Financial Development and Countries’ Production Efficiency: A Nonparametric Analysis

Abstract

:1. Introduction

2. Materials and Methods

2.1. Probabilistic Approach of Countries’ Production Frontier

2.2. Robust (Order-m) Conditional Frontiers

2.3. Analysing the Effect of Domestic Credit

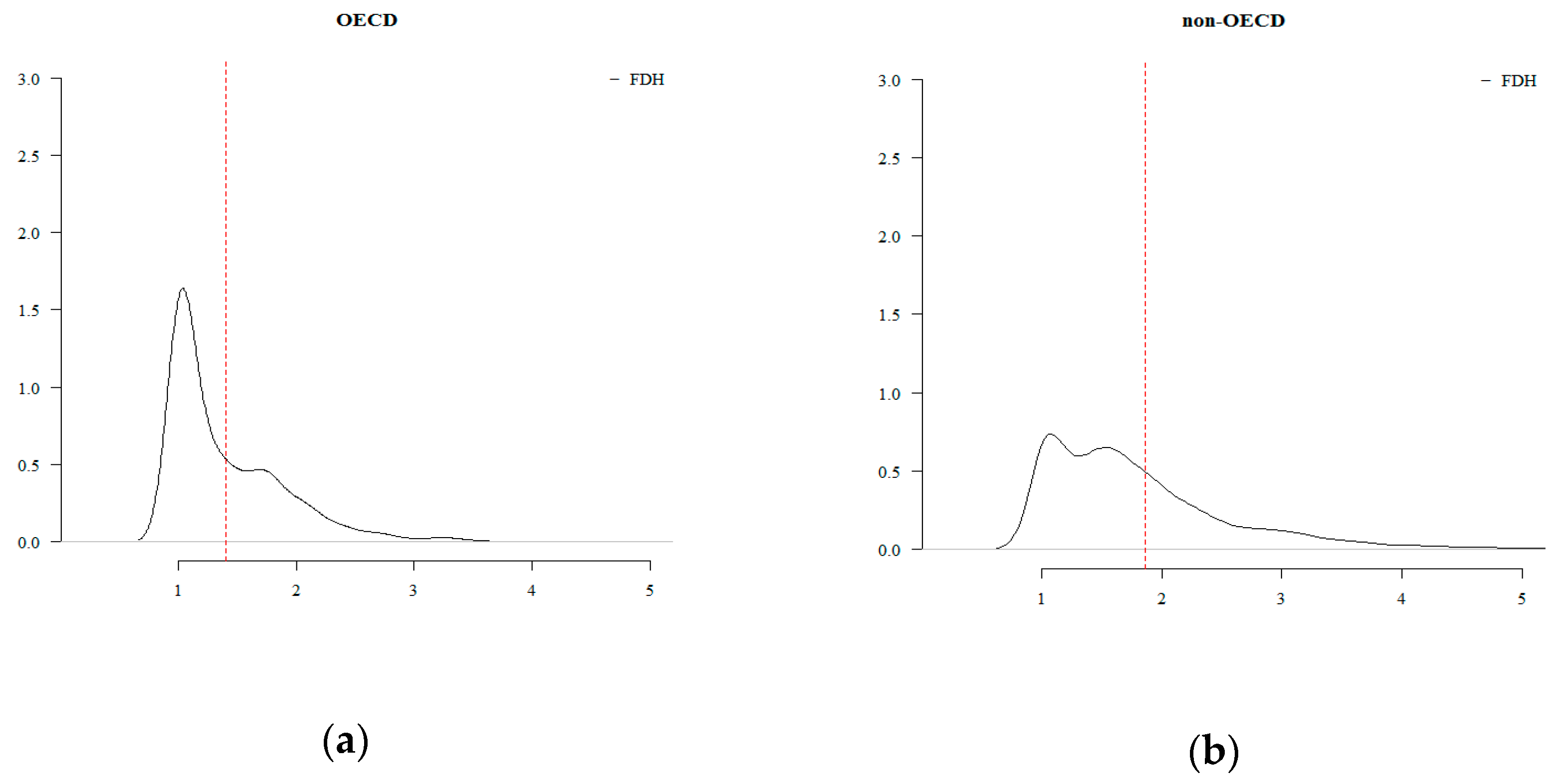

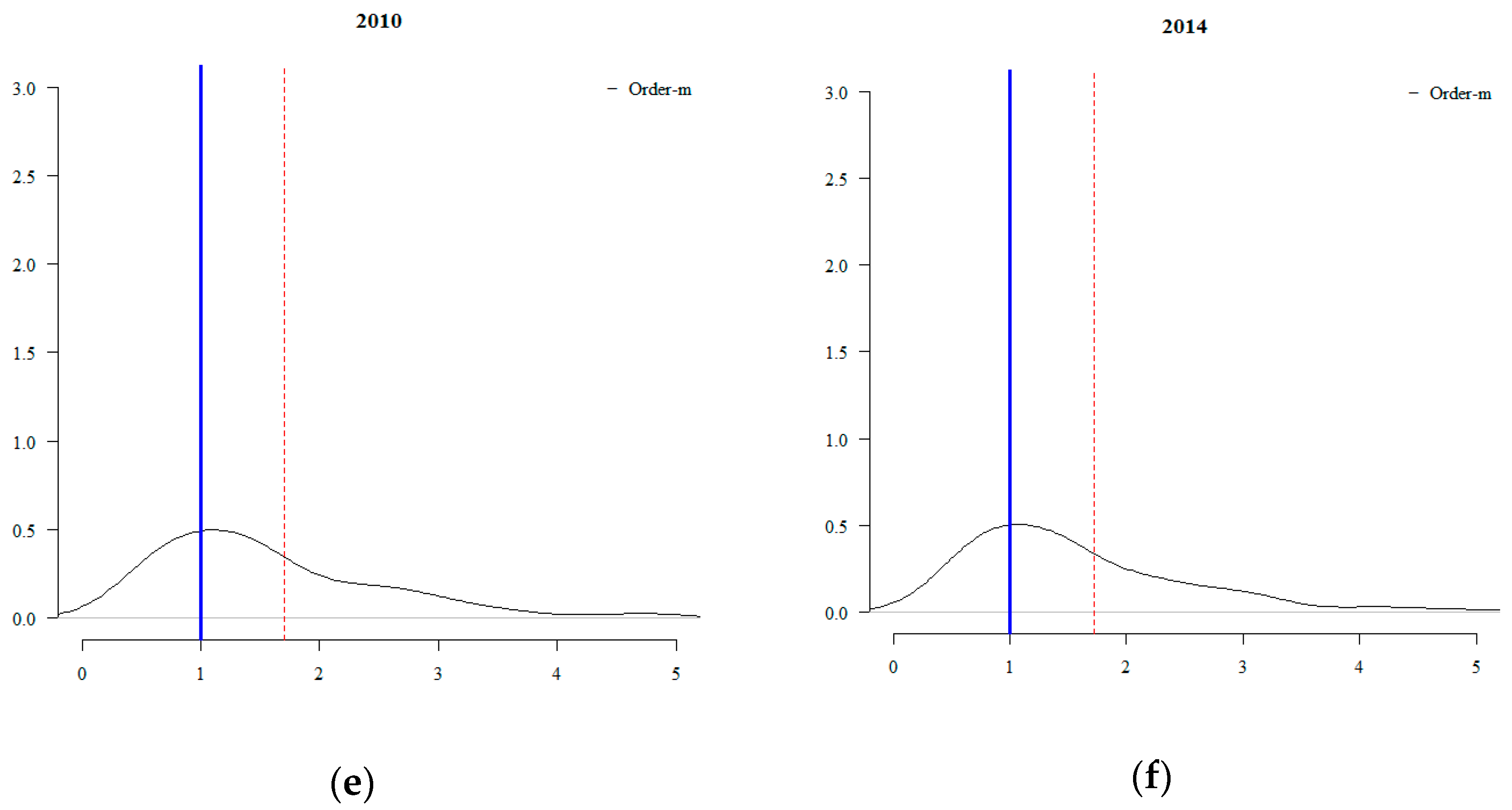

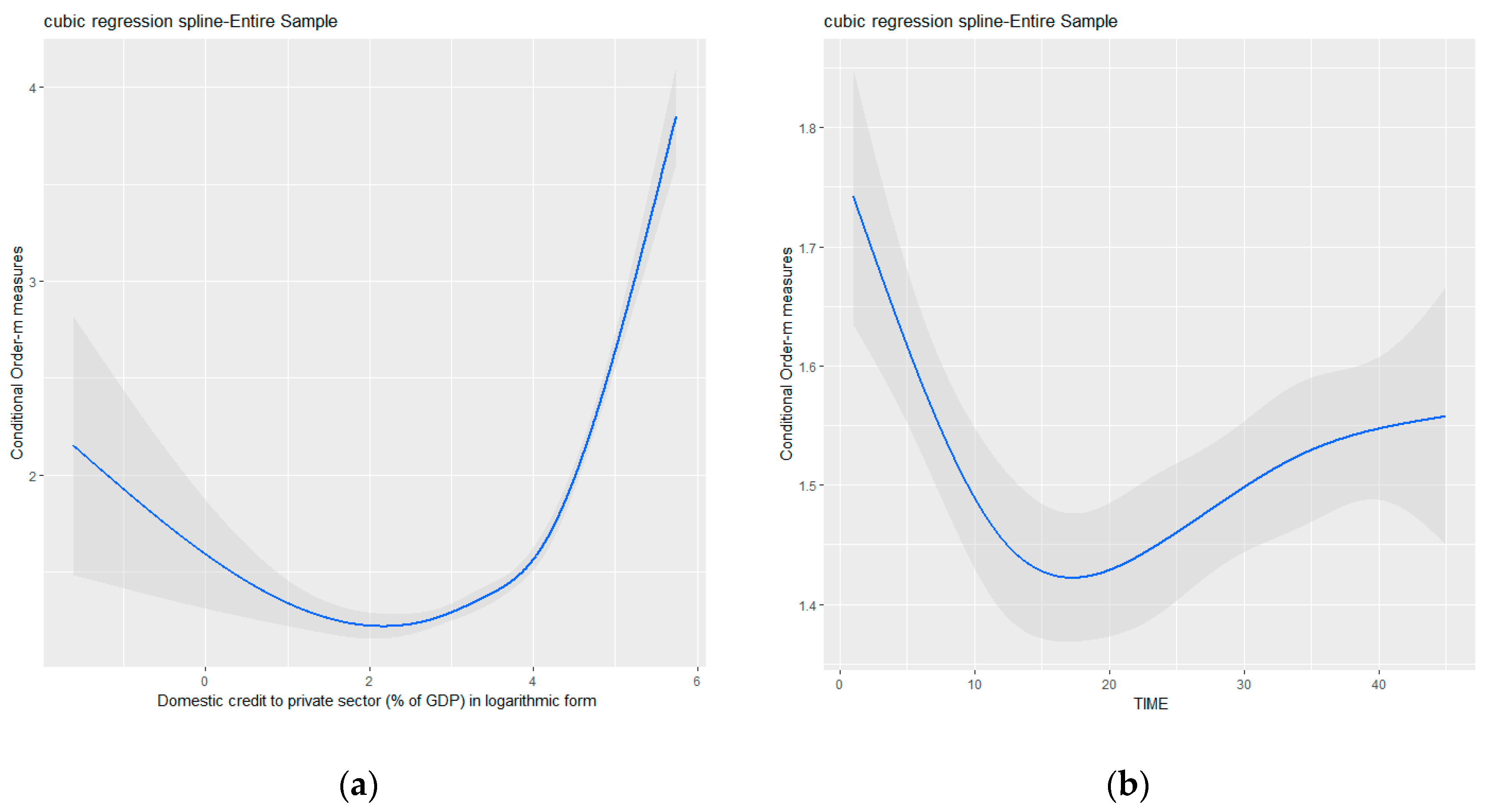

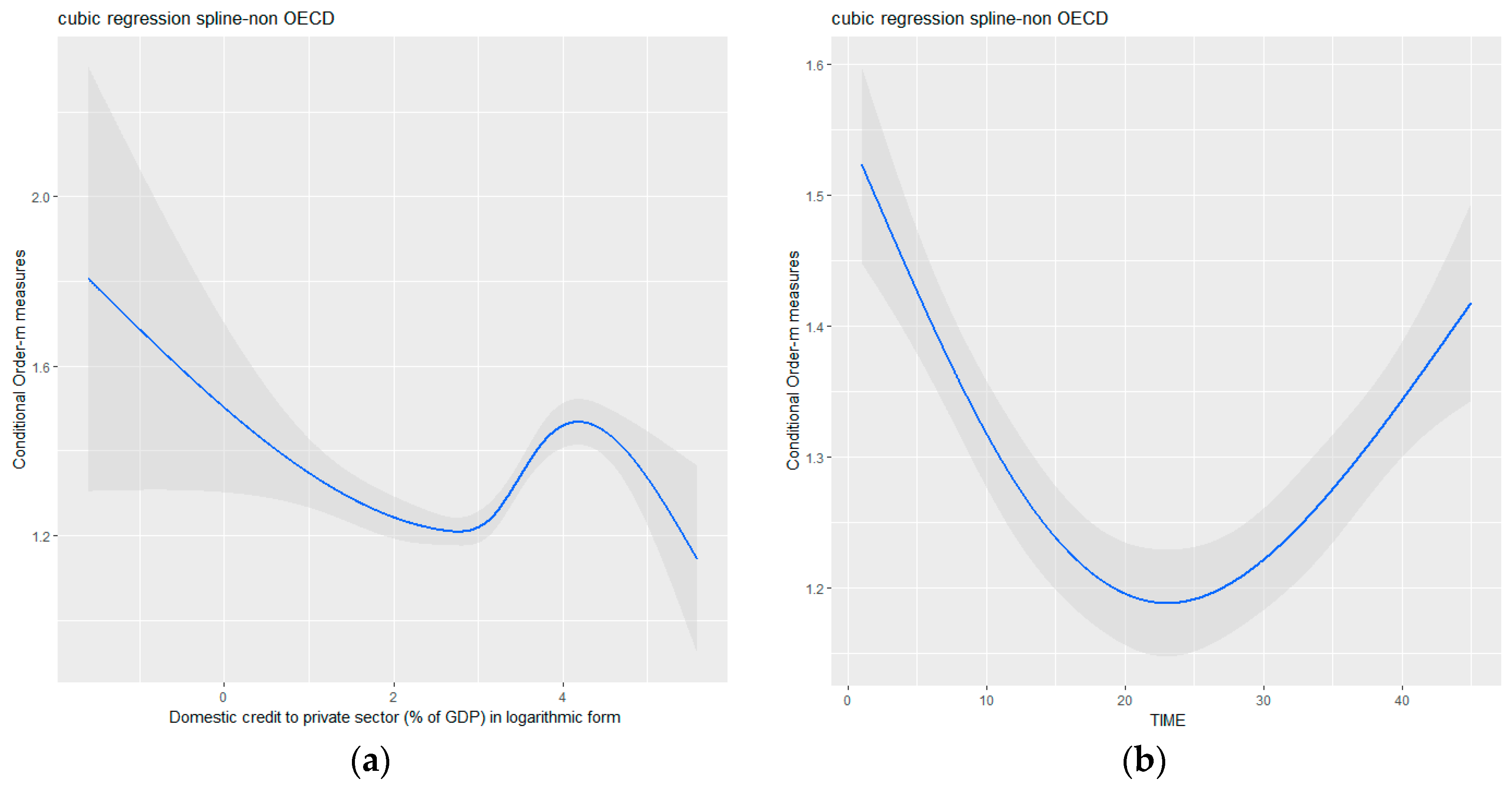

3. Results

4. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Ang, James B. 2011. Financial Development, Liberalization and Technological Deepening. European Economic Review 55: 688–701. [Google Scholar] [CrossRef]

- Arcand, Jean Louis, Enrico Berkes, and Ugo Panizza. 2015. Too Much Finance? Journal of Economic Growth 20: 105–48. [Google Scholar] [CrossRef]

- Arestis, Philip, and Panicos Demetriades. 1997. Financial Development and Economic Growth: Assessing the Evidence. Economic Journal 107: 783–99. [Google Scholar] [CrossRef]

- Bădin, Luiza, Cinzia Daraio, and Léopold Simar. 2010. Optimal Bandwidth Selection for Conditional Efficiency Measures: A Data-Driven Approach. European Journal of Operational Research 201: 633–40. [Google Scholar] [CrossRef]

- Bădin, Luiza, Cinzia Daraio, and Léopold Simar. 2012. How to Measure the Impact of Environmental Factors in a Nonparametric Production Model. European Journal of Operational Research 223: 818–33. [Google Scholar] [CrossRef]

- Bădin, Luiza, Cinzia Daraio, and Léopold Simar. 2014. Explaining Inefficiency in Nonparametric Production Models: The State of the Art. Annals of Operations Research 214: 5–30. [Google Scholar] [CrossRef]

- Beck, Roland, Georgios Georgiadis, and Roland Straub. 2014. The Finance and Growth Nexus Revisited. Economics Letters 124: 382–85. [Google Scholar] [CrossRef]

- Carroll, Raymond J., Jianqing Fan, Irene Gijbels, and Matt P. Wand. 1997. Generalized Partially Linear Single-Index Models. Journal of the American Statistical Association 92: 477–89. [Google Scholar] [CrossRef]

- Cazals, Catherine, Jean-Pierre Florens, and Léopold Simar. 2002. Nonparametric Frontier Estimation: A Robust Approach. Journal of Econometrics 106: 1–25. [Google Scholar] [CrossRef]

- Daraio, Cinzia, and Léopold Simar. 2005. Introducing Environmental Variables in Nonparametric Frontier Models: A Probabilistic Approach. Journal of Productivity Analysis 24: 93–121. [Google Scholar] [CrossRef]

- Daraio, Cinzia, and Léopold Simar. 2006. A Robust Nonparametric Approach to Evaluate and Explain the Performance of Mutual Funds. European Journal of Operational Research 175: 516–42. [Google Scholar] [CrossRef]

- Daraio, Cinzia, and Léopold Simar. 2007a. Advanced Robust and Nonparametric Methods in Efficiency Analysis: Methodology and Applications. Berlin: Springer Science & Business Media. [Google Scholar]

- Daraio, Cinzia, and Léopold Simar. 2007b. Conditional Nonparametric Frontier Models for Convex and Nonconvex Technologies: A Unifying Approach. Journal of Productivity Analysis 28: 13–32. [Google Scholar] [CrossRef]

- Daraio, Cinzia, and Léopold Simar. 2014. Directional Distances and Their Robust Versions: Computational and Testing Issues. European Journal of Operational Research 237: 358–69. [Google Scholar] [CrossRef]

- Daraio, Cinzia, Andrea Bonaccorsi, and Léopold Simar. 2015. Rankings and University Performance: A Conditional Multidimensional Approach. European Journal of Operational Research 244: 918–30. [Google Scholar] [CrossRef]

- Daraio, Cinzia, Léopold Simar, and Paul W. Wilson. 2018. Central Limit Theorems for Conditional Efficiency Measures and Tests of the ‘Separability’ condition in Non-Parametric, Two-Stage Models of Production. Econometrics Journal. [Google Scholar] [CrossRef]

- De Witte, Kristof, and Mika Kortelainen. 2013. What Explains the Performance of Students in a Heterogeneous Environment? Conditional Efficiency Estimation with Continuous and Discrete Environmental Variables. Applied Economics 45: 2401–12. [Google Scholar] [CrossRef]

- Debreu, Gerard. 1951. The Coefficient of Resource Utilization. Econometrica 19: 273–92. [Google Scholar] [CrossRef]

- Deprins, Dominique, Léopold Simar, and Henry Tulkens. 1984. Measuring Labor Inefficiency in Post Offices. In The Performance of Public Enterprises: Concepts and Measurements. Edited by Maurice Marchand, Pierre Pestieau and Henry Tulkens. Amsterdam: Elsevier Science Ltd., pp. 243–67. [Google Scholar]

- Farrell, Michael J. 1957. The Measurement of the Productive Efficiency. Journal of the Royal Statistical Society. Series A 120: 253–29. [Google Scholar] [CrossRef]

- Feenstra, Robert C., Robert Inklaar, and Marcel P. Timmer. 2015. The Next Generation of the Penn World Table. American Economic Review 105: 3150–82. [Google Scholar] [CrossRef]

- Gourinchas, Pierre-Olivier, and Maurice Obstfeld. 2012. Stories of the Twentieth Century for the Twenty-First. American Economic Journal: Macroeconomics 4: 226–65. [Google Scholar] [CrossRef]

- Hall, Peter, Jeff Racine, and Qi Li. 2004. Cross-Validation and the Estimation of Conditional Probability Densities. Journal of the American Statistical Association 99: 1015–26. [Google Scholar] [CrossRef]

- Hart, Jeffrey D. 1996. Some Automated Methods of Smoothing Time-Dependent Data. Journal of Nonparametric Statistics 6: 115–42. [Google Scholar] [CrossRef]

- Hastie, Trevor J., and Robert J. Tibshirani. 1990. Generalized Additive Models. In Monographs on Statistics and Applied Probability. London: Chapman & Hall, vol. 43. [Google Scholar]

- Jeong, Seok-Oh, Byeong U. Park, and Léopold Simar. 2010. Nonparametric Conditional Efficiency Measures: Asymptotic Properties. Annals of Operations Research 173: 105–22. [Google Scholar] [CrossRef]

- Kalaitzidakis, Pantelis, Theofanis P. Mamuneas, Andreas Savvides, and Thanasis Stengos. 2001. Measures of Human Capital and Nonlinearities in Economic Growth. Journal of Economic Growth 6: 229–54. [Google Scholar] [CrossRef]

- Li, Qi, and Jeffrey Scott Racine. 2007. Nonparametric Econometrics: Theory and Practice. Princeton: Princeton University Press. [Google Scholar]

- Liu, Zhenjuan, and Thanasis Stengos. 1999. Non-Linearities in Cross-Country Growth Regressions: A Semiparametric Approach. Journal of Applied Econometrics 14: 527–38. [Google Scholar] [CrossRef]

- Maasoumi, Esfandiar, Jeff Racine, and Thanasis Stengos. 2007. Growth and Convergence: A Profile of Distribution Dynamics and Mobility. Journal of Econometrics 136: 483–508. [Google Scholar] [CrossRef]

- Mallick, Sushanta, Roman Matousek, and Nickolaos G Tzeremes. 2016. Financial Development and Productive Inefficiency: A Robust Conditional Directional Distance Function Approach. Economics Letters 145: 196–201. [Google Scholar] [CrossRef]

- Mastromarco, Camilla, and Léopold Simar. 2015. Effect of FDI and Time on Catching Up: New Insights from a Conditional Nonparametric Frontier Analysis. Journal of Applied Econometrics 30: 826–47. [Google Scholar] [CrossRef]

- Rousseau, Peter L., and Paul Wachtel. 2011. What Is Happening to the Impact of Financial Deepening on Economic Growth? Economic Inquiry 49: 276–88. [Google Scholar] [CrossRef]

- Shen, Leilei. 2013. Financial Dependence and Growth: Diminishing Returns to Improvement in Financial Development. Economics Letters 120: 215–19. [Google Scholar] [CrossRef]

- Shephard, Ronald W. 1970. Theory of Cost and Production Functions. Princeton: Princeton University Press. [Google Scholar]

- Simar, Leopold, and Paul W. Wilson. 2007. Estimation and Inference in Two-Stage, Semi-Parametric Models of Production Processes. Journal of Econometrics 136: 31–64. [Google Scholar] [CrossRef]

- Simar, Léopold, and Paul W. Wilson. 2011. Two-Stage Dea: Caveat Emptor. Journal of Productivity Analysis 36: 205–18. [Google Scholar] [CrossRef]

- Stone, Charles J. 1985. Additive Regression and Other Nonparametric Models. The Annals of Statistics 13: 689–705. [Google Scholar] [CrossRef]

- Tzeremes, Nickolaos G. 2014. The Effect of Human Capital on Countries’ Economic Efficiency. Economics Letters 124: 127–31. [Google Scholar] [CrossRef]

- Wood, Simon N. 2002. Modelling and Smoothing Parameter Estimation with Multiple Quadratic Penalties. Journal of the Royal Statistical Society: Series B 62: 413–28. [Google Scholar] [CrossRef] [Green Version]

- Wood, Simon N. 2003. Thin Plate Regression Splines. Journal of the Royal Statistical Society: Series B 65: 95–114. [Google Scholar] [CrossRef]

- Wood, Simon N. 2004. Stable and Efficient Multiple Smoothing Parameter Estimation for Generalized Additive Models. Journal of the American Statistical Association 99: 673–86. [Google Scholar] [CrossRef]

- Wood, Simon N. 2006. Low-Rank Scale-Invariant Tensor Product Smooths for Generalized Additive Mixed Models. Biometrics 62: 1025–36. [Google Scholar] [CrossRef] [PubMed]

- Wood, Simon N. 2017. Generalized Additive Models: An Introduction with R. Boca Raton: Chapman and Hall/CRC. [Google Scholar]

| 1 | The environmental/exogenous factors are referring to those factors which are not under (or partially under) the control of the decision maker. |

| 2 | OECD countries (20): Australia, Canada, Chile, Denmark, Finland, Iceland, Ireland, Israel, Italy, Japan, Mexico, Netherlands, New Zealand, Norway, Republic of Korea, Sweden, Switzerland, Turkey, United Kingdom and United States. Non-OECD countries (67): Argentina, Bahamas, Benin, Bolivia, Botswana, Brazil, Burkina Faso, Burundi, Cameroon, Central African Republic, Chad, Colombia, Congo, Costa Rica, Côte d’Ivoire, D.R. of the Congo, Dominican Republic, Ecuador, Egypt, El Salvador, Fiji, Gabon, Gambia, Ghana, Guatemala, Honduras, India, Iran, Jamaica, Jordan, Kenya, Kuwait, Madagascar, Malawi, Malaysia, Mali, Malta, Mauritius, Morocco, Nepal, Niger, Nigeria, Oman, Pakistan, Panama, Paraguay, Peru, Philippines, Qatar, Saudi Arabia, Senegal, Sierra Leone, Singapore, South Africa, Sri Lanka, Sudan, Suriname, Swaziland, Syrian Arab Republic, Thailand, Togo, Trinidad and Tobago, Tunisia, Uganda, Uruguay, Venezuela and Zambia. |

| 3 | The codenames of the variables which have been extracted from PWT v9.0 are: “ck”, “emp” (inputs) and “cgdpo” (output). |

| 4 | The data for domestic credit to the private sector (% of GDP) has been extracted from World Development Indicators. |

| 5 | Note that since . |

| 6 | For computational details see Bădin et al. (2010, p. 640). |

| 8 | The Data Envelopment Analysis (DEA) and the FDH estimators are and respectively- consistent estimators (Daraio and Simar 2006). |

| 8 | The value of m has been chosen following Daraio and Simar (2005), suggesting that we select a value of m in which the number of super-efficient DMUs (in our case countries) stabilize. However, different m values have also been tested (i.e., 40, 50 and 80). When we increase the m parameter the results converge to the FDH estimator. All results which have been estimated with different m values are available upon request. |

| 9 | As presented previously, in the output oriented case Order-m efficiency values greater than unity indicate higher production inefficiency levels. |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tzeremes, N.G. Financial Development and Countries’ Production Efficiency: A Nonparametric Analysis. J. Risk Financial Manag. 2018, 11, 46. https://doi.org/10.3390/jrfm11030046

Tzeremes NG. Financial Development and Countries’ Production Efficiency: A Nonparametric Analysis. Journal of Risk and Financial Management. 2018; 11(3):46. https://doi.org/10.3390/jrfm11030046

Chicago/Turabian StyleTzeremes, Nickolaos G. 2018. "Financial Development and Countries’ Production Efficiency: A Nonparametric Analysis" Journal of Risk and Financial Management 11, no. 3: 46. https://doi.org/10.3390/jrfm11030046