Measure the Performance with the Market Value Added: Evidence from CSR Companies

Abstract

:1. Introduction

2. Literature Review

3. Corporate Financial Performance Measures

- Market Measures: (a) MKTCAP (It is the most important market-based performance measure with a huge amount of literature: [48,56,61,71,72,73,74]). (Market Capitalization) measures the market capitalization that defines the value of a firm; (b) Beta (It is a content of the CAPM (Capital Asset Pricing Model, see: [74,75,76,77]) and its importance has become one of the best known variables in investing and finance. Its main references are: [40,56,78]): describes the relation between the expected return of the whole market and the expected return of a financial portfolio (or a single stock). Its value represents also a risk measure: when its value is lower than one unit, the considered asset is likely to reduce the market fluctuations, while the opposite happens when its value is higher than 1. The economic literature shows that firms with high systemic risk use social certification to reduce their exposure risk: therefore, their beta coefficient reduces (see: [50,78]). Richardson et al. and Botosan [79,80] show that the reduction in the exposure to risk can also reduce the cost of capital and accordingly information asymmetries, thanks to the increased social information.

- Accounting measures: (a) ROE (One of the most widely used performance measures (see: [1,2,21,78,81,82,83,84,85,86]). It is defined as the percentage of the yearly net income of a firm (before common stock dividends and after preferred stock dividends) with respect the total equity (excluding preferred shares), and corresponds to the rate of return of the shareholders invested risk capital.): this measure is useful to estimate the profitability of a firm, that is its efficiency in generating earnings from every dollar/euro of net assets (assets minus liabilities); (b) ROA (See [1,2,3,48,87,88]): describes “what the company can do with what it has got”, i.e., how many euros of earnings it can obtain from each euro of assets. Its average value strongly depends on the economic sector analyzed, so it could be useful to compare the profitability of the companies of the same industry; ROCE (This measure is commonly used to compare the performance between different businesses and to verify if the generated return is sufficient to pay back the cost of capital. It is defined as the pre-tax operative profit divided for the employed capital. See [1]: in finance it measures the return that a company is generating from capital employed.

- Mixed Measures: Market Value Added (MVA). Firstly introduced by Simerly et al. and Cochran et al. [89,90], is defined as the difference of the current firm market value and the capital contributed by investors, as of the balance sheet. A positive MVA means added value in the company while distinguishing negative MVA that have destroyed value. This is a mixed measure because it combines both market and account values. MVA can also be seen as a manner to introduce the Tobin’s q, as in Shahzad et al. [65]. Bharadwaj et al. and Konar et al. [62,63] suggest that standard accounting measures of performance, such as (ROA) return on assets, lack in their ability to evaluate the future profit potential of such practices. To overcome these limitations some papers ([20,21,64,66]) consider the Market Value Added as a key variable of research.

3.1. Further Important Variables

- Industrial Sector. According to Dierkes et al. [91], those firms whose economic activities are involved in the exploitation of natural resources (mining, forestry, oil, gas and so on) or that affect the environment are subject to stronger environmental controls than those of other sectors. So, industrial sector could be important for CSR. Furthermore some enterprises with a strong relation with consumers need to show a clear social behaviour, in order strengthen the firm’s reputation and achieve positive effects on the sales volumes (see: [85]). Moreover, in Patten et al. (1991) [92] the authors explain that the industrial sector (as a proxy of dimension) affects the “fame policy” of a firm, forcing the management to take public opinion into account ([48]). Finally, this varable has effects on the number of enterprises belonging to the CSR group: low-labour intensity sector (i.e., banks, financial services, etc.) show higher number of firms than high capital intensity sectors.(About this, see [2]) Capelle-Blancard et al. [93] shows an interesting approach that takes into account the different weights of industrial sectors: the authors proposes an original weighting scheme, reflecting societal concerns and depending on sectors.

- Size (Economic literature show different manners to measure firm size: by using the total asset value, or the number of employees, or the total sales. Belkaoui et al. [48] use the natural logarithm of the sales net value, while Spicer et al. [78] use both the total asset value and the sales value. Cowen et al. and Patten [85,92] also use the natural logarithm of sales the Fortune 500 index. Kimberly et al. [94] show that all these measures are strongly correlated and quite similar.): Waddock et al. [2] write that it is possible to assume that as the size of a firm increases, so does its behaviour to act responsibly. This should happen because big companies are more conscious of the importance of their relationship with the public (and external stakeholders) than the smaller ones. The work of Dierkes et al. [91] confirm that the size can affect the firm performance and social certification link: at the beginning the firm strategy is focused on basic survival, while the focus changes to its philanthropic and ethical responsibilities as its size increases.

- Age of Capital. Roberts [95] assumes that the firms historically highly involved in social investment have a greater induced reputation, making the stakeholders more confident about the expected profits. Wood [96] measure the capital age as gross and net capital: the firm is relatively young when this index tends to 1. Therefore the age of capital is inversely correlated with the CSR variable: the younger the enterprise, the higher the ethical investment. It is interesting to stress that it is more expensive to change a firm’s structure than to create a new one and that new firms do not have transformation costs for new lines of production.

- Intangible Assets Expenses. Even if economic literature is strongly focused on R&D expenses, this variable if very close to the total expenses (also considering costs related to the CSR index). Indeed, R&D is a subset of total intangible assets and could also be their proxy variable. In McWilliams et al. (2001) [3] the authors show the correlation between the financial performance and the CSR index. Indeed innovation and R&D expenses are some of the main variables that can affect economic growth in the medium-long run. Moreover, R&D expenses are sometimes used as a proxy for social certification.

- Leverage. It is defined as the total debt and shares ratio. Myers and Wallace et al. [97,98] have shown a positive relation between CSR index and the leverage. (CSR index is defined by social disclosure, that is social information). Jensen et al. [99] supported this result by explaining that a firm tends to increase its social information in order to reduce rising monitoring costs from high leverage. Ahamed et al. [100] show a similar explanation, stressing that as the weight of the bond in the balance sheets increases at the expense of the ordinary stocks, so does importance of the social information and social certification. Roberts [50] did not find any statistical evidence in the test of the hypothesis that the higher a firm’s leverage, the higher creditors’ expectations. However, Belkaoui et al. [48] showed negative correlations.

4. The Sample

- We selected the CSR firms belonging at least to two of the three main stock option indices of the market in 2004: Domini 400 Social Index, Dow Jones Sustainability World Index, FTSE4Good Index. The indexes were selected because they are the most famous and recognizable indices at an international level. Implementing methodology used by Poddi et al. and Barnea [10,101], the CSR sample consists of 317 firms.

- In order to build the control sample, we chose 100 non-CSR firms from the Dow Jones Global Index. Sector stratification was implemented to make the Non-CSR sample homogeneous with the CSR sample. For each sector, firms were randomly selected.

- The final sample consist of 417 firms. In order to generate the time series, we started with the last year of our sample, and maintaining the total number of firms we worked backward until first one, changing the non-CSR/CSR ratio. Dummy variable for each year were created starting from the last year (1 if that firm was certified as a CSR firm in that year and zero otherwise). The finale sample results from the intersection (for a couple of sets) of the three indices. (We were not able to work further back than 1999 because the CSR firms available in our database were not sufficient)

5. Data

6. Empirical Analysis

6.1. Correlations among Variables

6.2. The Regression Model

7. Results

8. Close Examinations

8.1. CSR and Beta

- (1)

- A high volatility of the shares may be due to an economic shock and may involve a beta value greater than 1.

- (2)

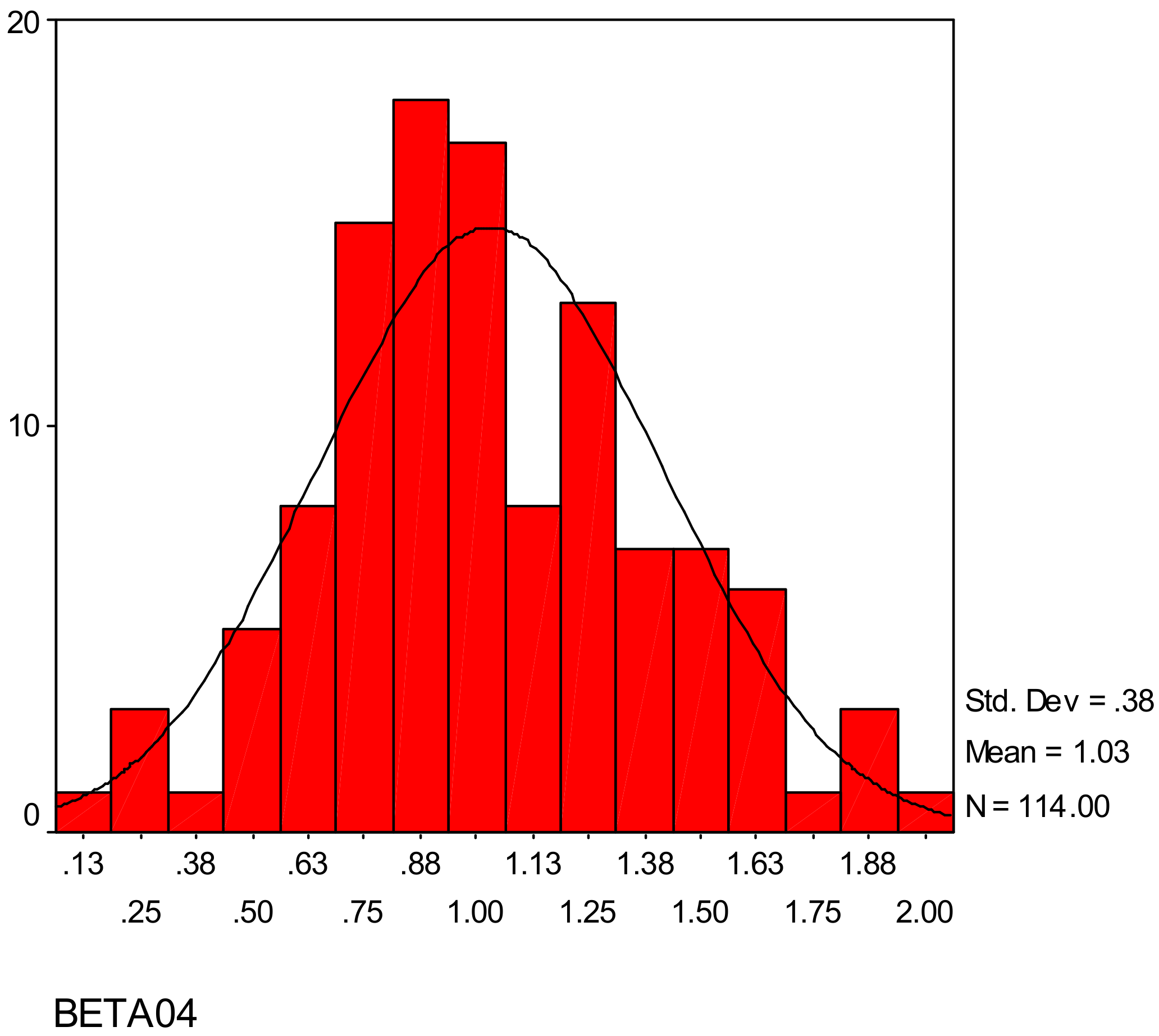

- In a perfect market environment, investors can perfectly predict the value and risk of the investment. Given the importance of this index, it is important and correct to evaluate in depth the total distribution of companies compared to the Beta index (Figure 1):

- (i)

- we have a higher number of non-risky enterprises, due to a positive (right) asymmetry of distribution;

- (ii)

- the average Beta is higher than 1 and this implies that in our simple there are some risky firms certified as CSR (i.e., outlier cases). This beta value is sufficiently high to move the distribution to the right.

8.2. A Comparison between MVA, Beta and CSR

8.3. Industrial Sectors

8.4. Reputation

8.5. Social Capital

9. Conclusions

Author Contributions

Conflicts of Interest

Appendix A

| Corr. | CSR | MVA | ROE | Size | Age | Inta | Inte | STLT | GDP |

|---|---|---|---|---|---|---|---|---|---|

| CSR | 1 | ||||||||

| MVA | 0.169 | 1 | |||||||

| (***) | |||||||||

| ROE | 0.002 | 0.0712 | 1 | ||||||

| Size | 0.137 | 0.4034 | −0.058 | 1 | |||||

| (***) | (***) | ||||||||

| Age | 0.033 | 0.0692 | 0.007 | 0.0473 | 1 | ||||

| Inta | 0.119 | 0.0028 | −0.071 | 0.2522 | 0.169 | 1 | |||

| (**) | (***) | (***) | |||||||

| Inte | −0.019 | −0.0718 | 0.234 | −0.097 | −0.066 | −0.086 | 1 | ||

| (***) | (*) | (*) | |||||||

| STLT | 0.032 | 0.0593 | −0.006 | −0.034 | −0.049 | −0.043 | 0.017 | 1 | |

| GDP | 0.040 | 0.0734 | −0.011 | 0.039 | −0.121 | −0.029 | 0.013 | −0.011 | 1 |

References

- Preston, L.E.; O’Bannon, D.P. The Corporate Social—Financial Performance Relationship: A Typology and Analysis. Bus. Soc. 1997, 36, 419. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The Corporate Social Performance-Financial Performance Link. Strag. Manag. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate ocial Responsibility: A Theory of the Firm Perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar]

- Ullmann, A. Data in Search of a Theory: A Critical Examination of the Relationship Among Social Performance, Social Disclosure, & Economic Performance. Acad. Manag. Rev. 1985, 10, 450–477. [Google Scholar]

- Wood, D.J. Corporate Social Performance Revisited. Acad. Manag. Rev. 1991, 16, 691–718. [Google Scholar]

- Dahlsrud, A. How Corporate Social Responsibility is Defined: An Analysis of 37 Definitions. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 1–13. [Google Scholar] [CrossRef]

- Benabou, R.; Tirole, J. Individual and Corporate Social Responsibility. Economica 2010, 77, 1–19. [Google Scholar] [CrossRef] [Green Version]

- Andries, M. Social Responsibility and Asset Prices: Is There a Relationship? University of Chicago: Chicago, IL, USA, 2008. [Google Scholar]

- Dou, J.; Shenghua, J.; Wang, Q. A Meta-Analytic Review of Corporate Social Responsibility and Corporate Financial Performance. Bus. Soc. 2015, 55, 1083–1121. [Google Scholar]

- Poddi, L.; Vergalli, S. Does Corporate Social Responsibility Affect The Performance of Firms; Feem Working Paper 52.09; University of Ferrara: Ferrara, Italy, 2009. [Google Scholar]

- Comincioli, N.; Poddi, L.; Vergalli, S. Does Corporate Social Responsibility Affect The Performance of Firms; Feem Working Paper No. 52.2009; University of Ferrara: Ferrara, Italy, 2012. [Google Scholar]

- Garriga, E.; Mele, D. Corporate Social Responsibility Theories Mapping the Territory. J. Bus. Ethic 2004, 53, 51–71. [Google Scholar] [CrossRef]

- KPMG Survay of Corporate Social Responsibility Reporting, 2015. Available online: https://home.kpmg.com/xx/en/home.html (accessed on 3 September 2017).

- Mattingly, J.E. Corporate Social Performance: A Review of Empirical Research Examining the Corporation-Society Relationship Using Kinder, Lydeberg, Domini Social Ratings Data. Bus. Soc. 2017, 56, 796–839. [Google Scholar] [CrossRef]

- Van Beurden, P.; Gossling, T. The Worth of Values—A Literatyre Review on the Relation between Corporate Social and Financial Performance. J. Bus. Ethic 2008, 82, 407–424. [Google Scholar] [CrossRef]

- Sanchez, J.L.F.; Sotorrio, L.L. Corporate Social Responsibility of the Most Highly Reputed European and North American Firms. J. Bus. Ethic 2008, 82, 379–390. [Google Scholar]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social Performance and Firm Risk: A Meta-Analytic Review. Bus. Soc. 2003, 40, 369–396. [Google Scholar] [CrossRef]

- Kitzmueller, M. Economics and Corporate Social Responsibility; Economics Working Paper; European University Institute: Fiesole, Italy, 2008. [Google Scholar]

- Wu, M. Corporate Social Performance, Corporate Financial Performance and Firm Size: A Meta-Analysis. J. Am. Acad. Bus. 2006, 8, 163–171. [Google Scholar]

- Singh, P.J.; Sethuraman, K.; Lam, J.Y. Impact of Corporate Social Responsibility Dimensions on Firm Value: Some Evidence from Hong Kong and China. Sustainability 2017, 9, 1532. [Google Scholar] [CrossRef]

- Charlo, M.J.; Moya, I.; Muñoz, A.M. Financial Performance of Socially Responsible Firms: The Short and Long-Term Impact. Sustainability 2017, 9, 1622. [Google Scholar] [CrossRef]

- Belghitar, Y.; Clark, E.; Deshmukh, N. Does it pay to be ethical? Evidence from the FTSE4Good. J. Bank. Financ. 2014, 47, 54–62. [Google Scholar] [CrossRef]

- Curran, M.; Moran, D. Impact of the FTSEGood Index on firm price: An event study. J. Environ. Manag. 2007, 82, 529–537. [Google Scholar] [CrossRef] [PubMed]

- Collision, D.J.G.; Gobb, D.; Power, M.; Stevenson, L.A. The financial performance of the FTSEGood indices. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 1–28. [Google Scholar]

- Lopez, V.A.; Garcia, A.; Rodriguez, L. Sustainable Development and Corporate Performance: A study Based on the Dow Jones Sustainability Index. J. Bus. Ethic 2007, 75, 285–300. [Google Scholar] [CrossRef]

- Searcy, C.; Elkhawas, D. Corporate Sustainability Ratings: An investigation into how corporations use Dow Jones Sustainability Index. J. Clean. Prod. 2012, 35, 79–92. [Google Scholar] [CrossRef]

- Consolandi, C.; Jaiswal-Dale, A.; Poggiani, E.; Vercelli, A. Global Standards and Ethical Stock Indexes: The Case of the Dow Jones Sustainability SToxx Index. J. Bus. Ethic 2009, 87, 185–197. [Google Scholar] [CrossRef]

- Sheldon, O. The Philosophy of Management; Sir Isaac Pitman and Son Ltd.: Emeryville, CA, USA, 1924. [Google Scholar]

- Lee, M.-D.P. A review of the theories of corporate social responsibility: Its evolutionary path and the road ahead. Int. J. Manag. Rev. 2008, 10, 53–73. [Google Scholar] [CrossRef]

- Turker, D. Measuring Corporate Social Responsibility: A Scale Development Stury. J. Bus. Ethic 2008, 85, 411–427. [Google Scholar] [CrossRef]

- Detomasi, D.A. The Political Roots of Corporate Social Responsibility. J. Bus. Ethic 2007, 82, 807–819. [Google Scholar] [CrossRef]

- Udayasankar, K. Corporate Social Responsibility and Firm Size. J. Bus. Ethic 2008, 83, 167–175. [Google Scholar] [CrossRef]

- Chen, H.; Wang, X. Corporate Social Responsibility and Corporate Financial Performance in China: An empirical research from Chinese firms. Corp. Gov. Int. J. Bus. Soc. 2011, 11, 361–370. [Google Scholar] [CrossRef]

- Quazi, A.; Richardson, A. Sources of variation in linking corporate social responsibility and financial performance. Soc. Responsib. J. 2012, 8, 242–256. [Google Scholar] [CrossRef]

- Ahmed, W.S.W.; Al-Smadi, A.W. Does Corporate Social Responsibility Lead to Improve in Firm Financial Performance? Evidence from Malaysia. Int. J. Econ. Financ. 2014, 6, 126–138. [Google Scholar]

- Whalen, D.J.; Jones, R.E. Stakeholder mismatching: A theoretical problem in empirical research on corporate social performance. Int. J. Organ. Anal. 2013, 3, 229–267. [Google Scholar]

- Mallin, C.; Farag, H.; Ow-Yong, K. Corporate Social Responsibility and Financial Performance in Islamic Banks. J. Econ. Behav. Organ. 2014, 103, 21–38. [Google Scholar] [CrossRef]

- Blasi, S.; Caporin, M.; Fontini, F. A multidimensional analysis of the relationship between Corporate Social Responsibility and Firms’ Economic Performance. In Proceedings of the EAERE Conference, Athens, Greece, 28 June–1 July 2017. [Google Scholar]

- Teoh, S.H.; Welch, I.; Wazzan, C.P. The Effect of Socially Activist Investment Policies on the Financial Markets: Evidence from the South African Boycott. J. Bus. 1999, 72, 35–89. [Google Scholar] [CrossRef]

- Choongo, P. A Longitudinal Study of the Impact of Corporate Social Responsibility on Firm Performance in SMEs in Zambia. Sustainability 2017, 9, 1300. [Google Scholar] [CrossRef]

- Maron, I.Y. Toward a Unified Theory of the CSP—CFP Link. J. Bus. Ethic 2006, 67, 191–200. [Google Scholar] [CrossRef]

- Beliveau, B.; Cottrill, M.; O’Neill, H.M. Predicting corporate social responsiveness: A model drawn from three perspectives. J. Bus. Ethic 1994, 13, 731–738. [Google Scholar] [CrossRef]

- Brammer, S.; Millington, A. Firm Size, Organizational Visibility and Corporate Philanthropy: An Empirical Analysis. Bus. Ethic Eur. Rev. 2006, 15, 6–18. [Google Scholar] [CrossRef]

- Hillman, A.J.; Keim, G. Shareholder Value, Stakeholder Management, and Social Issues: What’s the Bottom Line? Strateg. Manag. J. 2001, 22, 125–139. [Google Scholar] [CrossRef]

- Johnson, R.A.; Greening, D.W. The Effects of Corporate Governance and Institutional Ownership Types on Corporate Social Performance. Acad. Manag. J. 1999, 42, 564–576. [Google Scholar] [CrossRef]

- Mahoney, L.S.; Thorne, L. Corporate Social Responsibility and Long-Term Compensation: Evidence from Canada. J. Bus. Ethic 2005, 57, 241–253. [Google Scholar] [CrossRef]

- Moore, G. Corporate Social and Financial Performance: An Investigation in the U.K. Supermarket Industry. J. Bus. Ethic 2001, 34, 299–315. [Google Scholar] [CrossRef]

- Belkaoui, A.; Karpik, P.G. Determinants of the Corporate Decision to Disclose Social Information. Account. Audit. Account. J. 1989, 2, 36–51. [Google Scholar] [CrossRef]

- Brammer, S.J.; Pavelin, S. Corporate Reputation and Social Performance: The Importance of Fit. J. Manag. Stud. 2006, 43, 435–455. [Google Scholar] [CrossRef]

- Roberts, C. Determinants of Corporate Social Responsibility Disclosure: An Application of Stakeholder Theory. Account. Organ. Soc. 1992, 17, 595–612. [Google Scholar] [CrossRef]

- Stanwick, P.A.; Stanwick, S.D. The Relation Between Corporate Social Performance, and Organizational Size, Financial Performance, and Environmental Performance: An Empirical Examination. J. Bus. Ethic 1998, 17, 195–204. [Google Scholar] [CrossRef]

- Adams, M.; Hardwick, P. An Analysis of Corporate Donations: United Kingdom Evidence. J. Manag. Stud. 1998, 35, 641–654. [Google Scholar] [CrossRef]

- Amato, L.H.; Amato, C.H. The Effects of Firm Size and Industry on Corporate Giving. J. Bus. Ethic 2007, 72, 229–241. [Google Scholar] [CrossRef]

- Brammer, S.; Cox, P.; Millington, A. An Empirical Examination of Institutional Investor Preferences for Corporate Social Performance. J. Bus. Ethic 2004, 52, 27–43. [Google Scholar]

- Brammer, S.; Williams, G.; Zinkin, J. Religion and Attitudes to Corporate Social Responsibility in a Large Cross-Country Sample. J. Bus. Ethic 2007, 71, 229–243. [Google Scholar] [CrossRef]

- Alexander, G.J.; Buchholz, R.A. Corporate Social Responsibility and Stock Market Performance. Acad. Manag. J. 1978, 21, 479–486. [Google Scholar] [CrossRef]

- Belkaoui, A.R. The Impact of the Disclosure of the Environmental Effects of Organizational Behavior on the Market. Financ. Manag. 1976, 5, 26–31. [Google Scholar] [CrossRef]

- Clarkson, M.B.E. A Stakeholder Framework for Analyzing and Evaluating Corporate Social Performance. Acad. Manag. Rev. 1995, 20, 92–117. [Google Scholar]

- Harrison, J.S.; Freeman, R.E. Stakeholders, Social Responsibility, and Performance: Empirical Evidence and Theoretical Perspectives. Acad. Manag. J. 1999, 42, 479–485. [Google Scholar] [CrossRef]

- Kohers, T.; Simpson, W.G. The Link Between Corporate Social and Financial Performance: Evidence from the Banking Industry. J. Bus. Ethic 2002, 35, 97–109. [Google Scholar]

- Vance, S.C. Are Socially Responsible Corporations Good Investment Risks? Manag. Rev. 1975, 64, 18–24. [Google Scholar]

- Bharadwaj, A.; Bharadwaj, S.G.; Konsynki, B.R. Information technology effects on firm’s performance as measured by Tobin’s Q. Manag. Sci. 1999, 45, 1008–1024. [Google Scholar] [CrossRef]

- Konar, S.; Cohen, M.A. Does the Market Value Environmental Performance? Rev. Econ. Stat. 2001, 83, 281–289. [Google Scholar] [CrossRef]

- Jiang, B.; Belohlav, J.; Young, S.T. Outsourcing impact on manufacturing firm’s value: Evidence from Japan. J. Oper. Manag. 2007, 25, 885–900. [Google Scholar] [CrossRef]

- Shahzad, A.M.; Sharfman, M.P. Corporate Social Performance and Financial Performance: Sample-Selection Issues. Bus. Soc. 2017, 56, 889–918. [Google Scholar] [CrossRef]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef] [Green Version]

- Lindenberg, E.B.; Ross, S.A. Tobin’s q ratio and industrial organization. J. Bus. 1981, 54, 1–32. [Google Scholar] [CrossRef]

- Navarro, P. Why do corporations give to charity? J. Bus. 1988, 61, 65–93. [Google Scholar] [CrossRef]

- Vishwanatan, M. Curricular Innovations on Sustainability and Subsistence Marketplaces: Philosophical, Substantive and Methodological Orientations. J. Manag. Educ. 2012, 36, 389–427. [Google Scholar] [CrossRef]

- Quan, X.F.; Wu, S.N.; Yin, H.Y. Corporate Social Responsibility and Stock Price Crash Risk: “Self-interest Tool” or “Value Strategy”? Econ. Res. J. 2015, 11, 49–64. [Google Scholar]

- Moskowitz, M. Choosing Socially Responsible Stocks. Bus. Soc. Rev. 1972, 10, 1975. [Google Scholar]

- Patten, D.M. The market reaction to social responsibility disclosures: The case of the Sullivan principles signings. Account. Organ. Soc. 1990, 15, 575–587. [Google Scholar] [CrossRef]

- Wright, P.; Ferris, S.P. Agency Conflict and Corporate Strategy: The Effect of Divestment on Corporate Value. Strateg. Manag. J., 1997, 18, 77–83. [Google Scholar] [CrossRef]

- Treynor, J.L. Toward a Theory of Market Value of Risky Assets. In Treynor on Institutional Investing; Wiley: Hoboken, NJ, USA, 1962. [Google Scholar]

- Sharpe, W.F. Capital Asset Prices: A Theory of Market Equilibrium Under Conditions of Risk. J. Financ. 1964, 19, 425–442. [Google Scholar]

- Lintner, J. The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets. Rev. Econ. Stat. 1965, 47, 13–37. [Google Scholar] [CrossRef]

- Mossin, J. Equilibrium in a Capital Asset Market. Econometrica 1966, 34, 768–783. [Google Scholar] [CrossRef]

- Spicer, B.H. Investors, Corporate Social Performance and Information Disclosure: An Empirical Study. Account. Rev. 1978, 53, 94–111. [Google Scholar]

- Richardson, A.J.; Welker, M.; Hutchinson, I. Managing Capital Market Reactions to Corporate Social Responsibility. In. J. Manag. Rev. 1999, 1, 17–43. [Google Scholar] [CrossRef]

- Botosan, C.A. Disclosure Level and the Cost of Equity Capital. Account. Rev. 1997, 72, 323–349. [Google Scholar]

- Bowman, E.H.; Haire, M.A. Strategic Posture Toward Corporate Social Responsibility. Calif. Manag. Rev. 1975, 18, 49–58. [Google Scholar] [CrossRef]

- Bragdon, J.H.; Marlin, J.T. Is Pollution Profitable? Risk Manag. 1972, 19, 9–18. [Google Scholar]

- Parket, R.; Eilbirt, H. Social Responsibility: The Underlying Factors. Bus. Horiz. 1975, 18, 5–11. [Google Scholar] [CrossRef]

- Preston, L.E. Analyzing corporate social performance: Methods and results. J. Contemp. Bus. 1978, 7, 135–150. [Google Scholar]

- Cowen, S.S.; Ferreri, L.B.; Parker, D.B. The Impact of Corporate Characteristics on Social Responsibility Disclosure: A Typology and Frequency-Based Analysis. Account. Organ. Soc. 1987, 12, 111–122. [Google Scholar] [CrossRef]

- De Massis, A.; Kotlar, J.; Campopiano, G.; Cassia, L. The impact of family involvement on SMEs’ performance: Theory and evidence. J. Small Bus. Manag. 2015, 53, 924–948. [Google Scholar] [CrossRef] [Green Version]

- Aupperle, K.E.; Carroll, A.B.; Hatfield, J.D. An Empirical Examination of the Relationship between Corporate Social Responsibility and Profitability. Acad. Manag. J. 1985, 28, 446–463. [Google Scholar] [CrossRef]

- Luce, R.A.; Barber, A.E.; Hillman, A.J. Good Deeds and Misdeeds: A Mediated Model of the Effect of Corporate Social Performance on Organizational Attractiveness. Bus. Soc. 2001, 40, 397. [Google Scholar] [CrossRef]

- Simerly, R.L.; Li, M. Corporate Social Performance and Multinationality, A Longitudinal Study, 2001. Working Paper. Available online: http://www.westga.edu/~bquest/2000/corporate.html (accessed on 3 September 2017).

- Cochran, P.L.; Wood, R.A. Corporate Social Responsibility and Financial Performance. Acad. Manag. J. 1984, 27, 42–56. [Google Scholar] [CrossRef]

- Dierkes, M.; Preston, L. Corporate Social Accounting Reporting for the Physical Environment: A Critical Review and Implementation Proposal. Account. Organ. Soc. 1977, 2, 3–22. [Google Scholar] [CrossRef]

- Patten, D.M. Exposure, Legitimacy, and Social Disclosure. J. Account. Public Policy 1991, 10, 297–308. [Google Scholar] [CrossRef]

- Capelle-Blancard, G.; Petit, A. The Weighting of CSR Dimensions: One SIze Does Not Fit All. Bus. Soc. 2017, 56, 919–943. [Google Scholar] [CrossRef]

- Kimberly, J. Organizational size and the structuralist perspective: A review, critique, and proposal. Admin. Sci. Q. 1976, 21, 571–597. [Google Scholar] [CrossRef]

- Roberts, J. The manufacture of corporate social responsibility: Constructing corporate sensibility. Organization 2003, 10, 249–265. [Google Scholar] [CrossRef]

- Wood, D. Social Issue in Management: Theory and Research in Corporate Social Performance. J. Manag. 1991, 17, 383–406. [Google Scholar] [CrossRef]

- Myers, S. Determinants of Corporate Borrowing. J. Financ. Econ. 1977, 5, 147–175. [Google Scholar] [CrossRef]

- Wallace, R.S.O.; Naser, K.; Mora, A. The Relationship Between the Comprehensiveness of Corporate Annual Reports and Firm Characteristics in Spain. Account. Bus. Res. 1994, 25, 41–53. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Ahamed, K.; Courtis, J.K. Associations between corporate characteristics and disclosure levels in annual reports: A meta-analysis. Br. Account. Rev. 1999, 31, 35–61. [Google Scholar] [CrossRef]

- Barnea, A.; Rubin, A. Corporate Social Responsibility as a Conflict between Owners; Working Paper Series, No. 20; Center for Responsible Business, University of California, Berkeley: Berkeley, CA, USA, 2005. [Google Scholar]

- Rost, K.; Ehrmann , T. Reporting Biases in Empirical Management Research: The Example of Win-Win Corporate Social Responsibility. Bus. Soc. 2017, 56, 840–888. [Google Scholar]

- Fombrun, C.J.; Shanley, M. What’s in a name? Reputation building and corporate strategy. Acad. Manag. J. 1990, 33, 233–258. [Google Scholar] [CrossRef]

- Bourdieu, P. The forms of capital. In Handbook of Theory and Research for the Sociology of Education; Richardson, J.G., Ed.; Greenwood: New York, NY, USA, 1985; pp. 241–258. [Google Scholar]

- Coleman, J.S. Foundations of Social Theory; Harvard University Press: Cambridge, MA, USA, 1990. [Google Scholar]

- Putnam, R. Making Democracy Work Civic Traditions in Modern Italy; Princeton University Press: Princeton, NJ, USA, 1993. [Google Scholar]

- Fukuyama, F. Trust: The Social Virtues and the Creation of Prosperity; Free Press Paperbacks: New York, NY, USA, 1995. [Google Scholar]

- Guiso, L.; Sapienza, P.; Zingales, L. Cultural Biases in Econimic Exchange. Q. J. Econ. 2009, 124, 1095–1131. [Google Scholar] [CrossRef]

- Alesina, A.; La Ferrara, E. Participation in Heterogeneous Communities. Q. J. Econ. 2000, 115, 847–904. [Google Scholar] [CrossRef] [Green Version]

- McGuire, J.B.; Sundgren, A.; Schneeweis, T. Corporate Social Responsibility and Firm Financial Performance. Acad. Manag. J. 1988, 31, 854–872. [Google Scholar] [CrossRef]

- Newell, P. From Responsibility to Citizenship: Corporate Accountability for Development. IDS Bull. 2002, 33, 1–12. [Google Scholar] [CrossRef] [Green Version]

- Jenkins, R. Corporate Codes of Conduct: Self Regulation in a Global Economy; United Nations Research Institute For Social Development: Geneva, Switzerland, 2001. [Google Scholar]

- Poddi, L. Responsabilità Sociale e Performance d’Impresa: Un’analisi empirica. Ph.D. Thesis, Università di Ferrara, Ferrara, Italy, 2005. [Google Scholar]

- Spence, D.B. Corporate Social Responsibility in the Oil and Gas Industry: The Importance of Reputational Risk. Chicago-Kent Law Rev. 2010, 86, 59. [Google Scholar]

- Hilman, H.; Gorondutse, A.H. Relationship between perceived ethics and Trust of Business Social Responsibility (BSR) on performance of SMEs in Nigeria. Middle East J. Sci. Res. 2013, 15, 36–45. [Google Scholar]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, P.D. The Balanced Scorecard—Measures That Drive Performance. Harv. Bus. Rev. 1992, 70, 71–79. [Google Scholar] [PubMed]

- Smith, N.C. Corporate Social Responsiblility: Whether or How? Calif. Manag. Rev. 2003, 45, 52–76. [Google Scholar] [CrossRef]

- Holweg, M.; Pil, F. The advantages of thinking Small. MIT Sloan Manag. Rev. 2003, 44, 33–39. [Google Scholar]

- Peloza, J. Using corporate social responsibility as insurance for financial performance. Calif. Manag. Rev. 2006, 48, 52–72. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Creating Shared Value. Harv. Bus. Rev. 2011, 89, 62–77. [Google Scholar]

- McGuire, J.B.; Schneeweis, T.; Branch, B. Perceptions of firm quality: A cause or result of firm performance. J. Manag. 1990, 16, 167–180. [Google Scholar] [CrossRef]

- Hart, S.L.A. Natural-Resource-Based View of the Firm. Acad. Manag. Rev. 1995, 20, 986–1012. [Google Scholar]

- Porter, M.E.; Kramer, M.R. The Competitive Advantage of Corporate Philanthropy. Harv. Bus. Rev. 2002, 80, 56–68. [Google Scholar] [PubMed]

- Verschoor, C.C. More evidence of better financial performance. Strateg. Financ. 2003, 5, 18–20. [Google Scholar]

| Model | 1 | 2a | 2b | 3a | 3b | 4 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| z- | z- | z- | z- | z- | z- | |||||||

| Int. (a) | −1.3 | −2.1 | −1.6 | −2.3 | −1.4 | −2.4 | −0.42 | −1.4 | −0.04 | −1.8 | −0.9 | −1.8 |

| (**) | (**) | (**) | (*) | (*) | ||||||||

| CSR(a) | −0.3 | −2.5 | −0.3 | −2.6 | −0.3 | −2.7 | −0.35 | −2.6 | −0.35 | −2.6 | −0.32 | −2.2 |

| (**) | (**) | (***) | (**) | (***) | (**) | |||||||

| SIZE(a) | 0.03 | 1.6 | 0.05 | 2.0 | 0.04 | 2.0 | 0.04 | 1.9 | 0.04 | 1.9 | 0.03 | 1.4 |

| (**) | (**) | (*) | (*) | |||||||||

| x | 47.6 | 2.2 | 54.5 | 2.3 | 49.0 | 2.4 | 15.8 | 1.5 | ||||

| (**) | (**) | (**) | ||||||||||

| x | 33.7 | 1.9 | ||||||||||

| (*) | ||||||||||||

| INTE | 327.2 | 0.44 | ||||||||||

| STLT | 0.0004 | 1.8 | 0.0004 | 1.79 | 0.0004 | 1.7 | 0.0004 | 1.7 | 0.0004 | 1.7 | ||

| (*) | (*) | (*) | (*) | (*) | ||||||||

| D(a) | 24.4 | 2.0 | 31.2 | 2.3 | 15.3 | 1.7 | ||||||

| (**) | (**) | (*) | ||||||||||

| 0.78 | 0.717 | 0.72 | 0.725 | 0.725 | 0.858 | |||||||

| CSR | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | TOT |

|---|---|---|---|---|---|---|---|

| Nrisk | 34 | 37 | 46 | 59 | 65 | 71 | 112 |

| Risk | 42 | 48 | 62 | 71 | 78 | 82 | 102 |

| NCSR | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | TOT |

| Nrisk | 78 | 75 | 66 | 53 | 47 | 41 | 112 |

| Risk | 60 | 54 | 40 | 31 | 24 | 20 | 102 |

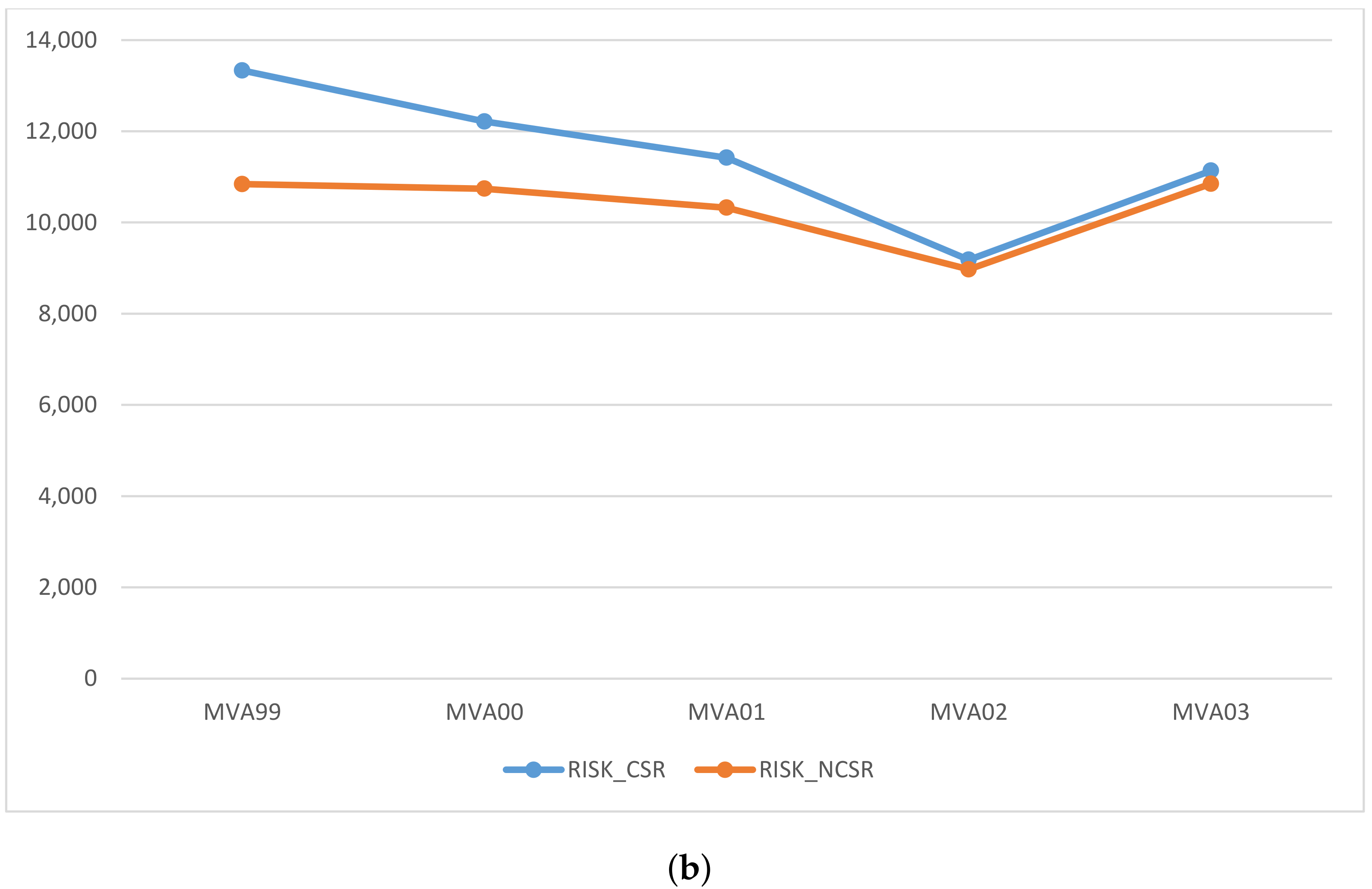

| MVA99 | MVA00 | MVA01 | MVA02 | MVA03 | |

|---|---|---|---|---|---|

| RISK_CSR | 52,318 | 36,532 | 22,343 | 10,618 | 18,110 |

| RISK_NCSR | 52,460 | 33,152 | 21,956 | 10,624 | 19,248 |

| NRISK_CSR | 13,332 | 12,214 | 11,419 | 9182 | 11,134 |

| NRISK_NCSR | 10,840 | 10,740 | 10,323 | 8972 | 10,849 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Carini, C.; Comincioli, N.; Poddi, L.; Vergalli, S. Measure the Performance with the Market Value Added: Evidence from CSR Companies. Sustainability 2017, 9, 2171. https://doi.org/10.3390/su9122171

Carini C, Comincioli N, Poddi L, Vergalli S. Measure the Performance with the Market Value Added: Evidence from CSR Companies. Sustainability. 2017; 9(12):2171. https://doi.org/10.3390/su9122171

Chicago/Turabian StyleCarini, Cristian, Nicola Comincioli, Laura Poddi, and Sergio Vergalli. 2017. "Measure the Performance with the Market Value Added: Evidence from CSR Companies" Sustainability 9, no. 12: 2171. https://doi.org/10.3390/su9122171