Asymmetric Price Transmission: A Case of Wheat in India

Abstract

:1. Introduction

2. Background

3. Data and Methodology

3.1. Johansen’s Approach to Cointegration

3.2. Error Correction Models (ECM)

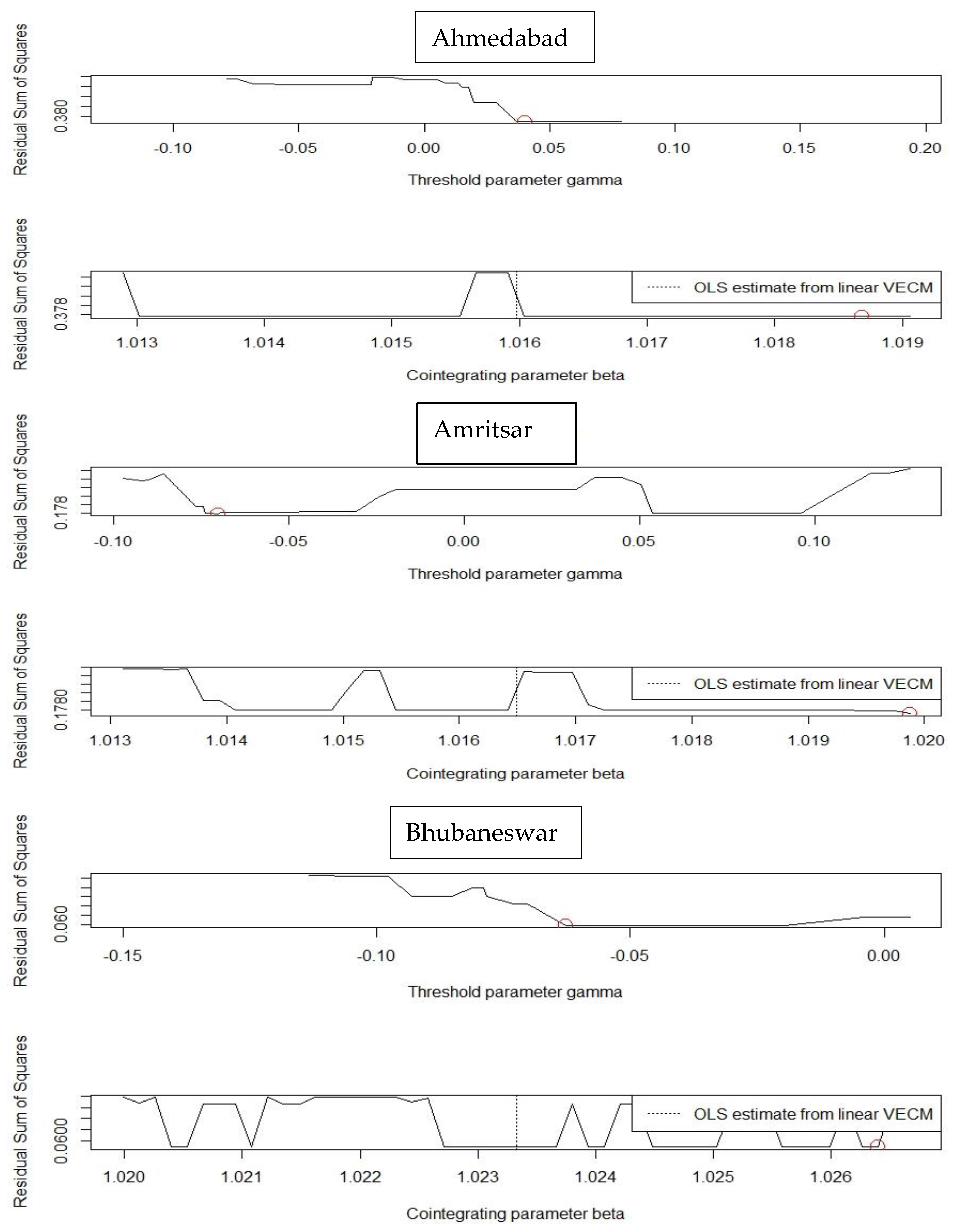

3.3. Asymmetric Cointegration

4. Results and Discussion

Cointegration in Price Series

5. Discussion

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Meyer, J.; Von Cramon-Taubadel, S. Asymmetric price transmission: A survey. J. Agric. Econ. 2004, 55, 581–611. [Google Scholar] [CrossRef] [Green Version]

- Perez-Mesa, J.; Galdeano-Gómez, E.; Aznar-Sánchez; José, A. Retail price rigidity in perishable food products: A case study. Span. J. Agric. Res. 2010, 8, 895–907. [Google Scholar] [CrossRef] [Green Version]

- Asche, F.; Jaffry, S.; Hartmann, J. Price transmission and market integration: Vertical and horizontal price linkages for salmon. Appl. Econ. 2007, 39, 2535–2545. [Google Scholar] [CrossRef]

- Das, S.; Bhattacharya, K. Price convergence across regions in India. Empir. Econ. 2008, 34, 299–313. [Google Scholar] [CrossRef] [Green Version]

- Jha, R.; Bhanu Murthy, K.V.; Sharma, A. Markets Market Integration in Wholesale Rice in India. In The Indian Economy Sixty Years after Independence; Jha, R., Ed.; Palgrave Macmillan: London, UK, 2008. [Google Scholar]

- Balaguer, J.; Ripollés, J. Are the transport fuel retail markets regionally integrated in Spain? Evidence from price transmission. Econ. Model. 2014, 42, 323–332. [Google Scholar] [CrossRef]

- Bhardwaj, S.P.; Paul, R.K.; Kumar, A. Future trading in soybean—An econometric analysis. J. Indian Soc. Agric. Stat. 2015, 69, 11–17. [Google Scholar]

- Hassouneh, I.; Serra, T.; Bojnec, Š. Nonlinearities in the Slovenian apple price transmission. Br. Food J. 2015, 117, 461–478. [Google Scholar] [CrossRef]

- Paul, R.K.; Saxena, R.; Chaurasia, S.; Zeeshan, M.; Rana, S. Examining export volatility, structural breaks in price volatility and linkages between domestic & export prices of onion in India. Agric. Econ. Res. Rev. 2015, 28, 101–116. [Google Scholar]

- Paul, R.K.; Sinha, K. Spatial market integration among major coffee markets in India. J. Indian Soc. Agric. Stat. 2015, 69, 281–287. [Google Scholar]

- Sergej, G.; Bojnec, S. Tourism price causalities: Case of an Adriatic country. Int. J. Tour. Res. 2018, 20, 82–87. [Google Scholar]

- Ricci, E.C.; Peri, M.; Baldi, L. The Effects of Agricultural Price Instability on Vertical Price Transmission: A Study of the Wheat Chain in Italy. Agriculture 2019, 9, 36. [Google Scholar] [CrossRef] [Green Version]

- Andrle, M.; Blagrave, P. Agricultural Market Integration in India. IMF Work. Pap. 2020, 20. [Google Scholar] [CrossRef]

- Gričar, S.; Bojnec, S.; Karadžić, V.; Backović, T. Tourism price normalities in two Adriatic east coast “euro” countries. Econ. Res. Ekon. Istraživanja 2021. [Google Scholar] [CrossRef]

- Ghosh, M. Spatial Integration of Wheat Markets in India: Evidence from Cointegration Tests. Oxf. Dev. Stud. 2003, 31, 159–171. [Google Scholar] [CrossRef]

- Gandhi, V.P.; Zhou, Z.Y. India’s Wheat Economy: Will Demand Be a Constraint or Supply? Econ. Political Wkly. 2004, 39, 4737–4746. [Google Scholar]

- Mukim, M.; Singh, K.; Kanakaraj, A. Market Integration, Transaction Costs and the Indian Wheat Market: A Systematic Study. Econ. Political Wkly. 2009, 44, 149–155. [Google Scholar]

- Hassanzoy, N.; Ito, S.; Isoda, H.; Amekawa, Y. A comparison of asymmetric price transmission from global to domestic markets between high and low quality grains: A case of Afghan rice markets. Econ. Bull. 2016, 36, 537–552. [Google Scholar]

- Hassanzoy, N.; Ito, S.; Isoda, H.; Amekawa, Y. Cointegration and spatial price transmission among wheat and wheat-flour markets in Afghanistan. Appl. Econ. 2017, 49, 2939–2955. [Google Scholar] [CrossRef]

- Enders, W.; Granger, C.W.J. Unit root tests and asymmetric adjustment with an example using the term structure of interest rates. J. Bus. Econ. Stat. 1998, 16, 304–311. [Google Scholar]

- Enders, W.; Siklos, P.L. Cointegration and threshold adjustment. J. Bus. Econ. Stat. 2016, 19, 166–176. [Google Scholar] [CrossRef] [Green Version]

- Hansen, B.E.; Seo, B. Testing for two regime threshold cointegration in vector error-correction models. J. Econom. 2002, 110, 293–318. [Google Scholar] [CrossRef] [Green Version]

- Seo, M.H. Estimation of nonlinear error correction models. Econ. Theory 2011, 27, 201–234. [Google Scholar]

- Wang, M.; Chan, N.H.; Yau, C.Y. Nonlinear error correction model and multiple-threshold cointegration. Stat. Sin. 2016, 26, 1479–1498. [Google Scholar] [CrossRef]

- Aghabeygi, M.; Antonioli, F.; Arfini, F. Assessing symmetric price transmission by using threshold cointegration in Iranian egg market. Br. Food J. 2021, 123, 2278–2288. [Google Scholar] [CrossRef]

- Rezitis, A.N.; Rokopanos, A. Asymmetric Price Transmission along the European Food Supply Chain and the CAP Health Check: A Panel Vector Error Correction Approach. J. Agric. Food Ind. Organ. 2019, 17, 20180002. [Google Scholar] [CrossRef]

- Deb, L.; Lee, Y.; Lee, S.H. Market Integration and Price Transmission in the Vertical Supply Chain of Rice: An Evidence from Bangladesh. Agriculture 2020, 10, 271. [Google Scholar] [CrossRef]

- Wiseman, T.; Luckstead, J.; Durand-Morat, A. Asymmetric Exchange Rate Pass-Through in Southeast Asian Rice Trade. J. Agric. Appl. Econ. 2021, 53, 341–374. [Google Scholar] [CrossRef]

- Mallick, L.; Behera, S.R.; Murthy, R.R. Dynamics of capital account and current account in India: Evidence from threshold cointegration with asymmetric error correction. Appl. Econ. Lett. 2021, 1–6. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Mutascu, M. The revenues-spending nexus in Romania: A TAR and MTAR approach. Econ. Res. Ekon. Istraživanja 2015, 29, 735–745. [Google Scholar] [CrossRef] [Green Version]

- Bagnai, A.; Opsina, C.A.M. Asymmetries, Outliers, and Structural Stability in the US Gasoline Market. Energy Econ. 2018, 69, 250–260. [Google Scholar] [CrossRef]

- DCA. Department of Consumer Affairs, Ministry of Consumer Affairs, Food and Public Distribution, Government of India. 2020. Available online: https://fcainfoweb.nic.in/reports/report_menu_web.aspx (accessed on 12 October 2020).

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Phillips, P.C.B.; Perron, P. Testing fora unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Kwiatkowski, D.; Phillips, P.C.B.; Schmidt, P.; Shin, Y. Testing the null hypothesis of stationarity against the alternative of a unit root. J. Econom. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Johansen, S. A statistical analysis of cointegration vectors. J. Econ. Dyn. Control. 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Tong, H. Threshold models in time series analysis—30 years on. Stat. Its Interface 2011, 4, 107–118. [Google Scholar] [CrossRef] [Green Version]

- Chan, K.S. Consistency and limiting distribution of the least squares estimator of a threshold autoregressive model. Ann. Stat. 1993, 21, 520–533. [Google Scholar] [CrossRef]

- Brock, W.; Dechert, D.; Scheinkman, J.; LeBaron, B. A test for independence based on the correlation dimension. Econom. Rev. 1996, 15, 197–235. [Google Scholar] [CrossRef]

- Granger, C.W.J. Some recent developments in the concept of causality. J. Econom. 1988, 39, 199–211. [Google Scholar] [CrossRef]

| Markets | Wholesale Price | Retail Price | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | Max | Min | SD | CV(%) | Mean | Median | Max | Min | SD | CV(%) | |

| Ahmedabad | 1647.75 | 1650.00 | 2000.00 | 1100.00 | 302.89 | 18.38 | 1851.49 | 1900.00 | 2300.00 | 1200 | 318.11 | 17.18 |

| Amritsar | 1491.28 | 1500.00 | 1900.00 | 1050.00 | 229.44 | 15.39 | 1688.93 | 1800.00 | 2200.00 | 1100 | 297.61 | 17.62 |

| Bengaluru | 2320.10 | 2500.00 | 2800.00 | 1671.43 | 418.44 | 18.04 | 2582.08 | 2700.00 | 3400.00 | 1800 | 530.42 | 20.54 |

| Bhopal | 1457.20 | 1500.00 | 1700.00 | 1050.00 | 170.97 | 11.73 | 1638.73 | 1700.00 | 2000.00 | 1100 | 234.91 | 14.33 |

| Bhubaneswar | 1512.65 | 1580.00 | 1580.00 | 1210.00 | 107.36 | 7.10 | 1803.18 | 1800.00 | 2014.29 | 1400 | 222.5 | 12.34 |

| Chennai | 2298.40 | 2342.86 | 2814.29 | 1800.00 | 204.42 | 8.89 | 2794.45 | 3000.00 | 3500.00 | 2000 | 439.36 | 15.72 |

| Dehradun | 1511.74 | 1512.86 | 1880.00 | 1120.00 | 218.85 | 14.48 | 1709.16 | 1600.00 | 2200.00 | 1200 | 310.24 | 18.15 |

| Delhi | 1590.37 | 1671.43 | 2227.86 | 1138.57 | 244.90 | 15.40 | 1800.62 | 1900.00 | 2414.29 | 1300 | 234.88 | 13.04 |

| Hyderabad | 2359.37 | 2400.00 | 2700.00 | 1490.71 | 356.55 | 15.11 | 2581.75 | 2700.00 | 2900.00 | 1700 | 353.88 | 13.71 |

| Jaipur | 1570.16 | 1600.00 | 2250.00 | 1150.00 | 233.97 | 14.90 | 1709.90 | 1700.00 | 2600.00 | 1300 | 256.55 | 15.00 |

| Jammu | 1562.63 | 1617.14 | 2560.00 | 1000.00 | 253.82 | 16.24 | 1698.18 | 1700.00 | 2200.00 | 1100 | 259.59 | 15.29 |

| Lucknow | 1445.64 | 1450.00 | 1900.00 | 1035.71 | 215.18 | 14.88 | 1576.59 | 1600.00 | 2000.00 | 1100 | 213.26 | 13.53 |

| Ludhiana | 1489.15 | 1350.00 | 1900.00 | 1114.29 | 242.65 | 16.29 | 1601.62 | 1592.86 | 2000.00 | 1200 | 243.15 | 15.18 |

| Mumbai | 2102.12 | 2200.00 | 2628.57 | 1453.57 | 313.44 | 14.91 | 2614.76 | 2700.00 | 3514.29 | 1700 | 447.64 | 17.12 |

| Patna | 1518.12 | 1600.00 | 2200.00 | 1100.00 | 238.40 | 15.70 | 1730.36 | 1800.00 | 2400.00 | 1200 | 292.66 | 16.91 |

| Thiruvananthapuram | 2331.98 | 2400.00 | 3200.00 | 1500.00 | 405.95 | 17.41 | 2557.70 | 2600.00 | 3500.00 | 1700 | 413.19 | 16.15 |

| Maximum Price | 2833.35 | 2850.00 | 4021.43 | 1833.00 | 546.88 | 19.30 | 3109.81 | 3100.00 | 4428.57 | 2100 | 632.25 | 20.33 |

| Minimum Price | 1276.89 | 1337.14 | 1471.43 | 100.00 | 169.09 | 13.24 | 1401.84 | 1500.00 | 1671.43 | 1000 | 177.20 | 12.64 |

| Modal Price | 1717.69 | 1667.86 | 2714.29 | 1100.00 | 395.82 | 23.04 | 1712.87 | 1797.64 | 2478.57 | 1200 | 267.59 | 15.62 |

| Markets | Original Series | Differenced Series | ||||

|---|---|---|---|---|---|---|

| Wholesale Price | ||||||

| ADF Test Statistic | PP Test Statistic | KPSS Test Statistic | ADF Test Statistic | PP Test Statistic | KPSS Test Statistic | |

| Ahmedabad | −1.43 | −1.44 | 114.11 * | −15.56 * | −15.74 * | 0.89 |

| Amritsar | −0.46 | −0.49 | 136.34 * | −14.92 * | −14.77 * | 1.46 |

| Bengaluru | −0.70 | −0.55 | 116.30 * | −15.37 * | −16.64 * | 0.99 |

| Bhopal | −0.71 | −0.82 | 178.78 * | −15.13 * | −14.31 * | 0.88 |

| Bhubaneswar | −1.89 | −1.77 | 295.55 * | −14.00 * | −13.90 * | 0.29 |

| Chennai | −2.48 | −2.78 | 235.84 * | −17.01 * | −14.80 * | 0.46 |

| Dehradun | −0.90 | −0.69 | 144.90 * | −13.66 * | −13.28 * | 1.16 |

| Delhi | −1.56 | −1.46 | 136.22 * | −15.00 * | −15.04 * | 0.75 |

| Hyderabad | −2.13 | −2.10 | 138.80 * | −18.50 * | −18.50 * | 1.22 |

| Jaipur | −1.71 | −1.66 | 140.77 * | −14.26 * | −14.27 * | 0.89 |

| Jammu | −1.80 | −2.45 | 129.14 * | −15.21 * | −21.69 * | 0.33 |

| Lucknow | −1.75 | −1.50 | 140.92 * | −13.14 * | −13.86 * | 1.02 |

| Ludhiana | −0.15 | −0.19 | 128.73 * | −15.79 * | −21.58 * | 1.31 |

| Maximum Price | −0.82 | −1.58 | 108.68 * | −18.52 * | −77.21 * | 0.71 |

| Minimum Price | −2.89 | −3.14 | 158.40 * | −20.26 * | −22.65 * | -0.01 |

| Modal Price | −2.64 | −3.95 | 91.03 * | −12.85 * | −41.55 * | 0.03 |

| Mumbai | −1.37 | −1.02 | 140.68 * | −14.51 * | −15.25 * | 0.89 |

| Patna | −2.01 | −2.06 | 133.58 * | −23.90 * | −24.12 * | 0.33 |

| Thiruvananthapuram | −1.97 | −2.10 | 120.50 * | −17.09 * | −16.53 * | 0.31 |

| Retail Price | ||||||

| Ahmedabad | −1.32 | −1.24 | 122.09 * | −14.47 * | −17.00 * | 0.31 |

| Amritsar | −1.43 | −1.23 | 119.04 * | −14.73 * | −14.08 * | 0.98 |

| Bengaluru | −0.32 | −0.26 | 102.11 * | −15.56 * | −15.52 * | 1.53 |

| Bhopal | −0.94 | −1.02 | 146.33 * | −10.61 * | −14.20 * | 0.91 |

| Bhubaneswar | −0.84 | −0.83 | 170.00 * | −13.44 * | −13.33 * | 0.89 |

| Chennai | −1.59 | −1.58 | 133.41 * | −15.52 * | −14.54 * | 1.08 |

| Dehradun | −0.69 | −0.79 | 115.56 * | −12.12 * | −13.87 * | 1.02 |

| Delhi | −2.02 | −1.43 | 160.81 * | −13.96 * | −13.72 * | 0.70 |

| Hyderabad | −2.55 | −2.49 | 153.03 * | −13.80 * | −13.09 * | 1.44 |

| Jaipur | −2.07 | −2.27 | 139.81 * | −15.30 * | −18.30 * | 0.51 |

| Jammu | −1.38 | −1.27 | 137.22 * | −9.34 * | −15.40 * | 0.70 |

| Lucknow | −1.45 | −1.45 | 155.07 * | −16.67 * | −15.30 * | 0.79 |

| Ludhiana | −0.92 | −0.66 | 138.17 * | −16.03 * | −18.52 * | 0.95 |

| Maximum Price | −0.30 | −0.09 | 103.17 * | −19.55 * | −31.50 * | 0.99 |

| Minimum Price | −1.83 | −1.69 | 165.94 * | −20.83 * | −20.98 * | 0.22 |

| Modal Price | −2.27 | −3.24 | 134.27 * | −21.57 * | −62.84 * | 0.20 |

| Mumbai | −1.37 | −1.23 | 122.53 * | −12.47 * | −17.59 * | 0.85 |

| Patna | −1.55 | −1.42 | 124.02 * | −10.28 * | −16.48 * | 1.24 |

| Thiruvananthapuram | −1.80 | −1.85 | 129.85 * | −16.67 * | −18.33 * | 0.13 |

| No. of Cointegrating Equations | Retail Price | |||

|---|---|---|---|---|

| Test Statistics (Trace) | 5% Critical Value | Test Statistics (Eigen) | 5% Critical Value | |

| None | 392.86 | 277.39 | 95.04 | 68.27 |

| At most 1 | 297.82 | 232.49 | 75.47 | 62.42 |

| At most 2 | 222.35 | 192.84 | 53.70 | 57.00 |

| At most 3 | 168.65 | 157.11 | 40.3 | 51.07 |

| At most 4 | 128.35 | 124.25 | 37.76 | 44.91 |

| At most 5 | 90.59 | 90.39 | 33.95 | 39.43 |

| At most 6 | 56.64 | 70.60 | 23.41 | 33.32 |

| At most 7 | 33.23 | 48.28 | 14.69 | 27.14 |

| At most 8 | 18.54 | 31.52 | 11.45 | 21.07 |

| At most 9 | 7.09 | 17.95 | 6.91 | 14.90 |

| At most 10 | 0.18 | 8.18 | 0.18 | 8.18 |

| Wholesale Price | ||||

| None | 438.07 | 277.39 | 126.4 | 68.27 |

| At most 1 | 311.67 | 232.49 | 79.39 | 62.42 |

| At most 2 | 232.28 | 192.84 | 73.67 | 57.00 |

| At most 3 | 158.61 | 157.11 | 50.88 | 51.07 |

| At most 4 | 107.73 | 124.25 | 34.12 | 44.91 |

| At most 5 | 73.61 | 90.39 | 25.90 | 39.43 |

| At most 6 | 47.71 | 70.60 | 17.71 | 33.32 |

| At most 7 | 30.00 | 48.28 | 14.84 | 27.14 |

| At most 8 | 15.16 | 31.52 | 8.71 | 21.07 |

| At most 9 | 6.45 | 17.95 | 6.34 | 14.90 |

| At most 10 | 0.11 | 8.18 | 0.11 | 8.18 |

| No. of Cointegrating Equations | Eigen Value | Test Statistics (Eigen) | 5% Critical Value | Test Statistics (Trace) | 5% Critical Value |

|---|---|---|---|---|---|

| Delhi | |||||

| None | 0.0054 | 22.43 | 14.90 | 24.85 | 17.95 |

| At most 1 | 0.0499 | 2.41 | 8.18 | 2.41 | 8.18 |

| Ahmedabad | |||||

| None | 0.0061 | 43.77 | 14.90 | 46.48 | 17.95 |

| At most 1 | 0.0951 | 2.71 | 8.18 | 2.71 | 8.18 |

| Amritsar | |||||

| None | 0.0023 | 9.54 | 14.90 | 10.58 | 17.95 |

| At most 1 | 0.0215 | 1.04 | 8.18 | 1.04 | 8.18 |

| Bengaluru | |||||

| None | 0.0016 | 8.75 | 14.90 | 9.47 | 17.95 |

| At most 1 | 0.0197 | 0.72 | 8.18 | 0.72 | 8.18 |

| Bhopal | |||||

| None | 0.0030 | 42.07 | 14.90 | 43.40 | 17.95 |

| At most 1 | 0.0915 | 1.33 | 8.18 | 1.33 | 8.18 |

| Bhubaneswar | |||||

| None | 0.0025 | 14.63 | 14.90 | 15.73 | 17.95 |

| At most 1 | 0.0328 | 1.10 | 8.18 | 1.10 | 8.18 |

| Chennai | |||||

| None | 0.0070 | 25.69 | 14.90 | 28.77 | 17.95 |

| At most 1 | 0.0569 | 3.09 | 8.18 | 3.09 | 8.18 |

| Dehradun | |||||

| None | 0.0026 | 13.67 | 14.90 | 14.84 | 17.95 |

| At most 1 | 0.0307 | 1.16 | 8.18 | 1.16 | 8.18 |

| Hyderabad | |||||

| None | 0.0089 | 37.59 | 14.90 | 41.53 | 17.95 |

| At most 1 | 0.0822 | 4.00 | 8.18 | 4.00 | 8.18 |

| Jaipur | |||||

| None | 0.0055 | 58.65 | 14.90 | 61.09 | 17.95 |

| At most 1 | 0.1253 | 2.44 | 8.18 | 2.44 | 8.18 |

| Jammu | |||||

| None | 0.0064 | 134.00 | 14.90 | 136.80 | 17.95 |

| At most 1 | 0.2634 | 2.84 | 8.18 | 2.84 | 8.18 |

| Lucknow | |||||

| None | 0.0068 | 52.58 | 14.90 | 55.61 | 17.95 |

| At most 1 | 0.1131 | 3.03 | 8.18 | 3.03 | 8.18 |

| Ludhiana | |||||

| None | 0.0015 | 31.19 | 14.90 | 31.88 | 17.95 |

| At most 1 | 0.0687 | 0.69 | 8.18 | 0.69 | 8.18 |

| Mumbai | |||||

| None | 0.0049 | 33.22 | 14.90 | 35.40 | 17.95 |

| At most 1 | 0.0730 | 2.18 | 8.18 | 2.18 | 8.18 |

| Patna | |||||

| None | 0.0061 | 21.00 | 14.90 | 23.67 | 17.95 |

| At most 1 | 0.0467 | 2.69 | 8.18 | 2.69 | 8.18 |

| Thiruvananthapuram | |||||

| None | 0.0101 | 52.46 | 14.90 | 56.95 | 17.95 |

| At most 1 | 0.1128 | 4.49 | 8.18 | 4.49 | 8.18 |

| Markets | Dimension | Epsilon (1) | Epsilon (2) | Epsilon (3) | Epsilon (4) |

|---|---|---|---|---|---|

| Ahmedabad_Retail | 2 | 600.67 | 173.78 | 117.59 | 70.00 |

| 3 | 1129.23 | 215.99 | 133.03 | 70.30 | |

| Ahmedabad_Wholesale | 2 | 2173.76 | 319.87 | 108.27 | 72.50 |

| 3 | 3950.85 | 431.49 | 119.93 | 72.39 | |

| Amritsar_Retail | 2 | 93.81 | 117.40 | 91.05 | 69.29 |

| 3 | 149.09 | 160.84 | 102.21 | 69.63 | |

| Amritsar_Wholesale | 2 | 180.06 | 136.23 | 88.66 | 73.80 |

| 3 | 329.51 | 181.74 | 96.50 | 71.81 | |

| Bengaluru_Retail | 2 | 292.59 | 323.93 | 131.92 | 59.34 |

| 3 | 522.18 | 439.46 | 147.52 | 57.72 | |

| Bengaluru_Wholesale | 2 | 244.40 | 1255.52 | 181.84 | 72.96 |

| 3 | 365.17 | 1663.65 | 217.31 | 73.67 | |

| Bhopal_Retail | 2 | 137.42 | 165.38 | 101.25 | 62.23 |

| 3 | 222.07 | 220.16 | 111.85 | 61.05 | |

| Bhopal_Wholesale | 2 | 209.93 | 180.14 | 101.56 | 64.07 |

| 3 | 421.36 | 247.94 | 111.55 | 62.80 | |

| Bhubaneshwar_Retail | 2 | 166.81 | 84.49 | 74.55 | 61.24 |

| 3 | 277.31 | 100.98 | 81.61 | 62.74 | |

| Bhubaneshwar_Wholesale | 2 | 36.89 | 51.99 | 45.93 | 35.62 |

| 3 | 47.80 | 63.11 | 50.41 | 35.26 | |

| Chennai_Retail | 2 | 181.38 | 187.00 | 103.10 | 73.61 |

| 3 | 295.91 | 241.48 | 116.06 | 74.61 | |

| Chennai_Wholesale | 2 | 100.65 | 85.42 | 63.95 | 53.87 |

| 3 | 156.00 | 103.09 | 67.05 | 51.98 | |

| Dehradun_Retail | 2 | 669.71 | 166.61 | 107.52 | 73.71 |

| 3 | 1230.74 | 210.35 | 121.92 | 72.53 | |

| Dehradun_Wholesale | 2 | 539.88 | 199.04 | 90.49 | 75.48 |

| 3 | 1033.83 | 276.57 | 96.11 | 73.98 | |

| Delhi_Retail | 2 | 88.11 | 91.31 | 72.94 | 61.73 |

| 3 | 135.25 | 115.87 | 80.75 | 61.20 | |

| Delhi_Wholesale | 2 | 113.22 | 92.92 | 83.71 | 70.42 |

| 3 | 177.46 | 118.92 | 95.89 | 70.09 | |

| Hyderabad_Retail | 2 | 72.33 | 65.15 | 57.72 | 50.04 |

| 3 | 118.83 | 80.06 | 62.26 | 49.80 | |

| Hyderabad_Wholesale | 2 | 103.98 | 69.05 | 64.85 | 52.94 |

| 3 | 185.87 | 83.48 | 71.01 | 53.02 | |

| Jaipur_Retail | 2 | 158.78 | 97.03 | 65.89 | 52.97 |

| 3 | 277.57 | 125.27 | 71.73 | 50.48 | |

| Jaipur_Wholesale | 2 | 183.13 | 102.85 | 72.85 | 64.64 |

| 3 | 315.12 | 133.01 | 79.83 | 63.58 | |

| Jammu_Retail | 2 | 111.30 | 129.08 | 68.34 | 66.87 |

| 3 | 194.38 | 173.25 | 76.45 | 63.79 | |

| Jammu_Wholesale | 2 | 109.77 | 99.42 | 68.60 | 58.83 |

| 3 | 191.54 | 129.57 | 74.86 | 56.69 | |

| Lucknow_Retail | 2 | 125.41 | 117.73 | 79.20 | 67.49 |

| 3 | 194.25 | 143.68 | 84.73 | 65.61 | |

| Lucknow_Wholesale | 2 | 390.74 | 164.18 | 92.79 | 74.23 |

| 3 | 741.61 | 216.04 | 100.56 | 73.06 | |

| Ludhiana_Retail | 2 | 262.12 | 937.45 | 179.97 | 84.53 |

| 3 | 397.97 | 1233.07 | 214.37 | 88.56 | |

| Ludhiana_Wholesale | 2 | 247.35 | 683.00 | 211.98 | 81.38 |

| 3 | 360.43 | 901.09 | 260.63 | 85.69 | |

| Maximum_Price_Retail | 2 | 493.20 | 175.26 | 96.65 | 71.00 |

| 3 | 939.21 | 234.04 | 105.91 | 70.88 | |

| Maximum_Price_Wholesale | 2 | 677.41 | 189.46 | 92.78 | 70.06 |

| 3 | 1324.58 | 253.50 | 103.21 | 71.68 | |

| Minimum_Price_Retail | 2 | 79.60 | 112.47 | 83.43 | 57.51 |

| 3 | 141.35 | 146.67 | 92.67 | 57.06 | |

| Minimum_Price_Wholesale | 2 | 80.12 | 76.01 | 60.34 | 44.10 |

| 3 | 121.74 | 90.87 | 65.72 | 43.64 | |

| Modal_Price_Retail | 2 | 118.78 | 118.55 | 66.71 | 47.41 |

| 3 | 201.10 | 155.97 | 72.70 | 48.17 | |

| Modal_Price_Wholesale | 2 | 143.71 | 60.58 | 42.94 | 36.59 |

| 3 | 236.28 | 73.09 | 45.92 | 36.09 | |

| Mumbai_Retail | 2 | 294.76 | 165.60 | 94.41 | 75.08 |

| 3 | 547.07 | 217.46 | 102.39 | 74.63 | |

| Mumbai_Wholesale | 2 | 129.13 | 132.31 | 89.78 | 66.80 |

| 3 | 205.21 | 166.97 | 100.58 | 67.68 | |

| Patna_Retail | 2 | 388.63 | 277.51 | 91.02 | 74.61 |

| 3 | 733.61 | 396.26 | 98.42 | 74.56 | |

| Patna_Wholesale | 2 | 199.47 | 191.24 | 84.96 | 61.60 |

| 3 | 357.21 | 254.22 | 94.33 | 60.17 | |

| Thiruvananthapuram_Retail | 2 | 203.09 | 111.99 | 81.55 | 64.48 |

| 3 | 349.40 | 141.54 | 88.10 | 63.15 | |

| Thiruvananthapuram_Wholesale | 2 | 224.43 | 227.39 | 102.92 | 67.89 |

| 3 | 387.76 | 290.76 | 113.16 | 66.63 |

| Markets | MTAR | |||

|---|---|---|---|---|

| PHI | APT | |||

| F Value | Pr. Value | F Value | Pr. Value | |

| Ahmedabad | 14.60 | <0.05 | 3.55 | 0.05 |

| Amritsar | 6.03 | <0.05 | 2.43 | 0.11 |

| Bengaluru | 3.48 | <0.05 | 3.05 | 0.08 |

| Bhopal | 26.91 | <0.05 | 4.88 | <0.05 |

| Bhubaneswar | 6.38 | <0.05 | 0.02 | 0.88 |

| Chennai | 11.05 | <0.05 | 12.74 | <0.05 |

| Dehradun | 4.61 | <0.05 | 1.17 | 0.27 |

| Delhi | 13.33 | <0.05 | 4.44 | <0.05 |

| Hyderabad | 63.31 | <0.05 | 96.47 | <0.05 |

| Jaipur | 42.80 | <0.05 | 47.64 | <0.05 |

| Jammu | 49.47 | <0.05 | 38.20 | <0.05 |

| Lucknow | 40.52 | <0.05 | 32.62 | <0.05 |

| Ludhiana | 41.19 | <0.05 | 54.91 | <0.05 |

| Mumbai | 7.80 | <0.05 | 1.93 | 0.16 |

| Patna | 43.31 | <0.05 | 51.02 | <0.05 |

| Thiruvananthapuram | 17.38 | <0.05 | 1.13 | 0.28 |

| Maximum | 31.52 | <0.05 | 23.55 | <0.05 |

| Minimum | 35.72 | <0.05 | 41.16 | <0.05 |

| Modal | 20.84 | <0.05 | 4.82 | <0.05 |

| Markets | Test Statistic | p Value |

|---|---|---|

| Ahmedabad | 17.27 | 0.03 |

| Amritsar | 10.88 | 0.77 |

| Bengaluru | 11.30 | 0.49 |

| Bhopal | 21.54 | 0.01 |

| Bhubaneswar | 14.07 | 0.39 |

| Chennai | 10.70 | 0.56 |

| Dehradun | 13.72 | 0.35 |

| Delhi | 22.66 | 0.01 |

| Hyderabad | 18.90 | 0.02 |

| Jaipur | 15.69 | 0.29 |

| Jammu | 22.91 | 0.01 |

| Lucknow | 9.36 | 0.88 |

| Ludhiana | 11.55 | 0.75 |

| Mumbai | 17.97 | 0.03 |

| Patna | 19.00 | 0.02 |

| Thiruvananthapuram | 19.17 | 0.02 |

| Maximum | 11.29 | 0.81 |

| Minimum | 25.77 | 0.01 |

| Modal | 35.03 | 0.001 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Paul, R.K.; Karak, T. Asymmetric Price Transmission: A Case of Wheat in India. Agriculture 2022, 12, 410. https://doi.org/10.3390/agriculture12030410

Paul RK, Karak T. Asymmetric Price Transmission: A Case of Wheat in India. Agriculture. 2022; 12(3):410. https://doi.org/10.3390/agriculture12030410

Chicago/Turabian StylePaul, Ranjit Kumar, and Tanmoy Karak. 2022. "Asymmetric Price Transmission: A Case of Wheat in India" Agriculture 12, no. 3: 410. https://doi.org/10.3390/agriculture12030410