Mexican Households’ Purchases of Foods and Beverages Vary by Store-Type, Taxation Status, and SES

Abstract

:1. Introduction

2. Materials and Methods

2.1. Dataset

2.2. Statistical Analyses

3. Results

3.1. Percentage of Beverage and Food Purchases by Store-Type

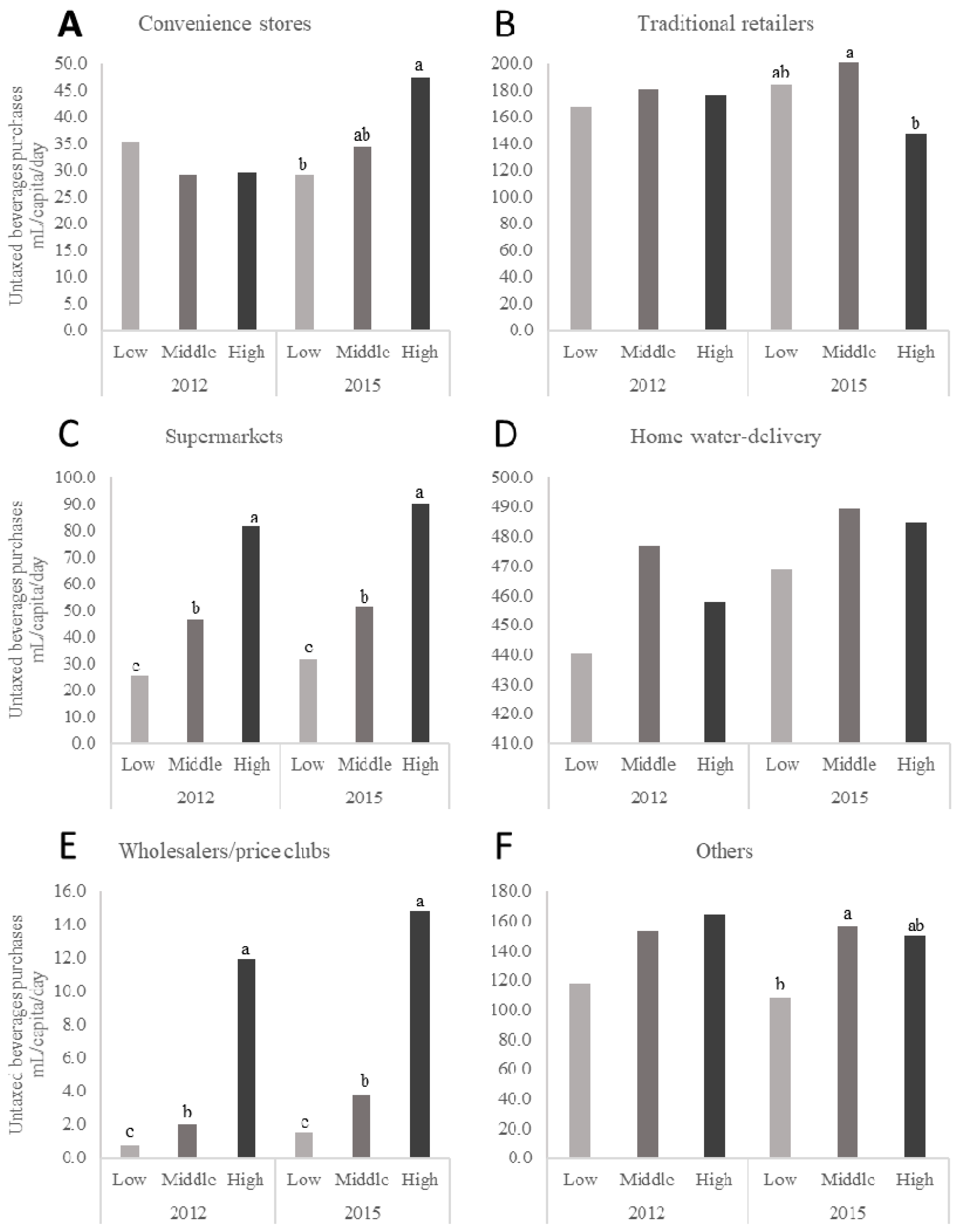

3.2. Differences in Volume Purchases of Beverages by Taxation Status and SES from 2012 to 2015

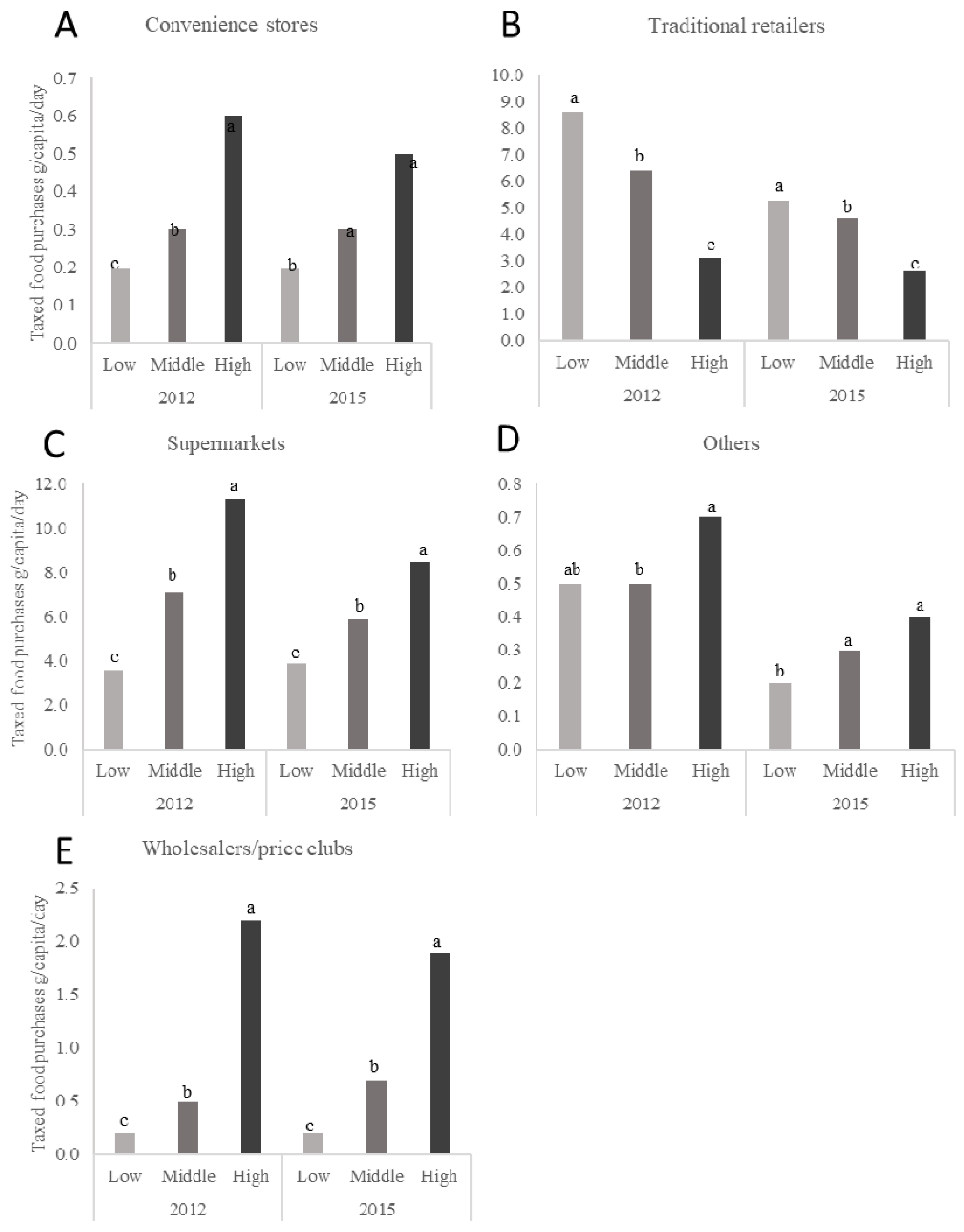

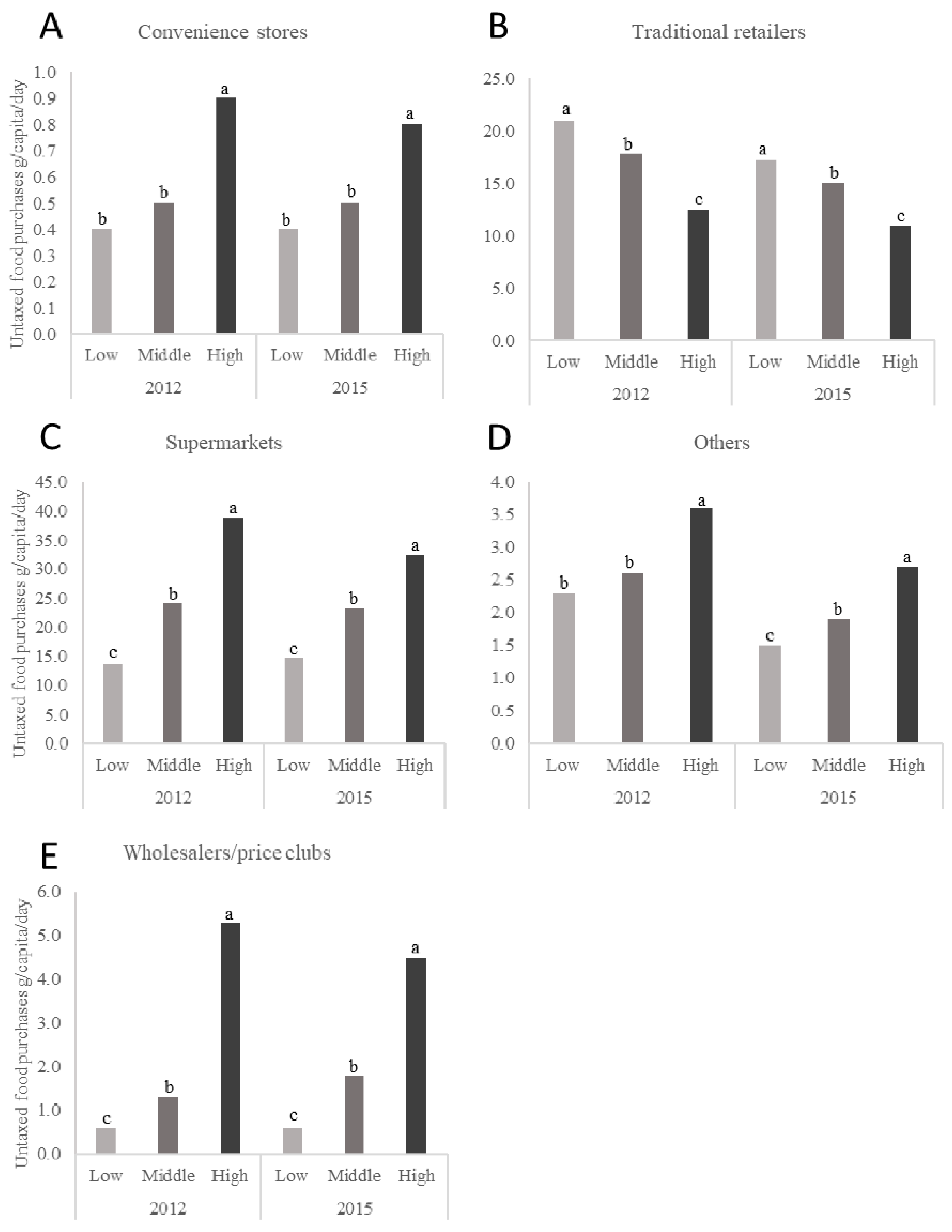

3.3. Differences in Volume Purchases of Foods by the Taxation Status and SES from 2012 to 2015

4. Discussion

Limitations

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Forouzanfar, M.; Alexander, L.; Anderson, H.; Bachman, V.; Biryukov, S.; Brauer, M.; Burnett, R.; Casey, D.; Coates, M.; Cohen, A. Global, regional, and national comparative risk assessment of 79 behavioural, environmental and occupational, and metabolic risks or clusters of risks in 188 countries, 1990–2013: A systematic analysis for the global burden of disease study 2013. Lancet 2015, 386, 2287–2323. [Google Scholar] [CrossRef]

- Vaughan, C.; Collins, R.; Ghosh-Dastidar, M.; Beckman, R.; Dubowitz, T. Does where you shop or who you are predict what you eat?: The role of stores and individual characteristics in dietary intake. Prev. Med. 2017, 100, 10–16. [Google Scholar] [CrossRef] [PubMed]

- Larson, N.I.; Story, M.T.; Nelson, M.C. Neighborhood environments: Disparities in access to healthy foods in the U.S. Am. J. Prev. Med. 2009, 36, 74–81. [Google Scholar] [CrossRef] [PubMed]

- Larson, N.; Story, M. A review of environmental influences on food choices. Ann. Behav. Med. 2009, 38, 56–73. [Google Scholar] [CrossRef] [PubMed]

- Black, C.; Ntani, G.; Inskip, H.; Cooper, C.; Cummins, S.; Moon, G.; Baird, J. Measuring the healthfulness of food retail stores: Variations by store type and neighbourhood deprivation. Int. J. Behav. Nutr. Phys. Act. 2014, 11, 69. [Google Scholar] [CrossRef] [PubMed]

- Volpe, R.; Okrent, A.; Leibtag, E. The effect of supercenter-format stores on the healthfulness of consumers’ grocery purchases. Am. J. Agr. Econ. 2013, 95, 568–589. [Google Scholar] [CrossRef]

- Yan, R.; Bastian, N.D.; Griffin, P.M. Association of food environment and food retailers with obesity in us adults. Health Place 2015, 33, 19–24. [Google Scholar] [CrossRef] [PubMed]

- Appelhans, B.M.; Milliron, B.J.; Woolf, K.; Johnson, T.J.; Pagoto, S.L.; Schneider, K.L.; Whited, M.C.; Ventrelle, J.C. Socioeconomic status, energy cost, and nutrient content of supermarket food purchases. Am. J. Prev. Med. 2012, 42, 398–402. [Google Scholar] [CrossRef] [PubMed]

- Powell, L.M.; Slater, S.; Mirtcheva, D.; Bao, Y.; Chaloupka, F.J. Food store availability and neighborhood characteristics in the united states. Prev. Med. 2007, 44, 189–195. [Google Scholar] [CrossRef] [PubMed]

- Demmler, K.M.; Klasen, S.; Nzuma, J.M.; Qaim, M. Supermarket purchase contributes to nutrition-related non-communicable diseases in urban Kenya. PLoS ONE 2017, 12, e0185148. [Google Scholar] [CrossRef] [PubMed]

- Rischke, R.; Kimenju, S.C.; Klasen, S.; Qaim, M. Supermarkets and food consumption patterns: The case of small towns in Kenya. Food Policy 2015, 52, 9–21. [Google Scholar] [CrossRef]

- Kimenju, S.C.; Rischke, R.; Klasen, S.; Qaim, M. Do supermarkets contribute to the obesity pandemic in developing countries? Public Health Nutr. 2015, 18, 3224–3233. [Google Scholar] [CrossRef] [PubMed]

- Witkowski, T. Food marketing and obesity in developing countries: Analysis, ethics, and public policy. J. Macromarketing 2007, 27, 126–137. [Google Scholar] [CrossRef]

- Bhurosy, T.; Jeewon, R. Overweight and obesity epidemic in developing countries: A problem with diet, physical activity, or socioeconomic status? Sci. World J. 2014, 2014, 1–7. [Google Scholar] [CrossRef] [PubMed]

- Jones-Smith, J.; Gordon-Larsen, P.; Siddiqi, A.; Popkin, B. Is the burden of overweight shifting to the poor across the globe? Time trends among women in 39 low-and middle-income countries (1991–2008). Int. J. Obes. 2011, 36, 1114–1120. [Google Scholar] [CrossRef] [PubMed]

- Reardon, T.; Berdegué, J. The rapid rise of supermarkets in Latin America: Challenges and opportunities for development. Dev. Policy Rev. 2002, 20, 371–388. [Google Scholar] [CrossRef]

- Schwentesius, R.; Gómez, M. Supermarkets in Mexico: Impacts on horticulture systems. Dev. Policy Rev. 2002, 20, 487–502. [Google Scholar] [CrossRef]

- Euromonitor International. Grocery Retailers in Mexico. Available online: http://www.euromonitor.com (accessed on 15 December 2017).

- Popkin, B.M.; Reardon, T. Obesity and the food system transformation in Latin America. Obes. Rev. 2018, 19, 1028–1064. [Google Scholar] [CrossRef] [PubMed]

- Popkin, B. Nutrition, agriculture and the global food system in low and middle income countries. Food Policy 2014, 47, 91–96. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Pan American Health Organization. Ultra-processed food and drink products in Latin America: Trends, impact on obesity, policy implications. Available online: http://iris.paho.org/xmlui/bitstream/handle/123456789/7699/9789275118641_eng.pdf (accessed on 15 December 2017).

- Aburto, T.C.; Pedraza, L.S.; Sanchez-Pimienta, T.G.; Batis, C.; Rivera, J.A. Discretionary foods have a high contribution and fruit, vegetables, and legumes have a low contribution to the total energy intake of the mexican population. J. Nutr. 2016, 146, 1881S–1887S. [Google Scholar] [CrossRef] [PubMed]

- Hernández-Ávila, M.; Rivera-Dommarco, J.; Shamah-Levy, T.; Cuevas-Nasu, L.; Gómez-Acosta, L.; Gaona-Pineda, E.; Romero-Martínez, M.; Méndez Gómez-Humarán, I.; Saturno-Hernández, P.; Villalpando-Hernández, S. Encuesta Nacional de Salud y Nutrición de Medio Camino 2016. Informe Final de Resultados. 2016. Available online: https://www.gob.mx/cms/uploads/attachment/file/209093/ENSANUT.pdf (accessed on 6 August 2018).

- Secretaria de Salud, M. Acuerdo Nacional para la Salud Alimentaria. Estrategia Contra el Sobrepeso y Obesidad. 2010. Available online: http://activate.gob.mx/documentos/acuerdo%20nacional%20por%20la%20salud%20alimentaria.pdf (accessed on 6 August 2018).

- Secretaria de Salud, M. Estrategia Nacional para la Prevención y el Control del Sobrepeso, la Obesidad y la Diabetes. 2013. Available online: https://www.gob.mx/cms/uploads/attachment/file/276108/estrategia_sobrepeso_diabetes_obesidad.pdf (accessed on 6 August2018).

- Chamber of Deputies of the Mexican Congress. Ley De Impuesto Especial Sobre Producción Y Servicios. [Law of Special Tax on Production and Services]. 2013. Available online: http://www.diputados.gob.mx/LeyesBiblio/pdf/78_181115.pdf (accessed on 6 December 2017).

- Colchero, M.; Salgado, J.; Unar-Munguía, M.; Molina, M.; Ng, S.; Rivera-Dommarco, J. Changes in prices after an excise tax to sweetened sugar beverages was implemented in Mexico: Evidence from urban areas. PLoS ONE 2015, 10, e0144408. [Google Scholar] [CrossRef] [PubMed]

- Colchero, M.; Zavala, J.; Batis, C.; Shamah-Levy, T.; Rivera-Dommarco, J. Changes in prices of taxed sugar-sweetened beverages and nonessential energy dense food in rural and semi-rural areas in Mexico. Salud. Publica Mexico 2017, 59, 137–146. [Google Scholar]

- Colchero, M.A.; Rivera-Dommarco, J.; Popkin, B.M.; Ng, S.W. In Mexico, evidence of sustained consumer response two years after implementing a sugar-sweetened beverage tax. Health Affair. 2017, 36, 564–571. [Google Scholar] [CrossRef] [PubMed]

- Taillie, L.S.; Rivera, J.A.; Popkin, B.M.; Batis, C. Do high vs. Low purchasers respond differently to a nonessential energy-dense food tax? Two-year evaluation of Mexico’s 8% nonessential food tax. Prev. Med. 2017, 105, S37–S42. [Google Scholar] [CrossRef] [PubMed]

- Ng, S.W.; Popkin, B.M. Monitoring foods and nutrients sold and consumed in the united states: Dynamics and challenges. J. Acad. Nutr. Diet. 2012, 112, 41–45. [Google Scholar] [CrossRef] [PubMed]

- The Nielsen Company Mexico. Acerca De Nielsen. Familias Nielsen. Available online: http://www.nielsen.com/mx/es/about-us/nielsen-families.html (accessed on 25 July 2018).

- Colchero, M.A.; Popkin, B.M.; Rivera, J.A.; Ng, S.W. Beverage purchases from stores in mexico under the excise tax on sugar sweetened beverages: Observational study. BMJ 2016, 352, h6704. [Google Scholar] [CrossRef] [PubMed]

- Batis, C.; Rivera, J.A.; Popkin, B.M.; Taillie, L.S. First-year evaluation of Mexico’s tax on nonessential energy-dense foods: An observational study. PLoS Med. 2016, 13, e1002057. [Google Scholar] [CrossRef] [PubMed]

- López, P.; Segovia, A.; García, C.; Beade, A. El sector de tiendas departamentales y de autoservicio en méxico. Brújula de compra. 2013. Available online: https://www.profeco.gob.mx/encuesta/brujula/bruj_2013/bol244_tiendas_autoservicio.asp (accessed on 23 October 2017).

- Euromonitor International. Retailing Category Definitions. Available online: http://www.euromonitor.com (accessed on 23 October 2017).

- Stern, D.; Ng, S.W.; Popkin, B.M. The nutrient content of U.S. Household food purchases by store type. Am. J. Prev. Med. 2016, 50, 180–190. [Google Scholar] [CrossRef] [PubMed]

- León, O. Las tiendas de autoservicio y la pugna por el mercado. Comercio. Exterior 2007, 57, 46–57. [Google Scholar]

- Castañeda-Sabido, A. Supermercados: Competencia en precios. Economía Mexicana. Nueva Época 2012, 21, 297–349. [Google Scholar]

- López-Olmedo, N.; Popkin, B.; Taillie, L. The socioeconomic disparities in intakes and purchases of less-healthy foods and beverages have changed over time in urban mexico. J. Nutr. 2018, 148, 109–116. [Google Scholar] [CrossRef] [PubMed]

- Pechey, R.; Monsivais, P. Supermarket choice, shopping behavior, socioeconomic status, and food purchases. Am. J. Prev. Med. 2015, 49, 868–877. [Google Scholar] [CrossRef] [PubMed]

- Instituto Nacional de Estadistica y Geografia (INEGI). Encuesta Nacional de Ingreso y Gastos de los Hogares. [National Household Income and Expenditure Survey]. 2016. Available online: http://www.beta.inegi.org.mx/proyectos/enchogares/regulares/enigh/nc/2016/ (accessed on 9 November 2017).

- Colchero, M.; Molina, M.; Guerrero-López, C. After Mexico implemented a tax, purchases of sugar-sweetened beverages decreased and water increased: Difference by place of residence, household composition, and income level. J. Nutr. 2017, 147, 1552–1557. [Google Scholar] [CrossRef] [PubMed]

- Colchero, M.; Zavala, J.; Batis, C.; Shamah-Levy, T.; Rivera-Dommarco, J. Cambios en los precios de bebidas y alimentos con impuesto en áreas rurales y semirrurales de méxico. Salud Publica Mexico 2017, 59, 137–146. [Google Scholar] [CrossRef] [PubMed]

- Guerrero-Lopez, C.; Molina, M.; Colchero, M. Employment changes associated with the introduction of taxes on sugar-sweetened beverages and nonessential energy-dense food in Mexico. Prev. Med. 2017, 105S, S43–S49. [Google Scholar] [CrossRef] [PubMed]

| Total Population | Low SES | Medium SES | High SES | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 | 2013 | 2014 | 2015 | p for trend | 2012 | 2013 | 2014 | 2015 | p for trend | 2012 | 2013 | 2014 | 2015 | p for trend | 2012 | 2013 | 2014 | 2015 | p for trend | |

| n = 5813 | n = 5775 | n = 5657 | n = 5493 | n = 959 | n = 1094 | n = 1087 | n = 1170 | n = 3133 | n = 2872 | n =2 815 | n = 2690 | n = 1721 | n = 1809 | n = 1755 | n = 1633 | |||||

| Total beverage purchases (%±SE) | ||||||||||||||||||||

| Convenience stores | ||||||||||||||||||||

| 4.0 | 4.5 | 4.7 | 4.8 | 0.019 | 4.4 | 4.8 | 4.7 | 4.2 | 0.615 | 3.8 | 3.8 | 4.2 | 4.4 | 0.098 | 4.2 | 5.4 | 5.7 | 6.1 | 0.025 | |

| ± 0.2 | ± 0.2 | ± 0.2 | ± 0.3 | ± 0.4 | ± 0.4 | ± 0.4 | ± 0.5 | ± 0.2 | ± 0.2 | ± 0.3 | ± 0.4 | ± 0.4 | ± 0.5 | ± 0.6 | ± 0.7 | |||||

| Supermarkets | 11.3 | 11.6 | 11.2 | 10.8 | 0.191 | 6.6 | 7.7 | 7.3 | 7.5 | 0.411 | 10.7 | 11.3 | 11.1 | 10.1 | 0.325 | 17.4 | 16.2 | 15.6 | 16 | 0.221 |

| ± 0.3 | ± 0.3 | ± 0.3 | ± 0.4 | ± 0.5 | ± 0.6 | ± 0.6 | ± 0.7 | ± 0.4 | ± 0.5 | ± 0.5 | ± 0.5 | ± 0.7 | ± 0.7 | ± 0.7 | ± 1 | |||||

| Wholesalers/price clubs | 0.9 | 0.9 | 1.0 | 1.1 | 0.181 | 0.2 | 0.3 | 0.3 | 0.2 | 0.684 | 0.5 | 0.6 | 0.8 | 0.7 | 0.042 | 2.5 | 2.4 | 2.1 | 2.7 | 0.808 |

| ± 0.1 | ± 0.1 | ± 0.1 | ± 0.1 | ± 0 | ± 0.1 | ± 0.1 | ± 0 | ± 0.1 | ± 0.1 | ± 0.1 | ± 0.1 | ± 0.2 | ± 0.2 | ± 0.2 | ± 0.5 | |||||

| Traditional retailers | 37 | 36.4 | 35.8 | 34.7 | 0.006 | 46 | 43.6 | 42.4 | 40.7 | 0.006 | 37.9 | 38 | 37.1 | 36.4 | 0.161 | 26.2 | 26 | 25.6 | 24.1 | 0.199 |

| ± 0.6 | ± 0.6 | ± 0.6 | ± 0.7 | ± 1.3 | ± 1.3 | ± 1.4 | ± 1.4 | ± 0.7 | ± 0.8 | ± 0.9 | ± 1 | ± 1.1 | ± 1.1 | ± 1.1 | ± 1.2 | |||||

| Home water-delivery | 34.8 | 34.9 | 34.9 | 36.8 | 0.054 | 33.5 | 33.7 | 34.9 | 37.2 | 0.054 | 34.7 | 33.9 | 33.6 | 35.6 | 0.625 | 36.1 | 38.1 | 37.9 | 39.2 | 0.197 |

| ± 0.6 | ± 0.7 | ± 0.7 | ± 0.8 | ± 1.3 | ± 1.4 | ± 1.5 | ± 1.6 | ± 0.8 | ± 0.9 | ± 1 | ± 1.2 | ± 1.3 | ± 1.4 | ± 1.5 | ± 1.7 | |||||

| Others | 12.0 | 11.7 | 12.5 | 11.9 | 0.833 | 9.2 | 10 | 10.5 | 10.2 | 0.405 | 12.4 | 12.4 | 13.2 | 12.8 | 0.525 | 13.6 | 11.8 | 13.1 | 11.8 | 0.397 |

| ± 0.4 | ± 0.4 | ± 0.5 | ± 0.5 | ± 0.7 | ± 0.8 | ± 0.8 | ± 0.9 | ± 0.5 | ± 0.7 | ± 0.7 | ± 0.9 | ± 1.1 | ± 0.8 | ± 0.9 | ± 1.0 | |||||

| Total food purchases (%±SE) | ||||||||||||||||||||

| Convenience stores | 1.5 | 1.5 | 1.6 | 1.6 | 0.261 | 1 | 1.4 | 1.4 | 1.3 | 0.606 | 1.4 | 1.3 | 1.4 | 1.5 | 0.291 | 2.1 | 2.2 | 2.4 | 2.2 | 0.744 |

| ± 0.1 | ± 0.1 | ± 0.1 | ± 0.1 | ± 0.2 | ± 0.2 | ± 0.2 | ± 0.2 | ± 0.1 | ± 0.1 | ± 0.1 | ± 0.1 | ± 0.3 | ± 0.2 | ± 0.3 | ± 0.2 | |||||

| Supermarkets | 46.7 | 48 | 47.4 | 48.5 | 0.087 | 31.1 | 34.7 ± 1.2 | 36.2 | 38 | <0.001 | 46.9 | 49 | 48 | 49 | 0.14 | 60.7 | 58.7 | 58 | 59.1 | 0.317 |

| ± 0.5 | ± 0.6 | ± 0.6 | ± 0.7 | ± 1.1 | ± 1.3 | ± 1.4 | ± 0.7 | ± 0.8 | ± 0.8 | ± 0.9 | ± 1.0 | ± 1.0 | ± 1.1 | ± 1.4 | ||||||

| Wholesalers/price clubs | 3.6 | 3.9 | 4.4 | 4.4 | 0.004 | 1.6 | 1.4 ± 0.3 | 1.7 | 1.6 | 0.822 | 2.5 | 3 | 4 | 3.8 | <0.001 | 8.3 | 8.3 | 8.3 | 8.8 | 0.574 |

| ± 0.2 | ± 0.2 | ± 0.2 | ± 0.3 | ± 0.4 | ± 0.3 | ± 0.3 | ± 0.2 | ± 0.3 | ± 0.3 | ± 0.4 | ± 0.6 | ± 0.5 | ± 0.6 | ± 0.8 | ||||||

| Traditional retailers | 42.6 | 42.4 | 42 | 40.7 | 0.028 | 60.5 | 58.6 ± 1.2 | 56.4 | 54.7 | 0.001 | 43.7 | 42.8 | 42.4 | 40.9 | 0.018 | 23.1 | 25.9 | 25.4 | 24.9 | 0.341 |

| ± 0.6 | ± 0.6 | ± 0.6 | ± 0.7 | ± 1.2 | ± 1.3 | ± 1.4 | ± 0.7 | ± 0.8 | ± 0.9 | ± 0.9 | ± 0.9 | ± 1.0 | ± 1.0 | ± 1.2 | ||||||

| Others | 5.7 | 4.2 | 4.6 | 4.8 | 0.015 | 5.7 | 3.9 ± 0.4 | 4.2 | 4.5 | 0.120 | 5.6 | 4 | 4.3 | 4.8 | 0.070 | 5.8 | 5 | 5.9 | 5.1 | 0.470 |

| ± 0.2 | ± 0.2 | ± 0.2 | ± 0.2 | ± 0.4 | ± 0.4 | ± 0.4 | ± 0.3 | ± 0.2 | ± 0.2 | ± 0.3 | ± 0.4 | ± 0.3 | ± 0.5 | ± 0.4 | ||||||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pedraza, L.S.; Popkin, B.M.; Salgado, J.C.; Taillie, L.S. Mexican Households’ Purchases of Foods and Beverages Vary by Store-Type, Taxation Status, and SES. Nutrients 2018, 10, 1044. https://doi.org/10.3390/nu10081044

Pedraza LS, Popkin BM, Salgado JC, Taillie LS. Mexican Households’ Purchases of Foods and Beverages Vary by Store-Type, Taxation Status, and SES. Nutrients. 2018; 10(8):1044. https://doi.org/10.3390/nu10081044

Chicago/Turabian StylePedraza, Lilia S., Barry M. Popkin, Juan C. Salgado, and Lindsey S. Taillie. 2018. "Mexican Households’ Purchases of Foods and Beverages Vary by Store-Type, Taxation Status, and SES" Nutrients 10, no. 8: 1044. https://doi.org/10.3390/nu10081044