Retailer’s Procurement Strategy under Endogenous Supply Stability

Abstract

:1. Introduction

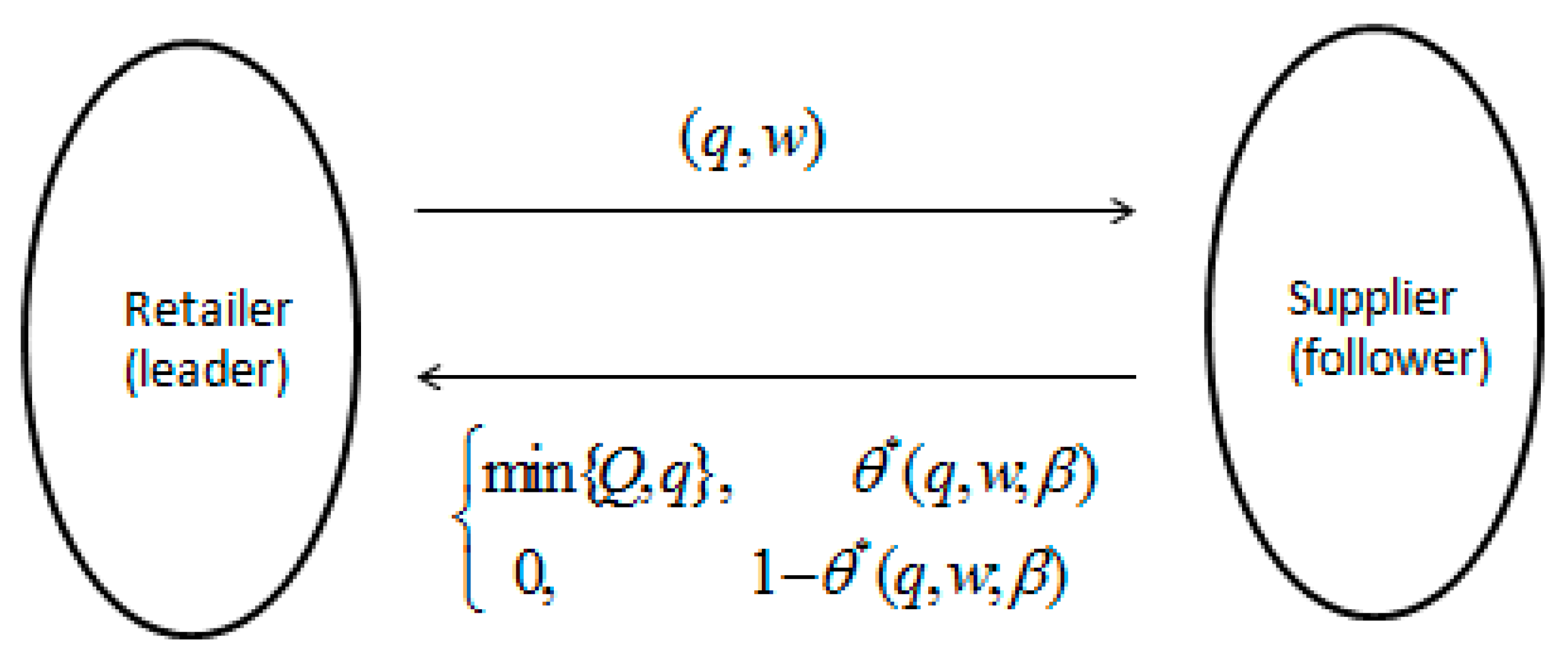

2. Model

3. Analysis

3.1. The Optimal Stability Level

3.2. Optimal Order Strategy

- (1)

- If , then for any purchasing price, retailer’s expected profit is concave on order quantity.

- (2)

- If , then for any order quantity, retailer expected profit is concave on purchasing price.

- (1)

- When , we have and profit function of retailer turns to be:where , and the first order and second order condition of the profit function on order quantity are:

- (2)

- When (supplier is completely stable when it is binding), we have and the profit function of the retailer turns to be:Then we have:

- (1)

- When , , put into (5), we have the profit function:Theni.e., it is decreasing with . Then we haveCase 1: Retailer’s expected profit turns to beWith constraints and . will be , .

- (2)

- When , , put them into function (5), we have the profit function ,Theni.e., it is decreasing with . Then we haveCase 2: The expected profit of retailer will beWith constraints and . will be , .

- (1)

- When , , it is obvious that the supply is stable. Put into (8) we have the profit function as:Theni.e., it is increasing with . Then we haveCase 3: The profit function of retailer isThe constraint is . Then we have = and .

- (2)

- When , , we put into (8), then the profit function is: ,Theni.e., it is increasing with . Then we haveCase 4: The profit function of retailer isThe constraint is . Then we have = and .

4. Uniform Distribution

- (1)

- When , supplier tends to be stable completely. When , the retailer’s optimal ordering quantity is , the optimal purchasing price is .

- (2)

- When , retailer will not purchase and there is no incentive for the supplier to be stable.

- (1)

- When and , the retailer’s optimal order quantity is , the optimal purchasing price is , the supplier is completely stable.

- (2)

- When , the retailer’s optimal order quantity is , the optimal purchasing price is , and the supplier is completely stable.

- (1)

- When .

- (2)

- When .

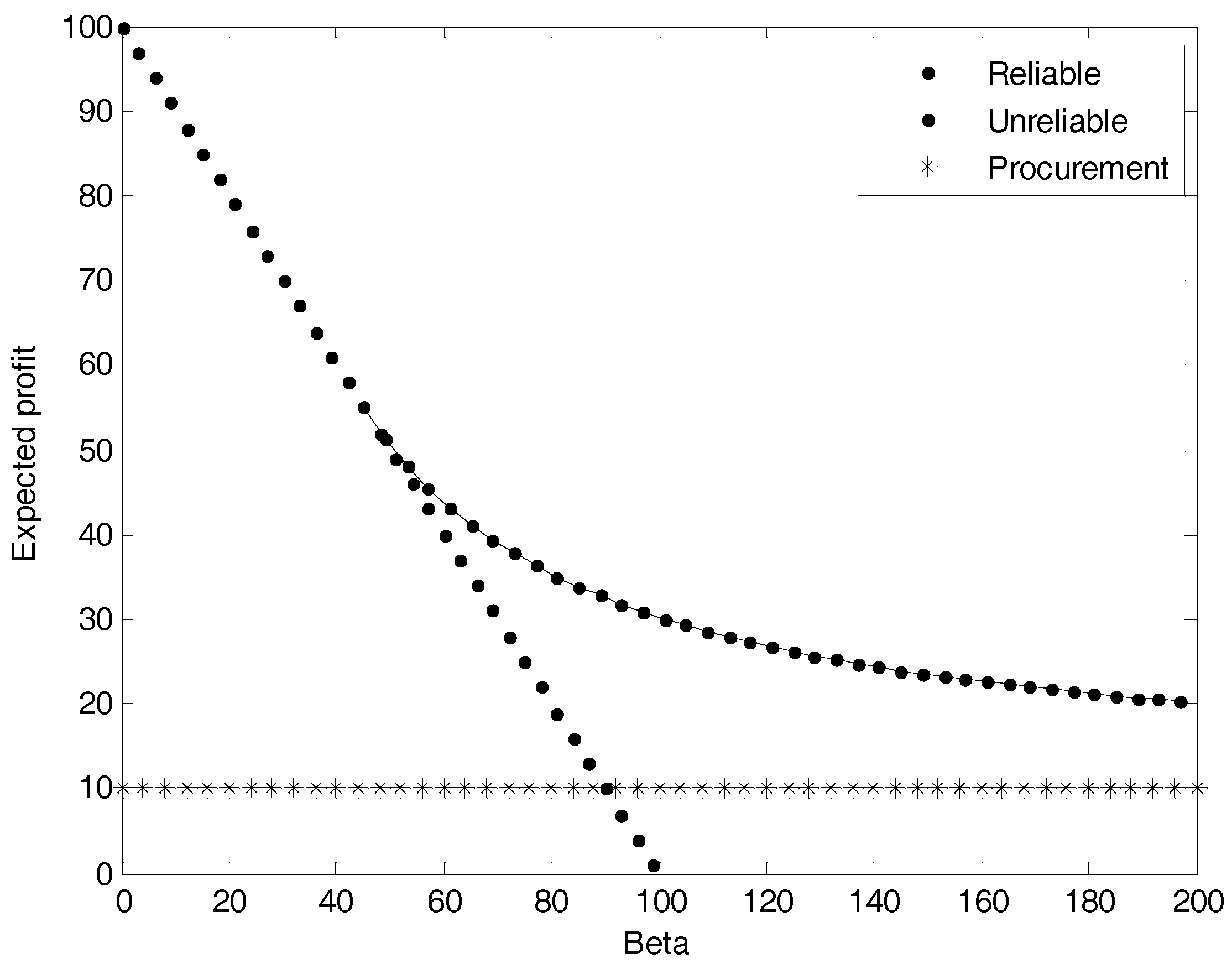

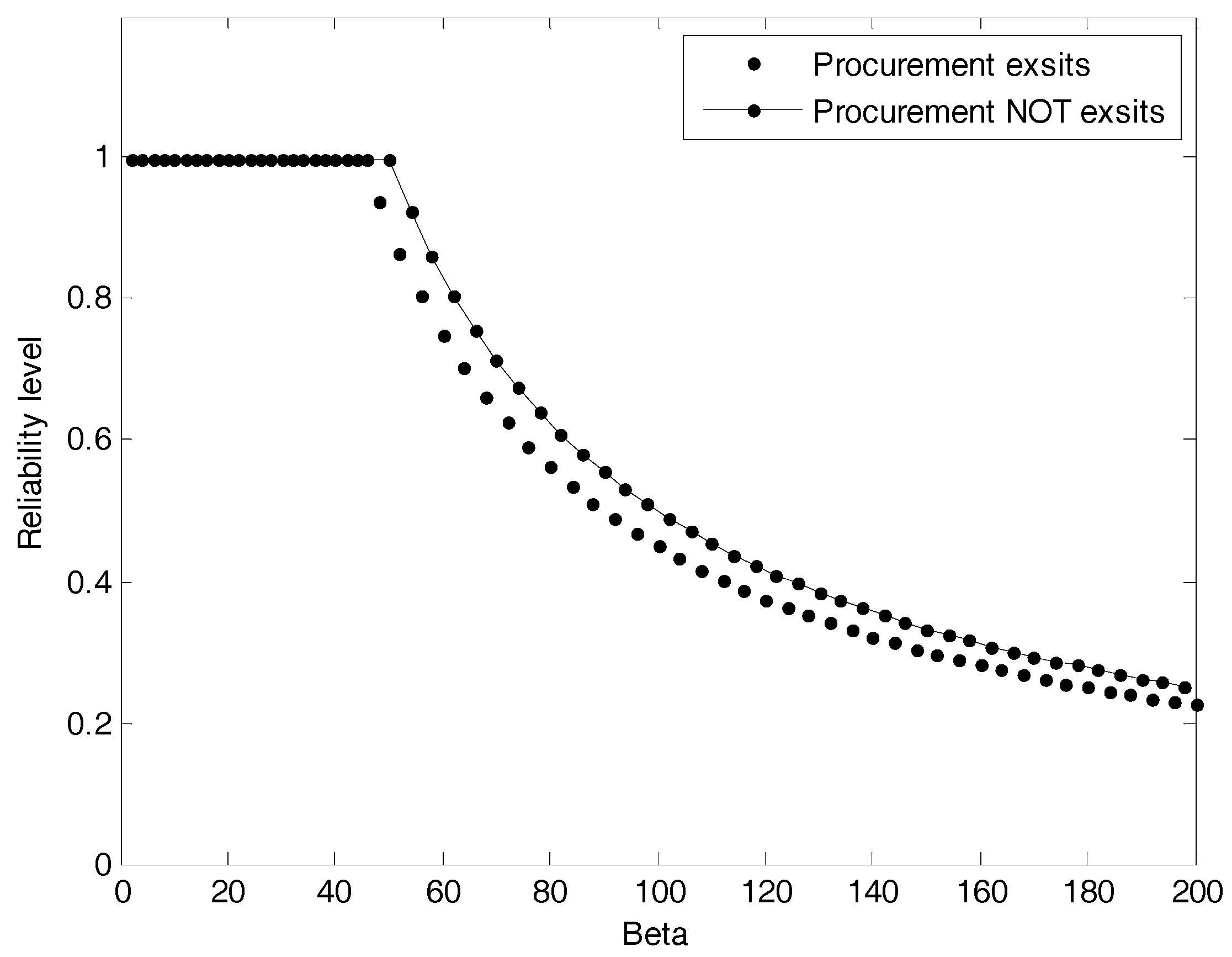

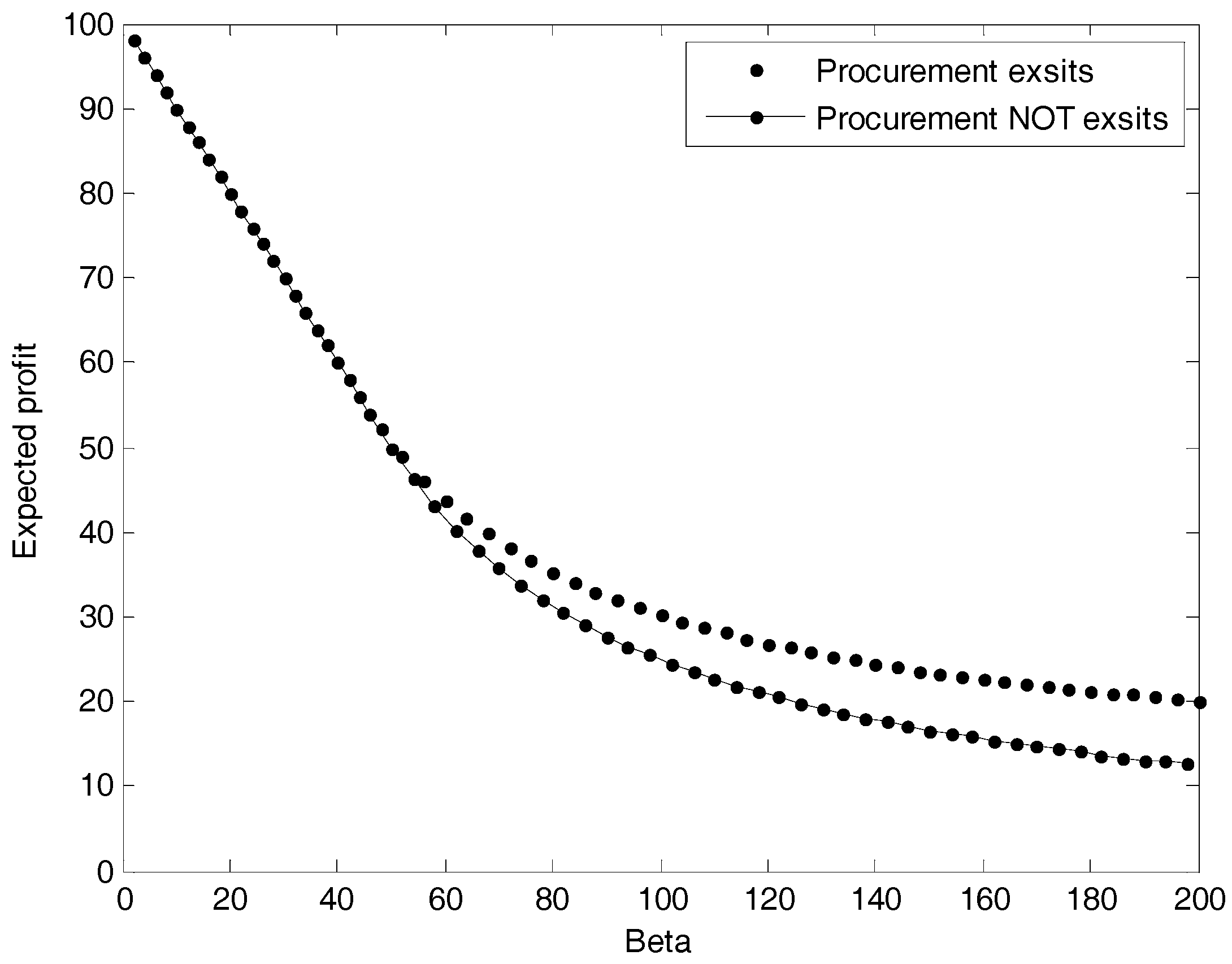

5. Numerical Analysis

6. Extended Model

6.1. The Optimal Stability Level

6.2. The Optimal Order Strategy

- (i)

- When the order satisfies the condition of , the supply is entirely stable, and the expected profit is the concave function of the order quantity;

- (ii)

- When the order satisfies the condition of , the expected profit is the concave function of the procurement price.

- (1)

- When , ;

- (2)

- When , , then , ;When , , then , ;When , , then the retailers will not order;

- (3)

- When , then , ;

- (4)

- When , then the retailers will not order.

- (1)

- When , then , ;

- (2)

- When , if , then , ; if , then , the retailers will not order.

- (i)

- When , then , , ;

- (ii)

- When , if , then , , ; if , retailers will not order, however, provided , then , , .

7. Conclusions

Supplementary Files

Supplementary File 1Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

Appendix A.1. Proof of Proposition 4

Appendix A.2. Proof of Proposition 5

Appendix A.3. Proof of Proposition 7

Appendix A.4. Proof of Proposition 8

Appendix A.5. Proof of Proposition 9

Appendix A.6. Proof of Proposition 10

Appendix A.7. Proof of Proposition 11

References

- Muthukrishnan, R.; Shulman, J.A. Understanding supply chain risk: A McKinsey global survey. McKinsey Q. 2006, 9, 1–9. [Google Scholar]

- Banker, S. Volcano Disrupts European Supply Chains. Logistics Viewpoints, 2010. Available online: http://logisticsviewpoints.com/2010/04/22/volcano-disrupts-european-supply-chains (accessed on 4 December 2017).

- Veysey, S. Majority of Companies Suffered Supply Chain Disruption in 2011: Survey. Business Insurance, 2011. Available online: http://www.businessinsurance.com/article/20111102/NEWS06/111109973# (accessed on 4 December 2017).

- Heyes, W. Honest Broker Solves Supply Problems. 2008. Available online: http://www.epdtonthenet.net/article.aspx?ArticleID=14675 (accessed on 4 December 2017).

- Hu, X.; Gurnani, H.; Wang, L. Managing risk of supply disruptions: Incentives for capacity restoration. Prod. Oper. Manag. 2013, 22, 137–150. [Google Scholar] [CrossRef]

- Tomlin, B. On the value of mitigation and contingency strategies for managing supply chain disruption risks. Manag. Sci. 2006, 52, 639–657. [Google Scholar] [CrossRef]

- Liker, J.K.; Choi, T.Y. Building Deep Supplier Relationships. Available online: https://hbr.org/2004/12/building-deep-supplier-relationships (accessed on 4 December 2017).

- Gümüş, M.; Ray, S.; Gurnani, H. Supply-side story: Risks, guarantees, competition, and information asymmetry. Manag. Sci. 2012, 58, 1694–1714. [Google Scholar] [CrossRef]

- Krause, D.R.; Handfield, R.B.; Tyler, B.B. The relationships between supplier development, commitment, social capital accumulation and performance improvement. J. Oper. Manag. 2007, 25, 528–545. [Google Scholar] [CrossRef]

- Bohn, R.E.; Terwiesch, C. The economics of yield-driven processes. J. Oper. Manag. 1999, 18, 41–59. [Google Scholar] [CrossRef]

- Mendoza-Fong, J.R.; García-Alcaraz, J.L.; Díaz-Reza, J.R.; Sáenz Diez Muro, J.C.; Blanco Fernández, J. The role of green and traditional supplier attributes on business performance. Sustainability 2017, 9, 1520. [Google Scholar] [CrossRef]

- Federgruen, A.; Yang, N. Technical note-procurement strategies with unreliable suppliers. Oper. Res. 2011, 59, 1033–1039. [Google Scholar] [CrossRef]

- Liu, S.; So, K.C.; Zhang, F. Effect of supply reliability in a retail setting with joint marketing and inventory decisions. Manuf. Serv. Oper. Manag. 2010, 12, 19–32. [Google Scholar] [CrossRef]

- Gurnani, H.; Shi, M. A bargaining model for a first-time interaction under asymmetric beliefs of supply reliability. Manag. Sci. 2006, 52, 865–880. [Google Scholar] [CrossRef]

- Tomlin, B. Impact of supply learning when suppliers are unreliable. Manuf. Serv. Oper. Manag. 2009, 11, 192–209. [Google Scholar] [CrossRef]

- Wang, Y.; Gilland, W.; Tomlin, B. Mitigating supply risk: Dual sourcing or process improvement? Manuf. Serv. Oper. Manag. 2010, 12, 489–510. [Google Scholar] [CrossRef]

- Tang, S.Y.; Gurnani, H.; Gupta, D. Managing disruptions in decentralized supply chains with endogenous supply process reliability. Prod. Oper. Manag. 2014, 23, 1198–1211. [Google Scholar] [CrossRef]

- Loseby, M. Vertical Coordination in the Fruit and Vegetable Sector: Implications for Existing Market Institutions and Policy Instruments; OECD: Paris, France, 1997. [Google Scholar]

- Yan, M.R.; Chien, K.M.; Yang, T.N. Green component procurement collaboration for improving supply chain management in the high technology industries: A case study from the systems perspective. Sustainability 2016, 8, 105. [Google Scholar] [CrossRef]

- Xue, X.; Wang, S.; Lu, B. Computational experiment approach to controlled evolution of procurement pattern in cluster supply chain. Sustainability 2015, 7, 1516–1541. [Google Scholar] [CrossRef]

- Lee, H.; Lodree, E.J. Modeling customer impatience in a newsboy problem with time-sensitive shortages. Eur. J. Oper. Res. 2010, 205, 595–603. [Google Scholar] [CrossRef]

- Kim, S.H.; Tomlin, B. Guilt by association: Strategic failure prevention and recovery capacity investments. Manag. Sci. 2013, 59, 1631–1649. [Google Scholar] [CrossRef]

- Li, G.; Zhang, L.; Guan, X.; Zheng, J. Impact of decision sequence on reliability enhancement with supply disruption risks. Transp. Res. Part E Logist. Transp. Rev. 2016, 90, 25–38. [Google Scholar] [CrossRef]

- Yan, R.; Lu, B.; Wu, J. Contract coordination strategy of supply chain with substitution under supply disruption and stochastic demand. Sustainability 2016, 8, 676. [Google Scholar] [CrossRef]

- Moorthy, K.S. Market segmentation, self-selection, and product line design. Mark. Sci. 1984, 3, 288–307. [Google Scholar] [CrossRef]

- Desai, P.; Kekre, S.; Radhakrishnan, S.; Srinivasan, K. Product differentiation and commonality in design: Balancing revenue and cost drivers. Manag. Sci. 2001, 47, 37–51. [Google Scholar] [CrossRef]

- Hill, T. Manufacturing Strategy, 3rd ed.; McGraw-Hill/Irwin: Boston, MA, USA, 2000. [Google Scholar]

- Xu, J.R.; Chen, J.S.; Niu, J.H. RFID and its application. Data Commun. 2009, 30, 21–26. (In Chinese) [Google Scholar]

- Heese, H.S.; Swaminathan, J.M. Product line design with component commonality and cost-reduction effort. Manuf. Serv. Oper. Manag. 2006, 8, 206–219. [Google Scholar] [CrossRef]

- Dada, M.; Petruzzi, N.C.; Schwarz, L.B. A newsvendor’s procurement problem when suppliers are unreliable. Manuf. Serv. Oper. Manag. 2007, 9, 9–32. [Google Scholar] [CrossRef]

- Tomlin, B.; Wang, Y. On the value of mix flexibility and dual sourcing in unreliable newsvendor networks. Manuf. Serv. Oper. Manag. 2005, 7, 37–57. [Google Scholar] [CrossRef]

- Das, T.; Krishnan, V.; McCalley, J.D. High-fidelity dispatch model of storage technologies for production costing studies. IEEE Trans. Sustain. Energy 2014, 5, 1242–1252. [Google Scholar] [CrossRef]

- Delen, D.; Hardgrave, B.C.; Sharda, R. RFID for better supply-chain management through enhanced information visibility. Prod. Oper. Manag. 2007, 16, 613–624. [Google Scholar] [CrossRef]

- Sekizaki, S.; Nishizaki, I.; Hayashida, T. Electricity retail market model with flexible price settings and elastic price-based demand responses by consumers in distribution network. Int. J. Electr. Power Energy Syst. 2016, 81, 371–386. [Google Scholar] [CrossRef]

| Cost-Efficient | Reliability Level | Quantity | Wholesale Price | Expected Profit |

|---|---|---|---|---|

| 16 | 1 | 12 | 1.4 | 116.390 |

| 31 | 1 | 14 | 2.5 | 99.358 |

| 66 | 1 | 12 | 5.5 | 73.895 |

| 91 | 0.77143 | 13 | 5.4 | 56.570 |

| 146 | 0.45959 | 11 | 6.1 | 40.108 |

| 211 | 0.31280 | 12 | 5.5 | 32.427 |

| 246 | 0.29593 | 13 | 5.6 | 29.432 |

| 276 | 0.27899 | 14 | 5.5 | 27.733 |

| 281 | 0.25907 | 13 | 5.6 | 27.679 |

| 336 | 0.22321 | 15 | 5.0 | 24.762 |

| 356 | 0.19719 | 13 | 5.4 | 24.539 |

| 376 | 0.17287 | 13 | 5.0 | 23.543 |

| 391 | 0.17187 | 12 | 5.6 | 23.049 |

| 416 | 0.15817 | 14 | 4.7 | 23.011 |

| 461 | 0.14317 | 12 | 5.5 | 21.674 |

| 496 | 0.13065 | 12 | 5.4 | 21.615 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Feng, C.; Wang, Z.; Jiang, Z. Retailer’s Procurement Strategy under Endogenous Supply Stability. Sustainability 2017, 9, 2261. https://doi.org/10.3390/su9122261

Feng C, Wang Z, Jiang Z. Retailer’s Procurement Strategy under Endogenous Supply Stability. Sustainability. 2017; 9(12):2261. https://doi.org/10.3390/su9122261

Chicago/Turabian StyleFeng, Chengxiao, Zongjun Wang, and Zhenyu Jiang. 2017. "Retailer’s Procurement Strategy under Endogenous Supply Stability" Sustainability 9, no. 12: 2261. https://doi.org/10.3390/su9122261