Estimating Parameters in Mathematical Model for Societal Booms through Bayesian Inference Approach

Abstract

:1. Introduction

2. Mathematical Model

2.1. Three Key Points to Derive Our Proposed Model

2.2. Mathematical Model for Societal Booms

- State1 Pre-boom: Condition where there is a potential to adopt a boom.

- State2 On-boom: Condition where the boom is captured.

- State3 Rooted-boom: Condition where the boom is retained.

- State4 Unrooted -boom: Condition where the boom did not take off.

3. Stability of the Equilibrium Point for the Reduced Model

4. Bayesian Inference Approach for Estimating Parameters

Markov Chain Monte Carlo Methods (MCMC)

- Step1: Generate (the normal distribution) with a given stander derivation for given .

- Step2: Calculate the choice .

- Step3: Update as with probability but otherwise set .

5. Using Real Data to Evaluate Validity of Proposed Model

5.1. Parameter Estimation Steps

5.2. Coefficient of Determination

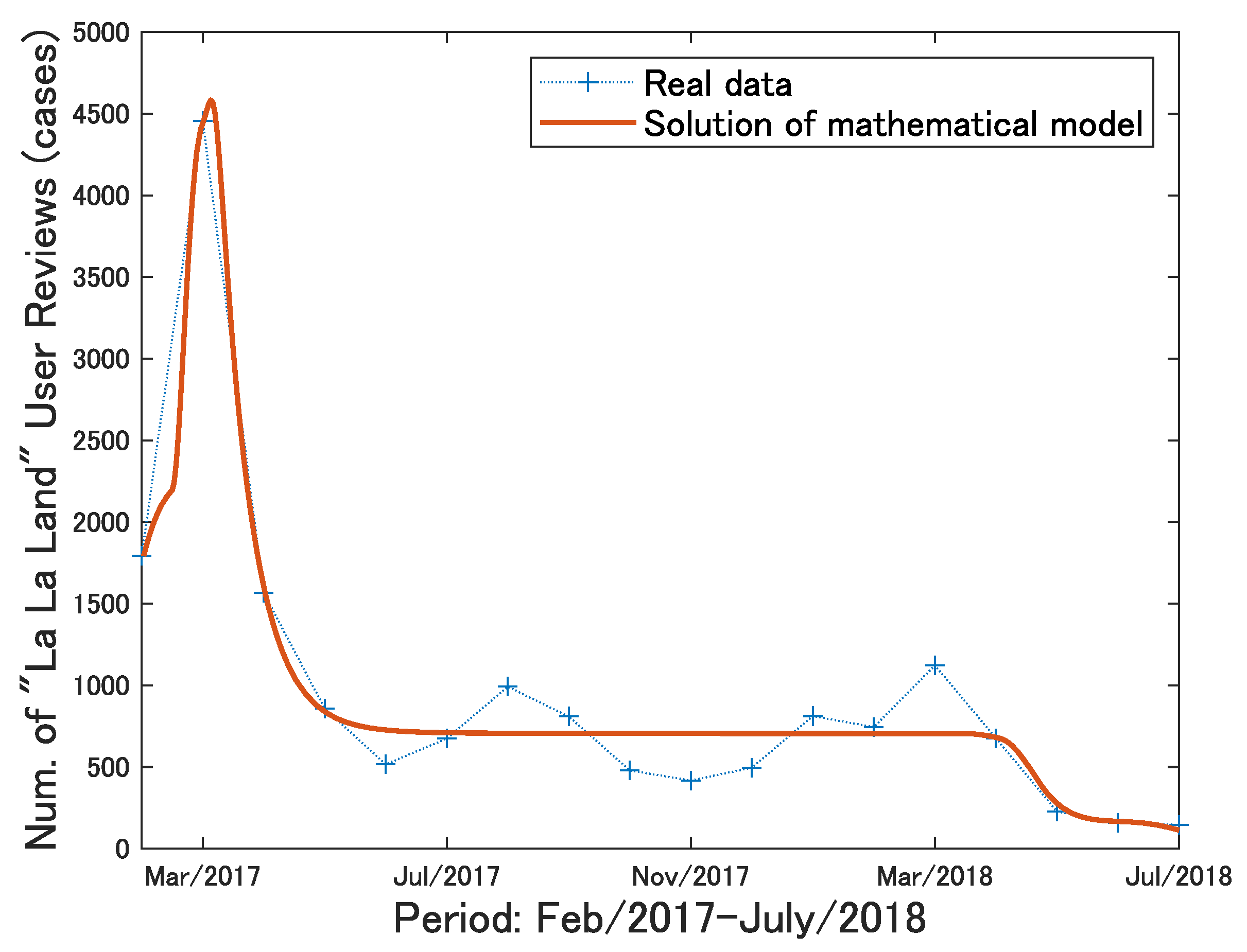

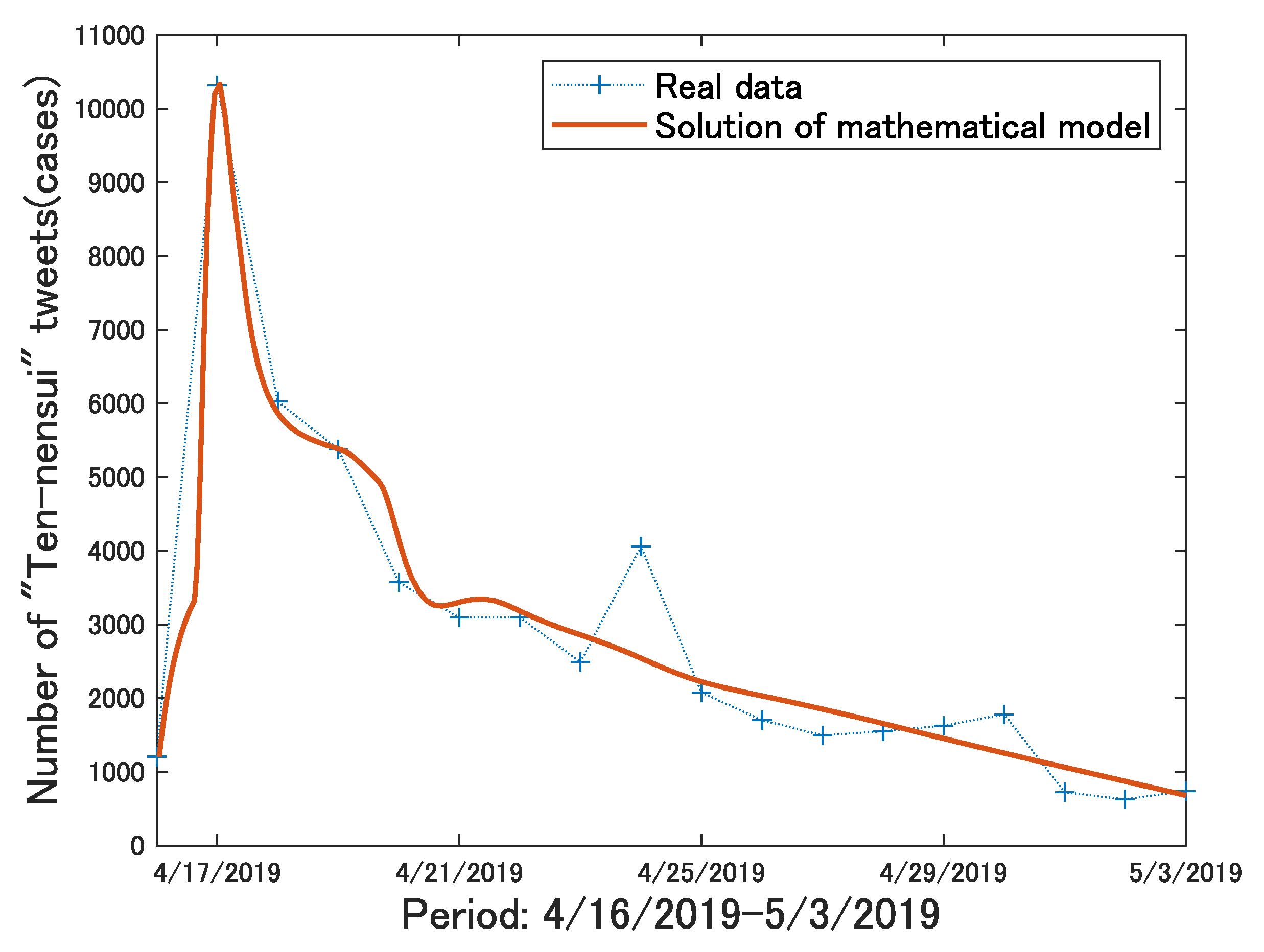

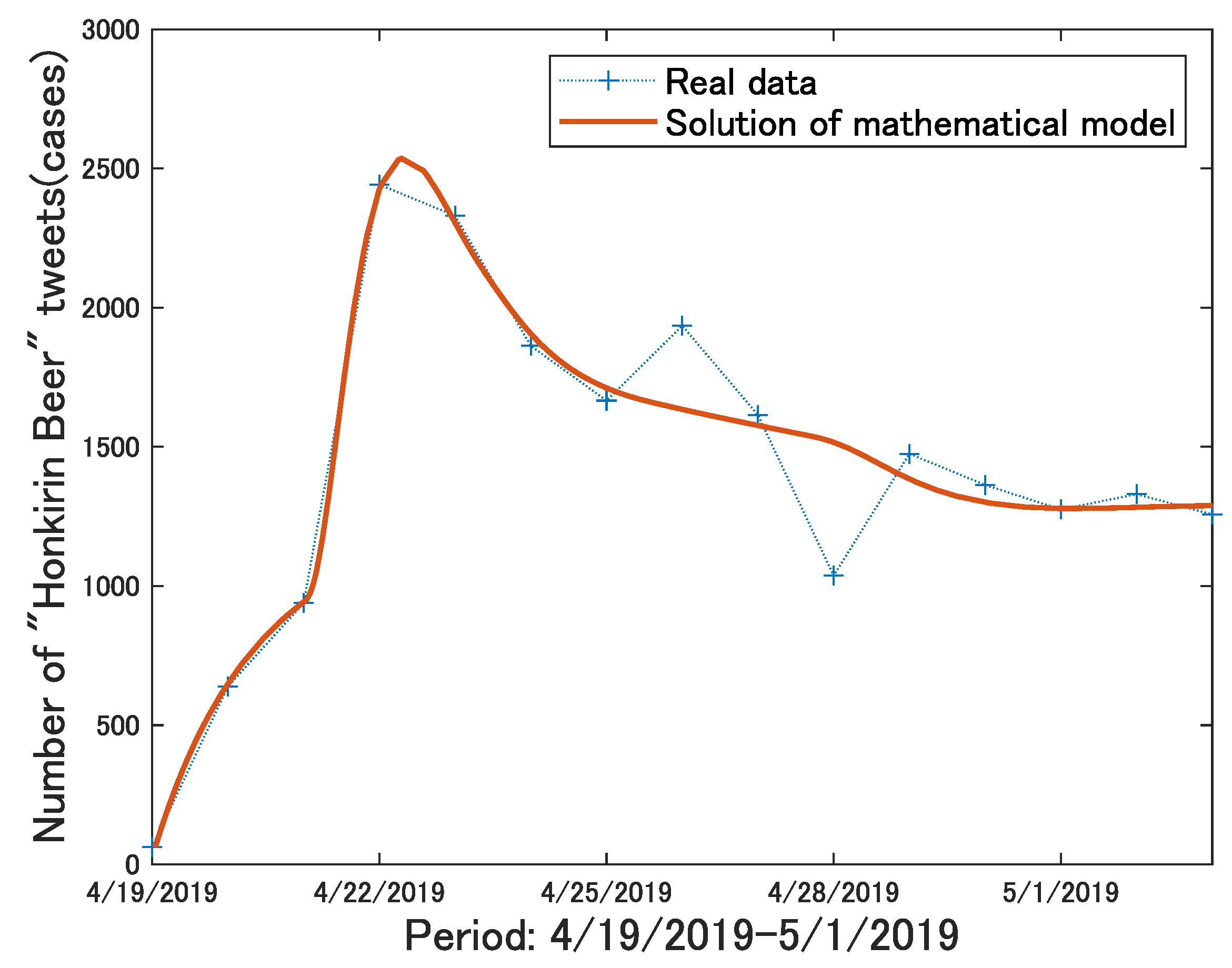

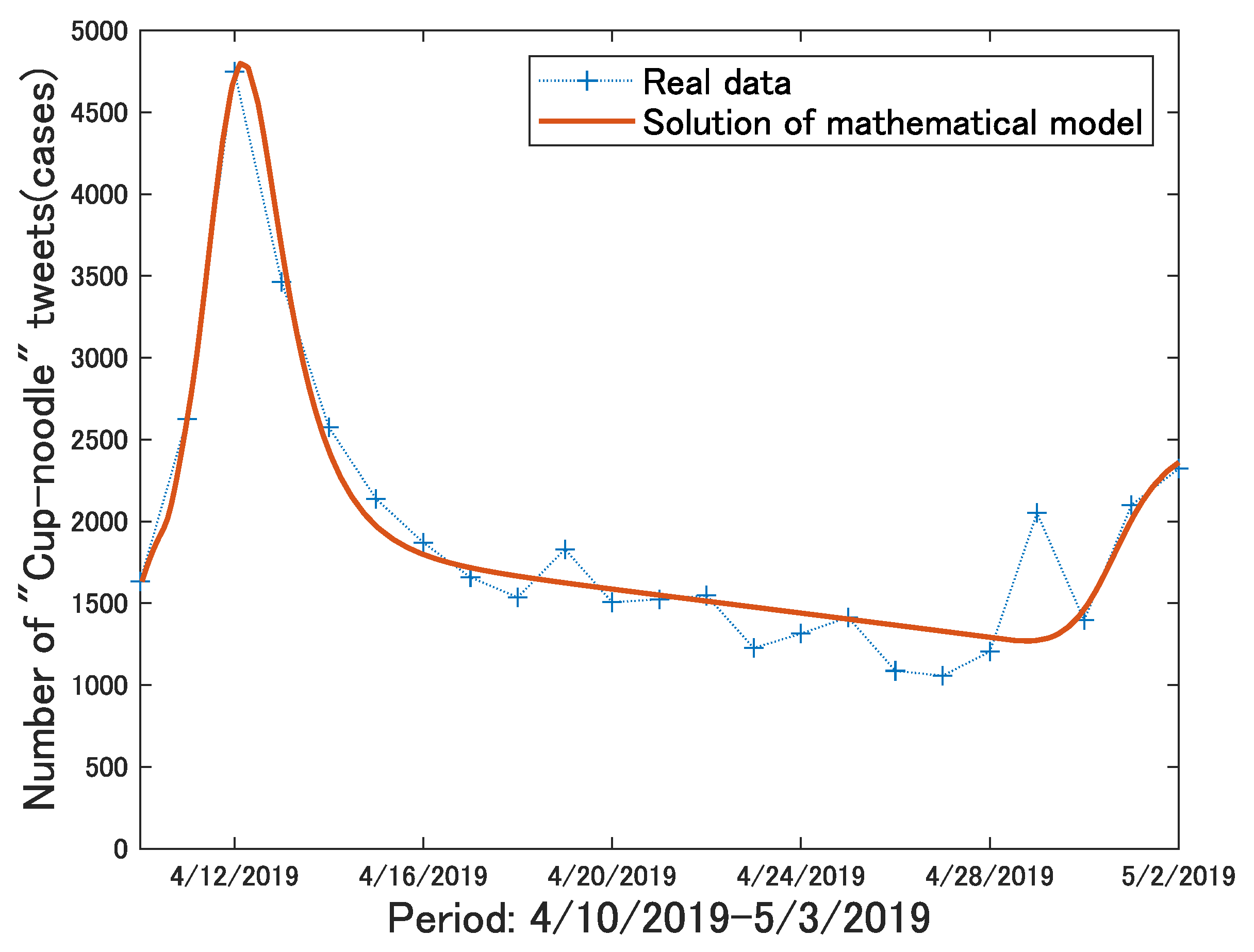

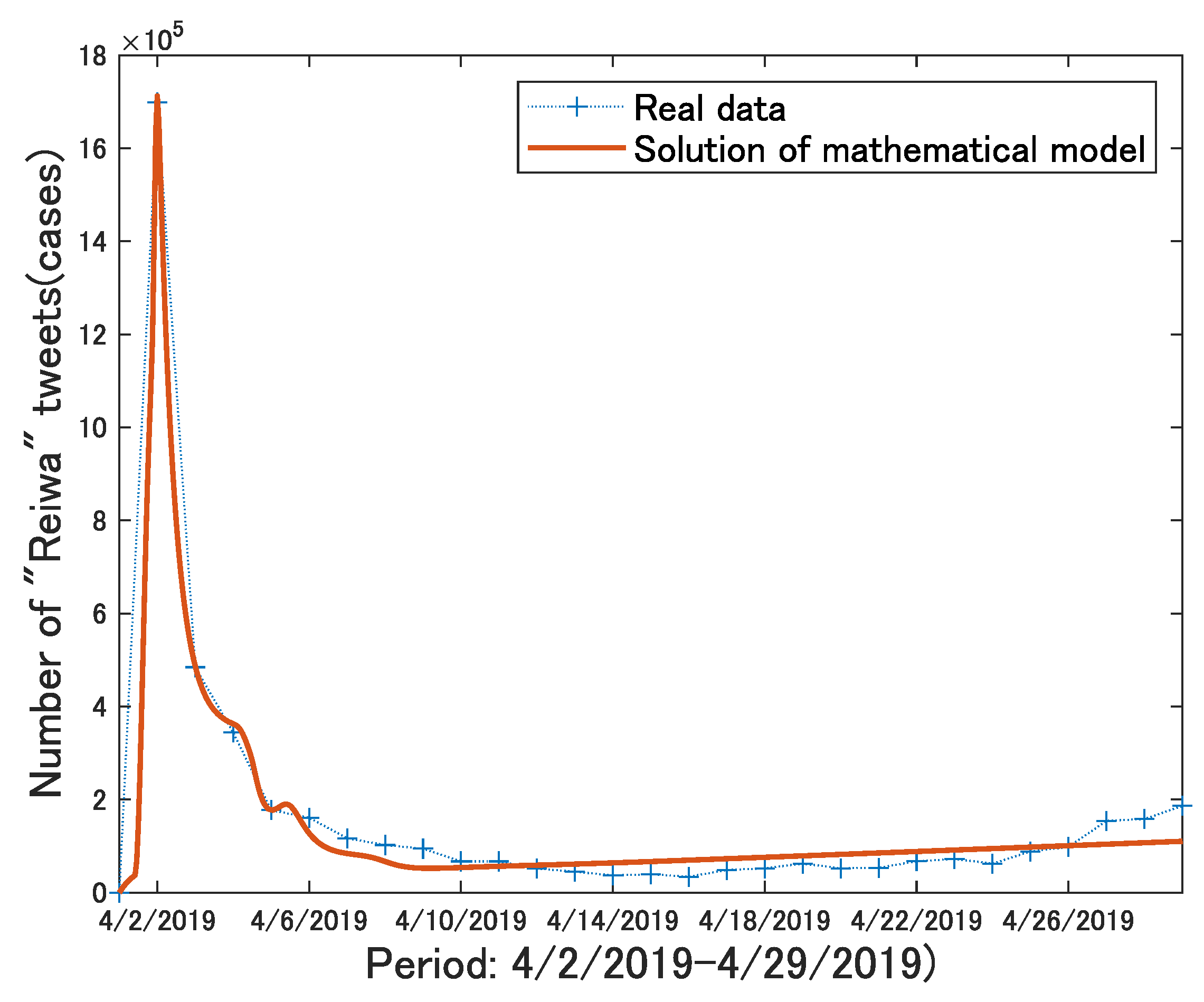

5.3. Model Fitting to Actual Data

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Anderson, R.M. Discussion: The Kermack–McKendrick epidemic threshold theorem. Bull. Math. Biol. 1991, 53, 1–32. [Google Scholar] [CrossRef]

- Busenberg, S.; Cooke, K. Vertically Transmitted Diseases Models and Dynamics; Springer: Berlin, Germany, 1993. [Google Scholar]

- Dietz, K. The first epidemic model A historical note on P.D. En’ko. Aust. J. Stat. 1988, 30, 56–65. [Google Scholar] [CrossRef]

- Kermack, W.O.; McKendrick, A.G. Contributions to the mathematical theory of epidemics—I. Proc. R. Soc. 1927, 115, 700–721. [Google Scholar]

- Ishii, A.; Arakaki, H.; Matsuda, N.; Umemura, S.; Urushidani, T.; Yamagata, N.; Yoshida, N. The ’hit’ phenomenon: A mathematical model of human dynamics interactions as a stochastic process. New J. Phys. 2012, 14, 063018. [Google Scholar] [CrossRef]

- Abdullah, S.; Wu, X. An Epidemic Model for News Spreading on Twitter. In Proceedings of the 2011 23rd IEEE International Conference on Tools with Artificial Intelligence, Boca Raton, FL, USA, 7–9 November 2011; Volume 1, pp. 163–169. [Google Scholar]

- Nakagiri, Y.; Kurita, O. On a differential equation model of booms. Trans. Oper. Res. Soc. Jpn. 2004, 47, 83–105. (In Japanese) [Google Scholar] [CrossRef] [Green Version]

- Ueda, Y.; Asahi, Y. Construction and verification for the interest shift model of Twitter users [Twitter-riyousya no kanshin-ikou model no kouchiku to kenshou]. Oper. Res. Manag. Sci. Res. 2014, 59, 219–228. (In Japanese) [Google Scholar]

- Ota, Y.; Mizutani, N. A proposal of mathematical model on booms for human and social life—Using diffusion of innovation theory and delay differential equations. Trans. Oper. Res. Soc. Jpn. 2020. to appear (In Japanese) [Google Scholar]

- Rogers, E.M. The Diffusion of Innovations, 5th ed.; The Free Press: New York, NY, USA, 2003. [Google Scholar]

- Hutchinson, G.E. Circular causal systems in ecology. Ann. N. Y. Acad. Sci. 1948, 50, 221–246. [Google Scholar] [CrossRef]

- May, R.M. Stability and Complexity in Model Ecosystems; Princeton University Press: Princeton, NJ, USA, 1974. [Google Scholar]

- Nicholson, A.J. The Self-Adjustment of Populations to Change. Cold Spring Harb Symp. Quant. Biol. 1957, 22, 153–173. [Google Scholar] [CrossRef]

- Cooke, K.L. Stability analysis for a vector disease model. Rocky Mount. J. Math. 1979, 9, 31–42. [Google Scholar] [CrossRef]

- Mena-Lorcat, J.; Hethcote, H.W. Dynamic models of infectious diseases as regulators of population sizes. J. Math. Biol. 1992, 30, 693–716. [Google Scholar] [CrossRef] [PubMed]

- Pyragas, K. Continuous control of chaos by self-controlling feedback. Phys. Lett. A 1992, 170, 421–428. [Google Scholar] [CrossRef]

- Smith, H.L. Subharmonic bifurcation in an S-I-R epidemic model. J. Math. Biol. 1983, 17, 163–177. [Google Scholar] [CrossRef] [PubMed]

- Kaipio, J.; Somersalo, E. Statistical and Computational Inverse Problems; Springer: New York, NY, USA, 2005. [Google Scholar]

- Robert, C.; Casella, G. Monte Carlo Statistical Methods; Springer: New York, NY, USA, 2004. [Google Scholar]

- Andersson, H.; Britton, T. Stochastic Epidemic Models and their Statistical Analysis; Springer: New York, NY, USA, 2000. [Google Scholar]

- Andrieu, C.; de Freitas, N.; Doucet, A.; Jordan, M.I. An Introduction to MCMC for Machine Learning. Mach. Learn. 2003, 50, 5–43. [Google Scholar] [CrossRef] [Green Version]

- Haario, H.; Laine, M.; Lehtinen, M.; Saksman, E.; Tamminen, J. Markov chain Monte Carlo methods for high dimensional inversion in remote sensing. J. R. Stat. Soc. B Stat. Methodol. 2004, 66, 591–608. [Google Scholar] [CrossRef]

- Jacquier, E.; Jarrow, R. Bayesian analysis of contingent claim model error. J. Econom. 2000, 94, 145–180. [Google Scholar] [CrossRef]

- Jacquier, E.; Polson, N. Bayesian methods in finance. In Oxford Handbook of Bayesian Econometrics; Oxford University Press: Oxford, UK, 2010; pp. 439–512. [Google Scholar]

- Martin, J.C.; Wilcox, L.C.; Burstedde, C.; Ghattas, O. A stochastic Newton MCMC method for large-scale statistical inverse problems with application to seismic inversion. SIAM J. Sci. Comput. 2012, 34, A1460–A1487. [Google Scholar] [CrossRef]

- Michelot, T.; Blackwell, P.G.; Jammes, S.C.; Matthiopoulos, J. Inference in MCMC step selection models. J. Int. Biom. Soc. 2019, 76, 438–447. [Google Scholar] [CrossRef]

- O’Neill, P.D.; Roberts, G.O. Bayesian inference for partially observed stochastic epidemics. J. R. Stat. Soc. A 1999, 162, 121–129. [Google Scholar] [CrossRef]

- Tunaru, R.; Zheng, T. Parameter estimation risk in asset pricing and risk management: A Bayesian approach. Int. Rev. Financ. Anal. 2017, 53, 80–93. [Google Scholar] [CrossRef]

- Wang, J.; Zabaras, N. A Bayesian inference approach to the inverse heat conduction problem. Int. J. Heat Mass Transf. 2004, 47, 3927–3941. [Google Scholar] [CrossRef]

- Levenberg, K. A method for the solution of certain non-linear problems in least squares. Q. Appl. Math. 1944, 2, 164–168. [Google Scholar] [CrossRef] [Green Version]

- Marquardt, D. An algorithm for least-squares estimation of nonlinear parameters. SIAM J. Appl. Math. 1963, 11, 431–441. [Google Scholar] [CrossRef]

- Gelman, A.; Bois, F.; Jiang, J. Physiological pharmacokinetic analysis using population modeling and informative prior distributions. J. Am. Stat. Assoc. 1996, 91, 1400–1412. [Google Scholar] [CrossRef]

- Girolami, M. Bayesian inference for differential equations. Theor. Comput. Sci. 2008, 408, 4–16. [Google Scholar] [CrossRef] [Green Version]

- Hastings, W.K. Monte Carlo sampling methods using Markov chains and their application. Biometrika 1970, 57, 97–109. [Google Scholar] [CrossRef]

- Metropolis, N.; Rosenbluth, A.W.; Rosenbluth, M.N.; Teller, A.H.; Teller, E. Equations of state calculations by fast computing machines. J. Chem. Phys. 1953, 21, 1087–1092. [Google Scholar] [CrossRef] [Green Version]

| Lalaland | |||||

|---|---|---|---|---|---|

| 0.0001 | 6700 | ||||

| 0.001 | 0 | ||||

| 0.01 | 1792 | ||||

| 0.001 | 0 | ||||

| 0.001 | 14 | ||||

| 0.001 | 405 | ||||

| Pure_Water | |||||

|---|---|---|---|---|---|

| 0.0001 | 19,000 | ||||

| 0.01 | 0 | ||||

| 0.01 | 1207 | ||||

| 0.01 | 0 | ||||

| 0.01 | 14 | ||||

| 0.01 | 72 | ||||

| Honkirin Beer | |||||

|---|---|---|---|---|---|

| 0.0001 | 4700 | ||||

| 0.01 | 0 | ||||

| 0.01 | 63 | ||||

| 0.01 | 0 | ||||

| 0.01 | 48 | ||||

| 0.01 | 158 | ||||

| Cupnoodle | |||||

|---|---|---|---|---|---|

| 0.0001 | 8200 | ||||

| 0.01 | 0 | ||||

| 0.01 | 1633 | ||||

| 0.01 | 0 | ||||

| 0.01 | 11 | ||||

| 0.01 | 444 | ||||

| Beautiful_Harmony | |||||

|---|---|---|---|---|---|

| 0.00001 | 2,700,000 | ||||

| 0.01 | 0 | ||||

| 0.01 | 0 | ||||

| 0.01 | 0 | ||||

| 0.01 | 10 | ||||

| 0.01 | 62 | ||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ota, Y.; Mizutani, N. Estimating Parameters in Mathematical Model for Societal Booms through Bayesian Inference Approach. Math. Comput. Appl. 2020, 25, 42. https://doi.org/10.3390/mca25030042

Ota Y, Mizutani N. Estimating Parameters in Mathematical Model for Societal Booms through Bayesian Inference Approach. Mathematical and Computational Applications. 2020; 25(3):42. https://doi.org/10.3390/mca25030042

Chicago/Turabian StyleOta, Yasushi, and Naoki Mizutani. 2020. "Estimating Parameters in Mathematical Model for Societal Booms through Bayesian Inference Approach" Mathematical and Computational Applications 25, no. 3: 42. https://doi.org/10.3390/mca25030042