The Effect of Biogas Production on Farmland Rental Prices: Empirical Evidences from Northern Italy

Abstract

:1. Introduction

2. The Impact of Bioenergy on the Land Market: Evidence from the Literature Review

3. Data and Methods

3.1. The Analytical Framework: The Hedonic Pricing Model

3.2. Case Study and Data: The Land Rent Contracts in the Province of Cremona

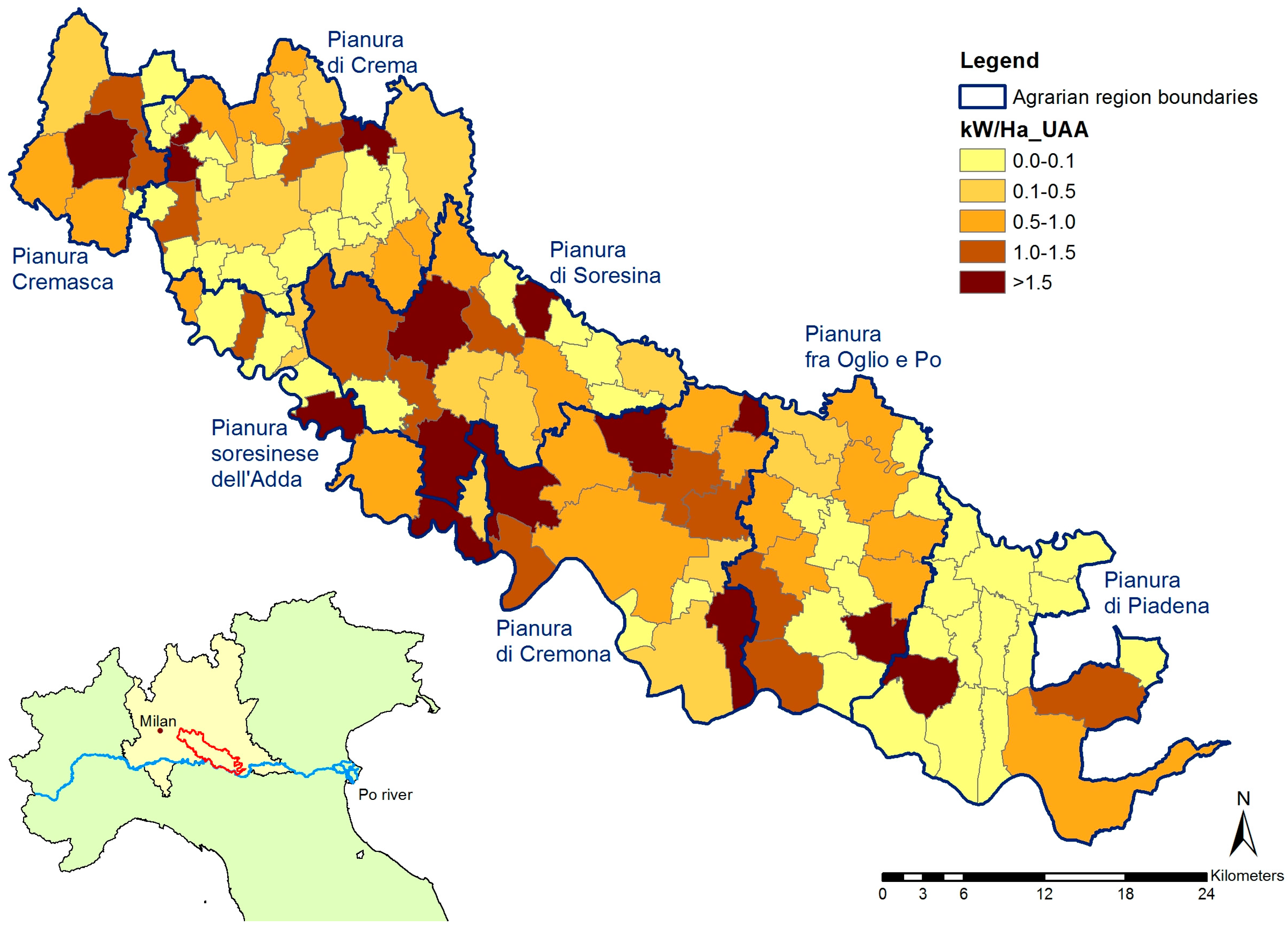

- Biogas plant data—give information about the quantity of plants and kW installed, the type of plants and their spatial distribution in the considered area. The number of plants and the kW installed approximate the dimension of the biogas sector (pl_m, pl_r, kw_m, and kw_r). These variables are expected to have a positive relationship with the price of the rented area, because they should approximate the quantity of energy crops (maize silage) requested and the effect of the shortage of available land [10]. Nonetheless, two more pieces information are needed to improve the description of this relationship. Firstly, it is known that different feedstock blends must be adopted depending on the technology of each plant, so we approximated differences in technology controlling for the average dimension of the plants (pp_m and pp_r). Secondly, as transport costs constrain energy crop provision [10,35], the distance of the plants from rented land has been approximated measuring the effect of kilowatts installed in the municipality and the agrarian regions the land rental contracts pertain to. This approximation of the distances between plants and rented land was an inevitable choice, due to the lack of georeferenced data.We used six variables to measure the impact of biogas production. They are a set of three variables, computed for two different buffers around each rental contract: at the municipal level (smaller buffer) and at the level of agricultural region (larger buffer). As the estimated model is not spatially explicit, the buffers are intended to account, indirectly, for the spatial effect of biogas plants on rental prices. The three variables considered, namely the number of plants (pl), nominal capacity per hectare (kw), and average size of the biogas plants (pp) used at different territorial levels (municipality and agrarian region) bring different information, even if correlated:

- ○

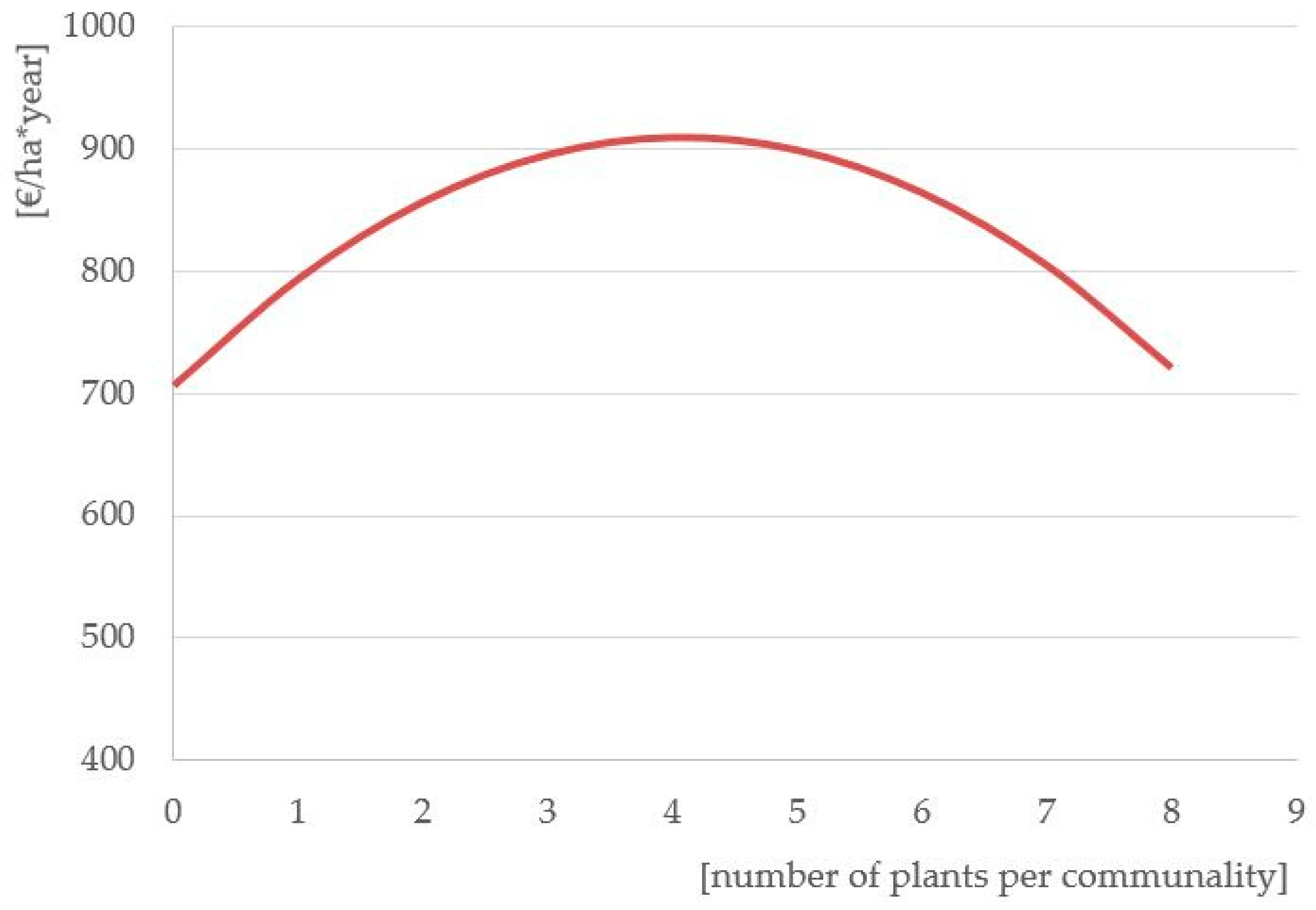

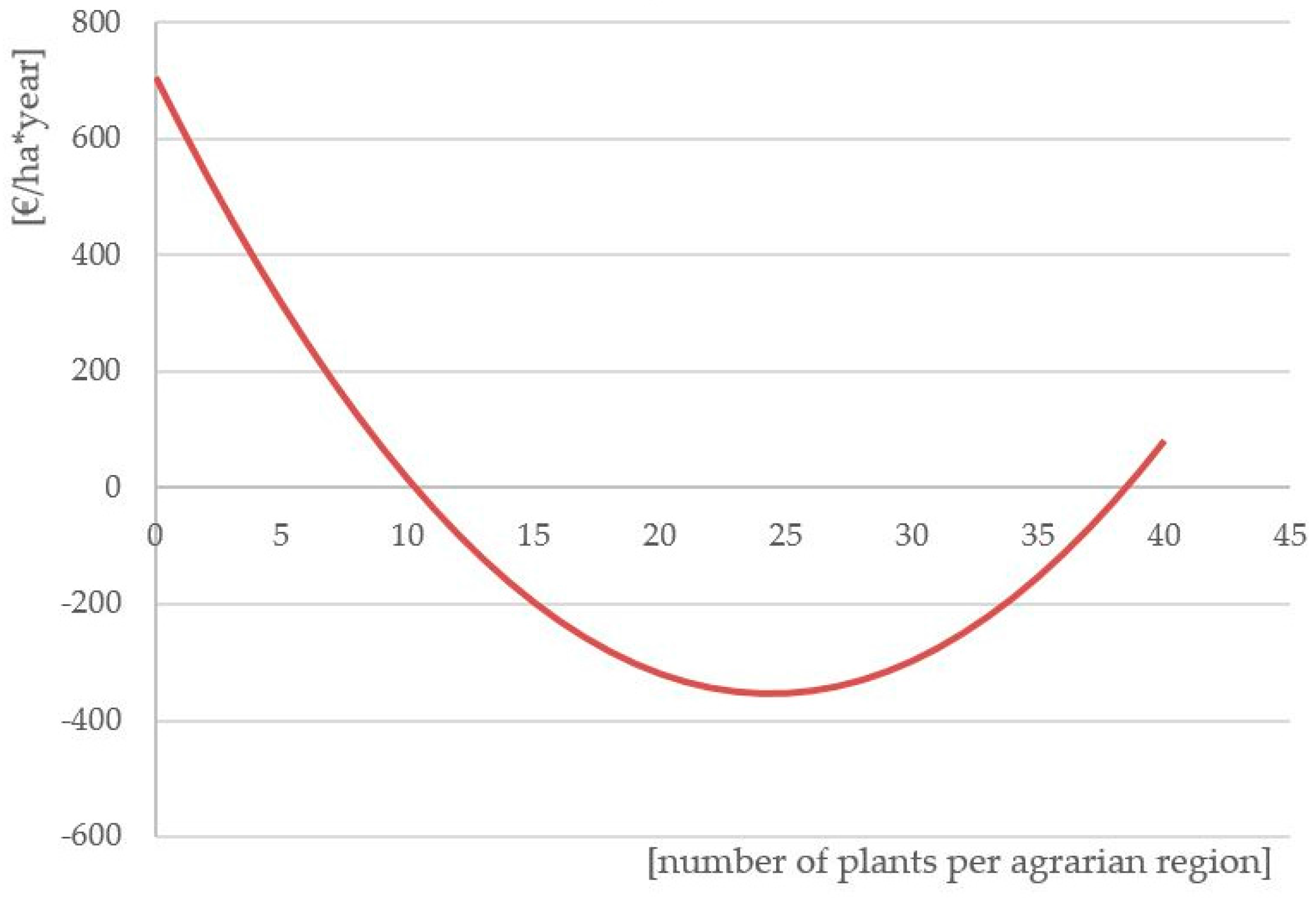

- The number of biogas plants in a given area (municipality, pl_m, or agrarian region, pl_r) affects the level of competition for feedstocks (manure, maize silage, or other crops). As shown in recent studies on biogas in the same area [10,35,36], the transport costs for biogas input and digestate spreading are non-linear, with an efficient ray of procurement that depends on plant size and feedstock mix. As spatial information on the location of rented land with respect to each biogas plant is missing, the model accounts for this feature by including the number of biogas plants in the surroundings of rented land. These variables capture the overlapping effect of efficient rays of feedstock procurement among biogas plants.

- ○

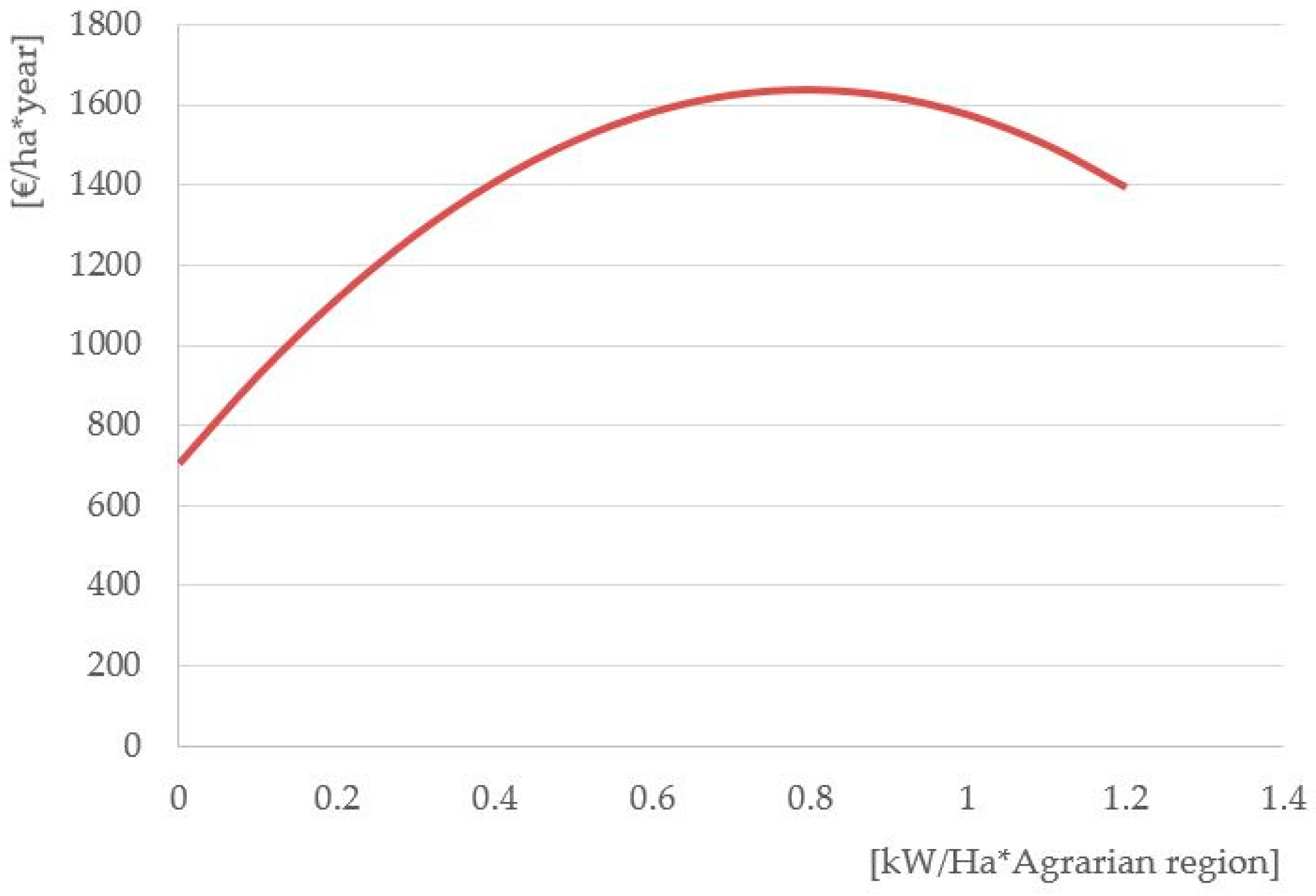

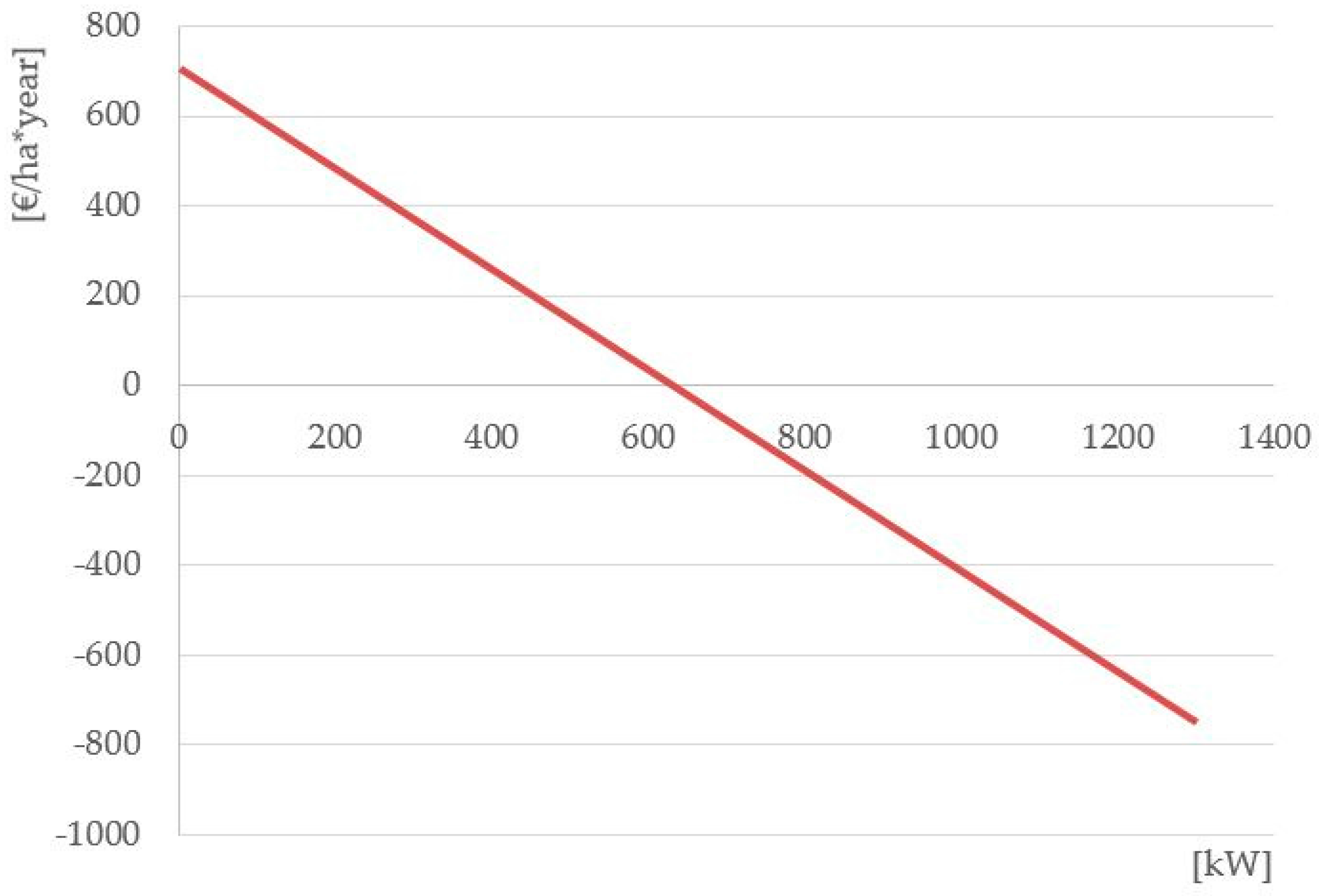

- The nominal capacity of biogas per hectare of UAA (municipality, kw_m, or agrarian region, kw_r) bring information on the density of the installed power and measure the demand for energy crops.

- ○

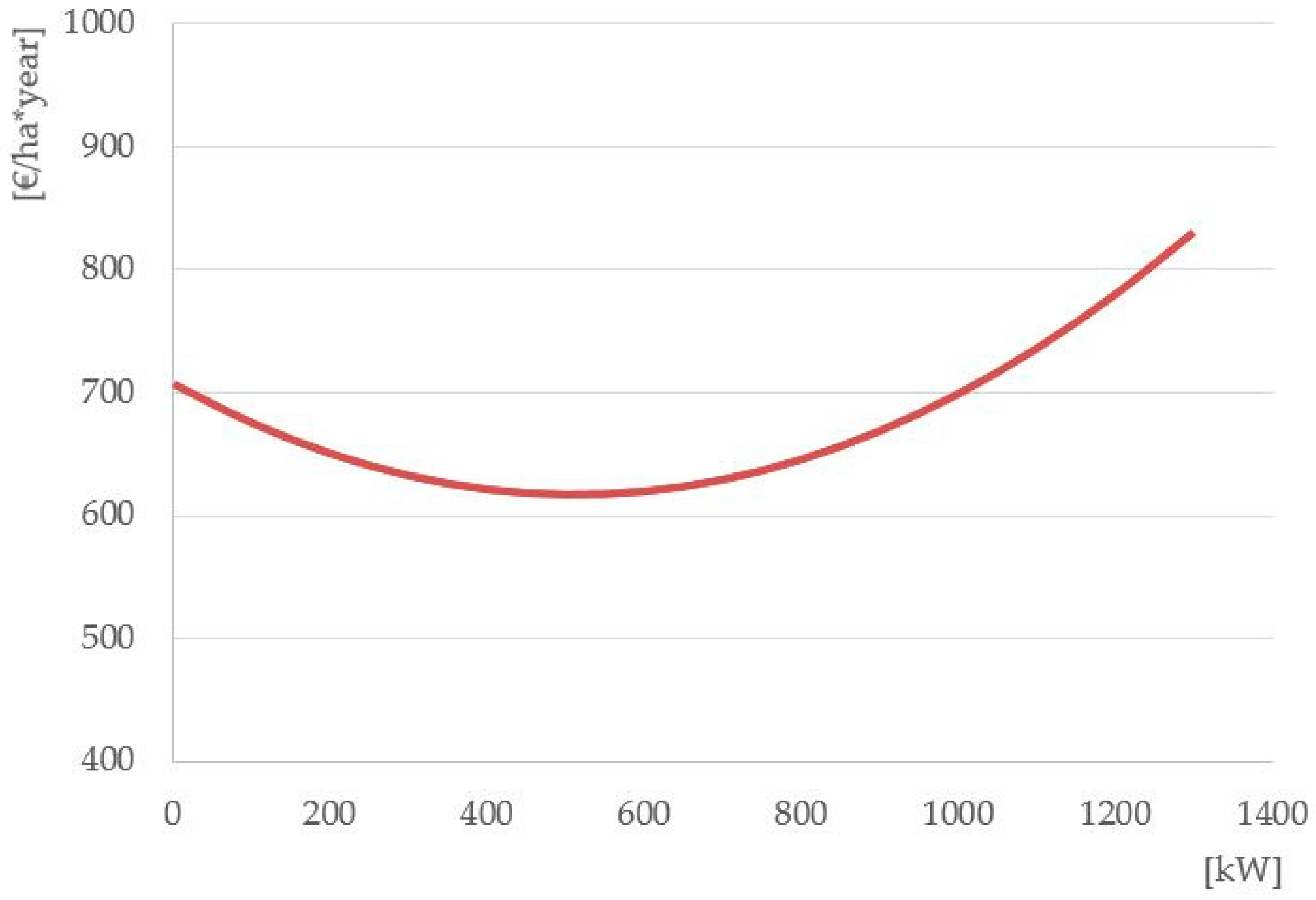

- The average size of biogas plants (municipality, pp_m, or agrarian region, pp_r) allows capturing the different technology of biogas production. In particular, small- and medium-sized biogas plants use larger proportions of manure and slurry that may decrease the value of land used for slurry location. On the other hand, large-sized plants are fed mainly with energy crops (maize silage), that may increase the demand of land for that purpose.

- Agricultural land use data—give information about farmers’ choices on land use and approximate if rented land is suited for the cultivation of certain crops. In our case, availability for maize and energy crops is expected to be directly related to the land rental price.

- Contract signature data—show when the contract was signed. This is considered relevant with reference to Italian subsidization schemes for biogas that changed in 2013 (according to Ministerial Decree 6 July 2012 [37]). The variable’s coefficient may change over years as an effect of change in policies. The institutional factors are decisive for the kind of biogas plants established, their scale, and the technology employed [25,26].

3.3. Estimation Strategy and Limitations of the Model

4. Results and Discussion

5. Conclusions and Policy Implications

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. A Brief Tutorial to Interpret the Results of Hedonic Prices Analysis of Farmland Attributes

Appendix B. Legend of Some Control Variables in Table 1

| Variable | Description |

|---|---|

| Presence of second crops | |

| sc_1 | Forage alternation as second use of the land |

| sc_2 | Corn as second use of the land |

| sc_3 | Vegetables as second use of the land |

| Type of land owner | |

| own_1 (reference) | One person |

| own_2 | More than one person |

| own_3 | Private company |

| own_4 | No profit/Public institution |

| Type of farming according to Reg. EC 1242/2008 | |

| tf_0 (reference) | Specialist milk production |

| tf_1 | Specialist cereals (other than rice), oilseeds and protein |

| tf_2 | Specialist root crops |

| tf_3 | Specialist root crops and cereals combined |

| tf_4 | Specialist field vegetables |

| tf_5 | Various field crops |

| tf_6 | Various permanent crops combined |

| tf_7 | Specialist milk production with cattle rearing |

| tf_8 | Specialist cattle-mainly rearing |

| tf_9 | Specialist cattle-mainly fattening |

| tf_10 | Specialist sheep |

| tf_11 | Specialist goats |

| tf_12 | Various grazing livestock-no dominant enterprise |

| tf_13 | Specialist pig fattening |

| tf_14 | Pig rearing and fattening combined |

| tf_15 | Specialist layers |

| tf_16 | Specialist poultry-meat |

| tf_17 | Pigs and poultry combined |

| tf_18 | Market gardening and permanent crops combined |

| tf_19 | Field crops and permanent crops combined |

| tf_20 | Mixed cropping, mainly field crops |

| tf_21 | Mixed livestock, mainly dairying |

| tf_22 | Mixed livestock: granivores and dairying combined |

| tf_23 | Mixed livestock: granivores with various livestock |

| tf_24 | Dairying combined with field crops |

| tf_25 | Field crops combined with grazing livestock other than dairying |

| tf_26 | Grazing livestock other than dairying combined with field crops |

| tf_27 | Field crops and granivores combined |

Appendix C. Descriptive Statistics of Regression Sample

| Variable | Description | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| Rent value (Dependent) | Price of land rental per hectare per year | 812 | 869.4 | 316.2 | 119.4 | 3241.7 |

| Biogas plant-related variables | ||||||

| pl_m | Number of biogas plants per municipality | 812 | 1.3 | 1.6 | 0.0 | 7.0 |

| pp_m | Average power of biogas plants in the municipality | 812 | 409.8 | 405.1 | 0.0 | 1130.5 |

| kw_m | Kilowatt per hectare of utilized agricultural area in the municipality | 812 | 0.5 | 0.7 | 0.0 | 5.1 |

| pl_r | Number of biogas plants per agrarian region | 812 | 18.0 | 10.1 | 2.0 | 36.0 |

| pp_r | Average power of biogas plants in the agrarian region | 812 | 714.2 | 136.7 | 286.7 | 1021.3 |

| kw_r | Kilowatt per hectare of utilized agricultural area in the agrarian region | 812 | 0.6 | 0.3 | 0.0 | 1.2 |

| liv | Livestock unit per utilized agricultural area in the municipality | 812 | 3.6 | 2.2 | 0.0 | 19.8 |

| Agricultural land use | ||||||

| w&u_s | Share of land used for wood crops or uncultivated | 812 | 3.3% | 7.3% | 0.0% | 100.0% |

| mai_s | Share of land used for corn and/or arable crops | 812 | 41.7% | 44.1% | 0.0% | 100.0% |

| ene_s | Share of land used for energy crops | 812 | 1.7% | 11.5% | 0.0% | 100.0% |

| foa_s | Share of land used for forage alternation | 812 | 49.0% | 44.4% | 0.0% | 100.0% |

| fop_s | Share of land used for permanent forage | 812 | 2.3% | 13.2% | 0.0% | 100.0% |

| veg_s | Share of land used for vegetables | 812 | 1.1% | 9.2% | 0.0% | 99.6% |

| vif_s | Share of land used for vine and/or orchard | 812 | 0.0% | 0.0% | 0.0% | 0.0% |

| nur_s | Share of land used for plant nursery | 812 | 0.9% | 9.1% | 0.0% | 100.0% |

| Other control variables—continuous | ||||||

| dim_c | Dimension of the rented area by contract | 812 | 13.0 | 18.5 | 0.2 | 188.0 |

| dim_u | Average dimension of agricultural units within the contracts | 812 | 1.7 | 2.0 | 0.1 | 23.9 |

| len | Length of the contract | 812 | 4.2 | 2.2 | 1.0 | 20.0 |

| uaa | Share of utilized agricultural area within the municipality | 812 | 0.8 | 0.1 | 0.5 | 1.0 |

| sto | Standard output of the farm of the land tenant (continuous, €/year); | 812 | 252.7 | 307.9 | 0.1 | 2680.8 |

| Variable | Description | Obs | % |

|---|---|---|---|

| Other control variables—categorical | |||

| cap | CAP subsidies coupled to the contract | 812 | - |

| Yes | 118 | 14.5% | |

| No | 694 | 85.5% | |

| bui | Rural building on the rented area | 812 | - |

| Yes | 74 | 9.1% | |

| No | 738 | 90.9% | |

| Year | 812 | - | |

| 2010 (reference) | Contract signed in 2010 | 80 | 9.9% |

| 2011 | Contract signed in 2011 | 158 | 19.5% |

| 2012 | Contract signed in 2012 | 142 | 17.5% |

| 2013 | Contract signed in 2013 | 160 | 19.7% |

| 2014 | Contract signed in 2014 | 272 | 33.5% |

| Agrarian Region | 812 | - | |

| 19-01 | Pianura Cremasca | 63 | 7.8% |

| 19-02 | Pianura di Crema | 148 | 18.2% |

| 19-03 | Pianura soresinese dell’Adda | 53 | 6.5% |

| 19-04 | Pianura di Soresina | 162 | 20.0% |

| 19-05 | Pianura di Cremona | 104 | 12.8% |

| 19-06 | Pianura fra Oglio e Po | 186 | 22.9% |

| 19-07 (reference) | Pianura di Piadena | 96 | 11.8% |

| Presence of second crops | |||

| sc_1 | Forage alternation as second use of the land | 812 | - |

| Yes | 137 | 16.9% | |

| No | 675 | 83.1% | |

| sc_2 | Corn as second use of the land | 812 | - |

| Yes | 39 | 4.8% | |

| No | 773 | 95.2% | |

| sc_3 | Vegetables as second use of the land | 812 | - |

| Yes | 1 | 0.1% | |

| No | 811 | 99.9% | |

| Type of land owner | 812 | - | |

| own_1 (reference) | One person | 450 | 55.4% |

| own_2 | More than one person | 258 | 31.8% |

| own_3 | Private company | 56 | 6.9% |

| own_4 | No profit/Public institution | 48 | 5.9% |

| Type of farming according to Reg. EC 1242/2008 | 812 | - | |

| tf_0 (reference) | Specialist milk production | 325 | 40.0% |

| tf_1 | Specialist cereals (other than rice), oilseeds and protein | 207 | 25.5% |

| tf_2 | Specialist root crops | 2 | 0.2% |

| tf_3 | Specialist root crops and cereals combined | 1 | 0.1% |

| tf_4 | Specialist field vegetables | 6 | 0.7% |

| tf_5 | Various field crops | 94 | 11.6% |

| tf_6 | Various permanent crops combined | 13 | 1.6% |

| tf_7 | Specialist milk production with cattle rearing | 5 | 0.6% |

| tf_8 | Specialist cattle-mainly rearing | 2 | 0.2% |

| tf_9 | Specialist cattle-mainly fattening | 6 | 0.7% |

| tf_10 | Specialist sheep | 1 | 0.1% |

| tf_11 | Specialist goats | 1 | 0.1% |

| tf_12 | Various grazing livestock-no dominant enterprise | 2 | 0.2% |

| tf_13 | Specialist pig fattening | 17 | 2.1% |

| tf_14 | Pig rearing and fattening combined | 21 | 2.6% |

| tf_15 | Specialist layers | 2 | 0.2% |

| tf_16 | Specialist poultry-meat | 3 | 0.4% |

| tf_17 | Pigs and poultry combined | 8 | 1.0% |

| tf_18 | Market gardening and permanent crops combined | 1 | 0.1% |

| tf_19 | Field crops and permanent crops combined | 5 | 0.6% |

| tf_20 | Mixed cropping, mainly field crops | 2 | 0.2% |

| tf_21 | Mixed livestock, mainly dairying | 10 | 1.2% |

| tf_22 | Mixed livestock: granivores and dairying combined | 6 | 0.7% |

| tf_23 | Mixed livestock: granivores with various livestock | 2 | 0.2% |

| tf_24 | Dairying combined with field crops | 6 | 0.7% |

| tf_25 | Field crops combined with grazing livestock other than dairying | 4 | 0.5% |

| tf_26 | Grazing livestock other than dairying combined with field crops | 2 | 0.2% |

| tf_27 | Field crops and granivores combined | 58 | 7.1% |

Appendix D. Estimation Results for Control Variables in Table 2

| Control Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Biogas Variables at Municipality Level | Biogas Variables at Agrarian Region Level | Biogas Variables at Municipality Level w/out Nominal Capacity per ha | Biogas variables at Agrarian Region Level w/out Nominal Capacity per ha | Biogas Variables at Municipality and Agrarian Region Level | ||||||

| R-squared | 0.221 | 0.225 | 0.218 | 0.233 | 0.236 | |||||

| Rent value (Dependent) | Coefficient | Coefficient | Coefficient | Coefficient | Coefficient | |||||

| ------ continue from Table 2 ------ | ||||||||||

| Control variables | ||||||||||

| dim_c | 2.310 | ** | 2.236 | ** | 2.202 | ** | 2.326 | ** | 2.428 | ** |

| dim_u | 15.223 | ** | 15.048 | ** | 17.286 | ** | 12.774 | * | 10.931 | * |

| dim_u2 | −0.859 | * | −0.912 | * | −0.987 | ** | −0.755 | - | −0.633 | - |

| len | −9.267 | * | −8.033 | - | −9.280 | * | −8.257 | - | −8.135 | - |

| uaa | −50.528 | - | −82.320 | - | −73.841 | - | −96.297 | - | −72.901 | - |

| cap | 109.285 | *** | 125.554 | *** | 110.041 | *** | 118.537 | *** | 118.628 | *** |

| bui | 6.832 | - | 15.603 | - | 10.242 | - | 13.510 | - | 9.836 | - |

| sto | 0.106 | - | 0.098 | - | 0.106 | - | 0.093 | - | 0.092 | - |

| Presence of second crops | ||||||||||

| sc_1 | 21.540 | - | 12.914 | - | 19.163 | - | 9.224 | - | 11.684 | - |

| sc_2 | 40.007 | - | 17.944 | - | 39.094 | - | 25.959 | - | 26.728 | - |

| sc_3 | 139.899 | * | 120.345 | - | 145.382 | * | 129.783 | - | 122.482 | - |

| Owner type-Reference = own_1 | ||||||||||

| own_2 | 20.789 | - | 19.277 | - | 21.208 | - | 18.457 | - | 18.234 | - |

| own_3 | −9.261 | - | −0.798 | - | −5.417 | - | −5.233 | - | −8.473 | - |

| own_4 | 0.688 | - | 3.683 | - | 3.941 | - | −11.076 | - | −14.113 | - |

| Type of farming-Reference = tf_0 | ||||||||||

| tf_1 | 1.064 | - | 0.610 | - | 3.523 | - | −8.435 | - | −10.872 | - |

| tf_2 | 170.323 | - | 137.066 | - | 186.942 | - | 124.774 | - | 106.468 | - |

| tf_3 | −82.899 | - | −174.195 | ** | −93.174 | - | −171.870 | * | −164.273 | * |

| tf_4 | −52.620 | - | −22.458 | - | −56.855 | - | −52.366 | - | −47.717 | - |

| tf_5 | 25.565 | - | 35.391 | - | 30.944 | - | 20.901 | - | 16.056 | - |

| tf_6 | −204.011 | * | −223.600 | ** | −205.884 | * | −229.036 | ** | −226.480 | ** |

| tf_7 | −39.267 | - | −71.925 | - | −33.472 | - | −76.557 | - | −80.888 | - |

| tf_8 | 102.643 | *** | 83.942 | ** | 77.581 | ** | 80.533 | * | 106.334 | *** |

| tf_9 | 231.592 | *** | 267.157 | *** | 242.201 | *** | 257.993 | *** | 247.880 | *** |

| tf_10 | 352.260 | *** | 334.972 | *** | 371.944 | *** | 352.934 | *** | 333.749 | *** |

| tf_11 | −101.537 | * | −185.306 | ** | −101.052 | - | −175.819 | ** | −177.343 | ** |

| tf_12 | 538.903 | ** | 510.572 | *** | 544.978 | *** | 489.028 | *** | 460.058 | ** |

| tf_13 | 246.432 | - | 246.895 | - | 238.832 | - | 237.459 | - | 244.089 | - |

| tf_14 | 118.824 | ** | 129.214 | ** | 111.109 | ** | 113.582 | ** | 120.252 | ** |

| tf_15 | −91.049 | - | −156.699 | - | −105.140 | - | −143.692 | - | −132.877 | - |

| tf_16 | −21.456 | - | −37.905 | - | −16.518 | - | −33.648 | - | −38.420 | - |

| tf_17 | 40.104 | - | 37.931 | - | 47.138 | - | 42.124 | - | 34.753 | - |

| tf_18 | 18.412 | - | 17.392 | - | 41.180 | - | −43.124 | - | −66.142 | - |

| tf_19 | −78.368 | - | −86.363 | - | −82.564 | - | −87.760 | - | −84.056 | - |

| tf_20 | 87.785 | - | 121.729 | - | 106.998 | - | 102.840 | - | 85.301 | - |

| tf_21 | 190.640 | - | 202.495 | - | 193.148 | - | 197.602 | - | 195.028 | - |

| tf_22 | 34.292 | - | 25.116 | - | 33.814 | - | 27.807 | - | 27.229 | - |

| tf_23 | 724.318 | *** | 719.590 | *** | 728.958 | *** | 714.722 | *** | 709.477 | *** |

| tf_24 | −64.546 | - | −64.737 | - | −66.728 | - | −69.281 | - | −67.202 | - |

| tf_25 | 184.111 | ** | 207.172 | ** | 193.104 | ** | 209.150 | ** | 199.997 | ** |

| tf_26 | 245.194 | *** | 278.272 | *** | 228.079 | *** | 243.287 | *** | 260.514 | *** |

| tf_27 | 57.571 | - | 56.548 | - | 59.537 | - | 46.958 | - | 45.108 | - |

References

- Böhringer, C.; Keller, A.; Van der Werf, E. Are green hopes too rosy? Employment and welfare impacts of renewable energy promotion. Energy Econ. 2013, 36, 277–285. [Google Scholar] [CrossRef]

- Tilman, D.; Socolow, R.; Foley, J.A.; Hill, J.; Larson, E.; Lynd, L.; Pacala, S.; Reilly, J.; Searchinger, T.; Somerville, C.; et al. Beneficial biofuels—The food, energy and environment trilemma. Science 2009, 325, 270–271. [Google Scholar] [CrossRef] [PubMed]

- Harvey, M.; Pilgrim, S. The new competition for land: Food, energy, and climate change. Food Policy 2011, 36, 40–51. [Google Scholar] [CrossRef]

- Murphy, R.; Woods, J.; Black, M.; McManus, M. Global developments in the competition for land from biofuels. Food Policy 2011, 36, 52–61. [Google Scholar] [CrossRef]

- Rathmann, R.; Szklo, A.; Schaeffer, R. Land use competition for production of food and liquid biofuels: An analysis of the arguments in the current debate. Renew. Energy 2010, 35, 14–22. [Google Scholar] [CrossRef]

- Dornburg, V.; van Vuuren, D.; van de Ven, G.; Langeveld, H.; Meeusen, M.; Banse, M.; van Oorschot, M.; Ros, J.; van den Born, G.J.; Aiking, H.; et al. Bioenergy revisited: Key factors in global potentials of bioenergy. Energy Environ. Sci. 2010, 3, 258–267. [Google Scholar] [CrossRef]

- Gelfand, I.; Sahajpal, R.; Zhang, X.; Izaurralde, R.C.; Gross, K.L.; Robertson, G.P. Sustainable bioenergy production from marginal lands in the US Midwest. Nature 2013, 493, 514–517. [Google Scholar] [CrossRef] [PubMed]

- Sgroi, F.; Foderà, M.; Di Trapani, A.M.; Tudisca, S.; Testa, R. Economic evaluation of biogas plant size utilizing giant reed. Renew. Sustain. Energy Rev. 2015, 49, 403–409. [Google Scholar] [CrossRef]

- Mela, G.; Canali, G. How distorting policies can affect energy efficiency and sustainability: The case of biogas production in the Po Valley (Italy). AgBioForum 2014, 16, 194–206. [Google Scholar]

- Bartoli, A.; Cavicchioli, D.; Kremmydas, D.; Rozakis, S.; Olper, A. The Impact of Different Energy Policy Options on Feedstock Price and Land Demand for Maize Silage: The Case of Biogas in Lombardy. Energy Policy 2016, 96, 351–363. [Google Scholar] [CrossRef]

- Feichtinger, P.; Salhofer, K. What Do We Know about the Influence of Agricultural Support on Agricultural Land Prices? Ger. J. Agric. Econ. 2013, 62, 71–85. [Google Scholar]

- März, A.; Klein, N.; Kneib, T.; Musshoff, O. Analysing farmland rental rates using Bayesian geoadditive quantile regression. Eur. Rev. Agric. Econ. 2015, 3, 1–36. [Google Scholar] [CrossRef]

- Guastella, G.; Moro, D.; Sckokai, P.; Veneziani, M. The capitalization of area payments into land rental prices: A panel sample selection approach. In Proceedings of the 2014 International Congress, European Association of Agricultural Economists (EAAE), Ljubljana, Slovenia, 26–29 August 2014.

- Latruffe, L.; Le Mouël, C. Capitalization of government support in agricultural land prices: What do we know? J. Econ. Surv. 2009, 23, 659–691. [Google Scholar] [CrossRef]

- Bartolini, F.; Viaggi, D. The common agricultural policy and the determinants of changes in EU farm size. Land Use Policy 2013, 31, 126–135. [Google Scholar] [CrossRef]

- Kilian, S.; Antón, J.; Salhofer, K.; Röder, N. Impacts of 2003 CAP reform on land rental prices and capitalization. Land Use Policy 2012, 29, 789–797. [Google Scholar] [CrossRef]

- Karlsson, J.; Nilsson, P. Capitalisation of Single Farm Payment on farm price: An analysis of Swedish farm prices using farm-level data. Eur. Rev. Agric. Econ. 2014, 41, 279–300. [Google Scholar] [CrossRef]

- Feichtinger, P.; Salhofer, K. The Fischler reform of the common agricultural policy and agricultural land prices. Land Econ. 2016, 92, 411–432. [Google Scholar] [CrossRef]

- Duvivier, R.; Gaspart, F.; de Frahan, B.H. A panel data analysis of the determinants of farmland price: An application to the effects of the 1992 CAP reform in Belgium. In Proceedings of the XIth EAAE Congress on “The Future of Rural Europe in the Global Agri-Food System”, Copenhagen, Denmark, 23–27 August 2005.

- Pyykkonen, P. Spatial analysis of factors affecting Finnish farmland prices. In Proceedings of the 2005 International Congress, European Association of Agricultural Economists, Copenhagen, Denmark, 23–27 August 2005.

- Folland, S.T.; Hough, R.R. Nuclear power plants and the value of agricultural land. Land Econ. 1991, 67, 30–36. [Google Scholar] [CrossRef]

- Morehart, M.; Kuethe, T.; Beckman, J.; Ifft, J.; Williams, R. Trends in US Farmland Values and Ownership; US Department of Agriculture, Economic Research Service: Washington, DC, USA, 2012.

- Borchers, A.; Ifft, J.; Kuethe, T. Linking the price of agricultural land to use values and amenities. Am. J. Agric. Econ. 2014, 96, 1307–1320. [Google Scholar] [CrossRef]

- Swinnen, J.; Ciaian, P.; Kancs, D.A. Study on the Functioning of Land Markets in the EU Member States under the Influence of Measures Applied under the Common Agricultural Policy; Unpublished Report to the European Commission; Centre for European Policy Studies: Brussels, Belgium, 2008. [Google Scholar]

- Carrosio, G. Energy production from biogas in the Italian countryside: Policies and organizational models. Energy Policy 2013, 63, 3–9. [Google Scholar] [CrossRef]

- Carrosio, G. Energy production from biogas in the Italian countryside: Modernization vs. repeasantization. Biomass Bioenergy 2014, 70, 141–148. [Google Scholar] [CrossRef]

- Johansson, D.J.; Azar, C. A scenario based analysis of land competition between food and bioenergy production in the US. Clim. Chang. 2007, 82, 267–291. [Google Scholar] [CrossRef]

- Ostermeyer, A.; Schönau, F. Effects of biogas production on inter-and in-farm competition. In Proceedings of the 131th EAAE Seminar ‘Innovation for Agricultural Competitiveness and Sustainability of Rural Areas’, Prague, Czech Republic, 18–19 September 2012.

- Appel, F.; Ostermeyer-Wiethaup, A.; Balmann, A. Effects of the German Renewable Energy Act on structural change in agriculture—The case of biogas. Utilities Policy 2016, 41, 172–182. [Google Scholar] [CrossRef]

- Emmann, C.H.; Guenther-Lübbers, W.; Theuvsen, L. Impacts of biogas production on the production factors land and labour–current effects, possible consequences and further research needs. Int. J. Food Syst. Dyn. 2013, 4, 38–50. [Google Scholar]

- Hüttel, S.; Odening, M.; Kataria, K.; Balmann, A. Price Formation on Land Market Auctions in East Germany—An Empirical Analysis. Ger. J. Agric. Econ. 2013, 62, 99–115. [Google Scholar]

- Lancaster, K.J. A new approach to consumer theory. J. Political Econ. 1966, 74, 132–157. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic prices and implicit markets: Product differentiation in pure competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Vaccari, V.; Manco, I.; Cordoni, C.; Valvassori, A. Features and sustainability components of a laboratory of analysis for biogas plants. Econ. Aziend. Online 2015, 6, 35–42. [Google Scholar]

- Gaviglio, A.; Pirazzoli, C.; Ragazzoni, A. Zootecnia e Biogas—Incentivi 2013, 100 Pagine per Capire; Edizioni L’Informatore Agrario: Verona, Italy, 2013. [Google Scholar]

- Gaviglio, A.; Pecorino, B.; Ragazzoni, A. Produrre energia rinnovabile nelle aziende agro-zootecniche. Effetti economici dalle novità introdotte nella normativa del 2012. Econ. Agro-Aliment. 2014, 16, 31–60. [Google Scholar] [CrossRef]

- Implementation of Art. 24 of Legislative Decree of 3 March 2011, n. 28, Containing Incentives for the Production of Electricity from Renewable Sources by Installations at Various PV; Ministerial Decree 6 July 2012. Available online: http://www.sviluppoeconomico.gov.it/images/stories/normativa/DM_6_luglio_2012_sf.pdf (accessed on 10 May 2016).

- Demartini, E.; Gaviglio, A.; Bertoni, D. Integrating agricultural sustainability into policy planning: A geo-referenced framework based on Rough Set theory. Environ. Sci. Policy 2015, 54, 226–239. [Google Scholar] [CrossRef]

- Pöschl, M.; Ward, S.; Owende, P. Evaluation of energy efficiency of various biogas production and utilization pathways. Appl. Energy 2010, 87, 3305–3321. [Google Scholar] [CrossRef]

- Murphy, D.J.; Hall, C.A.; Powers, B. New perspectives on the energy return on (energy) investment (EROI) of corn ethanol. Environ. Dev. Sustain. 2011, 13, 179–202. [Google Scholar] [CrossRef]

- Arodudu, O.; Voinov, A.; van Duren, I. Assessing bioenergy potential in rural areas—A NEG-EROEI approach. Biomass Bioenergy 2013, 58, 350–364. [Google Scholar] [CrossRef]

- Angrist, J.D.; Pischke, J.S. Mostly Harmless Econometrics: An Empiricist’s Companion; Princeton University Press: Princeton, NJ, USA, 2008. [Google Scholar]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, MA, USA, 2010. [Google Scholar]

- Wooldridge, J.M. Introductory Econometrics: A Modern Approach; Nelson Education: Toronto, ON, Canada, 2015. [Google Scholar]

| Variables | Description of the Variable | Unit of Measure | Explanation of Land Rent Values | |||

|---|---|---|---|---|---|---|

| Internal/Agricultural Variables | External Variables | |||||

| Returns from Agricultural Production | Government Payments | Variables Describing the Market | Urban Pressure Indicators | |||

| Rent value (Dependent) | Price of land rental per hectare per year | €/ha | ||||

| Biogas plants related variables | ||||||

| pl_m | Number of biogas plants per municipality | Number of plants | X | X | ||

| kw_m | Kilowatt per hectare of utilized agricultural area in the municipality | kW/ha | X | X | ||

| pp_m | Average power of biogas plants in the municipality | kW | X | X | ||

| pl_r | Number of biogas plants per agrarian region | Number of plants | X | X | ||

| kw_r | Kilowatt per hectare of utilized agricultural area in the agrarian region | kW/ha | X | X | ||

| pp_r | Average power of biogas plants in the agrarian region | kW | X | X | ||

| liv | Livestock unit per utilized agricultural area in the municipality | LU/ha | X | |||

| Agricultural land use—Reference = w&u_s | ||||||

| w&u_s | Share of land used for wood crops or uncultivated | % (ha/ha) | X | |||

| mai_s | Share of land used for maize and/or arable crops | % (ha/ha) | X | |||

| ene_s | Share of land used for energy crops | % (ha/ha) | X | |||

| foa_s | Share of land used for forage alternation | % (ha/ha) | X | |||

| fop_s | Share of land used for permanent forage | % (ha/ha) | X | |||

| veg_s | Share of land used for vegetables | % (ha/ha) | X | |||

| vif_s | Share of land used for vine and/or orchard | % (ha/ha) | X | |||

| nur_s | Share of land used for plant nursery | % (ha/ha) | X | |||

| Year—Reference = 2010 | ||||||

| 2010 | Contract signed in 2010 | Dummy (Yes/No) | X | |||

| 2011 | Contract signed in 2011 | Dummy (Yes/No) | X | |||

| 2012 | Contract signed in 2012 | Dummy (Yes/No) | X | |||

| 2013 | Contract signed in 2013 | Dummy (Yes/No) | X | |||

| 2014 | Contract signed in 2014 | Dummy (Yes/No) | X | |||

| Agrarian Region—Reference = 19-07 | ||||||

| 19-01 | Pianura Cremasca | Dummy (Yes/No) | X | |||

| 19-02 | Pianura di Crema | Dummy (Yes/No) | X | |||

| 19-03 | Pianura soresinese dell’Adda | Dummy (Yes/No) | X | |||

| 19-04 | Pianura di Soresina | Dummy (Yes/No) | X | |||

| 19-05 | Pianura di Cremona | Dummy (Yes/No) | X | |||

| 19-06 | Pianura fra Oglio e Po | Dummy (Yes/No) | X | |||

| 19-07 | Pianura di Piadena | Dummy (Yes/No) | X | |||

| Other control variables | ||||||

| dim_c | Dimension of the rented area by contract | ha | X | |||

| dim_u | Average dimension of agricultural units within the contracts | ha | X | |||

| len | Length of the contract | Years | X | |||

| uaa | Share of utilized agricultural area within the municipality | % (ha/ha) | X | |||

| cap | Common Agricultural Policy’s (CAP) subsidies coupled to the contract | Dummy (Yes/No) | X | |||

| bui | Presence of rural building on the rented area | Dummy (Yes/No) | X | |||

| sto | Standard output of the farm of the land tenant | €/year | X | X | ||

| Form sc_1 to sc_3 | Presence of second crops | Dummy (Yes/No) * | X | |||

| From own_1 to own_4 | Type of land owner | Categorical—4 items * | X | |||

| Form tf_0 to tf_27 | Type of farming | Categorical—28 items * | X | |||

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Biogas Variables at Municipality Level | Biogas Variables at Agrarian Region Level | Biogas Variables at Municipality Level w/out Nominal Capacity per ha | Biogas Variables at Agrarian Region Level w/out Nominal Capacity per ha | Biogas Variables at Municipality and Agrarian Region Level | ||||||

| R-squared | 0.221 | 0.225 | 0.218 | 0.233 | 0.236 | |||||

| Rent value (Dependent) | Coefficient | Coefficient | Coefficient | Coefficient | Coefficient | |||||

| Biogas variables | ||||||||||

| pl_m | 95.146 | *** | - | - | 86.870 | ** | 90.728 | ** | 99.324 | *** |

| pl_m2 | −11.096 | ** | - | - | −11.605 | ** | −12.553 | ** | −12.189 | ** |

| kw_m | −102.594 | - | - | - | - | - | - | - | −107.459 | - |

| kw_m2 | 16.670 | - | - | - | - | - | - | - | 19.370 | - |

| pp_m | −0.370 | - | - | - | −0.428 | * | −0.418 | ** | −0.353 | * |

| pp_m2 | 0.000 | ** | - | - | 0.000 | * | 0.000 | ** | 0.000 | ** |

| pl_r | - | - | −82.401 | ** | - | - | −84.986 | *** | −86.974 | *** |

| pl_r2 | - | - | 1.704 | ** | - | - | 1.758 | ** | 1.784 | *** |

| kw_r | - | - | 2324.436 | ** | - | - | 2332.303 | ** | 2348.650 | ** |

| kw_r2 | - | - | −1477.331 | ** | - | - | −1482.357 | ** | −1478.670 | ** |

| pp_r | - | - | −1.209 | ** | - | - | −1.103 | ** | −1.120 | ** |

| pp_r2 | - | - | 0.001 | * | - | - | 0.001 | - | 0.001 | - |

| liv | 13.781 | ** | 13.383 | ** | 13.212 | ** | 12.015 | ** | 12.577 | ** |

| Agricultural land use—Reference = w&u_s | ||||||||||

| mai_s | 282.483 | * | 245.839 | - | 281.272 | * | 263.700 | - | 262.627 | - |

| ene_s | 386.007 | ** | 342.262 | * | 373.166 | ** | 367.937 | * | 378.485 | * |

| foa_s | 332.679 | ** | 288.864 | * | 332.186 | ** | 306.245 | * | 304.234 | * |

| fop_s | 224.009 | - | 194.369 | - | 215.671 | - | 206.667 | - | 211.729 | - |

| veg_s | 399.413 | ** | 354.481 | * | 401.833 | ** | 379.191 | ** | 374.293 | ** |

| vif_s | 93,348.110 | - | 142,171.800 | - | 107,891.300 | - | 117,222.400 | - | 103,186.900 | - |

| nur_s | 896.572 | ** | 847.957 | ** | 889.587 | ** | 893.461 | ** | 896.782 | ** |

| Year—Reference = 2010 | ||||||||||

| 2011 | 125.392 | - | 207.114 | ** | 126.026 | * | 203.974 | ** | 209.924 | ** |

| 2012 | 146.193 | ** | 246.544 | * | 143.115 | ** | 241.001 | * | 253.344 | * |

| 2013 | 106.542 | *** | 204.394 | - | 101.886 | ** | 202.458 | - | 217.887 | - |

| 2014 | 115.008 | ** | 181.913 | - | 110.063 | ** | 184.284 | - | 200.543 | - |

| Agrarian Region—Reference = 19-07 | ||||||||||

| 19-01 | −103.537 | *** | −210.684 | - | −108.647 | *** | −203.130 | - | −200.241 | - |

| 19-02 | 6.241 | - | 153.985 | - | 3.754 | - | 171.681 | - | 186.836 | - |

| 19-03 | 90.899 | *** | −23.887 | - | 81.185 | *** | −20.397 | - | −17.447 | - |

| 19-04 | −8.317 | - | 97.430 | - | −6.976 | - | 108.883 | - | 117.896 | - |

| 19-05 | 22.185 | - | 170.505 | - | 16.111 | - | 175.220 | - | 186.905 | - |

| 19-06 | −47.948 | * | 113.103 | - | −54.068 | * | 122.238 | - | 137.390 | - |

| const | 368.818 | ** | 744.100 | *** | 392.240 | ** | 726.699 | *** | 706.983 | *** |

| ------ for control variables see Appendix D ------ | ||||||||||

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Demartini, E.; Gaviglio, A.; Gelati, M.; Cavicchioli, D. The Effect of Biogas Production on Farmland Rental Prices: Empirical Evidences from Northern Italy. Energies 2016, 9, 965. https://doi.org/10.3390/en9110965

Demartini E, Gaviglio A, Gelati M, Cavicchioli D. The Effect of Biogas Production on Farmland Rental Prices: Empirical Evidences from Northern Italy. Energies. 2016; 9(11):965. https://doi.org/10.3390/en9110965

Chicago/Turabian StyleDemartini, Eugenio, Anna Gaviglio, Marco Gelati, and Daniele Cavicchioli. 2016. "The Effect of Biogas Production on Farmland Rental Prices: Empirical Evidences from Northern Italy" Energies 9, no. 11: 965. https://doi.org/10.3390/en9110965

APA StyleDemartini, E., Gaviglio, A., Gelati, M., & Cavicchioli, D. (2016). The Effect of Biogas Production on Farmland Rental Prices: Empirical Evidences from Northern Italy. Energies, 9(11), 965. https://doi.org/10.3390/en9110965