Using the Electronic Industry Code of Conduct to Evaluate Green Supply Chain Management: An Empirical Study of Taiwan’s Computer Industry

Abstract

:1. Introduction

2. Literature Review and Hypothesis

3. Methodology

3.1. Questionnaire and Sample

| Environmental Dimension | Environmental Aspect | Number of Questions | Question Type |

|---|---|---|---|

| Environmental Management Systems | Management Accountability and History (MAH) | 2 | Environmental Management Representative, Violations |

| Environment Policy and Procedures (EPP) | 5 | Environmental Policy, Scope of Environmental Policy, Communication Method, Contractual Requirement on Suppliers, Voluntary Environmental Standards on Suppliers | |

| Management System Status (MSS) | 4 | Environmental Management Systems, Registered Environmental Management System, Documentation, Periodical Review | |

| Management System Elements (MSE) | 16 | Regulation Tracking System, Regulation Tracking Method, Written Performance, Periodic Review, Risk Assessment Process, Risk Management Program, Periodic Audit, External Audit, Corrective Actions, Root Cause Analysis, On-site Specialist, Employee Communication, Training Program and Measurement, Performance Communication, Method of Performance Communication | |

| Law Compliance | Environmental Permits (EP) | 4 | Program and Procedures, Permit Law Compliance, Government Inspection Frequency, Permits Violations |

| Hazardous Substances (HS) | 5 | Hazardous Material in Manufacturing Operations, Training, Reduction Plan for Hazardous Materials, Hazardous Waste, Reduction Plan for Hazardous Waste | |

| Wastewater and Solid Waste (WSW) | 4 | Type of Wastewater, Wastewater Management Plan, Solid Waste Management Plan, Wastewater and Solid Waste Reduction Program | |

| Airborne Emissions (AE) | 5 | Airborne Emissions, Airborne Emission Management Program, Airborne Emissions Reduction Program, Green House Gas (GHG) Reduction Program, Mobile Source Emissions Program | |

| Cleaner Production | Pollution Prevention (PP) | 5 | Systematically Pollution Reduction Program, Systematically Resource Reduction Program, Power Consumption Reduction of Product, Environmental Impacts Assessment Program, Awards in Pollution Prevention |

| Product Content (PC) | 9 | Materials List, Material Management Program, Materials Phase Out Program, Material Integrated Operation, Rejected or Banned, Recycled Materials Program, Information Disclosure Program, Work with Suppliers, Product Take-Back Program | |

| Total | 59 |

3.2. Data Collection

| Number | Percentage | |

|---|---|---|

| Product Type | ||

| Final Assembly | 16 | 25.4 |

| Memory | 10 | 15.9 |

| Display | 10 | 15.9 |

| Power | 8 | 12.7 |

| Storage | 12 | 19.0 |

| Others | 7 | 11.1 |

| Total | 63 | 100.0 |

| Geographical Area | ||

| China-East | 24 | 38.1 |

| China-South | 17 | 27.0 |

| Taiwan | 12 | 19.0 |

| * Other Asian regions | 10 | 15.9 |

| Total | 63 | 100.0 |

| Employees (Size) | ||

| >5000 | 35 | 55.6 |

| 1001–5000 | 20 | 31.7 |

| 101–1000 | 7 | 11.1 |

| <100 | 1 | 1.6 |

| Total | 63 | 100.0 |

3.3. Data Analysis

4. Results

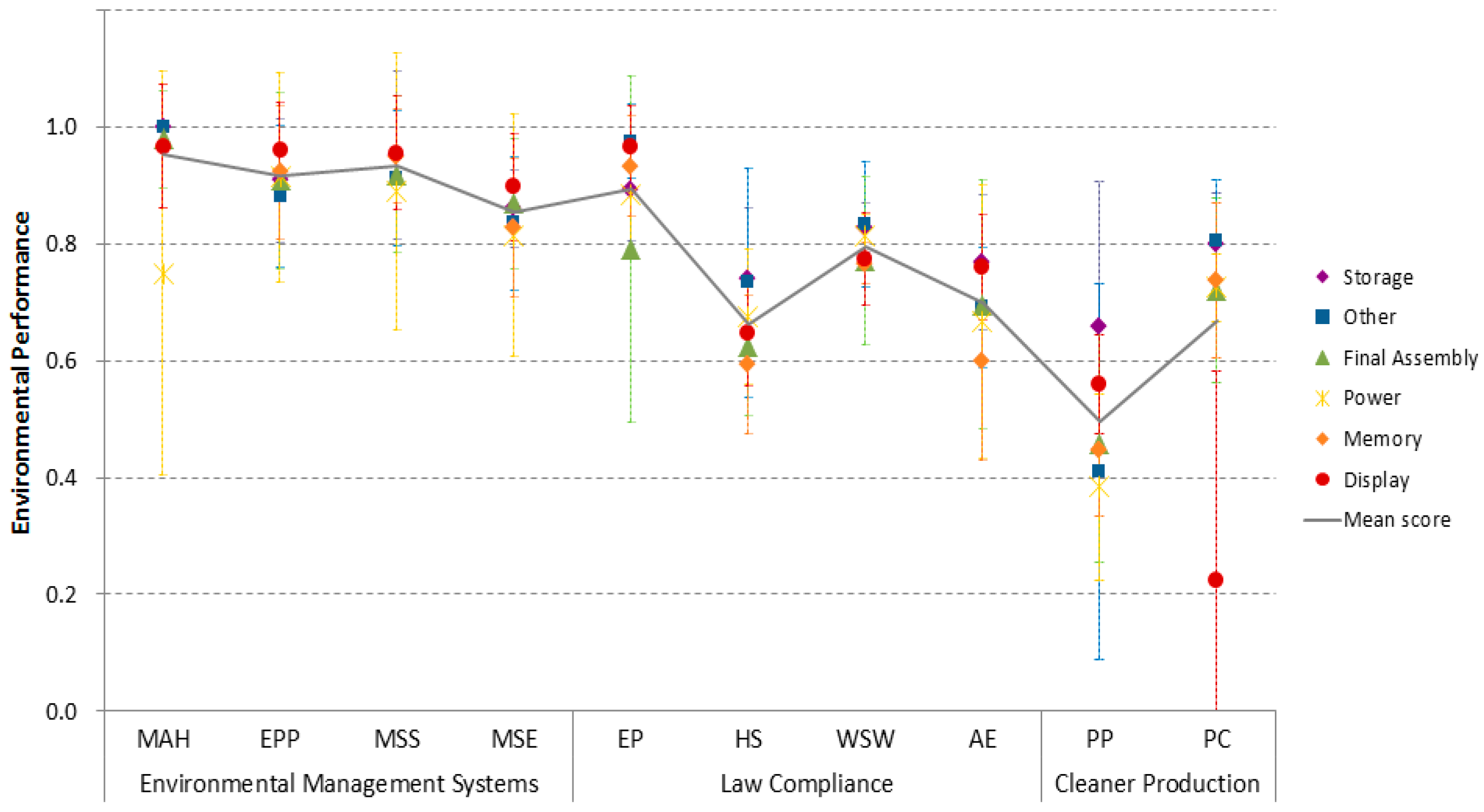

| Dimension/Aspects | Mean | SD |

|---|---|---|

| Environmental Management Systems | 0.914 | 0.150 |

| MAH | 0.952 | 0.157 |

| EPP | 0.917 | 0.126 |

| MSS | 0.932 | 0.136 |

| MSE | 0.855 | 0.118 |

| Law Compliance | 0.763 | 0.171 |

| EP | 0.893 | 0.175 |

| HS | 0.663 | 0.132 |

| WSW | 0.794 | 0.092 |

| AE | 0.700 | 0.171 |

| Cleaner Production | 0.583 | 0.254 |

| PP | 0.496 | 0.214 |

| PC | 0.670 | 0.264 |

5. Discussion and Conclusions

Author Contributions

Conflicts of Interest

References

- González-Benito, J.; Lannelongue, G.; Queiruga, D. Stakeholders and environmental management systems: A synergistic influence on environmental imbalance. J. Clean. Prod. 2011, 19, 1622–1630. [Google Scholar] [CrossRef]

- George, K.; Nikos, V. Stakeholder pressures and environmental performance. Acad. Manag. J. 2006, 49, 145–159. [Google Scholar] [CrossRef]

- The Economist. The Campaign against Palm Oil: The Other Oil Spill. 2010. Available online: http://www.economist.com/node/16423833 (accessed on 10 February 2015).

- World Bank. Company Codes of Conduct and International Standards: An Analytical Comparison, Volume 1: Apparel, Footwear and Light Manufacturing, Agribusiness, Tourism; World Bank: Washington, DC, USA, 2003. [Google Scholar]

- Lee, K.H.; Kim, J.W. Integrating Suppliers into Green Product Innovation Development: An Empirical Case Study in the Semiconductor Industry. Bus. Strateg. Environ. 2011, 20, 527–538. [Google Scholar] [CrossRef]

- Cao, M.; Zhang, Q. Supply chain collaborative advantage: A firm’s perspective. Int. J. Prod. Econ. 2010, 128, 358–367. [Google Scholar] [CrossRef]

- Kovács, G. Corporate environmental responsibility in the supply chain. J. Clean. Prod. 2008, 16, 1571–1578. [Google Scholar] [CrossRef]

- Franceschini, F.; Galetto, M.; Pignatelli, A.; Varetto, M. Outsourcing: Guidelines for a structured approach. Benchmark Int. J. 2003, 10, 246–260. [Google Scholar] [CrossRef]

- Testa, F.; Iraldo, F. Shadows and lights of GSCM (Green Supply Chain Management): Determinants and effects of these practices based on a multi-national study. J. Clean. Prod. 2010, 18, 953–962. [Google Scholar] [CrossRef] [Green Version]

- Ahi, P.; Searcy, C. A comparative literature analysis of definitions for green and sustainable supply chain management. J. Clean. Prod. 2013, 52, 329–341. [Google Scholar] [CrossRef]

- Tudor, T.L.; Bannister, S.; Butler, S.; White, P.; Jones, K.; Woolridge, A.C.; Bates, M.P.; Phillips, P.S. Can corporate social responsibility and environmental citizenship be employed in the effective management of waste? Case studies from the National Health Service (NHS) in England and Wales. Resour. Conserv. Recycl. 2008, 52, 764–774. [Google Scholar] [CrossRef]

- Risso, M. A horizontal approach to implementing corporate social responsibility in international supply chains. Int. J. Technol. Manag. 2012, 58, 64–82. [Google Scholar] [CrossRef]

- Krueger, D.A. The Ethics of Global Supply Chains in China—Convergences of East and West. J. Bus. Ethics 2008, 79, 113–120. [Google Scholar] [CrossRef]

- United Nations Global Compact Office & BSR. Supply Chain Sustainability: A Practical Guide to Continuous Improvement. Available online: http://supply-chain.unglobalcompact.org/site/article/68 (accessed on 26 February 2014).

- Preuss, L. Codes of Conduct in Organizational Context: From Cascade to Lattice-Work of Codes. J. Bus. Ethics 2010, 94, 471–487. [Google Scholar] [CrossRef]

- Hewlett-Packard (HP). 2011 Global Citizen Report. Available online: http://www8.hp.com/us/en/pdf/hp_fy11_gcr_tcm_245_1357670.pdf (accessed on 10 February 2014).

- Dell. 2011 Dell Corporate Responsibility Report. Available online: http://i.dell.com/sites/doccontent/corporate/corp-comm/en/documents/dell-fy11-cr-report.pdf (accessed on 10 February 2014).

- Acer. 2012 Corporate Responsibility Report. Available online: http://www.acer-group.com/public/Sustainability/pdf/Acer%20CR%20Report%202012_EN.pdf (accessed on 10 February 2014).

- Chang, D.S.; Kuo, L.C.R.; Chen, Y.T. Industrial changes in corporate sustainability performance—An empirical overview using data envelopment analysis. J. Clean. Prod. 2013, 56, 147–155. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J.; Lai, K.H. Initiatives and outcomes of green supply chain management implementation by Chinese manufacturers. J. Environ. Manag. 2007, 85, 179–189. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J. Relationships between operational practices and performance among early adopters of green supply chain management practices in Chinese manufacturing enterprises. J. Oper. Manag. 2004, 22, 265–289. [Google Scholar] [CrossRef]

- Tian, Y.; Govindan, K.; Zhu, Q. A system dynamics model based on evolutionary game theory for green supply chain management diffusion among manufactures. J. Clean. Prod. 2014, 80, 96–105. [Google Scholar] [CrossRef]

- Hsu, C.W.; Hu, A.H. Green supply chain management in the electronic industry. Int. J. Environ. Sci. Technol. 2008, 5, 205–216. [Google Scholar] [CrossRef]

- Srivastava, S.K. Green supply-chain management: A state-of-the-art literature review. Int. J. Manag. Rev. 2007, 9, 53–80. [Google Scholar] [CrossRef]

- Mathiyazhagan, K.; Govindan, K.; Noorul Haq, A. Pressure analysis for green supply chain management implementation in Indian industries using analytic hierarchy process. Int. J. Prod. Res. 2013, 52, 188–202. [Google Scholar] [CrossRef]

- Govindan, K.; Rajendran, S.; Sarkis, J.; Murugesan, P. Multi Criteria Decision Making approaches for green supplier evaluation and selection: A literature review. J. Clean. Prod. 2013. [Google Scholar] [CrossRef]

- Tate, W.L.; Ellram, L.M. Sourcing to Support. The Green Initiative, 1st ed.; Business Expert Press: New York, NY, USA, 2013. [Google Scholar]

- Govindan, K.; Kaliyan, M.; Kannan, D.; Haq, A.N. Barriers analysis for Green Supply Chain Management implementation in Indian Industries Using Analytic Hierarchy Process. Int. J. Prod. Econ. 2014, 147, 555–568. [Google Scholar] [CrossRef]

- Govindan, K.; Devika, K.; Mathiyazhagan, K.; Jabbour, A.B.L.; Jabbour, C.J.C. Analysing green supply chain management practices in Brazil’s electrical/electronics industry using interpretive structural modelling. Int. J. Environ. Stud. 2013, 70, 477–493. [Google Scholar] [CrossRef]

- Subic, A.; Shabani, B.; Hedayati, M.; Crossin, E. Performance Analysis of the Capability Assessment Tool for Sustainable Manufacturing. Sustainability 2013, 5, 3543–3561. [Google Scholar] [CrossRef]

- Plambeck, E.; Lee, H.L.; Yatsko, P. Improving Environmental Performance in Your Chinese Supply Chain. MIT Sloan Manag. Rev. 2012, 53, 43–51. [Google Scholar]

- Electronic Industry Citizenship Coalition (EICC),List Members, 2012. Available online: http://www.eiccoalition.org/about/members/ (accessed on 9 February 2015).

- Hsu, C.W.; Lee, W.H.; Chao, W.C. Materiality analysis model in sustainability reporting: A case study at Lite-On Technology Corporation. J. Clean. Prod. 2013, 57, 142–151. [Google Scholar] [CrossRef]

- Taiwan Semiconductor Manufacturing Company (TSMC). TSMC Joins Electronic Industry Citizenship Coalition. Available online: http://www.tsmc.com/uploadfile/ir/BusinessRelease/0107%20EICC%20E.pdf (accessed on 9 February 2015).

- Asustek, Asustek Joins with EICC to Promote Responsibility across the Supply Chain. Available online: http://csr.asus.com/english/index.aspx (accessed on 9 February 2015).

- Electronic Industry Citizenship Coalition (EICC). Electronic Industry Citizenship Coalition code of conduct v4.0. Available online: http://www.eiccoalition.org/media/docs/EICCCodeofConduct5_English.pdf (accessed on 16 January 2014).

- Electronic Industry Citizenship Coalition (EICC). 2009 EICC Annual Report. Available online: http://www.eiccoalition.org/media/docs/publications/2009AnnualReport.pdf (accessed on 26 September 2014).

- Electronic Industry Citizenship Coalition (EICC). Driving Change for a Sustainable Electronics Industry: 2010 EICC Annual Report. Available online: http://www.eiccoalition.org/media/docs/publications/2010EICCAnnualReport_000.pdf (accessed on 16 September 2014).

- Jabbour, A.B.; Jabbour, C.; Govindan, K.; Kannan, D.; Arantes, A.F. Mixed methodology to analyze the relationship between maturity of environmental management and the adoption of green supply chain management in Brazil. Resour. Conserv. Recycl. 2014, 92, 255–267. [Google Scholar] [CrossRef]

- Jabbour, A.B.L.S.; Jabbour, C.J.C.; Govindan, K.; Kannan, D.; Salgado, M.H.; Zanon, C.J. Factors affecting the adoption of green supply chain management practices in Brazil: Empirical evidence. Int. J. Environ. Stud. 2013, 70, 302–315. [Google Scholar] [CrossRef]

- Lee, K.H.; Kim, J.W. Current Status of CSR in the Realm of Supply Management: The Case of the Korean Electronics Industry. Suppl. Chain Manag. Int. J. 2009, 14, 138–148. [Google Scholar] [CrossRef]

- Market Intelligence & Consulting Institute (MIC). The Trend of Taiwan Notebook Industry in 2011; MIC: Taipei, Taiwan, 2011. (In Chinese) [Google Scholar]

- Market Intelligence & Consulting Institute (MIC). The Trend of Taiwan Notebook Industry in 2014; MIC: Taipei, Taiwan, 2014. (In Chinese) [Google Scholar]

- Market Intelligence & Consulting Institute (MIC). The Trend of Taiwan Desktop Industry in 2011; MIC: Taipei, Taiwan, 2011. (In Chinese) [Google Scholar]

- Market Intelligence & Consulting Institute (MIC). The Development of Taiwan ICT Industry in 2014; MIC: Taipei, Taiwan, 2014. (In Chinese) [Google Scholar]

- Yang, C.; Lin, S.; Chan, Y.; Sheu, C. Mediates effect of environmental management on manufacturing competitiveness: An empirical study. Int. J. Prod. Econ. 2010, 123, 210–220. [Google Scholar] [CrossRef]

- Simchi-Levi, D.; Kaminsky, P.; Simchi-Levi, E. Designing and Managing the Supply Chain: Concepts, Strategies, and Case Studies, 3rd ed.; McGraw-Hill: Boston, MA, USA, 2008. [Google Scholar]

- Hiratsuka, D. Production Networks in Asia: A Case Study from the Hard Disk Drive Industry. Available online: http://www.adbi.org/files/2011.07.28.wp301.production.networks.asia.hard.disk.case.pdf (accessed on 8 May 2014).

- Zhu, Q.; Sarkis, J.; Lai, K.H.; Geng, Y. The role of organizational size in the adoption of green supply chain management practices in China. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 322–337. [Google Scholar] [CrossRef]

- Boyer, K.K.; Ward, P.T.; Leong, G.K. Approaches to the factory of the future: An empirical taxonomy. J. Oper. Manag. 1996, 14, 297–313. [Google Scholar] [CrossRef]

- Rutherford, A. Introducing Anova and Ancova: A GLM Approach; SAGE Publications: London, UK, 2001. [Google Scholar]

- Sullivan, R. The management of greenhouse gas emissions in large European companies. Corp. Soc. Responsib. Environ. Manag. 2009, 16, 301–309. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J. An inter-sectoral comparison of green supply chain management in China: Drivers and practices. J. Clean. Prod. 2006, 14, 472–486. [Google Scholar] [CrossRef]

- Christmann, P.; Taylor, G. Globalization and the environment: Determinants of firm self-regulation in China. J. Int. Bus. Stud. 2001, 32, 439–458. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar]

- Barney, J.; Wrightb, M.; Ketchen, D.J. The resource-based view of the firm: Ten years after 1991. J. Manag. 2001, 28, 625–641. [Google Scholar]

- Christmann, P. Effects of “best practices” of environmental management on cost advantage: The role of complementary assets. Acad. Manag. J. 2000, 43, 663–880. [Google Scholar] [CrossRef]

- The Information and Communications Technology (ICT) Supplier Self-Assessment Questionnaire. Available online: http://www.verite.org/sites/default/files/Session_5A-Self-Assessment_HYUNSU_Mexico_SA%20_de_CV-Guadalajara%20120511.pdf (accessed on 5 March 2015).

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, C.-C.; Yu, Y.-H.; Wernick, I.K.; Chang, C.-Y. Using the Electronic Industry Code of Conduct to Evaluate Green Supply Chain Management: An Empirical Study of Taiwan’s Computer Industry. Sustainability 2015, 7, 2787-2803. https://doi.org/10.3390/su7032787

Liu C-C, Yu Y-H, Wernick IK, Chang C-Y. Using the Electronic Industry Code of Conduct to Evaluate Green Supply Chain Management: An Empirical Study of Taiwan’s Computer Industry. Sustainability. 2015; 7(3):2787-2803. https://doi.org/10.3390/su7032787

Chicago/Turabian StyleLiu, Ching-Ching, Yue-Hwa Yu, Iddo K. Wernick, and Ching-Yuan Chang. 2015. "Using the Electronic Industry Code of Conduct to Evaluate Green Supply Chain Management: An Empirical Study of Taiwan’s Computer Industry" Sustainability 7, no. 3: 2787-2803. https://doi.org/10.3390/su7032787

APA StyleLiu, C.-C., Yu, Y.-H., Wernick, I. K., & Chang, C.-Y. (2015). Using the Electronic Industry Code of Conduct to Evaluate Green Supply Chain Management: An Empirical Study of Taiwan’s Computer Industry. Sustainability, 7(3), 2787-2803. https://doi.org/10.3390/su7032787