An ESCO Business Model Using CER for Buildings’ Energy Retrofit

Abstract

:1. Introduction

2. Background

2.1. Concept of an ESCO

2.2. Literature Review

2.3. Real Options

3. Research Methodology

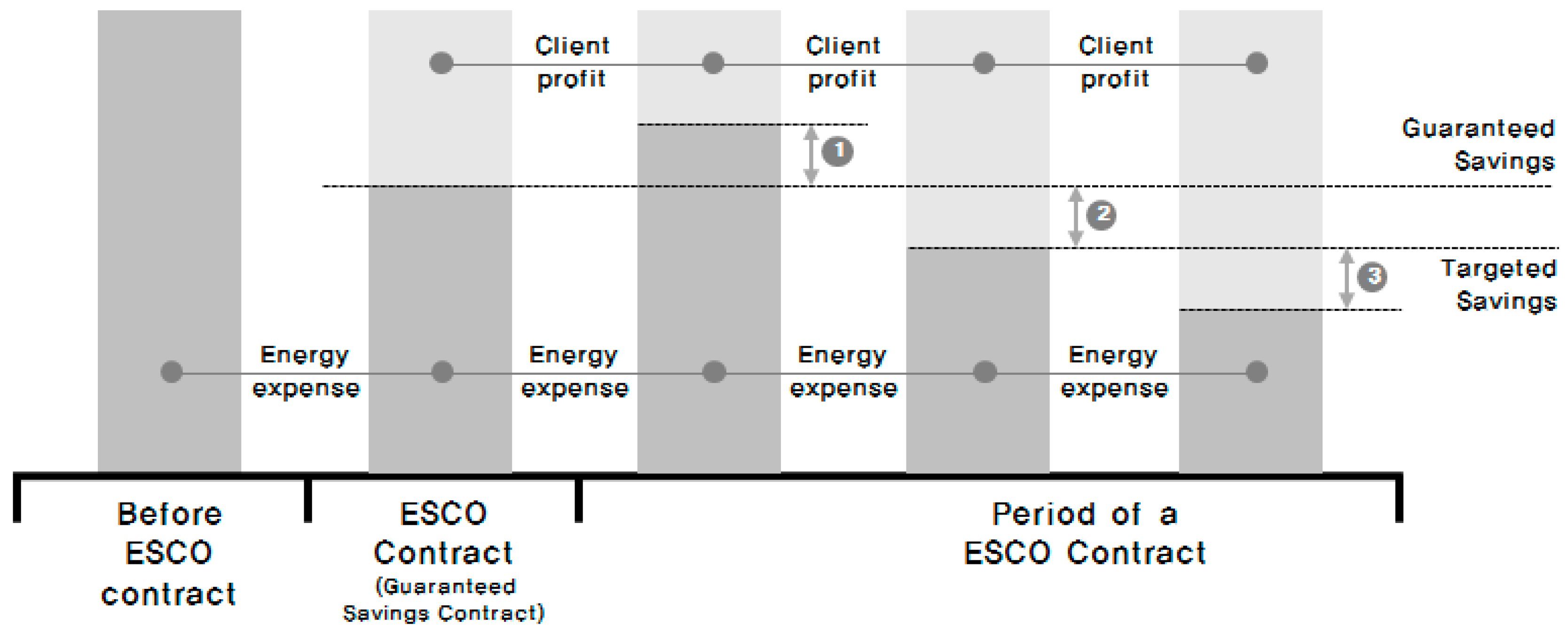

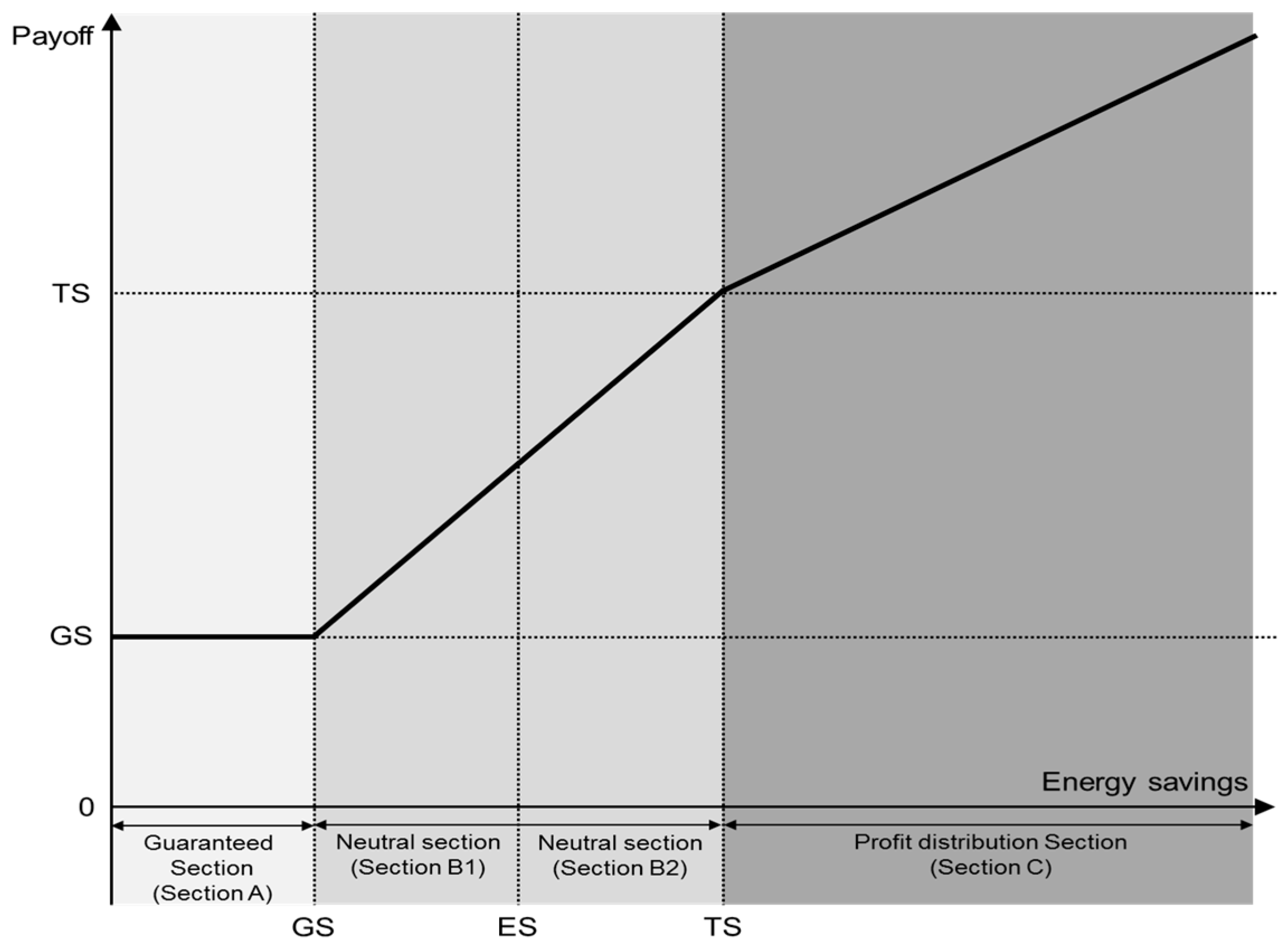

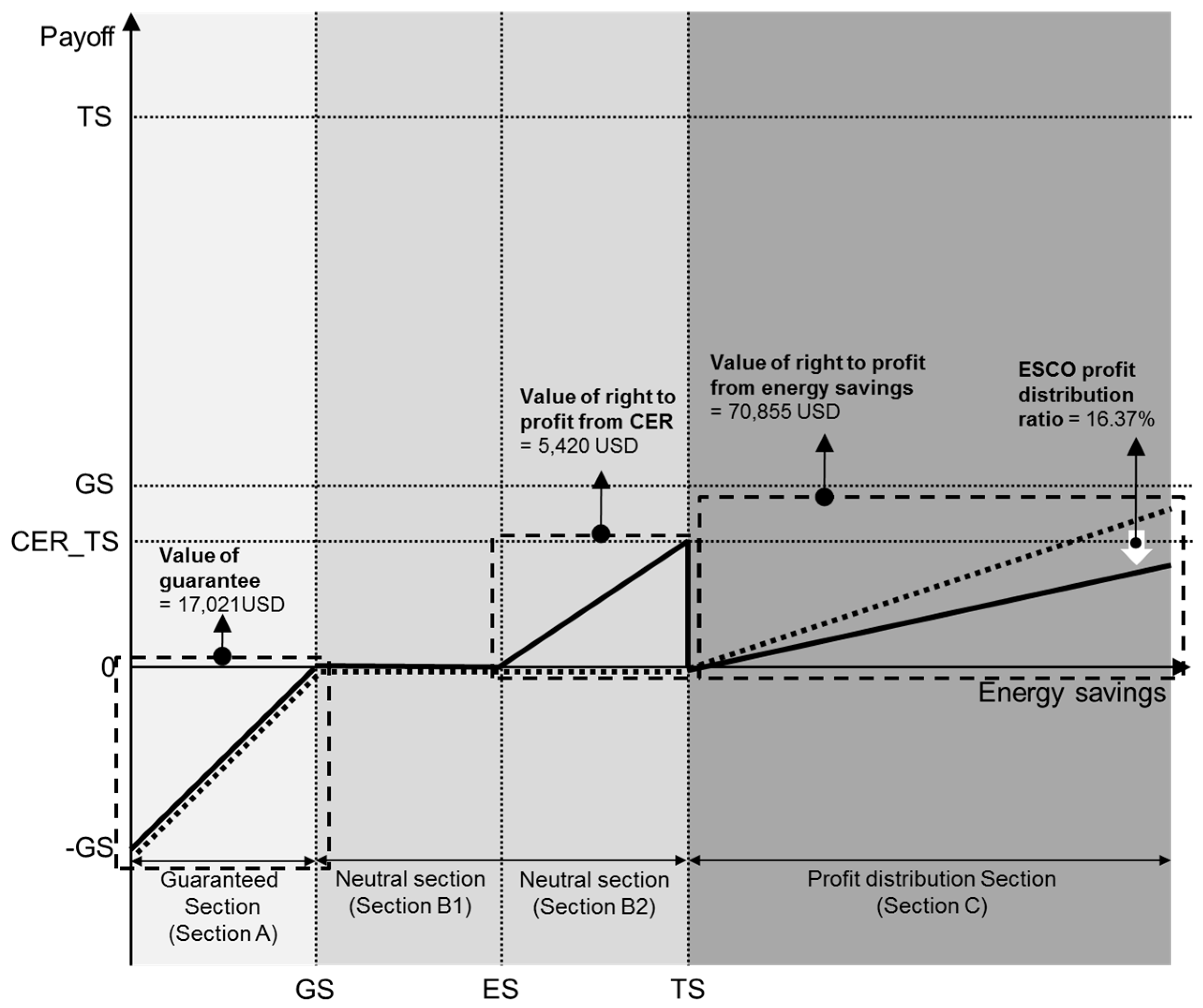

3.1. Proposal for a Guaranteed Savings Contract Model Using CER

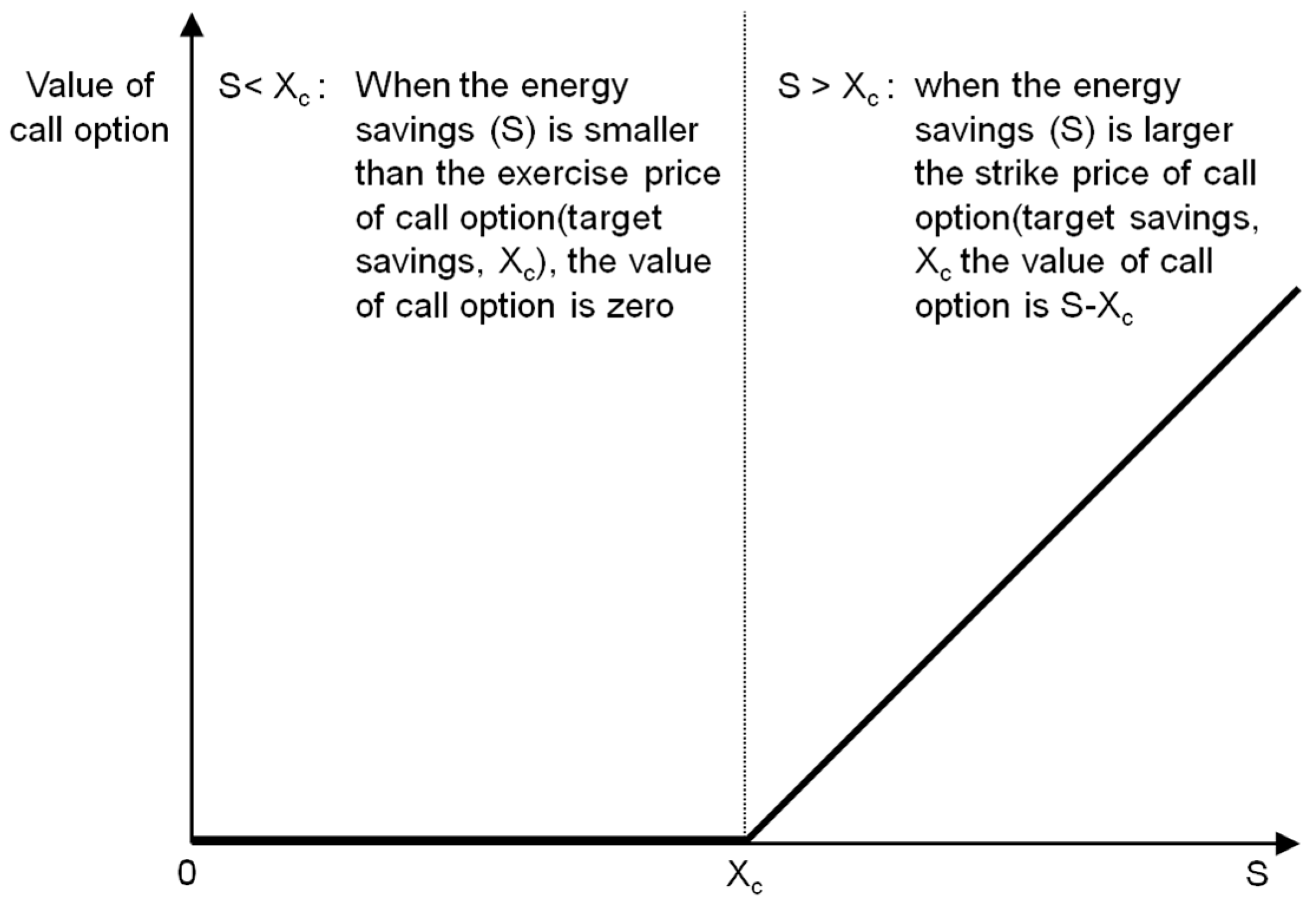

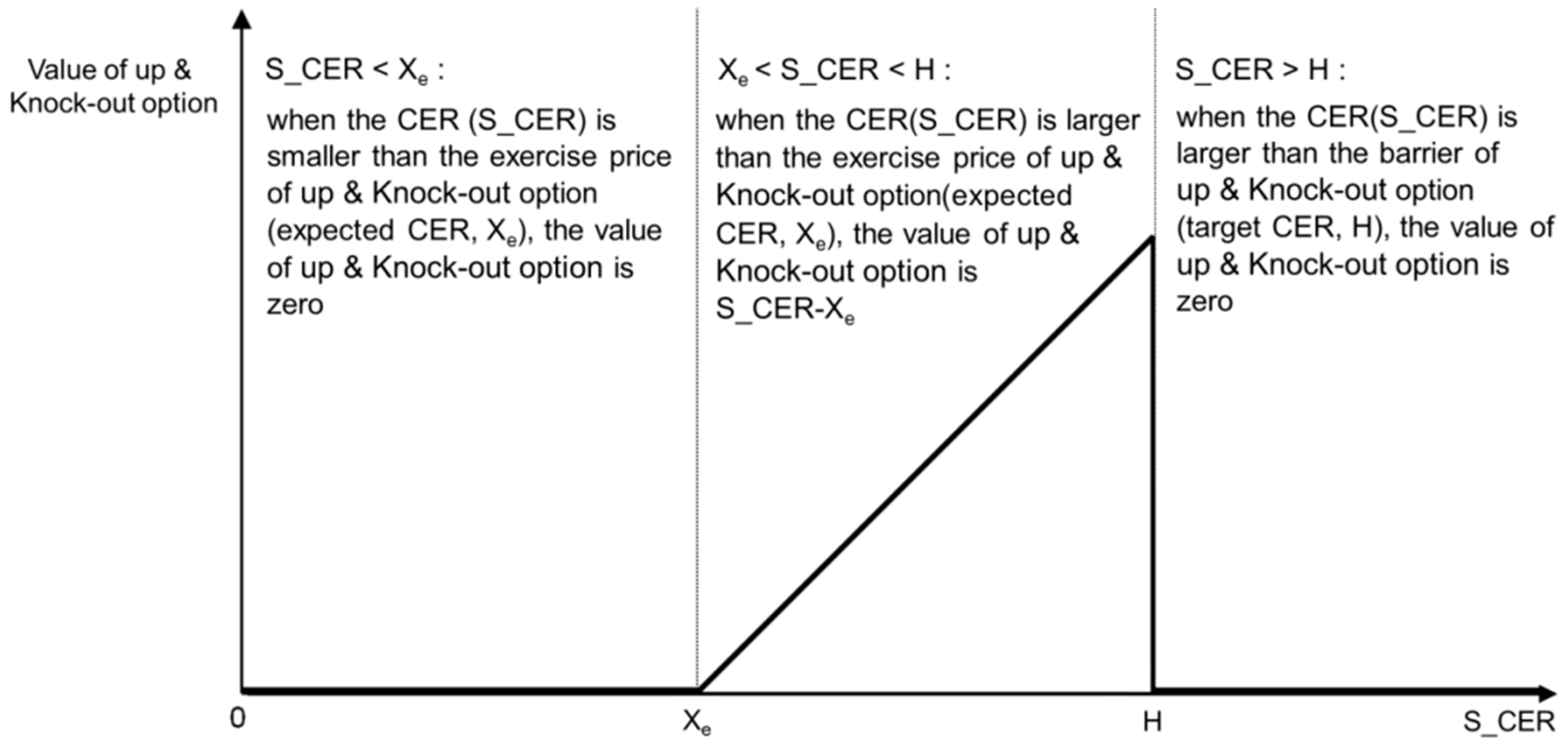

3.2. Applying Real Options to the Proposed Model Valuation

3.3. Binomial Lattice Model for Option Valuation

4. Applications

4.1. Data Collection

4.2. Results

5. Discussion and Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Pachauri, R.; Meyer, L. IPCC Fifth Assessment Report; IPCC: Copenhagen, Denmark, 2014. [Google Scholar]

- International Energy Agency (IEA). World Energy Outlook 2008; IEA: Paris, France, 2008. [Google Scholar]

- Pachauri, R.; Reisinger, A. IPCC Fourth Assessment Report; IPCC: Geneva, Switzerland, 2007. [Google Scholar]

- Xu, P.; Chan, E.H.; Qian, Q.K. Success factors of energy performance contracting (EPC) for sustainable building energy efficiency retrofit (BEER) of hotel buildings in China. Energy Policy 2011, 39, 7389–7398. [Google Scholar] [CrossRef]

- Sorrell, S. The economics of energy service contracts. Energy Policy 2007, 35, 507–521. [Google Scholar] [CrossRef]

- Larsen, P.; Goldman, C.; Satchwell, A. Evolution of the U.S. energy service company industry: Market size and project performance from 1990–2008. Energy Policy 2012, 50, 802–820. [Google Scholar] [CrossRef]

- Goldman, C.; Hopper, N.; Osborn, J. Review of US ESCO industry market trends: An empirical analysis of project data. Energy Policy 2005, 33, 387–405. [Google Scholar] [CrossRef]

- Lee, M.; Park, H.; Noh, J.; Painuly, J.P. Promoting energy efficiency financing and ESCOs in developing countries: Experiences from Korean ESCO business. J. Clean. Prod. 2003, 11, 651–657. [Google Scholar] [CrossRef]

- Steinberger, J.; Niel, J.; Bourg, D. Profiting from megawatts: Reducing absolute consumption and emissions through a performance–based energy economy. Energy Policy 2009, 37, 361–370. [Google Scholar] [CrossRef]

- Patari, S.; Sinkkonen, K. Energy Service Companies and Energy Performance Contracting: Is there a need to renew the business model? Insights from a Delphi study. J. Clean. Prod. 2014, 66, 264–271. [Google Scholar] [CrossRef]

- Lee, S.; Tae, S.; Shin, S. Profit Distribution in Guaranteed savings contract: Determination Based on the Collar Option Model. Sustainability 2015, 7, 16273–16289. [Google Scholar] [CrossRef]

- Dowson, M.; Poole, A.; Harrison, D.; Susman, G. Domestic UK retrofit challenge: Barriers, incentives and current performance leading into the Green Deal. Energy Policy 2012, 50, 294–305. [Google Scholar] [CrossRef]

- Booth, A.T.; Choudhary, R. Decision making under uncertainty in the retrofit analysis of the UK housing stock: Implications for the Green Deal. Energy Build. 2013, 64, 292–308. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, Y. Barriers’ and policies’ analysis of China’s building energy efficiency. Energy Policy 2013, 62, 768–773. [Google Scholar] [CrossRef]

- Intrachooto, S.; Horayangkura, V. Energy efficient innovation: Overcoming financial barriers. Build. Environ. 2007, 42, 599–604. [Google Scholar] [CrossRef]

- Hwang, B.; Zhao, X.; See, Y.L.; Zhong, Y. Addressing Risks in Green Retrofit Projects: The Case of Singapore. Proj. Manag. J. 2015, 46, 76–89. [Google Scholar] [CrossRef]

- Du, P.; Zheng, L.; Xie, B.; Mahalingam, A. Barriers to the adoption of energy–saving technologies in the building sector: A survey study of Jing–jin–tang, China. Energy Policy 2014, 75, 206–216. [Google Scholar] [CrossRef]

- Fang, W.S.; Miller, S.M.; Yeh, C. The effect of ESCOs on energy use. Energy Policy 2012, 51, 558–568. [Google Scholar] [CrossRef]

- Qian, D.; Guo, J. Research on the energy–saving and revenue sharing strategy of ESCOs under the uncertainty of the value of Energy Performance Contracting Projects. Energy Policy 2014, 73, 710–721. [Google Scholar] [CrossRef]

- Kostka, G.; Shin, K. Energy conservation through energy service companies: Empirical analysis from China. Energy Policy 2013, 52, 748–759. [Google Scholar] [CrossRef]

- Vine, E. An International Survey of the Energy Service Company (ESCO) Industry. Energy Policy 2005, 33, 691–704. [Google Scholar] [CrossRef]

- Painuly, J.P.; Park, H.; Lee, M.; Noh, J. Promoting energy efficiency financing and ESCOs in developing countries: Mechanisms and barriers. J. Clean. Prod. 2003, 11, 659–665. [Google Scholar] [CrossRef]

- Suhonen, N.; Okkonen, L. The Energy Services Company (ESCo) as business model for heat entrepreneurship—A case study of North Karelia, Finland. Energy Policy 2013, 61, 783–787. [Google Scholar] [CrossRef]

- Stuart, E.; Larsen, P.H.; Goldman, C.A.; Gilligan, D. A method to estimate the size and remaining market potential of the U.S. ESCO (energy service company) industry. Energy 2014, 77, 362–371. [Google Scholar] [CrossRef]

- Jensen, J.O.; Nielsen, S.B.; Hansen, J.R. Greening Public Buildings: ESCO–Contracting in Danish Municipalities. Energies 2013, 6, 2407–2427. [Google Scholar] [CrossRef]

- Lee, P.; Lam, P.T.I.; Lee, W.L. Risks in Energy Performance Contracting (EPC) projects. Energy Build. 2015, 92, 116–127. [Google Scholar] [CrossRef]

- Lee, P.; Lam, P.T.I.; Yik, F.W.H.; Chan, E.H.W. Probabilistic risk assessment of the energy saving shortfall in energy performance contracting projects—A case study. Energy Build. 2013, 66, 353–363. [Google Scholar] [CrossRef]

- Wang, Q.; Chen, Y. Barriers and opportunities of using the clean development mechanism to advance renewable energy development in China. Renew. Sustain. Energy Rev. 2010, 14, 1989–1998. [Google Scholar] [CrossRef]

- Rahman, S.M.; Kirkman, G.A. Costs of certified emission reductions under the Clean Development Mechanism of the Kyoto Protocol. Energy Econ. 2015, 47, 129–141. [Google Scholar] [CrossRef]

- Ren, H.; Zhou, W.; Gao, W.; Wu, Q. Promotion of energy conservation in developing countries through the combination of ESCO and CDM: A case study of introducing distributed energy resources into Chinese urban areas. Energy Policy 2011, 39, 8125–8136. [Google Scholar] [CrossRef]

- Sunderasan, S. Optimal pricing instruments for emission reduction certificates. Environ. Sci. Policy 2011, 14, 569–577. [Google Scholar] [CrossRef]

- Myers, S. Finance theory and financial strategy. Interfaces 1984, 14, 126–137. [Google Scholar] [CrossRef]

- Mun, J. Real Options Analysis: Tools and Techniques for Valuing Strategic Investments and Decisions; John Wiley & Sons: Hoboken, NJ, USA, 2005. [Google Scholar]

- Copeland, T.; Antikarov, V. Real Options: A Practitioner’s Guide; Texere: New York, NY, USA, 2003. [Google Scholar]

- Martins, J.; Marques, R.C.; Cruz, C.O. Real Options in Infrastructure: Revisiting the Literature. J. Infrastruct. Syst. 2015. [Google Scholar] [CrossRef]

- Cox, J.; Ross, S.; Rubinstein, M. Option pricing: A simplified approach. J. Financ. Econ. 1979, 7, 229–263. [Google Scholar] [CrossRef]

- Ho, P.S.; Liu, L.Y. How to Evaluate and Invest in Emerging A/E/C Technologies under Uncertainty. J. Constr. Eng. Manag. 2003, 129, 16–24. [Google Scholar] [CrossRef]

| Shared Savings Contract (SSC) | Guaranteed Savings Contract (GSC) | |

|---|---|---|

| Principle | Performance is related to the percentage of energy cost savings. Cost savings split for a pre-determined time in accordance with a prearranged percentage, based on the cost of the project, the length of the contract, and the risks assumed by the ESCO and the client. | Performance is related to the level of energy saved. The value of energy saved is guaranteed to cover the client’s annual debt obligations. |

| Financing | ESCO financing and/or TPF (through ESCO) | Client financing and/or TPF (through the client) |

| Risk taking | ||

| - Business | Client | Client |

| - Performance | ESCO (and client) | ESCO |

| - Credit | ESCO and/or financial institution | Client and/or financial institution |

| Advantages | Good introductory model in developing ESCO markets. The customer has no financial risks and is only obliged to pay a percentage of the actual savings to the ESCO over a specified period. This obligation is not considered a debt and does not appear on the customer’s balance sheet. | Fosters the growth and viability of newly established ESCOs that have limited resources and a credit history. |

| Disadvantages | ESCOs may become overly indebted, and may have difficulties in obtaining financing at a reasonable price and in contracting additional debt for subsequent projects. | It is challenging to function properly in countries with an undeveloped banking structure, insufficient technical expertise and a poor understanding of EE projects. |

| Term | Definition |

|---|---|

| Energy savings | Energy reductions from the installation of the energy reduction system |

| Target savings | The maximum energy savings that the ESCO calculates through an energy use diagnosis or other methods to guarantee a level of performance |

| Performance guarantee | The act of guaranteeing energy reduction value by installing the energy reduction system. ESCO provides this guarantee to the energy user |

| Guaranteed savings | The amount of guaranteed energy reductions that the ESCO provides to the user, which must be more than 80% of the target reduction value |

| Performance guarantee period | The period required to recover the entire project investment amount through guaranteed energy savings |

| Profit sharing | The sharing of profits resulting from surpassing the target reduction value between the energy user and the ESCO |

| Financial Options | Real Options |

|---|---|

| Stock price | Present value of expected incomes |

| Exercise price | Costs of irreversible follow-on investment |

| Time to maturity | Time until the investment opportunity disappears |

| Volatility of stock return | Variability of project value |

| Risk-free rate of return | Risk-free rate of return |

| Methods | Advantages | Disadvantages |

|---|---|---|

| BSOPM | Simple calculation of option value. | Only applicable to European options; Only works with normal distributions; Require advanced financial knowledge; Required assumptions limit the use of the model(price, volatility, duration); Can only manage one factor of uncertainty. |

| BOPM | Effective when dealing with one factor of uncertainty; Provides project managers with an appropriate evolution of the underlying asset; Estimates the value of several option futures. | Requires advanced financial knowledge; Can only manage Able to deal with only one factor of uncertainty. |

| RADT | Allows the mapping of complex problems; Can manage multiple uncertainties; Enables decision makers to develop insights into ROs; Useful in the case of a possible drastic change in systems. | Does not provide the true value of the project; If the number of branches is high, the method becomes complicated and unclear. |

| MCS | Demonstrates graphically the analysis results; Can manage multiple uncertainties; a full understanding of financial theory is not required; Helpful for problems with path-dependency; User-friendly multiple document interface. | Lacks transparency; Difficult methodology to implement with US options. |

| HROs | Can manage multiple uncertainties; Combines the best of decision analysis and options analysis; Independent handling of technical and financial components. | Difficult methodology to implement (it requires highly sophisticated mathematical modeling skills). |

| Category | Details | |

|---|---|---|

| Year Built | 1994 (21 years since completion) | |

| Site area | 83,263.10 m2 | |

| Principal use | Office | |

| Building size | 1 basement floor, 7 floors | |

| Building area | 15,010.83 m2 | |

| Total floor area | 25,840.80 m2 | |

| Equipment | Absorption chiller-heater, steam boiler | |

| Total project cost | Insulation | 242,203 USD |

| Window | 220,437 USD | |

| Total | 462,640 USD | |

| Category | Estimated Value |

|---|---|

| Target savings | 75,600 USD/year |

| Guaranteed savings | 60,480 USD/year |

| Expected savings | 66,528 USD/year |

| Performance guarantee period | 8 years |

| Year | Interest Rate | Inflation Rate | Real Discount Rate | Average Discount Rate |

|---|---|---|---|---|

| 2004 | 3.75 | 3.6 | 0.14 | 0.96 |

| 2005 | 3.57 | 2.8 | 0.74 | |

| 2006 | 4.36 | 2.2 | 2.11 | |

| 2007 | 5.01 | 2.5 | 2.45 | |

| 2008 | 5.67 | 4.7 | 0.93 | |

| 2009 | 3.23 | 2.8 | 0.42 | |

| 2010 | 3.18 | 3.0 | 0.17 | |

| 2011 | 3.69 | 3.6 | 0.09 | |

| 2012 | 3.43 | 2.2 | 1.20 | |

| 2013 | 2.70 | 1.3 | 1.38 |

| Time | Investment Cost | Guaranteed Savings (Constant) | Guaranteed Savings (Discounted) | Guaranteed Savings (Discounted) Accumulated Sum |

|---|---|---|---|---|

| 0 | 462,640 | |||

| 1 | 60,480 | 59,905 | 59,905 | |

| 2 | 60,480 | 59,335 | 119,240 | |

| 3 | 60,480 | 58,771 | 178,011 | |

| 4 | 60,480 | 58,212 | 236,224 | |

| 5 | 60,480 | 57,659 | 293,882 | |

| 6 | 60,480 | 57,110 | 350,993 | |

| 7 | 60,480 | 56,567 | 407,560 | |

| 8 | 60,480 | 56,030 | 463,590 |

| Variables | Estimated Value |

|---|---|

| Underlying asset (S) | 509,949 USD |

| Put option exercise price (Xp) | 463,590 USD |

| Call option exercise price (Xc) | 579,487 USD |

| Volatility (σ) | 11.0% |

| Risk-free rate (rf) | 2.00% |

| Time interval | 1 year |

| Rise rates (u) | 1.116 |

| Fall rates (d) | 0.896 |

| Risk-neutral probability (p) | 0.565 |

| Year | Gas | Electricity | Energy Cost (USD) | Change Rate | Volatility | ||

|---|---|---|---|---|---|---|---|

| Used Amount (Nm3) | Unit Price (USD/Nm3) | Used Amount (KWh) | Unit Price (USD/KWh) | ||||

| 2004 | 50,329 | 0.925 | 2,209,385 | 0.127 | 327,146 | 11.00 | |

| 2005 | 65,193 | 0.925 | 2,320,475 | 0.127 | 355,004 | 8.17 | |

| 2006 | 39,539 | 0.925 | 2,070,182 | 0.127 | 299,487 | −17.01 | |

| 2007 | 42,110 | 0.925 | 2,298,293 | 0.127 | 330,835 | 9.95 | |

| 2008 | 36,353 | 0.925 | 2,170,038 | 0.127 | 309,221 | −6.76 | |

| 2009 | 57,233 | 0.925 | 2,322,784 | 0.127 | 347,934 | 11.80 | |

| 2010 | 43,730 | 0.925 | 2,160,549 | 0.127 | 314,840 | −10.00 | |

| 2011 | 69,876 | 0.925 | 2,273,042 | 0.127 | 353,312 | 11.53 | |

| 2012 | 58,861 | 0.925 | 2,229,301 | 0.127 | 337,568 | −4.56 | |

| 2013 | 42,191 | 0.925 | 2,124,292 | 0.127 | 308,812 | −8.90 | |

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| 509,949 | 569,103 | 635,119 | 708,793 | 791,013 | 882,770 | 985,172 | 1,099,452 | 1,226,988 |

| 456,914 | 509,916 | 569,067 | 635,078 | 708,747 | 790,962 | 882,714 | 985,109 | |

| 409,395 | 456,885 | 509,884 | 569,030 | 635,038 | 708,702 | 790,912 | ||

| 366,818 | 409,369 | 456,856 | 509,851 | 568,994 | 634,997 | |||

| 328,669 | 366,795 | 409,343 | 456,827 | 509,818 | ||||

| 294,487 | 328,648 | 366,771 | 409,317 | |||||

| 263,851 | 294,469 | 328,627 | ||||||

| 236,419 | 263,844 | |||||||

| 211,832 |

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 17,021 | 8711 | 3406 | 778 | 0 | 0 | 0 | 0 | 0 | ||||||||

| 28,534 | 15,963 | 6957 | 1818 | 0 | 0 | 0 | 0 | |||||||||

| 46,080 | 28,328 | 13,913 | 4249 | 0 | 0 | 0 | ||||||||||

| 71,121 | 48,246 | 27,034 | 9933 | 0 | 0 | |||||||||||

| 103,927 | 77,857 | 50,361 | 23,219 | 0 | ||||||||||||

| 142,364 | 116,940 | 87,729 | 54,273 | |||||||||||||

| 181,727 | 160,031 | 134,963 | ||||||||||||||

| 218,081 | 199,746 | |||||||||||||||

| 251,758 | ||||||||||||||||

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| 70,855 | 100,819 | 140,863 | 192,820 | 257,990 | 336,707 | 428,187 | 531,327 | 647,501 |

| 35,399 | 53,718 | 80,207 | 117,479 | 168,139 | 233,977 | 314,589 | 405,622 | |

| 13,361 | 21,964 | 35,741 | 57,428 | 90,804 | 140,578 | 211,425 | ||

| 2860 | 5176 | 9366 | 16,950 | 30,674 | 55,510 | |||

| 0 | 0 | 0 | 0 | 0 | ||||

| 0 | 0 | 0 | 0 | |||||

| 0 | 0 | 0 | ||||||

| 0 | 0 | |||||||

| 0 |

| Variables | Estimated Value |

|---|---|

| Underlying asset(S_CER) | 30,608 USD |

| Exercise price (Xe) | 30,608 USD |

| Barrier(H) | 34,782 USD |

| Volatility(σ) | 10.0% |

| Risk-free rate (rf) | 2.00% |

| Time interval | 1 year |

| Rise Rates (u) | 1.105 |

| Fall Rates (d) | 0.905 |

| Risk-neutral probability (p) | 0.576 |

| Year | Gas | Electricity | CER Price (USD/ tonco2) | Value | Change Rate | Volatility | ||

|---|---|---|---|---|---|---|---|---|

| Used Amount (Nm3) | Conversion Coefficient (kg/kwh) | Used Amount (KWh) | Unit Price (USD/KWh) | |||||

| 2004 | 50,329 | 2.23 | 2,209,385 | 0.44 | 18 | 19,519 | 10.00 | |

| 2005 | 65,193 | 2.23 | 2,320,475 | 0.44 | 18 | 20,995 | 7.29 | |

| 2006 | 39,539 | 2.23 | 2,070,182 | 0.44 | 18 | 17,983 | −15.49 | |

| 2007 | 42,110 | 2.23 | 2,298,293 | 0.44 | 18 | 19,893 | 10.09 | |

| 2008 | 36,353 | 2.23 | 2,170,038 | 0.44 | 18 | 18,646 | −6.47 | |

| 2009 | 57,233 | 2.23 | 2,322,784 | 0.44 | 18 | 20,694 | 10.42 | |

| 2010 | 43,730 | 2.23 | 2,160,549 | 0.44 | 18 | 18,867 | −9.24 | |

| 2011 | 69,876 | 2.23 | 2,273,042 | 0.44 | 18 | 20,807 | 9.79 | |

| 2012 | 58,861 | 2.23 | 2,229,301 | 0.44 | 18 | 20,019 | −3.86 | |

| 2013 | 42,191 | 2.23 | 2,124,292 | 0.44 | 18 | 18,518 | −7.79 | |

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| 30,608 | 33,822 | 37,373 | 41,297 | 45,634 | 50,425 | 55,720 | 61,570 | 68,035 |

| 27,700 | 30,609 | 33,823 | 37,374 | 41,298 | 45,635 | 50,426 | 55,721 | |

| 25,069 | 27,701 | 30,610 | 33,824 | 37,375 | 41,299 | 45,636 | ||

| 22,687 | 25,069 | 27,702 | 30,610 | 33,824 | 37,376 | |||

| 20,532 | 22,688 | 25,070 | 27,702 | 30,611 | ||||

| 18,581 | 20,532 | 22,688 | 25,071 | |||||

| 16,816 | 18,582 | 20,533 | ||||||

| 15,219 | 16,817 | |||||||

| 13,773 |

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| 5420 | 7201 | 9281 | 11,514 | 13,577 | 14,878 | 14,406 | 10,464 | |

| 3266 | 4725 | 6697 | 9264 | 12,456 | 16,215 | 20,418 | 25,113 | |

| 1446 | 2280 | 3539 | 5381 | 7956 | 11,292 | 15,028 | ||

| 386 | 684 | 1214 | 2152 | 3817 | 6768 | |||

| 0 | 1 | 1 | 2 | 3 | ||||

| 0 | 0 | 0 | 0 | |||||

| 0 | 0 | 0 | ||||||

| 0 | 0 | |||||||

| 0 |

| Category | Estimated Value |

|---|---|

| Value of guarantee | 17,021USD |

| Value of right to profit from energy savings | 70,855 USD |

| Value of right to profit from CER | 5420 USD |

| ESCO profit sharing ratio | 16.37% |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yi, H.; Lee, S.; Kim, J. An ESCO Business Model Using CER for Buildings’ Energy Retrofit. Sustainability 2017, 9, 591. https://doi.org/10.3390/su9040591

Yi H, Lee S, Kim J. An ESCO Business Model Using CER for Buildings’ Energy Retrofit. Sustainability. 2017; 9(4):591. https://doi.org/10.3390/su9040591

Chicago/Turabian StyleYi, Hyein, Sanghyo Lee, and Jaejun Kim. 2017. "An ESCO Business Model Using CER for Buildings’ Energy Retrofit" Sustainability 9, no. 4: 591. https://doi.org/10.3390/su9040591