OTC Derivatives and Global Economic Activity: An Empirical Analysis

Abstract

:1. Introduction

So it comes as no surprise that, based on the survey of global business of Bodnar et al. (2011), firms report that protection from price surprises is the most important reason for using OTC derivatives:“Why do we see this great success of financial futures and the financial futures industry? The reasons are the same as the reasons for the successful growth of any other industry: The industry is offering a product that people want. To show that they want it, they are willing to pay for it. What is the product that the world seems to want and that is so much in demand? The answer is insurance. The world wants insurance against price risk.”

| Rating of Importance | ||

| Objective | Very Important | Not Important |

| Avoid losses from price surprises | 50% | 3% |

| Expectations from shareholders | 41% | 3% |

| Increase expected future cash flows | 38% | 3% |

| Source: Bodnar et al. (2011). | ||

- to address the mismatch in interest-rate sensitivities in firms’ balance sheets

- to protect lenders from borrowers’ defaults.

“... Historically, securitization has played a valuable role in housing finance. By allowing interest rate and credit risks to be allocated efficiently among investors with varying risk appetites, it expanded access to credit for many credit-qualified Americans. ...”2

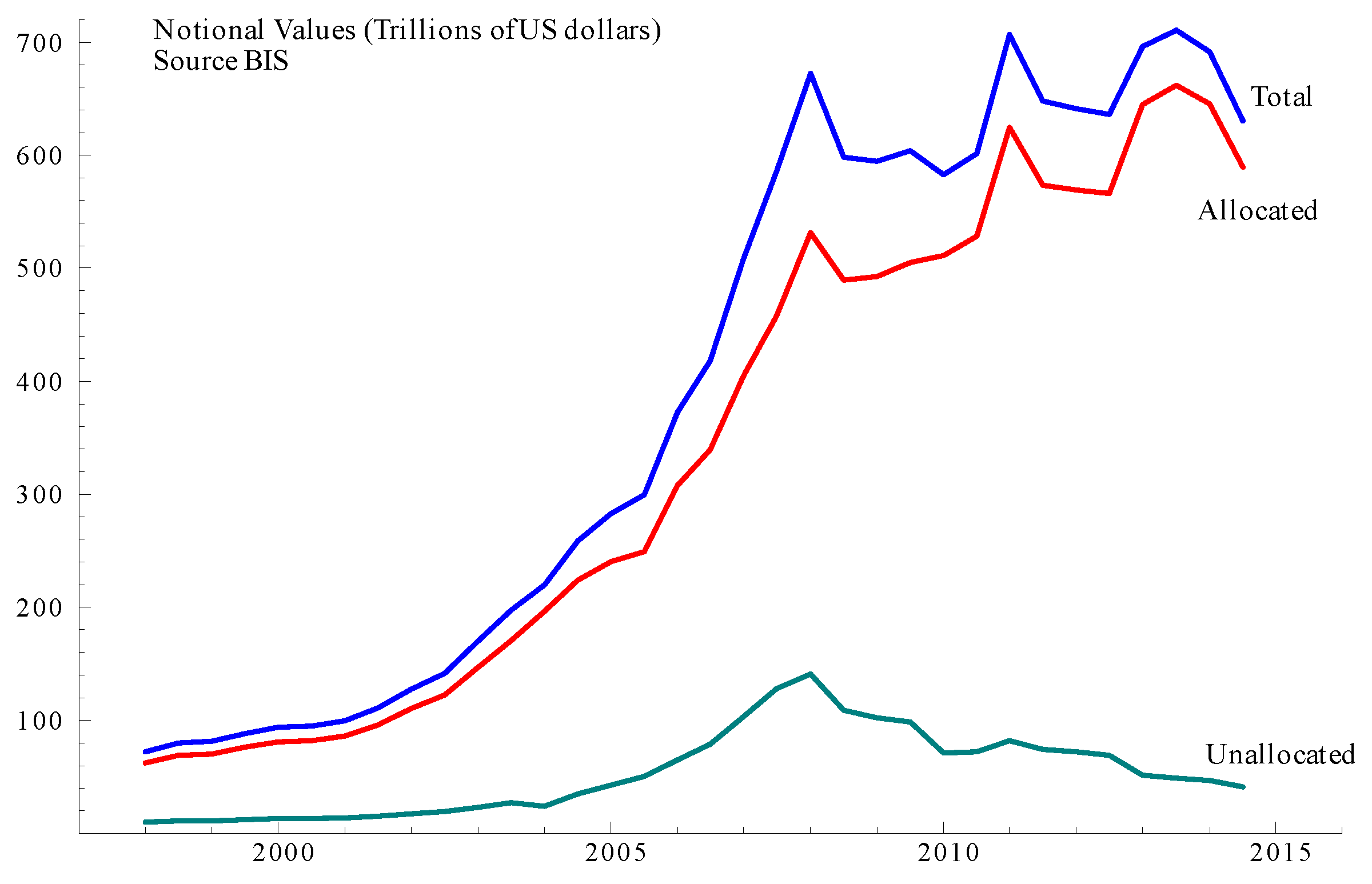

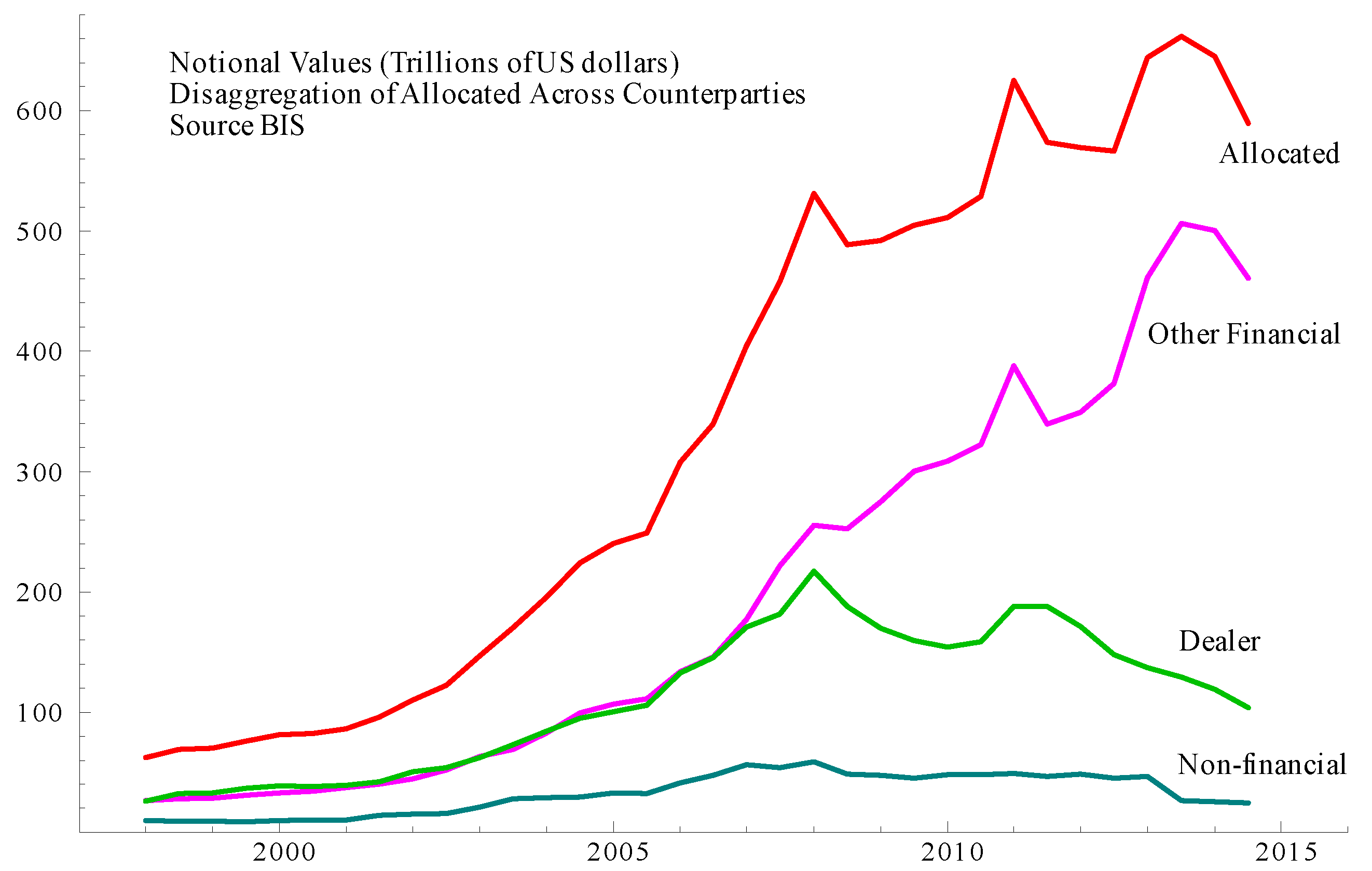

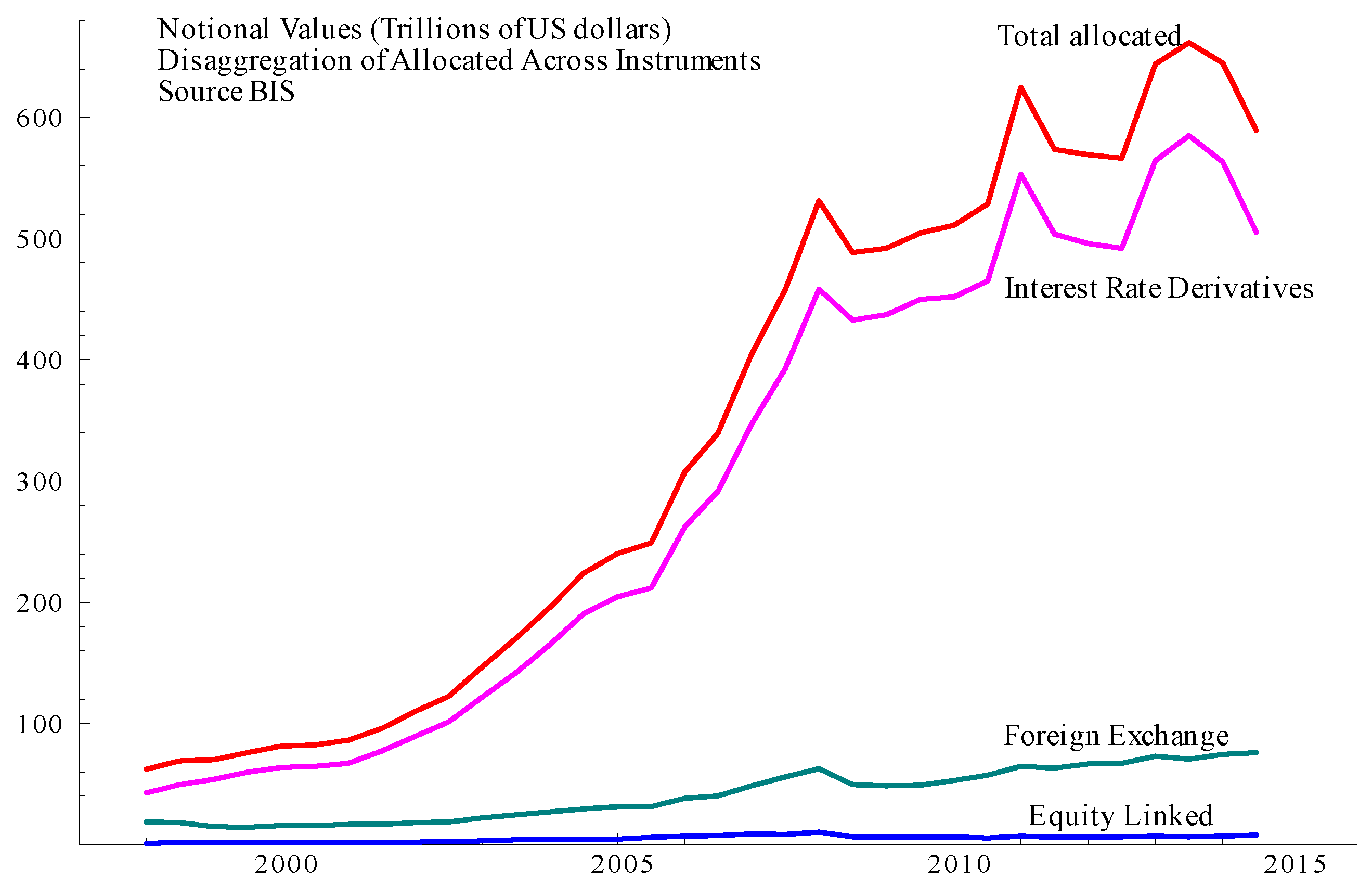

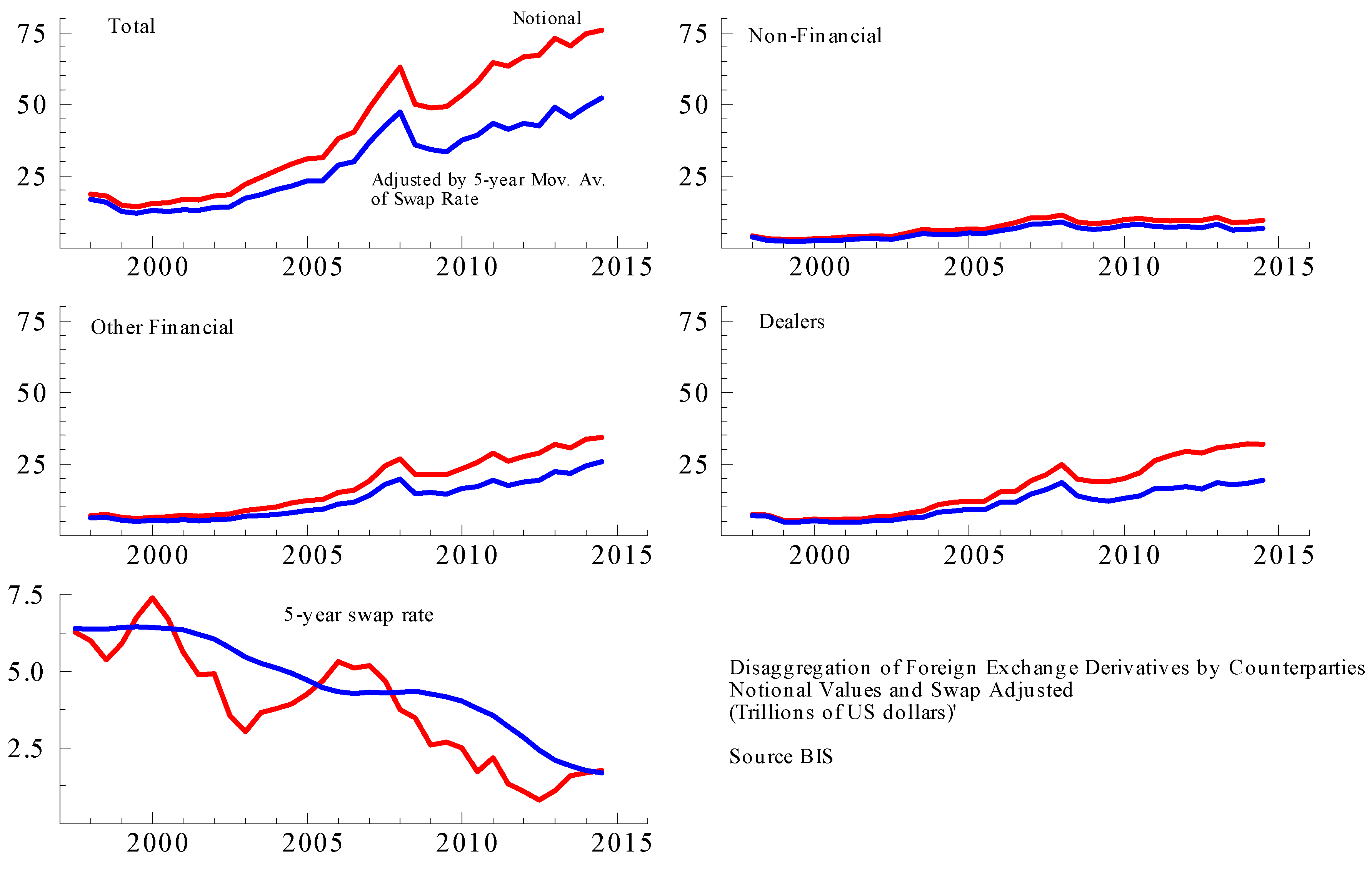

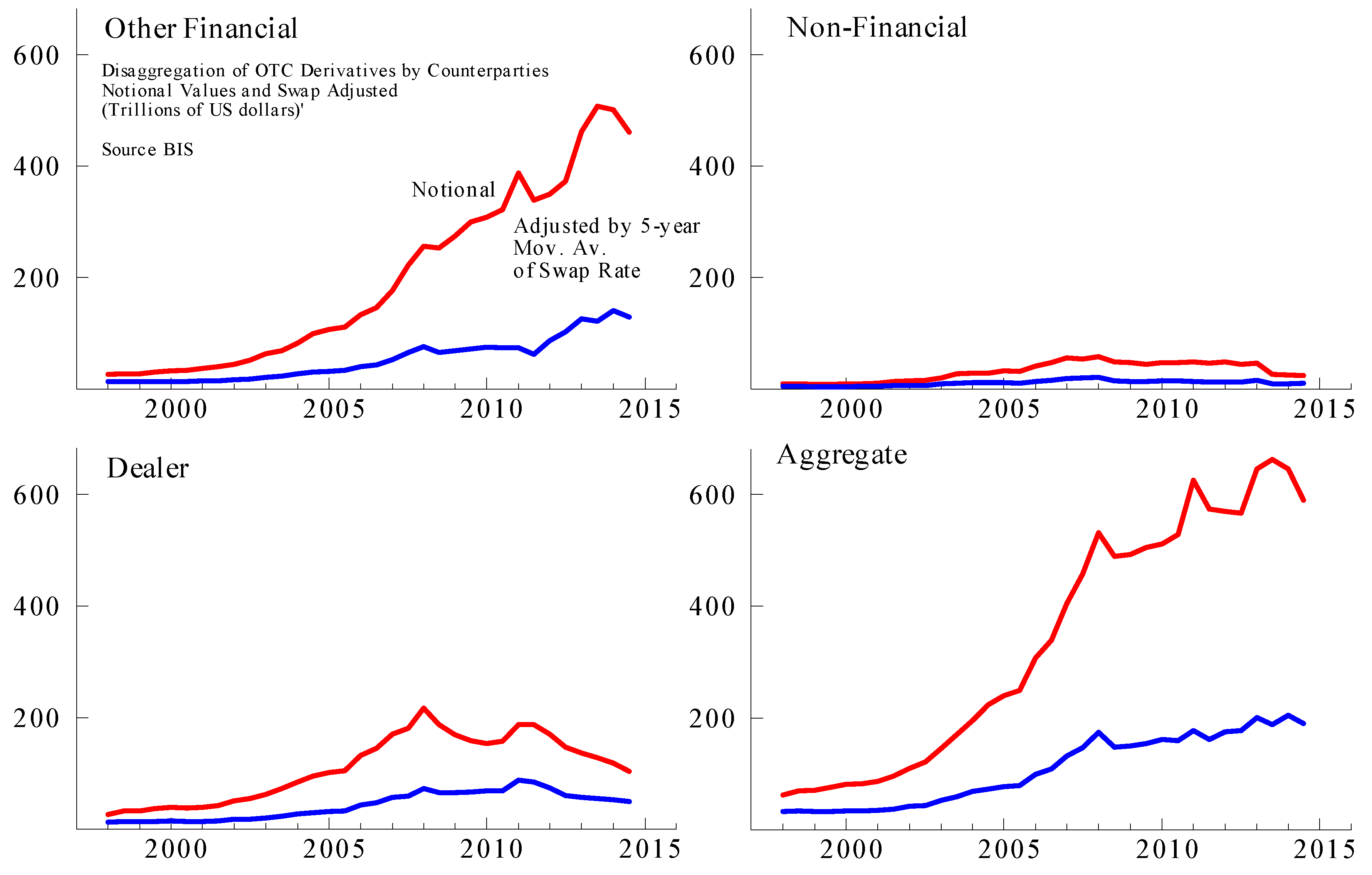

2. The Evolution of Global OTC Derivatives

3. Empirical Analysis

3.1. Measurement

| Counterparties | |||||

| Non-Financial | Other Financial | Dealers | |||

| Instruments | Foreign Exchange | Currency Swaps | |||

| Options | |||||

| Interest Rate | Interest Rate Swaps | ||||

| Options | |||||

| FRAs | |||||

| Equity Linked | Forwards and Swaps | ||||

| Options | |||||

| Counterparties | |||||

| Non-Financial | Other Financial | Dealers | |||

| Instruments | Foreign Exchange | Currency Swaps | |||

| Options | |||||

| Interest Rate | Interest Rate Swaps | ||||

| Options | |||||

| FRAs | |||||

| Equity Linked | Forwards and Swaps | ||||

| Options | |||||

| By Counterparty | ||

| Non-financial | ||

| Other financial | ||

| Dealer | ||

| By Instrument | ||

| Foreign exchange | ||

| Interest-rate | ||

| Equity-linked | ||

| Aggregate | ||

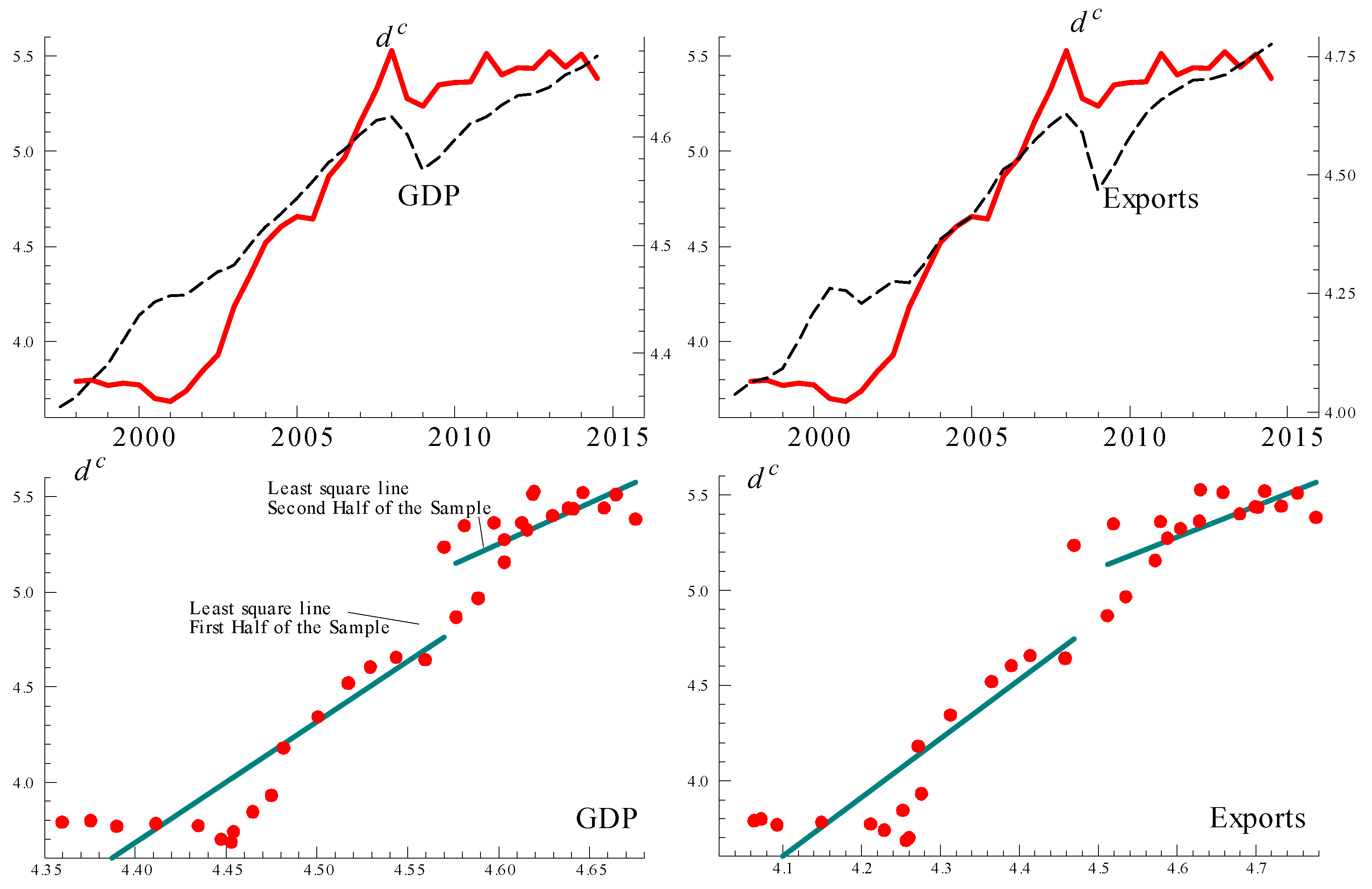

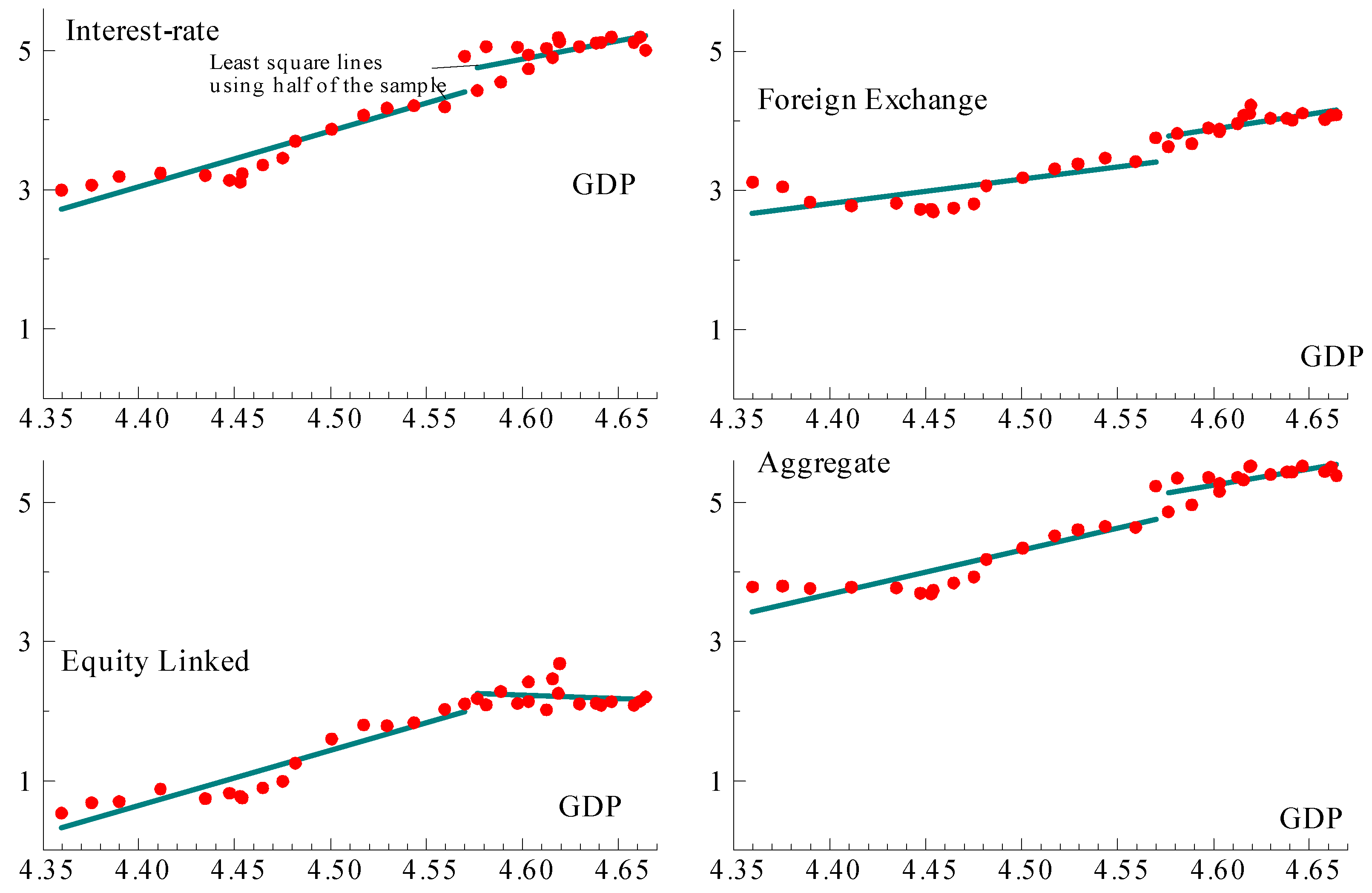

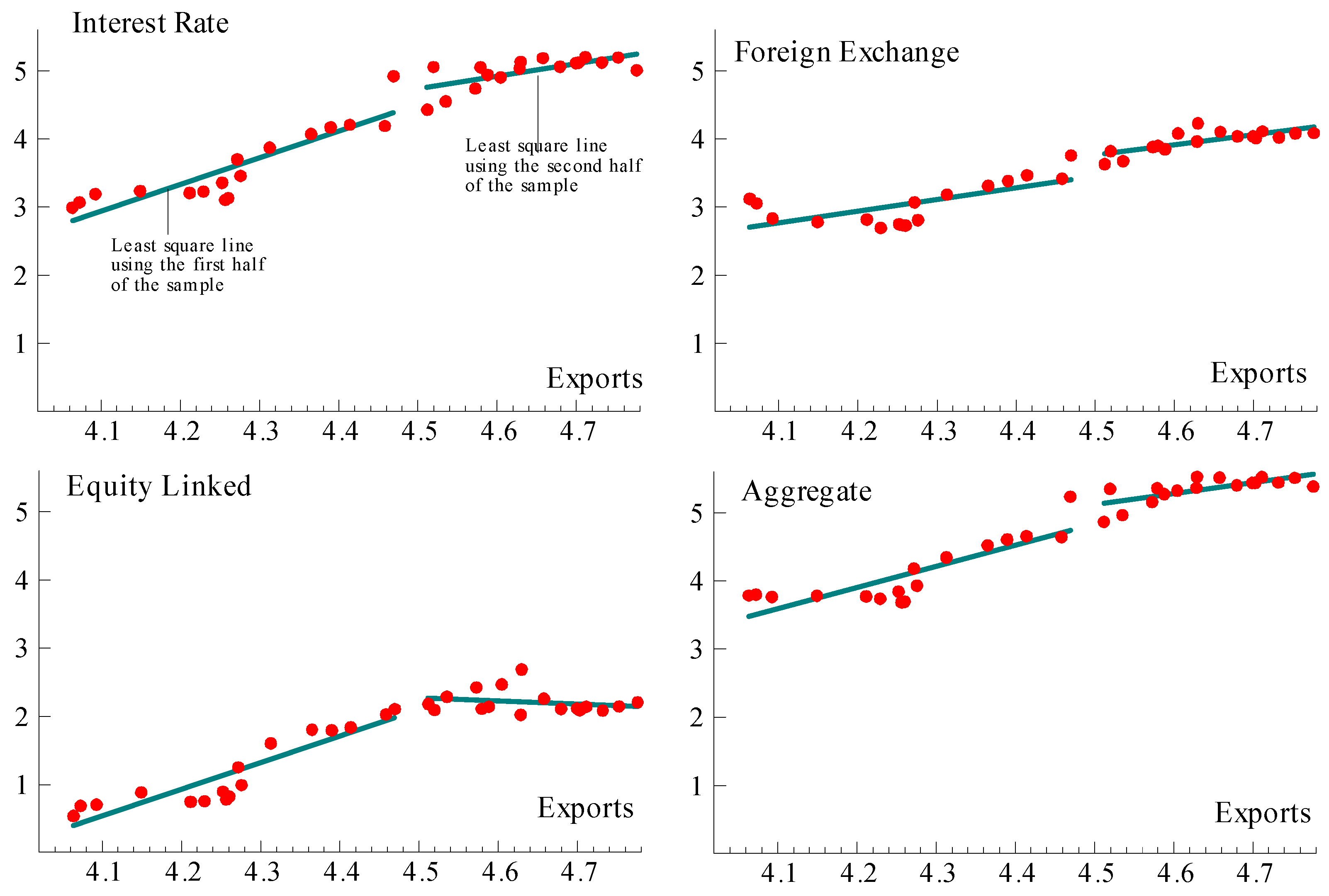

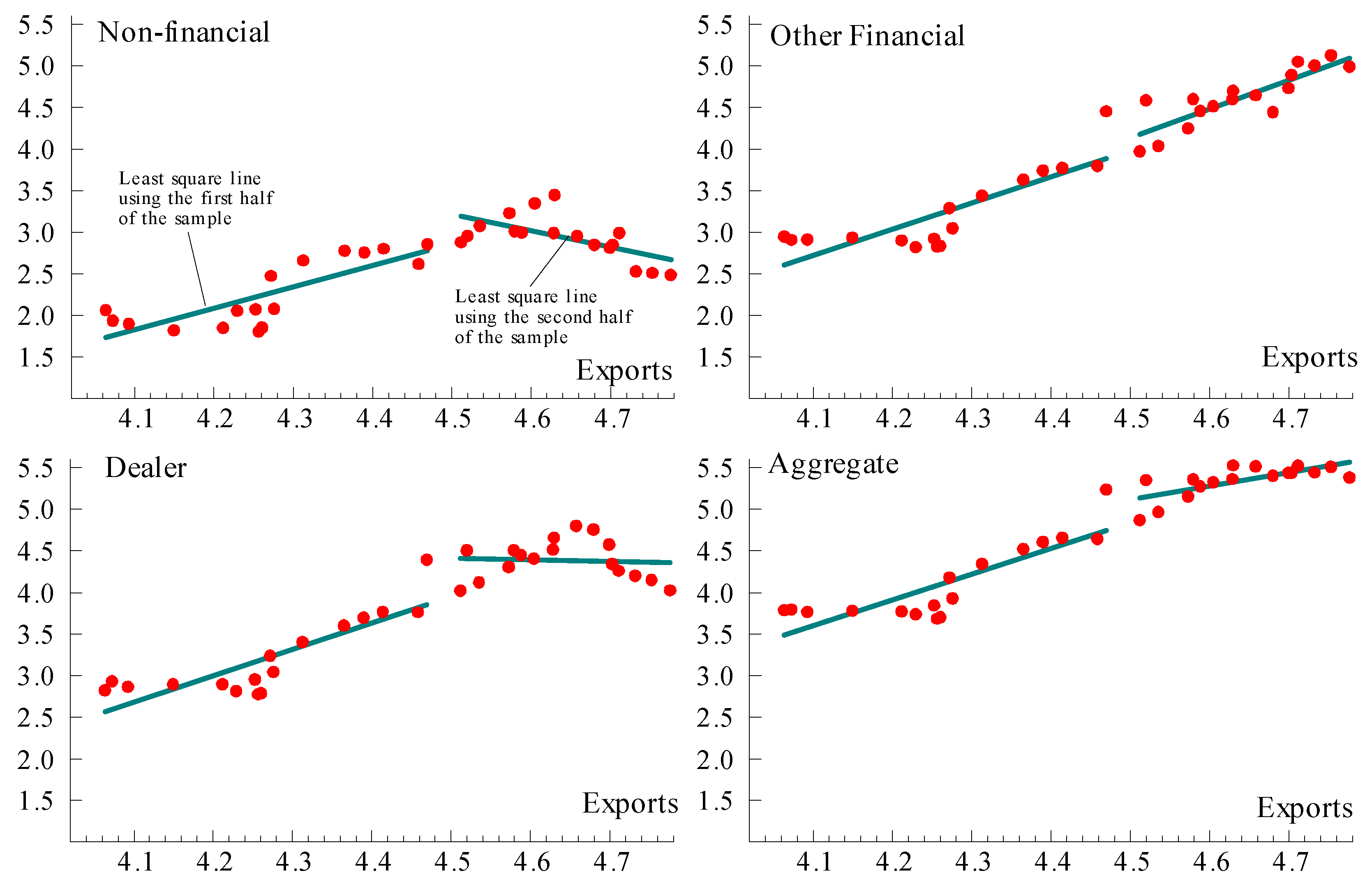

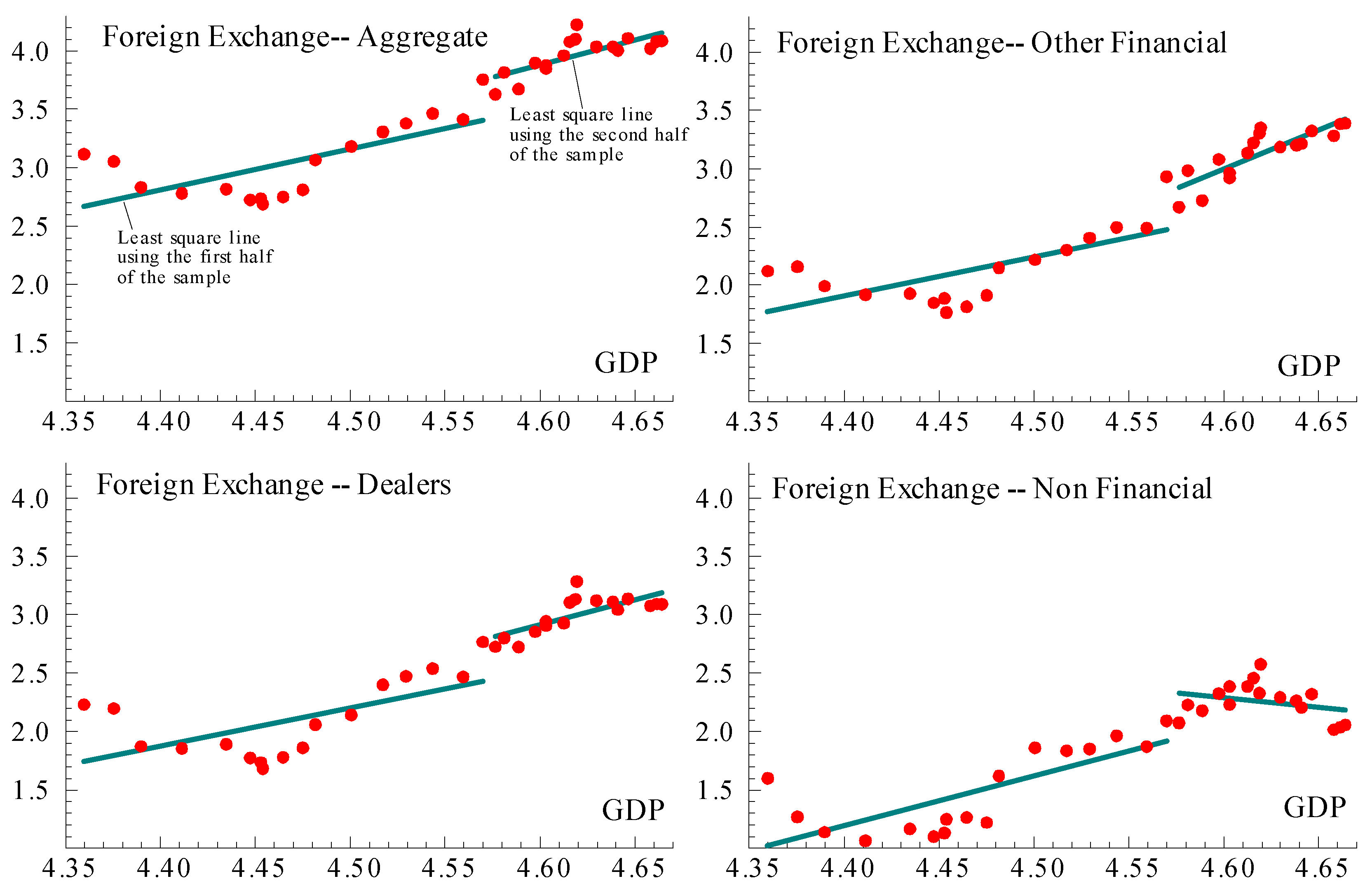

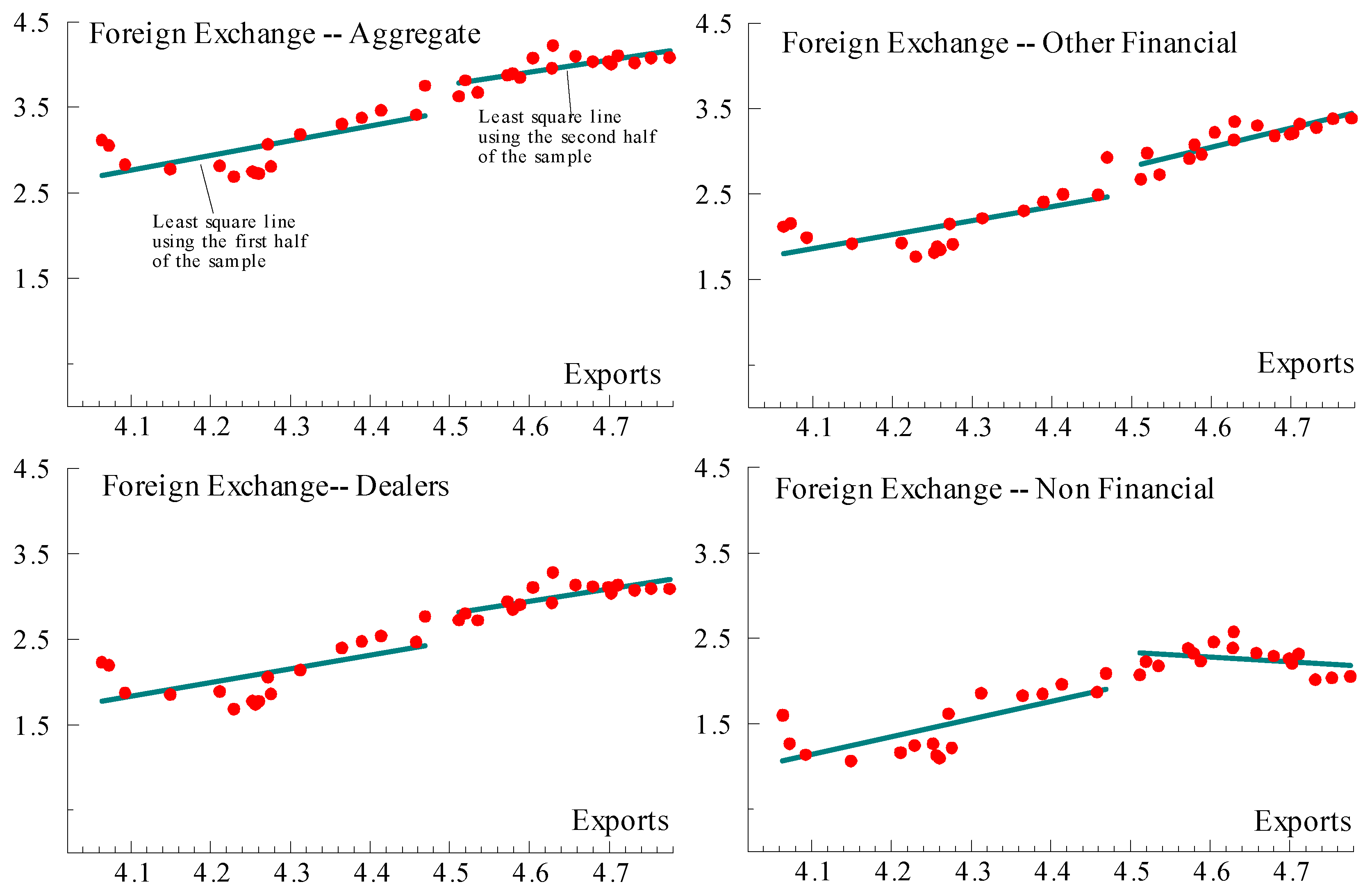

3.2. Unconditional Correlations

- 2 measures of economic activity “a” (Real GDP and Real Exports of goods and services)

- 4 alternative counterparties (Non-Financial, Other Financial, Dealers, and Aggregate)

- 2 instruments: (Foreign-Exchange derivatives and Interest-Rate derivatives).

- OTC derivatives aggregated across counterparties against either GDP or exports

- OTC derivatives aggregated across instruments against either GDP or exports

- OTC derivatives by instrument and counterparty against either GDP or exports.

3.3. Econometric Formulation

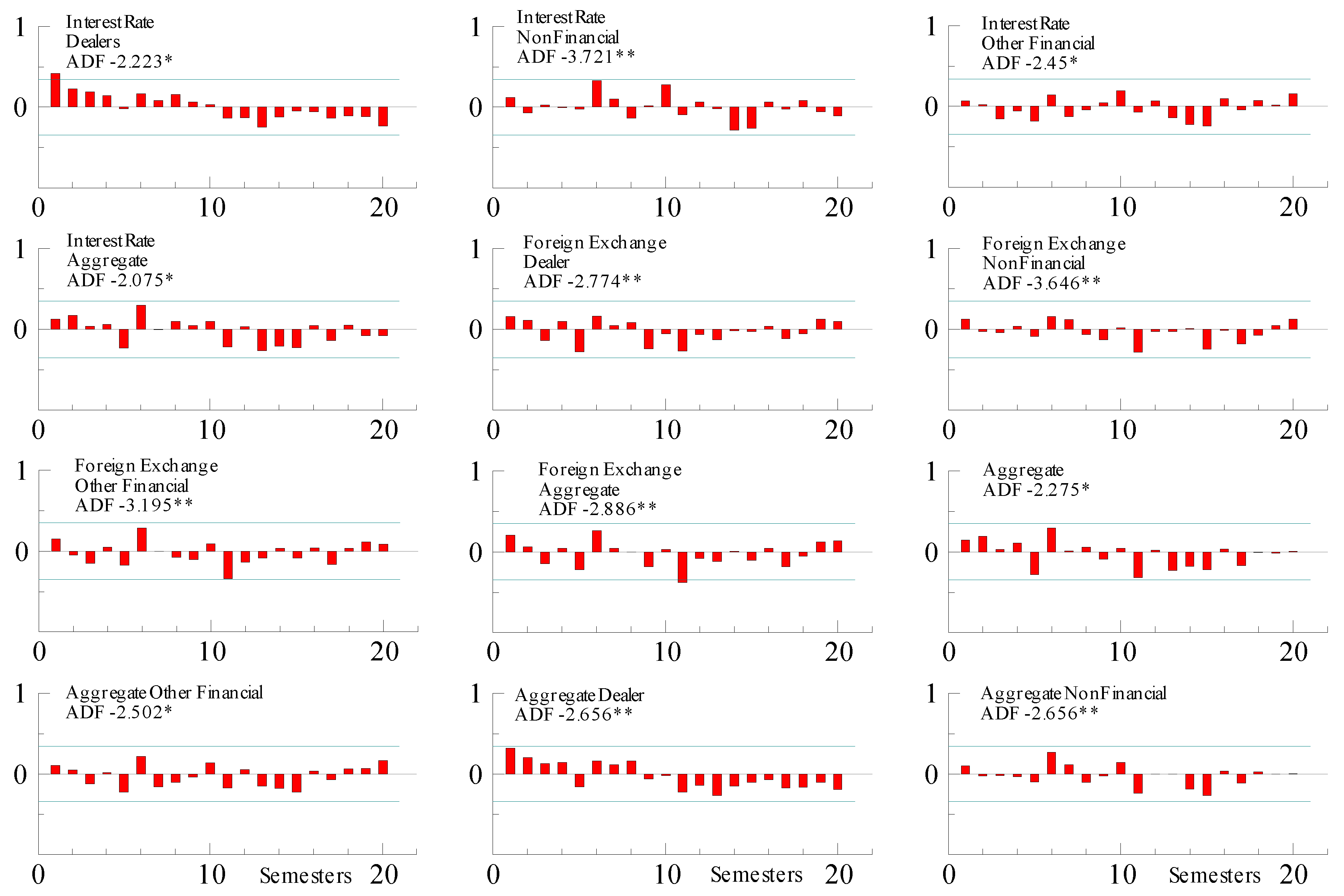

3.4. Cointegration Tests

3.4.1. Implementation

- 2 measures of economic activity (: Real GDP and Real Exports of goods and services

- 3 counterparties and their aggregate: Non-Financial, Other Financial, Dealers, and Aggregate

- 2 instruments: Foreign-Exchange derivatives and Interest-Rate derivatives17

- lags varying from 3 to 8 semesters.

3.4.2. Results

3.4.3. Statistical Reliability

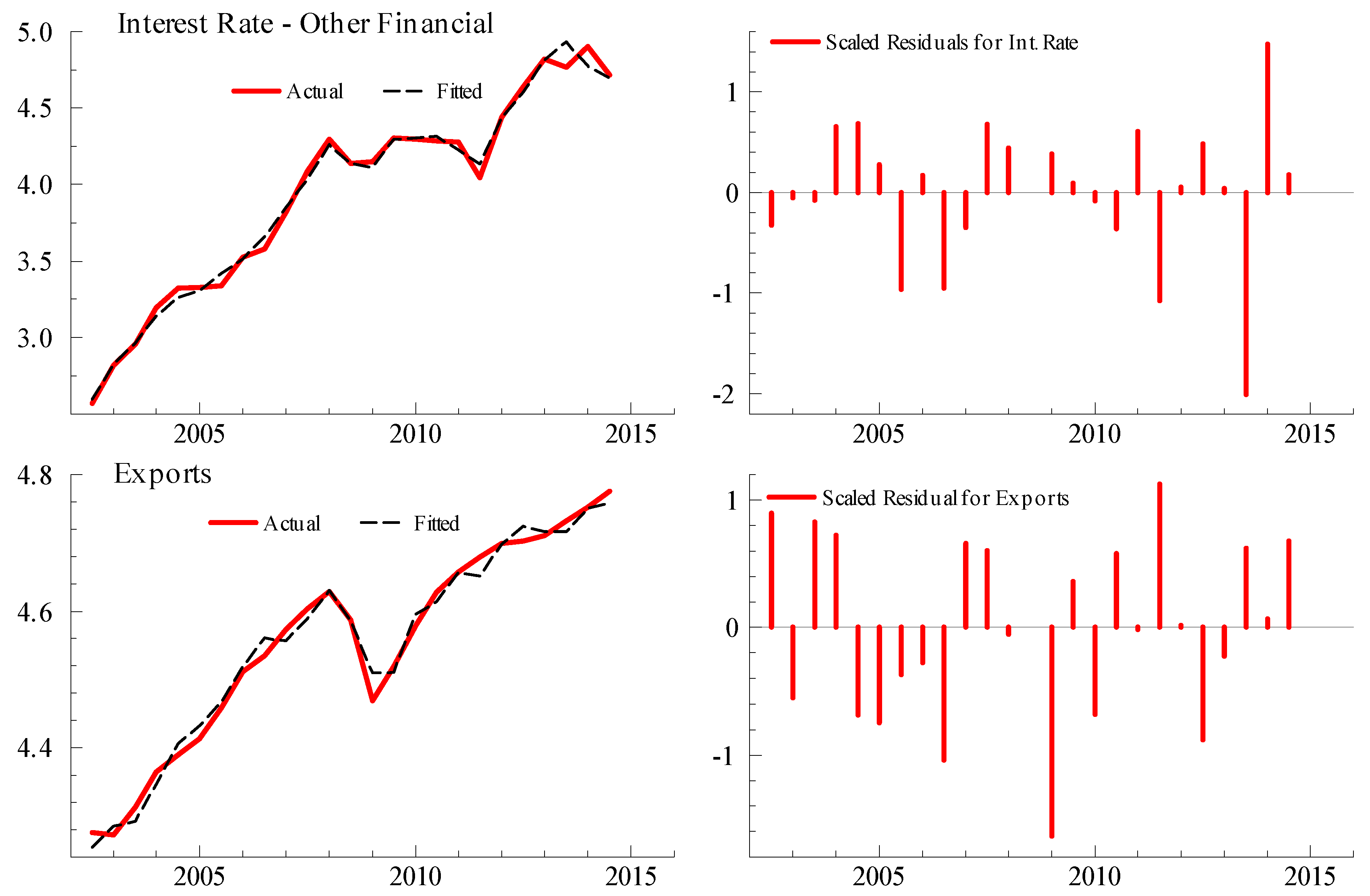

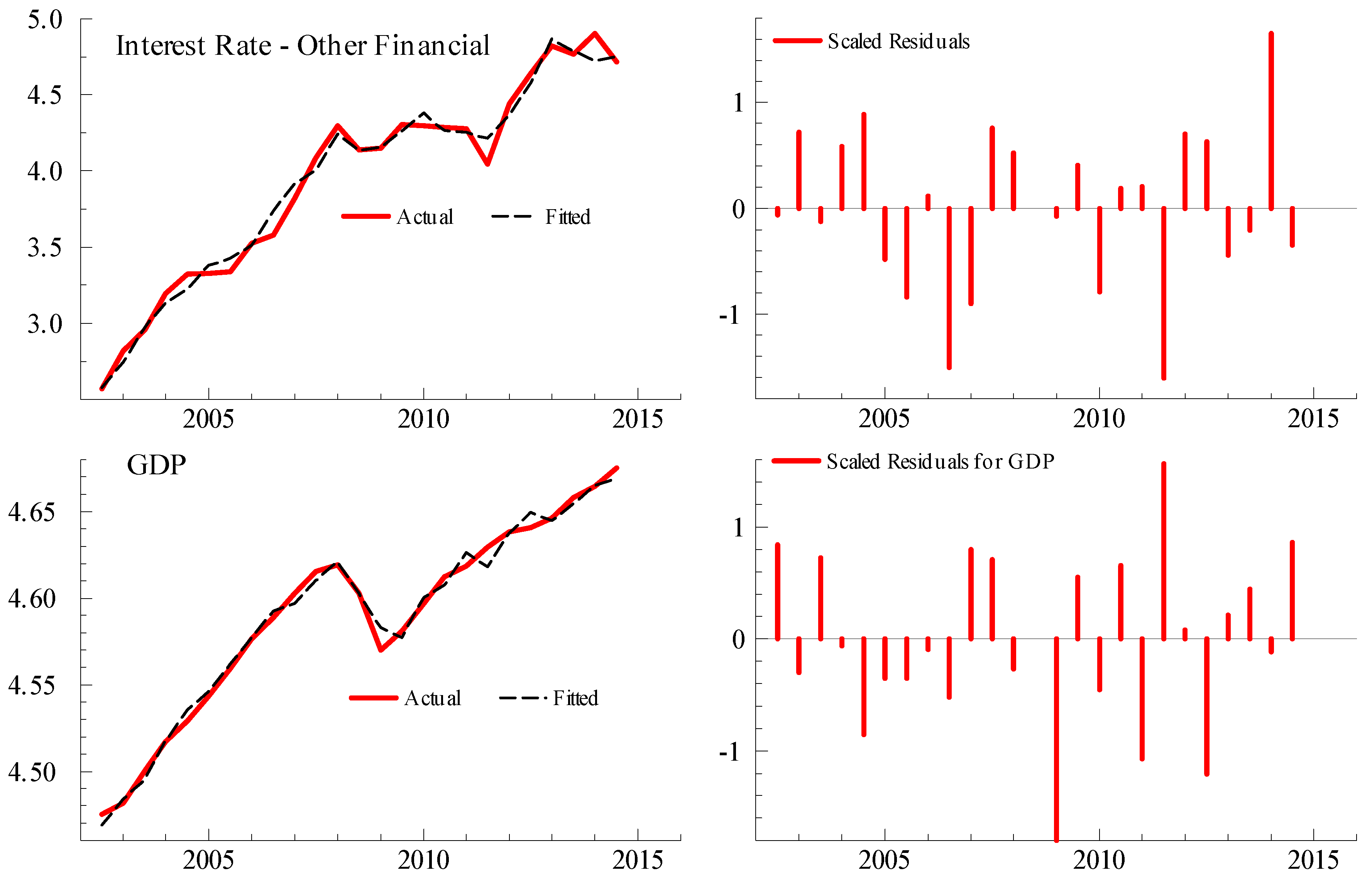

3.4.4. Model Fit

3.4.5. Residuals’ Properties

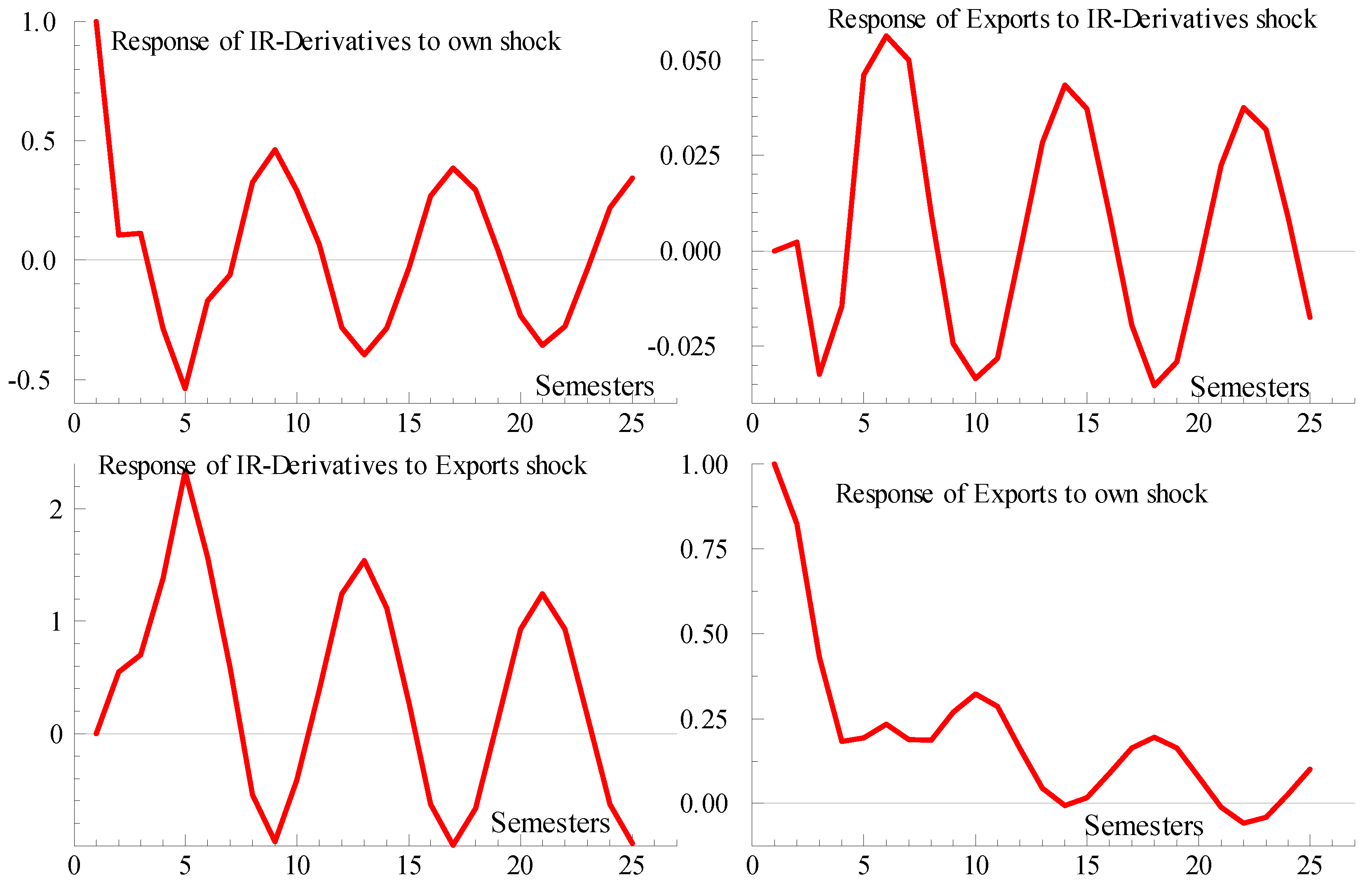

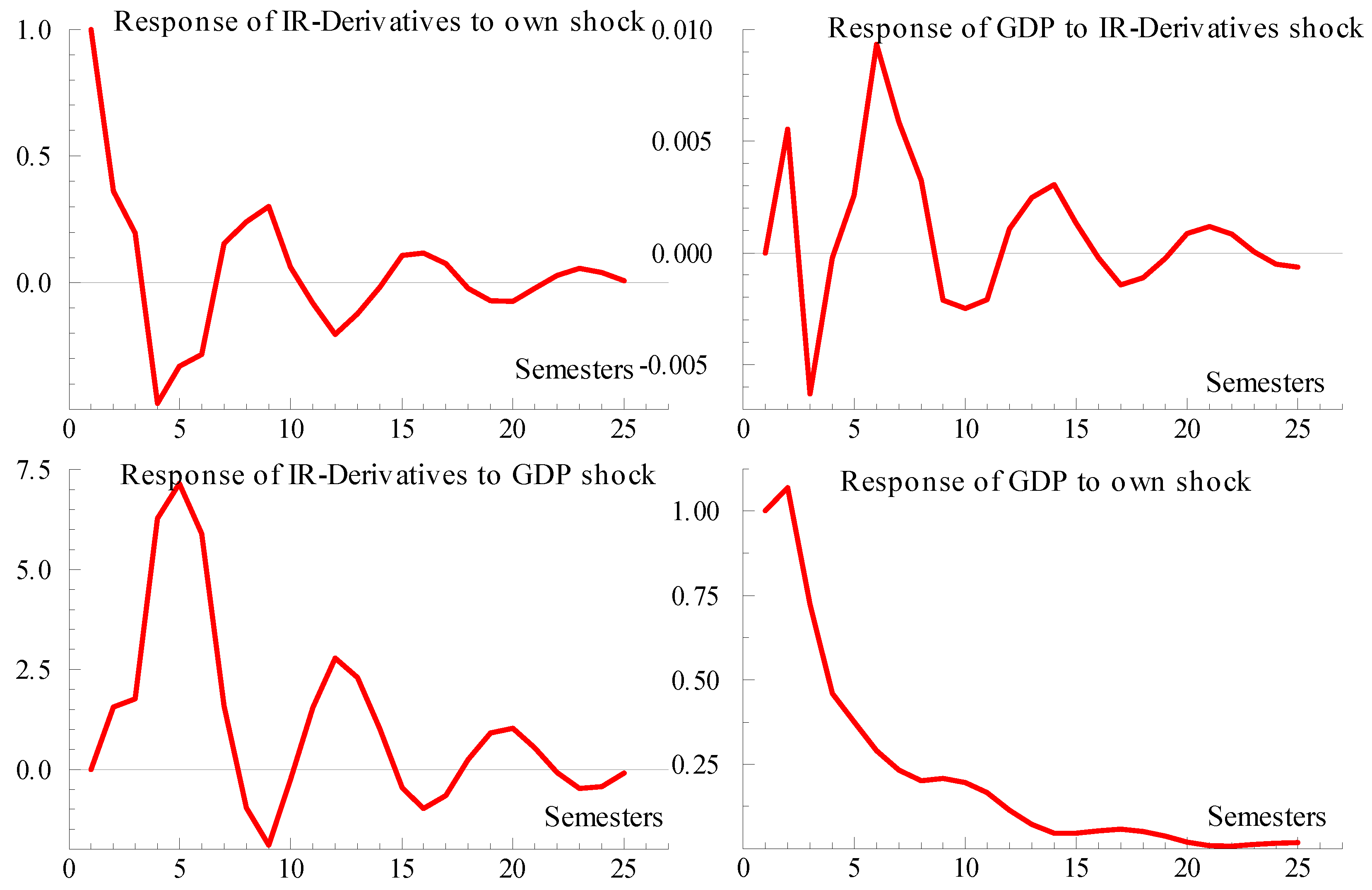

3.4.6. Dynamic Stability

3.4.7. Parameter Constancy

4. Applications

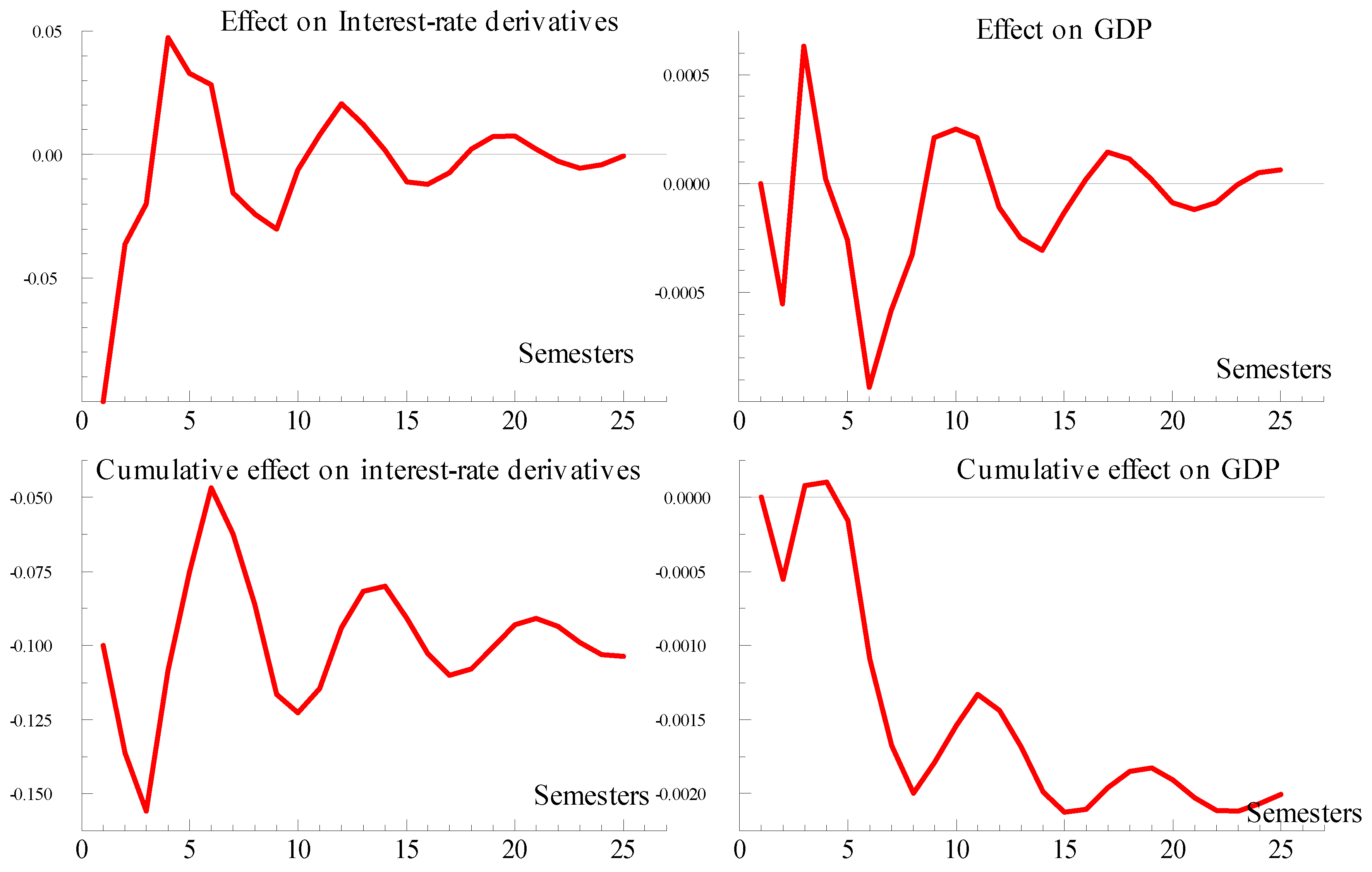

4.1. Estimating the Effects of Regulations

4.2. Estimating Speculative Trades

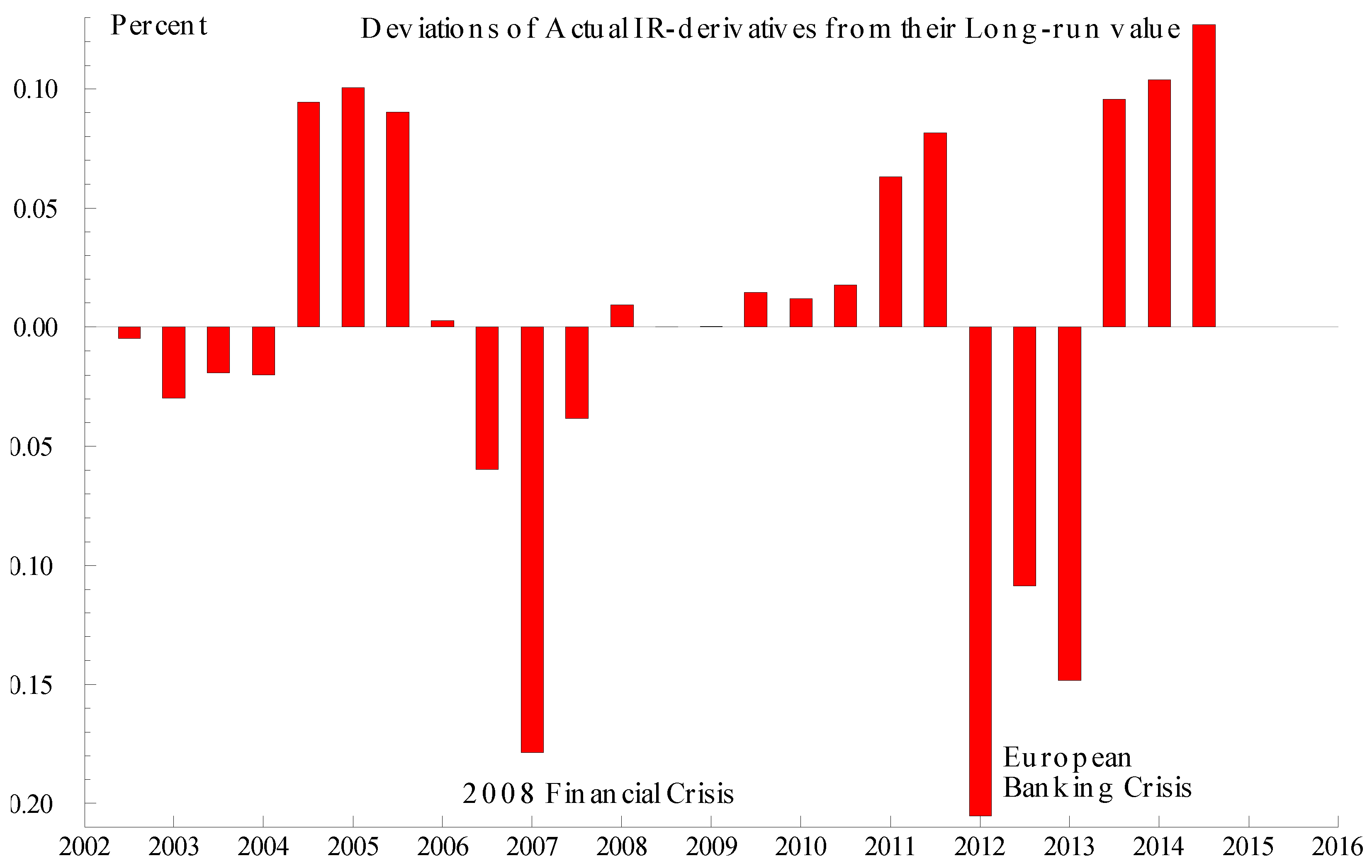

...In the run-up to the financial crisis, OTC derivatives markets grew rapidly, with interest rate and credit derivatives growing the fastest, as shown in the chart below. While these derivatives provide an important vehicle for hedging economic risks, recent academic literature has argued that market participants also use these markets to take speculative directional exposures....

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Bank for International Settlements. 2013. Macroeconomic Impact Assessment of OTC Derivatives Regulatory Reforms. Available online: http://www.bis.org/publ/othp20.htm (accessed on 12 June 2017).

- Bodnar, Gordon M., John Graham, Campbell R. Harvey, and Richard C. Marston. 2011. Managing Risk Management. Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1787144 (accessed on 12 June 2017).

- Boyarchenko, Nina, Or Shachar, and Jacqueline Yen. 2017. At the N. Y. Fed: The Evolution of OTC Derivatives Markets. Available online: http://libertystreeteconomics.newyorkfed.org/2017/05/at-the-ny-fed-the-evolution-of-otc-derivatives-markets.html (accessed on 12 June 2017).

- Doornik, Jurgen A., and David F. Hendry. 2013. Empirical Econometric Modeling. Vols. I and II, London: Timberlake Consultants. [Google Scholar]

- Dudley, William C. Remarks at the 2013 OTC Derivatives Conference, Paris, France. Available online: https://www.newyorkfed.org/newsevents/speeches/2013/dud130912.html (accessed on 12 June 2017).

- Greenspan, Alan. 1998. Testimony of Chairman Alan Greenspan to The Commodity Exchange Act and OTC derivatives Before the Committee on Agriculture, Nutrition, and Forestry. U.S. Senate, July 30. Available online: http://www.federalreserve.gov/boarddocs/testimony/1998/19980730.htm (accessed on 12 June 2017).

- Hopper, Gregory. 1995. A Primer on Currency Derivatives. Available online: https://www.philadelphiafed.org/research-and-data/publications/business-review/1995 (accessed on 12 June 2017).

- Lew, Jacob J. 2013. Testimony of Secretary Jacob J. Lew before the House Financial Services Committee. Available online: https://www.treasury.gov/press-center/press-releases/Pages/jl2242.aspx (accessed on 12 June 2017).

- Merton, Robert C. 1973. The Theory of Rational Option Pricing. Bell Journal of Economic and Management Science 4: 141–83. [Google Scholar] [CrossRef]

- Miller, Merton H. 1997. Merton Miller on Derivatives. New York: John Wiley. [Google Scholar]

- Morrison, Alan D. 2005. Credit Derivatives, Disintermediation, and Investment Decisions. Journal of Business. Available online: https://www.jstor.org/stable/10.1086/427641?seq=1#page_scan_tab_contents (accessed on 12 June 2017).

- Smithson, Charles. 1998. Managing Financial Risk. New York: McGraw Hill. [Google Scholar]

- Stegman, Michael. 2014. Presentation before a Bipartisan Policy Center Panel "Reigniting the Private Label Mortgage-Backed Securities Market". Available online: http://www.treasury.gov/press-center/press-releases/Pages/jl2634.aspx (accessed on 15 September 2014).

- Still, Keith. 1997. The Economic Benefits and Risks of Derivative Securities. January/February. Available online: https://www.philadelphiafed.org/research-and-data/economists/sill (accessed on 12 June 2017).

- Summers, Lawrence H. 1998. Testimony of Treasury Deputy Secretary Lawrence H. Summers to The Commodity Exchange Act and OTC derivatives before the Committee on Agriculture, Nutrition, and Forestry. U.S. Senate, July 30. Available online: https://www.treasury.gov/press-center/press-releases/Pages/rr2616.aspx (accessed on 12 June 2017).

- Sundaram, Rangarajan K. 2012. Derivatives in Financial Market Development. Available online: http://people.stern.nyu.edu/rsundara/papers/RangarajanSundaramFinal.pdf (accessed on 12 June 2017).

| 1. | Key features of OTC derivatives: Contracts are tailored to counterparties’ needs, counterparties do not post margins, contracts are not regulated: Only periodic disclosure required; no rules on who can hold derivatives; no limits on holdings. See the explanations provided by the Bank of International Settlements (BIS): https://www.bis.org/statistics/about_derivatives_stats.htm?m=6%7C32%7C639. |

| 2. | Dr. Michael Stegman before a Bipartisan Policy Center Panel “Reigniting the Private Label Mortgage-backed Securities Market” http://www.treasury.gov/press-center/press-releases/Pages/jl2634.aspx (accessed on 15 September 2014). |

| 3. | |

| 4. | (Smithson 1998, p. 229) and Merton (1973) relax the assumption of a constant interest rate in the Black-Scholes model. However, Merton did not endogenize the interest rate as a function of the aggregate derivative contracts. |

| 5. | Specifically, it is not enough to say that firms may use a forecast of GDP or interest rates. What is of interest is how those forecasts will react to changes in policies or other shocks. In addition, if they do and the associated forecast revision leads to a change in the hedging strategy, then it will represent the effect of economic activity on derivatives. |

| 6. | Interest in the finance-growth link is not new. What is new here is the focus on OTC derivatives. |

| 7. | |

| 8. | |

| 9. | |

| 10. | |

| 11. | The BIS’ Macroeconomic Assessment Group on Derivatives published a report (BIS 2013) finding that regulations on derivatives will have a minimal effect on economic activity (BIS 2013, p. 4). However, these calculations do not recognize the feedback effect from GDP to derivatives. BIS (2013) empirical work relies on models that treat the effect of income on derivatives as given. The idea is that deriviatives affect the cost of capital and therefore investment and therefore GDP. But again this work assumes that one can treat economic activity as not mattering for derivatives. |

| 12. | Thanks to Denis Pêtre from the BIS for clarifying the source of the unallocated derivatives. |

| 13. | Our data do not include Credit Default Swaps. The BIS treats this category separately and are a small fraction of the total; see http://www.bis.org/publ/otc_hy1705.pdf. |

| 14. | As one of the referees points out, further work is needed in this area. Importantly, there is no universally accepted method for converting notional values into cash-flow equivalents. We examined, however, the alternative of using the notional values as reported. The statistical properties of the associated models violate key assumptions such as residuals being white noise. Finding that ignoring adjustments leads to poor reliability does not automatically imply that our adjustment is correct but, we argue, it is better than the alternative. Specifically, given that the swap interest rate is influenced by economic fundamentals, we expect the movements in the adjusted series to embody economic information. |

| 15. | Thanks to one of the referees for calling this point to our attention. |

| 16. | The test result that we report is the one that minimizes the Akaike’s Information Criteria. The critical values for the ADF test are 5%–1.95; 1%–2.65. |

| 17. | Contracts on equity-linked derivatives are negligible and they are excluded from the modeling work. Their values are, however, included in the computation of the aggregates for the various counterparties; Section 3.1 shows the data matrix that we use. |

| 18. | See Doornik and Hendry (2013) for the empirical implementation of this test. |

| 19. | We could not reject the view that the residuals from the Engle-Granger equation are stationary. |

| 20. | For normality we use the Jarque-Bera test. For serial independence we test the hypothesis that all of the coefficients of an AR(7) of the residuals are jointly equal to zero. For homoskedasticity we test whether the residuals exhibit an ARCH of order 1. These tests are explained in Doornik and Hendry (2013). |

| 21. | |

| 22. | However, the BIS calculations do not recognize the feedback effect from GDP to derivatives. BIS (2013) empirical work relies on models that treat the effect of income on derivatives as given. The idea is that deriviatives affect the cost of capital and therefore investment and therefore GDP. Our contribution lies on treating economic activity as responding to regulations of derivatives. |

| Counterparties | ||||

|---|---|---|---|---|

| Non-Financial | Other Financial | Dealers | Total | |

| Instruments | ||||

| Foreign Exchange | ||||

| Interest Rate | ||||

| Equity-linked | ||||

| Total | ||||

| Economic Activity | Johansen | Engle-Granger *19 | ||||

|---|---|---|---|---|---|---|

| GDP | 4.98 | −1.15 | 0.0095 | 4.45 | ||

| (1.27) | (0.24) | (0.0176) | (1.34) | |||

| 4.696 | −1.12 | |||||

| (1.269) | (0.229) | |||||

| Exports | 1.887 | −1.156 | 0.0689 | 1.23 | ||

| (0.304) | (0.24) | (0.076) | (0.598) | |||

| 1.8276 | −1.5347 | |||||

| (0.304) | (0.241) | |||||

| Model | Null Hypothesis | ||

|---|---|---|---|

| Normality | Serial Ind. | Homosk. | |

| Interest Rates | 0.639 | 0.074 | 0.475 |

| and GDP | 0.816 | 0.084 | 0.274 |

| Interest Rates | 0.077 | 0.172 | 0.309 |

| and Exports | 0.639 | 0.074 | 0.475 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bodnar, G.; Fortun, J.; Marquez, J. OTC Derivatives and Global Economic Activity: An Empirical Analysis. J. Risk Financial Manag. 2017, 10, 13. https://doi.org/10.3390/jrfm10020013

Bodnar G, Fortun J, Marquez J. OTC Derivatives and Global Economic Activity: An Empirical Analysis. Journal of Risk and Financial Management. 2017; 10(2):13. https://doi.org/10.3390/jrfm10020013

Chicago/Turabian StyleBodnar, Gordon, Jonathan Fortun, and Jaime Marquez. 2017. "OTC Derivatives and Global Economic Activity: An Empirical Analysis" Journal of Risk and Financial Management 10, no. 2: 13. https://doi.org/10.3390/jrfm10020013