Determinants and Sustainability of House Prices: The Case of Shanghai, China

Abstract

:1. Introduction

| Items | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Sale prices of new commodity housing properties | 102.1 | 111.0 | 134.7 | 156.0 | 170.4 | 165.0 | 170.6 | 180.4 | - | - | - |

| Sale prices of existing housing properties | 110.8 | 117.1 | 142.4 | 167.3 | 185.1 | 188.4 | 195.6 | 208.9 | - | - | - |

| Housing land transaction prices | 92.2 | 102.3 | 125.1 | 161.8 | 170.6 | 169.7 | 177.2 | 189.5 | - | - | - |

| Sales of new commodity housing properties (10,000 m2) | 1647.9 | 1839.1 | 2224.5 | 3233.7 | 2845.7 | 2615.49 | 3279.2 | 1965.9 | 2928.0 | - | - |

| Completed new commodity housing properties (10,000 m2) | 1501.9 | 1708.0 | 2139.9 | 3076.2 | 2739.9 | 2699.1 | 2752.5 | 1763.3 | 1508.8 | 1396.05 | 1609.13 |

2. Sustainable House Prices

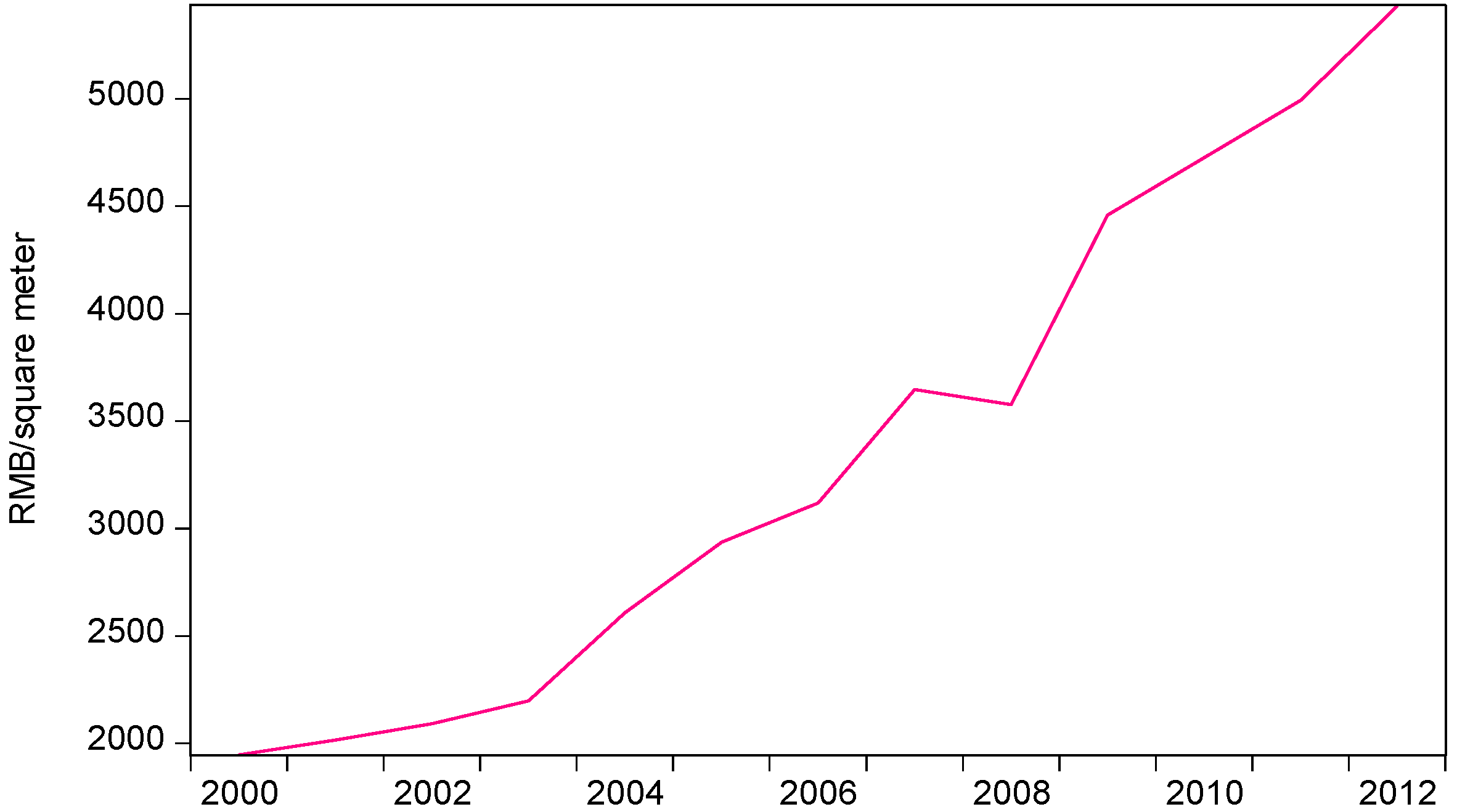

3. Review of Housing Demand and Price Policies in 2005−2013

3.1. The Demand Policy Omitted the Containment of Investment and Speculative Demand for Housing Properties in 2006−2009; the Policy Potentially Stimulated the Swift Growth in Investment Demand and Could Be the Reason for the Rapid Escalation of House Prices

3.2. The Price Policy Aimed at Curbing the Excessive Escalation of House Prices in June 2006−2010, Thereby Leading to Expectations of Rapid Escalation in House Price Levels

3.3. The Policy Encourages Reasonable Demand for Housing Properties; in Particular, the Policy Aimed to Restrain the Investment and Speculative Demand for Housing Properties since Early 2010

3.4. Housing Policy Enters the Period of Investment Containment and Speculative Demand for Housing Properties (Early 2010–Mid-2013)

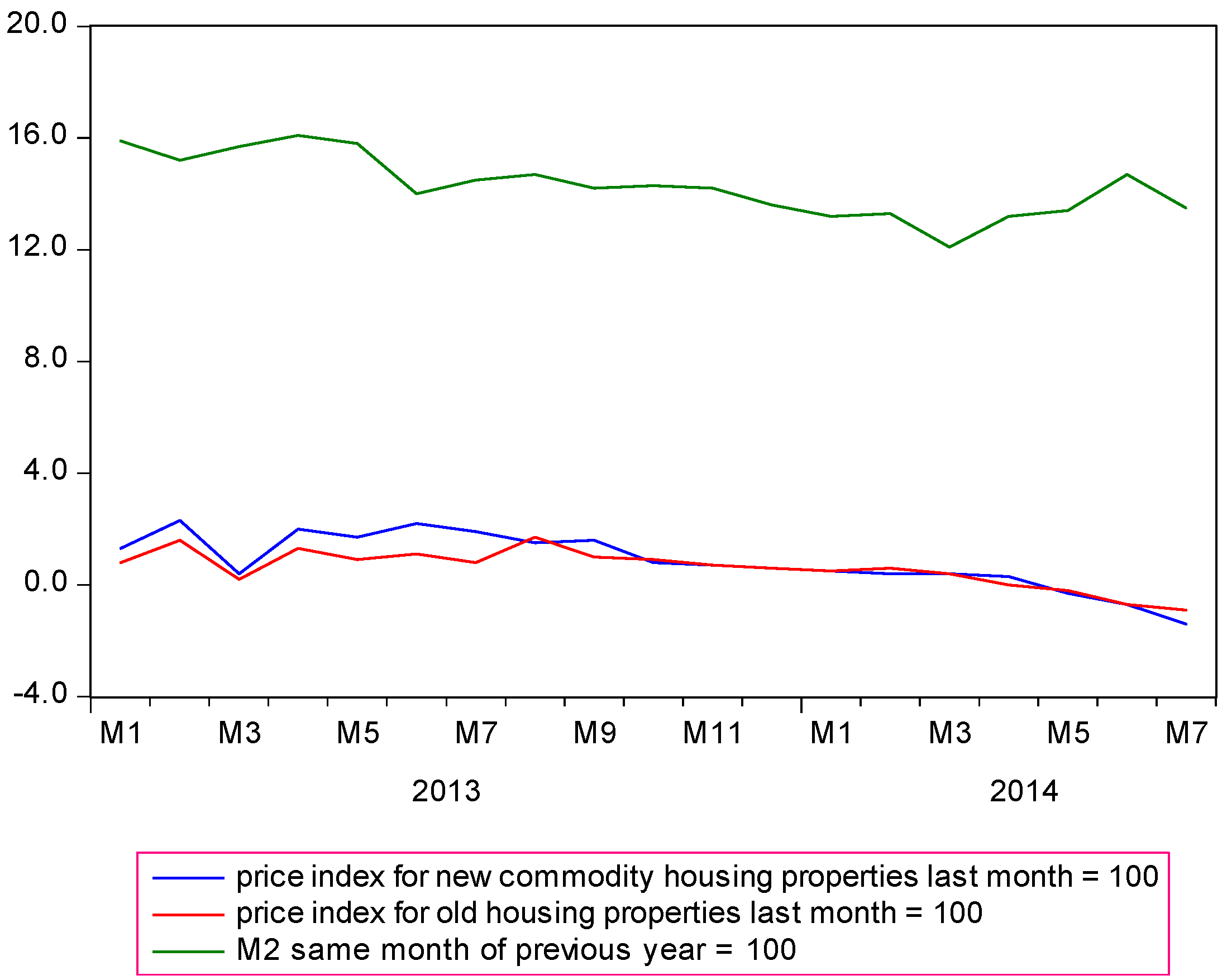

3.5. The Significant Changes in Housing Market Fundamentals since Mid-2013 Include Market-Orientated Management, Shanty Town Reconstruction, Establishment of the Property Registry System, and a Prudent Monetary Policy

4. Methods and Data

4.1. Methods

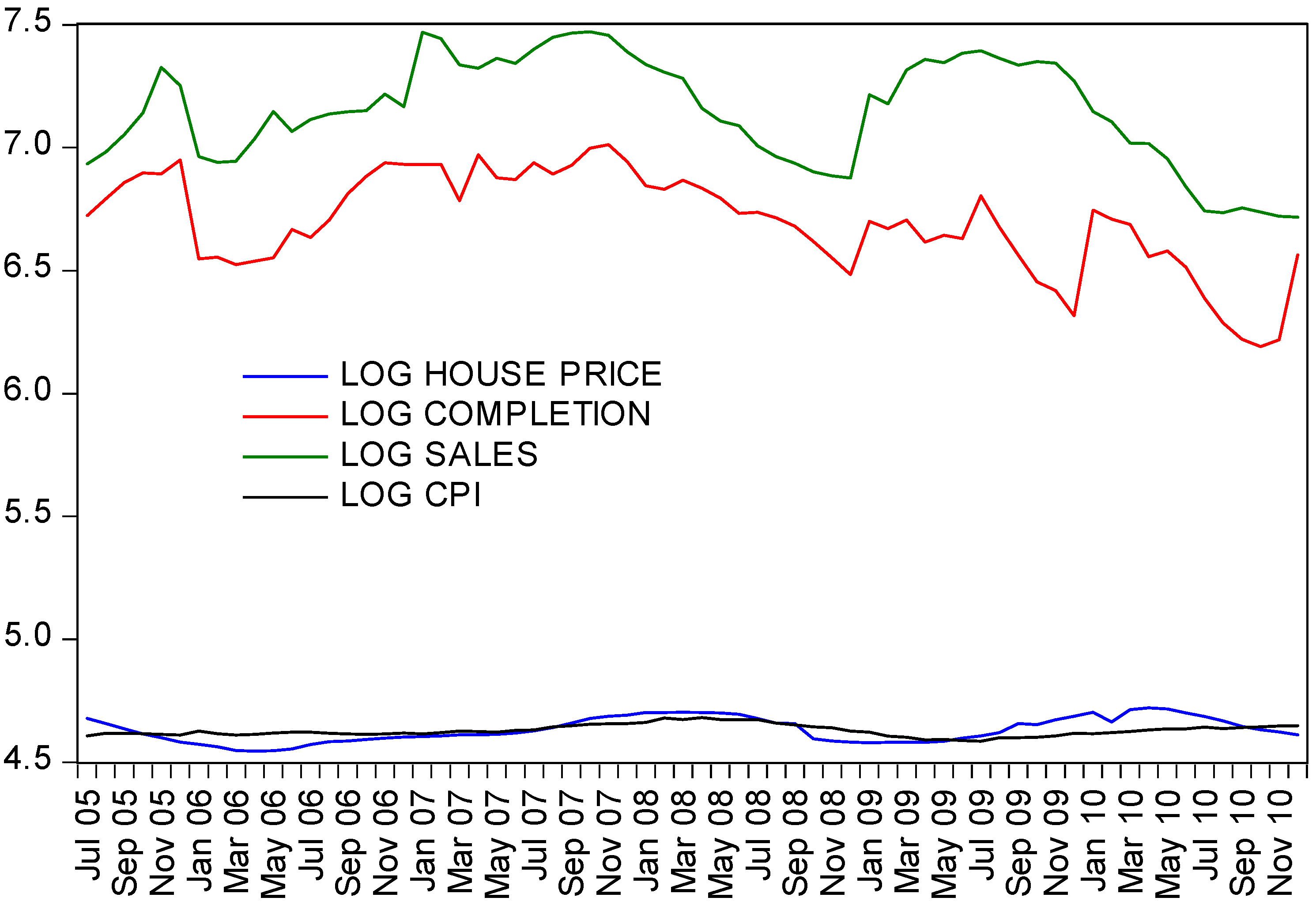

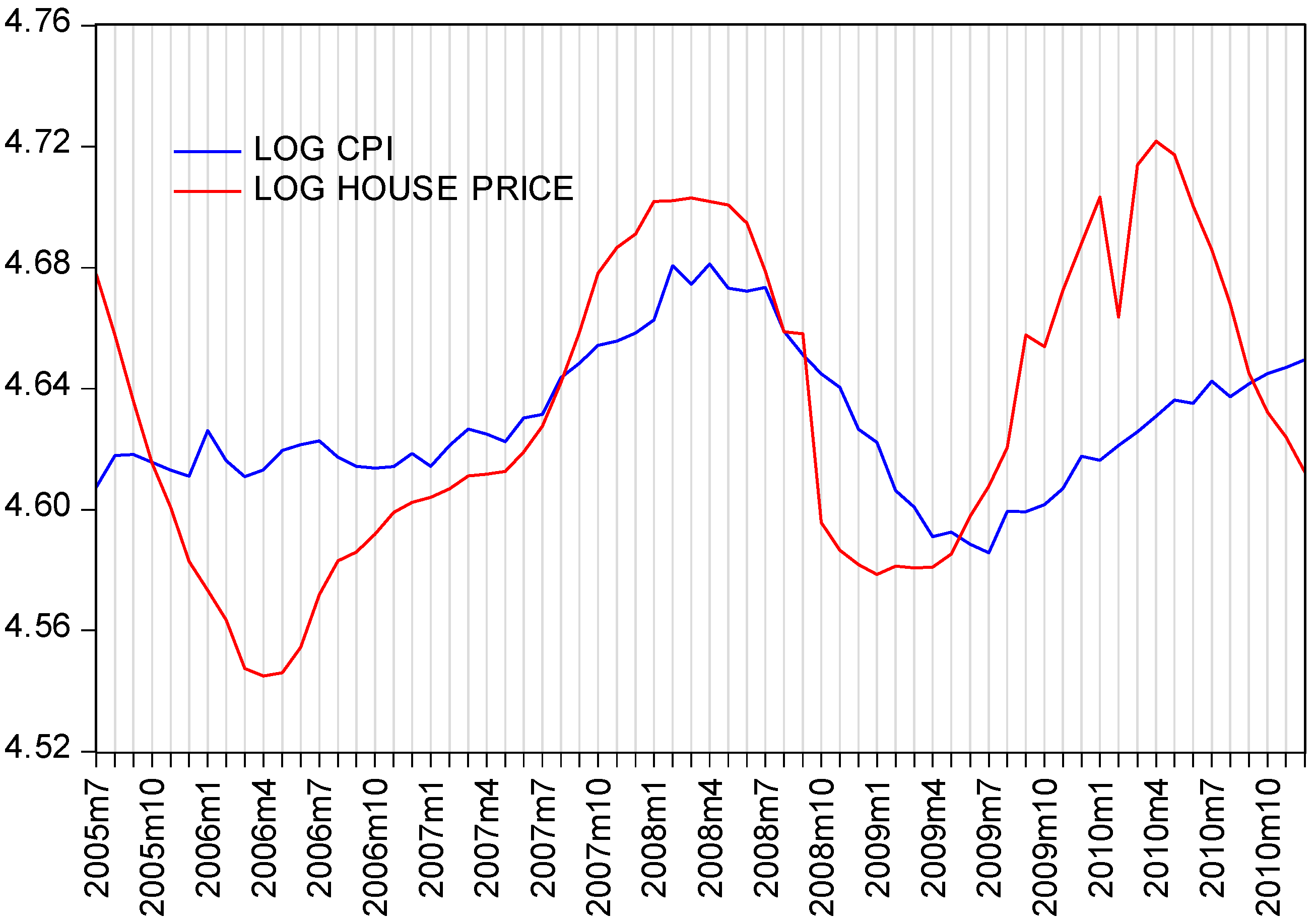

4.2. Data

| Definition | Index changes in nominal urban new commodity housing for the same period of previous year = 100 | Completed new commodity housing property (10,000 square meters) | Commodity housing property transacted (10,000 square meters) | City-specific CPI for the same period of previous year = 100 |

|---|---|---|---|---|

| Variable | HOUSE PRICE | COMPLETION | SALES | CPI |

| Mean | 102.89 | 826.07 | 1302.02 | 102.42 |

| Median | 101.72 | 818.24 | 1271.60 | 101.76 |

| Maximum | 112.36 | 1110.62 | 1756.88 | 107.90 |

| Minimum | 94.16 | 487.69 | 827.02 | 98.07 |

| Std. Dev. | 5.16 | 158.27 | 273.37 | 2.39 |

| Skewness | 0.17 | −0.22 | −0.06 | 0.54 |

| Kurtosis | 1.80 | 2.26 | 1.87 | 2.67 |

| Jarque–Bera | 4.30 | 2.04 | 3.57 | 3.46 |

| Probability | 0.12 | 0.36 | 0.17 | 0.18 |

| Sum | 6790.78 | 54,520.3 | 85,933.13 | 6759.9 |

| Sum Sq. Dev. | 1730.61 | 1,628,150 | 4,857,690.0 | 372.53 |

5. Empirical Results and Discussions

| ADF | ||||||

|---|---|---|---|---|---|---|

| Log of variable | k | Level | p | k | First difference | p |

| HOUSE PRICE | 4 | −3.94 | 0.02 | 1 | −3.37 | 0.06 |

| COMPLETION | 1 | −2.77 | 0.21 | 1 | −4.88 | 0.00 |

| SALES | 1 | −1.87 | 0.66 | 1 | −5.17 | 0.00 |

| CPI | 3 | −2.23 | 0.47 | 1 | −3.66 | 0.03 |

| PP | ||||||

| HOUSE PRICE | 5 | −2.53 | 0.32 | 4 | −6.21 | 0.00 |

| COMPLETION | 1 | −3.00 | 0.14 | 6 | −8.02 | 0.00 |

| SALES | 2 | −1.84 | 0.67 | 1 | −7.14 | 0.00 |

| CPI | 5 | −1.74 | 0.72 | 4 | −7.26 | 0.00 |

| Method | Log of variable | α | θ | Γ | d | β | μ | k | Tb | |

|---|---|---|---|---|---|---|---|---|---|---|

| Zivot–Andrews (Model B) | HOUSE PRICE | 0.64 | 0.02 | 0.00 | - | 0.00 | 1.66 | 7 | Aug 2007 | |

| t-statistic | 8.01 | 2.17 | 0.07 | - | −0.22 | 4.52 | ||||

| COMPLETION | −0.72 | −0.16 | −0.04 | - | 0.02 | 11.31 | 12 | Apr 2008 | ||

| t-statistic | −1.52 | −2.41 | −2.93 | - | 2.41 | 3.69 | ||||

| SALES | 0.24 | 0.07 | −0.01 | - | 0.01 | 5.33 | 10 | Aug 2007 | ||

| t-statistic | 1.48 | 1.28 | −2.29 | - | 1.42 | 4.71 | ||||

| CPI | 0.49 | 0.00 | 0.00 | - | 0.00 | 2.33 | 11 | Feb 2008 | ||

| t-statistic | 3.71 | 0.44 | −3.42 | - | 3.24 | 3.83 | ||||

| Perron (Model C) | HOUSE PRICE | 0.53 | 0.01 | 0.00 | −0.01 | 0.00 | 2.20 | 8 | Jun 2007 | |

| t-statistic | 5.41 | 0.35 | 1.26 | −0.98 | −1.43 | 4.88 | ||||

| COMPLETION | 0.00 | 0.77 | −0.03 | −0.10 | 0.02 | 6.53 | 6 | May 2007 | ||

| t-statistic | 0.00 | 3.98 | −3.63 | −0.96 | 2.59 | 4.67 | ||||

| SALES | 0.23 | 0.45 | −0.02 | 0.01 | 0.01 | 5.31 | 10 | Jan 2008 | ||

| t-statistic | 1.37 | 3.18 | −3.22 | 0.18 | 2.68 | 4.50 | ||||

| CPI | 0.49 | 0.05 | 0.00 | 0.00 | 0.00 | 2.32 | 11 | Dec 2007 | ||

| t-statistic | 3.67 | 3.23 | −3.37 | −0.63 | 3.15 | 3.75 |

| r | k | Eigenvalue | Trace | 5% O-L | 5% C&L | Reinsel–Ahn LR | Jarque–Bera (p-value) | LM statistic for no serial correlation (up to lags, p-value) |

|---|---|---|---|---|---|---|---|---|

| 0 | 9 | 0.62 | 147.5 | 63.9 | 132.2 | 46.9 | ||

| ≤1 | 0.54 | 93.7 | 42.9 | 88.8 | 29.8 | 56.3 (0.43) | 14.7 (1, 0.55) | |

| ≤2 | 0.41 | 50.8 | 25.9 | 53.6 | 16.2 | |||

| ≤3 | 0.32 | 21.5 | 12.5 | 25.9 | 6.85 |

| Log of dependent variable | Zα-statistic | p-value * |

|---|---|---|

| HOUSE PRICE | −24.41 | 0.11 |

| SALES | −49.19 | 0.00 |

| COMPLETION | −18.69 | 0.30 |

| CPI | −12.10 | 0.67 |

| Independent variable | Lagged terms | Estimates | t-stat. | Independent variable | Lagged terms | Estimates | t-stat. |

|---|---|---|---|---|---|---|---|

| ECt − 1 | 0.41 | 1.85 | |||||

| HOUSE PRICE | t − 1 | −0.97 | −3.20 | SALES | t − 1 | 0.08 | 2.27 |

| t − 2 | −0.87 | −2.84 | t − 2 | 0.09 | 2.57 | ||

| t − 3 | −0.71 | −2.43 | t − 3 | 0.03 | 1.17 | ||

| t − 4 | 0.05 | 0.22 | t − 4 | 0.02 | 0.67 | ||

| t − 5 | −0.09 | −0.42 | t − 5 | 0.04 | 1.54 | ||

| t − 6 | −0.19 | −0.83 | t − 6 | 0.07 | 2.72 | ||

| t − 7 | 0.06 | 0.31 | t − 7 | 0.04 | 1.76 | ||

| t − 8 | −0.26 | −1.64 | t − 8 | 0.05 | 1.97 | ||

| t − 9 | −0.17 | −1.23 | t − 9 | 0.02 | 0.86 | ||

| COMPLETION | t − 1 | 0.02 | 0.64 | CPI | t − 1 | 0.90 | 2.00 |

| t − 2 | 0.06 | 2.38 | t − 2 | 1.86 | 3.80 | ||

| t − 3 | 0.03 | 1.14 | t − 3 | 1.30 | 2.65 | ||

| t − 4 | 0.04 | 1.56 | t − 4 | 1.07 | 2.34 | ||

| t − 5 | 0.00 | 0.04 | t − 5 | 0.23 | 0.52 | ||

| t − 6 | −0.08 | −3.01 | t − 6 | −1.22 | −2.74 | ||

| t − 7 | −0.04 | −1.39 | t − 7 | −0.41 | −0.81 | ||

| t − 8 | −0.05 | −1.46 | t − 8 | −1.06 | −2.13 | ||

| t − 9 | −0.08 | −2.60 | t − 9 | −1.54 | −3.57 | ||

| Constant | 0.01 | 2.47 | |||||

| R-squared | 0.87 | ||||||

| Adj. R-squared | 0.60 | ||||||

| F-statistic | 3.19 | ||||||

| Akaike AIC | −6.05 |

| Dependent | ξk = 0 | Wald-χ2 | Degree of freedoms | p-value |

|---|---|---|---|---|

| HOUSE PRICE | COMPLETION | 33.9 | 9 | 0.00 |

| SALES | 16.9 | 9 | 0.05 | |

| CPI | 26.9 | 9 | 0.00 | |

| COMPLETION | HOUSE PRICE | 37.9 | 9 | 0.00 |

| SALES | 12.9 | 9 | 0.16 | |

| CPI | 21.2 | 9 | 0.01 | |

| SALES | HOUSE PRICE | 12.7 | 9 | 0.18 |

| COMPLETION | 6.58 | 9 | 0.68 | |

| CPI | 6.55 | 9 | 0.68 | |

| CPI | HOUSE PRICE | 4.75 | 9 | 0.94 |

| COMPLETION | 3.44 | 9 | 0.86 | |

| SALES | 9.81 | 9 | 0.37 |

| Log of variable in cointegrating vector | : corresponding adjustment coefficient α = 0 | Wald -χ2 | Degree of freedoms | p-value |

|---|---|---|---|---|

| HOUSE PRICE | α11 = 0 | 3.51 | 1 | 0.06 |

| COMPLETION | α21 = 0 | 4.72 | 1 | 0.03 |

| SALES | α31 = 0 | 5.40 | 1 | 0.02 |

| CPI | α41 = 0 | 1.36 | 1 | 0.24 |

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- NBSC. Yearly Statistical Data. Available online: http://data.stats.gov.cn/ (accessed on 5 October 2012). (In Chinese)

- Shanghai Municipal Bureau of Statistics. Shanghai Statistical Yearbook 2011. Available online: http://www.stats-sh.gov.cn (accessed on 8 October 2012). (In Chinese)

- Hui, E.C.M.; Yue, S. Housing Price Bubbles in Hong Kong, Beijing and Shanghai: A Comparative Study. J. Real Estate Finance Econ. 2006, 33, 299–327. [Google Scholar] [CrossRef]

- Wu, F. Changes in the Structure of Public Housing Provision in Urban China. Urban Stud. 1996, 33, 1601–1628. [Google Scholar] [CrossRef]

- Gu, J.F. An Analysis of the Effect of Overseas Funds on the Real Estate Market in Shanghai. World Econ. Stud. 2005, 5, 68–72. (In Chinese) [Google Scholar]

- Tu, J.; Zhang, J. What Pushes up the House Price: Evidence from Shanghai. World Econ. 2005, 5, 28–37. (In Chinese) [Google Scholar]

- Wang, L. Impact of Urban Rapid Transit on Residential Property Values. Chin. Econ. 2010, 43, 33–52. [Google Scholar] [CrossRef]

- Shanghai Municipal Housing Security and Administration Bureau. Notice on the Implementation of the Housing Purchase Policy That the Households in Shanghai or Other Provinces Can Only Once More Purchase a Commodity Housing in Shanghai. Available online: http://www.shfg.gov.cn/ (accessed on 7 June 2013). (In Chinese)

- Shanghai Municipal Bureau of Statistics. Shanghai Statistical Yearbook 2013. Available online: http://www.stats-sh.gov.cn (accessed on 8 March 2014).

- Rosen, K.T.; Ross, M.C. Increasing Home Ownership in Urban China: Note on the Problem of Affordability. Hous. Stud. 2000, 15, 77–88. [Google Scholar] [CrossRef]

- Su, D.Y.; Zhang, Y.X. An Analysis of the Causes of the Supply Shortage of Securitized Homes and Policies. China Real Estate Finan. 2010, 3, 38–40. [Google Scholar]

- Liang, S.L.; Du, D.B. Lack of the Justices of Housing Security Policies in China. Urban Issue 2007, 11, 67–70. [Google Scholar]

- Ministry of Land and Resources Lists 1457 Idle Plots in China. China News. 5 January 2011. Available online: www.chinanews.com (accessed on 5 January 2011). (In Chinese)

- Yu, M. Ministry of Land and Resources announces remediation of the land for real estate development, land idling becomes the biggest problem. People’s Daily. 20 August 2010. Available online: http://paper.people.com.cn/rmrb/html/2010-08/20/nbs.D110000renmrb_01.htm (accessed on 21 August 2010).

- State Council. Report on the Work of the Government 2014. Available online: http://www.gov.cn/zhuanti/2014gzbg.htm (accessed on 25 June 2014). (In Chinese)

- Kenny, G. Modelling the Demand and Supply Sides of the Housing Market: Evidence from Ireland. Econ. Model. 1999, 16, 389–409. [Google Scholar] [CrossRef]

- Ball, M.; Meen, G.; Nygaard, C. Housing Supply Price Elasticities Revisited: Evidence from International, National, Local and Company Data. J. Hous. Econ. 2010, 19, 255–268. [Google Scholar] [CrossRef]

- DiPasquale, D.; Wheaton, W.C. Housing Market Dynamics and the Future of House Prices. J. Urban Econ. 1994, 35, 1–27. [Google Scholar] [CrossRef]

- Gat, D.; Schwartz, A.L., Jr. Israel’s Housing Market Dynamics: A Tale of Two Sectors. J. Real Estate Lit. 2000, 8, 129–152. [Google Scholar]

- Case, K.E.; Shiller, R.J. The Behavior of Home Buyers and Boom and Post-Boom Markets. New Engl. Econ. Rev. 1988. [Google Scholar] [CrossRef]

- Hort, K. Prices and Turnover in the Market for Owner-Occupied Homes. Reg. Sci. Urban Econ. 2000, 30, 99–119. [Google Scholar] [CrossRef]

- Song, S.; Young, M.; Hargreaves, B. House Price-Volume Dynamics: Evidence from 12 Cities in New Zealand. J. Real Estate Res. 2010, 32, 75–99. [Google Scholar]

- Berkovec, J.A.; Goodman, J.L. Turnover as a Measure of Demand for Existing Homes. Real Estate Econ. 1996, 24, 421–440. [Google Scholar] [CrossRef]

- Stein, J.C. Prices and Trading Volume in the Housing Market: A Model with Down-Payment Effects. Quart. J. Econ. 1995, 110, 379–406. [Google Scholar] [CrossRef]

- Clayton, J.; MacKinnon, G.; Liang, P. Time Variation of Liquidity in the Private Real Estate Market: An Empirical Investigation. J. Real Estate Res. 2008, 30, 125–160. [Google Scholar]

- Yiu, C.Y.; Man, K.F.; Wong, S.K. Trading Volume and Price Dispersion in Housing Markets. J. Prop. Res. 2008, 25, 203–219. [Google Scholar] [CrossRef]

- Huang, Z.H.; Yu, X.F.; Du, X.J. Empirical Study of the Impact of Land Supply on Housing Price: A Case of Shanghai. Econ. Geogr. 2009, 29, 624–627. (In Chinese) [Google Scholar]

- Yu, H. China’s House Price: Affected by Economic Fundamentals or Real Estate Policy? Front. Econ. China 2010, 5, 25–51. [Google Scholar] [CrossRef]

- Friedman, M. Studies in the Quantity Theory of Money; University of Chicago Press: Chicago, IL, USA, 1956. [Google Scholar]

- Friedman, M. Price Theory; Aldine: Chicago, IL, USA, 1976. [Google Scholar]

- Buckley, R.; Ermisch, J. Government Policy and House Prices in the United Kingdom: An Econometric Analysis. Oxford Bull. Econ. Stat. 1982, 44, 273–304. [Google Scholar] [CrossRef]

- Fortura, P.; Kushner, J. Canadian Inter-City House Price Differentials. J. Am. Real Estate Urban Econ. Assoc. 1986, 14, 525–536. [Google Scholar] [CrossRef]

- Lastrapes, W.D. The Real Price of Housing and Money Supply Shocks: Time Series Evidence and Theoretical Simulations. J. Hous. Econ. 2002, 11, 40–74. [Google Scholar] [CrossRef]

- Eichholtz, P.M.A. A Long Run House Price Index:The Herengracht Index, 1628–1973. Real Estate Econ. 1997, 25, 175–192. [Google Scholar] [CrossRef]

- Ebrill, L.P.; Possen, U.M. Inflation and the Taxation of Equity in Corporations and Owner-Occupied Housing. J. Money Credit Bank. 1982, 14, 33–47. [Google Scholar] [CrossRef]

- Rubens, J.H.; Bond, M.T.; Webb, J.R. The Inflation-Hedging Effectiveness of Real Estate. J. Real Estate Res. 1989, 4, 45–56. [Google Scholar]

- Anari, A.; Kolari, J. House Prices and Inflation. Real Estate Econ. 2002, 30, 67–84. [Google Scholar] [CrossRef]

- Abelson, P.; Joyeux, R.; Milunovich, G.; Demi, C. Explaining House Prices in Australia: 1970–2003. Econ. Rec. 2005, 81, S96–S103. [Google Scholar] [CrossRef]

- People’s Bank of China. China Monetary Policy Report Quarter Four 2013. Available online: http://www.pbc.gov.cn/publish/zhengcehuobisi/591/index.html (accessed on 5 March 2014). (In Chinese)

- Koivu, T. Monetary Policy, Asset Prices and Consumption in China. Econ. Syst. 2012, 36, 307–325. [Google Scholar] [CrossRef]

- People’s Bank of China; CBRC. Notice on Further Improving Housing Finance Services. Available online: http://www.pbc.gov.cn/ (accessed on 20 October 2014). (In Chinese)

- People’s Bank of China. Statistics: Monely Supply. Available online: http://www.pbc.gov.cn/publish/english/963/index.html (accessed on 6 March 2013).

- NBSC. Statistical Data: Monthly Statistics. Available online: http://www.stats.gov.cn/ (accessed on 7 March 2013). (In Chinese)

- People’s Bank of China. People’s Bank of China Monetary Policy Committee Held a Regular Meeting in the Third Quarter of 2014. Available online: http://www.pbc.gov.cn/publish/diaochatongjisi/133/index.html (accessed on 2 January 2015). (In Chinese)

- Currier, K.M. Existence, Uniqueness, and Computation of Sustainable Prices. Math. Soc. Sci. 1994, 27, 105–109. [Google Scholar] [CrossRef]

- Spulber, D.F. Scale Economies and Existence of Sustainable Monopoly Prices. J. Econ. Theor. 1984, 34, 149–163. [Google Scholar] [CrossRef]

- DiPasquale, D.; Wheaton, W.C. Urban Economics and Real Estate Markets; Prentice-Hall: Upper Saddle River, NJ, USA, 1996. [Google Scholar]

- Benson, E.D.; Hansen, J.L.; Schwartz, A.L., Jr.; Smersh, G.T. The Influence of Canadian Investment on U.S. Residential Property Values. J. Real Estate Res. 1997, 13, 231–249. [Google Scholar]

- Glaeser, E.L.; Gyourko, J.; Saiz, A. Housing Supply and Housing Bubbles. J. Urban Econ. 2008, 64, 198–217. [Google Scholar] [CrossRef]

- Wheaton, W.C. Real Estate “Cycles”: Some Fundamentals. Real Estate Econ. 1999, 27, 209–230. [Google Scholar] [CrossRef]

- Kaiser, R.W. The Long Cycle in Real Estate. J. Real Estate Res. 1997, 14, 233–257. [Google Scholar]

- Stiglitz, J.E. Symposium on Bubbles. J. Econ. Perspect. 1990, 4, 13–18. [Google Scholar] [CrossRef]

- Shiratsuka, S. Asset Price Bubble in Japan in the 1980s: Lessons for Financial and Macroeconomic Stability; Discussion Paper No. 2003-E-15; IMES Institute for Monetary and Economic Studies, Bank of Japan: Tokyo, Japan, 2003. [Google Scholar]

- Bourassa, S.C.; Hendershott, P.H.; Murphy, J. Further Evidence on the Existence of Housing Market Bubbles. J. Prop. Res. 2001, 18, 1–19. [Google Scholar] [CrossRef]

- Abraham, J.; Hendershott, P. Bubbles in Metropolitan Housing Markets. J. Hous. Res. 1996, 7, 191–207. [Google Scholar]

- Hort, K. Determinants of Urban House Price Fluctuations in Sweden 1968–1994. J. Hous. Econ. 1998, 7, 93–120. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W.J. Cointegration and Error Correction: Representation, Estimation and Testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Granger, C.W.J. Long Memory Relationships and the Aggregation of Dynamic Models. J. Econom. 1980, 14, 227–238. [Google Scholar] [CrossRef]

- Granger, C.W.J. Developments in the Study of Cointegrated Economic Variables. Oxford Bull. Econ. Stat. 1986, 48, 213–228. [Google Scholar] [CrossRef]

- Engle, R.F.; Hendry, D.F.; Richard, J.F. Exogeneity. Econometrica 1983, 51, 277–304. [Google Scholar] [CrossRef]

- Ye, J.P.; Wu, Z.-H. Urban Housing Policy in China in the Macro-Regulation Period 2004–2007. Urban Pol. Res. 2008, 26, 283–295. [Google Scholar] [CrossRef]

- State Council. Notice of the General Office of the State Council on Effectively Stablizing Housing Prices. Available online: http://www.gov.cn/ztzl/2006-06/30/content_323694.htm (accessed on 6 March 2013). (In Chinese)

- State Council. Opinions of the Ministry of Construction and Other Ministries on Adjusting the Supply Structure of Housing and Stabilizing House Prices, Forwarded by the General Office of the State Council. Available online: http://www.gov.cn/zwgk/2006-05/29/content_294450.htm (accessed on 7 March 2013). (In Chinese)

- State Council. Opinions on Faciliating the Healthy Development of the Real Estate Market. Available online: http://www.gov.cn/zwgk/2008-12/21/content_1184227.htm (accessed on 10 March 2013). (In Chinese)

- State Council. Report on the Work of the Government 2009. Available online: http://www.gov.cn/test/2009-03/16/content_1260221.htm (accessed on 10 March 2013). (In Chinese)

- Guilfoyle, J.P. The Effect of Property Taxes on Home Values. J. Real Estate Lit. 2000, 82, 111–127. [Google Scholar]

- Oates, W.E. The Effects of Property Taxes and Local Public Spending on Property Values: An Empirical Study of Tax Capitalization and the Tiebout Hypothesis. J. Polit. Econ. 1969, 77, 957–971. [Google Scholar] [CrossRef]

- Dusansky, R.; Ingber, M.; Karatjas, N. The Impact of Property Taxation on Housing Values and Rents. J. Urban Econ. 1981, 10, 240–255. [Google Scholar] [CrossRef]

- Central Government. The 11th Five-Year Plan for China’s Economic and Social Development (2006–2010. Available online: http://www.gov.cn/gongbao/content/2006/content_268766.htm (accessed on 7 January 2013). (In Chinese)

- State Council. Notice of the State Council on Facilitating the Continuing and Healthy Development of the Real Estate Market. Available online: http://www.gov.cn/zhengce/content/2008-03/28/content_4797.htm (accessed on 8 January 2013). (In Chinese)

- State Council. Notice of the Promotion of Stable and Healthy Development of the Real Estate Market (General Office Issue (General Office Issue 2010, No. 4). Available online: http://www.gov.cn/zwgk/2010-01/10/content_1507058.htm (accessed on 7 March 2013). (In Chinese)

- State Council. Notice on Further Improving the Work on the Issues About the Real Estate Market Regulation (General Office Issue 2011, No. 1). Available online: http://www.gov.cn/zwgk/2011-01/27/content_1793578.htm (accessed on 8 March 2013). (In Chinese)

- Xinhuanet. Focus on the State Council’s Planning of the Adjustment and Promotion of Top Ten Industries. Available online: news.xinhuanet. com (accessed on 3 January 2014).

- Wang, B.; Sun, T. How Effective Are Macroprudential Policies in China? IMF Working Paper; International Monetary Fund: Washington, DC, USA, 2013; pp. 22–23. [Google Scholar]

- National Bureau of Statistics. China Statistical Yearbook 2011. Available online: www.stats.gov.cn (accessed on 7 January 2013). (In Chinese)

- State Council. Notice on Firmly Curbing the Surge in Housing Prices in Some Cities (General Office Issue 2010, No. 10). Available online: http://www.gov.cn/zwgk/2010-04/17/content_1584927.htm (accessed on 15 January 2013). (In Chinese)

- Shanghai Municipal Government. Notice of the Opinions of Implementation in Shanghai of the State Council’s Notice of Further Improving the Work of Relevant Issues About Real Estate Market Regulation. Available online: http://www.shfg.gov.cn/ (accessed on 6 July 2013). (In Chinese)

- State Council. State Council’s Opinions on Solving the Housing Difficulities in Low-Income Families in Cities. Available online: http://www.gov.cn/zwgk/2007-08/13/content_714481.htm (accessed on 9 July 2013). (In Chinese)

- People’s Bank of China. Notice on strengthening management of commercial real estate credit. Available online: http://finance.people.com.cn/GB/1037/6323893.html (accessed on 28 April 2013).

- Sina House. Thirty Six out of Fourty Seven Cities That Implement House Purchase Controls Remove the Purchase Control. Available online: http://sh.house.sina.com.cn/news/2014-08-11/09524361293.shtml (accessed on 1 September 2014). (In Chinese)

- Xinhuanet. Central Economic Work Conference 2014. Available online: http://news.xinhuanet.com/fortune/2014-12/11/c_1113611795.htm (accessed on 5 January 2015). (In Chinese)

- China Securities. Removement of House Purchase Control and Housing Sales Volume and Prices in Chinese Cities. Available online: http://www.cs.com.cn/ssgs/fcgs/201409/t20140910_4508011.html (accessed on 7 January 2015). (In Chinese)

- Johansen, S. Statistical Analysis of Cointegration Vectors. J. Econ. Dynam. Contr. 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum Likelihood Estimation and Inference on Cointegration—With Applications to the Demand for Money. Oxford Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Johansen, S. Estimation and Hypotheses Testing of Co-Integration Vectors in Gaussian Vector Autoregressive Models. Econometrica 1991, 59, 1551–1580. [Google Scholar] [CrossRef]

- Engle, R.F.; Yoo, B.S. Forecasting in Co-Integrated Systems. J. Econom. 1987, 35, 143–157. [Google Scholar] [CrossRef]

- Cheung, Y.-W.; Lai, K.S. Finite-Sample Sizes of Johansen’s Likelihood Ratio Tests for Cointegration. Oxford Bull. Econ. Stat. 1993, 55, 313–328. [Google Scholar] [CrossRef]

- Reinsel, G.C.; Ahn, S.K. Asymptotic Properties of the Likelihood Ratio Test for Cointegration in the Nonstationary Vector Ar Model; Technical Report; Department of Statistics, University of Wisconsin-Madison: Madison, WI, USA, 1988.

- Phillips, P.C.B. Optimal Inference in Cointegrated Systems. Econometrica 1991, 59, 283–306. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Fuller, W.A. Introduction to Statistical Time Series; John Wiley: New York, NY, USA, 1976. [Google Scholar]

- Phillips, P.C.B.; Perron, P. Testing for a Unit Root in Time Series Regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Nelson, C.R.; Plosser, C.I. Trends and Random Walks in Macroeconomic Time Series. J. Monet. Econ. 1982, 10, 139–162. [Google Scholar] [CrossRef]

- Perron, P. The Great Crash, the Oil Price Shock, and the Unit Root Hypothesis. Econometrica 1989, 57, 1361–1401. [Google Scholar] [CrossRef]

- Zivot, E.; Andrews, D.W.K. Further Evidence on the Great Crash, the Oil-Price Shock, and the Unit-Root Hypothesis. J. Bus. Econ. Stat. 1992, 10, 251–270. [Google Scholar]

- Perron, P. Further Evidence on Breaking Trend Functions in Macroeconomic Variables. J. Econom. 1997, 80, 355–385. [Google Scholar] [CrossRef]

- Sen, A. On Unit-Root Tests When the Alternative Is a Trend-Break Stationary Process. J. Bus. Econ. Stat. 2003, 21, 174–184. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-Spectral Methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Granger, C.W.J. Some Properties of Time Series Data and Their Use in Econometric Model Specification. J. Econom. 1981, 16, 121–130. [Google Scholar] [CrossRef]

- Hendry, D.F.; Juselius, K. Explaining Cointegration Analysis: Part Ii. Energy J. 2001, 22, 75–120. [Google Scholar] [CrossRef]

- Johansen, S. Testing Weak Exogeneity and the Order of Cointegration in UK Money Demand Data. J. Pol. Model. 1992, 14, 313–334. [Google Scholar] [CrossRef]

- Abeysinghe, T. Deterministic Seasonal Models and Spurious Regressions. J. Econom. 1994, 61, 259–272. [Google Scholar]

- Hamilton, H.D. Time Series Analysis, 1st ed.; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Ng, S.; Perron, P. Unit Root Tests in Arma Models with Data Dependent Methods for the Selection of the Truncation Lag. J. Am. Stat. Assoc. 1995, 90, 268–281. [Google Scholar] [CrossRef]

- MacKinnon, J.G. Numerical Distribution Functions for Unit Root and Cointegration Tests. J. Appl. Econom. 1996, 11, 601–618. [Google Scholar] [CrossRef]

- Banerjee, A.; Lumsdaine, R.L.; Stock, J.H. Recursive and Sequential Tests of the Unit Root and Trend Break Hypothesis: Theory and International Evidence. J. Bus. Econ. Stat. 1992, 10, 271–287. [Google Scholar]

- Johansen, S. Likelihood-Based Inference in Cointegrated Vector Autoregressive Models, 1st ed.; Oxford University Press: Oxford, UK, 1995. [Google Scholar]

- Urzua, C.M. Omnibus Tests for Multivariate Normality Based on a Class of Maximum Entropy Distributions; Advances in Econometrics; JAI Press: Greenwich, CT, USA, 1997; pp. 341–358. [Google Scholar]

- Osterwald-Lenum, M. A Note with Quantiles of the Asymptotic Distribution of the Maximum Likelihood Cointegration Rank Test Statistics. Oxford Bull. Econ. Stat. 1992, 54, 461–472. [Google Scholar] [CrossRef]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zou, G.L.; Chau, K.W. Determinants and Sustainability of House Prices: The Case of Shanghai, China. Sustainability 2015, 7, 4524-4548. https://doi.org/10.3390/su7044524

Zou GL, Chau KW. Determinants and Sustainability of House Prices: The Case of Shanghai, China. Sustainability. 2015; 7(4):4524-4548. https://doi.org/10.3390/su7044524

Chicago/Turabian StyleZou, Gao Lu, and Kwong Wing Chau. 2015. "Determinants and Sustainability of House Prices: The Case of Shanghai, China" Sustainability 7, no. 4: 4524-4548. https://doi.org/10.3390/su7044524