Investigating the Influence of Green Credit on Operational Efficiency and Financial Performance Based on Hybrid Econometric Models

Abstract

:1. Introduction

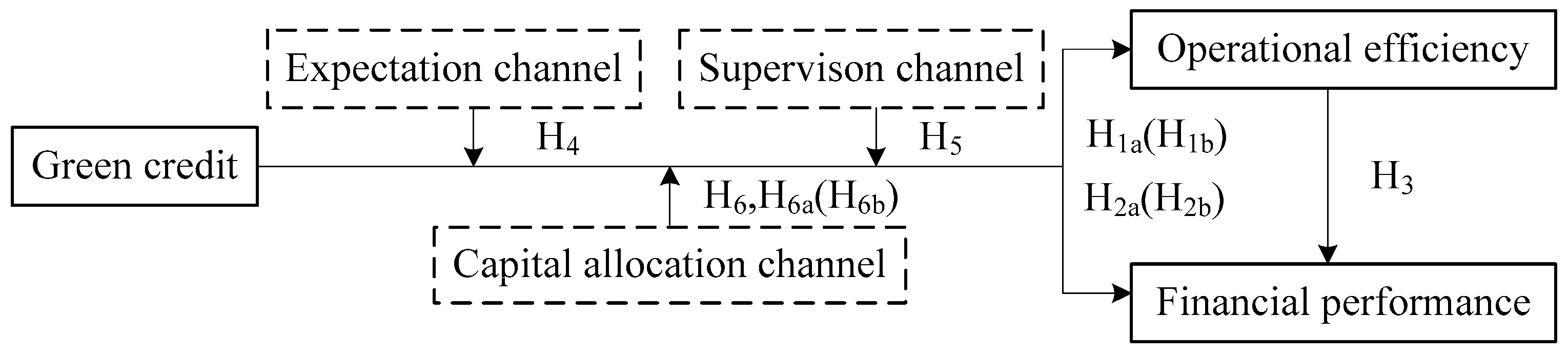

2. Hypotheses Development

2.1. The Supporting Role of Green Credit on Energy-Saving and Environmental Enterprises

2.2. Expectation Channel Hypothesis

2.3. Supervision Channel Hypothesis

2.4. Capital Allocation Channel Hypothesis

3. Design of Hybrid Econometric Models

3.1. Operational Efficiency Evaluation Based on Stochastic Frontier Analysis

3.2. Financial Performance Evaluation Based on the Grey Correlation Method

3.3. Examining the Influence of Green Credit Based on Dynamic Panel Data Models

4. Data Sources and Preliminary Analysis

5. Empirical Results Analysis

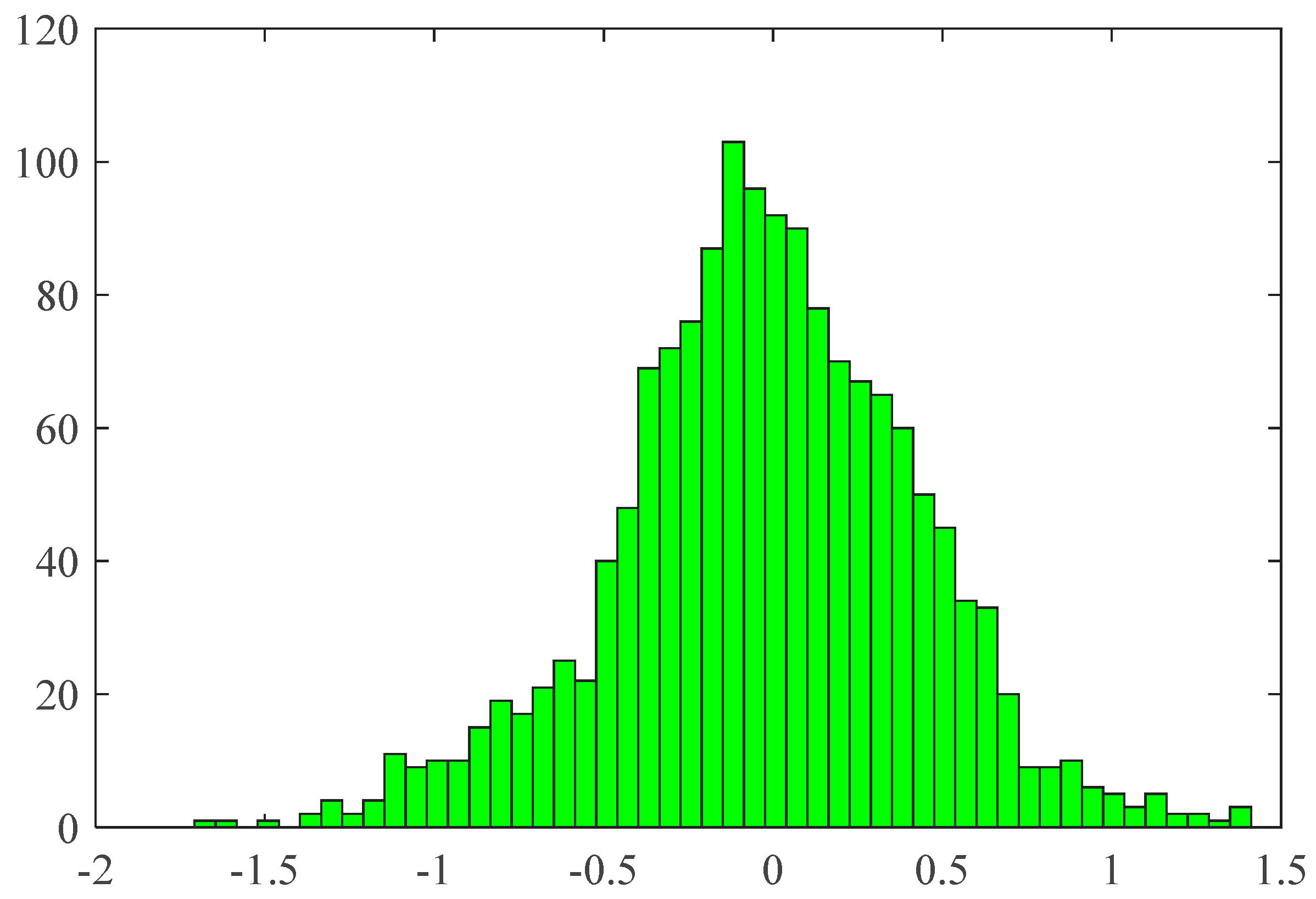

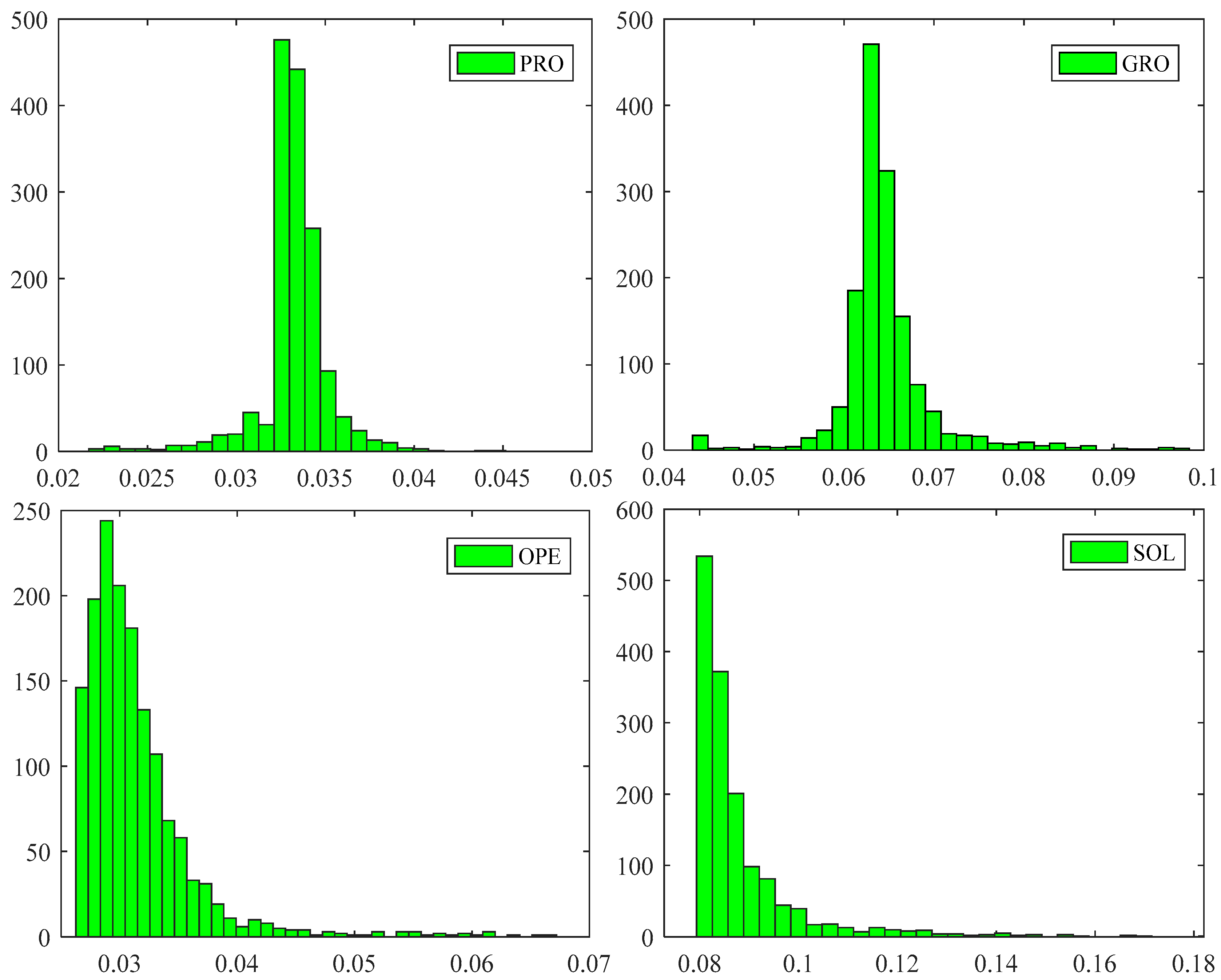

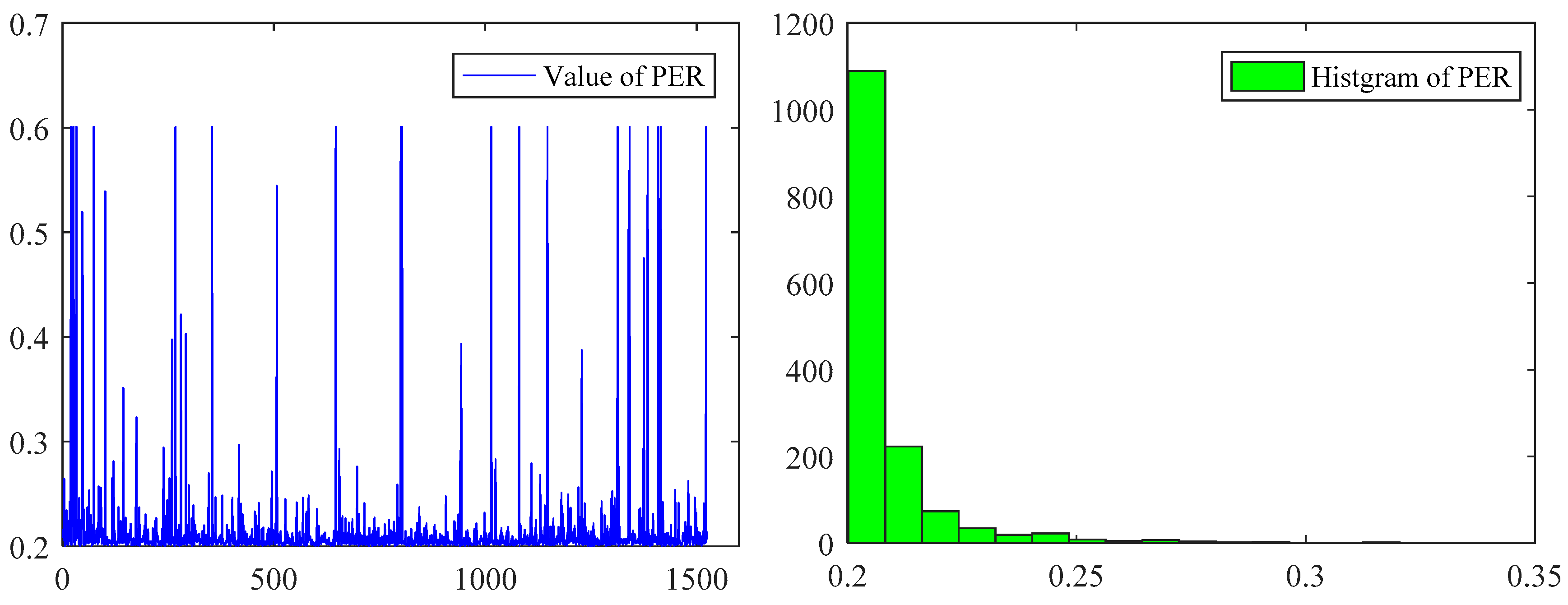

5.1. Evaluation Results of Financial Performance and Operational Efficiency

5.2. Specific Models and Hypotheses Tests

6. Policy Implications

- (1)

- Establish effective measures to strengthen the supporting role of green credit. A green economy with low energy consumption, low emissions, and low pollution levels has become an inevitable trend of economic development. It is necessary to establish effective incentive and restraint mechanisms to promote the driving force for green credit implementation. First, commercial banks could develop attractive green loan products with favourable interest rates to reduce the operating cost for energy-saving and environmental corporations. For example, commercial banks could generalize the experience of the ICBC (Industrial and Commercial Bank of China), which gives preferential loans and subsidies to support the green economy. Second, punishments or restraints should also be executed for those enterprises that cause damage to the environment. To avoid the phenomenon of bad money driving out good money, it is necessary to revise the current law and to clearly define green credit participators' rights and responsibilities. Meanwhile, the capital market and other financial markets could add the condition of using the green loan efficiently when the enterprise issues new shares or bonds. By establishing incentive and restraint mechanisms, green credit could be used more widely, and the enterprise’s financial performance and operational efficiency could also be enhanced.

- (2)

- Increase the content of information disclosure and improve public expectations. First, the enterprises should conduct voluntary disclosure. They can report the environmental costs and social performance indicators, thus making the public aware of what and how the enterprises are doing. This type of information disclosure is helpful for improving the public expectations of those enterprises. Second, the State Environmental Protection Department and banking supervisory departments should provide regular monitoring results to the public; the authorities' information could also be helpful for improving public expectations towards green related industries. Third, the supervisory departments and other government departments should increase the channels for green and environmental enterprises to report their performance, thus attracting more attention from the public to those enterprises. With the enhancement of expectation levels, more financial support and social resources could be brought to those enterprises.

- (3)

- Place the role of supervision of green credit on enterprises’ internal governance and operations. First, enterprise managers are supposed to focus on debt risk management, reduce unnecessary costs and inhibit overinvestment. Second, the supervisory role of green credit could be realized by optimizing the credit business process. Commercial banks or independent third parties could audit the green credit business and evaluate the green credit risk more strictly, thus executing more pressure on the enterprise managers to improve operational efficiency and financial performance. Third, commercial banks should also be more concerned about post-loan management. They could require the enterprise to report more details about the usage of the green credit and financial performance. As soon as they find potential problems with poor operations or environmental risk, the banks could take some early-warning measures and supervise the enterprises in improving their operations.

- (4)

- Enhance the R&D ability and core competence of the energy-saving and environmental enterprises. To spread the benefits of green credit and play a supporting role in the use of green credit, it is essential to develop technology for energy savings and emissions reduction. Enterprises should promote scientific cooperation with universities, and they could also establish their own R&D institutions and absorb advanced technology to boost their capability for technological innovation. Enterprises should also make full use of the policies issued by the government. In recent years, the central government as well as local governments has promulgated a series of fiscal and tax policies to support green credits and enterprises related to environmental protection. To cultivate their endogenous development ability, enterprises should take advantage of those policies and obtain external support as much as possible.

7. Conclusions

Acknowledgments

Author Contribution

Conflicts of Interest

Appendix A

| Symbols | Economic Meaning (Unit) | Computation Method |

|---|---|---|

| pro1 | Net profit margin (%) | (Net Income/operation income) × 100% |

| pro2 | Gross profit margin (%) | (Gross profit/operation income) × 100% |

| pro3 | Return on assets (%) | (Net income/average total assets) × 100% |

| pro4 | Return on equity (%) | (Net income/shareholder equity) × 100% |

| pro5 | Earnings per share(Chinese Yuan) | ((Profit-preferred dividends)/weighted average common shares) × 100% |

| gro1 | Growth rate of earnings per share (%) | ((Earning per share at t + 1 year-Earning per share at t year)/Earning per share at t year) × 100% |

| gro2 | Growth rate of operating revenue (%) | ((Operating revenue at t + 1 year-operating revenue at t year)/operating revenue at t year) × 100% |

| gro3 | Growth rate of operating profit (%) | ((operating profit at t + 1 year-operating profit at t year)/operating profit at t year) × 100% |

| gro4 | Growth rate of total assets (%) | ((total assets at t + 1 year-total assets at t year)/total assets at t year) × 100% |

| gro5 | Growth rate of net assets (%) | ((total assets at t + 1 year-total assets at t year)/total assets at t year) × 100% |

| gro6 | Growth rate of per share cash flow from operations (%) | ((per share cash flow from operations at t + 1 year-per share cash flow from operations at t year)/per share cash flow from operations at t year) × 100% |

| ope1 | Operating cycle | inventory turnover days + Receivables Turnover days |

| ope2 | Inventory turnover ratio | Sales cost/average inventory |

| ope3 | Receivables turnover ratio | Net receivable sales/average net receivables |

| ope4 | Current assets turnover ratio | Operating revenue/current assets |

| ope5 | Fixed assets turnover ratio | Operating revenue/fixed assets |

| ope6 | Total assets turnover ratio | Operating revenue/average total assets |

| sol1 | Current ratio | Current assets/current liabilities |

| sol2 | Quick ratio | Liquidity assets/current liabilities |

| sol3 | Conservative quick ratio | (cash + short term security + notes receivable + net accounts receivable)/current liability |

| sol4 | Debt asset ratio | Total liabilities/total assets |

| sol5 | Equity ratio | Shareholders’ equity/total assets |

| opcost | Operation cost | Operation cost/10 million Chinese Yuan |

| sloan | Short term loan | Short term loan/10 million Chinese Yuan |

| lloan | Long term loan | Long term loan/10 million Chinese Yuan |

| debt | Total debt | Total debt/10 million Chinese Yuan |

| rers | Expenditure on research and development | Expenditure on research and development/10 million Chinese Yuan |

| roninc | R&D expense ratio (%) | (Expenditure on R&D/Operation income) × 100% |

| equity | Total investors equity | Total investors equity/10 million Chinese Yuan |

| sharatio | Shareholding ratio of largest 10 major shareholders (%) | (Share held by top 10 shareholder/Total shares) × 100% |

| neprof | Net profit | Net profit/10 million Chinese Yuan |

| opinc | operating revenue | operating revenue/10 million Chinese Yuan |

| sasset | Total current assets | Total current assets/10 million Chinese Yuan |

| fiasset | Fixed assets | Fixed assets/10 million Chinese Yuan |

| scost | Selling expenses | Selling expenses/10 million Chinese Yuan |

| macost | Managing costs | Managing costs/10 million Chinese Yuan |

| ficost | Financing expenses | Financing expenses/10 million Chinese Yuan |

| noemp | Number of total employees | Number of total employees/10 thousands |

Appendix B

| Variable | Mean | S.D | Min | Max | Variable | Mean | S.D | Min | Max |

|---|---|---|---|---|---|---|---|---|---|

| pro1 | 6.54 | 16.15 | −100.00 | 100.00 | sol3 | 1.18 | 1.09 | 0.10 | 5.68 |

| pro2 | 21.68 | 12.05 | −15.00 | 55.00 | sol4 | 0.03 | 0.02 | 0.01 | 0.20 |

| pro3 | 5.57 | 6.14 | −20.28 | 31.62 | sol5 | 1.58 | 1.76 | 0.12 | 10.00 |

| pro4 | 6.20 | 14.92 | −109.00 | 114.00 | opcost | 78.41 | 346.80 | −5.32 | 6563.00 |

| pro5 | 0.31 | 0.48 | −1.35 | 1.87 | sloan | 11.36 | 33.92 | 0.00 | 498.80 |

| gro1 | −59.09 | 467.40 | −3001.00 | 1000.00 | lloan | 16.42 | 84.31 | 0.00 | 1456.00 |

| gro2 | 17.17 | 35.81 | −79.09 | 300.38 | debt | 76.46 | 228.59 | 0.00 | 3007.00 |

| gro3 | 3.47 | 191.34 | −574.38 | 700.58 | rers | 1.91 | 3.34 | 0.00 | 83.71 |

| gro4 | 17.21 | 24.15 | −72.89 | 103.42 | roninc | 7.05 | 0.00 | 7.05 | 7.05 |

| gro5 | 15.84 | 35.38 | −123.00 | 155.51 | equity | 45.69 | 126.75 | −27.25 | 2109.00 |

| gro6 | 56.79 | 367.84 | −1500.00 | 1600.00 | sharatio | 56.14 | 17.23 | 0.00 | 94.44 |

| ope1 | 0.01 | 0.01 | 0.00 | 0.08 | neprof | 4.73 | 25.03 | −59.87 | 400.70 |

| ope2 | 7.07 | 8.09 | 0.43 | 51.41 | opinc | 81.59 | 356.84 | 0.01 | 6614.00 |

| ope3 | 17.56 | 36.02 | 0.30 | 209.52 | sasset | 50.75 | 164.04 | 0.00 | 2699.00 |

| ope4 | 1.46 | 1.05 | 0.30 | 6.73 | fiasset | 41.26 | 131.33 | 0.00 | 1955.00 |

| ope5 | 3.72 | 4.27 | 0.20 | 23.18 | scost | 3.05 | 20.15 | 0.00 | 400.70 |

| ope6 | 0.64 | 0.41 | 0.10 | 2.40 | macost | 4.00 | 13.60 | 0.07 | 242.80 |

| sol1 | 1.74 | 1.44 | 0.11 | 7.83 | ficost | 1.59 | 5.65 | −4.77 | 88.88 |

| sol2 | 1.34 | 1.19 | 0.15 | 6.27 | noemp | 0.53 | 1.34 | 0.00 | 19.60 |

References

- Abdel Aleem, Shady H. E., Ahmed F. Zobaa, and Hala M. Abdel Mageed. 2015. Assessment of energy credits for the enhancement of the Egyptian Green Pyramid Rating System. Energy Policy 87: 407–16. [Google Scholar] [CrossRef]

- Bajo, Emanuele, Thomas J. Chemmanur, Karen Simonyan, and Hassan Tehranian. 2016. Underwriter networks, investor attention, and initial public offerings. Journal of Financial Economics 122: 376–408. [Google Scholar] [CrossRef]

- Barry, Christopher B., and Vassil T. Mihov. 2015. Debt financing, venture capital, and the performance of initial public offerings. Journal of Banking & Finance 58: 144–65. [Google Scholar]

- Cairns, Robert D., and Pierre Lasserre. 2006. Implementing carbon credits for forests based on green accounting. Ecological Economics 56: 610–21. [Google Scholar] [CrossRef]

- Campello, Murillo. 2006. Debt financing: Does it boost or hurt firm performance in product markets? Journal of Financial Economics 82: 135–72. [Google Scholar] [CrossRef]

- Carraro, Carlo, Alice Favero, and Emanuele Massetti. 2012. Investments and public finance in a green, low carbon, economy. Energy Economics 34: S15–S28. [Google Scholar] [CrossRef]

- Chang, T. C., and S. J. Lin. 1999. Grey relation analysis of carbon dioxide emissions from industrial production and energy uses in Taiwan. Journal of Environmental Management 56: 247–57. [Google Scholar] [CrossRef]

- Chava, Sudheer, and Amiyatosh Purnanandam. 2011. The effect of banking crisis on bank-dependent borrowers. Journal of Financial Economics 99: 116–35. [Google Scholar] [CrossRef]

- Chen, Shu-Heng, and Chia-Hsuan Yeh. 1997. Toward a computable approach to the efficient market hypothesis: An application of genetic programming. Journal of Economic Dynamics and Control 21: 1043–63. [Google Scholar] [CrossRef]

- Criscuolo, Chiara, and Carlo Menon. 2015. Environmental policies and risk finance in the green sector: Cross-country evidence. Energy Policy 83: 38–56. [Google Scholar] [CrossRef]

- Davydov, Denis. 2016. Debt structure and corporate performance in emerging markets. Research in International Business and Finance 38: 299–311. [Google Scholar] [CrossRef]

- Dobre, Elena, Georgiana Oana Stanila, and Laura Brad. 2015. The Influence of Environmental and Social Performance on Financial Performance: Evidence from Romania’s Listed Entities. Sustainability 7: 2513–53. [Google Scholar] [CrossRef]

- Eisenbach, Sebastian, Dirk Schiereck, Julian Trillig, and Paschen Flotow. 2014. Sustainable Project Finance, the Adoption of the Equator Principles and Shareholder Value Effects. Business Strategy and the Environment 23: 375–94. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1970. Efficient capital markets: A review of the theory and empirical work. The Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1988. Permanent and temporary components of stock prices. Journal of Political Economy 96: 246–73. [Google Scholar] [CrossRef]

- Gao, Lei, and Bin Mei. 2013. Investor attention and abnormal performance of timberland investments in the United States. Forest Policy and Economics 28: 60–65. [Google Scholar] [CrossRef]

- Gul, Ferdinand A., and Judy S. L. Tsui. 1997. A test of the free cash flow and debt monitoring hypotheses: Evidence from audit pricing. Journal of Accounting and Economics 24: 219–37. [Google Scholar] [CrossRef]

- House of Commons Environmental Audit Committee. 2015. Green Finance: Twelfth Report of Session 2013–2014. Available online: http://www.parliament.uk/business/committees/committees-a-z/commons-select/environmental-audit-committee/publications/?type=&session=1&sort=false&inquiry=all (accessed on 23 February 2017).

- Jandik, Tomas, and Anil K. Makhija. 2005. Debt, debtstructure and corporate performance after unsuccessful takeovers: Evidence from targets that remain independent. Journal of Corporate Finance 11: 882–914. [Google Scholar] [CrossRef]

- Jia, Xiaoliang, Haizhong An, Wei Fang, Xiaoqi Sun, and Xuan Huang. 2015. How do correlations of crude oil prices co-move? A grey correlation-based wavelet perspective. Energy Economics 49: 588–98. [Google Scholar] [CrossRef]

- Jin, Suk Ho, Suk Jae Jeong, and Kyung Sup Kim. 2017. A Linkage Model of Supply Chain Operation and Financial Performance for Economic Sustainability of Firm. Sustainability 9: 139. [Google Scholar] [CrossRef]

- Kellogg, David, and John M. Charnes. 2000. Real-options valuation for a biotechnology company. Financial Analysts Journal 56: 76–84. [Google Scholar] [CrossRef]

- Kocmanová, Alena, Marie Pavláková Dočekalová, Stanislav Škapa, and Lenka Smolíková. 2016. Measuring Corporate Sustainability and Environmental, Social, and Corporate Governance Value Added. Sustainability 8: 945. [Google Scholar] [CrossRef]

- Kot, Hung Wan, and Lewis H. K. Tam. 2016. Are stock price more informative after dual-listing in emerging markets? Evidence from Hong Kong-listed Chinese companies. Pacific-Basin Finance Journal 36: 31–45. [Google Scholar] [CrossRef]

- Lee, Chien-Chiang, Jun-De Lee, and Chi-Chuan Lee. 2010. Stock prices and the efficient market hypothesis: Evidence from a panel stationary test with structural breaks. Japan and the World Economy 22: 49–58. [Google Scholar] [CrossRef]

- Lewis, Craig M., Richard J. Rogalski, and James K. Seward. 2001. The long-run performance of firms that issue convertible debt: An empirical analysis of operating characteristics and analyst forecasts. Journal of Corporate Finance 7: 447–74. [Google Scholar] [CrossRef]

- Li, Wenjing, and Xiaoyan Lu. 2015. Does institutional investor care firm environmental performance? Evidence from the most polluting Chinese listed firms. Journal of Financial Research 38: 97–112. [Google Scholar]

- Linnenluecke, Martina K., Tom Smith, and Brent McKnight. 2016. Environmental finance: A research agenda for interdisciplinary finance research. Economic Modelling 59: 124–30. [Google Scholar] [CrossRef]

- Liu, Jing-Yu, Yan Xia, Ying Fan, Shih-Mo Lin, and Jie Wu. 2015. Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. Journal of Cleaner Production 163: 293–302. [Google Scholar] [CrossRef]

- Liu, J. J., Jie Fu, and Dan-NingJi. 2017. Political connection, debt maturity and corporate investment efficiency. Modern Finance and Economics-Journal of Tianjin University of Finance and Economics 37: 90–103. [Google Scholar]

- Luo, Changqing, and Zisheng Ouyang. 2014. Estimating IPO Pricing Efficiency by Bayesian Stochastic Frontier Analysis: The ChiNext Market Case. Economic Modelling 40: 152–57. [Google Scholar] [CrossRef]

- Milionis, Alexandros E. 2007. Efficient capital markets: A statistical definition and comments. Statistics & Probability Letters 77: 607–13. [Google Scholar]

- Modigliani, Franco, and Merton H. Miller. 1958. The cost of capital, corporation finance and the theory of investment. The American Economic Review 48: 261–97. [Google Scholar]

- Ng, Thiam Hee, and Jacqueline Yujia Tao. 2016. Bond financing for renewable energy in Asia. Energy Policy 95: 509–17. [Google Scholar] [CrossRef]

- Park, Cheol. 2000. Monitoring and structure of debt contracts. The Journal of Finance 55: 2157–95. [Google Scholar] [CrossRef]

- Park, Kwangmin, and Soo Cheong (Shawn) Jang. 2013. Capital structure, free cash flow, diversification and firm performance: A holistic analysis. International Journal of Hospitality Management 33: 51–63. [Google Scholar] [CrossRef]

- Shen, Kao-Yi. 2017. Compromise between Short- and Long-Term Financial Sustainability: A Hybrid Model for Supporting R&D Decisions. Sustainability 9: 375. [Google Scholar] [CrossRef]

- Steffen, Will, Paul J. Crutzen, and John R. McNeill Ambio. 2007. The Anthropocene: Are humans now overwhelming the great forces of nature. AMBIO 36: 614–21. [Google Scholar] [CrossRef]

- Tamanini, Jeremy. 2017. The Global Green Economy Index (GGEI) 2016. Available online: http://dualcitizeninc.com/GGEI-2016.pdf (accessed on 25 May 2017).

- Urquhart, Andrew, and Frank McGroarty. 2016. Are stock markets really efficient? Evidence of the adaptive market hypothesis. International Review of Financial Analysis 47: 39–49. [Google Scholar] [CrossRef]

- Wang, Yao, and Qiang Zhi. 2016. The Role of Green Finance in Environmental Protection: Two Aspects of Market Mechanism and Policies. Energy Procedia 104: 311–16. [Google Scholar] [CrossRef]

- Wörsdörfer, Manuel. 2015. Equator Principles: Bridging the Gap between Economics and Ethics? Business and Society Review 120: 205–43. [Google Scholar] [CrossRef]

- Xu, Xiang-Yi, and Xin Li. 2008. Free cash flow, debt financing and corporate over-investment: An empirical research of Chinese listed companies. Soft Science 22: 124–27, 139. [Google Scholar]

- Zhang, Bing, Yan Yang, and Jun Bi. 2011. Tracking the implementation of green credit policy in China: Top-down perspective and bottom-up reform. Journal of Environmental Management 92: 1321–27. [Google Scholar] [CrossRef] [PubMed]

- Zhuang, Xiaoyang, Yu Wei, and Feng Ma. 2015. Multifractality, efficiency analysis of Chinese stock market and its cross-correlation with WTI crude oil price. Physica A Statistical Mechanics & Its Applications 430: 101–13. [Google Scholar]

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| PRO | 1524 | 0.033 | 0.002 | 0.022 | 0.065 |

| GRO | 1524 | 0.066 | 0.012 | 0.043 | 0.129 |

| OPE | 1524 | 0.032 | 0.007 | 0.026 | 0.079 |

| SOL | 1524 | 0.091 | 0.023 | 0.079 | 0.238 |

| PER | 1524 | 0.215 | 0.049 | 0.200 | 0.601 |

| Variables | Coef. | Std. Err. | z | p > |z| | [95% Conf. Interval] | |

|---|---|---|---|---|---|---|

| Half normal model | sasset | 0.026 | 0.004 | 6.82 | 0.000 | [0.018, 0.033] |

| fiasset | 0.024 | 0.002 | 11.4 | 0.000 | [0.020, 0.028] | |

| noemp | −1.984 | 0.236 | −8.39 | 0.000 | [−2.447, −1.521] | |

| opcost | 0.055 | 0.002 | 29.98 | 0.000 | [0.051, 0.058] | |

| Truncated normal | sasset | 0.026 | 0.004 | 6.82 | 0.000 | [0.051, 0.058] |

| fiasset | 0.024 | 0.002 | 11.40 | 0.000 | [0.020, 0.028] | |

| noemp | −1.984 | 0.236 | −8.39 | 0.000 | [−2.447, −1.521] | |

| opcost | 0.055 | 0.002 | 29.98 | 0.000 | [0.051, 0.058] |

| Variables | Model I | Model II(a) | Model II(b) | |||

|---|---|---|---|---|---|---|

| Coef. | Z (p > |z|) | Coef. | Z (p > |z|) | Coef. | Z (p > |z|) | |

| PERt−1 | 0.456 | 9.36(0.000) | / | / | / | / |

| sloant | −0.000 | −0.50(0.620) | 0.000 | 0.20(0.839) | / | / |

| lloant | −0.000 | −0.06(0.955) | 0.000 | 3.00(0.003) | 0.000 | 3.28(0.001) |

| fiassett | −0.000 | −0.49(0.621) | −0.000 | −2.52(0.012) | −0.000 | −4.40(0.000) |

| sharatiot | 0.000 | 1.30(0.194) | 0.000 | 2.04(0.041) | 0.000 | 2.07(0.039) |

| OEt | 1.215 | 0.14(0.005) | 3.499 | 6.64(0.000) | 3.261 | 6.75(0.000) |

| PROt−1 | / | / | 0.217 | 2.39(0.017) | 0.223 | 2.32(0.02) |

| constant | 0.055 | 0.70(0.431) | 0.190 | 2.42(0.015) | 0.186 | 2.66(0.008) |

| AR(1) | / | −1.82(0.067) | / | −2.161(0.031) | / | −2.17(0.029) |

| AR(2) | / | 1.31(0.189) | / | 1.64(0.104) | / | 1.63(0.103) |

| Sargon test | / | 28.27(0.397) | / | 13.23(0.430) | / | 12.37(0.495) |

| Variables | Model III | Model IV | Model V | |||

|---|---|---|---|---|---|---|

| Coef. | Z (p > |z|) | Coef. | Z (p > |z|) | Coef. | Z (p > |z|) | |

| sloant | −0.000 | −0.26(0.792) | 0.000 | 1.41(0.158) | −0.000 | −0.94(0.345) |

| lloant | 0.000 | 0.18(0.856) | −0.000 | −0.74(0.458) | −0.000 | −0.36(0.719) |

| fiassett | 0.000 | 0.72(0.469) | 0.000 | 0.52(0.604) | −0.000 | −0.61(0.541) |

| sharatiot | 0.000 | 0.90(0.369) | −0.000 | −0.86(0.388) | 0.000 | 1.58(0.113) |

| OEt | 1.775 | 0.51(0.003) | 0.517 | 0.65(0.004) | 1.296 | 0.38(0.004) |

| GROt | −0.099 | −1.47(0.141) | / | / | / | / |

| OPEt | / | / | 0.624 | 8.17(0.000) | / | / |

| SOLt | / | / | / | / | 0.535 | 11.49(0.000) |

| constant | 0.061 | 0.65(0.518) | 0.043 | 0.91(0.363) | −0.003 | −0.10(0.923) |

| AR(1) | / | −4.35(0.000) | / | −2.09(0.036) | / | −2.44(0.015) |

| AR(2) | / | −0.14(0.660) | / | −0.82(0.407) | / | 1.68(0.092) |

| Sargon test | / | 28.41(0.390) | / | 26.40(0.496) | / | 29.13(0.355) |

| Variables | ModelVI | Model VII(a) | Model VII(b) | |||

|---|---|---|---|---|---|---|

| Coef. | Z (p > |z|) | Coef. | Z (p > |z|) | Coef. | Z (p > |z|) | |

| CARt−1 | −0.128 | −4.03(0.000) | −0.127 | −3.99(0.000) | −0.118 | −3.75(0.000) |

| sloant | −0.002 | −1.40(0.162) | −0.002 | −1.39(0.165) | / | / |

| lloant | −0.001 | 0.71(0.480) | −0.001 | 0.56(0.572) | / | / |

| pert | 0.382 | 0.64(0.525) | / | / | / | / |

| fiassett | −0.000 | −0.17(0.868) | −0.000 | −0.23(0.818) | / | / |

| sharatiot | −0.003 | −1.38(0.168) | −0.003 | −1.27(0.203) | / | / |

| OEt | 89.397 | 0.70(0.485) | 77.437 | 0.59(0.556) | / | / |

| PROt | / | / | 0.163 | 0.02(0.987) | / | / |

| GROt | / | / | 1.159 | 2.32(0.020) | 1.172 | 2.42(0.015) |

| OPEt | / | / | −14.424 | −0.85(0.393) | / | |

| SOLt | / | / | −0.740 | −0.50(0.617) | / | / |

| constant | −6.796 | −2.25(0.025) | 2.698 | 6.25(0.804) | 0.110 | 1.20(0.231) |

| AR(1) | −2.13(0.033) | −4.58(0.000) | −4.63(0.000) | |||

| AR(2) | −1.08(0.280) | 1.02(0.308) | −0.91(0.363) | |||

| Sargon test | 26.23(0.506) | 29.45(0.339) | 28.97(0.362) | |||

| Variables | Model VIII(a) | Model VIII(b) | ||

|---|---|---|---|---|

| Coef. | Z (p > |z|) | Coef. | Z (p > |z|) | |

| sloant | −0.000 | 8.51(0.000) | −0.000 | 8.55(0.000) |

| lloant | −0.000 | 3.45(0.001) | −0.000 | 3.51(0.000) |

| fiassett | 0.000 | −2.81(0.005) | 0.000 | −2.79(0.005) |

| sharatiot | −0.000 | 0.15(0.879) | / | / |

| OEt−1 | 0.273 | 2.38(0.017) | 0.265 | 2.35(0.019) |

| constant | 0.071 | 3.38(0.001) | 0.072 | 3.35(0.001) |

| AR(1) | 0.73(0.465) | 0.73(0.466) | ||

| AR(2) | −1.21(0.226) | −1.21(0.227) | ||

| Sargon test | 35.29(0.132) | 35.33(0.131) | ||

| sloant | lloant | fiassett | sharatiot | Constant | AR(1) | AR(2) | Sargon Test | |

|---|---|---|---|---|---|---|---|---|

| Model IX(a) | −0.002(0.69) | 0.002(0.00) | 0.007(0.00) | 0.007(0.21) | 1.341(0.01) | −4.58(0.00) | 1.02(0.308) | 35.28(0.132) |

| Model IX(b) | / | 0.002 (0.00) | 0.008(0.00) | / | −1.963(0.43) | −1.19(0.23) | −0.98(0.32) | 37.25(0.091) |

| Model X(a) | Model X(b) | Model XI(a) | Model XI(b) | Model XII | Model XIII(a) | Model XIII(b) | |

|---|---|---|---|---|---|---|---|

| sloant | 0.023(0.088) | 0.023(0.082) | −0.007(0.435) | / | 0.006(0.008) | 1.363(0.000) | 1.268(0.000) |

| lloant | 0.001(0.919) | / | −0.017(0.012) | −0.018(0.009) | 0.008(0.081) | 0.578(0.000) | 0.517(0.000) |

| fiassett | 0.015(0.005) | 2.84(0.005) | 0.042(0.000) | 0.041(0.000) | 0.025(0.000) | −0.064(0.268) | / |

| sharatiot | −0.014(0.424) | / | −0.008(0.500) | / | 0.025(0.000) | −0.012(0.954) | / |

| scostt−1 | 0.879(0.000) | 0.879(0.000) | / | / | / | ||

| macostt−1 | 0.823(0.000) | 0.823(0.000) | / | / | |||

| ficostt−1 | / | 0.260(0.000) | / | ||||

| opcost | / | / | 0.939(0.000) | 0.936(0.000) | |||

| constant | 0.248(0.751) | −0.193(0.430) | −0.225(0.573) | −0.149(0.774) | −0.365(0.285) | −8.243(0.042) | −6.796(0.025) |

| AR(1) | −1.18(0.235) | −1.19(0.236) | −0.523(0.601) | −0.682(0.547) | −1.097(0.273) | −2.146(0.032) | −2.132(0.033) |

| AR(2) | −0.99(0.324) | −0.99(0.324) | −1.028(0.304) | −1.029(0.304) | −0.808(0.419) | −1.081(0.279) | −1.081(0.279) |

| Sargon test | 28.79(0.496) | 28.98(0.362) | 29.50(0.337) | 27.75(0.424) | 38.08(0.077) | 27.44(0.440) | 27.58( 0.433) |

| Hypothesis | Conclusion |

|---|---|

| H1a: Green credits can increase the enterprises’ operational efficiency. | Not verified |

| H1b: Green credits can decrease the enterprises’ operational efficiency. | Not verified |

| H2a: Green credits can increase the enterprises’ financial performance. | Partly supported |

| H2b: Green credits can decrease the enterprises’ financial performance. | Not verified |

| H3: A higher operational efficiency leads to a higher financial performance. | Partly supported |

| H4: The impact of green credit is realized by the expectation channel. | Not verified |

| H5: The impact of green credit is realized by the supervision channel. | Not verified |

| H6: The impact of green credit is realized by the capital allocation channel. | Partly supported |

| H6a: Increased R&D and other expenditure promote the enterprise performance. | Partly supported |

| H6b: Increased R&D and other expenditure decrease the enterprise performance. | Not verified |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, C.; Fan, S.; Zhang, Q. Investigating the Influence of Green Credit on Operational Efficiency and Financial Performance Based on Hybrid Econometric Models. Int. J. Financial Stud. 2017, 5, 27. https://doi.org/10.3390/ijfs5040027

Luo C, Fan S, Zhang Q. Investigating the Influence of Green Credit on Operational Efficiency and Financial Performance Based on Hybrid Econometric Models. International Journal of Financial Studies. 2017; 5(4):27. https://doi.org/10.3390/ijfs5040027

Chicago/Turabian StyleLuo, Changqing, Siyuan Fan, and Qi Zhang. 2017. "Investigating the Influence of Green Credit on Operational Efficiency and Financial Performance Based on Hybrid Econometric Models" International Journal of Financial Studies 5, no. 4: 27. https://doi.org/10.3390/ijfs5040027

APA StyleLuo, C., Fan, S., & Zhang, Q. (2017). Investigating the Influence of Green Credit on Operational Efficiency and Financial Performance Based on Hybrid Econometric Models. International Journal of Financial Studies, 5(4), 27. https://doi.org/10.3390/ijfs5040027