Exploring the Impact of Complementary Assets on the Environmental Performance in Manufacturing SMEs

Abstract

:1. Introduction

How Do Complementary Assets Support SMEs to Improve Their Environmental Performance?

2. Environmental Innovation of SMEs

2.1. Environmental Innovation and Labor Productivity

2.2. Business-Group Affiliation and Labor Productivity

3. Moderating Effects on Environmental Performance

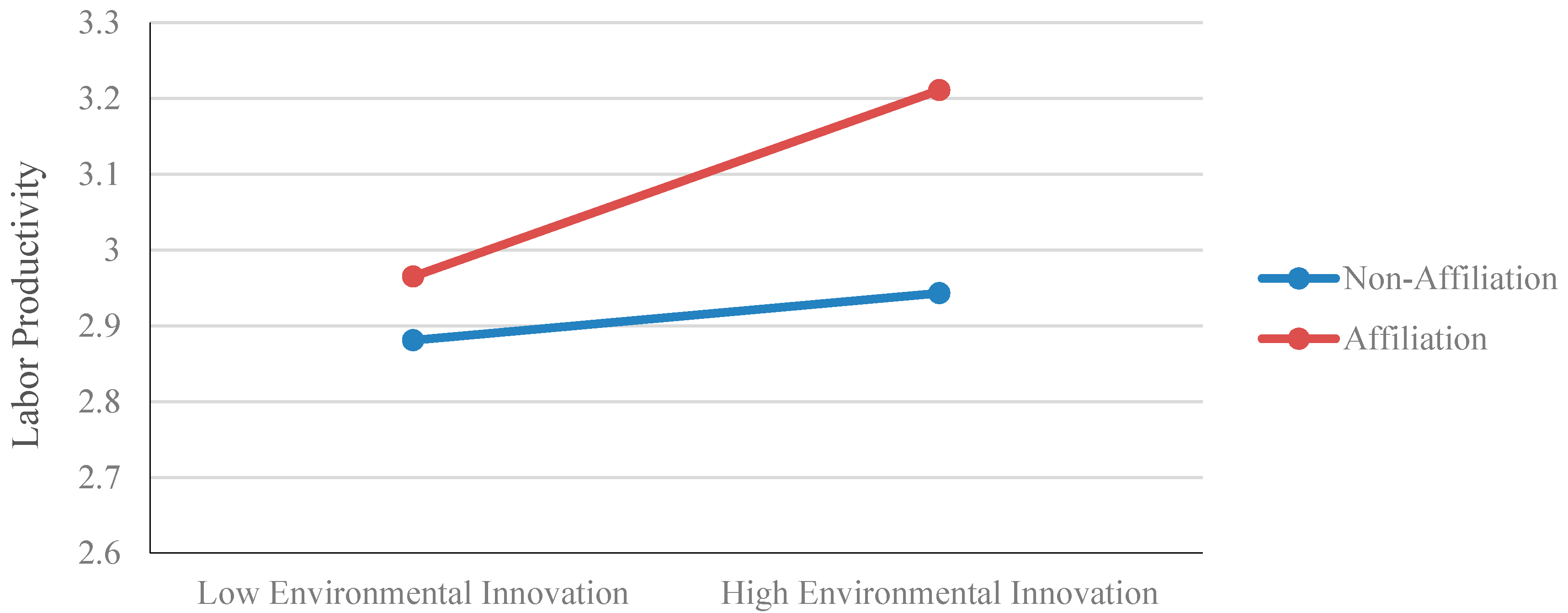

3.1. Business-Group Affiliation

Hypothesis 1: Business-group affiliation positively moderates the relationship between environmental innovation and labor productivity.

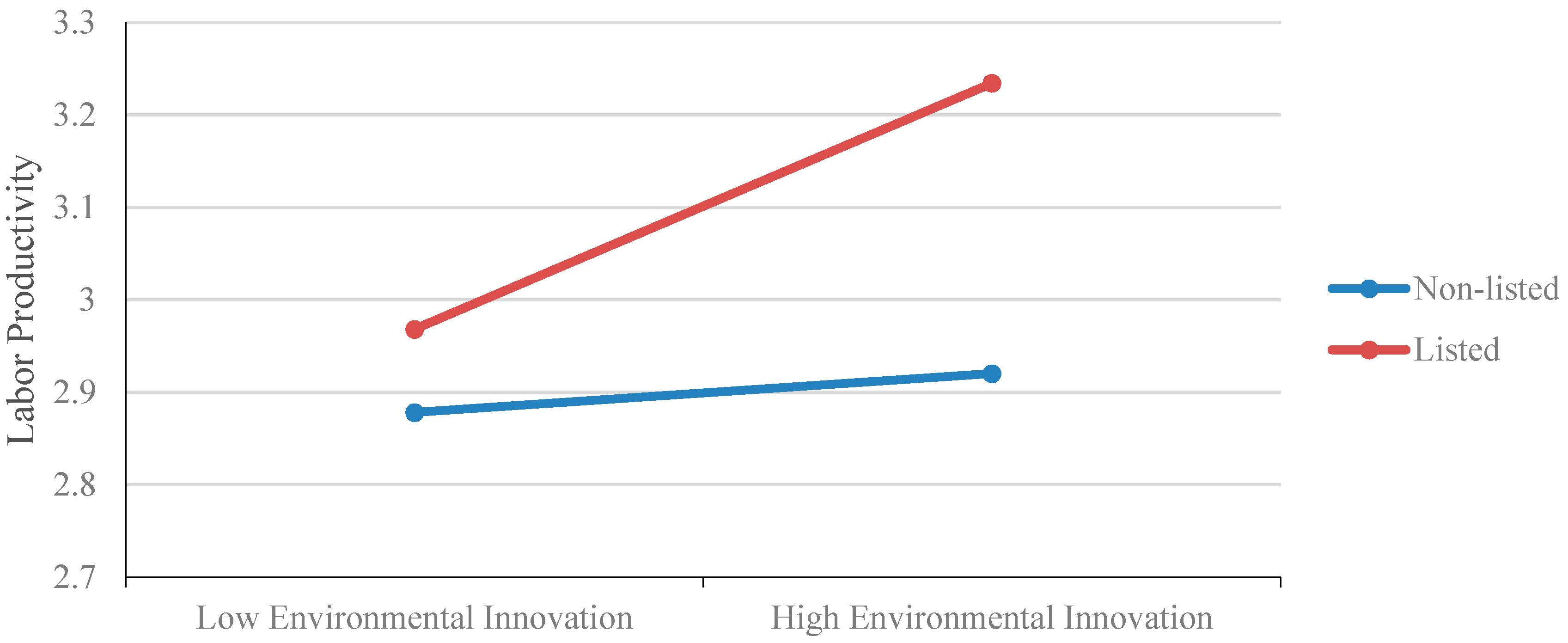

3.2. Listing Status

Hypothesis 2: A market listing positively moderates the relationship between environmental innovation and labor productivity.

4. Methodology

4.1. Sample and Data Collection

4.2. Measurements

4.2.1. Labor Productivity

4.2.2. Environmental Innovation

4.2.3. Control Variables

4.2.4. Interaction Terms

5. Empirical Results

| Title | Mean | S.D | EI | AGE | RDIN | SIZE | AFFIL | LIST | LPROD |

|---|---|---|---|---|---|---|---|---|---|

| EI | 0.360 | 0.479 | 1 | 0.087 ** | 0.051 * | 0.176 ** | 0.060 ** | 0.090 ** | 0.151 ** |

| AGE | 14.330 | 9.827 | 1 | −0.068 ** | 0.308 ** | 0.000 | 0.155 ** | 0.181 ** | |

| RDIN | 0.568 | 1.539 | 1 | −0.092 ** | −0.067 ** | 0.123 ** | 0.077 ** | ||

| SIZE | 3.663 | 1.031 | 1 | 0.215 ** | 0.323 ** | 0.138 ** | |||

| AFFIL | 0.040 | 0.187 | 1 | 0.037 * | 0.094 ** | ||||

| LIST | 0.050 | 0.209 | 1 | 0.157 ** | |||||

| LPROD | 5.215 | 0.871 | 1 |

| Dependent Variable = Ln (sales/employees) | Model 1 | Model 2 | Model 3 | |||

|---|---|---|---|---|---|---|

| Independent variable | Coefficient | t | Coefficient | t | Coefficient | t |

| Constant | 4.852 | 73.834 | 5.010 | 71.853 | 5.010 | 71.986 |

| EI | 0.119 *** | 3.773 | 0.117 *** | 3.759 | 0.105 *** | 3.340 |

| AGE | 0.007 *** | 4.458 | 0.008 *** | 4.724 | 0.008 *** | 4.744 |

| RDIN | 0.062 *** | 5.818 | 0.058 *** | 5.446 | 0.058 *** | 5.387 |

| SIZE | 0.143 *** | 8.724 | 0.100 *** | 5.704 | 0.099 *** | 5.678 |

| AFFIL | 0.329 *** | 4.510 | 0.276 *** | 3.428 | ||

| LIST | 0.291 *** | 4.736 | 0.248 *** | 3.815 | ||

| EI * AFFIL | 0.264 * | 1.836 | ||||

| EI * LIST | 0.258 ** | 2.303 | ||||

| HT | −0.377 *** | −8.587 | −0.401 *** | −9.171 | −0.395 *** | −9.044 |

| MHT | −0.187 *** | −3.907 | −0.187 *** | −3.939 | −0.184 *** | −3.883 |

| LT | −0.204 *** | −4.893 | −0.203 *** | −4.938 | −0.204 *** | −4.969 |

| N | 1656 | 1656 | 1656 | |||

| R squared | 0.138 | 0.159 | 0.164 | |||

| Adjusted R squared | 0.135 | 0.155 | 0.158 | |||

| Dependent Variable = Ln (sales/employees) | Affiliated Firms | Non-Affiliated Firms | ||

|---|---|---|---|---|

| Independent variable | Coefficient | t | Coefficient | t |

| Constant | 5.361 | 12.508 | 4.620 | 71.309 |

| EI | 0.305 * | 1.958 | 0.104 ** | 3.244 |

| AGE | 0.003 | 0.321 | 0.008 *** | 5.088 |

| RDIN | 0.055 | 1.252 | 0.065 *** | 5.934 |

| SIZE | 0.070 | 0.722 | 0.130 *** | 7.651 |

| HT | −0.696 *** | −3.280 | −0.143 *** | −3.183 |

| MHT | −0.194 | −0.892 | 0.028 | 0.580 |

| MLT | 0.293 | 1.440 | 0.205 *** | 4.860 |

| N | 81 | 1575 | ||

| R squared | 0.270 | 0.133 | ||

| Adjusted R squared | 0.201 | 0.129 | ||

| Dependent Variable = Ln (sales/employees) | Listed Group | Non-Listed Group | ||

|---|---|---|---|---|

| Independent variable | Coefficient | t | Coefficient | t |

| Constant | 6.396 | 14.741 | 4.669 | 68.714 |

| EI | 0.383 *** | 3.884 | 0.097 *** | 2.944 |

| AGE | −0.002 | −0.473 | 0.007 *** | 4.254 |

| RDIN | −0.004 | −0.122 | 0.060 *** | 5.329 |

| SIZE | −0.102 | −1.275 | 0.125 *** | 7.030 |

| HT | −0.351 * | −1.825 | −0.200 *** | −4.328 |

| MHT | −0.272 | −1.279 | 0.031 | 0.623 |

| MLT | 0.054 | 0.270 | 0.201 *** | 4.720 |

| N | 135 | 1521 | ||

| R squared | 0.217 | 0.123 | ||

| Adjusted R squared | 0.174 | 0.119 | ||

6. Discussion

6.1. Research Implication

6.2. Managerial Implications

6.3. Limitations

7. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Wilson, C.D.H.; Williams, I.D.; Kemp, S. An evaluation of the impact and effectiveness of environmental legislation in small and medium-sized enterprises: Experiences from the UK. Bus. Strategy Environ. 2012, 21, 141–156. [Google Scholar]

- González-Benito, J.; González-Benito, Ó. A study of determinant factors of stakeholder environmental pressure perceived by industrial companies. Bus. Strategy Environ. 2008, 19, 164–181. [Google Scholar]

- Zhu, Q.; Cordeiro, J.; Sarkis, J. Institutional pressures, dynamic capabilities and environmental management systems: Investigating the ISO 9000—Environmental management system implementation linkage. J. Environ. Manag. 2013, 114, 232–242. [Google Scholar]

- Feng, W.; Reisner, A. Factors influencing private and public environmental protection behaviors: Results from a survey of residents in Shaanxi, China. J. Environ. Manag. 2011, 92, 429–436. [Google Scholar]

- O’Rourke, D.; Lee, E. Mandatory planning for environmental innovation: Evaluating regulatory mechanisms for toxics use reduction. J. Environ. Plan. Manag. 2004, 47, 181–200. [Google Scholar]

- Valentine, S.V. Policies for enhancing corporate environmental management: A framework and an applied example. Bus. Strategy Environ. 2012, 21, 338–350. [Google Scholar]

- Hansen, O.E.; Søndergard, B.; Meredith, S. Environmental innovations in small and medium sized enterprises. Technol. Anal. Strateg. Manag. 2002, 14, 37–56. [Google Scholar]

- Delmas, M.A.; Toffel, M.W. Organizational responses to environmental demands: Opening the black box. Strateg. Manag. J. 2008, 29, 1027–1055. [Google Scholar]

- Jonker, J.; Foster, D. Stakeholder excellence? Framing the evolution and complexity of a stakeholder perspective of the firm. Corp. Soc. Responsib. Environ. Manag. 2002, 9, 187–195. [Google Scholar]

- Peters, M.; Turner, R.K. SME environmental attitudes and participation in locals-cale voluntary initiatives: Some practical applications. J. Environ. Plan. Manag. 2004, 47, 449–473. [Google Scholar]

- Porter, M.E.; van der Linde, C. Green and competitive: Ending the stalemate. Harv. Bus. Rev. 1995, 73, 120–134. [Google Scholar]

- Teece, D.J. Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Res. Policy 1986, 15, 285–305. [Google Scholar]

- Christmann, P. Effects of “best practices” of environmental management on cost advantage: The role of complementary assets. Acad. Manag. J. 2000, 43, 663–680. [Google Scholar]

- Granovetter, M. Coase revisited: Business groups in the modern economy. Ind. Corp. Chang. 1995, 4, 93–130. [Google Scholar]

- Chang, S.-J.; Chung, C.-N.; Mahmood, I.P. When and how does business group affiliation promote firm innovation? A tale of two emerging economies. Organ. Sci. 2006, 17, 637–656. [Google Scholar]

- Brammer, S.; Hoejmose, S.; Marchant, K. Environmental management in SMEs in the UK: Practices, pressures and perceived benefits. Bus. Strateg. Environ. 2012, 21, 423–434. [Google Scholar]

- Brammer, S.; Pavelin, S. Voluntary environmental disclosures by large UK companies. J. Bus. Financ. Account. 2006, 33, 1168–1188. [Google Scholar]

- Lee, S.Y. Drivers for the participation of small and medium-sized suppliers in green supply chain initiatives. Supply Chain Manag. 2008, 13, 185–198. [Google Scholar]

- Moore, S.B.; Manring, S.L. Strategy development in small and medium sized enterprises for sustainability and increased value creation. J. Clean. Prod. 2009, 17, 276–282. [Google Scholar]

- Bos-Brouwers, H.E.J. Corporate sustainability and innovation in SMEs: Evidence of themes and activities in practice. Bus. Strategy Environ. 2010, 19, 417–435. [Google Scholar]

- Khanna, T.; Rivkin, J.W. Estimating the performance effects of business groups in emerging markets. Strateg. Manag. J. 2001, 22, 45–74. [Google Scholar]

- Hart, S.L.; Dowell, G. Invited editorial: A natural-resource-based view of the firm fifteen years after. J. Manag. 2011, 37, 1464–1479. [Google Scholar]

- Khanna, T.; Palepu, K. Is group affiliation profitable in emerging markets? An analysis of diversified Indian business groups. J. Financ. 2000, 55, 867–891. [Google Scholar]

- Chang, S.J.; Choi, U. Strategy, structure and performance of Korean business groups: A transactions cost approach. J. Ind. Econ. 1988, 37, 141–158. [Google Scholar]

- Wong, S.K.S. Environmental requirements, knowledge sharing and green innovation: Empirical evidence from the electronics industry in China. Bus. Strategy Environ. 2012, 22, 321–338. [Google Scholar]

- Kim, J.B.; Yi, C.H. Ownership structure, business group affiliation, listing status, and earnings management: Evidence from Korea. Contemp. Account. Res. 2006, 23, 427–464. [Google Scholar]

- Keim, G.D. Managerial behavior and the social responsibility debate: Goals versus constraints. Acad. Manag. J. 1978, 21, 57–68. [Google Scholar]

- Caccavaio, M.; Carmassi, J.; di Giorgio, G.; Spallone, M. SMEs and the challenge to go public. Available online: http://rivistabancaria.it/Articoli/smes-and-challenge-go-public (accessed on 30 September 2014).

- Jun, S.-P.; Seo, J.H.; Son, J.-K. A study of the SME technology roadmapping program to strengthen the R&D planning capability of Korean SMEs. Technol. Forecast. Soc. Chang. 2012, 80, 1002–1014. [Google Scholar]

- Nugent, J.B.; Yhee, S.-J. Small and medium enterprises in Korea: Achievements, constraints and policy issues. Small Bus. Econ. 2002, 18, 85–119. [Google Scholar]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar]

- Brunnermeier, S.B.; Cohen, M.A. Determinants of environmental innovation in us manufacturing industries. J. Environ. Econ. Manag. 2003, 45, 278–293. [Google Scholar]

- Cainelli, G. Innovation and economic performance in services: A firm-level analysis. Camb. J. Econ. 2005, 30, 435–458. [Google Scholar]

- Woo, C.; Chung, Y.; Chun, D.; Han, S.; Lee, D. Impact of green innovation on labor productivity and its determinants: An analysis of the Korean manufacturing industry. Bus. Strategy Environ. 2013. [Google Scholar] [CrossRef]

- Al-Tuwaijri, S.A.; Christensen, T.E.; Hughes, K.E. The relations among environmental disclosure, environmental performance, and economic performance: A simultaneous equations approach. Account. Organ. Soc. 2004, 29, 447–471. [Google Scholar]

- Chen, Y.S.; Lai, S.B.; Wen, C.T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar]

- Chiou, T.-Y.; Chan, H.K.; Lettice, F.; Chung, S.H. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. Part E 2011, 47, 822–836. [Google Scholar]

- Lin, R.-J.; Tan, K.-H.; Geng, Y. Market demand, green product innovation, and firm performance: Evidence from Vietnam motorcycle industry. J. Clean. Prod. 2013, 40, 101–107. [Google Scholar]

- López-Gamero, M.D.; Molina-Azorín, J.F.; Claver-Cortés, E. The whole relationship between environmental variables and firm performance: Competitive advantage and firm resources as mediator variables. J. Environ. Manag. 2009, 90, 3110–3121. [Google Scholar]

- Alpkan, L.; Bulut, C.; Gunday, G.; Ulusoy, G.; Kilic, K. Organizational support for intrapreneurship and its interaction with human capital to enhance innovative performance. Manag. Decis. 2010, 48, 732–755. [Google Scholar] [Green Version]

- Armour, H.O.; Teece, D.J. Organizational structure and economic performance: A test of the multidivisional hypothesis. Bell J. Econ. 1978, 9, 106–122. [Google Scholar]

- Csaszar, F.A. Organizational structure as a determinant of performance: Evidence from mutual funds. Strateg. Manag. J. 2012, 33, 611–632. [Google Scholar]

- Jones, M.T. The institutional determinants of social responsibility. J. Bus. Ethics 1999, 20, 163–179. [Google Scholar]

- Kim, W.S.; Lyn, E.; Park, T.J.; Zychowicz, E. The wealth effects of capital investment decisions: An empirical comparison of Korean chaebol and non-chaebol firms. J. Bus. Financ. Account. 2005, 32, 945–971. [Google Scholar]

- Gunduz, L.; Tatoglu, E. A comparison of the financial characteristics of group affiliated and independent firms in turkey. Eur. Bus. Rev. 2003, 15, 48–54. [Google Scholar]

- Aragón-Correa, J.A.; García-Morales, V.J.; Cordón-Pozo, E. Leadership and organizational learning’s role on innovation and performance: Lessons from Spain. Ind. Mark. Manag. 2007, 36, 349–359. [Google Scholar]

- Hsieh, T.-J.; Yeh, R.-S.; Chen, Y.-J. Business group characteristics and affiliated firm innovation: The case of Taiwan. Ind. Mark. Manag. 2010, 39, 560–570. [Google Scholar]

- Mahmood, I.P.; Mitchell, W. Two faces: Effects of business groups on innovation in emerging economies. Manag. Sci. 2004, 50, 1348–1365. [Google Scholar]

- Reagans, R.; McEvily, B. Network structure and knowledge transfer: The effects of cohesion and range. Adm. Sci. Q. 2003, 48, 240–267. [Google Scholar]

- Reddy, N.M.; Zhao, L. International technology transfer: A review. Res. Policy 1990, 19, 285–307. [Google Scholar]

- Stuart, T.E. Interorganizational alliances and the performance of firms: A study of growth and innovation rates in a high-technology industry. Strateg. Manag. J. 2000, 21, 791–811. [Google Scholar]

- Khanna, T.; Palepu, K. Why focused strategies may be wrong for emerging markets. Harv. Bus. Rev. 1997, 75, 41–48. [Google Scholar]

- Durnev, A.; Li, K.; Mørck, R.; Yeung, B. Capital markets and capital allocation: Implications for economies in transition. Econ. Trans. 2004, 12, 593–634. [Google Scholar]

- Teece, D.J. Competition, cooperation, and innovation: Organizational arrangements for regimes of rapid technological progress. J. Econ. Behav. Organ. 1992, 18, 1–25. [Google Scholar]

- Baylis, R.; Connell, L.; Flynn, A. Company size, environmental regulation and ecological modernization: Further analysis at the level of the firm. Bus. Strategy Environ. 1998, 7, 285–296. [Google Scholar]

- Freel, M.S. Patterns of innovation and skills in small firms. Technovation 2005, 25, 123–134. [Google Scholar]

- Reinhardt, F. Environmental product differentiation: Implications for corporate strategy. Calif. Manag. Rev. 1998, 40, 43–73. [Google Scholar]

- Botosan, C.A. Disclosure level and the cost of equity capital. Account. Rev. 1997, 72, 323–349. [Google Scholar]

- Johnson, R.A.; Greening, D.W. The effects of corporate governance and institutional ownership types of corporate social performance. Acad. Manag. J. 1999, 42, 564–576. [Google Scholar]

- Li, W.; Zhang, R. Corporate social responsibility, ownership structure, and political interference: Evidence from China. J. Bus. Ethics 2010, 96, 631–645. [Google Scholar]

- Sengupta, P. Corporate disclosure quality and the cost of debt. Account. Rev. 1998, 73, 459–474. [Google Scholar]

- Ullmann, A.A. Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of us firms. Acad. Manag. Rev. 1985, 10, 540–557. [Google Scholar]

- Claessens, S.; Tzioumis, K. Ownership and financing structures of listed and large non-listed corporations. Corp. Gov. 2006, 14, 266–276. [Google Scholar]

- Nejati, M.; Amran, A. Does ownership type cause any difference in the perception of Malaysian SME owners/managers towards corporate social responsibility? Int. J. Bus. Gov. Ethics 2012, 7, 63–81. [Google Scholar]

- Thompson, J.K.; Smith, H.L. Social responsibility and small business: Suggestions for research. J. Small Bus. Manag. 1991, 29, 30–44. [Google Scholar]

- Spence, L.J.; Rutherfoord, R. Small business and empirical perspectives in business ethics: Editorial. J. Bus. Ethics 2003, 47, 1–5. [Google Scholar]

- Williams, S.; Schaefer, A. Small and medium-sized enterprises and sustainability: Managers’ values and engagement with environmental and climate change issues. Bus. Strategy Environ. 2013, 22, 173–186. [Google Scholar]

- Roberts, R.W. Determinants of corporate social responsibility disclosure: An application of stakeholder theory. Account. Organ. Soc. 1992, 17, 595–612. [Google Scholar]

- Bhattacharya, U.; Daouk, H.; Welker, M. The world price of earnings opacity. Account. Rev. 2003, 78, 641–678. [Google Scholar]

- Rennings, K.; Ziegler, A.; Zwick, T. The effect of environmental innovations on employment changes: An econometric analysis. Bus. Strategy Environ. 2004, 13, 374–387. [Google Scholar]

- Wagner, M. Innovation and competitive advantages from the integration of strategic aspects with social and environmental management in European firms. Bus. Strategy Environ. 2009, 18, 291–306. [Google Scholar]

- Horbach, J. Determinants of environmental innovation—New evidence from German panel data sources. Res. Policy 2008, 37, 163–173. [Google Scholar]

- Sørensen, J.B.; Stuart, T.E. Aging, obsolescence, and organizational innovation. Adm. Sci. Q. 2000, 45, 81–112. [Google Scholar]

- Diaz, M.A.; Sanchez, R. Firm size and productivity in Spain: A stochastic frontier analysis. Small Bus. Econ. 2008, 30, 315–323. [Google Scholar]

- Czarnitzki, D.; Thorwarth, S. Productivity effects of basic research in low-tech and high-tech industries. Res. Policy 2012, 41, 1555–1564. [Google Scholar]

- Yoon, S.S. A comparison of earnings management between KSE firms and KOSDAQ firms. J. Bus. Financ. Account. 2005, 32, 1347–1372. [Google Scholar]

- Jaccard, J.; Wan, C.K.; Turrisi, R. The detection and interpretation of interaction effects between continuous variables in multiple regression. Multivar. Behav. Res. 1990, 25, 467–478. [Google Scholar]

- Aiken, L.S.; West, S.G. Multiple Regression: Testing and Interpreting Interactions; Sage Publications: Thousand Oaks, CA, USA, 1991. [Google Scholar]

- Marquardt, D.W. You should standardize the predictor variables in your regression models. J. Am. Stat. Assoc. 1980, 75, 87–91. [Google Scholar]

- Goto, A.; Suzuki, K. R&D capital, rate of return on R&D investment and spillover of R&D in Japanese manufacturing industries. Rev. Econ. Stat. 1989, 71, 555–564. [Google Scholar]

- Wang, E.C.; Huang, W. Relative efficiency of R&D activities: A cross-country study accounting for environmental factors in the DEA approach. Res. Policy 2007, 36, 260–273. [Google Scholar]

- Robinson, C.D.; Schumacker, S.T.R.E. Tests of moderation effects: Difference in simple slopes versus the interaction term. Mult. Linear Regres. Viewp. 2013, 39, 16–24. [Google Scholar]

- Halila, F. Networks as a means of supporting the adoption of organizational innovations in SMEs: The case of environmental management systems (EMSS) based on ISO 14001. Corp. Soc. Responsib. Environ. Manag. 2007, 14, 167–181. [Google Scholar]

- Shin, H.-H.; Park, Y.S. Financing constraints and internal capital markets: Evidence from Koreanchaebols’. J. Corp. Financ. 1999, 5, 169–191. [Google Scholar]

- Douma, S.; George, R.; Kabir, R. Foreign and domestic ownership, business groups, and firm performance: Evidence from a large emerging market. Strateg. Manag. J. 2006, 27, 637–657. [Google Scholar]

- Chang, S.J.; Hong, J. Economic performance of group-affiliated companies in Korea: Intragroup resource sharing and internal business transactions. Acad. Manag. J. 2000, 43, 429–448. [Google Scholar]

- Hazilla, M.; Kopp, R.J. Social cost of environmental quality regulations: A general equilibrium analysis. J. Political Econ. 1990, 98, 853–873. [Google Scholar]

- Jang, M.; Kim, J.-A.; Sun, S.-T. Development and evaluation of laws and regulation for the low-carbon and green growth in Korea. Int. J. Urban Sci. 2010, 14, 191–206. [Google Scholar]

- Maas, S.; Schuster, T.; Hartmann, E. Pollution prevention and service stewardship strategies in the third-party logistics industry: Effects on firm differentiation and the moderating role of environmental communication. Bus. Strategy Environ. 2012, 23, 38–55. [Google Scholar]

- Qian, G. Multinationality, product diversification, and profitability of emerging us small- and medium-sized enterprises. J. Bus. Ventur. 2002, 17, 611–633. [Google Scholar]

- Stanny, E. Voluntary disclosures of emissions by us firms. Bus. Strategy Environ. 2012, 22, 145–158. [Google Scholar]

© 2014 by the authors; licensee MDPI, Basel, Switzerland. This article is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Woo, C.; Chung, Y.; Chun, D.; Seo, H. Exploring the Impact of Complementary Assets on the Environmental Performance in Manufacturing SMEs. Sustainability 2014, 6, 7412-7432. https://doi.org/10.3390/su6107412

Woo C, Chung Y, Chun D, Seo H. Exploring the Impact of Complementary Assets on the Environmental Performance in Manufacturing SMEs. Sustainability. 2014; 6(10):7412-7432. https://doi.org/10.3390/su6107412

Chicago/Turabian StyleWoo, Chungwon, Yanghon Chung, Dongphil Chun, and Hangyeol Seo. 2014. "Exploring the Impact of Complementary Assets on the Environmental Performance in Manufacturing SMEs" Sustainability 6, no. 10: 7412-7432. https://doi.org/10.3390/su6107412