Explaining Public Goods Game Contributions with Rational Ability

Abstract

:1. Introduction

2. Experimental Section

2.1. Survey

2.2. Public Goods Game

3. Results

Personality Traits

4. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Zelmer, J. Linear Public Goods Experiments: A Meta-Analysis. Exp. Econ. 2003, 6, 299–310. [Google Scholar] [CrossRef]

- Andreoni, J. Why free ride?: Strategies and learning in public goods experiments. J. Public Econ. 1988, 37, 291–304. [Google Scholar] [CrossRef]

- Andreoni, J. Cooperation in public-goods experiments: Kindness or confusion? Am. Econ. Rev. 1995, 891–904. [Google Scholar]

- Gächter, S.; Kölle, F.; Quercia, S. Reciprocity and the tragedies of maintaining and providing the commons. Nat. Hum. Behav. 2017, 1, 650–656. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Fosgaard, T.R.; Hansen, L.G.; Wengström, E. Framing and Misperception in Public Good Experiments. Scand. J. Econ. 2017, 119, 435–456. [Google Scholar] [CrossRef]

- Semmann, D.; Krambeck, H.-J.; Milinski, M. Volunteering leads to rock–paper–scissors dynamics in a public goods game. Nature 2003, 425, 390–393. [Google Scholar] [CrossRef] [PubMed]

- Romaniuc, R.; Dubois, D.; DeAngelo, G.; McCannon, B. Intergroup Solidarity and Local Public Goods Provision: An Experiment; Working Papers; Universitiy of Montpellier: Montpellier, France, 2018. [Google Scholar]

- Cinyabuguma, M.; Page, T.; Putterman, L. Cooperation under the threat of expulsion in a public goods experiment. J. Public Econ. 2005, 89, 1421–1435. [Google Scholar] [CrossRef] [Green Version]

- Fehr, E.; Gächter, S. Cooperation and Punishment in Public Goods Experiments. Am. Econ. Rev. 2000, 90, 980–994. [Google Scholar] [CrossRef] [Green Version]

- Czap, H.J.; Czap, N.V.; Bonakdarian, E. Walk the Talk? The Effect of Voting and Excludability in Public Goods Experiments. Available online: https://www.hindawi.com/journals/ecri/2010/768546/abs/ (accessed on 8 March 2018).

- John, O.P.; Donahue, E.M.; Kentle, R.L. The Big Five Inventory—Versions 4a and 54; University of California, Berkeley, Institute of Personality and Social Research: Berkeley, CA, USA, 1991. [Google Scholar]

- John, O.P.; Naumann, L.P.; Soto, C.J. Paradigm shift to the integrative big five trait taxonomy. In Handbook of Personality: Theory and Research; The Guilford Press: New York, NY, USA; London, UK, 2008; pp. 114–158. ISBN 978-1-59385-836-0. [Google Scholar]

- Perugini, M.; Tan, J.H.; Zizzo, D.J. Which is the more predictable gender? Public good contribution and personality. Econ. Issues 2010, 15, 83–110. [Google Scholar] [CrossRef]

- Volk, S.; Thöni, C.; Ruigrok, W. Temporal stability and psychological foundations of cooperation preferences. J. Econ. Behav. Organ. 2012, 81, 664–676. [Google Scholar] [CrossRef] [Green Version]

- Volk, S.; Thöni, C.; Ruigrok, W. Personality, personal values and cooperation preferences in public goods games: A longitudinal study. Personal. Individ. Differ. 2011, 50, 810–815. [Google Scholar] [CrossRef] [Green Version]

- Kurzban, R.; Houser, D. Individual differences in cooperation in a circular public goods game. Eur. J. Personal. 2001, 15, S37–S52. [Google Scholar] [CrossRef] [Green Version]

- Lohse, J. Smart or selfish—When smart guys finish nice. J. Behav. Exp. Econ. 2016, 64, 28–40. [Google Scholar] [CrossRef]

- Benet-Martinez, V.; John, O.P. Los Cinco Grandes across cultures and ethnic groups: Multitrait-multimethod analyses of the Big Five in Spanish and English. J. Pers. Soc. Psychol. 1998, 75, 729. [Google Scholar] [CrossRef] [PubMed]

- Lu, L.; Argyle, M. Happiness and cooperation. Personal. Individ. Differ. 1991, 12, 1019–1030. [Google Scholar] [CrossRef] [Green Version]

- Ashton, M.C.; Paunonen, S.V.; Helmes, E.; Jackson, D.N. Kin altruism, reciprocal altruism, and the Big Five personality factors. Evol. Hum. Behav. 1998, 19, 243–255. [Google Scholar] [CrossRef]

- Hirsh, J.B.; Peterson, J.B. Extraversion, neuroticism, and the prisoner’s dilemma. Personal. Individ. Differ. 2009, 46, 254–256. [Google Scholar] [CrossRef]

- Ben-Ner, A.; Kong, F.; Putterman, L. Share and share alike? Gender-pairing, personality, and cognitive ability as determinants of giving. J. Econ. Psychol. 2004, 25, 581–589. [Google Scholar] [CrossRef]

- Ben-Ner, A.; Kramer, A. Personality and altruism in the dictator game: Relationship to giving to kin, collaborators, competitors, and neutrals. Personal. Individ. Differ. 2011, 51, 216–221. [Google Scholar] [CrossRef]

- SurveyMonkey. Available online: www.surveymonkey.com (accessed on 17 August 2013).

- Pacini, R.; Epstein, S. The relation of rational and experiential information processing styles to personality, basic beliefs, and the ratio-bias phenomenon. J. Personal. Soc. Psychol. 1999, 76, 972–987. [Google Scholar] [CrossRef]

- Wonderlic, E.F. Wonderlic Personnel Test and Scholastic Level Exam: User’s Manual; Wonderlic and Associates: Northfield, IL, USA, 1992. [Google Scholar]

- Holt, C.A.; Laury, S.K. Risk aversion and incentive effects. Am. Econ. Rev. 2002, 92, 1644–1655. [Google Scholar] [CrossRef]

- Baron-Cohen, S.; Wheelwright, S.; Hill, J.; Raste, Y.; Plumb, I. The “Reading the Mind in the Eyes” Test revised version: A study with normal adults, and adults with Asperger syndrome or high-functioning autism. J. Child Psychol. Psychiatry 2001, 42, 241–251. [Google Scholar] [CrossRef] [PubMed]

- Baron-Cohen, S.; Jolliffe, T.; Mortimore, C.; Robertson, M. Another advanced test of theory of mind: Evidence from very high functioning adults with autism or Asperger syndrome. J. Child Psychol. Psychiatry 1997, 38, 813–822. [Google Scholar] [CrossRef] [PubMed]

- Hirschauer, N.; Musshoff, O.; Maart-Noelck, S.C.; Gruener, S. Eliciting risk attitudes—How to avoid mean and variance bias in Holt-and-Laury lotteries. Appl. Econ. Lett. 2014, 21, 35–38. [Google Scholar] [CrossRef]

- Craig, J.S.; Hatton, C.; Craig, F.B.; Bentall, R.P. Persecutory beliefs, attributions and theory of mind: Comparison of patients with paranoid delusions, Asperger’s syndrome and healthy controls. Schizophr. Res. 2004, 69, 29–33. [Google Scholar] [CrossRef]

- Golan, O.; Baron-Cohen, S.; Hill, J. The Cambridge Mindreading (CAM) Face-Voice Battery: Testing Complex Emotion Recognition in Adults with and without Asperger Syndrome. J. Autism Dev. Disord. 2006, 36, 169–183. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Murphy, D. Theory of mind in Asperger’s syndrome, schizophrenia and personality disordered forensic patients. Cognit. Neuropsychiatry 2006, 11, 99–111. [Google Scholar] [CrossRef] [PubMed]

- Isaac, R.M.; Walker, J.M.; Williams, A.W. Group size and the voluntary provision of public goods: Experimental evidence utilizing large groups. J. Public Econ. 1994, 54, 1–36. [Google Scholar] [CrossRef]

- Sladek, R.M.; Bond, M.J.; Phillips, P.A. Age and gender differences in preferences for rational and experiential thinking. Personal. Individ. Differ. 2010, 49, 907–911. [Google Scholar] [CrossRef]

- Calder, L.A.; Forster, A.J.; Stiell, I.G.; Carr, L.K.; Brehaut, J.C.; Perry, J.J.; Vaillancourt, C.; Croskerry, P. Experiential and rational decision making: A survey to determine how emergency physicians make clinical decisions. Emerg. Med. J. 2011. [Google Scholar] [CrossRef] [PubMed]

- Fujimoto, H.; Park, E.-S. Framing effects and gender differences in voluntary public goods provision experiments. J. Socio-Econ. 2010, 39, 455–457. [Google Scholar] [CrossRef]

- Park, E.-S. Warm-glow versus cold-prickle: A further experimental study of framing effects on free-riding. J. Econ. Behav. Organ. 2000, 43, 405–421. [Google Scholar] [CrossRef]

- Abdi, H. The Bonferonni and Šidák Corrections for Multiple Comparisons. In Encyclopedia of Measurement and Statistics; Salkind, N., Ed.; Sage: Thousand Oaks, CA, USA, 2007; p. 9. [Google Scholar]

- Epstein, S.; Pacini, R.; Denes-Raj, V.; Heier, H. Individual differences in intuitive-experiential and analytical-rational thinking styles. J. Personal. Soc. Psychol. 1996, 71, 390–405. [Google Scholar] [CrossRef]

| 1 | In unreported results, we include a series of interaction variables between group size, gender and other control variables. None of these interaction effects were statistically significant and, hence, we do not report these results here. |

| Variable | Median/Mean | S.D. |

|---|---|---|

| Age | 22/21.5 | 2.07 |

| Group size | 10/11.4 | 2.66 |

| Public Good Outcome | 3.4/3.41 | 0.827 |

| Public Good Contribution | ||

| • for all participants (N = 140) | 0.5/0.502 | 0.392 |

| • for all males (N = 85) | 0.5/0.517 | 0.429 |

| • for all females (N = 55) | 0.5/0.478 | 0.329 |

| • for group size = 8 (N = 32) | 0.5/0.495 | 0.400 |

| • for group size = 10 (N = 40) | 0.5/0.498 | 0.388 |

| • for group size = 12 (N = 24) | 0.64/0.566 | 0.394 |

| • for group size = 14 (N = 28) | 0.45/0.454 | 0.395 |

| • for group size = 16 (N = 16) | 0.5/0.513 | 0.416 |

| Rationality | ||

| • for all participants (N = 140) | 3.3/3.29 | 0.712 |

| • for all males (N = 85) | 3.3/3.198 | 0.755 |

| • for all females (N = 55) | 3.5/3.42 | 0.623 |

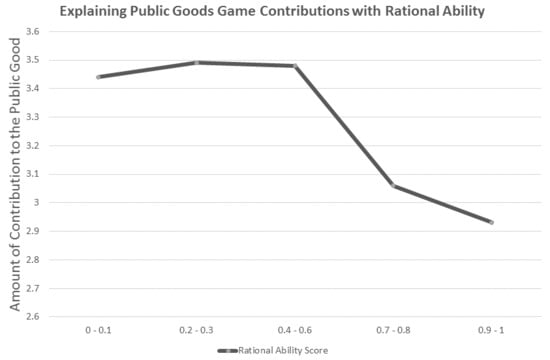

| Rational Ability Score | 0 < x ≤ 2 | 2 < x < 3 | 3 ≤ x < 3.5 | 3.5 ≤ x < 4 | 4 ≤ x | |

|---|---|---|---|---|---|---|

| Investment in Public Good | ||||||

| All participants (N = 140) | ||||||

| • N | 11 | 28 | 37 | 38 | 26 | |

| • Mean (S.D.) | 0.85 (0.32) | 0.60 (0.42) | 0.51 (0.36) | 0.42 (0.36) | 0.34 (0.38) | |

| PG Contribution | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| Rational Ability | −0.155 ** (0.047) | −0.153 ** (0.047) | −0.150 * (0.048) | −0.176 **(0.047) | −0.219 * (0.067) |

| Risk Aversion | −0.001 (0.075) | 0.005 (0.076) | 0.006 (0.078) | 0.047 (0.085) | −0.004 (0.078) |

| Age | 0.037 ** (0.012) | 0.043 ** (0.013) | 0.034 (0.017) | 0.038 * (0.013) | 0.048 ** (0.014) |

| Male | 0.015 (0.061) | 0.038 (0.072) | 0.022 (0.060) | 0.016 (0.069) | |

| Group Size | −0.014 (0.012) | −0.012 (0.014) | −0.009 (0.013) | −0.014 (0.012) | |

| Big 5—Extraversion | 0.016 (0.050) | ||||

| Big 5—Agreeableness | 0.079 (0.059) | ||||

| Big 5—Consciousness | −0.126 (0.065) | ||||

| Big 5—Neuroticism | 0.067 (0.055) | ||||

| Big 5—Openness | −0.060 (0.057) | ||||

| Rational Engagement | 0.089 (0.058) | ||||

| Experiential Ability | 0.014 (0.076) | ||||

| Experiential Engagement | −0.031 (0.079) | ||||

| Wonderlic Score | −0.006 (0.007) | ||||

| Mind in the Eyes Score | −0.007 (0.010) | ||||

| Constant | 0.206 (0.348) | 0.188 (0.352) | 0.132 (0.408) | 0.349 (0.390) | 0.500 (0.507) |

| Control Variables | No | No | College, Major, Years in College | No | No |

| R2 | 0.138 | 0.145 | 0.160 | 0.196 | 0.172 |

| Adjusted R2 | 0.119 | 0.114 | 0.088 | 0.133 | 0.108 |

| F | 11.46 *** | 7.712 *** | 4.412 *** | 6.050 *** | 4.010 *** |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lang, H.; DeAngelo, G.; Bongard, M. Explaining Public Goods Game Contributions with Rational Ability. Games 2018, 9, 36. https://doi.org/10.3390/g9020036

Lang H, DeAngelo G, Bongard M. Explaining Public Goods Game Contributions with Rational Ability. Games. 2018; 9(2):36. https://doi.org/10.3390/g9020036

Chicago/Turabian StyleLang, Hannes, Gregory DeAngelo, and Michelle Bongard. 2018. "Explaining Public Goods Game Contributions with Rational Ability" Games 9, no. 2: 36. https://doi.org/10.3390/g9020036

APA StyleLang, H., DeAngelo, G., & Bongard, M. (2018). Explaining Public Goods Game Contributions with Rational Ability. Games, 9(2), 36. https://doi.org/10.3390/g9020036