5.1. Linear Specification Results

The estimation results of the linear Taylor rule augmented simultaneously by the lagged monetary policy and REER for Tunisia and Egypt are presented in

Table 3.

Results in

Table 3 show that all estimates, except the intercept, are significant and have the expected signs in both Tunisia and Egypt series. However, these coefficients are less than unity, which violates the stability condition in the Taylor rule. Additionally, according to the

R2 criteria, we notice a good overall fit of the model for Tunisia. However, as can be seen in

Table 3, the regression explains about 34.62% of the variation in the interest rate of Egypt. Also, there is no ARCH effect in the residuals of the estimated linear Taylor in both Tunisia and Egypt.

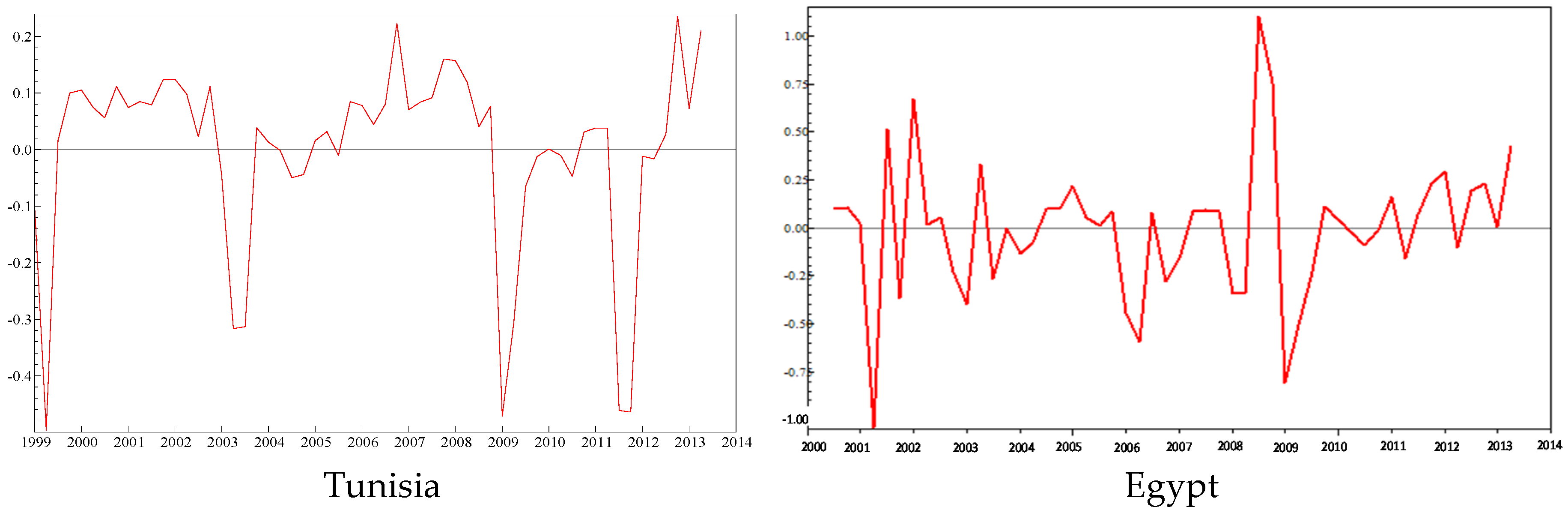

Inspection of the residuals series obtained from the estimation of the linear Taylor rule (

Figure 2) reveals that the rule seems to capture the behavior of decision makers for both Tunisia and Egypt well. However, it is interesting to note that there are large residual spikes for more than one period notably in 1999–2000, 2003–2004, 2009 and 2011:Q4 for Tunisia and in 2001–2002, 2008–2009, 2011 and 2013 for Egypt. The fitted interest rate is, over these time intervals, correlated and remarkably different from the actual value.

Negative (positive) residuals correspond to periods when the estimated rule leads to a higher (lower) interest rate than the actual ones. Accordingly, in such periods, monetary policy appears to have been tightened (relaxed) beyond what was suggested by the inflation, the output gap, the lagged interest rate, and the REER deviations. This could be explained by the fact that a linear Taylor rule even augmented is not able to perfectly describe the conduct of monetary policy in the presence of unusual contingencies (Baaziz

et al., 2013 [

29]; Baaziz

et al., 2014 [

30]).

In summary, we can deduce that although the linear Taylor rule describes well the broad contours of Tunisia and Egypt’s behavior, it fails to detect significant changes in policy direction in response to in response to the effect the terrorist attack in the US in September 2001, the global financial crisis in 2008, and the effect of political instability with the onset of the revolution, which affected the economy of these countries. Thus, the actual presence of finer monetary regimes corrupts the descriptive power of linear rules even augmented by the lagged policy rate and REER.

The theoretical basis of the linear rule comes from the assumption that policymakers have a quadratic and symmetric loss function and that the aggregate supply or Phillips curve is linear. However, in reality, this assumption is unrealistic; monetary authorities may have asymmetric preferences (Surico, 2007 [

8]) and the underlying aggregate supply schedule might be nonlinear leading to a nonlinear adjustment of the policy rate (Dolado

et al., 2005 [

6]).

Therefore, a nonlinear Taylor rule may be more appropriate to explain the behavior of monetary policy, and thus the adoption of a nonlinear specification instead of the linear one would leads to a better fit of the policy rate of the Tunisian and Egyptian Central Bank.

To get a deeper understanding of this phenomenon and to investigate to what extent concerns of monetary policymakers are related to unexpected events, we adopt the LSTR model to test the hypothesis that the strength of the response of monetary policy to macroeconomic conditions depends on the level of risk facing the economy.

5.2. Nonlinear Specification Results

The results of the tests for the selection among transition variables candidates are reported in

Table 4.

Considering the above results, we conclude that there is strong evidence against the linear specification of the Taylor rule and that the past interest rate is likely to be responsible for nonlinear behavior of BCT. Thus, the parameter set changes whenever the interest rate drops below or rises above some threshold value. With regard to the choice of the adequate transition variable for Egypt, the selected variable is the output gap because it provides the lowest p-value of the computed F-statistics for the rejection of the null hypothesis of linearity. Therefore, switching between regimes is controlled by output gap.

For Tunisia, the empirical work that is presented in

Table 4 clearly shows that the monetary policy followed by the BCT can be described by a nonlinear Taylor rule and the dynamic of a lagged interest rate seems to be the main driver of monetary policy. This is consistent with Bruggemann and Riedel (2011) [

31] and Alcidi

et al. (2011) [

32] identification of transition variable. They identify and use the lagged interest rate as a threshold variable. Thus the switching between regimes is controlled by concerns about hitting the zero lower bound of the nominal interest rate where policy instrument does not respond in the usual way to its determinants.

An economy is said to be in a “liquidity trap” when short-term nominal interest rates are at a minimum and when money creation is no longer able to stimulate the economy by driving down interest rates. A liquidity trap is related to situations of uncertainty which create great anxiety about the future among economic actors. In such circumstances, nobody would be willing to lend, assuming zero storing costs for cash and nominally riskless zero rate of return.

This problem returned to prominence with the Great Depression in the US (1929–1930). It has been suggested that monetary policy was completely ineffective by then, i.e., a liquidity trap prevailed. Similarly, there has been substantial debate regarding the bank of Japan’s (BoJ) monetary policy conduct during the 1990s and more recently with the Subprime Crisis. In such situations, the Fed’s traditional tools have been unable to provide further stimulus to the economy. The use of unconventional measures acts as substitutes to policy and aims to affect macroeconomic conditions.

Tunisia is not excluded as its economy was also mired in a slump, especially after the revolution of 2011. The first post revolution days were characterized by simultaneous sharp drops in demand and supply, accompanied by serious disturbances in the production system (sit-in, social unrest with strikes). Similarly, this period was marked by a sharp decline in foreign currency assets, down under the combined effect of the fall in the number of tourists visiting the country and exports of phosphates.

All these factors have led to a major shock reflected through the exceptional decline in real GDP growth. This brings the Tunisian economy to move into a situation of a liquidity trap when cuts in policy rates seem to have little or no impact of hick-starting demand and output (twice reducing its interest rate by 50 basis points both in June and September 2011).

This decline in interest rates failed to encourage the economic actors to lend money. These actors continue to be deaf to calls for consumption and investment as a result of growing anxiety about the future.

The empirical findings suggest that the monetary policy followed by the Egyptian Central Bank exhibits nonlinearity and concerns about recession seem to be the major determinant of the change in the conduct of monetary policy across regimes. Our results are consistent with those of Castro (2011) [

33], whose findings support evidence of a nonlinear Taylor rule for the European Central Bank and for the Bank of England. The study argues that once the output gap approaches a certain threshold, these central banks begin to react aggressively to recession regimes. He also shows that the Fed's monetary policy is better described by a linear Taylor rule.

We attribute this finding to the sequence of adverse supply shocks that hit the Egyptian economy. During the time spam that we consider in this paper, Egypt underwent several shocks: the terrorist attack in the US in September 2001, the global financial crisis in 2008, and the effect of political instability with the onset of the revolution. When the world financial crisis began, central bankers had expectations regarding its extent. Unfortunately, a series of consequential shocks to the world economy, such as the Lehman Brothers bankruptcy, the AIG flop, and the crush of the Reserve Primary Fund (a large money market mutual fund in the US), spoiled these expectations, leading to the demolition of the financial system and the economy (Mishkin, 2011 [

12]). Indeed, after the revolution the political instability in the country had increased uncertainty and led to a systematic capital outflow in the tourism sector, which prior to the revolution had represented 11% of the country’s GDP has been severely affected as tourism income plunged by 9 % after the January 25 revolution which took a toll on the Egyptian growth.

The test for the choice of the transition function is also presented in the

Table 4. It indicates that an LSTR1 model better fits the Tunisian and Egyptian monetary policies. This model is often used to capture the asymmetric behavior of the business cycle in the sense that booms and busts are characterized by different dynamics (Teräsvirta and Anderson, 1992 [

34]).

Furthermore, Equation (2) describes the model to be estimated with lagged interest rate as the selected threshold variable for Tunisia and with output gap as the selected threshold variable for Egypt, which split the samples into two regimes. Thus, the resulting detailed nonlinear LSTR model to be estimated is reported in Equation (4) for Tunisia and in Equation (5) for Egypt below.

LSTR model estimation results are reported in

Table 5.

Table 5 confirms our conjectures; the estimates clearly reveal the existence of two regimes. The first regime is very close to the linear augmented rule reported in

Table 3 while the second (that we will call the low interest rate regime for Tunisia and the low output gap regime (recession) for Egypt) is at odds with the classical Taylor rule. It clearly shows the existence of a special regime that applies only to unusual economic conditions, in response to which central banks change their usual policy conduct.

Results in

Table 5 show that the BCT reacts differently to the REER, the inflation rate and the output gap. This means that when the interest rate falls below the threshold value of 4.708%, monetary policy enters the liquidity trap regime where the policy instrument does not respond in the usual way to its determinants.

Similarly, the reaction of the Egypt's central bank to shocks on these variables changes depending on whether the level of the output gap is above or below the threshold value of –9.855.

The transition speed parameter is statistically significant and has an estimated value equal to 3.45 and 5.324 for Tunisia and Egypt respectively, indicating an abrupt change from one regime to another.

Our estimates suggest that the parameters of the monetary policy rule seem to change over time. We report that 1 > bπ.1 > bπ.2 in both Tunisia and Egypt. This result indicates an accommodative behavior of the interest rate to inflation in the special regime while it did not do so in a tranquil period. We also note that the Taylor principle is not satisfied in either regime; the estimated coefficient on inflation is always lower than one.

We also note that by.1 < by.2, indicating an asymmetric response from the BCT and ECB to the output gap. A plausible explanation is that for a period of distress, the monetary authority is concerned about the expense of recession, even at the expense of inflationary pressures.

Also bq.2 > bq.1 suggesting that the BCT pays close attention to the REER when setting its policy rate.

Additionally, the results reveal that for both Tunisia and Egypt, that is, an accommodative response to the inertia of monetary policy during the special regimes, which is consistent with Mishkin’s view that considers when macroeconomic risk is high, policy in this setting tends to respond aggressively. For this reason, the degree of inertia in such cases tends to be lower than in more routine circumstances.

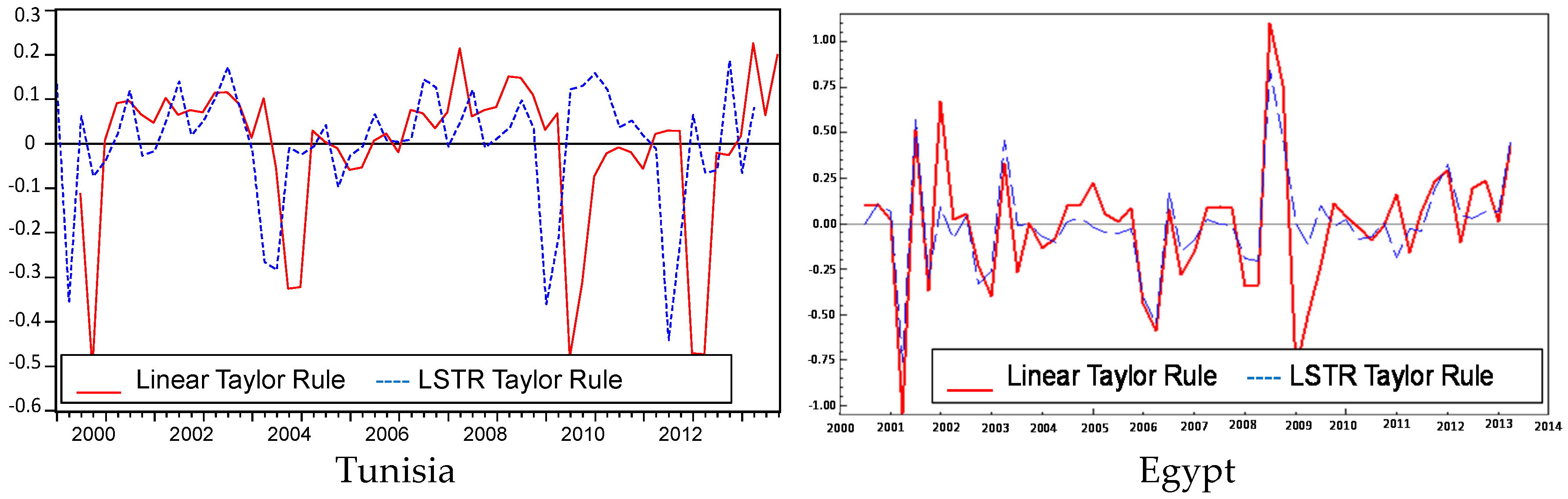

In order to better appreciate the gain in terms of fit obtained by leaving the linear rule for the nonlinear specification we plot in

Figure 3 both the residuals from the augmented linear Taylor rule and the nonlinear specification. We notice that allowing for the functional form to deviate from a constant parameter Taylor rule allows good description of the broad contours of Tunisian and Egyptian monetary policy conduct especially in periods of special regime and reveals less autocorrelation of the residuals. Indeed, such special regimes refer to some special circumstances in which policy makers extensively use their judgment to make decisions.

From these results, we can see that although the linear rule effectively describes the broad contours of monetary policy of the BCT and the ECB; it fails to detect significant changes in policy direction following the onset of the revolution. These findings suggest that adopting a nonlinear specification instead of the linear one leads to a reduction in errors of 150 basis points (bps) in 1999, 2009 and 60 bps in October 2011 for Tunisia and 250 bps in 2001, 700 bps in 2009, and 200 bps in 2012 for Egypt.

So far, this paper has provided evidence that it is possible to characterize the behavior of the BCT as a two-state Taylor rule, with different coefficients depending on whether the interest rate is below or above an estimated threshold value. This means that when the interest rate (output gap for the case of Egypt) falls below that value, monetary policy enters the special regime. These special regimes require disconnection from the automatic pilot rule of the Central Bank and policymakers should extensively use their judgments to make decision.

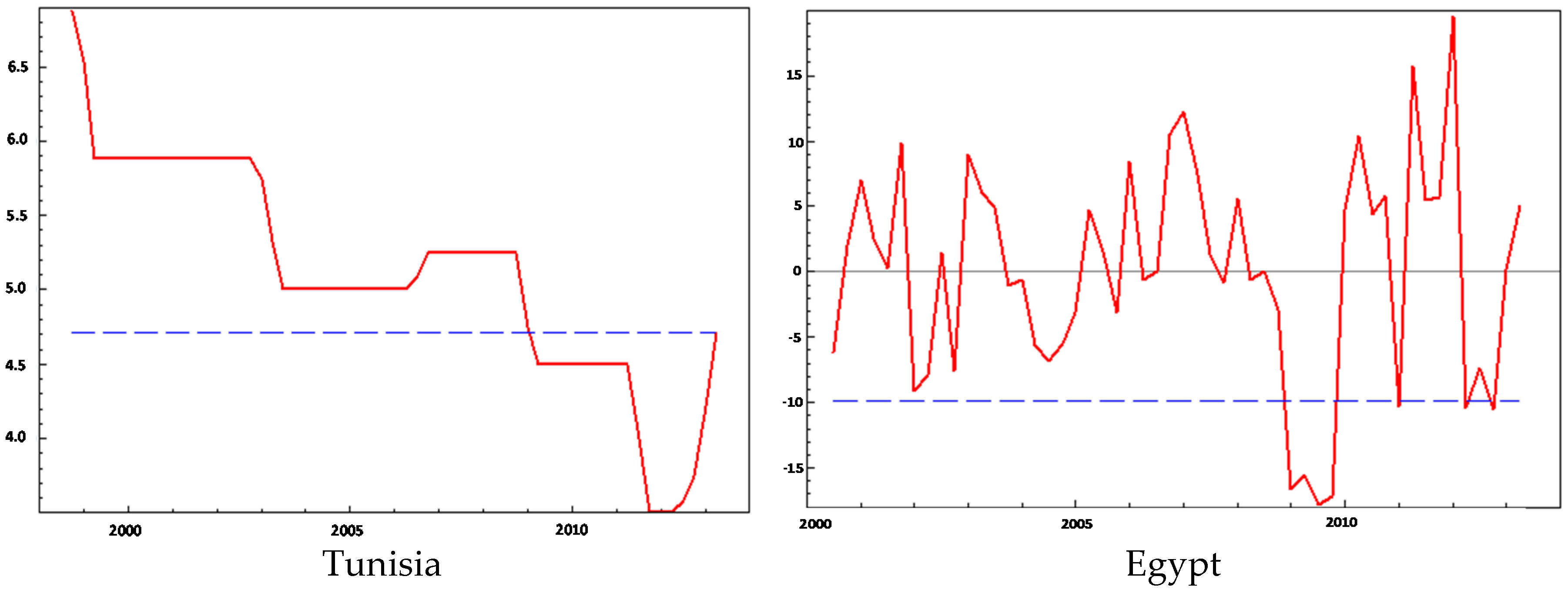

To better appreciate this similarity, the

Figure 4 illustrates the transition variable and the estimated threshold.

By looking at the transition variable using the estimated threshold plot, we can identify the timing of the policy switching. In the case of Tunisia, a stronger response regime takes place when the interest rate approaches the edges of liquidity trap band, especially from 2009 onward. However, in the case of Egypt, the estimated threshold value of the output gap is equal to −9.855, indicating that when the output gap falls below that value, monetary policy enters the special regime.

Estimated threshold value splits the sample into two distinct periods of time. The shorter regime can be seen as a finer regime that applies only to unusual economic conditions which requires disconnection from the automatic pilot rule and the use of judgement to make decisions. The other one can be interpreted as the general regime that is at odds with the former one and associated with normal economic conditions.

The Subprime Crisis and the political events that have unfolded in Tunisia since the 14 January 2011 revolution took its toll on the Tunisian economy. Then, many thought that cuts in policy interest rate would contribute to kick-starting an economy mired in slump, but this decline in interest rates failed to get the economic actors out of their reserves. These actors continue to be deaf to calls for consumption and investment as a result of growing anxiety about the future. Tunisia, in such a period, is in a significant "liquidity trap" that monetary policy alone cannot solve. In such a situation, conventional monetary regulation is not able to fully absorb turbulent times (the fallout from the subprime mortgage crisis, the road to the “Jasmine Revolution”). The traditional solutions fall short to regulate these special contingencies. Therefore, unconventional policies need to be taken, whether of credit easing vs quantitative easing. These policies are likely to be a useful complement to monetary policy since their toolbox includes a wide range of operational instruments (capital requirement regulation, leverage ratios, Required Reserve Ratio...). Added to these unconventional instruments, forward guidance regarding the path of the interest rate aims to influence the private sector expectations of the future. However, so long as the BCT is deprived of benefiting from the dynamic bond market, it will remain a prisoner of its traditional instruments (conventional).

It is important to institute stimulus programs to boost the bond market to allow the BCT to intervene in the long compartment and push long rates down through the massive purchase of bonds.

Moreover, the Egyptian situation could be more comfortably limited to the Tunisian economy insofar as the short-term rates are relatively high. In this sense, high-potential economic growth could be boosted by more relaxed monetary policy as low interest rates is likely to give way to reducing the cost of borrowing and support growth. Indeed, this finer regime represents an additional argument to exert a corrective action such as fiscal consolidation measures to foster economic growth.

Overall, this section concludes that the nonlinear models outperform the linear ones in the sense that the linear specification, by imposing a unique constant regime over the entire sample, fails to capture the special events and unexpected contingencies respectively, with the global financial crisis in 2008 and the effect of political instability with the onset of the revolution.

We perform misspecification tests to check for the robustness of our results and determine whether there is evidence of parameter instability, non-normality of residuals, and remaining nonlinearity. These tests have been proposed by Eitrheim and Teräsvirta (1996) [

28]. The results of these tests are presented in

Table 6.

The results of diagnostic tests indicate the absence of ARCH effects in the residuals. Moreover, the remaining nonlinearity test shows that some of the nonlinearity was absorbed by an LSTR model with two regimes. So, we come to find evidence for the validity of our empirical nonlinear model in both Tunisia and Egypt. In addition, the parameter constancy test shows that the parameters do not vary over time if we consider the two first functional forms suggested by Eitrheim and Teräsvirta (1996) [

28]. These various results therefore confirm the idea that the monetary policy followed by the BCT and the ECB exhibit a strong nonlinearity.