Size Effects of Fiscal Policy and Business Confidence in the Euro Area

Abstract

:1. Introduction

2. Materials and Methods

2.1. Empirical Specification

2.2. Data

3. Results

3.1. Shock in Government Spending

3.2. Shock in Business Confidence

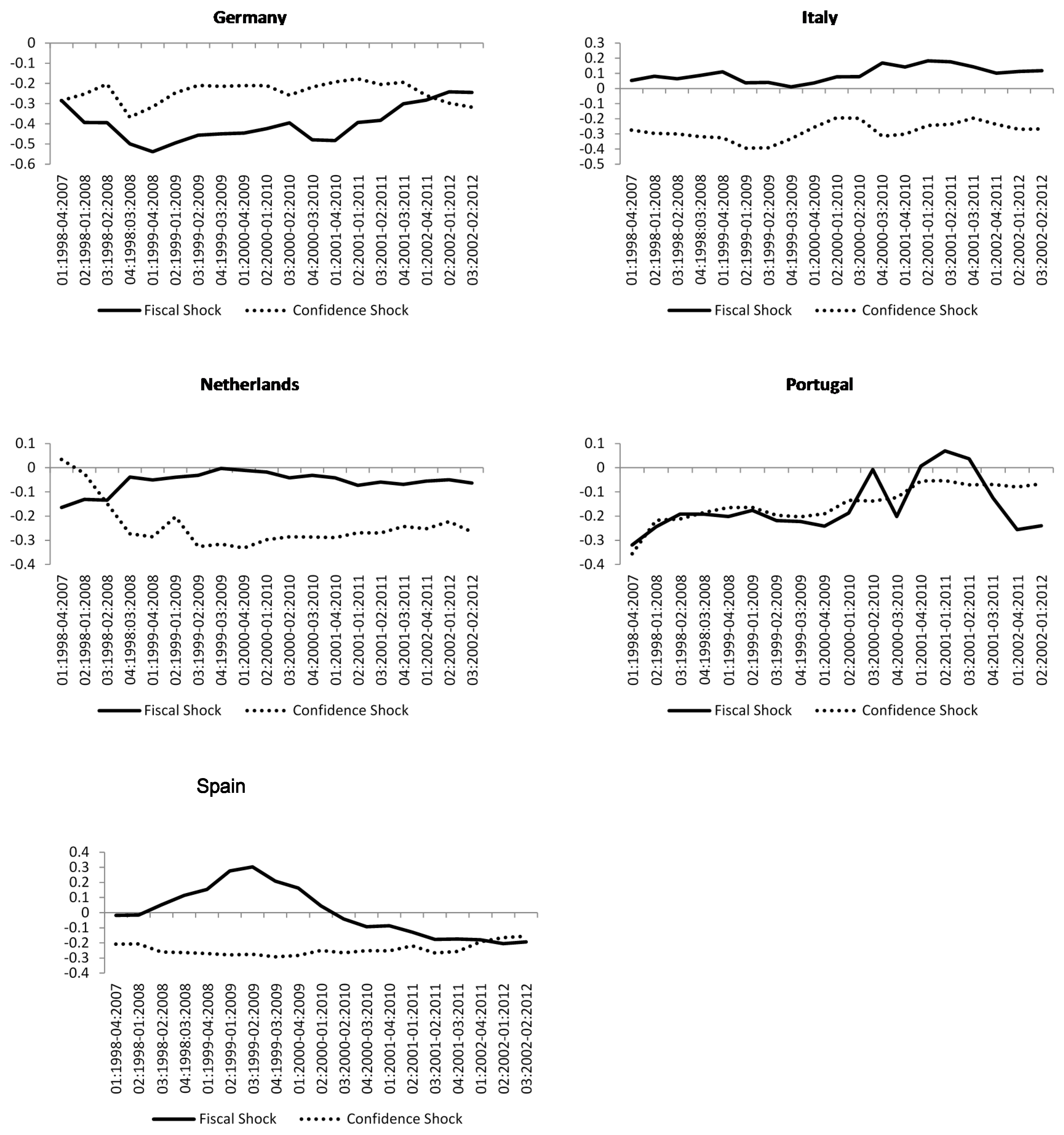

3.3. Rolling Windows

4. Discussion and Conclusions

Supplementary Materials

Author Contributions

Conflicts of Interest

References

- Alesina, Alberto, Carlo Favero, and Francesco Giavazzi. 2012. The Output Effect of Fiscal Consolidations; NBER Working Paper 18336; Cambridge, MA, USA: National Bureau of Economic Research.

- Alessi, Lucia, Matteo Barigozzi, and Marco Capasso. 2011. Non-fundamentalness in structural econometric models: A review. International Statistical Review 79: 16–47. [Google Scholar] [CrossRef]

- Arias, Jonas, Juan Rubio-Ramirez, and Daniel Waggoner. 2014. Inference Based on SVARs Identified with Sign and Zero Restrictions: Theory and Applications. Working Paper. Federal Reserve Bank of Atlanta: No. 2014-1. Atlanta, GA, USA. [Google Scholar]

- Auerbach, Alan J., and Yuriy Gorodnichenko, eds. 2012. Fiscal Multipliers in Recession and Expansion. In Alberto Alesina and Francesco Giavazzi. Fiscal Policy after the Financial Crisis. Chicago: University of Chicago Press, pp. 63–98. [Google Scholar]

- Auerbach, Alan J., and Yuriy Gorodnichenko. 2014. Fiscal Multipliers in Japan; No. w19911; Cambridge, MA, USA: National Bureau of Economic Research.

- Bai, Jushan, and Serena Ng. 2002. Determining the Number of Factors in Approximate Factor Models. Econometrica 70: 191–221. [Google Scholar] [CrossRef]

- Basile, Raffaella, Bruno Chiarini, Giovanni De Luca, and Elisabetta Marzano. 2016. Fiscal multipliers and unreported production: Evidence for Italy. Empirical Economics 51: 877–96. [Google Scholar] [CrossRef]

- Beaudry, Paul, Deokwoo Nam, and Jian Wang. 2011. Do Mood Swings Drive Business Cycles and Is It Rational? NBER Working Papers; Cambridge, MA, USA: National Bureau of Economic Research.

- Belke, Ansgar, and Florian Verheyen. 2013. Doomsday for the euro area: Causes, variants and consequences of breakup. International Journal of Financial Studies 1: 1–15. [Google Scholar] [CrossRef] [Green Version]

- Bénétrix, Agustın S., and Philip R. Lane. 2013. Fiscal Shocks and the Real Exchange Rate. International Journal of Central Banking 9: 1–32. [Google Scholar]

- Bernanke, Ben S., Jean Boivin, and Piotr Eliasz. 2005. Measuring the effects of monetary policy: A factor-augmented vector autoregressive (FAVAR) approach. Quarterly Journal of Economics 120: 387–422. [Google Scholar]

- Blanchard, Olivier, and Roberto Perotti. 2002. An Empirical Characterization of the Dynamic Effects of Changes in Government Spending and Taxes on Output. The Quarterly Journal of Economics 117: 1329–68. [Google Scholar] [CrossRef]

- Cavallari, Lilia, and Simone Romano. 2017. Fiscal policy in Europe: The importance of making it predictable. Economic Modelling 60: 81–97. [Google Scholar] [CrossRef]

- Celasun, Oya, R. Gaston Gelos, and Alessandro Prati. 2004. Obstacles to disinflation: What is the role of fiscal expectations? Economic Policy 19: 441–81. [Google Scholar] [CrossRef]

- Chian Koh, Wee. 2016. Fiscal multipliers: New Evidence from a Large Panel of Countries. Oxford Economic Papers 69: 569–90. [Google Scholar] [CrossRef]

- Christiano, Lawrence, Martin Eichenbaum, and Sergio Rebelo. 2011. When Is the Government Spending Multiplier Large? Journal of Political Economy 119: 78–121. [Google Scholar] [CrossRef]

- Cimadomo, Jacopo, and Agnès Bénassy-Quéré. 2012. Changing patterns of fiscal policy multipliers in Germany, the UK and the US. Journal of Macroeconomics 34: 845–73. [Google Scholar] [CrossRef]

- Corsetti, Giancarlo, Andre Meier, and Gernot J. Müller. 2012. What determines government spending multipliers? Economic Policy 27: 521–65. [Google Scholar] [CrossRef]

- De Cos, Pablo Hernández, and Enrique Moral-Benito. 2016. Fiscal multipliers in turbulent times: The case of Spain. Empirical Economics 50: 1589–625. [Google Scholar] [CrossRef]

- Dees, Stephane, and Jochen Guntner. 2014. The International Dimension of Confidence Shocks. ECB Working Paper Series, No. 1669; Frankfurt, Germany: European Central Bank. [Google Scholar]

- Demyanyk, Yuliya, Elena Loutskina, and Daniel Murphy. 2016. Does Fiscal Stimulus Work When Recessions Are Caused by Too Much Private Debt? Economic Commentary. Cleveland: Federal Reserve Bank of Cleveland, August. [Google Scholar]

- Erceg, Christopher J., and Jesper Linde. 2013. Fiscal consolidation in a currency union: Spending cuts vs. tax hikes. Journal of Economic Dynamics and Control 37: 422–45. [Google Scholar] [CrossRef]

- Eggertson, Gauti. 2008. Great Expectations and the End of the Depression. American Economic Review 98: 1476–516. [Google Scholar] [CrossRef]

- Eggertson, Gauti, Andrea Ferrero, and Andrea Raffo. 2014. Can Structural Reforms Help Europe? Journal of Monetary Economics 61: 2–22. [Google Scholar] [CrossRef]

- Eggertson, Gauti, and Michael Woodford. 2003. The Zero Bound on Interest Rates and Optimal Monetary Policy. Brookings Papers on Economic Activity 1: 139–211. [Google Scholar] [CrossRef]

- Fatas, Antonio, and Ilian Mihov. 2001. The Effects of Fiscal Policy on Consumption and Employment: Theory and Evidence. CEPR Discussion Paper, No. 2760. London, UK: Centre for Economic Policy Research (CEPR). [Google Scholar]

- Fisher, Irving. 1933. The debt-deflation theory of the Great Depression. Econometrica 1: 337–57. [Google Scholar] [CrossRef]

- Forni, Mario, and Luca Gambetti. 2010. Fiscal foresight and the effects of government spending. In Mimeo. Modena: University of Modena, Barcelona: University Autonoma de Barcelona. [Google Scholar]

- Forni, Mario, Domenico Giannone, Marco Lippi, and Lucrezia Reichlin. 2009. Opening the Black Box: Structural Factor Models with Large Cross-Sections. Econometric Theory 25: 1319–47. [Google Scholar] [CrossRef]

- Giavazzi, Francesco, and Marco Pagano. 1990. Can severe fiscal contractions be expansionary? Tales of two small European countries. NBER Macroeconomics Annual 5: 75–111. [Google Scholar] [CrossRef]

- Giordano, Raffaela, Sandro Momigliano, Stefano Neri, and Roberto Perotti. 2007. The effects of fiscal policy in Italy: Evidence from a VAR model. European Journal of Political Economy 23: 707–33. [Google Scholar] [CrossRef]

- Joyce, Michael, Matthew Tong, and Robert Woods. 2011. The United Kingdom’s Quantitative Easing Policy: Design Operation and Impact. London, UK: Bank of England Quarterly Bulletin. [Google Scholar]

- Caldara, Dario, and Christophe Kamps. 2008. What are the Effects of Fiscal Policy Shocks? A VAR-based Comparative Analysis, ECB Working Paper No. 877. Frankfurt, Germany: European Central Bank. [Google Scholar]

- Kataryniuk, Iván, and Javier Vallés. 2017. Fiscal Consolidation after the Great Recession: The Role of Composition. Oxford Economic Papers. [Google Scholar] [CrossRef]

- Kilian, Lutz. 1998. Small-sample confidence intervals for impulse response functions. Review of Economics and Statistics 80: 218–30. [Google Scholar] [CrossRef]

- Lippi, Marco, and Lucrezia Reichlin. 1993. The Dynamic Effects of Aggregate Demand and Supply Disturbances: Comment. American Economic Review 83: 644–52. [Google Scholar]

- Cottarelli, Carlo, Philip Gerson, and Abdelhak Senhadji, eds. 2014. Post-Crisis Fiscal Policy. In Aiko Mineshima, Marcos Poplawski-Ribeiro, and Anke Weber. Size of fiscal multipliers. Cambridge: The MIT Press, pp. 315–72. [Google Scholar]

- Mountford, Andrew, and Harald Uhlig. 2009. What are the effects of fiscal policy shocks? Journal of Applied Econometrics 24: 960–92. [Google Scholar] [CrossRef]

- Nickel, Christiane, and Andreas Tudyka. 2014. Fiscal Stimulus in Times of High Debt: Reconsidering Multipliers and Twin Deficits. Journal of Money, Credit and Banking 46: 1313–44. [Google Scholar] [CrossRef]

- O’Rourke, Kevin H., and Alan M. Taylor. 2013. Cross of Euros. Journal of Economic Perspectives 27: 167–92. [Google Scholar] [CrossRef]

- Owyang, Michael T., Valerie A. Ramey, and Sarah Zubairy. 2013. Are Government Spending Multipliers Greater during Periods of Slack? Evidence from 20th Century Historical Data, NBER Working Paper, 18769; Cambridge, MA, USA: National Bureau of Economic Research.

- Perotti, Roberto. 2004. Estimating the Effects of Fiscal Policy in OECD Countries. IGIER Working Paper, No. 276. Milan, Italy: IGIER. [Google Scholar]

- Ramey, Valerie A. 2011. Identifying government spending shocks: It’s all in the timing. Quarterly Journal of Economics 126: 1–50. [Google Scholar] [CrossRef]

- Stock, James, and Mark Watson. 1998. Diffusion Indexes; NBER Working Papers No. 6702; Cambridge, MA, USA: National Bureau of Economic Research.

- Stock, James, and Mark Watson. 2002. Macroeconomic Forecasting Using Diffusion Indexes. Journal of Business and Economic Statistics 20: 147–62. [Google Scholar] [CrossRef]

- Stock, James, and Mark Watson. 2005. Implications of Dynamic Factor Models for VAR Analysis; NBER Working Papers, No. 11467; Cambridge, MA, USA: National Bureau of Economic Research.

- Stock, James, and Mark Watson. 2006. Forecasting with many predictors. Handbook of Economic Forecasting 1: 515–54. [Google Scholar]

- Uhlig, Harald. 2010. Some fiscal calculus. The American Economic Review 100: 30–34. [Google Scholar] [CrossRef]

- Woodford, Michael. 2003. Interest and Prices: Foundations of a Theory of Monetary Policy. Princeton: Princeton University Press. [Google Scholar]

| 1 | For example “Madeira’s Missing Yachts Turn Into Lesson on Europe Debt Crisis”, Bloomberg News, 10 January 2012 (Portugal), “Crisis draws squatters to Spain’s empty buildings”, Reuters, 28 May 2012 (Spain), “What’s the matter with Italy?”, BBC News, 28 December 2011 (Italy). |

| 2 | Note that throughout the paper the use of “a shock on government consumption” or “a fiscal shock” are used interchangeably. It should be underlined that, contrary to what many papers suggest, the effects from a shock to government consumption should not be characterised as multipliers. This is because the actual implementation of a fiscal change requires that the change is held constant throughout the year and is zero afterwards, and thus is not suitable for a persistent shock. |

| 3 | The use of the sentiment index at a higher frequency could perhaps provide another interesting path for further understanding the effects of business confidence shocks on the economy. While this is a very intriguing question, we leave the use of higher frequency indices in a quarterly model under other specifications (such as MiDAS framework) for future research. |

| 4 | Foresight issues have also been dealt with through the use of the “narrative method”, which however suffers from the subjectiveness in the selection of the “news” variable (see (Ramey 2011) and (Owyang et al. 2013) for a detailed view of the methodology). |

| 5 | The principal component method employed for the estimation of factors implies that the cross-correlation between error terms in tends to zero as the number of series in

(i.e., N) becomes large (Stock and Watson 2002).

|

| 6 | The results presented in Section 3 remain qualitatively similar under different variable orderings. |

| 7 | It should be mentioned that even though the shock is one-off, we find that the response of government spending to a shock in itself is highly persistent. The same result was also documented in Blanchard and Perotti (2002). |

| 8 | Bootstrap results can be presented upon request. |

| 9 | In addition, we have also estimated a version of the model where government spending has been replaced with the change in government debt, with no material changes in the results. |

| Panel a: GDP | ||||||

| Timing | Germany | Italy | The Netherlands | Portugal | Spain | Average |

| 1st Quarter | −0.31 | 0.05 | −0.14 | −0.19 | −0.06 | −0.13 |

| 4th Quarter | −0.61 | −0.38 | −0.02 | −0.81 | −0.12 | −0.39 |

| 17th Quarter | −0.35 | −1.13 | −0.82 | −1.40 | −0.89 | −0.92 |

| Panel b: Tax revenue | ||||||

| 1st Quarter | −0.46 | −0.17 | −0.13 | −0.19 | −0.23 | −0.24 |

| 4th Quarter | −0.40 | −0.40 | −0.19 | −0.10 | −0.38 | −0.29 |

| 17th Quarter | −0.30 | −0.52 | −0.40 | −0.45 | −0.59 | −0.45 |

| Panel c: CPI | ||||||

| 1st Quarter | −0.21 | −0.56 | 0.14 | 0.34 | 0.12 | −0.03 |

| 4th Quarter | −0.41 | −0.73 | −0.56 | −0.58 | 0.71 | −0.31 |

| 17th Quarter | −0.55 | −0.74 | −1.16 | −1.90 | 0.43 | −0.78 |

| Panel d: Interest rate | ||||||

| 1st Quarter | −0.09 | −0.14 | −0.05 | −0.02 | 0.39 | 0.02 |

| 4th Quarter | −0.12 | 0.30 | −0.44 | 0.17 | 0.58 | 0.10 |

| 17th Quarter | −0.16 | −0.55 | −1.10 | 0.13 | 0.40 | −0.26 |

| Panel a: GDP | ||||||

| Timing | Germany | Italy | The Netherlands | Portugal | Spain | Average |

| 1st Quarter | −0.32 | −0.26 | −0.21 | −0.14 | −0.15 | −0.22 |

| 4th Quarter | −1.32 | −1.30 | −1.32 | −1.17 | −0.99 | −1.22 |

| 17th Quarter | −1.21 | −1.22 | −1.51 | −1.10 | −1.51 | −1.31 |

| Panel b: Tax revenue | ||||||

| 1st Quarter | −0.23 | −0.16 | −0.41 | −0.26 | −0.41 | −0.29 |

| 4th Quarter | −0.44 | −0.23 | −0.54 | −0.41 | −0.76 | −0.48 |

| 17th Quarter | −0.27 | −0.27 | −0.68 | −0.34 | −0.74 | −0.46 |

| Panel c: CPI | ||||||

| 1st Quarter | −0.97 | −0.96 | −0.10 | −0.53 | −0.25 | −0.56 |

| 4th Quarter | −1.96 | −2.06 | −0.32 | −1.73 | −1.21 | −1.46 |

| 17th Quarter | −1.87 | −2.37 | −0.76 | −1.68 | −1.57 | −1.65 |

| Panel d: Interest rate | ||||||

| 1st Quarter | −1.38 | −0.08 | −1.19 | −0.18 | −0.39 | −0.64 |

| 4th Quarter | −1.39 | −0.60 | −1.42 | −0.97 | −0.40 | −0.96 |

| 17th Quarter | −1.23 | −0.37 | −1.81 | −1.22 | 0.07 | −0.91 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Michail, N.A.; Savva, C.S.; Koursaros, D. Size Effects of Fiscal Policy and Business Confidence in the Euro Area. Int. J. Financial Stud. 2017, 5, 26. https://doi.org/10.3390/ijfs5040026

Michail NA, Savva CS, Koursaros D. Size Effects of Fiscal Policy and Business Confidence in the Euro Area. International Journal of Financial Studies. 2017; 5(4):26. https://doi.org/10.3390/ijfs5040026

Chicago/Turabian StyleMichail, Nektarios A., Christos S. Savva, and Demetris Koursaros. 2017. "Size Effects of Fiscal Policy and Business Confidence in the Euro Area" International Journal of Financial Studies 5, no. 4: 26. https://doi.org/10.3390/ijfs5040026