Sustainable Trade Credit and Replenishment Policies under the Cap-And-Trade and Carbon Tax Regulations

Abstract

:1. Introduction

2. Literature Review

3. Notations and Assumptions

3.1. Assumptions

- (1)

- Replenishment is instantaneous; shortage is not allowed.

- (2)

- The retailer provides the trade credit period to its customers.

- (3)

- Market demand: Demand follows the form of , where is a scaling factor, is a constant that governs the increasing rate of the demand with respect to the credit period, and reflects the demand decreasing with the carbon emissions. The carbon emission-dependent demand that is usually considered has a linear form [8]. The credit-dependent demand is used in three forms: linear, polynomial, and exponential [55]. This form of linear demand function has been used in other aspects (i.e., demand related to the price and environmental performance) [54].

- (4)

- The retailer would face the risk of a customers’ inability to pay off debt obligations when the retailer offers a credit period to its customers. The default risk, in which the retailer cannot receive all the receivables, is higher when the credit period offered by the retailer is longer. Three methods are used to express the increasing default risk with respect to the credit period: linear, polynomial, or exponential. The rate of the default risk given the credit period is , where [36,37,38].

- (5)

- (6)

- The retailer is assumed to be a rational man and the effect of social responsibility is not considered. Therefore, the retailer maximizes its profit to make decisions.

- (7)

3.2. Notations

| Notations | Meaning | |

|---|---|---|

| Input parameters | Unit selling price | |

| Uit purchasing price of the seller | ||

| Ordering cost of per order for the seller | ||

| Unit holding cost for the seller, excluding interest charges | ||

| Replenishment period for the seller | ||

| Trade price of unit carbon emissions | ||

| Carbon emissions cap | ||

| Tax rate of unit carbon emission | ||

| Market annual demand | ||

| Carbon emissions of per order for the retailer | ||

| Per unit carbon emission of purchased or produced product | ||

| Per unit carbon emission of held in inventory per unit time | ||

| Output | Q | Replenishment quantity for the seller, decision variable |

| Trade credit period offered to the consumers by the retailer, decision variable | ||

| Total carbon emissions | ||

| Annual profit of the enterprise with i = 1,2,3: 1 for no regulation, 2 for carbon cap and trade regulation, and 3 for carbon tax regulation |

4. Mathematical Model

5. Optimal Solutions with Exogenous Trade Credit

5.1. Case 1: Without Carbon Emissions Regulation

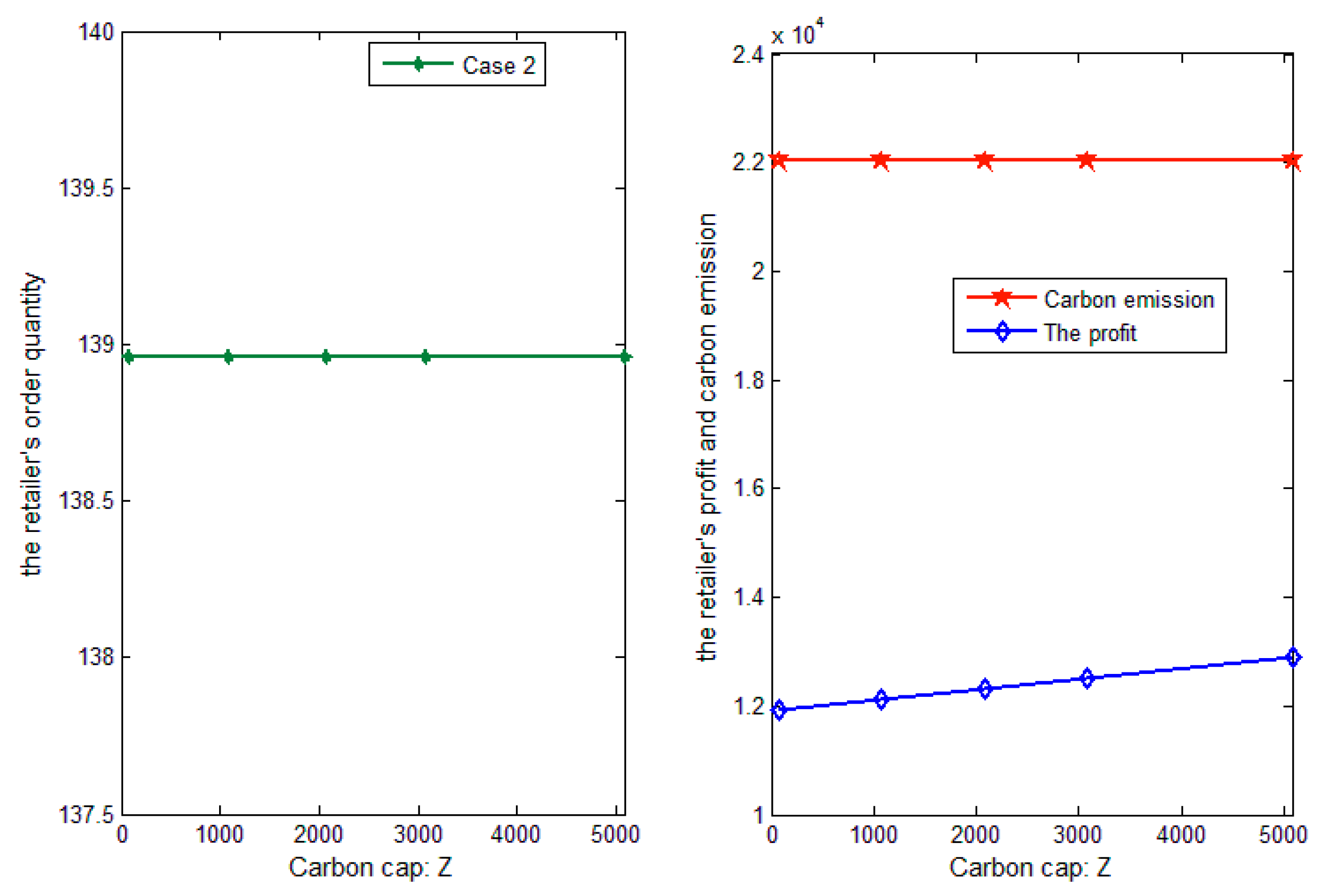

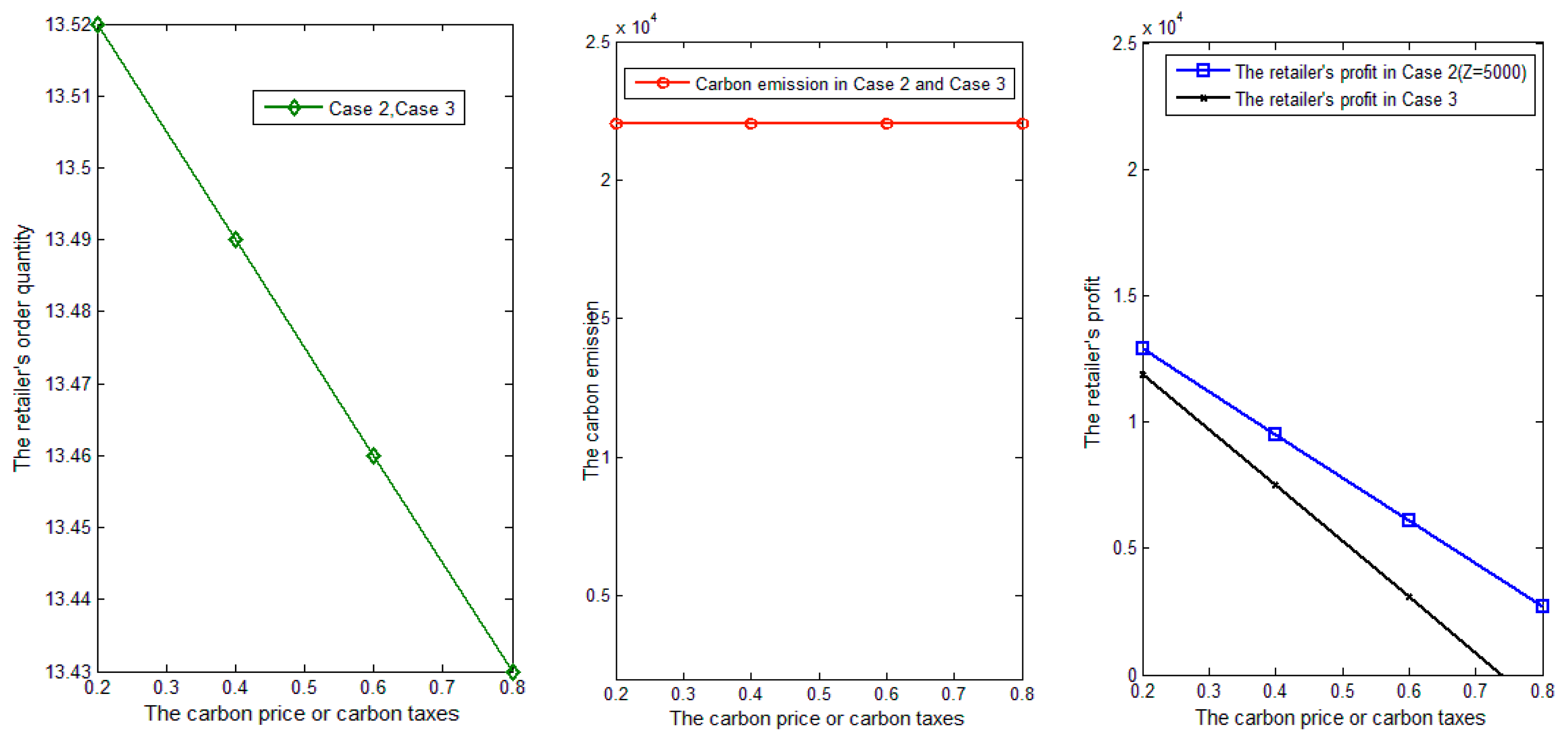

5.2. Case 2: Carbon Cap-and-Trade Regulation

5.3. Case 3: Carbon Tax Regulation

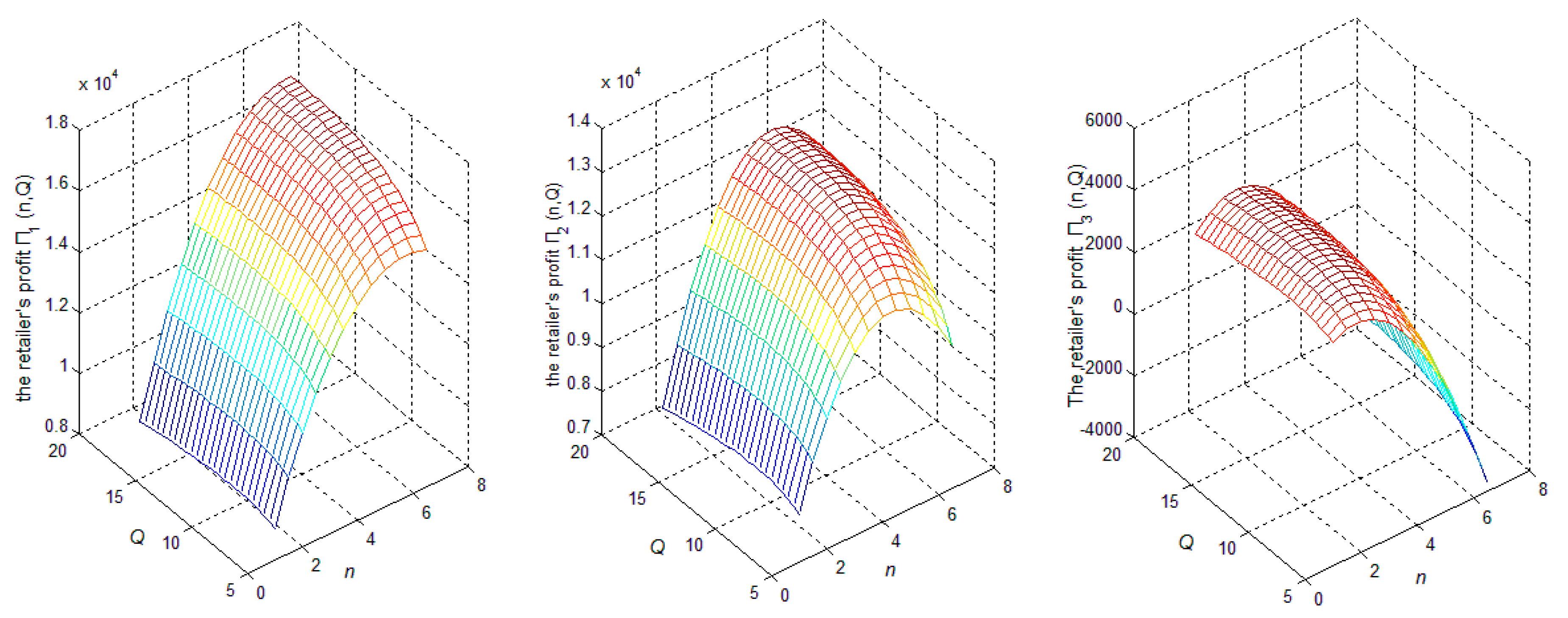

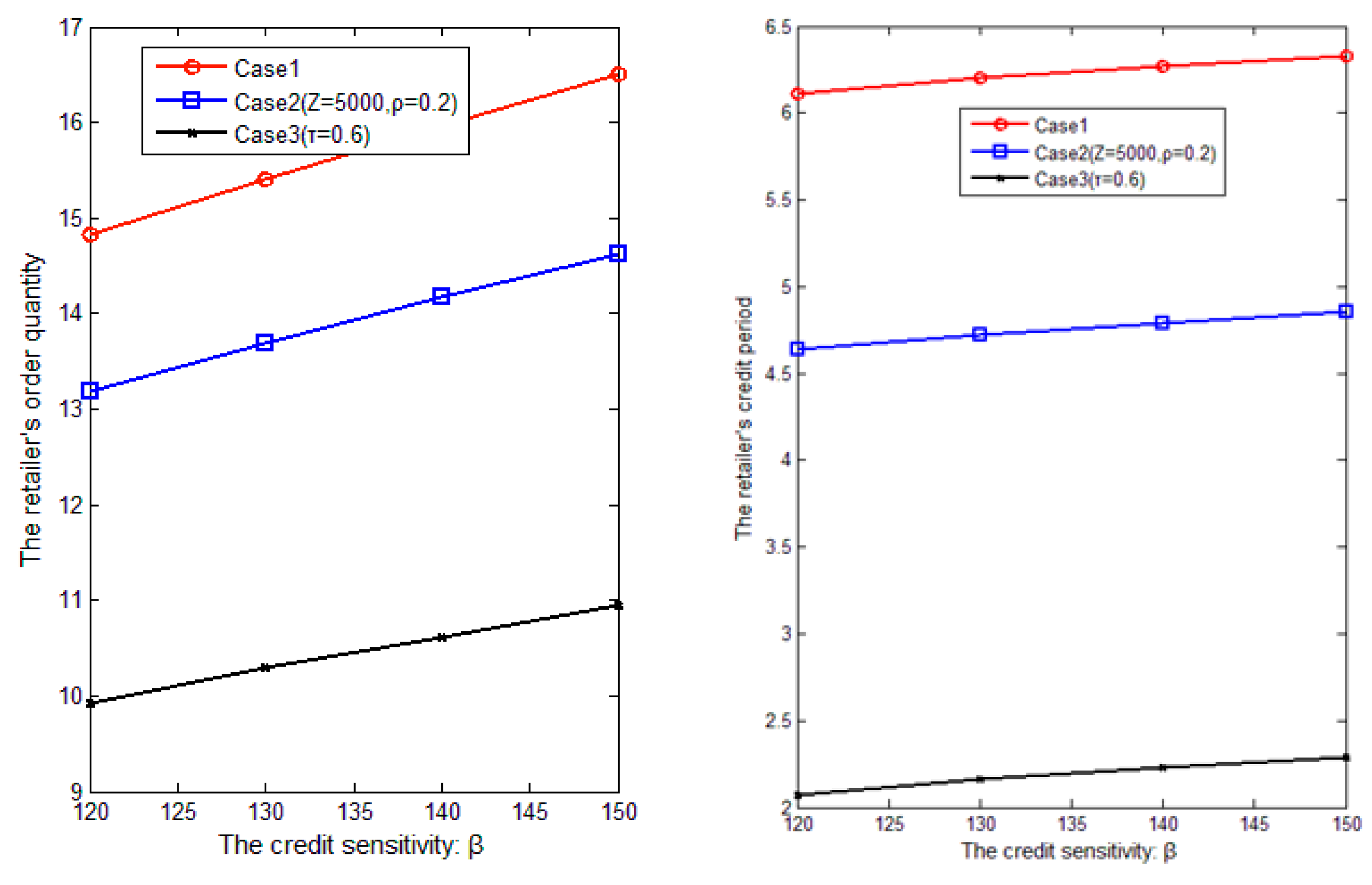

6. Optimal Solutions with Endogenous Trade Credit

6.1. Case 1: Without Carbon Emissions Regulation

- (1)

- is concave function with .

- (2)

- If , then the optimal credit period n*=0.

- (3)

- If 0, then the optimal credit period n*=.

6.2. Case 2: Carbon Cap-and-Trade Regulation

- (1)

- is concave function with .

- (2)

- If , then the optimal credit period n*=0.

- (3)

- If 0, then the optimal credit period n*=.

6.3. Case 3: Carbon Tax Regulation

- (1)

- is concave function with .

- (2)

- If , then the optimal credit period n*=0.

- (3)

- If 0, then the optimal credit period n*=.

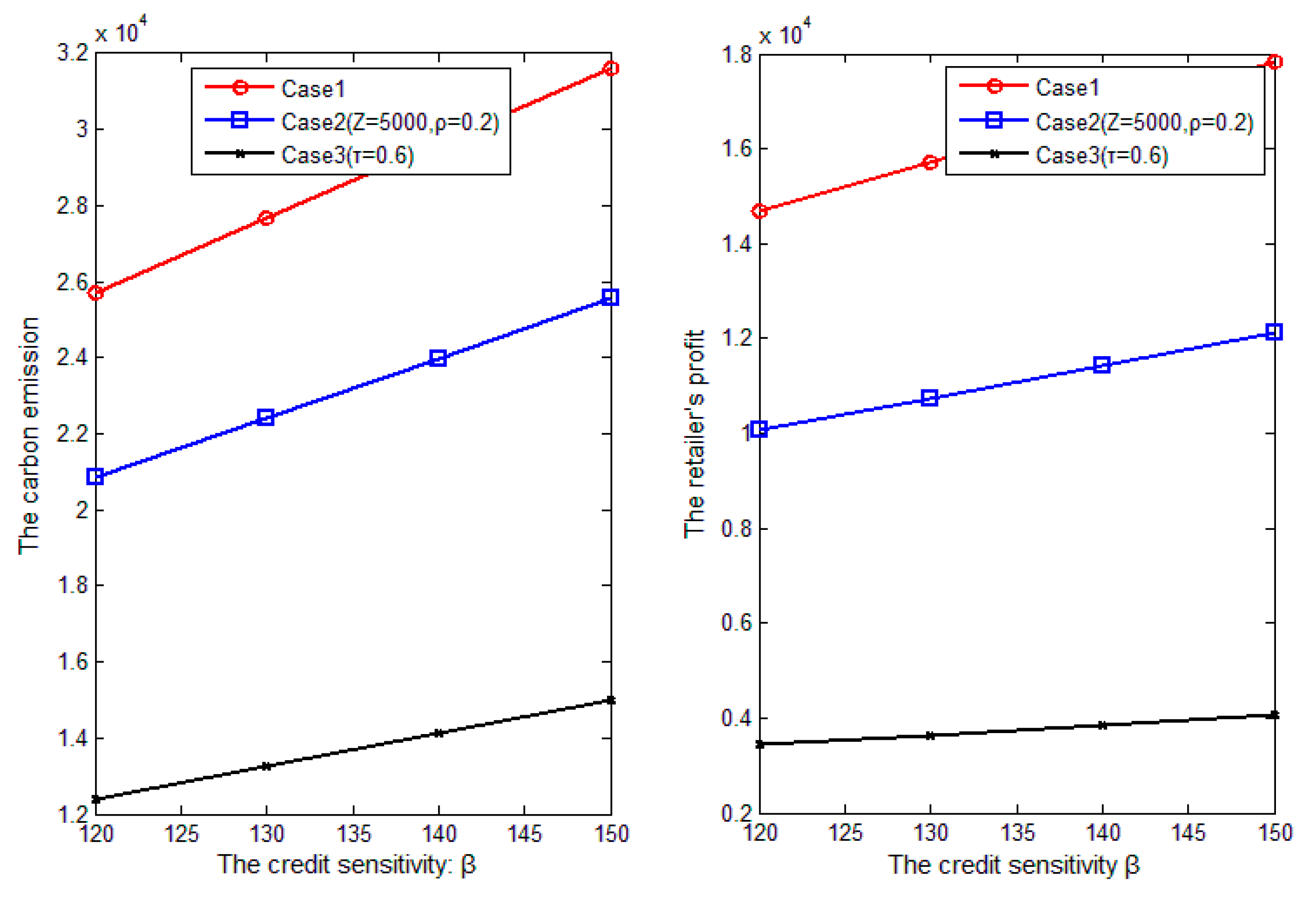

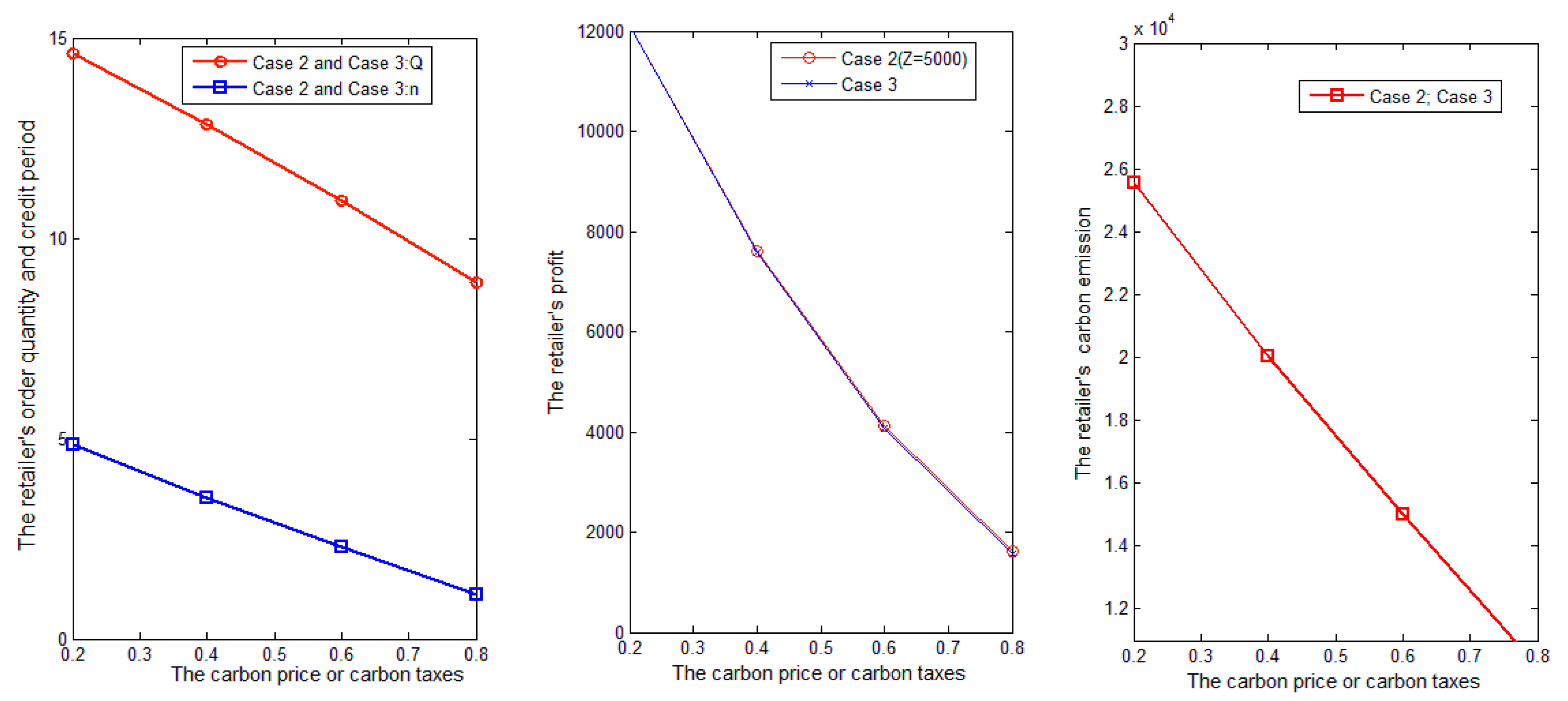

7. Numerical Analysis

7.1. Sensitivity Analysis of One Parameter

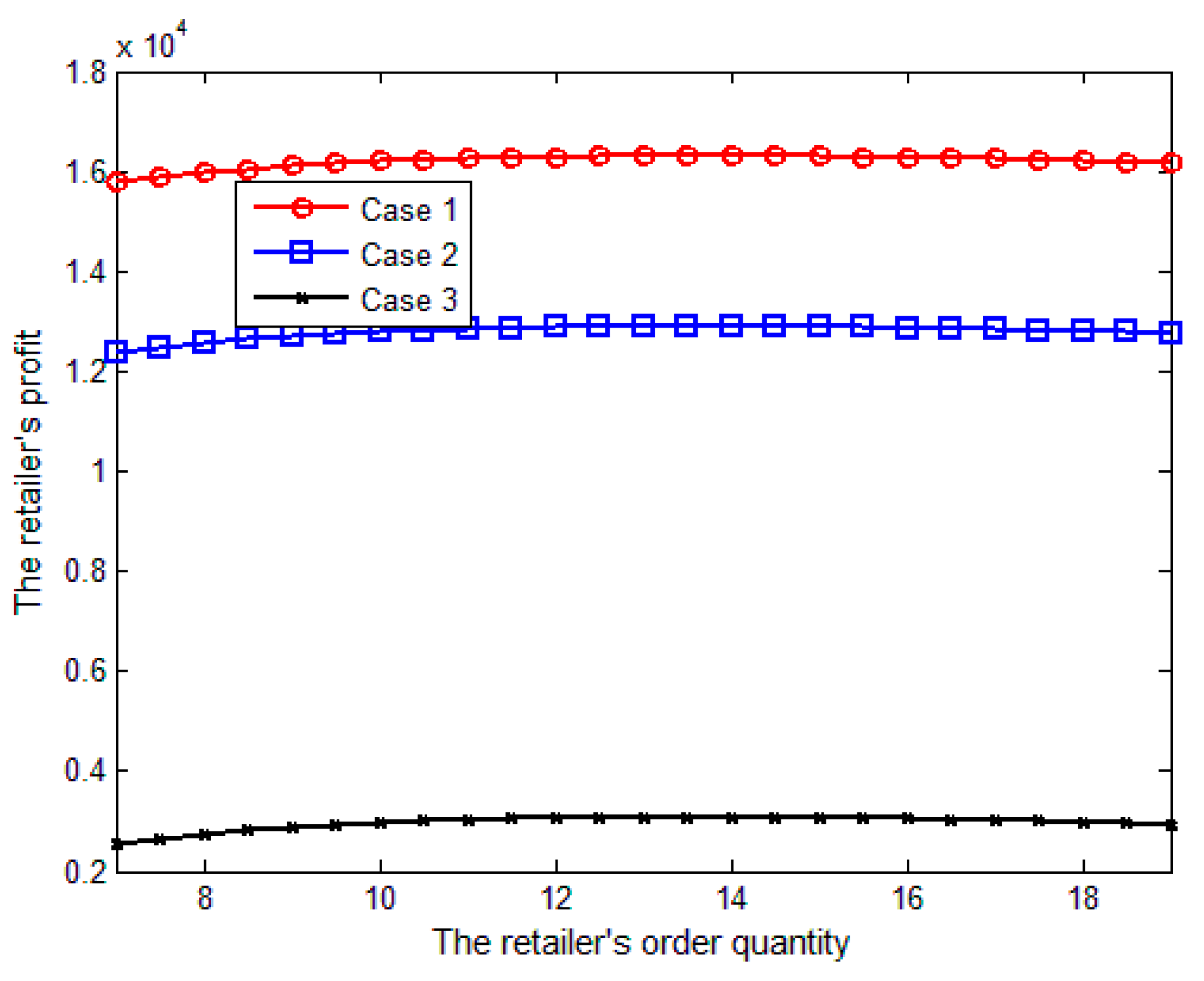

7.1.1. Exogenous Credit Period

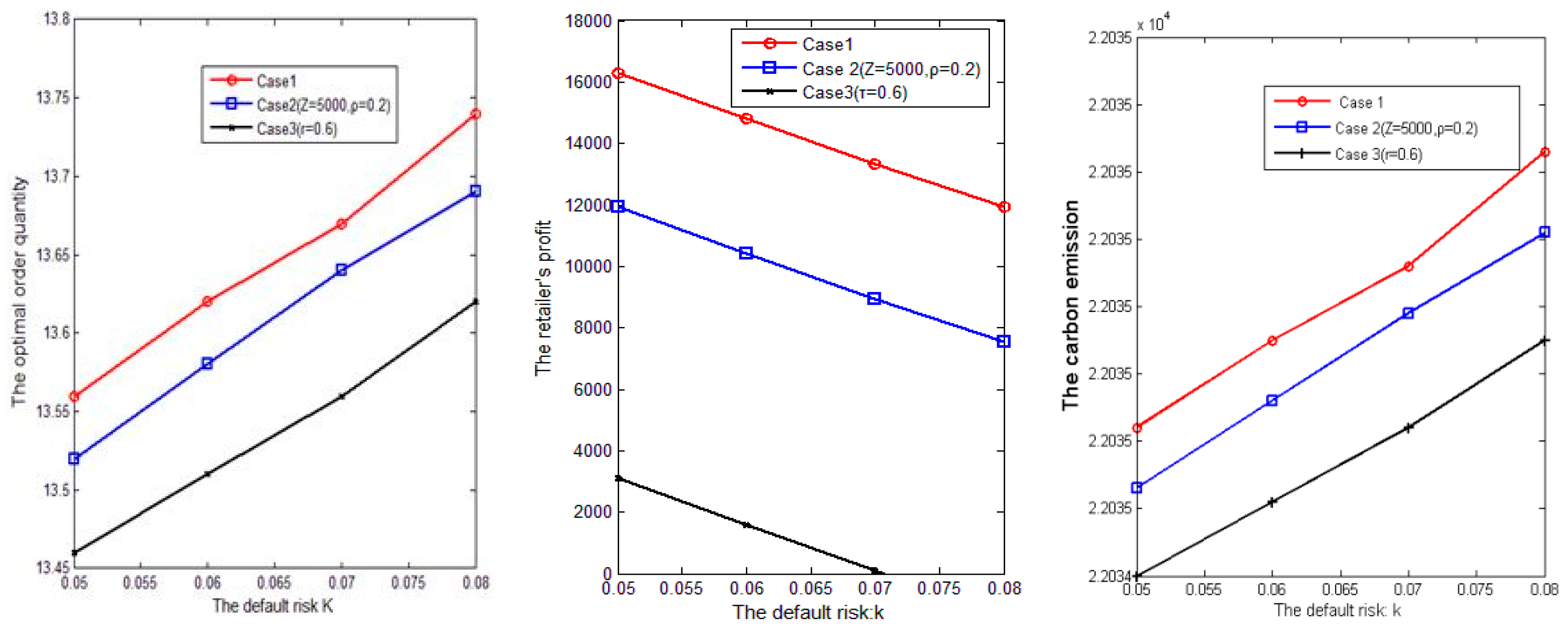

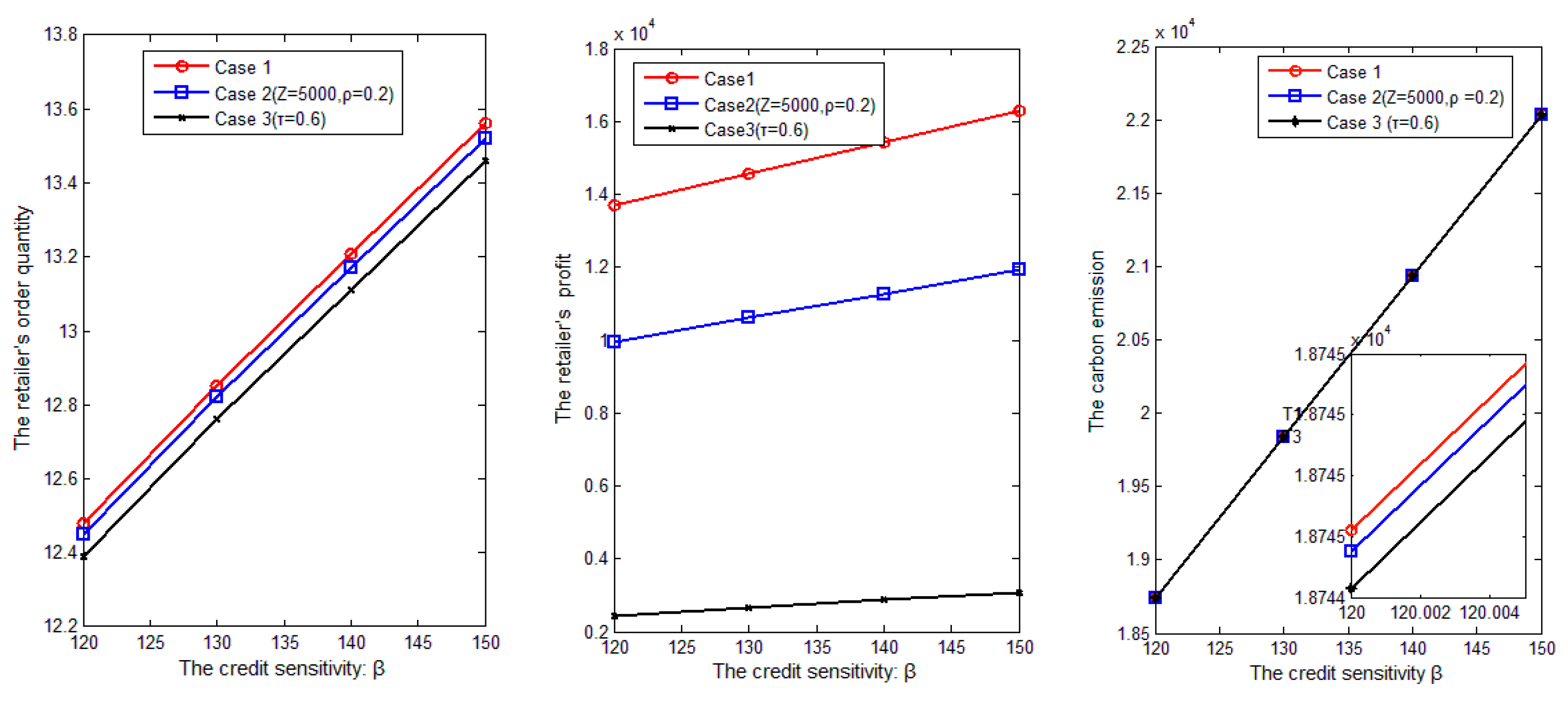

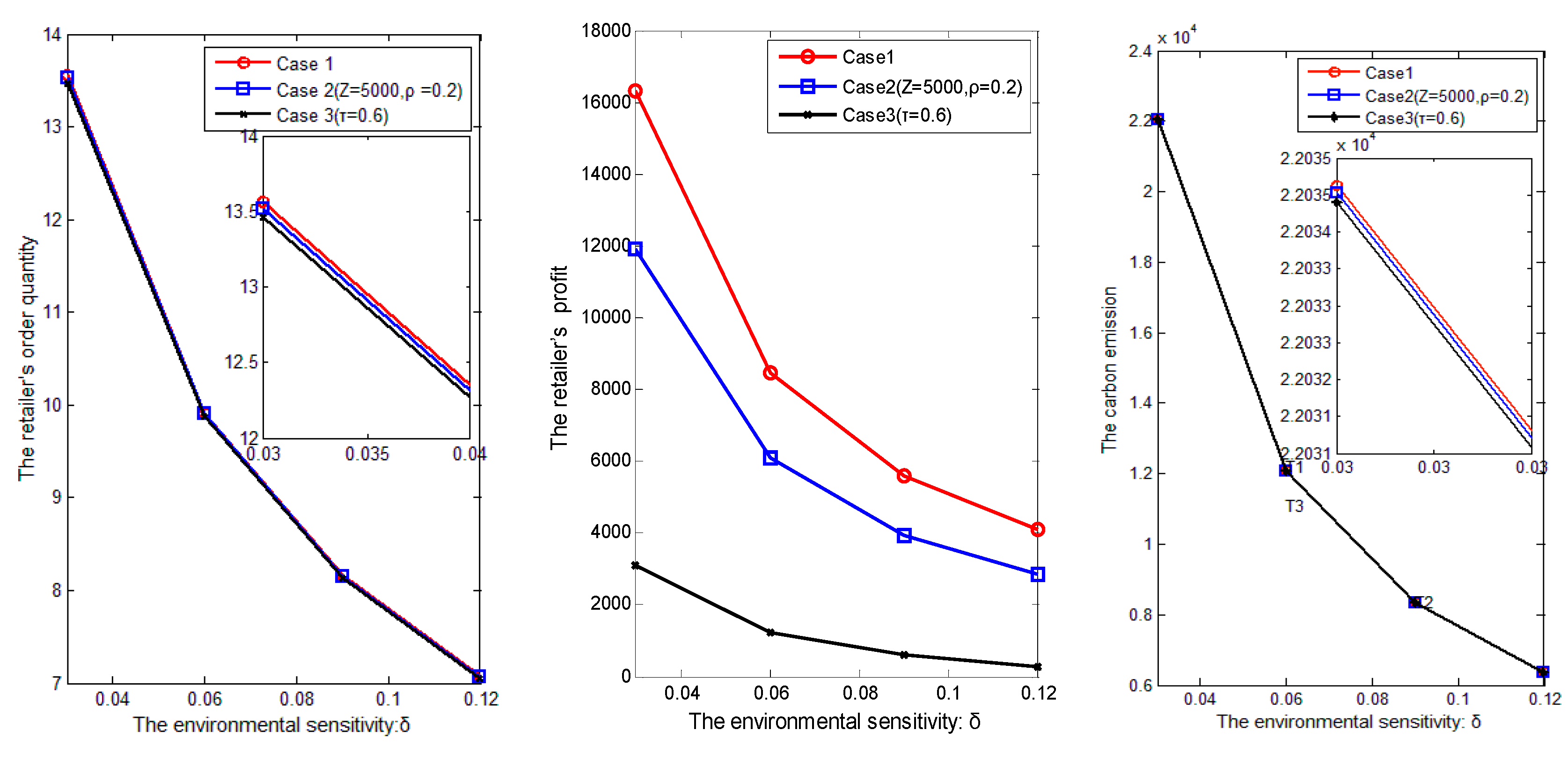

7.1.2. Endogenous Credit Period

7.2. Sensitivity Analysis of Multi Parameters: Monte Carlo Approach

| Adjusted Value | ||||

|---|---|---|---|---|

| 10% | −10% | 20% | −20% | |

| −0.0125 | 0.0147 | −0.0228 | 0.0339 | |

| 0.0018 | −0.0012 | 0.0026 | −0.0023 | |

| 0.0420 | −0.1991 | 0.1569 | −0.4637 | |

| Z | −1.23 × 10−9 | 2.96 × 10−9 | −9.10 × 10−10 | 5.87 × 10−10 |

| 0.0115 | −0.0535 | 0.0388 | −0.0732 | |

| Adjusted Value | ||||

|---|---|---|---|---|

| 10% | −10% | 20% | −20% | |

| −0.0429 | 0.0488 | −0.0929 | 0.1023 | |

| 0.0274 | −0.0766 | 0.0667 | −0.1423 | |

| 0.0306 | −0.0657 | 0.0800 | −0.1545 | |

| Z | 2.71 × 10−8 | 1.37 × 10−8 | −8.61 × 10−8 | 3.81 × 10−8 |

| 0.0101 | −0.0192 | 0.0226 | −0.0284 | |

| Adjusted Value | ||||

|---|---|---|---|---|

| 10% | −10% | 20% | −20% | |

| −0.0961 | 0.0921 | −0.1896 | 0.1887 | |

| 0.0027 | −0.2119 | 0.0898 | −0.4215 | |

| 0.0418 | −0.1569 | 0.1362 | −0.3741 | |

| Z | −8.58 × 10−10 | 2.44 × 10−9 | −8.16 × 10−10 | 4.95 × 10−9 |

| 0.0122 | −0.0412 | 0. 0347 | −0.0579 | |

| Adjusted Value | ||||

|---|---|---|---|---|

| 10% | −10% | 20% | −20% | |

| −0.0867 | 0.0831 | −0.1718 | 0.1693 | |

| 0.0045 | −0.2175 | 0.0894 | −0.4436 | |

| 0.0406 | −0.1398 | 0.1250 | −0.3389 | |

| Z | −0.0067 | 0.0066 | −0.0129 | 0.0131 |

| 0.0082 | −0.0711 | 0.0412 | −0.0974 | |

8. Conclusions

Acknowledgments

Author Contributions

Conflict of Interests

References

- IPCC. Climate Change 2007: The Physical Science Basis, 2007. Available online: http://www.slvwd.com/agendas/Full/2007/06-07-07/Item%2010b.pdf (accessed on 4 December 2015).

- Toptal, A.; Özlü, H.; Konur, D. Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. Int. J. Prod. Res. 2014, 52, 243–269. [Google Scholar] [CrossRef] [Green Version]

- He, P.; Zhang, W.; Xu, X. Production lot-sizing and carbon emissions under cap-and-trade and carbon tax regulations. J. Clean. Prod. 2015, 103, 241–248. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon footprint and the management of supply chains: Insights from simple models. IEEE Trans. Autom. Sci. Eng. 2013, 10, 99–116. [Google Scholar] [CrossRef]

- Avi-Yonah, R.S.; Uhlmann, D.M. Combating Global Climate Change: Why a Carbon Tax is a Better Response to Global Warming than Cap and Trade, 2009. Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1333673 (accessed on 4 December 2015).

- Cholette, S.; Venkat, K. The energy and carbon intensity of wine distribution: A study of logistical options for delivering wine to consumers. J. Clean. Prod. 2009, 17, 1401–1413. [Google Scholar] [CrossRef]

- Stock, J.R.; Boyer, S.L.; Harmon, T. Research opportunities in supply chain management. J. Acad. Mark. Sci. 2010, 38, 32–41. [Google Scholar] [CrossRef]

- Petersen, M.A.; Rajan, R.G. Trade credit: Theories and evidence. Rev. Financ. Stud. 1997, 10, 661–691. [Google Scholar] [CrossRef]

- Williams, F. World bank urged to lift trade credit finance. Financial Times, 11 November 2008. [Google Scholar]

- Yang, S.A.; Birge, J.R. How Inventory is (Should be) Financed: Trade Credit in Supply Chains with Demand Uncertainty and Costs of Financial Distress, 2013. Available online: http://dx.doi.org/10.2139/ssrn.1734682 (accessed on 4 December 2015).

- Miller, R. Does everyone have a price. Marketing 1997, 24, 30–33. [Google Scholar]

- Hovelaque, V.; Bironneau, L. The carbon-constrained EOQ model with carbon emission dependent demand. Int. J. Prod. Econ. 2015, 164, 285–291. [Google Scholar] [CrossRef]

- Upham, P.; Dendler, L.; Bleda, M. Carbon labelling of grocery products: public perceptions and potential emissions reductions. J. Clean. Prod. 2011, 19, 348–355. [Google Scholar] [CrossRef]

- Bemporad, R.; Baranowski, M. Conscious Consumers are Changing the Rules of Marketing. Are You Ready? 2007. Available online: https://www.fmi.org/docs/sustainability/BBMG_Conscious_Consumer_White_Paper.pdf (accessed on 4 December 2015).

- Pontin, J. Q&A with Bill Gates. Available online: http://www.technologyreview.com/qa/420342/qa-bill-gates/ (accessed on 4 December 2015).

- Covert, R.P.; Philip, G.C. An EOQ model for items with Weibull distribution deterioration. AIIE Trans. 1973, 5, 323–326. [Google Scholar] [CrossRef]

- Huang, Y.F. Optimal retailer’s ordering policies in the EOQ model under trade credit financing. J. Op. Res. Soc. 2003, 54, 1011–1015. [Google Scholar] [CrossRef]

- Goyal, S.K. Economic order quantity under conditions of permissible delay in payments. J. Op. Res. Soc. 1985, 36, 335–338. [Google Scholar] [CrossRef]

- Chu, P.; Chang, K.H.; Lan, S.P. Economic order quantity of deteriorating items under permissible delay in payments. Comput. Op. Res. 1998, 25, 817–824. [Google Scholar] [CrossRef]

- Jamal, A.M.; Sarker, B.R.; Wang, S. An ordering policy for deteriorating items with allowable shortage and permissible delay in payment. J. Op. Res. Soc. 1997, 48, 826–833. [Google Scholar] [CrossRef]

- Teng, J.T.; Chang, C.T.; Chern, M.S. Vendor–buyer inventory models with trade credit financing under both non-cooperative and integrated environments. Int. J. Syst. Sci. 2012, 43, 2050–2061. [Google Scholar] [CrossRef]

- Liao, J.J.; Huang, K.N.; Chung, K.J. Lot-sizing decisions for deteriorating items with two warehouses under an order-size-dependent trade credit. Int. J. Prod. Econ. 2012, 137, 102–115. [Google Scholar] [CrossRef]

- Tsao, Y.C.; Chen, T.H.; Zhang, Q.H. Effects of maintenance policy on an imperfect production system under trade credit. Int. J. Prod. Res. 2013, 51, 1549–1562. [Google Scholar]

- Cárdenas-Barrón, L.E. The economic production quantity (EPQ) with shortage derived algebraically. Int. J. Prod. Econ. 2001, 70, 289–292. [Google Scholar] [CrossRef]

- Chung, K.J.; Huang, Y.F. The optimal cycle time for EPQ inventory model under permissible delay in payments. Int. J. Prod. Econ. 2003, 84, 307–318. [Google Scholar] [CrossRef]

- Ho, C. H.; Ouyang, L.Y.; Su, C.H. Optimal pricing, shipment and payment policy for an integrated supplier-buyer inventory model with two-part trade credit. Eur. J. Op. Res. 2008, 187, 496–510. [Google Scholar] [CrossRef]

- Chung, K.J.; Liao, J.J. The simplified solution algorithm for an integrated supplier buyer inventory model with two-part trade credit in a supply chain system. Eur. J. Op. Res. 2011, 213, 156–165. [Google Scholar] [CrossRef]

- Sarkar, B. An EOQ model with delay in payments and time varying deterioration rate. Math. Comput. Model. 2012, 55, 367–377. [Google Scholar] [CrossRef]

- Min, J.; Zhou, Y.W.; Liu, G.Q. An EPQ model for deteriorating items with inventory-level-dependent demand and permissible delay in payments. Int. J. Syst. Sci. 2012, 43, 1039–1053. [Google Scholar] [CrossRef]

- Soni, N.H. Optimal replenishment policies for non-instantaneous deteriorating items with price and stock sensitive demand under permissible delay in payment. Int. J. Prod. Econ. 2013, 146, 259–268. [Google Scholar] [CrossRef]

- Su, C.H.; Ouyang, L.Y.; Ho, C.H.; Chang, C.T. Retailer’s inventory policy and supplier’s delivery policy under two-level trade credit strategy. Asia. Pac. J. Op. Res. 2007, 24, 613–630. [Google Scholar] [CrossRef]

- Jaggi, C.K.; Goyal, S.K.; Goel, S.K. Retailer’s optimal replenishment decisions with credit-linked demand under permissible delay in payments. Eur. J. Op. Res. 2008, 190, 130–135. [Google Scholar] [CrossRef]

- Jaggi, C.K.; Kapur, P.K.; Goyal, S.K.; Goel, S.K. Optimal replenishment and credit policy in EOQ model under two-levels of trade credit policy when demand is influenced by credit period. Int. J. Syst. Assur. Eng. Manag. 2012, 3, 352–359. [Google Scholar] [CrossRef]

- Thangam, A.; Uthayakumar, R. Two-echelon trade credit financing for perishable items in a supply chain when demand depends on both selling price and credit period. Comput. Ind. Eng. 2009, 57, 773–786. [Google Scholar] [CrossRef]

- Giri, B.C.; Maiti, T. Supply chain model with price-and trade credit-sensitive demand under two-level permissible delay in payments. Int. J. Syst. Sci. 2013, 44, 937–948. [Google Scholar] [CrossRef]

- Lou, K.R.; Wang, W.C. Optimal trade credit and order quantity when trade credit impacts on both demand rate and default risk. J. Oper. Res. Soc. 2012, 64, 1551–1556. [Google Scholar] [CrossRef]

- Wu, J.; Chan, Y.L. Lot-sizing policies for deteriorating items with expiration dates and partial trade credit to credit-risk customers. Int. J. Prod. Econ. 2014, 155, 292–301. [Google Scholar] [CrossRef]

- Wu, J.; Ouyang, L.Y.; Barron, L.; Goyal, S. Optimal credit period and lot size for deteriorating items with expiration dates under two level trade credit financing. Eur. J. Op. Res. 2014, 237, 898–908. [Google Scholar] [CrossRef]

- Zhang, Q.; Dong, M.; Luo, J.; Segerstedt, A. Supply chain coordination with trade credit and quantity discount incorporating default risk. Int. J. Prod. Econ. 2014, 153, 352–360. [Google Scholar] [CrossRef]

- Liu, Z.L.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Op. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Glock, C.H.; Jaber, M.Y.; Searcy, C. Sustainability strategies in an EPQ model with price-and quality-sensitive demand. Int. J. Logist. Manag. 2012, 23, 340–359. [Google Scholar] [CrossRef]

- Swami, S.; Shah, J. Channel coordination in green supply chain management. J. Op. Res. Soc. 2012, 64, 336–351. [Google Scholar] [CrossRef]

- Nouira, I.; Frein, Y.; Hadj-Alouane, A.B. Optimization of manufacturing systems under environmental considerations for a greenness-dependent demand. Int. J. Prod. Econ. 2014, 150, 188–198. [Google Scholar] [CrossRef]

- Zhang, L.; Wang, J.; You, J. Consumer environmental awareness and channel coordination with two substitutable products. Eur. J. Op. Res. 2015, 241, 63–73. [Google Scholar]

- Du, S.; Zhu, J.; Jiao, H.; Ye, W. Game-theoretical analysis for supply chain with consumer preference to low carbon. Int. J. Prod. Res. 2015, 53, 3753–3768. [Google Scholar] [CrossRef]

- He, L.; Zhao, D.; Xia, L. Game Theoretic Analysis of Carbon Emission Abatement in Fashion Supply Chains Considering Vertical Incentives and Channel Structures. Sustainability 2015, 7, 4280–4309. [Google Scholar]

- Hua, G.; Cheng, T.C.E.; Wang, S. Managing carbon footprints in inventory management. Int. J. Prod. Econ. 2011, 132, 178–185. [Google Scholar] [CrossRef]

- Hua, G.; Qiao, H.; Jian, L. Optimal order lot sizing and pricing with carbon trade. 2011. Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1796507 (accessed on 4 December 2015).

- Song, J.; Leng, M. Analysis of the single-period problem under carbon emissions policies. In Handbook of Newsvendor Problems; Springer: New York, NY, USA, 2012; pp. 297–313. [Google Scholar]

- Arslan, M.; Metin, T. EOQ revisited with sustainability considerations. Found. Comput. Decis. Sci. 2013, 38, 223–249. [Google Scholar]

- Chen, X.; Benjaafar, S.; Elomri, A. The carbon-constrained EOQ. Op. Res. Lett. 2013, 41, 172–179. [Google Scholar] [CrossRef]

- Dye, C.Y.; Yang, C.T. Sustainable trade credit and replenishment decisions with credit-linked demand under carbon emission constraints. Eur. J. Op. Res. 2015, 244, 187–200. [Google Scholar] [CrossRef]

- Teng, J.T.; Lou, K.R.; Wang, L. Optimal trade credit and lot size policies in economic production quantity models with learning curve production costs. Int. J. Prod. Econ. 2014, 155, 318–323. [Google Scholar] [CrossRef]

- Zanoni, S.; Mazzoldi, L.; Zavanella, L.E.; Jaber, M.Y. A joint economic lot size model with price and environmentally sensitive demand. Prod. Manuf. Res. 2014, 2, 341–354. [Google Scholar]

- Samsudin, M.D.M.; Don, M.M. Assessment of bioethanol yield by S. cerevisiae grown on oil palm residues: Monte Carlo simulation and sensitivity analysis. Bioresour. Technol. 2015, 175, 417–423. [Google Scholar] [CrossRef] [PubMed]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qin, J.; Bai, X.; Xia, L. Sustainable Trade Credit and Replenishment Policies under the Cap-And-Trade and Carbon Tax Regulations. Sustainability 2015, 7, 16340-16361. https://doi.org/10.3390/su71215818

Qin J, Bai X, Xia L. Sustainable Trade Credit and Replenishment Policies under the Cap-And-Trade and Carbon Tax Regulations. Sustainability. 2015; 7(12):16340-16361. https://doi.org/10.3390/su71215818

Chicago/Turabian StyleQin, Juanjuan, Xiaojian Bai, and Liangjie Xia. 2015. "Sustainable Trade Credit and Replenishment Policies under the Cap-And-Trade and Carbon Tax Regulations" Sustainability 7, no. 12: 16340-16361. https://doi.org/10.3390/su71215818