1. Introduction

In 2005, an emissions trading scheme (ETS) was adopted by the European Union (EU ETS) to reduce CO2 emissions by firms. According to the EU ETS, emissions-intensive firms have the right to release a certain amount of CO2 into the atmosphere. This amount of permitted CO2 emissions is allocated or auctioned to firms in the form of European Union Allowances (EUAs). The firm can emit 1 ton of CO2 via one EUA, which is the tradable commodity in the EU ETS.

The participating firms are forced to hold adequate emissions allowances for their outputs. The carbon market provides new business opportunities for market intermediaries, such as emissions-related firms, brokers, traders, and risk management consultants. For these groups, a valid spot price model becomes increasingly important.

Recently, to bridge the gap between theory and actual price behaviour, numerous empirical studies have investigated the time series of the emissions allowance price. Because the EU ETS is by far the largest, most developed market, empirical research has mainly focused on it. Paolella and Taschini [

1] advocated using econometric frameworks to explain the heteroscedastic dynamics of emissions allowance prices under the EU ETS. The authors summarized the poor performance of previous methods, such as forecasting analysis based on demand/supply fundamentals, and supported the employment of a well-suited generalized autoregressive conditional heteroscedasticity (GARCH)-type model, which is suitable for depicting the stylized facts of daily returns [

1]. By employing econometric testing procedures and trading strategies, Daskalakis and Markellos demonstrated that the market for European CO

2 emissions allowances is inefficient [

2]. Furthermore, within the framework of a GARCH approach, Oberndorfer claimed that the stock performance of electricity firms has a positive effect on the EUA price [

3]. On the other hand, some research has used the stochastic method to understand the stochastic properties of spot volatility. In the study of Daskalakis et al. [

4], several different diffusion and jump-diffusion processes were fitted to the European CO

2 futures and options time series. This study suggested that the proscription of banking, which implies that emissions allowances cannot be used in the next phase, plays a significant role in determining the prices of EUA futures. Benz and Trück [

5], employing a Markov switching model and AR-GARCH models, described the price dynamics and changes of the short-term allowance spot price. Similarly, Seifert et al. [

6] built a stochastic equilibrium model to analyse the dynamics of CO

2 allowances spot prices. The authors proposed that the CO

2 emissions allowance spot price process should have a time- and price-dependent volatility structure. Recently, Kim et al. [

7] estimated the dynamics of EUA futures prices based on Heston’s stochastic volatility model with or without jumps, and their empirical results revealed three important features of EUA futures prices: significant stochastic volatility, noticeable leverage effect, and inclusion of jumps.

There is extensive literature concerning the economic and policy aspects of the EU ETS, but there is little explicit study of the dynamic emissions allowance price in the presence of market uncertainty. Moreover, rare previous studies have covered the stochastic nature of emissions allowances in Phase III. There are three periods is EU-ETS protocol. Previous studies focused on Phases I and II, of which the main mechanism was free allocation based on past emissions. However, in Phase III, auctioning is expected to become the dominant allocation mechanism. It is necessary to examine adequate pricing models for EUA prices in this phase. Motivated by shortcomings of previous studies on carbon derivatives, we apply a new simple parameter estimation method for stochastic differential equations (SDEs) and discuss price forecast models based on different market data. We show that the mean reverting square root process (MRSRP) is the best of five SDEs to predict the EUA spot price.

In addition, the current ETS cannot reduce air pollution congestion (e.g., smog). This study is the first existing work to develop a new trading scheme to reduce air pollution congestion and explore the effect of air pollution on the EUA spot price by using the SDE MRSRP model with Markovian switching. The findings reveal that the spot price will not jump much under the new trading scheme when firms have to hand in more allowances on heavy pollution days.

The remainder of the paper is organized as follows. The following

Section 2 presents the econometric analysis of EUA spot prices.

Section 3 introduces a new parameter estimation methodology for SDEs and use empirical analysis to examine which SDE model is the best for reflecting the EUA spot price.

Section 4 sets up an SDE model with Markovian switching to depict the EUA spot price considering the effect of air pollution. Finally,

Section 5 concludes.

4. MRSRP with Markovian Switching

4.1. Effect of Air Pollution on the EUA Spot Price

Air pollution is a major environmental and social problem in almost all large cities worldwide and “smog” became a serious problem in China in 2013. Smog occurs when emissions reach a certain concentration that impairs property, public health, and ecosystems. A recent US study found that about 4000 Chinese people are killed by air pollution per day. Therefore, finding an efficient policy instrument is increasingly prominent in the country’s overall development plans. The EU ETS is one such attempt to alleviate air pollution from emissions via a financial market mechanism. However, the current EU ETS cannot effectively solve the problem of pollution congestion (e.g., smog).

To reduce the degree of smog, we suggest applying a new scheme to update the current ETS. In the current ETS, a firm hands in one allowance to the regulator when the firm emits 1 ton of air pollution. Meanwhile, in the new trading scheme, a firm has to hand in two or more emissions allowances to the regulator, when the firm emits 1 ton of air pollution on heavy pollution days (e.g., daily mean concentration exceeds 58 µg/m3), compared to only one allowance on clean days. In other words, under the new scheme, when pollution congestion (e.g., smog) occurs, the EUA spot price is higher than it is on clean days. Rationally, a firm will reduce emissions in pollution days and ease the degree of smog in the environment. Then, the spot price changes according to the air conditions, which can help to control excessive air pollution from emissions through a self-regulating mechanism. Therefore, it is necessary to examine the pricing models for EUA derivatives in this new environment. To depict how the EUA spot price evolves under the new trading scheme, we apply the SDE MRSRP with Markovian switching.

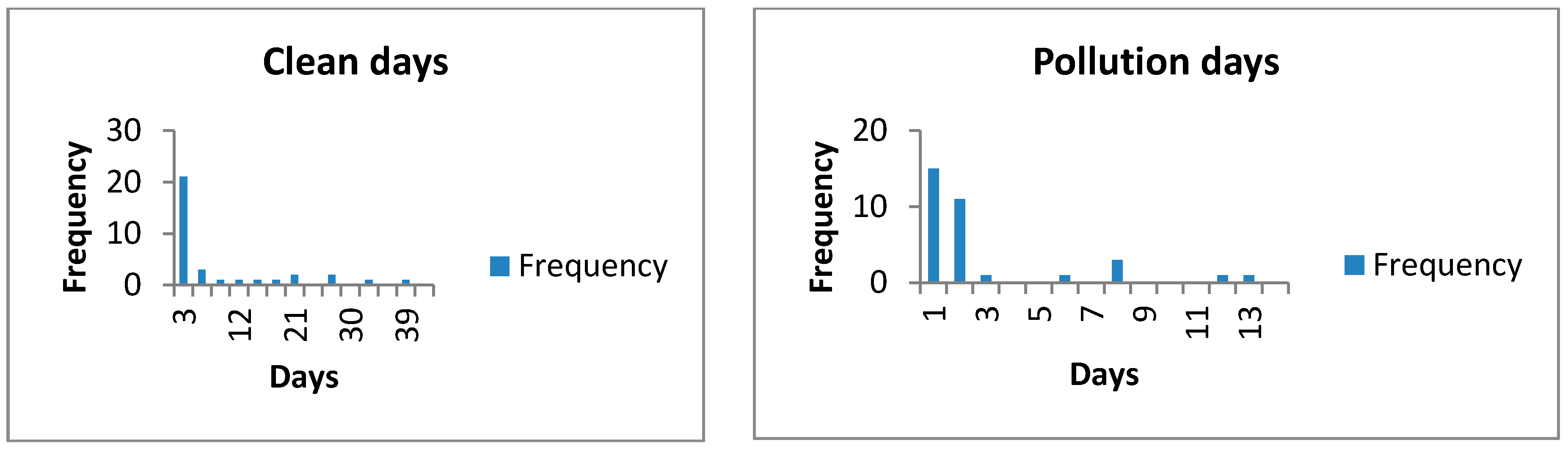

Air conditions affect the EUA spot price under the new scheme. To describe air pollution levels simply, based on a regulation of the UK Department for Environment, Food & Rural Affairs, a clean day is defined as having a daily mean concentration of less than 58 µg/m

3, otherwise, it is a pollution day. The frequency of “clean days” and “pollution days” in the UK in 2013 is shown in the following

Figure 1.

As

Figure 1 shows, “1” denotes clean days and “2” denotes pollution days. The probability distribution of the duration (in days) from clean to pollution (or from pollution to clean) follows an exponential distribution. Thus, we can apply the Markov chain to describe the switching.

4.2. Markovian Switching

The Markovian switching system was first introduced by Krasovskii and Lidskii [

20]. This kind of stochastic model describes different types of dynamic systems that might experience abrupt changes in their parameters and structures. The advantages in modelling have been reported in the literature (see Mao [

21], Boukas [

22], and references therein).

We let

be a complete probability space with filtration

, which satisfies the usual constraints (i.e., it is increasing right-continuous while

contains all

sets). Let

be a right continuous Markov chain on the probability space, which takes values in finite state space

with the following generator

Here,

is the transition rate from the state of “clean” to that of “pollution”, while

is the transition rate from the state of “pollution” to that of “clean”, and thus,

and

where

.

In our case, the Markov chain is independent of Brownian motion .

As is well known, almost every sample path of Markov chain

is a right-continuous step function [

23]. More precisely, there is a sequence

of finite-valued and

-stopping times, such that

almost certainly and

can be expressed as

Moreover, given that

, random variable

follows exponential distribution with parameter

, namely,

Meanwhile, given that

, random variable

follows exponential distribution with parameter

, namely,

We can easily simulate the sample paths of the Markov chain using the exponential distributions.

4.3. Simulation of the Spot Price in the New Trading Scheme

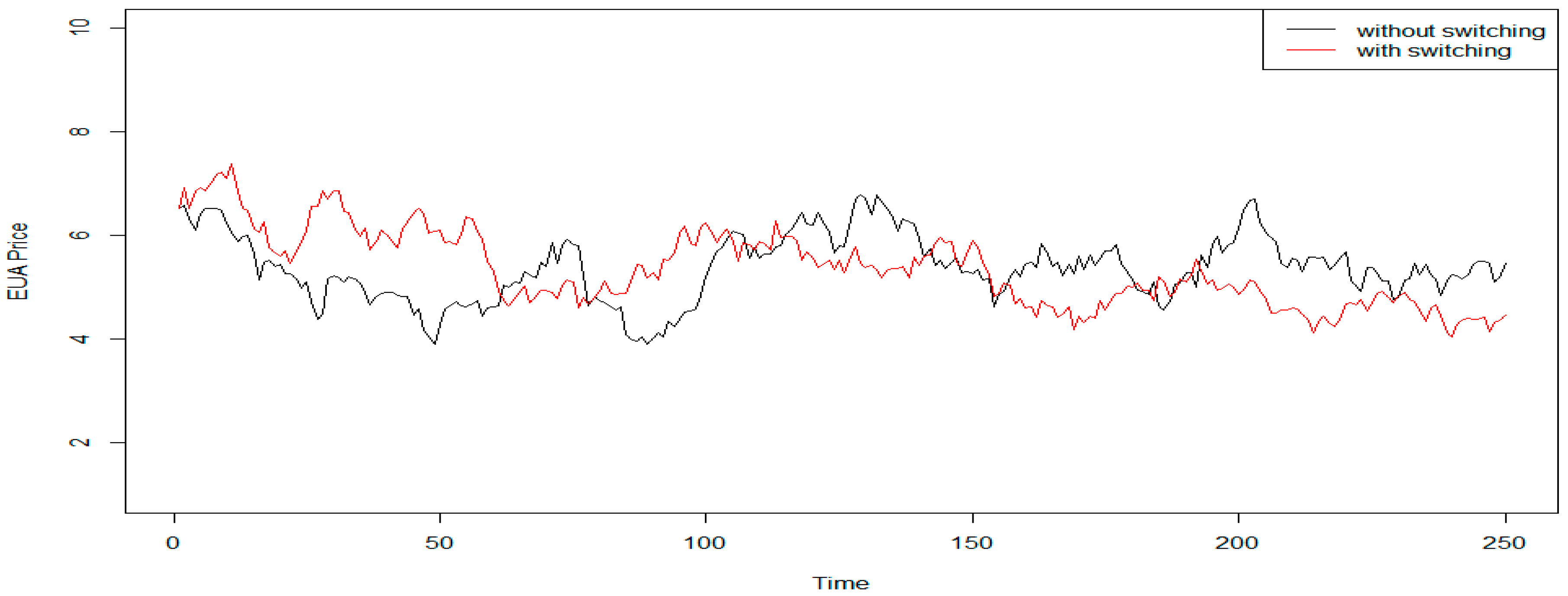

Having reviewed the details of the Markov chain, we now study the SDE MRSRP model with Markov switching. Our aim is to compute the EUA spot prices under the new trading scheme if the firm has to hand many more emissions allowances to the regulator for pollution days. Then, we can compare the spot prices between the current and new trading schemes.

We assume the system parameter is constant. Given that, on clean days, the parameter and on pollution days, the parameter . We estimate the transition rate from clean to pollution using and the transition rate from pollution to clean using .

In 2013, there were 250 business days in the EU ETS. Moreover, the starting level of the spot price on 2 January 2013 was 6.52, and we set it as the starting level for 2013, that is,

. In this study, we design a function in R-software to perform simulations of the spot price for the SDE MRSRP model (Equation (4)) with Markovian switching with step time

. Combined with the spot price of the current scheme without considering the effect of air pollution, we obtain

Figure 2.

Figure 2 depicts the computer simulation of the EUA spot price in 2013. The black line is the simulation of the EUA spot price without switching, while the red line is the simulation of the EUA spot price with switching. The former is the EUA spot price under the current EU ETS scheme; the latter is the EUA spot price under the new trading scheme considering the effect of air pollution. As shown in

Figure 2, the red line is more stable than the black one. The spot prices do not jump too much under the new ETS. Thus, it would help to improve the ETS and achieve the primary goal—reduction of air pollution by the government at least possible cost.

5. Discussions and Conclusions

This study examines the stochastic nature of emissions allowances under different schemes pertaining to the relevant models that previous studies failed to achieve. First, we analyse the two primary markets for CO

2 emissions allowance spot price under the scheme of the EU ETS: Powernext and ECX. In line with previous studies focused on the EUA spot prices in Phases I and II (e.g., [

4,

5,

6]), the empirical analysis provides evidence that EUA spot prices display non-stationary behaviour in Phase III. In addition, the EUA spot prices approximately follow geometric Brownian motion. An empirical evaluation using actual market data demonstrates that the MRSRP has the best fitness of the five SDEs for representing the dynamics of the EUA spot prices.

More importantly, to reduce smog, this study develops a new scheme in which a firm has to hand many more allowances to the regulator when it emits one unit of air pollution on heavy pollution days, compared to only one allowance on clean days. In

Section 4, we show that under the new trading scheme, the air condition can be improved in the pollution days. Using real-life data, we find that the time gap between clean days and pollution days follows exponential distribution, and therefore we develop a SDE MRSRP model with Markovian switching to predict the spot prices in the new trading scheme. The model simulation has shown that the spot prices are expected to not jump too much under the new trading system.

We contribute to the literature in three ways. First, we explore the fitness of the SDEs mainly based on the data of the Phase III of ETS, which has rarely been covered in previous studies. Second, this study is one of the earliest works to develop a new trading scheme with two different states to reduce pollution congestion. The theoretical conception would serve as the basis for more in-depth studies in the future and as a tool for formulating policies aimed at reducing pollution disasters. Third, although a lot of research has been done on spot price modelling, none of the existing literature used SDE with Markovian switching to study the effect of the air condition, and this model is better in our study because there are two different air conditions under our new scheme.

There are several important implications arising from this study for the regulators and managers. First, the current CO

2 emissions market behaves like the MRSRP model. One explanation is that the supply of EUA is fixed in ETS, when there is an increase in demand due to policy or weather conditions, pushing prices higher. When demand returns to normal levels, prices will fall. Besides the mean reverting characteristic, the spot price is proportion to its variance in the current CO

2 emission market [

7]. This important property improves the assessment of production costs incorporating CO

2 costs since the introduction of emission trading system, or supports emissions-related investment decisions. The ability of managers to predict the EUA spot prices helps to maintain market efficiency and sustain a healthy trading volume. Second, the estimations in this study showed that the EUA price would not fluctuate too much under the new trading scheme, which greatly enhances the political acceptability of the scheme. Specifically, it implies that the new trading scheme does not lead to more complications in the pricing of emission allowances or to the adverse effect on market liquidity and efficiency. We suggest the government to apply our scheme to upgrade the current trading scheme.

The study has methodological limitations. Primarily, we compare only five SDEs to the EUA spot prices, neglecting other SDEs. In addition, for lack of the EUA price, we cannot compare the theoretical and actual spot price under the new scheme. When future data become available in years to come, it would be worthwhile to re-perform the work in greater detail than the current data allow. Finally, more advanced econometric techniques to estimate the model parameters, including the MCMC method, will be widely elaborated on in the future.