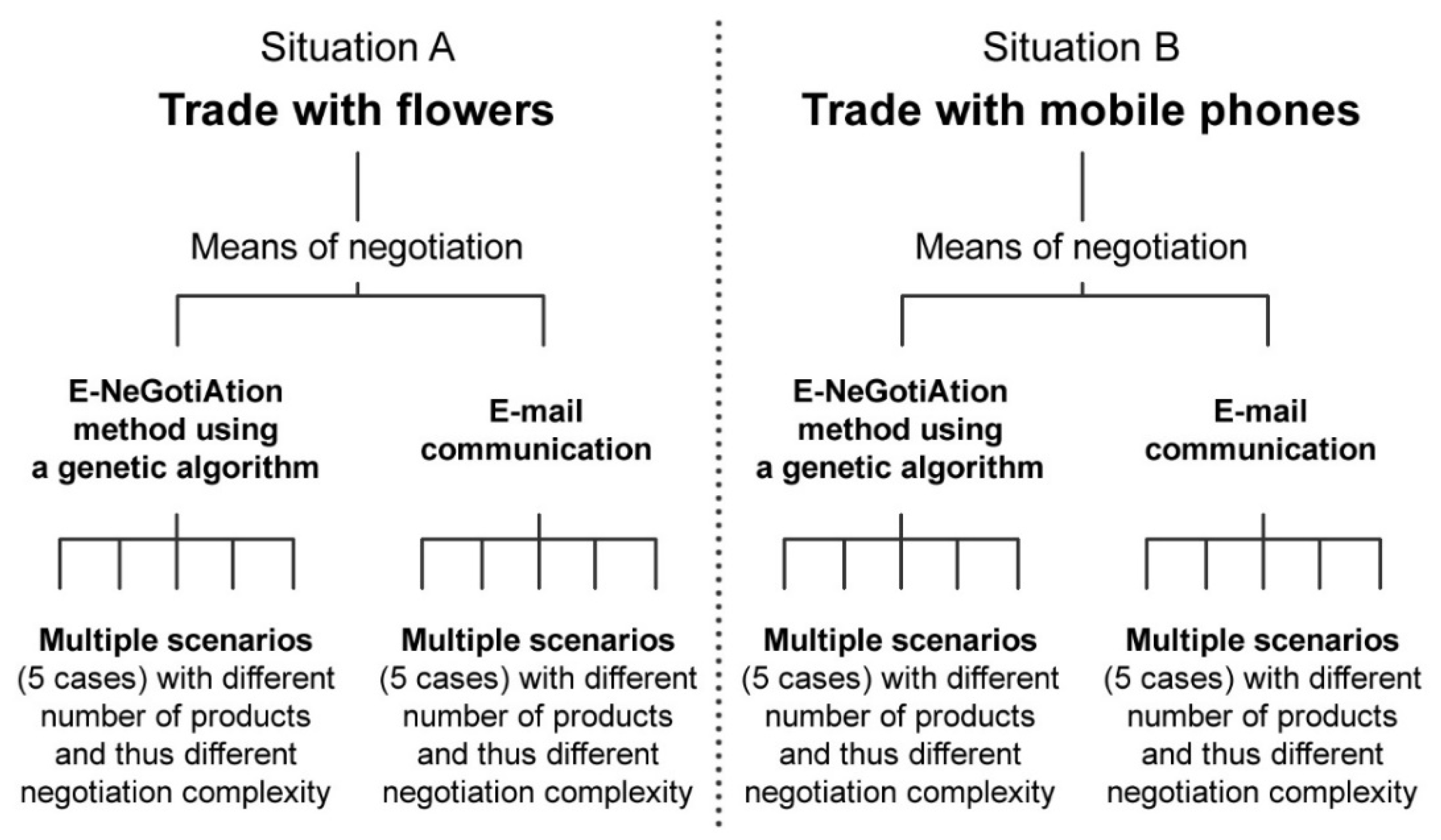

In connection with the design science methodology, it is appropriate to clearly define the technical research problem [

34], that can be formulated: Improve the area of ODR focused on B2B relationships by designing a method that satisfies the specific needs of both negotiating companies in order to quickly and objectively reach a settlement of the dispute. Alternatively, it may be formulated the technical research question, that is typical for design science research (DSR): How to design a method that meets the specific needs of both negotiating companies so that interested parties can quickly and objectively reach a settlement of the dispute in the area of ODR focused on B2B relationships? In order to confirm the versatility of the proposed ODR solution in the defined area, the artifact evaluation focused on embedded single-case study research in two situations (trading with flowers and mobile phones) with a different number of the goods—see Section Evaluation of the Proposed Solution. The main contribution of the article is presenting how the solution is designed (in the form of the method) and thus contributing also to knowledge on ODR design in B2B relationships.

The article is structured as ollows:

Section 1 introduces the ODR concept and identifies the problem and goal of the proposed solution.

Section 2 presents the literature review focused on the development of out-of-court dispute resolution in the European Union and the related design of artifacts in the ODR area. The methodology, including the evaluation of the proposed artifact, is presented in

Section 3. The design of the E-NeGotiAtion method for ODR in B2B relationships is presented in

Section 4, followed in

Section 5 by an embedded single-case study assessing the method. The discussion of the proposed solution, including the limitations and benefits of the presented method, is given in

Section 6. Conclusions with potential future research directions are presented in

Section 7.

2. Background

The European Commission considers the development of out-of-court dispute resolution to be important, because, according to Eurostat [

35], 50.2% of individuals shopped online in the European Union, an increase of nearly 30% compared to 2004. This B2C e-commerce growth increases the frequency of disputes between companies and consumers resulting from these transactions. Tonio Borg, European Commissioner for Health and Consumer Policy (2013–2014), sees ADR and ODR as a win-win strategy for consumers who will be able to resolve their disputes out of court in a simple, fast and inexpensive way, as well as for traders who will be able to maintain good customer relationships and avoid the cost of litigation [

36]. In some respects, ODR can be seen as the future of justice [

7].

In Flash Eurobarometer no. 359 retailers were asked whether they know and use alternative dispute resolution bodies with consumers in their country [

37]. The results showed that 44% of retailers did not know any ADR authorities in their country in 2012, and 86% of retailers who knew ADR did not use any of them in the last two years. According to the Consumer Scoreboard in 2015, about 45% of consumers in the EU think it is easy to resolve ADR disputes, and 70% were satisfied with how their complaint was solved using the ADR [

38]. About 40% of traders in the EU do not know ADR, but about 30% know it and are willing to use it; at the same time about 15% would use it, but it is not available in their industry. For this reason, the European Commission has adopted several recommendations, directives and regulations to facilitate consumer access to ADR and ODR.

In 2013, the Directive 2013/11/EU [

39] of the European Parliament and of the Council of 21 May 2013 on alternative dispute resolution for consumer disputes was adopted together with the Regulation (EU) No 524/2013 [

40] of the European Parliament and of the Council of 21 May 2013 on online dispute resolution for consumer disputes. Based on this, the EU ODR platform, which has been in operation since 15 February 2016, together with traders established within the European Union engaging in online sales or service contracts who are committed or obliged to use one or more ADR entities to resolve disputes with consumers, shall inform users about the existence of the ODR platform and the possibility of using the ODR platform for resolving their disputes. They shall provide an electronic link to the ODR platform (

http://ec.europa.eu/odr accessed on 29 March 2021) on their websites and if the offer is made by e-mail, in that e-mail. The information shall also be provided, where applicable, in the general terms and conditions applicable to online sales and service contracts.

Loutocký [

41] points to the partial problems that arise from the European regulation in this area. These are the inappropriate legal basis for the European ADR and ODR, general issues related to the ODR platform functionality, the absence of online ODR platform negotiations and the problematic use of other related tools, misleading reference to ODR platform use, a lack of evaluation and motivation of parties to settle the dispute, language problems, forum shopping, and a lack of interconnection of the ODR with small claims (and possibly legal proceedings) into a single entity. There are quite a lot of problems in this area, and this focuses only on the area of consumer disputes. Rogers et al. [

42] recommend that negotiation should always be part of the consumer ODR regime. Cortés and Lodder [

43] also point out that timely resolution of the dispute without third party intervention will always be the most effective (or only available) solution to simple consumer disputes.

2.1. Types of ODR

ODR provides the opportunity for two or more parties to resolve their dispute through computer-mediated communication, e.g., communication via the Internet. It is, therefore, a process in which disputes are solved mainly through electronic networks [

44]. ODR can be split into dispute prevention (internal complaint handling, escrows, online payment services, reputation systems, and confidence marks) and dispute resolution [

45]. Xu and Yuan [

44] mention the four main forms of ODR systems: automated negotiation, assisted negotiation, mediation, and arbitration, but there are several other methods depending on the extent to which the participants are involved in the process and outcome, see

Table 1.

2.2. Overview of Different ODR Artifacts Using AI Techniques

Negotiation is the most suitable type of ODR for the AI & Law application area because it is the only process in which the parties try to settle the dispute on their own. Moreover, there are no additional costs for paying thirds [

46].

Table 2 focuses on design type of research and introduces selected ODR artifacts using AI approaches that were designed in the last 15 years.

These solutions are applied to different domains—construction, civil, labor, and family law. DRExM by Elziny et al. [

47] allows companies to facilitate dispute management and asses the current status of the dispute. Still, this artifact is suitable only for the evaluation of the overall dispute settlement procedures at the company’s projects. The architecture of the program is designed to be open, flexible, and upgradable (can be customized for individuals and corporations).

eJRS-IRS system by El Jelali et al. [

48] provides better match disputant case description (informal and concise) with court decision (formal and verbose) and the ability of the proposed solution to empower court decision retrieval. However, it is dependent on specific domains. Future work could be aimed to extract semantic concepts from court decisions and disputant case descriptions to subsequently match them.

The project UMCourt was also used for Portuguese consumer law—B2C relationships [

49]. This solution has evolved by the study [

20]. Case-based reasoning algorithm can be used as a tool to compile useful information for the parties, the neutral or the platform itself, or can be integrated into a higher-level process (litigation, mediation, negotiation). Negotiators and mediators can rely on their past experiences in order to make better decisions. On the negative side, case-based approaches may suffer from inefficiency (especially when the size of the database grows). The efficiency and efficacy of case-based approaches are also known to depend directly on the number and characteristics of the cases in the database. Case-based approaches are highly domain-dependent (cases take place in a given legal context and are not easily adapted to other domains as the norms are different). Therefore, case-based reasoning should be supported by other tools that can generate solutions when a case-based approach alone is not enough. Carneiro et al. [

21] states that disadvantages of using case-based reasoning could be removed by applying the GA (GA should be able to generate a wide range of solutions from which the most relevant ones may complement the case-based approach), but the application of GA for ODR in domain B2B relationships is missing—see

Section 2.2.

IMODRE presented in [

50] helps parties reach agreements that better satisfy their long-term interests and supports the continuation of constructive relationships following disputes. Unfortunately, it is just the presentation of vision. Suggestions for future work are missing in the study.

Re-Consider designed by Muecke et al. [

51], helps disputants to reach outcomes that take judicial practices into account. Also, this artifact is just a prototype of the ODR system. It cannot make findings of fact that are associated with judicial decision making (what the facts of a case are), but it attempts to find disagreement on leaf claims. Necessary steps in the future are absent in the study.

Other behavioral researchers explore the various aspects of negotiation, which are not discussed in design type of research: promoting agreements [

52], the importance of language familiarity [

53], anger, and flaming [

54], different media and agreement [

55], longer-term consequences of anger expression [

56], and the effect of emotive language [

57]. There are also studies [

54,

55,

56,

57,

58,

59] which used students in simulated deal-making negotiations.

2.3. Using a Genetic Algorithm in ODR

Carneiro, Novais, and Neves [

21] introduce in their article the application of GA in ODR. The authors decided to replace the component of the previously proposed UMCourt platform [

31], which uses case-based reasoning, by a new component using a GA to address the negotiated task. The reason was the constraint resulting from case-based reasoning. The authors of the article deal with the general possibilities of applying biologically inspired approaches as a GA in ODR, but a component using the GA, which they design and introduce on an example, is part of the UMCourt platform for the resolution of labor disputes [

31].

The proposed GA in the specific task for which the UMCourt platform was designed has got three advantages over the previously used case-based approach—the proposed solutions cover virtually all search space, it is independent of the legal domain, and the number and quality of cases present in the database [

21]. The applicability of their GA in practice was illustrated by the authors in four scenarios in which students were involved in negotiating roles. Further, on the basis of illustrative examples, the authors identified two disadvantages which are again related to the specific task that GA in the UMCourt platform should address. The first is that in areas where there were few cases, the system was unable to generate information of sufficient quality for parties to be able to make a good decision. The second disadvantage is that changes in the law are relatively frequent, which may render past cases inapplicable.

According to our literature review, the solution presented in [

21] is the only proposal for ODR solutions using the GA. This solution is focused only on the specific implementation solution in UMCourt platform where the case-based approach was replaced by a biologically inspired approach. The authors also discuss the general use of GA in other cases that can be solved by ODR while not addressing B2B relationships.

The basic principles of GA are very general, which also distinguishes them from specialized approaches to optimization or search of state-space—see e.g., [

60,

61,

62]. Hynek [

63] also pointed out that due to the character of GA and its design options in solving a specific task, it is up to the researcher to acquire a sufficient understanding of his or her area of interest and to suggest the most appropriate combination of tools and parameters that will lead to the desired goal for the identified problem. Each implementation of a GA in a certain area is thus an original solution to the problem.

To resolve the problem in B2B relationships defined in this paper, it was also decided to use a GA, but one that is quite different from that introduced in [

21]. The reason is that the algorithm proposed in [

21] addresses one specific task that is clearly defined and linked to the UMCourt platform. Although the authors continue to discuss the use of the GA at a more general level, a solution concerning another area would require either a redesign of their solution or the design of a new one. In this article, the proposed GA has the same goal, but addresses another task in other (jural) conditions and (B2B) context.

3. Methodology

The aim of the research is to solve the needs and problems identified in the previous sections related to B2B business ventures in connection with alternative dispute resolution, using a design solution in the form of an artifact—the E-NeGotiAtion method. For this reason, the proposed artifact design is based on the formulated technical research problem (see

Section 1) and methodically builds on the principles applied in DSR. This type of research offers a high degree of relevance (e.g., the problems and needs of companies and society) and a rigorous solution that uses existing knowledge bases and explicit procedures of execution [

64]. The field of DSR uses a large number of methodological approaches—see e.g., [

65]. There are four stages that are shared by the vast majority of methodological approaches to DSR: problem definition, suggestion for possible solution, development, and evaluation [

65]. The research in this article is based on the Design Science Research Methodology (DSRM) proposed by Peffers et al. [

66]. The research process consists of six stages [

65,

67]: (1) problem identification and motivation, (2) Defining the objectives of a solution; (3) design and development; (4) Demonstration; (5) Evaluation; and (6) communication. The methodological approach, according to Peffers et al. [

66], was selected because this approach focuses on an application in information systems research to which the presented research also belongs.

The outputs of stages (1) and (2) are presented in

Section 1, which identifies the problems and needs of companies and then defines the objectives of the designed solution. For this purpose, an extensive literature review of ODR is also used, as described in

Section 2. Both sections justify the relevance of the research, the importance of the problem, and the possible usability of a solution. This also included setting the objectives for a solution and formulating the research question, which emphasizes the technical research problem, according to Wieringa [

34]. The research question formulated in accordance with DSR takes into account the type of artifact, problem context, requirements, and stakeholder goals.

The defined technical research problem, together with the outputs from the literature review, forms the basis for the design of own artifact (3)—the E-NeGotiAtion method. The designed solution for ODR in B2B relationships is presented in

Section 4. For the planned evaluation, a program implementing the proposed GA was developed. Further research activities by Peffers et al. [

66] are demonstrations and evaluations, and it is up to researchers to assess whether they first conduct a demonstration where they present the idea in progress or move on to the evaluation. For the purpose of demonstration (4), a conceptual design of the method was developed, which was presented at an international conference [

68], where the authors received feedback from the participants. The contribution also demonstrated how the proposed method solved a defined task on a selected example.

When artifact design is carried out using design science methodology, the researcher’s task is to design and examine an artifact in context [

34]. The context in which an artefact is deployed (which includes people, laws, processes, values, software) is important because it determines the success of implementing the artifact in practice—this area is studied in particular by social informatics. The social context determines how a particular technological solution is used in practice and how social organizations are influenced by social forces and practices in organizations [

69,

70]. A successful deployment of the proposed solution retroactively affects stakeholder organizations and eventually, the society [

71]. For research in the area of DSR, it is therefore important to provide an ex-ante or ex-post evaluation [

72] of the proposed solution that evaluates not only the benefits of the proposed E-NeGotiAtion approach compared to another approach but also assures the usability of the proposed artifact in the social context. Although the ex-ante evaluation (also referred to as validation) would be sufficient in the context of the research cycle [

34], the authors decided to continue to the engineering cycle and carry out a practical ex-post evaluation of the proposed method in a simulation of inter-company negotiation (Internet-mediated communication between managers of two organizations). The aim of the proposed assessment is to approximate as much as possible the real environment and the social context in which the proposed method is to be deployed.

The evaluation (5) consisted of the embedded single-case study that simulated the realities of negotiation between firms. The aim of such an evaluation is to find out to what extent an artifact is effective in solving the problem for which it was designed [

72]. The methodology and execution of the embedded single-case study are described in more detail in Section Evaluation of the Proposed Solution and

Section 5. The last stage in connection with DSRM is communication (6). Researchers who design and place an artifact into a problem context should publish the results of their work on a continuous basis. For this purpose, international conferences have been used so far where part of the research [

68,

73,

74,

75] has been published and discussed with other researchers and practitioners.

Design science methodology used in information systems research has several strengths: a high degree of relevance, a rigorous approach to constructive research, and using practical oriented case study for evaluation based on design science methodology. It can be found several weaknesses of the selected research method that is shared by all methodological approaches to DSR. The evaluation should focus on the usefulness of the proposed solution [

34], e.g., in practice. Therefore, the conducted evaluation does not deal with a more extensive comparison of different negotiation methods, but the comparison is carried on only one negotiation method. A theoretical comparison of another approach to design ODR with GA is given in

Section 2.3. Evaluation stage can also use other research methods, e.g., action research or ethnographic research, but selected qualitative method enough reveals sociotechnical interaction and possible issues when the artifact is used in practice.

Evaluation of the Proposed Solution

In order to evaluate the relevance of the proposed method, the embedded single-case study was prepared according to [

76], which compares traditional negotiation using only e-mail communication with the proposed method using the GA. The sample was collected using purposive nonprobability sampling that is typical for qualitative research [

77]. Therefore, only students of economics and management from two countries were included. They were situated in the role of manager and appropriately motivated.

The structure of case study is described in

Figure 1. Ten case study units were conducted with two basic situations (A and B) with different numbers of goods (3, 4, 5, 6, and 7). The different numbers of goods were used due to the different complexity of the task—it is important for the evaluation that the proposed method is able to find reasonable solutions also for more complex tasks. These products were the subject of a dispute and had to be negotiated. The same case study was applied only to pairs that utilized different negotiation methods. The pair consisted of one student from the Czech Republic and one student from Slovakia to simulate international negotiation, which is typical for B2B relationships. The expected scenario was that the buyer finds that the goods delivered differed from the original order and contact the seller and informs him or her about the situation; the seller already knew about the differences in some goods and found out about others only from the buyer.

Conducting such a case study in practice on real companies is very difficult. Among other things, ODR works with confidential business information. As reported by Gabuthy et al. [

52], a laboratory experiment is the only way to get data. In their case, this was a simulation experiment using game theory and did not directly involve human participants, as the experiment requires full control of the systematicity and accuracy of the realization by the researcher [

76]. A case study is similar to an experiment because it also answers questions How and Why, but the researcher has less control of the events because the bounded system being investigated is not deterministic due to the involvement of the social component.

Conducting case study allows a deeper understanding that is illustrative and confirmable [

78] and the authors are able to clarify whether their findings are valuable or not [

79] with regard to the objectives of the research. Given that this is an internet-mediated negotiation between managers of two companies, it was decided to use a case study where students from the Czech and Slovak Republics act as managers and are motivated to negotiate in the given scenario. This solution allows measurable conditions and scenarios to be created. At the same time, this avoids possible conflicts of interest of individual companies in relation to the confidential information they would have to provide.

According to Yin [

76], the case study can be defined by a double definition. The first part shows that it examines the current phenomenon (case) in the context of the real world, especially if the boundaries between the phenomenon and the context may not be quite clear. The second part of the definition focuses on case study design and data collection, the case study having more areas of interest than data points. The authors perceive the realization of case study research as a linear but iterative process that consists of six parts:

Plan: The objectives of the case study were set—to find out how the method used would influence the results of the negotiation from an objective point of view (the financial outcome of a successful negotiation) and from a subjective perspective (satisfaction), why the outcome of the negotiations differs, and how and why the proposed E-NeGotiAtion method is beneficial for B2B relationships.

Design: After studying the theoretical backgrounds, the next step was to define the unit of analysis (pair) and the case (dispute negotiation) from a temporal and geographical point of view, on the basis of which the procedure of the case study was established (informing the participants about the task, scheduling the implementation by individual groups of participants). An embedded single-case study was chosen.

Prepare: A program was created using the GA in the E-NeGotiAtion method, the pairs of participants were formed in a random manner. The introductory and final questionnaire was prepared, as well as the web interface for research and other supporting materials (e.g., documents with the results of negotiations within individual iterations).

Collect: Individual case study units were executed. Data were obtained from various sources of evidence (documents, introductory and final questionnaires, direct observation of participants’ behavior in the web interface, and in the negotiation process) and were collected into a complex database.

Analyze: Data were evaluated from several points of view and then interpreted.

Share: Specific case study outputs were prepared for different audiences, together with a presentation of the conclusions at conferences, and papers in journals.

The questionnaire was a basic tool for obtaining primary information from respondents and included open and closed questions for the research participants. The questionnaire survey allowed to obtain and analyze the data on the participants’ satisfaction with the dispute settlement in relation to their personality and other data obtained from the introductory questionnaire. The questionnaire survey was divided into two questionnaires—introductory and final. The introductory questionnaire allowed obtaining basic information about respondents and their personality characteristics based on the Ten Item Personality Inventory [

80], and about their emotions using the Positive and Negative Affect Schedule [

81]. The final questionnaire focused on the assessment of the proposed method based on the research participants’ subjective evaluation. These data were supplemented by an objective indicator (the financial outcome of a successful negotiation) in the evaluation, taking into account the economic efficiency of the ongoing negotiations for both parties.

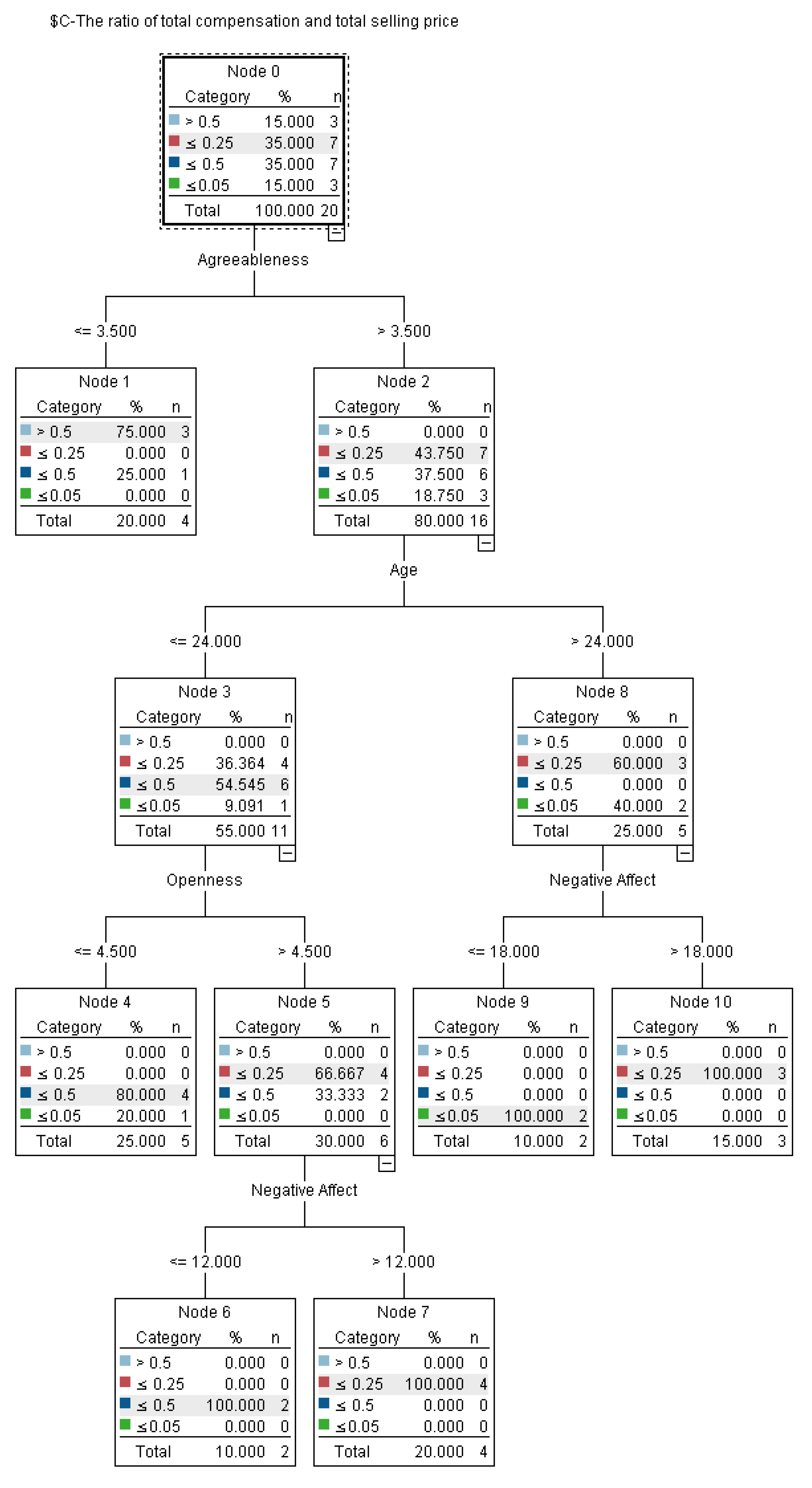

The synthesis method was used to evaluate the questionnaires. The results were interpreted verbally, in tables and graphically. Mathematical and statistical methods (Mann-Whitney Nonparametric Test) were supported by appropriate computer software—spreadsheet, statistical, and econometric programs. The analysis and description were performed on the processed data to evaluate the subjective perception of satisfaction with the proposed E-NeGotiAtion method based on the use of the GA. The data obtained from the questionnaires were interconnected through the Clementine 11.1 SPSS software, using the C5.0 algorithm to create the decision tree (

Appendix A) and the rules, as well as the generalized rule induction (GRI) algorithm to formulate the association rules. In addition to processing and evaluating the questionnaires, additional data collected during case study was used for subsequent discussion and helped to understand the events that took place in the background.

4. Design of E-NeGotiAtion Method

This section is focused on the artifact design for B2B negotiation, which used the AI approach for dispute resolution. The proposed method or its GA can become part of AI-based systems for legal domains. Based on the literature review in

Section 1 and

Section 2 can be concluded that the presented artifact with GA for ODR is first of its kind in the area of B2B relationships. The presented solution is part of AI & Law approaches, where it offers an opportunity to resolve disputes as an out-of-court settlement through computer-mediated communication. First, it is outlined the assumptions and rules the design puts forward. Then the method itself is presented and its individual phases described in detail. The end of this section provides a description of the GA proposed to optimize the choice of the most appropriate dispute solution.

The designed method is built on a conceptual design published in [

68]. The method is based on three assumptions. The first is that there are only bilateral negotiations between Seller and Buyer (business customer). The second assumption is that both parties want to resolve their dispute constructively. The last assumption is that the negotiation concerns a portfolio of products (more than 2 items) or several contracts which are negotiated simultaneously.

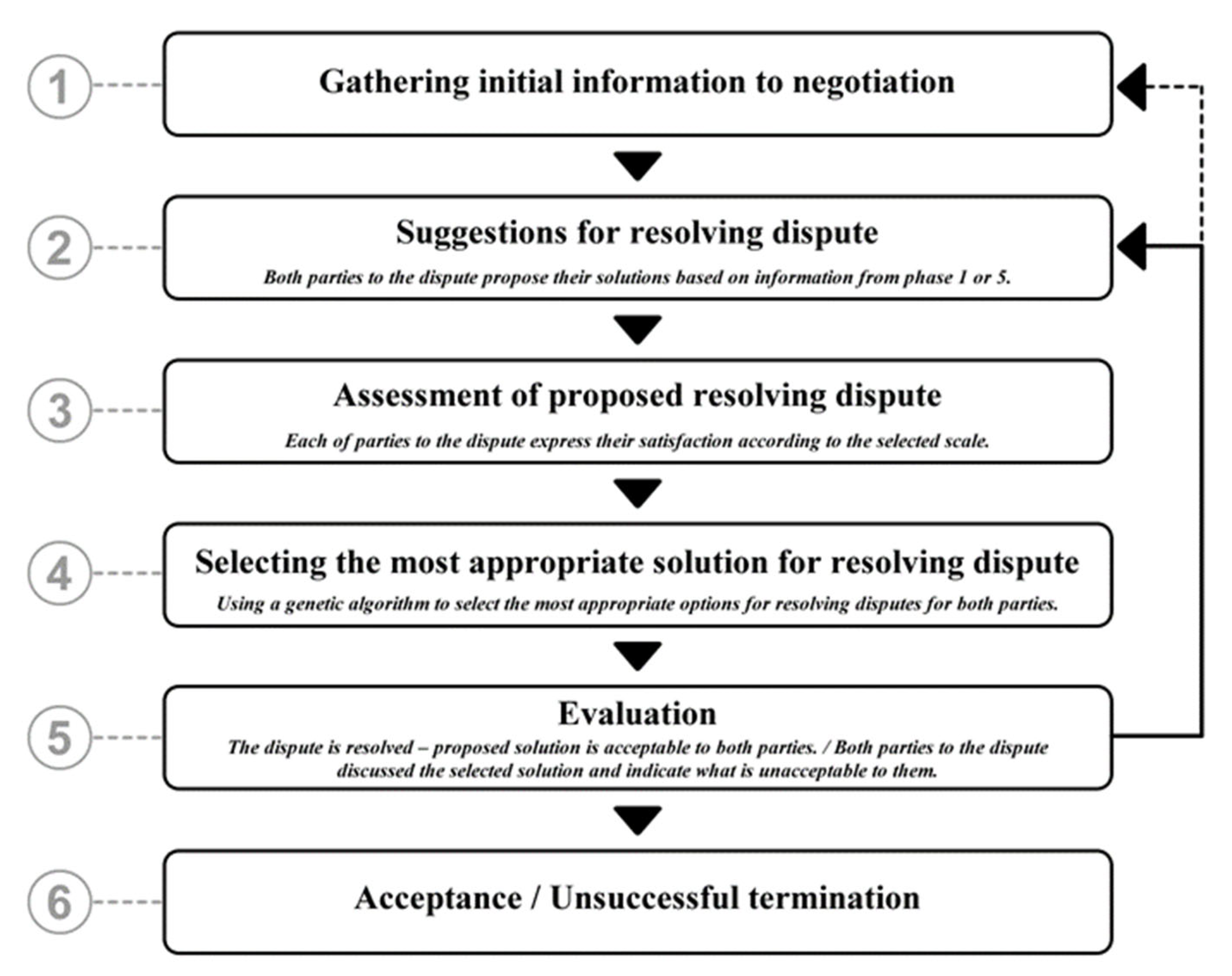

The proposed artifact also sets the rules affecting both parties. The first is that the Buyer determines the maximum time for negotiations because it is assumed that his or her company must respect obligations to other partners. One iteration of negotiating is fixed to three days. The second implicit rule is that in the 4th phase, the GA favors the valuation of Seller since it is assumed that his or her company will have lower profits from the contract in case of dispute resolution (Buyer satisfaction). Based on these, the negotiation method is designed, consisting of six phases, as presented in

Figure 2.

On these bases, it can be implemented an application to support the negotiation process and enable the early resolution of disputes. Each phase is presented below in detail.

Gathering initial information to negotiation (Phase 1)

Each party fills a short questionnaire to define their positions clearly. The results are then made available to both parties, as they constitute the basis for proposals on how to resolve the dispute as well as for the evaluation of individual proposals (see Phases 2 and 3).

The Buyer answers the following questions for each type of goods (or disputed contract):

- (a)

What quantity of goods delivered is defective?—indicates the number of pieces or percentage

- (b)

What is the price of defective goods according to the agreement with the Seller?—indicates the price in Euro

- (c)

What is the estimated loss for the Buyer caused by defective goods?—indicates the amount in Euros (It can be the case when the Buyer has signed a contract with a wholesaler for a certain number of pieces. If the Buyer does not deliver the goods, the contract will be canceled, and the damage can, therefore, exceed the purchase price of goods.)

- (d)

When does the Buyer need the defective goods to be replaced (delivered)?—indicates the number of days

- (e)

How many days can be devoted to negotiations?—indicates the number of days (one iteration of negotiating is fixed to three days)

Based on Buyer’s responses, the Seller answers the following questions for each type of goods (or disputed contract):

- (a)

When can the Seller deliver the required number of (missing) goods?—indicates the number of days (in case the production is too difficult and not profitable, he or she indicates N)

- (b)

What substitutes for the goods is he or she ready to deliver?—provides a description of the goods (if the goods cannot be substituted, he or she indicates N)

- (c)

By when can he or she deliver the given number of substitutes?—indicates the number of days (or N)

When both parties have answered their questions, the results are made available to both parties of the dispute. Based on this information, they can go to the second phase.

Suggestions for resolving a dispute (Phase 2):

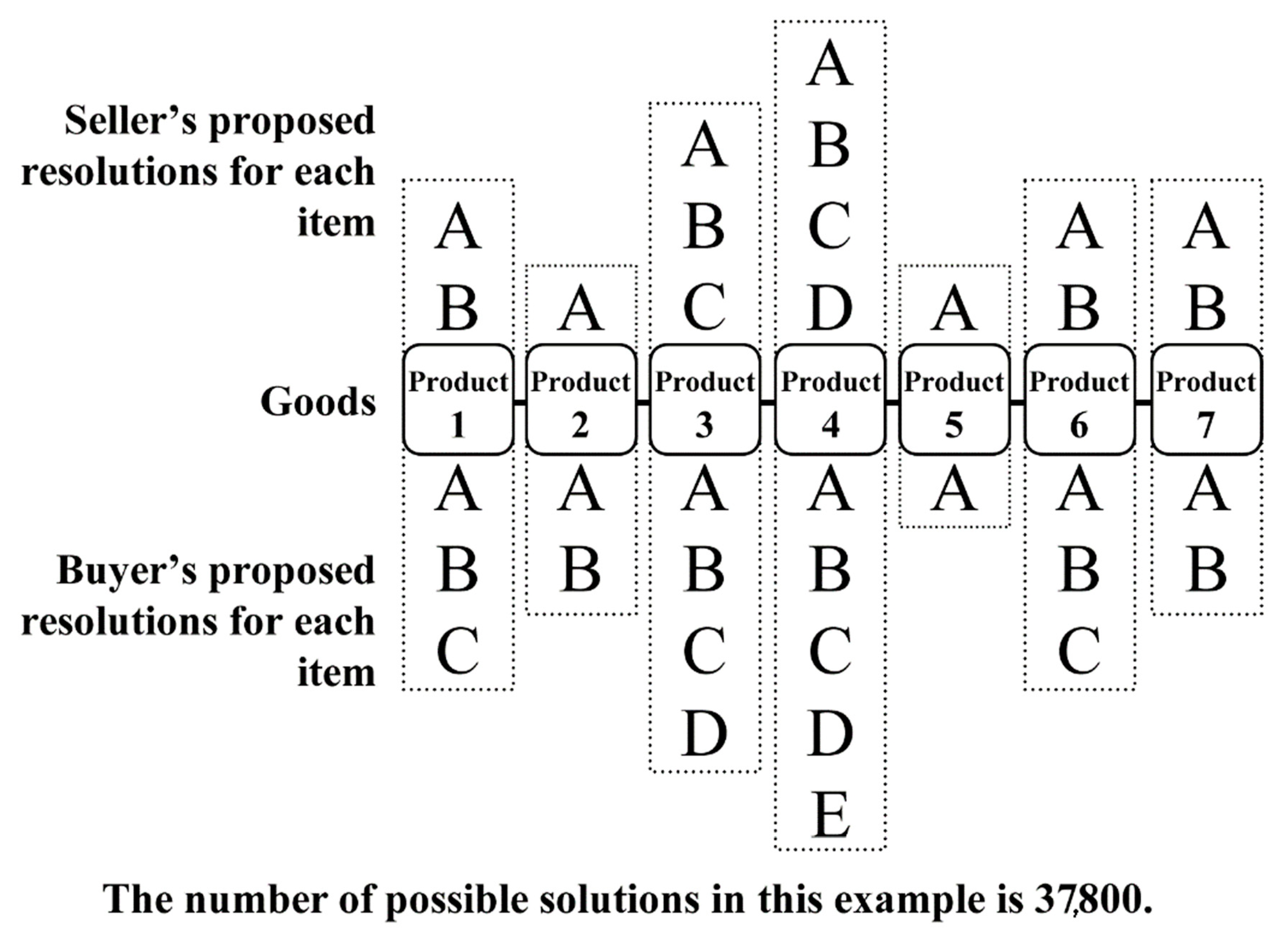

Each of the parties proposes their own solution, which they would prefer for each good (

Figure 3). For each product, a different number of solution variants can exist—e.g., for Product 1 the Buyer states three and the Seller two variants that solve the problem (the number of variants of the problem solution may be arbitrary for Seller and Buyer).

Assessment of the proposed resolution of the dispute (Phase 3):

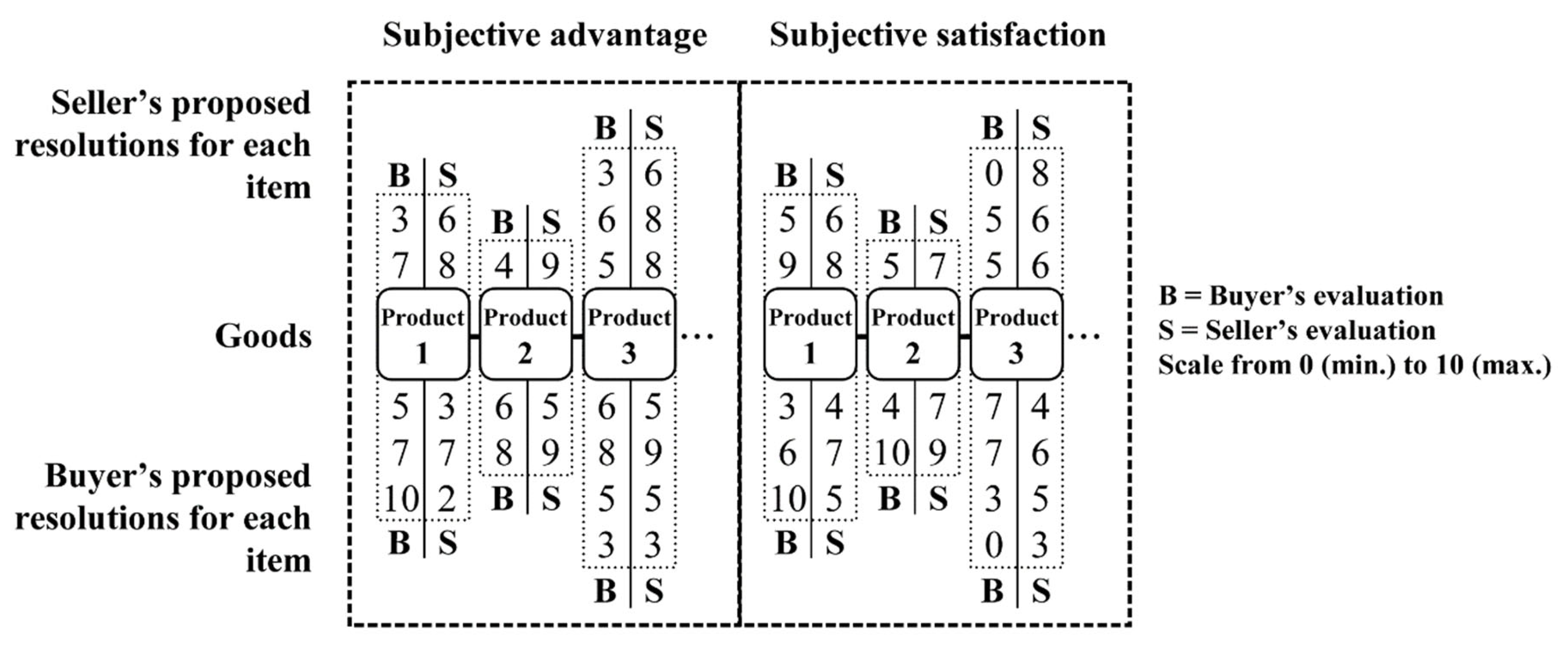

After the completion of the proposed variants of the solution, all the proposed options are presented to both parties. Each party evaluates the variants in terms of subjective advantage and subjective satisfaction (described in

Section 4.1) on a scale from 0 to 10, while 10 is the most appropriate solution (

Figure 4).

Selecting the most appropriate solution for resolving the dispute (Phase 4):

Based on the assessment of individual variants (by Seller and Buyer), the GA selects the best solution based on the following criteria: Both variants of the solution must be similarly good or bad for both sides, except the Seller, for whom the whole solution could be slightly more acceptable. For example, if the Seller rates a variant as 6 and the Buyer as 5, such a variant is more appropriate than the possibility that both rate the variant as 5. The best solution is selected by a multiple running of the GA presented in

Section 4.1. The result that fulfills the criterial function (or is very close) is declared as the best solution and chosen for the next phase.

Evaluation (Phase 5):

In this phase, each of the parties expresses their opinion of the selected solution as a whole—what is convenient for them and what is still questionable. Satisfaction with the overall solution is evaluated on a scale from 0 to 10, with 10 being the most appropriate solution.

Acceptance (Phase 6):

Information on the proposed solutions is then presented to both parties. Each of the parties chooses one solution or none of the evaluated solutions based on this information. If the chosen solutions match, it is considered to be a dispute resolution accepted by both parties and a successfully resolved dispute. As part of this phase, the legal conditions for the performance of the parties may also be agreed on the basis of the agreed solution to the dispute.

If they do not agree, the party that made the selection later is shown information about what solution has already been chosen by their business partner. This party has the opportunity to review their selection and accept the same solution as the partner. If, however, he or she insists on his or her choice, the parties continue to negotiate and proceed to the next iteration from Phase 2 (both sides of the dispute will learn about the choice of the counterparty). An alternative option is also to return to Phase 1, where each party can redefine their positions based on the experience from the last negotiation.

The method offers two options for how negotiations can be unsuccessfully terminated. The number of iterations is restricted by the Buyer, and after they are depleted, the negotiation is ended. After the third iteration, both parties have to evaluate their commitment to continue the negotiation on a scale from 1 to 5, where 5 is the highest commitment to continue. If both parties indicate 2 or less, the negotiation is terminated, and it is necessary to proceed to other options to resolve the dispute. At the same time, both parties have the option of terminating the negotiation at any stage of the negotiation, which then results in an unsuccessful settlement of the dispute.

4.1. A Genetic Algorithm for Selecting the Most Appropriate Solution

The proposed GA as a non-deterministic method of solving a problem, based on the principles of Darwin’s evolutionary theory. The benefits of using a GA are mainly the following: a solution is found in large state space in a reasonable amount of time, the GA is domain-independent, and the solution covers practically all search facilities [

21]. For these reasons, using a GA is much better than simpler ranking or comparison methods. While the general principle of the GA can be found, for example, in [

61], the most important part of the algorithm is its own fitness function, the representation of chromosome and the description of selection, crossover, mutation, and termination, which makes it an original GA.

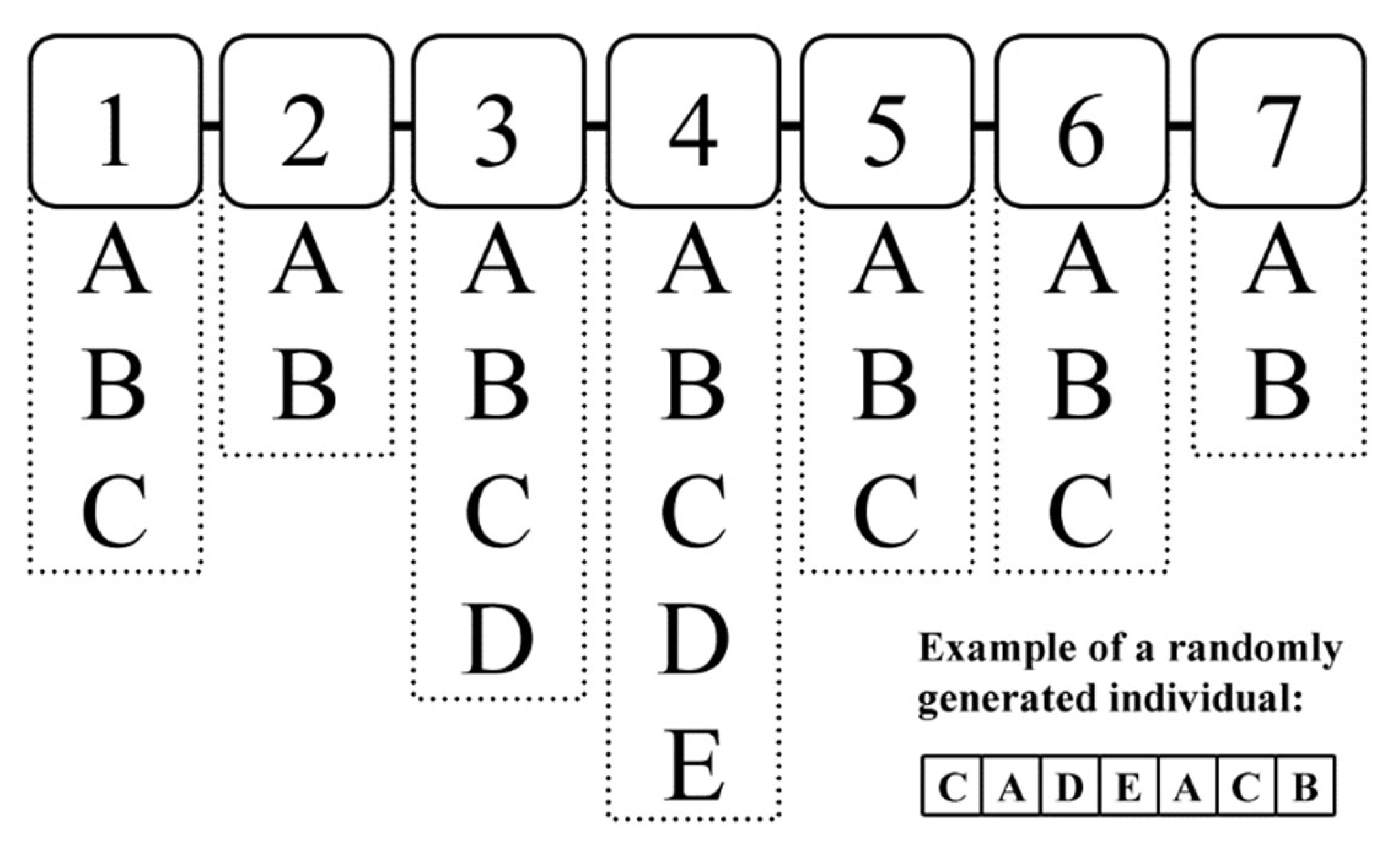

In this case, a nonlinear optimization task is solved in which individual genes can have entirely different values in extreme cases. The reason is that each product represented by one gene may have a different number of resolutions offered by buyer and seller. For example, the buyer offers two resolutions for the first product and the seller offers three resolutions of the problem—the allele can thus have five different values.

An individual is represented by a chromosome, i.e., a chain (s1, s2,…, sL) of finite length. Each si is selected from alphabet Ai, thus si ∈ Ai. In the E-NeGotiAtion method (and its own GA), several different alphabets can exist within individual genes, thus A = A1, A2,… AP, in which P is the final number of specific alphabets. The alphabet always has at least two symbols. The length of an individual’s chromosome equals the number of products with which the negotiation is concerned.

To give a better idea,

Figure 5 shows an individual that represents seven products, the number of partial solutions suggested by the seller and buyer together being 22. In this case, the number of different alphabets equals four.

The function used by the E-NeGotiAtion method is as follows:

where

Fi is the fitness of the individual, which is calculated as the sum of the partial fitness of the individual variants (the lower the value, the better);

n is the number of variants for a given product (or item);

Sv indicates the Seller and the chosen variant, e.g., variant 1;

Bv stands for Buyer and selected variant;

lower index ’a’ means that evaluation is made in terms of subjective advantage—the negotiator assesses the extent to which the proposed solution for a given product is financially advantageous for the firm (either in the short term in the form of immediate compensation for defective goods or in the form of negotiated compensation in the future), helps to keep orders for other business partners and contributes to meeting the needs of the company;

lower index ‘b’ takes a subjective satisfaction assessment—the negotiator assesses the extent to which the proposed solution for a given product contributes to their feeling of satisfaction, relaxes their emotions, helps maintain relationships with the business partner and builds mutual trust (for example through perceived mutual concessions between partners), empathy, and so on. Since the negotiator is the manager of a firm who decides on its activities, the dimension of the assessment of the solution in terms of their feelings is also important;

Smax and Bmax is the maximum possible value in evaluating the variants (for the purposes of this paper, a fixed value of 10);

wx are weights assigned to the individual rating components, it is possible to shift the focus to one or the other side (e.g., the Seller, who will incur the additional costs associated with the compensation). Different software solutions using the method presented here and this GA can set the weights differently (according to the context of ODR and what is emphasized in the negotiation). In our case study, as presented in

Section 5, all weights were set to 1.

The lower the value of fitness an individual achieves, the closer he or she gets to the optimal solution. First, the default population is randomly generated. After evaluating each individual, it is necessary to sort the individuals according to the achieved values and choose the most suitable ones using the roulette rule. The roulette rule, using the so-called sequential selection, has the following form [

63]:

where

N is the size of generation and

i ∈ {1,…,

N}. The roulette wheel (for example 10,000 holes) will be divided into

N parts, each part (hole segment) corresponding to an individual’s

pi. An

N rotation will be performed to select the next generation.

Not all individuals have to go through the crossover. Usually, the probability of crossover between 60 and 100 percent is set, and the probability of mutation is 5 to 15 percent [

82]. These parameters affect the speed of the result. For the tasks presented in the case study, they were experimentally determined as follows: the probability of crossover 70 percent and the probability of mutation 35 percent were set experimentally by the authors. For the implementation of the GA, the method of uniform crossover and random mutation of a randomly chosen allele [

63] was used. Thus, the cycle continues until the termination condition is met which in this case was the provision that if after 30 iterations a better individual is not found, the individual was declared the best solution. The individual characters that the individual contains are then decoded into each variant of the solution—each character symbolizes a variant of the solution.

The GA was run five times for each task (one iteration). The reason is that every time the GA is run, it does not have to find the best solution because it is principally a stochastic algorithm. Another reason is that there may be an equally good solution for the evaluation used. It is, therefore, appropriate to have the same or very close solutions approaching the one that is optimal for the individual parties of the dispute. This is also an advantage of the E-NeGotiAtion and of extending the approaches to assisted negotiations—instead of one solution, there are several options approaching the optimal solution on which both sides can decide.

4.2. Solution of the Technical Research Problem

DSR brings two main benefits [

34,

72]. The first is a practical kind of benefit when the proposed artifact solves a defined problem associated with the negotiation of companies in the area of ODR focused on B2B relationships. This problem is related to the needs of firms that trade mainly at the international level, and it is closely related to the recent legislative changes at the level of the European Union—see

Section 1. The second type is the theoretical contribution when a solution is presented, providing a description of the procedures that were followed and the solutions that were chosen—e.g.,

Section 2.3 lists the reasons for choosing a different GA than previously proposed to solve a similar category of problems. In this way, the presented artifact design affects future strategies and approaches to solving a similar category of problems, while contributing to creating more general theories about designing similar artifacts.

For the purpose of defining the technical problem, a research question was used in a structure typical of design science [

34] in

Section 1. The answer to the research question is provided in this section because it presents a principled proposal for creating ODR in B2B relationships, which uses the proposed GA for the purpose of choosing suitable dispute resolutions. The proposed method thus fulfills the set goal and allows the parties of the dispute to arrive at a quick and objective solution to the dispute.

The proposed method is intended for assisted negotiation in which the ODR provider does not have the capacity to decide. The ODR provider offers software for communication, engaging in discussions, identifying and evaluating potential solutions, and writing agreements [

83]. In addition, this method enriches the negotiation and the selection of the most appropriate solutions using the GA—it offers not only one solution to the participants of the dispute but a number of variants of solutions approaching the optimal solution on which both sides can decide.

Part of design science methodology is also the evaluation of the given artifact (how well the designed method E-NeGotiAtion fulfills its purpose from the point of view of the negotiating parties), and a comparison of this negotiation method with an alternative way of negotiating via e-mail is provided in the following section.

5. Evaluation

This section contains a description of the embedded single-case study. Subsequently, it deals with their results, monitoring the impact of personality traits on the results of the negotiation, assesses the financial aspect of the negotiation, and the satisfaction of the participants recorded in the questionnaire. The summary of the results is the subject of the last section.

5.1. The Process of Embedded Single-Case Study

To facilitate communication with research participants, a third-party web application was created, based on the authors’ description. Each respondent received an e-mail with research instructions along with the login data for that interface at the beginning of his or her case study. After their first sign-up, they were given a link to the introductory questionnaire that they filled in before the negotiation. In addition to obtaining basic information on respondents (age and sex), its main objective was to determine whether there were any differences between randomly created pairs, which was inspired by the techniques used in recent research [

84]. The personality of the participants was assessed with the help of the Ten-Item Personality Inventory (TIPI) [

80], which is used in situations where personality traits are not a major research topic, but the identification of these factors can help the research, and at the same time it should not exhaust the respondent with too many of questions. To identify the Big-Five Personality Dimensions (Extraversion, Agreeableness, Conscientiousness, Emotional Stability and Openness), participants were asked to what extent they agreed or disagreed with 10 statements on a 7-point scale (1—Disagree strongly, 7—Agree strongly). These statements started with the phrase ‘I see myself as:’ and were completed by 10 different pairs of traits: (1) extraverted, enthusiastic, (2) critical, quarrelsome, (3) dependable, self-disciplined, (4) anxious, easily upset, (5) open to new experiences, complex, (6) reserved, quiet, (7) sympathetic, warm, (8) disorganized, careless, (9) calm, emotionally stable, (10) conventional, uncreative. The Slovak translation of the TIPI instrument was by Gurňáková et al. [

85].

It was also interesting to measure emotions after reading the introduction to the case study. For this purpose, the Positive and Negative Affect Schedule (PANAS) tool was used [

81]. The statement began with the phrase ‘I see myself as:’ and was completed by two groups of items. The first group included 10 adjectives describing the positive affect scale (interested, excited, strong, enthusiastic, proud, alert, inspired, determined, attentive and active) and the second one had 10 adjectives describing negative affect (distressed, upset, guilty, scared, hostile, irritable, ashamed, nervous, jittery and afraid) to define their feelings. Students were given the task of assigning to each item the degree to which they felt that way, after reading the introduction to the case study, on a 5-point scale (1—Very Little or Not at All, 5—Extremely). A high score means experiencing intensely a positive/negative affect [

86]. The Slovak translation of the PANAS instrument was by Sedlár [

87].

After completing the introductory questionnaire, the students returned to the web interface. Students negotiating via e-mail and the E-NeGotiAtion method continued in the web interface with Phases 1 and 2 (described in

Section 4). Participants using asynchronous communication via e-mail were informed after Phase 2 about the e-mail address of their business partner with whom they were in dispute and subsequently negotiated this way. Respondents negotiating through the E-NeGotiAtion method went through the other phases of this method (described in

Section 4), with multiple repeats of this process until the dispute was successfully resolved (participants agreed) or the negotiation ended unsuccessfully (the number of iterations was exhausted, commitment to continuing negotiation was low, or participants ended the negotiation). At the end of the negotiation, all participants returned to the web interface, where the final questionnaire was used to evaluate the progress of the research.

5.2. The Influence of Personality Characteristics on the Results of the Negotiation

Through the introductory questionnaire, the values of five personality factors were obtained, as well as the two dominant dimensions of emotional experiencing for each respondent.

Table 3 summarizes the measured values of personality and emotions for two groups of 40 participants—those using the new E-NeGotiAtion method, and those negotiating via e-mail.

The Mann–Whitney nonparametric test was used to identify possible differences in personality and emotional state of respondents. At a significance level (α = 0.05), the following hypotheses were tested:

H0: The medians for personality/emotional measure (E/A/C/ES/O/PA/NA) of the two groups (buyers/sellers, E-NeGotiAtion/e-mail method, case study scenario 1/case study scenario 2, students from Slovakia/students from the Czech Republic, males/females) are equal.

H1: The medians for personality/emotional measure of the two groups are not equal.

According to the aspects that were randomly assigned to participants (role, method, and type of case study scenario), all cases (E/A/C/ES/O/PA/NA) produced a

p-value exceeding the significance level, so the null hypothesis is not rejected. This means that possible different results of the negotiation between the two groups are not caused by statistically significant differences in personalities or their emotional states after reading a case study. Aspects such as the country of study and sex, which were not assigned randomly, brought slightly different results: students in Slovakia had a statistically significant higher agreeableness compared with students in the Czech Republic, and males had lower agreeableness and conscientiousness than females, which is confirmed by many studies about gender differences in personality, more in [

74].

5.3. Evaluation of the Financial Perspective of the Negotiation

All the pairs came to an agreement, so their agreements could be analyzed from a financial point of view. The solution for each product was expressed in money, the sum represents the total compensation. The values from the point of view of the buyer will be mentioned in the first place, and for the seller, they are at the opposite value because what the buyer gets as compensation the seller must provide and vice versa. It is important to realize that the goal of negotiating methods is not to maximize profit for either or both sides of the dispute, but rather to achieve a solution that would favor one or the other party the least.

However, when comparing the results, it is important to realize that the case study units move in different financial ranges so that absolute results can only be compared within the same case study. In

Table 4, it can be seen that on average buyers negotiated a higher value (150.62€) with a lower standard deviation (62.82€) with the new E-NeGotiAtion method in the case study units of flowers (situation A), compared to participants negotiating via e-mail. For case study units of mobile phones (situation B), the buyers received higher average compensation (2001.03€) via e-mail, but the standard deviation was again higher (2477.82€).

In

Table 5, the difference can be seen between the total compensation received by the buyer through the E-NeGotiAtion method, and that obtained in the case of negotiation via e-mail in the same case study. For 3 and 4 products, the difference is positive, so the total agreed compensation is higher for the buyer within the E-NeGotiAtion method. With a greater number of products, the compensation agreed via e-mail is already higher. This is the benefit the pair achieved through the E-NeGotiAtion method compared to the e-mail negotiation pair. In situation B with six products, the difference can reach up to −9109.94€. Of course, from a buyer’s point of view, this is a favorable situation, but from a seller’s point of view, it means that the seller has agreed to pay via e-mail (through immediate cash compensation, discounts on a future order, etc.) 9109.94€ more than the seller through the E-NeGotiAtion method.

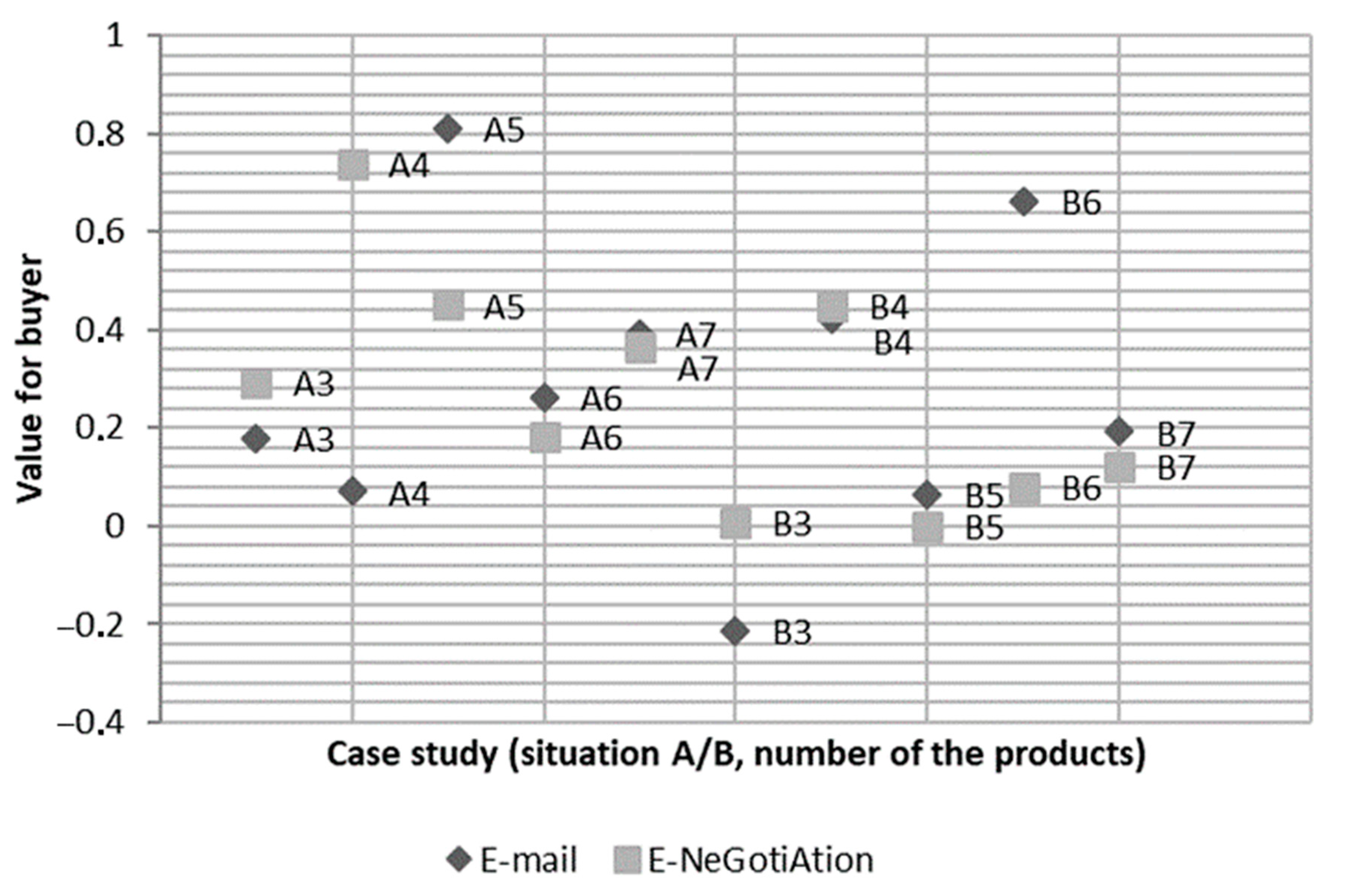

As already mentioned, comparing the absolute results is complicated, so a relative indicator was chosen that is only related to the value of the defective goods, i.e., goods that were delivered in insufficient quantity or quality. The indicator can be tracked for both buyers and sellers as the ratio of total compensation and total sales price for defective goods.

Figure 6 shows the value of this ratio for the buyer (for the seller, there would be values with the opposite sign), according to the case study (situation and number of negotiated products) and the method used.

The buyer seeks to maximize this ratio, obtaining the highest possible compensation for the sales price he or she has paid for the defective goods. The results also reflect the values in the

Table 5, which shows the difference between the compensations through the E-NeGotiAtion method and e-mail. Again, it can be seen that the e-mail negotiation ratios reach extreme values. The maximum ratio was agreed in the case study of 5 products related to flowers (situation A). The minimum gets a negative value for mobile phones (situation B), where three products were negotiated. This means that the buyer has accepted a solution that gives him or her less value than he or she has paid (for example, he or she has accepted a cheaper substitute, made another purchase). The same situation in which the seller made a profit in the negotiation did not happen with the E-NeGotiAtion method.

If a pair reached the same solution, and at the same time possible different results of the negotiation between buyers and sellers were not caused by statistically significant differences in their personalities or affects (see

Section 5.2), the results of the negotiation were analyzed only for one group—the buyers. It was considered how the characteristics of the buyer (seller)—age, sex, country of study, five factors of personality, positive and negative affects—influences the ratio of total compensation and total sales price for defective goods, which was divided into four groups, depending on the value they acquire. Using the C5.0 algorithm, a decision tree (

Appendix A) and five decision rules were obtained with 90% confidence:

Rule: if a person has a negative affect less than or equal to 18, his or her agreeableness exceeds 3.5, and this person is older than 24 years, then the ratio of total compensation and total sales price is less than or equal to 0.05 (instance: 2, confidence: 0.75);

Rule: if a person has a negative affect greater than 12, agreeableness greater than 3.5, openness greater than 4.5, and is younger than 24 years inclusive, then the ratio of total compensation and total sales price is less than or equal to 0.25 (I:4, C:0.833);

Rule: if a person has a negative affect greater than 18, agreeableness greater than 3.5 and is older than 24 years, then the ratio of total compensation and total sales price is Less than or equal to 0.25 (I:3, C:0.8);

Rule: if a person has agreeableness of more than 3.5 and is younger than 24 years old, then the ratio of total compensation and total sales price is less than or equal to 0.5 (I:11, C:0.538);

Rule: if a person exhibits agreeableness of less than or equal to 3.5, then the ratio of total compensation and total sales price is greater than 0.5 (I:4, C:0.667).

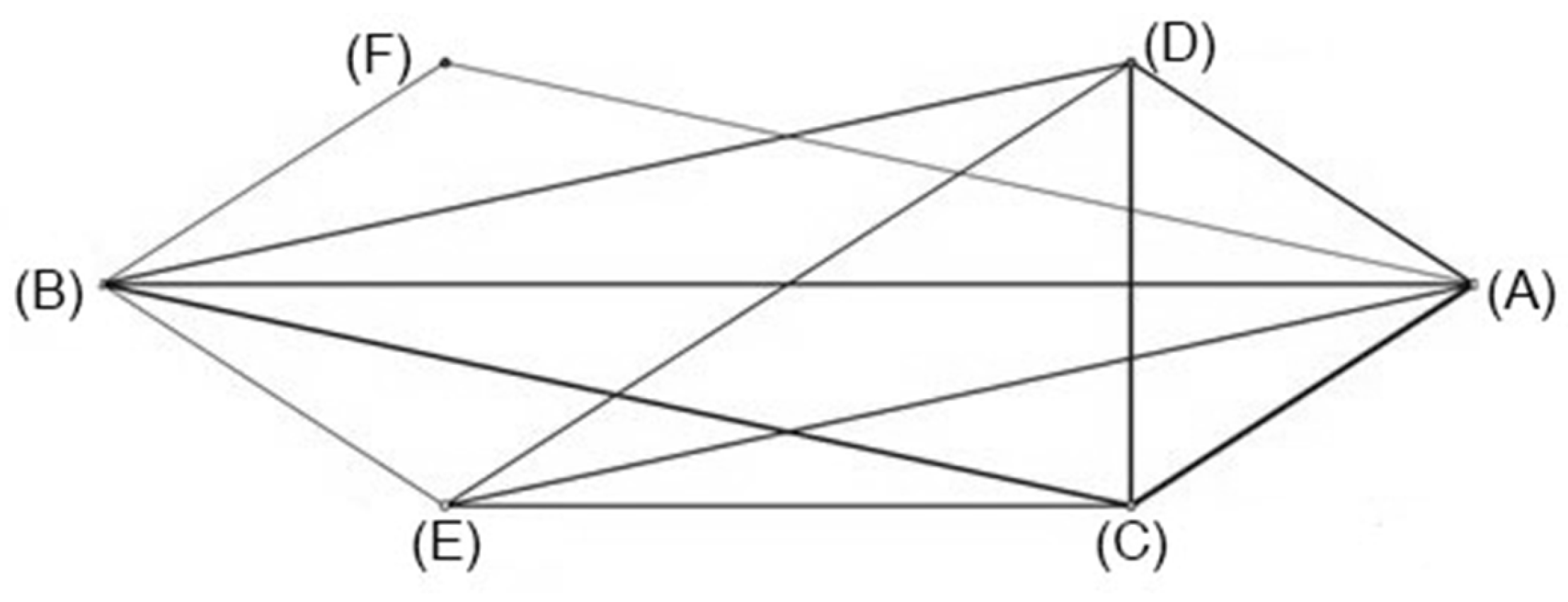

Total compensation is the sum of the monetary values of the different types of compensation: (A) Delivered new goods (original goods, substitute); (B) Financial compensation (cash); (C) Discount on a future order; (D) Transport (some pairs also agreed on transport discounts for new orders, although the transport was reported as free of charge in the case study); (E) Free goods (original goods, substitute, complementary goods—sprayer, plastic containers, etc.): (F) Others (reduction of ordered pieces, etc.). The spider graph (

Figure 7) shows in which combinations these types of compensation occurred. Most often, there was a pair of delivered new goods and a discount on a future order. Other combinations are discount on a future order and financial compensation, as well as a discount on a future order and transport. There is also a link between the delivered new goods and monetary compensation, or new goods and transport.

When analyzing the combinations of compensation types, association rules (the GRI algorithm) is used with a chosen confidence level of at least 80%. It produced 11 association rules, which can be seen in the

Table 6. Support represents how often an itemset appears in the dataset. For example, the combination of financial compensation and transport appeared in 25% of cases. Confidence is the probability of consequent occurring under the condition of the antecedent, i.e., how often the rule was found to be true. For example, the discount on a future order still occurred when the pair of financial compensation and transport appeared.

5.4. Satisfaction with Negotiation

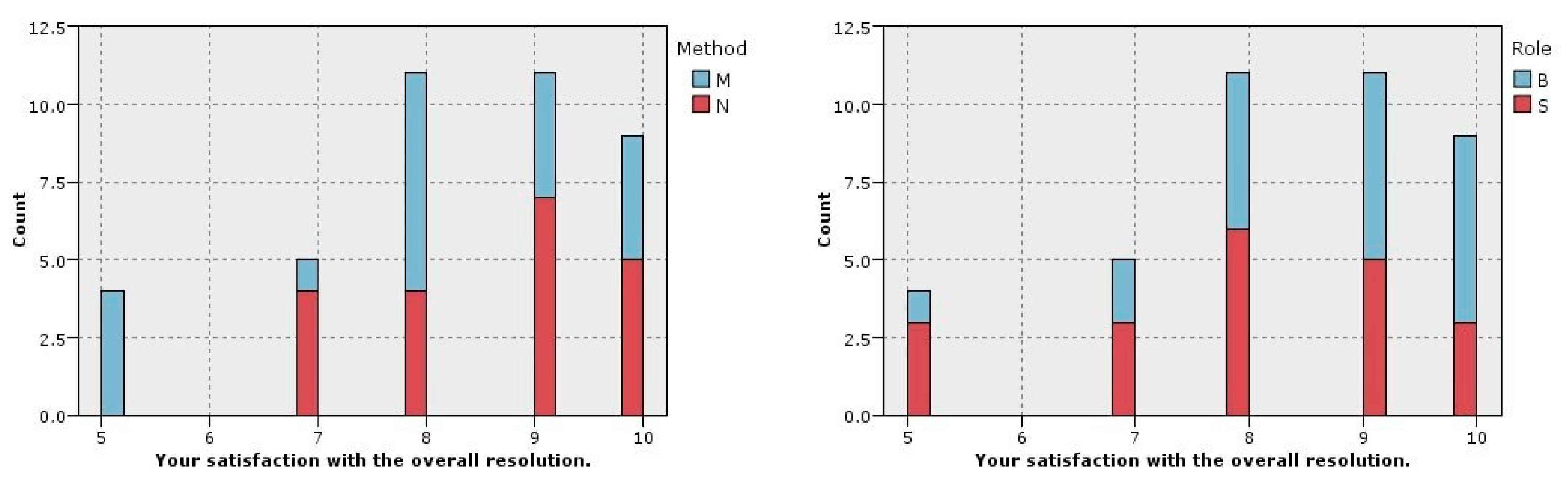

Respondents rated satisfaction with the overall dispute resolution on a scale from 0 (absolutely unsatisfactory solution) to 10 (maximum satisfaction with solution), which can be seen in

Figure 8. All respondents using the E-NeGotiAtion method expressed their satisfaction with the overall solution (values above 7 inclusive). 20% of participants negotiating via e-mail rated their satisfaction with the value of 5, i.e., did not show dissatisfaction or satisfaction with the overall solution, three of which were sellers.

The final questionnaire was also focused on the evaluation of the new E-NeGotiAtion method.

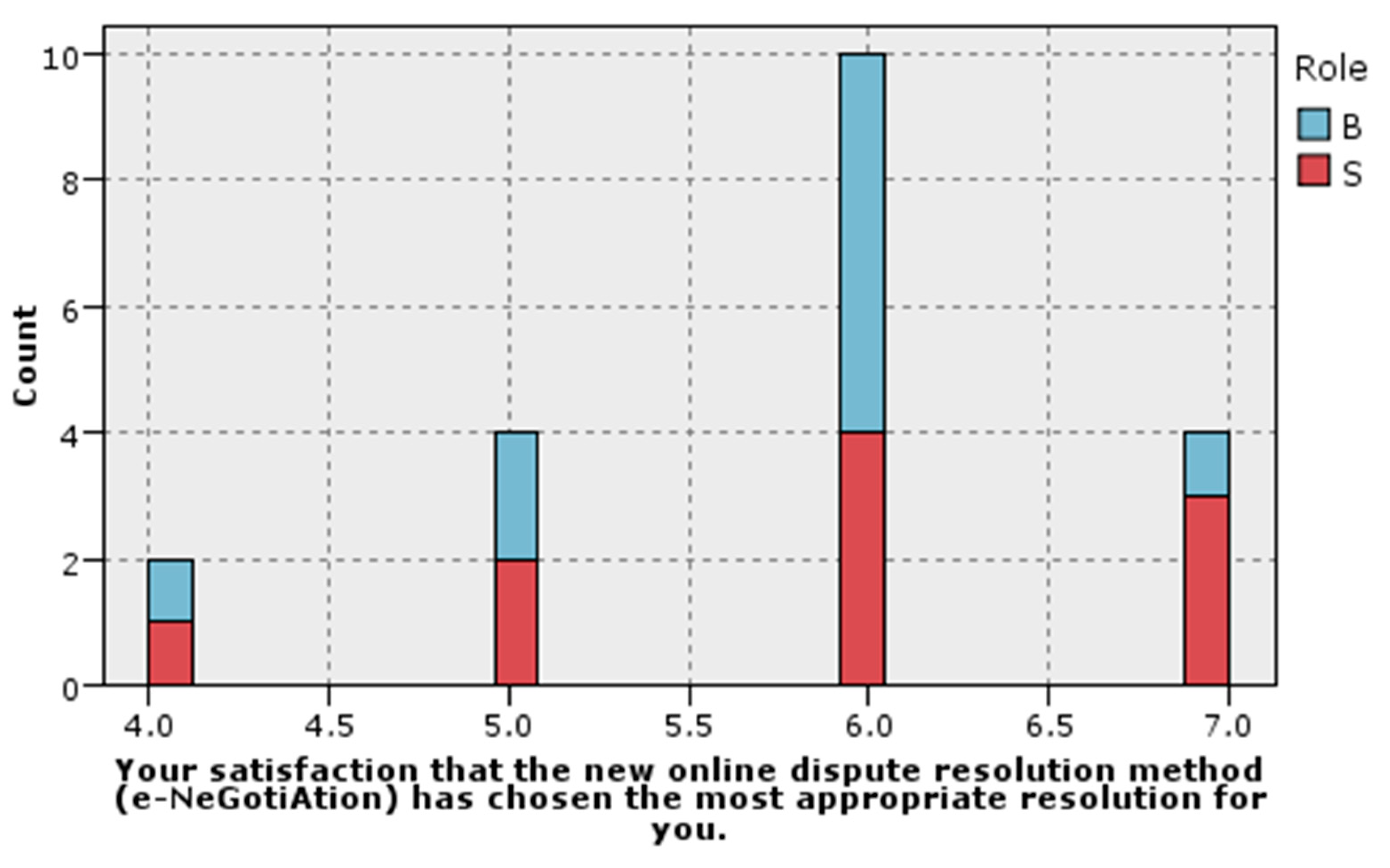

Figure 9 shows expressed satisfaction with the fact that the E-Negotiation method selected the most appropriate solution(s), depending on the assigned role.

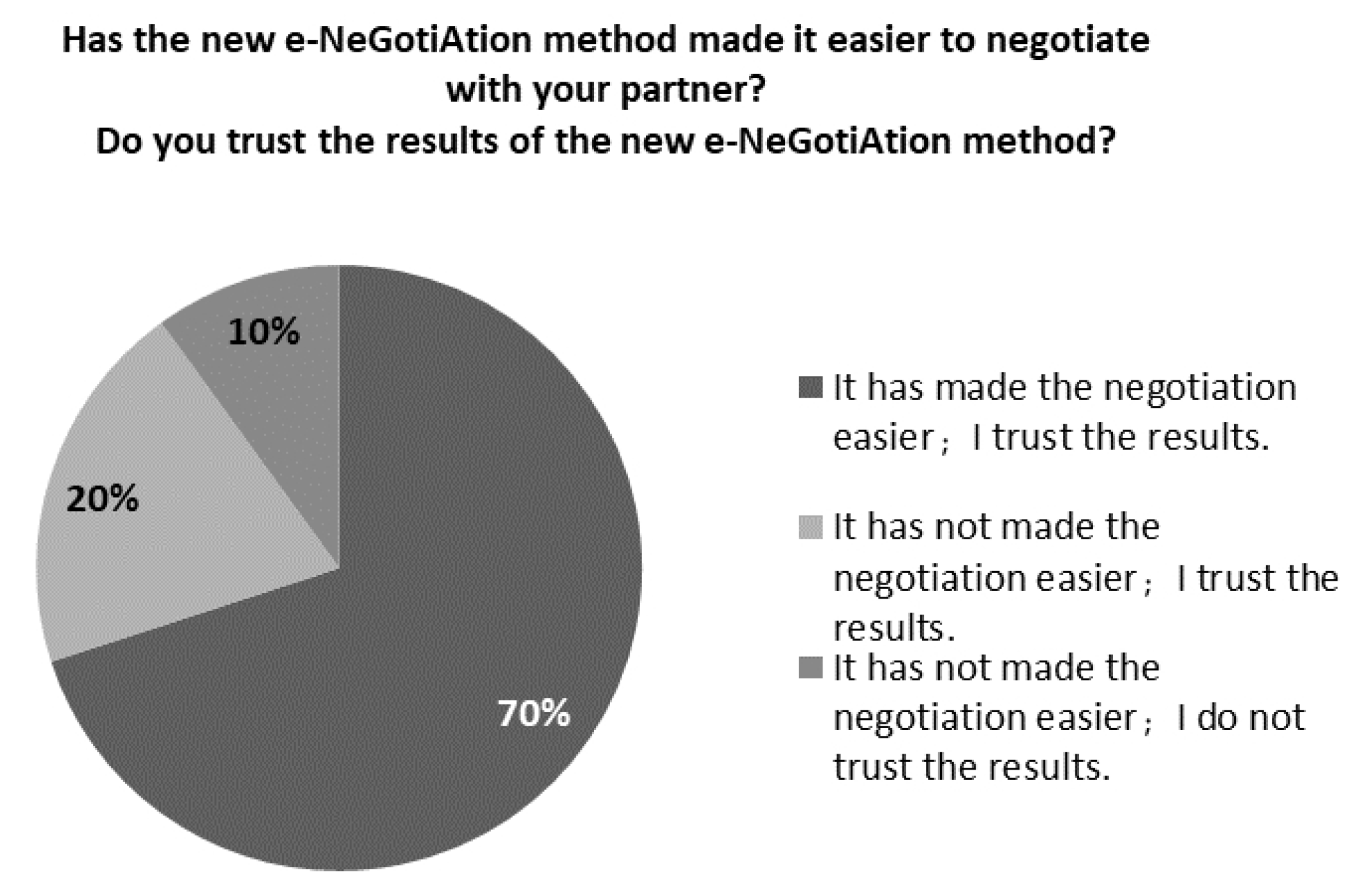

The scale of satisfaction ranged from 1 (very dissatisfied) to 7 (very satisfied), and 90% of the participants using the proposed method expressed their satisfaction. As can be seen in the pie chart (

Figure 10), 70% of the respondents confirmed that the new E-NeGotiAtion method facilitated negotiation with the partner, and they trusted its result. Then, 20% of the participants who used the E-NeGotiAtion method stated that this method did not facilitate their negotiation, but they trusted its result. The remainder did not trust the result of the method.

In open questions, respondents using the E-NeGotiAtion method had to evaluate its positives and negatives. A summary of the advantages is given in the

Table 7. Participants positively assessed the objectivity of the method, the transparency of the application, time, and money savings.

The respondents also considered the negatives of this method. They reported most frequently that communication was being delayed due to a later reaction of the partner or the absence of personal contact. An overview of the disadvantages can be seen in

Table 8.

The respondents had an optional open question about suggestions to improve the negotiation process. In the

Table 9 are the three most frequently mentioned comments, such as the limitation of the number of steps or the possibility of adding further proposals. These comments will be incorporated into the framework of further research.

5.5. Results Summary

The obtained results should be compared with the results of similar studies. Currently, there is no similar study (using the method/system for assisted negotiation in B2B relationships) that would provide comparable results. Overview in

Section 2.2 (

Table 2) shows that there exist artifacts in different domains (construction, civil, labor, and family law). There is also an application for B2C relationships. Issues connected to B2B negotiation have not yet been dealt with, and the artifact presented in

Section 4 is the first of its kind. For this reason, the results of the proposed method E-NeGotiAtion are compared with the results of the negotiation via e-mail (as a comparable baseline).

The possible different results of the negotiation were not caused by statistically significant differences in personalities or affects between the two groups (see

Section 5.2). In the study, the average compensation varied according to the case study scenario used (higher through E-NeGotiAtion in situation A and higher via e-mail in situation B). The highest average number of participants was negotiated by e-mail and the lowest by E-NeGotiAtion method. What the buyer obtains in the form of higher compensation must be provided by the seller. For this reason, it turns out that the E-NeGotiAtion method helps the parties to come up with a solution that is economically efficient for them because the buyer has agreed to a compensation that is lower for the seller than the use of another method, which also fulfills the definition of the dual-task of ODR—it resolves disputes and also builds confidence [

32]. Of course, the assessment of the average compensation would not be sufficient, so the standard deviation was also observed. The lowest standard deviation was reached by the pairs using the E-NeGotiAtion method.

There were 10 case study units with two basic situations (A and B) showing different numbers of goods (3, 4, 5, 6, and 7). Different goods were used due to the different complexity of the task—for the evaluation, it is important that the proposed method is able to find reasonable solutions even for more complex tasks. For five and more products, compensation negotiated via E-NeGotiAtion was lower than via e-mail. For a more complicated task, the E-NeGotiAtion method is more suitable for achieving a resolution that favors one side or the other as little as possible.

A relative indicator was also observed and how the respondent’s characteristics affect its value. It turned out that the lower the agreeableness of a participant, the higher the ratio. In the case of an older respondent, the ratio is lower, which may reflect greater experience.

Most often, there was a combination of compensation—delivered new goods and a discount on a future order. The highest support (25%) and confidence (100%) was achieved by the association rule: financial compensation and transport (antecedent)—discount for future order (consequent).

All respondents using the E-NeGotiAtion method expressed their satisfaction with the overall solution. Participants were satisfied that the new E-NeGotiAtion method had chosen the most appropriate solution(s) (90% of respondents). They confirmed that the new E-NeGotiAtion method facilitated negotiation with the partner, and at the same time, they trusted the result (70% of respondents). Participants positively assessed the objectivity of the method, transparency of the application, time and money savings, as well as the possibility of remote communication. Respondents saw the negatives of this method, compared with the partners reaching an overall solution to the dispute themselves, in prolonged communication due to waiting for a partner, or lack of personal contact. The most frequent suggestions on how to improve the negotiation process were the limitation of the number of steps and the possibility of adding a proposal.

7. Conclusions

This research was intended to design and evaluate the new ODR method focused on B2B relationships, which fills the gap in research. The study appears to support the argument for a preference of the E-NeGotiAtion method for ODR compared to traditional negotiation via e-mail. Evaluation of the proposed method by embedded single-case study confirmed that its solution is economically efficient for parties of the dispute.

7.1. Main Conclusions for Practice

The main contribution for praxis is the designed method and its usability and usefulness for users. The E-NeGotiAtion method and proposed GA can be implemented as part of other AI & Law solutions or in other intelligent systems for business support using B2B negotiation. These AI & Law solutions can be a part of e-commerce systems.

The main advantage of the E-NeGotiAtion method from a practical point of view is a very good quality of outputs for complex tasks, where the state space of possible solutions is very extensive. For a more complicated task with five and more products, the proposed method is significantly more suitable for achieving a resolution that favors one side or the other as little as possible than negotiation via e-mail.

E-NeGotiAtion facilitates negotiation with the partner and creates a trusted result, especially in a resolution of a more complicated task (negotiation about five and more products). Based on the case study, it is possible to say that for negotiation is a more suitable negotiator who has less agreeableness and is older than 24 years. Such a negotiator agrees with a lower compensation regarding the sales price, which will be achieved with a solution that would favor one or the other party the least.

7.2. Main Conclusions for Science and Possibilities of Future Research

The main contribution of the article to the design of intelligent solution based on AI is the presentation of the proposed E-NeGotiAtion method, which enriches the knowledge based in the field of solution design in ODR focused on negotiation. The artifact evaluation confirms the usefulness of the solution. This is the first artifact design that is determined for specific B2B negotiation conditions and thus fills the gap in ODR research. This is also the main theoretical benefit according to design science methodology in addition to practical usability and usefulness.

Simultaneously, the results of this article confirm that the use of evolutionary computation brings advantages compared to case-based and rule-based reasoning, which are by nature more domain-related, e.g., with legislation, rules identified by an expert, or available cases from the past. The proposed method applies to a wide area of B2B negotiation and offers more flexibility because the specific contextual conditions can be included in the modification of negotiation process (method) without intervention into the GA that focuses on the general problem of finding the optimal solution in the state space of possible solutions.