1.1. Overview of the Research

In this paper, we investigate the evolution and heterogeneity of commodities from a quality perspective. Therefore, it is critical to have an abstract representation of this evolutionary process,

i.e., a representation of commodities and their changes over time. Conventional economic theory, which is very much quantity-oriented, does not offer a quality-oriented representation of commodities and the changes therein, so we resolve this by using a modular representation. (Some earlier related works using a different representation, namely, Kauffman’s NK landscape model, will be briefly reviewed in

Section 1.3.)

This modular representation was inspired by Herbert Simon’s work on near decomposability or modularity [

1]. Modularity refers to a structural relationship between a system as a whole and the constituent components, which can function as independent entities. It is a key to harnessing a possibly unbounded complex system. Simon [

1] was probably one of the most influential pioneers inspiring many follow-up works in various scientific disciplines [

2]. (Simon may never have used the term modularity, while his notion of near decomposability was frequently renamed modularity in the literature [

3], and Simon did not seem to object to this different name [

2]. Of course, one has to pay particular attention to the fine difference between the two. In particular, modules, as manifested in many concrete applications, may be viewed as only parts of near-decomposable systems. They serve as the elementary units, which are fully decomposable and fully encapsulated and upon which near decomposable (weakly-interacting) systems can be built.) In addition to near decomposability, Simon viewed hierarchy as a general principle of complex structures. He advocated the use of a hierarchical measure—the number of successive levels of hierarchical structuring in a system—to define and measure complexity; furthermore, he argued that hierarchy emerges almost inevitably through a wide variety of evolutionary processes, for the simple reason that hierarchical structures are stable.

Our modular representation naturally allows for a hierarchical representation of a commodity, which can then explicitly manifest the quality of the commodity (see

Section 1.2 for an illustration). The hierarchical modular representation of a commodity can be interpreted as an explicit layout of a production process, which combines various raw and intermediary materials using different processors at different stages and at different times.

In order to understand the changes in the hierarchical-modular commodities in a dynamic context, we will need the fundamental driving force from the demand side. This requires us to have a preference and utility theory that is compatible with the hierarchical representation of the commodity. Not surprisingly, the quantity-oriented microeconomic theory does not leave room for such a development. We need to search for a new foundation for the evolutionary process of the hierarchical products.

It turns out that, to have a compatible preference theory, we also need a modular representation of preferences. The assumption that preferences also have a hierarchical modular structure is less evident than that for a commodity. While modularity in the brain and mind has recently been extensively studied [

4,

5,

6,

7,

8,

9], whether the claim of a modular brain or mind implies the claim of a modular preference is still an issue to be addressed. Without empirical grounds, [

10] proposed three conditions required for a well-behaved modular preference: monotonicity, synergy and consistency [

10]. If the preference can be given a modular structure, then the utility of consuming a specific commodity can be calculated using the module matching algorithm, which we propose in this stage of the research. Furthermore, the aforementioned synergy condition can lead to a utility function, which has increasing marginal utility in quality. This last property seems to be the backbone of the value-added-oriented service economy.

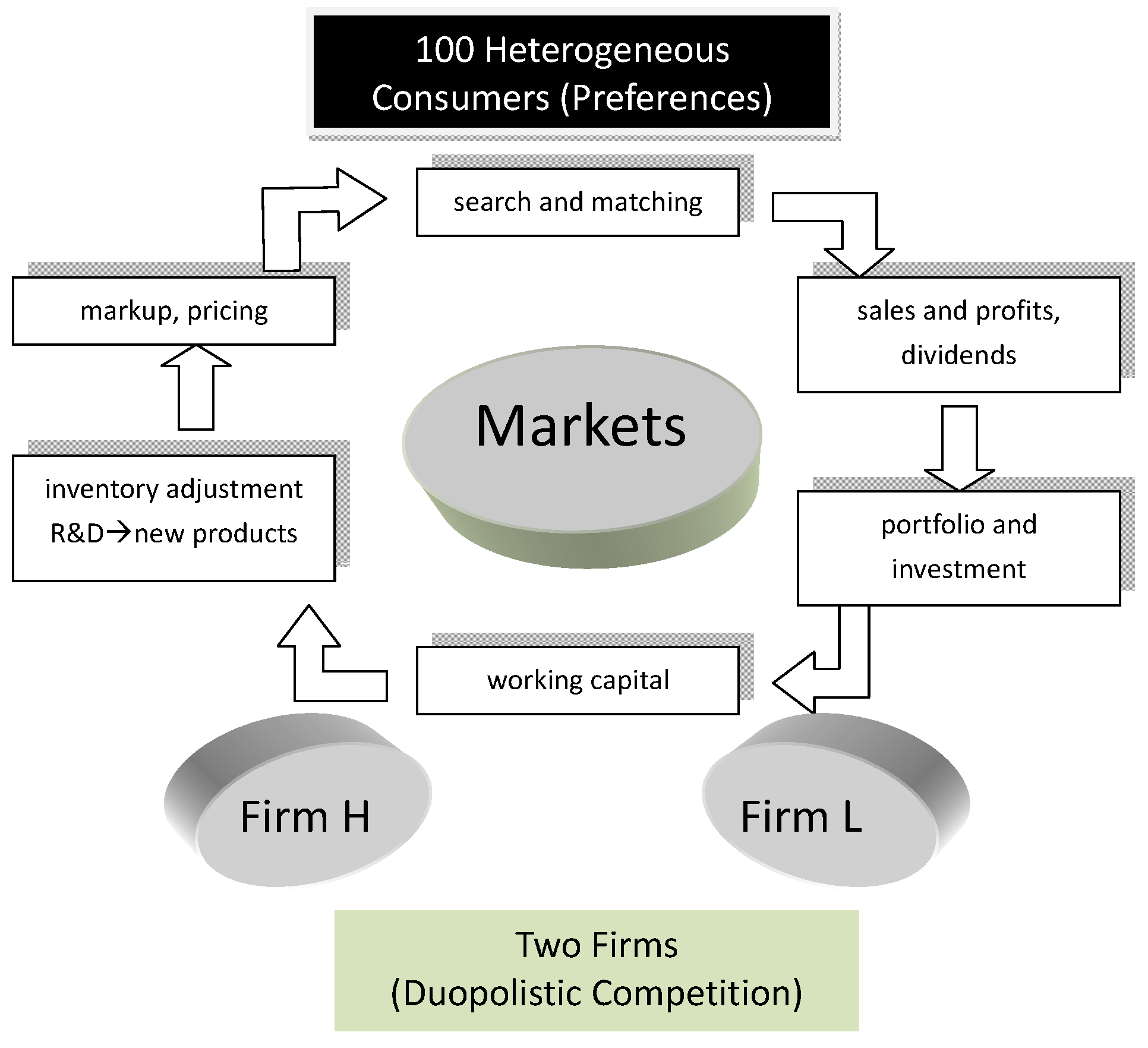

The next two elements are firms that produce these commodities and the markets where demand meets supply. In addition to product diversification, the firms in this modular production framework need to decide on product quality (the hierarchical content of the commodity) and the efforts devoted to the development of new products. Without R&D, the above choices become rather superficial; therefore, the searching behavior (R&D) for new and good products also becomes a transparent part of the model. In this stage, our demand-supply model (a market model) of a quality-oriented economy is ready, and we call it the modular economy.

Technically, the modular economy relies on a formalization quite different from the ones used in conventional mathematical economics. Rather than real analysis, this new formalization relies more on formal language theory, such as context-free grammar, and combinatorics. (The representation of the preference and the production (commodity) space can be constructed using the theory of formal languages, for example, the Backus–Nauer form (BNF) of grammars invented by John Backus (1924–2007). The class of languages described by the BNF, including recursively defined non-terminals, is equivalent to the context-free languages (Chomsky’s Type 2 languages). The well-known Chomsky hierarchy of languages, established by Noam Chomsky, has four types of languages. From the languages generated by the very restricted grammars to those generated by the unrestricted grammars, there are the regular languages (generated by the regular grammars), the context-free languages (by the context-free grammars), the context-sensitive languages (by the context-sensitive grammars) and the recursively enumerable languages (by the unrestricted grammars). The one generated by the more restricted grammars is a proper subset of the one generated by the less restricted grammars. In addition, based on the languages that can be accepted or recognized, there is a corresponding hierarchy of automata: the finite state automata (accepting the regular languages), the pushdown automata (the context-free languages), the linear bounded automata (the context-sensitive languages) and the Turing machines (the recursive enumerable languages). In other words, the commodities and the preferences operated in this paper are those that can be accepted by the pushdown automata. We can certainly consider the higher classes as a future direction for research. For the details of these technical backgrounds, the interested reader is referred to [

11].) Specifically, the evolutionary process of the commodities in the modular economy (the searching process for new and good-quality products) is realized through genetic programming [

12,

13].

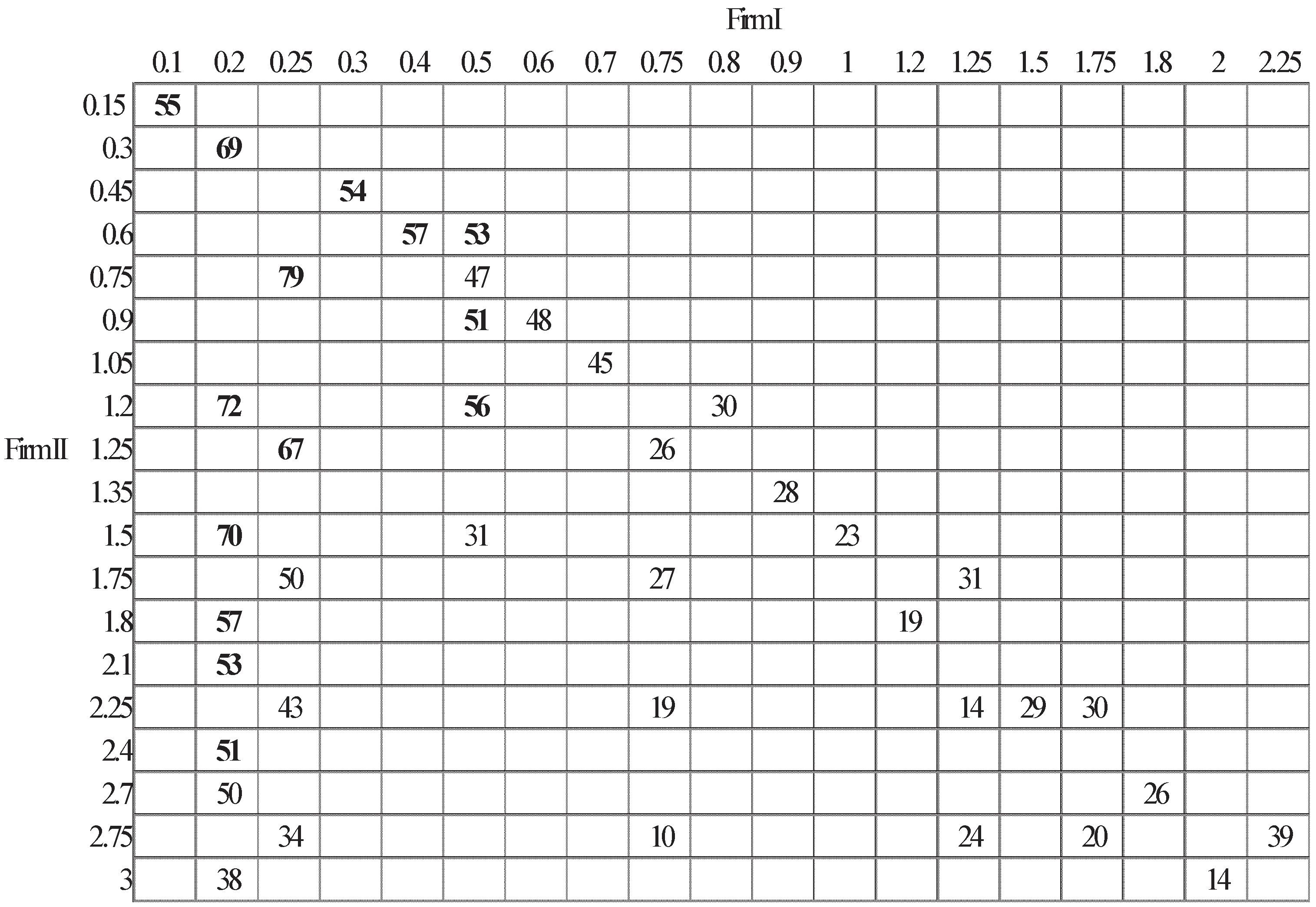

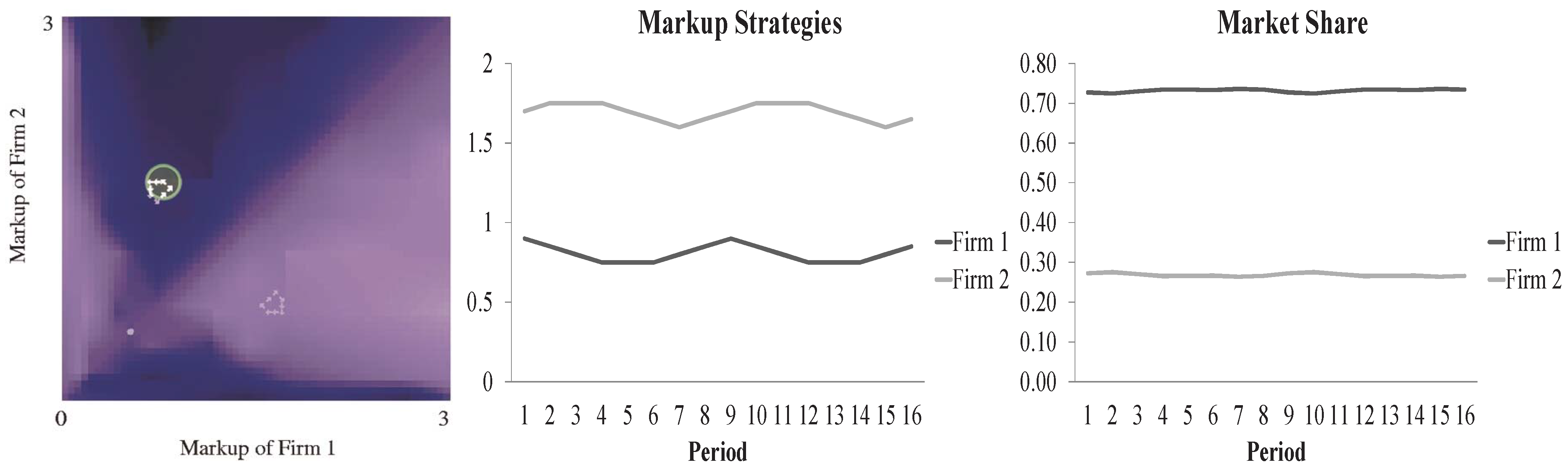

To see whether we can gain some insights from the operation of the modular economy, the aforementioned modular economy is applied to the study of price competition or non-price competition. We begin this study with a duopolistic competition market [

14]. There are two firms; each one applies a uniform markup rate to set the prices of all of the products they supply. One firm adopts a high markup rate and the other adopts a low markup rate. The research aims to see whether price competition is critical for the firms’ survival in this duopolistic competition. Through multiple runs (100 runs) of the simulation, we find that the high markup firm has competitive superiority as compared to the low markup firms. Out of these 100 runs, the high markup firm actually drives out the low markup firm 50 times, while the process also takes place in the other direction 37 times. Despite the lack of the overwhelming dominance, the result is counterintuitive, because, in a weak sense, it has violated the law of one price, or at least people would expect the result to be expressed the other way round.

Based on their observation of the simulations, Chie and Chen [

14] proposed one explanation for this puzzling result. Basically, in the modular economy, the competition among firms does not just proceed in a horizontal way, but more in a vertical way. The sophisticated products (the more hierarchical ones) may be the substitutes for the less sophisticated products (the less hierarchical ones) if the former can match the consumers’ modular preference at a higher level. In this case, the former can generate a larger synergy effect than the latter and, hence, can provide consumers with a higher utility. Nonetheless, to successfully develop this product, the firm needs a higher markup in order to generate enough revenue for R&D. Although this may not explain the whole story in the complex evolving economy, it provides the basic justification for the survival of the high markup firm with the presence of the low markup firm as its rival.

In this paper, we extend the simulation model in Chie and Chen [

14]. While the previous study shows the superiority of a high markup strategy, the simulation was performed with a fixed pair of markups. In a more realistic setting, the firm may change its markup rate in response to its competitor’s strategy under the survival pressure. This may trigger further reactions of the rival firm. This chain of reactions can lead to different sorts of dynamics as the outcome, and it is not clear

a priori which one will emerge. Would there be a fixed point in the end, so that only one markup can exist in the market and the law of one price is saved in this sense? Or, would there be limit cycles or strange attractors, so that the differences in markups can persistently exist? These are the issues that this paper shall address. Our contribution is to show the possible attractors of the co-evolving markup dynamics, which shed light on the interesting patterns observed in the empirical IO literature [

15,

16,

17,

18]. For that purpose, we also give some thought to the discovered attractors. In sum, this work extends Chie and Chen’s model [

14] by allowing the dynamically evolving markups and then examines the role of price in duopolistic competition.

The rest of the paper is organized as follows. In

Section 1.2, we use the evolution of the mobile phone to motivate the idea of the modular economy. We then present in

Section 2 the agent-based modular economy of duopolistic competition. Simulation designs are presented in

Section 3, followed by the simulation results and their analysis (

Section 4). Finally,

Section 5 provides the concluding remarks.

1.2. Hierarchical Representation of the Evolution of Mobile Phones

To motivate the idea of the modular economy, we use the well-known example of the mobile phone.

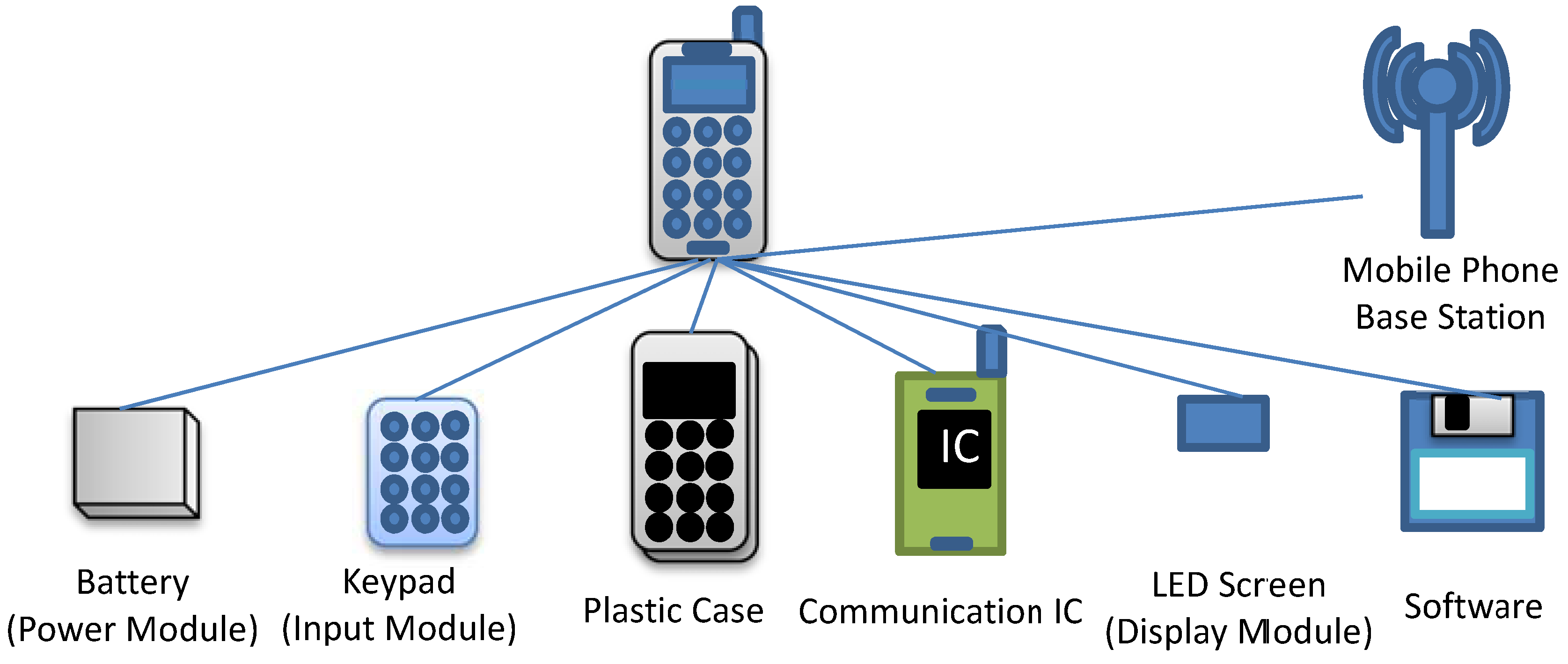

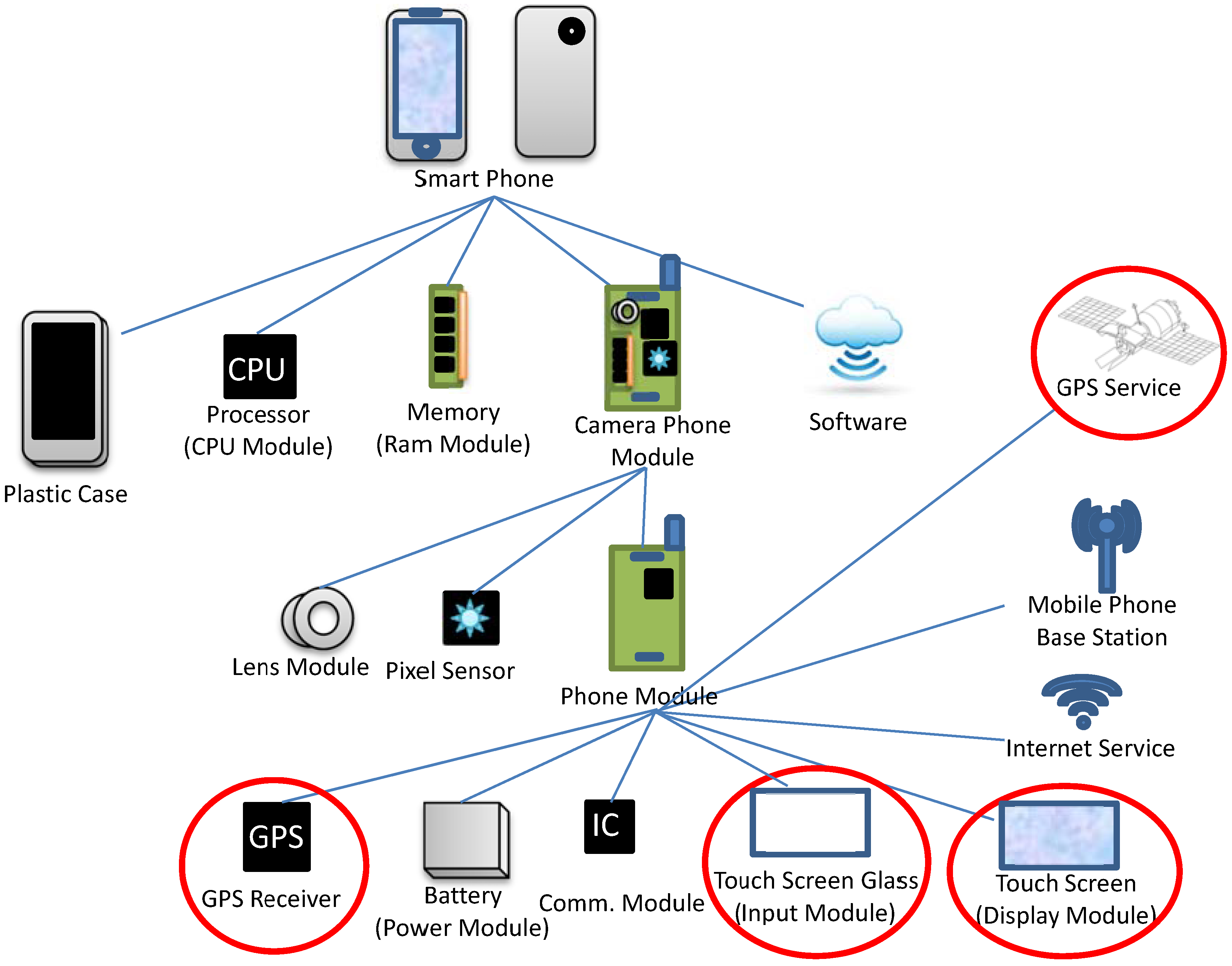

Figure 1 shows the constituent modules of a mobile phone. The battery (power model), keypad (input model), plastic case, communication IC and LED screen (the display module), shown at the bottom of

Figure 1, are considered to be the encapsulated (internal) modules and the base station (connecting or networking module) to be an internal module. One form of the evolution of the mobile phone is that one or many of its modules undergo a “mutation”. For example, in

Figure 2, a “mutation” occurs in the display module; the original black-and-white display screen is replaced by a color screen. Then, a new product emerges. At this point, the mobile phone is still just a phone. As time goes by, some modules evolve into independent modules of a two-level hierarchy and work with another independent module (camera). This synergy takes place by incorporating into the mobile phone a number of the conventional camera modules, including a lens, pixel sensor, and memory, as shown in

Figure 3. Now, we have a new product, the camera phone, a product with three levels of hierarchy, as shown in

Figure 3. Next, this camera phone serves as another independent module and is integrated with a module known as the “assistant” or “secretary” module, which has the submodules of, for example, CPU and RAM (

Figure 4). Then, this integration is accompanied by another indispensable independent module, namely, the Internet service. As a result, a new product with four levels of hierarchy, known as the PDA phone or the feature phone, emerges. In the final stage of this example, a number of the constituent modules of the feature phone are enhanced. The input module is upgraded to touch screen glass and the display module is upgraded to a touch screen. The further additions of a GPS receiver as an internal module and the GPS service as an external module make the feature phone become a smart phone (

Figure 5).

Figure 1.

Mobile phone: black and white.

Figure 1.

Mobile phone: black and white.

Figure 2.

Mobile phone: color.

Figure 2.

Mobile phone: color.

Figure 1,

Figure 2,

Figure 3,

Figure 4 and

Figure 5 give an overview of the evolution of the mobile phone, specifically expressed in terms of hierarchical modularity. The description may be rather casual, but the message delivered is quite clear. Modularity becomes the essential element that one cannot afford afford to miss, if one wants to have a reasonable representation of the evolution of the economy in terms of what is produced. A more abstract or general presentation of the evolutionary process is drawn in

Figure 6.

What appears at the top of

Figure 6 is the parse-tree representation of a consumer’s preference, which introduces the “problem” for producers. The whole parse tree corresponds to a word generated by recursively applying a number of production rules from a context-free grammar. Each of its subtrees is also a word, but with less deep recursion. The shallowest recursion is just the application of a single production rule: null →

x, where

x∈Σ and Σ is the terminal set. All of the nodes at the bottom of the tree, also called leaves, are this kind of shallowest recursion. The deeper the recursion, the bigger the subtree, and the complete tree involves the largest number of recursions compared to all of its subtrees. This recursive structure denotes the modular structure of a preference, from a very primitive preference with shallow recursion to a complex preference with deep recursion. It also indicates the growing and evolving nature of a preference.

As seen in

Section 2.3 and

Table 1, a power utility function will be used to represent this modular preference. The power utility function is used mainly for the purpose of satisfying the synergy condition (other specifications that satisfy this condition can also be employed). Taking the mobile phone as an example, the synergy effect means that the utility of a camera phone is greater than the sum of the utility of a phone and the utility of a camera. Of course, in the real economy, we would not expect this assumption to hold true for all consumers over all commodities. In other words, consumers are heterogeneous in their modular preferences (the preferences of consumers are randomly generated, and the degree of the heterogeneity of their preferences is directly controlled by the number of distinctive elements in the function set and the terminal set (to be given in

Table 1)). That is, the synergy effect applies to each consumer in different ways. Hence, camera phones may have the synergy effect for some consumers, but not for all; likewise, smart phones may have the synergy effect for some consumers, but not for all.

Figure 6.

Hierarchical representation of the evolution of an artificial commodity.

Figure 6.

Hierarchical representation of the evolution of an artificial commodity.

Table 1.

The parameter settings.

Table 1.

The parameter settings.

| Parameter | Type (Variable) | Range | Value |

|---|

| Producer |

| Number of Firms | Integer () | [1, ∞] | 2 |

| Initial Working Capital | Integer () | [0, ∞] | 100 × B(, 0.5) |

| Inventory Adjustment Rate | Real (λ) | [0, 1] | 80% |

| Markup Rate | Real (η) | [0, ∞] | Figure 7 |

| R&D Rate | Real () | [0, 1] | 1% |

| Retained Earnings | Integer () | [0, ∞] | 500 |

| Consumer |

| Number of Consumers | Integer () | [1, ∞] | 100 |

| Base of the Power Utility Function | Real | [2, ∞] | 4 |

| Consumer Income per Period | Integer (I) | [1, ∞] | 10,000 |

| Search Intensity | Real () | [0, 1] | 100% |

| Investor |

| Number of Investors | Integer () | [1, ∞] | 100 |

| Initial Budget | Integer () | [1, ∞] | 1,000 |

| Probability of ZIStrategy | Real () | [0, 1] | 20% |

| Reinvestment Ratio | Real (α) | [0, 1] | 80% |

| Investment Ceiling | Integer | [0, ∞] | 2000 |

| Time Schedule |

| Number of Rounds per Trading Day | Integer (R) | [1, ∞] | 5 |

| Number of Trading Days | Integer (T) | [1, ∞] | 5,000 |

| Genetic Programming |

| Size of Terminal Set | Integer | [1, ∞] | 5 |

| Size of Function Set | Integer | [1, ∞] | 5 |

| Crossover Rate | Real () | [0, 1] | 90% |

| Mutation Rate | Real () | [0, 1] | 80% |

| Tree Mutation Rate | Real () | [0, 1] | 50% |

Notice that the consumer himself may not know his own preference ex ante. In this case, the preference is revealed only up to the extent that there is a product that matches the preference. This has been shown in the sequence of diagrams below the consumer’s preference (tree). In each of these diagrams, one can see that a number of products, circled in red, have been successfully developed to match some subtrees of the whole preference. In this case, only these parts of the preference (the matched ones) are revealed.

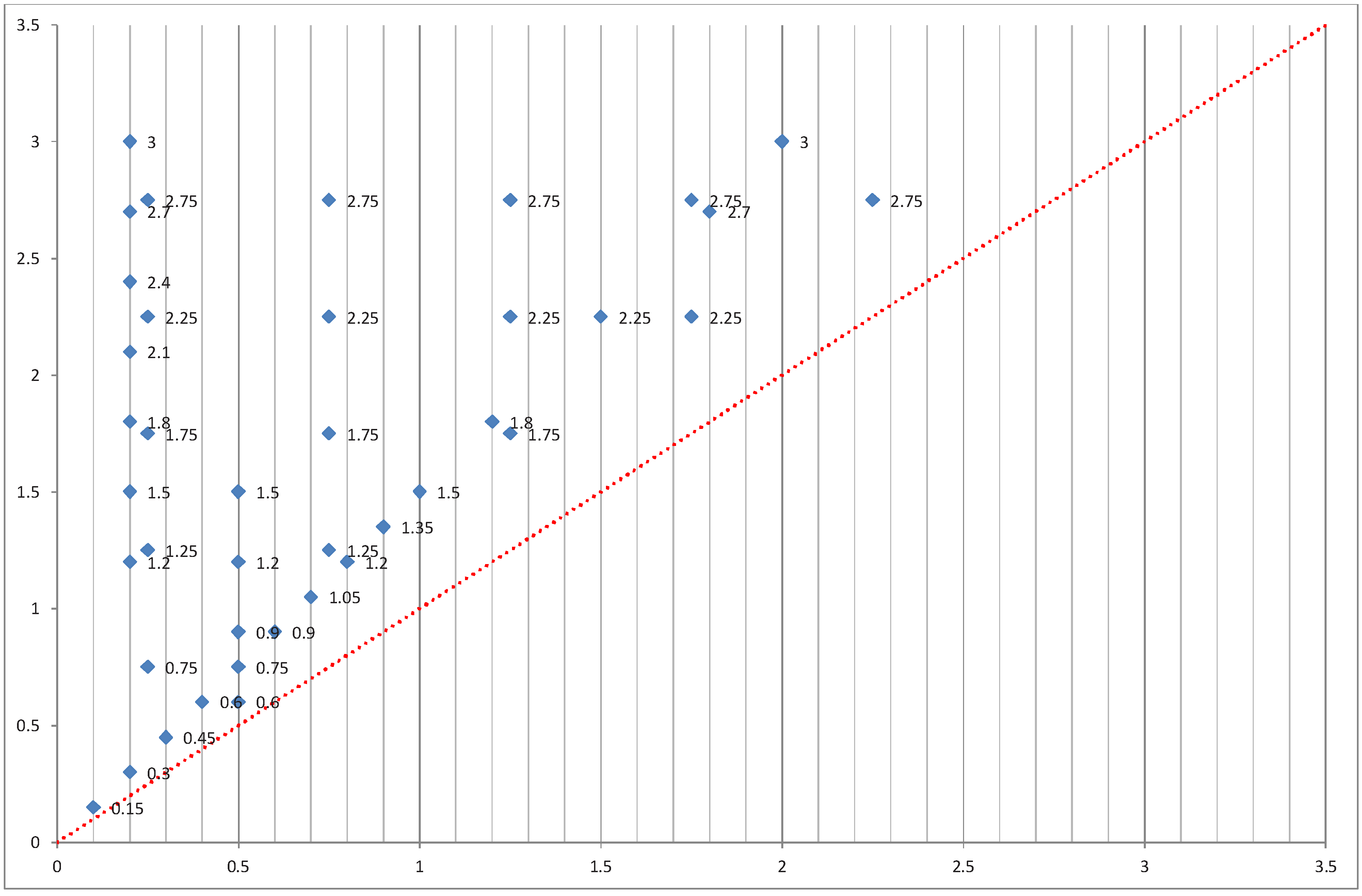

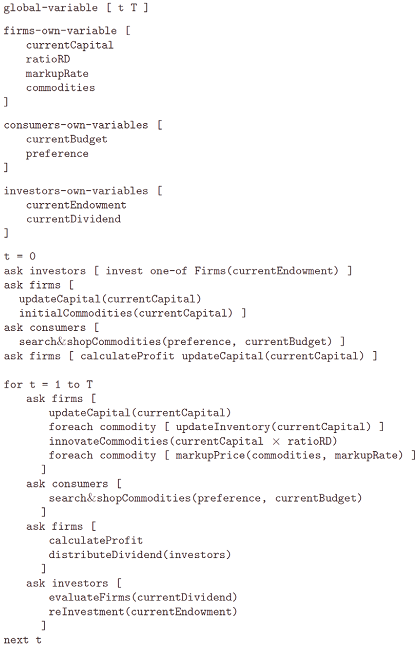

Figure 7.

Simulation designs: 40 pairs of markup rates.

Figure 7.

Simulation designs: 40 pairs of markup rates.

1.3. A Brief Remark on the NK Model

The general analytical or computational model, which is able to demonstrate the evolutionary process, as demonstrated in

Figure 6, is very limited in the literature. Based on Frenken [

19], the only available alternative is Kauffman’s NK model [

20,

21]. (For a general review of the agent-based computational models of innovation, the interested reader is referred to Dawid [

22]. However, Dawid [

22] does not include the work on the NK model. In a separate article appearing in the same volume, Chang and Harrington [

23] did give a review of the relevance of the NK models in the evolution of organizations.) In the NK model, the features or modules of a product,

i.e.,

N, and the possibility of their interactions,

i.e.,

K, are given exogenously. The evolution of the product can then be perceived as the optimal design to combine these features or modules. Various search algorithms have been proposed to find the optimal design over the landscape [

20,

21,

24,

25]. The search process itself can then be perceived as an evolutionary process.

We consider this class of models as a good starting point to approach Simon’s idea of the complex system,

i.e., near-decomposable system. We, however, are not satisfied with the NK landscape model due to the following two conceptual limitations. First, the space to embed the evolutionary process as demonstrated in

Figure 6 should, in principle, be infinite-dimensional rather than finite-dimensional. For example, it would be inconceivable to think of the evolution from the DOS system to the Windows system as just the fine-tuning of some parameters in a finite-dimensional space. Second, the features (modules) of a product in general should be part of the evolutionary process and emerge out of the process rather than being exogenously given. As in the mobile phone example, the number of features changes over time when the mobile phone evolves into the smart phone.

Technically speaking, the NK model normally represents a product with a fixed-length string with a fixed set of alphabets. This representation can capture the ideas of the modularity, but not the hierarchical ones. Our proposed tree representation is equivalent to the string representation, but with variable lengths [

26]. Therefore, the tree model is more general than the string model and can work well with the idea of the hierarchical modularity. Less formally, the evolutionary search and discovery process should include both what we know we do not know (known unknowns) and what we do not know we do not know (unknown unknowns). The NK model is more suitable for the former, but not the latter. However, for those who are familiar with Hugo in Simon’s famous story of

Apple [

27], the real-life scenarios are filled with a series of unknown unknowns.

Apple, as Simon described, is a non-technical version of [

27].