1. Introduction

Over time, the importance of communicating the most relevant information about a business and the organization’s activities to the market has led to the development of specific codes of corporate disclosure (within Company Laws, Accounting rules, or Securities Laws) aimed at regulating the level and content of the mandatory communication by each organization. The main aim of these regulations is to reduce the information asymmetry between managers and stakeholders to contain the related risk to trade (as investor, client, supplier, and so on) within the organization [

1].

However, more and more organizations are deciding to go beyond these regulations, freely opting to disclose further (mostly non-financial) information on their business in the form of “voluntary disclosure” [

2]. Such a decision is specifically included in the increasing attention to corporate social responsibility (CSR) spurred by the widespread conviction that CSR may “pay off” for organizations as well as for their stakeholders and society and supporting the organizations’ achievement of strategic benefits oriented towards value creation [

3].

Indeed, following the stakeholder approach to strategic management initially promoted by Freeman [

4], corporate disclosure is certainly a CSR action as it may substantially support the legitimacy management necessary to build “sustainable growth for business in a responsible manner” [

5] (p. 17), [

6,

7].

The two aforementioned typologies of corporate disclosure (mandatory and voluntary) are mutually complementary and influence each other. The reason for this is that the former may restrain or boost the latter depending on the quantity of compulsory information that organizations are already being asked, whereas quality or credibility of the latter may affect the former, thus encouraging greater or lesser market regulation [

8,

9,

10]. Subsequently, the issue of corporate disclosure requires a consideration of not only (or not so much) the amount of (mandatory and voluntary) data disclosed, but also the materiality of the corporate communication, which is to be assessed while checking if the information provided is actually useful for the different stakeholders and their behaviors towards the organization.

To date, the considerable literature on the topic has mainly focused on the role of corporate disclosure for capital markets, assuming that managers have to take relevant disclosure decisions even in an efficient capital market due to their superior knowledge of the organization in comparison to outside investors, e.g., [

11,

12,

13,

14,

15,

16,

17]. Indeed, previous studies have mainly investigated the following: on the one hand, the reasons underlying the organization’s propensity for the (voluntary) communication of more information about its activities, and on the other, the impact of corporate disclosure on the organization’s performance in the short, medium, and long term.

The literature on the topic is very extensive and is mostly focused on the impact of corporate disclosure on specific variables of the capital markets such as stock performance, cost of capital, or analyst coverage [

18], mainly adopting the disclosure index or the event study approach [

19]. Unfortunately, some of these studies include measurement errors that affect the interpretation of results, hence requiring further investigation on the topic [

20]. Moreover, few studies have included in their analysis the concept of materiality and the necessity of relating the impact on the capital markets to the disclosure of material information [

21,

22].

To address this research gap in the literature, the aim of this article is to specifically analyze the impact produced on the capital markets by the publication of a recent tool of corporate disclosure, characterized by the essential purpose of providing a holistic representation of the organization’s performance, and explicitly adopting materiality as its guiding principle. We refer to the “Integrated Report” and the framework released by the International Integrated Reporting Council (IIRC) [

23]. Specifically, the article aims to:

first, verify, through the event study methodology, if the publication of the Integrated Report, containing material information on the organization, is able to support the overall scope of corporate disclosure, thus definitely producing a statistically significant effect on the share price of that organization;

second, investigate, by means of the adoption of a statistical significance test for categorical data, the association of the share price impact with the naming of the report; specifically, the aim is to verify if (and eventually to what extent) the name “integrated” (instead of “sustainability” or “annual”) for a report and its specific association with the principle of materiality play a significant role in the impact registered on the share price of the organization.

The article is structured as follows. The next two sections introduce a brief literature review on corporate disclosure and its combination with the materiality principle as premises for the development of the research hypotheses of the study. The next section presents the method adopted for the analysis and the results achieved. The last section discusses the results referring to the research hypotheses, including some conclusive considerations.

2. Corporate Disclosure and Capital Markets: A Brief Literature Review

In recent years, organizations have increasingly improved their disclosure processes for two reasons. The first is due to the critical role played by corporate disclosure for the effectiveness of business exchanges and activities in a capital market, while the second focuses on the sustainable growth of an organization [

5,

7,

24]. Corporate disclosure may include financial statements, management discussions, footnotes, as well as press releases, internet sites, and every other type of business report useful to provide data and information about the organization’s activities to the market [

20]. Over time, scholars have suggested a number of corporate reporting models, which is partly a consequence of changes in the international markets and the related requirement for continuous business innovation, including the disclosure processes implemented by the organizations [

25].

To understand the reasons underlying the development of corporate disclosure, previous studies have analyzed a wide range of variables to identify which factors may influence the level of corporate communication to the market—e.g., [

26,

27]. A necessary premise of this research is the information asymmetry between managers and shareholders that was introduced by the separation of roles (decision-makers on one side, capital providers on the other) and relies on the traditional agency approach to the relationship between ownership and control [

28]. Under agency theory, managers need to resort to corporate disclosure in order to affect the organization’s access to capital as required by the capital market users, including both sophisticated subjects (such as brokers or investment funds) and non-sophisticated ones (i.e., capital providers without specialized knowledge) [

24].

Specifically, previous studies have searched for the factors affecting the level of corporate disclosure, while underlining the relevance of variables such as the organization’s size and typology, the information asymmetry risk of the market (influencing the potential assumption of opportunistic behaviors), the professional degree of the intermediary agencies (affecting the credibility of the information disclosed), the board composition (also in terms of the presence of women), or the traditional attitude of the management (whose hostility toward the costs of voluntary disclosure may be mainly reduced by strong economic incentives)—e.g., [

29,

30,

31,

32,

33,

34].

Moreover, focusing on the managers’ decision on this issue, other studies have identified some forces which can intensify the corporate disclosure level for capital market reasons [

20]. These forces entail the necessity of reducing the information asymmetry between managers and outside investors in order to improve the conditions for the following:

capital market transactions, by reducing the cost of capital—e.g., [

35,

36,

37];

corporate control, by affecting the managers’ turnover—e.g., [

38,

39];

stock-based compensation plans, by correcting potential undervaluation—e.g., [

40];

development of litigation hypotheses, in turn impacting on the disclosure behaviors—e.g., [

41,

42];

managers’ recognition, spreading their talent—e.g., [

43];

competition in product markets, which is the only hypothesis assuming the absence of conflict of interest between management and ownership—see [

13,

44].

With respect to these motivations, other studies have associated the evidence of some positive effects with the development (especially in terms of voluntary decision) of corporate disclosure, essentially as a consequence of the mitigation of the cited investors’ information asymmetry and the possibility of using private information in trading [

11]. These effects essentially refer to three typologies of positive impact on capital markets: the stock liquidity, the cost of capital, and the information intermediation [

20]. These studies have tested that voluntary disclosure can:

increase the stock liquidity, thus improving investors’ trust about the (affected) “fair price” of stock transactions—e.g., [

45,

46];

reduce the cost of capital, limiting the information risk—e.g., [

47,

48,

49,

50,

51];

develop information intermediation, reducing the cost of attaining data for financial analysts—e.g., [

52,

53].

However, other studies have highlighted that corporate disclosure may also have negative impacts on the capital markets, primarily because revealing substantial data to competitors may harm the competitive position of the organization—e.g., [

13,

54,

55,

56]. This eventuality may induce managers to reduce the (voluntary) information disclosed, thus foregoing the advantages derived from corporate disclosure previously noted. This is in consideration of the perceived risk of losing the competitive position possessed against the organization’s existing or potential competitors. The “nature” of the information to disclose (i.e., if there is good or bad news about the organization’s performance) may certainly influence such a managers’ decision, as tested by previous studies focused on their tendency to withhold bad news—e.g., [

41,

57,

58].

In addition, it is worth remembering that corporate disclosure also entails supporting some specific costs, derived by the same disclosure process in terms of technological and human resources involved in the data collection, processing, and auditing, that might lead to the managerial decision to limit the flow of information to the market [

24] (p. 1409). Assuming the costs related to the mandatory disclosure are unavoidable, the managerial decision on the degree of voluntary disclosure requires a specific cost-profit analysis (which is rather difficult to implement and is subjective) and is essentially aimed at checking that the marginal cost of additional information does not exceed the marginal profit resulting from the addition of information [

59]. With this aim in mind, Holland [

19] (p. 30) suggested that “management would publicly disclose up to (or towards) the point where the perceived reduction in the agency costs of equity capital equalled the increased costs of public disclosure to markets and the public domain”.

Such an analysis is undeniably rather difficult to implement and is subjective, and requires the adoption of practical rules aimed at detecting and calculating the positive and negative effects of corporate disclosure. Some scholars have specifically explained the organizations’ decision to extend the disclosure level beyond the mandatory requirements with considerations related to the concept of materiality [

21,

22], as better specified in the next section.

3. Disclosing Material Information: The Hypotheses Development

“Materiality is a vital concept, one of the cornerstones of accountancy” [

60] (p. 116). From the 1960s and the development of capital markets, this axiom has been reiterated in the accounting and auditing literature, highlighting the relevance of what should be one of the main guides for accountants and auditors, despite the difficulty in understanding its actual meaning. Many scholars have tried to provide a definition of the concept of materiality but its meaning is still quite intuitive [

22]. All of the definitions provided essentially point to the relationship between materiality and the decision-making processes in organizations, underlining the necessary “decision usefulness” of material data [

61,

62].

In these terms, an item is “material” if it is suitable to condition the behavior of an informed investor (or, generally, of a reasonable person), adding to his/her total information more than it detracts by complicating a report with the further detail provided. The materiality level of an item is measured by its potentiality to change the decision-maker’s expectations, beyond its absolute dimension [

22]. Moreover, according to Black et al. [

63] (p. 144), the materiality principle arises as “a practical guide which helps the accountant decide to what extent to follow accounting principles” and it is related to the “relative importance” of data that can influence the decisions of the reader of a specific organization’s report and only under particular circumstances. This implies the necessary involvement of the managers’ judgment, essentially aimed at identifying what the report users need to know about the organization’s activities in order to make reasonable decisions [

64]. Many variables may influence this judgment, including both financial and non-financial issues, as well as both quantitative and qualitative factors, such as some characteristics (experience included) of the organization or its industry, the general economic context, the managers’ ability and wishes, and so on [

65,

66,

67].

Assuming the multi-dimensionality of corporate disclosure decisions, involving not only the amount but also the timing and nature of the information that is to be provided, an effective study on corporate disclosure consequently needs to consider the materiality principle as a key reference for the selection and the analysis of the data being disclosed. Unfortunately, few studies in the literature have included the impact of materiality in their analysis of corporate disclosure [

21,

22], justifying the development of further studies characterized by the inclusion of such a relevant variable.

Materiality is now a key reporting principle, not only for the financial impact of the organization’s activities, but also for their social and environmental effects, in the interests of all of the organization’s stakeholders [

68]. Indeed, the materiality principle already appears in some corporate reporting models provided by scholars and/or professional accounting bodies to answer the aforementioned need of corporate disclosure beyond compulsory requirements. These models include the Global Reporting Initiative (GRI), according to which the materiality principle lies in the commitment of the report to “cover aspects that: Reflect the organization’s significant economic, environmental and social impacts; or Substantively influence the assessments and decisions of stakeholders” [

69] (p. 17), and the AA1000 standard, which defines as material any “issue that will influence the decisions, actions and performance of an organization or its stakeholders” [

70] (p. 12).

Within this context, our study focuses on a more recent (and thus less analyzed) model of corporate disclosure, i.e., Integrated Report (hereafter IR), aimed at providing a holistic representation of the organization’s activities and the related financial, social, and environmental performance achieved. Despite the wide variety of information provided and the interests involved, a crucial aim of this report is the organization’s access to capital, since, according to its framework, “The primary purpose of an integrated report is to explain to providers of financial capital how an organization creates value over time” [

23] (p. 8). The IR proposition builds on the explicit demand for a reporting approach integrating financial and sustainability information suggested by scholars and practitioners on the expectation of improving the decision-making processes for providers of financial capital [

71,

72,

73]. Nevertheless, there is not enough evidence on whether integrated reports are concretely more useful than traditional annual reports in supporting investors’ decisions [

74,

75,

76].

In these terms, an analysis on the impact of IR on market valuation may certainly provide new evidence on the IR usefulness for investors [

77] and, more broadly, on the effect of corporate disclosure on the organizations’ access to capital, as required by the measurement errors affecting results of previous studies [

20].

Specifically, the first research hypothesis of this study concerns the capacity of IR, as a corporate disclosure tool, to influence the organization’s access to capital, producing, at the time of its publication, a significant impact on the share price of the organization. The analysis is coherent with the aforementioned necessity of integrating the disclosure issue with the materiality principle, as materiality represents one of the seven guiding principle suggested by the IIRC to prepare and present effectively an integrated report [

23] (p. 17). Indeed, in line with the primary purpose of the IR framework, the report has to include all material information assuming that “a matter is material if it is of such relevance and importance that it could substantively influence the assessments of providers of financial capital with regard to the organization’s ability to create value over the short, medium and long term” [

78] (p. 2). We thus formulate the first research hypothesis of this study as follows.

Hypothesis 1 (H1). The IR publication, disclosing material information of an organization, significantly affects the share price of that organization.

The article also aims to further investigate the impact of IR on the capital markets focusing on its name, in order to check if (and eventually to what extent) it may be statistically associated with the effect produced by the report publication on the organizations’ share prices. Such a research question may be connected with the literature debate developed in the last years on the comparison of IR with other corporate disclosure tools (mainly the “annual report” and the “sustainability report”) in order to identify which one is the most effective model of corporate reporting. Specifically, this debate argues that sustainability reporting, even if aimed at mitigating the limitations of annual reporting (analyzing the organization’s performance beyond its financial aspect), is usually presented as a distinct document and turns out to be incomplete in demonstrating the connection between sustainability and financial information [

79,

80,

81]. According to its supporters, e.g., [

82,

83,

84], IR on the other hand provides the specific benefit of highlighting any relationship among different organizational data as a consequence of the “integrated thinking” approach adopted and its overall aim of providing a holistic representation of the organization’s performance [

85,

86].

Although related to distinct models of corporate reporting, the “annual report” and the “sustainability report” surprisingly represent the name of some integrated reports included in the database of the IR Pilot Program. This was probably due to two different reasons. First, some organizations participating in the program were probably interested in exploiting the greater notoriety that the other two models of corporate reporting certainly had in comparison with IR at the time of the report publication. Second, these reports, initially identified as “annual” or “sustainability” (reports) by the same organizations releasing them, could have been subsequently recognized by the IIRC as “integrated” as they were consistent with the content elements and the guiding principles of the IR framework.

Irrespective of the reason, it is the authors’ opinion that this peculiarity about the IR name deserves further investigation aimed at testing its potential association with the impact produced in the capital markets by the report publication. Specifically, the second research hypothesis of the article builds on the assumption that the name “integrated” for the reports, drafted according to the IIRC framework, automatically stimulates providers of financial capital to recognize the existence and application of all of the guiding principles underlying those reports, with the principle of materiality being at the core of the entire process. In these terms, the adoption of the name “integrated” (instead of “sustainability” or “annual”) for the report may contribute to producing some impact on the capital markets, as stated by our second research hypothesis:

Hypothesis 2 (H2). The naming of the report as “integrated” and the related association with the principle of materiality play a statistically significant role in the impact produced by this disclosure tool on the organizations’ share prices.

4. Method and Results

4.1. Sample Selection

To identify which organizations to include in the analysis, we focused on the “Integrated Reporting Examples database” [

87], which “contains examples of emerging practice in Integrated Reporting”. The Examples database is structured in order to classify organizations not only by name, but also with reference to a variety of other features, such as their localization, or the fiscal year of the IR drafting. Moreover, the database allows the selection of reports according to the content elements and guiding principles applied to the report drafting, as identified by the IIRC Framework. Among these criteria of selection and according to the research hypotheses of this study, we adopted “materiality” as a filter to identify the integrated reports to be included in our analysis.

The criteria of selection returned 47 reports (drafted for the fiscal years from 2011 to 2015) that refer to organizations from any localization in the world.

We excluded six of the organizations that were not quoted on the capital markets, another one that was no longer active on the date of the analysis (since it had been acquired by a different company), and two others because it was not possible to identify the exact publication date of their IR.

The final sample therefore consisted of 38 reports.

According to the industry classification provided by the IIRC, the three industries most represented in our sample were: Financial services, Consumer goods, and Basic Materials. From a geographical point of view, almost 50% of the organizations involved in the analysis were from Europe.

Dates of publication were identified directly in the reports, or by searching the organizations’ web sites, or by contacting the organizations and asking for this information.

To address our first research hypothesis, we decided to adopt the event study analysis, and we extracted all financial data relevant for the analysis from the Thomson Reuters DATASTREAM database.

To address our second research hypothesis, we adopted a statistical significance test for categorical data applied to the reports’ names.

Below we provide more information on the event study analysis performed.

4.2. Event Study Analysis

Event study analysis [

88,

89,

90] is a statistical technique aimed at determining if an event affects the returns of specific securities in a time period called an event window. Initially, event studies were very simple from a statistical perspective [

91]. Later, the quality of event studies increasingly improved and their frequency of use increased in accounting, finance, management and other fields. From a practical viewpoint, event studies compare the returns that would have been expected if the analyzed event would not have taken place (normal returns) and the actual returns including one or more securities. The differences between actual returns and normal returns are called abnormal returns and represent the core element of event study analyses. If the distributional properties of abnormal returns are known (it depends on which techniques were used to estimate the normal returns), it is possible to assess if they are statistically significantly different from 0, which would mean that the event does affect the security price.

When performing an event study, the date of the event analyzed has to be accurately defined. The event window, which typically includes the event, consists of the day(s) on which the analysis is performed. Different test period lengths were used in event studies. For example, event windows from −4 to 4 trading days (where 0 is the publication date, −4 stands for the fourth day before the event and 4 is the fourth day after it) or from −5 to 5 trading days were used in some research articles focusing on the impact of corporate disclosure and other CSR actions—e.g., [

92,

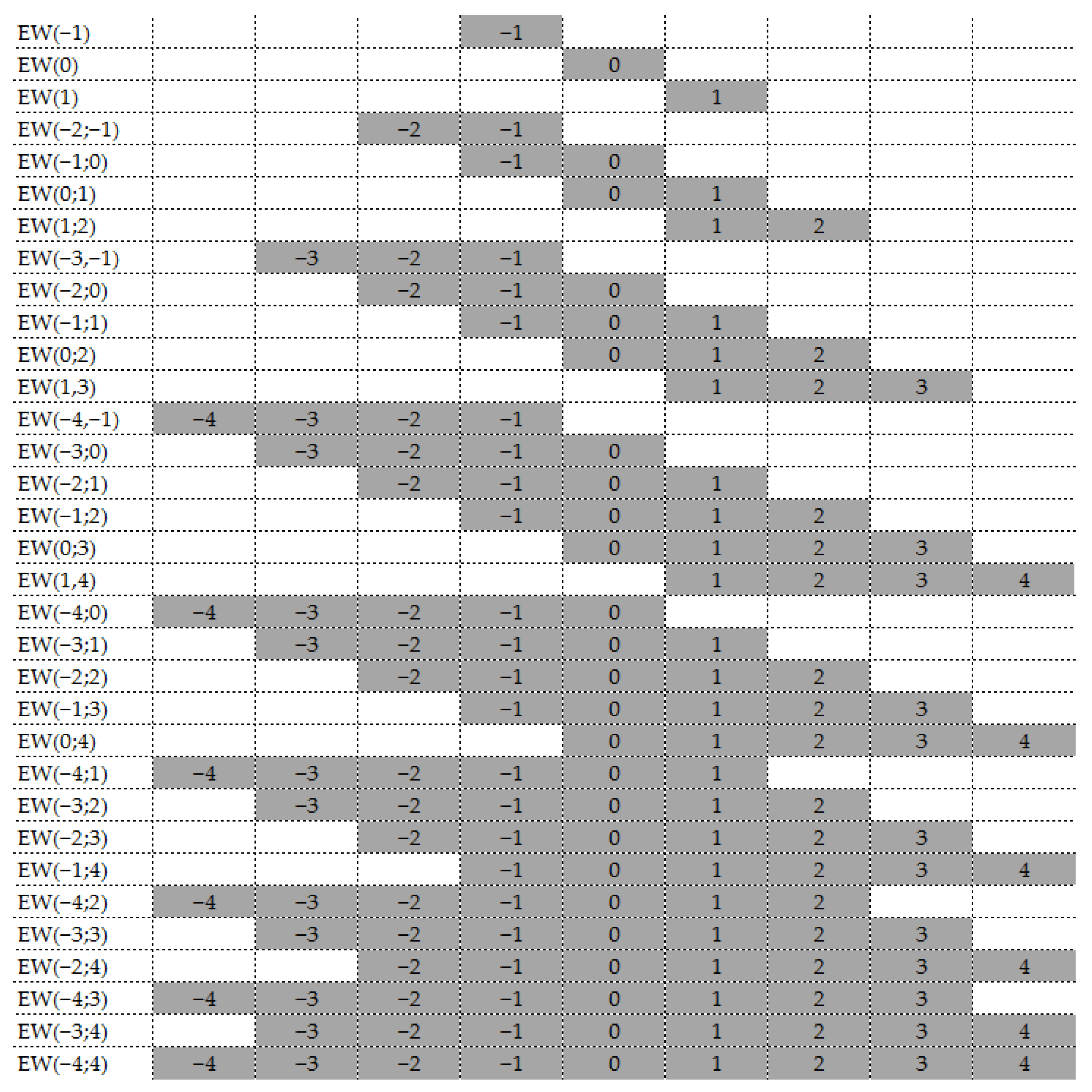

93]. In this study, 33 event windows were considered. In particular, all the event windows from 1 to 9 days, containing the day of the event, the previous or the subsequent ones, were analyzed.

Figure 1 shows all the event windows considered in this study.

Event windows may also include some days before the event analyzed in order to consider certain effects produced by previews or leaks (information leakage period). The maximum leakage period used in this study is 4 trading days. When considering a single organization, actual returns have to be compared with expected ones calculated using statistical or economic models. For organization

, event date

and the conditioning information

, the abnormal return, which is the difference between actual returns and estimated (normal) ones, is:

With reference to the present study, daily expected returns were calculated using a simple linear regression model which assumes that the return on a generic

i-th security at time t (

, explained variable) depends on the return on the market portfolio at the same time (

, explanatory variable), i.e., the market model:

From the statistical model in Equation (2), the regression line can be written and the coefficients

and

can be estimated, using historical data for

and

:

The time series data used in the market model refer to the so-called estimation window. From an econometrical point of view, the number of trading days which the estimation window (

) consists of is fundamental. In fact, abnormal returns are forecast errors, presenting the following distributional parameters:

The variance of abnormal returns is higher than the variance of the market model regression errors () because abnormal returns are technically forecast errors. However, this difference becomes shorter and shorter when the estimation period increases—indeed, decreases bit by bit—and can be ignored if the number of observations used in the market model () is large enough. In this study, we chose an estimation period of 200 trading days, starting 216 trading days before the date of the analyzed event and ending the seventeenth trading day before it.

Once having calculated the abnormal returns for all the organizations and the event windows analyzed, they can be aggregated through the time generating the Cumulative Abnormal Returns (CAR), which indicate the financial returns for all organizations in all the event windows selected. Since Cumulative Abnormal Returns are random variables consisting of the sum of as many abnormal returns as the days composing the event window analyzed, their distributional parameters (as

is large enough) are the following:

Finally, in order to generalize the results obtained for the single organization, the Average Cumulative Abnormal Return (

) can be calculated.

Its distributional parameters, asymptotic with respect to

and

(the number of events analyzed), are the following:

The distributional parameters for , and () allow us to test the evidence in relation to the null hypothesis that the given event does not have an impact on the behaviour of the security returns.

4.3. Empirical Evidence

This study considered the publication dates of the 38 integrated reports included in our sample.

Cumulative Abnormal Returns and Average Cumulative Abnormal Returns were calculated for all the 33 event windows analyzed and were tested in contrast to the null hypothesis that the report disclosure does not affect the behavior of the security returns. A total of 13 out of the 33 event windows analyzed show, on average, a statistically significant impact of the report publication on the returns of disclosing organizations. Thus, it is possible to reject the null hypothesis that the average cumulative abnormal returns are zero. The results are shown in

Table 1. (

are the absolute values of the scaled Average Cumulative Abnormal Returns for all the event windows analyzed).

With reference to the cumulative abnormal returns, 16 out of 38 disclosures analyzed highlight a statistically significant impact (at both 5% and 10% level) of the report publication on the returns of the disclosing organization on—at least—one event window. Out of the 16 significant reports, 75% were published after 2013. Reports whose disclosure significantly affects the return were released by organizations listed in Europe (37.5%), Africa (37.5%), America (12.5%), and Asia (12.5%). With reference to the economic sectors, considering the industry classification provided by the IIRC, 50% of the reports are released by organizations producing services, whereas the remaining 50% is equally distributed among organizations producing consumer goods and industrials.

Notably, 69% of the documents included in this study are named as “integrated reports” (whereas the others are either “annual reports” or “sustainability reports”). In detail, the analysis of the name was useful to address our second research hypothesis, according to which the naming of the report as IR plays a statistically significant role in the impact produced by this disclosure tool on the organization’s share price.

To this end, we performed a statistical hypothesis test aimed at determining whether there was a significant difference between the expected frequencies and the observed frequencies in one or more categories of the qualitative variables: significance (with reference to the values of the average abnormal returns) and the name of the reports. The results are shown in

Table 2.

Table 2 highlights that there is quite a strong association between the variables’

significance (which can assume the modalities “yes” or “no”, depending on the fact that the CAR of the specific firm analyzed is statistically significantly different from 0 or not) and

name of the disclosed report (annual report “AR”, integrated report “IR” and sustainability report “SR”). Eleven out of nineteen Integrated Reports (58%) refer to firms whose disclosure affected their share price in a statistically significant way. On the other hand, annual reports and sustainability reports seem to influence the assessment of financial capital providers less substantively; in fact, only 33% and 0%, of respectively annual reports and sustainability reports, presented a CAR statistically significantly different from 0. The results of the tests performed seem to confirm these considerations: both the Pearson’s Chi-squared test and the Fisher’s Exact Test are statistically significant at 10%.

5. Discussion and Conclusions

The results we obtained in our event study analysis show that IR publications produced, on average, significant effects on disclosing share prices. As previously highlighted, the event windows confirming a statistically significant effect in the average CAR are specifically those including the days from −1, −2 and −3 to 0 and from −3 to 3 and 4 (where 0 is the publication date).

Our results provide support for Hypothesis 1, indicating that the organizations’ decision to publish IR has a statistically significant effect on share prices. Indeed, consistent with this hypothesis, a significant number of analyzed organizations experienced share price shocks when their IR was published. Therefore, it is possible to claim that shareholders responded to the organizations’ decision to adopt this disclosure tool.

Beyond the general aim of any IR (i.e., the holistic representation of an organization and its performance), our findings are probably related to the specific informative usefulness of the reports analyzed. Indeed, according to the criteria adopted to select the documents to be included in the analysis, all these reports efficiently apply the materiality principle as defined by the IR framework [

78]. As indirectly stated by the same IIRC (through the association of the reports analyzed with the database filter referring to the guiding principle of materiality), all these documents include data and information which can influence the stakeholders’ actions, and they communicate all material information affecting the decisions of the organization’s financial capital providers. The analysis of the average CAR confirms this IR potential, hence demonstrating that the organizations releasing the report tended to modify their perception as investment in the capital markets [

23].

This result has beneficial implications for both researchers and practitioners.

For the former category, our findings add new evidence to previous research on corporate disclosure, confirming that an organization’s decision to improve its level of communication and transparency towards the market (in this case, releasing an IR) affects the shareholders’ expectations about that organization’s performance—see [

20]. Moreover, this study contributes to validating the “vital” function of materiality in the corporate disclosure process [

60], since the impact registered on the organizations’ share prices assumes that the IR analyzed includes all material information on the process of value creation implemented [

21,

22].

With reference to practitioners, our results suggest that managers should make their disclosure decisions by trying to anticipate how the corporate reporting might be able to influence shareholders’ behaviors and hence share prices. Specifically, this study adds new evidence on IR usefulness in acting on the information asymmetry between managers and outside investors, in line with the agency approach [

28,

84]. In these terms, our findings may also support the managers’ judgement in interpreting the materiality principle [

64,

65], in association with the studies investigating the managers’ communication strategy in relationship with the nature (i.e., good or bad news) of the information to be disclosed [

41,

58].

In reference to our Hypothesis 2, this study verified that, among the reports included in the statistical significance test for categorical data, the ones named “integrated” (instead of “sustainability” or “annual”) report, were associated with a greater impact on the share prices. This result is consistent with our assumption according to which the name adopted for the reports may influence the investors’ perception and behavior. Indeed, all of the organizations relying on the IIRC framework for drafting their integrated reports should adopt materiality as one of the guiding principles of the entire reporting process. However, the choice of the name “integrated” for these reports favors their association with the disclosure of the organization’s information that may influence the assessments and decisions of providers of financial capital [

78].

Regarding the extent of the impact association with the naming of the report, it is noteworthy remembering that the p-value registered for our analysis was statistically significant at the 0.1 level, but not significant at the 0.05 level. This was likely due to the size of the sample, including the 38 reports corresponding to the selection criteria adopted. Nevertheless, our result certainly represents a first interesting finding about the potential of the name “integrated” to be associated with the materiality of the information disclosed in the report.

As discussed for Hypothesis 1, the aforementioned results may also be commented on in terms of helpful implications and contributions for both researchers and practitioners, mostly referred to the specific disclosure tool analyzed here (i.e., IR).

For researchers, our findings support the greater appreciation that IR has recently received in the literature as an example of an effective corporate disclosure tool [

82,

83]. For practitioners, our result might be useful to support managers’ decisions about how to “present” IR to the capital markets, assuming that if it is quickly recognizable as an integrated report (adopting this name for the document), its publication may have greater effects on the organization’s share price.

Regarding the limits and further developments of this study, it is worth remembering that the concept of performance disclosed in an integrated report has a multidimensional quality, because it includes a variety of information about the social and environmental impacts of the organization’s activities, plus the more traditional financial data. Indeed, the investors’ decisions go beyond expected profits, and include the requirement of broader analyses related to the organization’s environmental and social goals. Unfortunately, at this stage our analysis is not able to reveal which specific aspect of the organization’s performance was mostly responsible for the share price shock registered in association with the IR publication. This is certainly a limit of this study that might be addressed by collecting further data on the investors’ behaviors and investigating more deeply the reasons underlying their allocation decisions, as already planned by the authors for the future development of the research.

Moreover, with reference to our second research hypothesis, we planned to develop a few qualitative case studies in order to explore and understand in more detail the motivations and decisions (including the report name) that informed those organizations in drafting their integrated report.