In this section, we go through two numerical examples with a one-policy portfolio and a two-policy portfolio. A larger portfolio would, of course, be more realistic, but a large number of policies could easily drown the key insights from the examples. Going from one to two policies is by far the biggest step, and conceptually, there is no impediment to extending the theory to larger portfolios. Working in a discrete projection setup, we show how to find a fair bonus and guarantee fee strategy for the one-policy portfolio, and we exemplify the fairness challenges in a two-policy portfolio. The examples are based on 5000 scenarios generated via Monte Carlo simulation. We have made sure that the number of simulated scenarios is sufficiently high for our numerical results and graphs not to change between simulations, but we do not go into details about the robustness of the simulations, since the examples only serve to demonstrate the possible applications of our model.

4.11.1. One-Policy Portfolio

We consider a portfolio consisting of a single policy. The policy is the one from Examples 1–4. The policyholder is a female aged 25 at time 0, where the policy is issued. We fix

, and we assume that

, which is natural for a newly-issued policy. Thereby, we only consider the bonus scheme “additional benefits”. We recall that bonus is used to increase the endowment sum and not the term insurance sum. The death of the policyholder is governed by the technical mortality intensity

For the last three decades, this has served as a standard mortality intensity for adult women in Denmark. It is part of the so-called G82 technical basis that was set forth as a Danish industry standard in 1982. The market mortality intensity is given by

With this choice of mortality intensities and with the product choices below, the technical basis is on the safe side, except for low ages, where the death sum exceeds the savings, resulting in a negative contribution from mortality risk. However, due to the low mortality for low ages, the negative contribution is insignificantly small.

The policy expires at time

when the policyholder is 65. We fix the term insurance sum at

and the pure endowment sum at

. The equivalence premium is determined via the equivalence relation

i.e.,

Using numerical methods, we obtain

. The bonus

d is allocated and the guarantee fee

is paid once a year. Hence, we have

We note that

for

. We project the two accounts

X and

Y using steps of a size of one year by applying a discretized version of the stochastic differential equations for

X and

Y. For the discretization, we recall from Example 2 that

is a pure jump function and that

ς and

are continuous functions. Hence, we get the stochastic difference equations

We assume a deterministic market interest rate

, and the assets of the portfolio (in this case, the assets of the policy) are invested in a fund with log-normal returns that are paid out once a year,

i.e.,

where

S is a geometric Brownian motion. We basically consider a simple Black–Scholes financial market. We assume that the fund size

S has drift

and volatility

under the physical measure

P (and, consequently, drift

and volatility

under the pricing measure

Q).

The bonus

d is determined as a fraction

of the excess collective bonus potential

K just before the bonus allocation over a threshold

if this fraction exceeds the positive part of the natural risk bonus

α (see

Section 4.9 for more on risk bonus),

i.e.,

where

K and

are given by

with the guaranteed liabilities

L defined in Equation (

5). The threshold

can be seen as a preferred minimum collective bonus potential. We fix

and

. As mentioned, the chosen technical transition intensity is not on the safe side for low ages. Therefore, we need to take the positive part of

α in the expression above to exclude negative risk bonus. Finally, we choose the guarantee fee

to be a fraction

of the positive part of the returns on the assets,

i.e.,

In addition to the yearly guarantee fee, the equity holders of the insurance company receives the remaining collective bonus potential at expiration as part of the final guarantee fee. We determine the fraction

according to the fairness criterion in Equation (

8). Furthermore, using this guarantee fee, we consider:

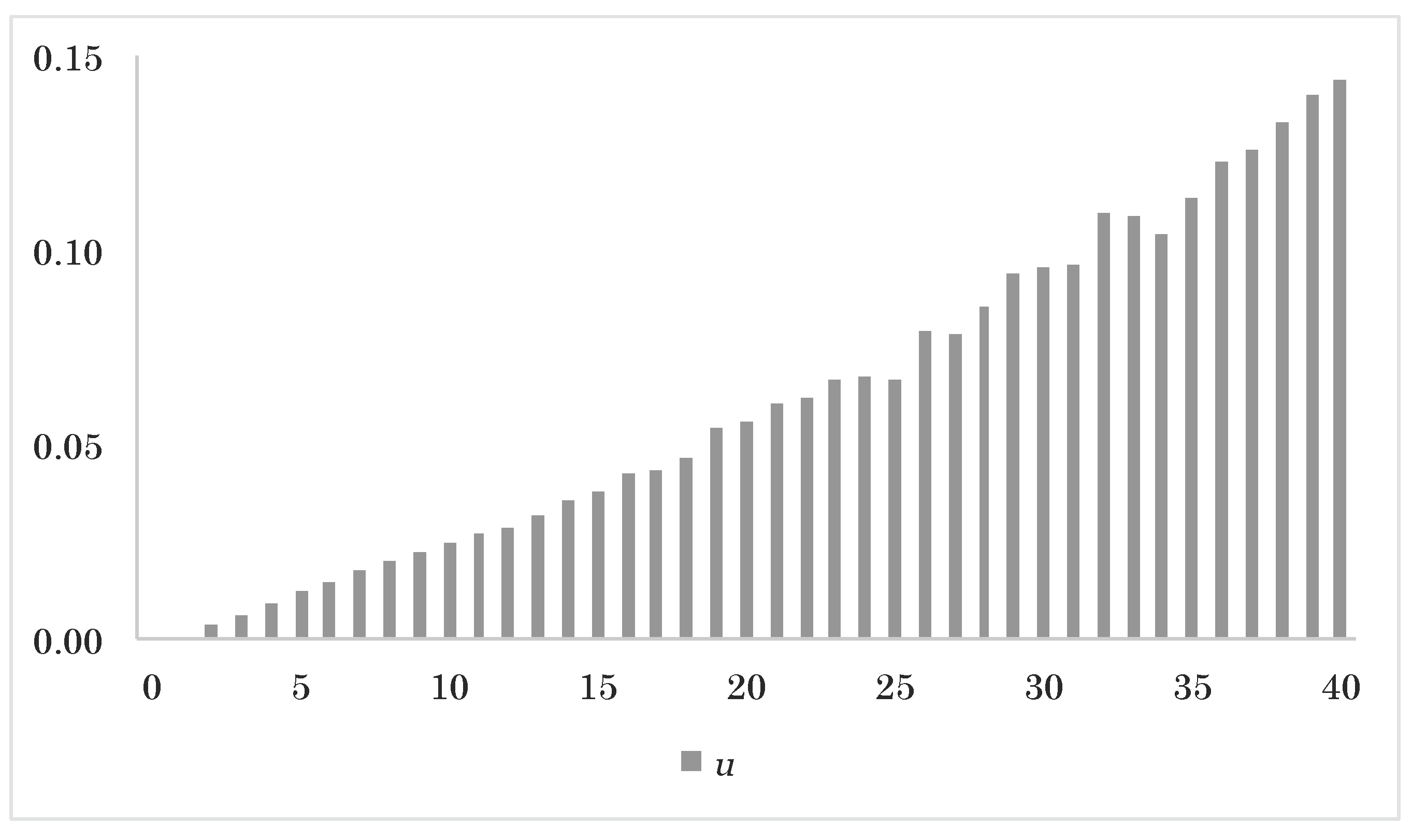

the expected evolution of the upscaling factor ,

the expected evolution of the assets , market reserve , technical reserve and collective bonus potential ,

the expected level for the guarantee injections and guarantee fees ,.

Using standard Monte Carlo methods, we simulate 5000 sample paths for the asset returns

under the measure

Q, and for each sample path, we project

X and

Y for different values of

, using the difference equations in Equation (

12). More specifically, we look for a

, such that we get zero when approximating the time 0 market value

from Equation (

11). We recall that

W is the market value of the guaranteed and non-guaranteed payments. We arrive at the fair guarantee fee fraction

.

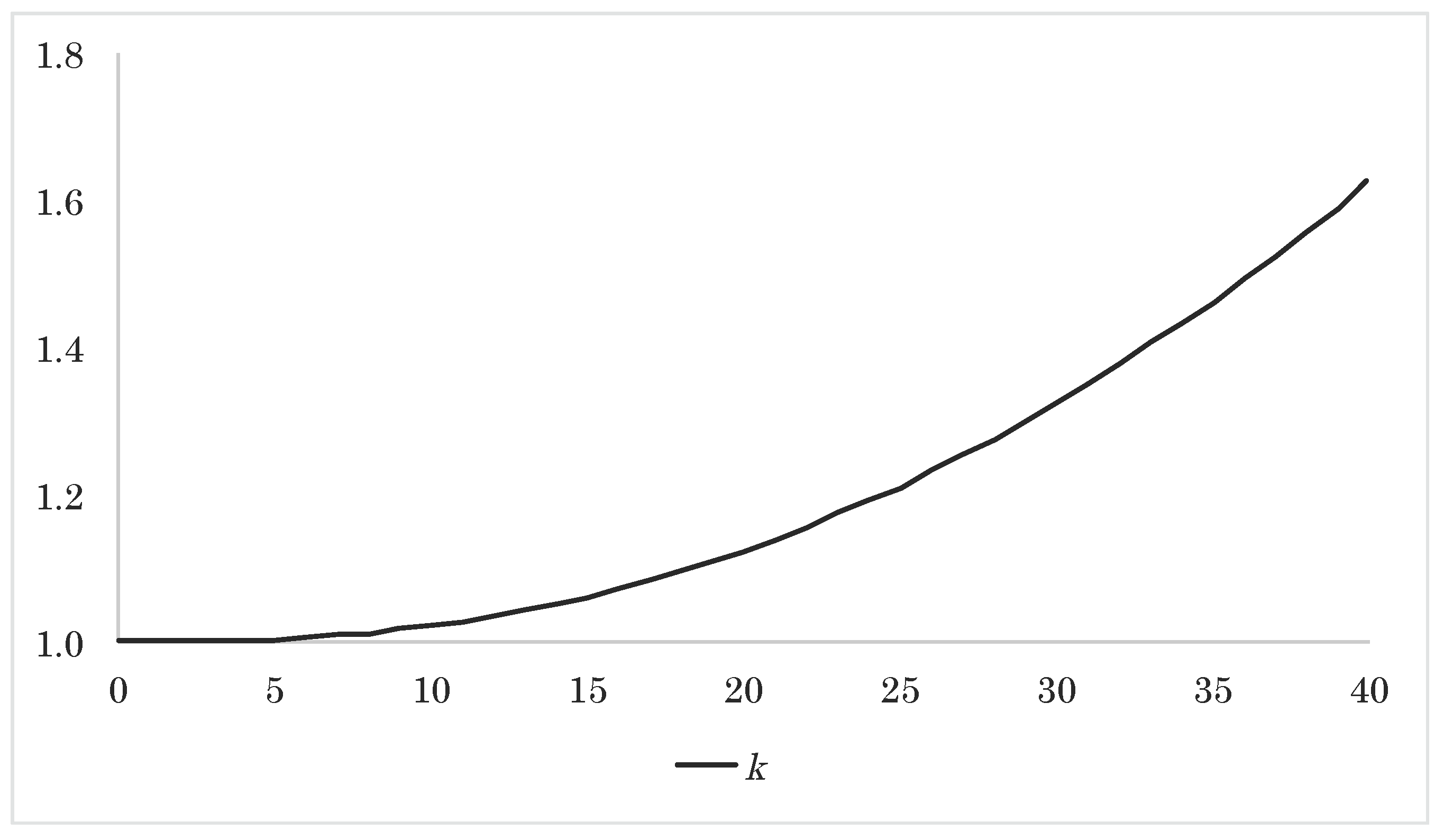

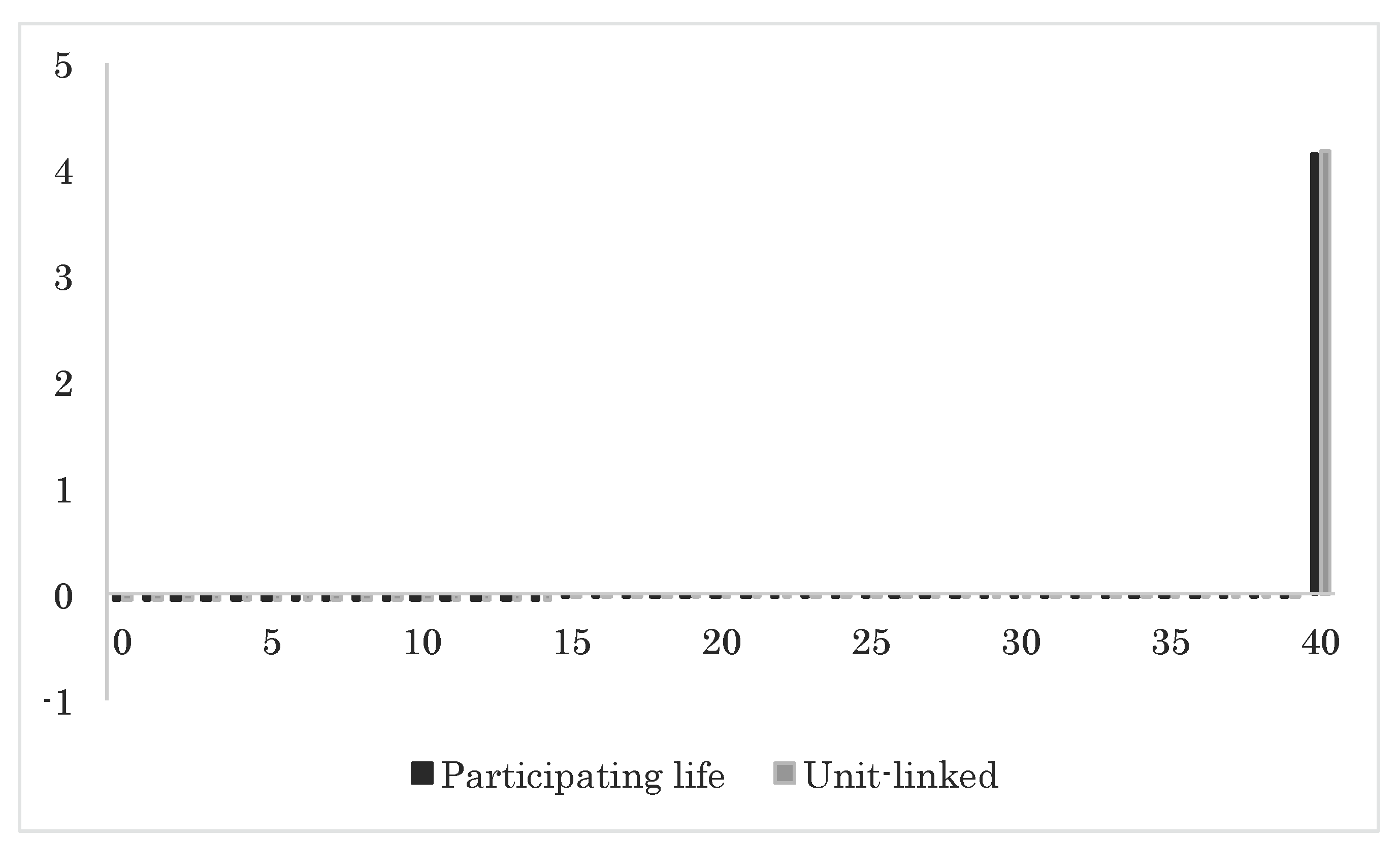

Figure 2.

Approximated expected upscaling factor k as a function of time.

Figure 2.

Approximated expected upscaling factor k as a function of time.

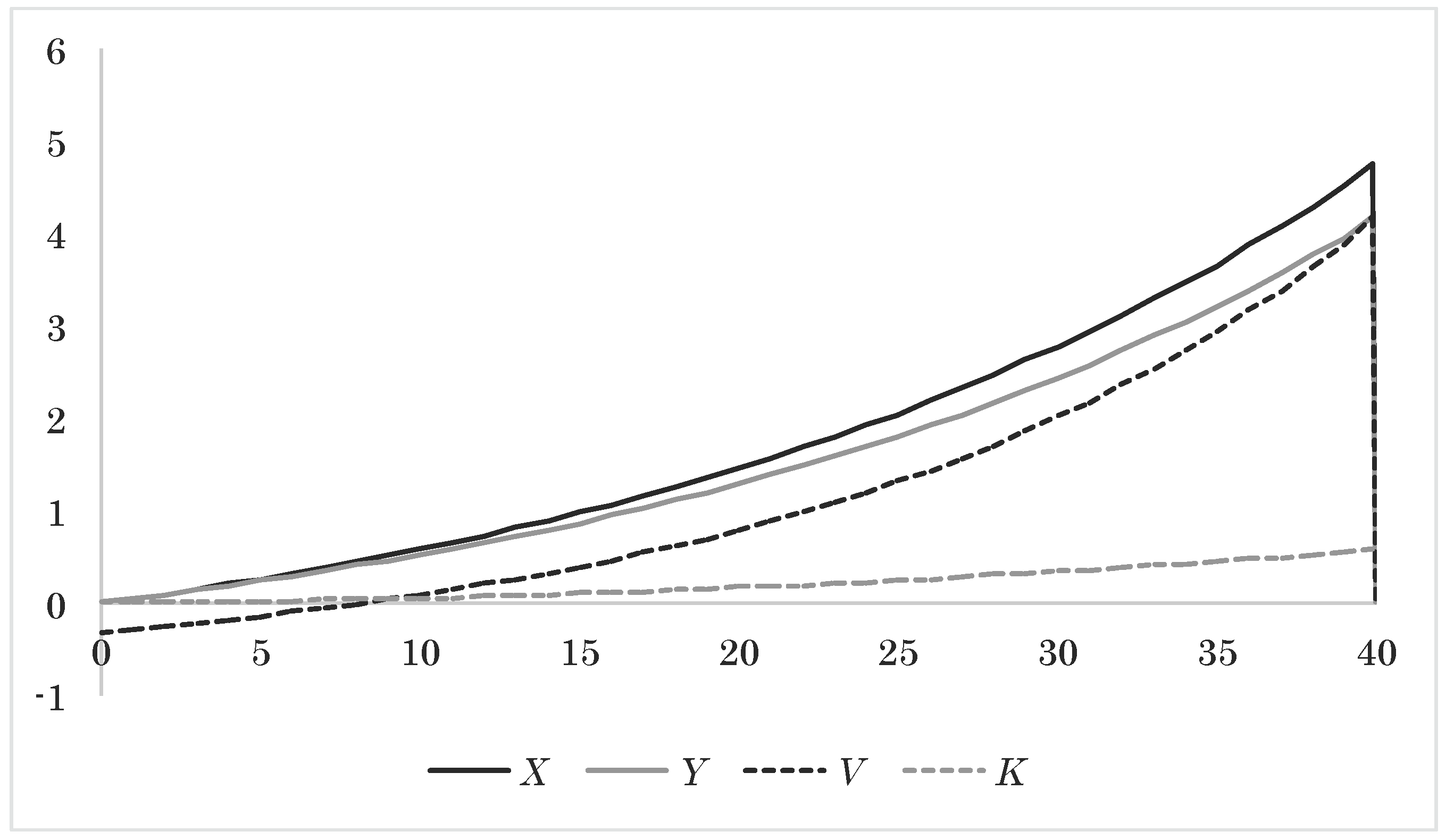

Figure 3.

Approximated expected guarantee injection g and guarantee fee πg as a function of time.

Figure 3.

Approximated expected guarantee injection g and guarantee fee πg as a function of time.

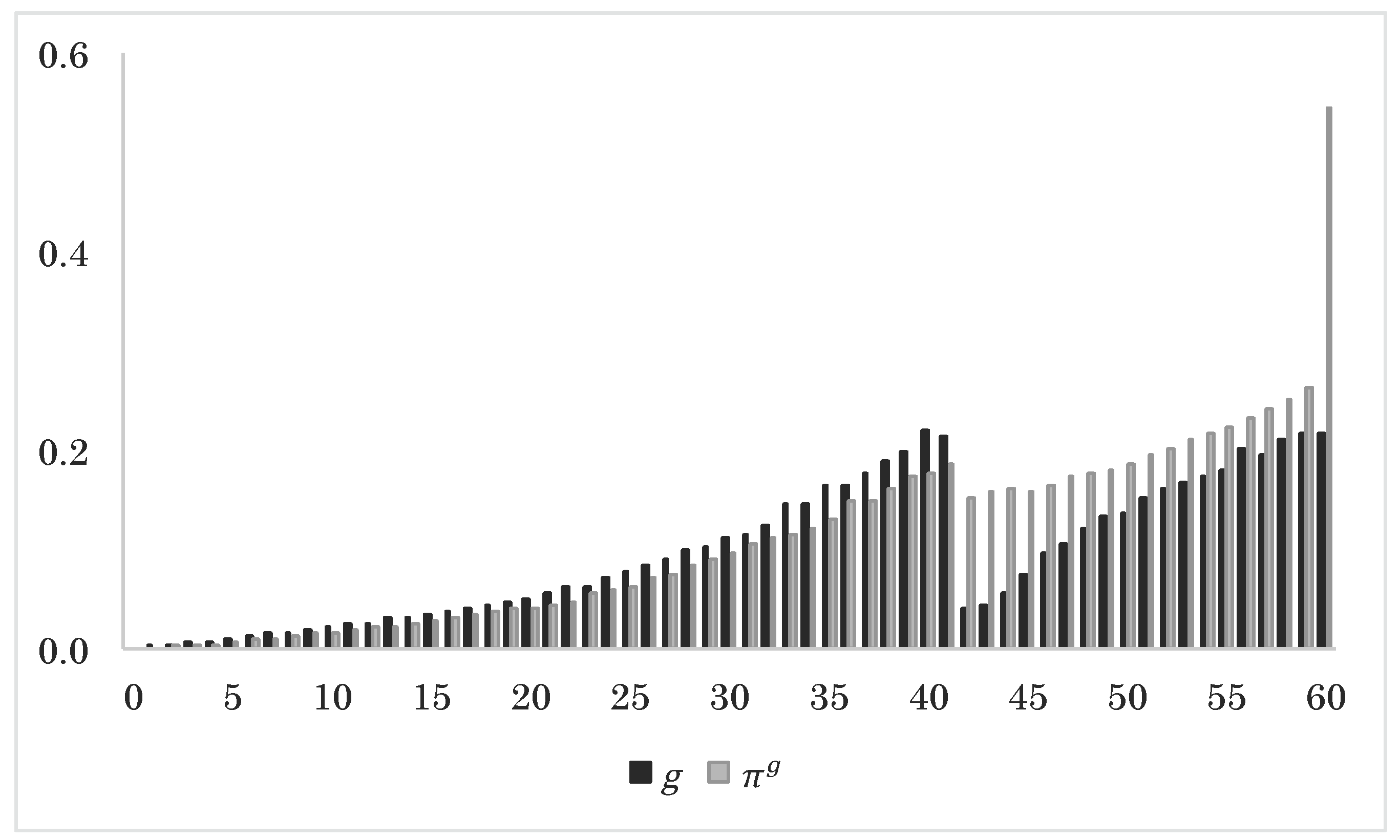

In

Figure 2,

Figure 3 and

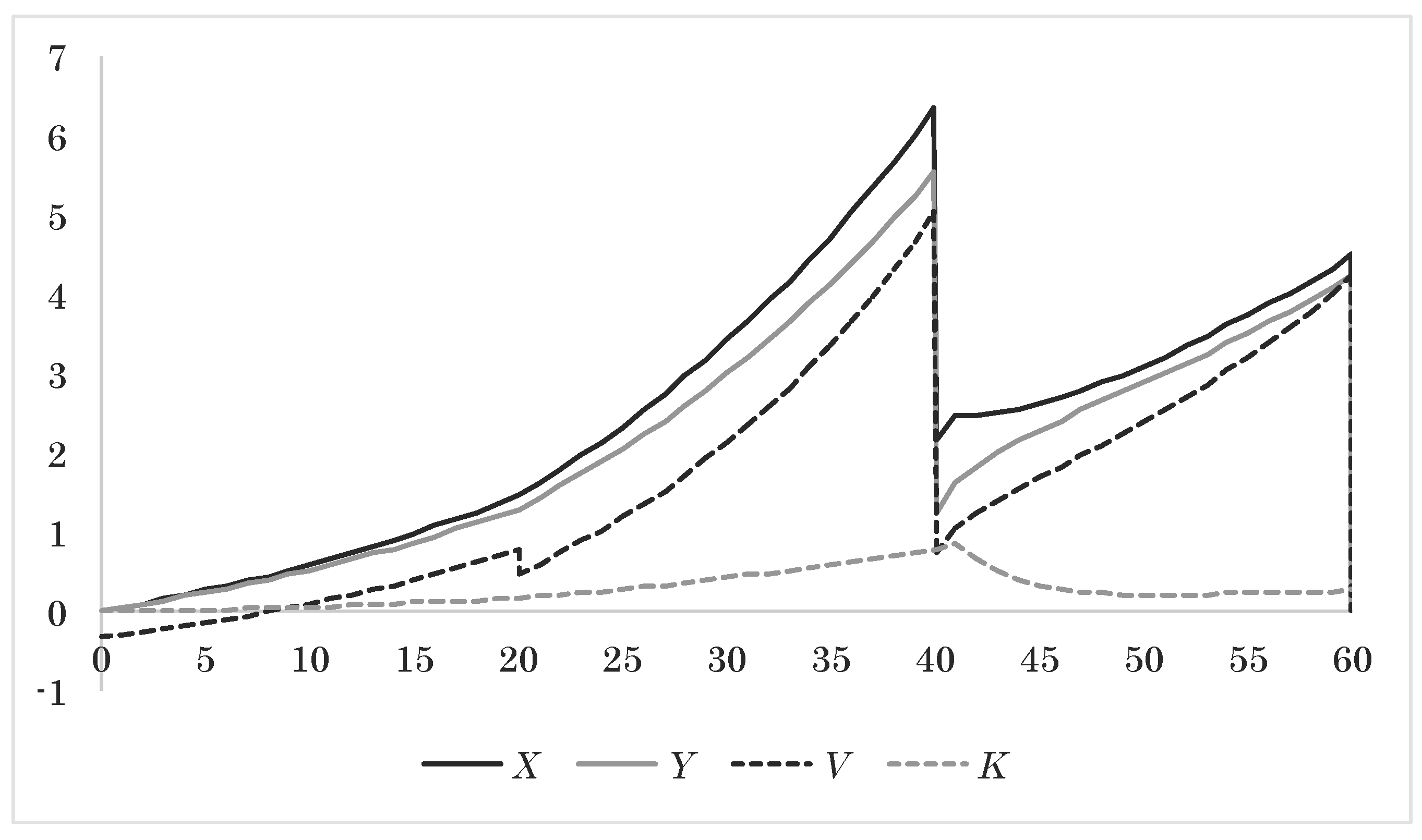

Figure 4, we plot the average evolution of the upscaling factor, the average level for the guarantee injection and guarantee fee, and the average evolution of the assets, reserves and collective bonus potential. From

Figure 2, we see that more than 60% of the final endowment sum comes from bonus. This is primarily due to the technical interest rate being only half the size of the market interest rate. From

Figure 3, we observe that the guarantee fees and the guarantee injections follow each other closely, implying that the structure of the guarantee fee is reasonable. The final guarantee fee includes the remaining collective bonus potential at expiration and is, consequently, much higher than the other guarantee fees. We note that a considerable part of the guarantee injections are paid for by giving up the remaining collective bonus potential at expiration. In a multi-generation portfolio, this is of course transferred to the other policies, leading to a higher guarantee fee throughout the period. From

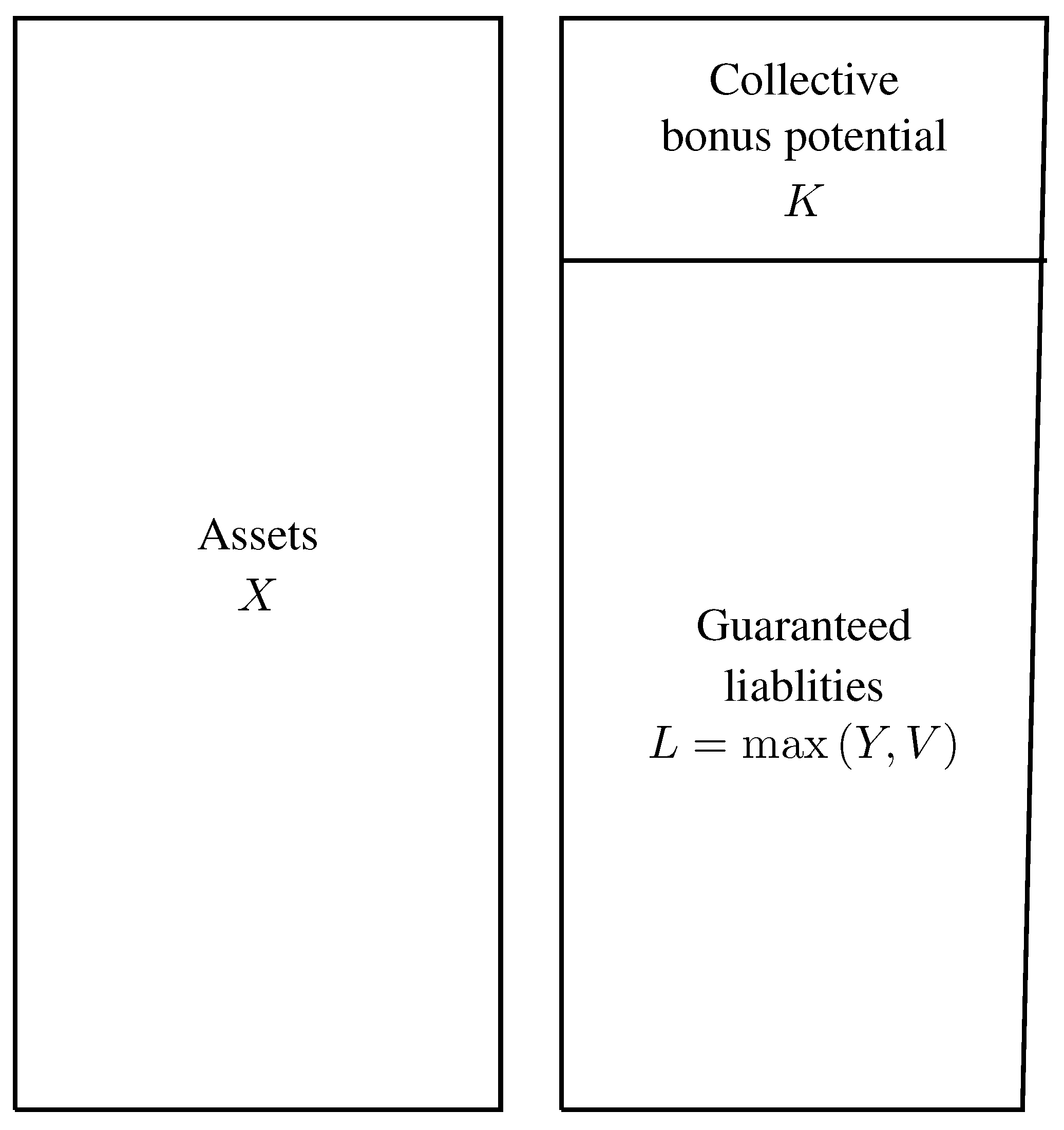

Figure 4, we see how the different parts of the balance in

Figure 1 evolve in expectation.

Figure 4.

Approximated expected assets X, technical reserve Y, market reserve V and collective bonus potential K as a function of time.

Figure 4.

Approximated expected assets X, technical reserve Y, market reserve V and collective bonus potential K as a function of time.

4.11.2. Two-Policy Portfolio

We consider a portfolio consisting of two policies, Policy 1 and 2, which are identical to the one in

Section 4.11.1. However, only Policy 1 is issued at time 0; Policy 2 is not issued until time 20. Hence, from time 0 to time 20, there is one policy in the portfolio; from time 20 to time 40, there are two policies in the portfolio; and from time 40 to time 60, there is, again, one policy in the portfolio. If not careful, this overlap in time easily causes an unfair redistribution between the two policies.

We let , and denote, respectively, the adjustment term, the upscaling factor and the market expected technical reserve for policy . We work with the convention that all quantities (except the upscaling factor) are zero for Policy 2 until time 20 and zero for Policy 1 after time 40. By X, V and Y, we denote the total assets, the total market expected market reserve and the total market expected technical reserve of the portfolio.

We make the same market assumptions as in

Section 4.11.1, and because of the longer time period, we now have

The guarantee injection

g is calculated on portfolio level and reads

where the guaranteed liabilities

L are given by

The total bonus to the policies in the portfolio is determined as a fraction

of the excess collective bonus potential

K just before the bonus allocation over a threshold

if this fraction exceeds the positive part of the total natural risk bonus

α for the policies of the portfolio,

i.e.,

where

α,

K and

are given by

The threshold

can again be seen as a preferred minimum collective bonus potential for the portfolio. We keep

and

. The bonus is divided between the policies of the portfolio in the following way: First, each policy receives its natural risk bonus given by the adjustment terms

and

. We, thereby, use the collective bonus potential as a financial buffer only. Second, the remaining bonus (if any) is distributed as a technical interest rate margin,

i.e., proportional to the market expected technical reserves

and

. In formulas, the bonus to policy

is given by

4.11.3. Constant Guarantee Fee Fraction

First, we stick to a guarantee fee

that is a constant fraction

of the positive part of the returns on the assets,

i.e.,

In addition to the yearly guarantee fee, the equity holders of the insurance company receive the remaining collective bonus potential at the expiration of Policy 2 as part of the final guarantee fee. We determine the fraction

according to the fairness criterion in Equation (

8) applied on portfolio level. We take the 5000 sample paths simulated in

Section 4.11.1, and for each sample path, we project

X,

and

for different values of

, using three difference equations almost identical to the ones in Equation (

12). More specifically, we look for a

, such that we get zero when approximating the time 0 market value from Equation (

11) on portfolio level. We arrive at the guarantee fee fraction

. We notice that the fraction is higher than in the one-policy case, possibly to cover increased risk associated with an extra policy and a longer time horizon. Furthermore, we calculate the average evolution of the upscaling factor, the average guarantee injection and guarantee fee levels, and the average evolution of the assets, reserves and collective bonus potential. We discover that the guarantee fee is only fair on portfolio level. Approximating the time 0 market value from Equation (

11) for each of the policies individually, we get

Hence, a significant amount of the systematic surplus is being redistributed from Policy 1 to Policy 2. We recall that

and

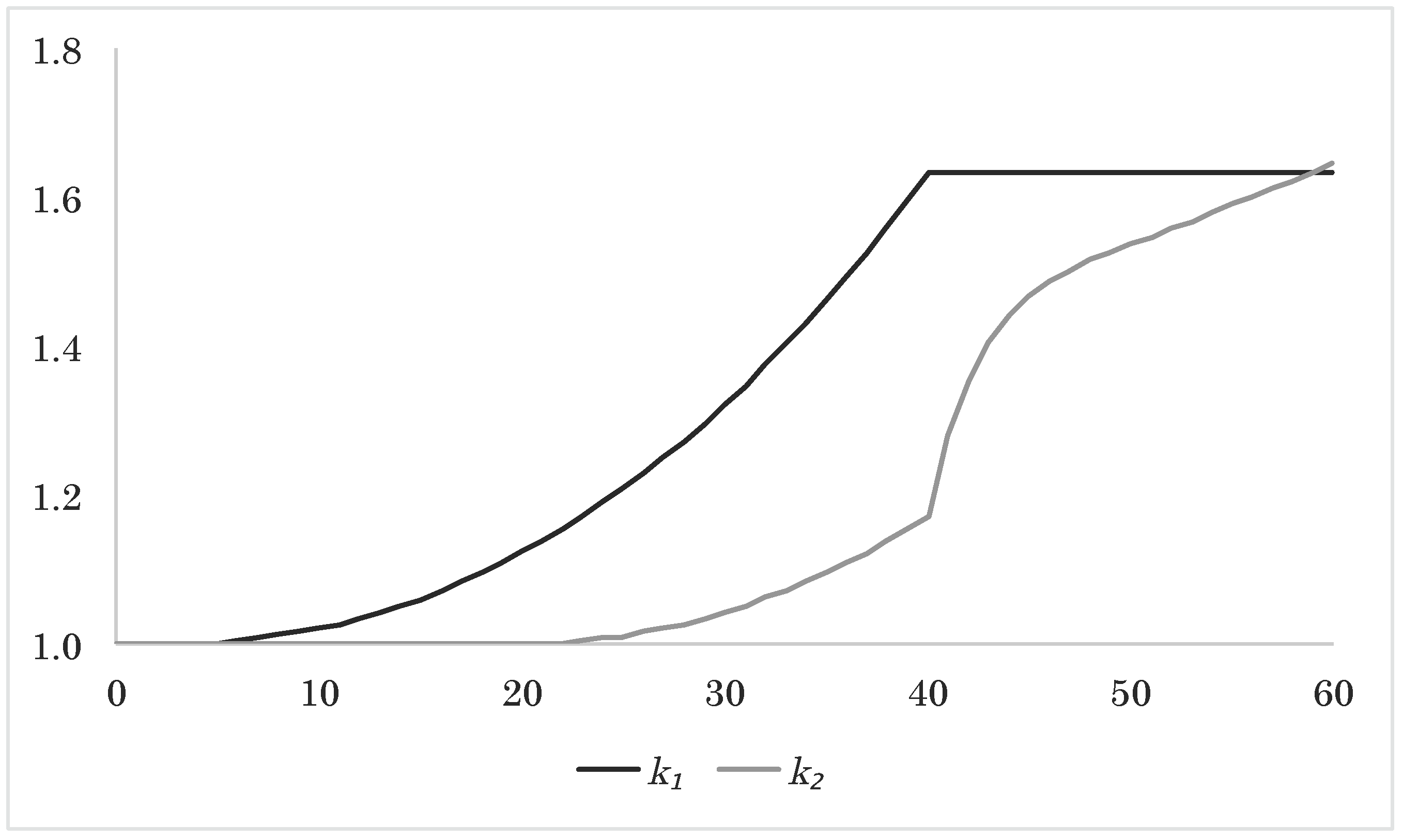

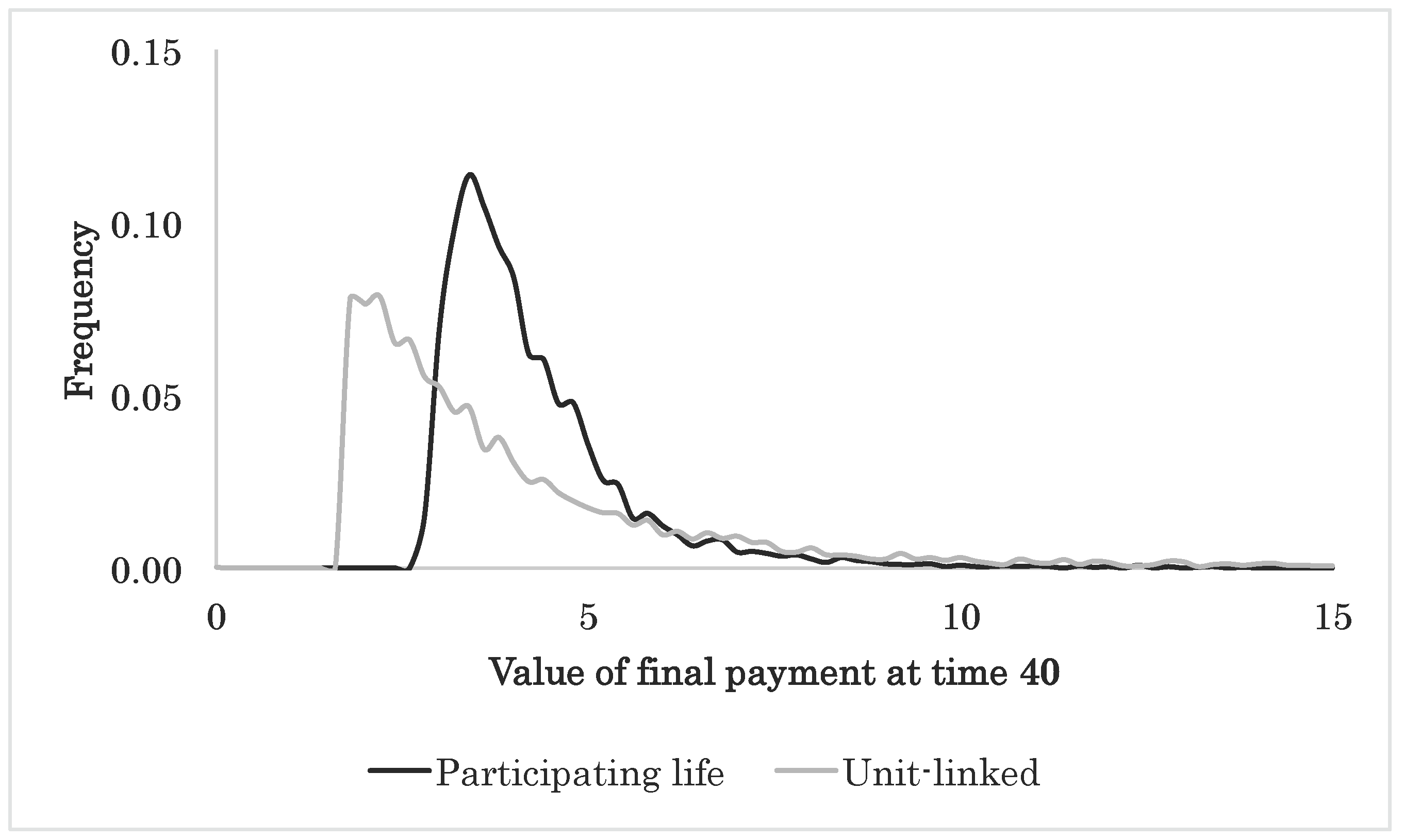

are the market values of the guaranteed and non-guaranteed payments; and not the usual market values that only include guaranteed payments. To illustrate the redistribution, we plot the average evolution of the upscaling factors in

Figure 5. From the figure, it appears that Policy 2's final upscaling factor is much larger than Policy 1's. Furthermore, comparing with

Figure 2, we see that Policy 1's final upscaling factor is significantly smaller than in the one-policy case, so it is not just a matter of both policies benefiting from being part of the two-policy portfolio and Policy 2 benefiting more from it than Policy 1.

Figure 5.

Approximated expected upscaling factors and as function of time.

Figure 5.

Approximated expected upscaling factors and as function of time.

4.11.4. Period-Dependent Guarantee Fee Fraction

To overcome the unfairness introduced by the constant guarantee fee fraction, we allow there to be a different fraction

determining the guarantee fee for each of the time periods

,

and

,

i.e.,

where

In addition to the yearly guarantee fee, the equity holders of the insurance company still receive the remaining collective bonus potential at the expiration of Policy 2 as part of the final guarantee fee. First, we fix

, since this is the fair guarantee fee fraction from the one-policy portfolio. Second, we take the 5000 sample paths simulated in

Section 4.11.1 and search (in the same way as before) for a value of

for which

, meaning that the guarantee fee determined by the pair

is fair for Policy 1. We find the fair guarantee fee fraction

. Third, we search for a value of

for which

, meaning that the guarantee fee determined by the triplet

is fair for Policy 2. We find the fair guarantee fee fraction

. We notice that the guarantee fee fraction is much higher in the last time period than in the first two time periods and that the guarantee fee fraction in the second time period is slightly smaller than in the first time period. This is best explained by the fact that Policy 2 inherits collective bonus potential from Policy 1. Policy 1 is compensated for this transfer via the lower guarantee fee fraction in the second time period, and Policy 2 pays for the transfer in terms of the high guarantee fee fraction in the last time period. This is reflected in

Figure 6. Again, the final guarantee fee is much higher than the other guarantee fees, since it includes the remaining collective bonus potential at the expiration of Policy 2. In a multi-generation portfolio, this is transferred to the other policies, leading to a higher guarantee fee throughout the period.

Figure 6.

Approximated expected guarantee injection g and guarantee fee πg as a function of time.

Figure 6.

Approximated expected guarantee injection g and guarantee fee πg as a function of time.

Figure 7.

Approximated expected upscaling factors k1 and k2 as a function of time.

Figure 7.

Approximated expected upscaling factors k1 and k2 as a function of time.

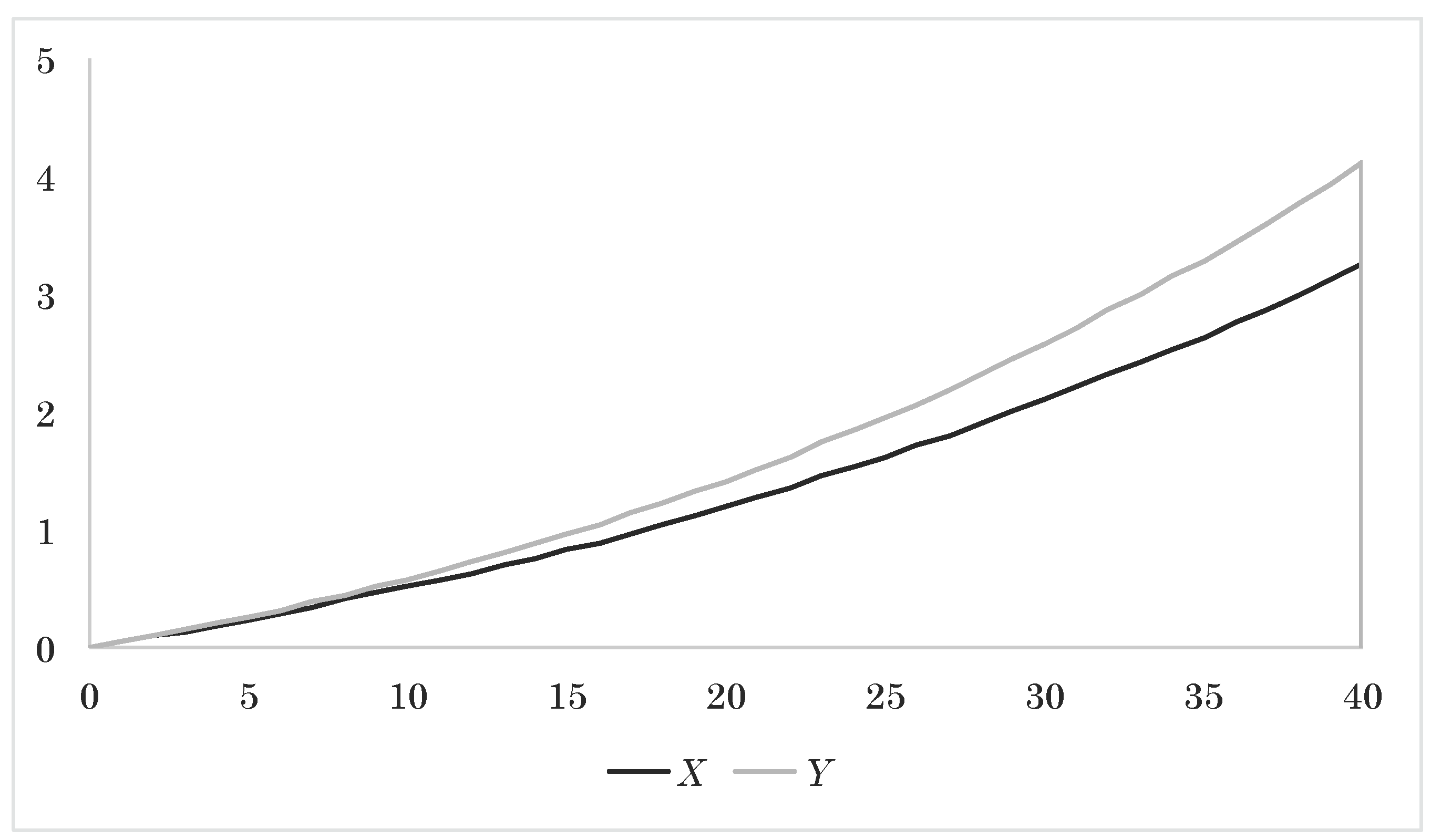

In

Figure 6,

Figure 7 and

Figure 8, we plot the average evolution of the upscaling factors, the average guarantee injection and guarantee fee, and the average evolution of the assets, reserves and collective bonus potential. With the fair guarantee fee, we see from

Figure 7 that the two policies' final upscaling factors are essentially equal; also to the final upscaling factor from

Section 4.11.1. From

Figure 8, we see how the different parts of the balance in

Figure 1 evolve in expectation for the two-policy portfolio.

Figure 8.

Approximated expected assets X, technical reserve Y, market reserve V and collective bonus potential K as a function of time.

Figure 8.

Approximated expected assets X, technical reserve Y, market reserve V and collective bonus potential K as a function of time.