How Do Chain Governance and Fair Trade Matter? A S-LCA Methodological Proposal Applied to Food Products from Belgian Alternative Chains (Part 2)

Abstract

1. Introduction

1.1. Social Sustainability Issues in Food Chains: A Sector with High Risks for Farms and Their Workers

1.2. Alternative Food Networks as Responses to Food Chain Issues or How Chain Governance Could Matter

1.3. Objective of the Article and Structure

2. Materials and Methods

2.1. Goal and Scope: Assessed Products, Alternatives, Assessed Criteria and Indicators, Product Systems and System Boundaries

2.2. Inventory

2.3. Life Cycle Impact Assessment (LCIA) and Interpretation of Results

2.3.1. Type I LCIA or Referencing

2.3.2. Type II LCIA or Interpreting Results by Investigating Impact Pathways

3. Results of Type I Assessment: Reporting on Social Hotspots at Different Levels of the AFNs’ Chains

3.1. Chain Governance and Relations between VCAs or the Promises of Democratization and Fair Trade

3.1.1. Mainstream Chains

3.1.2. CSA Chains

3.1.3. Webshop Chains

3.1.4. Organic Shop Chains

Downstream Side of Chains

Upstream Side of Chains

3.1.5. Price Setting Mechanisms

3.2. Value Chain Actors or the Promise of Better Social Relationships and Profitability

3.3. Workers and the Promise of Better Employment and Working Conditions

3.4. Consumers and the Promise of Better Access to Quality Products and Consumer Education

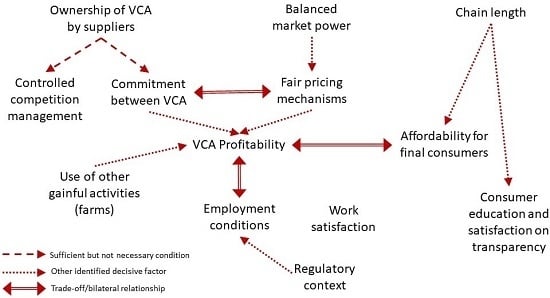

4. Results of Type II Assessment: Interpreting Results by Linking Sustainability Dimensions

4.1. Ownership and Controlled Competition Management and Commitment: Useful but Not Necessary

4.2. Pricing: Ownership, Balanced Governance or a Trade-Off with Commitment

4.3. Transaction Modalities, Profitability and Use of other Gainful Activities

4.4. Profitability and Employment Conditions: A Complex Relationship

4.5. Work Conditions and Hardness, Financial and other Rewards

4.6. Impacts on the Consumer Side and the Role of Proximity with Producers

4.7. Financial and Professional Insecurity of Farmers Versus Affluence of Consumers

4.8. … A Lever to Improve the Sustainability of AFN Products?

5. Discussion and Conclusions

5.1. What Can We Conclude from This Case Study about the Role of Chain Governance? Insights for other and Mainstream Chains and for S-LCA Practice

5.2. How Efficient and Relevant our Methodological Proposals are to Assess and Understand the Social Sustainability Performances of Products?

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Criteria | Indicators | Reference Points | |

|---|---|---|---|

| Chain/VCA Governance | |||

| Chain governance and relations between VCA | Chain length | Number of intermediaries between producer and final user | A. 0 B. Maximum 1 C. More than 1 D. More than 2 |

| Level of control of the organization | Actual ownership | B. Most of the capital is owned by users of the organization (partners, workers, clients, suppliers) C. Most of the capital is owned by known investors D. The company is quoted on the stock exchange | |

| Participation of other VCA in decision making | Actual and potential ownership by other VCA | A. All capital owned by other VCA and shareholding open under conditions (e. g. producer co-op) B. Other VCA own part of the capital and shareholding open and supported (co-op) C. Other VCA might own part of the capital but shareholding by other VCA not supported or open | |

| Competition management | Buying obligations towards certain suppliers | A. The purpose of the organization is to buy and sell all the supply of certain suppliers (usually its members) B. The purpose of the organization is to buy and sell products of certain suppliers in priority C. The organization has no obligation regarding sourcing | |

| Market power of the organization | Size of organization and market concentration | A. Small organization in a low concentrated market B. Small organization in a concentrated market C. Big organization (< C8) in a concentrated market D. Very big organization (<C4) in a concentrated market | |

| Transaction modalities | |||

| Commitment between VCA | Contract between the buyer and the supplier | A. Very high commitment (open-ended or with risk sharing) B. Formalized contract on several months at least C. Non-formalized commitment D. No commitment or commitment with penalties if non-compliance | |

| Price fairness | Pricing mechanism (1): Who sets the price? | B. The supplier C. The price is negotiated D. The buyer | |

| (2): Basis to set the price | B. On the basis of cost price C. On the basis of market or competitor’s price, adapted according to specific costs, or with a multiplying factor D. On the basis of pure market price | ||

| Unfair trade practices | Payment term | A. Within 7 days B. Within 30 days C. Within 3 months D. After 3 months | |

| Social Ties Felt by VCA | |||

| VCA | Trust in the trading relationship | Whether the supplier feels that it trusts the reliability of the trading relationship with the client/that it will continue (1. I do not trust it at all, 5. I trust it absolutely) | A. x >= 4 B. 3 =< x < 4 C. 2 =< x < 3 D. x < 2 |

| Recognition between VCA | Whether the supplier feels recognized and valued for his/her work by the client | ||

| Understanding of each other’s reality | Whether the supplier feels that the client understands his/her reality/difficulties | ||

| Profitability and autonomy of VCA | |||

| Profitability of VCA | Takings-income/year | B. For sole proprietorship: if the generated income/capita is above the Belgian living wage; for companies: if profit before tax is positive C. For sole proprietorship: If the generated income is below the Belgian living wage; for companies: If profit before tax is negative | |

| Use of other gainful activity | B. No, C. Yes (including purchase and resale activity) | ||

| Employment conditions | |||

| Workers | Social benefits/social security | Provision of contracts with full benefits/ employee contracts to workers (other than partners) | A. Provision of some permanent employee contracts B. Provision of some temporary employee contracts C. Non provision of any jobs D. Non-provision of any employee contracts |

| Use of ‘low-cost’ worked hours (subsidized and daily contracts, disguised employment/’false’ self-employed person, non-paid familial labour, or non-declared) | B. Non-use (except trainees) C. Use for some worked hours D. Use for most worked hours (outside of hours worked by partners) | ||

| Stability of work contracts | Use of unstable contracts/arrangements | A. Use of open-ended contracts only B. Use of open-ended contracts mainly C. Use of temporary employee contracts for more than 10% of worked hours (outside of hours worked by partners/managers) D. Use of daily contracts (incl. temporary work) or self-employed persons | |

| Working conditions | |||

| Working time | Excessive work hours per week | A. Equivalent or less than 38 h a week B. Less than 48 h (max allowed in agriculture) C. Between 48 and 68 h a week D. More than 68 h a week | |

| Possibility to have weekly days off | B. At least 1 day a week C. 1/2 day a week D. No day off | ||

| Possibility to take annual leave | B. Yes C. No | ||

| Work hardness | Feeling of workers regarding psychological and physical work hardness | A. x >= 4 B. 3 =< x < 4 C. 2 =< x < 3 D. x < 2 | |

| Concerns of workers regarding potential future occupational health problems | |||

| Work satisfaction | Feeling of workers on general satisfaction, autonomy, learning, relations with supervisor and colleagues, work recognition, work-life balance and pay | ||

| Final consumers | Product’s Quality and Transparency | ||

| Food safety | Trust of consumers regarding food safety | A. x >= 4 B. 3 =< x < 4 C. 2 =< x < 3 D. x < 2 | |

| Taste | Satisfaction of consumers regarding taste quality | ||

| Product’s transparency | Satisfaction of consumers regarding the information provided on the product and on production methods | ||

| Product’s accessibility | |||

| Product’s affordability | Satisfaction about product affordability | A. x >= 4 B. 3 =< x < 4 C. 2 =< x < 3 D. x < 2 | |

| Accessibility to vulnerable people | Representation of young, low educated, and low income people among consumers | A. Upper representation of targeted people in comparison to the regional mean (>5 points more/regional mean) B. Equal representation (+/− 5 points difference) C. Lower representation (>5 points less) D. Very low representation (>15 points less) | |

| Awareness raising on sustainability issues | |||

| Consumer education | Feeling of consumers regarding the evolution of their awareness on sustainability issues, since they buy the product through the channel | A. x >= 4 B. 3 =< x < 4 C. 2 =< x < 3 D. x < 2 | |

Appendix B

| Criteria/Indicator | Farm | Wholesaler | Retailer | Final Consumer |

|---|---|---|---|---|

| Commitment between VCA | A | CSA | ||

| Who sets the price? | B | |||

| On which basis? | C | |||

| Payment term | B | |||

| Commitment between VCA | D | D | Web-shop | |

| Who sets the price? | B | |||

| On which basis? | B | |||

| Payment term | A | A | ||

| Commitment between VCA | D | D | Organic shop short chain | |

| Who sets the price? | B | B | ||

| On which basis? | C | B | ||

| Payment term | B | A | ||

| Commitment between VCA | C | D | D | Organic shop long chain |

| Who sets the price? | C | C | B | |

| On which basis? | C | B | B | |

| Payment term | B | B | A | |

| Commitment between VCA | A | D | D | Mainstream chain |

| Who sets the price? | D | D | B | |

| On which basis? | D | B | B | |

| Payment term | B | C/D | A | |

| Criteria/Indicator | Farm | Co-op | Processor | Wholesaler | Retailer | Final Consumer |

|---|---|---|---|---|---|---|

| Commitment between VCA | B | CSA | ||||

| Who sets the price? | B | |||||

| On which basis? | C | |||||

| Payment term | A | |||||

| Commitment between VCA | D | D | Web-shop | |||

| Who sets the price? | B | |||||

| On which basis? | B | |||||

| Payment term | A | A | ||||

| Commitment between VCA | D | D | D | Organic shop short chain | ||

| Who sets the price? | B | C | B | |||

| On which basis? | C | B | B | |||

| Payment term | B | B | B | |||

| Commitment between VCA | A | A | D | D | D | Organic shop long chain |

| Who sets the price? | D | Nap | C | C | B | |

| On which basis? | D | B | B | B | B | |

| Payment term | B | B | B | B | A | |

| Commitment between VCA | B | B | D | Mainstream chain | ||

| Who sets the price? | D | C | B | |||

| On which basis? | C | B | B | |||

| Payment term | B | C/D | A | |||

| Criteria/Indicator | Farm | Wholesaler | Retailer | Chains |

|---|---|---|---|---|

| Trust in the trade relationship | [3.5–4] | CSA | ||

| Felt recognition | [4–5] | |||

| Felt understanding | [3.5–4] | |||

| Trust in the trade relationship | [4.5–5] | 5 | Web-shop | |

| Felt recognition | [3–5] | 5 | ||

| Felt understanding | [3–5] | 4 | ||

| Trust in the trade relationship | 5 | Nap | Organic shop short chain | |

| Felt recognition | 5 | 3 | ||

| Felt understanding | 5 | 2 | ||

| Trust in the trade relationship | 4 | 3 | Nap | Organic shop long chain |

| Felt recognition | 5 | 2 | 3 | |

| Felt understanding | 3 | 2 | 2 | |

| Criteria/Indicator | Farm | Co-op/processor  | Wholesaler | Retailer | Chains | |

|---|---|---|---|---|---|---|

| Trust in the trade relationship | [3–5] | CSA | ||||

| Felt recognition | [4–4.5] | |||||

| Felt understanding | [3–4] | |||||

| Trust in the trade relationship | 5 | Web-shop | ||||

| Felt recognition | [4.5–5] | |||||

| Felt understanding | [4–5] | |||||

| Trust in the trade relationship | 4 | 4 | Nap | Organic shop short chain | ||

| Felt recognition | 4 | 4 | 3 | |||

| Felt understanding | 4 | 3.5 | 2 | |||

| Trust in the trade relationship | 5 | 5 | 4 | Nap | Organic shop long chain | |

| Felt recognition | 5 | 4 | 4 | 3 | ||

| Felt understanding | 5 | 2 | 3.5 | 2 | ||

| Criteria/Indicator | Farm | Wholesaler | Retailer | Chains |

|---|---|---|---|---|

| Profitability/farmer income (market share) | C (100%)/C (80%)/B (50%) | CSA | ||

| Farms: use of other gainful activity | B/C/C | |||

| Provision of contracts with full benefits | C/C/D | |||

| Use of ‘low cost’ worked hours | B/D/C | |||

| Use of unstable work contracts | Nap/Nap/D | |||

| Profitability/farmer income (market share) | B (30%)/C (30%) | B | Web-shop | |

| Farms: use of other gainful activity | B/B | Nap | ||

| Provision of contracts with full benefits | A/D | A | ||

| Use of ‘low cost’ worked hours | C/D | B | ||

| Use of unstable work contracts | D/D | Nap | ||

| Profitability/farmer income (market share) | C (15%) | C | Organic shop short chain | |

| Farms: use of other gainful activity | B | Nap | ||

| Provision of contracts with full benefits | A | A | ||

| Use of ‘low cost’ worked hours | C | C | ||

| Use of unstable work contracts | C | C | ||

| Profitability/farmer income (market share) | C (2%) | B (<5%) | C | Organic shop long chain |

| Farms: use of other gainful activity | C | Nap | Nap | |

| Provision of contracts with full benefits | A | A | A | |

| Use of ‘low cost’ worked hours | B | B | C | |

| Use of unstable work contracts | C | B | C | |

| Criteria/Indicator | Farm | Co-op | Processor | Wholesaler | Retailer | Chains | |

|---|---|---|---|---|---|---|---|

| Profitability/farmer income (market share) | B (14%)/C (25%)/C (33%) | CSA | |||||

| Farms: use of other gainful activity | B/B/B | ||||||

| Provision of contracts with full benefits | A/D/D | ||||||

| Use of ‘low cost’ worked hours | B/D/D | ||||||

| Use of unstable work contracts | B/D/D | ||||||

| Profitability/farmer income (market share) | C (60%)/Nav (30%)/Nav (20%) | B | Web-shop | ||||

| Farms: use of other gainful activity | B/B/B | Nap | |||||

| Provision of contracts with full benefits | D/A/Nav | A | |||||

| Use of ‘low cost’ worked hours | D/B/Nav | B | |||||

| Use of unstable work contracts | Nap/B/Nav | B | |||||

| Profitability/farmer income (market share) | B (19%) | B (12%) | C | Organic shop short chain | |||

| Farms: use of other gainful activity | B | Nap | Nap | ||||

| Provision of contracts with full benefits | A | A | A | ||||

| Use of ‘low cost’ worked hours | B | B | C | ||||

| Use of unstable work contracts | B | B | C | ||||

| Profitability/farmer income (market share) | B (97%) | B (<1%) | B (<1%) | B (12%) | C | Organic shop long chain | |

| Farms: use of other gainful activity | B | Nap | Nap | Nap | Nap | ||

| Provision of contracts with full benefits | C | A | A | A | A | ||

| Use of ‘low cost’ worked hours | B | B | B | B | C | ||

| Use of unstable work contracts | Nap | B | B | B | C | ||

| Criteria/Indicators | CSA | Webshop | Organic Shop Chain | |

|---|---|---|---|---|

| Short | Long | |||

| Excessive work hours * | A/C/D | D/D | D | C |

| Weekly days off * | B/B/C | D/B | C | D |

| Annual leave * | B/B/B | B/B | B | B |

| Physical hardness | 4/2/2 | [2–3]/[3–5] | 2 | [1–4] |

| Psychological hardness | 3/3/4 | [3–4]/[2–5] | 2 | [2–5] |

| Concerns for occupational health problems | 5/3/4 | [3–5]/[3–5] | 3 | [2–5] |

| General work satisfaction | 5/5/4 | [4–5]/5 | 4 | 4 |

| Variety of tasks | 5/4/4 | [4–5]/5 | 5 | [3–5] |

| Autonomy | 5/5/4 | [4–5]/5 | 5 | [3–5] |

| Possibility of continuous learning | Nav/5/4 | [4–5]/5 | 5 | [2–4] |

| Respect and fair treatment by the supervisor | Nap/Nap/Nap | Nap/5 | Nap | [4–5] |

| Support from colleagues | Nap/Nap/4 | [4–5]/[4–5] | 4 | [4–5] |

| Recognition of the work by colleagues | Nap/Nap/5 | [4–5]/[4–5] | 3 | [4–5] |

| Work-life balance | Nav/4/3 | [3–5]/[-] | 2 | Nav |

| Work satisfaction/pay | 3/2 | [3–4]/[2–5] | Nav | [2–5] |

| Criteria/Indicators | CSA | Webshop | Organic Shop Chain | |

|---|---|---|---|---|

| Short | Long | |||

| Excessive work hours * | C/D/C | D/D/C | C | C |

| Weekly days off * | B/C/B | [B–D]/[B–C]/B | B | C |

| Annual leave * | B/B/C | B/B/B | B | B |

| Physical hardness | 3/[2–3]/2 | [2–3]/[1–3]/4 | 3 | 3 |

| Psychological hardness | 2/[3–4]/3 | 3/[1–3]/4 | 2 | 3 |

| Concerns for occupational health problems | 4/[4–5]/2 | [1–5]/[3–5]/4 | 4 | 3 |

| General work satisfaction | 5/[4;5]/3 | 5/[3–4]/5 | 5 | 4 |

| Variety of tasks | 4/5/4 | [4–5]/[4–5]/4 | 4 | 3 |

| Autonomy | 4/5/4 | 4/5/4 | 4 | 4 |

| Possibility of continuous learning | 5/5/4 | [3–4]/5/3 | 5 | 3 |

| Respect and fair treatment by the supervisor | Nap/Nap/4 | Nap/Nap/Nap | Nap | Nap |

| Support from colleagues | 4/5/2 | 5/[4–5]/5 | 4 | 2 |

| Recognition of the work by colleagues | 4/5/3 | 5/4/5 | 4 | 3 |

| Work-life balance | Nav/4/3 | 5/Nav/Nav | Nav | 3 |

| Work satisfaction/pay | 4/2/4 | 1/[3–4]/2 | 4 | 4 |

| Criteria/Indicators | CSA | Webshop | Organic Shop |

|---|---|---|---|

| Food safety | A | A | A |

| Taste | A | A | A |

| Product’s transparency | B | A | B |

| Product affordability | A | B | B |

| Accessibility of products to vulnerable people: | |||

| Representation of young people (under 25) | D | D | D |

| Representation of low educated people | D | D | D |

| Representation of low income people | C | D | C |

| Consumer education | A | A | B |

References

- International Labor Office. Non-Standard Employment around the World: Understanding Challenges, Shaping Prospects; International Labor Office (ILO): Geneva, Switzerland, 2016; p. 396. [Google Scholar]

- International Labor Office. World Employment and Social Outlook: Trends 2018; International Labor Office (ILO): Geneva, Switzerland, 2018; p. 82. [Google Scholar]

- International Labor Office. Agriculture; Plantations; Other Rural Sectors. Available online: https://www.ilo.org/global/industries-and-sectors/agriculture-plantations-other-rural-sectors/lang--en/index.htm (accessed on 11 January 2019).

- Eurofound (European Foundation for the Improvement of Living and Working Conditions). Agriculture Sector: Working Conditions and Job Quality; Eurofound: Loughlinstown, Ireland, 2014. [Google Scholar]

- Hill, B.; Bradley, D. Comparison of Farmers’ Incomes in the Eu Member States. In DG for Internal pOlicies, Policy Department, B: Structural and Cohesion Policies, Agriculture and Rural Development; European Parliament: Brussels, Belgium, 2015. [Google Scholar]

- Meert, H.; Van Huylenbroeck, G.; Vernimmen, T.; Bourgeois, M.; Van Hecke, E. Farm household survival strategies and diversification on marginal farms. J. Rural. Stud. 2005, 21, 81–97. [Google Scholar] [CrossRef]

- Vallerie, E. Crises. Trois Agriculteurs Sur Dix Gagnent Moins de 354 € Par Mois. Ouest France. 12 October 2016. Available online: http://www.ouest-france.fr/economie/agriculture/crises-trois-agriculteurs-sur-dix-gagnent-moins-de-354-eu-par-mois-4553326/ (accessed on 31 January 2017).

- INSEE France. Portrait Social; INSEE France: Paris, France, 2014. [Google Scholar]

- De Schutter, O. Addressing Concentration in Food Supply Chains the Role of Competition Law in Tackling the Abuse of Buyer Power; United Nations Human Rights Council: Geneva, Switzerland, 2010. [Google Scholar]

- Forssell, S.; Lankoski, L. The sustainability promise of alternative food networks: An examination through “alternative” characteristics. Agric. Hum. Values 2014, 32, 63–75. [Google Scholar] [CrossRef]

- World Fair Trade Organization History of Fair Trade. Available online: https://wfto.com/about-us/history-wfto/history-fair-trade (accessed on 13 January 2019).

- Wilshaw, R. Better Jobs in Better Supply Chains; Oxfam International: Oxford, UK, 2010; p. 21. [Google Scholar]

- Clean Cothes Campaign. Cashing in—Giant Retailers, Purchasing Practices, and Working Conditions in the Garment Industry; Clean Cothes Campaign: Amsterdam, The Netherlands, 2009. [Google Scholar]

- Locke, R.M. The Promise and Limits of Private Power: Promoting Labor Standards in a Global Economy; Cambridge University Press: New York, NY, USA, 2013. [Google Scholar]

- Rossi, A. Economic and Social Upgrading in Global Production Networks: The Case oftThe Garment Industry in Morocco; Institute of Development Studies, University of Sussex: Brighton, UK, 2011. [Google Scholar]

- Barrientos, S.; Smith, S. Do workers benefit from ethical trade? Assessing codes of labour practice in global production systems. Third World Q. 2007, 28, 713–729. [Google Scholar] [CrossRef]

- International Labor Office. World Employment and Social Outlook: The Changing Nature of Jobs; International Labor Office: Geneva, Switzerland, 2015; p. 162. [Google Scholar]

- Feschet, P. Analyse du Cycle de vie Sociale. Pour un Nouveau Cadre Conceptuel et Théorique; Université de Montpellier: Montpellier, France, 2014. [Google Scholar]

- Macombe, C. ACV Sociales, Effets Socio-Économiques des Chaines de Valeurs; FruiTrop Thema; CIRAD: Montpellier, France, 2013; ISBN 1256-544X. [Google Scholar]

- Sureau, S.; Neugebauer, S.; Achten, W.M.J. Different paths in social life cycle impact assessment (S-LCIA)–A classification of Type II or impact pathways approaches. Int. J. Life Cycle Assess. 2019. under review. [Google Scholar]

- Sim, S. Sustainable Food Supply Chains. PhD Thesis, University of Surrey, Guildford, UK, 2006. [Google Scholar]

- Bouzid, A.; Padilla, M. Analysis of social performance of the industrial tomatoes food chain in Algeria. New Medit 2014, 13, 60–65. [Google Scholar]

- Sureau, S.; Mazijn, B.; Garrido, S.R.; Achten, W.M.J. Social life-cycle assessment frameworks: A review of criteria and indicators proposed to assess social and socioeconomic impacts. Int. J. Life Cycle Assess. 2017, 23, 904–920. [Google Scholar] [CrossRef]

- Barrientos, S.; Gereffi, G.; Rossi, A. Economic and social upgrading in global production networks: A new paradigm for a changing world. Int. Labour Rev. 2011, 150, 319–340. [Google Scholar] [CrossRef]

- Community-Supported Agriculture. Wikipedia, 2019. Available online: https://en.wikipedia.org/w/index.php?title=Community-supported_agriculture&oldid=877797688 (accessed on 18 January 2019).

- Sureau, S.; Lohest, F.; Van Mol, J.; Bauler, T.; Wouter, M.J.A. What does the S-LCA participatory approach bring? A S-LCA methodological proposal applied to food products from belgian alternative chains (part 1). Resources 2019. under review. [Google Scholar]

- Brown, C.; Miller, S. The Impacts of Local Markets: A Review of Research on Farmers Markets and Community Supported Agriculture (CSA). Am. J. Agric. Econ. 2008, 90, 1296–1302. [Google Scholar] [CrossRef]

- Galt, R.E. The Moral Economy is a Double-Edged Sword: Explaining Farmers’ Earnings and Self-exploitation in Community-Supported Agriculture. Econ. Geogr. 2013, 89, 341–365. [Google Scholar] [CrossRef]

- Wangel, A. Slca Scenarios: Engaging Producers and Consumers in New Domestic Oyster Value Chains in Denmark, Proceedings of the Social LCA in Progress—4th SocSem, Montpellier, France, 19–21 November 2014; CIRAD: Montpellier, France, 2014. [Google Scholar]

- Sureau, S.; Achten, W.M.J. Including Governance and Economic Aspects to Assess and Explain Social Impacts: A Methodological Proposal for S-Lca. In Proceedings of the Pre-Proceedings, Pescara, Italy, 10–12 September 2018. [Google Scholar]

- Sureau, S. Entre Food Miles et Circuits Courts: Essai de Comparaison Des Circuits de Distribution du Bio en Belgique à Partir D’une Analyse de Cycle de Vie de Légumes Wallons du Champ à L’étal. Master’s Thesis, Université Libre de Bruxelles, Brussels, Belgium, 2014. [Google Scholar]

- Verbeke, P. Beknopt Marktoverzicht Voor Biologische Groenten in Vlaanderen en Europa; BioForum Vlaanderen: Antwerp, Belgium, 2015. [Google Scholar]

- Ramirez, P.K.S.; Petti, L.; Haberland, N.T.; Ugaya, C.M.L. Subcategory assessment method for social life cycle assessment. Part 1: Methodological framework. Int. J. Life Cycle Assess. 2014, 19, 1515–1523. [Google Scholar] [CrossRef]

- Tregear, A. Progressing knowledge in alternative and local food networks: Critical reflections and a research agenda. J. Rural Stud. 2011, 27, 419–430. [Google Scholar] [CrossRef]

- SPF Economie. Observatoire des Prix—Institut des Comptes Nationaux Mise à Jour de L’étude Sur la Filière Laitière; SPF Economie: Brussels, Belgium, 2014. [Google Scholar]

- Biowallonie. Biowallonie Les Chiffres du Bio 2017; Biowallonie: Namur, Belgique, 2018. [Google Scholar]

- Rizet, C.; Brown, M.; Leonardi, J.; Allen, J.; Piotrowska, M.; Cornelis, E.; Descamps, J. Chaînes Logistiques et Consommation D’énergie: Cas Des Meubles et Des Fruits et Légumes; INRETS: Noisy Le Grand, France, 2008; p. 179. [Google Scholar]

- La Spina, S. Nature et Progrès Belgique Pistes D’avenir Pour le Secteur Laitier Wallon—Compte-Rendu Des Rencontres Citoyennes Dans le Cadre du Projet Echangeons Sur Notre Agriculture; Nature et Progrès Belgique: Jambes, Belgique, 2016; p. 128. [Google Scholar]

- Filippi, M. Rémunération en coopératives agricoles: Les dessous du débat. RECMA 2016, 341, 119–125. [Google Scholar] [CrossRef]

- European Milk Board. European Milk Board Coopératives, Entre Mythe et Réalité; European Milk Board: Hamm, Germany, 2012; p. 31. [Google Scholar]

- VRT Wilt u 10 Cent Meer Betalen Voor uw Groenten en Fruit? Available online: https://www.vrt.be/vrtnws/nl/2018/04/11/pano--wil-u-10-cent-meer-betalen-voor-uw-groenten-en-fruit-/ (accessed on 26 March 2019).

- Lambaré, P.; Dervillé, M.; You, G. Quelles conditions d’accès au marché des éleveurs après les quotas laitiers? Econ. Rurale 2018, 364, 55–71. [Google Scholar] [CrossRef]

- International Institute for Sustainable Development (IISD) Contract Farming: Challenges and a New Tool for Success. Available online: https://www.iisd.org/blog/model-contract-farming (accessed on 2 February 2019).

- SPW Agriculture. SPW Agriculture Evolution de l’économie agricole et horticole de la Wallonie 2018; SPW Agriculture: Namur, Belgique, 2018. [Google Scholar]

- Observatoire Bruxellois de L’emploi Secteur Commerce—Actualité et Perspectives. In VEILLE & Anticipation Emploi, Formation et Intermédiation sur le Marché du Travail à BRUXELLES; Observatoire bruxellois de l’emploi: Bruxelles, Belgique, 2014.

- Merel, P.R. Efficiency and Redistribution in the French Comte Cheese Market. In Proceedings of the 103rd Seminar, Barcelona, Spain, 23–25 April 2007; European Association of Agricultural Economists: Barcelona, Spain, 2007. [Google Scholar]

- Dumont, A. Analyse Systémique des Conditions de Travail et D’emploi Dans la Production de Légumes Pour le Marché du Frais en Région Wallonne (Belgique), Dans Une Perspective de Transition Agroécologique; UCL—Université Catholique de Louvain: Ottignies-Louvain-la-Neuve, Belgium, 2017. [Google Scholar]

- Collège des Producteurs Se Rapprocher du Consommateur: Une Opportunité Pour des Prix Plus Justes en Agriculture? Available online: https://www.collegedesproducteurs.be/site/index.php/presse/399-article-se-rapprocher-du-consommateur-une-opportunite-pour-des-prix-plus-justes-en-agriculture (accessed on 27 March 2019).

| Criteria | Farm | Co-op/Wholesaler  | Retailer | Chain |

|---|---|---|---|---|

| Chain length | A | (a) CSA | ||

| Level of control of the organization | SP/co-op farms | |||

| Participation by other VCA | Nap | |||

| Competition management | Nap | |||

| Market power | A | |||

| Chain length | B | (b) Web-shop | ||

| Level of control of the organization | Mainly SP farms | Retail co-op | ||

| Participation by other VCA | Nap | B | ||

| Competition management | Nap | B | ||

| Market power | A | B | ||

| Chain length | B | (c) Organic shop short chain | ||

| Level of control of the organization | Co-op farm | Retail co-op | ||

| Participation by other VCA | Nap | B | ||

| Competition management | Nap | C | ||

| Market power | A | B | ||

| Chain length | C | (d) Organic shop long chain | ||

| Level of control of the organization | SP farm | Ltd wholesaler | Retail co-op | |

| Participation by other VCA | Nap | C | B | |

| Competition management | Nap | C | C | |

| Market power | A | C | B | |

| Chain length | C | Mainstream chain | ||

| Level of control of the organization | SP farm | Auction co-op | Plc retailer | |

| Participation by other VCA | Nap | A | C | |

| Competition management | Nap | C | C | |

| Market power | A | D | D | |

| Criteria | Farm | Co-op | Processor | Wholesaler | Retailer | Chain |

|---|---|---|---|---|---|---|

| Chain length | A | (a) CSA | ||||

| Level of control of the organization | SP/co-op farms | |||||

| Participation by other VCA | Nap | |||||

| Competition management | Nap | |||||

| Market power | A | |||||

| Chain length | B | (b) Web-shop | ||||

| Level of control of the organization | Mainly SP farms | Retail co-op | ||||

| Participation by other VCA | Nap | B | ||||

| Competition management | Nap | B | ||||

| Market power | A | B | ||||

| Chain length | C | (c) Organic shop short chain | ||||

| Level of control of the organization | SP farm | Ltd wholesaler | Retail co-op | |||

| Participation by other VCA | Nap | C | B | |||

| Competition management | Nap | C | C | |||

| Market power | A | C | B | |||

| Chain length | C | (d) Organic shop long chain | ||||

| Level of control of the organization | SP farm | Prod co-op | Plc dairy | Ltd wholesaler | Retail co-op | |

| Participation by other VCA | Nap | A | A | C | B | |

| Competition management | Nap | A | A | C | C | |

| Market power | A | D | C | C | B | |

| Chain length | B | Mainstream chain | ||||

| Level of control of the organization | SP farm | Plc dairy | Plc retailer | |||

| Participation by other VCA | Nap | C | C | |||

| Competition management | Nap | C | C | |||

| Market power | A | D | D | |||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sureau, S.; Lohest, F.; Van Mol, J.; Bauler, T.; Achten, W.M.J. How Do Chain Governance and Fair Trade Matter? A S-LCA Methodological Proposal Applied to Food Products from Belgian Alternative Chains (Part 2). Resources 2019, 8, 145. https://doi.org/10.3390/resources8030145

Sureau S, Lohest F, Van Mol J, Bauler T, Achten WMJ. How Do Chain Governance and Fair Trade Matter? A S-LCA Methodological Proposal Applied to Food Products from Belgian Alternative Chains (Part 2). Resources. 2019; 8(3):145. https://doi.org/10.3390/resources8030145

Chicago/Turabian StyleSureau, Solène, François Lohest, Joris Van Mol, Tom Bauler, and Wouter M. J. Achten. 2019. "How Do Chain Governance and Fair Trade Matter? A S-LCA Methodological Proposal Applied to Food Products from Belgian Alternative Chains (Part 2)" Resources 8, no. 3: 145. https://doi.org/10.3390/resources8030145

APA StyleSureau, S., Lohest, F., Van Mol, J., Bauler, T., & Achten, W. M. J. (2019). How Do Chain Governance and Fair Trade Matter? A S-LCA Methodological Proposal Applied to Food Products from Belgian Alternative Chains (Part 2). Resources, 8(3), 145. https://doi.org/10.3390/resources8030145