Threshold Effect of High-Tech Industrial Scale on Green Development—Evidence from Yangtze River Economic Belt

Abstract

:1. Introduction

2. Measure of Green Development

2.1. Super-SBM DEA Model

2.2. Input–Output Indicators

2.2.1. Energy Input

2.2.2. Non-Energy Input

2.2.3. Desirable Output

2.2.4. Undesirable Output

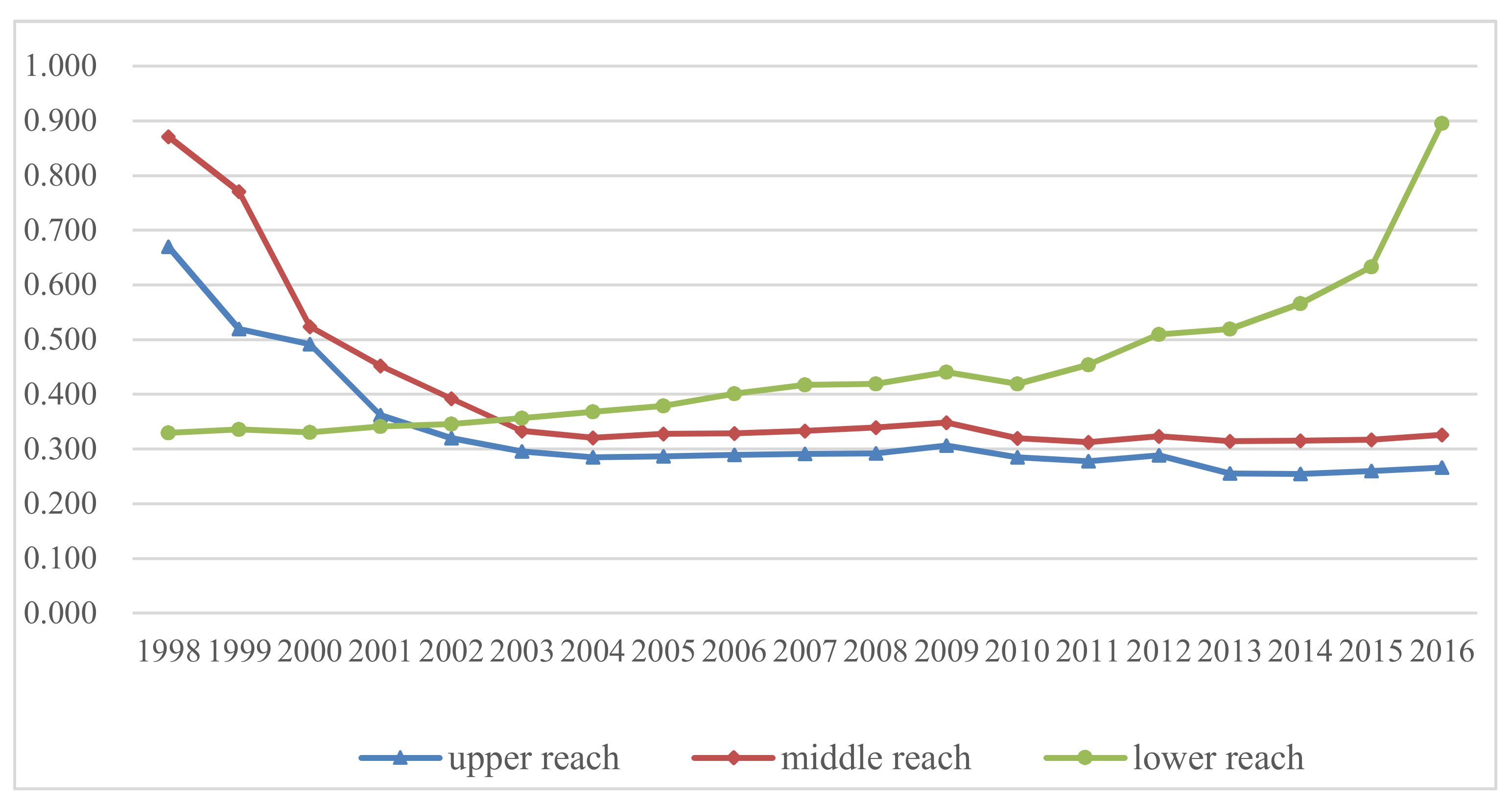

2.3. Result of Green Development

3. Threshold Model and Variable Description

3.1. Threshold Model

3.2. Data Sources and Description of Variables

3.2.1. Social Capital (K)

3.2.2. Human Capital (humcap)

3.2.3. Industrial Structure (struct)

3.2.4. Openness (open)

3.2.5. Technological Innovation (techinn)

3.2.6. Population Density (popden)

4. Empirical Analysis

4.1. Threshold Effect Test of YREB

4.2. Threshold Effect in Upper, Middle, and Lower Reaches

5. Conclusions and Recommendations

- (1)

- In general, the expansion of the high-tech industry scale in the YREB promoted green development and the promoting effect was different in the regions of the upper, middle, and lower reaches. We verified that the scale of high-tech industry had a double-threshold effect on the green development efficiency. The threshold values were 8.884 and 8.671. We compared this with the previous linear model (model 2) in Table 5, which shows that human capital (humcap), openness (open), and the explanatory variable high-tech industry scale were not significant. From model 1, openness (open) was significant at the 10% level; population density (popden) and high-tech industry scale in the third stage were significant at the 5% level. The rest of the variables were significant at the 1% level in model 1. The results of the robust test in model 3 were similar to the results in model 1. The threshold model (model 1) was more appropriate to analyze the relationship between high-tech industry and green development. According to the results of the threshold model, we conclude that excessive industrial scale limits the promotion effect of green development, and the greatest promotion impact is between the two threshold values (8.671 and 8.884).

- (2)

- In the upper reaches, there was no threshold effect as shown in Table 7, and the relationship between the high-tech industry scale and green development was linear after the regression test (the results of the non-linear test were not significant). Therefore, we used the fixed effect linear model to analyze the relationship between high-tech industry and green development. From the results in Table 8, the coefficient of the high-tech industry scale was positive and significant at the 5% level. Thus, we conclude that high-tech industry in remote and developing upstream areas has a positive effect on green development. The coefficients of social capital (K), industrial structure (struct), and human capital (humcap) were positive, and the coefficients of openness (open), technological innovation (techinn), and population density (popden) were negative. However, human capital (humcap) and openness (open) were not significant. The other control variables were significant at the 1% level. This indicates that social capital accumulation and industrial structure significantly positively impact green development. However, enhanced technological innovation and increased population density have an inhibitory effect on green development in upstream regions.

- (3)

- In the middle reaches, the expansion of high-tech industries had a single threshold effect on green development (Table 7), where the threshold value was 4.6830. According to the result in Table 8, high-tech industrial expansion had a positive impact in two stages (less than or greater than the threshold value). In the second stage, when the scale was greater than the threshold value, the expansion of the high-tech industry scale played a more significant role in promoting green development (the coefficient in the first stage was 0.074 and significant at the 5% level; the coefficient in the second stage was 0.183 and significant at the 1% level). The coefficients of social capital (K) and human capital (humcap) were positive, and the coefficients of industrial structure (struct), openness (open), technological innovation (techinn), and population density (popden) were negative. Among these control variables, openness (open) and population density (popden) were not significant. The rest of the variables were significant at the 5% or 1% level. This implies that social capital accumulation and improvement in the education level of residents can promote green development, but industrial structure improvement and enhanced technological innovation can be obstructions for green development in the midstream regions.

- (4)

- In the lower reaches, from Table 7, the expansion of the high-tech industry had a double threshold effect on green development and the threshold values were 5.872 and 7.851. In Table 8, the coefficients of the first stage and second stage were positive, so we conclude that the expansion of high-tech industry promoted green development. The coefficient of the first stage (high-tech_1) was greater than the coefficient of the second stage (high-tech_2). The decline of the high-tech coefficient indicated that the promotion of green development decreased with the expansion of the industrial scale. At the end of the time period, influence coefficient became obscure or even counterproductive, as in the third stage, the coefficient was negative and not significant. This means that high-tech industry had a weak or even negative impact on green development with further expansion of the industrial scale in the third stage. These control variables were significant at the 1% or 5% level. Among these control variables, the coefficients of social capital (K), openness (open), and population density (popden) were negative, and the coefficients of industrial structure (struct), human capital (humcap), and technological innovation (techinn) were positive. This suggests that upgrading the industrial structure, improving of the education level of residents, and enhancing technological innovation are beneficial to green development. However, social capital accumulation, strengthening openness, and increased population density negatively impacted green development in the downstream regions.

- (1)

- The YREB is one of four high-tech industrial clusters in China. Local governments should improve the high-tech industrial innovation system in these areas to effectively combine scientific research institutions, enterprises, and other institutions to drive high-tech industrial innovation. Taking technological innovation as the key starting point to develop low-carbon industries and avoiding using high technology to develop high-carbon and high-emissions industries could not only alleviate the pressure on resources and the environment, but also promote the sustainable development of the economy, which is the essence of green development.

- (2)

- For the upper reaches of the YREB, the high-tech industry is still in the early stages of development. According to further analysis, we found the following three implications. First, its economic foundation is weak and the people are poor, which restrict the development of local high-tech industry to a certain extent. Second, most of the cities in the upstream region have a good natural environment and rich ecological resources. They mainly focus on the tourism industry and have ignored the importance of the high-tech industry. However, sole dependence on tourism cannot support the economic demand of the whole region. Third, due to the low education level of the residents and the lack of high-tech talent, the high-tech industry is developing slowly in this area. Therefore, in the upstream regions, local governments should accelerate the pace of precise poverty alleviation and improve people’s living standards. In order to achieve sustainable economic development, they should increase the attractiveness of talent (especially high-tech innovative talent) to expand the scale of high-tech industries and strengthen the positive impact of high-tech industries in green development.

- (3)

- The high-tech industry has already developed on a certain scale in the middle reaches of the region. Its promotion effect on green economic development has achieved initial results and is increasing. The current bottleneck is mainly due to the conversion rate of high-tech achievements. The middle reaches have a certain economic base and a considerable reserve of high-tech talent compared with the upstream regions. However, few scientific and technological innovations are actually applied to actual products. This low transformation rate of scientific and technological innovation ultimately limits the role of high-tech industries in promoting green development. Therefore, to realize the effective connection between high-tech products and the market and further accelerate the green development of the economy, local governments should establish a third-party platform as soon as possible and improve the mechanism to encourage the transformation of high-tech achievements.

- (4)

- In the downstream region, the scale of the high-tech industry has reached a relatively large scale, and could even be considered saturated. This has played an evident role in promoting economic green development. These regions have already obtained a high level of economy and a high-tech talent-intensive industry. If investment continues to increase to expand the scale, there will be a marginal declining effect or even play a counterproductive role, resulting in the waste of labor, materials, and financial resources, which violates the original intention of green development. Therefore, the key to promoting green development in developed areas is to control the scale of high-tech industry and to balance the allocation of social resources.

Author Contributions

Funding

Conflicts of Interest

References

- Markandya, A.; Barbier, E.; Pearce, D. Blueprint for a Green Economy; Earth scan Publication Limited: London, UK, 1989. [Google Scholar]

- Brand, U. Green economy–the next oxymoron? No lessons learned from failures of implementing sustainable development. Gaia-Ecol. Perspect. Sci. Soc. 2012, 21, 28–32. [Google Scholar] [CrossRef]

- THE 2010 POPULATION CENSUS OF THE PEOPLES REPUBLIC OF CHINA. Available online: http://www.stats.gov.cn/tjsj/pcsj/rkpc/6rp/indexch.htm (accessed on 29 January 2019).

- Yao, X.; Feng, W.; Zhang, X.; Wang, W.; Zhang, C.; You, S. Measurement and decomposition of industrial green total factor water efficiency in China. J. Clean. Prod. 2018, 198, 1144–1156. [Google Scholar] [CrossRef]

- Penghao, C.; Pingkuo, L.; Hua, P. Prospects of hydropower industry in the Yangtze River Basin: China’s green energy choice. Renew. Energy 2019, 131, 1168–1185. [Google Scholar] [CrossRef]

- Bieri, D.S. Booming Bohemia? Evidence from the US High-Technology Industry. Ind. Innov. 2010, 17, 23–48. [Google Scholar] [CrossRef]

- Yan, M.; Chien, K. Evaluating the Economic Performance of High-Technology Industry and Energy Efficiency: A Case Study of Science Parks in Taiwan. Energies 2013, 6, 973–987. [Google Scholar] [CrossRef] [Green Version]

- Lee, A.H.; Kang, H.-Y.; Hsu, C.-F.; Hung, H.-C. A green supplier selection model for high-tech industry. Expert Syst. Appl. 2009, 36, 7917–7927. [Google Scholar] [CrossRef]

- Xu, B.; Lin, B. Investigating the role of high-tech industry in reducing China’s CO2 emissions: A regional perspective. J. Clean. Prod. 2018, 177, 169–177. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, Y. Evaluation of the provincial competitiveness of the Chinese high-tech industry using an improved TOPSIS method. Expert Syst. Appl. 2014, 41, 2824–2831. [Google Scholar] [CrossRef]

- Czarnitzki, D.; Thorwarth, S. Productivity effects of basic research in low-tech and high-tech industries. Res. Policy 2012, 41, 1555–1564. [Google Scholar] [CrossRef] [Green Version]

- Alecke, B.; Alsleben, C.; Scharr, F.; Untiedt, G. Are there really high-tech clusters? The geographic concentration of German manufacturing industries and its determinants. Ann. Reg. Sci. 2006, 40, 19–42. [Google Scholar] [CrossRef]

- Simonen, J.; Svento, R.; Juutinen, A. Specialization and diversity as drivers of economic growth: Evidence from High-Tech industries. Pap. Reg. Sci. 2015, 94, 229–247. [Google Scholar]

- Zheng, Q.; Xu, A.; Deng, H.; Wu, J.; Lin, Q. Based on Competitive Strategy to Discuss the Effect of Organizational Operation on Business Performance in High-Tech Industries. Rev. De Cercet. Si Interv. Soc. 2018, 61, 134–146. [Google Scholar]

- Zeng, G.; Liefner, I.; Si, Y. The role of high-tech parks in China’s regional economy: Empirical evidence from the IC industry in the Zhangjiang High-tech Park, Shanghai. Erdkunde 2011, 65, 43–53. [Google Scholar] [CrossRef]

- Lee, H.; Kim, N.; Kwak, K.; Kim, W.; Soh, H.; Park, K. Diffusion Patterns in Convergence among High-Technology Industries: A Co-Occurrence-Based Analysis of Newspaper Article Data. Sustainability 2016, 8, 1029. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous technological change. J. Political Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef]

- Grossman, G.; Helpman, E.M. Innovation and Growth in the Global Economy; MIT Press: Cambridge, MA, USA, 1993. [Google Scholar]

- Morrison, C.J.; Berndt, E.R. High-tech capital formation and economic performance in U.S. manufacturing industries: An exploratory analysis. J. Econ. 1995, 65, 9–43. [Google Scholar]

- Goldstein, A. The political economy of high-tech industries in developing countries: Aerospace in Brazil, Indonesia and South Africa. Camb. J. Econ. 2002, 26, 521–538. [Google Scholar] [CrossRef]

- Ching, C.-H.; Fan, S.-M.; Chou, T.L.; Chang, J.-Y. Global Linkages, the Chinese High-tech Community and Industrial Cluster Development. Urban Stud. 2011, 48, 3019–3042. [Google Scholar]

- Shankar, K.; Ghosh, S. A Theory of Worker Turnover and Knowledge Transfer in High-Technology Industries. J. Hum. Cap. 2013, 7, 107–129. [Google Scholar] [CrossRef]

- Lin, Y.; Wang, Y.; Kung, L. Influences of cross-functional collaboration and knowledge creation on technology commercialization: Evidence from high-tech industries. Ind. Mark. Manag. 2015, 49, 128–138. [Google Scholar] [CrossRef]

- Saboo, A.R.; Sharma, A.; Chakravarty, A.; Kumar, V. Influencing Acquisition Performance in High-Technology Industries: The Role of Innovation and Relational Overlap. J. Mark. Res. 2017, 54, 219–238. [Google Scholar] [CrossRef]

- Szücs, S.; Zaring, O. Innovation Governance Nexuses: Mapping Local Governments’ University-Industry Relations and Specialization in High Technology in Sweden. Eur. Plan. Stud. 2014, 22, 1769–1782. [Google Scholar]

- Albino, V.; Balice, A.; Dangelico, R.M. Environmental strategies and green product development: An overview on sustainability-driven companies. Bus. Strategy Environ. 2009, 18, 83–96. [Google Scholar] [CrossRef]

- Aldieri, L.; Vinci, C. Green Economy and Sustainable Development: The Economic Impact of Innovation on Employment. Sustainability 2018, 10, 3541. [Google Scholar] [CrossRef]

- Yang, Q.; Wan, X.; Ma, H. Assessing Green Development Efficiency of Municipalities and Provinces in China Integrating Models of Super-Efficiency DEA and Malmquist Index. Sustainability 2015, 7, 4492–4510. [Google Scholar] [CrossRef] [Green Version]

- Law, K.M.Y.; Gunasekaran, A. Sustainability development in high-tech manufacturing firms in Hong Kong: Motivators and readiness. Int. J. Prod. Econ. 2012, 137, 116–125. [Google Scholar] [CrossRef]

- Huang, Y.-C.; Huang, Y.; Wu, Y.J.; Wu, Y.-C.J. The effects of organizational factors on green new product success. Manag. Decis. 2010, 48, 1539–1567. [Google Scholar] [CrossRef]

- Chesbrough, H.; Crowther, A.K. Beyond high tech: Early adopters of open innovation in other industries. Rd Manag. 2006, 36, 229–236. [Google Scholar] [CrossRef]

- Liu, X.; Buck, T. Innovation performance and channels for international technology spillovers: Evidence from Chinese high-tech industries. Res. Policy 2007, 36, 355–366. [Google Scholar] [CrossRef]

- Guo, L.; Qu, Y.; Tseng, M.-L. The interaction effects of environmental regulation and technological innovation on regional green growth performance. J. Clean. Prod. 2017, 162, 894–902. [Google Scholar] [CrossRef]

- Ryszko, A. Proactive Environmental Strategy, Technological Eco-Innovation and Firm Performance—Case of Poland. Sustainability. 2016, 8, 156. [Google Scholar] [CrossRef]

- Caldarelli, C.E.; Gilio, L. Expansion of the sugarcane industry and its effects on land use in São Paulo: Analysis from 2000 through 2015. Land Use Policy. 2018, 76, 264–274. [Google Scholar] [CrossRef]

- Xing, Z.; Wang, J.; Zhang, J. Total-factor ecological efficiency and productivity in Yangtze River Economic Belt, China: A non-parametric distance function approach. J. Clean. Prod. 2018, 200, 844–857. [Google Scholar] [CrossRef]

- Adams, B. Green Development: Environment and Sustainability in a Developing World; Routledge: Abingdon, UK, 2008. [Google Scholar]

- Lélé, S.M. Sustainable development: A critical review. World Dev. 1991, 19, 607–621. [Google Scholar] [CrossRef]

- Cecchini, L.; Venanzi, S.; Pierri, A.; Chiorri, M. Environmental efficiency analysis and estimation of CO2 abatement costs in dairy cattle farms in Umbria (Italy): A SBM-DEA model with undesirable output. J. Clean. Prod. 2018, 197, 895–907. [Google Scholar] [CrossRef]

- Chu, J.; Wu, J.; Song, M. An SBM-DEA model with parallel computing design for environmental efficiency evaluation in the big data context: A transportation system application. Ann. Oper. Res. 2018, 270, 105–124. [Google Scholar] [CrossRef]

- Choi, Y.; Yu, Y.; Lee, H. A Study on the Sustainable Performance of the Steel Industry in Korea Based on SBM-DEA. Sustainability 2018, 10, 173. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of effciency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Zhang, S.; Huang, D.; Chen, Y. The development of China’s Yangtze River Economic Belt: How to make it in a green way. Sci. Bull. 2017, 62, 648–651. [Google Scholar]

- Sun, C.; Chen, L.; Tian, Y. Study on the urban state carrying capacity for unbalanced sustainable development regions: Evidence from the Yangtze River Economic Belt. Ecol. Indic. 2018, 89, 150–158. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econ. 1999, 93, 345–368. [Google Scholar] [CrossRef] [Green Version]

- Kwaku, A.G.; Murray, J.Y. Exploratory and Exploitative Learning in New Product Development: A Social Capital Perspective on New Technology Ventures in China. J. Int. Mar. 2007, 15, 1–29. [Google Scholar]

- Kansanga, M.M. Who you know and when you plough? Social capital and agricultural mechanization under the new green revolution in Ghana. Int. J. Agri. Sust. 2017, 15, 708–723. [Google Scholar] [CrossRef]

- Goldsmith, R.W. A Perpetual Inventory of National Wealth. In Studies in Income and Wealth; National Bureau of Economic Research: Cambridge, MA, USA, 1951. [Google Scholar]

- Wu, Y. The role of productivity in China’s growth: New estimates. J. Chin. Econ. Bus. Stud. 2008, 6, 141–156. [Google Scholar] [CrossRef]

- Storper, M.; Scott, A.J. Rethinking human capital, creativity and urban growth. J. Econ. Geogr. 2008, 9, 147–167. [Google Scholar] [CrossRef]

- Iammarino, S.; McCann, P. The structure and evolution of industrial clusters: Transactions, technology and knowledge spillovers. Res. Policy 2006, 35, 1018–1036. [Google Scholar] [CrossRef] [Green Version]

- Rafiq, S.; Salim, R.; Nielsen, I. Urbanization, openness, emissions, and energy intensity: A study of increasingly urbanized emerging economies. Energy Econ. 2016, 56, 20–28. [Google Scholar] [CrossRef]

- Harrison, A.E.; Eskelanda, G.S. Moving to greener pastures Multinationals and the pollution haven hypothesis. J. Dev. Econ. 2003, 70, 1–23. [Google Scholar]

- Yang, J.; Guo, H.; Liu, B. Environmental regulation and the Pollution Haven Hypothesis: Do environmental regulation measures matter? J. Clean. Prod. 2018, 202, 993–1000. [Google Scholar] [CrossRef]

- Wang, Z.; Li, C.; Liu, Q. Pollution haven hypothesis of domestic trade in China: A perspective of SO2 emissions. Sci. Total Environ. 2019, 663, 198–205. [Google Scholar] [CrossRef]

- John, C.S.; Ana, E.A.; Felix, M.G. Regulation, free-riding incentives, and investment in R&D with spillovers. Res. Energy Econ. 2018, 53, 133–146. [Google Scholar]

- Meng, X.; Han, J. Roads, economy, population density, and CO2: A city-scaled causality analysis. Resour. Conserv. Recycl. 2018, 128, 508–515. [Google Scholar] [CrossRef]

- Onozaki, K. Population Is a Critical Factor for Global Carbon Dioxide Increase. J. Health Sci. 2009, 55, 125–127. [Google Scholar] [CrossRef] [Green Version]

| 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Guizhou | 2.285 | 1.016 | 1.007 | 0.531 | 0.375 | 0.289 | 0.263 | 0.262 | 0.269 | 0.275 | 0.285 | 0.305 | 0.291 | 0.281 | 0.280 | 0.122 | 0.131 | 0.142 | 0.154 |

| Sichuan | 0.373 | 0.317 | 0.291 | 0.283 | 0.280 | 0.258 | 0.255 | 0.269 | 0.274 | 0.286 | 0.289 | 0.308 | 0.272 | 0.272 | 0.284 | 0.291 | 0.293 | 0.299 | 0.306 |

| Yunnan | 0.307 | 0.296 | 0.280 | 0.270 | 0.262 | 0.261 | 0.258 | 0.264 | 0.265 | 0.268 | 0.268 | 0.276 | 0.254 | 0.244 | 0.256 | 0.261 | 0.254 | 0.251 | 0.243 |

| Chongqing | 0.714 | 0.450 | 0.390 | 0.364 | 0.364 | 0.376 | 0.365 | 0.353 | 0.349 | 0.337 | 0.325 | 0.338 | 0.322 | 0.313 | 0.332 | 0.346 | 0.342 | 0.347 | 0.359 |

| Anhui | 1.009 | 0.779 | 0.506 | 0.413 | 0.364 | 0.347 | 0.345 | 0.348 | 0.338 | 0.329 | 0.313 | 0.306 | 0.280 | 0.272 | 0.285 | 0.277 | 0.273 | 0.267 | 0.263 |

| Hubei | 0.433 | 0.349 | 0.325 | 0.333 | 0.325 | 0.263 | 0.266 | 0.284 | 0.300 | 0.313 | 0.331 | 0.355 | 0.333 | 0.326 | 0.328 | 0.330 | 0.336 | 0.351 | 0.375 |

| Hunan | 1.011 | 1.013 | 0.550 | 0.466 | 0.371 | 0.325 | 0.317 | 0.322 | 0.328 | 0.338 | 0.360 | 0.384 | 0.360 | 0.352 | 0.364 | 0.342 | 0.344 | 0.351 | 0.370 |

| Jiangxi | 1.033 | 0.942 | 0.714 | 0.598 | 0.510 | 0.398 | 0.355 | 0.358 | 0.349 | 0.352 | 0.354 | 0.351 | 0.308 | 0.300 | 0.319 | 0.310 | 0.306 | 0.301 | 0.297 |

| Jiangsu | 0.370 | 0.373 | 0.365 | 0.366 | 0.377 | 0.382 | 0.379 | 0.384 | 0.427 | 0.437 | 0.446 | 0.477 | 0.434 | 0.468 | 0.537 | 0.573 | 0.652 | 0.781 | 1.043 |

| Shanghai | 0.251 | 0.263 | 0.275 | 0.302 | 0.305 | 0.325 | 0.351 | 0.373 | 0.397 | 0.424 | 0.423 | 0.448 | 0.455 | 0.485 | 0.522 | 0.499 | 0.529 | 0.575 | 1.003 |

| Zhejiang | 0.368 | 0.371 | 0.350 | 0.356 | 0.354 | 0.363 | 0.374 | 0.379 | 0.381 | 0.390 | 0.389 | 0.399 | 0.368 | 0.409 | 0.469 | 0.488 | 0.518 | 0.543 | 0.641 |

| Variables | Statistic Value | Prob. | Testing Method | Result |

|---|---|---|---|---|

| gdeff | −4.491 *** | 0.000 | LLC | Stationary |

| hightech | −1.921 ** | 0.018 | LLC | Stationary |

| K | −10.291 *** | 0.000 | LLC | Stationary |

| humcap | −3.138 ** | 0.006 | LLC | Stationary |

| struct | −6.299 *** | 0.000 | LLC | Stationary |

| open | −5.669 *** | 0.000 | LLC | Stationary |

| techinn | −6.679 *** | 0.000 | LLC | Stationary |

| popden | −2.301 ** | 0.010 | LLC | Stationary |

| Thresholds | Test for Threshold Effect | Robust Test for Threshold Effect | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| F-Value | Prob. | Critical Value | F-Value | Prob. | Critical Value | |||||

| 10% | 5% | 1% | 10% | 5% | 1% | |||||

| Single Threshold | 67.05 | 0.000 | 34.528 | 43.156 | 52.478 | 66.77 | 0.000 | 34.350 | 41.396 | 57.685 |

| Double Threshold | 53.46 | 0.003 | 25.063 | 40.333 | 50.635 | 52.92 | 0.000 | 40.744 | 50.783 | 76.063 |

| Triple Threshold | 9.56 | 0.407 | 31.402 | 108.207 | 155.510 | 11.00 | 0.230 | 23.659 | 88.246 | 156.177 |

| Thresholds | Test for Threshold Effect | Robust Test for Threshold Effect | ||

|---|---|---|---|---|

| Threshold Value | 95% Confidence Interval | Threshold Value | 95% Confidence Interval | |

| Single Threshold | 8.884 *** | (3.730, 9.165) | 8.867 *** | (8.860, 8.955) |

| Double Threshold | 8.671 *** | (8.599, 8.855) | 8.653 ** | (8.610, 8.798) |

| Variable | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| K | 0.293 *** (0.030) | 0.244 *** (0.034) | 0.302 *** (0.032) |

| struct | 0.508 *** (0.095) | 0.642 *** (0.108) | 0.522 *** (0.103) |

| humcap | 0.599 *** (0.200) | 0.386 (0.234) | 0.953 *** (0.271) |

| open | −0.030 * (0.017) | −0.014 (0.019) | −0.047 *** (0.018) |

| techinn | −0.250 *** (0.028) | −0.235 *** (0.033) | −0.282 *** (0.032) |

| popden | −0.045 ** (0.016) | −0.031 * (0.018) | −0.061 *** (0.017) |

| hightech_1 | 0.078 *** (0.024) | −0.017 (0.028) | 0.065 ** (0.025) |

| hightech_2 | 0.117 *** (0.023) | 0.101 *** (0.024) | |

| hightech_3 | 0.059 ** (0.024) | 0.044 * (0.025) | |

| constant | 5.552 *** (0.395) | 5.591 *** (0.442) | 6.195 *** (0.434) |

| observation | 220 | 220 | 198 |

| R-squared | 0.949 | 0.926 | 0.954 |

| Thresholds | Upper Reaches | Middle Reaches | Lower Reaches | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| F-Value | Prob. | Critical Value | F-Value | Prob. | Critical Value | F-Value | Prob. | Critical Value | |||||||

| 10% | 5% | 1% | 10% | 5% | 1% | 10% | 5% | 1% | |||||||

| Single Threshold | 12.51 | 0.217 | 16.284 | 18.847 | 21.569 | 43.11 | 0.000 | 21.618 | 27.773 | 38.377 | 29.62 | 0.000 | 10.856 | 11.636 | 12.314 |

| Double Threshold | 6.13 | 0.440 | 12.349 | 15.576 | 18.201 | 12.52 | 0.248 | 19.499 | 26.497 | 45.539 | 12.55 | 0.027 | 8.870 | 9.191 | 16.546 |

| Triple Threshold | 5.76 | 0.537 | 11.675 | 14.589 | 16.684 | 8.00 | 0.355 | 16.153 | 20.781 | 30.736 | 19.51 | 0.167 | 22.502 | 23.239 | 35.976 |

| Thresholds | Upper Reaches | Middle Reaches | Lower Reaches | |||

|---|---|---|---|---|---|---|

| Threshold Value | 95% Confidence Interval | Threshold Value | 95% Confidence Interval | Threshold Value | 95% Confidence Interval | |

| Single Threshold | \ | \ | 4.683 *** | (4.619, 4.805) | 5.872 *** | (5.568, 5.966) |

| Double Threshold | \ | \ | \ | \ | 7.851 ** | (7.543, 7.863) |

| Variables | Upper Reaches | Middle Reaches | Lower Reaches |

|---|---|---|---|

| ln K | 0.414 *** (0.044) | 0.173 ** (0.079) | −0.156 *** (0.030) |

| ln struct | 0.740 *** (0.176) | −0.382 ** (0.178) | 1.989 *** (0.158) |

| ln humcap | 0.134 (0.251) | 0.757 *** (0.284) | 0.615 ** (0.275) |

| ln open | −0.011 (0.022) | −0.047 (0.034) | −0.091 ** (0.041) |

| ln techinn | −0.453 *** (0.051) | −0.282 *** (0.062) | 0.292 *** (0.060) |

| ln popden | −0.049 *** (0.017) | −0.029 (0.033) | −0.118 *** (0.032) |

| ln high-tech_1 | 0.066 ** (0.032) | 0.074 ** (0.030) | 0.085 *** (0.028) |

| ln hightech_2 | 0.183 *** (0.061) | 0.057 * (0.029) | |

| ln hightech_3 | −0.006 (0.028) | ||

| constant | 5.687 *** (0.635) | 1.475 * (0.862) | 8.245 *** (0.709) |

| observations | 80 | 80 | 60 |

| Hausman test | F = 59.75 P = 0.000 | F = 43.79 P = 0.000 | F = 27.78 P = 0.000 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Y.; Huang, X.; Chen, W. Threshold Effect of High-Tech Industrial Scale on Green Development—Evidence from Yangtze River Economic Belt. Sustainability 2019, 11, 1432. https://doi.org/10.3390/su11051432

Liu Y, Huang X, Chen W. Threshold Effect of High-Tech Industrial Scale on Green Development—Evidence from Yangtze River Economic Belt. Sustainability. 2019; 11(5):1432. https://doi.org/10.3390/su11051432

Chicago/Turabian StyleLiu, Yanhong, Xinjian Huang, and Weiliang Chen. 2019. "Threshold Effect of High-Tech Industrial Scale on Green Development—Evidence from Yangtze River Economic Belt" Sustainability 11, no. 5: 1432. https://doi.org/10.3390/su11051432