Journal Description

Econometrics

Econometrics

is an international, peer-reviewed, open access journal on econometric modeling and forecasting, as well as new advances in econometrics theory, and is published quarterly online by MDPI.

- Open Access— free for readers, with article processing charges (APC) paid by authors or their institutions.

- High Visibility: indexed within Scopus, ESCI (Web of Science), EconLit, EconBiz, RePEc, and other databases.

- Rapid Publication: manuscripts are peer-reviewed and a first decision is provided to authors approximately 34.6 days after submission; acceptance to publication is undertaken in 8.6 days (median values for papers published in this journal in the first half of 2025).

- Recognition of Reviewers: reviewers who provide timely, thorough peer-review reports receive vouchers entitling them to a discount on the APC of their next publication in any MDPI journal, in appreciation of the work done.

Impact Factor:

1.4 (2024);

5-Year Impact Factor:

1.2 (2024)

Latest Articles

Forecasting of GDP Growth in the South Caucasian Countries Using Hybrid Ensemble Models

Econometrics 2025, 13(3), 35; https://doi.org/10.3390/econometrics13030035 - 10 Sep 2025

Abstract

►

Show Figures

This study aimed to forecast the gross domestic product (GDP) of the South Caucasian nations (Armenia, Azerbaijan, and Georgia) by scrutinizing the accuracy of various econometric methodologies. This topic is noteworthy considering the significant economic development exhibited by these countries in the context

[...] Read more.

This study aimed to forecast the gross domestic product (GDP) of the South Caucasian nations (Armenia, Azerbaijan, and Georgia) by scrutinizing the accuracy of various econometric methodologies. This topic is noteworthy considering the significant economic development exhibited by these countries in the context of recovery post COVID-19. The seasonal autoregressive integrated moving average (SARIMA), exponential smoothing state space (ETS) model, neural network autoregressive (NNAR) model, and trigonometric exponential smoothing state space model with Box–Cox transformation, ARMA errors, and trend and seasonal components (TBATS), together with their feasible hybrid combinations, were employed. The empirical investigation utilized quarterly GDP data at market prices from Q1-2010 to Q2-2024. According to the results, the hybrid models significantly outperformed the corresponding single models, handling the linear and nonlinear components of the GDP time series more effectively. Rolling-window cross-validation showed that hybrid ETS-NNAR-TBATS for Armenia, hybrid ETS-NNAR-SARIMA for Azerbaijan, and hybrid ETS-SARIMA for Georgia were the best-performing models. The forecasts also suggest that Georgia is likely to record the strongest GDP growth over the projection horizon, followed by Armenia and Azerbaijan. These findings confirm that hybrid models constitute a reliable technique for forecasting GDP in the South Caucasian countries. This region is not only economically dynamic but also strategically important, with direct implications for policy and regional planning.

Full article

Open AccessArticle

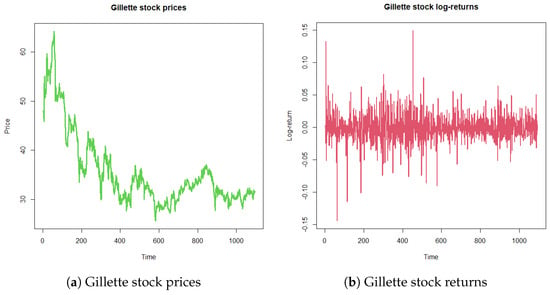

Volatility Analysis of Returns of Financial Assets Using a Bayesian Time-Varying Realized GARCH-Itô Model

by

Pathairat Pastpipatkul and Htwe Ko

Econometrics 2025, 13(3), 34; https://doi.org/10.3390/econometrics13030034 - 9 Sep 2025

Abstract

In a stage of more and more complex and high-frequency financial markets, the volatility analysis is a cornerstone of modern financial econometrics with practical applications in portfolio optimization, derivative pricing, and systematic risk assessment. This paper introduces a novel Bayesian Time-varying Generalized Autoregressive

[...] Read more.

In a stage of more and more complex and high-frequency financial markets, the volatility analysis is a cornerstone of modern financial econometrics with practical applications in portfolio optimization, derivative pricing, and systematic risk assessment. This paper introduces a novel Bayesian Time-varying Generalized Autoregressive Conditional Heteroskedasticity (BtvGARCH-Itô) model designed to improve the precision and flexibility of volatility modeling in financial markets. Original GARCH-Itô models, while effective in capturing realized volatility and intraday patterns, rely on fixed or constant parameters; thus, it is limited to studying structural changes. Our proposed model addresses this restraint by integrating the continuous-time Ito process with a time-varying Bayesian inference to allow parameters to vary over time based on prior beliefs to quantify uncertainty and minimize overfitting, especially in small-sample or high-dimensional settings. Through simulation studies, using sample sizes of N = 100 and N = 200, we find that BtvGARCH-Itô outperformed original GARCH-Itô in-sample fit and out-of-sample forecast accuracy based on posterior estimates comparison with true parameter values and forecasting error metrics. For the empirical validation, this model is applied to analyze the volatility of S&P 500 and Bitcoin (BTC) using one-minute length data for S&P 500 (from 3 January 2023 to 31 December 2024) and BTC (from 1 January 2023 to 1 January 2025). This model has potential as a robust tool and a new direction in volatility modeling for financial risk management.

Full article

(This article belongs to the Special Issue Innovations in Bayesian Econometrics: Theory, Techniques, and Economic Analysis)

►▼

Show Figures

Figure 1

Open AccessArticle

Modelling and Forecasting Financial Volatility with Realized GARCH Model: A Comparative Study of Skew-t Distributions Using GRG and MCMC Methods

by

Didit Budi Nugroho, Adi Setiawan and Takayuki Morimoto

Econometrics 2025, 13(3), 33; https://doi.org/10.3390/econometrics13030033 - 4 Sep 2025

Abstract

►▼

Show Figures

Financial time-series data often exhibit statistically significant skewness and heavy tails, and numerous flexible distributions have been proposed to model them. In the context of the Log-linear Realized GARCH model with Skew-t (ST) distributions, our objective is to explore how the choice

[...] Read more.

Financial time-series data often exhibit statistically significant skewness and heavy tails, and numerous flexible distributions have been proposed to model them. In the context of the Log-linear Realized GARCH model with Skew-t (ST) distributions, our objective is to explore how the choice of prior distributions in the Adaptive Random Walk Metropolis method and initial parameter values in the Generalized Reduced Gradient (GRG) Solver method affect ST parameter and log-likelihood estimates. An empirical study was conducted using the FTSE 100 index to evaluate model performance. We provide a comprehensive step-by-step tutorial demonstrating how to perform estimation and sensitivity analysis using data tables in Microsoft Excel. Among seven ST distributions—namely, the asymmetric, epsilon, exponentiated half-logistic, Hansen, Jones–Faddy, Mittnik–Paolella, and Rosco–Jones–Pewsey distributions—Hansen’s ST distribution is found to be superior. This study also applied the GRG method to estimate new approaches, including Realized Real-Time GARCH, Realized ASHARV, and GARCH@CARR models. An empirical study showed that the GARCH@CARR model with the feedback effect provides the best goodness of fit. Out-of-sample forecasting evaluations further confirm the predictive dominance of models incorporating real-time information, particularly Realized Real-Time GARCH for volatility forecasting and Realized ASHARV for 1% VaR estimation. The findings offer actionable insights for portfolio managers and risk analysts, particularly in improving volatility forecasts and tail-risk assessments during market crises, thereby enhancing risk-adjusted returns and regulatory compliance. Although the GRG method is sensitive to initial values, its presence in the spreadsheet method can be a powerful and promising tool in working with probability density functions that have explicit forms and are unimodal, high-dimensional, and complex, without the need for programming experience.

Full article

Figure 1

Open AccessArticle

Comparisons Between Frequency Distributions Based on Gini’s Approach: Principal Component Analysis Addressed to Time Series

by

Pierpaolo Angelini

Econometrics 2025, 13(3), 32; https://doi.org/10.3390/econometrics13030032 - 13 Aug 2025

Abstract

In this paper, time series of length T are seen as frequency distributions. Each distribution is defined with respect to a statistical variable having T observed values. A methodological system based on Gini’s approach is put forward, so the statistical model through which

[...] Read more.

In this paper, time series of length T are seen as frequency distributions. Each distribution is defined with respect to a statistical variable having T observed values. A methodological system based on Gini’s approach is put forward, so the statistical model through which time series are handled is a frequency distribution studied inside a linear system. In addition to the starting frequency distributions that are observed, other frequency distributions are treated. Thus, marginal distributions based on the notion of proportionality are introduced together with joint distributions. Both distributions are statistical models. A fundamental invariance property related to marginal distributions is made explicit in this research work, so one can focus on collections of marginal frequency distributions, identifying multiple frequency distributions. For this reason, the latter is studied via a tensor. As frequency distributions are practical realizations of nonparametric probability distributions over

Open AccessArticle

A Statistical Characterization of Median-Based Inequality Measures

by

Charles M. Beach and Russell Davidson

Econometrics 2025, 13(3), 31; https://doi.org/10.3390/econometrics13030031 - 9 Aug 2025

Abstract

For income distributions divided into middle, lower, and higher regions based on scalar median cut-offs, this paper establishes the asymptotic distribution properties—including explicit empirically applicable variance formulas and hence standard errors—of sample estimates of the proportion of the population within the group, their

[...] Read more.

For income distributions divided into middle, lower, and higher regions based on scalar median cut-offs, this paper establishes the asymptotic distribution properties—including explicit empirically applicable variance formulas and hence standard errors—of sample estimates of the proportion of the population within the group, their share of total income, and the groups’ mean incomes. It then applies these results for relative mean income ratios, various polarization measures, and decile-mean income ratios. Since the derived formulas are not distribution-free, the study advises using a density estimation technique proposed by Comte and Genon-Catalot. A shrinking middle-income group with declining relative incomes and marked upper-tail polarization among men’s incomes are all found to be highly statistically significant.

Full article

Open AccessArticle

Simple Approximations and Interpretation of Pareto Index and Gini Coefficient Using Mean Absolute Deviations and Quantile Functions

by

Eugene Pinsky and Qifu Wen

Econometrics 2025, 13(3), 30; https://doi.org/10.3390/econometrics13030030 - 8 Aug 2025

Abstract

►▼

Show Figures

The Pareto distribution has been widely used to model income distribution and inequality. The tail index and the Gini index are typically computed by iteration using Maximum Likelihood and are usually interpreted in terms of the Lorenz curve. We derive an alternative method

[...] Read more.

The Pareto distribution has been widely used to model income distribution and inequality. The tail index and the Gini index are typically computed by iteration using Maximum Likelihood and are usually interpreted in terms of the Lorenz curve. We derive an alternative method by considering a truncated Pareto distribution and deriving a simple closed-form approximation for the tail index and the Gini coefficient in terms of the mean absolute deviation and weighted quartile differences. The obtained expressions can be used for any Pareto distribution, even without a finite mean or variance. These expressions are resistant to outliers and have a simple geometric and “economic” interpretation in terms of the quantile function and quartiles. Extensive simulations demonstrate that the proposed approximate values for the tail index and the Gini coefficient are within a few percent relative error of the exact values, even for a moderate number of data points. Our paper offers practical and computationally simple methods to analyze a class of models with Pareto distributions. The proposed methodology can be extended to many other distributions used in econometrics and related fields.

Full article

Figure 1

Open AccessArticle

Beyond GDP: COVID-19’s Effects on Macroeconomic Efficiency and Productivity Dynamics in OECD Countries

by

Ümit Sağlam

Econometrics 2025, 13(3), 29; https://doi.org/10.3390/econometrics13030029 - 4 Aug 2025

Cited by 1

Abstract

The COVID-19 pandemic triggered unprecedented economic disruptions, raising critical questions about the resilience and adaptability of macroeconomic productivity across countries. This study examines the impact of COVID-19 on macroeconomic efficiency and productivity dynamics in 37 OECD countries using quarterly data from 2018Q1 to

[...] Read more.

The COVID-19 pandemic triggered unprecedented economic disruptions, raising critical questions about the resilience and adaptability of macroeconomic productivity across countries. This study examines the impact of COVID-19 on macroeconomic efficiency and productivity dynamics in 37 OECD countries using quarterly data from 2018Q1 to 2024Q4. By employing a Slack-Based Measure Data Envelopment Analysis (SBM-DEA) and the Malmquist Productivity Index (MPI), we decompose total factor productivity (TFP) into efficiency change (EC) and technological change (TC) across three periods: pre-pandemic, during-pandemic, and post-pandemic. Our framework incorporates both desirable (GDP) and undesirable outputs (inflation, unemployment, housing price inflation, and interest rate distortions), offering a multidimensional view of macroeconomic efficiency. Results show broad but uneven productivity gains, with technological progress proving more resilient than efficiency during the pandemic. Post-COVID recovery trajectories diverged, reflecting differences in structural adaptability and innovation capacity. Regression analysis reveals that stringent lockdowns in 2020 were associated with lower productivity in 2023–2024, while more adaptive policies in 2021 supported long-term technological gains. These findings highlight the importance of aligning crisis response with forward-looking economic strategies and demonstrate the value of DEA-based methods for evaluating macroeconomic performance beyond GDP.

Full article

(This article belongs to the Special Issue Advancements in Macroeconometric Modeling and Time Series Analysis)

►▼

Show Figures

Figure 1

Open AccessArticle

Analyzing the Impact of Carbon Mitigation on the Eurozone’s Trade Dynamics with the US and China

by

Pathairat Pastpipatkul and Terdthiti Chitkasame

Econometrics 2025, 13(3), 28; https://doi.org/10.3390/econometrics13030028 - 29 Jul 2025

Abstract

►▼

Show Figures

This study focusses on the transmission of carbon pricing mechanisms in shaping trade dynamics between the Eurozone and key partners: the USA and China. Using Bayesian variable selection methods and a Time-Varying Structural Vector Autoregressions (TV-SVAR) model, the research identifies the key variables

[...] Read more.

This study focusses on the transmission of carbon pricing mechanisms in shaping trade dynamics between the Eurozone and key partners: the USA and China. Using Bayesian variable selection methods and a Time-Varying Structural Vector Autoregressions (TV-SVAR) model, the research identifies the key variables impacting EU carbon emissions over time. The results reveal that manufactured products from the US have a diminishing positive impact on EU carbon emissions, suggesting potential exemption from future regulations. In contrast, manufactured goods from the US and petroleum products from China are expected to increase emissions, indicating a need for stricter trade policies. These findings provide strategic insights for policymakers aiming to balance trade and environmental objectives.

Full article

Figure 1

Open AccessArticle

Pseudo-Panel Decomposition of the Blinder–Oaxaca Gender Wage Gap

by

Jhon James Mora and Diana Yaneth Herrera

Econometrics 2025, 13(3), 27; https://doi.org/10.3390/econometrics13030027 - 19 Jul 2025

Abstract

This article introduces a novel approach to decomposing the Blinder–Oaxaca gender wage gap using pseudo-panel data. In many developing countries, panel data are not available; however, understanding the evolution of the gender wage gap over time requires tracking individuals longitudinally. When individuals change

[...] Read more.

This article introduces a novel approach to decomposing the Blinder–Oaxaca gender wage gap using pseudo-panel data. In many developing countries, panel data are not available; however, understanding the evolution of the gender wage gap over time requires tracking individuals longitudinally. When individuals change across time periods, estimators tend to be inconsistent and inefficient. To address this issue, and building upon the traditional Blinder–Oaxaca methodology, we propose an alternative procedure that follows cohorts over time rather than individuals. This approach enables the estimation of both the explained and unexplained components—“endowment effect” and “remuneration effect”—of the wage gap, along with their respective standard errors, even in the absence of true panel data. We apply this methodology to the case of Colombia, finding a gender wage gap of approximately 15% in favor of male cohorts. This gap comprises a −5.6% explained component and a 20% unexplained component without controls. When we control by informality, size of the firm and sector the gap comprises a −3.5% explained component and a 18.7% unexplained component.

Full article

Open AccessArticle

Daily Emissions of CO2 in the World: A Fractional Integration Approach

by

Luis Alberiko Gil-Alana and Carlos Poza

Econometrics 2025, 13(3), 26; https://doi.org/10.3390/econometrics13030026 - 17 Jul 2025

Abstract

►▼

Show Figures

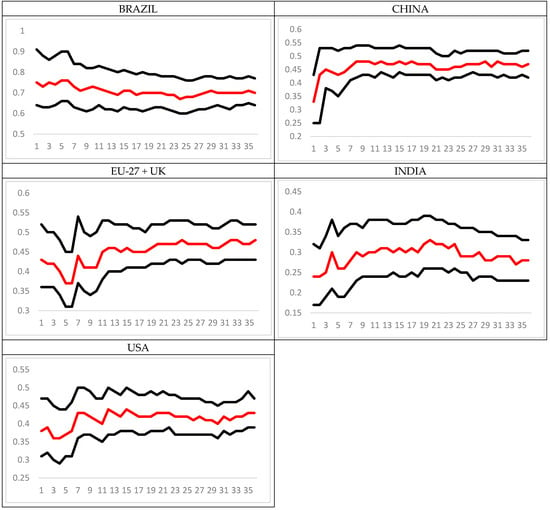

In this article, daily CO2 emissions for the years 2019–2022 are examined using fractional integration for Brazil, China, EU-27 (and the UK), India, and the USA. According to the findings, all series exhibit long memory mean-reversion tendencies, with orders of integration ranging

[...] Read more.

In this article, daily CO2 emissions for the years 2019–2022 are examined using fractional integration for Brazil, China, EU-27 (and the UK), India, and the USA. According to the findings, all series exhibit long memory mean-reversion tendencies, with orders of integration ranging between 0.22 in the case of India (with white noise errors) and 0.70 for Brazil (under autocorrelated disturbances). Nevertheless, the differencing parameter estimates are all considerably below 1, which supports the theory of mean reversion and transient shocks. These results suggest the need for a greater intensification of green policies complemented with economic structural reforms to achieve the zero-emissions target by 2050.

Full article

Figure 1

Open AccessArticle

The Long-Run Impact of Changes in Prescription Drug Sales on Mortality and Hospital Utilization in Belgium, 1998–2019

by

Frank R. Lichtenberg

Econometrics 2025, 13(3), 25; https://doi.org/10.3390/econometrics13030025 - 23 Jun 2025

Abstract

►▼

Show Figures

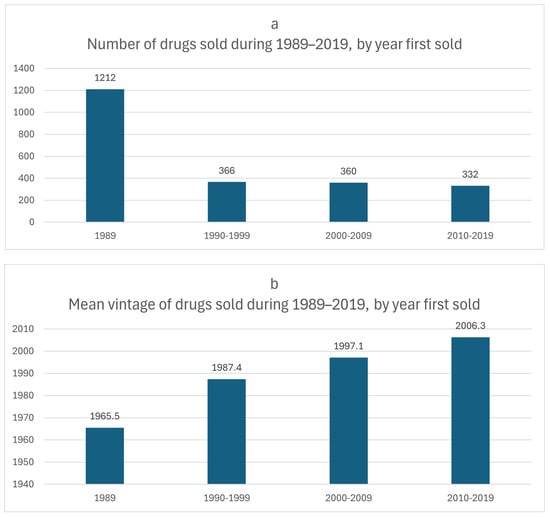

Objectives: We investigate the long-run impact of changes in prescription drug sales on mortality and hospital utilization in Belgium during the first two decades of the 21st century. Methods: We analyze the correlation across diseases between changes in the drugs used to treat

[...] Read more.

Objectives: We investigate the long-run impact of changes in prescription drug sales on mortality and hospital utilization in Belgium during the first two decades of the 21st century. Methods: We analyze the correlation across diseases between changes in the drugs used to treat the disease and changes in mortality or hospital utilization from that disease. The measure of the change in prescription drug sales we use is the long-run (1998–2018 or 2000–2019) change in the fraction of post-1999 drugs sold. A post-1999 drug is a drug that was not sold during 1989–1999. Results: The 1998–2018 increase in the fraction of post-1999 drugs sold is estimated to have reduced the number of years of life lost before ages 85, 75, and 65 in 2018 by about 438 thousand (31%), 225 thousand (31%), and 114 thousand (32%), respectively. The 1995–2014 increase in in the fraction of post-1999 drugs sold is estimated to have reduced the number of hospital days in 2019 by 2.66 million (20%). Conclusions: Even if we ignore the reduction in hospital utilization attributable to changes in pharmaceutical consumption, a conservative estimate of the 2018 cost per life-year before age 85 gained is EUR 6824. We estimate that previous changes in pharmaceutical consumption reduced 2019 expenditure on inpatient curative and rehabilitative care by EUR 3.55 billion, which is higher than the 2018 expenditure on drugs that were authorized during the period 1998–2018: EUR 2.99 billion.

Full article

Figure 1

Open AccessArticle

The Effect of Macroeconomic Announcements on U.S. Treasury Markets: An Autometric General-to-Specific Analysis of the Greenspan Era

by

James J. Forest

Econometrics 2025, 13(3), 24; https://doi.org/10.3390/econometrics13030024 - 21 Jun 2025

Abstract

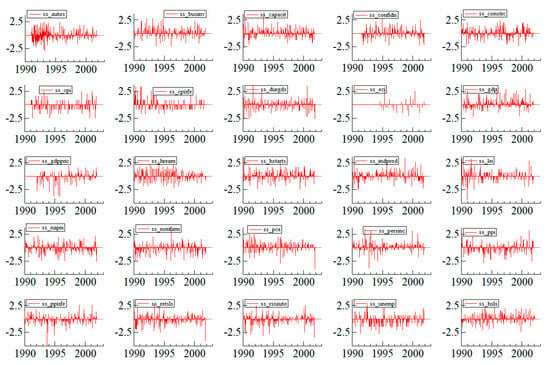

This research studies the impact of macroeconomic announcement surprises on daily U.S. Treasury excess returns during the heart of Alan Greenspan’s tenure as Federal Reserve Chair, addressing the possible limitations of standard static regression (SSR) models, which may suffer from omitted variable bias,

[...] Read more.

This research studies the impact of macroeconomic announcement surprises on daily U.S. Treasury excess returns during the heart of Alan Greenspan’s tenure as Federal Reserve Chair, addressing the possible limitations of standard static regression (SSR) models, which may suffer from omitted variable bias, parameter instability, and poor mis-specification diagnostics. To complement the SSR framework, an automated general-to-specific (Gets) modeling approach, enhanced with modern indicator saturation methods for robustness, is applied to improve empirical model discovery and mitigate potential biases. By progressively reducing an initially broad set of candidate variables, the Gets methodology steers the model toward congruence, dispenses unstable parameters, and seeks to limit information loss while seeking model congruence and precision. The findings, herein, suggest that U.S. Treasury market responses to macroeconomic news shocks exhibited stability for a core set of announcements that reliably influenced excess returns. In contrast to computationally costless standard static models, the automated Gets-based approach enhances parameter precision and provides a more adaptive structure for identifying relevant predictors. These results demonstrate the potential value of incorporating interpretable automated model selection techniques alongside traditional SSR and Markov switching approaches to improve empirical insights into macroeconomic announcement effects on financial markets.

Full article

(This article belongs to the Special Issue Advancements in Macroeconometric Modeling and Time Series Analysis)

►▼

Show Figures

Figure 1

Open AccessArticle

Leveraging Success: The Hidden Peak in Debt and Firm Performance

by

Suzan Dsouza, Krishnamoorthy Kathavarayan, Franklin Mathias, Dharmesh Bhatia and Abdallah AlKhawaja

Econometrics 2025, 13(2), 23; https://doi.org/10.3390/econometrics13020023 - 10 Jun 2025

Abstract

►▼

Show Figures

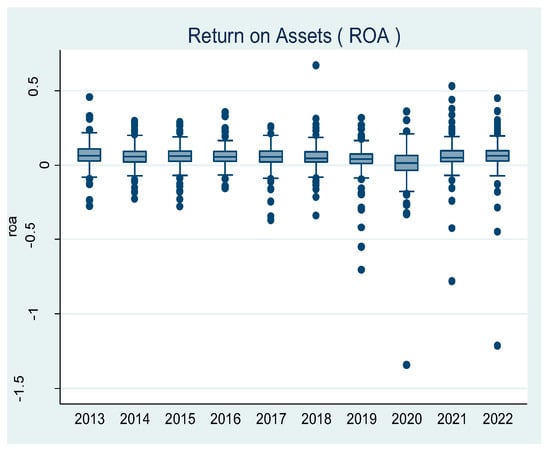

This study investigates the relationship between capital structure and financial performance in South African firms, focusing on the potential non-linear, inverse U-shaped effect of leverage on profitability. Drawing on data from 1548 firm-year observations covering 183 publicly listed South African companies between 2013

[...] Read more.

This study investigates the relationship between capital structure and financial performance in South African firms, focusing on the potential non-linear, inverse U-shaped effect of leverage on profitability. Drawing on data from 1548 firm-year observations covering 183 publicly listed South African companies between 2013 and 2022, the analysis employs both Fixed Effects (FE) and System Generalized Method of Moments (System-GMM) models to address endogeneity and capture dynamic adjustments. The findings indicate that moderate levels of debt enhance profitability, but excessive leverage leads to diminishing returns, confirming an inverse U-shaped relationship. System-GMM results further reveal the persistence of past profitability and validate the dynamic nature of capital structure decisions. Larger firms appear more capable of sustaining higher leverage without adverse effects, while smaller firms benefit from maintaining lower debt levels. The study concludes that strategic debt management, tailored to firm size and economic context, is critical for optimizing financial performance in emerging markets like South Africa. The study identifies the optimal leverage ratio for South African firms and shows how firm size moderates the relationship between debt and profitability, offering tailored insights for firms of different sizes. These insights offer valuable guidance for managers, investors, and policymakers aiming to strengthen financial stability and efficiency through informed capital structure choices.

Full article

Figure 1

Open AccessArticle

Dependent and Independent Time Series Errors Under Elliptically Countered Models

by

Fredy O. Pérez-Ramirez, Francisco J. Caro-Lopera, José A. Díaz-García and Graciela González Farías

Econometrics 2025, 13(2), 22; https://doi.org/10.3390/econometrics13020022 - 21 May 2025

Abstract

►▼

Show Figures

We explore the impact of time series behavior on model errors when working under an elliptically contoured distribution. By adopting a time series approach aligned with the realistic dependence between errors under such distributions, this perspective shifts the focus from increasingly complex and

[...] Read more.

We explore the impact of time series behavior on model errors when working under an elliptically contoured distribution. By adopting a time series approach aligned with the realistic dependence between errors under such distributions, this perspective shifts the focus from increasingly complex and challenging correlation analyses to volatility modeling that utilizes a novel likelihood framework based on dependent probabilistic samples. With the introduction of a modified Bayesian Information Criterion, which incorporates a ranking of degrees of evidence of significant differences between the compared models, the critical issue of model selection is reinforced, clarifying the relationships among the most common information criteria and revealing limited relevance among the models based on independent probabilistic samples, when tested on a well-established database. Our approach challenges the traditional hierarchical models commonly used in time series analysis, which assume independent errors. The application of rigorous differentiation criteria under this novel perspective on likelihood, based on dependent probabilistic samples, provides a new viewpoint on likelihood that arises naturally in the context of finance, adding a novel result. We provide new results for criterion selection, evidence invariance, and transitions between volatility models and heuristic methods to calibrate nested or non-nested models via convergence properties in a distribution.

Full article

Figure 1

Open AccessArticle

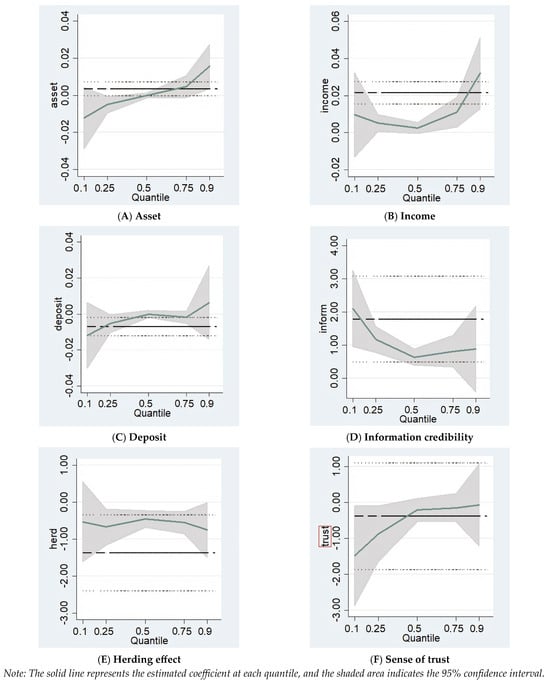

Decomposing the Household Herding Behavior in Stock Investment: The Case of China

by

Yung-Ching Tseng, I.-Fan Hsiao and Guo-Chen Wang

Econometrics 2025, 13(2), 21; https://doi.org/10.3390/econometrics13020021 - 12 May 2025

Abstract

►▼

Show Figures

Financial studies on the herding effect have been very popular for decades, as detecting herding behavior helps to explain price deviations and market inefficiencies. However, studying the herding effect as a single influencing factor is believed to be insufficient to explain the changes

[...] Read more.

Financial studies on the herding effect have been very popular for decades, as detecting herding behavior helps to explain price deviations and market inefficiencies. However, studying the herding effect as a single influencing factor is believed to be insufficient to explain the changes in investment behavior, as the herding effect itself may be caused by other influencing factors. In other words, the issue must be studied alongside other factors. In this study, we adopt the quantile regression model to comprehensively understand the herding effect’s influence on household investment in China, and the empirical results indicate that herding behavior leads to different investment outcomes for households in different scenarios. In this analysis, we consider a variety of household characteristics, such as income level and risk tolerance, to provide a nuanced understanding of investment behavior. Additionally, in this study, we explore the interaction between herding behavior and macroeconomic variables. Nevertheless, the results suggest that, if herding behavior can be reduced by the head of the household, profitability can be increased, or at the very least, losses can be reduced.

Full article

Figure 1

Open AccessArticle

Government Subsidies and Industrial Productivity in South Africa: A Focus on the Channels

by

Brian Tavonga Mazorodze

Econometrics 2025, 13(2), 20; https://doi.org/10.3390/econometrics13020020 - 1 May 2025

Cited by 1

Abstract

►▼

Show Figures

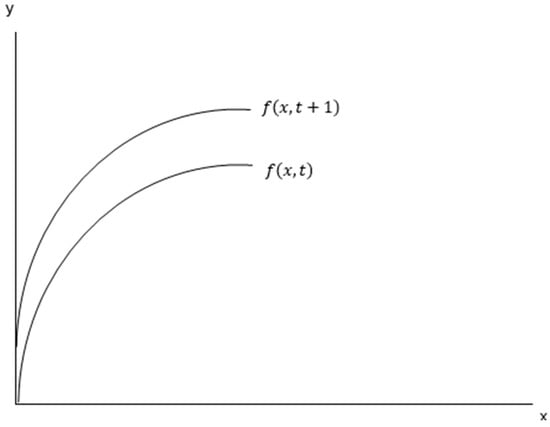

This article estimates the impact of government subsidies on productivity growth in South Africa, joining the ongoing debate among economists regarding the effectiveness of subsidies as a driver of industrial productivity. While some argue that subsidies address market failures, facilitate R&D, and improve

[...] Read more.

This article estimates the impact of government subsidies on productivity growth in South Africa, joining the ongoing debate among economists regarding the effectiveness of subsidies as a driver of industrial productivity. While some argue that subsidies address market failures, facilitate R&D, and improve efficiency, others criticise the attendant dependence, which reduces the incentive for industries to operate efficiently. This article contributes by examining the specific channels—efficiency and technical changes—through which subsidies affect productivity in South Africa. The analysis is based on a panel dataset comprising 64 three-digit industries observed between 1993 and 2023. Estimation is performed through an endogeneity robust panel stochastic frontier model, which treats subsidies as both an inefficiency driver and a technology variable. An additional estimation approach is proposed integrating the true fixed effects with a control function in a bid to account for both unobserved heterogeneity and idiosyncratic endogeneity. The results show that subsidies are detrimental to productivity, particularly through stifling technological progress. This result supports the view that subsidies reduce the incentive for beneficiaries to innovate. This evidence calls for a reevaluation and a possible restructuring of subsidy programmes in South Africa in a bid to mitigate their adverse effects on industrial productivity.

Full article

Figure 1

Open AccessArticle

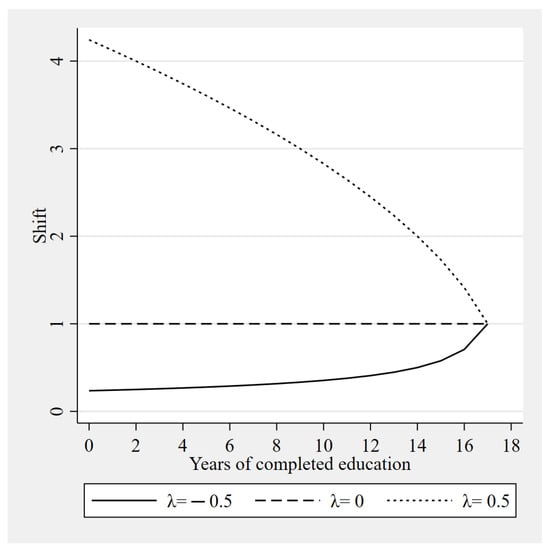

Generalized Recentered Influence Function Regressions

by

Javier Alejo, Antonio Galvao, Julián Martínez-Iriarte and Gabriel Montes-Rojas

Econometrics 2025, 13(2), 19; https://doi.org/10.3390/econometrics13020019 - 18 Apr 2025

Abstract

►▼

Show Figures

This paper suggests a generalization of covariate shifts to study distributional impacts on inequality and distributional measures. It builds on the recentered influence function (RIF) regression method, originally designed for location shifts in covariates, and extends it to general policy interventions, such as

[...] Read more.

This paper suggests a generalization of covariate shifts to study distributional impacts on inequality and distributional measures. It builds on the recentered influence function (RIF) regression method, originally designed for location shifts in covariates, and extends it to general policy interventions, such as location–scale or asymmetric interventions. Numerical simulations for the Gini, Theil, and Atkinson indexes demonstrate strong performance across a myriad of cases and distributional measures. An empirical application examining changes in Mincerian equations is presented to illustrate the method.

Full article

Figure 1

Open AccessArticle

Is VIX a Contrarian Indicator? On the Positivity of the Conditional Sharpe Ratio †

by

Ehud I. Ronn and Liying Xu

Econometrics 2025, 13(2), 18; https://doi.org/10.3390/econometrics13020018 - 14 Apr 2025

Cited by 1

Abstract

The notion of compensation for systematic risk is well ingrained in finance and constitutes the basis for numerous empirical tests. The concept an increase in systematic risk is accompanied by an increase in the required risk premium has strong intuitive content: The more

[...] Read more.

The notion of compensation for systematic risk is well ingrained in finance and constitutes the basis for numerous empirical tests. The concept an increase in systematic risk is accompanied by an increase in the required risk premium has strong intuitive content: The more risk there is to be borne, the greater the compensation therefor. In recognizing previous research on the ex ante and ex post reward to risk, the thrust of this paper is to augment those previous tests of expected and realized returns by providing several distinct empirical tests of the proposition the market rewards the undertaking of systematic equity risk, the latter as measured by the VIX volatility index. Thus, in this paper’s empirical section, we use several empirical approaches to answer the question, Using realized returns, is an increase in systematic risk VIX accompanied by an increase in the equity risk premium? While the empirical results are not always statistically significant, our answer is in the affirmative.

Full article

Open AccessArticle

Forecasting Asset Returns Using Nelson–Siegel Factors Estimated from the US Yield Curve

by

Massimo Guidolin and Serena Ionta

Econometrics 2025, 13(2), 17; https://doi.org/10.3390/econometrics13020017 - 11 Apr 2025

Abstract

This paper explores the hypothesis that the returns of asset classes can be predicted using common, systematic risk factors represented by the level, slope, and curvature of the US interest rate term structure. These are extracted using the Nelson–Siegel model, which effectively captures

[...] Read more.

This paper explores the hypothesis that the returns of asset classes can be predicted using common, systematic risk factors represented by the level, slope, and curvature of the US interest rate term structure. These are extracted using the Nelson–Siegel model, which effectively captures the three dimensions of the yield curve. To forecast the factors, we applied autoregressive (AR) and vector autoregressive (VAR) models. Using their forecasts, we predict the returns of government and corporate bonds, equities, REITs, and commodity futures. Our predictions were compared against two benchmarks: the historical mean, and an AR(1) model based on past returns. We employed the Diebold–Mariano test and the Model Confidence Set procedure to assess the comparative forecast accuracy. We found that Nelson–Siegel factors had significant predictive power for one-month-ahead returns of bonds, equities, and REITs, but not for commodity futures. However, for 6-month and 12-month-ahead forecasts, neither the AR(1) nor VAR(1) models based on Nelson–Siegel factors outperformed the benchmarks. These results suggest that the Nelson–Siegel factors affect the aggregate stochastic discount factor for pricing all assets traded in the US economy.

Full article

(This article belongs to the Special Issue Advancements in Macroeconometric Modeling and Time Series Analysis)

►▼

Show Figures

Figure 1

Open AccessArticle

A Meta-Analysis of Determinants of Success and Failure of Economic Sanctions

by

Binyam Afewerk Demena and Peter A. G. van Bergeijk

Econometrics 2025, 13(2), 16; https://doi.org/10.3390/econometrics13020016 - 9 Apr 2025

Cited by 1

Abstract

►▼

Show Figures

Political scientists and economists often assert that they understand how economic sanctions function as a foreign policy tool and claim to have backed their theories with compelling statistical evidence. The research puzzle that this article addresses is the observation that despite almost four

[...] Read more.

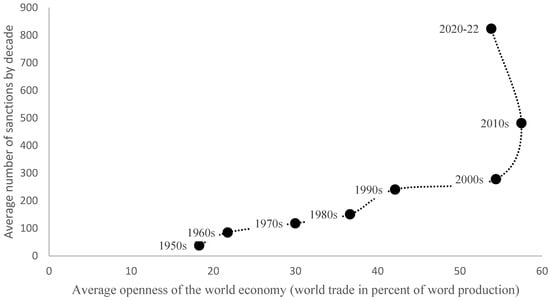

Political scientists and economists often assert that they understand how economic sanctions function as a foreign policy tool and claim to have backed their theories with compelling statistical evidence. The research puzzle that this article addresses is the observation that despite almost four decades of empirical research on economic sanctions, there is still no consensus on the direction and magnitude of the key variables that theoretically determine the success of economic sanctions. To address part of this research puzzle, we conducted a meta-analysis of 37 studies published between 1985 and 2018, focusing on three key determinants of sanction success: trade linkage, prior relations, and duration. Our analysis examines the factors contributing to the variation in findings reported by these primary studies. By constructing up to 27 moderator variables that capture the contexts in which researchers derive their estimates, we found that the differences across studies are primarily influenced by the data used, the variables controlled for in estimation methods, publication quality, and author characteristics. Our results reveal highly significant effects, indicating that sanctions are more likely to succeed when there is strong pre-sanction trade, when sanctions are implemented swiftly, and when they involve countries with better pre-sanction relationships. In our robustness checks, we consistently confirmed these core findings across different estimation techniques.

Full article

Figure 1

Highly Accessed Articles

Latest Books

E-Mail Alert

News

Topics

Special Issues

Special Issue in

Econometrics

Advancements in Macroeconometric Modeling and Time Series Analysis

Guest Editor: Julien ChevallierDeadline: 31 December 2025

Special Issue in

Econometrics

Innovations in Bayesian Econometrics: Theory, Techniques, and Economic Analysis

Guest Editor: Deborah GefangDeadline: 31 May 2026

Special Issue in

Econometrics

Labor Market Dynamics and Wage Inequality: Econometric Models of Income Distribution

Guest Editor: Marc K. ChanDeadline: 25 June 2026