Analysis of Potential for Critical Metal Resource Constraints in the International Energy Agency’s Long-Term Low-Carbon Energy Scenarios

Abstract

:1. Introduction

1.1. Background

1.2. Related Work

1.3. Research Objectives and Steps

- Development of low carbon energy technology introduction scenarios based on the IEA’s long-term energy scenarios.

- Quantification of the impact of expansion of low carbon energy technology on future metal demand based on the developed scenarios.

- Supply balance analysis comparing estimated future metal demand with reserves, resources and current production.

- Estimation of future end-of-life low carbon energy technology and potential change in supply-demand balance based on changing in recycling rate.

- Identification of critical metals that require priority measures from among the low carbon energy technology related metals.

2. Methodology

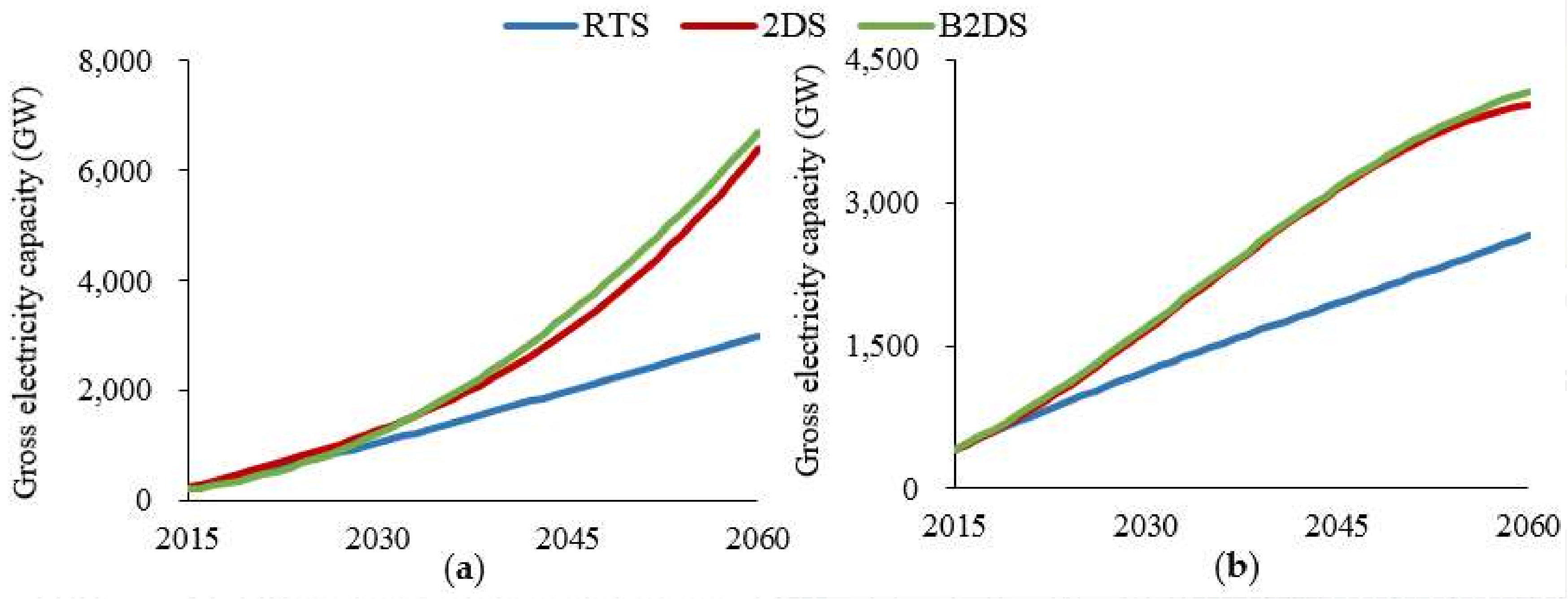

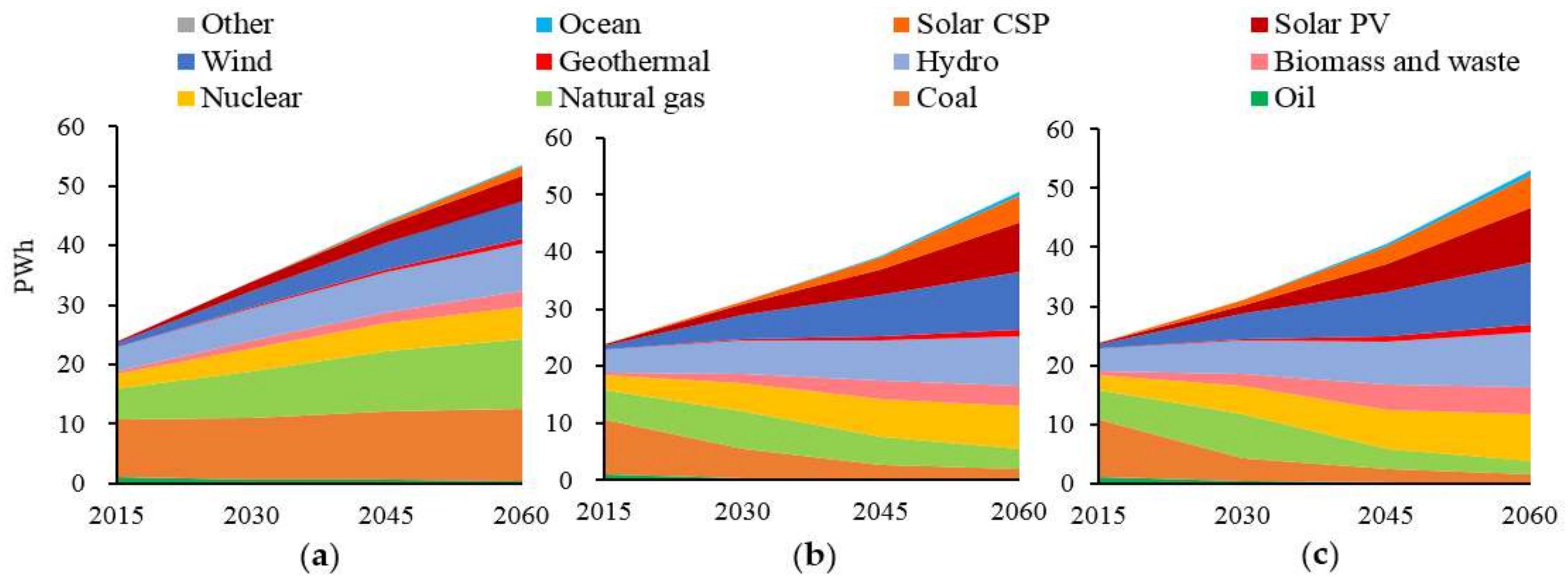

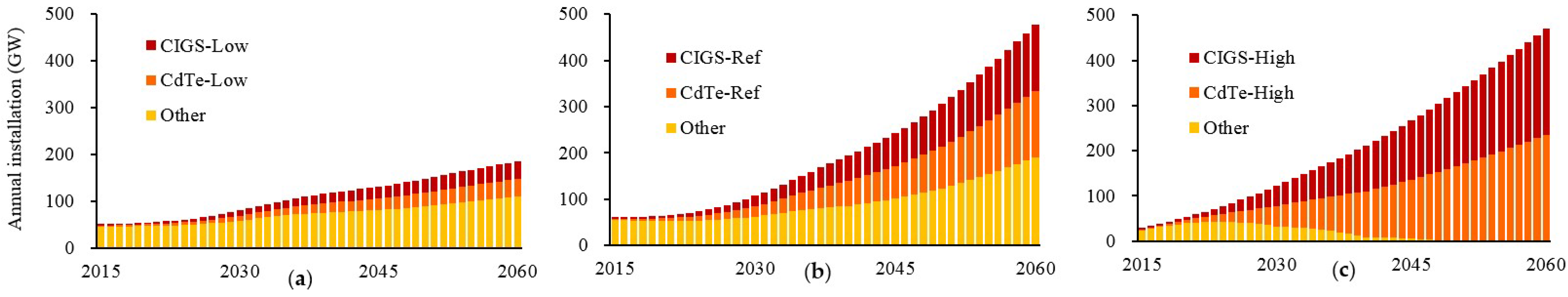

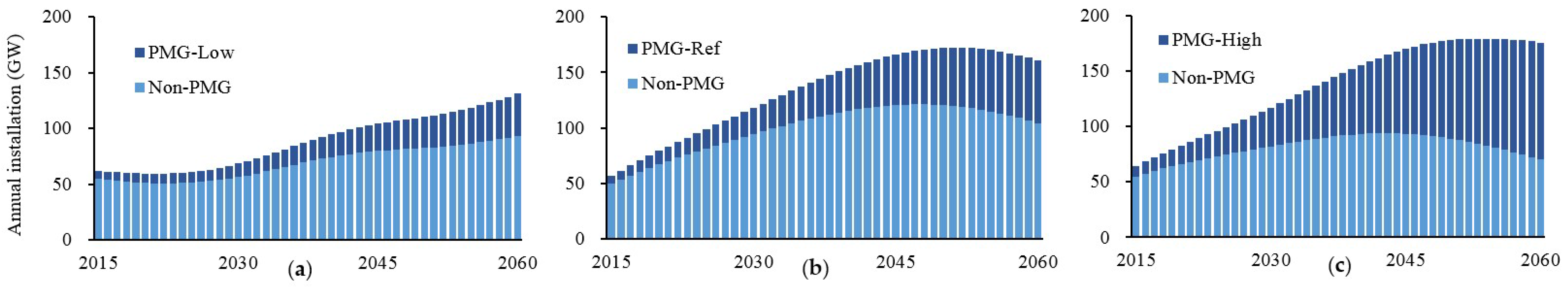

2.1. Scenario Development

2.2. Forecasting Metal Demand Considering Expansion of Low Carbon Energy Technology

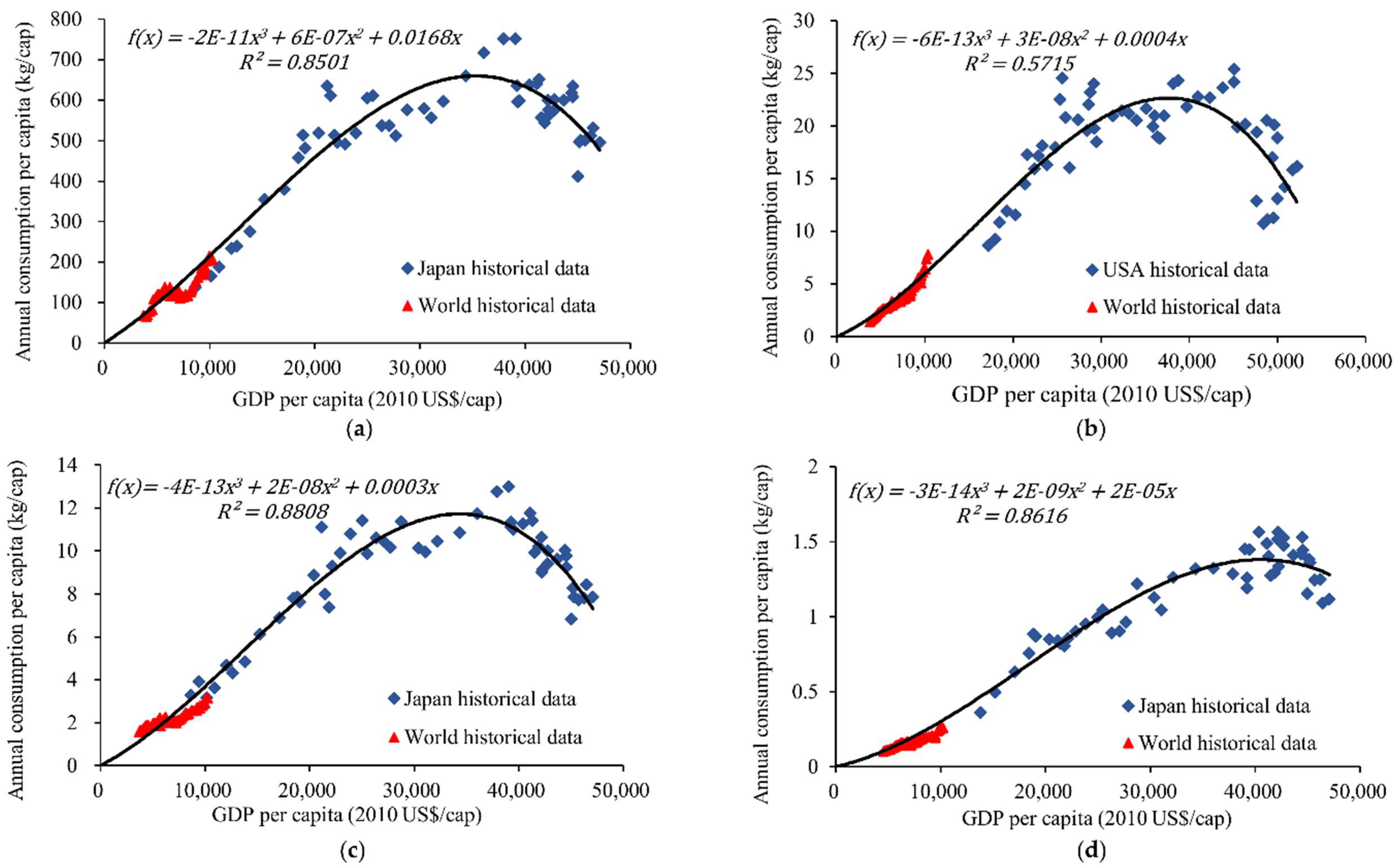

2.2.1. Top-Down Model

2.2.2. Bottom-Up Model

2.2.3. Integrated Model

2.3. Sustainability Analysis

2.4. Estimation of Recycling Effect on Future Metal Demand

2.5. Identifying Critical Metals That Require Priority Measures

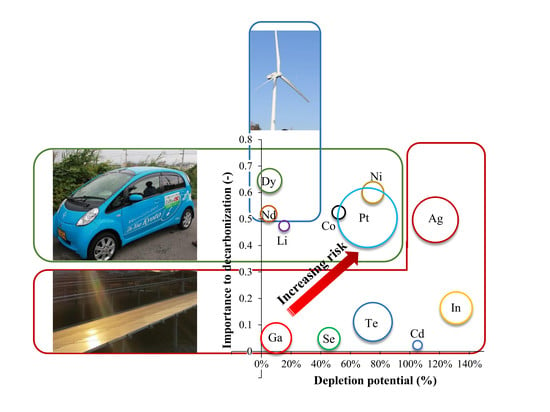

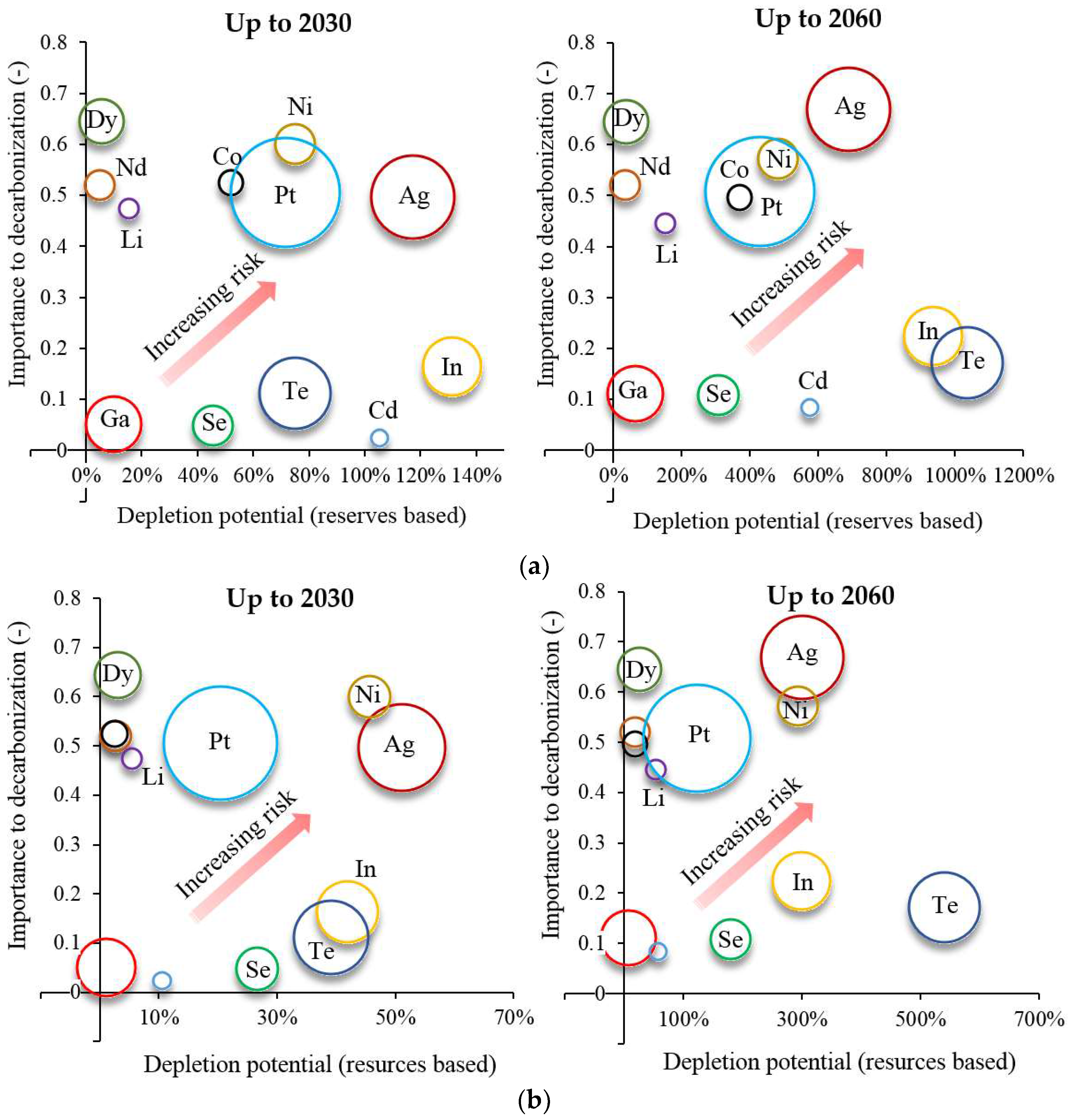

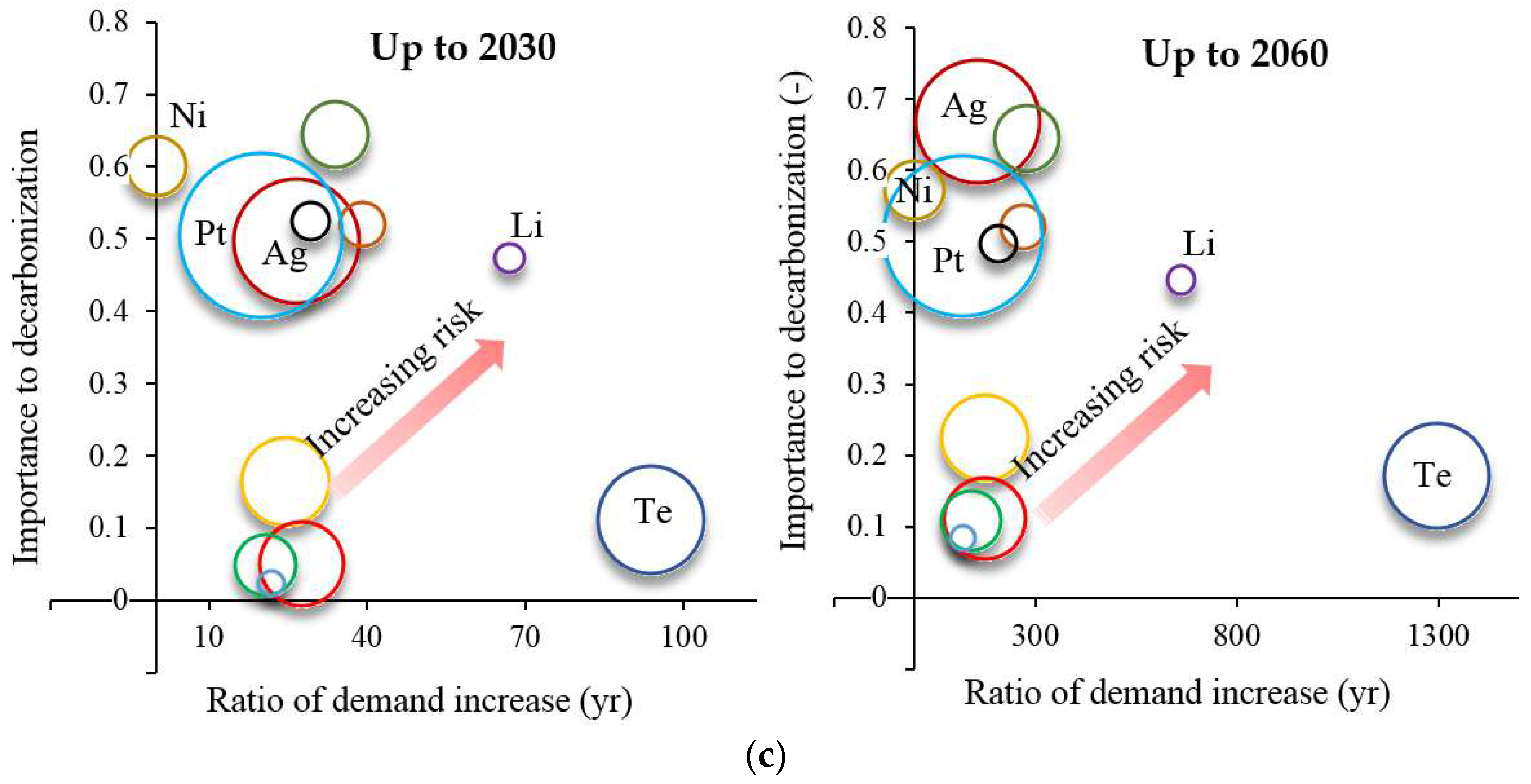

2.5.1. Depletion Potential and Ratio of Demand Increase

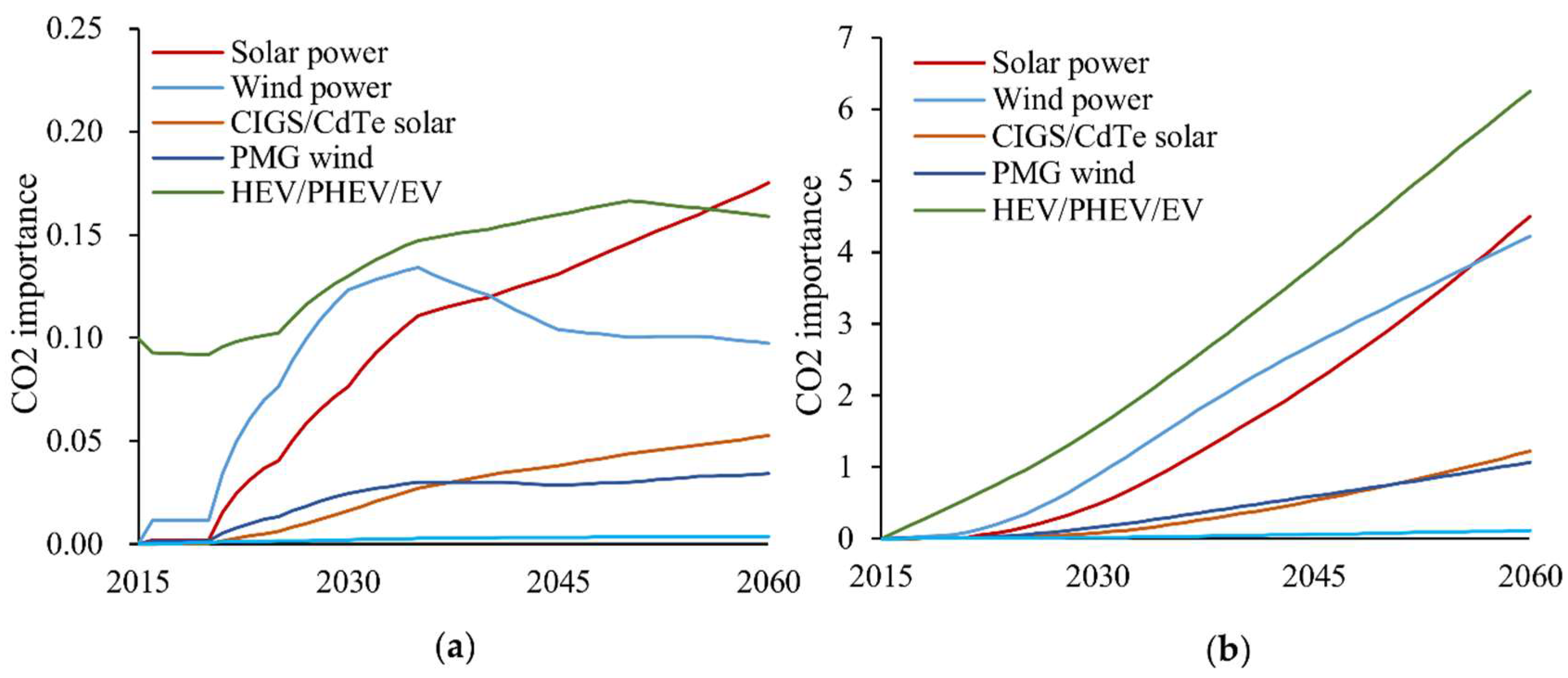

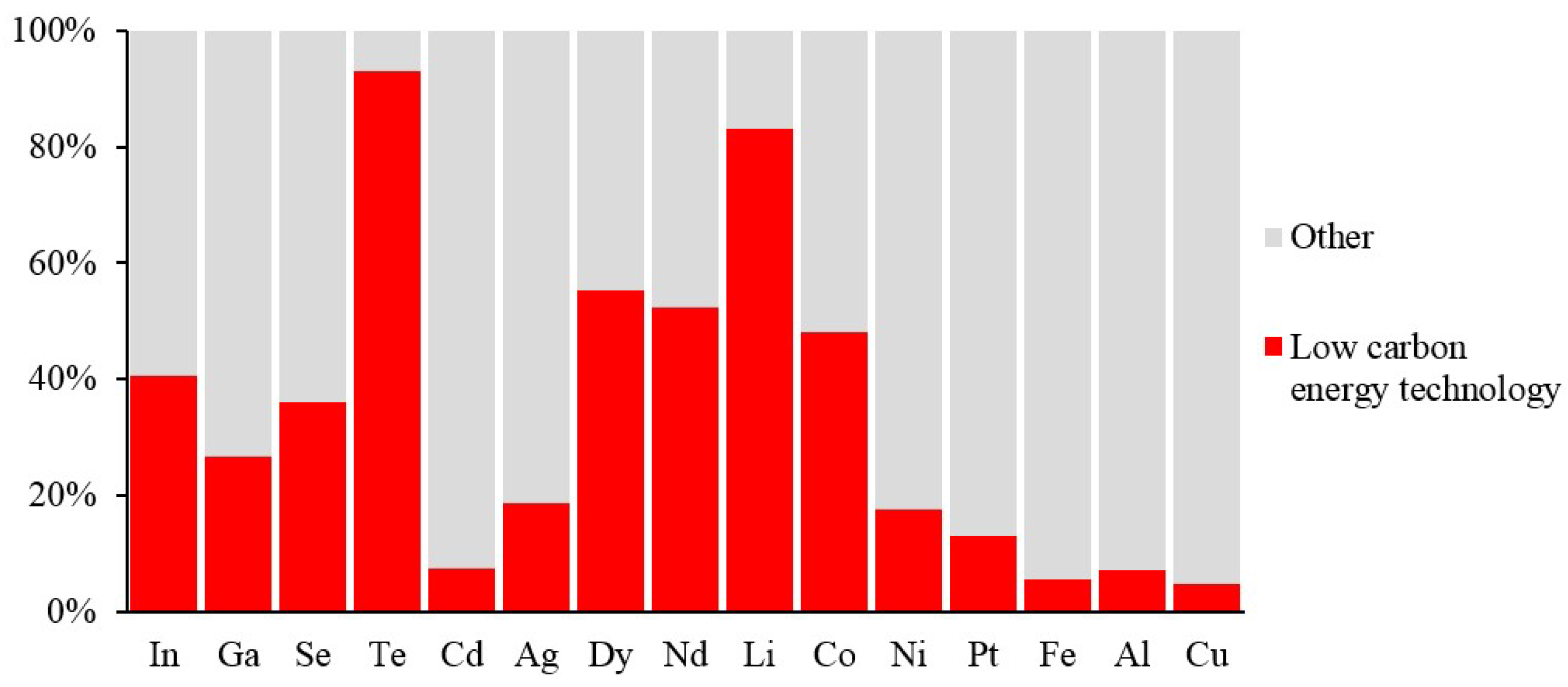

2.5.2. Importance for Decarbonization

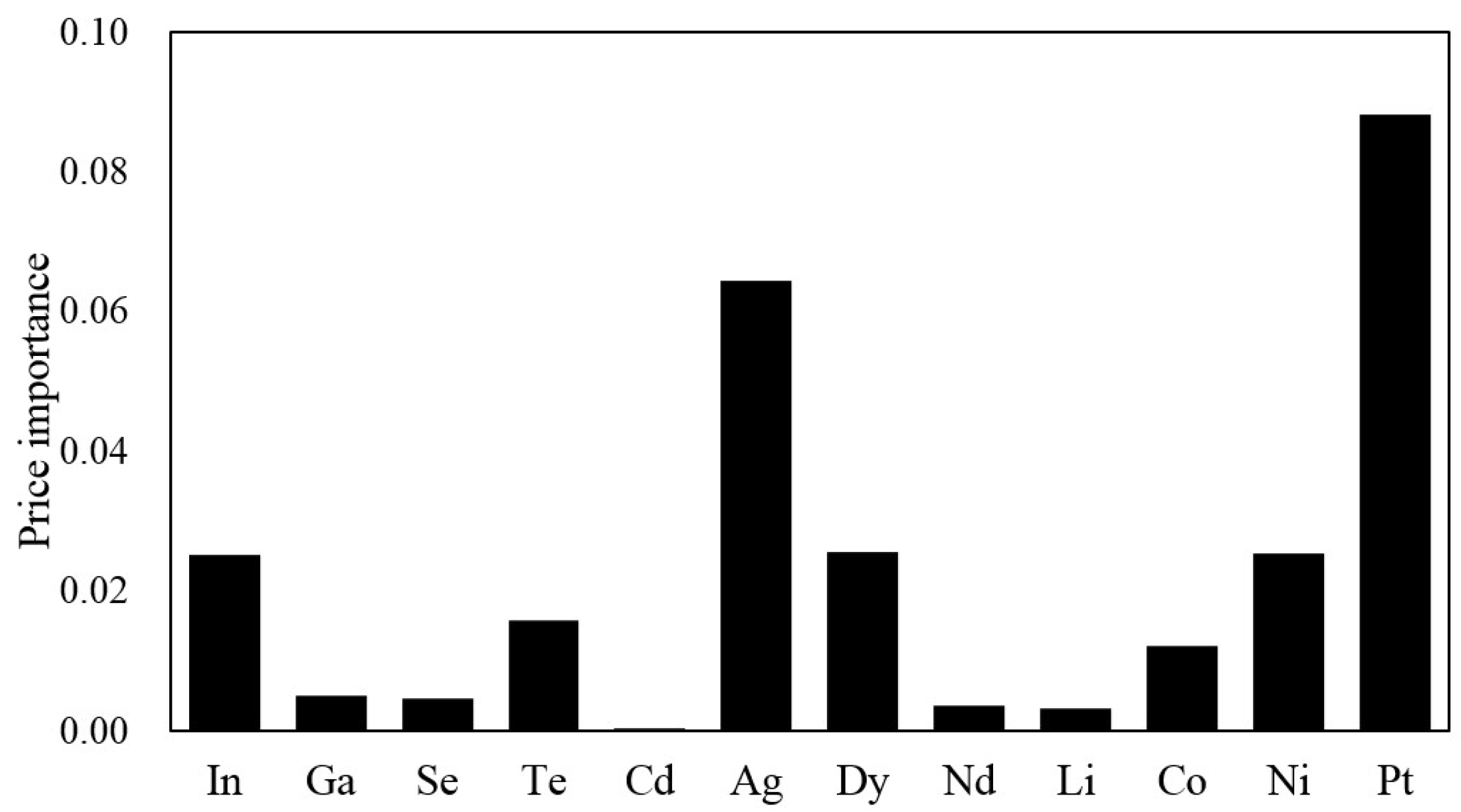

2.5.3. Environmental Impact

3. Results

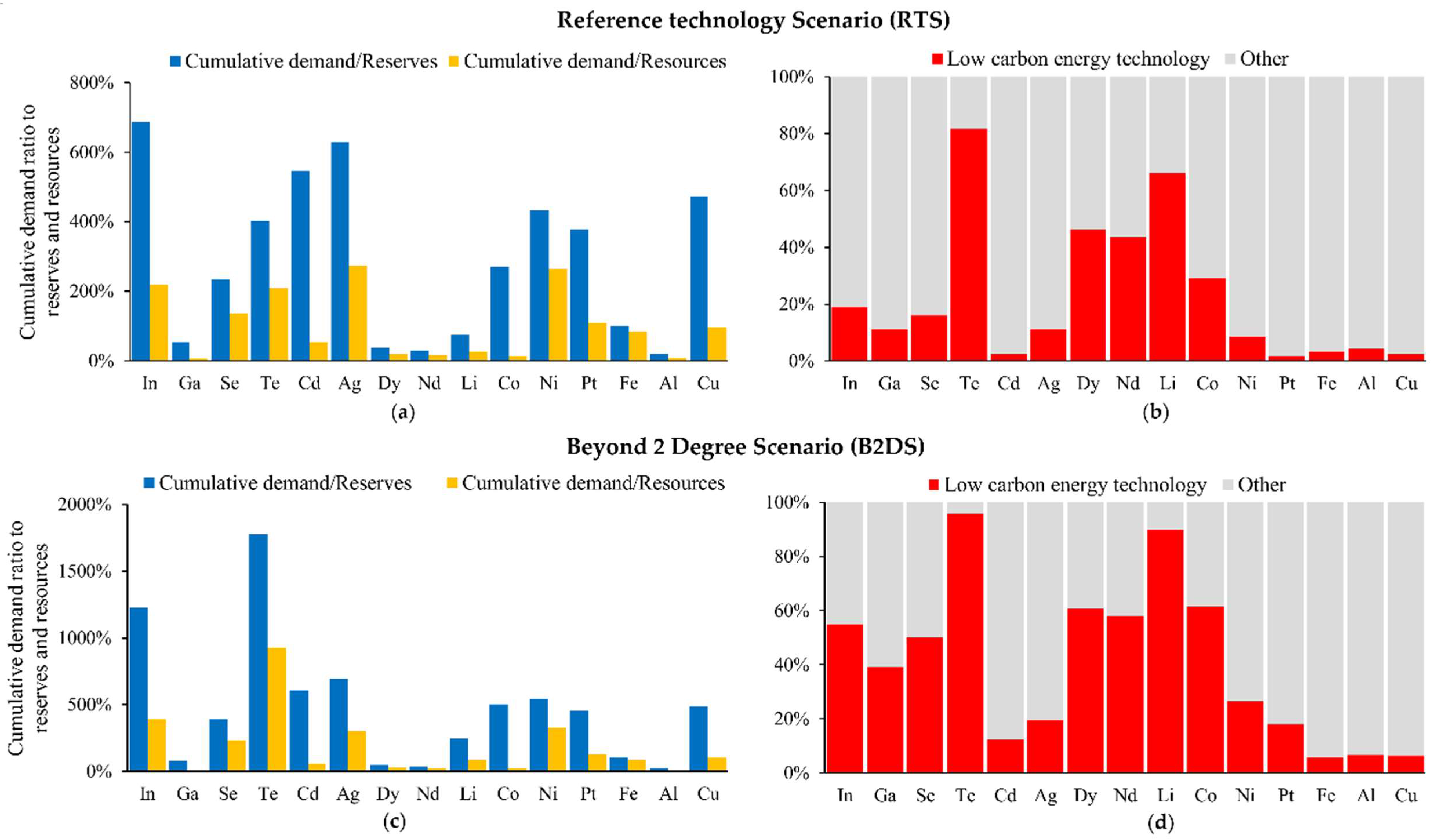

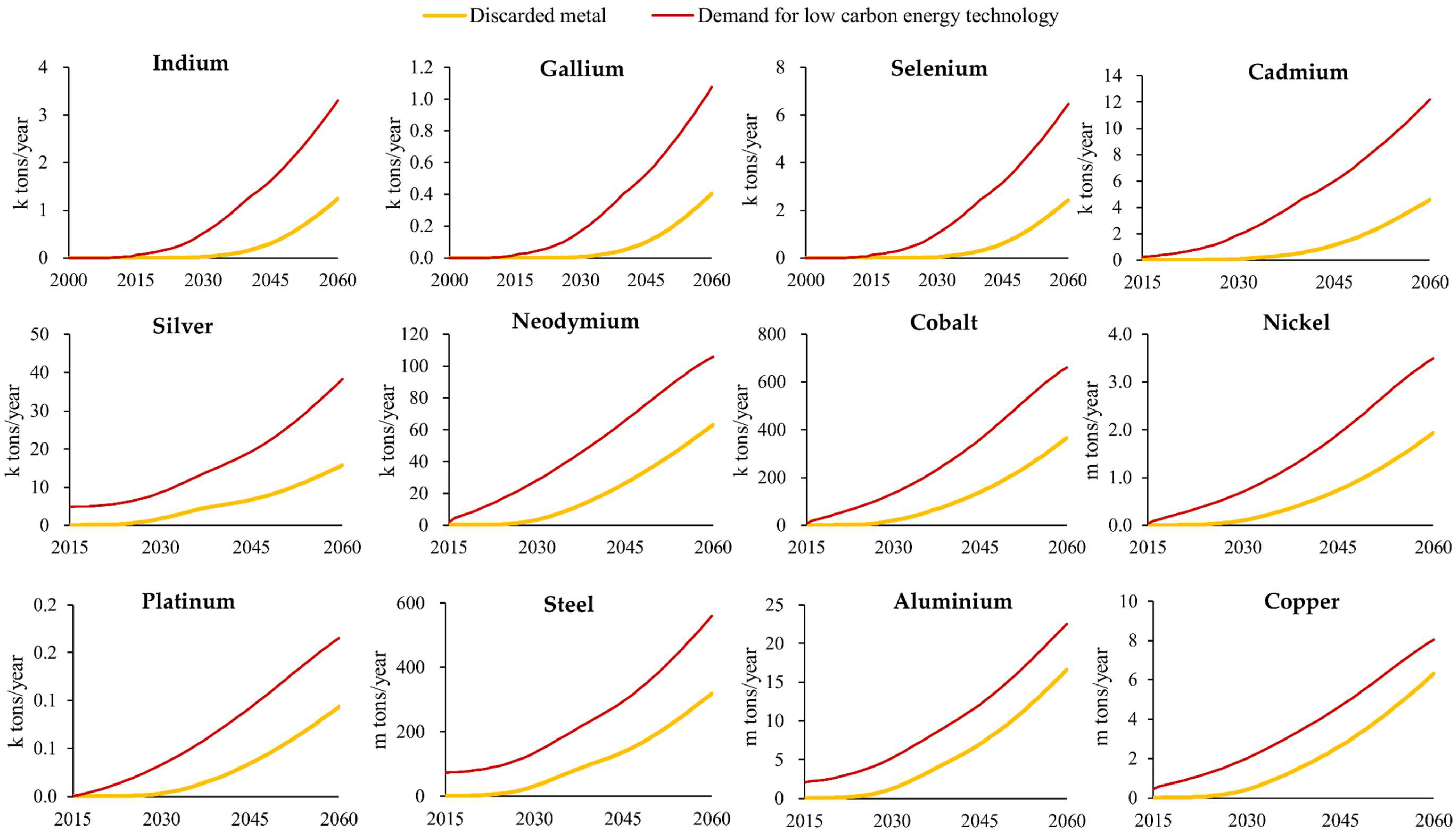

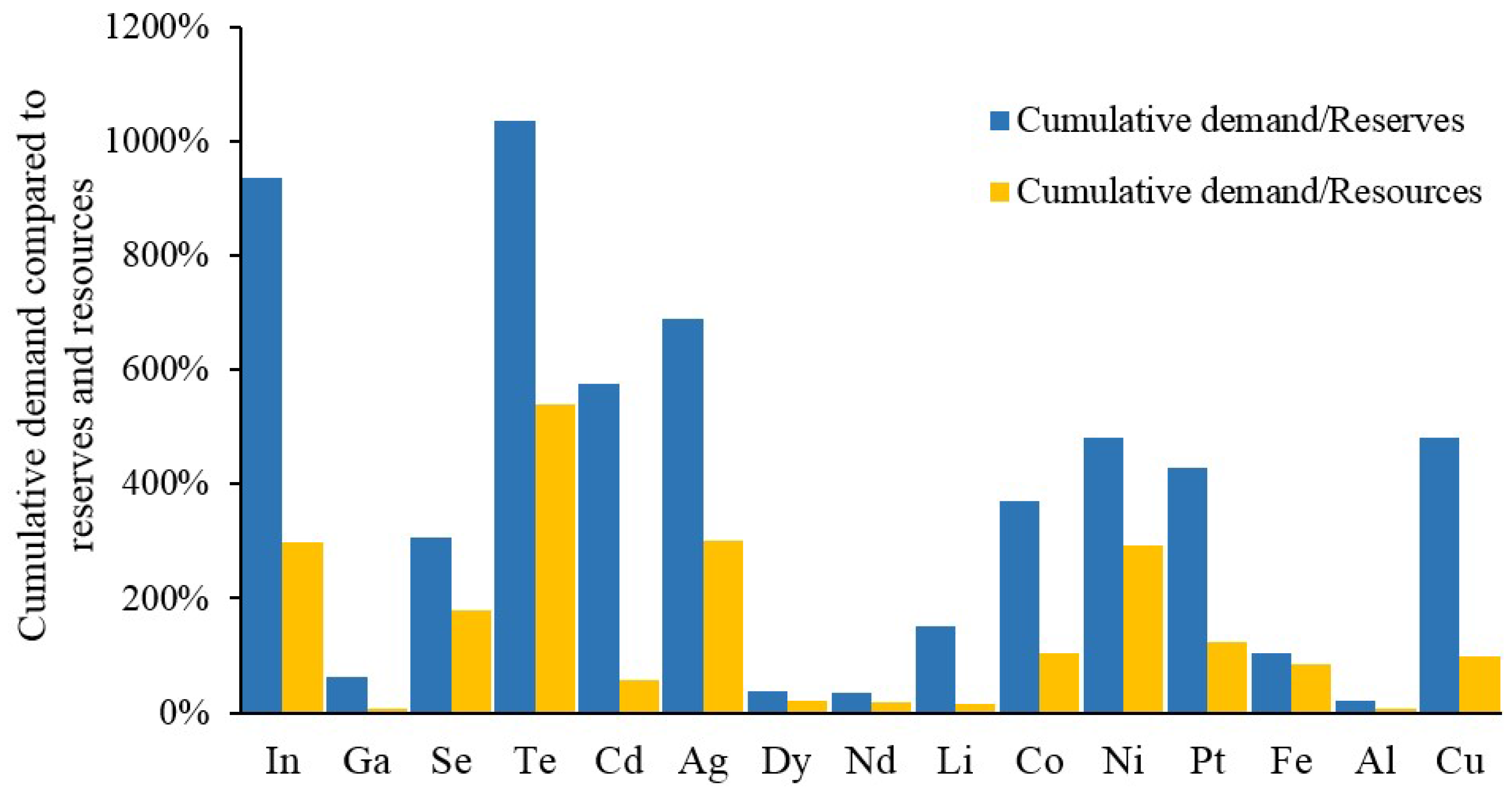

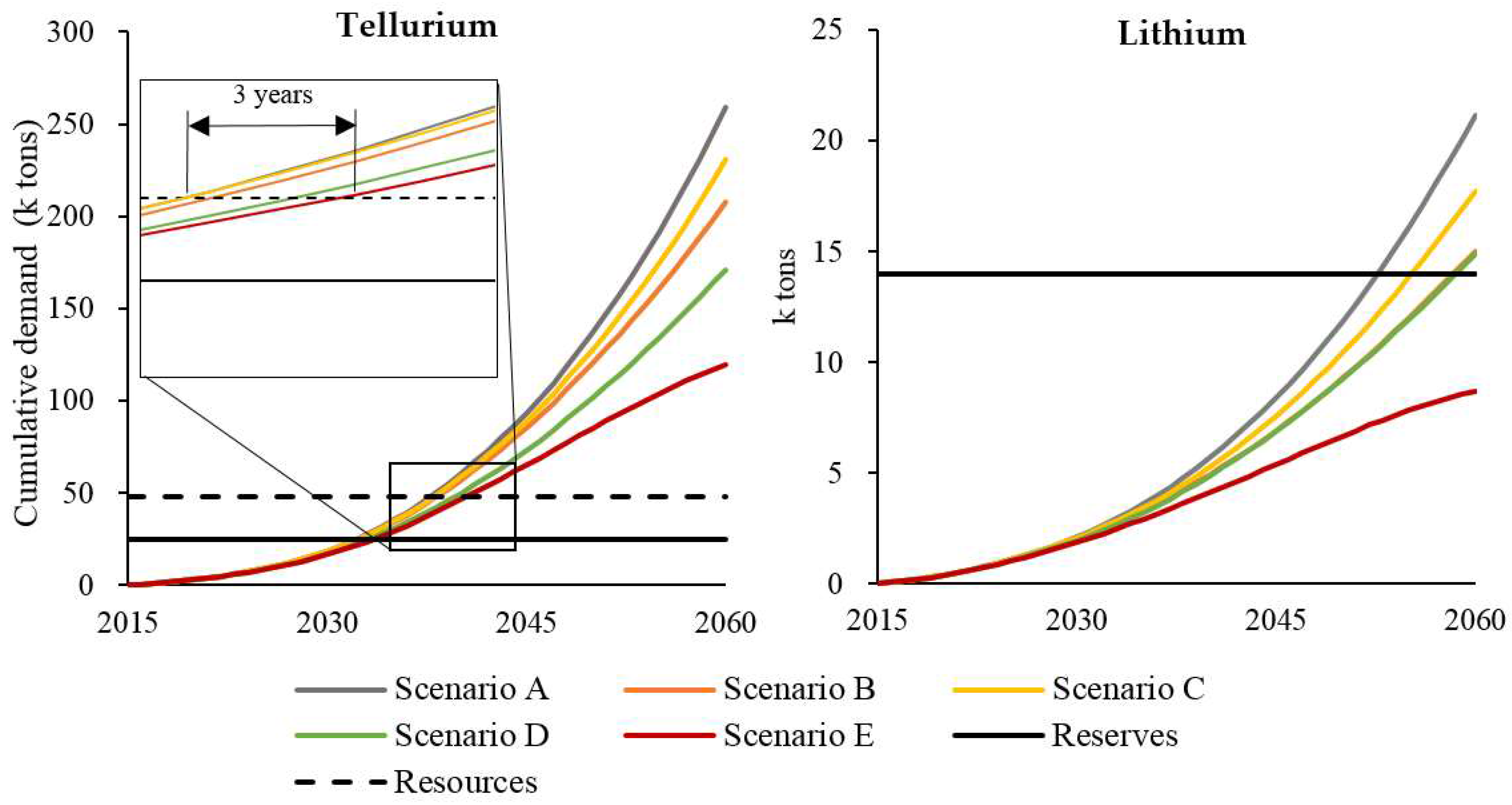

3.1. Future Metal Demand and Sustainability

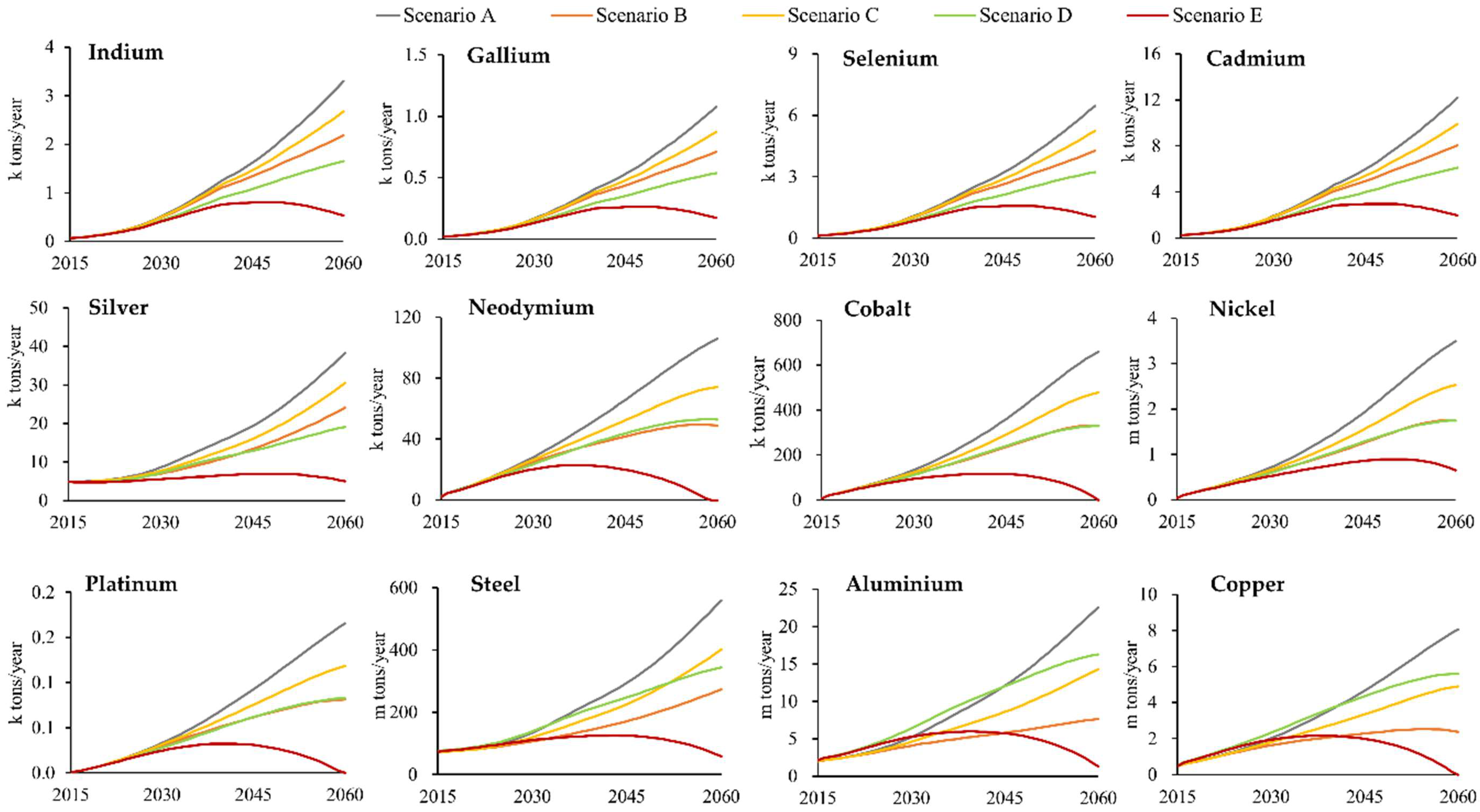

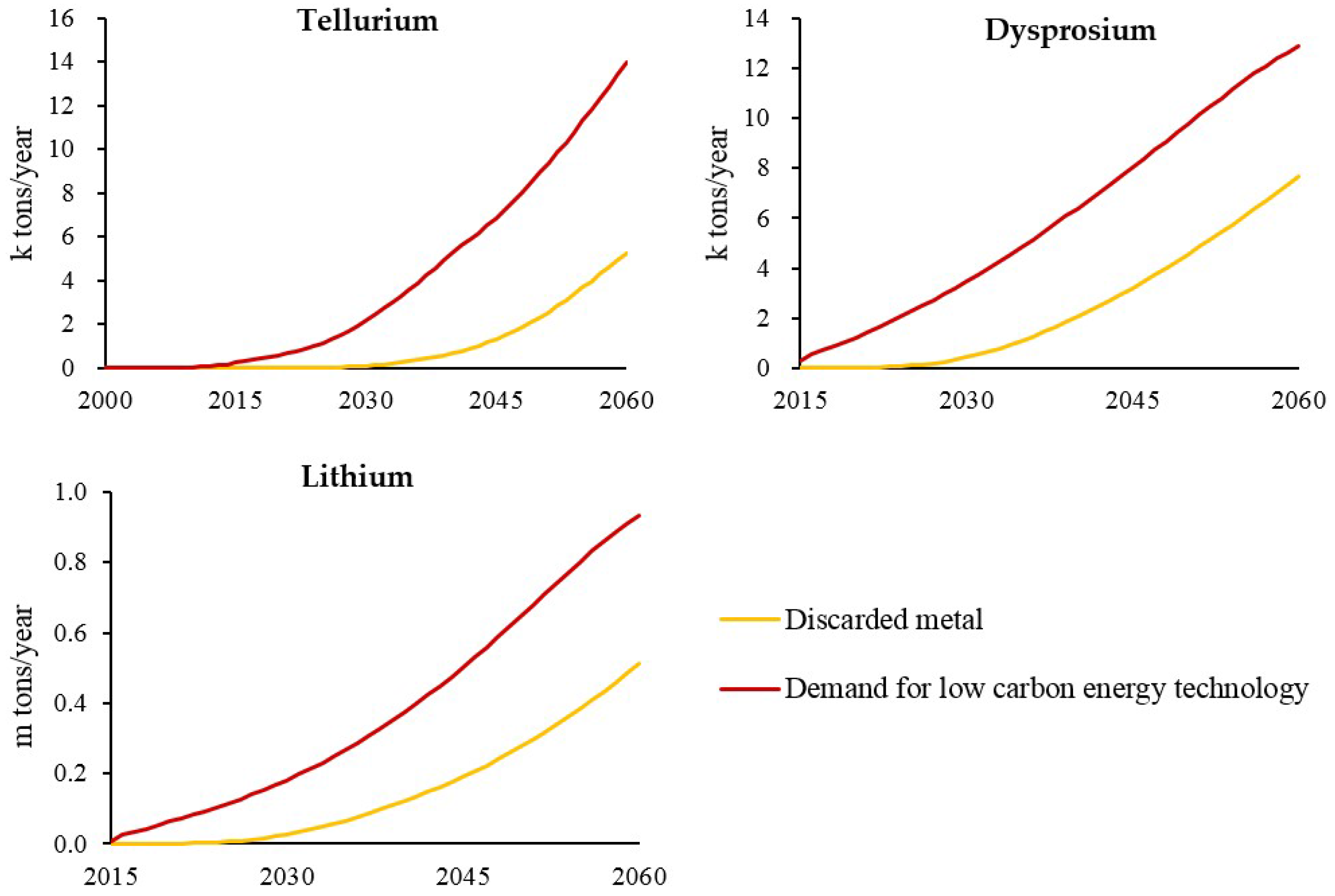

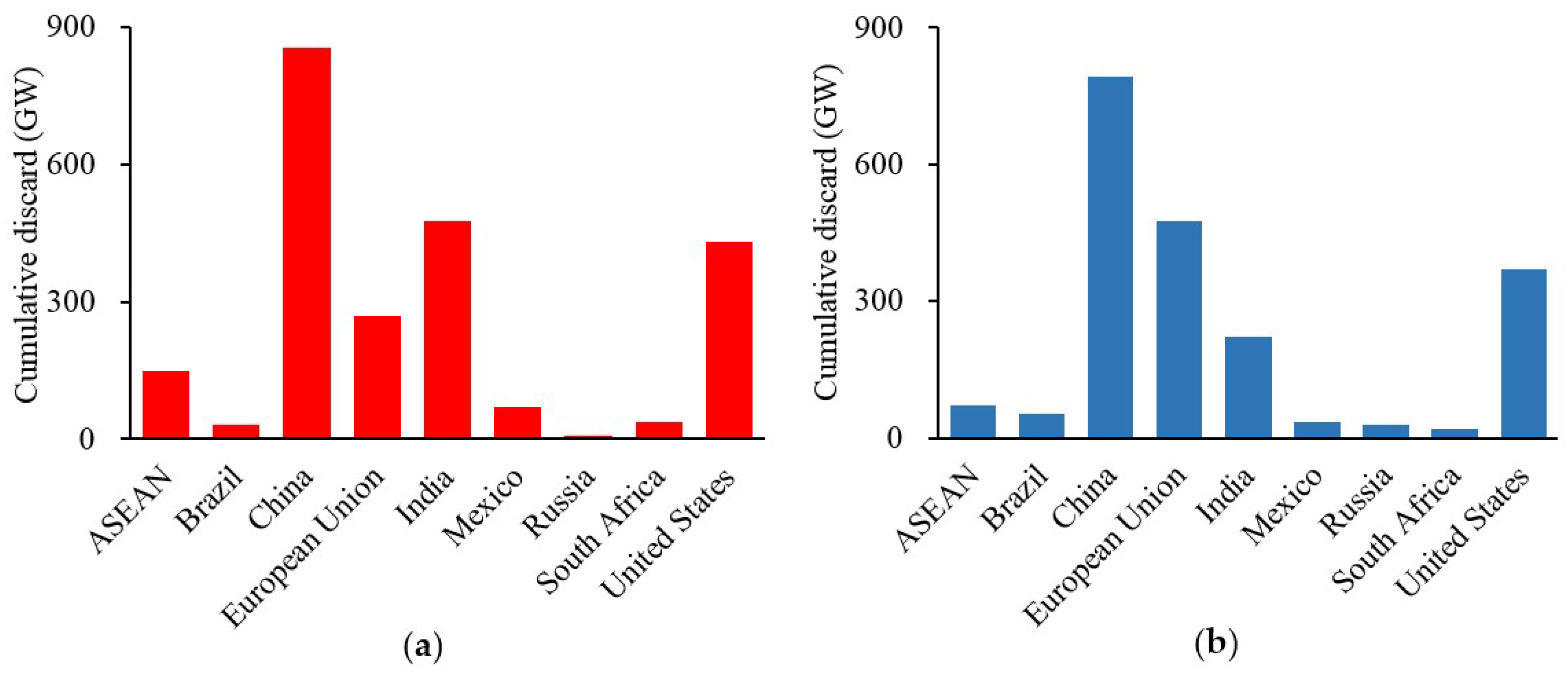

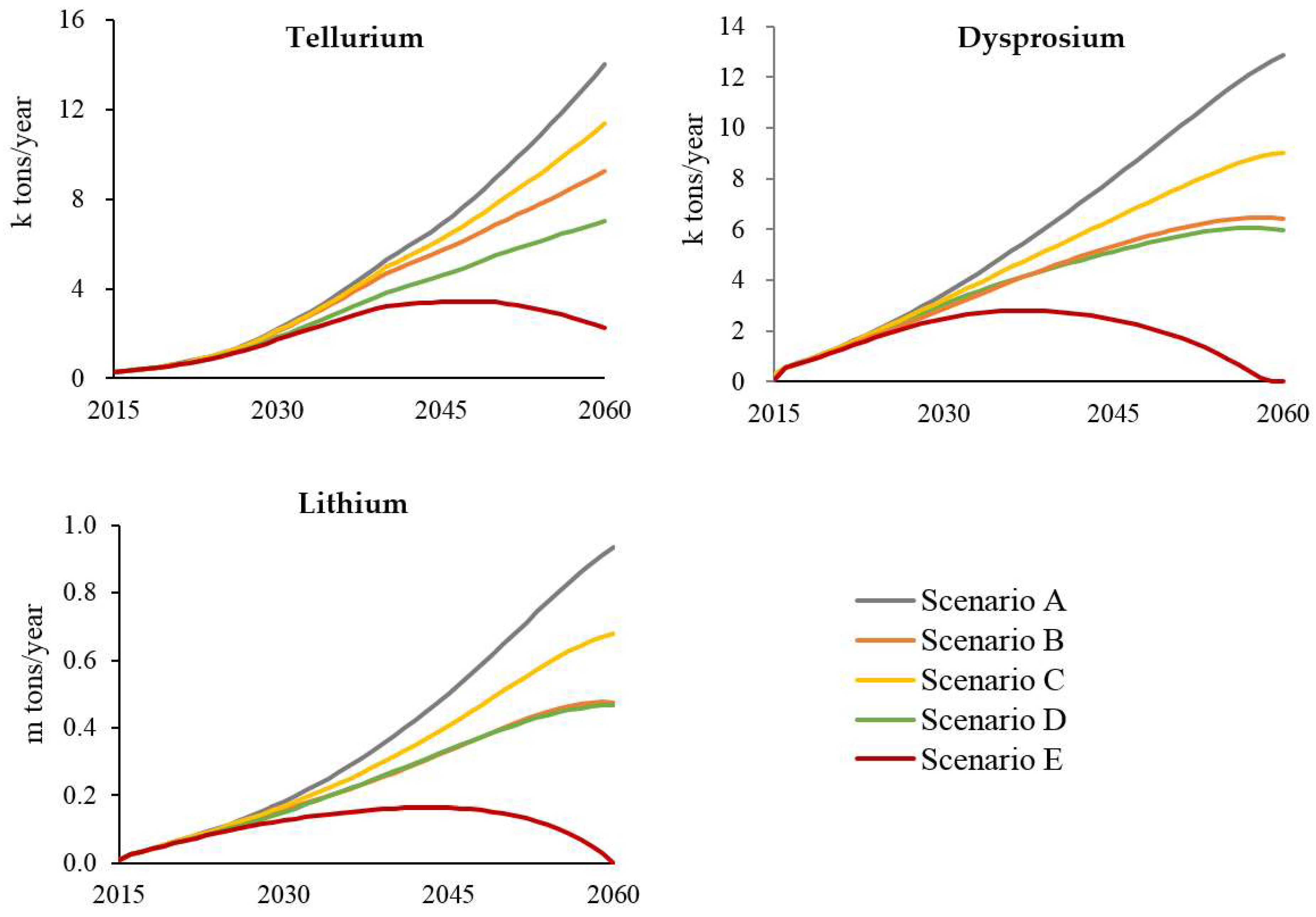

3.2. Potential Change in Supply-Demand Balance Based on Changes in Recycling Rate

3.3. Critical Metals That Require Priority Measures

4. Discussion

4.1. Comparison with Previous Studies

4.2. Uncertainties of Estimation Method

- In the top-down model, since the world future demand was estimated based only on Japan and USA historical data, differences in characteristics between countries were not sufficiently considered. Therefore, it is desirable to undertake the same type of regression for more countries, so that the applicability of the approach for each country or region can be better justified.

- In the bottom-up model, since the diffusion growth rate of uses other than low carbon energy technology was considered to be about the same as GDP growth rate, differences between products are not considered. For other uses, the breakdown should be analyzed in more detail and the diffusion growth rate should be given according to the product characteristics.

- In the supply balance analysis, the current recycling rate for uses other than low carbon energy technology was ignored. The recycling rate varies greatly for each metal and product and the higher the rate of the secondary resource supply of demand is, the lower the possibility of depletion. Therefore, for other uses, it is necessary to estimate the secondary resource supply by giving the average lifetime and recycling rate for each product.

- There is a possibility that reserves and resources will change significantly in the future. Especially if the price of metals and therefore the incentive for mining development, rises as demand increases there is a high possibility that format least some of what is currently considered uneconomic resources will be transferred to the class of reserves. This may also occur due to the improvement of mining technology. Therefore, there is a need for ongoing data collection and updating of the assessment.

- In the critical metal identification method, this paper considered only the possibility of physical depletion, the ratio of demand increase, the importance for decarbonization and the magnitude of environmental impact, however there are various other potential indicators of criticality, such as price volatility, concentration of producing countries and by-product ratio, that could also be applied. Hence, it is desirable to carefully examine these factors and incorporate them into the identification method appropriately.

- The substitution potential was not considered in this analysis. For example, REE permanent magnets could be replaced by electromagnets, CIGS and CdTe solar panel could be replaced by Si based solar panels and cobalt content of Li-ion batteries has been reduced significantly in the past decade and alternatives are being developed. This means that resource constraints may not have as significant an impact on the creation of a low-carbon society. Therefore, although it is difficult to quantify the substitution potential, it should be considered as an indicator of importance for decarbonization.

5. Conclusions

- The diffusion of solar power and next-generation vehicles may be hindered by resource depletion.

- The demand increase factor of common metals is dominated by economic and population growth in emerging countries, on the contrary, many rare metals are largely influenced by the expansion of low carbon energy technology.

- By establishing a recycling system, annual primary metal demand for low carbon energy technology in 2060 can be reduced by from 20% to 70% and it is possible to bring the net demand to approximately zero if reduction of material intensity is also undertaken.

- Critical metals that require special measures were identified as indium, tellurium, silver, lithium, nickel and platinum from the viewpoints of physical depletion potential, ratio of demand increase, importance for low carbonization and magnitude of environmental impact in the production process.

Author Contributions

Conflicts of Interest

Appendix A

| Technology | Price (USD/kW) | Technology | Price (USD/Vehicle) |

|---|---|---|---|

| CIGS PV module | 478 | HEV battery | 2240 |

| CdTe PV module | 478 | PHEV battery | 10,880 |

| Average PV module | 628 | EV battery | 14,100 |

| Wind turbine | 1013 | HFV fuel cell | 9200 |

References

- Giurco, D.; McLellan, B.; Franks, D.M.; Nansai, K.; Prior, T. Responsible mineral and energy futures: Views at the nexus. J. Clean. Prod. 2014, 84, 322–338. [Google Scholar] [CrossRef] [Green Version]

- The Warren Centre. The Copper Technology Roadmap 2030 Asia’s Growing Appetite for Copper; The Warren Centre: Sydney, Australia, 2016. [Google Scholar]

- International Copper Association. The Electric Vehicle Market and Copper Demand; International Copper Association: New York, NY, USA, 2017. [Google Scholar]

- International Energy Agency (IEA). Energy Technology Perspectives 2017: Catalysing Energy Technology Transformations; International Energy Agency: Paris, France, 2017; ISBN 978-92-64-27597-3. [Google Scholar]

- Goe, M.; Gaustad, G. Identifying critical materials for photovoltaics in the US: A multi-metric approach. Appl. Energy 2014, 123, 387–396. [Google Scholar] [CrossRef]

- Weiser, A.; Lang, D.J.; Schomerus, T.; Stamp, A. Understanding the modes of use and availability of critical metals—An expert-based scenario analysis for the case of indium. J. Clean. Prod. 2015, 94, 376–393. [Google Scholar] [CrossRef]

- Woodhouse, M.; Goodrich, A.; Margolis, R.; James, T.L.; Lokanc, M.; Eggert, R. Supply-Chain Dynamics of Tellurium, Indium, Manufacturing Costs. IEEE J. Photovolt. 2013, 3, 833–837. [Google Scholar] [CrossRef]

- Andersson, B.A. Materials availability for large-scale thin-film photovoltaics. Prog. Photovolt. Res. Appl. 2000, 8, 61–76. [Google Scholar] [CrossRef]

- Andersson, B.A.; Azar, C.; Holmberg, J.; Karlsson, S. Material constraints for thin-film solar cells. Energy 1998, 23, 407–411. [Google Scholar] [CrossRef]

- Candelise, C.; Spiers, J.F.; Gross, R.J.K. Materials availability for thin film (TF) PV technologies development: A real concern? Renew. Sustain. Energy Rev. 2011, 15, 4972–4981. [Google Scholar] [CrossRef]

- Fthenakis, V. Sustainability metrics for extending thin-film photovoltaics to terawatt levels. MRS Bull. 2012, 37, 425–430. [Google Scholar] [CrossRef]

- Redlinger, M.; Eggert, R.; Woodhouse, M. Evaluating the Availability of Gallium, Indium, and Tellurium from Recycled Photovoltaic Modules. Sol. Energy Mater. Sol. Cells 2014, 138, 58–71. [Google Scholar] [CrossRef]

- Stamp, A.; Wäger, P.A.; Hellweg, S. Linking energy scenarios with metal demand modeling-The case of indium in CIGS solar cells. Resour. Conserv. Recycl. 2014, 93, 156–167. [Google Scholar] [CrossRef]

- Choi, C.H.; Cao, J.; Zhao, F. System Dynamics Modeling of Indium Material Flows under Wide Deployment of Clean Energy Technologies. Resour. Conserv. Recycl. 2016, 114, 59–71. [Google Scholar] [CrossRef]

- Kim, J.; Guillaume, B.; Chung, J.; Hwang, Y. Critical and precious materials consumption and requirement in wind energy system in the EU 27. Appl. Energy 2015. [Google Scholar] [CrossRef]

- Nansai, K.; Nakajima, K.; Kagawa, S.; Kondo, Y.; Suh, S.; Shigetomi, Y.; Oshita, Y. Global Flows of Critical Metals Necessary for Low-Carbon Technologies: The Case of Neodymium, Cobalt, and Platinum. Environ. Sci. Technol. 2014, 48, 1391–1400. [Google Scholar] [CrossRef] [PubMed]

- Hoenderdaal, S.; Tercero Espinoza, L.; Marscheider-Weidemann, F.; Graus, W. Can a dysprosium shortage threaten green energy technologies? Energy 2013, 49, 344–355. [Google Scholar] [CrossRef]

- Roelich, K.; Dawson, D.A.; Purnell, P.; Knoeri, C.; Revell, R.; Busch, J.; Steinberger, J.K. Assessing the dynamic material criticality of infrastructure transitions: A case of low carbon electricity. Appl. Energy 2014, 123, 378–386. [Google Scholar] [CrossRef]

- Wilburn, D.R. Wind Energy in the United States and Materials Required for the Land-Based Wind Turbine Industry From 2010 Through 2030. 2011. Available online: http://pubs.usgs.gov/sir/2011/5036 (accessed on 1 October 2017).

- Habib, K.; Wenzel, H. Exploring rare earths supply constraints for the emerging clean energy technologies and the role of recycling. J. Clean. Prod. 2014, 84, 348–359. [Google Scholar] [CrossRef]

- Busch, J.; Dawson, D.; Roelich, K. Closing the low-carbon material loop using a dynamic whole system approach. J. Clean. Prod. 2017, 149, 751–761. [Google Scholar] [CrossRef]

- Glaister, B.J.; Mudd, G.M. The environmental costs of platinum-PGM mining and sustainability: Is the glass half-full or half-empty? Miner. Eng. 2010, 23, 438–450. [Google Scholar] [CrossRef]

- Alonso, E.; Field, F.R.; Kirchain, R.E. Platinum availability for future automotive technologies. Environ. Sci. Technol. 2012, 46, 12986–12993. [Google Scholar] [CrossRef] [PubMed]

- Borgwardt, R.H. Platinum, fuel cells, and future US road transport. Transp. Res. Part D Transp. Environ. 2001, 6, 199–207. [Google Scholar] [CrossRef]

- Kromer, M.A.; Joseck, F.; Rhodes, T.; Guernsey, M.; Marcinkoski, J. Evaluation of a platinum leasing program for fuel cell vehicles. Int. J. Hydrogen Energy 2009, 34, 8276–8288. [Google Scholar] [CrossRef]

- Yang, C.J. An impending platinum crisis and its implications for the future of the automobile. Energy Policy 2009, 37, 1805–1808. [Google Scholar] [CrossRef]

- Spiegel, R.J. Platinum and fuel cells. Transp. Res. Part D Transp. Environ. 2004, 9, 357–371. [Google Scholar] [CrossRef]

- Saurat, M.; Bringezu, S. Platinum group metal flows of Europe, part II exploring the technological and institutional potential for reducing environmental impacts. J. Ind. Ecol. 2009, 13, 406–421. [Google Scholar] [CrossRef]

- Mohr, S.H.; Mudd, G.; Giurco, D. Lithium Resources and Production: Critical Assessment and Global Projections. Minerals 2012, 2, 65–84. [Google Scholar] [CrossRef]

- Grosjean, C.; Herrera Miranda, P.; Perrin, M.; Poggi, P. Assessment of world lithium resources and consequences of their geographic distribution on the expected development of the electric vehicle industry. Renew. Sustain. Energy Rev. 2012, 16, 1735–1744. [Google Scholar] [CrossRef]

- Kushnir, D.; Sandén, B.A. The time dimension and lithium resource constraints for electric vehicles. Resour. Policy 2012, 37, 93–103. [Google Scholar] [CrossRef]

- Prior, T.; Wäger, P.A.; Stamp, A.; Widmer, R.; Giurco, D. Sustainable governance of scarce metals: The case of lithium. Sci. Total Environ. 2013, 461–462, 785–791. [Google Scholar] [CrossRef] [PubMed]

- Speirs, J.; Contestabile, M.; Houari, Y.; Gross, R. The future of lithium availability for electric vehicle batteries. Renew. Sustain. Energy Rev. 2014, 35, 183–193. [Google Scholar] [CrossRef]

- Forster, J.; Rutherford, T.F. A Lithium Shortage: Are Electric Vehicles Under Threat? Swiss Federal Institute of Technology Zurich: Zurich, Switzerland, 2011. [Google Scholar]

- Fishman, T.; Myers, R.; Rios, O.; Graedel, T.E. Implications of Emerging Vehicle Technologies on Rare Earth Supply and Demand in the United States. Resources 2018, 7, 9. [Google Scholar] [CrossRef]

- Mclellan, B.C.; Yamasue, E.; Tezuka, T.; Corder, G.; Golev, A.; Giurco, D. Critical Minerals and Energy—Impacts and Limitations of Moving to Unconventional Resources. Resources 2016, 5, 19. [Google Scholar] [CrossRef]

- Tokimatsu, K.; Wachtmeister, H.; McLellan, B.; Davidsson, S.; Murakami, S.; Höök, M.; Yasuoka, R.; Nishio, M. Energy modeling approach to the global energy-mineral nexus: A first look at metal requirements and the 2 °C target. Appl. Energy 2017, 1–16. [Google Scholar] [CrossRef]

- National Research Council (NRC). Minerals, Critical Minerals, and the U.S. Economy; Committee on Critical Mineral Impacts of the U.S. Economy: Washington, DC, USA, 2008. [Google Scholar]

- European Commission. Critical Raw Materials for the EU, Report of the Ad-Hoc Working Group on Defining Critical Raw Materials; European Commission: Brussels, Belgium, 2010; Volume 39. [Google Scholar]

- European Commission. Report on Critical Raw Materials for the EU, Report of the Ad Hoc Working Group on Defining Critical Raw Materials; European Commission: Brussels, Belgium, 2014. [Google Scholar]

- Graedel, T.E.; Barr, R.; Chandler, C.; Chase, T.; Choi, J.; Christoffersen, L.; Friedlander, E.; Henly, C.; Jun, C.; Nassar, N.T.; et al. Methodology of metal criticality determination. Environ. Sci. Technol. 2012, 46, 1063–1070. [Google Scholar] [CrossRef] [PubMed]

- Nassar, N.T.; Barr, R.; Browning, M.; Diao, Z.; Friedlander, E.; Harper, E.M.; Henly, C.; Kavlak, G.; Kwatra, S.; Jun, C.; et al. Criticality of the geological copper family. Environ. Sci. Technol. 2012, 46, 1071–1078. [Google Scholar] [CrossRef] [PubMed]

- Graedel, T.E.; Nassar, N.T. The criticality of metals: A perspective for geologists. Geol. Soc. Spec. Publ. 2015, 393, 291–302. [Google Scholar] [CrossRef]

- Nuss, P.; Harper, E.M.; Nassar, N.T.; Reck, B.K.; Graedel, T.E. Criticality of iron and its principal alloying elements. Environ. Sci. Technol. 2014, 48, 4171–4177. [Google Scholar] [CrossRef] [PubMed]

- Harper, E.M.; Kavlak, G.; Burmeister, L.; Eckelman, M.J.; Erbis, S.; Sebastian Espinoza, V.; Nuss, P.; Graedel, T.E. Criticality of the Geological Zinc, Tin, and Lead Family. J. Ind. Ecol. 2015, 19, 628–644. [Google Scholar] [CrossRef]

- Nassar, N.T.; Graedel, T.E.; Harper, E.M. By-product metals are technologically essential but have problematic supply. Sci. Adv. 2015, 1, e1400180. [Google Scholar] [CrossRef] [PubMed]

- Nassar, N.T.; Du, X.; Graedel, T.E. Criticality of the Rare Earth Elements. J. Ind. Ecol. 2015, 19, 1044–1054. [Google Scholar] [CrossRef]

- Harper, E.M.; Diao, Z.; Panousi, S.; Nuss, P.; Eckelman, M.J.; Graedel, T.E. The criticality of four nuclear energy metals. Resour. Conserv. Recycl. 2015, 95, 193–201. [Google Scholar] [CrossRef]

- Panousi, S.; Harper, E.M.; Nuss, P.; Eckelman, M.J.; Hakimian, A.; Graedel, T.E. Criticality of Seven Specialty Metals. J. Ind. Ecol. 2016, 20, 837–853. [Google Scholar] [CrossRef]

- Graedel, T.E.; Harper, E.M.; Nassar, N.T.; Nuss, P.; Reck, B.K. Criticality of metals and metalloids. Proc. Natl. Acad. Sci. USA 2015, 112, 4257–4262. [Google Scholar] [CrossRef] [PubMed]

- Ciacci, L.; Nuss, P.; Reck, B.; Werner, T.; Graedel, T. Metal Criticality Determination for Australia, the US, and the Planet—Comparing 2008 and 2012 Results. Resources 2016, 5, 29. [Google Scholar] [CrossRef]

- U.S. Department of Energy. Critical Materials Strategy: 2011; U.S. Department of Energy: Washington, DC, USA, 2011.

- McLellan, B.; Corder, G.; Ali, S. Sustainability of Rare Earths—An Overview of the State of Knowledge. Minerals 2013, 3, 304–317. [Google Scholar] [CrossRef]

- Moss, R.L.; Tzimas, E.; Willis, P.; Arendorf, J. Critical Metals in the Path towards the Decarbonisation of the EU Energy Sector; Publications Office of the European Union: Brussels, Belgium, 2013. [Google Scholar]

- Habib, K.; Wenzel, H. Reviewing resource criticality assessment from a dynamic and technology specific perspective—Using the case of direct-drive wind turbines. J. Clean. Prod. 2016, 112, 3852–3863. [Google Scholar] [CrossRef]

- Glöser-Chahoud, S.; Tercero Espinoza, L.; Walz, R.; Faulstich, M. Taking the Step towards a More Dynamic View on Raw Material Criticality: An Indicator Based Analysis for Germany and Japan. Resources 2016, 5, 45. [Google Scholar] [CrossRef]

- Sugiyama, K.; Honma, O.; Mishima, N. Quantitative Analysis of Material Flow of Used Mobile Phones in Japan. Procedia CIRP 2016, 40, 79–84. [Google Scholar] [CrossRef]

- Xu, C.; Zhang, W.; He, W.; Li, G.; Huang, J. The situation of waste mobile phone management in developed countries and development status in China. Waste Manag. 2016, 58, 341–347. [Google Scholar] [CrossRef] [PubMed]

- Li, B.; Yang, J.; Lu, B.; Song, X. Estimation of retired mobile phones generation in China: A comparative study on methodology. Waste Manag. 2015, 35, 247–254. [Google Scholar] [CrossRef] [PubMed]

- Sarath, P.; Bonda, S.; Mohanty, S.; Nayak, S.K. Mobile phone waste management and recycling: Views and trends. Waste Manag. 2015, 46, 536–545. [Google Scholar] [CrossRef] [PubMed]

- Yokoyama, K.; Nakano, K.; Nagasaka, T.; Nakajima, K. Substance Flow Analysis of Indium for Flat Panel Displays in Japan. Mater. Trans. 2008, 48, 99–104. [Google Scholar]

- Ashby, M.F. Materials for low-carbon power. In Materials and the Environment; Elsevier: New York, NY, USA, 2013; pp. 349–413. ISBN 978-0-12-385971-6. [Google Scholar]

- Weckend, S.; Wade, A.; Heath, G. End-of-Life Management Solar Photovoltaic Panels; International Renewable Energy Agency and International Energy Agency Photovoltaic Power Systems: Paris, France, 2016. [Google Scholar]

- Hatayama, H.; Daigo, I.; Matsuno, Y.; Adachi, Y. Evolution of aluminum recycling initiated by the introduction of next-generation vehicles and scrap sorting technology. Resour. Conserv. Recycl. 2012, 66, 8–14. [Google Scholar] [CrossRef]

- Müller, D.B. Stock dynamics for forecasting material flows—Case study for housing in The Netherlands Daniel. Ecol. Econ. 2005, 59, 82–93. [Google Scholar] [CrossRef]

- Gerst, M.D. Linking material flow analysis and resource policy via future scenarios of in-use stock: An example for copper. Environ. Sci. Technol. 2009, 43, 6320–6325. [Google Scholar] [CrossRef] [PubMed]

- Hatayama, H.; Daigo, I.; Matsuno, Y.; Adachi, Y. Outlook of the World Steel Cycle Based on the Stock and Flow Dynamics. Environ. Sci. Technol. 2010, 44, 6457–6463. [Google Scholar] [CrossRef] [PubMed]

- Elshkaki, A.; Graedel, T.E. Dynamic analysis of the global metals flows and stocks in electricity generation technologies. J. Clean. Prod. 2013, 59, 260–273. [Google Scholar] [CrossRef]

- Busch, J.; Steinberger, J.K.; Dawson, D.A.; Purnell, P.; Roelich, K. Managing critical materials with a technology-specific stocks and flows model. Environ. Sci. Technol. 2014, 48, 1298–1305. [Google Scholar] [CrossRef] [PubMed]

- Halada, K.; Shimada, M.; Ijima, K. Decoupling Status of Metal Consumption from Economic Growth. J. Jpn. Inst. Met. 2007, 71, 823–830. [Google Scholar] [CrossRef]

- The World Bank World Development Indicators. Available online: https://data.worldbank.org/data-catalog (accessed on 1 July 2017).

- World Bureau of Metal Statistics. World Metal Statistics Yearbook; World Bureau of Metal Statistics: Ware, UK, 2016. [Google Scholar]

- Sigen Sozai Gakkai. Koubutsu Shigen Data Book, 2nd ed.; Ohmusha: Tokyo, Japan, 2006. [Google Scholar]

- U.S. Geological Survey (USGS). Commodity Statistics and Information. Available online: https://minerals.usgs.gov/minerals/pubs/mcs/ (accessed on 1 October 2017).

- Bleiwas, D.I. Byproduct Mineral Commodities Used for the Production of Photovoltaic Cells; USGS Publications Team: Reston, VA, USA, 2010; Volume 1365.

- Berry, C. Case Study of a Growth Driver—Silver Use in Solar. Available online: https://www.pv-tech.org/guest-blog/case_study_of_a_growth_driver_silver_use_in_solar (accessed on 1 October 2017).

- Bödeker, J.M.; Bauer, M.; Pehnt, M. Aluminium and Renewable Energy Systems—Prospects for the Sustainable Generation of Electricity and Heat; Institut für Energie und Umweltforschung Heidelberg GmbH: Heidelberg, Germany, 2010. [Google Scholar]

- U.S. Geological Survey (USGS). Historical Statistics for Mineral and Material Commodities in the United States. Available online: https://minerals.usgs.gov/minerals/pubs/historical-statistics/ (accessed on 1 October 2017).

- BGS Minerals UK. World Mineral Statistics Data. Available online: https://www.bgs.ac.uk/mineralsuk/statistics/wms.cfc?method=searchWMS (accessed on 1 October 2017).

- Lokanc, M.; Eggert, R.; Redlinger, M.; Lokanc, M.; Eggert, R. The Availability of Indium : The Present, Medium Term, and Long Term; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2015.

- Sverdrup, H.; Ragnarsdóttir, K.V. Natural Resources in a Planetary Perspective. Geochem. Perspect. 2014, 3, 129–341. [Google Scholar] [CrossRef]

- Kleijn, R.; Van Der Voet, E. Resource constraints in a hydrogen economy based on renewable energy sources: An exploration. Renew. Sustain. Energy Rev. 2010, 14, 2784–2795. [Google Scholar] [CrossRef]

- United States Geological Survey (USGS). Commodity Statistics and Information. Available online: https://minerals.usgs.gov/minerals/pubs/commodity/ (accessed on 1 January 2017).

- Kondo, S.; Takeyama, A.; Okura, T. A study on the Forecasts of Supply and Demand of Platinum Group Metals. Shigen-to-Sozai 2006, 122, 386–395. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA). Data & Statistics. Available online: http://www.irena.org/ourwork/Knowledge-Data-Statistics/Data-Statistics (accessed on 1 October 2014).

| Required Metals | Solar Power | Wind Power | Next-Generation Vehicle |

|---|---|---|---|

| Indium | ✓ | ||

| Gallium | ✓ | ||

| Selenium | ✓ | ||

| Tellurium | ✓ | ||

| Cadmium | ✓ | ||

| Silver | ✓ | ||

| Dysprosium | ✓ | ✓ | |

| Neodymium | ✓ | ✓ | |

| Lithium | ✓ | ||

| Cobalt | ✓ | ||

| Nickel | ✓ | ||

| Platinum | ✓ | ||

| Steel | ✓ | ✓ | ✓ |

| Aluminum | ✓ | ✓ | ✓ |

| Copper | ✓ | ✓ | ✓ |

| Technology | Distribution Function | Average Lifetime (Year) | Shape Parameter α | Ref. |

|---|---|---|---|---|

| Solar power | Weibull | 20 | 5.38 | [62,63] |

| Wind power | 25 | 5.38 | [62,63] | |

| Next-generation vehicle | 15 | 3.50 | [64] |

| Type | Scenario | 2010 | 2020 | 2030 | 2040 | 2050 | 2060 |

|---|---|---|---|---|---|---|---|

| CIGS/CdTe | Low | 2% | 7% | 14% | 18% | 20% | 20% |

| Ref | 2% | 9% | 21% | 28% | 30% | 30% | |

| High | 2% | 13% | 37% | 48% | 50% | 50% | |

| PMG | Low | 10% | 14% | 18% | 21% | 25% | 25% |

| Ref | 10% | 15% | 20% | 25% | 30% | 30% | |

| High | 10% | 20% | 30% | 40% | 50% | 50% |

| Metal | Type | Metal Intensity (t/GW) | Ref. | Price (USD/t) 1 |

|---|---|---|---|---|

| Indium | CIGS | 23 | [12] | 520,000 |

| Gallium | CIGS | 7.5 | [12] | 317,000 |

| Selenium | CIGS | 45 | [36] | 48,700 |

| Tellurium | CdTe | 97.5 | [75] | 77,000 |

| Cadmium | CdTe | 85 | [75] | 1470 |

| Silver | All | 80 | [76] | 505,000 |

| Steel | All | 1,100,000 | [62] | 81 |

| Aluminum | All | 32,000 | [77] | 1940 |

| Copper | All | 4000 | [2] | 5650 |

| Metal | Type | Metal Intensity (t/GW) | Ref. | Price (USD/t) 1 |

|---|---|---|---|---|

| Dysprosium | PMG | 27.7 | [17] | 240,000 |

| Neodymium | PMG | 198 | [17] | 42,000 |

| Steel | All | 103,000 | [19] | 81 |

| Aluminum | All | 1060 | [77] | 1940 |

| Copper | All | 3000 | [19] | 5560 |

| Metal | ICEV | HEV | PHEV | EV | HFV | Ref. | Price (USD/t) 1 |

|---|---|---|---|---|---|---|---|

| Dysprosium | 0 | 83 | 83 | 83 | 0 | [17] | 240,000 |

| Neodymium | 0 | 695 | 695 | 695 | 0 | [17] | 42,000 |

| Lithium | 0 | 0 | 5100 | 12,700 | 0 | [52] | 4540 |

| Cobalt | 0 | 660 | 3500 | 8800 | 0 | [52] | 29,200 |

| Nickel | 0 | 3200 | 18,600 | 46,500 | 0 | [52] | 11,800 |

| Platinum | 0 | 0 | 0 | 0 | 60 | [28] | 13,500,000 |

| Steel | 921,900 | 1,056,200 | 1,185,900 | 909,500 | 911,800 | [35] | 81 |

| Aluminum | 71,300 | 114,500 | 162,400 | 78,600 | 65,000 | [35] | 1940 |

| Copper | 23,000 | 40,000 | 60,000 | 83,000 | 23,000 | [3] | 5650 |

| Metal | Reserves | Resources | Production | Ref. |

|---|---|---|---|---|

| Indium | 15 | 47 | 0.8 | [80,81] |

| Gallium | 110 | 1000 | 0.4 | [82,83] |

| Selenium | 100 | 171 | 2.2 | [74,81] |

| Tellurium | 25 | 48 | 0.2 | [74] |

| Cadmium | 500 | 6000 | 24 | [74] |

| Silver | 570 | 1308 | 25 | [74,81] |

| Dysprosium 1 | 1100 | 1980 | 1.8 | [20,81] |

| Neodymium 1 | 12,800 | 23,040 | 16 | [20,81] |

| Lithium | 14,000 | 39,500 | 32 | [74] |

| Cobalt | 7100 | 145,000 | 126 | [74] |

| Nickel | 79,000 | 130,000 | 2280 | [74] |

| Platinum | 6 | 20 | 0.2 | [84] |

| Steel | 85,000,000 | 230,000,000 | 2,280,000 | [74] |

| Aluminum | 28,000,000 | 55,000,000 | 57,500 | [74] |

| Copper | 720,000 | 3,500,000 | 19,100 | [74] |

| Scenario | Characteristics |

|---|---|

| A | No management measures |

| B | 90% recycling for end-of-life low carbon energy technology |

| C | 50% recycling for end-of-life low carbon energy technology |

| D | Reducing metal intensity by 50% by 2060 (Linearly) |

| E | Recycle + Reduce (Scenario B + Scenario D) |

| Study | Region | Period | Comparison with | Bottleneck Metal |

|---|---|---|---|---|

| This study | World | 2060 | Reserves/Resources/Production | In, Se, Te, Ag, Li, Ni, Pt, |

| McLellan et al. [36] | World | 2050 | Reserves | In, Se, Te, Dy, Nd |

| Tokimatsu et al. [37] | World | 2100 | Production | In, Se, Te, Li, Co, Ni, Mn |

| Study | Region | Period | Criteria | Critical Metal |

|---|---|---|---|---|

| This study | World | 2060 | Depletion/Importance for decarbonization/Environmental | In, Te, Ag, Li, Ni, Pt |

| USDOE [52] | USA | 2025 | Supply risk/Importance to clean energy | Dy, Nd, Eu, Tb, Y |

| JRC [54] | EU | 2030 | Market factors/Geopolitical factors | Ga, Te, Dy, Nd, Eu, Tb, Y, Pr |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Watari, T.; McLellan, B.C.; Ogata, S.; Tezuka, T. Analysis of Potential for Critical Metal Resource Constraints in the International Energy Agency’s Long-Term Low-Carbon Energy Scenarios. Minerals 2018, 8, 156. https://doi.org/10.3390/min8040156

Watari T, McLellan BC, Ogata S, Tezuka T. Analysis of Potential for Critical Metal Resource Constraints in the International Energy Agency’s Long-Term Low-Carbon Energy Scenarios. Minerals. 2018; 8(4):156. https://doi.org/10.3390/min8040156

Chicago/Turabian StyleWatari, Takuma, Benjamin C. McLellan, Seiichi Ogata, and Tetsuo Tezuka. 2018. "Analysis of Potential for Critical Metal Resource Constraints in the International Energy Agency’s Long-Term Low-Carbon Energy Scenarios" Minerals 8, no. 4: 156. https://doi.org/10.3390/min8040156