Game Theoretic Analysis of Carbon Emission Abatement in Fashion Supply Chains Considering Vertical Incentives and Channel Structures

Abstract

:1. Introduction

| SC Structures | Supply Chain Excluding TPERS Provider (E) | Supply Chain Including TPERS Provider (I) | |

|---|---|---|---|

| Vertical Incentives | |||

| No transfer payment (N) | Model NE | Model NI | |

| Having transfer payment (H) | Model HE | Model HI | |

- (1)

- Whether there exists any transfer payment scheme to achieve Pareto improvement for the supply chain excluding or including TPERS provider, respectively?

- (2)

- Should the manufacturer induce the TPERS provider into the system when the transfer payment scheme is devised? The same question arises in the other case when the transfer payment scheme is not adopted.

- (3)

- What is the impact of different supply chain configuration combinations of vertical relationship (absorbing or dropping transfer payment) and supply chain structures (excluding or including TPERS provider) on the emission abatement efficiency and system-wide profitability?

2. Related Literature

3. Notation, Assumptions and Problem Characteristics

- (1)

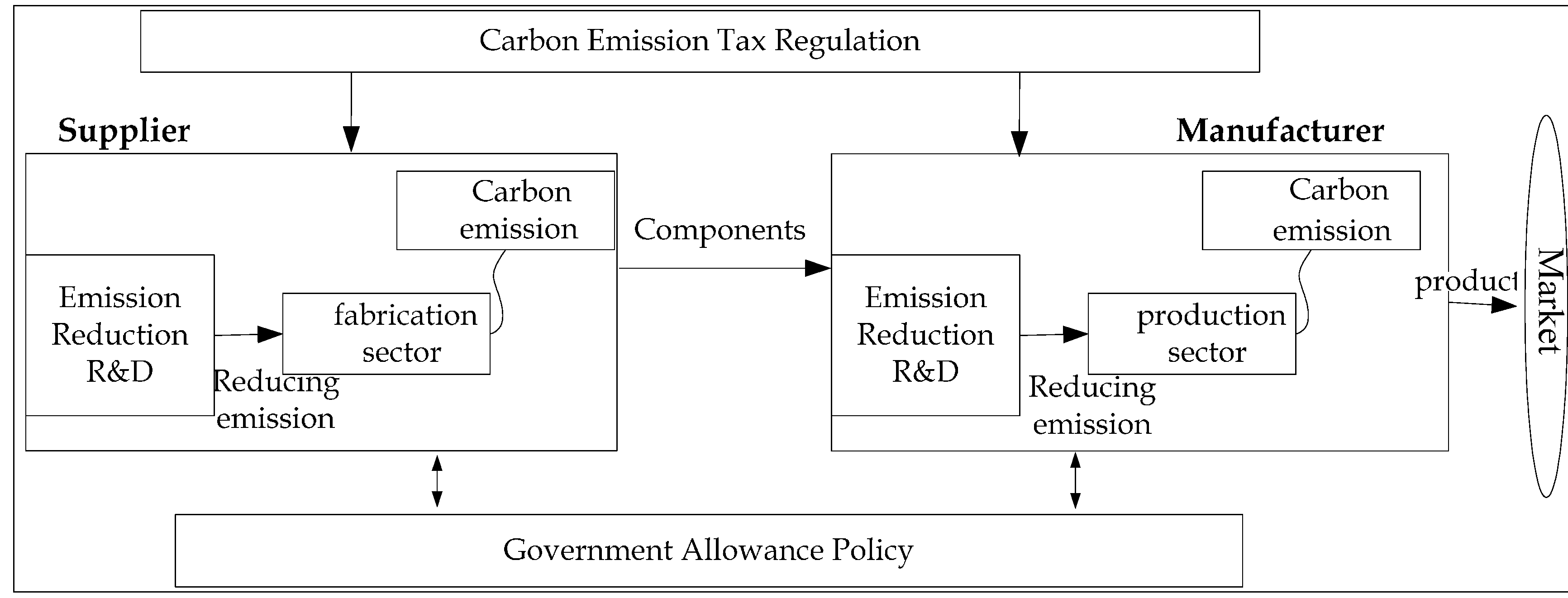

- Upstream and downstream sides reduce emission separately (denoted Model NE);

- (2)

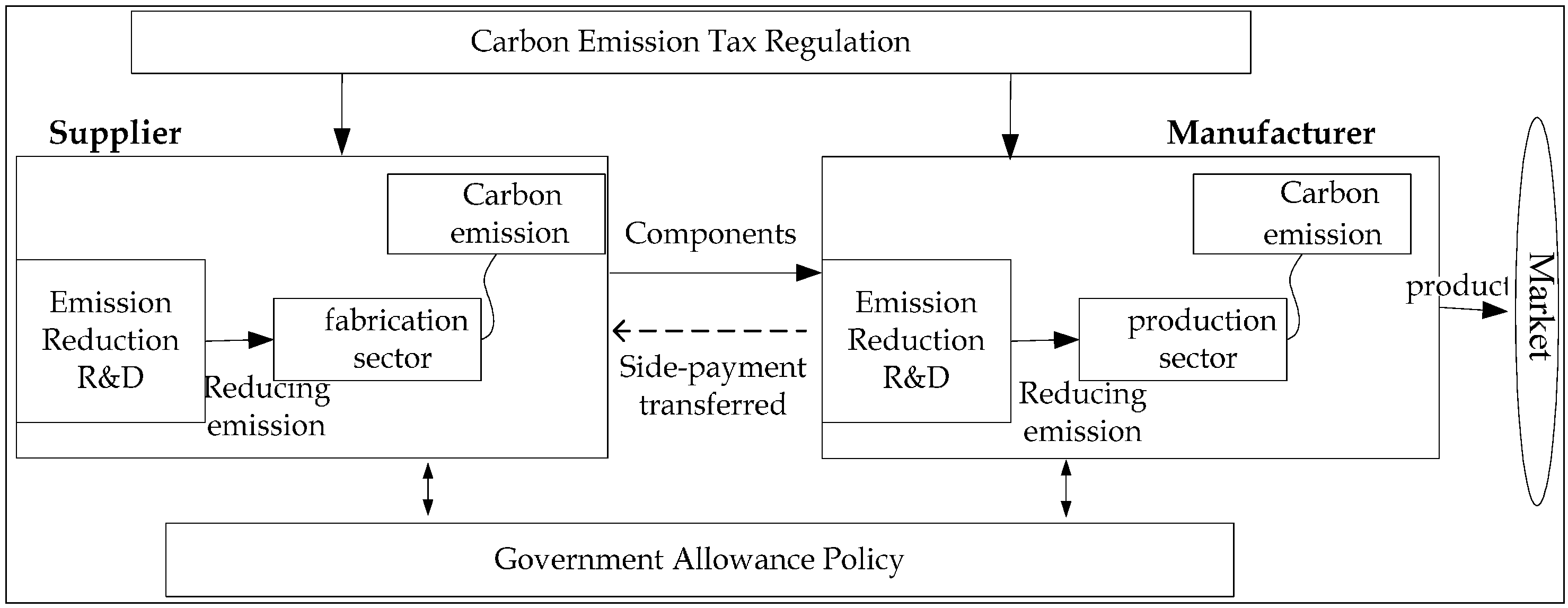

- Only stimulate supplier to reduce emission (denoted Model HE);

- (3)

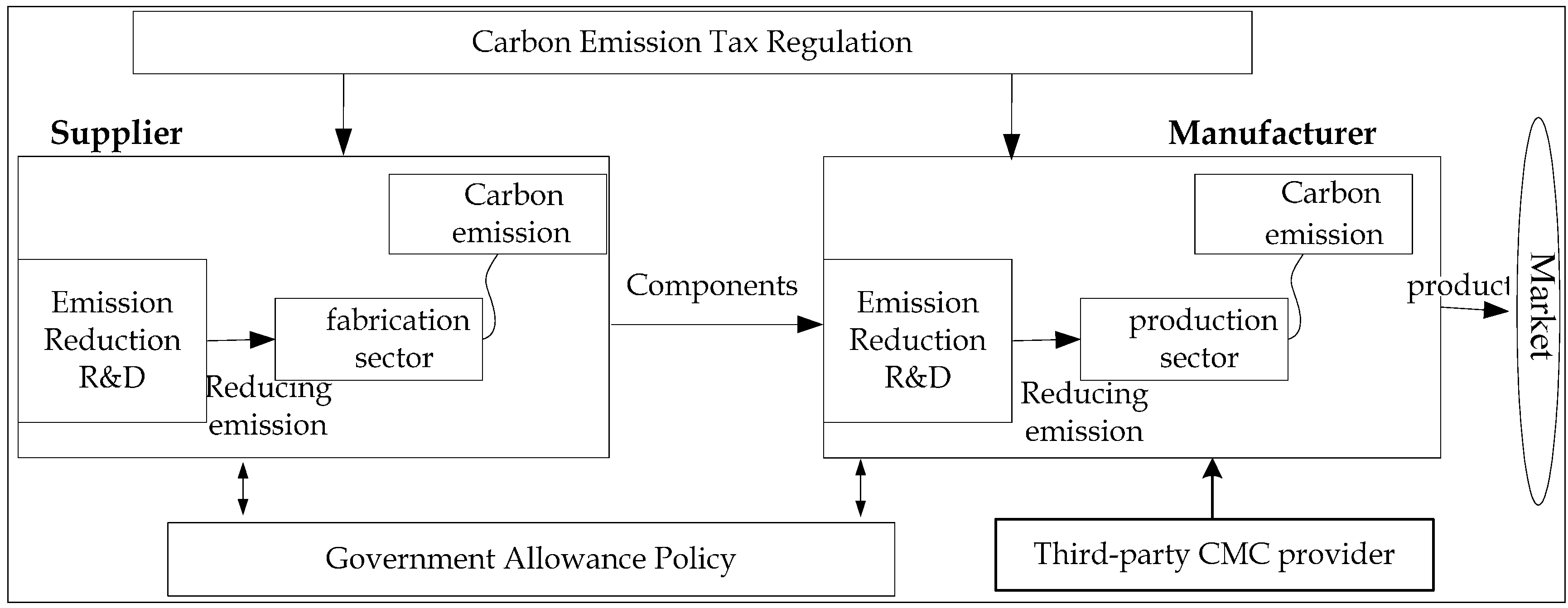

- Only introduce a TPERS provider to reduce emission without stimulating supplier (denoted Model NI);

- (4)

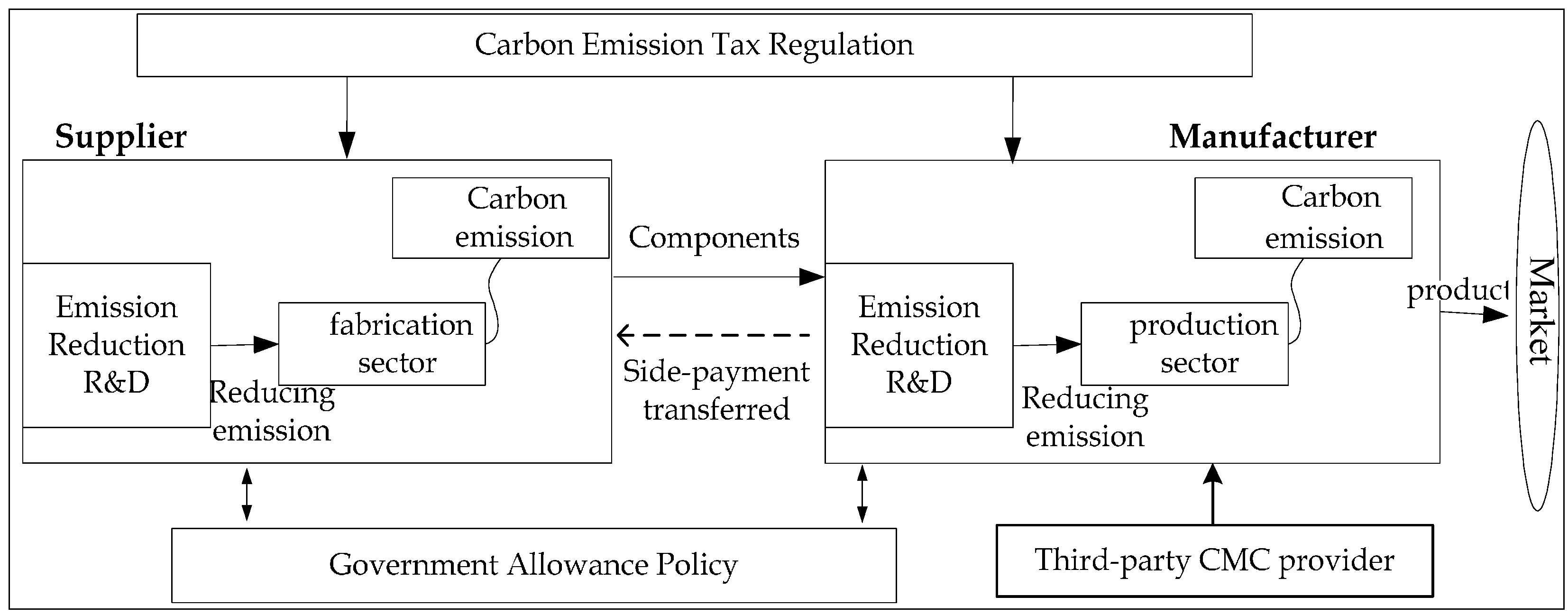

- Introduce a TPERS provider and simultaneously simulate supplier to reduce emission (denoted Model HI). Subscripts m, s, t denote the manufacturer, the supplier and third-party emission reduction service (TPERS) provider, respectively.

3.1. Parameters

- λi: Initial emission rate for firm i, i = m, s;

- r: Demand sensitivity coefficient on emission, r > 0;

- σi: Government carbon emission allowance that is provided in the form of duty-free emission quota for each unit product, i = m, s 0 ≤ σi < λi;

- pc: Carbon emission tax rate for or the tax-rebate rate for , ;

- ρi: Unit product profit of manufacturer or supplier (cost of emission reduction not counted), ρi > 0;

- ui: Emission reduction relevant fixed cost coefficient for firm i, i = m, s, t where 0 < ui > um;

- d: Intrinsic demand without considering the influence of emission reduction, d > 0;

- a: Intrinsic demand equaling after accounting for variable costs, emission reductions, initial emission rates and fixed margin profits;

- ci: Unit production cost of firm i, i = m, s.

- D(es, em, ei): Deterministic market demand of product generated by aggregate emission decrements under our assumptions;

- : Profit of firm i, i = m, s, t;

- Π: Total profit of the supply chain.

3.2. Decision Variables

- ei: Emission decrement per unit product for firm i, 0 ≤ ei < λ, i = m, s, t;

- v: Transfer payment coefficient provided by the manufacturer to the supplier, v ≥ 0;

- θ: Unit emission reduction amount compensation coefficient provided by manufacturer to third-party, θ ≥ 0.

- A1.

- Only one kind of product is considered and shortage is not permitted;

- A2.

- Both supplier and manufacturer maintain fixed margin profits, respectively, namely, ρm and ρr are constants;

- A3.

- The deterministic demand function is linear in the supplier’s and the manufacturer’s emission decrements with same coefficient;

- A4.

- The manufacturer is as a dominant leader to move first, while the supplier as a follower;

- A5.

- All information of parameters is common knowledge to supplier and manufacturer.

4. The Models

4.1. The Setting neither with Transfer Payment nor TPERS (Model NE)

4.1.1. The Supplier’s Emission-Reduction Decision

4.1.2. The Manufacturer’s Emission-Reduction Decision

4.2. The Setting with Transfer Payment Incentive Only (Model HE)

4.2.1. The Supplier’s Emission-Reduction Decision

4.2.2. The Manufacturer’s Emission-Reduction Decision

4.3. The Setting with Only TPERS Involved (Model NI)

4.4. The Setting with Emission-Reducing Incentive and TPERS Simultaneously (Model HI)

5. Discussion and Numerical Studies

5.1. Results Analysis

- (1)

- No matter whether the TPERS provider is engaged or not in the supply chain carbon emission reduction, we can always find a transfer pricing contract to realize the Pareto improvement of the supply chain performance.

- (2)

- The coefficients design for transfer payment contracts keeps the same in those two settings of including or excluding TPERS provider, i.e., in our study. Furthermore, the coefficient v is increasing in ρm, , and r, decreasing in ρs and , and independent of um and us.

- (1)

- The supplier’s emission-reduction level under transfer payment is not lower than that without transfer payment, and it is an increasing function of the transfer payment coefficient v. But the manufacturer’s optimal emission-reduction level is irrespective of the transfer payment;

- (2)

- After the transfer payment contract performs, the increment of the supplier’s emission reduction level increases with the transfer payment coefficient v, supplier’s potential emission-reduction space , emission tax Pc and demand responsiveness r, but decreases with manufacturer’s potential emission-reduction space , supplier’s emission-reduction relevant fixed cost coefficient us and independent of um of manufacturer’s, respectively.

- (1)

- The manufacturer’s optimal reduction level increases with emission-reduction compensation coefficient θ and decreases with TPERS provider’s emission-reduction fixed cost factor ut;

- (2)

- Emission reduction compensation coefficients are independent of the existence of transfer payment, i.e., ; and they decrease with ut, and , but increase with and ρs.

- (1)

- Outsourcing is more beneficial to emission reduction than doing it in-house, i.e., and when inequalities holds;

- (2)

- On the contrary, outsourcing is less beneficial to emission reduction than doing it in-house, i.e., and when inequalities holds.

- (1)

- if and ; on the contrary, if and ;

- (2)

- if and ; otherwise, if and .

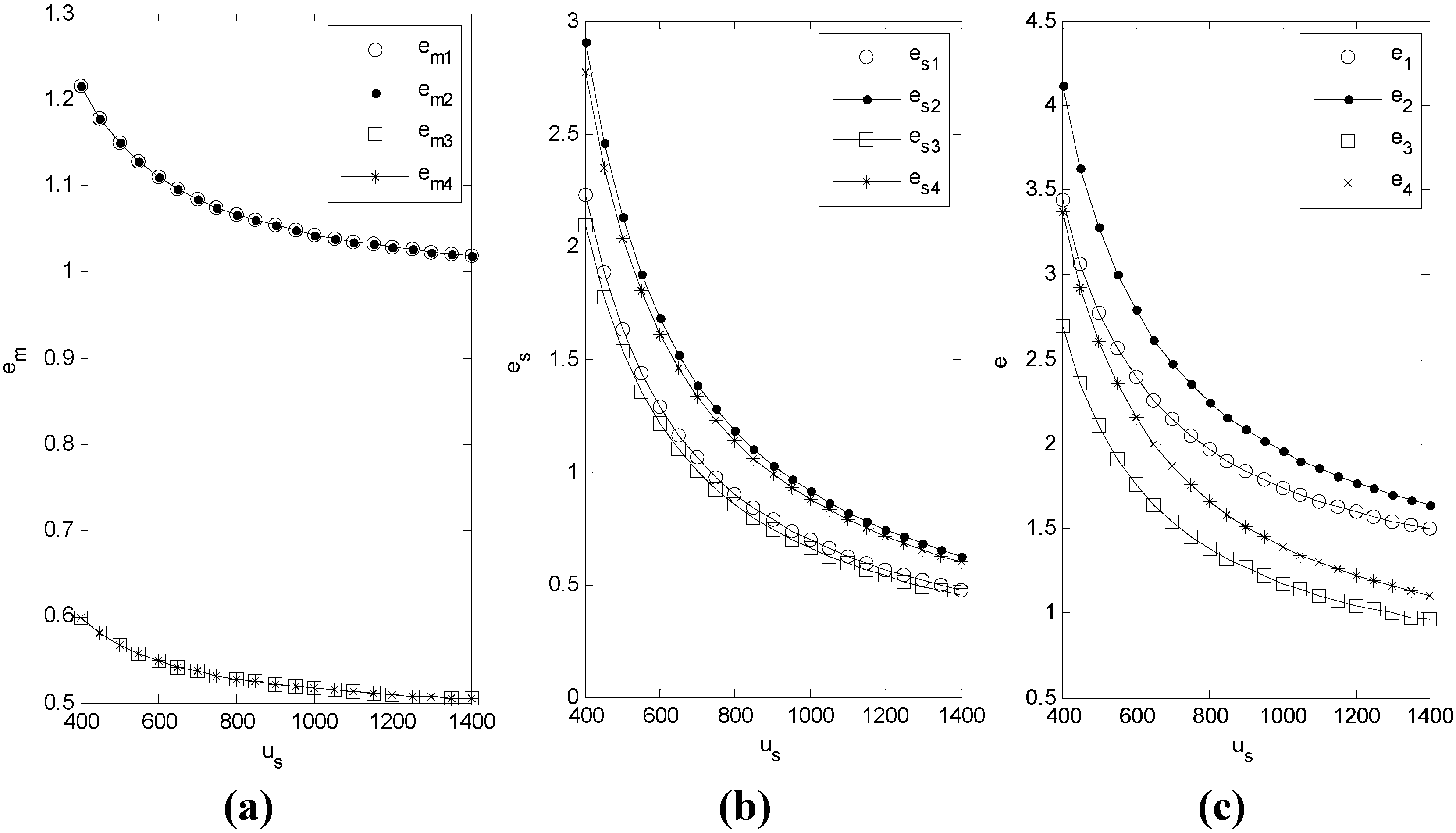

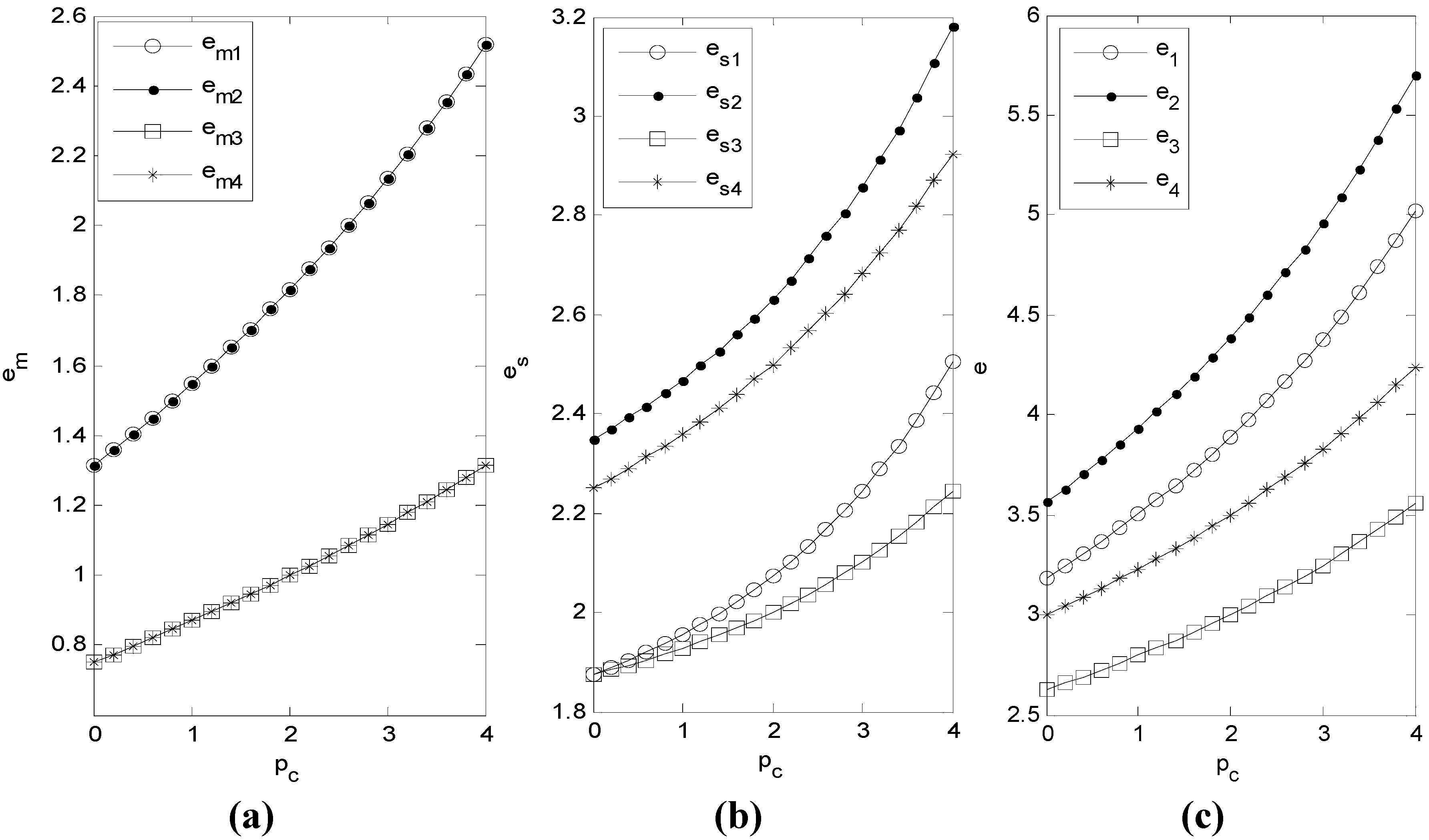

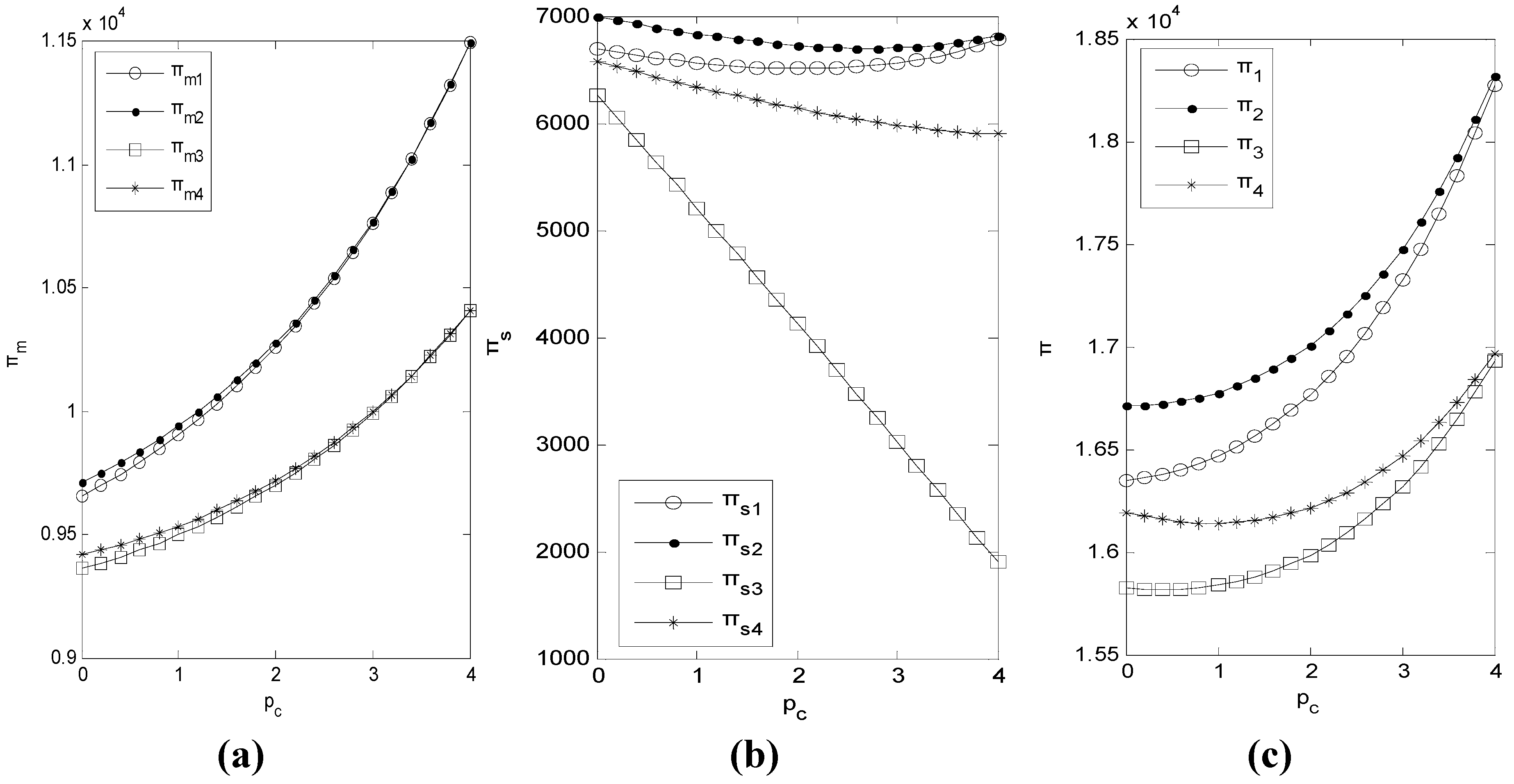

5.2. Numerical Experiments

| a | ρm | ρs | σm | σs | λm | λs | r | um | us | ut | pc |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 100 | 70 | 50 | 4 | 10 | 6 | 20 | 15 | 500–1500 | 400 | 450 | 4 |

| 100 | 70 | 50 | 4 | 10 | 6 | 20 | 15 | 1500 | 400–1400 | 1450 | 4 |

| 100 | 70 | 50 | 4 | 10 | 6 | 20 | 15 | 1500 | 400 | 450–1400 | 4 |

| 100 | 70 | 50 | 4 | 10 | 6 | 20 | 15 | 800 | 400 | 700 | 0–4 |

6. Concluding Remarks

- (1)

- No matter whether the manufacturer employed the third-party emission-reduction service provider or not, such as Carbon Management Contracting, the transfer payment incentive scheme between the supplier and the manufacturer can increase the channel carbon reduction amount and realize the Pareto improvement of the supply chain profits.

- (2)

- The optimal coefficient parameters design are the same when the supply chain adopted a transfer payment scheme between the upstream and the downstream without respect to the manufacturer consigned the emission reduction to third-party emission-reduction provider or not.

- (3)

- When the transfer payment contract was executed, introducing a third-party emission-reduction provider can incur higher emission decrement per product only if the coefficient of emission reduction relevant fixed cost for emission-reduction provider is lower than the half of that of the manufacturer’s. The comparison outcomes of the individual as well as supply chain profits depending on a variety of parameters, such as emission-reduction relevant fixed cost coefficients and carbon tax regulatory parameters.

Acknowledgment

Author Contributions

Appendix A

Appendix B

Appendix C

Conflicts of Interest

References

- Congressional Budget Office (CBO). Policy options for reducing CO2 emissions: A CBO study. 2008. Available online: http://www.cbo.gov/sites/default/files/02-12-carbon.pdf (accessed on 1 March 2015).

- Kyoto-Protocol. Kyoto Protocol to the United Nations Framework Convention on Climate Change. Available online: http://unfccc.int/kyoto_protocol/status_of_ratification/items/2613.php (accessed on 20 February 2015).

- Dowdey, S. How Carbon Tax Works. Available online: http://science.howstuffworks.com/environmental/green-science/carbon-tax.htm (accessed on 22 October 2014).

- Du, S.; Ma, F.; Fu, Z.; Zhu, L.; Zhang, J. Game-Theoretic analysis for an emission-dependent supply chain in a “cap-and-trade” system. Ann. Oper. Res. 2011. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon footprint and the management of supply chains: Insights from simple models. IEEE Trans. Autom. Sci. Eng. 2013, 10, 99–116. [Google Scholar] [CrossRef]

- Chen, X.; Benjaafar, S.; Elomri, A. The Carbon-Constrained EOQ. Oper. Res. Lett. 2012, 41, 172–179. [Google Scholar] [CrossRef]

- Song, J.; Leng, M. Analysis of the Single-Period Problem under Carbon Emissions Policies. In Handbook of Newsvendor Problems; Springer: New York, NY, USA, 2012; pp. 297–313. [Google Scholar]

- Plambeck, E.L. Reducing Greenhouse Gas Emissions through Operations and Supply Chain Management. Energy Econ. 2012, 34, 64–74. [Google Scholar] [CrossRef]

- Geller, H.; Harrington, P.; Rosenfeld, A.H.; Tanishima, S.; Unander, F. Policies for increasing energy efficiency: Thirty years of experience in OECD countries. Energy Policy 2006, 34, 556–773. [Google Scholar] [CrossRef]

- Tesco PLC. Corporate Social Responsibilty 2011. Available online: http://www.tescoplc.com/media/60113/tesco_cr_report_2011_final.pdf (accessed on 20 February 2015).

- Low Carbon of China. Wal-Mart China “Low-Carbon Environmental Protection” Community Welfare Education Started. Available online: http://www.ditan360.com/GongYi/Info-77368.html (accessed on 20 February 2015).

- Dell. FY14 Corporate Responsibility Report. 2013. Available online: http://www.dell.com/learn/us/en/uscorp1/report?c=us&l=en&s=corp (accessed on 20 February 2015).

- Carbon Trust. In Carbon Footprints in the Supply Chain: The Next Step For Business; Carbon Trust: London, UK, 2006.

- Du, S.; Zhu, L.; Liang, L.; Ma, F. Emission-dependent supply chain and environment policy-making in the “cap-and-trade” system. Energy Policy 2013, 57, 61–67. [Google Scholar] [CrossRef]

- Jing, S. The green marketing and its influence on consumers mental and behavior. Manag. World 2004, 5, 145–146. [Google Scholar]

- Spengler, J. Vertical integration and antitrust policy. J. Polit. Econ. 1950, 58, 347–352. [Google Scholar] [CrossRef]

- Leng, M.; Zhu, A. Side-payment contracts in two-person nonzero-sum supply chain games: Review, discussion and applications. Eur. J. Oper. Res. 2009, 196, 600–618. [Google Scholar] [CrossRef]

- He, L.; Zhao, D.; Liu, Y. Dynamic game of supply chain coordination based on automatically perform contract. Syst. Eng. Theory Pract. 2011, 31, 1864–1878. [Google Scholar]

- Chen, J. Research on low carbon supply chain management. J. Syst. Manag. 2012, 21, 721–728. [Google Scholar]

- He, L. Emission Abatement, Regulations and Operations in Carbon Efficient Supply Chain: Theoretic Review and Extensions. Working Paper, Institute for Manufacturing and Technology, College of Management and Economics, Tianjin University, Tianjin, China, 18 March 2012. [Google Scholar]

- Xia, L.J.; Zhao, D.; Yuan, B. Carbon Efficient Supply Chain Management: Literature Review with Extensions. Appl. Mech. Mater. 2013, 291, 1407–1412. [Google Scholar]

- Du, S.; Dong, J.; Liang, L.; Zhang, J. Production optimization considering the emission permit and trade. Chin. J. Manag. Sci. 2009, 17, 81–86. [Google Scholar]

- Zhang, J.; Nie, T.; Du, S. Optimal emission-dependent production policy with stochastic demand. Int. J. Soc. Syst. Sci. 2011, 3, 21–39. [Google Scholar] [CrossRef]

- Hua, G.; Cheng, T.C.E.; Wang, S. Managing carbon footprints in inventory management. Int. J. Prod. Econ. 2011, 132, 178–185. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y. Carbon Emissions and the Supply Chain: A Review of Environmental Legislation, Industry Initiatives, Measurement Standards, and Emission Trading Markets. Working Paper, University of Minnesota, Minneapolis, MN, USA, 2009. [Google Scholar]

- Hoen, K.M.R.; Tan, T.; Fransoo, J.C.; van Houtum, G.J. Effect of carbon emission regulations on transport mode selection under stochastic demand. Flex. Serv. Manuf. J. 2014, 26, 170–195. [Google Scholar] [CrossRef]

- Hoen, K.M.R.; Tan, T.; Fransoo, J.C.; van Houtum, G.J. Switching transport modes to meet voluntary carbon emission targets. Transp. Sci. 2013, 48, 592–608. [Google Scholar] [CrossRef]

- Abdallah, T.; Diabat, A.; Simchi-Levi, D. A carbon sensitive supply chain network problem with green procurement. In Proceedings of the 40th International Conference on Computers and Industrial Engineering, Awaji City, Japan, 25–28 July 2010; pp. 1–6.

- Diabat, A.; Simchi-Levi, D. A Carbon-Capped Supply Chain Network Problem. In Proceedings of the IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Hong Kong, China, 8–12 December 2009; pp. 523–527.

- Sundarakani, B.; de Souza, R.; Goh, M.; Wagner, S.M.; Manikandan, S. Modeling carbon footprints across the supply chain. Int. J. Prod. Econ. 2010, 128, 43–50. [Google Scholar] [CrossRef]

- Cachon, G.P. Supply Chain Design and the Cost of Greenhouse Gas Emissions. Working Paper, The Wharton School, University of Pennsylvania, Philadelphia, PA, USA, 2011. [Google Scholar]

- Ramudhin, A.; Chaabane, A.; Paquet, M. Design of sustainable supply chains under the emission trading scheme. Int. J. Prod. Econ. 2012, 135, 37–49. [Google Scholar] [CrossRef]

- Cachon, G.P. Retail store density and the cost of greenhouse gas emissions. Manag. Sci. 2014, 60, 1907–1925. [Google Scholar] [CrossRef]

- Li, Y.; Wei, C.; Cai, X. Optimal pricing and order policies with B2B product returns for fashion products. Int. J. Prod. Econ. 2012, 135, 637–646. [Google Scholar] [CrossRef]

- Li, Y.; Xu, L.; Choi, T.-M.; Govindan, K. Optimal advance-selling strategy for fashionable products with opportunistic consumers returns. IEEE Trans. Syst. Man Cybern.: Syst. 2014, 44, 938–952. [Google Scholar] [CrossRef]

- Li, Y.; Zhao, X.; Shi, D.; Li, X. Governance of sustainable supply chains in the fast fashion industry. Eur. Manag. J. 2014, 32, 823–836. [Google Scholar] [CrossRef]

- Shen, B.; Li, Q. Impacts of Returning Unsold Products in Retail Outsourcing Fashion Supply Chain: A Sustainability Analysis. Sustainability 2015, 7, 1172–1185. [Google Scholar] [CrossRef]

- Choi, T.-M.; Chiu, C.-H. Mean-downside-risk and mean-variance newsvendor models: Implications for sustainable fashion retailing. Int. J. Prod. Econ. 2012, 135, 552–560. [Google Scholar] [CrossRef]

- Nagurney, A.; Yu, M. Sustainable fashion supply chain management under oligopolistic competition and brand differentiation. Int. J. Prod. Econ. 2012, 135, 532–540. [Google Scholar] [CrossRef]

- Shen, B. Sustainable fashion supply chain: Lessons from H&M. Sustainability 2014, 6, 6236–6249. [Google Scholar] [CrossRef]

- Liu, Z.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Huang, Z.; Li, S.X. Co-op advertising models in manufacturer-retailer supply chains: A game theory approach. Eur. J. Oper. Res. 2001, 135, 527–544. [Google Scholar] [CrossRef]

- Yue, J.; Austin, J.; Wang, M.-C.; Huang, Z. Coordination of cooperative advertising in a two-level supply chain when manufacturer offers discount. Eur. J. Oper. Res. 2006, 168, 65–85. [Google Scholar] [CrossRef]

- Jones, R.; Mendelson, H. Information Goods vs. Industrial Goods: Cost Structure and Competition. Manag. Sci. 2011, 57, 164–176. [Google Scholar] [CrossRef]

- Zeng, G.; Wan, Z. Carbon Emission Permits Trading: A Summary. Chin. Rev. Financ. Stud. 2010, 4, 54–67. [Google Scholar]

- Stackelberg, H.F.V. Market Structure and Equilibrium; Springer-Verlag Berlin Heidelberg: Berlin, Germany, 2010. [Google Scholar]

- Myerson, R.B. Game Theory: Analysis of Conflict; Harvard University: Cambridge, MA, USA, 1991. [Google Scholar]

- Etro, F. Stackelberg, Heinrich von: Market Structure and Equilibrium. J. Econ. 2013, 109, 89–92. [Google Scholar] [CrossRef]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, L.; Zhao, D.; Xia, L. Game Theoretic Analysis of Carbon Emission Abatement in Fashion Supply Chains Considering Vertical Incentives and Channel Structures. Sustainability 2015, 7, 4280-4309. https://doi.org/10.3390/su7044280

He L, Zhao D, Xia L. Game Theoretic Analysis of Carbon Emission Abatement in Fashion Supply Chains Considering Vertical Incentives and Channel Structures. Sustainability. 2015; 7(4):4280-4309. https://doi.org/10.3390/su7044280

Chicago/Turabian StyleHe, Longfei, Daozhi Zhao, and Liangjie Xia. 2015. "Game Theoretic Analysis of Carbon Emission Abatement in Fashion Supply Chains Considering Vertical Incentives and Channel Structures" Sustainability 7, no. 4: 4280-4309. https://doi.org/10.3390/su7044280