Enhancing Urban Development Quality Based on the Results of Appraising Efficient Performance of Investors—A Case Study in Vietnam

Abstract

:1. Introduction

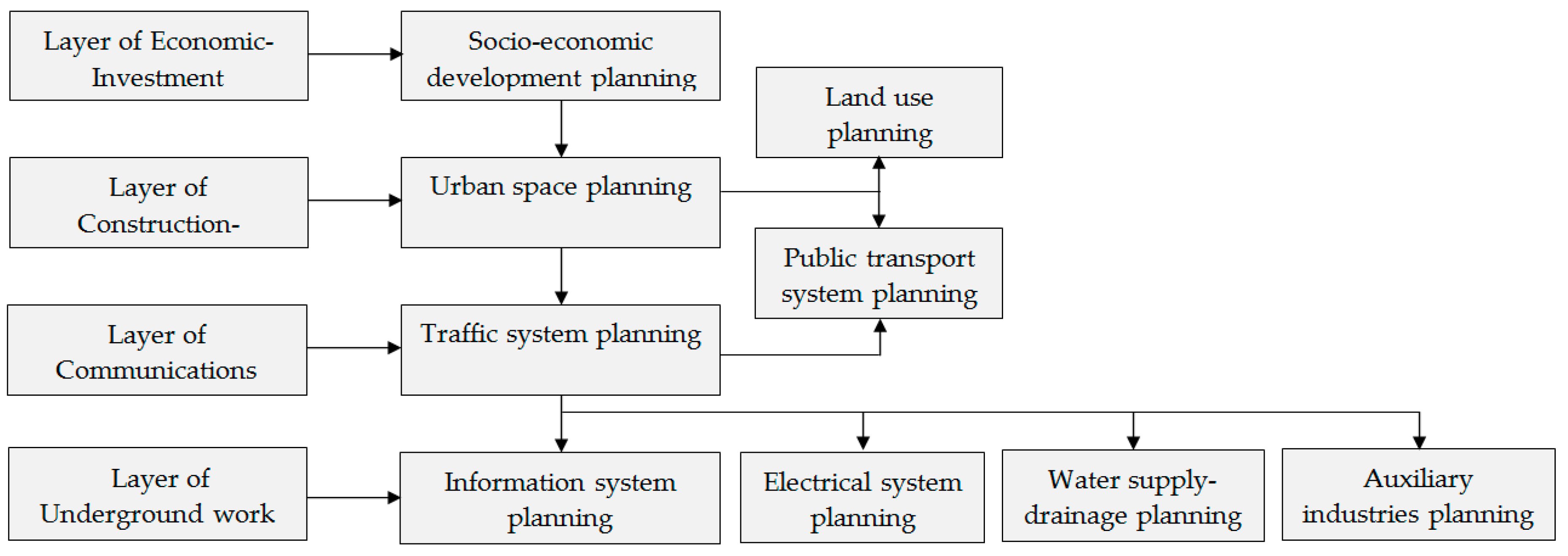

1.1. Urban Planning and Development

1.2. Orientation and Urban Development in Vietnam

2. Literature Review

3. Materials and Methodology

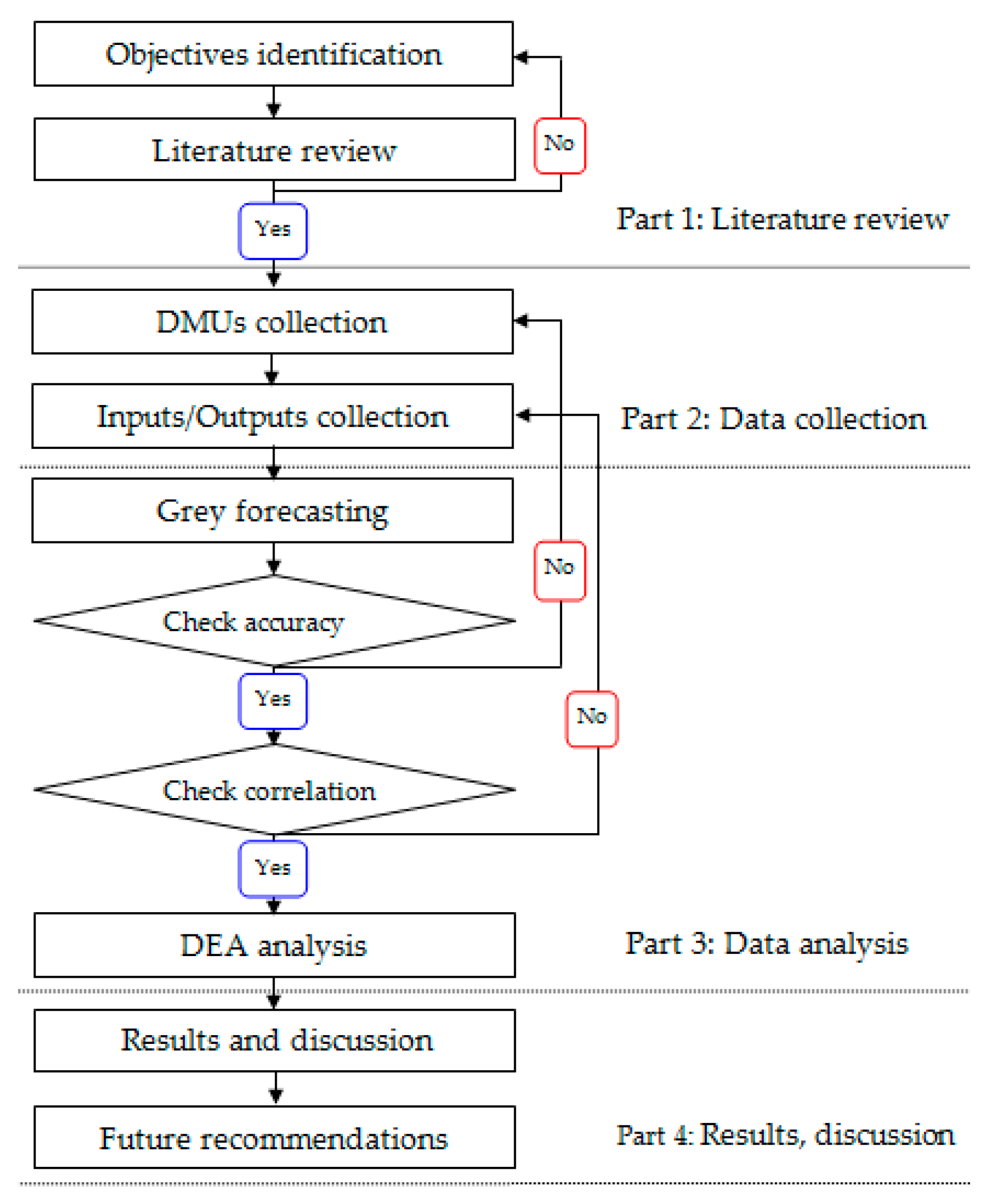

3.1. Research Development

- If the variables had MAPE, which were too large, they would be removed and returned to the step collecting data to rebuild a new DMU-DMU, which had variables that met our requirements. Besides, Malmquist radial models were used to evaluate a corporation’s performance in this period. Next, the results of GM (1,1), were utilized to see future trends.

- The business results from year 2013 to year 2016 of DMUs were put in the DEA model to measure the efficiency and distinguish the ranking of corporations. The DEA model was used to establish a best practice group from among a set of observed units and to identify the units that were inefficient when compared with the best practice group [17]. In this case, if the input factors and output factors had a correlation coefficient at zero and negative, they would be removed and returned to the step collecting data to rebuild a new DMU-DMU, which had variables that could meet our requirements.

- Next, the prediction results were put into the DEA model to measure efficiency and to distinguish the ranking of corporations in the period from 2017–2020.

3.2. Data Collection

- (1)

- Owner’s equity (OE): Total amount of capital contributed by owners that the business is not required to pay. The capital is invested by business owners and investors or formed from business results.

- (2)

- Total assets (TA): Total value of all assets of an enterprise, both tangible and intangible.

- (3)

- Cost of goods sold (CS): Total cost of the input of the business to create the product.

- (4)

- Total operating expenses (TE): Includes items of financial costs, selling expenses, and business management costs.

- (1)

- Net sales (NS): Reflects an enterprise’s sales revenue and providing a service.

- (2)

- Profit after tax (PT): Reflects the result of a business (profit and loss) after income tax.

3.3. Methodology

3.3.1. Grey Forecasting Generation Theory

Evaluation of Volatility Forecasts

3.3.2. Data Envelopment Analysis Model

Super Efficiency SBM Model

Malmquist Productivity Index (MPI)

- (MI) evaluates the performance change in the second period compared with the first period.

- (C) assesses the level of effort to improve the performance of the second period compared with the first period.

- (F) evaluates the change in performance boundaries around the second period compared with the first period.

- The performance of period 2 is better than period 1.

- The performance of period 2 is equivalent to period 1.

- The performance of period 2 is less than period 1.

4. Results and Discussion

4.1. Results and Analysis of the Grey Forecasting

| X(0) = (364,972, 390,115, 382,949, 400,377) |

| X(1)(1) = X(0)(1) = 364,972 |

| X(1)(2) = X(0)(1) + X(0)(2) = 755,087 |

| X(1)(3) = X(1)(2) + X(0)(3) = 1,138,036 |

| X(1)(4) = X(1)(3) + X(0)(4) = 1,538,413 |

| k = 1 | X(1)(1) = 364,972.00; | k = 5 | X(1)(5) = 1,940,019.92 | |||

| k = 2 | X(1)(2) = 750,939.24; | k = 6 | X(1)(6) = 2,347,005.30 | |||

| k = 3 | X(1)(3) = 1,142,057.00; | k = 7 | X(1)(7) = 2,759,421.68 | |||

| k = 4 | X(1)(4) = 1,538,394.01; | k = 8 | X(1)(8) = 3,177,341.53 |

| X(0)(1) = X(1)(1) = 364,972.00—for year 2012 |

| X(0)(2) = X(1)(2) − X(1)(1) = 385,967.24 |

| X(0)(3) = X(1)(3) − X(1)(2) = 391,117.76 |

| X(0)(4) = X(1)(4) − X(1)(3) = 396,337.01 |

| X(0)(5) = X(1)(5) − X(1)(4) = 401,625.91—result forecast for year 2017 |

| X(0)(6) = X(1)(6) − X(1)(5) = 406,985.38—result forecast for year 2018 |

| X(0)(7) = X(1)(7) − X(1)(6) = 412,416.38—result forecast for year 2019 |

| X(0)(8) = X(1)(8) − X(1)(7) = 417,919.85—result forecast for year 2020 |

4.2. Pearson Correlation

4.3. Performance Rankings

- Group 1: DMUs get effective business; they are always at the top position and include DMU4 (ranking is, respectively, 3, 1, 1, 1); DMU5 (ranking is, respectively, 1, 2, 2, 2); DMU7 (ranking is, respectively, 2, 3, 3, 3); DMU15 (ranking is, respectively, 5, 4, 4, 4).

- Group 2: DMUs make strong progress in the future: DMU8 (ranking is, respectively, 13, 13, 9, 3); DMU9 (ranking is, respectively, 16, 13, 12, 10); DMU11 (ranking is, respectively, 9, 9, 6, 6); DMU14 (ranking is, respectively, 15, 16, 8, 7).

- Group 3: DMUs have inefficient business in the future: DMU10 (ranking is, respectively, 4, 5, 10, 13); DMU12 (ranking is, respectively, 12, 12, 14, 15); DMU16 (ranking is, respectively, 11, 15, 16, 16).

- Group 4: For other DMUs, there are small changes in this period.

4.4. Components of the Malmquist Productivity Index (MPI)

4.4.1. Catch-Up Efficiency Change

4.4.2. Frontier Shift

4.4.3. Malmquist Productivity Index

4.5. Results Forecasting of the Malmquist Productivity Index in the Future

4.6. Discussion

5. Conclusions

Author Contributions

Conflicts of Interest

Appendix A

| DMUs | Inputs | Outputs | ||||

|---|---|---|---|---|---|---|

| (I)OE | (I)TA | (I)CS | (I)TE | (O)NS | (O)PT | |

| DMU1 | 364,972 | 1,112,361 | 140,222 | 41,366 | 238,066 | 44,749 |

| DMU2 | 3,215,849 | 14,585,799 | 5,198,012 | 419,958 | 7,021,749 | 1,110,753 |

| DMU3 | 868,026 | 1,323,357 | 350,870 | 13,554 | 453,946 | 91,875 |

| DMU4 | 1,628,823 | 5,607,236 | 374,765 | 177,180 | 631,443 | 70,127 |

| DMU5 | 171,963 | 423,897 | 1,559,802 | 16,887 | 1,593,895 | 26,080 |

| DMU6 | 437,460 | 872,182 | 101,766 | 41,052 | 169,987 | 20,682 |

| DMU7 | 87,124 | 171,527 | 79,723 | 7671 | 82,503 | 1208 |

| DMU8 | 2,417,833 | 4,634,308 | 593,471 | 181,543 | 754,950 | 53,333 |

| DMU9 | 663,615 | 1,268,215 | 136,660 | 144,083 | 342,591 | 82,764 |

| DMU10 | 1,264,280 | 2,100,861 | 1,598,173 | 65,474 | 1,744,013 | 99,117 |

| DMU11 | 577,910 | 1,271,924 | 202,263 | 39,678 | 273,126 | 26,090 |

| DMU12 | 848,650 | 2,327,799 | 805,250 | 94,766 | 988,683 | 122,776 |

| DMU13 | 577,507 | 1,845,614 | 1,620,882 | 159,270 | 1,804,414 | 41,099 |

| DMU14 | 3,007,699 | 4,807,856 | 352,831 | 108,963 | 615,153 | 161,533 |

| DMU15 | 4,914,775 | 12,532,339 | 577,262 | 444,938 | 1,072,821 | 72,499 |

| DMU16 | 142,783 | 509,250 | 86,874 | 20,233 | 132,330 | 19,171 |

| DMUs | Inputs | Outputs | ||||

|---|---|---|---|---|---|---|

| (I)OE | (I)TA | (I)CS | (I)TE | (O)NS | (O)PT | |

| DMU1 | 390,115 | 1,114,028 | 195,573 | 43,110 | 295,588 | 57,299 |

| DMU2 | 2,726,244 | 15,567,845 | 4,841,982 | 1,063,880 | 6,512,808 | 498,757 |

| DMU3 | 861,747 | 1,367,020 | 174,517 | 21,567 | 228,313 | 36,675 |

| DMU4 | 1,765,921 | 5,419,827 | 892,867 | 182,754 | 1,226,062 | 156,395 |

| DMU5 | 181,772 | 397,461 | 1,664,585 | 11,406 | 1,700,861 | 27,004 |

| DMU6 | 545,379 | 1,392,932 | 253,451 | 49,235 | 448,924 | 85,090 |

| DMU7 | 81,584 | 161,321 | 93,363 | 8638 | 96,190 | 1366 |

| DMU8 | 2,458,135 | 5,034,820 | 540,795 | 118,835 | 691,031 | 43,921 |

| DMU9 | 1,072,227 | 2,160,453 | 204,365 | 136,709 | 506,181 | 167,834 |

| DMU10 | 3,915,705 | 5,403,552 | 1,805,738 | 107,434 | 2,063,590 | 355,854 |

| DMU11 | 609,786 | 1,207,709 | 325,809 | 36,536 | 392,025 | 22,689 |

| DMU12 | 1,051,315 | 2,293,764 | 1,300,332 | 79,301 | 1,554,415 | 148,275 |

| DMU13 | 627,893 | 1,950,652 | 1,861,845 | 175,989 | 2,119,961 | 90,419 |

| DMU14 | 3,066,255 | 6,730,499 | 641,228 | 114,830 | 1,035,575 | 230,445 |

| DMU15 | 6,256,482 | 13,048,822 | 481,366 | 390,485 | 1,069,035 | 325,617 |

| DMU16 | 231,191 | 479,857 | 145,182 | 21,595 | 235,077 | 51,018 |

| DMUs | Inputs | Outputs | ||||

|---|---|---|---|---|---|---|

| (I)OE | (I)TA | (I)CS | (I)TE | (O)NS | (O)PT | |

| DMU1 | 382,949 | 1,105,783 | 186,792 | 51,776 | 277,039 | 54,700 |

| DMU2 | 7,128,550 | 25,306,639 | 3,286,015 | 1,180,780 | 4,920,363 | 795,075 |

| DMU3 | 892,604 | 1,277,582 | 330,708 | 21,961 | 473,237 | 93,954 |

| DMU4 | 1,990,459 | 5,734,361 | 540,712 | 17,518 | 855,452 | 225,105 |

| DMU5 | 193,955 | 400,575 | 1,887,753 | 31,257 | 1,945,178 | 28,913 |

| DMU6 | 1,099,046 | 2,621,012 | 301,505 | 73,494 | 639,404 | 139,432 |

| DMU7 | 78,031 | 163,262 | 97,076 | 8687 | 100,020 | 2038 |

| DMU8 | 2,656,336 | 5,089,310 | 491,248 | 175,063 | 655,225 | 10,461 |

| DMU9 | 1,771,359 | 3,573,347 | 735,260 | 277,948 | 1,394,505 | 336,629 |

| DMU10 | 6,231,111 | 9,814,813 | 4,662,388 | 205,714 | 5,326,248 | 902,186 |

| DMU11 | 634,389 | 1,197,205 | 323,158 | 42,790 | 423,552 | 47,740 |

| DMU12 | 1,306,733 | 3,054,981 | 1,250,096 | 85,649 | 1,479,927 | 123,459 |

| DMU13 | 1,220,681 | 3,480,209 | 2,181,049 | 314,383 | 2,543,398 | 100,163 |

| DMU14 | 2,958,255 | 7,330,710 | 413,047 | 145,057 | 686,153 | 122,021 |

| DMU15 | 8,036,005 | 13,653,707 | 861,405 | 169,258 | 1,434,852 | 611,910 |

| DMU16 | 405,457 | 499,712 | 158,758 | 24,357 | 242,135 | 58,776 |

| DMUs | Inputs | Outputs | ||||

|---|---|---|---|---|---|---|

| (I)OE | (I)TA | (I)CS | (I) TE | (O)NS | (O)PT | |

| DMU1 | 400,377 | 1,375,058 | 320,147 | 41,542 | 412,151 | 55,192 |

| DMU2 | 6,486,159 | 34,317,744 | 6,763,559 | 3,128,873 | 11,217,376 | 1,648,549 |

| DMU3 | 960,240 | 1,361,034 | 349,763 | 21,183 | 433,359 | 74,755 |

| DMU4 | 2,111,372 | 5,973,319 | 272,802 | 35,620 | 522,934 | 176,768 |

| DMU5 | 219,655 | 418,065 | 2,173,099 | 12,382 | 2,233,442 | 43,405 |

| DMU6 | 1,565,350 | 3,845,534 | 892,916 | 209,639 | 1,389,774 | 159,497 |

| DMU7 | 97,067 | 195,844 | 105,544 | 7254 | 109,313 | 1022 |

| DMU8 | 2,821,029 | 5,900,679 | 845,290 | 199,359 | 1,160,790 | 77,791 |

| DMU9 | 3,537,355 | 5,562,791 | 1,454,880 | 441,255 | 2,506,517 | 537,203 |

| DMU10 | 8,407,080 | 17,790,121 | 4,581,295 | 878,184 | 6,284,334 | 979,250 |

| DMU11 | 668,047 | 1,424,087 | 372,527 | 40,763 | 478,861 | 58,141 |

| DMU12 | 1,698,364 | 6,518,163 | 1,368,415 | 365,333 | 1,982,946 | 202,947 |

| DMU13 | 2,162,392 | 5,041,852 | 3,714,012 | 312,354 | 4,046,846 | 104,962 |

| DMU14 | 2,978,667 | 9,123,731 | 1,599,369 | 189,242 | 1,959,659 | 137,835 |

| DMU15 | 8,622,076 | 14,657,548 | 865,066 | 252,696 | 1,972,459 | 557,957 |

| DMU16 | 509,974 | 664,521 | 189,209 | 49,318 | 282,883 | 43,630 |

Appendix B

| DMUs | Inputs | Outputs | ||||

|---|---|---|---|---|---|---|

| (I)OE | (I)TA | (I)CS | (I) TE | (O)NS | (O)PT | |

| DMU1 | 401,625.91 | 1,493,716.17 | 401,448.05 | 44,030.38 | 472,768.12 | 53,635.64 |

| DMU2 | 9,599,183.79 | 49,323,893.70 | 7,619,434.05 | 4,820,006.57 | 14,470,832.58 | 2,724,994.08 |

| DMU3 | 1,008,340.96 | 1,329,105.69 | 487,146.46 | 21,192.45 | 598,982.62 | 107,328.33 |

| DMU4 | 2,322,397.48 | 6,282,729.81 | 172,325.44 | 3390.86 | 365,955.39 | 205,245.64 |

| DMU5 | 239,714.55 | 426,512.99 | 2,474,423.15 | 19,066.82 | 2,552,657.96 | 54,071.53 |

| DMU6 | 2,467,059.08 | 5,994,681.61 | 1,348,359.99 | 332,697.37 | 2,244,721.91 | 215,828.75 |

| DMU7 | 102,941.49 | 211,902.54 | 111,547.06 | 6936.69 | 115,765.27 | 1211.68 |

| DMU8 | 3,027,087.41 | 6,286,282.96 | 1,031,922.58 | 257,675.67 | 1,476,073.78 | 95,119.83 |

| DMU9 | 5,858,764.19 | 8,491,323.52 | 2,988,004.70 | 725,207.47 | 4,670,966.44 | 880,872.80 |

| DMU10 | 11,962,047.87 | 29,519,601.10 | 6,883,331.46 | 640,619.30 | 9,971,156.30 | 1,505,650.36 |

| DMU11 | 697,933.26 | 1,514,906.06 | 391,083.83 | 44,283.44 | 526,196.48 | 87,804.43 |

| DMU12 | 2,136,617.49 | 10,282,494.66 | 1,377,309.19 | 266,449.65 | 2,174,322.28 | 228,133.96 |

| DMU13 | 3,636,516.68 | 7,685,015.54 | 5,141,238.78 | 418,143.16 | 5,487,800.82 | 113,782.79 |

| DMU14 | 2,913,864.46 | 10,491,506.98 | 2,128,601.23 | 240,364.68 | 2,647,888.12 | 82,396.81 |

| DMU15 | 10,227,133.89 | 15,478,539.04 | 1,162,283.64 | 140,178.78 | 2,635,794.46 | 744,701.53 |

| DMU16 | 732,552.40 | 767,500.24 | 214,006.17 | 72,361.45 | 305,969.74 | 44,645.92 |

| DMUs | Inputs | Outputs | ||||

|---|---|---|---|---|---|---|

| (I)OE | (I)TA | (I)CS | (I) TE | (O)NS | (O)PT | |

| DMU1 | 406,985.38 | 1,672,630.65 | 538,209.07 | 43,326.97 | 572,672.25 | 52,622.03 |

| DMU2 | 12,891,994.66 | 71,262,852.64 | 9,590,593.64 | 9,388,769.86 | 20,954,720.41 | 5,096,575.57 |

| DMU3 | 1,065,120.08 | 1,326,064.51 | 645,944.95 | 21,006.33 | 760,437.87 | 135,287.74 |

| DMU4 | 2,534,707.54 | 6,594,014.25 | 99,926.75 | 928.12 | 244,720.14 | 215,641.95 |

| DMU5 | 263,989.56 | 437,556.71 | 2,828,537.22 | 19,437.10 | 2,925,041.28 | 70,318.70 |

| DMU6 | 3,914,309.29 | 9,492,120.91 | 2,919,045.02 | 755,659.86 | 4,176,431.95 | 284,494.36 |

| DMU7 | 113,147.20 | 234,754.07 | 118,706.86 | 6391.06 | 123,538.23 | 1099.58 |

| DMU8 | 3,241,464.44 | 6,829,971.75 | 1,352,088.02 | 326,260.53 | 2,016,067.99 | 169,202.95 |

| DMU9 | 10,809,453.21 | 13,391,523.79 | 6,479,164.36 | 1,229,583.76 | 9,144,709.47 | 1,492,764.04 |

| DMU10 | 17,108,394.17 | 52,639,620.42 | 9,554,195.16 | 2,001,077.48 | 15,166,884.96 | 2,185,132.89 |

| DMU11 | 730,643.35 | 1,653,269.53 | 419,589.49 | 46,601.06 | 582,392.70 | 129,144.09 |

| DMU12 | 2,722,053.14 | 18,452,454.53 | 1,414,476.73 | 720,431.82 | 2,490,144.95 | 276,670.84 |

| DMU13 | 6,514,121.45 | 11,888,410.03 | 7,544,169.80 | 527,726.04 | 7,787,422.79 | 122,419.79 |

| DMU14 | 2,871,351.94 | 12,294,320.85 | 4,278,868.76 | 308,978.82 | 4,230,600.52 | 59,802.34 |

| DMU15 | 11,889,421.27 | 16,412,834.59 | 1,475,434.90 | 103,046.86 | 3,580,228.41 | 916,694.81 |

| DMU16 | 1,039,636.84 | 914,945.17 | 245,190.37 | 117,352.06 | 336,932.06 | 41,748.47 |

| DMUs | Inputs | Outputs | ||||

|---|---|---|---|---|---|---|

| (I)OE | (I)TA | (I)CS | (I) TE | (O)NS | (O)PT | |

| DMU1 | 412,416.38 | 1,872,975.17 | 721,560.38 | 42,634.79 | 693,687.86 | 51,627.58 |

| DMU2 | 17,314,339.42 | 102,960,123.09 | 12,071,695.30 | 18,288,149.26 | 30,343,817.82 | 9,532,161.10 |

| DMU3 | 1,125,096.40 | 1,323,030.29 | 856,508.09 | 20,821.85 | 965,413.25 | 170,530.66 |

| DMU4 | 2,766,426.66 | 6,920,721.60 | 57,944.76 | 254.04 | 163,648.22 | 226,564.86 |

| DMU5 | 290,722.82 | 448,886.39 | 3,233,328.47 | 19,814.58 | 3,351,748.11 | 91,447.76 |

| DMU6 | 6,210,559.48 | 15,030,049.18 | 6,319,398.32 | 1,716,340.06 | 7,770,487.64 | 375,005.82 |

| DMU7 | 124,364.72 | 260,069.91 | 126,326.22 | 5888.34 | 131,833.11 | 997.85 |

| DMU8 | 3,471,023.56 | 7,420,683.16 | 1,771,588.33 | 413,100.43 | 2,753,609.06 | 300,984.95 |

| DMU9 | 19,943,502.58 | 21,119,547.35 | 14,049,365.73 | 2,084,749.91 | 17,903,299.54 | 2,529,700.63 |

| DMU10 | 24,468,816.23 | 93,867,448.58 | 13,261,404.82 | 6,250,687.54 | 2,306,9982.30 | 3,171,258.00 |

| DMU11 | 764,886.45 | 1,804,270.38 | 450,172.89 | 49,039.97 | 644,590.50 | 189,947.10 |

| DMU12 | 3,467,898.82 | 33,113,858.99 | 1,452,647.26 | 1,947,917.77 | 2,851,841.20 | 335,534.23 |

| DMU13 | 1,166,8797.91 | 1,839,0892.28 | 1,107,0191.52 | 666,027.33 | 1,105,0684.17 | 131,712.41 |

| DMU14 | 2,829,459.67 | 1,440,6922.24 | 8,601,290.64 | 397,179.46 | 6,759,341.75 | 43,403.61 |

| DMU15 | 1,382,1891.80 | 1,740,3524.88 | 1,872,957.74 | 75,750.81 | 4,863,063.36 | 1,128,410.98 |

| DMU16 | 1,475,450.46 | 1,090,715.83 | 280,918.61 | 190,315.49 | 371,027.58 | 39,039.06 |

| DMUs | Inputs | Outputs | ||||

|---|---|---|---|---|---|---|

| (I)OE | (I)TA | (I)CS | (I) TE | (O)NS | (O)PT | |

| DMU1 | 417,919.85 | 2,097,316.57 | 967,373.86 | 41,953.67 | 840,276.18 | 50,651.91 |

| DMU2 | 2,325,3682.43 | 148,756,140.88 | 1,519,4661.87 | 3,562,3027.09 | 4,393,9850.41 | 1,782,8067.87 |

| DMU3 | 1,188,449.95 | 1,320,003.01 | 1,135,709.94 | 20,638.99 | 1,225,639.57 | 214,954.50 |

| DMU4 | 3,019,329.19 | 7,263,616.02 | 33,600.56 | 69.53 | 109,434.15 | 238,041.05 |

| DMU5 | 320,163.26 | 460,509.43 | 3,696,049.29 | 20,199.39 | 3,840,703.20 | 118,925.58 |

| DMU6 | 9,853,858.31 | 2,379,8936.04 | 1,368,0773.95 | 3,898,345.45 | 1,445,7431.33 | 494,313.37 |

| DMU7 | 136,694.34 | 288,115.81 | 134,434.64 | 5425.17 | 140,684.93 | 905.54 |

| DMU8 | 3,716,839.96 | 8,062,484.09 | 2,321,243.28 | 523,054.28 | 3,760,965.85 | 535,404.02 |

| DMU9 | 3,679,5875.53 | 3,330,7283.59 | 3,046,4526.99 | 3,534,677.62 | 3,505,0663.50 | 4,286,936.90 |

| DMU10 | 3,499,5860.03 | 167,385,285.69 | 1,840,7082.44 | 1,952,5028.49 | 3,509,1192.73 | 4,602,409.92 |

| DMU11 | 800,734.43 | 1,969,062.85 | 482,985.48 | 51,606.53 | 713,430.85 | 279,377.08 |

| DMU12 | 4,418,107.07 | 5,942,4487.71 | 1,491,847.84 | 5,266,818.51 | 3,266,074.22 | 406,921.17 |

| DMU13 | 2,090,2411.14 | 2,844,9970.86 | 1,624,4218.18 | 840,573.28 | 1,568,1390.87 | 141,710.41 |

| DMU14 | 2,788,178.60 | 1,688,2543.64 | 1,729,0130.84 | 510,557.72 | 1,079,9578.16 | 31,501.67 |

| DMU15 | 1,606,8460.25 | 1,845,4013.94 | 2,377,584.19 | 55,685.20 | 6,605,552.09 | 1,389,024.26 |

| DMU16 | 2,093,956.23 | 1,300,253.90 | 321,853.04 | 308,643.83 | 408,573.37 | 36,505.49 |

References

- Sikder, S.K.; Eanes, F.; Asmelash, H.B.; Kar, S.; Koetter, T. The Contribution of Energy-Optimized Urban Planning to Efficient Resource Use—A Case Study on Residential Settlement Development in Dhaka City, Bangladesh. Sustainability 2016, 8, 119. [Google Scholar] [CrossRef]

- Urban Planning Process. Available online: http://cayxanhcanhquan.com (accessed on 18 July 2017).

- Vietnam Map. Available online: http://datsohongbinhduong.com (accessed on 18 July 2017).

- Resolution No.134/2016/QH13. Available online: http://www.sggp.org.vn (accessed on 15 May 2017).

- The Situation of Vietnam’s Population in 2016. Available online: http://kehoachviet.com (accessed on 15 May 2017).

- Average Vietnam’s Population by Areas. Available online: https://www.gso.gov.vn (accessed on 15 May 2017).

- Renovating the Urban Construction Planning. Available online: http://kienviet.net (accessed on 15 May 2017).

- Saranga, H. The Indian Auto Component Industry–Estimation of Operational Efficiency and Its Determinants Using DEA. Eur. J. Oper. Res. 2009, 196, 707–718. [Google Scholar] [CrossRef]

- Leachman, C.; Pegels, C.C.; Kyoon Shin, S. Manufacturing Performance: Evaluation and Determinants. Int. J. Oper. Prod. Manag. 2005, 25, 851–874. [Google Scholar] [CrossRef]

- Zhao, X.; Li, L.; Zhang, X.S. Analysis of Operating Efficiency of Chinese Coal Mining Industry. In Proceedings of the IEEE 18th International Conference on Industrial Engineering and Engineering Management, Changchun, China, 3–5 September 2011. [Google Scholar]

- Chandraprakaikul, W.; Suebpongsakorn, A. Evaluation of Logistics Companies Using Data Envelopment Analysis. In Proceedings of the 4th IEEE International Symposium on Logistics and Industrial Informatics, Smolenice, Slovakia, 5–7 September 2012. [Google Scholar]

- Lo, S.-F.; Lu, W.-M. An integrated performance evaluation of financial holding companies in Taiwan. Eur. J. Oper. Res. 2009, 198, 341–350. [Google Scholar] [CrossRef]

- Charles, V.; Kumar, M.; Kavitha, I. Measuring the Efficiency of Assembled Printed Circuit Boards with Undesirable Outputs Using Data Envelopment Analysis. Int. J. Prod. Econ. 2012, 136, 194–206. [Google Scholar] [CrossRef]

- Chang, Y.T.; Zhang, N.; Danao, D.; Zhang, N. Environmental Efficiency Analysis of Transportation System in China. A Non-Radial Approach. Energy Policy 2013, 58, 277–283. [Google Scholar] [CrossRef]

- Wang, C.N.; Nguyen, N.T. Forecasting the manpower requirement in Vietnamese tertiary institutions. Asian J. Empir. Res. 2013, 3, 563–575. [Google Scholar]

- Deng, J.L. Introduction to Grey system theory. J. Grey Syst. 1989, 1, 1–24. [Google Scholar]

- Ren, J.; Tan, S.; Dong, L.; Mazzi, A.; Scipioni, A.; Sovacool, B.K. Determining the life cycle energy efficiency of six biofuel systems in China: A Data Envelopment Analysis. Bioresour. Technol. 2014, 162, 1–7. [Google Scholar] [CrossRef] [PubMed]

- Financial Report. Industrial Urban Development J.S.C. Available online: http://www.d2d.com.vn/ (accessed on 5 May 2017).

- Financial Report. Hanoi Southern City Development J.S.C. Available online: http://www.namhanoijsc.vn (accessed on 5 May 2017).

- Financial Report. Tu Liem Urban Development J.S.C. Available online: http://lideco.vn/ (accessed on 5 May 2017).

- Financial Report. Song Da Urban & Industrial Zone Investment & Development J.S.C. Available online: http://www.sudicosd.com.vn (accessed on 5 May 2017).

- Financial Report. Idico Urban and House Development J.S.C. Available online: http://www.idico-udico.com.vn (accessed on 8 May 2017).

- Financial Report. C.E.O Investment J.S.C. Available online: http://ceogroup.com.vn (accessed on 8 May 2017).

- Financial Report. Real Estate 11 J.S.C. Available online: http://diaoc11.com.vn/ (accessed on 8 May 2017).

- Financial Report. Development Investment Construction J.S.C. Available online: http://www.dic.vn (accessed on 8 May 2017).

- Financial Report. Dat Xanh Real Estate Service & Construction Corporation. Available online: https://www.datxanh.vn/ (accessed on 15 May 2017).

- Financial Report. FLC Group J.S.C. Available online: http://www.flc.vn/ category_id=12 (accessed on 15 May 2017).

- Financial Report. Ba Ria-Vung Tau House Development J.S.C. Available online: http://hodeco.vn (accessed on 15 May 2017).

- Financial Report. Ha Do Group J.S.C. Available online: http://www.hado.com.vn (accessed on 15 May 2017).

- Financial Report. International Development and Investment Corporation. Available online: http://www.idiseafood.com/ (accessed on 15 May 2017).

- Financial Report. Becamex Infrastructure Development J.S.C. Available online: http://www.becamexijc.net/ (accessed on 15 May 2017).

- Financial Report. Kinh Bac City Development Share Holding Corporation. Available online: http://www.kinhbaccity.vn (accessed on 15 May 2017).

- Financial Report. Danang Housing Investment Development J.S.C. Available online: http://ndn.com.vn/ (accessed on 15 May 2017).

- Lo, F.-Y.; Chien, C.-F.; Lin, J.T. A DEA study to evaluate the relative efficiency and investigate the districtre organization of the Taiwan Power Company. IEEE Trans. Power Syst. 2001, 16, 170–178. [Google Scholar]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Düzakın, E.; Düzakın, H. Measuring the performance of manufacturing firms with super slacks based model of data envelopment analysis: An application of 500 major industrial enterprises in Turkey. Eur. J. Oper. Res. 2007, 182, 1412–1432. [Google Scholar] [CrossRef]

- Wang, C.N.; Nguyen, N.-T.; Tran, T.-T. Integrated DEA Models and Grey System Theory to Evaluate Past-to-Future Performance: A Case of Indian Electricity Industry. Sci. World J. 2015. [Google Scholar] [CrossRef] [PubMed]

| Targets | Acreage (1000 ha) | |||

|---|---|---|---|---|

| 2017 | 2018 | 2019 | 2020 | |

| 1. Agricultural land | 26,898.14 | 26,960.77 | 27,009.46 | 27,038.09 |

| 2. Non-agricultural land group | 4363.59 | 4503.75 | 4645.04 | 4780.24 |

| • Defence land | 290.08 | 308.85 | 325.16 | 340.96 |

| • Security land | 62.58 | 65.54 | 68.51 | 71.14 |

| • Industrial zone land | 141.61 | 157.69 | 174.84 | 191.42 |

| • Infrastructure development land | 1434.45 | 1477.48 | 1519.94 | 1561.39 |

| • Historic land | 30.23 | 31.84 | 33.57 | 35.19 |

| • Landfill land | 16.45 | 18.31 | 20.17 | 21.91 |

| • Urban areas inhabited land | 184.52 | 189.67 | 194.74 | 199.13 |

| 3. Unused land | 1866.97 | 1664.15 | 1474.19 | 1310.36 |

| 4. High-tech zone land | 3.63 | 3.63 | 3.63 | 3.63 |

| 5. Economic zone land | 1582.96 | 1582.96 | 1582.96 | 1582.96 |

| 6. Urban land | 1766.50 | 1828.94 | 1890.96 | 1941.74 |

| Areas | Population |

|---|---|

| Red River Delta | 20,925.5 |

| Northern Midlands and mountain areas | 11,803.7 |

| North Central and Central coastal areas | 19,658.0 |

| Central Highlands | 5607.9 |

| South East | 16,127.8 |

| Mekong River Delta | 17,590.4 |

| Order | Code | Corporations Name |

|---|---|---|

| 1 | DMU1 | Industrial Urban Development Joint Stock Company (J.S.C) No. 2-D2D |

| 2 | DMU2 | Hanoi Southern City Development J.S.C-NHN |

| 3 | DMU3 | Tu Liem Urban Development J.S.C-NTL |

| 4 | DMU4 | Song Da Urban & Industrial Zone Investment & Development J.S.C-SJC |

| 5 | DMU5 | Idico Urban And House Development J.S.C-UIC |

| 6 | DMU6 | C.E.O. Investment J.S.C-CEO |

| 7 | DMU7 | Real Estate 11 J.S.C-D11 |

| 8 | DMU8 | Development Investment Construction J.S.C-DIG |

| 9 | DMU9 | Dat Xanh Real Estate Service & Construction Corporation-DXG |

| 10 | DMU10 | FLC Group J.S.C-FLC |

| 11 | DMU11 | Ba Ria-Vung Tau House Development JSC-HDC |

| 12 | DMU12 | Ha Do Group J.S.C-HDG |

| 13 | DMU13 | International Development and Investment Corporation-IDI |

| 14 | DMU14 | Becamex Infrastructure Development J.S.C-IJC |

| 15 | DMU15 | Kinh Bac City Development Share Holding Corporation-KBC |

| 16 | DMU16 | Danang Housing Investment Development J.S.C-NDN |

| MAPE Valuation (%) | ≤10 | 10 ÷ 20 | 20 ÷ 50 | ≥50 |

| Accuracy | Excellent | Good | Qualified | Unqualified |

| Year | Inputs | Outputs | ||||

|---|---|---|---|---|---|---|

| (I)OE | (I)TA | (I)CS | (I)TE | (O)NS | (O)PT | |

| 2013 | 364,972 | 1,112,361 | 140,222 | 41,366 | 238,066 | 44,749 |

| 2014 | 390,115 | 1,114,028 | 195,573 | 43,110 | 295,588 | 57,299 |

| 2015 | 382,949 | 1,105,783 | 186,792 | 51,776 | 277,039 | 54,700 |

| 2016 | 400,377 | 1,375,058 | 320,147 | 41,542 | 412,151 | 55,192 |

| DMUs | Average MAPE (%) | DMUs | Average MAPE (%) |

|---|---|---|---|

| DMU1 | 5.11 | DMU9 | 7.40 |

| DMU2 | 14.43 | DMU10 | 18.84 |

| DMU3 | 8.44 | DMU11 | 3.31 |

| DMU4 | 12.65 | DMU12 | 13.95 |

| DMU5 | 7.59 | DMU13 | 5.12 |

| DMU6 | 11.33 | DMU14 | 12.15 |

| DMU7 | 5.21 | DMU15 | 8.15 |

| DMU8 | 16.49 | DMU16 | 5.30 |

| Average all MAPE | 9.72% | ||

| Correlation Coefficient | <0.2 | 0.2 ÷ 0.4 | 0.4 ÷ 0.6 | 0.6 ÷ 0.8 | >0.8 |

| Degree of Correlation | Very low | Low | Medium | High | Very high |

| 2013 | 2014 | |||||||||||

| OE | TA | CS | TE | NS | PT | OE | TA | CS | TE | NS | PT | |

| OE | 1.0000 | 0.8956 | 0.3377 | 0.8618 | 0.4085 | 0.4343 | 1.0000 | 0.8169 | 0.2255 | 0.4591 | 0.2958 | 0.7434 |

| TA | 0.8956 | 1.0000 | 0.6323 | 0.9515 | 0.7039 | 0.7256 | 0.8169 | 1.0000 | 0.6200 | 0.8739 | 0.7068 | 0.8842 |

| CS | 0.3377 | 0.6323 | 1.0000 | 0.5650 | 0.9923 | 0.9007 | 0.2255 | 0.6200 | 1.0000 | 0.8277 | 0.9895 | 0.6999 |

| TE | 0.8618 | 0.9515 | 0.5650 | 1.0000 | 0.6322 | 0.6125 | 0.4591 | 0.8739 | 0.8277 | 1.0000 | 0.8966 | 0.8088 |

| NS | 0.4085 | 0.7039 | 0.9923 | 0.6322 | 1.0000 | 0.9409 | 0.2958 | 0.7068 | 0.9895 | 0.8966 | 1.0000 | 0.7635 |

| PT | 0.4343 | 0.7256 | 0.9007 | 0.6125 | 0.9409 | 1.0000 | 0.7434 | 0.8842 | 0.6999 | 0.8088 | 0.7635 | 1.0000 |

| 2015 | 2016 | |||||||||||

| OE | 1.0000 | 0.8945 | 0.5852 | 0.6072 | 0.6733 | 0.8947 | 1.0000 | 0.8081 | 0.5866 | 0.5522 | 0.6486 | 0.7838 |

| TA | 0.8945 | 1.0000 | 0.5739 | 0.8659 | 0.7043 | 0.8182 | 0.8081 | 1.0000 | 0.8244 | 0.9188 | 0.9093 | 0.9544 |

| CS | 0.5852 | 0.5739 | 1.0000 | 0.5656 | 0.9805 | 0.7666 | 0.5866 | 0.8244 | 1.0000 | 0.8571 | 0.9776 | 0.8304 |

| TE | 0.6072 | 0.8659 | 0.5656 | 1.0000 | 0.7001 | 0.6236 | 0.5522 | 0.9188 | 0.8571 | 1.0000 | 0.9389 | 0.9260 |

| NS | 0.6733 | 0.7043 | 0.9805 | 0.7001 | 1.0000 | 0.8384 | 0.6486 | 0.9093 | 0.9776 | 0.9389 | 1.0000 | 0.9201 |

| PT | 0.8947 | 0.8182 | 0.7666 | 0.6236 | 0.8384 | 1.0000 | 0.7838 | 0.9544 | 0.8304 | 0.9260 | 0.9201 | 1.0000 |

| 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|

| No. of DMUs in Data | 16 | 16 | 16 | 16 |

| No. of DMUs with inappropriate Data | 0 | 0 | 0 | 0 |

| No. of evaluated DMUs | 16 | 16 | 16 | 16 |

| Average of scores | 1.1851 | 1.4334 | 1.4159 | 1.6396 |

| No. of efficient DMUs | 9 | 11 | 11 | 12 |

| No. of inefficient DMUs | 7 | 5 | 5 | 4 |

| No. of over iteration DMUs | 0 | 0 | 0 | 0 |

| DMUs | 2013 | 2014 | 2015 | 2016 | ||||

|---|---|---|---|---|---|---|---|---|

| Score | Rank | Score | Rank | Score | Rank | Score | Rank | |

| DMU1 | 1.0194 | 8 | 0.7131 | 13 | 0.7838 | 12 | 1.0624 | 9 |

| DMU2 | 1.0000 | 9 | 1.0000 | 11 | 1.0739 | 8 | 1.0000 | 12 |

| DMU3 | 1.6226 | 3 | 0.5665 | 14 | 1.0806 | 7 | 1.1992 | 7 |

| DMU4 | 0.6281 | 15 | 0.7183 | 12 | 1.6596 | 3 | 1.4672 | 4 |

| DMU5 | 3.9616 | 1 | 5.0496 | 1 | 5.0439 | 1 | 6.7785 | 1 |

| DMU6 | 0.7708 | 10 | 1.0435 | 9 | 1.0644 | 9 | 1.0070 | 11 |

| DMU7 | 2.0837 | 2 | 2.4658 | 2 | 3.1740 | 2 | 4.3096 | 2 |

| DMU8 | 0.4246 | 16 | 0.4283 | 16 | 0.4249 | 16 | 0.5909 | 16 |

| DMU9 | 1.3485 | 4 | 1.8046 | 4 | 1.3862 | 5 | 1.4677 | 3 |

| DMU10 | 0.6559 | 13 | 2.3425 | 3 | 1.0000 | 11 | 1.1962 | 8 |

| DMU11 | 0.6299 | 14 | 0.5364 | 15 | 0.7269 | 14 | 0.9121 | 13 |

| DMU12 | 0.6982 | 12 | 1.0852 | 7 | 0.7687 | 13 | 0.8644 | 14 |

| DMU13 | 0.7281 | 11 | 1.0205 | 10 | 1.0311 | 10 | 1.3319 | 6 |

| DMU14 | 1.1724 | 5 | 1.0651 | 8 | 0.5085 | 15 | 0.6002 | 15 |

| DMU15 | 1.0488 | 7 | 1.5420 | 6 | 1.5632 | 4 | 1.4197 | 5 |

| DMU16 | 1.1694 | 6 | 1.5532 | 5 | 1.3651 | 6 | 1.0271 | 10 |

| DMUs | 2017 | 2018 | 2019 | 2020 | ||||

|---|---|---|---|---|---|---|---|---|

| Score | Rank | Score | Rank | Score | Rank | Score | Rank | |

| DMU1 | 1.0064 | 13 | 0.6811 | 14 | 0.5632 | 15 | 0.4814 | 14 |

| DMU2 | 1.0000 | 14 | 1.0000 | 10 | 1.0000 | 11 | 1.0000 | 11 |

| DMU3 | 1.2837 | 6 | 1.3321 | 7 | 1.2843 | 7 | 1.2471 | 8 |

| DMU4 | 4.2784 | 3 | 9.4478 | 1 | 22.1119 | 1 | 54.7273 | 1 |

| DMU5 | 6.6878 | 1 | 7.6942 | 2 | 7.8405 | 2 | 6.5804 | 2 |

| DMU6 | 1.0204 | 10 | 0.9058 | 11 | 0.7502 | 13 | 0.8902 | 12 |

| DMU7 | 5.2242 | 2 | 5.5088 | 3 | 5.8675 | 3 | 6.3164 | 3 |

| DMU8 | 0.6351 | 16 | 0.7750 | 13 | 0.8752 | 12 | 1.0129 | 10 |

| DMU9 | 1.2783 | 7 | 1.3705 | 6 | 1.7778 | 5 | 3.0782 | 5 |

| DMU10 | 1.7949 | 4 | 1.4234 | 5 | 1.1025 | 10 | 0.8158 | 13 |

| DMU11 | 1.0318 | 9 | 1.1620 | 9 | 1.3741 | 6 | 1.7206 | 6 |

| DMU12 | 1.0119 | 12 | 0.7924 | 12 | 0.5928 | 14 | 0.4704 | 15 |

| DMU13 | 1.2003 | 8 | 1.2671 | 8 | 1.1409 | 9 | 1.0888 | 9 |

| DMU14 | 0.6496 | 15 | 0.6059 | 16 | 1.2029 | 8 | 1.6515 | 7 |

| DMU15 | 1.6205 | 5 | 2.7488 | 4 | 3.9337 | 4 | 5.9245 | 4 |

| DMU16 | 1.0176 | 11 | 0.6534 | 15 | 0.5180 | 16 | 0.4300 | 16 |

| Catch-Up | 2013–2014 | 2014–2015 | 2015–2016 | Average |

|---|---|---|---|---|

| DMU1 | 0.8786 | 1.0944 | 0.9441 | 0.9724 |

| DMU2 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| DMU3 | 0.7399 | 1.1463 | 0.9206 | 0.9356 |

| DMU4 | 0.9043 | 1.0113 | 1.1720 | 1.0292 |

| DMU5 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| DMU6 | 1.0403 | 1.0000 | 0.9432 | 0.9945 |

| DMU7 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| DMU8 | 0.8159 | 1.0124 | 1.2358 | 1.0214 |

| DMU9 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| DMU10 | 1.0574 | 1.0000 | 0.9929 | 1.0168 |

| DMU11 | 0.8670 | 1.0655 | 1.0374 | 0.9899 |

| DMU12 | 1.1063 | 0.8562 | 1.0333 | 0.9986 |

| DMU13 | 1.0240 | 1.0000 | 1.0000 | 1.0080 |

| DMU14 | 0.8888 | 0.8944 | 0.9145 | 0.8992 |

| DMU15 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| DMU16 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| Average | 0.9577 | 1.0050 | 1.0121 | 0.9916 |

| Max | 1.1063 | 1.1463 | 1.2358 | 1.0292 |

| Min | 0.7399 | 0.8562 | 0.9145 | 0.8992 |

| SD | 0.0978 | 0.0665 | 0.0838 | 0.0324 |

| Frontier | 2013–2014 | 2014–2015 | 2015–2016 | Average |

|---|---|---|---|---|

| DMU1 | 0.4547 | 0.8993 | 0.8898 | 0.7479 |

| DMU2 | 1.0368 | 1.0000 | 1.0774 | 1.0380 |

| DMU3 | 0.1583 | 0.9707 | 0.9153 | 0.6814 |

| DMU4 | 0.7103 | 1.1709 | 0.9955 | 0.9589 |

| DMU5 | 0.4103 | 1.6863 | 1.7506 | 1.2824 |

| DMU6 | 0.5330 | 0.9905 | 0.8968 | 0.8068 |

| DMU7 | 0.3183 | 1.0153 | 0.8626 | 0.7321 |

| DMU8 | 0.7677 | 1.0057 | 0.8912 | 0.8882 |

| DMU9 | 0.8591 | 1.1723 | 0.9949 | 1.0088 |

| DMU10 | 0.3185 | 1.1166 | 0.8116 | 0.7489 |

| DMU11 | 0.4734 | 1.0205 | 0.9466 | 0.8135 |

| DMU12 | 0.3630 | 1.0675 | 1.0760 | 0.8355 |

| DMU13 | 0.7848 | 0.9642 | 1.3873 | 1.0454 |

| DMU14 | 0.3988 | 1.0070 | 0.9993 | 0.8017 |

| DMU15 | 1.3651 | 0.9133 | 1.0188 | 1.0991 |

| DMU16 | 0.5040 | 0.9165 | 0.7770 | 0.7325 |

| Average | 0.5910 | 1.0573 | 1.0182 | 0.8888 |

| Max | 1.3651 | 1.6863 | 1.7506 | 1.2824 |

| Min | 0.1583 | 0.8993 | 0.7770 | 0.6814 |

| SD | 0.3113 | 0.1867 | 0.2407 | 0.1672 |

| Malmquist | 2013–2014 | 2014–2015 | 2015–2016 | Average |

|---|---|---|---|---|

| DMU1 | 0.3995 | 0.9842 | 0.8400 | 0.7412 |

| DMU2 | 1.0368 | 1.0000 | 1.0774 | 1.0380 |

| DMU3 | 0.1172 | 1.1127 | 0.8426 | 0.6908 |

| DMU4 | 0.6423 | 1.1841 | 1.1667 | 0.9977 |

| DMU5 | 0.4103 | 1.6863 | 1.7506 | 1.2824 |

| DMU6 | 0.5545 | 0.9905 | 0.8458 | 0.7969 |

| DMU7 | 0.3183 | 1.0153 | 0.8626 | 0.7321 |

| DMU8 | 0.6264 | 1.0181 | 1.1014 | 0.9153 |

| DMU9 | 0.8591 | 1.1723 | 0.9949 | 1.0088 |

| DMU10 | 0.3368 | 1.1166 | 0.8059 | 0.7531 |

| DMU11 | 0.4104 | 1.0873 | 0.9820 | 0.8266 |

| DMU12 | 0.4016 | 0.9141 | 1.1119 | 0.8092 |

| DMU13 | 0.8036 | 0.9642 | 1.3873 | 1.0517 |

| DMU14 | 0.3544 | 0.9007 | 0.9139 | 0.7230 |

| DMU15 | 1.3651 | 0.9133 | 1.0188 | 1.0991 |

| DMU16 | 0.5040 | 0.9165 | 0.7770 | 0.7325 |

| Average | 0.5713 | 1.0610 | 1.0299 | 0.8874 |

| Max | 1.3651 | 1.6863 | 1.7506 | 1.2824 |

| Min | 0.1172 | 0.9007 | 0.7770 | 0.6908 |

| SD | 0.3140 | 0.1902 | 0.2509 | 0.1731 |

| Malmquist | 2017–2018 | 2018–2019 | 2019–2020 | Average |

|---|---|---|---|---|

| DMU1 | 0.3340 | 0.9765 | 0.9728 | 0.7611 |

| DMU2 | 0.7597 | 1.0305 | 1.0268 | 0.9390 |

| DMU3 | 0.2551 | 1.1260 | 1.1560 | 0.8457 |

| DMU4 | 0.1038 | 1.4516 | 1.4562 | 1.0039 |

| DMU5 | 0.4963 | 1.7417 | 1.6653 | 1.3011 |

| DMU6 | 0.6704 | 0.9928 | 1.2483 | 0.9705 |

| DMU7 | 0.2448 | 0.9393 | 0.9388 | 0.7076 |

| DMU8 | 0.8115 | 1.1183 | 1.1216 | 1.0171 |

| DMU9 | 0.7836 | 1.6098 | 0.9909 | 1.1281 |

| DMU10 | 0.3202 | 1.0751 | 1.1066 | 0.8340 |

| DMU11 | 0.4078 | 1.2105 | 1.2316 | 0.9499 |

| DMU12 | 0.5595 | 1.0918 | 1.0873 | 0.9129 |

| DMU13 | 0.5598 | 1.1097 | 0.9427 | 0.8707 |

| DMU14 | 0.6600 | 1.4771 | 1.7048 | 1.2806 |

| DMU15 | 0.2891 | 1.0983 | 1.1234 | 0.8369 |

| DMU16 | 0.5404 | 0.9376 | 0.9338 | 0.8039 |

| Average | 0.4872 | 1.1867 | 1.1692 | 0.9477 |

| Max | 0.8115 | 1.7417 | 1.7048 | 1.3011 |

| Min | 0.1038 | 0.9376 | 0.9338 | 0.7076 |

| SD | 0.2161 | 0.2470 | 0.2437 | 0.1698 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, C.-N.; Nguyen, H.-K. Enhancing Urban Development Quality Based on the Results of Appraising Efficient Performance of Investors—A Case Study in Vietnam. Sustainability 2017, 9, 1397. https://doi.org/10.3390/su9081397

Wang C-N, Nguyen H-K. Enhancing Urban Development Quality Based on the Results of Appraising Efficient Performance of Investors—A Case Study in Vietnam. Sustainability. 2017; 9(8):1397. https://doi.org/10.3390/su9081397

Chicago/Turabian StyleWang, Chia-Nan, and Han-Khanh Nguyen. 2017. "Enhancing Urban Development Quality Based on the Results of Appraising Efficient Performance of Investors—A Case Study in Vietnam" Sustainability 9, no. 8: 1397. https://doi.org/10.3390/su9081397