Cap Rate as the Interpretative Variable of the Urban Real Estate Capital Asset: A Comparison of Different Sub-Market Definitions in Palermo, Italy

Abstract

:1. Introduction

1.1. General Issues and Aims

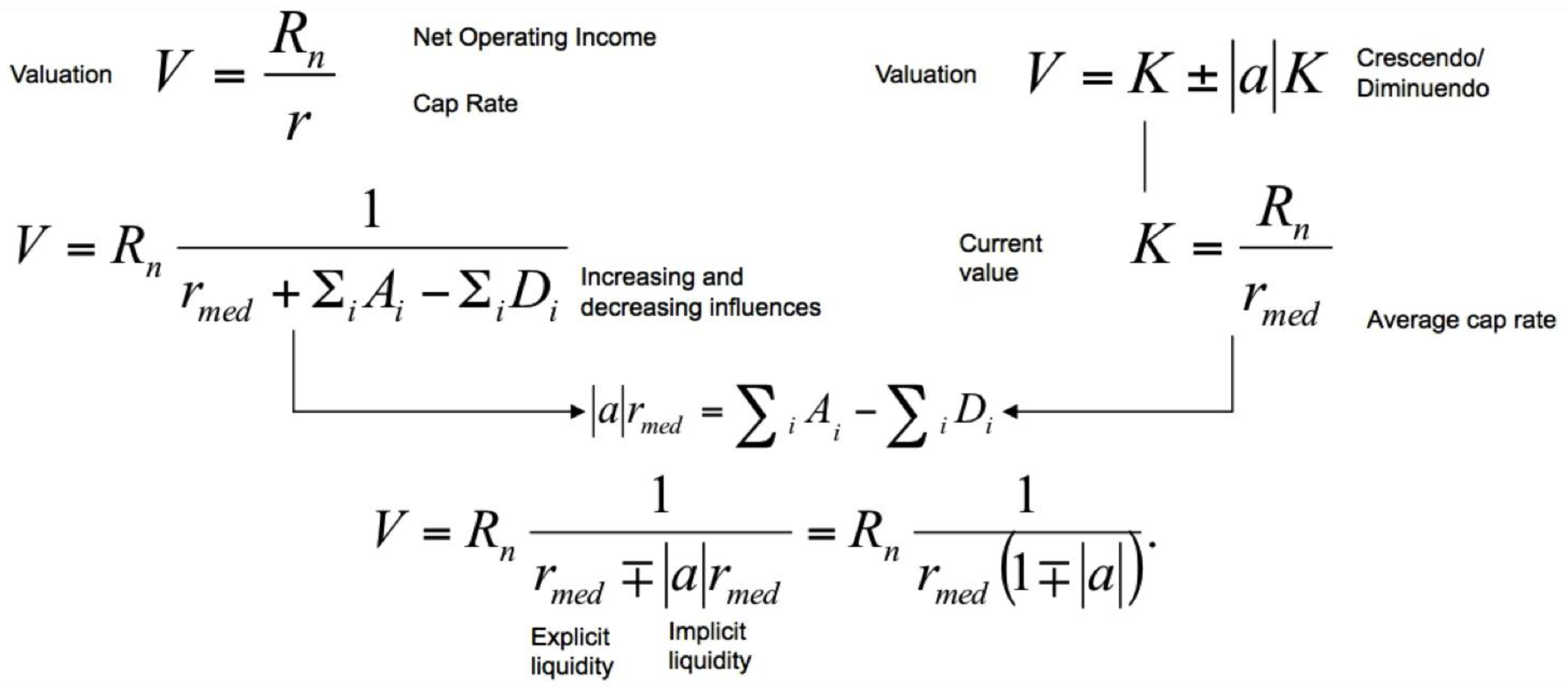

1.2. Capital Theory and Cap Rate (Best) Practice

1.3. Proposals

2. Methodology for Appraising Cap Rate

- Real estate market survey and database;

- Definition of the submarkets:

- 2.1.

- by cluster (application of cluster analysis);

- 2.2.

- by neighbourhood (selection on the basis of location);

- Appraisal and comparison of the cap rates of the submarket (by cluster and by neighbourhood).

2.1. Real Estate Market Survey and Database

2.2. Cluster Analysis and Housing Submarkets

2.2.1. Submarkets by Cluster

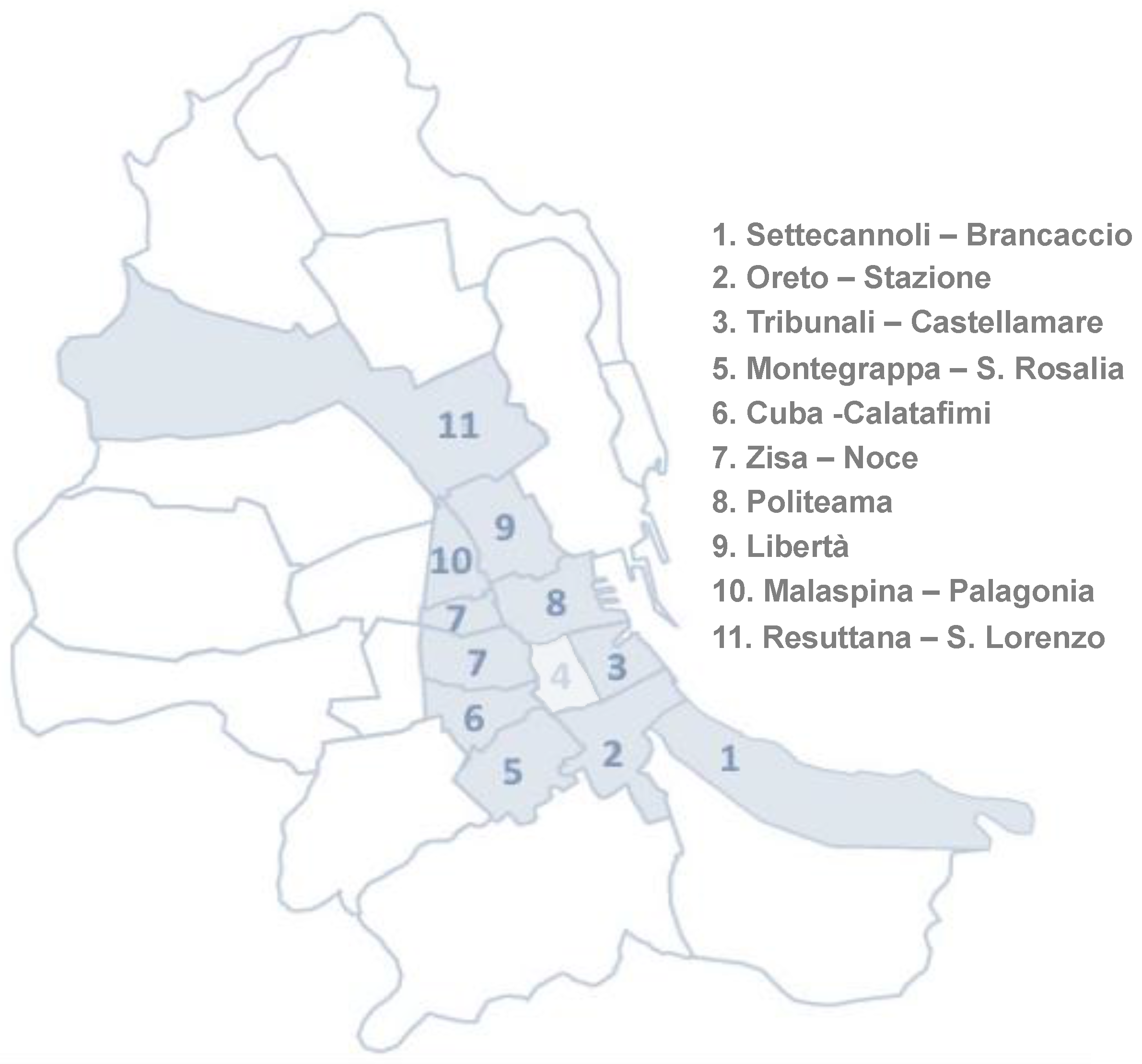

2.2.2. Submarkets by Neighbourhood

2.3. Cap Rate Appraisal

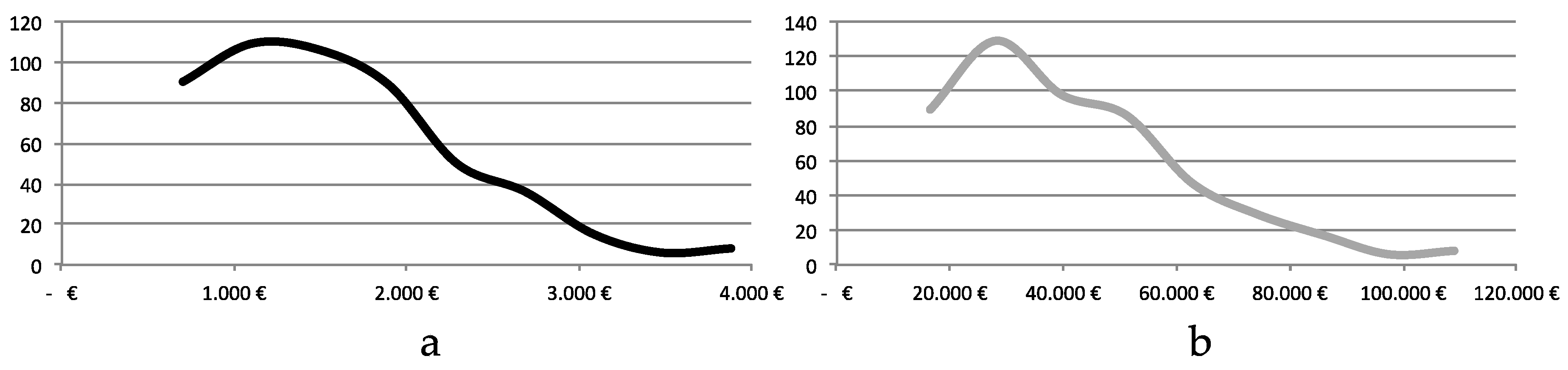

2.3.1. Appraisal of the Rent in the Partition by Cluster

- In order for point to be a core point it needs to have a minimum number of points within its -neighbourhood.

- | (core point condition).

- and is density-reachable from with respect to and , then .Two points belongs to the same cluster , i.e., is density-connected to with respect to the given distance and the number of points within that given distance.

- is density-connected to with respect to and .

- all points inside are mutually density-connected;

- if a point is density-connected to another point, it is also part of the cluster.

2.3.2. Appraisal of the Rent in the Partition by Neighbourhood

3. The Case Study: Analysis of Cap Rate in the City of Palermo

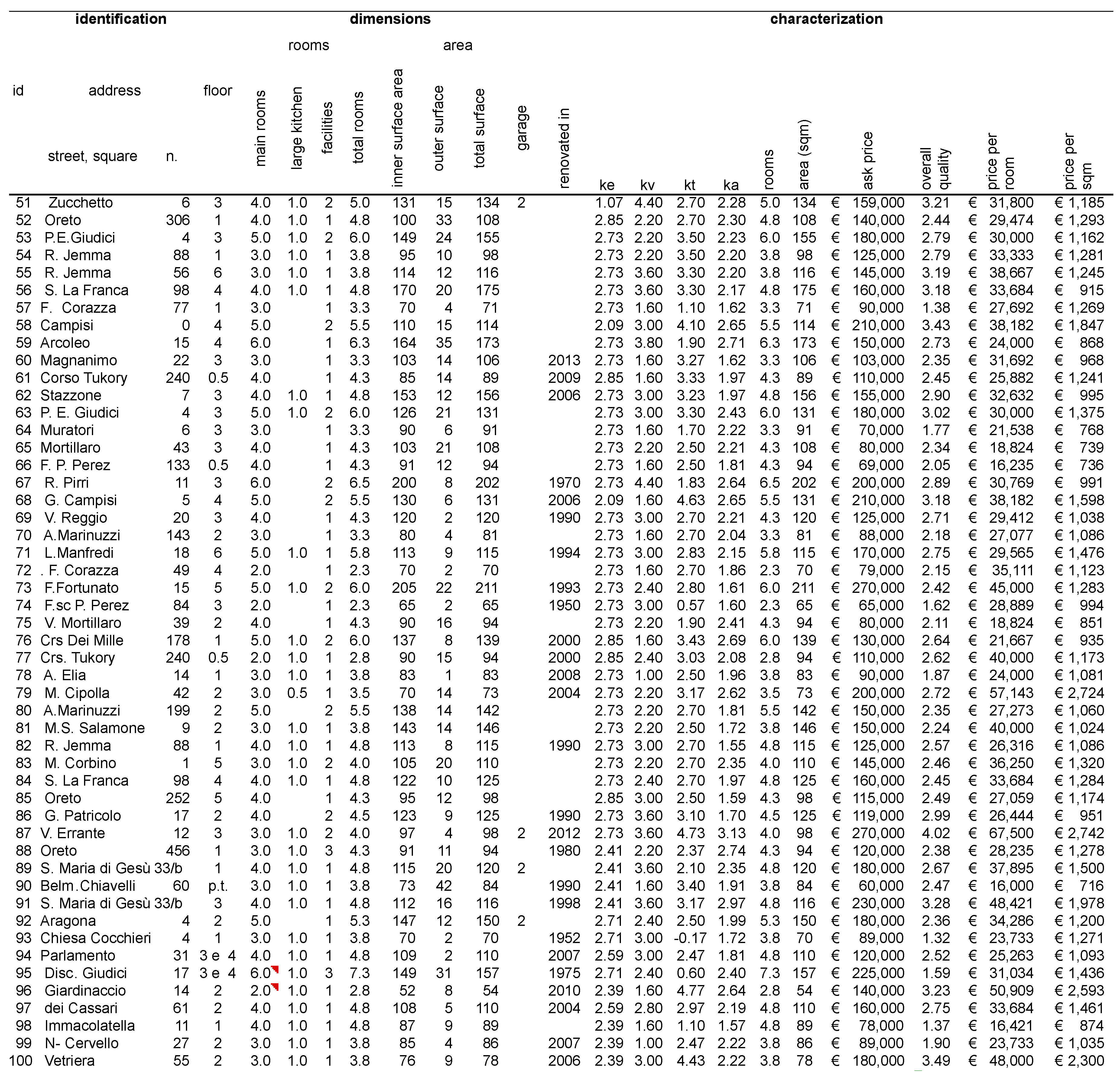

3.1. The Real Estate Market and the Database of the Case Study

4. Results and Discussion

4.1. Cap Rates in the Submarkets by Cluster

4.1.1. Delimitation and Characteristics of the Clusters

4.1.2. Appraisal of Cap Rates by Clusters

4.2. Cap Rates in the Neighbourhoods

4.2.1. Characteristics of the Neighbourhoods

4.2.2. Appraisal of Cap Rate by Neighbourhood

- -

- as an exception. is stable compared to the range and this might contradict the observations and deductions performed in the other neighbourhoods;

- -

- as an achievement. Two considerations can be made:

- ○

- the first concerns the prevailing of the identity and symbolic value of the location over the other characteristics whose value does not significantly influence the liquidity and profitability profile of the investment in such areas; something similar also happens in Neighbourhood 7, except for some outliers and the higher cap rate featuring as riskier the investments in that area;

- ○

- the second concerns a deeper and mostly theoretical issue; as previously mentioned, the characteristics generally influence the size of NOI and, as a consequence, the profitability of a real estate investment; cap rate, instead, is influenced by expectations; the latter are weakly represented by characteristics, as Rizzo addresses by distinguishing explicit (NOI) and implicit (expected capital gain/loss) liquidity [22], which is related to the concept of crescendo or diminuendo; furthermore, Forte [30] also distinguished the abovementioned 23 characteristics from the 36 influences (18 ascending and 18 descending), the latter affecting cap rate because of some prospective features of a property; as a consequence we conclude that in Neighbourhoods 7 and 9 the influences prevail over the characteristics, whereas in the other areas the characteristics interact with each other to overcome their additive value, embodying the contents of the influences and in some way replacing them.

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Gabrielli, L.; Giuffrida, S.; Trovato, M.R. Gaps and Overlaps of Urban Housing Sub-market: Hard Clustering and Fuzzy Clustering Approaches. In Appraisal: From Theory to Practice; Springer International Publishing: Cham, Switzerland, 2017; pp. 203–219. [Google Scholar]

- Napoli, G.; Giuffrida, S.; Trovato, M.R. Fair Planning and Affordability Housing in Urban Policy. The Case of Syracuse (Italy). In Computational Science and Its Applications; Gervasi, O., Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Tanier, D., Apduhan, B.O., Stankova, E., Wang, S., Eds.; Springer International Publishing: Cham, Switzerland, 2016; Volume 9789, pp. 46–62. [Google Scholar]

- Giuffrida, S.; Napoli, G.; Trovato, M.R. Industrial Areas and the City. Equalization and Compensation in a Value-Oriented Allocation Pattern. In Computational Science and Its Applications; Gervasi, O., Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Tanier, D., Apduhan, B.O., Stankova, E., Wang, S., Eds.; Springer International Publishing: Cham, Switzerland, 2016; Volume 9789, pp. 79–89. [Google Scholar]

- Browun, G.R.; Matysiak, G.A. Real Estate Investment: A Capital Market Approach; Prentice Hall-Pearson Education: Harlow, UK, 2000. [Google Scholar]

- Chaney, A.; Hoesli, M. The Interest Rate Sensitivity of Real Estate. J. Prop. Res. 2010, 27, 61–85. [Google Scholar] [CrossRef]

- Ciuna, M.; Milazzo, L.; Salvo, F. A mass appraisal model based on market segment parameters. Buildings 2017, 7, 34. [Google Scholar] [CrossRef]

- Simonotti, M.; Salvo, F.; Ciuna, M.; De Ruggiero, M. Measurements of rationality for a scientific approach to the Market Oriented Methods. J. Real Estate Lit. 2016, 24, 403–427. [Google Scholar] [CrossRef]

- Ciuna, M.; Salvo, M.; Simonotti, M. Multilevel methodology approach for the construction of real estate monthly index numbers. J. Real Estate Lit. 2014, 22, 281–302. [Google Scholar]

- Ciuna, M.; Salvo, M.; De Ruggiero, M. Property prices index numbers and derived indices. Prop. Manag. 2014, 32, 139–153. [Google Scholar] [CrossRef]

- Wofford, L.E. A Simulation Approach to the Appraisal of Income Producing Real Estate. Real Estate Econ. 1978, 6, 370–394. [Google Scholar] [CrossRef]

- D’Amato, M. A location value response surface model for mass appraising: An “iterative” location adjustment factor in Bari, Italy. Int. J. Strateg. Prop. Manag. 2010, 14, 231–244. [Google Scholar] [CrossRef]

- Napoli, G.; Gabrielli, L.; Barbaro, S. The efficiency of the incentives for the public buildings energy retrofit. The case of the Italian Regions of the “Objective Convergence”. Valori e Valutazioni 2017, 18, 25–39. [Google Scholar]

- Simonotti, M. Ricerca del saggio di capitalizzazione nel mercato immobiliare. Aestimum 2011, 59, 171–180. [Google Scholar]

- Ambrose, B.W.; Nourse, H.O. Factor influencing capitalization rate. J. Real Estate Res. 1993, 8, 221–237. [Google Scholar]

- Chichernea, D.; Miller, N.; Fisher, J.; Sklarz, M.; White, B. A Cross Sectional Analysis of Cap Rates by MSA. J. Real Estate Res. 2008, 30, 249–292. [Google Scholar]

- Soderberg, B.; Janssan, C. Estimating Distance Gradients for Apartment Properties. Urban Stud. 2001, 38, 61–79. [Google Scholar] [CrossRef]

- Nourse, H.O. Cap rates 1966–1984: A Test of the Impact of the Income Tax Changes in Income Property. Land Econ. 1987, 63, 147–152. [Google Scholar] [CrossRef]

- Copeland, T.E.; Weston, J.F. Financial Theory and Corporate Policy, 3rd ed.; Addison-Wesley: Reading, PA, USA, 1988. [Google Scholar]

- Jud, G.D.; Winkler, D.T. The Capitalization Rate of Commercial Properties and Market Returns. J. Real Estate Res. 1995, 10, 509–518. [Google Scholar]

- Weaver, W.; Michelson, S.A. A pedagogical tool to assist in teaching real estate investment risk analysis. J. Real Estate Pract. Educ. 2004, 7, 45–52. [Google Scholar]

- Chaney, A.; Hoesli, M. Transaction-Based and Appraisal-Based Capitalization Rate Determinants. Int. Real Estate Rev. 2015, 18, 1–43. [Google Scholar] [CrossRef]

- Rizzo, F. Analisi Critica della Teoria delle Valutazioni; Seminario Economico Dell’Università di Catania: Catania, Italy, 1977. [Google Scholar]

- Rizzo, F. Valore e Valutazioni. La Scienza Dell’economia o L’economia della Scienza; FrancoAngeli: Milan, Italy, 1999. [Google Scholar]

- Rizzo, F. Dalla Rivoluzione Keynesiana alla Nuova Economia. Dis-Equilibrio, Tras-Informazione e Co- Efficiente di Capitalizzazione; FrancoAngeli: Milano, Italy, 2002. [Google Scholar]

- Rizzo, F. Nuova Economia. Felicità del Lavoro Creativo e della Conservazione Delal Natura, Infelicità Della Speculazione Finanziaria e Dell’inquinamento Ambientale; Aracne: Roma, Italy, 2013. [Google Scholar]

- Keynes, J.M. Teoria Generale Della Moneta, Dell’interesse e Dell’occupazione; UTET: Torino, Italy, 2001. [Google Scholar]

- Giuffrida, S. The True Value. On understanding Something. In Appraisal: From Theory to Practice. Green Energy and Technology; Stanghellini, S., Morano, P., Bottero, M., Oppio, A., Eds.; Springer: Cham, Switzerland, 2017. [Google Scholar]

- Guatri, L. Trattato Sulla Valutazione delle Aziende; EGEA: Milano, Italy, 1998. [Google Scholar]

- Guatri, L. Il Giudizio Integrato di Valutazione. Dalle Formule al Processo Valutativo; Università Bocconi Editore: Milano, Italy, 2000. [Google Scholar]

- Forte, C. Elementi di Estimo Urbano; Etas Kompass: Naples, Italy, 1968. [Google Scholar]

- Giuffrida, S.; Ferluga, G.; Valenti, A. Capitalization rates and “real estate semantic chains”. An application of clustering analysis. Int. J. Bus. Intell. Data Min. 2015, 10, 174–199. [Google Scholar] [CrossRef]

- Giuffrida, S.; Ventura, V.; Trovato, M.R.; Napoli, G. Axiology of the historical city and the cap rate. The case of the old town of Ragusa Superiore. Valori e Valutazioni 2017, 18, 41–55. [Google Scholar]

- Napoli, G.; Giuffrida, S.; Valenti, A. Forms and functions of the real estate market of Palermo. Science and knowledge in the cluster analysis approach. In Appraisal: From Theory to Practice. Results of SIEV 2015; Stanghellini, S., Morano, P., Bottero, M., Oppio, A., Eds.; Springer International Publishing: Cham, Switzerland, 2017; pp. 191–202. [Google Scholar]

- International Valuation Standards Committee. International Valuation Standards; IVSC: London, UK, 2017. [Google Scholar]

- Gabrielli, L.; Giuffrida, S.; Trovato, M.R. From Surface to Core: A Multi-layer Approach for the Real Estate Market Analysis of a Central Area in Catania. In Computational Science and Its Applications—ICCSA 2015; Gervasi, O., Murgante, B., Misra, S., Gavrilova, M.L., Rocha, A.M.A.C., Torre, C.M., Taniar, D., Apduhan, B.O., Eds.; Springer: Berlin, Germany, 2015; Volume III, pp. 284–300. [Google Scholar]

- Giuffrida, S.; Ferluga, G.; Valenti, A. Clustering Analysis in a Complex Real Estate Market: The Case of Ortigia (Italy). In Computational Science and Its Applications—ICCSA 2014; Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Rocha, J.G., Falcão, M.I., Taniar, D., Apduhan, B.O., Gervasi, O., Eds.; Springer: Berlin, Germany, 2014; Volume III. [Google Scholar]

- Valenti, A.; Giuffrida, S.; Linguanti, F. Decision Trees Analysis in a Low Tension Real Estate Market: The Case of Troina (Italy). In Computational Science and Its Applications—ICCSA 2015; Gervasi, O., Murgante, B., Misra, S., Gavrilova, M.L., Rocha, A.M.A.C., Torre, C.M., Taniar, D., Apduhan, B.O., Eds.; Springer: Berlin, Germany, 2015; Volume III, pp. 237–252. [Google Scholar]

- Chan, L.; Ng, H.T.; Ramchand, R. “A Cluster Analysis Approach to Examining Singapore’s Property Market”. In Property Markets and Financial Stability; BIS Papers; Bank for International Settlements: Basel, Switzerland, 2012; Volume 64, pp. 43–53. [Google Scholar]

- Gabrielli, L. Cluster Analysis and Italian Real Estate Market Analysis during the Downturn. In Proceedings of the 20th Annual European Real Estate Society Conference, Vienna, Austria, 3–6 July 2013. [Google Scholar]

- Hepşen, A.; Vatansever, M. ‘Using Hierarchical Clustering Algorithms for Turkish Residential Market’. Int. J. Econ. Financ. 2012, 4, 138–150. [Google Scholar]

- Nesticò, A.; De Mare, G.; Galante, M. The Sustainable Limit of the Real Estate Tax: An Urban-Scale Estimation Model. In Computational Science and Its Applications—ICCSA 2014; Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Rocha, J.G., Falcão, M.I., Taniar, D., Apduhan, B.O., Gervasi, O., Eds.; Springer: Berlin, Germany, 2014; Volume III. [Google Scholar]

- Jardine, N.; Sibson, R. The construction of hierarchic and non-hierarchic classifications. Comput. J. 1968, 1, 177–184. [Google Scholar] [CrossRef]

- King, R. Cluster Analysis and Data Mining: An Introduction; Mercury Learning & Information: Herndon, VA, USA, 2014. [Google Scholar]

- Everitt, B.; Landau, S.; Morvene, L.; Stahl, D. Cluster Analysis, 5th ed.; John Wiley and Sons: New York, NY, USA, 2011. [Google Scholar]

- Kaufman, L.; Rousseeuw, P. Finding Groups in Data: An Introduction to Clustering Analysis; John Wiley and Sons: New York, NY, USA, 1990. [Google Scholar]

- Steinley, D. Profiling Local optima in k-means clustering: What you don’t know may hurt you. Psychol. Methods 2003, 8, 294–304. [Google Scholar] [CrossRef] [PubMed]

- Steinley, D. Profiling local optima in K-means clustering: Developing a diagnostic technique. Psychol. Methods 2006, 11, 178–192. [Google Scholar] [CrossRef] [PubMed]

- Milligan, G.; Cooper, M. An examination of procedures for determining the number of clusters in a data set. Psychometrika 1985, 50, 159–179. [Google Scholar] [CrossRef]

- Yanchi, L.; Zhongmou, L.; Hui, X.; Xuedong, G.; Junjie, W. Understanding of Internal Clustering Validation Measures. In Proceedings of the IEEE International Conference on Data Mining, Sydney, Australia, 14–17 December 2010; Available online: http://datamining.it.uts.edu.au/icdm10/index.php (accessed on 18 September 2015).

- Camagni, R. Economia Urbana. Principi e Modelli Teorici; La Nuova Italia Scientifica: Roma, Italy, 1992. [Google Scholar]

- Rizzo, F. Un’economia della Speranza per la Città Multietnica. Economia della Contemplazione o Contemplazione Dell’economia; FrancoAngeli: Milano, Italy, 2007. [Google Scholar]

- Napoli, G.; Schilleci, F. An Application of Analytic Network Process in the Planning Process: The Case of an Urban Transformation in Palermo (Italy). In ICCSA 2014, Part III, LNCS 8581; Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Rocha, J.G., Falcão, M.I., Taniar, D., Apduhan, B.O., Gervasi, O., Eds.; Springer International Publishing: Cham, Switzerland, 2014; pp. 300–314. [Google Scholar]

- Napoli, G. Financial Sustainability and Morphogenesis of Urban Transformation Project. In ICCSA 2015, Part III, LNCS 9157; Gervasi, O., Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Tanier, D., Apduhan, B.O., Stankova, E., Wang, S., Eds.; Springer International Publishing: Cham, Switzerland, 2015; pp. 178–193. [Google Scholar]

- Trovato, M.R.; Giuffrida, S. The choice problem of the urban performances to support the Pachino’s redevelopment plan. Int. J. Bus. Intell. Data Min. 2014, 9, 330–355. [Google Scholar] [CrossRef]

- Trovato, M.R.; Giuffrida, S. A DSS to Assess and Manage the Urban Performances in the Regeneration Plan: The Case Study of Pachino. In Computational Science and Its Application—ICCSA 2014; Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Rocha, J.G., Falcão, M.I., Taniar, D., Apduhan, B.O., Gervasi, O., Eds.; Springer International Publishing: Cham, Switzerland, 2014; pp. 224–239. [Google Scholar]

- Gabrielli, L.; Giuffrida, S.; Trovato, M.R. Functions and Perspective of Public Real Estate in the urban Policies: The Sustainable Development Plan of Syracuse. In Computational Science and Its Applications—ICCSA 2016; Springer International Publishing: Cham, Switzerland, 2016. [Google Scholar]

| Features (Main Characteristics) | |||

|---|---|---|---|

| Location | Intrinsic | Technological | Architectural |

| Functional complexity Urban shape Facilities Centrality Functional mix Symbolic quality Settlement quality Societal mix | View Exposure Overlooking Brightness Security | Building maintenance status Property maintenance status Building structure Technologic equipment Building finishes | Architectural type Floor Size and functional adequacy Quality of finishing Accessories |

| Maintenance | Insurance | Management | Services | Vacancy and Written-off Amounts | Taxes | Total | |

|---|---|---|---|---|---|---|---|

| Min | 2.0% | 0.5% | 0.5% | 0.5% | 1.5% | 30.0% | 35.0% |

| Max | 6.0% | 1.0% | 1.5% | 1.5% | 9.0% | 30.0% | 49.0% |

| Neighbourhoods | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | Tot. | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sample | n. | 51 | 40 | 27 | - | 82 | 40 | 30 | 37 | 78 | 35 | 80 | 500 |

| Sample | n. | 50 | 32 | 23 | - | 72 | 40 | 51 | 33 | 67 | 36 | 44 | 448 |

| Number of Clusters | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|

| CH index | 32.32 | 38.56 | 40.51 | 46.31 | 50.14 | 55.64 | 63.60 | 58.20 |

| Segments of Market (by Cluster) | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | Tot. | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| —number of properties for sale | n. | 45 | 40 | 69 | 29 | 80 | 151 | 47 | 19 | 20 | 500 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Napoli, G.; Giuffrida, S.; Trovato, M.R.; Valenti, A. Cap Rate as the Interpretative Variable of the Urban Real Estate Capital Asset: A Comparison of Different Sub-Market Definitions in Palermo, Italy. Buildings 2017, 7, 80. https://doi.org/10.3390/buildings7030080

Napoli G, Giuffrida S, Trovato MR, Valenti A. Cap Rate as the Interpretative Variable of the Urban Real Estate Capital Asset: A Comparison of Different Sub-Market Definitions in Palermo, Italy. Buildings. 2017; 7(3):80. https://doi.org/10.3390/buildings7030080

Chicago/Turabian StyleNapoli, Grazia, Salvatore Giuffrida, Maria Rosa Trovato, and Alberto Valenti. 2017. "Cap Rate as the Interpretative Variable of the Urban Real Estate Capital Asset: A Comparison of Different Sub-Market Definitions in Palermo, Italy" Buildings 7, no. 3: 80. https://doi.org/10.3390/buildings7030080

APA StyleNapoli, G., Giuffrida, S., Trovato, M. R., & Valenti, A. (2017). Cap Rate as the Interpretative Variable of the Urban Real Estate Capital Asset: A Comparison of Different Sub-Market Definitions in Palermo, Italy. Buildings, 7(3), 80. https://doi.org/10.3390/buildings7030080