1.1. Background

In the 21st century, international society entered an era of large-scale shifts in power [

1], and the world political and economic center is shifting towards the Asia-Pacific Region. Today, the Asia-Pacific Region is still the world’s most dynamic region and contributes the most to world economic growth [

2]. As China’s economy has rapidly developed, its global influence has also increased. Vietnam, as a small newly industrialized economy, has gained increasing economic strength and influence in the Asia-Pacific Region. At the same time, Vietnam has a high degree of trade linkages with China, but it is also highly vulnerable to any trade restrictions. It will actually result in “a tilt toward a third power such as US” [

3].

China, as an emerging power, might challenge the established power, the United States (US), and exert more influence on the status quo in the Asia-Pacific Region [

4]. In order to strengthen economic interdependence with other countries and enhance influence in the region, both China and the United States want to build a framework conducive to their own trade relations. Thus, when the Obama administration took office, President Obama proposed a rebalanced strategy toward the Asia-Pacific Region, aiming to show the US’s power and presence in the region. In the economic realm, to coordinate with the strategic rebalance, the US government established a US-centered and China-free Trans-Pacific Partnership (TPP) [

5]. At the same time, “the momentum of the TPP appears to have spurred China to push more actively for promoting regional comprehensive economic partnership (RCEP)” [

6]. Therefore, member countries like Vietnam, which belong to both the TPP and the Association of Southeast Asian Nations (ASEAN), are becoming the focus of both China and the United States. In this context, as one of the largest trading partners of both Vietnam and China, the United States is likely to seek to reduce trade with China but increase trade with Vietnam in some commodities. Accordingly, the relationship between Vietnam and China and its influence on bilateral trade has become a political and academic concern.

On one hand, China’s rise in the last decade has attracted the attention of the world. In 2010, China’s gross domestic product (GDP) caught up with Japan, and it now ranks as the second largest economy in the world. In 2011, the International Monetary Fund (IMF) predicted that China’s GDP would surpass the United States in 2016 if measured on the basis of purchasing power parity (PPP). To China’s Asian neighbors and other foreign powers, especially the United States, the rise of China means a new distribution of power in the Asia-Pacific Region. This is closely related to the security interests of all countries. Some scholars have studied how China’s Asian neighbors view the rise of China, and they found that “geographical and cultural proximity” has a great positive impact on people’s perception of China, and the rise of China has been largely recognized and welcomed by the East Asian countries overall [

7]. Almost all of China’s neighbors are unwilling to see the geopolitical rivalry between China and the US which could destroy regional stability and prosperity, because they can realize the maximum of interests of continuing to trade freely with China while benefiting from the security umbrella from the US.

On the other hand, since becoming a World Trade Organization (WTO) member at the end of 2006, Vietnam has enjoyed many benefits from opening up to the world. In order to open up more, Vietnam actively joined the TPP negotiations and eventually became one of its members. Vietnam has its own advantages: First, due to abundant labor and natural resources, Vietnam will be able to attract more labor-intensive industries from other countries, which will be conducive to its long-term economic development. A recent study shows that Vietnam has a clearer advantage than China in population health, although it fell behind in education [

8]. Second, US trade with Vietnam increased more than 8-fold from 2002 to 2012, and Vietnam’s rapid increase in goods supplied to the US made it the second-largest supplier of US imports among the Asia-Pacific countries (excluding Canada, Japan and Mexico) in 2012 [

9]. Lastly, Vietnam is good at using the rules of trade agreements. Since becoming a member of WTO and TPP, Vietnam has received considerable benefits for each agreement, and is being actively engaged in RCEP negotiations with China. Here, we just take the TPP as a case: the terms for exception of the TPP let twelve countries protect their important industries; these exceptions give Vietnam a long enough protection period to adapt to the rules. However, from Vietnamese and other Asian TPP members’ perspectives, joining in the agreements will help them not only to maximize their own trade with China and the US, but also to balance China with the US in terms of influence in Asia [

10]. Moreover, in order to integrate into the Asia-Pacific market, Vietnam could also join in RCEP if the TPP doesn’t really come into force.

China is expected to face some competition with Vietnam, which is considered by many scholars to be an important competitor to China. The relationship between China and Vietnam has been delicate since ancient times. During and even after the Cold War, as national interests diverged, and due to political asymmetry, many neighboring countries felt an implicit threat from China, and Vietnam is the archetypal example of such a fearful neighbor [

11]. As historic enmity and suspicions between the two countries simmered, Vietnam has been taking dynamic “soft balancing” as a response to the rising China [

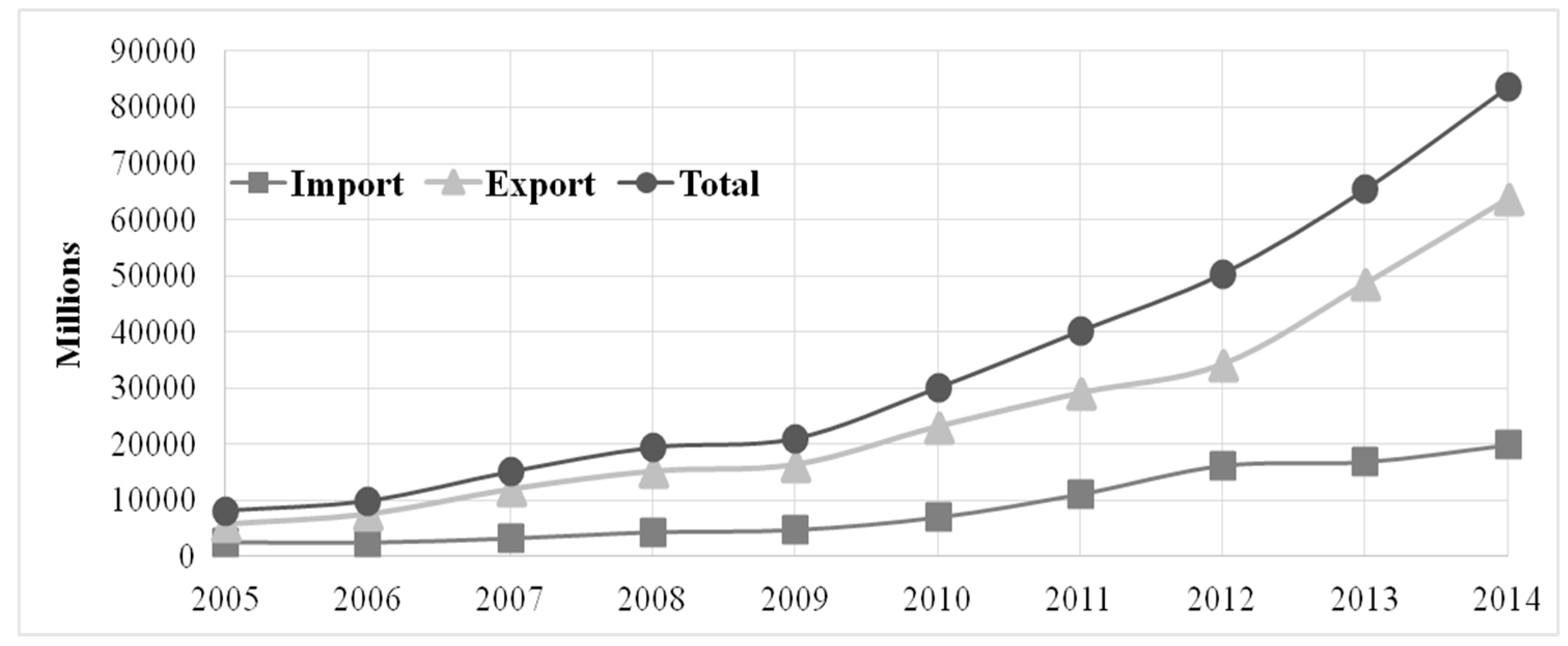

12]. In recent years, in the South China Sea, the two countries have had frequent conflicts, and this in turn has altered their geo-economic relations. The trade competition between Vietnam and China has also begun to be intensified. In this study, we focus specifically on the textile, apparel and clothing, and footwear instead of all the industries, because there is competition and cooperation in these three industries between Vietnam and China. China and Vietnam are both populous countries, and labor-intensive industries developed rapidly due to their abundant labor resources. Some products of labor-intensive industries, like textile, apparel and clothing, and footwear, are competitive in the international market. The export target market for these three products is mainly concentrated in developed countries, such as the US, Japan and Australia. Once Vietnam starts to enjoy more favorable open-market access conditions in the textile and apparel markets, will China still be able to maintain its current key market share in textile and apparel export markets, such as the US and Japanese markets? Furthermore, as has been mentioned before, Vietnam’s trade has been closely linked to China in the most recent decade (

Figure 1). China is currently one of the leading suppliers of textiles to Vietnam and other Asia-Pacific countries. Thus, the increased import demand for textiles from Vietnam and other Asian countries might create additional export opportunities for China after the implementation of a new trade agreement [

13].

1.2. Literature Review

Comparative study helps understand the similarities and differences of the targets, usually used to analyze the political and economic relations between two countries [

3]. Comparative study focuses on one scientific question, and the target objectives for a comparative study can be two countries, or more countries and economies [

14,

15]. Through the comparative study, we can find which commodities have competition in the international market between China and Vietnam. Trade division effect is closely linked to trade agreements, just as TPP and RCEP [

16]. There has been abundant research on the topic from different perspectives, and many models and equations for trade diversion have been developed [

17]. In this paper, we use this method to explain whether there is a trade division effect between the two countries before the agreements.

Geo-economy is the relationship, including competition, cooperation and alliance between countries and regions under the influence of geopolitics [

18]. In today’s world, economic factors have become one of the most important factors affecting international relations [

19], economic interdependence has led to increasingly close geo-economic ties between nations. The trade links between countries is an important indicator to reflect their geo-economic ties. This tightening of geo-economic ties will deeply impact the geopolitical pattern among countries in a certain region [

20].

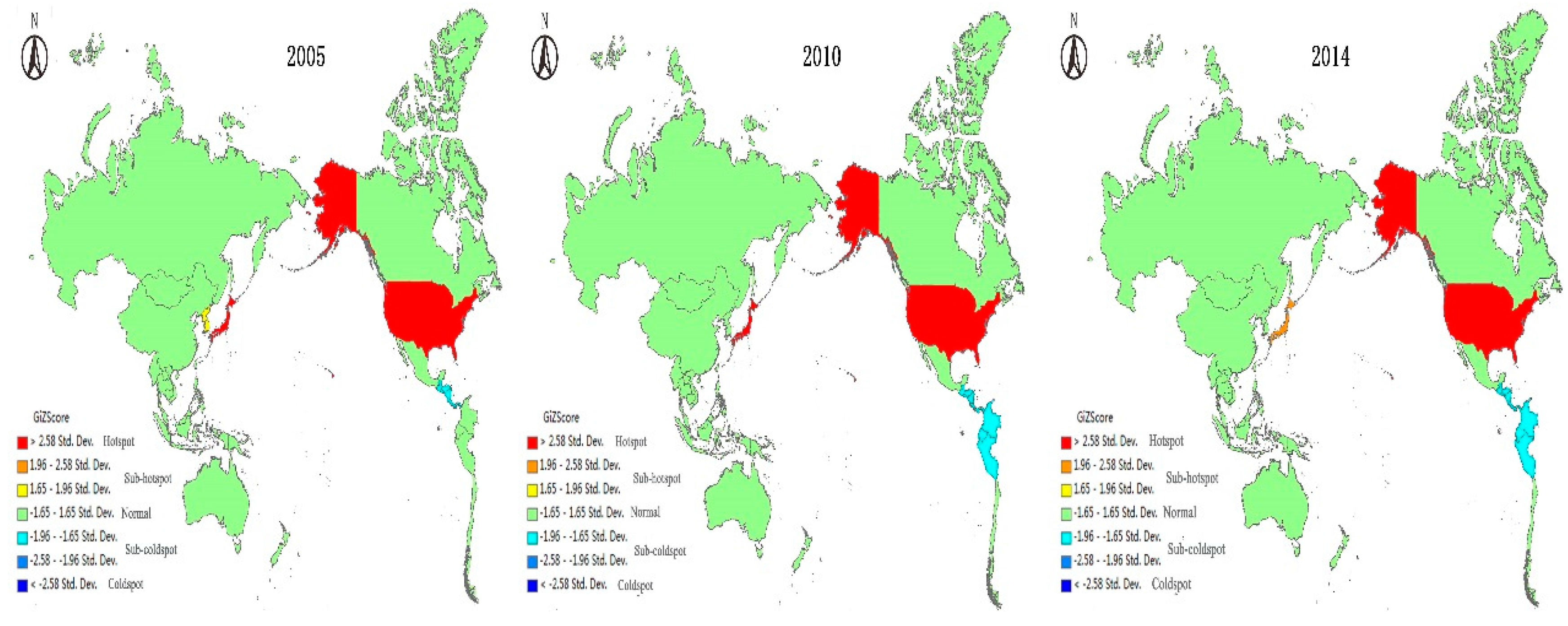

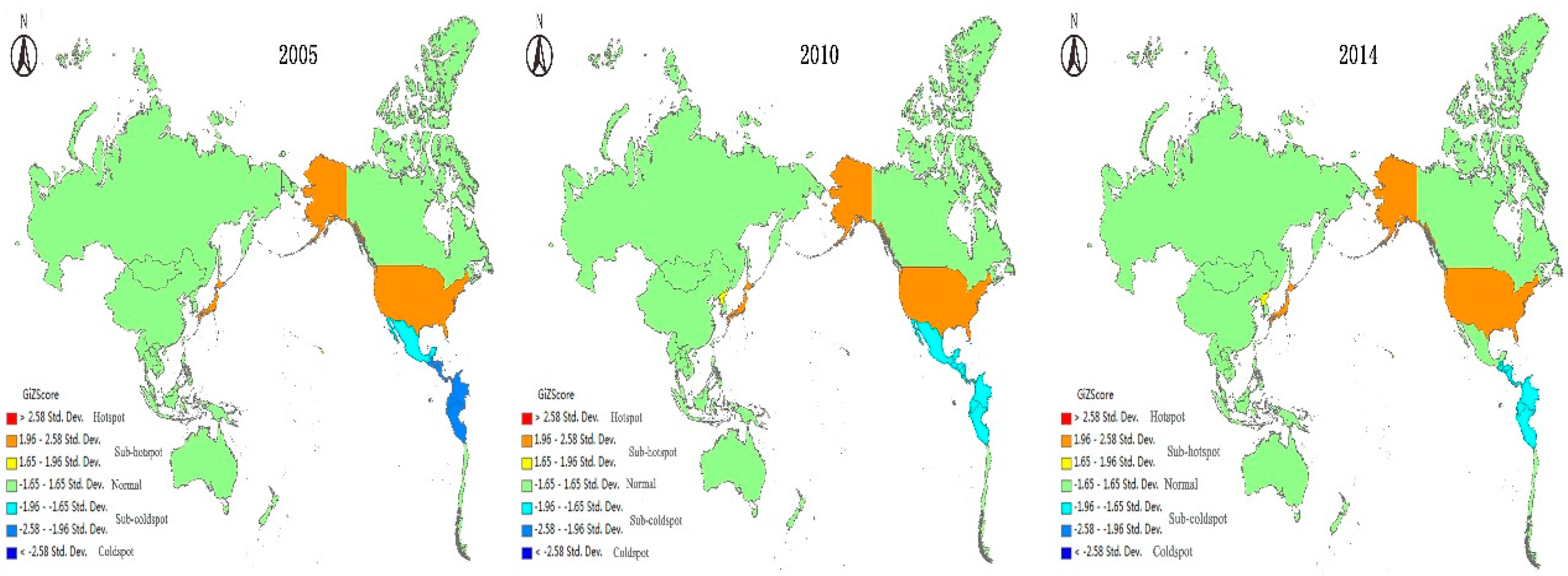

Reviewing the existing literature, comparative studies only focus on the target countries; little research has put the target countries on a larger scale to study their economic relations. The current research has been focused on the economic and trade perspectives [

8], seldom analyzing trade relations from the perspective of geography. Thus, combining trade relation and geography perspectives, this study not only compares the trade relation between Vietnam and China, but also puts them in the context of the integration of the Asia-Pacific; it is from the national and regional scales to study the economic relationship between the two countries. In order to conduct a comprehensive comparative study, we first calculated the competitiveness of China and Vietnam’s main export industries. Next, we constructed a model to contribute to a better understanding of a question: is there a trade diversion effect on China? Lastly, through spatio-temporal analysis, we compared the trends of the geo-economic relationship between the two countries and other Asia-Pacific countries.