The Tale of Two Financial Crises: An Entropic Perspective

Abstract

:1. Introduction

2. Tsallis Entropy

- Number of states: With too few states, one may not be able to characterize the underlying market sentiment reliably, and with too many states, tracking fine changes becomes difficult. Without loss of generality, we set n .

- Partitioning method: There are two different methods for partitioning the range of a time series: (a) fixed partitioning (equipartition is performed on all available data) and (b) adaptive partitioning (equipartition is performed on each moving-window of data, i.e., it changes over time). The adaptive partitioning approach can track transient changes better than the fixed partitioning and is more suitable for our application.

- Estimation of q: The entropic index q is the degree of long-memory in the data. Gell-Mann and Tsallis [1] estimate for high-frequency financial data (returns and volumes) and stress that as the data frequency decreases, q approaches unity. Larger q values () emphasize highly volatile activities in the signal when a time-dependent entropy is plotted against time, i.e., the entropy is more sensitive to possible disturbances in the probability distribution function. In this paper, we find the optimal q by using the maximum likelihood (ML) estimator, as explained in the Results section.

- Sliding step () and moving window size (K): The sliding step (the number of observations by which the moving window is shifted forward across time) and moving window size (the number of observations used in calculating the entropy) determine the time resolution of . If the focus is on tracking the local changes, the sliding step is set to be very small (e.g., one observation: ). Non-overlapping windows () are useful only when one is interested in monitoring the general trend of a time series. To get a reliable probability distribution function, K should not be too small. We set , and K is varied from 50–120 days. As demonstrated in [16], the results are unaffected by the (reasonable) choices for the moving-window size (from 50–120 days). The reason we use 50 days in 2008 and 120 days in 1987 is to generate more data points in 2008, given that we could track two years around the other crisis (1987 and 1988).

3. Approximate Entropy

4. Data

5. Results

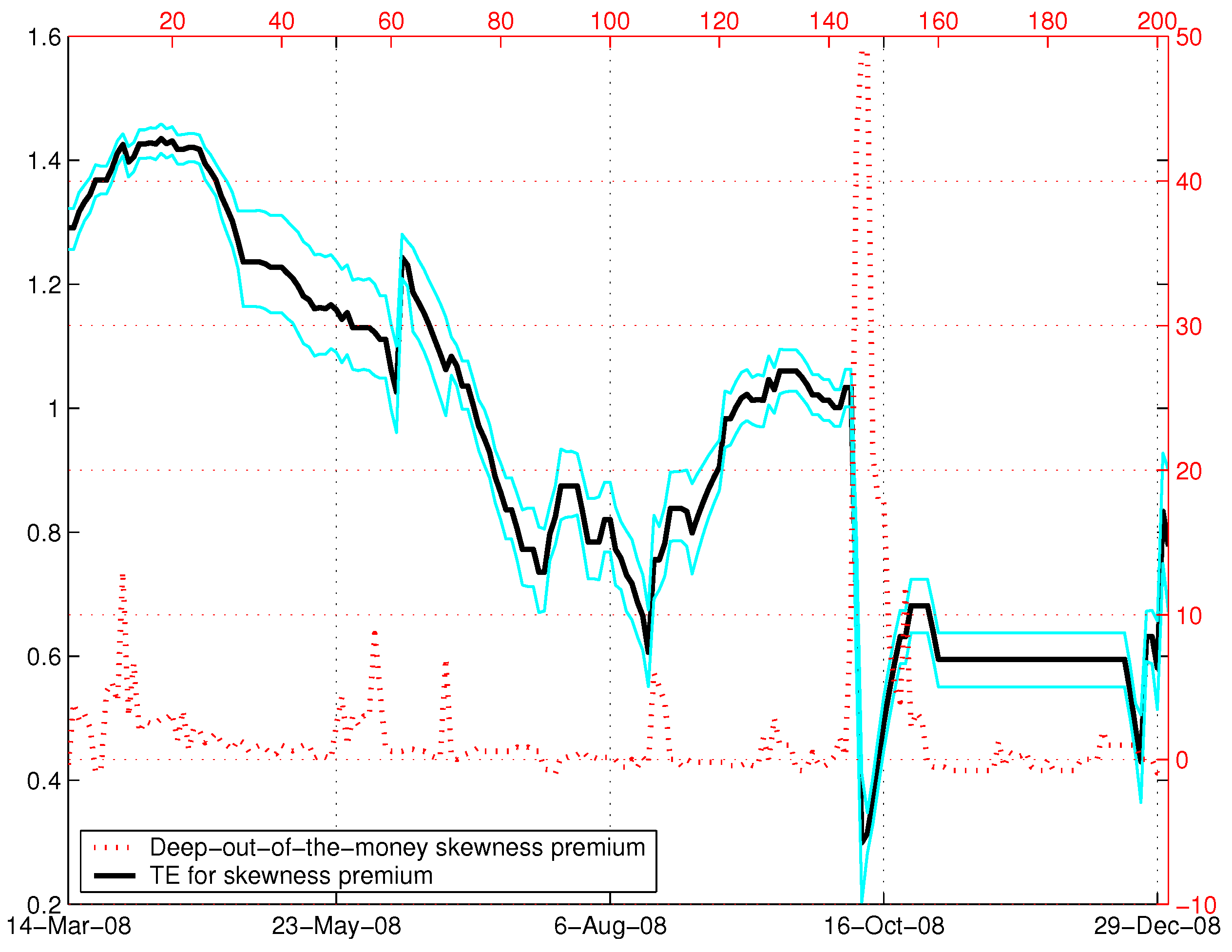

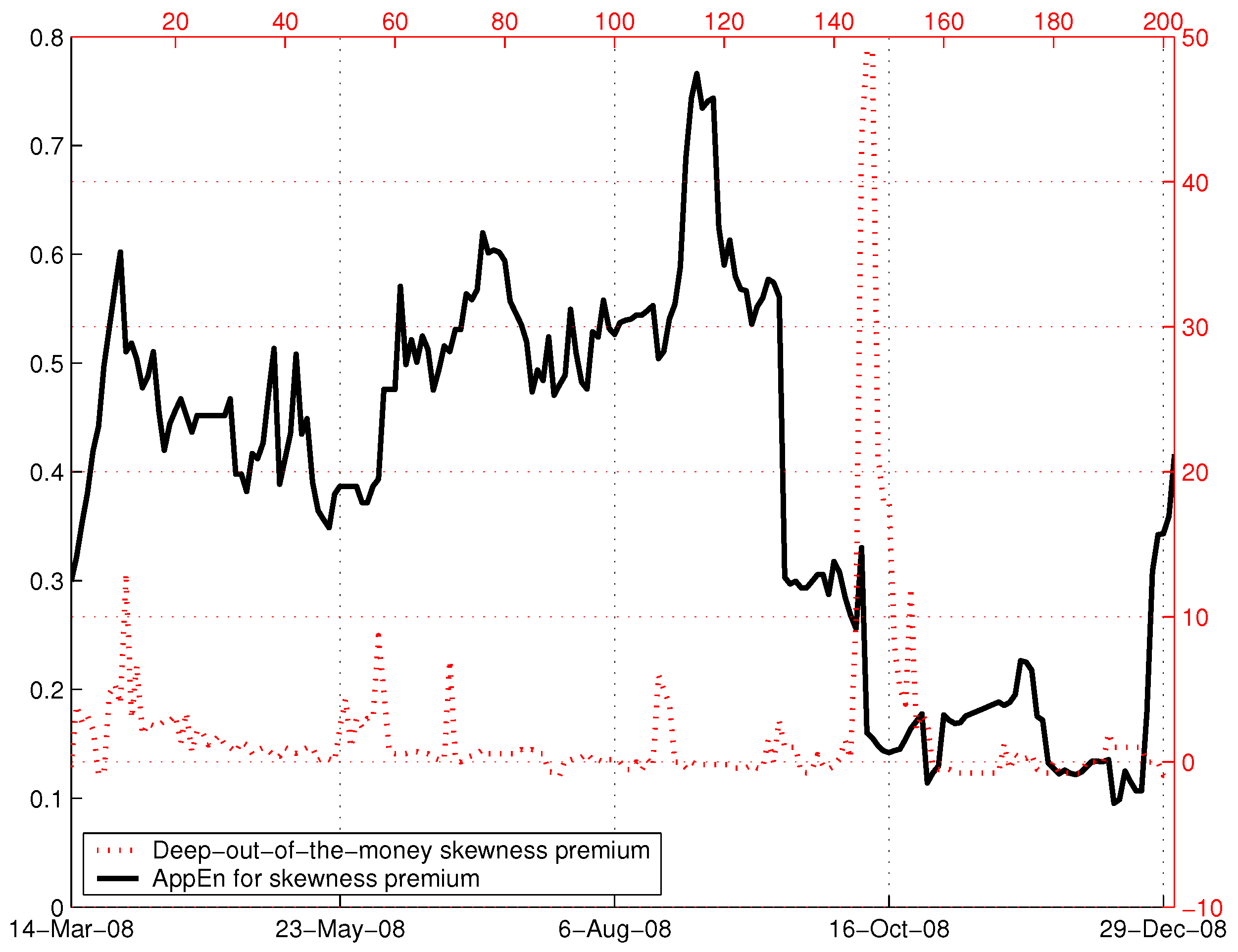

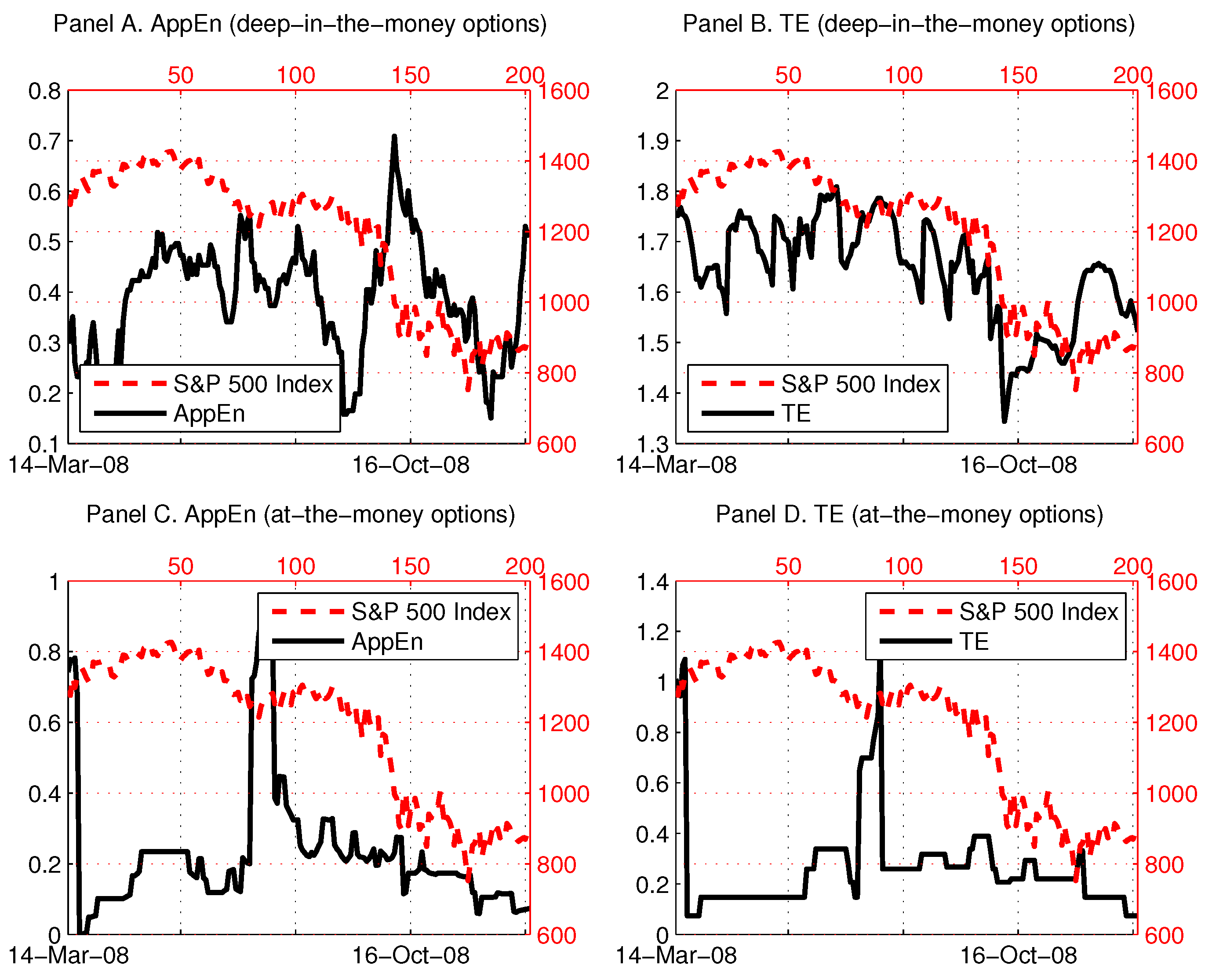

5.1. 2008 Crisis

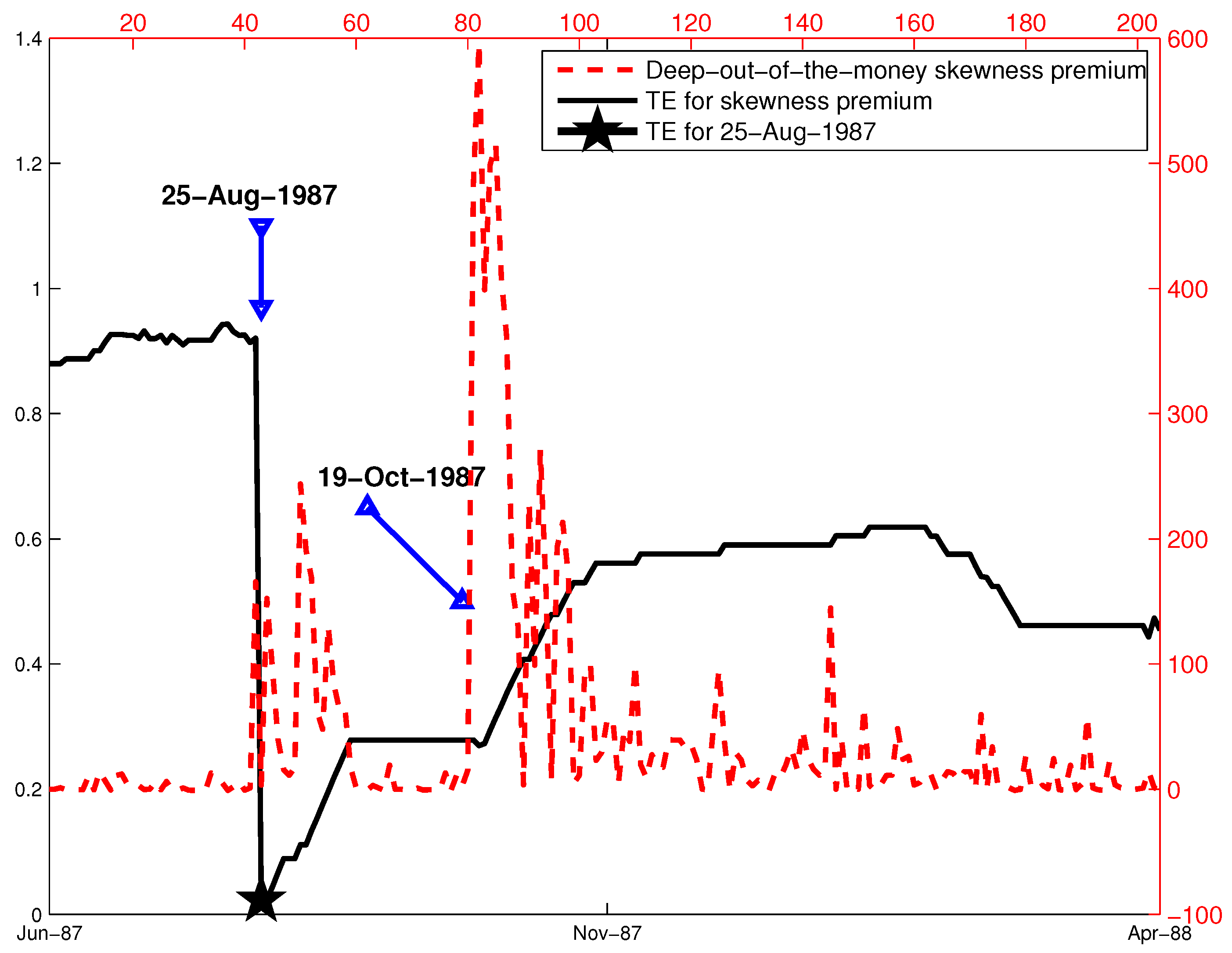

5.2. 1987 Crash

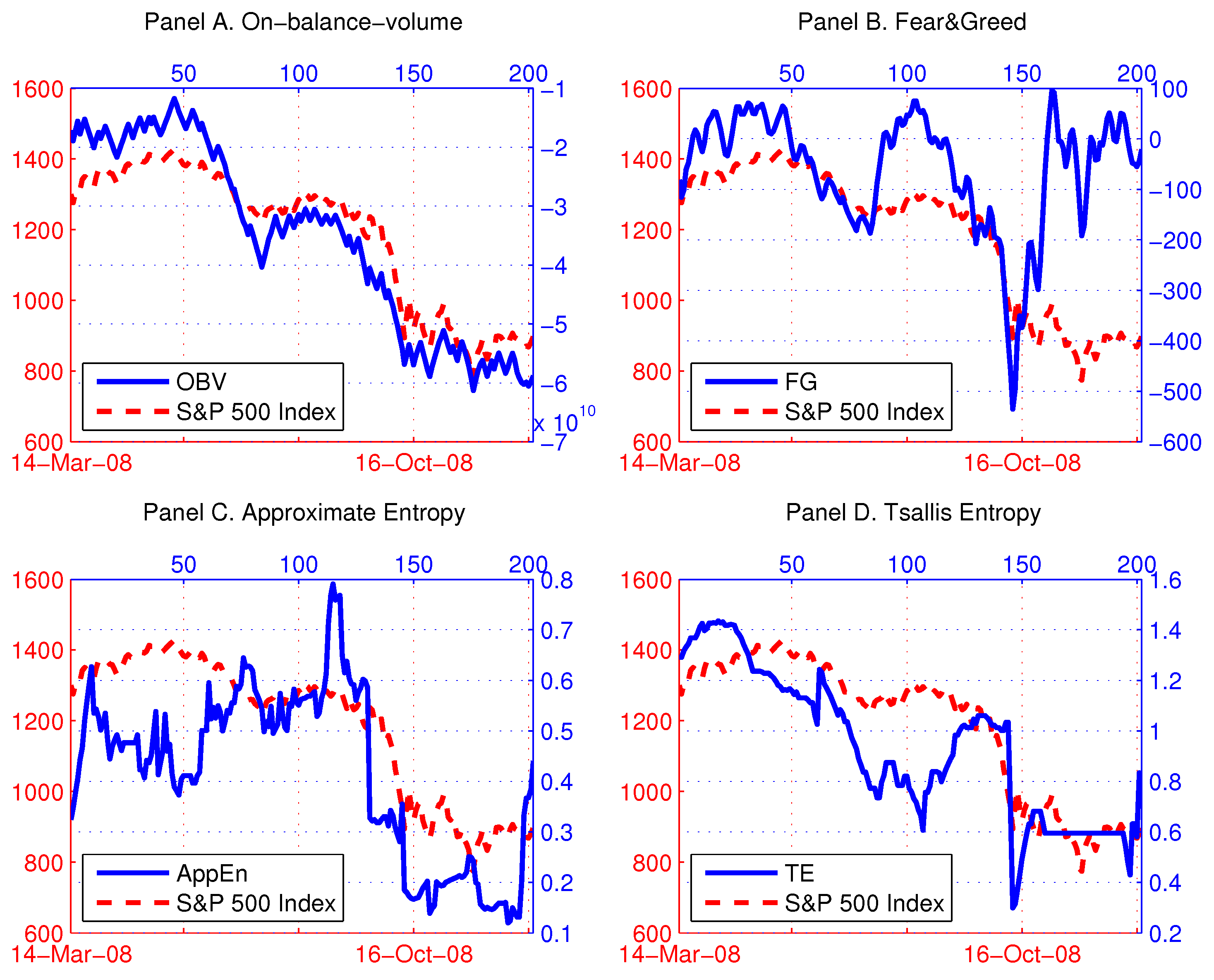

5.3. Entropy and Technical Analysis

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Gell-Mann, M.; Tsallis, C. Nonextensive Entropy: Interdisciplinary Applications; Oxford University Press: Oxford, UK, 2004. [Google Scholar]

- Tsallis, C. Introduction to Nonextensive Statistical Mechanics: Approaching a Complex World; Springer: New York, NY, USA, 2009. [Google Scholar]

- Tsallis, C. The nonadditive entropy Sq and its applications in physics and elsewhere: Some remarks. Entropy 2011, 13, 1765–1804. [Google Scholar] [CrossRef]

- Ishizaki, R.; Inoue, M. Time-series analysis of foreign exchange rates using time-dependent pattern entropy. Phys. A Stat. Mech. Appl. 2013, 392, 3344–3350. [Google Scholar] [CrossRef]

- Namaki, A.; Lai, Z.K.; Jafari, G.; Raei, R.; Tehrani, R. Comparing emerging and mature markets during times of crises: A non-extensive statistical approach. Phys. A Stat. Mech. Appl. 2013, 392, 3039–3044. [Google Scholar] [CrossRef]

- Bentes, S.; Menezes, R. Entropy: A new measure of stock market volatility? J. Phys. Conf. Ser. 2012, 394, 012033. [Google Scholar] [CrossRef]

- Gradojevic, N.; Gençay, R. Financial applications of nonextensive entropy. IEEE Signal Process. Mag. 2011, 28, 116–121. [Google Scholar] [CrossRef]

- Stutzer, M.J. Simple entropic derivation of a generalized Black-Scholes option pricing model. Entropy 2000, 2, 70–77. [Google Scholar] [CrossRef]

- Stutzer, M.J.; Kitamura, Y. Connections between entropic and linear projections in asset pricing estimation. J. Econ. 2002, 107, 159–174. [Google Scholar] [CrossRef]

- Yang, J.; Qiu, W. A measure of risk and a decision-making model based on expected utility and entropy. Eur. J. Oper. Res. 2005, 164, 792–799. [Google Scholar] [CrossRef]

- Kaynar, B.; Ridder, A. The cross-entropy method with patching for rare-event simulation of large markov chains. Eur. J. Oper. Res. 2010, 207, 1380–1397. [Google Scholar] [CrossRef]

- Moreno, B.; López, A.J. Combining economic forecasts by using a maximum entropy econometric approach. J. Forecast. 2013, 32, 124–136. [Google Scholar] [CrossRef]

- Bowden, R.J. Directional entropy and tail uncertainty, with applications to financial hazard. Quant. Financ. 2011, 11, 437–446. [Google Scholar] [CrossRef]

- Bekiros, S.; Marcellino, M. The multiscale causal dynamics of foreign exchange markets. J. Int. Money Financ. 2013, 38, 282–305. [Google Scholar] [CrossRef]

- Bekiros, S. Timescale analysis with an entropy-based shift-invariant discrete wavelet transform. Comput. Econ. 2014, 44, 231–251. [Google Scholar] [CrossRef]

- Gençay, R.; Gradojevic, N. Crash of ’87—Was it expected? Aggregate market fears and long range dependence. J. Empir. Financ. 2010, 17, 270–282. [Google Scholar] [CrossRef]

- Gradojevic, N.; Gençay, R. Overnight interest rates and aggregate market expectations. Econ. Lett. 2008, 100, 27–30. [Google Scholar] [CrossRef]

- Gradojevic, N.; Caric, M. Predicting systemic risk with entropic indicators. J. Forecast. 2017, 36, 16–25. [Google Scholar] [CrossRef]

- McKeon, R.; Netter, J. What caused the 1987 stock market crash and lessons for the 2008 crash. Rev. Account. Financ. 2009, 8, 123–137. [Google Scholar] [CrossRef]

- Geanakoplos, J. The Leverage Cycle; University of Chicago Press: Chicago, IL, USA, 2010; pp. 1–65. [Google Scholar]

- Pincus, S.M. Approximate entropy as a measure of system complexity. Proc. Natl. Acad. Sci. USA 1991, 88, 2297–2301. [Google Scholar] [CrossRef] [PubMed]

- Tsallis, C. Possible generalization of Boltzmann–Gibbs statistics. J. Stat. Phys. 1988, 52, 479–487. [Google Scholar] [CrossRef]

- Borland, L. A theory of non-gaussian option pricing. Quant. Financ. 2002, 2, 415–431. [Google Scholar] [CrossRef]

- Gamero, L.G.; Plastino, A.; Torres, M.E. Wavelet analysis and nonlinear dynamics in a nonextensive setting. Physica A 1997, 246, 487–509. [Google Scholar] [CrossRef]

- Tong, S.; Bezerianos, A.; Paul, J.; Zhu, Y.; Thakor, N.V. Nonextensive entropy measure of eeg following brain injury from cardiac arrest. Physica A 2002, 305, 619–628. [Google Scholar] [CrossRef]

- Thakor, N.V.; Tong, S. Advances in quantitative electroencephalogram analysis methods. Annu. Rev. Biomed. Eng. 2004, 6, 453–495. [Google Scholar] [CrossRef] [PubMed]

- Garcia, R.; Gençay, R. Pricing and hedging derivative securities with neural networks and a homogeneity hint. J. Econom. 2000, 94, 93–115. [Google Scholar] [CrossRef]

- Kirkpatrick, C.D.; Dahlquist, J.R. Technical Analysis: The Complete Resource for Financial Market Technicians; FT Press: Upper Saddle River, NJ, USA, 2016. [Google Scholar]

| Date | TE | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 April 2008 | 0.3 | 0.2 | 0.1 | 0.2 | 0.06 | 0.02 | 0.04 | 0.04 | 0.02 | 0.02 | 1.397 |

| 1 May 2008 | 0.24 | 0.22 | 0.28 | 0.2 | 0.02 | 0.02 | 0 | 0 | 0 | 0.02 | 1.236 |

| 2 June 2008 | 0.18 | 0.42 | 0.26 | 0.08 | 0.02 | 0.02 | 0 | 0 | 0 | 0.02 | 1.130 |

| 1 July 2008 | 0.56 | 0.22 | 0.08 | 0.06 | 0.02 | 0.02 | 0 | 0 | 0.02 | 0.02 | 1.005 |

| 1 August 2008 | 0.08 | 0.72 | 0.02 | 0.04 | 0.06 | 0.04 | 0 | 0 | 0.02 | 0.02 | 0.784 |

| 15 August 2008 | 0.02 | 0.74 | 0 | 0 | 0 | 0.02 | 0 | 0 | 0.02 | 0.02 | 0.606 |

| 2 September 2008 | 0.22 | 0.62 | 0.08 | 0 | 0 | 0 | 0.02 | 0.02 | 0.02 | 0.02 | 0.869 |

| 15 September 2008 | 0.24 | 0.46 | 0.24 | 0 | 0 | 0 | 0 | 0.02 | 0.02 | 0.02 | 1.014 |

| 1 October 2008 | 0.30 | 0.50 | 0.10 | 0.02 | 0 | 0.02 | 0 | 0.02 | 0.02 | 0.02 | 1.012 |

| 8 October 2008 | 0.48 | 0.32 | 0.08 | 0.04 | 0 | 0.02 | 0 | 0.02 | 0.02 | 0.02 | 1.033 |

| 9 October 2008 | 0.76 | 0.10 | 0.04 | 0.02 | 0.02 | 0.02 | 0.02 | 0 | 0 | 0.02 | 0.679 |

| 10 October 2008 | 0.90 | 0.06 | 0.02 | 0 | 0 | 0 | 0 | 0 | 0 | 0.02 | 0.299 |

| 15 October 2008 | 0.86 | 0.04 | 0.02 | 0 | 0.02 | 0 | 0 | 0 | 0.02 | 0.04 | 0.430 |

| 3 November 2008 | 0.80 | 0.04 | 0.04 | 0.04 | 0.02 | 0 | 0 | 0 | 0.02 | 0.04 | 0.595 |

| 1 December 2008 | 0.80 | 0.04 | 0.04 | 0.04 | 0.02 | 0 | 0 | 0 | 0.02 | 0.04 | 0.595 |

| Date | TE | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 August 1987 | 0.53 | 0.19 | 0.06 | 0.04 | 0.04 | 0.03 | 0.00 | 0.07 | 0.01 | 0.03 | 0.92 |

| 21 August 1987 | 0.53 | 0.19 | 0.05 | 0.04 | 0.04 | 0.03 | 0.00 | 0.07 | 0.02 | 0.03 | 0.91 |

| 24 August 1987 | 0.53 | 0.20 | 0.04 | 0.04 | 0.04 | 0.03 | 0.00 | 0.07 | 0.02 | 0.03 | 0.92 |

| 25 August 1987 | 0.99 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.02 |

| 26 August 1987 | 0.99 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.04 |

| 27 August 1987 | 0.99 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.06 |

| 16 September–16 October 1987 | 0.89 | 0.05 | 0.01 | 0.02 | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.27 |

| 19 October 1987 | 0.89 | 0.05 | 0.01 | 0.03 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.26 |

| Null Hypothesis | Prob | ||

|---|---|---|---|

| OBV does not cause S&P 500 index daily returns | 3.08 | 0.378 | 198 |

| S&P 500 index daily returns does not cause OBV | 14.27 | 0.003 | (3) |

| FG does not cause S&P 500 index daily returns | 8.12 | 0.044 | 198 |

| S&P 500 index daily returns does not cause FG | 16.96 | 0.001 | (3) |

| TE does not cause S&P 500 index daily returns | 35.44 | 0.000 | 193 |

| S&P 500 index daily returns does not cause TE | 15.68 | 0.047 | (8) |

| does not cause S&P 500 index daily returns | 17.61 | 0.001 | 198 |

| S&P 500 index daily returns does not cause | 3.97 | 0.264 | (3) |

| Regressor () | OBV | FG | TE | |

|---|---|---|---|---|

| 6.6781 | 6.8730 | 6.0965 | 6.6398 | |

| 54% | 49% | 60% | 54% |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gençay, R.; Gradojevic, N. The Tale of Two Financial Crises: An Entropic Perspective. Entropy 2017, 19, 244. https://doi.org/10.3390/e19060244

Gençay R, Gradojevic N. The Tale of Two Financial Crises: An Entropic Perspective. Entropy. 2017; 19(6):244. https://doi.org/10.3390/e19060244

Chicago/Turabian StyleGençay, Ramazan, and Nikola Gradojevic. 2017. "The Tale of Two Financial Crises: An Entropic Perspective" Entropy 19, no. 6: 244. https://doi.org/10.3390/e19060244